#ClientPortal

Explore tagged Tumblr posts

Text

The Future of Insurance Broker CRMs: Simplifying Client Management & Sales

As the insurance industry evolves, the role of a CRM for insurance brokers has become essential. A modern CRM should offer:

Streamlined Client Management: Keep all policy and interaction data in one place.

Sales & Pipeline Visibility: Visual pipelines that help track deals and follow-ups.

Automated Marketing: Send personalized campaigns effortlessly.

Integrations: Sync with email, calendar, and even chatbots for a seamless workflow.

This user-friendly approach transforms how brokers manage their clients and close more deals, all while improving customer satisfaction. Learn more about the best CRM solutions for insurance brokers here.

#InsuranceBrokerCRM#InsuranceSoftware#SalesAutomation#ClientManagement#CRMforInsurance#InsuranceCRM#LeadManagement#PolicyManagement#CustomerEngagement#CRMDesign#InsuranceMarketing#SalesPipeline#ClientRetention#InsuranceSales#PolicyRenewals#AutomatedFollowUp#SalesManagement#InsuranceTech#CRM2024#CustomerSatisfaction#InsuranceIndustry#InsuranceSolutions#DigitalInsurance#LeadTracking#UserFriendlyCRM#InsuranceInnovation#ClientPortal#InsuranceAgents#MarketingAutomation#InsuranceBusiness

0 notes

Text

Streamline your financial management with Zoho Books, an all-in-one accounting solution designed for businesses of all sizes. Automate invoicing, track expenses effortlessly, and reconcile bank statements with ease. Zoho Books offers detailed reporting, multi-currency handling, and tax compliance tools to ensure your business stays on track. Enhance your client interactions with a dedicated portal for viewing and paying invoices. Discover how Zoho Books can save you time, reduce errors, and improve your cash flow management. Start simplifying your finances today!

#ZohoBooks#AccountingSoftware#FinancialManagement#AutomatedInvoicing#ExpenseTracking#BankReconciliation#DetailedReporting#MultiCurrency#TaxCompliance#ClientPortal#BusinessEfficiency#AccountingMadeEasy#SmallBusinessSolutions#FinanceSimplified#BusinessGrowth#StreamlineAccounting#FinancialSoftware#Bookkeeping#BusinessFinance#ZohoApps

0 notes

Text

Abstract: Interactive Brokers has recently made an improvement to its FX CFD symbol search feature in the Client Portal. This update is aimed at providing a more streamlined and efficient search experience for users.

#InteractiveBrokers#FXTrading#CFDTrading#ClientPortal#UserExperience#Improvements#StreamlinedProcess#UserFeedback

0 notes

Text

The Role of Secure Patient Portals in Modern Medical Websites

0 notes

Text

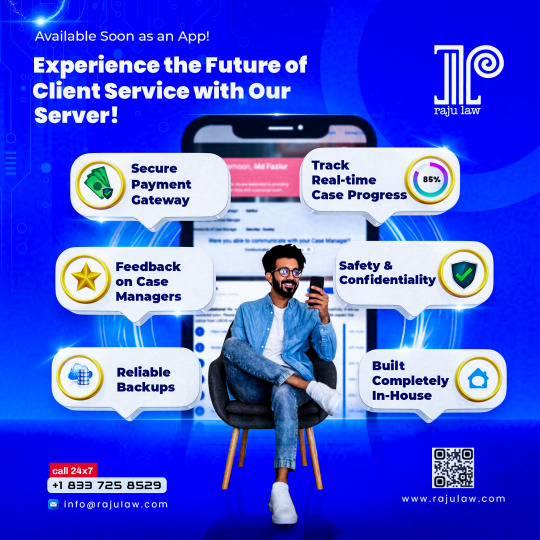

At Raju Law, we're redefining client service with our in-house built automated server! Our state-of-the-art system is designed with our client’s convenience and confidentiality in mind. Here's how we put our clients first through our server: Track the real-time progress of all your ongoing cases. Check payment history and make payments securely. Contact your case managers directly and provide feedback on the server. Enjoy utmost data safety and confidentiality—your data never goes to any third party. Our custom-built software ensures reliability with multiple backups. Access our services on-the-go with our upcoming app for Android and Apple users. Choose us for your immigration needs and experience the difference our cutting edge technology and dedication can make. Your satisfaction and privacy are always our top priorities. #ClientPortal #TechFriendly #DataSafety #SecurePayments #InHouseSoftware #LegalTech #ClientFirst #ComingSoon"

0 notes

Text

Understand the Benefits of Working with a Sports & Performance Psychologist

Working with a sports & performance psychologist can be an invaluable way to navigate and improve your mental and physical performance in any sport or activity. A sports & performance psychologist is trained to help you become the best athlete or performer that you can be, using techniques such as goal setting, relaxation, imagery, and self-talk. With their expertise, they are able to provide insight into how psychological factors may affect your performance and suggest strategies for improvement.

Sports & performance psychologists can also assist athletes in developing better awareness of their emotions, helping them recognize when they are feeling overwhelmed or anxious so that they can take steps to manage these states more effectively. This increased emotional intelligence allows athletes to make informed decisions about how to approach challenging situations on the court or field. Additionally, working with a Sports & performance psychologists in Queensland can provide an opportunity for athletes who struggle with interpersonal relationships or communication issues related to their sport find more effective ways of dealing with problems within their team environment.

Set realistic goals for yourself before working with a sports & performance psychologist. Identify any obstacles that may prevent you from achieving your goal, such as lack of resources or financial constraints. Communicate effectively with a psychologist to help you get the most out of the experience. Follow through on your treatment plan and follow through on the necessary steps to reach your desired outcome. Take notes during sessions so that you can refer back if needed.

Laura Eyles, the Senior Psychologist & Sports/ Performance Psychologist at Modern Minds, enjoys assisting people in creating distinct pathways to improve wellbeing. She has a warm, compassionate, and enthusiastic communication approach, with over 13 years of experience working with adults of all ages and backgrounds. In order to get perspective and a sense of direction for the future, Laura feels that your past and present must be integrated. She is passionate about fostering a safe space where you can feel empowered to talk about your experiences. You can book an appointment through this portal: https://clientportal.powerdiary.com/clientportal/bbdd45c3-72ef-4694-ab05-c65d021f7e26

#Sports & Performance Psychologist#Sports & Performance Psychologists in Queensland#Sports Psychologist#Performance Psychologist

0 notes

Text

3 Best Client Portal WordPress Plugins (Free + Paid)

https://technicalsphere.com/client-portal-wordpress-plugins/

1 note

·

View note

Link

Deliver the best customer experience with SuiteCRM Customer Portal. Monitors, all the customer-centric activity to convey customer satisfaction.

"Treat the customer as God "

For more info -: http://bit.ly/2ms2WKM

1 note

·

View note

Photo

www.jumppl.com is a Project & Team Management Platform that delivers measurable improvement in Team’s Productivity.

#projectmangement#workcollaboration#businesschat#workfromhome#teamproductivity#clientportal#cloudstorage

0 notes

Photo

For #september , www.bedfordstmarketing.com is working on a #seomanagement and #digitalmarketing platform to our site.... stay tuned for updates and how to access this amazing tool for #smallbusiness ... email [email protected] for more details.... @getthryv @hcalumni @stamforddowntown @stamford_connecticut #customers #marketing #digitalmarketing #business #seo #retargeting #onlinebusiness #api #clientportal #socialmediamarketing #branding #brandawareness #marketingdigital #instagood #instalike #emailmarketing (at Bedford Street Marketing) https://www.instagram.com/p/B11CqUMpGo2/?igshid=1e8vuiyj59g25

#september#seomanagement#digitalmarketing#smallbusiness#customers#marketing#business#seo#retargeting#onlinebusiness#api#clientportal#socialmediamarketing#branding#brandawareness#marketingdigital#instagood#instalike#emailmarketing

0 notes

Text

What Is Insurance Broker Management Software and How Does It Benefit Insurance Brokers?

Insurance Broker Management Software is a specialized tool designed to streamline the operations of insurance brokers by automating and organizing various processes like client management, policy administration, claims handling, and reporting. It helps brokers manage their relationships with clients, track policies and renewals, and handle claims more efficiently, ultimately enhancing productivity and client satisfaction.

Here are some key features of Insurance Broker Management Software:

Client and Policy Management: Centralized management of client details, policy information, and renewal tracking, allowing brokers to easily access customer history and manage multiple policies from a single platform.

Document Management: Securely store and manage insurance documents, proposals, and claims forms, with easy access for both brokers and clients.

Claims Processing: Streamlines the process of tracking and managing claims, from filing to settlement, ensuring transparency and quicker resolution.

Automated Renewals and Reminders: Helps brokers keep track of policy renewals and sends automated reminders to clients, reducing the risk of missed renewals.

Reporting and Analytics: Provides detailed reports on sales performance, client acquisition, claims ratio, and other important metrics, helping brokers make data-driven decisions.

Integration Capabilities: Often integrates with other tools like accounting software, email platforms, and customer support systems, providing a seamless workflow.

Client Portal: Allows clients to log in and view their policy details, download documents, and track the status of their claims, offering transparency and convenience.

Some popular examples of Insurance Broker Management Software include:

Mzapp Insurance Broker Software: Focused on CRM functionalities, client login, and policy management tailored for the Indian insurance market.

Applied Epic: A widely used platform offering comprehensive management for brokers with features like accounting integration and carrier connectivity.

HawkSoft: Known for its user-friendly interface and capabilities to automate various insurance processes, suitable for small to mid-sized brokerages.

Such software helps insurance brokers save time, improve client engagement, and efficiently handle the complexities of the insurance industry.

#InsuranceBroker#InsuranceManagement#InsuranceSoftware#CRMSoftware#EmployeeBenefits#PolicyManagement#InsuranceCRM#ClientManagement#ClaimsProcessing#InsuranceTechnology#InsurTech#InsuranceAutomation#DigitalInsurance#InsuranceSolutions#InsuranceIndia#PolicyRenewal#InsuranceBusiness#InsuranceIndustry#BrokerSoftware#InsuranceOperations#HealthInsurance#InsuranceSales#InsurancePlatform#CustomerEngagement#InsuranceBrokersIndia#BusinessGrowth#ClientPortal#PolicyTracking#ClaimsManagement#PolicyAdministration

0 notes

Link

Your clients are likely facing tight deadlines, so it’s important to have a quick and direct communication channel. Zoho Recruit’s dedicated client portal takes care of both these situations.

2 notes

·

View notes

Photo

Join our portal today to connect with jobs that match your skills and interests.

Click here --> https://www.powelsonconsulting.com/client-openings

#jobsearch #jobsearching #jobsearchtips #jobsearchadvice #jobsearchhelp #JobsearchRockStar #powelsonconsulting #jobsearchwisdom #joinnow #clientportal #Recruiting #Recruitingnow #recruitinglife #RecruitingAgency #recruitingduty

1 note

·

View note

Photo

Get paid faster with ReadyPAY Payment Services through the RC2 ReadyCOLLECT Online Application. ReadyPAY is the integrated solution that allows law firms to collect payments from debtors online through our client payment portal. For more information visit http://bit.ly/2w4TRbP

#RC2#ReadyCOLLECT#ReadyPAY#Payment#Services#CertMAIL#ClientPortal#Collections#debt collection#AssociationREADY

0 notes

Text

Wealth and millennials: how they think, spend and save, the need for a client portal.

The millennial generation – those born between the early 1980s and mid 1990s – are now either just joining the workforce, or well into their careers. As millennials gather the responsibilities of adulthood, financial and wealth management products come with the territory – this is the essence of financial mobility. Not surprisingly the wealth industry is paying close attention to this coming generation. Millennials are looking for a financial institution that will provide a first class client portal, client communication, client reporting, advisor portal, financial mobility, and digital platform

Possibly the most studied segment in history, millennials have been variously labelled as narcissistic, entitled, tech-savvy and ethically conscious. Their relationship with financial institutions is well documented. The financial crisis and subsequent scandals created a general feeling of distrust toward the industry, but millennials have started to emerge as the largest client opportunity in the coming years. In order to capitalize on the opportunity, wealth and asset managers must adapt to successfully serve this complicated and fiscally important generation. This generation specifically wants to the following tools: client portal, client communication, client reporting, financial mobility, advisor portal, and digital platform.

The growing millennial impact

Last year 40 percent of the global adult population were under 35 years old. Today they account for US $1.3 trillion in direct consumer spending in the US. This figure will balloon over the next decade as the millennial generation is projected to account for 75 percent of the workforce by 2025 (source: Bank of America Merrill Lynch).

Three trends will dictate how this population will acquire and use their wealth.

First, as the current 18-34-year-old cohort enter prime earning years, their liquid assets will increase substantially.

Second, these younger generations are seen to be more entrepreneurial than their parents, which should accelerate the increase of their available assets: Deloitte found that 54 percent of millennials have started, or plan to start, their own business – 27 percent are already self-employed.

And thirdly, millennials should benefit from a transfer of wealth from their parents, the baby-boomers, driving a future wave of inheritance that wealth managers need to prepare for.

Behavioral characteristics

So how should wealth managers adapt to serve this group successfully? Critically, you need to get a good understanding of their behaviors.

Millennials are drawn to authenticity and want this reflected in how they live, work and invest. Long-established wealth managers steeped in the traditions of stability and continuity may need to rethink their own culture and recruitment policies to connect and engage this coming generation, using a more empathetic client communication approach.

They are socially and environmentally aware, not only concerned with the state of the world, but vocal about the need for change. Which means they don’t consider profit as the sole success factor of an investment. Millennials seek out organizations and investments that prove their value with acts of social responsibility. They also seek out organizations that listen to their need for https://www.investcloud.com/MemberShip/Apps/BlueDemo_Holder_App.aspx?IX_mId=6 client portal https://www.investcloud.com/Membership/Apps/EmeraldDemo_Holder_App.aspx advisor portal https://www.investcloud.com/Membership/Apps/NavyDemo_Holder_App.aspx client communication https://www.investcloud.com/Membership/Apps/PurpleDemo_Holder_App.aspx client reporting https://www.investcloud.com/Membership/Apps/WhiteDemo_Holder_App.aspx digital platform and financial mobility tools

Nor has the impact of the global financial crisis been forgotten. This generation was greatly affected and as a result is more cautious and conservative than baby boomers. Their caution highlights the importance of client communication and financial mobility, as well as an advisor portal that provides top tier insight.

This was also the first generation to grow up in a digital platform world, acknowledging technological innovation as a constant. They adopt early. They try out new services. They value utility. They resent friction. And they expect a client portal, client communication, client reporting, financial mobility, digital platform, and advisor portal.

Their financial habits are like everything for them, always online first – it is their default setting.

For millennials, technology is the key differentiator that wealth managers must be aware of. Deloitte found that 57 percent would change banks for a better technology platform solution. There is no reason to think wealth managers are not under the same scrutiny to offer client portal and client reporting advancements as well as financial mobility.

Financial advisory adaptations

Based on these different behaviors, it is fair to assume millennials are not being satisfied. But the opportunity to do so clearly exists, and for wealth managers who react it will be greatly rewarding. To combat distrust, financial advisors need to focus on pricing transparency and become more communicative and open, ideally with new choices of alternative investments, markets and products. New products such as client portal, client communication, client reporting, advisor portal, digital platform, and financial mobility.

Most importantly, wealth managers need to better engage millennials digitally. The InvestCloud Digital Experience involves clients, provides an intuitive experience and is highly personalized, supporting many varied personas in order to work for each individual. Opportunities abound for wealth managers to advance the millennial client experience – not to mention to make advisor portal and other internal tools better for the management of this crucial client demographic. Now is the time to act.

To find out more about how we can help you digitally engage millennials, request a demo through our website at www.investcloud.com/Demo or call us at +1 (888) 800-0188.

#clientportal #advisorportal #clientcommunication #clientreporting #digitalplatform #financialmobility

www.investcloud.com

0 notes

Photo

Now that #NYBFW #BridalMarket is over and #EB #events are winding down it's time for me to get back to #Business. It maybe a gloomy rainy day here in #NYC but it's bright and cheerful in my workspace thanks to @mydubsado! I'm in the middle of #refreshing #rebranding #EventsBeyond, #EB! I have been working with a lovely design company who hooked me up with the idea to check out @mydubsado a #CRM for #creativeentrepreneurs. The best part of this rebranding has been learning about #Dubsado. I decided to dive in recently and it's been the best experience ever!! On top of everything #mydubsado offers #businessowners they have the most fabulous #facebook groups ever!!!! The #Dubsado family is the greatest #business support out there. Quick dubsado overview: send #contracts, #invoices, #questionnaires #workflows, #clientportal, and manage all things business in one system! New features just keep coming!! Trust me from #EB #businessconsultant point of view you need to join the #DubsadoFamily today! Use my code: goingbeyond to get 20% off your first month or a year. I recommend diving in and getting the yearly plan. {https://www.dubsado.com/?c=goingbeyond} Now it's time for me to get back to work. Enjoy your day and #EBBusinessTip! #clientmanagmentsystemforeventplanners #clientmanagmentsystemforcreatives #clientmanagmentsystemsforentrepreneurs. Best #customerexperience #customerservice ever!

#businessconsultant#mydubsado#business#invoices#creativeentrepreneurs#workflows#clientmanagmentsystemforeventplanners#eb#ebbusinesstip#questionnaires#clientportal#clientmanagmentsystemforcreatives#eventsbeyond#customerexperience#dubsado#bridalmarket#nyc#businessowners#rebranding#nybfw#crm#facebook#dubsadofamily#events#customerservice#refreshing#contracts#clientmanagmentsystemsforentrepreneurs

0 notes