#CRYPTO ARBITRAGE

Explore tagged Tumblr posts

Text

Only Way to Sustain on this Bear Run Market: The Solution Crypto Arbitrage Bot

The cryptocurrency market has been experiencing a long bear run, leaving many investors grappling with significant losses. In these difficult times, the search for sustainable strategies to survive and succeed has become crucial. One such solution that is gaining traction is the crypto arbitrage bot.

The Lifeline : Arbitrage Bot

Before hearing about how arbitrage bots can be a lifeline in a bear market, it's essential to grasp the concept of arbitrage. In essence, it involves capitalizing on price differences between different cryptocurrency exchanges.

When a particular cryptocurrency is trading at different prices on two or more exchanges, an arbitrage opportunity occurs. Traders can swiftly purchase the asset on the exchange at a lower price and simultaneously sell it at a higher price, profiting from the price differential.

Duty of Bot

Manually using arbitrage opportunities is a time-consuming and often unusable task due to the quick changes in cryptocurrency prices. These refined algorithms are designed to scan multiple exchanges simultaneously, identifying price differences within milliseconds. Once an opportunity is detected, the bot automatically executes trades to capitalize on the price difference.

Sustaining in a Bear Market with Arbitrage Bots

Consistent Profitability: Unlike traditional trading strategies heavily reliant on market trends, arbitrage bots generate profits regardless of market conditions. Whether the market is bullish, bearish, or sideways, price differences continue to exist, providing consistent income streams.

Risk Comfort: Arbitrage bots primarily focus on short-term trades, reducing exposure to market volatility. By minimizing holding periods, the risk of significant price drops is significantly curtailed.

Diversification: Using an arbitrage bot allows investors to diversify their portfolios. While the broader cryptocurrency market may be experiencing a downturn, arbitrage opportunities continue across various cryptocurrencies, providing a wall against overall market volatility.

Automation and Efficiency: Manual arbitrage trading is nearly impossible due to how quickly cryptocurrency prices fluctuate. Arbitrage bots eliminate human error and execute trades, maximizing profit potential.

All-time actions: Unlike human traders who require rest, arbitrage bots operate tirelessly, round-the-clock, ensuring no profitable opportunities are missed.

Essential Concerns

While crypto arbitrage bots offer an effective solution, it's essential to approach them with caution and conduct thorough research.

Bot Reliability: Choose a reputed bot provider with a proven track record and strong security measures.

Fee Structure: Understand the fees associated with using the bot, including trading fees, subscription costs, and potential slippage.

Market Liquidity: Ensure the bot focuses on cryptocurrency pairs with sufficient liquidity to facilitate smooth trades.

Risk Management: Implement stop-loss orders and other risk management strategies to protect your capital.

Conclusion

In the challenging situation on a bear market, crypto arbitrage bots appear as a beacon of hope for investors seeking sustainable profitability. By capitalizing on price differences across different exchanges, these bots offer a consistent income stream, mitigate risks, and provide diversification benefits. While not entirely risk-free, arbitrage bots can be a valuable tool in an investor's arsenal for guiding the complexities of the cryptocurrency market.

To know about more techniques to sustain with Arbitrage Bot on Bear Market check through FREE DEMO - Crypto Arbitrage Bot Development

2 notes

·

View notes

Text

youtube

BEST ARBITRAGE TO EARN DAILY 3% RISK FREE

This video is just to show you proof of withdrawal i made from Pantrage.com I will be showing you guys my recent withdrawal of $20 made from my account and i received it instantly on my Binance wallet.

At Pantrage, their team of Crypto Experts uses Artificial Intelligence BOT to scan the top 10 Crypto Exchange Platforms and then Buy low at one Platform and sell high at another platform simultaneously.The entire process is carried out countless times a day by their team without you doing a single thing. Once the arbitrage transactions for the day have been completed, you will be paid your daily 3% earnings at the end of each trading day. Minimum deposit is $100. You also earn $5 per each referral that joins through your referral link and you can withdraw your referral bonus once it get to the $20 minimum withdrawal amount without using it for the arbitrage. Deposit and withdrawal method is by USDT only. There is no risk involved here and your funds are 100% safe. This is pure arbitrage and not a Ponzi scheme or Trading. Join through my referral link below and start earning your daily profit as well.

NB: My referral link https://pantrage.com/my-account/?wwref=abbafrye

YouTube Video: https://youtu.be/5UHj3pxSF6g

#arbitrage#crypto arbitrage#latest arbitrage#2024 arbitrage#make money online#make money from crypto arbitrage#how to make money from arbitrage#risk free arbitrage#best arbitrage#profitable arbitrage#new arbitrage#arbitrage trading#free arbitrage bot#trade arbitrage#bot arbitrage#arbitrage US#US arbitrage#best worldwide arbitrage#profit from arbitrage#Youtube

0 notes

Text

Crypto Arbitrage: Maximizing Profits in the Digital Asset World

Cryptocurrencies have revolutionized the financial landscape, offering a decentralized digital alternative to traditional currencies. Among the various strategies in this volatile market, Crypto arbitrage has garnered significant attention. This article delves into the intricate world of Crypto arbitrage, outlining its concepts, strategies, risks, and potential for profits.

Understanding Crypto Arbitrage

Cryptocurrency arbitrage is a strategy that leverages the price differences of a particular digital asset across different exchanges. It involves purchasing an asset on one exchange at a lower price and then selling it on another exchange where the price is higher. This method exploits market inefficiencies to generate profit.

The Significance of Crypto Arbitrage

In the rapidly evolving world of cryptocurrency, arbitrage plays a vital role. It contributes to market efficiency by balancing prices across exchanges, preventing significant price divergences, and fostering liquidity.

Exploring Opportunities in Crypto Arbitrage

Discovering profitable opportunities in Crypto arbitrage requires in-depth market knowledge and technical understanding. Traders use various tools and platforms to identify these discrepancies, often utilizing automated trading bots to capitalize on price differentials swiftly.

Strategies for Successful Arbitrage

Triangular Arbitrage

Triangular arbitrage involves exploiting price differences between three currencies in the same market.

Statistical Arbitrage

This strategy relies on mathematical models to identify and capitalize on temporary mispricing in the market.

Exchange Arbitrage

Utilizing differences in prices of the same asset on different exchanges is a common approach in Crypto arbitrage.

Risks and Challenges

While the potential for profit is appealing, Crypto arbitrage is not without its risks. Market volatility, transaction costs, and regulatory changes are some of the challenges that traders face in this arena.

Mitigating Risks

Traders navigate these risks by conducting comprehensive research, using reliable tools, and staying updated with market trends and news.

Importance of Speed and Accuracy

In the highly competitive Crypto market, speed and accuracy are paramount. Swift execution of trades and precise timing significantly impacts the success of arbitrage.

FAQs

What is the minimum investment required for Crypto arbitrage?

The investment threshold varies and largely depends on the trading platform. However, it's advisable to start with a reasonable sum to effectively explore opportunities.

Are there any regulatory challenges in Crypto arbitrage?

Regulatory landscapes vary across different regions, leading to challenges in compliance. Traders must stay updated on regulations to ensure legal operations.

How can one identify arbitrage opportunities?

Utilizing arbitrage bots and tracking price differentials across exchanges are effective methods to identify opportunities.

Is Crypto arbitrage risk-free?

No, Crypto arbitrage involves market risks and requires a deep understanding of the market and its dynamics.

What are the primary tools for conducting Crypto arbitrage?

Arbitrage bots, trading platforms, and analytical tools are essential for successful Crypto arbitrage.

How can beginners start in Crypto arbitrage?

Newcomers should educate themselves, start with small investments, and gradually expand their knowledge and experience in the field.

Conclusion

Crypto arbitrage presents a promising avenue for traders to capitalize on price differences in the dynamic cryptocurrency market. It demands a blend of market insights, technical expertise, and a comprehensive understanding of risks and strategies. As with any investment, careful research and continuous learning are keys to success.

0 notes

Text

CEO OF AAS-JESAM MICHAEL OPENED UP

WE MEAN BUSINESS WHEN WE SAY WE ARE HERE TO CHANGE THE NARRATIVES AND REBUILD DESTINIES. DO YOU KNOW THAT JUST $1K WORTH OF AAS TOKEN AT THE PRE-LAUNCH PRICE OF $0.0001 PHASE 1CAN COMFORTABLY GIVE YOU MORE THAN $100K WITHIN THE NEXT FEW MONTHS AS THE BULL SEASON DRAWS VERY CLOSE?ALL YOU NEED TO ACHIEVE THIS IS TO POSITION YOURSELF STRATEGICALLY. $1K CAN COMFORTABLY GIVE YOU $100K AS SOON AS AAS…

View On WordPress

#AAS ARBITRAGE TRADING SYSTEM#AAS Blockchain#AAS exchange wallet#AAS token#Arbitrage system#BINANCE#binance official#binance wallet#BITCOIN FUTURE MONEY#BNB#BTC#BULLISH#CANDLESTICK#CEO#CRYPTO ARBITRAGE#Crypto Earning#CRYPTO MINING#CRYPTOCURRENCY#Digital News#Earn money online#ETH#free airdrop.#FREE Crypto

0 notes

Text

Arbitrage Trading Strategies - A Comprehensive Guide

Arbitrage trading is a strategy that involves taking advantage of price differences between different markets or exchanges. It is a low-risk strategy, but it can be difficult to execute profitably due to the competitive nature of the market and the need for quick execution. There are two main types of arbitrage: forex arbitrage and crypto arbitrage. Forex arbitrage involves exploiting price…

View On WordPress

#arbitrage opportunity#arbitrage trading#cross-exchange arbitrage#crypto arbitrage#execute arbitrage trades#forex arbitrage#liquidity risk#successful arbitrage trading#trading bot#triangular arbitrage#volatility risk

0 notes

Text

At the request of our clients, we are launching a WhiteLabel.

We currently have several tools ready for use. Instead of spending $30-50K on purchasing unclear tokens/shieldcoins and waiting for the right moment or investing in a seed round and waiting 2-3 years, it is more profitable to buy a ready-made business and start earning immediately.

For example, a subscription to the Expert plan costs $400 per month. If you were to purchase the plan for a year, you would pay $4800. Alternatively, you could pay $10K and receive a ready-made website and the same Expert plan for a whole year. In other words, the WhiteLabel itself costs only $5K, with already connected exchanges and DEX, but you can sell the product to anyone you want.

You only purchase limits! The most important advantage - no need to hire programmers and spend thousands of dollars every month on development. You buy a turnkey ready-made business with our support.

You can learn more about it on the D page and find out in detail what is included in the plans.

0 notes

Text

Why crypto arbitrage software is good for crypto market?

PlatinX crypto arbitrage software allows for maximizing your arbitrage trading potential. It also benefits from price differences compared to any other software in the market. This platform brought a tremendous revolution in the market last year.

Learn more: https://cryptoarbitragesoftware.wordpress.com/

0 notes

Text

Crypto Arbitrage: A Comprehensive Guide to the Popular Cryptocurrency Trading Strategy (2023 Update)

Arbitrage is a time-tested technique in the world of trading, and now it’s taking the crypto world by storm. Key Takeaways Crypto arbitrage capitalizes on price discrepancies between different exchanges or trading platforms. There are various types of crypto arbitrage, including spatial, statistical, and triangular arbitrage. While profitable, crypto arbitrage comes with its own set of risks…

View On WordPress

#arbitrage opportunities#crypto arbitrage#cryptocurrency trading strategy#digital assets#price discrepancies#trading platforms

0 notes

Text

Crypto Arbitrage Maximize Profit through Market Inefficiency

Cryptocurrencies have been the talk of the town for several years, and their popularity only seems to be growing. With the rise of cryptocurrencies, a new investment opportunity has emerged – crypto arbitrage. Crypto arbitrage refers to the practice of taking advantage of price differences in cryptocurrencies across different markets or exchanges to make a profit. This article aims to provide an…

View On WordPress

0 notes

Text

A Simple Guide to Understanding Crypto Arbitrage

A Simple Guide to Understanding Crypto Arbitrage

A Simple Guide to Understanding Crypto Arbitrage : There are sometimes considerable price discrepancies across exchanges since cryptocurrency trading is still in its infancy and marketplaces are dispersed all over the globe. Arbitrage is acquiring a security or asset on one market, selling it on another at a higher price, and profiting from the transaction. This trading method allows crypto…

View On WordPress

0 notes

Text

How Effective is Crypto Algo Trading Bot in the Trading Journey

The cryptocurrency market is well-known for its volatility and quick price changes. Amidst this activity, crypto algo trading bots have appeared as effective tools for guiding the complexity of trading. These automated systems, driven by algorithms and advanced data analysis, offer the potential to improve trading efficiency and profitability. But how effective are they truly in a trader's journey?

Comprehending Crypto Algo Trading Bots

Crypto algo trading bots are computer programs developed to perform trades automatically based on predefined parameters. They work on various strategies, from simple trend-following to complex arbitrage opportunities. These bots can analyze market data at sparky speed, recognizing patterns and executing trades exactly, often exceeding human capabilities.

Key Advantages of Crypto Algo Trading Bots

Emotional detachment: One of the biggest advantages of algo trading is the elimination of human emotions. Fear and desire can often cloud judgment, leading to impulsive decisions. Bots operate in a pure sense, without emotional preferences, ensuring disciplined trading.

Speed and efficiency: Humans have limitations in processing data and responding to market changes. Algo bots can execute trades in milliseconds, capitalizing on quick opportunities that humans might miss.

All time function: The crypto market never sleeps. Algo bots can trade constantly, without the need for rest or breaks, maximizing potential profits.

Backtesting and optimization: Before deploying a bot, traders can backtest its performance on recorded data to assess its significance. This allows for the optimization of trading strategies and risk management parameters.

Diversification: Algo bots can manage numerous trading strategies simultaneously, diversifying risk and increasing the possibility for constant returns.

Impact and Success Stories

Multiple traders have reported significant benefits from using crypto algo trading bots. Some have achieved consistent profitability, outperforming manual trading strategies. These bots have been confirmed particularly effective in high-frequency trading, where speed is essential. Additionally, they can be valuable for arbitrage opportunities, using price differences across different exchanges.

However, it's essential to recognize that not all algo trading bots are created equal. The point of a bot depends on several aspects, including the underlying trading method, the quality of data used, and the bot's ability to adjust to market conditions.

Challenges and Concerns

While the potential advantages of crypto algo trading bots are important, it's crucial to approach them with real expectations. Overfitting to historical data can lead to suboptimal performance in future market conditions.

Moreover, developing and maintaining a good algo trading system requires specialized expertise and continuous monitoring. Traders should carefully evaluate the risks involved and consider their ability and help before launching into algo trading.

Conclusion

Crypto algo trading bots have the prospect of being effective tools in a trader's journey. They offer advantages in terms of speed, efficiency, and emotional detachment. While not a guaranteed path to riches, they can significantly improve trading performance when used wisely.

It's important to approach algo trading with a combination of confidence and notice. Thorough research, backtesting, and ongoing monitoring are essential for increasing the benefits and reducing risks. As with any investment, diversification is key. Combining algo trading with other strategies can help create a well-rounded investment portfolio.

In conclusion, crypto algo trading bots represent an exciting frontier in the world of trading. While challenges exist, the potential rewards are significant for those who approach this technology with knowledge and discipline.

Get a opportunity to grab a FREE DEMO - Crypto Algo Trading Bot Development

2 notes

·

View notes

Text

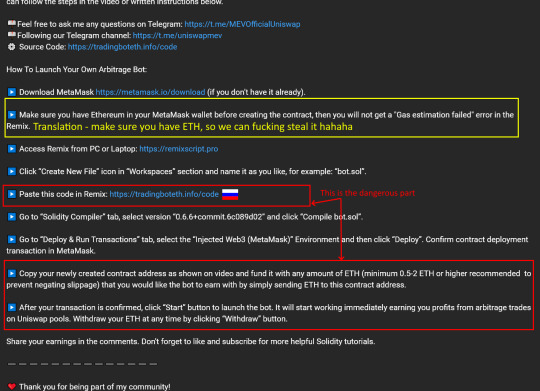

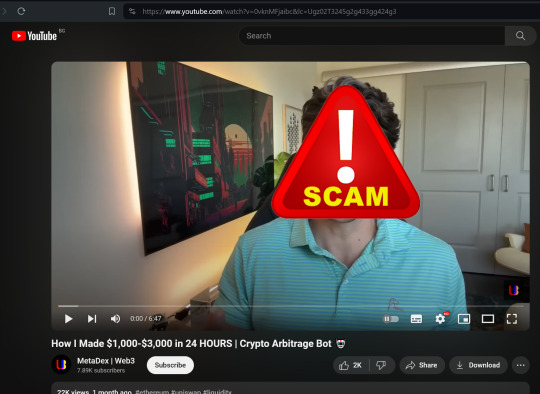

Uniswap MEV arbitrage scams

Thanks to AI TechBro garbage, scammers now have full fledged multi-social media network posts, interlinked to each other, where BOTS comment on how much money they have made, all fueled by AI, and BOTS.

Social media platforms like Youtube and X/Twitter supposedly also use AI, to try and combat abuse, but for whatever reason their AI Is "dumber" that the one used by the scammers, or the scammers just spawn attacks non stop, so suspending one or two of the scam accounts has no real world effect on the overall scam operation's success.

It is all a scam, of course.

Uniswap arbitrage MEV bot scams work this way:

1. Scammers post videos with instructions how to make money via "ArBiTraGe".

In this scam, users' deposited Ethereum is not used for automatic arbitrage, but is directly transferred to the hacker's address.

2. In the video on Vimeo or Youtube there are steps, one of which is grab code and run it!

3. Running the code results in theft of assets and the victim's wallet being DRAINED.

The scammers also post wallets full of ETH to increase the credibility of their scam.

The scam works by exploiting a legitimate platform, by pasting SCAM solidity code. The said code is posted on a dodgy website registered in Russia (how totally unexpected).

A very nice looking gentleman with a sexy moustache baits naïve users, who believe they can make something out of nothing to loose the little ETH they may have.

One of the steps users are instructed to make is COPY and PASTE solidity code, which drains their assets.

Essentially this scam is asking users to shoot themselves in the foot, by copy pasting and executing malicious code themselves, all while thinking "I am so smart".

It is not as dumb as entering your seed phrase directly, so many gullible users may get fooled.

And hosted on Russian Criminal IP, which hosts ONLY scams, nothing else:

Remember MEV Bot = SCAM!

https://www.youtube.com/@MetaWeb3x --> Scammer

https://x.com/DeWolfKelley --> Scammer

Same scam, different name. arbitrageservice.info arbitrageuni.com arbitrageuni.info arbitrageuni.net arbitrageuni.org basetake.info bincap.info blnance.shop blog.events.solllet.io botarbitrageservice.info botechnology.info botstrategy.info chamathcap.info chamathcapital.info claim.seedity.fun codecompile.pro codecompilleremix.com codedeploy.tech codesetup.pro coingive.info community.uni-arbitragebot.info compilercode.pro compileremix.com compileremixscript.tech compilerscript.pro compilescript.pro contractcompiler.pro contractdeploy.pro cryptapple.com czbinance.info davincij.info driden131.site eth-arbitrages.com eth-arbitrages.info eth-arbitrages.net eth-arbitrages.org eth-holesky.com eth-strategy.info eth-tradebot.info etharbitrages.com etharbitrages.info etharbitrageservice.com etharbitrageservice.info ethbotprovider.info ethereum-arbitrage.com ethereum-arbitrage.info ethereum-arbitrage.net ethremixcompile.pro ethstrategybot.info fond-xrp.com fundxrp.info gemlni.info hold-xrp.info idecompile.pro litecoln.info ltcdrop.info marfian.life mev-arbitrage.com mev-arbitrage.info mev-arbitrage.org mev-arbitrage.pro mev-arbitrages.info mevbot.info mevbotsetup.com mevsetuparbitrage.info mevstrategy.company mevtradingtool.info msiafetrburner.com ovvl.games owlgames.click pontem.life pop.uni-arbitrage.com remixcompiledeploy.com remixcompilercode.pro remixcontractcreate.pro remixcontractsetup.pro remixdeploy.pro remixdeploycompile.com remixdeploycontract.com remixdeploycontract.pro remixdeployide.com remixdeploying.pro remixethcontract.com remixethcontract.pro remixidecode.pro remixidecompile.pro remixscriptdeploy.pro remixscripts.tech remixsetupcompiler.pro remixsetupdeploy.pro remixsoliditydeploy.pro restake.online scriptremix.pro seedfiy.fun seedify.cloud seedifysolar.fun seedity.fun seedlfy.fun setarbitrage.info setuptradingbot.info shibatokens.info shibtake.info shlbainu.com shlbatoken.com shlbatoken.info shlbatokens.com shlbtoken.info socialcap.info solcasino.site solllet.io spotxrp.info strategiestrading.info strategyarbitrage.com strategybot.info strategyeth.info strategymevbot.info strategytrading.info tradingarticle.info tradingbotarbitrage.info tradingboteth.info tradingbotstrategy.info tradingservice.info tradingsetup.info umngawwwm.unimevarbitrage.info uni-arbitrage.com uni-arbitrage.info uni-arbitrage.net uni-arbitragebot.info uni-arbitrages.com uni-arbitrages.info uni-arbitrages.net uni-arbitrages.org uniarbitrage.com uniarbitrages.com unibotservice.com unimevarbitrage.info uniservicebot.info unitradingservice.info videoloader.info videosourcearbitrage.info videosourcetrading.info vpn.solllet.io webarbitragebot.info webarbitragestrategy.info webmevservice.info webtradingbot.info webtradingstrategies.info winklcap.info winklebit.info winklecap.info

Remember MEV Bot = SCAM!

#uniswap#scam#MEV scam#mev#crypto#phishing#erc20#smart contracts#arbitrage#uni swap#ddos guard ru#reg ru#youtube#vimeo

53 notes

·

View notes

Text

Crypto-Forex Arbitrage: Strategies for Maximizing Profits

Crypto-Forex arbitrage involves leveraging the price differences between cryptocurrencies and traditional currencies across various exchanges. This strategy aims to maximize profits by exploiting these discrepancies. Understanding and implementing effective arbitrage strategies can help traders capitalize on market inefficiencies. Understanding Arbitrage Arbitrage is a trading strategy that…

#Arbitrage Strategies#Automated Trading#Bitcoin#Crypto#Crypto-Forex Arbitrage#Cryptocurrency#Exchange Rates#Forex#Forex Trading#Liquidity#Market Conditions#Market Inefficiencies#Market News#Market Volatility#Price Movements#Profitability#Security#Spatial Arbitrage#Statistical Arbitrage#Trading Bots#Trading Strategy#Transaction Costs#Triangular Arbitrage#Volatility

3 notes

·

View notes

Text

Exploring the World of Crypto Arbitrage

CASHBITEX

In the fast-paced realm of cryptocurrency, traders are always on the lookout for opportunities to profit. One such strategy that has gained popularity in recent years is crypto arbitrage. In this article, we will delve into the intricacies of crypto arbitrage, explaining what it is, how it works, and whether Cryptocurrency arbitrage involves exploiting price differences of the same cryptocurrency on different exchanges. It's like buying low and selling high, but with digital assets. Traders aim to profit from market inefficiencies that lead to price divergences between exchanges.

Understanding Arbitrage in Finance

Arbitrage is a common practice in the financial world. It refers to the simultaneous purchase and sale of an asset to profit from differences in its price. In the context of cryptocurrency, these price differences can be substantial, offering a lucrative opportunity for traders.

Crypto Markets: A Brief Overview

Before diving into arbitrage, it's essential to understand the cryptocurrency markets. They operate 24/7, allowing for continuous trading across the globe. Cryptos like Bitcoin, Ethereum, and Litecoin are traded on numerous exchanges, each with its pricing dynamics.

How Crypto Arbitrage Works

Crypto arbitrage exploits price differences between exchanges. A trader buys the cryptocurrency on the exchange with the lowest price and sells it on the exchange with the highest price, pocketing the difference as profit.

Types of Crypto Arbitrage

5.1. Statistical Arbitrage

Statistical arbitrage relies on mathematical models and historical data to identify arbitrage opportunities. It's a data-driven approach that requires advanced analytical skills.

5.2. Spatial Arbitrage

Spatial arbitrage involves buying and selling the same cryptocurrency on different exchanges located in various geographical regions. Time zone differences and market dynamics can create price variations.

5.3. Temporal Arbitrage

Temporal arbitrage focuses on price differences that occur over time. Traders look for opportunities where a cryptocurrency's price fluctuates predictably during specific hours or days.

Risks and Challenges

While crypto arbitrage can be profitable, it's not without risks. Market volatility, exchange fees, and execution times can erode profits quickly. Additionally, regulatory changes can impact the legality of arbitrage practices.

The Tools of the Trade

Successful arbitrageurs rely on advanced trading bots and software that can execute trades swiftly and accurately. These tools are essential for capitalizing on fleeting opportunities.

Choosing the Right Cryptocurrencies

Not all cryptocurrencies are suitable for arbitrage. Traders must carefully select assets with sufficient liquidity and trading volumes to ensure smooth transactions.

Setting Up Your Arbitrage Strategy

Creating a well-defined arbitrage strategy is crucial. It should include criteria for selecting exchanges, risk management, and profit-taking strategies.

Executing Arbitrage Trades

Executing trades promptly is vital for success. Traders must be vigilant and ready to act when an opportunity arises.

Tax Implications of Crypto Arbitrage

Tax authorities are paying close attention to crypto transactions. Traders should be aware of the tax implications of their arbitrage activities to avoid legal issues.

Crypto Arbitrage: Legal Considerations

The legal status of crypto arbitrage varies from one jurisdiction to another. It's essential to understand the regulatory environment in your area and comply with any relevant laws.

Is Crypto Arbitrage Worth It?

The profitability of crypto arbitrage depends on various factors, including market conditions and the trader's skills. While it can be lucrative, it's not a guaranteed way to riches.

Success Stories: Real-Life Examples

Explore inspiring success stories of individuals who have made a significant profit through crypto arbitrage.

Conclusion

Crypto arbitrage offers a unique opportunity for traders to profit from the volatile cryptocurrency markets. However, it's not a risk-free venture and requires careful planning, execution, and compliance with legal regulations.

FAQs

1. Is crypto arbitrage legal?

Crypto arbitrage's legality varies by jurisdiction. It's essential to research and understand the regulations in your area before engaging in arbitrage activities.

2. Can I start crypto arbitrage with a small budget?

While it's possible to start with a small budget, higher capital can yield more significant profits in crypto arbitrage due to transaction fees and potential price discrepancies.

3. Are there any risks involved in crypto arbitrage?

Yes, crypto arbitrage carries risks such as market volatility, exchange fees, and regulatory changes. Traders should be aware of these risks and manage them effectively.

4. Do I need advanced technical skills for crypto arbitrage?

While technical skills can be helpful, many trading bots and tools simplify the process, making it accessible to traders with varying levels of expertise.

5. How can I stay updated on arbitrage opportunities?

Staying informed about crypto market developments and using real-time tracking tools can help you identify and capitalize on arbitrage opportunities.

0 notes

Text

HOW TO DEPOSIT INTO AAS AFRIQ ARBITRAGE SYSTEM

STEP ONE Once you login to your dashboard If you are yet to register click here first, then process to login You will see your dashboard like the screenshot below STEP TWO Then click on Deposit and another drop-down will show STEP THREE Then click on deposit as shown on the red arrow below STEP FOUR Click on Select wallet and choose Tether(Min:20 USDT) Then type the amount of what you…

View On WordPress

#AAS ARBITRAGE TRADING SYSTEM#Arbitrage system#BINANCE COMPETITIVE#binance official#binance wallet#BITCOIN FUTURE MONEY#BTC#Coinbase#CRYPTO ARBITRAGE#Crypto Earning#CRYPTO MINING#CRYPTOCURRENCY#Earn money online#FREE Crypto

0 notes