#Best government schemes

Explore tagged Tumblr posts

Text

Best government schemes for home buyers

It can be both thrilling and perplexing to purchase your first house. To help you, the Indian government has special schemes designed for first-time home buyers. These programs make home ownership simpler and more inexpensive by providing financial assistance as well as other advantages.

These programs are available to assist you in your home-buying endeavors, offering tax savings and loan interest rate reductions. The greatest government programs for first-time homebuyers in India will be discussed in this article, along with how they may assist you in obtaining your ideal residence.

PMAY, or Pradhan Mantri Awas Yojana

In India, PMAY is a well-liked program for first-time homebuyers. Its goal is to make housing accessible to all.

Qualifications:

Families earning up to ₹3 lakh annually are classified as being in the Economically Weaker Section (EWS).

Families in the Low-Income Group (LIG) make between ₹3 lakh and ₹6 lakh a year.

Families in the Middle-Income Group (MIG) earn between ₹6 lakh and ₹18 lakh annually, and they are further separated into:

MIG I: ₹6 lakh – ₹12 lakh

MIG II: between ₹12 and ₹18 lakh

Benefits

Interest subsidy: EWS: Discounts of up to ₹2.67 lakh on a loan of ₹6.5 lakh.

LIG: On a loan of ₹9 lakh, you can save up to ₹2.35 lakh.

MIG I: A ₹12 lakh loan can be repaid up to ₹2.35 lakh.

MIG II: A ₹12 lakh loan can be repaid up to ₹1.65 lakh.

Tax Advantages:

Section 80C: Up to ₹1.5 lakh can be deducted from a house loan's principal installment.

Section 24: Up to ₹2 lakh can be deducted from the interest paid on a housing loan.

Section 80EE: First-time MIG I buyers receive an additional ₹50,000 off interest.

Section 80EEA: First-time EWS/LIG buyers receive an additional ₹50,000 off interest.

Scheme for Credit-Linked Subsidies (CLSS)

As a component of the PMAY program, the CLSS provides LIG and MIG groups with interest rate breaks on house loans.

Qualifications:

must fall into one of the MIG or LIG income brackets.

must not be the owner of another home registered in the applicant's or their family's name.

must not have previously received any government housing assistance.

CLSS advantages include:

Discount on Interest Rates:

LIG: Interest on loans up to ₹6 lakh is discounted by 6.5 percent.

MIG I: interest on loans up to ₹9 lakh is discounted by 4%.

MIG II: 3% discount on interest for loans up to ₹12 lakh.

Reduced Monthly Payments: Your monthly loan payments are lessened thanks to the interest rate discount.

Loan Term: The subsidy can be used for a maximum of 20 years

State-Specific Plans

For first-time homebuyers, several Indian states have their own housing schemes with special advantages. Some noteworthy state-specific strategies are as follows:

Adults in the EWS, LIG, MIG, or HIG categories may apply for housing through the Delhi Development Authority (DDA) housing scheme.

For interest rate savings, PMAY is linked.

The Tamil Nadu Housing Board Scheme provides a 20-year loan period with an interest rate of 6.50%.

Caste, occupation, and disability are the basis for reservations.

In collaboration with PMAY, the Ahmedabad Urban Development Authority (AUDA) New Housing Scheme offers reasonably priced housing in Ahmedabad.

The Maharashtra Housing and Area Development Authority (MHADA) Scheme distributes dwellings equitably using a lottery mechanism.

Residents of Maharashtra who fall under the LIG, MIG, or HIG categories are eligible.

MHADA provides loans to assist with the purchase of a home.

#Best government schemes for home buyers#Best government schemes#Best schemes for home buyers#government schemes#Real estate

0 notes

Note

Boo!

I have a question! >:]

Do any kids work under anyone in the role swap au?

I figured that maybe Midoriya would work under all might so would the others work under their respective heroes in the main series?

I think creati and Edgeshot would be an interesting duo; they got the sameish vibe!

Oh absolutely! (have some doodles:)

Most of the kids would work with/under the same as their mentors in the main thingy! All might and Midoriya, Jeans n Bakugou, Aizawa and Shinsou, etc.

But it varies from person to person.

UA exists as a hero school as usual in this au, but our usual teachers and students don't go there (bc they ain't heroes). Instead there is a rather small private school relatively nearby that is seen as just a regular school (that only certain people can get in)

In reality they're an undercover villain association, run by Nedzu (who is also still UA principal), and our usual teachers are "teachers" there. The students go there to help set up evil schemes, mingle and find other villains and be all villain-like /lh

There are some (like Momo) who run their own stuff and work with multiple different characters. (so we get same hair club, and she also works a lot with Jeanist and mainly resides with Uwabami).

But yeah! I've. run out of words. brain has stopped braining, but thats about it! they do work with/under their respective mentors and get to be lil villains and stuff <3

#bnha#eclair's art#roleswap au#edgeshot#best jeanist#momo yaoyorozu#bakugou katsuki#yeah i cannot be botheresd to tag any more than that but mhm#yes#i have thoughts but theyve all disapeared as soon as i start wrinting#im struggling to type lol#momo would also work well with powerloader bc my boy be corrupting government schemes and blowing buildings up and she could help with that#shed work with most of them tbh#yes. googngiht

10 notes

·

View notes

Text

Lekki Avana Bungalow and Resort – Idera Scheme, Eleko

Invest In a Solar Powered Estate at Idera Eleko, Ibeju Lekki

#3-bedroom bungalow Lekki#affordable homes in Lekki#best estates in Lekki#best real estate deals Lekki#bungalow for sale in Lagos#buy house in Lekki#buy property in Lagos#eco-friendly estate Lagos#government allocation land#Idera Scheme Eleko#land with government allocation#Lekki Avana Bungalow and Resort#Lekki Epe corridor investment#Lekki Epe investment#Lekki International Airport properties#Lekki property promo price#luxury bungalow in Lekki#real estate investment Nigeria#smart home in lagos

0 notes

Text

Personal Loan Eligibility for People with Disabilities

Introduction

Financial independence is essential for everyone, including individuals with disabilities. A personal loan can help people with disabilities manage medical expenses, home modifications, assistive technology, education, or any other financial needs. However, many individuals face challenges in securing a personal loan due to lender concerns about income stability and repayment capacity.

This guide explores personal loan eligibility for people with disabilities, special loan schemes available, required documentation, and tips for increasing approval chances.

Challenges Faced by People with Disabilities in Getting a Personal Loan

Although many financial institutions provide loans to individuals with disabilities, some common challenges include:

Limited Employment Opportunities – Some lenders consider job stability a key factor in loan approval.

Irregular Income Sources – Self-employed individuals or those relying on disability pensions may have difficulty proving steady income.

Higher Interest Rates – Lenders may impose higher interest rates due to perceived financial risk.

Lack of Awareness – Many applicants are unaware of special loan schemes available for people with disabilities.

🔹 Tip: Understanding these challenges can help applicants take the necessary steps to secure a loan with better terms.

Personal Loan Eligibility Criteria for People with Disabilities

Each lender has different criteria for approving a personal loan. Here are some general requirements:

1. Age Requirement

Applicants must be between 21 and 65 years old.

2. Employment Status

Salaried Employees – Government and private-sector employees are eligible.

Self-Employed Individuals – Business owners, freelancers, or professionals must show stable income proof.

Pensioners & Disability Allowance Recipients – Some banks consider disability pensions as income.

3. Minimum Income Requirement

A steady monthly income of at least ₹15,000 – ₹25,000, depending on the lender.

4. Credit Score

A CIBIL score of 700+ improves loan approval chances.

5. Documentation

Identity Proof: Aadhaar Card, PAN Card, Passport

Address Proof: Voter ID, Utility Bill, Rent Agreement

Income Proof: Salary slips, bank statements, ITR (for self-employed)

Disability Certificate (if required)

Special Personal Loan Schemes for People with Disabilities

Several banks and NBFCs offer specialized personal loan schemes for individuals with disabilities.

1. SBI Healthcare Loan

✅ Loan Amount: ₹50,000 – ₹7.5 lakh ✅ Interest Rate: 9.75% – 12.50% p.a. ✅ Tenure: Up to 5 years ✅ Eligibility: Individuals requiring medical assistance or rehabilitation ✅ Processing Fee: 0.5% – 1% of the loan amount 📌 Best For: People with disabilities needing financial aid for healthcare and assistive devices.

2. HDFC Bank Personal Loan for Special Needs Individuals

✅ Loan Amount: ₹50,000 – ₹25 lakh ✅ Interest Rate: 10.50% – 17.00% p.a. ✅ Tenure: Up to 6 years ✅ Eligibility: Salaried or self-employed individuals with disability certification ✅ Processing Fee: 1% – 2.5% of the loan amount 📌 Best For: Quick processing and high loan amounts.

3. ICICI Bank Personal Loan for Differently-Abled Individuals

✅ Loan Amount: ₹50,000 – ₹20 lakh ✅ Interest Rate: 10.75% – 19.00% p.a. ✅ Tenure: Up to 7 years ✅ Eligibility: Individuals receiving stable income from employment, business, or pension ✅ Processing Fee: 1% – 2% of the loan amount 📌 Best For: Hassle-free application and flexible loan tenure.

4. Punjab National Bank (PNB) Personal Loan for Disabled Individuals

✅ Loan Amount: ₹50,000 – ₹10 lakh ✅ Interest Rate: 10.00% – 13.50% p.a. ✅ Tenure: Up to 5 years ✅ Eligibility: Salaried, self-employed, and pensioners with disability ✅ Processing Fee: 0.5% – 1% of the loan amount 📌 Best For: Low processing fees and flexible repayment options.

Tips to Improve Loan Approval Chances for People with Disabilities

1. Maintain a High Credit Score

Pay existing EMIs and credit card dues on time.

Keep your credit utilization below 30%.

2. Show Proof of Income Stability

Provide bank statements, salary slips, and tax returns.

If self-employed, submit business records and invoices.

3. Apply for a Lower Loan Amount

Borrow within your repayment capacity to increase approval chances.

4. Consider a Secured Loan

Offering collateral like property, gold, or fixed deposits (FDs) reduces lender risk and ensures lower interest rates.

5. Apply with a Co-Applicant

A co-borrower (spouse, parent, or sibling) with stable income can improve loan approval chances.

Benefits of Personal Loans for People with Disabilities

✔️ Lower Interest Rates – Some banks offer preferential rates for disabled individuals. ✔️ Flexible Repayment Options – Loan tenure up to 7 years. ✔️ Minimal Documentation – Simple and quick loan application process. ✔️ No Collateral Required – Most personal loans for disabled individuals are unsecured. ✔️ Quick Disbursal – Many banks provide funds within 24-48 hours.

Things to Consider Before Applying for a Personal Loan

🔹 Compare Loan Offers – Different lenders have varying interest rates and processing fees. 🔹 Check EMI Affordability – Use a personal loan EMI calculator to plan repayments. 🔹 Beware of Hidden Charges – Read the loan agreement carefully before signing. 🔹 Avoid Over-Borrowing – Borrow only what is necessary to prevent financial strain.

Final Verdict: Which Bank Offers the Best Personal Loan for People with Disabilities?

✅ For Lowest Interest Rates: SBI Healthcare Loan & PNB Personal Loan ✅ For High Loan Amounts: HDFC Bank & ICICI Bank ✅ For Instant Processing: Bajaj Finserv & Axis Bank ✅ For Flexible Repayment Options: Bank of Baroda & Kotak Mahindra Bank

Tip: Choose a loan based on your financial needs, repayment ability, and employment status.

For expert financial guidance and the best personal loan offers, visit www.fincrif.com today!

FAQs

Q1: Can people with disabilities get a personal loan? Yes, many banks offer personal loans to individuals with disabilities based on income stability.

Q2: What is the maximum loan amount available? Loans up to ₹25 lakh, depending on eligibility.

Q3: Do disabled individuals need collateral for a personal loan? No, most personal loans for people with disabilities are unsecured.

Achieve Financial Freedom – Get the Best Personal Loan Today!

#finance#personal loan online#fincrif#bank#personal loans#loan services#nbfc personal loan#personal loan#loan apps#personal laon#Personal loan#Personal loan for disabled individuals#Loan eligibility for disabled persons#Unsecured personal loan#Disability loan schemes in India#Best personal loans for disabled individuals#Low-interest personal loans for disabled#Loan options for disabled individuals#How to get a loan with disability income#Special loan schemes for disabled persons#Can disabled individuals get a personal loan in India?#Best banks offering loans for people with disabilities#How to apply for a personal loan with disability benefits?#Documents required for a personal loan for disabled persons#Government loan schemes for differently-abled individuals

1 note

·

View note

Text

#best government schemes for farmers#best govt schemes for farmers#government schemes for farmers#government schemes for agriculture#government schemes for farming

0 notes

Text

#national pension scheme#equity fund#corporate debt fund#government securities fund#long term financial goals#best investment scheme#corporate bonds

0 notes

Text

Waaree सोलर ऑफर: 2kW सिस्टम से मात्र ₹600 में शुरू करें बिजली की बचत

अगर आप अपने घर की छत पर सोलर सिस्टम लगाने का सपना देख रहे हैं, लेकिन पैसों की कमी आपको रोक रही है, तो अब चिंता की कोई बात नहीं। केंद्र सरकार की “पीएम सूर्यघर योजना” के तहत आप मात्र ₹600/महीने की किस्त पर Waaree का 2kW सोलर सिस्टम अपने घर पर लगवा सकते हैं। यह योजना आपके लिए बिजली के बढ़ते बिलों से छुटकारा दिलाने का बेहतरीन मौका है। खास बात यह है कि सिर्फ 4 साल में यह सोलर सिस्टम आपका हो जाएगा, और…

#2kW solar panel daily electricity production#2kW solar system EMI#advantages of solar panels India#affordable solar systems in India#best rooftop solar companies in India#best solar panels in India#EMI options for solar panels#how to apply for PM Suryaghar Yojana#how to reduce electricity bills in India#how to save on electricity bills with solar#PM solar energy scheme benefits#PM Suryaghar solar subsidy eligibility#PM Suryaghar Yojana#rooftop solar panel installation cost#rooftop solar panel maintenance tips#rooftop solar system benefits India#rooftop solar system India#solar energy benefits#solar panel government subsidy 2025#solar panel loan process#solar panel subsidy India#Waaree 2kW solar panel price#Waaree solar panel benefits#Waaree solar system reviews

0 notes

Text

Home Loan for Solar Rooftop | Financing & EMI Schemes

EcoSoch offers financing for rooftop solar installations, home improvement loans with tax benefits, and easy EMI schemes for residential, commercial projects.

#Best home loan for rooftop solar#Home loan for rooftop solar#EMI schemes for solar systems#Financing for solar projects#Solar loan options for homes#government subsidies for solar panels in domestic homes

0 notes

Text

What Should You Know About Pensions and Financial Planning?

A very big financial step in his whole life takes place when he plans for his retirement. Since one can opt for a government pension plan, as well as individual pension plans, it is vital to understand how these plans function to determine the security of your future. Proper pension planning would ensure that you live comfortably when that day of not working has come, whether you are just starting your career or nearing retirement. In this blog, we will talk about financial advice pensions and many more things related to this:

How Does a Government Pension Plan Work?

Always pay as much tax as you can pay to the government. Chief terms. Retirement savings scheme. Pretty much sums up how it guts the budget" government pension plans.

For qualification, there are required minimum periods of qualifying contributions. In terms of amount, it will be based on the contribution records and the type of State Pension you are entitled to. Government pension schemes act as a safety net, but they will not suffice for all expenses in retirement; hence, savings must be additional.

What is an Individual Pension Plan?

An individual pension plan (IPP) is a private retirement savings program that meets the specific needs of the individual in line with his financial goals. They are flexible plans that allow one to define the amount one wants to contribute and choose where to invest the funds.

They include personal pensions and self-invested personal pensions (SIPPs), which give you greater power over your investments. These IPPs can be mentioned as an addition to a government pension plan to come up with a larger amount for a retirement fund. They may probably be useful for a self-employed person or individuals who want to save more.

Why is Financial Advice Important for Pension Planning?

Finding a financial planner is a good choice to have the information needed in choosing the correct pension plan that suits the situation because pensions tend to be complicated, and without proper advice, some wrong decisions could endanger one's financial security later in life. Financial advisory services cover:

So you know how much you need to save for retirement.

So, you find the pension that best meets your lifestyle and career stage.

Maximize tax benefits from your pension contributions. With the advice of the aforementioned specialists, you will have avoided the common pitfalls of creating a custom retirement strategy.

How Can You Maximize Your Pension Savings?

Maximizing pension savings typically requires a combination of regular contributions, smart investments, and taking advantage of tax reliefs. This is how best to achieve it:

Start Early: The sooner you begin saving, the more compound interest will accrue on your pension pot.

Increase Contributions: Incrementally increase your contributions with an increase in your income.

Diversify Investments: Spread your investments to avoid risks and maximize returns.

Track Your Progress: Regularly reviewing your pension plan will ensure it is still on course for your retirement goals.

If you are in doubt, engage a financial advisor and refer them to the strategies designed specifically for your needs.

Conclusion

Pension strategy is the groundwork for a really nice and secure retirement. Government pension plans are not enough; individual pension plans offer flexibility and room for growth. Crown Trustees ensure that you have all the information with which to make the right decisions and maximize your savings while minimizing obstacles.

Today is your day; start taking personal control of your economics by choosing the best possible pension options for yourself and making a plan that really works for you. Well-planned retirement is not just dreamland; it is your earned reward for hard work and preparation.

#best government pension plans#pension trustee consultants#pension trustee#pension scheme#pension care scheme

0 notes

Text

Choosing The Best Bank for Msme Loan: Top Options For 2024

In the dynamic landscape of small and medium enterprises (SMEs), securing the right financing is crucial for growth and sustainability. For MSMEs in India, finding the best bank for MSME loan can make a significant difference in their financial health and expansion capabilities. With various options available, it's essential to understand the top banks and their offerings for 2024, especially for those seeking a 2-crore loan for business or exploring unsecured SME loans.

Understanding MSME finance

MSME finance encompasses a range of financial services tailored to meet the needs of micro, small, and medium enterprises. Given the diversity in the needs of MSMEs, banks offer various loan products like machinery loan for msme and msme subsidy on machinery, including those under the MSME startup scheme and government loan for MSME programs.

Top banks for MSME loans in 2024

1. State Bank of India (SBI)

SBI continues to be a leader in the MSME finance sector. SBI’s offerings include unsecured SME loans, which are ideal for businesses that may not have significant collateral to pledge.

2. HDFC Bank

HDFC Bank is another top contender when it comes to MSME loans. For those looking for a substantial sum, HDFC also facilitates a 2 crore loan for business purposes, ensuring ample capital for expansion.

3. ICICI Bank

ICICI Bank offers a comprehensive suite of MSME finance solutions, including the MSME startup scheme. Their user-friendly application process and quick disbursal times are added advantages.

4. Punjab National Bank (PNB)

PNB stands out with its dedicated MSME loan products that cater to various business needs. Their government loan for MSME programs are designed to provide financial assistance with favourable terms.

5. Bank of Baroda

Bank of Baroda has a strong presence in the MSME sector, offering a range of financial products to support business growth. Their MSME loans are designed to cater to different business stages and needs, including the requirement for a 2 crore loan for business expansion. Bank of Baroda also participates in government initiatives, providing govt MSME loans to help businesses access affordable financing.

Factors to consider when choosing a bank

When selecting the best bank for MSME loan, several factors should be considered:

- Interest rates and fees: Compare the interest rates and any additional fees associated with the loan. Lower rates can significantly reduce the cost of borrowing.

- Loan amount and terms: Ensure that the bank offers the loan amount you need, such as a 2 crore loan for business, and flexible repayment terms that suit your financial capabilities.

- Collateral requirements: Determine if the loan is secured or unsecured. Unsecured SME loans are beneficial for businesses without substantial assets to pledge.

- Application process: Look for banks with a straightforward and quick application process. This can save time and help you access funds faster.

- Customer service: Good customer service can make the loan process smoother and provide ongoing support for your financial needs.

Leveraging Klub for funding opportunities

Klub, an innovative platform specialising in revenue-based financing, offers startups an alternative funding model. By leveraging Klub, entrepreneurs can access capital without giving up equity, aligning repayments with their revenue streams.

Conclusion

Choosing the best bank for MSME loan involves careful consideration of various factors, including the specific needs of your business and the terms offered by different banks. In 2024, banks like SBI, HDFC, ICICI, PNB, and Bank of Baroda stand out as top options for MSME finance. Whether you are seeking a government loan for MSME or a govt msme loan scheme, an unsecured SME loan, or a substantial loan amount for business expansion, these banks provide a range of solutions to support your enterprise’s growth. By evaluating the available options and selecting the best fit, MSMEs can secure the financial backing needed to thrive in today’s competitive market.

#2 crore loan for business#best bank for msme loan#msme startup scheme#government loan for msme#unsecured sme loans

0 notes

Text

Filfox Wealth offers professional assistance in application for start-up grants consultancy. Our team of experienced consultants will guide you through the process, helping you to secure the funding you need to successfully launch your business.

Visit here: https://www.filfoxwealth.com/

#How to raise funds for Startup business in India#Government Schemes for Startups in India#Policy making and analysis for Startups in India#Name of top firms to prepare for Investment Readiness#Assistance in Application for Startup Grants Consultancy#Legal due diligence services for Startups#AIF registration consultants#Top or Best firm to prepare/ draft Pitch Deck Report for Startups#How to prepare Founders Agreement#How to set up Family Offices

0 notes

Text

Scholarship Assistance in Durg

Higher education demands not only a lot of focus, commitment, and will, but also effective capitalisation. It is now crucial to have a complete financial strategy in place for how you will pay for your education after the 12th grade due to the rising costs of various institutions.

There are various Government schemes such as (State or National) and also some PPP model companies. As Scholarship Assistance in Durg guides everything related to scholarship like how to apply for the scholarships or which documents required, which scholarship is best fulfilling your needs we do everything for you or your higher studies. Our aim is to educate every student, bcoz we believe ‘padhega India to bhadega India’ and money does not break you, to pursue higher studies. Here we give you some lists for these schemes, so now you properly understand.

Scholarship Assistance in Durg

For more info.:- https://www.visionguruji.in/scholarship-assistance-in-durg For more info.:- https://www.visionguruji.in/scholarship-assistance-in-Umarpoti-Bhilai For more info.:- https://www.visionguruji.in/scholarship-assistance-in-Sector-10-Bhilai For more info.:- https://www.visionguruji.in/scholarship-assistance-in-Newai-Bhilai For more info.:- https://www.visionguruji.in/scholarship-assistance-in-Bhilai For more info.:- https://www.visionguruji.in/scholarship-assistance-in-Bhilai-3-Bhilai For more info.:- https://www.visionguruji.in/scholarship-assistance-in-Vidhyut-Nagar-Durg For more info.:- https://www.visionguruji.in/scholarship-assistance-in-Sikola-Basti-Durg For more info.:- https://www.visionguruji.in/scholarship-assistance-in-Gaya-Nagar-Talab-para-Durg For more info.:- https://www.visionguruji.in/scholarship-assistance-in-Adarsh-Nagar-Durg

#Scholarship#Assistance#best fulfilling#focus#commitment#Government schemes#padhega India to bhadega India#durg#bhilai

1 note

·

View note

Text

youtube

Adding the follow up and some more context to how dire this bot problem is.

youtube

This isn't just about having a functioning product that Valve is expecting us to pay for. There is alleged criminal activity that Valve is ignoring and perhaps even profiting from.

youtube

a presentation of solid evidence that the VAST MAJORITY of the steam player count is bots, and that the number of humans in the game is much smaller than previously thought. judging by this, it's not surprising valve would abandon it. there appear to be less than 15,000 players. all the rest, making up some 80% of the steam statistic, are just item-farming bots idling on the main menu.

#tf2#I feel like at best Valve will ignore tf2 leaving the community to do all the work or at worse they will shut it down in 3~5 years#but i'll be damned if the community shouldn't at least work toward a better outcome#ngl i feel like this bot problem opens a can of worms into their gaming economy all this time#no one seems to remember that there was a russian money laundering scheme a decade ago- criminal activity is no stranger to tf2#My favorite comment from this whole ordeal has to be:#Government Mandated Update

153 notes

·

View notes

Text

How to Get a Personal Loan in Rural Areas?

In today’s world, access to personal loans is essential, whether you live in urban or rural areas. However, in rural areas, financial inclusion can sometimes be a challenge, with limited access to banking services and personal loan products. Still, it is very much possible to secure a personal loan in rural areas. With the increasing digitization of financial services, many financial institutions are now making it easier for people in rural areas to access personal loans through both traditional banks and fintech apps.

In this article, we will explore how you can apply for a personal loan in rural areas, the requirements, and some tips to improve your eligibility for better loan terms.

1. Understanding the Challenges of Getting a Personal Loan in Rural Areas

While the demand for personal loans is high in rural areas, several factors make getting a loan a bit more challenging:

Limited access to banking services: Rural areas may have fewer bank branches, and some people may not have access to digital banking services.

Low awareness: Many individuals in rural areas may not be fully aware of the various loan products available to them.

Financial instability: Many rural residents may have seasonal income or irregular jobs, which makes it difficult to show consistent creditworthiness.

Low credit scores: A significant number of rural residents might not have a credit history or may have low credit scores, which can hinder approval for loans.

However, despite these challenges, lenders and banks are increasingly offering personal loans tailored to the needs of individuals in rural areas.

2. Steps to Get a Personal Loan in Rural Areas

2.1 Choose the Right Lender

To get a personal loan in rural areas, the first step is to find a lender who offers loans in your area. Traditional banks and Non-Banking Financial Companies (NBFCs) are the two primary sources for personal loans.

Here are some options:

Public Sector Banks (PSBs): Many government banks have branches and financial schemes in rural areas. Banks like State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda offer loans with competitive interest rates.

Private Banks and NBFCs: Private banks like Axis Bank and IDFC First Bank are offering loans in rural areas as well. Some NBFCs like Bajaj Finserv, Tata Capital, and InCred are also extending personal loan services to rural populations.

Fintech Apps: Digital lending apps and peer-to-peer (P2P) lending platforms are increasingly available, allowing rural residents to apply for loans through their mobile phones.

Tip: Look for digital platforms or banks with rural outreach programs to make the loan application process simpler.

2.2 Ensure You Meet the Eligibility Criteria

Lenders will review your eligibility criteria before approving your loan. Here are the basic factors you need to meet to qualify for a personal loan:

Age: Most lenders require you to be between 21 and 60 years old.

Income: You need to have a steady income from a job, farming, or business. Lenders may accept seasonal income, but regular, predictable income can increase your chances of approval.

Employment Status: If you are employed, your employer should have a stable history. Self-employed individuals and farmers may also be eligible if they can show income records.

Credit Score: A credit score of 750+ is ideal, but some banks and NBFCs offer loans for individuals with lower credit scores, especially if they have consistent income and good repayment history.

2.3 Gather the Necessary Documents

To apply for a personal loan, you will need to provide some basic documentation. In rural areas, the documentation process is often streamlined for convenience. The required documents typically include:

Proof of Identity: Aadhaar Card, Voter ID, PAN Card, or Passport

Proof of Address: Utility bills, Bank statements, Aadhaar Card

Income Proof: Salary slips, bank statements, income tax returns, or proof of income from farming or business

Bank Statements: Typically the last 3-6 months of bank statements

Photographs: Passport-sized photographs

Some lenders also allow applicants to apply using their Aadhaar-based eKYC, which simplifies the process.

2.4 Apply Online or Visit the Bank Branch

In rural areas where internet access may be limited, many banks still allow you to apply for personal loans by visiting a local bank branch. However, if you have access to smartphones and internet banking, many banks and NBFCs now offer digital loan applications through their websites or apps.

For traditional banks, visit the nearest branch and submit your application along with the necessary documents.

For NBFCs and fintech apps, download the app, fill in the required details, upload documents, and wait for approval.

2.5 Wait for Loan Approval

Once your application is submitted, lenders will assess your eligibility based on your income, credit score, and other factors. In rural areas, loan approval can sometimes take 2-5 business days, but instant loans from digital platforms may be approved within 24 hours. Some apps even allow immediate disbursal of funds directly to your bank account after approval.

3. Top Lenders Offering Personal Loans for Rural Areas

Here are some of the best lenders offering personal loans to rural borrowers:

3.1 IDFC First Bank

IDFC First Bank is known for offering personal loans with flexible terms. They have a strong presence in rural areas and offer easy documentation and quick processing.

🔗 Apply for IDFC First Bank Personal Loan

3.2 Bajaj Finserv

Bajaj Finserv is an NBFC that offers personal loans with attractive interest rates and easy repayment options. They have expanded their reach to rural India and offer instant loans with minimal documentation.

🔗 Apply for Bajaj Finserv Personal Loan

3.3 Tata Capital

Tata Capital is another reliable option for rural borrowers looking for personal loans. The company offers flexible terms and easy documentation, ensuring that people in rural areas can apply with ease.

🔗 Apply for Tata Capital Personal Loan

3.4 Axis Finance

Axis Finance is known for providing personal loans with quick approval and competitive interest rates. They also offer flexible loan amounts, making them an excellent option for borrowers in rural areas.

🔗 Apply for Axis Finance Personal Loan

3.5 InCred

InCred is a digital lender that offers quick personal loans with flexible terms. With their online application process, borrowers in rural areas can get access to funds quickly.

🔗 Apply for InCred Personal Loan

4. Tips for Getting a Personal Loan in Rural Areas

4.1 Build a Strong Credit Profile

A strong credit score (750+) makes it easier to get approved for personal loans. Pay off existing debts, make timely payments, and keep your credit utilization low.

4.2 Maintain a Steady Income Record

Banks and NBFCs prefer individuals with a steady income. If you’re a farmer or self-employed, ensure you keep detailed records of your income to show lenders that you can repay the loan.

4.3 Be Mindful of Loan Amounts

While you may be eligible for a large loan, borrowing only what you need can help reduce your financial burden and make loan repayment easier.

4.4 Opt for Government Schemes

Some government schemes in rural areas offer subsidized loans or interest rate reductions for farmers, self-employed individuals, and small businesses. Explore these options for additional support.

Getting a Personal Loan in Rural Areas

Getting a personal loan in rural areas is now easier than ever with the growing reach of digital lending platforms and the expansion of traditional banks and NBFCs into rural regions. By following the right steps and choosing the right lender, you can get the financial support you need, even in the most remote locations.

For the best personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By improving your credit score, maintaining stable income records, and applying through the right channels, you can unlock the benefits of personal loans and handle emergencies or financial goals with ease.

#Personal loan in rural areas#Getting a personal loan in villages#Personal loan for farmers#Personal loan for rural residents#How to apply for a personal loan in rural India#Rural area loan application process#Eligibility for personal loans in rural areas#Personal loan in rural India#Bank loans for rural areas#Personal loans without collateral in rural areas#finance#personal loan online#personal loans#personal loan#loan services#personal laon#bank#fincrif#loan apps#nbfc personal loan#fincrif india#Personal loan for low-income individuals in rural areas#Instant personal loans in villages#Loan schemes for rural borrowers#NBFC loans for rural borrowers#Government schemes for personal loans in rural areas#How to improve personal loan eligibility in rural areas#Digital loans in rural areas#Personal loans for farmers and rural self-employed#Best personal loan options for rural residents

0 notes

Text

The Best News of Last Week

1. ‘We are just getting started’: the plastic-eating bacteria that could change the world

In 2016, Japanese scientists Oda and Hiraga published their discovery of Ideonella sakaiensis, a bacterium capable of breaking down PET plastic into basic nutrients. This finding marked a shift in microbiology's perception, recognizing the potential of microbes to solve pressing environmental issues.

France's Carbios has successfully applied bacterial enzyme technology to recycle PET plastic waste into new plastic products, aligning with the French government's goal of fully recycling plastic packaging by 2025.

2. HIV cases in Amsterdam drop to almost zero after PrEP scheme

According to Dutch AIDS Fund, there were only nine new cases of the virus in Amsterdam in 2022, down from 66 people diagnosed in 2021. The organisation claimed that 128 people were diagnosed with HIV in Amsterdam in 2019, and since 2010, the number of new infections in the Dutch capital has fallen by 95 per cent.

3. Cheap and drinkable water from desalination is finally a reality

In a groundbreaking endeavor, engineers from MIT and China have designed a passive solar desalination system aimed at converting seawater into drinkable water.

The concept, articulated in a study published in the journal Joule, harnesses the dual powers of the sun and the inherent properties of seawater, emulating the ocean’s “thermohaline” circulation on a smaller scale, to evaporate water and leave salt behind.

4. World’s 1st drug to regrow teeth enters clinical trials

The ability to regrow your own teeth could be just around the corner. A team of scientists, led by a Japanese pharmaceutical startup, are getting set to start human trials on a new drug that has successfully grown new teeth in animal test subjects.

Toregem Biopharma is slated to begin clinical trials in July of next year after it succeeded growing new teeth in mice five years ago, the Japan Times reports.

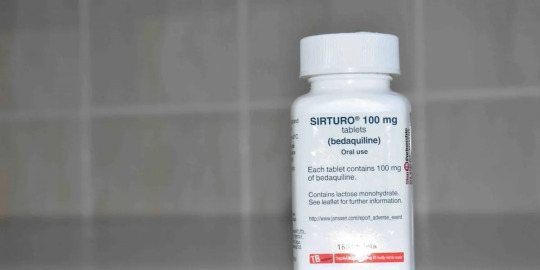

5. After Decades of Pressure, US Drugmaker J&J Gives Up Patent on Life-Saving TB Drug

In what can be termed a huge development for drug-resistant TB (DR-TB) patients across large parts of the world, bedaquiline maker Johnson and Johnson said on September 30 (Saturday) that it would drop its patent over the drug in 134 low- and middle-income countries (LMICs).

6. Stranded dolphins rescued from shallow river in Massachusetts

youtube

7. ‘Staggering’ green growth gives hope for 1.5C, says global energy chief

The prospects of the world staying within the 1.5C limit on global heating have brightened owing to the “staggering” growth of renewable energy and green investment in the past two years, the chief of the world’s energy watchdog has said.

Fatih Birol, the executive director of the International Energy Agency, and the world’s foremost energy economist, said much more needed to be done but that the rapid uptake of solar power and electric vehicles were encouraging.

---

That's it for this week :)

This newsletter will always be free. If you liked this post you can support me with a small kofi donation here:

Buy me a coffee ❤️

Also don’t forget to reblog this post with your friends.

11K notes

·

View notes

Text

Can govt employee invest in share market 2023

Can govt employee invest in share market? Can govt employee invest in share market?Investing in the Share Market: A Comprehensive Guide for Government EmployeesIntroductionUnderstanding the Share MarketAssessing Your Financial GoalsInvestment Options for Government EmployeesAdvantages of Investing in the Share MarketMitigating Risks in the Share MarketTax Implications for Government…

View On WordPress

#apy comes under which section#best government investment schemes#best monthly saving scheme in india#best saving scheme#best scheme to invest money#can a government employee do business#can a government employee do trading#can a government employee invest in share market#can a government employee invest in stock market#can a govt employee do business#can government employee do business#can government employee do business in india#can government employee do intraday trading#can government employee do trading#can government employee invest in mutual funds#can government employee invest in stock market#can government employee open demat account#can government employees invest in stocks#can government employees trade in share market#can govt employee do trading#can ias invest in stock market#government investment schemes#government investment schemes with high returns#government jobs in stock market#government schemes for private employees#government sip plans#govt investment schemes#how can i show sukanya samriddhi yojana for tax exemption#i have 50000 rs where to invest#list of government investment schemes

0 notes