#Government Schemes for Startups in India

Explore tagged Tumblr posts

Text

Government & Special Schemes: A Complete Guide to Personal Loans

When it comes to financing personal expenses, a personal loan can be a valuable tool. However, did you know that there are several government-backed schemes and special loan programs designed to make personal loans more accessible and affordable for various groups of people? Whether you are a government employee, a first-time homebuyer, or an individual with specific financial needs, understanding these schemes can help you secure better terms and lower interest rates.

In this article, we will explore government and special schemes that offer financial assistance, discuss how these programs work, and provide a list of lenders who offer personal loans under these schemes.

1. Government Schemes for Personal Loans in India

1.1 Pradhan Mantri Mudra Yojana (PMMY)

One of the most prominent government schemes for financing small businesses and individuals is the Pradhan Mantri Mudra Yojana (PMMY). This scheme offers financial support to non-corporate, non-farm small/micro enterprises and is especially helpful for those looking to start their own business or expand an existing one.

Types of Loans under PMMY: ✔ Shishu Loan – Up to ₹50,000 for startups and small businesses in the early stages. ✔ Kishore Loan – ₹50,001 to ₹5 lakh for businesses that have a more established track record. ✔ Tarun Loan – ₹5 lakh to ₹10 lakh for larger small enterprises looking to grow.

💡 Tip: Since PMMY loans are aimed at small businesses and entrepreneurs, they can also be used for personal purposes like buying equipment or funding personal projects related to business needs.

🔗 Best lenders for PMMY loans: 👉 IDFC FIRST Bank Personal Loan 👉 Bajaj Finserv Personal Loan

1.2 Atal Pension Yojana (APY)

The Atal Pension Yojana (APY) is a government-backed pension scheme designed for workers in the unorganized sector. This scheme provides pension benefits to people between the ages of 18 to 40 years, ensuring a steady income after retirement. Though primarily a pension scheme, APY participants may also benefit from certain loan schemes tailored to meet their financial needs.

1.3 National Handicapped Finance and Development Corporation (NHFDC) Loans

The NHFDC offers personal loans at subsidized rates to people with disabilities, helping them fund various personal needs, including: ✔ Education ✔ Employment creation ✔ Livelihood enhancement

Eligibility Criteria: ✔ Individuals with disabilities must be between 18 to 55 years. ✔ A minimum of 40% disability must be verified by a medical board.

💡 Tip: NHFDC loans are especially helpful for disabled individuals to set up small businesses or manage personal expenses.

2. Special Loan Schemes for Government Employees

2.1 Government Employee Personal Loan Schemes

Many banks and NBFCs offer special personal loan schemes tailored specifically for government employees. These loans typically come with lower interest rates, flexible terms, and quick processing. Since government employees are considered low-risk borrowers, these schemes are designed to offer more favorable conditions.

Key Features: ✔ Lower Interest Rates – Reduced interest rates for government employees. ✔ Longer Tenure – Extended repayment periods (up to 7 years). ✔ Higher Loan Amount – Government employees can avail of larger loans than those with private-sector jobs.

💡 Best for: Government employees looking for unsecured loans to cover personal expenses or emergencies.

🔗 Best lenders for government employee loans: 👉 Tata Capital Personal Loan 👉 Axis Bank Personal Loan

2.2 Nationalized Banks Personal Loans for Government Employees

Nationalized banks such as SBI, PNB, and Bank of India also offer exclusive personal loan schemes for government employees. These loans are typically available at lower interest rates, making them an ideal choice for government staff members.

3. Schemes for Women Entrepreneurs

3.1 Stand-Up India Scheme

The Stand-Up India Scheme was launched to promote entrepreneurship among women, Scheduled Castes (SCs), and Scheduled Tribes (STs). Under this scheme, banks offer loans ranging from ₹10 lakh to ₹1 crore for greenfield projects in the manufacturing, services, or trading sectors.

Key Features: ✔ Collateral-free loans for women entrepreneurs. ✔ Repayment tenure of up to 7 years. ✔ Lower interest rates compared to standard loans.

💡 Tip: This scheme is ideal for women entrepreneurs who want to establish or grow a small business and need financial assistance.

🔗 Best lenders for Stand-Up India loans: 👉 Axis Finance Personal Loan 👉 InCred Personal Loan

4. Schemes for First-Time Homebuyers

4.1 Pradhan Mantri Awas Yojana (PMAY)

The Pradhan Mantri Awas Yojana (PMAY) aims to provide affordable housing to the urban poor and those from rural areas. This scheme offers subsidized loans for first-time homebuyers and those looking to upgrade their homes.

Key Benefits of PMAY: ✔ Subsidized interest rates (up to 6.5% p.a.) for home loans. ✔ Affordable repayment terms with long loan tenures. ✔ Available to both urban and rural residents.

💡 Tip: Check if you’re eligible for a PMAY subsidy before applying for a home loan to save significantly on interest payments.

🔗 Best lenders for PMAY loans: 👉 IDFC FIRST Bank Personal Loan 👉 Bajaj Finserv Personal Loan

5. How to Apply for Government and Special Scheme Loans

Step 1: Check Eligibility Criteria

Each government-backed or special loan scheme has specific eligibility criteria that must be met. Be sure to review the eligibility conditions for each scheme before applying.

Step 2: Gather Required Documents

Most loans will require basic documentation such as: ✔ Identity Proof ✔ Address Proof ✔ Income Proof (ITR, Salary slips, or Bank Statements) ✔ Property Papers (for housing schemes)

Step 3: Apply Through Approved Lenders

Many of these loans are disbursed by banks and financial institutions that are approved by the government. Ensure that the lender you choose is part of the approved list for each scheme.

Leveraging Government & Special Schemes for Personal Loans

Government and special schemes play a vital role in providing financial support to individuals from various backgrounds, whether you are a first-time homebuyer, government employee, or women entrepreneur. These schemes typically offer lower interest rates, longer repayment periods, and less stringent eligibility conditions, making them highly beneficial for personal and business needs.

Before applying, make sure you: ✔ Check the eligibility for the scheme that fits your needs. ✔ Compare interest rates and loan terms to get the best deal. ✔ Prepare your documents in advance to speed up the approval process.

For the best personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By leveraging these government and special schemes, you can achieve your financial goals more affordably and efficiently.

#Government loan schemes#Special loan schemes in India#Pradhan Mantri Mudra Yojana loan#Personal loan schemes for government employees#Stand-Up India scheme loans#Affordable housing loan schemes#Government-backed personal loans#PMAY loan eligibility#Personal loan for women entrepreneurs#Personal loan schemes for first-time homebuyers#Mudra Yojana loan for business#National Handicapped Finance and Development Corporation loan#Personal loans for self-employed individuals#Loans for disabled individuals in India#Personal loan eligibility criteria for government employees#Affordable personal loans for startups#How to apply for PMAY home loan#Pradhan Mantri Awas Yojana subsidy#Subsidized personal loans for women#Low-interest government personal loan schemes#finance#bank#nbfc personal loan#personal loans#loan services#personal loan#fincrif#loan apps#personal loan online#personal laon

0 notes

Text

Legal Aspects of Investment in India: What Investors Need to Know

Investing in India's vibrant startup ecosystem offers lucrative opportunities for investors seeking high growth potential and diversification. However, understanding the legal aspects of investment is crucial to mitigate risks and ensure compliance with regulatory requirements. In this blog, we will delve into the critical legal aspects of funding and investment in Indian startups, covering equity financing, debt financing, crowdfunding, incubators, and government schemes like the Startup India Seed Fund Scheme (SISFS). By gaining insights into these legal frameworks, investors can make informed decisions and navigate the complexities of the Indian investment landscape effectively.

Equity Financing:

Equity financing plays a pivotal role in funding Indian startups, with angel investors, venture capitalists, and private equity investors being key stakeholders. Venture capitalists typically enter into non-binding offers with startups based on preliminary valuations and due diligence processes. This involves the execution of various transaction documents, including term sheets, share subscription agreements, and shareholders' agreements, which outline rights, obligations, and exit options for investors. Similarly, angel investors, who are industry professionals, fund startups in return for equity stakes, subject to regulations imposed by SEBI. Understanding these legal agreements and regulatory requirements is essential for investors engaging in equity financing in India.

Debt Financing:

Debt financing, through loans or external commercial borrowings (ECBs), is another avenue for financing Indian startups. Banks and non-banking finance companies (NBFCs) provide loans to startups for purchasing inventory, equipment, and securing operating capital. However, obtaining a loan involves rigorous documentation, including loan agreements, security/collateral documentation, and compliance with regulatory norms. Additionally, external commercial borrowings from non-resident lenders require adherence to restrictions on capital market investments and acquisitions in India. Investors should familiarize themselves with these legal requirements to facilitate smooth debt financing transactions.

Crowdfunding:

Crowdfunding has emerged as a revolutionary way of obtaining seed funding for startups by securing funds from a large group of people through online platforms. While crowdfunding offers a decentralized approach to fundraising, regulatory frameworks governing this practice are still evolving in India. The Securities and Exchange Board of India (SEBI) released a consultation paper on crowdfunding in 2014, but formal regulations are yet to be issued. Investors should stay updated on regulatory developments and exercise caution when participating in crowdfunding activities in India.

Incubators:

Incubators play a crucial role in nurturing startup ventures by providing resources and services in exchange for equity stakes. These entities, whether government-aided or private, offer management training, administrative support, and legal compliance assistance to startups during the incubation period. Understanding the terms and conditions of engagement with an incubator, including equity dilution and exit options, is essential for investors considering incubation as a financing option for Indian startups.

Startup India Seed Fund Scheme (SISFS):

The Startup India Seed Fund Scheme (SISFS), launched by the Department of Promotion of Industry and Internal Trade (DPIIT), aims to provide financial assistance to startups for proof of concept, prototype development, and market entry. Eligible startups can receive grants and investments from selected incubators, subject to certain criteria and guidelines. Investors interested in leveraging the SISFS should familiarize themselves with the scheme's objectives, eligibility criteria, and disbursement process to maximize investment opportunities in Indian startups.

In conclusion, navigating the legal aspects of investment in India's vibrant startup ecosystem is essential for investors looking to capitalize on the country's burgeoning entrepreneurial landscape. As highlighted throughout this guide, understanding the nuances of equity financing, debt financing, crowdfunding, incubators, and government schemes like the Startup India Seed Fund Scheme (SISFS) is crucial for making informed investment decisions and mitigating risks effectively.

Equity financing, facilitated by angel investors, venture capitalists, and private equity investors, offers startups the capital needed for growth while providing investors with opportunities for high returns. However, navigating the intricacies of term sheets, share subscription agreements, and shareholders' agreements requires a deep understanding of legal frameworks and regulatory requirements. By comprehensively analyzing these documents and seeking legal counsel, investors can safeguard their interests and maximize their investment potential in Indian startups.

Similarly, debt financing presents an alternative avenue for startups to access capital through loans and external commercial borrowings. While loans from banks and NBFCs provide startups with operational flexibility, compliance with regulatory norms and documentation requirements is paramount. Investors must conduct thorough due diligence and assess the risks associated with debt financing, including collateral obligations and repayment terms, to ensure a sound investment strategy.

Crowdfunding, although gaining popularity as a decentralized funding mechanism for startups, remains relatively nascent in India. While platforms like Wishberry and Catapoolt offer startups access to a broader investor base, regulatory frameworks governing crowdfunding are still evolving. Investors should closely monitor regulatory developments and exercise caution when participating in crowdfunding activities to mitigate potential risks and ensure compliance with applicable laws.

Incubators play a pivotal role in nurturing early-stage startups by providing resources, mentorship, and networking opportunities. However, investors considering incubation as a financing option must carefully evaluate the terms and conditions of engagement, including equity dilution and exit options. By aligning their investment objectives with the goals of the incubator and conducting thorough due diligence on prospective startups, investors can enhance their chances of success in the incubation ecosystem.

Government schemes like the Startup India Seed Fund Scheme (SISFS) offer additional avenues for financing startups and promoting innovation. By providing financial assistance and support to eligible startups, these schemes aim to foster entrepreneurship and accelerate economic growth. Investors interested in leveraging government initiatives should familiarize themselves with the eligibility criteria, application process, and disbursement mechanisms to capitalize on investment opportunities in Indian startups.

In conclusion, investing in India's dynamic startup ecosystem offers unparalleled opportunities for growth, innovation, and diversification. However, navigating the legal complexities of investment requires diligence, expertise, and a thorough understanding of regulatory frameworks. By staying informed, seeking professional advice, and conducting comprehensive due diligence, investors can effectively navigate the legal aspects of investment in Indian startups and unlock the full potential of this thriving ecosystem. As India continues to emerge as a global hub for entrepreneurship and innovation, strategic investments in its startup landscape have the potential to yield significant returns and shape the future of the country's economy.

This post was originally published on: Foxnangel

#investment in india#invest in india#business legal aspects#startup ecosystem#indian startups#startups in india#startup india seed fund scheme#sisfs#government schemes#foxnangel#fdi in india

1 note

·

View note

Text

Central Bank of India Recruitment : थेट मॅनेजर पदावर काम करण्याची संधी, सेंट्रल बँक ऑफ इंडियामध्ये १००० रिक्त पदांसाठी भरतीला सुरुवात.

Central Bank of India Recruitment :- सेंट्रल बँक ऑफ इंडियाने व्यवस्थापक पदासाठी 1000 रिक्त जागांसाठी अधिसूचना प्रसिद्ध केली आहे. ज्या उमेदवारांना सेंट्रल बँक ऑफ इंडियामध्ये जॉईन किंवा नोकरी करायची आहे त्यांनी ही पोस्ट शे��टपर्यंत तपासा. CBI बँक भरतीसाठी ऑनलाइन अर्ज करण्याची अंतिम तारीख १५ जुलै २०२३ आहे. इच्छुक आणि पात्र उमेदवारांनी या भरतीपूर्वी ऑनलाइन अर्ज करावा. अर्ज करण्याशी संबंधित सर्व माहिती…

View On WordPress

#Business#Central Bank of India Recruitment#Central Bank of India Recruitment 2023#Government Scheme#maharashtra#mumbai#National Government Scheme#News#Startup

0 notes

Text

New Company Registration in India – A Step-by-Step Guide

Starting a business in India is an exciting venture, but it requires careful planning and adherence to legal regulations. Mercuries & Associate LLP specializes in company registration services, ensuring a seamless and hassle-free process for entrepreneurs. If you are planning to register a new company in India, this guide will help you understand the key steps involved.

Why Register a Company in India?

India offers a dynamic business environment with numerous benefits for startups and established businesses. Some of the advantages of registering a company in India include:

Limited Liability Protection: Safeguards personal assets from business liabilities.

Legal Recognition: A registered company enjoys credibility and trust in the market.

Access to Funding: Makes it easier to raise capital through investors and banks.

Tax Benefits: Eligible for tax exemptions and deductions under government schemes.

Perpetual Succession: Ensures continuity irrespective of ownership changes.

Types of Business Entities in India

Before proceeding with registration, choosing the right business structure is essential. The common types of business entities in India include:

Private Limited Company (PLC)

Public Limited Company (PLC)

Limited Liability Partnership (LLP)

One Person Company (OPC)

Sole Proprietorship

Partnership Firm

Step-by-Step Process for New Company Registration

Step 1: Obtain Digital Signature Certificate (DSC)

The first step is acquiring a Digital Signature Certificate (DSC) for the proposed directors, as all filings with the Ministry of Corporate Affairs (MCA) are done electronically.

Step 2: Apply for Director Identification Number (DIN)

Every company director must have a unique DIN, which can be obtained by filing Form DIR-3 with the MCA.

Step 3: Name Reservation with MCA

Choosing a unique name is crucial. The name must comply with MCA guidelines and can be reserved using the SPICe+ Part A form.

Step 4: Drafting of Memorandum & Articles of Association

The Memorandum of Association (MoA) and Articles of Association (AoA) define the company's objectives, rules, and regulations. These documents are filed with the MCA.

Step 5: Filing of Incorporation Forms

The company incorporation application is submitted through the SPICe+ Part B form, along with necessary documents, including identity proof, address proof, and NOC from the property owner (if applicable).

Step 6: PAN and TAN Application

Upon successful incorporation, the company receives its Certificate of Incorporation (CoI), along with its PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number).

Step 7: Open a Business Bank Account

A corporate bank account is necessary for conducting business transactions. The company can use its incorporation documents to open a bank account.

Step 8: GST Registration and Other Compliances

Depending on the nature of the business, GST registration, MSME registration, and other regulatory compliances may be required.

Why Choose Mercuries & Associate LLP?

At Mercuries & Associate LLP, we provide expert guidance and end-to-end assistance for new company registration in India. Our services include:

Business structure advisory

Name reservation assistance

Documentation and legal compliance

PAN, TAN, and GST registration

Post-incorporation compliance support

Conclusion

Registering a company in India is a strategic decision that can set the foundation for business success. With expert support from Mercuries & Associate LLP, entrepreneurs can navigate the legal requirements effortlessly and focus on growing their business.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

3 notes

·

View notes

Text

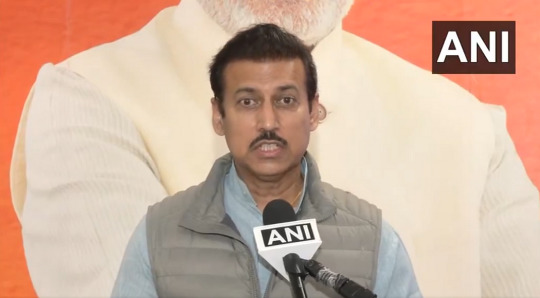

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

Viksit Bharat Budget 2025: Col Rajyavardhan Rathore’s Insights on India’s Growth Vision

The Viksit Bharat Budget 2025 marks a pivotal moment in India’s economic trajectory, laying the foundation for a developed nation by 2047. Colonel Rajyavardhan Singh Rathore, a distinguished parliamentarian and former Union Minister, has been a vocal proponent of initiatives that drive national growth and development.

1. Introduction to Viksit Bharat Budget 2025

The Union Budget for 2025–26, termed the Viksit Bharat Budget, underscores the government’s commitment to transforming India into a developed nation by its centenary of independence in 2047. This budget introduces several key initiatives aimed at bolstering various sectors of the economy.

2. Key Highlights of the Budget

2.1. Prime Minister’s Dhan-Dhanya Yojana

A significant highlight is the introduction of the Prime Minister’s Dhan-Dhanya Yojana, targeting the agricultural sector. This scheme aims to provide financial and infrastructural support to approximately 1.7 crore farmers, especially in regions with low agricultural productivity. The focus is on enhancing crop production, improving rural infrastructure, and ensuring financial stability for farmers.

2.2. Emphasis on Technology and Innovation

The budget places a strong emphasis on technology and innovation, recognizing them as catalysts for economic growth. Investments are directed towards research and development, digital infrastructure, and fostering startups, aiming to position India as a global leader in technological advancements.

2.3. Infrastructure Development

Significant allocations have been made for infrastructure projects, including the development of highways, railways, and urban facilities. These projects are expected to enhance connectivity, boost trade, and create employment opportunities across the country.

3. Col Rajyavardhan Rathore’s Perspective

Col Rajyavardhan Rathore has consistently advocated for policies that promote holistic national development. His insights into the Viksit Bharat Budget 2025 reflect his commitment to India’s growth vision.

3.1. Support for Agricultural Initiatives

Recognizing the pivotal role of agriculture in India’s economy, Col Rathore supports the Dhan-Dhanya Yojana’s focus on uplifting farmers. He emphasizes the need for modernizing agricultural practices and providing farmers with the necessary resources to enhance productivity.

3.2. Promotion of Sports and Youth Development

As a former Olympian and Sports Minister, Col Rathore underscores the importance of investing in sports infrastructure and youth development programs. He advocates for initiatives that nurture young talent, promote physical fitness, and position India as a formidable presence in international sports.

3.3. Encouragement of Technological Advancements

Col Rathore highlights the significance of embracing technological innovations to drive economic growth. He supports policies that foster research and development, encourage startups, and integrate technology across various sectors to enhance efficiency and competitiveness.

The Viksit Bharat Budget 2025 sets a comprehensive roadmap for India’s development, with strategic initiatives across agriculture, technology, and infrastructure. Col Rajyavardhan Rathore’s insights and advocacy align with this vision, emphasizing a holistic approach to national growth that leverages India’s strengths and addresses its challenges.

4 notes

·

View notes

Text

Empowerment Redefined: BJP’s Commitment to Promises Under PM Narendra Modi’s Leadership — Col Rajyavardhan Rathore

Colonel Rajyavardhan Rathore has lauded the leadership of Prime Minister Narendra Modi for redefining empowerment and fulfilling the promises made to the people of India. He highlighted how the BJP government has consistently worked towards fostering inclusive development, ensuring that the benefits of governance reach every corner of the country.

Key Highlights of Empowerment Under PM Modi’s Leadership:

Transformational Schemes:

Initiatives like Jan Dhan Yojana, Ayushman Bharat, and Ujjwala Yojana have revolutionized the way governance impacts the underprivileged.

Programs like Digital India and Startup India have empowered youth and entrepreneurs to explore new horizons.

2. Commitment to Inclusivity:

Sabka Saath, Sabka Vikas, Sabka Vishwas has been the guiding principle, ensuring no one is left behind, be it women, youth, farmers, or marginalized communities.

Landmark laws like the Transgender Persons (Protection of Rights) Act showcase a commitment to building a more equitable society.

3. Youth-Centric Development:

The government’s focus on skilling and education has equipped millions of young Indians to contribute to a Viksit Bharat (Developed India) vision.

Rathore emphasized initiatives like Khelo India and the National Education Policy (NEP) as game-changers for youth empowerment.

4. Strengthening the Economy:

India’s rise as the 5th largest economy in the world is a testament to the visionary economic policies of the government.

Infrastructure development projects like Gati Shakti and the Bullet Train corridor are paving the way for future growth.

5. Global Recognition:

Under PM Modi, India’s stature on the global stage has risen significantly, with a focus on diplomacy, trade partnerships, and climate leadership.

Colonel Rathore’s Perspective:

Reflecting on the progress, Colonel Rathore stated:

“Empowerment under PM Modi is not just a slogan; it is a reality. Whether it’s providing houses to the homeless, toilets for dignity, or digital connectivity, the BJP government has delivered on its promises with transparency and accountability.”

Call to Action:

Col Rathore urged citizens, especially the youth, to take active participation in the ongoing transformation:

Engage: Be a part of initiatives that empower and uplift communities.

Innovate: Use platforms like Digital India to innovate and create solutions for societal challenges.

Lead: Become ambassadors of change in your communities.

The unwavering commitment of the BJP government, guided by PM Modi, has redefined empowerment in India. Col Rajyavardhan Rathore’s vision aligns seamlessly with this transformative journey, inspiring a new era of growth and progress.

4 notes

·

View notes

Text

Empowering MSMEs with Budget 2025: The Role of Business Automation Tools

The 2025-26 Budget prioritizes empowering Micro, Small, and Medium Enterprises (MSME), to promote automation and digital innovation. With critical provisions to improve operational efficiency competitiveness, this budget has introduced measures like enhanced investment and turnover limits, raised by 2.5 and 2 times. This strategic move caters to empowering MSMEs to scale operations and promote economic growth and job creation through business automation tools.

In addition to financial reforms, the union budget emphasized integrating automation systems to modernize MSMEs to stay ahead of the curve. By providing accessibility to credit and minimizing bureaucratic hurdles, governments strive to encourage adopting digital technologies like field sales automation solutions to improve productivity and more.

These tools will provide MSMEs with great ease in their operations and expand the market reach of their offer competitiveness in both national and international markets. The focus presented on digital transformation in the union budget was anticipated to transform the game, facilitating MSMEs to utilize contemporary technologies to drive sustained growth in a relativistic business landscape.

Key Takeaways of India’s Budget 2025 for MSME Digital Transformation

MSME Classification Thresholds: Investment and turnover limits for Micro, Small, and Medium Enterprises classification have been revised for the purposes of the Budget. The investment limit in respect to micro-enterprises is now set at Rs. 2.5 crore and it is further enhanced by setting Rs. 10 crore as the limit on turnover. For small enterprises, however, the limits on investment and turnover are now set at Rs. 25 crore and Rs. 100 crores respectively, whereas for medium enterprises the limits are Rs. 125 crore with Rs. 1 billion set for turnover.

UPI-Linked Credit System: The 2025 Indian budget has proposed increasing UPI-linked credit systems for MSMEs to make credit and digital payments accessible. This will minimize reliance on traditional banking procedures and drive automation.

MSME Credit Cards: A new custom Credit Card scheme of Rs. 5 lakh is now available to micro-enterprises registered on the Udyam portal with plans to issue 10 lakh cards in the first year.

Significant Tax Benefits: Small businesses' corporate tax rate has been reduced to 20%, which will relieve the financial burden and allow MSMEs to invest in essential business automation tools to stay competitive. Moreover, startups registered before March 2027 can avail of tax holidays for an extended period.

Enhanced Credit Access: Credit cover has increased to Rs 10 crore, potentially unlocking Rs 1.5 lakh crore in credit. Furthermore, the government strives to enhance credit penetration to a minimum of 25% by 2028 and uncover an estimated Rs 5 lakh crore in economic activity.

Limitations on Investment/Turnover: The investment limit for MSMEs has been enhanced by 2.5 times and the turnover limit by 2 times, which will promote business growth and allow companies to access technology in the future.

Digital Transformation: In the 2025 budget, another use of the term for MSMEs is to embrace technologies such as automation, AI-based field sales automation solutions, blockchain, etc.

Benefits of Adopting Business Automation Tools for MSMEs in India

Enhanced Productivity: By deploying automation tools, things that take a lot of employee time are sped up and done in a very efficient way, allowing employees to focus only on high-value work and not on regular functions like data entry, generating reports, and scheduling.

Minimizes Operational Costs: By reducing errors and waste via automation, MSMEs can significantly save overall costs and streamline resource allocation. As per Gartner's study, businesses that invest in automation can expect to reduce operational expenses by 70%.

Fosters Business Accuracy: The digitization and automation help ensure the same task is completed accurately and that human errors will be reduced by 25%, thus improving work quality.

Improves Consumer Experience: MSMEs can automate their customer service with advanced components such as chatbots, allowing 24/7 seamless service to eventually attain customer satisfaction.

Fosters Insightful Decision-Making: Among other advantages of utilizing automated tools is that they allow for detailed analysis and insights of your entire business operation necessary for making decision-making regarding resource allocation, marketing strategy, management of leads, sales opportunities, etc. The diverse data sources and predictive analytics allow MSMEs to quickly foresee market trends, ascertain customer behaviour, and accurately make informed decisions.

Enables to Focus on Core Tasks: By using advanced technologies, MSMEs can decide on prioritizing key business activities, improving business growth, and efficient market expansion.

Real-Time Data Accessibility: AI and IoT give MSMEs advanced technology-managed tools and line processing assistance for a better decision-making process by collecting real-time data on their differences.

How will the Reduced Corporate Tax Rate for Small Businesses Impact MSMEs?

With the expected sharp cut in corporate tax rates for small businesses beginning in 2025, MSMEs in India might count on a positive impact.

Enhanced Investment: Added savings from taxes can be spent on investing in technologies like business automation tools, R&D, and market expansion for further growth.

Creating New Jobs: Lower taxes leave room for businesses to expand and hire more employees to drive efficiency and optimal results.

Improves Financial Health: Minimized corporate tax rates will free up additional funds for business growth and enhance the financial health of MSMEs to make better decisions.

Competitive Advantage: Tax relief will allow MSMEs to retain more earnings and reinvest in advanced tools for automated operations. Businesses can stay ahead of the curve in local and global markets by reducing costs and fostering efficiency.

How can TrackOlap’s Automation Tools Impact MSME Growth?

1. Field Sales Tracker

The field sales automation solution is crucial for MSMEs with their mobile field sales team. It allows businesses to constantly track diverse field activities, monitor sales performance in real-time, streamline workflows, identify time thefts and more under one roof.

Key Features for MSMEs:

Real-time GPS-based Tracking: It helps monitor sales rep’s locations and activities to ensure employee accountability and enhanced task completion rates.

Automated Data-driven Reporting: It helps MSMEs in India to minimize manual data entry with computerised sales reports and make informed decisions at the right time.

Automated Sales Performance Analytics: Enables businesses to gain insights into customer’s interactions and improve conversion rates.

As the government encourages MSMEs to adopt digitization and automation, businesses can use their budget incentives to incorporate sales tracking tools, drive efficiency, and effectively transform sales performance.

2. Lead Management Solution

TrackOlap’s lead management tool will assist MSMEs to capture, monitor and nurture leads with data-driven insights to ensure no potential customer is lost amid the sales pipeline.

Key Features for MSMEs:

Comprehensive Lead-based Database: You can organize your customer data into one platform based on the stages of your sales pipeline.

Automated Lead Follow-ups: MSMEs can quickly schedule automated emails and calls to nurture prospects, which frees up employees and pushes them to focus on other core tasks.

Data-backed Decision Making: Leverage advanced analytics to refine your marketing strategies and enhance lead conversion rates.

The recent Union Budget 2025 has encouraged MSMEs to invest in innovative digital solutions, wherein a centralized lead management system can help them streamline marketing efforts and boost conversion rates and sales rates.

3. Sales Opportunity Software

TrackOlap’s sales opportunity management software enables businesses to monitor potential sales deals, forecast revenues via data-driven reports and manage customer relationships with advanced features.

Key Features for MSMEs:

Visualization of Sales Deals: Enables MSMEs to track the progress of each potential sales opportunity to automate resource allocation and refine strategies in real time.

Seamless Collaboration Tools: Allows teams to coordinate across departments capture and seize deals by accessing accurate insights in real-time.

Insightful Deal Forecasting: MSMEs can accurately predict future revenue trends and sales opportunities and develop sales strategies and resource allocation plans.

MSMEs can utilize digital incentives from Budget 2025 to integrate a sales opportunity system to optimize sales deal management and drive business growth and efficiency.

Align Budget Initiatives with Significant Automation Tools

The Indian Union Budget offers various advantages that automation solutions can support. Hence, let's go ahead and see how MSMEs can benefit from.

1. Leverage Credit Support for Tech Adoption

With enhanced accessibility to credit, MSMEs can seamlessly invest in automation tools without any financial strain. Field sales tracker, CRM software, and lead management system can be incorporated with more straightforward financing options.

2. Digital Adoption Based Incentives

There are certain government subsidies for technology adoption to minimize MSMEs initial investment burden. Businesses can further implement automation tools with lower financial burdens and enhance long-term profitability rates.

3. Benefit from Compliance Simplification

Automation tools can simplify compliance, and reporting can help MSMEs adhere to regulatory requirements effectively and simultaneously focus on driving business growth.

4. Improve Efficiency with Digital Infrastructure

With enhanced digital connectivity, cloud-based automation tools can function smoothly in business operations; make sure you can access critical and insightful data in real-time.

Conclusion

India’s Budget 2025 is a transformation phase for MSMEs to promote a digital-first approach. Business automation tools, including lead management systems, field sales tracking tools, opportunity management software, and others, can greatly raise efficiency, competitive advantage, and revenues.

Besides, government incentives that are aimed directly at promoting digital transformation dictate that MSMEs embrace automation if they are to future-proof their operations and gain a vantage point to achieve sustainable growth in a constantly changing business environment. Connect with our experts today to drive automation into your business operation on a regular basis.

#employee tracking#employee tracking software#employee time tracking software#employee tracking app#employee monitoring software#business automation software

0 notes

Text

Government-Backed Business Loans in 2025: Latest Schemes and How to Apply

Understanding Government-Backed Business Loans

Government-backed business loans have become a crucial source of funding for entrepreneurs and small business owners in 2025. These loans are designed to provide financial support to businesses, enabling them to grow, innovate, and contribute to the economy. If you're looking for the best business loan provider, understanding government-backed options is essential.

What Are Government-Backed Business Loans?

Government-backed business loans are financial products supported by the government to encourage entrepreneurship and economic growth. They often come with lower interest rates, flexible repayment terms, and easier eligibility criteria compared to traditional loans. Choosing a reliable business loan provide company can make the process smoother.

Benefits of Government-Backed Loans

Lower Interest Rates – More affordable compared to private lenders.

Flexible Repayment Terms – Helps businesses manage cash flow.

Easier Eligibility Criteria – Designed for startups and SMEs.

Support for Innovation – Encourages technological advancement.

If you're searching for a business loan company in Delhi, it's crucial to consider government-backed options that align with your financial needs.

Top Government-Backed Business Loan Schemes in 2025

1. Startup India Loan Scheme

Loan Amount: Up to ₹50 lakhs

Interest Rate: As low as 6% per annum

How to Apply:

Register on the Startup India website.

Submit business plan and financial projections.

Await approval and disbursement from a business loan provide company.

2. MSME Business Loan Scheme

Loan Amount: Up to ₹2 crores

Repayment Period: Up to 7 years

How to Apply:

Approach a recognized business loan company in Delhi.

Submit business details and financial statements.

Await loan approval and disbursement from the best business loan provider.

3. Green Energy Business Loan

Loan Amount: Up to ₹5 crores

Interest Rate: 5% per annum

How to Apply:

Submit project proposal to MNRE.

Provide financial projections and feasibility reports.

Loan disbursed in installments based on milestones by a business loan provide company.

4. Women Entrepreneurship Loan Scheme

Loan Amount: Up to ₹1 crore

Interest Rate: 7% per annum (with 2% subsidy for 3 years)

How to Apply:

Register under the Women Entrepreneurship Platform (WEP).

Submit a business plan and financial documents.

Receive loan disbursement within 10 working days from a trusted business loan company in Delhi.

5. Export Promotion Business Loan

Loan Amount: Up to ₹10 crores

Interest Rate: 8% per annum

How to Apply:

Submit export business details to ECGC.

Provide proof of export orders.

Await loan approval and disbursement by the best business loan provider.

How to Choose the Best Business Loan Provider

Compare Interest Rates – Find the most affordable option.

Check Repayment Terms – Ensure it aligns with business cash flow.

Verify Eligibility Criteria – Meet the requirements before applying.

Research Reputation – Read reviews and assess credibility of a business loan provide company.

If you're based in Delhi, finding a reliable business loan company in Delhi can help streamline the process.

Conclusion Government-backed business loans in 2025 offer an excellent opportunity for SMEs and startups to secure funding. By choosing the right scheme and business loan provide company, businesses can thrive and contribute to economic growth. If you're searching for the best business loan provider, government-backed loans are a smart choice for financial stability and business success.

#best business loan provider#business loans#business loan provide company#business loan company in delhi

0 notes

Text

Name of top firms to prepare for Investment Readiness | Filfox Wealth

Elevate your investment strategy with Filfox Wealth and gain access to the name of top firms to prepare for investment readiness. Our tailored services are designed to align your financial goals with the standards set by industry leaders. Trust Filfox Wealth to guide you towards success and secure your financial future.

Click Here: https://www.filfoxwealth.com/

#how to raise funds for startup business in india#how to prepare founders agreement#legal due diligence services for startups#how to set up family offices#policy making and analysis for startups in india#aif registration consultants#government schemes for startups in india

0 notes

Text

Best CA Firms in India: Why AKMG Associates Is Your Trusted Partner

In moment’s complex business terrain, choosing the best CA firms in India can be a daunting task. Whether you're a incipiency, an established business, or an transnational pot, you need expert fiscal and legal guidance to insure compliance, minimize duty arrears, and streamline your business operations. A well- known chartered account establishment furnishing expansive fiscal and legal services, AKMG Associates, is another estimable brand in the field.

AKMG Associates: Why Choose Them?

Because of its fidelity to quality, professional ethics, and client- concentrated methodology, AKMG Associates stands piecemeal among the best CA firms in India. With moxie gauging multiple disciplines, the establishment provides top- notch results to businesses of all sizes.

Online Company Incorporation Services

Starting a business in India requires proper legal attestation, duty enrollment , and compliance with commercial laws. At AKMG Associates, we offer Online Company Incorporation Services to help entrepreneurs set up their businesses snappily and efficiently. Our platoon ensures hassle-free enrollment of private limited companies, LLPs, OPCs, and more. From drafting the Memorandum of Association( MoA) to carrying GST enrollment , we handle every aspect of company objectification seamlessly.

International Tax and Cross Border Taxation Services

Global businesses frequently face challenges related to transnational duty laws, transfer pricing, and double taxation issues. AKMG Associates specializes in International Tax and Cross Border Taxation Services, fixing that companies misbehave with global duty regulations while optimizing their duty arrears. We help businesses with aboriginal taxation, foreign direct investments( FDIs), and duty structuring for transnational deals, enabling smoothcross-border operations.

Advisory Services for Startups

Dealing with legal and fiscal issues can be tempting for new businesses. Our Startup Advisory Services are intended to give comprehensive backing, ranging from compliance and fundraising tactics to business planning and fiscal modeling. We help new businesses in gaining access to government impulses, effectively handling levies, and creating strong fiscal fabrics that foster sustained expansion.

Forensic and Investigation Services

Fraud and fiscal irregularities can have a severe impact on businesses. At AKMG Associates, we give Forensic and Investigation Services to descry and help fiscal frauds, misconduct, and commercial malpractices. Our platoon of forensic experts conducts fiscal checkups, investigates disagreement, and tools fraud forestallment strategies to guard businesses from fiscal losses and reputational damage.

What Sets AKMG Associates piecemeal?

Endured Professionals – Our platoon comprises largely good chartered accountants, legal experts, and fiscal counsels with times of assiduity experience.

Customer-Centric Approach – We understand the unique requirements of each customer and give customized results.

Technology- Driven Services – Our online platforms insure presto and secure service delivery.

Comprehensive results – From duty advisory to commercial compliance, we offer end- to- end fiscal and legal services.

Constantly Asked Questions( FAQs)

Q1 Why should I use AKMG Associates for services related to online company objectification?

By streamlining the incorporation process, an AKMG Associate makes company registration quick and easy. We take care of the legal paperwork so you can concentrate on expanding your company.

Q2 What arecross-border taxation services and international duty?

A In order to reduce arrears and stay out of trouble, these services help companies in navigating transnational duty rules, transfer pricing schemes, and international duty restrictions.

Q3 How can my firm benefit from Startup Advisory Services?

A Our Startup Advisory Services grease a flawless business trip for entrepreneurs by aiding them with taxation, business structuring, legal compliance, and financial planning.

Q4 What are included in forensic and exploration services?

A To find and exclude fiscal problems, we offer forensic account, internal checkups, financial fraud discovery, and marketable assessments.

Conclusion

Still, AKMG Associates is your go-to fiscal mate If you're looking for the best CA firms in India. From Online Company Incorporation Services to International Tax and Cross Border Taxation Services, we give comprehensive results for businesses of all sizes. Our Startup Advisory Services and Forensic and Investigation Services further insure fiscal stability and business compliance.

Choose AKMG Associates for expert guidance and professional excellence. communicate us moment to take your business to new heights!

Source Url: https://akmgassociates.wordpress.com/2025/02/27/best-ca-firms-in-india-why-akmg-associates-is-your-trusted-partner/.

#AKMG Associates#best CA firms in India#Forensic and Investigation Services#Online Company Incorporation Services#International Tax and Cross Border Taxation Services#Startup Advisory Services

0 notes

Text

FDI in India: Unleashing Growth Potential in 2024

Introduction

Foreign Direct Investment (FDI) has been a cornerstone of India's economic growth, driving industrial development, technological advancement, and job creation. As we move into 2024, the FDI landscape in India is poised for substantial growth, bolstered by a favorable policy environment, a burgeoning consumer market, and strategic government initiatives. This blog delves into the potential of FDI in India for 2024, examining the key sectors attracting investment, the regulatory framework, and the strategies investors can employ to navigate this dynamic market.

The Significance of FDI in India

FDI is crucial for India’s economic progress, providing the capital, technology, and expertise needed to enhance productivity and competitiveness. It facilitates the integration of India into the global economy, stimulates innovation, and creates employment opportunities. Over the past decade, India has emerged as one of the top destinations for FDI, reflecting its economic resilience and strategic importance.

Historical Context and Recent Trends

India's FDI inflows have shown a consistent upward trend, reaching record levels in recent years. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India attracted FDI inflows worth $81.72 billion in 2021-22, highlighting its strong appeal among global investors. The sectors that have traditionally attracted significant FDI include services, telecommunications, computer software and hardware, trading, construction, and automobiles.

Key Factors Driving FDI in India

1. Economic Growth and Market Size

India's economy is one of the fastest-growing in the world, with a projected GDP growth rate of around 6-7% in 2024. The country’s large and youthful population offers a vast consumer base, making it an attractive market for foreign investors. The rising middle class and increasing disposable incomes further fuel demand across various sectors.

2. Strategic Government Initiatives

The Indian government has implemented several initiatives to make the country more investor-friendly. Programs like 'Make in India,' 'Digital India,' and 'Startup India' are designed to boost manufacturing, digital infrastructure, and entrepreneurial ventures. These initiatives, coupled with reforms in labor laws and ease of doing business, create a conducive environment for FDI.

3. Infrastructure Development

Significant investments in infrastructure development, including roads, railways, ports, and urban infrastructure, enhance connectivity and logistics efficiency. The development of industrial corridors and smart cities further improves the attractiveness of India as an investment destination.

4. Favorable Regulatory Environment

India has progressively liberalized its FDI policy, allowing 100% FDI in most sectors under the automatic route. This means that foreign investors do not require prior government approval, simplifying the investment process. The government has also streamlined regulatory procedures and improved transparency to facilitate ease of doing business.

Key Sectors Attracting FDI in 2024

1. Technology and Digital Economy

The technology sector continues to be a magnet for FDI, driven by India’s growing digital ecosystem, skilled workforce, and innovation capabilities. Investments in software development, IT services, and emerging technologies like artificial intelligence, blockchain, and cybersecurity are expected to surge.

2. Manufacturing and Industrial Production

The 'Make in India' initiative aims to transform India into a global manufacturing hub. Key sectors attracting FDI include electronics, automobiles, pharmaceuticals, and renewable energy. The Production-Linked Incentive (PLI) schemes introduced by the government provide financial incentives to boost manufacturing and attract foreign investment.

3. Healthcare and Biotechnology

The COVID-19 pandemic has underscored the importance of healthcare infrastructure and innovation. India’s pharmaceutical industry, known for its generic drug production, continues to attract substantial FDI. Additionally, biotechnology and medical devices are emerging as significant sectors for investment.

4. Infrastructure and Real Estate

Infrastructure development is critical for sustaining economic growth. Sectors like transportation, logistics, urban development, and real estate offer significant investment opportunities. The government's focus on developing smart cities and industrial corridors presents lucrative prospects for foreign investors.

5. Renewable Energy

With a commitment to achieving net-zero emissions by 2070, India is focusing on renewable energy sources. The solar, wind, and hydroelectric power sectors are witnessing substantial investments. The government's policies and incentives for green energy projects make this a promising area for FDI.

Regulatory Framework for FDI in India

Understanding the regulatory framework is essential for investors looking to enter the Indian market. The key aspects of India's FDI policy include:

1. FDI Policy and Routes

FDI in India can be routed through the automatic route or the government route. Under the automatic route, no prior approval is required, and investments can be made directly. Under the government route, prior approval from the concerned ministries or departments is necessary. The sectors open to 100% FDI under the automatic route include:

- Infrastructure

- E-commerce

- IT and BPM (Business Process Management)

- Renewable Energy

2. Sectoral Caps and Conditions

While many sectors allow 100% FDI, some have sectoral caps and conditions. For example:

- Defense: Up to 74% FDI under the automatic route, and beyond 74% under the government route in certain cases.

- Telecommunications: Up to 100% FDI allowed, with up to 49% under the automatic route and beyond that through the government route.

- Insurance: Up to 74% FDI under the automatic route.

3. Regulatory Authorities

Several regulatory authorities oversee FDI in India, ensuring compliance with laws and policies. These include:

- Reserve Bank of India (RBI): Oversees foreign exchange regulations.

- Securities and Exchange Board of India (SEBI): Regulates investments in capital markets.

- Department for Promotion of Industry and Internal Trade (DPIIT): Formulates and monitors FDI policies.

4. Compliance and Reporting Requirements

Investors must comply with various reporting requirements, including:

- Filing of FDI-related returns: Periodic filings to RBI and other regulatory bodies.

- Adherence to sector-specific regulations: Compliance with industry-specific norms and guidelines.

- Corporate Governance Standards: Ensuring adherence to governance standards as per the Companies Act, 2013.

Strategies for Navigating the FDI Landscape

1. Thorough Market Research

Conducting comprehensive market research is crucial for understanding the competitive landscape, consumer behavior, and regulatory environment. Investors should analyze market trends, identify potential risks, and evaluate the long-term viability of their investment.

2. Partnering with Local Entities

Collaborating with local businesses can provide valuable insights into the market and help navigate regulatory complexities. Joint ventures and strategic alliances with Indian companies can facilitate market entry and expansion.

3. Leveraging Government Initiatives

Tapping into government initiatives like 'Make in India' and PLI schemes can provide financial incentives and support for setting up manufacturing units and other projects. Staying updated on policy changes and leveraging these initiatives can enhance investment returns.

4. Ensuring Legal and Regulatory Compliance

Compliance with local laws and regulations is paramount. Engaging legal and financial advisors with expertise in Indian regulations can ensure that all legal requirements are met. This includes obtaining necessary approvals, adhering to reporting norms, and maintaining corporate governance standards.

5. Focusing on Sustainable Investments

Given the global emphasis on sustainability, investments in green technologies and sustainable practices can offer long-term benefits. The Indian government’s focus on renewable energy and sustainable development provides ample opportunities for environmentally conscious investments.

Conclusion

India's FDI landscape in 2024 is ripe with opportunities across various sectors, driven by robust economic growth, strategic government initiatives, and a favorable regulatory environment. However, navigating this dynamic market requires a deep understanding of the legal and regulatory framework, thorough market research, and strategic partnerships.

For investors looking to unleash the growth potential of their investments in India, staying informed about policy changes, leveraging government incentives, and ensuring compliance with local laws are critical. By adopting a strategic approach and focusing on sustainable investments, foreign investors can tap into the immense opportunities offered by the Indian market and contribute to its economic transformation.

In conclusion, FDI in India in 2024 presents a compelling opportunity for global investors. With the right strategies and guidance, investors can navigate the complexities of the Indian market and achieve significant growth and success.

This post was originally published on: Foxnangel

#fdi in india#fdi investment in india#foreign direct investment in india#economic growth#foreign investors#startup india#pli schemes#renewable energy#indian market#foxnangel

2 notes

·

View notes

Text

Udyam Registration Benefits in Maharashtra

Udyam Registration in Maharashtra is an essential certification for Micro, Small, and Medium Enterprises (MSMEs) in Maharashtra, offering numerous benefits to business owners. This registration, introduced by the Government of India, helps MSMEs gain official recognition and access various incentives and support programs. Below are the key advantages of obtaining Udyam Registration in Maharashtra:

1. Financial Benefits and Subsidies

Businesses registered under Udyam can avail of various government subsidies, including those for technology upgradation, quality certification, and infrastructure development.

Priority in government tenders and procurement processes ensures better business opportunities.

2. Ease of Getting Loans and Credit Facilities

MSMEs with Udyam Registration are eligible for collateral-free loans under government-backed schemes.

Lower interest rates on loans and financial assistance for startups and expanding businesses.

ALSO READ - Udyam Registration in Tamil Nadu

3. Tax and Compliance Benefits

Registered enterprises can benefit from reduced tax rates, exemptions, and rebates under various state and central government policies.

Apply online for Udyog/Udyam Re-registration in Maharastra

Access to government trade fairs, exhibitions, and exclusive buyer-seller meets to promote business growth.

Increased credibility and brand recognition, helping MSMEs attract clients and investors.

7. Technology and Skill Development Support

Support for skill development programs, training, and workshops to enhance productivity and efficiency.

Access to government-supported incubation centers and R&D initiatives.

Conclusion

Udyam Registration is a valuable initiative for MSMEs in Maharashtra, offering financial, legal, and operational advantages. By registering, businesses can unlock multiple growth opportunities, enhance their competitiveness, and contribute to the state’s economic development. Entrepreneurs are encouraged to complete their Udyam Registration to avail themselves of these extensive benefits and take their business to the next level.

1 note

·

View note

Text

GST Return Filing in Delhi by Masllp: Simplifying Your Compliance Journey

If you are a business owner in Delhi, managing Goods and Services Tax (GST) returns can be challenging. Staying compliant with the evolving GST laws while running day-to-day operations is no easy task. That’s where Masllp steps in. With our expert GST return filing services, we help businesses in Delhi stay compliant, efficient, and stress-free.

Why GST Return Filing Is Important GST return filing is a mandatory requirement for all registered businesses in India. It involves the submission of details regarding sales, purchases, input tax credit (ITC), and tax payments to the government. Failing to file GST returns on time can result in penalties, interest, and even suspension of your GST registration. Therefore, it is crucial to partner with professionals who can help you manage this process seamlessly.

Common Challenges Faced by Businesses in GST Return Filing Complexity in compliance: The frequent changes in GST regulations can make compliance complicated, especially for small businesses. Technical errors: Filing incorrect returns can lead to penalties and issues with GST reconciliation. Timely submissions: Missing GST filing deadlines can result in heavy fines. Lack of clarity on ITC: Understanding input tax credits and adjusting them correctly is often confusing for business owners. How Masllp Simplifies GST Return Filing in Delhi At Masllp, we understand that every business has unique tax filing requirements. We offer tailored GST return filing solutions that are designed to help businesses in Delhi navigate the complexities of GST compliance. Here’s how we do it:

End-to-End Support From the collection of data to the final filing of your GST returns, we manage everything on your behalf. Our team of tax experts ensures that your GST returns are accurate and filed on time, preventing any penalties.

Expert Consultation Our professionals are well-versed in the latest GST regulations. We provide personalized consultation, helping you understand your GST liabilities, input tax credits, and the correct way to file returns.

Timely Reminders We send out timely reminders about upcoming deadlines to ensure you never miss a filing date. This helps in avoiding last-minute hassles and potential penalties.

Accurate ITC Calculations One of the most critical aspects of GST return filing is claiming Input Tax Credits (ITC) accurately. Our experts ensure that your ITC claims are correct and compliant with GST rules, maximizing your tax benefits.

Error-Free Filing We take utmost care to avoid technical errors in your returns, ensuring that your filings are error-free and compliant with the latest GST laws.

Why Choose Masllp for GST Return Filing in Delhi? Experience & Expertise: We have years of experience in handling GST returns for businesses across various sectors. Tailored Services: Our services are customized to meet the specific needs of your business. Cost-Effective Solutions: We offer competitive pricing without compromising on the quality of our services. Data Security: Your financial data is safe with us. We maintain strict confidentiality and follow best practices in data security. Hassle-Free Process: With our GST return filing services, you can focus on growing your business while we handle the compliance work. Types of GST Returns We Handle At Masllp, we provide end-to-end support for all types of GST returns, including:

GSTR-1: Details of outward supplies GSTR-3B: Summary return for tax payment GSTR-4: For composition scheme taxpayers GSTR-9: Annual return GSTR-10: Final return for canceled GST registrations Whether you are a small business, a startup, or a large corporation, we have the right solutions to simplify your GST return filing process.

Contact Us If you are looking for reliable GST return filing services in Delhi, look no further than Masllp. Our team of experts is here to make your GST compliance journey easy and hassle-free.

Contact us today to learn more about how we can assist you with GST return filing and ensure timely and accurate submissions.

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

5 notes

·

View notes

Text

Recognizing and Empowering Talent: Col Rajyavardhan Rathore on BJP Government’s Vision

Colonel Rajyavardhan Rathore, a staunch advocate for nurturing talent, highlights the BJP government’s unwavering commitment to identifying and empowering individuals with potential. According to him, the government’s initiatives aim to provide the right platforms and opportunities for people to shine, regardless of their background or circumstances.

A Vision for Inclusive Growth

Under the leadership of the BJP, the focus has been on ensuring that talent is not only recognized but also cultivated through various avenues. This vision aligns with the broader goal of nation-building, where every individual’s contribution matters.

Key Initiatives that Foster Talent

Skill Development Programs: Numerous initiatives, such as the Skill India Mission and Atal Tinkering Labs, equip young individuals with industry-relevant skills, ensuring they are future-ready.

Educational Reforms: Policies such as the National Education Policy 2020 prioritize holistic learning and emphasize creativity, innovation, and critical thinking, helping students excel academically and beyond.

Sports and Arts Platforms: With schemes like Khelo India and support for cultural programs, the BJP government has opened doors for budding sportspeople and artists to showcase their skills on national and international stages.

Opportunities in Startups and Technology: Initiatives such as Startup India encourage entrepreneurs to transform their ideas into successful ventures, creating a culture of innovation and excellence.

Empowering the Underserved

Col Rathore emphasized that the BJP government has ensured that no talent goes unnoticed, especially in rural and marginalized communities. Programs like scholarships, mentorship, and financial aid have enabled countless individuals to break barriers and achieve their dreams.

Real-Life Success Stories

From rural athletes competing globally to young innovators revolutionizing industries, countless examples underscore the BJP government’s success in recognizing and uplifting talent.

These achievements reflect the government’s dedication to building a robust ecosystem for growth and development.

A Platform for Every Dream

Col Rathore reiterated that the BJP government is dedicated to creating a society where talent meets opportunity. By providing resources, mentorship, and platforms, they ensure that every dream has the chance to become a reality.

As he aptly puts it: “India’s greatest asset is its people, and under the BJP government, we’re ensuring every individual gets the opportunity to shine.”

#EmpoweringIndia #TalentRecognition #ColRathore #BJPVision

4 notes

·

View notes

Text

How has Col. Rajyavardhan Rathore contributed to the development of Rajasthan?

1. Infrastructure Development

Roads and Connectivity: Col. Rathore has focused on improving the region’s connectivity by advocating for the construction and expansion of highways, rural roads, and bridges. These initiatives have boosted trade and accessibility for remote areas.

Smart Cities and Urban Renewal: He has supported urban development projects, modernizing cities like Jaipur and Jodhpur to meet global standards while preserving cultural heritage.

2. Water Resource Management

Water Accessibility: Col. Rathore has been a vocal supporter of initiatives like the Jal Jeevan Mission, which aims to provide piped water to every household. His efforts have been pivotal in addressing water scarcity, especially in Rajasthan’s arid regions.

Irrigation Projects: Promoting sustainable irrigation practices and modern systems to empower farmers and improve agricultural productivity.

3. Focus on Rural Development

Basic Amenities: His leadership has ensured improved access to electricity, clean water, and healthcare in rural areas.

Skill Development: Launching programs for rural youth to enhance employability and foster entrepreneurship in villages.

4. Economic Growth Through Investments

Rising Rajasthan Global Investment Summit: Col. Rathore played a key role in attracting domestic and international investments. His efforts have brought industrial projects, IT hubs, and manufacturing units to Rajasthan, creating jobs and spurring economic growth.

MSME Empowerment: Advocating policies to support small and medium enterprises, which are the backbone of the state’s economy.

5. Promotion of Renewable Energy

Green Energy Initiatives: Rajasthan has emerged as a leader in solar and wind energy under his guidance. He supports large-scale renewable energy projects to ensure sustainable development.

6. Education and Skill Development

Kalwad Mahavidyalaya Land Allotment: Col. Rathore facilitated the allotment of land for the development of educational institutions to provide better learning opportunities.

Tech-Driven Education: Promoting digital literacy and introducing smart classrooms to prepare students for a competitive world.

7. Support for Sports and Youth Development

Sports Infrastructure: Leveraging his background as an Olympian, Col. Rathore has advocated for sports facilities, promoting athletic talent across Rajasthan.

Youth Engagement: Organizing programs to inspire and involve young people in the development of their communities.

8. Tourism Promotion

Cultural Preservation: Encouraging eco-tourism and cultural tourism while preserving Rajasthan’s rich heritage.

Infrastructure for Tourism: Supporting the development of tourist-friendly facilities to boost the state’s economy.

9. Digital Transformation

IT Hubs and Startups: His initiatives have led to the establishment of IT cities and startup incubation centers near key urban areas like Jaipur, bringing innovation and employment.

Smart Villages: Integrating technology into rural areas to improve governance and service delivery.

10. Advocacy for Women Empowerment and Social Welfare

Empowering Women: Supporting schemes that provide women with access to education, healthcare, and skill development.

Social Upliftment: Advocating for programs to aid underprivileged communities and improve their standard of living.

Conclusion

Col. Rajyavardhan Rathore has consistently championed initiatives that aim for a holistic transformation of Rajasthan. His contributions span across sectors, ensuring that the state achieves balanced development while empowering its people. Through his leadership and commitment, Rajasthan is on a trajectory toward becoming a model state in India.

3 notes

·

View notes