#Best personal loan for self-employed

Explore tagged Tumblr posts

Text

Personal Loans for Self-Employed: Everything You Need to Know

Self-employed individuals often face challenges in securing financial assistance due to irregular income streams and fluctuating business profits. However, personal loans can be an ideal solution, providing quick access to funds without requiring collateral. This guide explores everything you need to know about personal loans for self-employed individuals, including eligibility criteria, required documents, and the best lenders offering these loans in India.

Understanding Personal Loans for Self-Employed

A personal loan is an unsecured financial product that allows individuals to borrow money without pledging assets as security. Self-employed individuals, including freelancers, consultants, and business owners, can apply for personal loans to meet various financial needs such as business expansion, medical expenses, or personal emergencies.

Eligibility Criteria for Self-Employed Individuals

The eligibility criteria for self-employed applicants may differ slightly from those for salaried individuals. Common factors include:

Age: Typically between 21 and 65 years.

Business Stability: Minimum operational period of 2-3 years.

Minimum Annual Income: Varies by lender, generally INR 2-5 lakh per annum.

Credit Score: A good credit score (typically 700+) enhances loan approval chances.

IT Returns: Banks may require income tax returns (ITR) for the last two years to verify income stability.

Documents Required for a Self-Employed Personal Loan

When applying for a personal loan, self-employed individuals must submit the following documents:

Identity Proof: PAN Card, Aadhaar Card, Passport.

Address Proof: Utility bills, rental agreement, or voter ID.

Income Proof: ITR documents for the past two years.

Bank Statements: Last six months' statements.

Business Proof: Business registration certificate, GST registration, or shop act license.

Steps to Apply for a Personal Loan as a Self-Employed Individual

Step 1: Research Lenders and Compare Offers

Several banks and Non-Banking Financial Companies (NBFCs) provide personal loans for self-employed individuals. Some top lenders include:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

Step 2: Check Eligibility and Gather Documents

Before applying, ensure you meet the lender’s eligibility criteria and have all necessary documents prepared.

Step 3: Apply Online or Offline

Online Application: Visit the lender’s website and submit an online application.

Offline Application: Apply through a branch or an authorized loan agent.

Step 4: Document Submission and Verification

The lender will verify submitted documents and assess creditworthiness before approving the loan.

Step 5: Loan Approval and Disbursal

Once approved, the loan amount is credited directly to your bank account, typically within 24-48 hours.

Key Factors to Consider Before Applying

1. Interest Rates & Processing Fees

Interest rates typically range between 10% - 25% per annum. Always compare rates and additional charges before choosing a lender.

2. Loan Tenure

Repayment tenure varies between 12 to 60 months, so select a tenure that suits your financial capability.

3. Prepayment and Foreclosure Charges

Check if the lender allows prepayment without hefty penalties.

4. Business Stability & Cash Flow

Ensure your business has a steady cash flow to meet monthly EMI payments without financial strain.

Top Lenders Offering Personal Loans for Self-Employed Individuals

1. IDFC First Bank

Competitive interest rates.

Minimal documentation required.

Fast approval process.

2. Bajaj Finserv

High loan amounts available.

Flexible repayment options.

Quick disbursal process.

3. Tata Capital

Hassle-free application process.

Tailored repayment plans.

Low processing fees.

4. Axis Finance

No collateral required.

Suitable for various business professionals.

Attractive interest rates.

5. Axis Bank

Easy online application.

Customizable EMI options.

Special benefits for existing customers.

Conclusion

For self-employed individuals, securing a personal loan in India is easier than ever, thanks to digital banking solutions and customized loan offerings. By ensuring a good credit score, maintaining stable business income, and selecting the right lender, self-employed professionals can efficiently access financial support.

For more details on personal loans, visit Fincrif.

#finance#personal loan online#nbfc personal loan#loan apps#bank#personal loans#loan services#personal loan#fincrif#personal laon#Personal loan for self-employed#Self-employed personal loan eligibility#Instant personal loan for self-employed#Best personal loan for self-employed#Personal loan without income proof#Unsecured personal loan for self-employed#Personal loan for business owners#Loan for freelancers in India#Low-interest personal loan for self-employed#Quick personal loan for self-employed#Personal loan for small business owners#Personal loan for entrepreneurs#Best NBFC personal loans for self-employed#How to get a personal loan being self-employed#Online personal loan for self-employed#Personal loan for professionals#Self-employed personal loan interest rate#Business loan vs personal loan for self-employed#Self-employed loan application process#Documents required for self-employed personal loan

0 notes

Text

The not so subtle sentimentality of Mordecai Heller

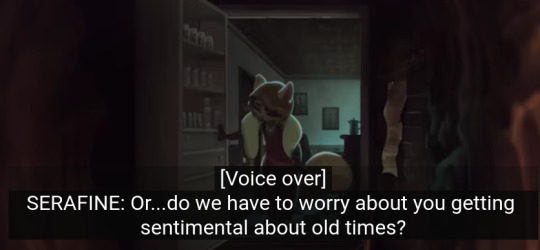

With the Lackadaisy Short Film teaser trailer hitting over 800K views one line from Serafine got me thinking about a side of Mordecai that is not often discussed but is crucial to his character and may play a key part in the comics story before the end

Though it is easy for both other characters in the story and readers to see Mordecai as just a cold killer that cares more about stains on his shirt than ending multiple lives in grizzly ways (and that is true for anyone who makes the mistake of getting in the way of him completing his work) a closer look reveals that, while reserved for a short list of people, there is a strong streak of sentimentality hidden behind the buttoned down aloof professional persona he tries so hard to maintain

His Mother and Sisters

Mordecai was dealt a very bad starting hand in life. With his father dying when he and his sisters were still very young, despite his loving and hard working mother doing her best to provide for them, the family lived in poverty in the slums of New York

As a result Mordecai has to start working at a very early age and being naturally gifted with numbers he becomes a book keeper and soon enough gets drawn into running the numbers for gambling and loan sharking gangs.

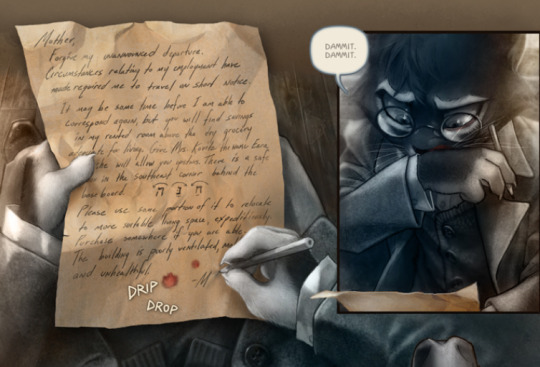

All of this was done to try and make life better for his mother and his sisters. In a flashback to when he was on the run from the criminals he had been working for after being caught embezzling funds from them, his life is in danger and he needs to get out of town in a hurry and so jumps on a train in either 1920 or 1921.

Despite this he fixates on writing a letter to send to his mother in which he explains the location of his ill gotten savings and urges her to move with his sisters to cleaner better ventilated housing.

Because the money wasn’t primarily for his benefit

Mordecai clearly loved his sisters very much and they could break him out of his reserved bookish demeanor. We can see even as an adult Modecai holds the memory of his childhood with his sisters, impoverished and hard though it clearly was, very close. Close enough that thinking about them are enough to bring out his very small but very genuine smile that could not be further away from his “ice pick look”.

Atlas

The next imporant relationship in his life is with Atlas May. When on that getaway train he soon realized that cut throats from his former employers are already in the carriage waiting for their moment to pounce

Mordecai is 100% certain that he is about to get a bullet to the head and the tunnel will provide the hitmen with the perfect cover as the darkness and noise descends.

Only for a ray of light to suddenly appear

Atlas gave Mordecai the means to survive, not just by literally giving him what he needed to escape his would be murderers, but by employing him and providing a new purpose when he had nowhere else to go and no idea what to do.

Atlas being dead by the time of the main story, by design we know very little about his personality and relationships with others except for what the people who knew him have to say.

But is is very clear that Mordecai felt a deep loyalty to Atlas. It may even be speculated that he became a surrogate father figure for him, having lost his own father so young and having been moulded while working for him from the scared youth in shabby second hand clothes to a dapper professional bookkeeping bootlegger

This loyalty has not ended with Atlas’s death. He is determined to get to the bottom of the mystery of his murder. This is despite the fact it would be a much smarter move by far for the sake of both professionalism and survival to let dead former employers lie and simply carry out his new role with the Marigold gang no questions asked

Instead it is clear the entire reason he has abandoned The Lackadaisy is not, as Mitzi and the rest think, cold self interest but so he can investigate if the rival gang had any role in his mentors death

Even discussing the topic causes his cold passive exterior to crack and makes him look broken and overwhelmed

Viktor (You knew this was coming)

As anyone who has followed this account will know this is one of my (and many other fans) favourite dynamics in the series

At fist it seems there is little reason for these two to have any kind of bond. Mordecai is pretty much obsessed with good grooming, high quality tailoring, correct grammar, and tends to go on one-sided rambles when perturbed.

This clashes hard with the surly Slovak who is often unshaven, relatively casual in his attire, speaks a broken English, and hates people chattering or “noise, noise, noise” as he calls it. Indeed the two often bicker and act as if they can’t stand the other

However for whatever reason, in spite of these big differences, the big bruiser mechanic and the fussy nerdy sharp shooter are able to work very well together and soon become key weapons in Atlas’s arsenal

And in spite of their differences there is evidence, that over the course of the roughly six years they were working together before their bosses death, that these two extremely anti-social personalities actually began to form an unlikely rapport

On the one known occasion when Mordecai actually drank strong alcohol, and predictably got hilariously drunk, one of his chosen topics of conversation is his “friend” Viktor and how “great” he is (including a possibly telling comment about his large physique *cough*)

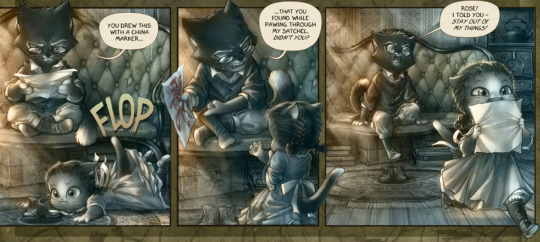

Mordecai also, despite being the type of person who you would assume would just radiate Scrooge energy, makes a point of buying Viktor a Christmas/hanukka present. Though he keeps up appearances by presenting it as another criticism of Viktor’s fashion sense

Tellingly Viktor voluntarily wears the tie for the rest of the day, something only Ivy (someone Viktor treats as a surrogate daughter) is able to get away with as well.

The two also not only work well together in a professional capacity, but seem to truly look out for each others welfare when on the job. Not only does Mordecai save Viktor from being shot while distracted, Viktor then goes out of his way to retrieve Mordecai’s pince-nez from the staircase of a burning building

While a hilarious moment as Mordecai fails to react in the “correct” way to having just survived a bloody shoot out, it also sums up his entire attitude to people, that he separates the world into those who count and those who don’t. The former are a short list

Viktor, along with the others on here, counts for Mordecai

This is made clear at his chat with Mitzi at the lunch meeting.

Mordecai may have kneecapped Viktor when he left the Lackadaisy gang, but from what we know now this was clearly an attempt to get Viktor out of harms way by forcing him to retire from bootlegging, and quite possibly to avoid Marigold putting him in a position where he would have to fight Viktor if he was told to finish off the failing speakeasy. Something he could hardly refuse if he wanted to keep investigating Atlas’s death

Mitzi seems to know Viktor is a chink in Mordecai’s armour, and of course exploits that to the fullest. When she informs him that his theft of the Lackadaisy arsenal put Viktors life in danger Mordecai’s face makes less than neutral expression

As Mitzi keeps twisting that screw Mordecai knows he is in danger of giving something away and with Asa right next to him he needs to restore his barriers.

In this case quite literally using a menu to cover his face to ensure he doesn’t slip up again

It seem to work as Asa laughs of the idea of Mordecai having a heart beneath the cold exterior (something we know is a big mistake)

Even when the attention is off him and the topic of conversation moves on his gaze remains firmly fixed down at the table.

Until Atlas lets slip some crucial information about Atlas’s last days. So much for there being “no heartstrings to tug on”

I am sure the Lackadaisy Animated Movie is going to be amazing and hopefully will only lead to ever more popularity and attention for this amazing world and its characters

#lackadaisy#lackadaisycats#tracy j butler#mordecai heller#viktor vasko#vikdecai#viktor x mordecai#asa sweet#zippy heller#rose heller#esther heller#atlas may#mitzi may#1920s#cats#calvin mcmurray#rocky rickaby#ivy pepper

2K notes

·

View notes

Text

Respect

Monday - October 21, 2024

In the early 90s I worked for an Executive who was a Japanese national. For two years he was "on loan" from a Tokyo based company, and during my time in Mr. Takei's employ I learned about the energy of "respect" in a way that complimented my Southern raising.

I don't know how to define "respect," but I know it when I see it. I guess it all comes down to being energetically aware about others, and the impact your actions have on them. With that definition, I'm still very much learning about how "respect" is best demonstrated.

"Respect" is a good key word for today as Mars sits at 24° Cancer, a degree it moved to yesterday and will stay at most of Tuesday. 24° is a Libra ruled degree; Mars is the ruler of Aries, the opposing sign of Libra. So this planet/degree combination in the sign of Cancer should help all of us understand the importance of Respect. How it binds a society, helps it face difficult times together, and how it sets up concepts that will serve you well in both your personal and professional relationships.

Find a way to "respect" another today. Hold the door open for someone, do more listening than talking, check in on that Elder you haven't heard from in a while, or withhold your "constructive criticism" for a time when another is prepared to listen to it.

Respect will take you a long way in all your relationships, including the relationship with your Self.

19 notes

·

View notes

Text

How to Get the Best Personal Loan Offers in India

Introduction

In today’s fast-paced world, financial needs often arise unexpectedly. Whether it’s a medical emergency, a home renovation project, or a dream vacation, personal loans can provide the financial flexibility you need to make your aspirations a reality.

Pricemint, an Indian fintech platform, is dedicated to helping individuals unlock their financial potential by offering a straightforward and user-friendly process for obtaining personal loans.

Benefits:

Loan Comparison: Easily compare personal loan offers from multiple banks and financial institutions.

Competitive Interest Rates: Access low-interest rates and potentially save money over the loan tenure.

Convenient Digital Process: Apply for personal loans conveniently online, from anywhere.

Customized Loan Offers: Get loan offers tailored to your unique financial situation.

Flexible Loan Amounts: Choose from a wide range of loan amounts to suit your needs.

Varied Tenure Options: Select a repayment period that matches your financial circumstances.

Regional Considerations: Loan terms are adjusted to regional factors that may affect your eligibility.

Transparent Process: Clear information about interest rates, fees, and terms is provided.

Personalized Assistance: Receive guidance and support throughout the loan application process.

Privacy and Security: Your personal information is protected in accordance with their Privacy Policy.

How to Get the Best Personal Loan in a Minute –

Step 1: Select Your Employment Type

The first step in securing a personal loan through Pricemint is to define your employment status. Pricemint recognizes that different employment types may have distinct loan eligibility criteria. You can choose from the following options:

Salaried: Select this option if you are employed by a company and receive a regular salary.

Self-Employed Professional: If you work independently as a professional, this is the choice for you.

Business Owner: If you own a business, you can choose this option.

This initial step helps Pricemint tailor your loan options to your specific employment situation, ensuring that you receive the most relevant loan offers.

Step 2: Your Monthly Salary

Your monthly income plays a crucial role in determining your eligibility and the loan terms available to you. In this step, you will be asked to provide your monthly in-hand income. It’s essential to provide an accurate representation of your earnings to receive loan offers that align with your financial capacity.

Alternatively, you can simply type in your monthly income to expedite the process.

Step 3: Choose Your Primary Bank Account

Selecting the bank account for loan disbursement and repayments is the next step in the process. Your primary account should be the one you actively use for your financial transactions. Pricemint offers a list of popular banks to choose from, including HDFC BANK, SBI BANK, ICICI BANK, KOTAK BANK, AXIS BANK, BOB BANK, YES BANK, and an option for OTHER BANK. This choice ensures seamless loan disbursements and repayments.

Step 4: Provide Your Employment/Company Name

To gain deeper insights into your employment details, Pricemint requests the name of your employer or company. This information helps in assessing your financial stability and eligibility for personal loans.

Step 5: What’s Your Residence Type?

Understanding your living situation is crucial for evaluating your lifestyle and its financial implications. You will be asked to choose from various residence types:

Owned by You/Spouse

Owned by Parents

Rented with Family

Rented and Stay Alone

Company Provided

By selecting the option that best represents your current residence type, you help Pricemint tailor loan offers to your specific circumstances.

Step 6: Enter Your Current Residence City or Town

To consider regional factors that may affect your loan terms and eligibility, Pricemint requests the city or location where you currently reside. This information ensures that the loan offers you receive are in line with the conditions in your area.

Step 7: All Set! What’s Your Desired Loan Amount?

Finally, it’s time to specify the loan amount you wish to borrow. Pricemint offers a flexible range, catering to various financial needs. You can choose from the following options:

Under 1 Lakh

2/4 Lakh

5/9 Lakh

10 Lakh And Above

This wide range provides the

flexibility to select the loan amount that best suits your unique financial requirements.

Final Step – Enter Your Personal Details

In the last step, you will be required to enter your personal details, including:

Your Name

Your Email Address

Your Phone Number

This information is necessary to complete the application process and to contact you with personalized loan offers.

By clicking the “Get Offers/Apply Now/Continue” button, you indicate your acceptance of the Privacy Policy, ensuring the security of your personal information.

Conclusion

Pricemint makes obtaining personal loans in India a hassle-free process. By following the step-by-step guide outlined in this article, you can seamlessly navigate the application process, receive personalized loan offers tailored to your unique circumstances, and secure the financial support you need to achieve your goals and secure your future.

With a wide range of loan amounts, flexible tenure options ranging from 3 months to 8 years, and the ability to compare multiple offers with different interest rates, Pricemint empowers you to make informed financial decisions and choose the best loan deal for your needs.

Don’t let financial constraints hold you back from pursuing your dreams and addressing your urgent financial needs. Unlock your financial potential with Pricemint’s user-friendly personal loan application process and take control of your financial future. Get started today and embark on your journey toward financial stability and prosperity.

2 notes

·

View notes

Note

OMG I WAS THINKING! Ghost sims would make really good holograms …that sound creepy… but anyways especially the blue one. Also what do you think cyberpunk school would look like… sorry I’ve been searching on Pinterest and can’t find anything. Im at a tie with college like sermon with holograms, some where they’re hooked into vr headsets or computers, and just… there is no school. Idk what your thoughts?

(Sending Love … 98% Complete)

I love when people come to my inbox and posit things like this! I have a lot to say, lol.

As a baseline definition, cyberpunk as a genre is a near-future dystopia, defined by the domination of megacorporations, technology and the escalation of class stratification and its ramifications. So, I think there definitely is school and higher education.

Everything below is based heavily on the workings of US school systems.

There is general education through the high school level provided by the district/city but, much like in our own world, the quality of this education is dependent on the wealth of the district. The schools in poorer districts have less funding, and thus less access to technology and different specialties and extracurriculars for study. I imagine that, if you're lucky, there might have been a wealthy benefactor that decided to be generous and fund the operation of the cyberpunk equivalent of a charter school in your district.

The best schools are going to be corporation-owned or private institutions. These are private schools with all of the best amenities and access to the latest technology. Even amongst these schools there's a hierarchy, with the tuition costs reflecting the level of prestige. In Cyberpunk 2077, corporate workers get access to the corporation's healthcare plan; I imagine that getting discounted tuition for your child to the corporation's school is also one of the benefits, thus incentivizing people to join the megacorp machine (like in the US, how a lot of people join the military because they promise to cover the cost of your schooling).

On to higher education. College/university is astronomically expensive (and that's saying a lot considering how expensive it already is *cries in American with student loan debt*). Only the ultra rich, or those with connections can afford it. If you're not in one of the aforementioned categories, the amount of debt you would incur trying to finance education is a life sentence. For reference, there's an ad in Cyberpunk 2077 offering a loan with a 31.1% interest rate (can you imagine!?) and obviously, poorer people with bad or no credit are going to be subjected to the higher rates.

Now, about your ideas on the different manifestations of school, my answer is 'all of the above'! Dictated by funding, a school/business probably employs a mix of all of those methods. Imagine a guest lecturer joining via holo (in-person/physical classes probably cost more), or a netrunning class where they get to experience the net without the risk via a VR simulation. This applies not only to traditional academia, but other skill classes as well (martial arts, pottery, aerial silks, you name it!); just like in our reality, you can take singular classes in whatever you want, for a price.

As a result of everything previously mentioned, I think the majority of people in a cyberpunk reality make it through basic schooling and then engage in nontraditional/nonstandard methods of education. I imagine that some people may find someone who can train them in their desired trade/skill, and a lot of the hackers/netrunners, techies etc. are self-taught. In this vein, just like currently in our world we have access to lots of tutorials via youtube and websites like skillshare etc., the popularity of this has probably only grown and I imagine that training braindances/simulations are commonplace, both in and out of the workplace.

The one time I did a hologram (of a person) I just used a regular sim and edited them in post to get that holo effect. I haven't messed around much with ghost sims; I'm curious about how the ghost sim form would interact with lighting and such. Maybe next time I do a hologram I'll try it and see if I like it. It might save some time if all I have to add are the scanlines, lol.

4 notes

·

View notes

Text

ICICI Bank Personal Loan Eligibility Based on Salary – Everything You Need to Know

Personal loans have gained popularity everywhere among borrowers looking to meet their urgent and oftentimes whimsical needs for the hospital, education, travel, or home repair. ICICI Bank personal loan interest rates and repayment flexibility are, therefore, among the most popular in the industry in India. However, knowledge of the ICICI personal loan eligibility salary parameter becomes essential before one even applies for a loan. This article elaborates on the extent to which your salary affects loan eligibility and how to improve approval chances.

Understanding ICICI Bank Personal Loan Eligibility Salary Criteria

ICICI Bank personal loan approval hinges on many factors with salary criteria being one of the most prominent. Your income determines how much your banking institution could loan you and also how much you are comfortable paying back. The ICICI Bank personal loan eligibility salary requirement varies under your employment type, city, and additional financial obligations.

Minimum Salary Requirement for ICICI Bank Personal Loan

The minimum salary for an ICICI Bank personal loan depends on job types, as follows:

1. For Salaried Individuals in Metro Cities, a minimum monthly salary of Rs. 25,000 is required.

2. For Salaried Individuals in Non-Metro Cities, a minimum monthly salary of Rs. 20,000 is required.

3. For Self-employed Individuals, eligibility is based on income tax returns and business sustainability.

If you meet the minimum ICICI Bank personal loan eligibility salary requirement, chances of approval are high.

Factors Affecting ICICI Bank Personal Loan Eligibility

Besides salary, some other factors that have a say in your loan eligibility:

1. Credit Score

A good credit score above 750 will increase the chances of getting a loan with favorable interest rates, whereas a low credit score may lead to rejection or high interest rates.

2. Employment Stability

icici bank personal loan eligibility salary favors applicants who are in a stable job with a reputed company. A minimum of 2 years of total work experience with at least 1 year in the current organization is best.

3. Existing Financial Liabilities

Your debt-to-income ratio matters at this stage. If you have pre-existing multiple loans or credit card dues, it will affect the ICICI Bank personal loan eligibility salary assessment.

4. Loan Amount and Repayment Tenure

For the approval of a higher loan amount, a higher salary requirement applies. Moreover, a long tenure will ease your EMI burden.

How to Improve Your ICICI Bank Personal Loan Eligibility

If you do not satisfy ICICI Bank's minimum personal loan eligibility salary requirement, these tips will help improve your eligibility:

1. Increase Your Credit Score

To up your creditworthiness, and pay off any existing debts, be sure to make your credit card payments on time and keep your credit utilization ratio good.

2. Co-Applicant

A co-applicant with a steady income will help increase the chance of being approved for a loan. This will also help you secure a higher quantum of loan.

3. Previous Income

Mention any other alternative sources of income such as rent, commissions, or freelance work in your loan application to boost income eligibility.

4. Extend Tenure

This option will lessen the burden of EMI, thereby helping the bank to repose trust in you and approve your loan.

ICICI Bank Personal Loan EMI Calculation Based on Salary

Calculating the EMI before applying for a personal loan helps you have a smooth repayment. icici bank personal loan eligibility salary offers an EMI calculator to calculate the monthly installment based on the loan amount, interest rate, and tenure. As a rule of thumb, banks prefer that an EMI does not exceed 40-50% of the net monthly salary.

Example:

If your monthly salary is Rs. 50,000, your EMI should be ideally under Rs. 25,000.

If your monthly salary is Rs. 1,00,000, your EMI should not be more than Rs. 50,000.

How Can Arena Fincorp Help You?

Sometimes, a personal loan application can seem overwhelming due to various eligibility factors and documentation requirements. Arena Fincorp provides expert financial consultation to assist you smoothly through the loan application. From helping you enhance your ICICI Bank personal loan eligibility salary criteria to choosing the correct loan tenure, Arena Fincorp ensures that you secure the best deal for your financial requirements.

Documents Required for ICICI Bank Personal Loan

So that the loan application process will run smoothly, keep the following documents ready:

1. Aspiring Identity Proof-Aadhaar Card, PAN Card, Passport, Voter ID

2. Address Proof-Utility Bills, Home Tax, Aadhaar Card or Passport

3. Income Proof-Last 3-month Salary Slips, Last 6 months Bank Statements, Form 16

4. Employment Proof-Offer Letter or Job Confirmation Letter

Conclusion

Before applying for a loan, understanding ICICI Bank personal loan eligibility salary criteria is of great importance. These criteria will include salary, credit score, stability of employment, as well as existing financial obligations affecting your eligibility. If you start building your credit profile, managing current debts, and seeking the proper loan tenure, your chances of securing a loan greatly increase.

If you need qualified assistance in scoring the best personal loan deal, Arena Fincorp will help you out. With professional financial consultation and personalized loan solutions, you can get the right financial support tailored to your needs.

Start your journey to financial freedom today by checking your eligibility and applying for an ICICI Bank personal loan!

0 notes

Text

Back to Home

Apply For A Personal Loan

Check Offers

Check Eligibility Criteria

Let your customer know they’ll get an OTP after form submission

Get upto ₹8lacs

Fully digital process

No spam calls to customers

Get upto ₹8lacs

Fully digital process

No spam calls to customers

Don't worry, checking offers will not impact your customer's credit score.

Earn 1.25% on every loan disbursement

Eligibility Criteria for Personal Loans

Age21 to 60 years

Credit ScoreShould be above 700

Monthly IncomeMinimum of ₹15,000. Loan up to 20 times your monthly income

Employment TypeSalaried individuals or self-employed with ITR

Existing EMIsCurrent EMIs should not exceed 60% of your monthly income

Last LoanShould not have been taken in the past 30 days

Backed By The Best

ROI 18-24%

1 - 2 Days

ROI 9.9-19%

4 - 12 Hrs

ROI 18-28%

12 - 24 Hrs

ROI 24-30%

4 - 12 Hrs

ROI 10-17%

1 - 3 Days

ROI 10-32%

7 - 10 Days

ROI 14-36%

12 - 24 Hrs

ROI 11-30%

12 - 24 Hrs

ROI 18-24%

1 - 2 Days

ROI 9.9-19%

4 - 12 Hrs

ROI 18-28%

12 - 24 Hrs

ROI 24-30%

4 - 12 Hrs

ROI 10-17%

1 - 3 Days

ROI 10-32%

7 - 10 Days

ROI 14-36%

12 - 24 Hrs

ROI 11-30%

12 - 24 Hrs

Get quick assistance with your sales now

Request a callback

Personal LoansApply in 3 Easy Steps

01Customer Details

Ensure the customer uses their own mobile for OTP verification and has their Aadhar and PAN card ready for smooth KYC via DigiLocker or manual entry.

02Offer Selection

03Loan Agreement

Why Turtlemint?Partner with the Best in Insurance and Lending!

Timely Payouts to Partners

No Spam Calls to Customers

Fair Credit Assessments

Trusted Loans, Verified NBFCs

No Follow-Up for Repayment

Timely Payouts to Partners

No Spam Calls to Customers

Fair Credit Assessments

Trusted Loans, Verified NBFCs

No Follow-Up for Repayment

FAQs

How to check the status of a loan application?

Digital Partners can check the status of a lead in the lead module.

What are the lenders available?

What are the documents needed for a personal loan application?

How to avoid personal loan rejection?

What are the prevailing rates for personal loans?

Can I apply for a digital personal loan with a low credit score?

Are there any hidden fees associated with digital personal loans?

How to file/track a complaint against entities?

Contact For Help

Get Help On ChatCall Turtlemint Expert

© 2025 Turtlemint Pro All Rights

0 notes

Text

Ultimate Guide to Urgent Cash Loan in Delhi – Quick & Easy Loan Solutions

Introduction

Financial emergencies can arise at any moment, making it essential to have access to quick and hassle-free loan solutions. Whether it’s for medical expenses, urgent bill payments, or unforeseen financial needs, an Urgent Cash Loan in Delhi can be the perfect solution.

At LoansWala, we specialize in providing instant financial assistance with minimal documentation and quick approvals. Our services cater to a wide range of financial needs, including personal loans, business loans, and emergency cash loans.

Why Choose an Urgent Cash Loan in Delhi?

An Urgent Cash Loan is designed for individuals who need immediate funds without lengthy approval processes. Here’s why it’s the best option:

Fast Approval: Get loan approval within minutes.

Quick Disbursal: Funds are transferred within 24 hours.

Minimal Documentation: No complex paperwork required.

No Collateral Needed: Completely unsecured loans.

Flexible Repayment: Choose a repayment plan that suits your needs.

Who Can Apply for an Urgent Cash Loan?

Salaried individuals with a stable income

Self-employed professionals

Business owners looking for quick financial assistance

Individuals with a valid ID and address proof

Types of Loans Available in Delhi

Besides urgent cash loans, LoansWala offers various loan options to cater to different financial needs:

1. Best Cash Loan in Delhi

If you are looking for the best cash loan in Delhi, LoansWala provides customized loan solutions with competitive interest rates. Whether it’s a short-term loan or a high-value personal loan, we have got you covered.

2. Emergency Personal Loans

Unplanned expenses can cause financial distress. Our Emergency Personal Loans are designed to provide instant relief in situations like medical emergencies, travel expenses, or urgent home repairs.

3. Business Loan in Delhi

For business owners who need capital for expansion, inventory purchase, or operational expenses, we provide Business Loans in Delhi with flexible terms and low-interest rates.

4. Car Loan Online in Delhi

Dreaming of owning a car? Apply for a Car Loan Online in Delhi and get quick approval with minimal documentation.

5. Instant Home Loan in Delhi

Planning to buy your dream home? Our Instant Home Loan in Delhi offers easy financing solutions to help you purchase property without financial stress.

How to Apply for an Urgent Cash Loan in Delhi?

Applying for a loan with LoansWala is a simple and straightforward process. Follow these steps:

Visit Our Website – Go to LoansWala.

Fill Out the Application Form – Enter basic personal and financial details.

Upload Required Documents – Submit ID proof, income proof, and bank statements.

Loan Approval & Disbursal – Once verified, the loan amount will be transferred to your bank account within hours.

Eligibility Criteria for Urgent Cash Loans

To qualify for a loan, you must meet the following requirements:

Age: 21-60 years

Minimum Monthly Income: ₹15,000 (salaried) / ₹25,000 (self-employed)

Credit Score: 650 or above (preferred)

Work Experience: Minimum 1 year (salaried) / 2 years (self-employed)

Documents Required

Here’s a checklist of documents needed for a quick loan approval:

Identity Proof: Aadhaar Card, PAN Card, Passport

Address Proof: Utility Bills, Rent Agreement

Income Proof: Salary Slips (for salaried), ITR (for self-employed)

Bank Statements: Last 3-6 months

Photograph: Recent passport-size photo

Why Choose LoansWala?

LoansWala is a trusted name in the financial sector, offering fast and secure loan services. Here’s why customers choose us:

✅ Instant Loan Approvals – No long waiting periods.

✅ Low-Interest Rates – Competitive pricing for all loan types.

✅ Secure Transactions – 100% online and hassle-free process.

✅ Expert Financial Guidance – Personalized solutions for every borrower.

Frequently Asked Questions (FAQs)

1. How quickly can I get an urgent cash loan in Delhi?

You can receive loan approval within minutes, and the funds are typically disbursed within 24 hours after document verification.

2. What is the minimum and maximum loan amount I can apply for?

Loan amounts vary depending on your eligibility and repayment capacity. Generally, you can apply for amounts ranging from ₹10,000 to ₹5,00,000.

3. Will applying for a loan affect my credit score?

If you repay your loan on time, it will have a positive impact on your credit score. However, multiple loan applications in a short period may temporarily lower your score.

4. Can I apply for a loan if I have a low credit score?

Yes, but approval will depend on other factors like income, employment stability, and repayment history.

5. What happens if I am unable to repay the loan on time?

Failure to repay on time may result in penalties, additional interest, and a negative impact on your credit score.

Conclusion

An Urgent Cash Loan in Delhi is the best solution for those who need immediate financial assistance. Whether it’s a personal loan, business loan, or emergency loan, LoansWala offers quick approvals, minimal paperwork, and fast disbursals.

For more information Visit Here:- https://loanswala.in/contact1.php

#loanswala#business loan in delhi#urgent cash loan in delhi#low-interest business loan in delhi#cashloandelhi#carloanonline

0 notes

Text

Top 4 Reasons to Consider Private Mortgage Lenders

Choosing private mortgage lenders Ontario is helpful when traditional options do not work. Their flexibility helps individuals with various financial situations to secure loans without severe approval difficulties. Private mortgage lenders consider applications beyond credit scores to help people in need genuinely. Choosing private mortgage lenders also helps those with irregular incomes, self-employed professionals, or individuals who want to build their credit. This approach also provides quick approval. The best advantage of choosing private mortgage lenders is that they provide flexible loan structures for specific needs. Private lending solutions are the best choice for quickly getting the required money. Click here to know more. Flexible Lending Private mortgage lenders provide customized solutions by considering the individuals' financial situations. Choosing private mortgage lenders helps individuals with irregular income sources to get the needed funds without unnecessary delays. Their approval process focuses on practical affordability by not considering the credit standards. Their structured repayment options are beneficial and manageable for every individual. Faster Loan Processing Getting funds through private mortgage lenders is very quick. This private lenders Ontario approach reduces the need for extensive paperwork and waiting times to provide required funds without unnecessary pressure. This direct process eliminates unnecessary intermediaries by approving the loans faster. Quick funding is invaluable when purchasing property or requiring urgent needs. Personalized Loan Structures Private mortgage lenders are dedicated to helping individuals by offering flexible repayment plans according to individual financial situations. They may also adjust the loan terms based on the individual's repayment capacity to reduce financial strain. Interest rates and payment structures also vary according to the individual's requirements. Visit here for more details. Direct Access & Transparent Private mortgage lenders follow a clear approach by allowing individuals to communicate directly. They also clearly explain the terms and conditions before going forward. By avoiding multiple layers of approvals, they genuinely want to help every person in need. They also explain financing options to individuals by eliminating hidden terms. Their focus on transparency makes it easier to understand before proceeding. Their open communication helps individuals to make decisions with clarity. With direct access to financial experts, getting the required funds is easy and quick for individuals. About Brayden Hooper Mortgages Brayden Hooper Mortgages has a team of expert mortgage brokers who help find the best private mortgage lenders. Whether it's debt consolidation Oakville or securing a mortgage, their agents have the knowledge and experience to help individuals get the right financing. To get more details, visit https://braydenhoopermortgages.com/ Original Source: https://bit.ly/3XtUZ6D

0 notes

Text

How to Get the Lowest Interest Rate on a Personal Loan

A personal loan is a convenient financial tool that helps individuals meet their urgent expenses. Whether it’s for medical bills, home renovation, education, or travel, getting a personal loan with the lowest interest rate is essential to keeping repayment affordable. Lower interest rates mean reduced EMIs and overall cost savings. In this guide, we will explore how you can secure a personal loan with the best interest rates and what factors influence your loan offer.

Factors That Affect Personal Loan Interest Rates

1. Credit Score

One of the biggest determinants of your personal loan interest rate is your credit score. Lenders assess your creditworthiness based on your CIBIL score or other credit reports. A high credit score (750 or above) signifies responsible credit behavior and qualifies you for lower interest rates. If your score is low, lenders may charge a higher rate to compensate for the risk.

2. Income and Employment Stability

Your monthly income and employment type impact your loan terms. Salaried individuals with stable jobs, particularly those working with reputed organizations, get lower interest rates. Self-employed applicants may have to provide additional proof of financial stability to avail of a competitive rate.

3. Loan Amount and Tenure

The amount you borrow and the loan tenure influence your interest rate. While short-term loans may have higher monthly EMIs, they usually come with lower interest rates. On the other hand, long-term loans can accumulate more interest over time.

4. Relationship with the Lender

If you have an existing relationship with a bank or NBFC, such as a savings account, fixed deposit, or previous loan, they may offer you preferential interest rates on personal loans.

5. Market Conditions and Lender Policies

Interest rates are also affected by economic factors, such as inflation, repo rates, and RBI regulations. Keeping an eye on these factors can help you choose the right time to apply for a personal loan.

Tips to Secure the Lowest Personal Loan Interest Rate

1. Maintain a High Credit Score

Pay your credit card bills and EMIs on time.

Avoid excessive credit inquiries, as they lower your score.

Regularly check your credit report and correct any discrepancies.

2. Compare Personal Loan Offers

Don’t settle for the first offer you receive. Compare personal loan interest rates from different lenders, including banks and NBFCs. Some of the top lenders offering competitive rates include:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

3. Opt for a Shorter Loan Tenure

While longer tenures reduce your monthly EMI burden, they increase the overall interest paid. If you can afford higher EMIs, choose a shorter tenure to reduce the interest outgo.

4. Negotiate with Your Lender

If you have a strong credit profile and an existing relationship with the lender, negotiate for a lower interest rate. Banks often offer special deals to loyal customers.

5. Choose a Floating Interest Rate

Some lenders offer floating interest rates, which fluctuate based on the market. If you anticipate a decline in interest rates, opting for a floating rate loan can be beneficial.

6. Avoid Multiple Loan Applications

Applying for multiple loans at once can lower your credit score and make you appear desperate for credit. Instead, pre-check your eligibility using online tools before formally applying.

7. Consider Balance Transfer Options

If you already have a personal loan with a high interest rate, you can opt for a balance transfer to another lender offering a lower rate. Many NBFCs and banks provide attractive balance transfer options that help you save on interest.

Why Choosing the Right Lender Matters

Not all lenders offer the same interest rates. Choosing a reputed financial institution ensures transparency, flexible repayment options, and minimal hidden charges. Some of the top lenders for personal loans include:

Personal Loan Options

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Final Thoughts

Getting the lowest interest rate on a personal loan requires strategic planning and research. By maintaining a high credit score, comparing different lenders, negotiating with banks, and opting for the right loan tenure, you can significantly reduce your borrowing costs. Always read the fine print and be aware of hidden charges before finalizing a personal loan.

If you're looking for competitive personal loan options, check out our recommended lenders at Fincrif.

#loan apps#fincrif#personal loans#nbfc personal loan#bank#personal loan#loan services#finance#personal laon#personal loan online#Personal loan#Lowest interest rate personal loan#Personal loan interest rate#Best personal loan interest rates#Low-interest personal loans#How to get the lowest interest rate on a personal loan#Personal loan EMI calculation#Compare personal loan interest rates#Personal loan eligibility criteria#Best banks for personal loans#How to reduce personal loan interest#Tips to get the lowest personal loan interest rate#Personal loan interest rate comparison 2024#Fixed vs. floating personal loan interest rates#Best lender for low-interest personal loans#Personal loan for salaried employees#Self-employed personal loan interest rates#Loan tenure and interest rates#Personal loan balance transfer benefits#Factors affecting personal loan interest rates

0 notes

Text

Mortgage: The Smart Choice for Homeownership

Securing a mortgage is one of the most critical financial decisions individuals make when purchasing a home. Many borrowers often turn to traditional banks and financial institutions for home loans, but mortgage loan societies provide a compelling alternative. A mortgage loan society mortgage is a home loan offered by a member-based cooperative that aims to provide affordable home financing with lower interest rates, flexible repayment terms, and reduced fees.

This article explores the benefits of obtaining a mortgage loan from a mortgage loan society, how it differs from traditional bank loans, and why it may be the best choice for many borrowers.

What is a Mortgage Loan Society?

A mortgage loan society is a cooperative financial institution that provides mortgage loans to its members. Unlike traditional banks, which operate to generate profits for shareholders, mortgage loan societies reinvest their earnings to offer lower interest rates and better loan terms to their members. These institutions are typically community-focused and prioritize long-term financial stability for borrowers.

Key Features of Mortgage Loan Societies:

Member-Owned Structure – Borrowers must become members, ensuring profits benefit members rather than external investors.

Lower Interest Rates – These societies generally offer more competitive rates than traditional banks.

Flexible Loan Terms – Customizable repayment schedules to suit individual financial situations.

Personalized Customer Service – A more relationship-driven lending approach.

Lower Fees and Charges – Reduced processing, origination, and administrative costs.

Benefits of a Mortgage Loan Society Mortgage

1. Lower Interest Rates

One of the biggest advantages of a mortgage loan society mortgage is the lower interest rates. Since these institutions operate on a not-for-profit model, they do not need to generate high returns for investors. This results in lower borrowing costs for homeowners.

2. Flexible Loan Terms

Unlike traditional banks, mortgage loan societies offer customized loan terms. Borrowers can choose between fixed-rate and adjustable-rate mortgages, and societies often provide options for payment restructuring in times of financial difficulty.

3. Reduced Fees and Hidden Costs

Traditional banks impose various fees such as loan origination fees, underwriting fees, and early repayment penalties. Mortgage loan societies generally minimize or eliminate these costs, making homeownership more affordable.

4. Easier Qualification for Borrowers

First-time homebuyers, self-employed individuals, and those with moderate credit scores often find it easier to qualify for a mortgage loan society mortgage. These institutions take a more holistic approach to assessing a borrower’s financial health.

5. Community-Based and Member-Centric

Mortgage loan societies are typically community-driven, meaning they focus on supporting local homeownership rather than maximizing profits. This member-first approach ensures fair lending practices and financial security.

How Mortgage Loan Societies Differ from Traditional Banks

FeatureMortgage Loan SocietyTraditional BankOwnership ModelMember-OwnedShareholder-OwnedInterest RatesLower RatesHigher RatesLoan FlexibilityMore FlexibleMore RigidProcessing FeesLower or NoneHigher FeesCustomer ServicePersonalized SupportAutomated & GenericQualification ProcessMore InclusiveStrict Criteria

These differences highlight why a mortgage loan society mortgage can be a better alternative for borrowers looking for affordable home financing.

FAQs About Mortgage Loan Society Mortgages

1. Who is eligible for a mortgage loan society mortgage?

Anyone who becomes a member of the mortgage loan society can apply for a mortgage. Membership criteria vary but often include residency requirements or professional affiliations.

2. How do mortgage loan societies offer lower interest rates?

Since they operate on a not-for-profit basis, mortgage loan societies reinvest earnings into better loan terms for their members rather than distributing profits to shareholders.

3. Can I get a mortgage loan society mortgage with a low credit score?

Yes, mortgage loan societies often take a holistic approach to lending, considering factors beyond just credit scores, such as employment history and repayment capacity.

4. Are mortgage loan society mortgages available nationwide?

Most mortgage loan societies operate regionally, but some larger societies provide loans across multiple areas.

5. How do I apply for a mortgage loan society mortgage?

The application process typically involves becoming a member, submitting financial documents, and undergoing a loan assessment similar to traditional banks.

Conclusion

A mortgage loan society mortgage is an excellent option for individuals looking for an affordable, member-focused, and flexible mortgage solution. With lower interest rates, reduced fees, easier qualification processes, and personalized customer service, these societies provide a compelling alternative to traditional bank mortgages.

For borrowers seeking long-term financial stability and homeownership opportunities, mortgage loan societies offer a path to achieving these goals with better financial security and reduced borrowing costs. If you are considering purchasing a home, exploring mortgage loan societies can help you secure the best possible financing option.

0 notes

Text

ICICI Car Loan Interest Rate: Latest Rates, EMI Options & Benefits

Buying a car is an important investment, and most people need a car loan to have one. ICICI Bank is one of the premier private sector banks in India and offers car loans at competitive rates and flexible repayment options. It is important to know the ICICI Car Loan Interest Rate if you want to finance your car through ICICI Bank. This blog will look into the interest rate, its determinants, eligibility criteria, and ways to get the most out of a car loan deal.

ICICI Car Loan Interest Rate Overview

ICICI Bank provides car loans at attractive rates to salaried persons and the self-employed. The bank extends its services to offer loans for new car purchases, used cars, and refinancing existing car loans. The ICICI Car Loan Interest Rate stays competitive, dependent on certain factors including the applicant's credit profile, loan tenure, and type of vehicle.

Current ICICI Car Loan Interest Rates (effective 2024)

ICICI Bank has fixed interest rates on the car loan, that is the interest is fixed for the whole tenure of the loan. The general interest rates are mentioned below:

New Car Loans: Interest rates from 8.50% pa onwards

Used Car Loans: Interest rates from 10.75% pa onwards

Car Loan Balance Transfer: Dependent on various conditions of the existing loan

However, the actual amount of ICICI Car Loan Interest Rate is fixed depending on the credit rating of the applicant and other factors.

Factors Affecting the ICICI Car Loan Interest Rate

There are a number of factors that may trigger the change in ICICI's Car Loan Interest Rate. Thus, the knowledge of these variables may assist in the negotiations for a better rate with ICICI Bank.

1. Credit Score

Your CIBIL score acts as the most vital factor determining the interest rates. Hence a higher score in the credit range (750 and above) is favorable for getting low ICICI Car Loan Interest Rate and a lower score can complicate with high interest rates or even higher rejection chances.

2. Loan Amount

The loan amount also affects the ICICI Car Loan Interest Rate. Higher loan amounts usually attract slightly lower rates than small loans.

3. Loan Tenure

The car loans from ICICI Bank are offered between a period of one year, that is 12 months to seven years, that is 84 months. An ICICI Car Loan Interest Rate is usually less on a shorter tenure as compared to a longer tenure.

4. Income and Employment Type

Salaried professionals with a steady job in a reputed institution are then given lesser ICICI Car Loan Interest Rate rates as compared to self-employed persons whose income is often classified as uncertain.

5. Type of Car

Luxury and premium cars might attract an ICICI Car Loan Interest Rate different from that for economy or standard cars. The rate applicable for used car loans is higher than that for new ones.

6. Relationship with the Bank

Arena Fincorp: Your Trusted Partner for Car Loans

Arena Fincorp is a reputed financial service entity catering to customers in securing the best car loans on the market. Arena Fincorp will help you analyze multiple options, thus helping you secure the lowest ICICI Car Loan Interest Rate along with expert advice and smooth loan approval.

Eligibility Criteria for ICICI Car Loan

Ensure that you meet the eligibility requirements listed below before applying for a car loan in ICICI Bank.

Salaried Individuals

Age: 21-65 years

Monthly income: ₹20,000

Minimum work experience: 1 year

Must be employed in a well-reputed company

Self-Employed Individuals

Age: 23-65 years

Annual income: ₹2 lakhs (depends on the car type)

Minimum business stability: 3 years

Document Required for ICICI Car Loan

The following documents are required to apply for the car loan:

Identity Proof- Aadhaar Card/PAN Card/Passport/Voter ID

Address Proof- Utility Bill/Rent Agreement/Passport

Income Proof- Salary slips(for salaried)/IT returns(for self-employed)

Bank Statements: Last 6 months' statement

Vehicle Document: Quotation or invoice from the dealer

How to Apply for an ICICI Car Loan?

The application for car loans from ICICI is simple and can be done either online or by visiting any nearest ICICI Bank branch.

Online Process

Visit ICICI Bank Car Loan Page

Fill up the necessary details such as personal and income information

Select the loan amount and tenure

Submit the application form

Upload required documents

The bank will process your application and grant the loan following verification.

Offline Process

Visit the nearest ICICI Bank branch

Speak to a loan officer and fill out all necessary forms

Submit the required documents

The bank will assess your application, and disburse the loan upon approval

Arena Fincorp: Simplifying Your Car Loan Process

Arena Fincorp makes the procedures for securing an ICICI Bank car loan simple. With its years of experience in the financial industry, Arena Fincorp negotiates the competitive ICICI Car Loan Interest Rate and shall ensure a smooth approval process. Thus Arena Fincorp offers a hassle-free journey wherein clients receive the best interest rates and terms for their loans.

Conclusion

ICICI Bank gives competitive car loan interest rates with flexible repayment options. It certainly makes for a good financing option for buying a car. By knowing the factors that affect the ICICI Car Loan Interest Rate, you will really be able to work on getting a better deal. As much as the rates for comparison between banks should be done in purchasing both new or used cars, maintaining a good credit score and negotiating with a bank can greatly help in minimizing interest charges.

Arena Fincorp is at your side, offering professional guidance to help you smoothly navigate the entire loan application process and find the best ICICI Car Loan Interest Rate that meets your requirements. With this kind of expert assistance from Arena Fincorp, securing the lowest ICICI Car Loan Interest Rate for your hassle-free journey in car financing will surely become easy. So, have fun on your car hunt.

0 notes

Text

ICICI Car Loan Interest Rate 2024: Check Current Rates, Eligibility & How to Apply

A car is no longer a luxury but rather a necessity for many today. Be it an upgrade or the purchase of one's first car, the financing options available enable easy vehicle ownership, courtesy starting from the ICICI car loan interest rate for 2024. Widely recognized as a trusted name in India's financial sector, ICICI Bank offers competitive rates along with a flexible repayment term and fast processing. This blog post provides insights into current trends in ICICI car loan interest rates for 2024, eligibility criteria, application procedures, and tips to grab the best offer.

Current Interest Rates on ICICI Car Loans as of 2024

The ICICI car loan interest rate is one of the most alluring in the lending market, starting at 8.75% per annum for 2024. Varied reasons cause shifts to different interest rates.

Loan Amount: Larger loans may land at smaller rates.

Credit Score: A borrower having scored above 750 generally is favoured.

Employment Profile: Professionals receive more favourable terms than those self-employed.

Make of the Car: New cars receive comparatively favourable interest rates than old ones.

For example, a 5-year loan of ₹5 lakh at a rate of 8.75% announced by the ICICI car loan interest rate yields an EMI of ₹10,320. Use the ICICI online EMI calculator to receive customized estimates.

Qualification Conditions for ICICI Car Loans:

In order to qualify for the ICICI car loan interest rate 2024, the following conditions need to be fulfilled:

Age: 21-60 years (salaried); for self-employment: 25-65 years.

Income: monthly income of at least ₹25,000 if salaried or profitability of ₹3 lakh annually if self-employed.

Documents Needed:

Identity proof/address proof (Aadhaar, PAN, passport)-salary slips or ITR for the last 2 years' statements.

How to Apply for the ICICI Car Loan

Availing the car loan against ICICI car loan interest rates can be done through:

Online Application:

Go to ICICI’s car loan portal.

Hit on "Apply Now" and fill in personal, employment, and car details.

Uploading Documents.

In-principle approval will be granted within two hours.

Offline Application:

Make it to your nearest ICICI branch.

Submit official documents and fill in the application form.

You can track the status via SMS or email.

ICICI banks have an easy way of approving loans, generally disbursing within 48-72 hours after cash verification.

Credit Score: above 650, with at least 750 to avail the lowest rates.

Employment stability: 2 years plus of employment.

What documents to submit?

Identity/address proof: Aadhaar, PAN, passport and so on.

Salary slips for salaried/proof of income for salaried/ITR.

Bank statements.

Applying for the ICICI Car Loan

Applying for a loan at the very best ICICI car loan interest rate is one of the easiest tasks:

Benefits of Choosing ICICI Car Loan

Competitive Rates: ICICI loan rates for car loans for 2024 are much better than their immediate competitors like HDFC (at 9.15%) and SBI (at 9.25%).

Tenure: Repayment could be done over 1-7 years.

No foreclosure charges: After the 12th EMI, the borrower can settle the loan without any fine.

100% Financing: Covers insurance and registration as well.

Things to Rate ICICI Against Other Lenders

Although the car loan interest rate is impressive with ICICI, before going for that, one should compare the lending rates in case a better opportunity happens to be available. Rates at Arena Fincorp are slightly more than ICICI, starting from 9.05% p.a., while there are fast delivery and doorstep services. Always look at the processing fees, prepayment terms, and customer's comments before accepting or declining.

Tips to Access Lower Interest Rates for ICICI Car Loans

Improve your credit rating: Clear existing debts; stay away from defaulting on dues.

Work out a package deal from the dealer: Many dealers have arrangements with ICICI for preferential rates.

Choose a shorter tenure: A short tenure generally means lower service outgo.

Apply jointly: Better eligibility can be achieved with a co-applicant who has a commendable income.

Final Thoughts

The ICICI car loan interest rate of 2024 is, thus, affordable and a flexible choice as well. Hence, by fulfilling the eligibility criteria and comparing options available (and alternatives like Arena Fincorp), you are free to drive home your dream car without any financial constraints. So are you ready to apply? Go on visit the website of ICICI Bank today or meet a loan advisor for personalized one-on-one assistance.

0 notes

Text

ICICI Loan Interest Rates are Exhaustive- They are of Home, Personal, Car, and Business Loan Interest Rates

Be it personal finance or business finance, it is ICICI Bank which usually turns out to be the best and one of the first options for Indian consumers. It has multiple loan offerings to potential customers under different categories-to buy a house, a new car, or to even raise money for personal and business needs.

Look at the different kinds of ICICI Bank loan interest rates such as the ICICI car loan interest rate, home loan, personal loan, and business loan. If you are considering financing, Arena Fincorp would help you in the smooth path of applying for loans.

ICICI Home Loan Interest Rates

To many, a home is what they dream about, and the institution makes it all possible with home loans and attractive interest rates when actually the time comes to fulfill such a dream. The home loan interest rates offered by ICICI vary on the account of loan tenure, profile of the applicant, and market conditions.

On the whole, they range between 8.40% to 9.50% per annum on the basis of individual credit score and financial history.

Salient Features of ICICI Home Loans

Loan tenure up to 30 years

Attractive interest rates along with flexible repayment options

Minimal documentation, quick processing, and

Balance transfer facility to reduce interest burden

ICICI Personal Loan Interest Rates

Simply put, personal loans are handy for those times when one requires quick money to fulfill a medical emergency, travel costs, wedding expenses, or any other personal requirement. ICICI offers personal loans with interest rates between typically 10.75% and 16.00% per annum, depending on the credit profile of the borrower.

Key Highlights of ICICI Personal Loans

Up to ₹50 lakhs loan

No collateral required

Quick approval and disbursal within 24-48 hours

Flexibility up to 6 years of repayment tenure

ICICI Car Loan Interest Rate

Considering the fact that one is planning to buy a car, understanding the ICICI car loan interest rate is important. ICICI Bank has car loans with attractive interest rates making it easier for people to afford their dream cars. The ICICI car loan interest rate would generally range between 7.50%-9.00% per annum, depending on the loan amount, tenure, and the creditworthiness of the applicant.

Why ICICI Car Loans?

Loan tenure - up to 7 years

Financing - up to 100% of ex-showroom price

Attractive ICICI car loan interest rate for salaried and self-employed individuals

Hassle-free online application and disbursal in no time

Arena Fincorp will enable its applicants to easily compare among the different ICICI car loan interest rate options to figure out which is the best deal tailored toward fulfilling their financial needs.

ICICI Interest Rates on Business Loans

ICICI Bank offers business loans to facilitate entrepreneurs and corporates to grow their enterprises by purchasing equipment or products. One can avail of interest rates for business loans starting from 13% up to 18% in a year's term; however, a lot will be determined by the applicant's turnover, credit score, and tenure required for the loan.

Features of ICICI Business Loans

Loan amount: INR up to 2 crore Loans for specific amounts may not require collateral. Very simple application processing-that is minimum documentation Easy repayment over a flexible period that does not exceed 5 years.

Arena Fincorp advises and helps businesses with as little hassle as necessary to secure the best loan terms.

Factors Affecting ICICI Loan Interest Rates

The ICICI car loan interest rate, home loan, personal loan, and business loan interest rates are determined by various factors.

Credit Score – Higher credit scores (750 and above) provide lower interest rates.

Loan Amount – Generally, larger loan amounts could attract lower negotiation rates.

Repayment tenure – Longer tenure would generally also translate into marginally higher interest rates.

Employment Status – Salaried usually get lower rates than self-employed individuals.

Market Conditions – Changes in RBI policies regarding repo and other matters also change loan rates.

How to Secure the Best Possible ICICI Loan Interest Rate?

To access the lowest ICICI car loan interest rate, consider these points

Keep a good credit score to qualify for superior rates.

Comparison of various loan options and negotiation of interest rates with ICICI Bank.

Choose shorter tenure; hence the total interest payment will be reduced.

Maintain stable income and a good financial profile to boost eligibility.

Seek expert consultation using Arena Fincorp to find the best loan options.

Conclusion

Offering all forms of loans for all different financial conditions- from home loans to personal loans to the ICICI car loan interest rate to business loans- this is about ICICI Bank. ICICI loans are a sound financial tool for everyone and businesses for they feature competitive rates and flexible repayment plans.

Should you need professional assistance in choosing the right loan for you, then Arena Fincorp can help you compare loans and finally secure the best deal. Be it an ICICI car loan interest rate or absolutely any other financing need, indulge in wise thinking to achieve your financial goals.

0 notes

Text

LAP Loan Guide: Eligibility, Interest Rates & Best Banks

A loan against property (LAP) is a secured loan where you pledge your residential or commercial property as collateral to obtain funds. This type of property mortgage loan is an excellent way to secure a substantial amount at lower interest rates compared to personal loans. Whether you need funds for business expansion, medical emergencies, or education, a LAP loan can be an ideal solution.

How Does a Loan Against Property Work?

A loan against property allows borrowers to unlock the financial value of their real estate. Banks and financial institutions assess the market value of the property and typically offer loans ranging from 50% to 75% of its value. The funds can be used for various purposes except for speculative activities.

Benefits of a Loan Against Property

Lower Interest Rates – Since it is a secured loan, the interest rates are significantly lower than unsecured loans.

High Loan Amount – Depending on the value of the property, borrowers can avail of a larger loan amount.

Flexible Repayment Tenure – Most lenders provide tenures ranging from 10 to 20 years, reducing EMI burdens.

No Usage Restrictions – The borrowed funds can be used for business, education, weddings, or medical emergencies.

Quick Processing – With proper documentation, approvals are faster compared to unsecured loans.

Eligibility Criteria for LAP Loan

Eligibility depends on several factors such as income, credit score, property value, and repayment capacity. Typically, both salaried and self-employed individuals can apply. Having a stable income and a good credit history increases approval chances.

Documents Required for Property Mortgage Loan

Identity Proof (Aadhaar, PAN Card, Passport, Voter ID)

Address Proof (Utility Bills, Rental Agreement, Passport)

Income Proof (Salary Slips, ITR, Bank Statements)

Property Documents (Title Deed, Tax Receipts, Encumbrance Certificate)

Factors Affecting LAP Loan Interest Rates

The interest rate for a loan against property depends on:

Credit Score: A higher score results in lower interest rates.

Property Type: Residential properties fetch better rates than commercial properties.

Loan Amount: Higher loan amounts may have slightly higher interest rates.

Lender Policies: Different banks offer varying rates based on risk assessment.

How to Apply for a Loan Against Property

Check Eligibility – Use online LAP eligibility calculators to assess loan qualification.

Compare Lenders – Analyze different banks and NBFCs for the best interest rates.

Prepare Documents – Keep all required documents ready for faster processing.

Apply Online or Offline – Submit an application through the lender’s website or visit a branch.

Property Valuation & Approval – The lender assesses the property before final approval.

Loan Disbursal – Once approved, the loan amount is credited to your account.

Common FAQs on Loan Against Property

What is the maximum tenure for a LAP loan? Most banks offer repayment tenure ranging from 10 to 20 years.

Can I get a loan against a property if I have an existing home loan? Yes, you can avail of a LAP loan, but the property should have sufficient market value and equity.

What happens if I fail to repay the LAP loan? The lender has the right to take possession of the property and sell it to recover the outstanding amount.

Is a loan against property tax-deductible? Tax benefits depend on the usage of funds. If used for business purposes, interest paid can be claimed as an expense.

Can I prepay my loan against property? Yes, most banks allow prepayment, though some may charge a foreclosure fee.

A loan against property is a smart financial tool to leverage your assets for various needs. Always compare different lenders and read the terms carefully before applying.

0 notes

Text

ICICI Car Loan Interest Rate: Latest Interest Rates, Eligibility, Features, and Benefits Explained

It has always been a dream for many to buy a car and the availability of car loans has made this dream come true. ICICI Bank, one of the leading financial institutions in India, provides competitive car loans to aid people in acquiring their dream vehicles. The blog will delve into various details like interest rates of ICICI car loans, eligibility criteria, major features, and benefits that will help you make an informed choice.

ICICI Car Loan Interest Rate 2025

These will be the initial considerations you'll need to keep in mind while financing your car with an ICICI car loan interest rates play a crucial role in deciding your EMI and the overall amount payable as these multiples are taken into consideration. The ICICI Bank car loans offered in 2025 range from 7.50%-14.50% p.a. The ICICI Bank will quote interest rates based on factors such as the credit score of the applicant, the amount of loan taken, the tenure of the loan, and the type-group which refers to salaried persons and self-employed persons.

Factors Affecting ICICI Car Loan Interest Rate

Credit Score: A higher credit score (i.e. above 750) means less interest.

Loan Amount & Tenure: Larger loan amounts could have small or lesser interest, while longer tenures may have a higher rate.

Employment Type: Salaried people earn a constant income whereas self-employed suffer.

Car Model: The model of the car impacts interest.

Eligibility Criteria for ICICI Car Loan

Let us first understand some of the basic eligibility conditions before applying for an ICICI car loan:

Age: The applicant should be between 21 to 65 years old.

Employment Type: Salaried employees, self-employed professionals, and businessmen can apply.

Income Requirement: Minimum annual income of ₹2.5 lakh for salaried and self-employed applicants.

Credit Score: A credit score of 750 or above enhances the chances of loan approval at better interest rates.

Work Experience: Salaried individuals should have at least one year of work experience, while self-employed individuals should have at least three years of stable business operations.

ICICI Car Loan: Major Characteristics

Loan amount: Up to 100% of the on-road price of the car.

Flexible Repayment Tenure: One to 7 years.

Attractive Interest Rates: From 7.50% p.a.

Less Documentation: Fast processing with the least paperwork.

Prepayment: Prepayment can be done for smaller charges.

Quick Approval: The money is disbursed faster, usually after 48 hours.

Why an ICICI Car Loan?

Competitive Interest Rates: They offer one of the most competitive interest rates today.

Convenient Application Process: Apply online or walk into a branch for easy processing.

EMIs as per the lengths: Pick an EMI plan that works for you.

Pre-Approved Offers: Existing ICICI customers have special offers on our pre-approved car loans.

Good Reputation: Being a good name in the market, ICICI Bank works toward providing secured and transparent loan processing.

How to Apply for an ICICI Car Loan?

Applying for an ICICI car loan is simple and can be done in a few steps: