#Competition for startup funding

Explore tagged Tumblr posts

Text

What are some innovative Entrepreneurship Ideas to explore?

Unwrap a world of innovative and game-changing entrepreneurship ideas at Flagship.club! Immerse yourself in a captivating experience during the extraordinary "Business Fair Day" contest tailored for ambitious high school student competitions. Get your boundless imagination, originality, and enterprising mindset as you connect with like-minded individuals, present your visionary concepts, and vie for prestigious accolades. This is your golden chance to transform aspirations into tangible achievements.

#Business idea competition#Entrepreneurship competition#Student entrepreneurship competitions#Competition for startup funding#Unique small business ideas

0 notes

Text

Collaboration Over Competition: Leveraging Partnerships for Growth

In today’s hyper-competitive business landscape, the adage "Collaboration over Competition" takes on new significance. As companies navigate complex challenges, thriving relies increasingly on forming strategic partnerships. Leveraging collaborations not only drives innovation and enhances market reach but also fosters an ecosystem of shared knowledge and resources. This article explores how…

#best practices for brand management#Branding strategies for small businesses#building brand loyalty#business growth strategies#Collaboration#Competition#corporate social responsibility#creating a strong brand identity#customer relationship management#digital marketing for startups#e-commerce tips for businesses#Growth#how to scale your business.#how to start a successful business#importance of social media for businesses#influencer marketing for brands#Leveraging#Partnerships#small business funding options#top business trends 2024

0 notes

Text

🎖️🌎 Out of hundreds of companies, Make My Day has been selected as a finalist for The 7th China (Shenzhen) Innovation and Entrepreneurship International Competition (Israeli Division) Finals! This is the biggest and most exclusive international innovation competition coming out of #China!

Taking part in this international competition is an honor for us as an #Energy and #Environment startup with #Climatech#technology that can revolutionize the automobile industry.

The #Shenzhen Innovation & Entrepreneurship International Competition celebrates innovation, entrepreneurship, and global collaboration, and is a gateway to a thriving ecosystem of innovation, collaboration, and global partnerships. For more information, visit the competition's official website: https://lnkd.in/dWQK3gNT

China (Shenzhen) Innovation and Entrepreneurship International CompetitionOhad MaromNisan KatzCnaan AvivLee paztal

#entrepreneurship#China#innovation#prize#event#Shenzhen#competition#startup#shenzhen#china#ShenzhenInnovationCompetition#InnovationEcosystem#GlobalInnovation#StartupJourney#tech#collaboration#funding#MakeMyDay#InternationalCompetition#Entrepreneurship#EV#Energy#Climatech

0 notes

Video

youtube

Should Billionaires Exist?

Do billionaires have a right to exist?

America has driven more than 650 species to extinction. And it should do the same to billionaires.

Why? Because there are only five ways to become one, and they’re all bad for free-market capitalism:

1. Exploit a Monopoly.

Jamie Dimon is worth $2 billion today… but not because he succeeded in the “free market.” In 2008, the government bailed out his bank JPMorgan and other giant Wall Street banks, keeping them off the endangered species list.

This government “insurance policy” scored these struggling Mom-and-Pop megabanks an estimated $34 billion a year.

But doesn’t entrepreneur Jeff Bezos deserve his billions for building Amazon?

No, because he also built a monopoly that’s been charged by the federal government and 17 states for inflating prices, overcharging sellers, and stifling competition like a predator in the wild.

With better anti-monopoly enforcement, Bezos would be worth closer to his fair-market value.

2. Exploit Inside Information

Steven A. Cohen, worth roughly $20 billion headed a hedge fund charged by the Justice Department with insider trading “on a scale without known precedent.” Another innovator!

Taming insider trading would level the investing field between the C Suite and Main Street.

3. Buy Off Politicians

That’s a great way to become a billionaire! The Koch family and Koch Industries saved roughly $1 billion a year from the Trump tax cut they and allies spent $20 million lobbying for. What a return on investment!

If we had tougher lobbying laws, political corruption would go extinct.

4. Defraud Investors

Adam Neumann conned investors out of hundreds of millions for WeWork, an office-sharing startup. WeWork didn’t make a nickel of profit, but Neumann still funded his extravagant lifestyle, including a $60 million private jet. Not exactly “sharing.”

Elizabeth Holmes was convicted of fraud for her blood-testing company, Theranos. So was Sam Bankman-Fried of crypto-exchange FTX. Remember a supposed billionaire named Donald Trump? He was also found to have committed fraud.

Presumably, if we had tougher anti-fraud laws, more would be caught and there’d be fewer billionaires to preserve.

5. Get Money From Rich Relatives

About 60 percent of all wealth in America today is inherited.

That’s because loopholes in U.S. tax law —lobbied for by the wealthy — allow rich families to avoid taxes on assets they inherit. And the estate tax has been so defanged that fewer than 0.2 percent of estates have paid it in recent years.

Tax reform would disrupt the circle of life for the rich, stopping them from automatically becoming billionaires at their birth, or someone else’s death.

Now, don’t get me wrong. I’m not arguing against big rewards for entrepreneurs and inventors. But do today’s entrepreneurs really need billions of dollars? Couldn’t they survive on a measly hundred million?

Because they’re now using those billions to erode American institutions. They spent fortunes bringing Supreme Court justices with them into the wild.They treated news organizations and social media platforms like prey, and they turned their relationships with politicians into patronage troughs.

This has created an America where fewer than ever can become millionaires (or even thousandaires) through hard work and actual innovation.

If capitalism were working properly, billionaires would have gone the way of the dodo.

427 notes

·

View notes

Text

No, “convenience” isn’t the problem

I'm touring my new, nationally bestselling novel The Bezzle! Catch me in CHICAGO (Apr 17), Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

Using Amazon, or Twitter, or Facebook, or Google, or Doordash, or Uber doesn't make you lazy. Platform capitalism isn't enshittifying because you made the wrong shopping choices.

Remember, the reason these corporations were able to capture such substantial market-share is that the capital markets saw them as a bet that they could lose money for years, drive out competition, capture their markets, and then raise prices and abuse their workers and suppliers without fear of reprisal. Investors were chasing monopoly power, that is, companies that are too big to fail, too big to jail, and too big to care:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

The tactics that let a few startups into Big Tech are illegal under existing antitrust laws. It's illegal for large corporations to buy up smaller ones before they can grow to challenge their dominance. It's illegal for dominant companies to merge with each other. "Predatory pricing" (selling goods or services below cost to prevent competitors from entering the market, or to drive out existing competitors) is also illegal. It's illegal for a big business to use its power to bargain for preferential discounts from its suppliers. Large companies aren't allowed to collude to fix prices or payments.

But under successive administrations, from Jimmy Carter through to Donald Trump, corporations routinely broke these laws. They explicitly and implicitly colluded to keep those laws from being enforced, driving smaller businesses into the ground. Now, sociopaths are just as capable of starting small companies as they are of running monopolies, but that one store that's run by a colossal asshole isn't the threat to your wellbeing that, say, Walmart or Amazon is.

All of this took place against a backdrop of stagnating wages and skyrocketing housing, health, and education costs. In other words, even as the cost of operating a small business was going up (when Amazon gets a preferential discount from a key supplier, that supplier needs to make up the difference by gouging smaller, weaker retailers), Americans' disposable income was falling.

So long as the capital markets were willing to continue funding loss-making future monopolists, your neighbors were going to make the choice to shop "the wrong way." As small, local businesses lost those customers, the costs they had to charge to make up the difference would go up, making it harder and harder for you to afford to shop "the right way."

In other words: by allowing corporations to flout antimonopoly laws, we set the stage for monopolies. The fault lay with regulators and the corporate leaders and finance barons who captured them – not with "consumers" who made the wrong choices. What's more, as the biggest businesses' monopoly power grew, your ability to choose grew ever narrower: once every mom-and-pop restaurant in your area fires their delivery drivers and switches to Doordash, your choice to order delivery from a place that payrolls its drivers goes away.

Monopolists don't just have the advantage of nearly unlimited access to the capital markets – they also enjoy the easy coordination that comes from participating in a cartel. It's easy for five giant corporations to form conspiracies because five CEOs can fit around a single table, which means that some day, they will:

https://pluralistic.net/2023/04/18/cursed-are-the-sausagemakers/#how-the-parties-get-to-yes

By contrast, "consumers" are atomized – there are millions of us, we don't know each other, and we struggle to agree on a course of action and stick to it. For "consumers" to make a difference, we have to form institutions, like co-ops or buying clubs, or embark on coordinated campaigns, like boycotts. Both of these tactics have their place, but they are weak when compared to monopoly power.

Luckily, we're not just "consumers." We're also citizens who can exercise political power. That's hard work – but so is organizing a co-op or a boycott. The difference is, when we dog enforcers who wield the power of the state, and line up behind them when they start to do their jobs, we can make deep structural differences that go far beyond anything we can make happen as consumers:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

We're not just "consumers" or "citizens" – we're also workers, and when workers come together in unions, they, too, can concentrate the diffuse, atomized power of the individual into a single, powerful entity that can hold the forces of capital in check:

https://pluralistic.net/2024/04/10/an-injury-to-one/#is-an-injury-to-all

And all of these things work together; when regulators do their jobs, they protect workers who are unionizing:

https://pluralistic.net/2023/09/06/goons-ginks-and-company-finks/#if-blood-be-the-price-of-your-cursed-wealth

And strong labor power can force cartels to abandon their plans to rig the market so that every consumer choice makes them more powerful:

https://pluralistic.net/2023/10/01/how-the-writers-guild-sunk-ais-ship/

And when consumers can choose better, local, more ethical businesses at competitive rates, those choices can make a difference:

https://pluralistic.net/2022/07/10/view-a-sku/

Antimonopoly policy is the foundation for all forms of people-power. The very instant corporations become too big to fail, jail or care is the instant that "voting with your wallet" becomes a waste of time.

Sure, choose that small local grocery, but everything on their shelves is going to come from the consumer packaged-goods duopoly of Procter and Gamble and Unilever. Sure, hunt down that local brand of potato chips that you love instead of P&G or Unilever's brand, but if they become successful, either P&G or Unilever will buy them out, and issue a press release trumpeting the purchase, saying "We bought out this beloved independent brand and added it to our portfolio because we know that consumers value choice."

If you're going to devote yourself to solving the collective action problem to make people-power work against corporations, spend your precious time wisely. As Zephyr Teachout writes in Break 'Em Up, don't miss the protest march outside the Amazon warehouse because you spent two hours driving around looking for an independent stationery so you could buy the markers and cardboard to make your anti-Amazon sign without shopping on Amazon:

https://pluralistic.net/2020/07/29/break-em-up/#break-em-up

When blame corporate power on "laziness," we buy into the corporations' own story about how they came to dominate our lives: we just prefer them. This is how Google explains away its 90% market-share in search: we just chose Google. But we didn't, not really – Google spends tens of billions of dollars every single year buying up the search-box on every website, phone, and operating system:

https://pluralistic.net/2024/02/21/im-feeling-unlucky/#not-up-to-the-task

Blaming "laziness" for corporate dominance also buys into the monopolists' claim that the only way to have convenient, easy-to-use services is to cede power to them. Facebook claims it's literally impossible for you to carry on social relations with the people that matter to you without also letting them spy on you. When we criticize people for wanting to hang out online with the people they love, we send the message that they need to choose loneliness and isolation, or they will be complicit in monopoly.

The problem with Google isn't that it lets you find things. The problem with Facebook isn't that it lets you talk to your friends. The problem with Uber isn't that it gets you from one place to another without having to stand on a corner waving your arm in the air. The problem with Amazon isn't that it makes it easy to locate a wide variety of products. We should stop telling people that they're wrong to want these things, because a) these things are good; and b) these things can be separated from the monopoly power of these corporate bullies:

https://pluralistic.net/2022/11/08/divisibility/#technognosticism

Remember the Napster Wars? The music labels had screwed over musicians and fans. 80 percent of all recorded music wasn't offered for sale, and the labels cooked the books to make it effectively impossible for musicians to earn out their advances. Napster didn't solve all of that (though they did offer $15/user/month to the labels for a license to their catalogs), but there were many ways in which it was vastly superior to the system it replaced.

The record labels responded by suing tens of thousands of people, mostly kids, but also dead people and babies and lots of other people. They demanded an end to online anonymity and a system of universal surveillance. They wanted every online space to algorithmically monitor everything a user posted and delete anything that might be a copyright infringement.

These were the problems with the music cartel: they suppressed the availability of music, screwed over musicians, carried on a campaign of indiscriminate legal terror, and lobbied effectively for a system of ubiquitous, far-reaching digital surveillance and control:

https://pluralistic.net/2023/02/02/nonbinary-families/#red-envelopes

You know what wasn't a problem with the record labels? The music. The music was fine. Great, even.

But some of the people who were outraged with the labels' outrageous actions decided the problem was the music. Their answer wasn't to merely demand better copyright laws or fairer treatment for musicians, but to demand that music fans stop listening to music from the labels. Somehow, they thought they could build a popular movement that you could only join by swearing off popular music.

That didn't work. It can't work. A popular movement that you can only join by boycotting popular music will always be unpopular. It's bad tactics.

When we blame "laziness" for tech monopolies, we send the message that our friends have to choose between life's joys and comforts, and a fair economic system that doesn't corrupt our politics, screw over workers, and destroy small, local businesses. This isn't true. It's a lie that monopolists tell to justify their abuse. When we repeat it, we do monopolists' work for them – and we chase away the people we need to recruit for the meaningful struggles to build worker power and political power.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/12/give-me-convenience/#or-give-me-death

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

350 notes

·

View notes

Text

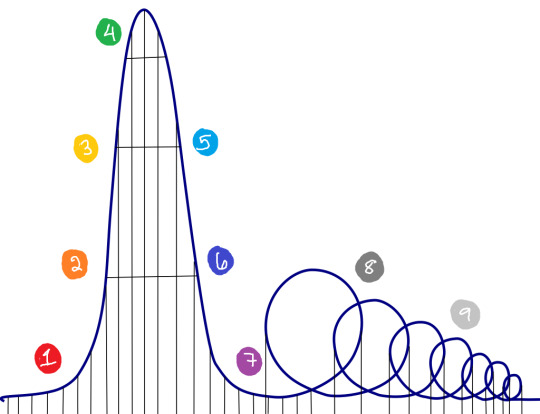

this is the startup coaster as I'm familiar with it:

(1) three guys named scott snag a few million in seed funding, hire a few engineers to work with them in the abandoned wework they're renting from the ghost of a 15th century land baron.

(2) headcount slowly grows, they release a product that "works" but it's either cheap as hell or free so people are starting to adopt it; adoption is a sign of growth, which in turn yields more funding from eager investors.

(3) scott^3 have enough cash reserves to move into a real office and hire marketing/sales people, product improves a bit. still not even close to being profitable but it's okay because funding continues to pour in!

(4) incremental product improvements, user adoption crescendoes, maybe another funding round. possible hiring frenzy to follow. cue a chorus of scotts, in perfect unison: "our company is valued at almost at a billion dollars! an IPO is just around the corner!"

(5) investor money becomes harder and harder to come by over time; company slows spending.

(6) "well, all we have to do is focus on revenue instead of growth... profitability is within reach." management may or may not make poor decisions that spur original critical employees to jump ship, taking their expertise and guiding philosophy with them.

(7) money continues to hemorrhage with no VC infusions in sight. company makes significant cuts to their workforce, pares back their roadmap.

(8) in the absence of key personnel (and without the necessary cushion to develop new features or offer competitive pricing), the product either stagnates or gets noticeably worse. users revolt and either threaten to leave or actually do.

(9) final death spiral where revenue continues to dry up, which leads to more layoffs, which makes the product worse, which means users continue to churn, which makes revenue dry up even more. any investors cut their losses and move on to their next prospect. scott, scott, and scott either go on the podcast circuit or start over again to get seed funding for a new startup that they can only describe as "the uber of canine saunas"

348 notes

·

View notes

Note

…so can you expand on the psychological ramifications of stewy being in private equity? that has definitely been lost on me given that i barely understand what private equity is

ok this is an underrated funny aspect of the show imo, and also good insight into stewy and kendall. i'm trying to spare you a bunch of stupid business jargon but basically, maesbury capital (which stewy represents but sandy/sandi ultimately own) is a private equity fund, meaning it's a big pile of a bunch of rich people's money, and stewy's job is to take that money and invest in private companies. a PE fund can invest at a few different points: at the very beginning of a startup's life (venture or angel investing), at a point where the company is trying to grow or restructure (growth investing), or when a company is struggling financially, in which case the fund is usually planning to either dismantle it and sell it for scrap, restructure and go public, or sell it for cash to another company. PE firms like to present themselves as doing a lot of growth or venture investing, but in truth many/most are primarily engaging in this third category of investment strategies, because they're lucrative (and because many startups are stupid, and only good for generating investor payouts).

so, when kendall went and dismantled vaulter in season 2 because logan decided that selling most of it for scrap would be more profitable? that's basically a dramatisation of what stewy does routinely, except of course the exact financial instruments and strategies will differ because stewy represents a PE firm. like, if kendall's venture capitalist schemes tell us about his delusions of creating cool new products and services, stewy is sort of the opposite because his structural goal is usually to dismantle companies and liquidate them however is best for maesbury's backers. it's a total destruction of all use-value and a conversion of it into pure exchange-value in the form of capital (which goes into his pockets and maesbury's). stewy generates money by destroying utility, which is perverse if you think capitalism is supposed to create and sustain human life, but actually completely comprehensible if you understand that capitalism is an insatiable growth machine with inherently contradictory internal tendencies and no raison d'être beyond the endless accumulation of pure capital itself.

many viewers think stewy is insane because he is friends with kendall roy. this is true, but on a deeper level stewy is insane because his job is to participate in the inexorable tendency to more and more abstraction in the capitalist mode of production. it literally does not matter at all to someone like stewy whether people are fed or clothed or happy, or have any of their needs met. the point is solely to create money, to turn all social forms and values into numbers on a balance sheet. this is why, when kendall tries to threaten him on axos at the end of season 2, stewy is able to casually tell him that "it doesn't matter; it doesn't mean anything." he and sandy are convincing shareholders that their offer will be able to make them more money, "and that's all that this is." stewy speaks the language of business differently than logan, because stewy doesn't care about dick-swinging competitions or demonstrating dominance in logan's cringey old catholic military way. which makes stewy more rational in certain ways, but also more insane, in that he operates in a way totally detached from this type of social value system and solely motivated by cold hard numbers.

the irony is that, whilst being detached and disembodied in his business practices, stewy is also better than the roys at appreciating the material fruits of wealth. he eats; he dresses well; he enjoys the "several houses" he owns. kendall is always trying to come up with some grand moral bullshit masculinity reason that what he's doing is noble or whatever, and he's alienated from his body and afflicted with severe catholic martyr disease. stewy just bypasses all that shit, measures his success by his payouts, and enjoys wealth because he sees it as an end in itself and not a means to logan roy's respect.

this is also why kendall's line in 'living+' about "it's enough to make you lose your faith in capitalism" is so funny. kendall can't just accept that business is a bunch of meaningless bullshit confidence games played by coked-up assholes who like to win; he always has to try to convince himself he's making cool new tech shit, or saving the world from the spectre of death itself or some shit. it's like, insane that he made it to literally 40 years old, growing up in a media conglomerate of all things, and still thinks that what he's doing requires actual skill or creates actual social value—but of course, part of the reason he still thinks this is because he deified logan and was therefore incapable of ever seeing logan or waystar for what they really were. stewy would never say that line because he can't be disillusioned this way on account of he already knows the whole thing is bullshit. it's just that to him it doesn't matter, because being bullshit does not preclude it from paying well.

#some1 also asked about that kendall line and it seemed like it wanted to be bundled into this post lol i hope that answers yr q#blood sacrifice#typing this gave me flashbacks to when i did freelance transcription and i used to do this guy's podcast on angel investing#literal nightmare fodder. the hours-long homophobic baptist sermons were better

543 notes

·

View notes

Note

What is capitalism if private ownership and monopolization are out

This is about the insulin thing, right? Let me walk you through the steps.

The current situation is, there are three big corporations making insulin. They make it for super cheap, like $2 a dose or something including packaging and distribution and all that jazz, but they know that people need this stuff in order to not die, so there's no reason to restrain themselves as far as pricing goes. So they sell the stuff for like $500 a vial, earning a tidy 25,000% profit, because what are customers gonna do, not buy it?

In a capitalist system, this is a huge opportunity for anybody with a few thousand in seed money and a smidge of ambition. The process of making insulin is hardly a secret. I might not have the economy of scale going and I need a big up-front investment for equipment, but even if it costs me five times as much per dose to produce the stuff, that's still less than 2% of the current market price. So I start making and distributing the stuff for $10 a vial, and selling it for $400, and all the customers see that they can get the same product for $100 less so they stop buying from those three big companies and start buying from my startup. Then a month later, somebody else comes along with the same idea but undercuts me, and I lose all my customers to sombody willing to sell the stuff for $350, but that's fine I just change all my labels to sell for $300 and they come rushing back, and I'm still making $290 pure profit on every vial. Fast forward a couple years, and the market price of insulin is like, $12 a vial tops, because if you try to get profit margins any bigger than that you're the most expensive option and nobody buys from you. There was never any altruism involved in that process, no magic, no glorious savior who figured out a way to impose their will upon the world in order to save lives, just ordinary greedy humans fighting each other to make more money for themselves, but the end result is that the people who need this stuff to survive get it for a tiny fraction of what they used to be paying.

In the system that we're actually using, the three big corporations go to the government with three big suitcases full of cash, and the government passes a law that says anybody who tries to make insulin who isn't one of the three big corporations goes directly to prison forever. All the competition vanishes, and without the risk of somebody selling the same product for less they're able to keep raising the price as much as they want. I mean, if you get up to the point where the majority of your customers literally can't buy it anymore and they die then you have fewer customers, so going up into the millions per vial would be counterproductive, but as long as the majority of people who need insulin can just barely scrape together enough, you maximize your profits. And all it costs is widespread human suffering and a few surprisingly affordable bribes.

And then here's the really funny part: the corporations that benefit most from government interference in the market? They're the ones that fund all the media that convinces kids that the solution to all their problems is to give the government even more control over every aspect of life. They're the ones who pushed the narrative that 'libertarian' is synonymous with 'pedophile'. They're the ones who bury stories about corrupt politicians so you never question how a congressman can have a salary under $200,000 a year, go into the position with a net worth of a million dollars, and come out eight years later as a billionaire. Almost every "anti-capitalist" movement out there, if you follow the chain of evidence back, is funded directly by the corporations it claims to oppose, because shifting the balance of power further away from the individual and more toward the State means more profit for the people who are in a position to manipulate the state.

Now, this isn't to say that a free market is without problems. If there was zero regulation of the production of insulin, then a particularly unethical person could undercut the legitimate sources by making a loose approximation of the product people need for much cheaper by using dangerous or ineffective methods, and then sell it at prices that legitimate manufacturers can't compete with because the purchase price is lower than the manufacturing price. Which means that when you buy insulin, you would need to do your own research into who's got a reputation for quality, and there would be people who straight up die because they decided to go for the $4-6 "insulin" instead of the $12-15 insulin. But I'm pretty sure that would still be better than the only option being $500.

498 notes

·

View notes

Text

Trumps territorial Ambition and Economic Strategy: How Greenland, the Panama Canal, Mexico, and Canada Could Reshape U.S. Power;

The United States is often celebrated for its culture of individualism, business innovation, and economic ambition. However, a less glamorous yet equally pivotal aspect of its rise to power has been its use of tariffs and territorial expansion. In the late 18th and 19th centuries, the U.S. was like a tech startup competing against industrial giants such as Britain, relying on tariffs to protect its fledgling industries and grow its economy.

Fast forward to the present, and the discussion about economic expansion has taken on new dimensions, with proposals like acquiring Greenland, controlling the Panama Canal, integrating Mexico and Canada, or using tariffs as a strategic tool. These ideas, while seemingly bold or even outlandish, echo historical strategies that shaped the U.S. into a global superpower. To understand the potential implications, let’s explore the economic and historical context of these proposals and how they might reshape the United States.

Tariffs: The Foundation of Early U.S. Economic Growth

Before the 20th century, tariffs were the backbone of the federal government’s revenue. From the late 18th century to the introduction of income taxes in 1913, tariffs funded as much as 90% of federal expenditures. For example, the Tariff of 1789 provided the young nation with critical revenue while protecting its nascent industries from foreign competition.

Tariffs not only paid for government operations but also supported domestic manufacturing. The Tariff of 1816, the first explicitly protective tariff, helped American industries compete with Britain’s advanced machinery. Similarly, the Morrill Tariff of 1861 raised rates to shield Northern industries during the Civil War. These policies underscored the importance of economic self-sufficiency and industrial development—principles that remain relevant in modern debates about economic strategy.

Greenland: Strategic and Economic Potential

Greenland, governed by Denmark, has long been of interest to the United States. During World War II, the U.S. established military bases there to monitor the Atlantic and protect Allied shipping routes. In 1946, the U.S. offered Denmark $100 million for Greenland, recognizing its strategic importance.

Today, Greenland’s value has only increased. Its vast reserves of rare earth minerals, essential for modern technologies, could reduce U.S. dependence on China for these critical resources. Additionally, as climate change opens new Arctic shipping lanes, Greenland’s location offers unparalleled geopolitical advantages. Acquiring Greenland could bolster U.S. economic and military influence in the Arctic, but such a move would likely face resistance from Denmark and the global community.

The Panama Canal: A Strategic Trade Asset

The Panama Canal, completed in 1914, revolutionized global trade by providing a shortcut between the Atlantic and Pacific Oceans. Originally controlled by the United States, the canal was handed over to Panama in 1999 under the Torrijos-Carter Treaties. During its time under U.S. control, the canal not only facilitated trade but also served as a strategic military asset.

Reclaiming control of the Panama Canal would give the U.S. significant leverage over international shipping. The canal handles approximately 5% of global trade, making it a vital artery of commerce. However, such a move would undoubtedly provoke geopolitical tensions, particularly with Panama and nations dependent on the canal for their trade routes.

Mexico: Economic Integration and Security

Mexico has historically been both a competitor and a partner to the United States. The U.S. annexed much of Mexico’s northern territory following the Mexican-American War in 1848, including present-day Texas, California, and Arizona. Today, Mexico is America’s largest trading partner under the USMCA (United States-Mexico-Canada Agreement).

Integrating Mexico more deeply into the U.S. economy or even considering annexation would have profound implications. Mexico’s manufacturing base, agricultural output, and workforce could provide significant economic benefits. However, it would also require addressing complex issues such as governance, social integration, and disparities in income and development levels. Historically, such large-scale integrations, like the annexation of Texas, have been contentious and politically fraught.

Canada: The 51st State?

Canada, with its vast resources, stable economy, and shared border, has always been a critical ally and trading partner for the U.S. During the War of 1812, American attempts to annex Canada were unsuccessful, and the relationship has since evolved into one of mutual cooperation.

Integrating Canada into the United States would provide unparalleled access to natural resources, including oil, natural gas, and freshwater. Canada’s advanced industries, from technology to healthcare, could strengthen the U.S. economy. However, such a move would face significant cultural and political resistance, as Canadians value their sovereignty and distinct identity. Historically, attempts to merge distinct nations under one government have proven challenging, as seen in the annexation of Hawaii or the Reconstruction-era South.

Historical Lessons and Modern Implications

Throughout U.S. history, territorial acquisitions and economic policies have been driven by the pursuit of growth and security. The Louisiana Purchase, Alaska acquisition, and annexation of Hawaii are examples of successful expansions that enhanced U.S. resources and global influence. However, these moves often came with significant challenges, including resistance from local populations and geopolitical tensions.

Proposals to acquire Greenland, control the Panama Canal, or integrate Mexico and Canada reflect similar ambitions but must be approached with caution. The global political landscape is more interconnected than ever, and such bold moves could provoke backlash from allies and rivals alike.

My concerns

The ideas of acquiring Greenland, controlling the Panama Canal, or integrating Mexico and Canada may seem ambitious, but they are not without precedent, especially with growing concerns of influence of external political players. However, History shows that the United States has consistently pursued strategies to strengthen its economy and global standing, whether through tariffs, territorial expansion, or economic integration. While these proposals carry risks, they also present opportunities to reshape the U.S. economy and its role in the world. The challenge lies in balancing ambition with pragmatism in a complex and interconnected global landscape.

#trump#donald trump#panama canal#canada#gulf of mexico#gulf of america#tariffs#be concerned#body expansion#greenland

3 notes

·

View notes

Text

How did Flagship.club's Entrepreneurship Competition Empower Student Innovators?

Flagship.club is hosting an exciting business fair day student competition exclusively for students between 10-18 years of age. This event will offer a unique platform for budding entrepreneurs to showcase their innovative business ideas for entrepreneurship, foster connections with industry experts, and gain valuable insights into the world of business.

#Student entrepreneurship competitions#Competition for startup funding#Unique small business ideas#Online business ideas#Small business ideas for 2023

0 notes

Text

Innovate Your Brand: Best Practices for Staying Ahead in a Competitive Market

In today’s rapidly evolving marketplace, innovation has become a necessity for brands aiming to stay relevant and succeed. "Innovate Your Brand: Best Practices for Staying Ahead in a Competitive Market" explores the significance of innovation and presents actionable insights to help businesses differentiate themselves from competitors. From understanding customer needs to leveraging technology,…

#Ahead#best practices for brand management#Brand#Branding strategies for small businesses#building brand loyalty#business growth strategies#Competitive#corporate social responsibility#creating a strong brand identity#customer relationship management#digital marketing for startups#e-commerce tips for businesses#how to scale your business.#how to start a successful business#importance of social media for businesses#influencer marketing for brands#Innovate#Market#Practices#small business funding options#Staying#top business trends 2024

0 notes

Text

Excerpt from this story from Canary Media:

Octopus Energy has surged to the top of the U.K. electricity market with its plucky brand of clean, flexible, customer-centric energy. Now it’s loading up on new investment to make a broader push into North America.

The sprawling clean energy startup pulled in two new investments in recent weeks. On May 7, it announced a re-up from existing investors, including Al Gore’s Generation Investment Management and the Canada Pension Plan. Last week, it added a new round from the $1 billion Innovation and Expansion Fund at Tom Steyer’s Galvanize Climate Solutions. The parties did not disclose the size of the new infusions but said that they lift Octopus’ private valuation to $9 billion. Previously, Octopus raised an $800 million round in December, putting its valuation at $7.8 billion. Thus, eight-year-old Octopus enters the summer of 2024 as one of the most valuable privately held startups in the world, but one whose impact is felt far more in Europe than in the U.S. The new influx of cash will help fund expansion in North America, both by growing its retail foothold in Texas and by ramping up sales of the company’s marquee Kraken software to other utilities. The company has its work cut out if it wants to reproduce its U.K. market dominance across the pond.

“It is a Cambrian explosion of exciting growth in almost every direction,” Octopus Energy U.S. CEO Michael Lee told Canary Media last week.

In the U.K., Octopus has gobbled its way up the leaderboard of electricity retailers, consuming competitors large and small until it reached the No. 1 slot this year. It supplies British customers in part with clean power from a multibillion-dollar portfolio of renewables plants that it owns. The company lowers costs to customers by using smart devices or behavioral nudges to shift their usage to times when the renewables are producing the most cheap electricity. Octopus also began making its own heat pumps, to help households break out of dependence on fossil gas at a volatile time.

In the U.S., land of free markets and capitalist competition, market design largely blocks Octopus from rolling out its innovations, and instead protects the monopoly power of century-old incumbent utilities. There is no national electricity market to take over, but a state-by-state hodgepodge of fiefdoms that obey differing rules. So Octopus made its first stand in Texas, whose competitive power market most closely resembles the U.K.’s system. It now sources power for tens of thousands of retail customers in the state.

“It is absolutely clear to me that the energy transition is happening first in Texas,” Lee said. “This is a fantastic market to be in if you know how to work with customers and help them be a central focus in providing that energy transition to the grid.”

Such an assertion might have elicited derisive snorts from Californians or New Yorkers a few years ago, but facts on the ground now support Lee’s thesis.

6 notes

·

View notes

Text

Luxembourg-based satellite telecom operator OQ Technology is testing investor appetite for space-based Internet of Things (IoT) technology, seeking EUR 30 million in fresh funding as competition intensifies in the nascent market for satellite-enabled device connectivity.

The company, which has deployed 10 satellites since 2019, plans to launch 20 more as larger telecommunications companies and satellite operators begin developing similar IoT services. The Series B funding round follows a EUR 13 million raise in 2022 and aims to strengthen its global 5G IoT network coverage.

OQ Technology has secured initial backing through a convertible loan from the Luxembourg Space Sector Development Fund, a joint initiative between SES S.A. and the Luxembourg government. Previous investors, including Aramco's venture capital arm Wa'ed Ventures and Greece's Phaistos Investment Fund, are participating in the new round.

The startup differentiates itself by focusing on standardized cellular technology for narrowband-IoT, contributing to 3GPP protocols that allow existing cellular chips to connect with satellites. This approach contrasts with proprietary systems offered by competitors, replacing traditional bulky satellite systems with compact, cost-efficient IoT modems that offer plug-and-play functionality.

"The satellite IoT sector is still largely in the proof-of-concept phase," says the company representative. "While there's significant potential, companies face challenges in standardization and convincing industries to adopt these new technologies at scale."

In an effort to secure its supply chain, the company is exploring partnerships in Taiwan's semiconductor industry. It has begun collaborating with the Industrial Technology Research Institute (ITRI), though these relationships are still in the early stages. The company has shipped initial terminals to prospective Taiwanese clients, marking its first steps in the Asian market.

The global reach for semiconductor partnerships comes as the company expands its geographical footprint, having established subsidiaries in Greece, Saudi Arabia, and Rwanda. Plans for US market entry are underway, though regulatory approvals and spectrum access remain hurdles in some markets.

Current clients include Aramco, Telefonica, and Deutsche Telekom, primarily using the technology for asset tracking and remote monitoring in industries such as energy, logistics, and agriculture. While the company estimates a potential market of 1.5 billion devices that could use satellite IoT connectivity, actual adoption rates remain modest.

"The challenge isn't just technical capability," notes the company representative. "It's about proving the economic case for satellite IoT in specific use cases where terrestrial networks aren't viable but the application can support satellite connectivity costs."

Market dynamics are also shifting. Recent announcements from major tech companies about satellite-to-phone services have sparked interest in space-based connectivity, but may also increase competition for spectrum and market share. Several companies are pursuing similar standards-based approaches, potentially commoditizing the technology.

For OQ Technology, the ability to deploy its planned satellites and convert pilot projects into paying customers will be crucial. While the company's focus on standardized technology may reduce technical risks, successfully scaling the business will require navigating complex regulatory environments and proving the technology's reliability across different use cases.

4 notes

·

View notes

Text

The Economic Impact of Coworking Spaces in Pune: A Closer Look

The importance of coworking spaces in fostering creativity and economic growth cannot be emphasized, especially as Pune develops into a thriving hub for startups, independent contractors, and remote workers. In this piece, we examine the financial effects of coworking space in Pune, looking at how they solve common issues and support the vibrant business community in the area.

Resolving the Pain Points: The high setup and maintenance costs associated with traditional office space represent one of the biggest obstacles that firms, particularly those in the technology industry, must overcome. This can be a significant barrier to entry for new and small enterprises with little funds. Pune’s coworking spaces provide an economical alternative by renting out fully furnished workstations with facilities, meeting rooms, and high-speed internet at reasonable prices. For instance, The Mesh Cowork in Pune provides freelancers and startups with affordable access to first-rate office space through customizable membership levels that are catered to their needs.

Additionally, Pune’s coworking spaces help freelancers and distant workers overcome their common loneliness and lack of networking chances. Coworking spaces promote collaboration, knowledge exchange, and networking by uniting professionals from many industries under one roof. This leads to more relationships and business opportunities in addition to increased productivity and innovation. Examples from the real world, like The Daftar Coworking Space in Pune, show how members have grown their networks and scaled their businesses by utilizing the community and resources offered by coworking spaces.

Moreover, coworking spaces in Pune are essential to the growth of business and the gig economy. increasingly professionals are looking for flexible work arrangements that let them follow their hobbies and maintain a work-life balance as freelance and remote work become increasingly popular. Coworking spaces offer a supportive and infrastructural environment that fosters growth and creativity for independent contractors and solopreneurs. Testimonials from Spaces Coworking members in Pune demonstrate how its amenities and working atmosphere have enabled them to follow their entrepreneurial aspirations and create prosperous firms.

Conclusion: To sum up, co working space in Pune are more than just places to work; they are hubs for invention, cooperation, and economic progress. Coworking spaces enable professionals and enterprises to prosper in the current competitive market by resolving typical issues including excessive overhead costs, isolation, and a lack of networking possibilities. Pune’s coworking spaces will become more crucial in determining the city’s economic landscape and promoting sustainable growth as it develops into a premier business destination.

7 notes

·

View notes

Text

SVB bailouts for everyone - except affordable housing projects

For the apologists, the SVB bailout was merely prudent: a bunch of innocent bystanders stood in harm’s way — from the rank-and-file employees at startups to the scholarship kids at elite private schools that trusted their endowment to Silicon Valley Bank — and so the government made an exception, improvising measures that made everyone whole without costing the public a dime. What’s not to like?

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/15/socialism-for-the-rich/#rugged-individualism-for-the-poor

But that account doesn’t hold up to even the most cursory scrutiny. Everything about it is untrue. Take the idea that this wasn’t a “bailout” because it was the depositors who got rescued, not the shareholders. That’s just factually untrue: guess where the shareholders kept their money? That’s right, SVB. The shareholders of SVB will get billions in public money thanks to the bailout. Billions:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

But is it really public money? After all, the FDIC payouts come from a pool of funds raised from all of America’s banks. The billions the public put into SVB will be recouped through hikes on the premiums paid by every bank. Well, sure — but who do you think the banks are going to gouge to cover those additional expenses? Hint: it’s not going to be the millionaires who get white-glove treatment and below-cost loans. It’ll be the working people whom the banks steal billions from every year in overdraft fees — 78% of these are paid by 9.2% of customers, the very poorest, and they amortize to a 3,500% loan:

https://pluralistic.net/2021/04/22/ihor-kolomoisky/#usurers

As Adam Levitin put it on Credit Slips:

They will pass those premiums through to customers because the market for banking services is less competitive than the market for capital. In particular, the higher costs for increased insurance premiums are likely to flow to the least price-sensitive and most “sticky” customers: less wealthy individuals. So average Joes are going to be facing things like higher account fees or lower APYs, without gaining any benefit. Instead, the benefit of removing the cap would flow entirely to wealthy individuals and businesses. This is one massive, regressive cross-subsidy. It’s not determinative of whether raising the cap is the right policy move in the end, but this is something that should be considered.

https://www.creditslips.org/creditslips/2023/03/the-regressive-cross-subsidy-of-uncapping-deposit-insurance.html

The SVB apologists display the most curious and bizarre imaginative leaps…and imaginative failings. For them, imagining that regulators will just wing it to the tune of hundreds of billions in public money is simplicity itself. Meanwhile, imagining that those same regulators would say, “Not one penny unless every shareholder agrees to sign away their deposits” is literally impossible.

This bizarrely inconstant imagination carries over into all of the claims used to justify the SVB bailout — like, say, the claim that if SVB wasn’t bailed out, everyone would pile into too big to fail banks like Jpmorgan. This is undoubtably true — unless (and hear me out here!), regulators were to use this failure as a launchpad for public banks, and breakups of Jpmorgan, Wells Fargo, Citi, et al.

This is a very weird imaginative failure. America operated public banks. It had broken up too big to fail banks. These weren’t the deeds of a fallen civilization whose techniques were lost to the mists of time. There are literally people alive today who were around when America operated nationwide public banks — a practice that only ended in 1966! We’re not talking about recovering the lost praxis of the druids who built Stonehenge without power-tools, here.

The most telling imaginative failure of SVB apologists, though, is this: they think that people are angry that the government saved the janitors at startups and the scholarship kids at private schools, and can’t imagine that people are angry that America didn’t save anyone else. If you’re a low-income student at an elite private school, there’s billions on hand to save you — but not because the government gives a damn about you — saving you is a side effect of saving all the rich kids you go to school with.

Likewise, the startup janitors aren’t the target of the bailout — they’re overspill from the billions mobilized to rescue the personal fortunes of tech billionaires who supply VCs’ investment capital. If there was a way to bail out the startups without bailing out the janitors, that’s exactly what would happen.

How do I know this? Well, first of all, the “investors” who demanded — and received — a bailout are on record as hating workers and wanting to fire as many of them as possible. As one of the loudest voices for the bailout said of Twitter employees, in a private message to Elon Musk following the takeover: “Day zero: Sharpen your blades boys 🔪”:

https://pluralistic.net/2023/03/21/tech-workers/#sharpen-your-blades-boys

But there’s even better evidence that the bailout’s intended target was wealthy, powerful people, and every chance to carve out working people was seized upon. When regulators engineered the sale of SVB to First Citizens Bank, they did not require First Citizens to honor SVB’s community development obligations, killing thousands of affordable housing units that had been previously greenlit:

https://calreinvest.org/wp-content/uploads/2021/05/Community-Benefits-Plan-SVB-CRC-GLI.pdf

Tens of thousands of people wrote to regulators, urging them to transfer SVB’s Community Benefits Plan obligation to First Citizens:

https://www.dailykos.com/campaigns/petitions/sign-the-petition-save-affordable-housing-keep-the-promises-silicon-valley-bank-made

As did Rep Maxine Waters, the ranking member of the House Financial Services Committee:

https://democrats-financialservices.house.gov/uploadedfiles/318_cwm_ltr_fdic.pdf

But First Citizens — a bank whose slot in America’s top-20 banks was secured through a string of exceptions, exemptions and waivers — was not required to take on SVB’s obligations to carry out loans to build thousands of affordable housing units in the Bay Area and Boston, including a 112-unit building for people with disabilities planned for a plum spot across from San Francisco City Hall:

https://www.levernews.com/regulators-stiffed-low-income-communities-in-silicon-valley-bank-bailout/

All those people who wanted SVB’s community development obligations to carry forward vastly outnumbered the people calling for billionaires portfolio companies to be saved — but they merely spoke on behalf of people who sought the most basic of human rights — shelter. No one listened to them. Instead, it was the hyperventilating all-caps “investors” who spent SVB’s no-good weekend shouting on Twitter about the fall of civilization who got what they wanted, with a bow on top, and a glass of publicly funded warm milk before bed.

The US finance sector is reckless to the point of being criminally negligent. It constitutes an existential risk to the nation. And yet, every time it gets into trouble, regulators are able to imagine anything and everything to shift their risks to the public’s shoulders.

Meanwhile, everyday people are frozen out. School lunches? Unaffordable. Student debt cancellation? Inconceivable. Help for the hundreds of thousands of NYC schoolchildren whose schools are facing a $469m hack-and-slash attack? That’s clearly impossible:

https://council.nyc.gov/joseph-borelli/2022/09/06/nyc-council-calls-for-mayor-adams-doe-to-fully-restore-469m-in-school-funding/

When it comes to helping everyday people, American elites and their captured champions in the US government have minds that are so rigid and inflexible that it’s a wonder they can even dress themselves. But when the fortunes and wellbeing of the wealthy and powerful are on the line, their minds are so open that some of their brains actually leak out of their ears and nostrils:

https://pluralistic.net/2023/03/15/mon-dieu-les-guillotines/#ceci-nes-pas-une-bailout

Every bank merger is supposed to come with a “public interest analysis.” But these analyses are “perfunctory.” They needn’t be:

https://openyls.law.yale.edu/bitstream/handle/20.500.13051/8305/Kress_Article._Publication__1_.pdf

First Citizens got a hell of a bargain: it paid zero dollars for SVB’s assets, its deposits and its loans. Any losses it incurs from its commercial loans over the next five years will be paid by the FDIC, no questions asked. The inability of regulators to convince First Citizens to assume SVB’s community obligations along with those billions in public largesse speaks volumes.

Meanwhile, SVB’s shareholders continue to claim that their headquarters are a relatively unimportant office in Manhattan, and not their glittering, massive corporate offices in San Jose, as part of their bid to shift their bankruptcy proceeding to the Southern District of New York, where corporate criminals like the Sackler opioid family have found such a warm reception that they were able to escape “bankruptcy” with billions in the bank, while their victims were left in the cold:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

Contrary to what SVB’s apologists think, the case against them isn’t driven by spite — it’s driven by fury. America’s “socialism for the rich, rugged individualism for the poor” has been with us for generations, but rarely is it so plain as it is in this case.

There’s only two days left in the Kickstarter campaign for the audiobook of my next novel, a post-cyberpunk anti-finance finance thriller about Silicon Valley scams called Red Team Blues. Amazon’s Audible refuses to carry my audiobooks because they’re DRM free, but crowdfunding makes them possible.

[Image ID: A glass-and-steel, high-tech office building. Atop it is a cartoon figure of Humpty Dumpty, whose fall has been arrested by masses of top-hatted financiers, who hold fast to a rope that keeps him in place. At the foot of the office tower is heaped rubble. On top of the rubble is another Humpty Dumpty figure, this one shattered and dripping yolk. Protruding from the rubble are modest multi-family housing units.]

Image:

Lydia (modified) https://commons.wikimedia.org/wiki/File:Vicroft_Court_Starley_Housing_Co-operative_%282996695836%29.jpg

Oatsy40 (modified) https://www.flickr.com/photos/oatsy40/21647688003

Håkan Dahlström (modified) https://www.flickr.com/photos/93755244@N00/4140459965

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#housing crisis#svb#silicon valley bank#plutocracy#bailouts#affording housing#socialism for the rich#rugged individualism for the poor#regional banking#community development banks#housing

89 notes

·

View notes

Text

Myntra co-founder Mukesh Bansal gets VC funding for new startup Nurix AI

Mukesh Bansal, the co-founder of online fashion major Myntra and Cult.fit, has secured $27.5 million in his new fundraising for artificial intelligence firm Nurix AI. This funding round combines seed investment and series A funding and was supported by Accel and General Catalyst.

Vision and Strategic Partnerships of Nurix AI

Nurix AI is primarily interested in offering AI-based customer communication tools. The kind of AI it seeks to incorporate into companies and organizations is to become functional agents within enterprises, boosting the effectiveness of their communication with an enterprise’s customers. Bansal believes that in the not-too-distant future, advanced intelligent agents supported by the human knowledge base will perform a great portion of work, generating unheard-of levels of efficiency and an increase in product quality.

Nurix AI intends to forge strategic collaborations with AI hardware and product makers. These partnerships help the company aim at the implementation of state-of-the-art AI technologies into the solutions, offering a competitive advantage in the market. Moreover, for Nurix AI, the improvement of the firm’s research & development functions will be vital so that its solutions remain cutting-edge in the field of AI.

Funding Details

The $27.5 million raised shall play a critical role in accelerating the operations of Nurix AI. The collected funds will be utilized for the company’s improvement of its technological portfolio, strengthening research and development, and for the development of strategic collaborations with AI hardware and product providers. The strategic investment has been informed by the growing demand for artificial intelligence solutions across Asia & North America markets and its ability to address this space squarely will be strategic for Nurix AI.

Mukesh Bansal said, “At Nurix, we envision a future where AI agents, guided by human expertise, handle a significant portion of tasks, driving unprecedented gains in productivity and quality.”

Entrepreneurial Journey of Mukesh Bansal

Mukesh Bansal co-founded Myntra in the same year and will be one of India’s most popular fashion e-tailers. Mukesh Bansal in 2014 managed to sell Myntra to his biggest rival Flipkart. Later, he started Curefit, a fitness services firm in 2021. It was renamed Cult.fit after receiving funding from Tata Digital. Mukesh Bansal was also the President of Tata Digital before he started his two-year sabbatical from the company in 2023.

Market Potential and Unique Approach

The overall AI market is rapidly growing and enterprises are choosing AI solutions more frequently to improve customer productivity and interaction. The market research shows that the AI market is projected to grow at a CAGR of 42.2% within the years 2020 to 2027. This growth of improvements in AI technology, growing investment, and the ever-growing need for AI solutions in various organizations.

Nurix AI has the opportunity to stand out as the company offering customer experience services enhanced by artificial intelligence, yet implemented jointly with human contributors. The first service offering is in the BPO sector and the company aims at helping enterprises have highly involved and productive conversations with their customers. With AI integration Nurix AI hopes to minimize the time and energy that customers have to spend interacting with the AI itself.

Conclusion

The new startup founded by Mukesh Bansal, Nurix AI, will be the next major player in AI and customer engagement. After receiving $27.5 million in funding from Accel and General Catalyst, the firm is prepared for increased expansion of operations to meet demand. With the growth and development of Nurix AI, the field of customer interaction with companies through artificial intelligence will be influenced.

4 notes

·

View notes