#CPA services

Explore tagged Tumblr posts

Text

Trusted Small Business CPA Services California

At CoreCPAs, we are a team of tax experts for small business CPA services in California. Get in touch with certified public accountants for and tax solutions. Visit for more information -> https://corecpas.com/

2 notes

·

View notes

Text

Stay Ahead with Expert Accounting & Tax Services!

Managing your finances can be overwhelming, but with Sai CPA Services, you don’t have to do it alone! Whether you're an individual, a small business, or a growing enterprise, our expert financial solutions ensure compliance, maximize savings, and help you achieve financial success.

💼 Our Key Services: ✅ Accounting & Bookkeeping – Keep your records organized and accurate ✅ Tax Preparation & Planning – Minimize liabilities and maximize deductions ✅ Payroll Services – Smooth and hassle-free payroll management ✅ Business Start-Up Consulting – Get the right financial foundation for success ✅ IRS Representation – Strong support for audits and tax issues

With over 25 years of experience, we provide tailored solutions to meet your unique financial needs. Let us take care of the numbers while you focus on growth and success!

📞 Connect with Us Today!

🌐 Sai CPA Services 📍 1 Auer Ct, 2nd Floor, East Brunswick, NJ 08816 📞 908-380-6876 🔗 Facebook | Instagram | Twitter | LinkedIn | WhatsApp

#SAI CPA SERVICES#cpa firms#cpa services#virtual cfo services#accounting services#tax#entrepreneur#entrepreneurship#financial solutions#us taxes#irs#irs audit#financial services#taxes#tax season#accounting#financial support#finance#startup#financial success#book keeping#tax planning#business growth

0 notes

Text

Understanding Forensic Accounting: How CPAs Detect Fraud

Forensic accounting involves investigating financial records to uncover fraud, embezzlement, or financial misconduct. CPAs use specialized techniques to analyze discrepancies and trace illicit transactions. Their expertise in identifying red flags and providing litigation support is invaluable in legal disputes. Experts offering CPA accounting services help businesses detect fraud early, ensuring financial integrity and protecting assets.

0 notes

Text

Syriac CPA Tax And Accounting Services Inc. We offer expert tax preparation, accounting, and consulting solutions for businesses and individuals. Newport beach Office Address: https://maps.app.goo.gl/BETAeAfYsjTJfYE18

Artesia Office Address: https://maps.app.goo.gl/jMrjytiRhFJyvaF69

0 notes

Text

Get Top-Notch Bookkeeping Services With J Francis Davis, CPA LLC

Discover the top-notch online bookkeeping platform QuickBooks with us. Our reliable bookkeeping services and responsiveness, with attention to detail and a high level of work quality help you grow your business. View this infographic to learn more, or visit us.

#bookkeeping service#accounting services#financial reporting#quickbooks bookkeeping services#accounting for small companies#cpa services

0 notes

Text

The Indispensable Role of CPA Firms in Charting Success for M&A

#cpafirm#cpapractices#cpa services#accouting#accounting services#ACCOUTINGFIRMS#outsouring services#magistral consulting

0 notes

Text

CPA Preparation

Choosing the right US CPA study materials can be overwhelming, with so many options available but Beckar Study text stands a part in many ways. Becker CPA Study Material is a popular study program that offers comprehensive materials to help candidates prepare for and pass the CPA exam.

The Becker CPA Review course typically includes the following components:

✨Video Lectures: Becker provides video lectures led by experienced instructors. These lectures cover the topics included in the CPA exam syllabus and are designed to help candidates understand key concepts. ✨Textbooks and E-books: Comprehensive textbooks and e-books are provided to candidates, offering in-depth coverage of the CPA exam content. ✨Practice Questions: Becker includes a large number of practice questions and multiple-choice questions (MCQs) for each exam section. ✨Simulated Exams: Candidates are often provided with simulated exams that mimic the format and conditions of the actual CPA exam. ✨Flashcards: Becker may offer flashcards that cover important concepts and terms, providing a quick and portable way for candidates to review key information. ✨Interactive Online Platform: Becker's CPA Review platform is often delivered through an online interface that allows candidates to access study materials, track their progress, and engage in interactive learning activities.

FinTram Provides the Latest Becker CPA Books and Content Hard Copy as well if you are willing to buy plzz Connect us at:-https://fintram.com/us-cpa-course/

youtube

#cpa#cpa classes#cpa online#cpa online institute#cpa course#cpa exam#cpa services#cpa firm#finances#Youtube

0 notes

Text

Empowering Nonprofits: Velu's Commitment to Strategic Financial Leadership

Welcome to Velu, where accounting expertise meets community empowerment. We are dedicated to supporting nonprofits with tailored CFO services that amplify their impact. Led by CEO Tyler Wilcox, CPA, Velu is more than a financial services provider; we are your strategic partner in driving growth and maximizing community benefit.

Our Specialized Approach

At Velu.us, we understand the unique challenges nonprofits face in managing finances while striving to achieve their mission. Our outsourced accounting solutions are designed to alleviate the burden of financial management, allowing nonprofits to focus on their core activities and community initiatives. With a foundation of comprehensive expertise in accounting, tax, consulting, and auditing, we offer a holistic approach to financial management.

Tailored CFO Services

Our CFO services are customized to meet the specific needs and goals of each nonprofit organization we serve. From budgeting and financial forecasting to grant management and compliance.

Remote Accounting & Bookkeeping- Grow your nonprofit or small business with the support of a Velu CPA.

Tax Strategy & Compliance- We’ll take care of the legal matters so you can focus on growing your nonprofit or small business.

Fractional CFO Services - Partner with Velu and grow your organization confidently.

Quickbooks Cleanup- From Messy to Mastered, Clean up your Quickbooks with the help of a Velu CPA.

Meet Our CEO: Tyler Wilcox, CPA

Tyler Wilcox leads Velu with a passion for community empowerment and financial excellence. As a Certified Public Accountant (CPA) with extensive experience in accounting and consulting, Tyler brings a wealth of knowledge to the nonprofit sector. His vision is to equip nonprofits with the financial tools and insights they need to thrive and make a lasting impact in their communities.

Driving Greater Community Impact

At Velu, we believe that strong financial management is key to maximizing a nonprofit's potential for community impact. By providing strategic financial planning and CFO services, we enable nonprofits to allocate resources efficiently, pursue growth opportunities, and achieve sustainable outcomes. Our goal is to empower nonprofits to reach more beneficiaries and create positive change on a larger scale.

Comprehensive Expertise

Our team at Velu combines technical expertise with a deep understanding of nonprofit operations. Whether you are a small startup or a large established entity, we offer scalable solutions tailored to your organization's size and complexity. From day-to-day accounting tasks to complex financial analysis and reporting, Velu is committed to delivering reliable and accurate support.

Commitment to Community Empowerment

Community empowerment is at the core of everything we do at Velu. We believe that strong nonprofits are essential for building resilient and thriving communities. By supporting nonprofits with strategic financial leadership, we contribute to the overall well-being and sustainability of the social sector.

Why Choose Velu?

Choosing Velu means partnering with a team of dedicated professionals who are passionate about your organization's success. We go beyond traditional accounting services to become trusted advisors and advocates for your mission. Our commitment to transparency, integrity, and innovation sets us apart in the field of nonprofit financial management.

Join Us in Making a Difference

If you're a nonprofit organization seeking to enhance your financial capabilities and drive greater community impact, Velu is here to support you every step of the way. Let's work together to create a brighter future for those we serve.

Get in Touch

Ready to take your nonprofit's financial management to the next level? Contact Velu today to schedule a consultation with our team. Together, we can unlock new opportunities and accelerate your organization's growth.

Experience the Velu Difference

Visit our website at velu.us to learn more about our services and discover how Velu can empower your nonprofit to thrive. We look forward to partnering with you on your journey towards greater impact and sustainability. This blog captures the essence of Velu's mission and commitment to empowering nonprofits through strategic financial leadership. By highlighting our expertise, personalized approach, and dedication to community empowerment, we invite nonprofits to explore the transformative possibilities of partnering with Velu.

0 notes

Text

Navigating Tax Challenges in Cape Cod: The Role of CPA Services and Tax Resolution Experts

In the serene landscapes of Cape Cod, where sandy beaches meet quaint coastal towns, residents and businesses alike often find themselves navigating the intricate maze of tax laws and regulations. Whether you're a small business owner, a freelancer, or an individual taxpayer, the complexities of tax filing and resolution can be daunting. That's where the expertise of CPA services and tax resolution experts becomes invaluable.

Understanding CPA Services in Cape Cod

Certified Public Accountants (CPAs) are financial professionals equipped with the knowledge and expertise to assist individuals and businesses with a wide range of accounting and financial matters. In Cape Cod, one name stands out for its commitment to excellence and personalized service: Peter D. Arnold, CPA.

Meet Peter D. Arnold: Your Trusted Tax Problem Solver

Peter D. Arnold is not just a CPA; he's a tax problem solver dedicated to helping clients navigate the intricate landscape of tax laws and regulations. With years of experience and a deep understanding of local tax dynamics, Peter D. Arnold has earned a reputation as a trusted advisor for individuals and businesses across Cape Cod.

Services Offered

Peter D. Arnold offers a comprehensive suite of CPA services in Cape Cod:

Tax Preparation: From individual tax returns to complex business filings, Peter D. Arnold ensures accuracy and compliance with ever-changing tax laws.

Tax Planning: Proactive tax planning can help minimize tax liabilities and optimize financial outcomes. Peter D. Arnold provides strategic tax planning services tailored to each client's unique circumstances.

IRS Representation: Dealing with the IRS can be intimidating. Peter D. Arnold offers expert IRS representation, helping clients navigate audits, appeals, and tax disputes with confidence.

Business Consulting: Whether you're starting a new business or seeking to improve financial performance, Peter D. Arnold provides strategic business consulting services to help you achieve your goals.

Navigating Tax Challenges with Personal Tax Resolution Experts

In addition to his role as a CPA, Peter D. Arnold is also a personal tax resolution expert. When individuals find themselves facing tax-related challenges, whether it's IRS debt, tax liens, or wage garnishments, Peter D. Arnold steps in to provide expert guidance and representation.

Contact Information

For those seeking CPA services and tax resolution expertise in Cape Cod, Peter D. Arnold is ready to assist:

Name: Peter D. Arnold

Profession: CPA (Certified Public Accountant Tax Problem Solver)

Address: 25 Mid-Tech Dr Suite H, West Yarmouth, MA 02673, United States

Phone Number: +1 508-771-3775

Website: https://www.cpacapecodma.com/

Don't let tax challenges hold you back. With the expertise of Peter D. Arnold, CPA, and tax problem solver, individuals and businesses in Cape Cod can navigate the complexities of tax laws with confidence and peace of mind.

0 notes

Text

Navigating Financial Waters: Unraveling the Benefits of CPA Services for Optimal Wealth Management

In the intricate world of wealth management, individuals seek expert guidance to navigate the complex terrain of their finances. One key player making waves in this field is CPA, a renowned financial services provider committed to transforming the way people manage their wealth. This article delves into the essential guide of CPA financial services, shedding light on how CPA can play a pivotal…

View On WordPress

0 notes

Text

Looking to boost your accounting career? Join a CPA course in India and gain the expertise needed for global accounting standards. Start your journey today!

Join now : https://www.ifcpltd.com/cpa

Connect with us for more information: 📲+91 9903100338 📧[email protected]

#cpa#cpa course#cpa course online#cpa marketing#cpa firm#cpa exam#cpa services#education#e learning#career#accountant#higher education#finance and accounting#online courses#accounting professional#finance professionals#accounting careers#big4#ipfc#cpa course in india

0 notes

Text

Navigating Complexities with Ease: IRS Problems & Representations Services

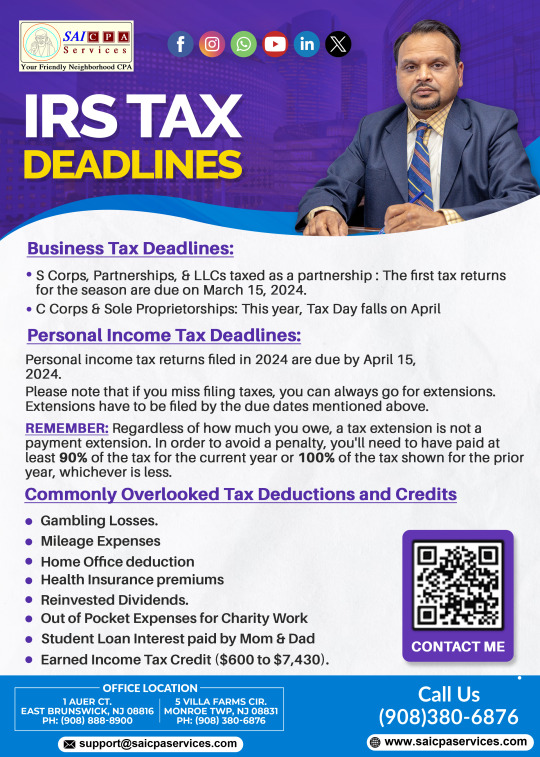

Dealing with IRS issues can be daunting and time-consuming for both individuals and businesses. At SAI CPA Services, our IRS problems & representations services are designed to alleviate the stress and provide expert solutions.

Our experienced team understands the intricacies of IRS regulations and is well-equipped to handle audits, disputes, and other tax-related challenges. We work diligently on your behalf, communicating with the IRS and developing effective strategies to resolve issues quickly and favorably.

With SAI CPA Services, you can trust that your IRS matters are in capable hands. We provide comprehensive representation, ensuring your rights are protected and your financial interests are prioritized. Our goal is to minimize disruptions and help you achieve a positive outcome.

Contact us today to learn more about our IRS problems & representations services and regain peace of mind in your financial affairs.

Stay tuned for more insights into our comprehensive range of accounting and financial services, designed to support your success.

Connect Us: https://www.saicpaservices.com/contact-us/ https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ 908-380-6876 1 Auer Ct, 2nd Floor East Brunswick, NJ 08816

1 note

·

View note

Text

CPA Services For E-Commerce Businesses: Challenges And Solutions

The rise of e-commerce has transformed the way businesses operate, creating unique financial and operational challenges. Certified Public Accountants (CPAs) play a vital role in helping e-commerce businesses navigate these challenges, ensuring that their financial operations remain efficient, compliant, and tax-optimized. CPAs specializing in e-commerce understand the nuances of online selling and provide essential services that address specific challenges, such as managing inventory, handling multi-state tax obligations, and ensuring profitability.

1. Managing Complex Taxation

One of the most significant challenges for e-commerce businesses is dealing with varying tax laws across different jurisdictions. Sales tax rules differ from state to state and sometimes even by county or city. E-commerce companies often find themselves dealing with complex nexus laws and thresholds, making it difficult to determine where they are required to collect sales tax.

Solution:

CPAs with expertise in e-commerce tax services help businesses understand nexus laws and ensure compliance with multi-state sales tax regulations. They assist in setting up automated systems to calculate sales tax rates accurately and ensure proper remittance. Moreover, CPAs help businesses with tax planning and preparing for potential audits.

2. Inventory Management and Valuation

Managing inventory efficiently is a major challenge for e-commerce businesses, especially those with high volumes or diverse product lines. Incorrect inventory valuation can result in overstatements or understatements of profits, affecting tax calculations and financial statements.

Solution:

CPAs assist e-commerce businesses in choosing the right inventory accounting methods, such as First-In-First-Out (FIFO), Last-In-First-Out (LIFO), or the Weighted Average Cost method. They ensure that inventory is accurately tracked, valued, and reported in compliance with accounting standards. Additionally, they help businesses optimize their inventory levels, reducing costs and improving cash flow.

3. Handling Payment Gateways and Merchant Accounts

E-commerce businesses rely on various online payment gateways and merchant accounts to process transactions. The integration of these systems with accounting software can be complex and prone to errors, leading to discrepancies between sales data and accounting records.

Solution:

CPAs specializing in e-commerce services integrate payment gateway data with accounting systems, ensuring that all transactions are accurately recorded. They also provide guidance on handling chargebacks, refunds, and payment processing fees, which are common in e-commerce businesses. By ensuring the correct allocation of funds, CPAs help businesses maintain accurate financial records and reduce the risk of financial misstatements.

4. Managing Multi-Currency Transactions

Global e-commerce businesses often deal with transactions in multiple currencies, adding complexity to financial reporting. Currency conversion rates fluctuate, and proper accounting is required to ensure that profits and expenses are accurately reflected in the business's home currency.

Solution:

CPAs with experience in international e-commerce help businesses manage multi-currency transactions by providing accurate conversion methods and ensuring compliance with accounting standards. They also offer advice on tax implications related to cross-border transactions, such as VAT or customs duties, and help businesses navigate the complexities of global taxation.

5. Growth and Scalability

As e-commerce businesses grow, they face challenges related to scaling operations, expanding product lines, and managing larger volumes of transactions. Financial systems must evolve to handle increased complexity, and e-commerce businesses often struggle to keep up.

Solution:

CPAs assist e-commerce businesses with strategic financial planning, advising on the most scalable accounting systems and processes. They provide financial analysis to ensure that growth remains profitable and sustainable, offering advice on cash flow management, tax efficiency, and financial forecasting.

Conclusion

E-commerce businesses face unique accounting challenges, but CPAs provide essential services to navigate these complexities. From managing multi-state taxes and inventory to handling international transactions and payment processing, CPAs ensure that e-commerce businesses operate smoothly and remain compliant. With the help of virtual CPA services, businesses can receive timely, expert advice that supports growth, financial optimization, and long-term success.

0 notes

Text

Maximize your savings and minimize your tax stress with Syriac CPA Tax And Accounting Services! Our experienced team is here to help with expert tax preparation, filing, and strategic planning, ensuring you take advantage of every possible deduction. Let us handle the complexities, so you can focus on what matters most. Contact us today to schedule a consultation and discover how we can assist you in making smarter tax decisions! For more info visit www.syriaccpa.com

#taxservices#cpa services#cpa firm#tax planning#retirement tax planning#financialplanning#tax return 2024#tax return filing#tax preparation

0 notes

Text

Understanding CPA: A Simple Guide

In the world of finance and accounting, the term "CPA" is often thrown around. But what exactly does it mean, and how does it relate to marketing and different regions like Canada and the United States? Let's break it down into simple terms.

What is a CPA?

CPA stands for Certified Public Accountant. It's a professional designation that signifies expertise in accounting and financial matters. CPAs undergo rigorous education, examination, and experience requirements to earn their certification. They are trusted advisors who provide various services such as tax preparation, auditing, financial planning, and consulting.

CPA Marketing

In the realm of marketing, CPA takes on a slightly different meaning. Here, CPA stands for Cost Per Action or Cost Per Acquisition. It's a pricing model where advertisers pay a fee whenever a specific action is completed, such as a purchase, form submission, or app installation. CPA marketing is popular in online advertising as it allows advertisers to pay only for desired outcomes, making it a cost-effective strategy.

CPA in Canada

In Canada, CPA refers to the Chartered Professional Accountant designation. It's the unified accounting designation that replaced several legacy designations such as Chartered Accountant (CA), Certified Management Accountant (CMA), and Certified General Accountant (CGA). Becoming a CPA in Canada involves completing a prescribed educational program, passing the CPA Examination, and fulfilling practical experience requirements.

Finding a CPA Close to Me

If you're in need of accounting services, you might search for a "CPA close to me." This simply means looking for a Certified Public Accountant in your local area. Working with a CPA close to you offers the advantage of easy accessibility for meetings and consultations, facilitating smoother communication and collaboration.

American CPA

In the United States, CPA also refers to Certified Public Accountant. Similar to Canada, CPAs in the US are highly respected professionals with expertise in accounting and finance. They play crucial roles in auditing financial statements, preparing tax returns, providing consulting services, and ensuring compliance with regulatory requirements.

What Are CPAs?

In summary, CPAs are highly trained professionals in the fields of accounting and finance. They provide a range of services including tax preparation, auditing, financial planning, and consulting. In marketing, CPA refers to Cost Per Action, a pricing model where advertisers pay for specific actions. In Canada and the United States, CPA represents the professional designation for accountants who have met stringent educational, examination, and experience requirements.

Whether you're seeking accounting services, delving into marketing strategies, or simply curious about the world of finance, understanding CPA can provide valuable insights into these domains.

#cpamarketing#cpanel#cpa course#cpafirm#cpa services#accounting#entrepreneur#beautiful photos#curvy and cute#business growth#cpau#canandaigua#new york city#san francisco

0 notes