#Blackrock Larry Fink

Explore tagged Tumblr posts

Text

Larry Fink: 5 Life Changing Lessons from a Financial Guru

Larry Fink: 5 Life Changing Lessons from a Financial Guru

Larry Fink, CEO of BlackRock, is the man who revolutionized today’s finance and oversees more than $9 trillion. His journey offers valuable lessons:

1. Learn from Failure: Fink who learned the value of risk management after BlackRock sustained an initial $100 million loss in his career.

2. Think Long-Term: Fink also focuses on sustainability, but he extends it too far when he calls on companies to tie their revenues with the welfare of society.

3. Leverage Technology: In one of BlackRock’s key displays of Aladdin platform, it is visible how much he steers with innovative approach towards risk management.

4. Lead with Purpose: Fink supports the business management for companies to benefit all the stakeholders and not only shareholders.

5. Adaptability Wins: Acceptance of change always places Fink in the right side of the ivory tower of the ever changing face of financial services.

Fink takes special lessons from this story as a model for leadership.

if you wants more related this kinds of content please visit finniftyindex

1 note

·

View note

Text

"Football, beer and gambling filled the horizon of their minds. To keep them in control was not difficult." - George Orwell 1984

🔥 Fuel Our Work: https://bit.ly/TFTPSubs 🎙 TFTP Podcast: https://bit.ly/TFTPPodcast

#TheFreeThoughtProject #TFTP

#the free thought project#tftp#blackrock#orwell#president#election 2024#trump#larry fink#capitol hill#white house#usa

13 notes

·

View notes

Text

The Dark Side of Tesla

#elon musk#tesla#larry fink#blackrock#salim ramji#vanguard#douglas emhoff#kamala harris#donald trump#melania trump#bill clinton#hillary clinton#barack obama#michelle obama#2024 presidential election#election 2024#usa#united states#america#nwo#new world order#illuminati#agenda 2030#event 201#covid 1984#plandemic#cashless society#one world government#the great reset#green new deal

4 notes

·

View notes

Photo

οὐ γὰρ ἔστιν ἔπαλξις πλούτου πρὸς κόρον ἀνδρὶ λακτίσαντι μέγαν Δίκας βωμὸν εἰς ἀφάνειαν*

- Aeschylus

Riches are no defence for a man who has insolently trampled underfoot the altar of Justice until it disappears.*

Larry Fink, chairman and CEO of BlackRock. The main instigator behind the ESG fad with his much derided annual ‘CEO’s Letter.’

#aeschylus#greek#classical#quote#riches#esg#shareholders#duty#profit#social engineering#pensions#blackrock#larry fink#business#social justice

76 notes

·

View notes

Text

#larry fink#blackrock#kamala harris#tim walz#democrats#liberals#donald trump#jd vance#republicans#conservatives#us elections#election 2024#bitcoin

4 notes

·

View notes

Text

#blackrock#black rock#vanguard#trump#larry fink#john bogle#esoterik#occultism#esoteric#flat earth#freemason#freemasonry#elite

4 notes

·

View notes

Text

Larry Fink Blackrock Grand Theft Auto AI Gencraft.ai

#blackrock#larry fink#grand theft auto#gta#ai art generator#rockstar games#ai artist#ai fanart#capitalism#asset management#esg

2 notes

·

View notes

Text

The federal reserve, wall street, and big banking are all evil. BUT, if we had to start with a specific company of PURE FUCKING EVIL WHO HAVE ONLY DONE EVIL, there's blakc rock. AND THEY HAVE NAMES YOU NEVER HEARD!

Larry Fink, Susan Wagner, Robert S. Kapito, Barbara Novick, Ralph Sclosstein, Hugh R. Frater, and Ben Golub.

"BlackRock has nearly $10 trillion in assets under management. That’s more than the GDP of every country in the world except for the United States and China."

#blackrock#investment firm#larry fink#susan wagner#robert kapito#barbara novick#ralph sclosstein#hugh frater#ben golub#money#ban#banking#wall street#federal reserve

10 notes

·

View notes

Text

Blackrock and AmEx ESG is forcing discrimination 😡

youtube

6 notes

·

View notes

Text

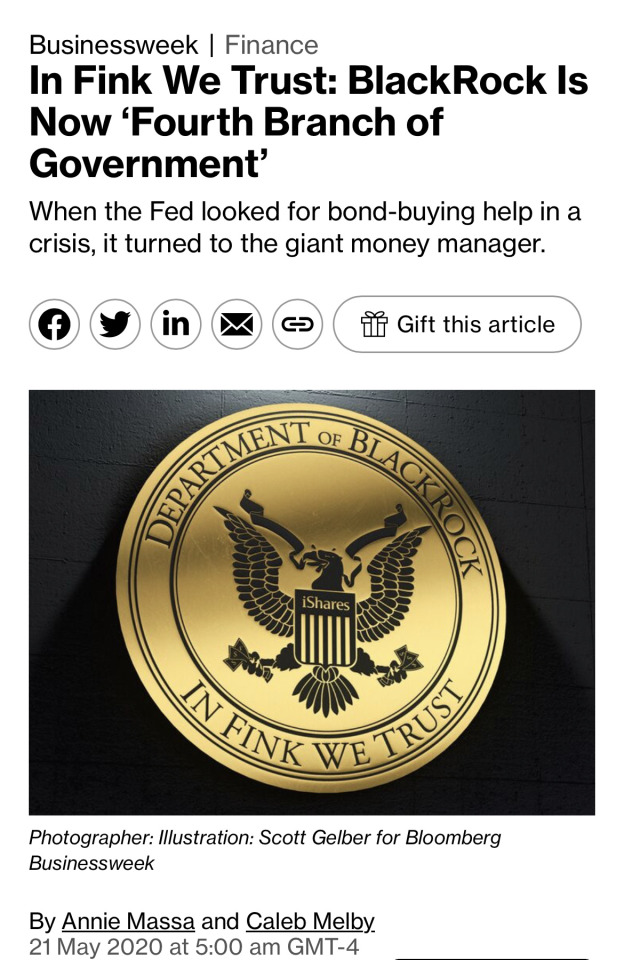

“Still the arrangement is bringing new attention to the company’s scale and ubiquity. “It’s impossible to think of BlackRock without thinking of them as a fourth branch of government,” says William Birdthistle, a professor at the Chicago-Kent College of Law who studies the fund industry.

(…)

There’s probably no other financial institution that brings to the table what BlackRock does. It’s experienced in running large portfolios on behalf of others. It’s ubiquitous in markets for everything from passive, index-linked products to hands-on mutual funds, with $6.5 trillion in assets under management as of March 31. It’s the largest issuer of ETFs, which act like mutual funds but trade on an exchange. It actively manages more than $625 billion in bond funds for pension plans and other institutional clients. Almost anyone looking to buy a diverse portfolio quickly would consider BlackRock—and the Fed did the same. In a virtual hearing of the Senate Banking Committee on May 19, Fed Chairman Jerome Powell said BlackRock was hired for its expertise and “it was done very quickly due to the urgency” of the matter.

Beyond money management, BlackRock’s software platform, Aladdin, appealed to the Fed. The program evaluates risk for clients that include governments, insurers, and rival wealth managers, monitoring more than $20 trillion in assets. (Bloomberg LP, the parent company of Bloomberg News, sells financial software that competes with Aladdin.)

BlackRock has ascended to speed-dial status among Washington officialdom in part through shrewd business maneuvering. It scooped up Barclays Global Investors, including its iShares ETF division, in the fallout from the 2008 crisis. That gave BlackRock a stronghold in low-cost index funds, transforming it into the world’s largest asset manager almost overnight—and supercharging more than a decade of growth.

At the same time, the money manager built a powerful advocacy arm. Its sphere of influence reaches beyond the central bank to lawmakers, presidents, and government agency heads from both political parties, though its hiring leans Democratic. Bloomberg found only a handful of current BlackRock executives who came out of the George W. Bush administration, but more than a dozen Barack Obama alumni. These include Obama’s national security adviser, senior adviser for climate policy, the former Federal Reserve vice chairman he appointed, and numerous White House, Treasury, and Fed economists.

(…)

BlackRock, however, was handed three Fed assignments without any competitive process—though the Fed plans to rebid the contracts once the programs are in full swing. BlackRock will manage portfolios of corporate bonds and debt ETFs. It will do the same for newly issued bonds—sometimes acting as the sole buyer—and for up to 25% of bank-syndicated loans. And it will purchase commercial mortgage-backed securities from quasi-government agencies such as Fannie Mae and Freddie Mac.

BlackRock could reap as much as $48 million a year in fees for its Fed work, according to a Bloomberg analysis. That’s no windfall, especially in relation to its $4.5 billion in earnings last year. But it may further cement the money manager’s ties with policymakers. On May 12, BlackRock began the first stage of these programs when it began buying ETFs.

As with technology companies Facebook Inc. and Alphabet Inc., BlackRock’s growth raises questions over how big and useful a company can become before its size poses a risk. The firm has long argued that, unlike banks, it’s not making investments for itself with tons of borrowed money. Watching over large sums of money for clients doesn’t make its business a threat to the broader financial system.

With its latest assignment, that argument could be harder to make, says Graham Steele, director of the Corporations and Society Initiative at the Stanford Graduate School of Business. “They are so intertwined in the market and government that it’s a really interesting tangle of conflicts,” says Steele, who formerly worked at the Federal Reserve Bank of San Francisco. “In the advocacy community there’s an opinion that asset managers, and this one in particular, need greater oversight.”

Already there are growing worries about the power of BlackRock, Vanguard Group Inc., and State Street, often called the Big Three because they hold about 80% of all indexed money. That raises concerns about how they wield their voting power as shareholders and has even drawn attention from antitrust officials.

(…)

And then there are the potential conflicts. One arm of BlackRock knows what the Fed is buying, while other parts of the business participating in credit markets could benefit from that knowledge. To avoid conflicts, “there are stringent information barriers in place,” says the BlackRock spokesman. BlackRock employees working on the Fed programs must segregate their operations from all other units, including trading, brokerage, and sales. The fee waiver on ETFs helps avoid the appearance of self-dealing.

But BlackRock’s contract with the Fed also acknowledges that senior executives “may sit atop of the information barrier” and “have access to confidential information on one side of a wall while carrying out duties on the other side.” Staff working on the Fed programs must go through a cooling-off period before moving to jobs on the corporate side, but it would last only two weeks.

Birdthistle, the Chicago-Kent law professor, suggests the Fed could have made its process more competitive by allocating some of its funds for buying corporate credit to a group of asset managers from the outset, instead of just one. “It raises the question: Why did all the money have to go to one company?” he asks. “I get why BlackRock would be on the list, but I don’t understand why it would be the only one on the list.””

6 notes

·

View notes

Text

Repost:

Larry Fink “forcing behaviors” via Blackrock and companies they control like Disney, Target and Kroger and whole categories of food like meat (vs fake meat) eggs (vs fake eggs)

#larry fink#blackrock can kiss my ass#blackrock#esg#war on kids#war on food#war on humanity#war on meat#war on eggs#overwhelming propaganda dominance

2 notes

·

View notes

Text

“I’m tired of hearing this is the biggest election in your lifetime. The reality is over time it doesn’t matter”, said BlackRock chief Larry Fink at an October 21 conference. He's not wrong!

Read More: https://thefreethoughtproject.com/government-corruption/it-really-doesnt-matter-blackrock-ceo-says-wall-street-benefits-regardless-who-is-president

#TheFreeThoughtProject

#the free thought project#tftp#police state#oligarchy#blackrock#ceo#larry fink#trump#kamala#biden#wall street

2 notes

·

View notes

Text

Lobbying

(Source)

#larry fink#blackrock#salim ramji#vanguard#douglas emhoff#kamala harris#donald trump#melania trump#bill clinton#hillary clinton#barack obama#michelle obama#agenda 2030#event 201#id2020#one world government#the great reset#nwo#new world order#illuminati#usa#united states#america#2024 presidential election#election 2024#democrat#republican#liberal#conservative#vote

3 notes

·

View notes

Text

BlackRock CEO Larry Fink downplayed the significance of the upcoming US presidential election for financial markets, stating that the outcome “really doesn’t matter" in the long run. Fink also emphasised that BlackRock works with both Republican and Democratic administrations and is currently engaged in discussions with both 2024 presidential candidates.

#larry fink#blackrock#kamala harris#tim walz#democrats#liberals#donald trump#jd vance#republicans#conservatives#us elections#election 2024#political#politics

2 notes

·

View notes

Text

https://www.mirrorreview.com/blackrock-ceo-larry-fink/

Have you ever wondered who built the largest asset management company in the world? Well, it was BlackRock’s CEO Larry Fink!

His vision for using cutting-edge technology, his focus on ETFs, and his commitment to sustainability have made BlackRock the largest asset manager in the world. From a setback early in his career to becoming a billionaire leader, the story of Blackrock’s CEO Larry Fink is one of strength and smart strategies. In this blog, you will explore how his bold moves shaped modern finance and catapulted him to global success!

0 notes

Text

BlackRock: The Neo-Monopoly of Modern Finance

BlackRock. A name not of a far-off mountain or an industrial power plant, but of a financial titan with a grip spanning the globe. Its reach is beyond Wall Street, stretching into the lives of millions in ways both seen and unseen, both public and deeply private. Founded in 1988, BlackRock has risen from a quiet asset manager to a giant, holding sway over corporations, governments, and every…

0 notes