#Capital raising

Explore tagged Tumblr posts

Text

Fueling Dreams: The Ins and Outs of Capital Raising for Start-ups

Building a successful start-up requires more than just a great idea—it takes the right financial backing. Raising capital is one of the most critical aspects of growing a business, and understanding how to approach this process effectively can determine whether a start-up thrives or fades away. Entrepreneurs often find themselves navigating a complex world of investors, funding rounds, and…

0 notes

Text

Complii committed to sophisticated FASEA requirements

Complii FinTech Solutions have taken a significant step forward in the improvement of their compliance systems by fulfilling the increasingly sophisticated FASEA requirements. FASEA requirements represents not only a significant advance for Australian financial compliance, but significant opportunities for stockbrokers to ensure their compliance into the future.

WHAT ARE FASEA REQUIREMENTS? FASEA (or the Financial Adviser Standards and Ethics Authority Ltd) was established in early 2017 with the intention of setting standards for the education and training of financial advisers across Australia. As an adviser, you need to make sure that you comply with these standards, or you could face significant sanctions.

The guidance is based on five core values, which are all central to financial advisers being trusted by their clients:

TRUSTWORTHINESS For a good relationship, clients need to trust financial advisers. To do so, financial advisers need to do what’s right in all cases, even occasionally to their own personal detriment. Integrity, honesty, and a strong sense of ethical duty being at the centre of a financial adviser’s operation increases confidence and quality of work.

COMPETENCE The ongoing development and maintenance of workspace knowledge is key to a good financial adviser, as it indicates a strong level of competence and ability within the role. FASEA recommends that in the case that an adviser is not able to help a particular client, they strive to find one with the ability to do so. By doing so, all clients get the able and talented financial adviser that they deserve.

HONESTY This one speaks for itself. A financial adviser must be honest and transparent with their clients. Beyond simply telling the truth, financial advisers should never withhold information. Honesty is the first step to trust, and trust makes a good working relationship.

FAIRNESS A financial adviser must be objective and treat all their clients equally and fairly. This includes knowing if you can actually go forward with what your client needs, and properly investigating and evaluating for a client in all cases. Therefore, whoever a client may be, they’re certain to get the best service possible.

DILIGENCE Having a strong level of diligence in every job means that each individual case has a high level of care and attention paid to it. Advisers should meticulously look through every single detail of a client’s accounts, which makes sure that the best advice possible is always given to clients and they receive the best-tailored service for their accounts.

Combining all these factors means that financial advisers are excellently equipped for any and all eventualities. Thanks to a higher level of required training, the quality of advisers going forward will significantly increase in the long run. Compliance to these guidelines demonstrates Complii’s dedication to the clientele and helps their clients manage their compliance into the future.

WHAT DOES THIS MEAN FOR INVESTORS? Investors, under the new FASEA guidelines, will have new processes to go through regarding stockbroker compliance, in order to become a sophisticated investor. This system includes sending a request to become a sophisticated investor, followed by a series of online questions and supporting documentation. Following a review, a client is either accepted as sophisticated or not.

Firstly, the wider FASEA guidelines mean that a higher level of adviser is essentially guaranteed. Whereas before, companies may have risked a worse adviser that may have slipped up in one of the five values. FASEA’s new overhauled requirements guarantee that attention will be paid to all these vital values. Financial advisers will, therefore, work to a guaranteed high standard, which is best for all investors across the country.

This enhancement in Complii’s product line means that ethical standards and guidelines are followed more thoroughly throughout Complii’s processes. Where Complii’s stockbroking compliance software was previously top of the line and ahead of industry standards, the advances made make sure that investors can be even more secure and aligned with Australian law than previously. With Complii’s continuing support for the most up-to-date compliance regulations, businesses can focus on increasing their revenues, maximising efficiency and avoid spending human resources on guaranteeing a good level of compliance.

SHOULD I USE COMPLII? In order to make sure that your company remains compliant with ever-changing compliance regulations, use Complii. Our web-based risk and compliance solution is expertly designed to automate the compliance procedures of companies and protect them from any potential legal issues and financial crimes arising from compliance issues in the future. The Complii digital platform also removes the needs for paper-based compliance, moving all compliance procedures to a secure, online platform.

Need advice as well? Our MIntegrity business unit are experts at regulatory risk and FASEA / AFSL compliance.

If you want to learn more about what Complii or MIntegrity can do for you and your company, then get in touch with a member of the team.

1 note

·

View note

Text

Global Star Capital founder Rich Cocovich recently met with principals in both New York City and Los Angeles California on a $5 Million USD entertainment sector project and bridged the gap of funding with a private California based investor. Since 1991, Cocovich has serviced clients in 126 countries and all 50 states in America as the top expert and private funding. Over 30 billion USD from private investors awaits the projects Global Star Capital and Rich Cocovich represent. If you are a solvent and prepared project principal who understands that high end, professional expertise is not free, not contingent, not pro bono, and not wrapped into a closing, then you are welcome to visit one of our two main websites www.globalstarcapital.com or https://lnkd.in/eFeNm-pb and begin in the Our Process Section. Our engagement process and fee structure is etched in stone and non-negotiable. Project principals who follow our protocol, including the mandatory face-to-face meeting steps, succeed in gaining the attention their project deserves. Within seven days of meeting Rich Cocovich in person, a greenlight from a private funding facilitator/investor will be established.

#richcocovich #globalstarcapital #privefunding #projectfunding #richcocovichreviews #globalstarcapitalreviews #cocovich #capitalraising #topconsultant #familyoffice #equity #equityfunding #projectequity #equityinvesting

#rich cocovich#global star capital#richard cocovich#private funding#richard cocovich and global star capital#rich cocovich top consultant in private funding#rich cocovich and global star capital#global star capital news#global star capital comments#rich cocovich private funding expert#private funding intermediaries#private funding project funding#project funding professionals#project funding#capital raising#global star capital information#family offices#equity funding#equity capital#equity financing#private equity#cocovich#rich cocovich review#richard cocovich review#project funding services

0 notes

Text

Global Star Capital founder Rich Cocovich recently met with principals in both New York City and Los Angeles California on a $5 Million USD entertainment sector project and bridged the gap of funding with a private California based investor. Since 1991, Cocovich has serviced clients in 126 countries and all 50 states in America as the top expert and private funding. Over 30 billion USD from private investors awaits the projects Global Star Capital and Rich Cocovich represent. If you are a solvent and prepared project principal who understands that high end, professional expertise is not free, not contingent, not pro bono, and not wrapped into a closing, then you are welcome to visit one of our two main websites www.globalstarcapital.com or www.globalstarcapital.international and begin in the Our Process Section. Our engagement process and fee structure is etched in stone and non-negotiable. Project principals who follow our protocol, including the mandatory face-to-face meeting steps, succeed in gaining the attention their project deserves. Within seven days of meeting Rich Cocovich in person, a greenlight from a private funding facilitator/investor will be established.

#richcocovich #globalstarcapital #privefunding #projectfunding #richcocovichreviews #globalstarcapitalreviews #cocovich #capitalraising #topconsultant #familyoffice #equity #equityfunding #projectequity #equityinvesting

#rich cocovich#richard cocovich#global star capital#global star capital review#rich cocovich review#entrepreneur#founder#rich cocovich funding#rich cocovich united states#rich cocovich client reviews#rich cocovich client comments#rich cocovich top consultant in private funding#globalstarcapital#global star capital information#global star capital projects#global star capital funding#global star capital customer reviews#rich cocovich and global star capital#private funding consultants#private funding project funding#privatefunding#top private funding consultant#private funding#private investors#project funding#project equity#capital raising#equity investors#equity financing#equity funding

0 notes

Text

ZENITH BANK SET TO RAISE N290 BILLION CAPITAL THROUGH RIGHTS ISSUE AND PUBLIC OFFER

Zenith Bank Plc is set to raise N290 billion through a combination of a Rights Issue and a Public Offer in compliance with the revised minimum capital requirements for Nigerian commercial banks introduced by the Central Bank of Nigeria (CBN). This announcement was made during the Zenith Bank Rights Issue/Public Offer Signing Ceremony held yesterday, July 29, 2024, at The Civic Centre, Victoria…

#- Financial growth#capital raising#CBN Regulations#Investment Opportunities#Nigerian Banks#public offer#rights issue#Shareholders#Stock Market#Touchaheart.com.ng#Zenith Bank

0 notes

Text

In the past 45 days, Global Star Capital founder Rich Cocovich has met with clients in multiple sectors, executives and established entertainment brass on multiple projects in Los Angeles, Pittsburgh, Phoenix, San Diego, Washington DC and Miami. He is a gearing up for international clients in Spain, Italy, The UAE and South Africa also. If you are a solvent and prepared project principal who understands that high end professional services are not free, not “wrapped into a closing” and not contingent then you are welcome to apply at our website www.globalstarcapital.com beginning in the Our Process section. Projects $1 Million and up are welcome. We are the top experts in private funding with clients in 126 countries and all 50 states since 1991. Our mandatory protocol is etched in stone with fre structure that includes meeting face to face. Over $30 Billion USD awaits our clients from private investors worldwide who cannot be reached without Global Star Capital and our founder.

#richcocovichreviews #richcocovich #globalstarcapital #globalstarcapitalreviews #projectfunding #projectfinance #capitalraising #equityinvesting #equityfunding #topconsultant #privateequity #privatemoney #privatefunding #funding #fundingnews

#global star capital#rich cocovich#global star capital funding#richard cocovich#global star capital review#project funding#equity investors#equity capital#capital raising#equity investor#rich cocovich top consultant in private funding#cocovich#(richard cocovich]#richard cocovich and global star capital#[rich cocovich]#rich cocovich review#rich cocovich and global star capital#global star capital customer reviews

0 notes

Text

Access North America's Largest Online Investor Community

youtube

#investment#stock markets#stocks#press release#canadian#united states#breaking news#youtube#awareness#fundraising#capital raising#Youtube

0 notes

Text

Steer Clear of These 9 Common Capital Raising Mistakes for Start-ups

Start-ups often require more capital than initially anticipated. Underestimating your funding needs can lead to a cash crunch down the road, hindering growth and operations. Factor in all potential expenses to ensure you secure sufficient capital to reach key milestones. In conclusion, avoiding these common capital raising mistakes can significantly enhance your start-up's chances of securing funding from investors who share your vision and believe in your potential. By crafting a solid business plan, conducting thorough market research, valuing your start-up appropriately, and building strong investor relationships, you'll be well on your way to a successful capital raising journey.

0 notes

Text

0 notes

Text

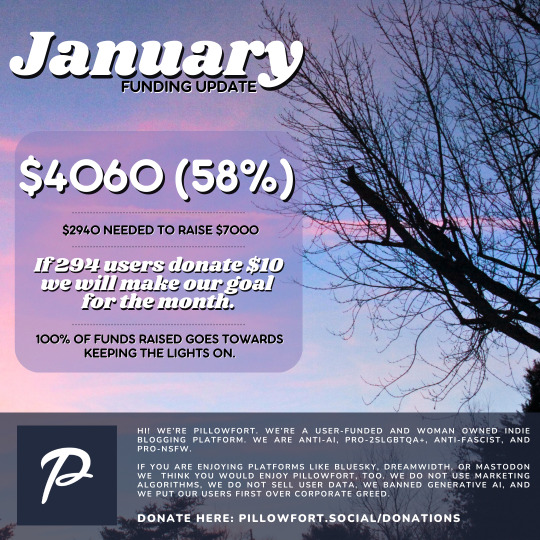

1/24 FUNDING UPDATE: $4060 / $7000 (58%)

Hi! We're Pillowfort: a 100% user-funded and woman owned indie blogging platform. We need help to meet our funding goal. The Link to Donating is available by clicking on the image above. Pillowfort is: - PRO 2SLGBTQA+ - PRO NSFW - ANTI NFTs/Crypto/GenAI - ANTI Fascist

#pillowfort#pifo#social media#twitter#facebook#yes we tagged twitter and facebook but those are trending#and we want to point out we are nothing like twitter or facebook#we aren't owned by greedy megalomaniac billionaires#we despise venture capital#also we literally aren't nazis!!!#ANYWAYS I am here with a fun weather fact for you#a heat burst is a rare phenomenon where there is sudden localized increase in air temperature near the earth's surface#the last documented case of a heat burst was september 9 2023 in schertz texas where the initial temperature was 23C and raised to 34C#that's 73F to 93F#weather is so neat!

173 notes

·

View notes

Text

Money Matters: The Dynamics of Capital Raising in Start-ups

Raising capital is one of the cornerstones of turning a startup idea into a thriving business. For most entrepreneurs, it’s not a one-time event but an ongoing process that evolves alongside the company. From early seed funding to the later stages of investment, capital raising is what enables companies to scale, hire talent, and build out their vision. While the mechanics of fundraising can…

0 notes

Text

can 2024 be the year we stop calling stay-at-home moms stupid for being ‘financially dependent’ and risking being trapped in abusive relationships, and instead start addressing why there are no social safety nets in place for people who choose to leave the workforce to raise their children

#i’m so tired of the way everyone talks about this issue#like no it actually is really fucked up that doing something which is a net positive for society (raising children)#can put someone in a potentially devastating and life ruining situation#tradwife discourse#stay at home mom#stay at home parent#feminism#anti capitalism#capitalism#star rambles

587 notes

·

View notes

Text

my secret confession is i think a lot of current art in comics is pretty but sometimes way too glossy and lifeless... it kinda feels like a sticker sheet where they just swap out generic stock poses that they have on hand for that character rather than the art being reflective of the actual story and moment the character is currently in

#does this make sense#like its generic 'heres this character with a hand on their hip. this is their idle position. their arms are stiffly raised now to talk.#theyre back to their idle pose (2nd version). heres them suddenly springing to life (aka arms over head as they fly abruptly and stiffly).#they land the exact same way everytime regardless of where theyre at (fist clenched by their sides)'#like it feels like different poses you can alternate between in a dress up game rather than being present in the story#wheres the expressions! the body language! the moment! the way they differently carry themselves!#i know im biased for older styles but :// idk it sometimes feels lifeless in a sense#but im not an artist so. cant complain too much. gorgeous art but it's like you can see where capitalism and demand to be sellable#kills any creative input or fun twist that makes that artist or that arc remarkable and rememberable#but whatever.... 70s and 80s comics save me.....#ransom note

564 notes

·

View notes

Text

Meanwhile the CEOs in the "land of the free" be like: What Are You Looking For, A Raise? Get Out!

#Meanwhile the CEOs in the “land of the free” be like: What Are You Looking For#A Raise? Get Out!#spongebob squarepants#spongebob squarepants meme#fuck ceos#ceo shooting#tech ceos#ceo second au#ceo shot#ceos#ceo down#uhc ceo#ceo information#ceo#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#class war#anti capitalism#anticeo#boycotts

80 notes

·

View notes

Text

In the past 45 days, Global Star Capital founder Rich Cocovich has met with clients in multiple sectors, executives and established entertainment brass on multiple projects in Los Angeles, Pittsburgh, Phoenix, San Diego, Washington DC and Miami. He is a gearing up for international clients in Spain, Italy, The UAE and South Africa also. If you are a solvent and prepared project principal who understands that high end professional services are not free, not “wrapped into a closing” and not contingent then you are welcome to apply at our website www.globalstarcapital.com beginning in the Our Process section. Projects $1 Million and up are welcome. We are the top experts in private funding with clients in 126 countries and all 50 states since 1991. Our mandatory protocol is etched in stone with fre structure that includes meeting face to face. Over $30 Billion USD awaits our clients from private investors worldwide who cannot be reached without Global Star Capital and our founder.

#richcocovichreviews #richcocovich #globalstarcapital #globalstarcapitalreviews #projectfunding #projectfinance #capitalraising #equityinvesting #equityfunding #topconsultant #privateequity #privatemoney #privatefunding #funding #fundingnews

#rich cocovich#global star capital#richard cocovich#private funding#richard cocovich and global star capital#private equity#equity funding#equity financing#project funding professionals#equity#project funding#equity capital#cocovich#rich cocovich top consultant in private funding#capital raising#global star capital review#rich cocovich baseball#rich cocovich review

0 notes

Text

Baby Zenos being curious of everything means Atticus can't skip out on tuning anymore and Solus gets extra hands for some of his tools.

#ffxiv#sketch#emet selch#solus zos galvus#zenos yae galvus#oc#atticus van simularus#ancient tech wizard uses the power of a cute baby to get his henchmen to stop running from check-ups#don't trust his cute little face zenos is still armed and dangerous (of poking someone's eye out)#I continue to offer my 'zenos is the favorite prince' propaganda- he's got that naming privilege and I'm gonna capitalize off of it#at least out of the four remaining during that time#and also a reason why im going to eventually write zenos working on fixing up busted machina-#i like to think he fixed that old era reaper- not really knowing why he wanted to and later slowly remembering the time he spent with emet#i simply draw the periods of time I imagine emet stealing zenos away from the maids/butlers of the palace#if varis didnt raise him directly you bet your ass im gonna use it to show zenos taking after emet lmao

76 notes

·

View notes