#cross-exchange arbitrage

Explore tagged Tumblr posts

Text

Arbitrage Trading Strategies - A Comprehensive Guide

Arbitrage trading is a strategy that involves taking advantage of price differences between different markets or exchanges. It is a low-risk strategy, but it can be difficult to execute profitably due to the competitive nature of the market and the need for quick execution. There are two main types of arbitrage: forex arbitrage and crypto arbitrage. Forex arbitrage involves exploiting price…

View On WordPress

#arbitrage opportunity#arbitrage trading#cross-exchange arbitrage#crypto arbitrage#execute arbitrage trades#forex arbitrage#liquidity risk#successful arbitrage trading#trading bot#triangular arbitrage#volatility risk

0 notes

Text

Spookyswap is a decentralized exchange built on the Fantom blockchain that offers a wide range of trading opportunities for users. Understanding the different strategies for trading on Spookyswap can help you maximize your profits and minimize risks.

One popular strategy on Spookyswap is liquidity farming. By providing liquidity to the trading pairs on Spookyswap, users can earn rewards in the form of the native token, BOO. Liquidity farming involves depositing assets into liquidity pools, which are then used for trading on the platform. The more liquidity you provide, the higher your potential rewards. However, it's important to consider the risks associated with impermanent loss when participating in liquidity farming.

Another strategy is arbitrage trading, which involves taking advantage of price differences between different exchanges. Since Spookyswap is connected to other decentralized exchanges through cross-chain bridges, there can sometimes be price discrepancies between different platforms. By buying assets on one exchange and selling them on another at a higher price, traders can profit from these price differences.

Swapping tokens is another fundamental trading strategy on Spookyswap. The platform supports a wide range of tokens, including stablecoins, governance tokens, and tokens from different blockchain networks. By swapping tokens on Spookyswap, traders can take advantage of market movements and access different assets efficiently.

Lastly, yield farming is another strategy that allows users to earn additional rewards by staking their tokens in specific pools. By providing liquidity or staking their tokens, users can earn additional rewards in the form of BOO tokens. Yield farming can be a profitable strategy, but it's important to carefully consider the risks and rewards o

2 notes

·

View notes

Text

THINGS I HAVE LEARNED THAT I DON’T WANT TO FORGET, FOR THE FUTURE

Will be updated

1. When you’re getting a house, make sure you have a copy of the underground floor plans, with things like the pipe/ water systems. Show it to a plumber and find out if the system is convenient to detect and fix leakages, etc.

2. Avoid high risk, high funding businesses that you barely have any experience in. Also, if you borrow from friends to fund it - avoid friends that live abroad because if the business collapses, the exchange rate increases will mean you’ll have to pay moreeeee money than you borrowed and you didn’t even have that in the first place.

3. Never use your own house as collateral for business bank loans unless you’re 95% and above sure it will be highly profitable.

4. Being wealthy > being busy or prominent. Avoid opportunities that will not easily translate into tangible economic benefit. It is a waste of time (this OBVIOUSLY does not refer to philanthropic venture of course)

5. Make use of arbitrage! Expected changes in exchange rates and pay in the dominant currency.

6. Double check, confirm, cross check, confirm, pester, bother, worry until you’re sure whatever it is you need confirmation on is fully confirmed. Never leave room for doubt if it is avoidable .

2 notes

·

View notes

Text

Global Arbitrage Funds Explained: Key Insights for Investors Seeking Diversification

In an increasingly interconnected financial landscape, investors seek opportunities beyond domestic markets to enhance returns and manage risks. Global Arbitrage Funds are an investment vehicle designed to exploit price inefficiencies across international markets. These funds leverage various arbitrage strategies to generate returns, making them an attractive option for diversification. This guide explores the mechanics of global arbitrage funds, their benefits, associated risks, and key factors investors should consider before adding them to their portfolios.

What Are Global Arbitrage Funds?

A Global Arbitrage Fund operates by taking advantage of price differences in securities across different geographical markets. These discrepancies may arise due to variations in market efficiencies, time zones, regulatory structures, and investor behavior. The fund managers employ complex strategies to capitalize on these inefficiencies while aiming to minimize risk exposure.

Key Characteristics:

Geographical Arbitrage: The ability to capitalize on pricing differentials across international stock exchanges.

Market Inefficiencies: Exploiting variations in asset prices due to diverse regulatory environments.

Risk Mitigation: Employing hedging strategies to manage exposure to currency fluctuations and economic shifts.

Strategies Employed by Global Arbitrage Funds

Global arbitrage funds utilize multiple approaches to maximize returns. Below are the most common strategies:

1. Statistical Arbitrage

This involves leveraging quantitative models to identify mispricings in securities. Fund managers use algorithmic trading techniques to execute high-frequency trades and profit from short-term market inefficiencies.

2. Merger Arbitrage

When a company announces an acquisition or merger, arbitrageurs capitalize on the price difference between the acquiring and target companies. This strategy involves buying the target company’s stock and short-selling the acquiring firm’s stock.

3. Currency Arbitrage

By trading different currency pairs across markets, investors benefit from exchange rate discrepancies caused by variations in interest rates and economic conditions.

4. Cross-Border Arbitrage

Investors identify assets that trade at different valuations in multiple countries due to varying investor sentiment, regulations, or tax implications.

5. Fixed Income Arbitrage

This strategy focuses on exploiting price inefficiencies in government and corporate bonds. Traders take advantage of yield differences across global financial markets.

Risks Involved in Global Arbitrage Funds

1. Market Volatility

Price discrepancies can be temporary and influenced by sudden geopolitical events or economic crises, leading to potential losses.

2. Regulatory Risks

Diverse regulatory frameworks across global financial markets pose challenges to arbitrage strategies. Compliance issues can impact trade execution and returns.

3. Currency Fluctuations

Investing in different countries exposes funds to foreign exchange risk. Unfavorable currency movements can erode gains unless appropriate hedging mechanisms are in place.

4. Liquidity Risks

Some arbitrage opportunities exist in low-liquidity markets, making it difficult to exit positions without incurring losses.

5. Operational Risks

Global arbitrage funds rely on advanced trading systems and algorithms. Any technological failure or error in execution can lead to substantial financial setbacks.

The Role of Global Arbitrage Funds in Portfolio Diversification

Investing in global arbitrage funds can be beneficial for diversification purposes. These funds typically have low correlation with traditional asset classes, reducing overall portfolio volatility. Key advantages include:

Hedging Against Domestic Market Risks: Exposure to multiple markets mitigates the impact of downturns in any single economy.

Enhanced Return Potential: Leveraging arbitrage opportunities enhances profit margins beyond conventional investment strategies.

Adaptive Strategies: These funds adjust dynamically to changing market conditions, ensuring agility in volatile periods.

Case Studies: Successful Arbitrage Opportunities

Case Study 1: Volkswagen-Porsche Merger Arbitrage

In 2008, hedge funds engaged in merger arbitrage when Porsche attempted to acquire Volkswagen. Short sellers anticipated a price correction but were caught in a short squeeze, leading to significant gains for arbitrage investors who positioned themselves correctly.

Case Study 2: Nikkei Futures Arbitrage

Institutional traders have frequently leveraged the price difference between the Nikkei 225 futures trading on the Osaka Stock Exchange and the Chicago Mercantile Exchange. This arbitrage opportunity has provided consistent profits to high-frequency trading firms.

How to Assess a Global Arbitrage Fund Before Investing

Investors should conduct thorough due diligence before committing capital to a global arbitrage fund. Key evaluation metrics include:

1. Fund Performance History

Examine historical returns, volatility levels, and risk-adjusted performance metrics such as the Sharpe ratio.

2. Fund Manager Expertise

The experience and track record of fund managers play a crucial role in execution success. Investors should evaluate their expertise in handling arbitrage strategies.

3. Expense Ratios and Fees

Management fees and performance-based charges can impact net returns. Compare these costs across multiple global financial services companies.

4. Risk Management Strategies

Ensure that the fund has effective hedging mechanisms and compliance frameworks in place to mitigate risks.

5. Regulatory Compliance

Verify if the fund complies with international financial regulations and operates under reputable jurisdictions.

Conclusion

Global Arbitrage Funds offer a compelling investment strategy for those looking to capitalize on market inefficiencies while achieving portfolio diversification. However, understanding the underlying risks and strategies is crucial for successful investment outcomes. By carefully assessing fund performance, management expertise, and risk mitigation approaches, investors can make informed decisions to optimize their returns.

For more information on global arbitrage funds and investment opportunities, visit Radiant Global Fund or explore their investment suite.

FAQs

1. What is an arbitrage fund?

An arbitrage fund is a type of investment fund that exploits price discrepancies in financial markets to generate returns. It employs strategies such as merger arbitrage, currency arbitrage, and statistical arbitrage to capitalize on market inefficiencies while aiming for low-risk profit opportunities.

2. Is an arbitrage fund better than FD?

Arbitrage funds often offer better returns than fixed deposits (FDs) but come with higher risk. While FDs provide guaranteed returns, arbitrage funds capitalize on market inefficiencies, making them more volatile yet potentially more profitable over the long term.

3. What are the disadvantages of arbitrage funds?

The key disadvantages include market volatility, regulatory risks, liquidity constraints, and operational challenges. Additionally, arbitrage opportunities may not always be available, leading to inconsistent returns.

4. Can you lose money in arbitrage?

Yes, while arbitrage is considered low-risk, it is not risk-free. Market fluctuations, unexpected regulatory changes, and liquidity issues can lead to losses in arbitrage funds.

5. Is arbitrage risk-free?

No investment is entirely risk-free. Arbitrage strategies attempt to minimize risk, but factors such as market instability, execution delays, and unexpected macroeconomic shifts can affect profitability.

6. Is an arbitrage fund tax-free?

Arbitrage funds are subject to taxation based on the holding period. In many jurisdictions, short-term capital gains tax applies if held for less than a year, while long-term capital gains tax may be lower.

7. Can I make money from arbitrage?

Yes, investors and traders can make money from arbitrage by identifying price inefficiencies and executing trades quickly. However, it requires expertise, technology, and timely execution.

8. Is arbitrage legal or not?

Arbitrage is completely legal and widely practiced in financial markets. However, some forms, such as insider trading-based arbitrage, are illegal and subject to strict regulatory scrutiny.

#geographical arbitrage#global arbitrage#global arbitrage fund#global direct investment#global equity fund#global financial firm#global financial markets#global financial services company#global foreign investment#global funds#global idea archive fund

0 notes

Text

The Hidden Algorithm: How HFT and Risk Parity Shape the Forex Market The Underground Truth About HFT & Risk Parity in Forex When traders hear high-frequency trading (HFT) and risk parity, they usually imagine institutional titans pulling the strings behind the scenes, executing trades faster than you can say "stop-loss." And you’d be right. But what if I told you these strategies don’t just belong to Wall Street giants? Understanding the hidden mechanics behind HFT and risk parity could change the way you approach Forex trading. If you've ever wondered why price movements sometimes feel like they're predicting your every move, congratulations—you’ve been playing against the fastest, smartest, and most ruthless traders in the game. Let’s break it down, ninja-style. Why You Keep Losing to Machines Imagine you’re playing a game of chess, but your opponent sees 20 moves ahead while you’re still figuring out which piece to move. That’s HFT in a nutshell. HFT: The Speed Demon of Forex HFT is all about speed—using algorithms and co-located servers (placed physically close to exchange data centers) to execute trades in milliseconds. These systems exploit micro-second inefficiencies and capitalize on them before retail traders even get a chance to react. How HFT Affects You (Without You Even Knowing It) - Quote Stuffing – HFT firms flood the market with fake orders to create an illusion of liquidity. This manipulates the bid-ask spread and tricks traders into making impulsive moves. - Latency Arbitrage – If you’re using a traditional retail broker, your trade execution is already a step behind. HFT traders front-run your orders by milliseconds and profit from your trades before they even execute. - Stop-Hunting with Speed – Ever felt like the market is hunting your stop-loss? That’s because HFT bots analyze clustered stop-loss levels and execute rapid-fire liquidations, forcing market shifts. So, how do you beat the bots? We’ll get there. But first, let’s talk about another hidden force driving market behavior: risk parity. Risk Parity: The Silent Market Shaker Risk parity strategies don’t get as much attention as HFT, but they quietly dictate massive capital flows. The idea behind risk parity is simple: allocate capital based on risk-weighted exposure rather than equal capital allocation. Institutions use volatility-adjusted leverage to balance risk across asset classes. Why Risk Parity Moves Forex Markets - Leverage Magnifies Impact – Risk parity portfolios heavily rely on leverage to balance risk-adjusted returns. This means minor shifts in volatility cause massive capital reallocations. - The Volatility Paradox – Low volatility lulls traders into overleveraging. But when volatility spikes, forced deleveraging triggers liquidation cascades—wiping out retail traders in the process. - Cross-Asset Connections – Forex, bonds, and equities are all interconnected under risk parity models. If stock markets crash, risk parity funds unwind their positions, and guess what? Forex markets feel the shockwaves. If you’ve ever felt like market moves are predicting your emotions, now you know why. These strategies are designed to react before you do. How to Outsmart the Machines and Trade Smarter 1. Stop Trading Like a Human, Think Like an Algo - Avoid predictable trading behaviors—if your stop-loss is at an obvious level, HFT bots will find it. - Use non-linear risk management: Instead of fixed stop-losses, consider time-based exits or dynamic trailing stops. - Trade during off-peak hours when HFT activity is lower (Asian session for non-JPY pairs). 2. Hedge Against Risk Parity Unwinds - Watch for volatility spikes in other asset classes (VIX, bond yields) as early warning signs. - Reduce leverage during prolonged periods of low volatility—because the unwinding phase will be brutal. - Focus on currency pairs not heavily influenced by equities and bonds (e.g., exotic pairs). 3. Use Smart Trading Tools - Algorithms are beating retail traders because they have superior execution speed. You may not have an HFT bot, but you can use smart trading tools to level the playing field. - Try our Smart Trading Tool to optimize lot sizes and risk management: https://www.starseedfx.com/smart-trading-tool - Track real metrics with a free trading journal to identify weak points: https://www.starseedfx.com/free-trading-journal Final Takeaways: The Cheat Sheet - HFT exploits speed and micro-inefficiencies—avoid being predictable and use dynamic risk management. - Risk parity strategies influence massive market flows—watch for volatility spikes in correlated asset classes. - Retail traders lose because they lack execution speed—use automated tools to enhance trade efficiency. Want to stay ahead of the algorithms? - Get real-time Forex insights: https://www.starseedfx.com/forex-news-today - Join the StarseedFX community for elite insights: https://www.starseedfx.com/community Don’t just trade—trade smarter. The machines won’t wait for you to catch up. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Revolutionizing Cryptocurrency Trading: The Rise of Advanced Crypto Arbitrage Bots

In the fast-paced world of cryptocurrency, staying ahead of the competition requires speed, precision, and innovation. Enter the Crypto Arbitrage Trade Bot — a cutting-edge technology designed to exploit market inefficiencies and maximize profitability. These bots have become indispensable for traders and institutions alike, offering a seamless, automated solution to the complex world of cryptocurrency arbitrage trading.

In this article, we will explore the mechanics, benefits, and trends of Arbitrage Trading Bot Solutions, while showcasing how Mobiloitte is pioneering Crypto Arbitrage Solutions to revolutionize cryptocurrency trading.

Understanding Arbitrage in Cryptocurrency Markets

Arbitrage trading is a strategy that involves buying a cryptocurrency on one exchange where the price is lower and selling it on another exchange where the price is higher, capturing the difference as profit. In the volatile crypto market, price discrepancies are common due to factors like liquidity variations, trading volumes, and regional demand.

However, executing arbitrage trades manually is highly challenging due to the rapid nature of market movements. This is where Cryptocurrency Arbitrage Bots step in, automating the process to execute trades faster and more efficiently than any human could.

How Do Crypto Arbitrage Bots Work?

A Crypto Arbitrage Technology uses advanced algorithms and automation to identify and act on price discrepancies across cryptocurrency exchanges. Here’s how they operate:

Market Monitoring: Bots continuously scan multiple cryptocurrency exchanges to detect price differences for trading pairs like BTC/USDT, ETH/USDT, and others.

Trade Execution: Once an opportunity is identified, the bot executes simultaneous buy and sell trades to capture the profit margin.

Fee Optimization: The bot calculates transaction fees and adjusts strategies to ensure profits are maximized after costs.

Real-Time Speed: These bots operate within milliseconds, significantly reducing the risk of losing opportunities due to price corrections.

Types of Cryptocurrency Arbitrage Bots

1. Simple Arbitrage Bots

Focus on price differences between two exchanges.

Ideal for beginners and traders seeking low-risk opportunities.

2. Triangular Arbitrage Bots

Exploit price discrepancies between three trading pairs within a single exchange.

For example, trading BTC → ETH → USDT → BTC to secure profits.

3. Statistical Arbitrage Bots

Use historical price data and machine learning to predict price movements and identify arbitrage opportunities.

4. Decentralized Exchange (DEX) Arbitrage Bots

Operate on blockchain-based exchanges, leveraging smart contracts for secure and efficient arbitrage trades.

Key Benefits of Crypto Arbitrage Bots

1. Automation and Speed

Manual trading is time-consuming and prone to human error. Automated Crypto Arbitrage ensures trades are executed instantly, 24/7, without the need for constant supervision.

2. Risk Mitigation

By completing trades almost instantaneously, Arbitrage Trading Automation minimizes market exposure and reduces the risk of price fluctuations.

3. Scalability

With Advanced Trade Bots, traders can monitor and execute arbitrage opportunities across dozens of exchanges simultaneously, enabling greater scalability.

4. Maximized Profits

Through Crypto Trade Optimization, bots minimize fees and latency, ensuring every trade yields the highest possible profit.

Mobiloitte: Your Partner in Arbitrage Trading Bot Development

At Mobiloitte, we are leaders in creating Expert Arbitrage Bots that empower traders to unlock the full potential of cryptocurrency markets. Our Mobiloitte Arbitrage Solutions are tailored to meet the diverse needs of both individual traders and institutional investors.

Key Features of Mobiloitte Arbitrage Bots:

Real-Time Monitoring: Continuously scan multiple exchanges for the best arbitrage opportunities.

Cross-Exchange Compatibility: Fully compatible with leading centralized and decentralized exchanges.

Smart Execution Algorithms: Leverage AI and machine learning to optimize trading decisions.

Customizable Settings: Allow traders to define risk thresholds, preferred trading pairs, and profit margins.

Secure Infrastructure: Built with robust encryption and secure API integrations to protect user assets.

Multi-Currency Support: Trade across a wide range of cryptocurrencies, stablecoins, and altcoins.

With Mobiloitte’s Blockchain Arbitrage Bots, traders can achieve higher efficiency, profitability, and confidence in their trading strategies.

Trends Shaping Crypto Arbitrage Solutions

1. Rise of AI in Trading

AI-driven Crypto Trading Bots are becoming increasingly popular, as they enhance decision-making by analyzing market trends and predicting arbitrage opportunities.

2. Decentralized Finance (DeFi)

The growing adoption of DeFi platforms has opened up new opportunities for arbitrage trading, particularly on decentralized exchanges where price discrepancies often persist longer.

3. Global Adoption of Cryptocurrencies

As more countries embrace cryptocurrencies, the number of exchanges and trading opportunities is expanding, driving demand for Automated Arbitrage Systems.

4. Institutional Participation

Financial institutions and hedge funds are adopting Cryptocurrency Trading Automation to optimize portfolio performance and capture market inefficiencies.

Challenges in Arbitrage Trading Automation

Despite its advantages, arbitrage trading is not without its challenges:

Transaction Fees: High fees on some exchanges can erode profits. Mobiloitte Arbitrage Solutions are designed to optimize trade execution and minimize costs.

Latency: Delays in executing trades across exchanges can result in missed opportunities. Mobiloitte’s Advanced Trade Bots are engineered for ultra-low latency trading.

Regulatory Compliance: Navigating the legal complexities of arbitrage trading across different jurisdictions is crucial for sustainable operations.

Liquidity: Ensuring adequate liquidity on both buying and selling exchanges is critical for successful arbitrage trades.

Why Choose Mobiloitte for Crypto Arbitrage Solutions?

Mobiloitte stands out as a trusted partner for Trading Bot Development, delivering robust and innovative solutions tailored to your specific trading needs. Here’s why:

Industry Expertise: Years of experience in blockchain and cryptocurrency development.

Cutting-Edge Technology: Advanced tools for Crypto Arbitrage Technology and trade optimization.

Customization: Solutions designed to align with your trading strategies and risk appetite.

Proven Success: A track record of enabling clients to achieve higher profitability through Automated Crypto Arbitrage.

Case Study: Achieving Success with Mobiloitte

A prominent cryptocurrency fund partnered with Mobiloitte to implement a custom Cryptocurrency Arbitrage Bot. The result? A 40% increase in monthly returns through optimized trading strategies and seamless automation across 15 exchanges. The client now uses our Automated Arbitrage Systems to maintain a competitive edge in the market.

The Future of Arbitrage Trading

The future of arbitrage trading is bright, with innovations like AI-powered bots, smart contract integrations, and cross-chain trading set to revolutionize the landscape. As the cryptocurrency ecosystem evolves, so too will the opportunities for traders to capitalize on market inefficiencies.

Conclusion

In an industry driven by speed and innovation, Crypto Arbitrage Trade Bots are transforming how trades are executed. From Automated Crypto Arbitrage to Blockchain Arbitrage Bots, these advanced tools enable traders to navigate the complexities of the market with ease. With Mobiloitte’s Arbitrage Trading Bot Solutions, you can unlock the full potential of cryptocurrency trading and achieve unparalleled success.

Let Mobiloitte’s expertise in Crypto Arbitrage Technology guide you toward smarter, faster, and more profitable trading. The future of cryptocurrency trading is automated — and with Mobiloitte, the possibilities are limitless.

#Crypto Arbitrage Trade Bot#Arbitrage Trading Bot Solutions#Cryptocurrency Arbitrage Bot#Automated Crypto Arbitrage#Crypto Trading Bots#Arbitrage Trading Automation#Crypto Arbitrage Solutions#Expert Arbitrage Bots

0 notes

Text

ICYMI: Cross-Exchange Arbitrage: Chancen und Herausforderungen im Krypto-Bereich http://dlvr.it/TGcvv4

0 notes

Text

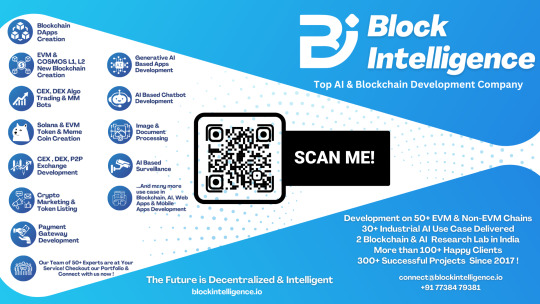

Block Intelligence Emerges as Leading Blockchain Development Company

Block Intelligence is rapidly emerging as a leading blockchain development company, offering specialized solutions for Blockchain & AI Startups. By focusing on creating highly scalable, secure, and interoperable blockchain ecosystems & AI Systems, Block Intelligence is revolutionizing the way businesses launch and manage their own blockchain networks, AI Apps and decentralized applications (dApps). Their approach enables seamless development of custom blockchain platforms that help businesses stay ahead in the fast-evolving decentralized landscape.

“We are committed to empowering businesses with tailor-made blockchain solutions that drive innovation and transformation,” says Anmol Jayan, Director Business Operation of Block Intelligence. “By simplifying the complex architecture of blockchain technology, we make it accessible for businesses to scale efficiently and securely.”

Blockchain-Based Trading Bots Delivering High Returns

In addition to blockchain infrastructure development, Block Intelligence has developed a robust blockchain-based

trading bot platform that has consistently delivered impressive returns. With advanced strategies, the platform provides an average return of 1% per day, with some strategies yielding up to 2–3% per day.

The trading bot platform uses sophisticated trading strategies like triangular arbitrage, cross-exchange arbitrage, intraday trading, and algorithmic trading. These strategies identify market inefficiencies across multiple cryptocurrency exchanges, providing users with real-time, data-driven opportunities to optimize trading performance.

“Clients have expressed immense satisfaction with the consistent returns generated by our trading bots,” says Chris D’souza, Chief of Operations at Block Intelligence. “Our trading platform has been designed to work flawlessly across the major crypto exchanges, providing both security and profitability for our users.”

This trading platform underscores Block Intelligence’s technical mastery and ability to drive results in the complex world of cryptocurrency trading.

AI Solutions for Computer Vision and CCTV Analysis

In addition to their blockchain expertise, Block Intelligence is also a leader in AI services, particularly in the areas of computer vision and CCTV analysis. Their advanced AI tools offer cutting-edge video surveillance, facial recognition, behavioral analysis, and anomaly detection, enhancing the capabilities of businesses in security and monitoring.

“We’re at the forefront of using AI-powered computer vision to transform the security and surveillance industry,” adds Chris D’souza. “By leveraging machine learning algorithms, we offer solutions that deliver precision and efficiency in analyzing CCTV footage and identifying potential security risks.”

Block Intelligence’s AI-driven solutions are widely deployed in industries like retail, logistics, and public safety, offering businesses the ability to improve their monitoring systems with more intelligent and automated processes.

Pioneers in Layered Blockchain Solutions

Block Intelligence’s core expertise in developing Layer 0, Layer 1, and Layer 2 blockchains allows businesses to create secure, scalable platforms for a variety of industries. Their ability to develop customized blockchains gives clients the freedom to build decentralized ecosystems tailored to their unique operational requirements.

“We understand the importance of providing businesses with the tools they need to succeed in a decentralized future,” explains Anmol Jayan. “Our layered blockchain solutions ensure that our clients are equipped with the infrastructure necessary to thrive in the world of decentralized finance and commerce.”

By providing innovative blockchain architectures, Block Intelligence is empowering businesses to transform the way they operate, leading the charge toward a decentralized future.

Block Intelligence also offers a wide range of innovative solutions to cater to diverse business needs. The company specializes in blockchain development, providing Layer 0, Layer 1, and Layer 2 solutions, along with crypto wallet development, DEX/CEX development, and custom token creation. Their expertise in AI-powered applications, such as computer vision, CCTV analysis, generative AI, and chatbot development, adds cutting-edge automation to business operations. Additionally, Block Intelligence excels in Web2 software development, including iOS & Android apps, MERN stack websites, and deep learning/NLP applications. Their regulatory consulting services cover FIU and VARA licenses and Dubai company registration, helping businesses navigate crypto regulations effortlessly. Further, they offer staking platforms, trading bot development, market-making bots, NFT marketplace development, metaverse creation, and seamless payment gateway, launchpad, and IEO/ICO platform development. For businesses looking to expand their reach, the company provides PR services, blockchain event management, and even luxury yacht event hosting. Whether it’s smart contract auditing, DAO development, or RWA projects, Block Intelligence remains a trusted partner for end-to-end blockchain and AI solutions.

For more information about Block Intelligence and its projects, visit blockintelligence.io and for Block Intelligence portfolio visit portfolio.blockintelligence.io

Media Contact: Organization: Synergy Global Enterprise LLC Name: Gopi Divecha Address: 111 North Bridge Road #21–01, Singapore 179098 Website: https://airdropbounty.events/ | https://pixelproduction.com/ Email: [email protected] | [email protected] WhatsApp: https://wa.me/+6586940671

0 notes

Text

An In-Depth Exploration of Forex Trading: Market Dynamics, Strategies, and Risk Management

Forex trading, or foreign exchange trading, is a global financial activity that involves the exchange of one currency for another, primarily to make a profit. The forex market, operating as the largest and most liquid financial market globally, sees a daily trading volume exceeding $6 trillion, underscoring its role in the global economy. Due to its vast scope and the involvement of diverse players such as banks, corporations, hedge funds, and individual traders, the forex market functions on a decentralized structure, operating 24 hours a day across various global time zones.

The Structure of Forex Trading and Key Currency Pairs

Forex trading pairs two currencies, with the base currency quoted against the quote currency (e.g., EUR/USD). In each pair, the first currency listed is the base currency, while the second is the quote currency. The trader’s goal is to speculate on the exchange rate between the two. For example, in the EUR/USD pair, a trader anticipates either appreciation or depreciation of the euro relative to the U.S. dollar, trading accordingly to realize gains or limit losses.

The most commonly traded currency pairs fall into three categories:

Major pairs: Pairs like EUR/USD, USD/JPY, GBP/USD, and USD/CHF, which involve the U.S. dollar and are typically the most liquid.

Cross pairs: These include major currencies traded against each other without the USD, such as EUR/GBP or AUD/JPY.

Exotic pairs: Combinations that include a major currency paired with an emerging market currency, such as USD/TRY or USD/MXN.

Reasons for Forex Trading: Speculation, Hedging, and Arbitrage

Speculation: This is the primary reason for many individual and institutional traders in forex. They predict the future direction of currency values based on analysis or market sentiment, aiming to profit from fluctuations. For example, following the 2016 Brexit referendum, the GBP/USD pair became highly volatile, with speculative traders anticipating major shifts in the British pound’s value against the dollar.

Hedging: Many corporations use forex to protect themselves against foreign exchange risk, ensuring predictable profits when dealing with multiple currencies. For example, multinational corporations operating in several countries may hedge their currency exposure to minimize potential losses. A notable example occurred with European exporters hedging against fluctuations in the EUR/USD to maintain predictable costs and revenues.

Arbitrage: Arbitrage is taking advantage of small price discrepancies between markets. In forex, this can occur across various currency exchanges or between related pairs. While opportunities for arbitrage are generally short-lived due to market efficiency, high-frequency trading firms often employ complex algorithms to capitalize on these fleeting price differences.

Benefits and Challenges of Forex Trading

Advantages:

Liquidity: The high liquidity in forex means traders can buy and sell currencies easily without major price changes due to large trades. This liquidity is especially evident in major currency pairs, where market depth allows substantial trades to occur with minimal slippage.

Accessibility: Forex trading is accessible to anyone with an internet connection and a trading platform, making it a popular choice among retail traders worldwide.

Market Volatility: Currency prices are influenced by various economic indicators, geopolitical events, and market sentiment. This volatility creates profit opportunities, such as those seen in the rapid changes in the GBP/USD exchange rate following Brexit.

Leverage: Forex brokers offer leverage, which allows traders to control larger positions with a smaller initial investment. This leverage can magnify both potential gains and losses, making it a powerful tool in the hands of skilled traders.

Challenges and Risks:

Market Risk: Currency values can be highly volatile, with sudden changes stemming from economic events or political decisions. For example, the Swiss National Bank’s decision in 2015 to unpeg the Swiss franc from the euro led to a 30% surge in the franc’s value within minutes, causing significant losses for traders unprepared for such volatility.

Leverage Risk: While leverage amplifies profit potential, it equally magnifies losses. Traders using high leverage without adequate risk management are vulnerable to substantial losses that could exceed their initial investment.

Liquidity Risk: While major currency pairs are generally liquid, exotic pairs can sometimes become illiquid, making it difficult to exit positions during extreme market conditions. This risk is often observed in emerging market currencies, where low liquidity can lead to higher spreads and limited trading options.

Key Forex Trading Strategies

Forex trading strategies are as varied as the traders who use them, but the most common approaches include technical analysis, fundamental analysis, and risk management techniques to safeguard against adverse market movements.

Technical Analysis: This approach involves analyzing historical price charts and patterns to predict future movements. Indicators like moving averages, support and resistance levels, and trendlines are commonly used tools. For example, traders might use the Relative Strength Index (RSI) to determine whether a currency is overbought or oversold. Technical analysis proved valuable during the 2020 COVID-19 pandemic, when rapid price fluctuations required traders to adapt quickly to new trends.

Fundamental Analysis: Fundamental analysts focus on economic indicators, geopolitical news, and financial policies. Key indicators include interest rates, GDP growth, inflation rates, and employment figures. For instance, a positive NFP (Non-Farm Payroll) report in the U.S. might signal economic strength, often leading to a stronger dollar. The 2008 financial crisis is a historical example of how fundamental analysis can inform traders; as global markets deteriorated, central banks cut interest rates, leading to significant changes in currency values.

Risk Management: Risk management is crucial in forex to protect against unpredictable losses. Common practices include using stop-loss orders, setting risk-reward ratios, and diversifying trades across different currency pairs. For instance, during periods of high uncertainty, such as major central bank announcements, experienced traders often use tighter stop-loss orders to limit potential losses from unexpected price swings.

Real-World Examples and Historical Context

The forex market has seen transformative events that highlight the impact of geopolitical and economic shifts. In recent history:

The Japanese Yen during 2012-2013: The Bank of Japan’s aggressive monetary easing under “Abenomics” led to a dramatic weakening of the yen, which strengthened Japanese exports. Forex traders who recognized this shift profited by shorting the yen against other major currencies.

Swiss Franc in 2015: When the Swiss National Bank unexpectedly removed the Swiss franc’s peg to the euro, it led to unprecedented volatility, causing massive losses for some traders and even bankrupting several small forex brokers. This event underscored the importance of understanding central bank policies and maintaining proper risk management.

COVID-19 Pandemic Impact on Forex Markets: The pandemic led to significant shifts in major currency values as governments implemented stimulus measures, and investors sought safe-haven currencies like the U.S. dollar and Japanese yen. This period of heightened volatility provided opportunities and challenges for traders, demonstrating how external shocks can affect the forex market.

Conclusion: Mastering Forex Trading with Knowledge and Caution

Forex trading offers ample opportunities for profit but also presents substantial risks, underscoring the need for disciplined strategies, solid market knowledge, and effective risk management. The lessons of historical events—like the unpegging of the Swiss franc, shifts under Abenomics, and recent volatility caused by COVID-19—illustrate the market’s complexity and the potential for sudden, drastic changes. By staying informed, analyzing market data, and using proven trading strategies, forex traders can navigate this dynamic environment, balancing the pursuit of profit with the essential practice of risk management.

Maximize Profits, Minimize Losses: A 3-Step Risk Management Strategy for Forex Trading

youtube

Forex trading is an exciting yet challenging field, with the allure of high profits balanced by the risk of substantial losses. For new traders, the complexity of the market can be daunting, making effective risk management critical for long-term success. While there’s no magic formula to eliminate risk entirely, seasoned traders know that disciplined risk management is the secret to consistent profitability. This article will present a practical, three-step strategy to help traders maximize their gains while protecting against unnecessary losses.

Step 1: Set a Risk Tolerance Level

The first step to managing risk effectively is understanding your personal risk tolerance and setting boundaries. This involves deciding how much of your capital you’re willing to risk on each trade. A common guideline is the “1% rule,” which suggests risking no more than 1% of your total trading capital on any single trade. For example, if your account balance is $10,000, you’d aim to risk no more than $100 on each trade.

This rule limits potential losses, preventing emotional decision-making, which can often lead to poor trading choices. By establishing a clear risk tolerance, you build a protective foundation that lets you stay focused on strategy, not fear of losses. While the 1% rule is a common benchmark, some traders might find a 2% or even 0.5% limit more suitable, depending on their risk appetite and trading experience.

Step 2: Use Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for implementing your risk tolerance in real time. A stop-loss order automatically closes a trade when it reaches a specified price level, helping limit potential losses. Take-profit orders, on the other hand, lock in profits when the trade reaches a target price. Using these orders effectively enables traders to cap both their losses and their gains in advance, which brings greater consistency and reduces emotional trading.

For instance, suppose a trader buys the EUR/USD pair at 1.1000, targeting a 100-pip gain with a take-profit order at 1.1100 and placing a stop-loss order 50 pips below at 1.0950. In this scenario, the trader sets a risk-to-reward ratio of 1:2, meaning they stand to gain twice as much as they could potentially lose. Such a ratio helps traders manage risk efficiently, aiming to make profits larger than their losses over time.

Real-world data supports this approach. According to a study by FXCM, traders who maintained a 1:2 risk-to-reward ratio tended to be more successful than those with less favorable ratios. This illustrates that managing both the upside and downside of a trade is essential for consistent profitability.

Step 3: Diversify and Limit Leverage

Leverage can amplify returns, but it can also increase losses dramatically if not managed carefully. In forex, leverage allows traders to control larger positions than their account balance would normally permit. For instance, with a 50:1 leverage ratio, a $200 investment can control a $10,000 position. However, this also means that a minor 1% price change could wipe out the account balance if things go wrong.

Many traders fall into the trap of overleveraging, lured by the prospect of massive returns. But the key to sustainable growth is to use leverage prudently. Experts recommend limiting leverage to a manageable level—ideally no more than 10:1 or even lower for beginner traders. Limiting leverage helps prevent catastrophic losses, especially during volatile market conditions, which can create unexpected price movements.

Diversification is also critical. Relying on a single currency pair or market can expose you to undue risk if that specific market experiences extreme volatility. Instead, trading across multiple pairs reduces exposure to adverse price movements in a single pair. For example, if a trader is focusing primarily on EUR/USD, they might add USD/JPY or GBP/USD positions to balance their exposure to any euro or dollar-specific risks.

Conclusion

In conclusion, effective risk management is the backbone of successful forex trading. By setting clear risk limits, utilizing stop-loss and take-profit orders, and controlling leverage and diversification, traders can protect their capital while still pursuing profitable trades. These three steps—setting a risk tolerance, using stop-loss and take-profit orders, and managing leverage and diversification—create a balanced approach that keeps emotions in check and helps traders make rational decisions. While forex trading is inherently risky, applying these strategies enables traders to maximize profits while keeping losses within manageable limits, setting the stage for long-term success in the forex market.

Learn more...

#ForexTrading#MarketDynamics#Strategies#RiskManagement#CurrencyMarkets#TradingStrategies#TechnicalAnalysis#FundamentalAnalysis#MarketVolatility#Leverage#Liquidity#RiskRewardRatio#PositionSizing#StopLoss#TradingPlan#EmotionalControl#ContinuousLearning#ProfessionalDevelopment#Youtube

0 notes

Text

Brazil’s Central Bank considers FX license, IOF tax for crypto firms

Primary target for measure would be stablecoins, digital tokens pegged to traditional currencies like the U.S. dollar

Brazil’s Central Bank policymakers have recently engaged in discussions with cryptocurrency sector representatives to gauge the feasibility of requiring a foreign exchange license for some companies in the industry. The idea is that, when the final version of the regulation for the segment is released—which is expected to happen in 2025—some companies would apply for a standard Virtual Asset Service Provider (VASP) license, while others would need registration to operate with FX transactions.

The Central Bank’s primary target for this measure would be stablecoins, digital tokens pegged to traditional currencies like the U.S. dollar, which are not only used as a store of value, for speculation, or as an inflation hedge but also as a means for remittances and cross-border payments. The license differentiation would apply since some companies in the sector, such as tokenizers, do not conduct such international transfers and instead focus on registering domestic assets on the blockchain that already exist within the financial system. The FX license would only be required for those facilitating cross-border money transfers.

Authorities are concerned about the regulatory and tax arbitrage opportunities that stablecoins enable, as buying U.S. dollars or other currencies in the traditional market requires paying fees, like the Financial Transactions Tax (IOF) with a rate of 1.1%. Since stablecoins are still viewed as financial assets similar to bitcoin, they are not treated as currencies for tax purposes, so no IOF is applied when purchasing stablecoins like USDT and USDC, even though both are digital representations of the U.S. dollar and hold a constant value of $1 per unit. According to the Federal Revenue Service, transactions involving these two stablecoins totaled R$17.5 billion in August, three times the volume of bitcoin.

Another issue closely monitored by the Central Bank is the impact of stablecoins—and cryptocurrencies in general—on the Brazil’s capital account, given the significant outflow of dollars. “The key agenda is to maintain visibility over currency control, tracking the money that exits Brazil for foreign destinations. This is central to the Central Bank, alongside related controls like anti-money laundering and anti-tax evasion measures,” said Nicole Dyskant, legal counsel to blockchain infrastructure provider Fireblocks.

Continue reading.

#brazil#brazilian politics#politics#economy#cryptocurrency#monetary policy#central bank#image description in alt#mod nise da silveira

1 note

·

View note

Text

Blockchain and Cryptocurrency Monetization Models: A Guide to Multi-dimensional Revenue Strategies

In the blockchain industry, there are multiple proven revenue models. Here are the main validated monetization models: Trading Arbitrage Model Cross-exchange price arbitrage Futures-spot arbitrage mechanisms Triangular arbitrage strategies Flash trading methods DeFi Liquidity Mining LP market maker revenue model Single token staking strategies Protocol governance token rewards Liquidity…

0 notes

Text

Future Trends in Crypto Arbitrage Bot Technology for 2025

Crypto arbitrage bots are becoming a vital tool for traders looking to maximize earnings from price disparities across exchanges as the cryptocurrency market continues to develop. Exciting developments in this technology are anticipated by 2025, propelled by improvements in artificial intelligence, improved blockchain infrastructure, and market demand. The future of cryptocurrency arbitrage bot technology is anticipated to be shaped by the major trends listed below.

AI-Assisted Decision Making

In the future, crypto arbitrage bots will likely be significantly impacted by artificial intelligence (AI). By 2025, bots will use artificial intelligence (AI) to better assess and make trading decisions from massive volumes of market data. Bots can perform arbitrage transactions more precisely, anticipate price patterns, and optimize entry and exit locations via AI-based algorithms. Profitability will rise and human mistake risk will be minimized by this evolution.

Cross-Chain Arbitrage

At the moment, the majority of arbitrage bots are limited to using a single blockchain or exchange. But by 2025, cross-chain interoperability will be easier to obtain, making it possible for bots to carry out arbitrage trades across several blockchains without difficulty. Because bots can now take advantage of price differences across a larger spectrum of cryptocurrency assets, this will open up more trading opportunities.

Increased Security Standards

The development of future arbitrage bots will prioritize security due to the increase in cryptocurrency scams and exchange vulnerabilities. The best crypto arbitrage trading bot development company will focus on integrating advanced encryption, secure multi-signature wallets, and decentralized platforms to ensure safe transactions. Future bots might also include insurance against exchange-related risks, shielding traders from losses brought on by fraud or hacking.

Real-Time Market Monitoring

Crypto arbitrage requires speed, therefore in the future, bots will concentrate on enhancing real-time market monitoring. Due to developments in data analytics, bots can now monitor small changes in price over hundreds of exchanges in real-time. As a result, traders will be able to take advantage of momentary arbitrage possibilities that they might have otherwise missed.

Customizable User Interfaces

Bots will get easier to use as cryptocurrency arbitrage trading gains popularity. By 2025, traders should anticipate user interfaces that are adaptable to the needs of both novice and seasoned traders. More flexibility over bot configurations will be available through these interfaces, enabling users to customize trading strategies, risk thresholds, and performance indicators.

Conclusion

With developments like AI-driven decision-making, cross-chain interoperability, and improved security, the future of crypto arbitrage bot technology seems bright. Collaborating with the crypto arbitrage trading bot development company will be essential for traders looking to take advantage of these developments and remain one step ahead of the competition.

Book a Free Demo - https://bit.ly/3XDvBLR

Talk to our Experts Today.,

Whatsapp - https://bit.ly/3Xg3h0O

Skype - live:62781b9208711b89

Email Id - [email protected]

Telegram: https://telegram.me/ClariscoSolutions

#Crypto Arbitrage Trading Bot Development Company#Crypto Arbitrage Trading Bot Development#Arbitrage Trading Bot Development#crypto arbitrage trading bot#cryptocurrency arbitrage trading bot

0 notes

Text

Behind the Scenes: Crafting a Successful Flash Loan Arbitrage Bot

The world of Decentralized Finance (DeFi) has brought about revolutionary ways to trade, invest, and make profits, with flash loans standing at the forefront of this evolution. One of the most lucrative methods for tapping into DeFi’s potential is through arbitrage, particularly using flash loans. If you’re considering Flash Loan Arbitrage Bot Development, this blog will take you behind the scenes to understand the critical aspects of building a successful flash loan arbitrage bot.

What Is Flash Loan Arbitrage?

Flash loan arbitrage is a trading strategy that capitalizes on the price differences of assets across multiple decentralized exchanges (DEXs). A flash loan allows traders to borrow large sums of cryptocurrency without collateral, but with the caveat that the loan must be repaid within a single blockchain transaction. This allows traders to quickly execute profitable trades across different exchanges.

A flash loan arbitrage bot is an automated tool designed to identify arbitrage opportunities and execute trades in real time. With the fast pace of DeFi, automation is crucial to ensure trades happen in fractions of seconds, maximizing profit potential.

Key Components of a Successful Flash Loan Arbitrage Bot

1. Automated Flash Loan Execution

The core feature of any flash loan arbitrage bot is its ability to automate the borrowing and repayment of flash loans. The bot must interact seamlessly with DeFi platforms like Aave, dYdX, or Uniswap to ensure that the loan is repaid within the same transaction, minimizing risks for the trader.

- Why it matters: Without automation, it would be impossible to execute a flash loan arbitrage opportunity within the tight time constraints of a single transaction.

2. Real-Time Price Tracking Across DEXs

For a flash loan arbitrage bot to be effective, it must constantly monitor price discrepancies across various DEXs. Platforms like Uniswap, SushiSwap, PancakeSwap, and others present frequent arbitrage opportunities, and the bot needs to scan real-time data feeds and APIs to find these opportunities instantly.

- Why it matters: Even a minor delay in detecting price discrepancies can result in missed profit opportunities, especially in the fast-moving world of DeFi.

3. Smart Contract Integration

Smart contracts are at the heart of DeFi, and your flash loan arbitrage bot must be built with robust smart contract integration. These contracts manage the borrowing, trading, and repayment of flash loans, ensuring everything happens within one seamless transaction.

- Why it matters: Smart contracts enable trustless, secure transactions. If a flash loan arbitrage opportunity is not profitable or the conditions aren't met, the transaction is automatically canceled.

4. Gas Fee Optimization

One of the most overlooked but vital aspects of Flash Loan Arbitrage Bot Development is gas fee optimization. On networks like Ethereum, high gas fees can significantly cut into your profits. Your bot should include techniques to minimize these costs, such as bundling transactions or executing trades during periods of lower network congestion.

- Why it matters: High gas fees can quickly turn a profitable arbitrage trade into a loss. Optimizing these fees is crucial for maintaining profitability.

5. Risk Management Protocols

Risk management is another key component. Arbitrage opportunities can be highly profitable, but they also carry risks such as slippage (price movement during the trade) and failed transactions. Your bot should be designed to handle these risks by setting slippage limits and aborting trades that fall below a certain profitability threshold.

- Why it matters: Effective risk management ensures that your bot only engages in trades where the likelihood of profit outweighs potential losses.

6. Cross-Chain Compatibility

As DeFi expands across multiple blockchain ecosystems such as Ethereum, Binance Smart Chain, and Polygon, your flash loan arbitrage bot should be able to function on various chains. Cross-chain compatibility widens the range of arbitrage opportunities and increases the bot’s profitability by allowing it to take advantage of different market conditions.

- Why it matters: Multi-chain compatibility enables your bot to operate in more diverse markets, increasing the likelihood of finding profitable arbitrage opportunities.

Development Challenges and Solutions

Security Risks

DeFi is a high-stakes environment, and your flash loan arbitrage bot is only as good as its security. Since flash loans involve high-value, instant transactions, your bot must be thoroughly tested for vulnerabilities, such as reentrancy attacks or bugs that could expose funds to hackers.

- Solution: Comprehensive audits of the bot’s code and smart contracts and continuous monitoring can mitigate security risks.

Network Latency

Speed is crucial for successful arbitrage. Any delay in data processing or transaction execution can mean missing out on profitable opportunities. Your bot needs to be optimized for low latency and high-speed transaction execution.

- Solution: Use optimized coding practices, low-latency servers, and efficient communication with blockchain nodes to ensure your bot performs at optimal speeds.

Profitability Monitoring

Your bot mustn’t engage in unprofitable trades. A built-in profitability monitoring system will evaluate potential trades by factoring in gas fees, slippage, and other transaction costs before executing them.

- Solution: Set a threshold for minimum profits and only allow the bot to proceed with trades that meet this criterion.

Conclusion

Building a successful flash loan arbitrage bot requires careful planning, technical expertise, and a deep understanding of market dynamics. With features like automated execution, cross-exchange price monitoring, smart contract integration, and gas optimization, your bot can effectively capitalize on arbitrage opportunities. As Flash Loan Arbitrage Bot Development continues to evolve alongside the growth of DeFi, it remains a profitable venture for developers and traders alike.

By focusing on security, speed, and profitability, you can craft a bot that not only survives but thrives in the highly competitive DeFi ecosystem.

#flash loan arbitrage bot#flash loan arbitrage bot development#flash loan arbitrage bot development company

0 notes

Text

Cross-Exchange Arbitrage: Chancen und Herausforderungen im Krypto-Bereich http://dlvr.it/TG1pW4

0 notes

Text

Greetings, Trade11 Community

Cross Exchange Trading is Live Now

Navigate to Arbitrage Menu & you can Execute Trades.

Bind all 3 Exchanges

Maintain USDT/BTC/ETH

Execute Trades in One Exchange

Get your Capital with Profit in another Exchange

If you are new to these Exchanges, no need to worry. Soon, will share the Tutorials

#trade11io#trade11net#trade11ai#arbitragebot#arbitragetrading#Arbitrage#cryptoarbitrage#CryptoRevolution

1 note

·

View note

Text

How Cross-Chain Swapping is Revolutionizing DeFi on Spider Swap

Decentralized Finance (DeFi) has been a game-changer in the financial world, bringing a plethora of opportunities for users to engage in financial activities without the need for traditional intermediaries. One of the groundbreaking innovations in the DeFi space is cross-chain swapping, and Spider Swap is at the forefront of this revolution. In this blog, we’ll delve into how cross-chain swapping on Spider Swap is transforming DeFi and what it means for the future of decentralized finance.

What is Cross-Chain Swapping?

Cross-chain swapping is a process that allows the exchange of cryptocurrencies across different blockchain networks without the need for an intermediary. This means that users can crypto swap tokens from one blockchain to another directly, ensuring a seamless and efficient transaction process.

The Need for Cross-Chain Swapping in DeFi

The DeFi ecosystem is vast and diverse, with multiple blockchain networks offering unique advantages. However, the lack of interoperability between these networks has been a significant barrier, limiting users to operate within isolated ecosystems. Cross-chain swapping addresses this challenge by enabling interoperability, allowing users to:

Diversify their portfolios across multiple blockchains.

Access a broader range of DeFi services and opportunities.

Enhance liquidity by connecting disparate blockchain networks.

How Spider Swap is Leading the Way

Spider Swap has integrated cross-chain swapping into its platform, providing users with unparalleled flexibility and access to a wider array of assets and DeFi protocols. Here’s how Spider Swap is revolutionizing DeFi with its cross-chain swapping capabilities:

1. Seamless Asset Transfers

Spider Swap’s cross-chain swapping feature allows users to transfer assets seamlessly between different blockchains. This eliminates the need for multiple transactions and intermediaries, reducing costs and saving time.

Efficiency: Users can execute swaps quickly without waiting for confirmations from multiple networks.

Cost-Effective: Reduces transaction fees associated with multiple swaps and intermediaries.

User-Friendly: Simplifies the swapping process with an intuitive interface.

2. Enhanced Liquidity

By enabling cross-chain swaps, Spider Swap significantly enhances liquidity within the DeFi ecosystem. Users can move assets freely between networks, providing more opportunities for trading, lending, and borrowing.

Increased Trading Volume: Facilitates higher trading volumes by connecting multiple networks.

Better Price Discovery: Enhanced liquidity leads to more accurate and fair pricing of assets.

Expanded Market Access: Users can access a broader market, increasing the potential for arbitrage opportunities.

3. Diversification Opportunities

Cross-chain swapping on Spider Swap allows users to diversify their crypto portfolios across different blockchain networks. This reduces risk and opens up new avenues for investment and growth.

Risk Mitigation: Spreading investments across multiple networks reduces exposure to risks associated with any single blockchain.

Access to Unique Assets: Enables users to invest in tokens and assets that are native to other blockchains.

Broader DeFi Participation: Users can participate in various DeFi projects and protocols across different networks.

4. Improved Interoperability

Spider Swap’s cross-chain swapping feature enhances the interoperability of DeFi protocols. This interconnectedness is crucial for the growth and maturation of the DeFi ecosystem.

Protocol Compatibility: Ensures compatibility and seamless interaction between different DeFi protocols.

Unified Ecosystem: Creates a more unified and cohesive DeFi ecosystem by bridging isolated blockchains.

Innovation and Collaboration: Fosters innovation and collaboration among different blockchain communities.

5. Security and Transparency

Security is a paramount concern in the DeFi space. Spider Swap leverages advanced security protocols to ensure that cross-chain swaps are secure and transparent.

Trustless Transactions: Uses smart contracts to facilitate swaps without the need for a trusted intermediary.

Transparency: All transactions are recorded on the blockchain, providing a transparent and immutable record.

Security Protocols: Implements robust security measures to protect user funds and data.

Use Cases and Applications

Cross-chain swapping on Spider Swap opens up numerous use cases and applications, making it a versatile tool for DeFi enthusiasts:

Arbitrage Opportunities

Traders can exploit price differences between tokens on different blockchains, executing arbitrage strategies efficiently without moving assets through multiple exchanges.

Yield Farming and Liquidity Mining

Users can move their assets across different blockchain networks to participate in the most lucrative yield farming and liquidity mining opportunities available.

Decentralized Exchanges (DEXs)

Cross-chain swaps enhance the functionality of decentralized exchanges by providing liquidity and enabling trading pairs that span multiple blockchains.

Lending and Borrowing

Users can leverage cross-chain swaps to access lending and borrowing platforms on different networks, optimizing their interest rates and collateral options.

Conclusion

Cross-chain swapping is a revolutionary feature that is transforming the DeFi landscape, and Spider Swap is leading the charge. By enabling seamless asset transfers, enhancing liquidity, providing diversification opportunities, improving interoperability, and ensuring security, Spider Swap is setting a new standard in the DeFi space. As the DeFi ecosystem continues to evolve, cross-chain swapping will undoubtedly play a pivotal role in shaping its future, offering users unprecedented flexibility and opportunities. Embrace the future of decentralized finance with Spider Swap and experience the power of cross-chain swapping today.

0 notes