#Basic of Stock Market

Explore tagged Tumblr posts

Text

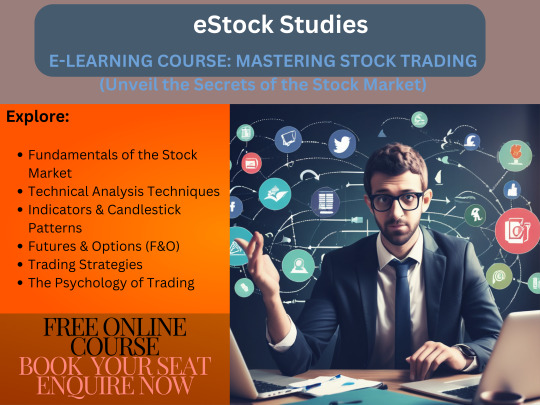

eStock Studies: Online Trading Courses from Basics to Advanced.

eStock Studies: free Online Stock Market Trading Courses from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading courses#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading Courses#expert trading institute

2 notes

·

View notes

Text

Mastering Stock Market Fundamental Analysis for Smart Investing

There are countless ways to approach the stock market in the world of investing, but one method that stands the test of time is fundamental analysis. Diving into the intricacies of fundamental analysis is crucial for anyone looking to truly understand how the stock market works and how to make informed investment decisions. For those interested in mastering this approach, join the Bharti Stock Market Training Institute can offer structured learning and guidance to succeed While fundamental analysis is a powerful tool for stock market success, it’s not something you can master overnight. Bharti Stock Market Training Institute A reputable training institute that offers an immersive learning experience, helps individuals navigate the complexities of stock market analysis and investment strategies. and covering essential topics like fundamental analysis and intraday trading strategies.

#stock market trading#stock market training institute in pune#stock market courses in pune#stock market fundamental analysis#basic of stock market

0 notes

Text

Basics of the Stock Market

0 notes

Text

Why Choose Bharti Share Market Institute in India?

Here are some additional details about Bharti Share Market:

They were founded in 2008 by Prof. Ravindra Bharti.

They have over 550+ franchises all over India.

They have trained over 2 lakh+ students.

Their courses are taught by experienced and qualified faculty.

They offer a variety of courses, including beginner, intermediate, and advanced courses.

They also offer portfolio management services and demat account opening services.

If you are interested in learning about the share market, Bharti Share Market is a good option. They offer a variety of courses to suit your needs and their faculty are experienced and qualified.

#share market courses#stock market trading#Basic of Stock Market#share market classes near me#stock market futures#online trading course#Share Market classes#basic of share market#online stock market courses#stock trading courses#stock market classes#technical analysis course

0 notes

Text

Crime / Social Welfare

Real talk; so much 'crime' wouldn't be an issue if everyone had the means to get by.

Oh no, someone stole your car? Good thing public insurance has no deductible and you needed to repair the old thing, anyway. Oh no, your art got cut and pasted? Good thing you have everything you need to get by thanks to universal basic income, affordable housing, reliable health insurance, and a food stipend. Oh no, AI is ruining the chance to become a successful artist? Well, no, art is and has always been a shot in the dark to be seen in the crowd.

The real CRIME is that no one has the CHOICE to pursue a life of art without shackling themselves to a debt, whether it be housing, credit, or education. That debt will forever limit their wings. I wanted to be an artist from the moment I understood what my choices were. And in that same moment I knew I would rather die than have to perform something so beautiful and sacred for the price it would be worth to someone else.

I don't think any artist should be limited by the means necessary to survive. Maybe that made sense in a scarcity society but we are far beyond the ability to completely support (fund) a third of the earth's populace (with the resources distributed better). These people are not worthless just because the value they produce doesn't have a monetary value by an objective metric. Hey, neither does stock.

#art#opinion#artist#artists on tumblr#writer#writers on tumblr#legalism#crime#piracy#theft#digital art#stock market#education#debt#economy#us politics#universal basic income#america#affordable housing#america right now#america is a hellscape#class consciousness#deny defend depose#social welfare#politics

26 notes

·

View notes

Text

on one hand im still somewhat emotionally numb and on the other hand i havent done anything creative in so long i feel so itchy. its like not having a shower in a week but for your brain so i have to fix that.

but cooking is scratching a little part of that itch at least and hopefully eating will be equally rewarding

#dad and i are making borscht#we basically cleared out half of the stock at the local ukrainian centre#so we could commemorate the 1 year anniversary of gma's death#how the local community survives on that tiny little freezer is beyond me omg#back home the average farmers market stall will have 10x that stock minimum while here it is a slavic food desert#still grateful it exists because while i have gma's cabbage roll recipe i am too intimidated to try it still#thank you local ukrainian centre ;;;;#i s2g when i get back home and fix my freezer i am going to stock tf up#maybe i will attempt easter bread again this year if im feeling really ambitious#hapo rambles#personal hapo

4 notes

·

View notes

Text

thinkin' about rescreatu hours. specifically the stock market and the fact that they had to take away the "stocks rise and fall based on the NPC shops' sales" function because players kept using it to influence the stocks' prices and make themselves money. virtual pet site market manipulation, babey!

#i know a lot of pet sites are basically 'do capitalism for PNGs of cute animals' but the stock market thing is so funny in hindsight#yoshiposts

3 notes

·

View notes

Text

Had a successful trip to the spice store today :)

#apparently the trial bags of vanilla sugar have trans flags on them#I used up my 1/4 cup jar fast last time so I got a 1/2 cup jar#and unfortunately the jars don’t have trans flags on them :(#most of the jars don’t have pictures on them so it matches the other branding#so it makes sense#but also: why leave all the rainbows and trans flags for the trial bags?#I’m a simple person with simple desires#if they’d put a little rainbow on the jars of poppy seeds I would’ve fought harder to get them#(as it is: neither of us really uses poppy seeds enough to justify getting a jar. especially when we got so many other things)#(but I am easily swayed by rainbow colored marketing and could’ve been convinced to go find some poppy seed recipes lmao)#but yeah! sooooooo many spices#so so so so many#I’m very pleased#we’re not gonna need to stock up on spices for at Least another year or so#at least that’s how long it’s been since our last big spice order lol#and now that I’m familiar with what th store looks like I’ll feel better about maybe stopping in instead of ordering online#which means making smaller but more frequent purchases#instead of waiting a year until we were out of basically everything#so so so happy for the big vanilla sugar jar because I’ve been missing that in my coffee for awhile#and gf is very pleased to have her beloved tsardust memories#and also lots of other things but those are the big exciting ones imo

2 notes

·

View notes

Text

For some reason I keep getting a feeling that SynthV Studio 2 is going to be a strange disaster on launch with kind of no basis for that whatsoever. Other than the fact that manual mode seemingly no longer exists and they just expect you to draw straight lines on every note by hand now

#They demonstrated drawing straight lines on the notes by hand officially.#I kind of don't know why they thought this would be more convenient to people who want there to be a straight line.#Honestly SynthV is kind of in an awkward place where Dreamtonics seems to really want to appeal to Serious Normal Music Producers#but they're making the synth that literally Kasane Teto is on.#So their userbase is split between dedicated vocaloid fans and like#guys who put random stock photos as their cover art and may or may not use ChatGPT for the lyrics.#Nobody really cares about the stock photo guys because they're basically not in the scene at all but you can find them on the subreddit#It's like the logical conclusion of the dissonant marketing but it's strange to witness.#mypost

2 notes

·

View notes

Text

शेयर बाज़ार समाचार

भारतीय शेयर बाज़ार पिछले कुछ हफ़्तों से अस्थिर रहे हैं। मिश्रित वैश्विक संकेतों और कच्चे तेल की कीमतों में उतार-चढ़ाव के बीच बेंचमार्क सूचकांकों, सेंसेक्स और निफ्टी में उतार-चढ़ाव देखा गया है।

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

मुख्य रूप से आईटी और बैंकिंग शेयरों में गिरावट के कारण आज कारोबार के दौरान सेंसेक्स लगभग 100 अंक गिरकर बंद हुआ। निफ्टी 17,900 के ठीक नीचे बंद हुआ।

वैश्विक मोर्चे पर, अधिकांश एशियाई बाजार आज गिरावट के साथ कारोबार कर रहे थे। अमेरिकी बाजार रात भर के कारोबार में मिश्रित समाप्त हुए क्योंकि निवेशकों ने कॉर्पोरेट आय और आर्थिक आंकड़ों के नवीनतम बैच का आकलन किया।

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

हालिया उछाल के बाद कच्चे तेल की कीमतों में थोड़ी नरमी आई है। हालाँकि, मुद्रास्फीति संबंधी चिंताएँ वैश्विक और स्थानीय दोनों स्तर���ं पर बनी हुई हैं।

हालिया उछाल के बाद कच्चे तेल की कीमतों में थोड़ी नरमी आई है. हालाँकि, मुद्रास्फीति संबंधी चिंताएँ वैश्विक और स्थानीय दोनों स्तरों पर बनी हुई हैं।

कॉर्पोरेट समाचारों में, आईटी प्रमुख विप्रो ने दूसरी तिमाही की आय उम्मीद से बेहतर दर्ज की। कंपनी का मुनाफ़ा पिछले साल की तुलना में 12% से ज़्यादा बढ़ गया।

कम यूएस सीपीआई प्रिंट के कारण उभरते बाजार की परिसंपत्तियों को बढ़ावा मिलने के बाद आज रुपया भी अमेरिकी डॉलर के मुकाबले मामूली बढ़त के साथ बंद हुआ।

कुल मिलाकर, अस्थिरता अधिक रहने की संभावना है क्योंकि बाजार ब्याज दरों में बढ़ोतरी, मंदी की चिंता और भू-राजनीतिक तनाव जैसे विभिन्न कारकों का आकलन करता है। निवेशकों को सतर्क रहने की सलाह दी जाती है।

शेयर बाज़ार समाचार प्रमुख सूचकांक गतिविधियाँ

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

बेंचमार्क सूचकांकों सेंसेक्स और निफ्टी में आज उतार-चढ़ाव भरा कारोबारी सत्र देखा गया, लेकिन ये ऊंचे स्तर पर बंद होने में कामयाब रहे। सेंसेक्स 0.2% बढ़कर 57,260 पर बंद हुआ जबकि निफ्टी 0.25% बढ़कर 17,053 पर बंद हुआ।

सप्ताह के दौरान, सेंसेक्स 0.8% बढ़ा जबकि निफ्टी 0.6% बढ़ा। मासिक आधार पर, फरवरी 2022 में सेंसेक्स और निफ्टी दोनों में लगभग 2% की गिरावट आई।

बाजार ने दिन की शुरुआत सपाट रुख के साथ की, लेकिन दोपहर के कारोबार में बिकवाली का दबाव तेज हो गया, जिससे सूचकांक नीचे आ गए। हालाँकि, बैंकिंग, ऑटो और आईटी शेयरों में देर से खरीदारी सामने आई, जिससे बाजार को ज्यादातर नुकसान से उबरने में मदद मिली।

टॉप गेनर्स

आज शीर्ष लाभ वाले स्टॉक थे:

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

रिलायंस इंडस्ट्रीज लिमिटेड (आरआईएल) – 4.5% ऊपर एचडीएफसी बैंक लिमिटेड – 3.2% ऊपर आईसीआईसीआई बैंक लिमिटेड – 2.7% ऊपर भारती एयरटेल लिमिटेड – 2.1% ऊपर टाटा कंसल्टेंसी सर्विसेज लिमिटेड (टीसीएस) – 1.8% ऊपर

आरआईएल आज शीर्ष लाभ में रही क्योंकि कंपनी द्वारा अपनी खुदरा शाखा रिलायंस रिटेल के लिए आईपीओ की संभावना तलाशने की घोषणा के बाद उसके शेयरों में उछाल आया। निवेशक रिलायंस रिटेल की विकास संभावनाओं को लेकर आशावादी हैं क्योंकि कंपनी पूरे भारत में अपने स्टोर नेटवर्क का विस्तार करना जारी रख रही है।

एचडीएफसी बैंक और आईसीआईसीआई बैंक के शेयरों में भी तेजी से बढ़ोतरी हुई क्योंकि निवेशकों ने संपत्ति की गुणवत्ता में सुधार और ऋण वृद्धि की उम्मीद पर बैंकिंग स्टॉक खरीदना जारी रखा। इस बीच, निवेशकों द्वारा रक्षात्मक क्षेत्रों की ओर रुख करने से भारती एयरटेल और टीसीएस को लाभ हुआ। कुल मिलाकर, आज बाजार की स्थिति सकारात्मक थी जो व्यापक आधार वाली खरीदारी रुचि का संकेत देती है।

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

क्षेत्रीय सूचकांक

सेक्टोरल सूचकांक आज मिला-जुला रहा। सन फार्मा और सिप्ला में बढ़त के कारण निफ्टी फार्मा इंडेक्स 1.2% बढ़कर सबसे अच्छा प्रदर्शन करने वाला सूचकांक रहा। आने वाली तिमाहियों में आय वृद्धि की आशा से निवेशकों ने फार्मा शेयरों में खरीदारी की। दूसरी ओर, निफ्टी पीएसयू बैंक इंडेक्स 0.8% की ��िरावट के साथ शीर्ष पर रहा। ऐसा हालिया तेजी के बाद पीएसयू बैंक शेयरों में मुनाफावसूली के कारण हुआ।

सेक्टोरल स्टोर आज मिला-जुला रहा। दवा और सिप्ला में बढ़त के कारण सन मेकर दवा विक्रेता 1.2% सबसे अच्छा प्रदर्शन करने वाला विक्रेता बना हुआ है। आने वाली तिमाहियों में आय वृद्धि की आशा से सुपरमार्केट में दवा की खरीदारी की। दूसरी ओर, मैकयूएसयू बैंक के स्टाक 0.8% की गिरावट के साथ शीर्ष पर बने हुए हैं। ऐसा किशोर रैपिड के बाद पीयूएसयू बैंक स्टॉक में दावावसूली का कारण हुआ।

इस बीच, चीन में धीमी मांग पर चिंता के कारण टाटा स्टील और जेएसडब्ल्यू स्टील में गिरावट के कारण निफ्टी मेटल इंडेक्स में 0.7% की गिरावट आई। निफ्टी ऑटो इंडेक्स भी 0.5% गिर गया क्योंकि निवेशक अगले सप्ताह आने वाले मासिक बिक्री डेटा से पहले सतर्क रहे।

शेयर बाज़ार समाचार वैश्विक बाजार

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

इस सप्ताह वैश्विक बाजारों में मिला-जुला रुख रहा। मजबूत कमाई और आर्थिक आंकड़ों के समर्थन से अमेरिकी बाजार बढ़त पर बंद हुए।

डॉव जोन्स इंडस्ट्रियल एवरेज इस सप्ताह 1.4% बढ़कर 33,072 पर बंद हुआ। एस & पी सप्ताह के दौरान 500 सूचकांक 1.6% बढ़कर 4,155 पर बंद हुआ। टेक-हैवी नैस्डैक कंपोजिट इंडेक्स इस सप्ताह 1.8% बढ़कर 12,059 पर बंद हुआ।

इस सप्ताह अधिकांश यूरोपीय बाज़ार बढ़त के साथ बंद हुए। पैन-यूरोपीय STOXX 600 सूचकांक में 0.3% की वृद्धि हुई। जर्मनी का DAX सूचकांक 0.7% बढ़कर बंद हुआ जबकि फ्रांस का CAC 40 सूचकांक सप्ताह के लिए सपाट समाप्त हुआ। यूके का FTSE 100 इंडेक्स 0.4% गिर गया।

विकास संबंधी चिंताओं के कारण इस सप्ताह अधिकांश एशियाई बाजार गिरावट के साथ बंद हुए। जापान का निक्केई 225 सूचकांक इस सप्ताह 1.3% गिर गया जबकि चीन का शंघाई कंपोजिट सूचकांक 0.6% गिर गया। हालाँकि, भारत के निफ्टी 50 इंडेक्स ने इस प्रवृत्ति को उलट दिया और मजबूत कॉर्पोरेट आय के समर्थन से 1.4% की बढ़त हासिल की।

कुल मिलाकर, जहां अमेरिकी बाजारों ने मजबूत आर्थिक आंकड़ों के समर्थन से बेहतर प्रदर्शन किया, वहीं अन्य वैश्विक बाजारों ने विकास संबंधी चिंताओं और भू-राजनीतिक तनावों के बीच मिश्रित रुझान दिखाया। निवेशकों का ध्यान आगामी आर्थिक आंकड़ों और प्रमुख केंद्रीय बैंकों के नीतिगत संकेतों पर रहेगा।

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

आर्थिक समाचार

पिछले सप्ताह कुछ प्रमुख आर्थिक आंकड़े जारी हुए और नीतिगत घोषणाएँ हुईं जिनका असर बाज़ार पर पड़ा।

भारतीय रिजर्व बैंक (RBI) ने अपनी मौद्रिक नीति समीक्षा में आर्थिक विकास को समर्थन देने के लिए अपने उदार रुख को बनाए रखते हुए रेपो दर को 4% पर अपरिवर्तित रखा। हालाँकि, आरबीआई ने वित्त वर्ष 2013 के लिए सकल घरेलू उत्पाद की वृद्धि दर का अनुमान पहले अनुमानित 7% से घटाकर 6.8% कर दिया।

फरवरी में उपभोक्ता मूल्य सूचकांक (सीपीआई) आधारित मुद्रास्फीति जनवरी के 6.01% की तुलना में बढ़कर 6.07% हो गई, जो लगातार दूसरे म��ीने आरबीआई की 6% की ऊपरी सहनशीलता सीमा को पार कर गई। यह वृद्धि मुख्य रूप से खाद्य पदार्थों की ऊंची कीमतों के कारण हुई।

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

जनवरी में औद्योगिक उत्पादन सूचकांक (आईआईपी) की वृद्धि धीमी होकर 1.4% रह गई, जो पिछले महीने में 2.2% थी। माह के दौरान विनिर्माण क्षेत्र का उत्पादन 0.5% घटा।

सरकारी आंकड़ों से पता चला है कि पेट्रोलियम उत्पादों, कोयले और रसायनों के बढ़ते आयात के कारण देश का व्यापार घाटा फरवरी में बढ़कर 20.88 बिलियन डॉलर हो गया, जो जनवरी में 17.94 बिलियन डॉलर था।

आर्थिक आंकड़ों ने बढ़ती मुद्रास्फीति के दबाव के साथ-साथ धीमी औद्योगिक वृद्धि पर चिंताओं को उजागर किया। बाजार इस बात पर बारीकी से नजर रखेगा कि ये आर्थिक रुझान और साथ ही वैश्विक कारक आरबीआई की मौद्रिक नीति रुख को आगे कैसे प्रभावित करते हैं।

शेयर बाज़ार समाचार कॉर्पोरेट समाचार

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

रिलायंस इंडस्ट्रीज ने घोषणा की कि उसने कैलिफोर्निया स्थित सौर ऊर्जा सॉफ्टवेयर डेवलपर सेंसहॉक में 32 मिलियन डॉलर में 79.4% हिस्सेदारी हासिल कर ली है। इस अधिग्रहण से रिलायंस के सौर ऊर्जा व्यवसाय को मजबूत करने में मदद मिलेगी क्योंकि सेंसहॉक सौर ऊर्जा संयंत्र प्रबंधन और विश्लेषण में माहिर है।

टाटा मोटर्स ने अगले कुछ वर्षों में 25,000 XPRES T EVs की आपूर्ति के लिए राइड हेलिंग कंपनी Uber के साथ एक समझौते पर हस्ताक्षर किए। इलेक्ट्रिक सेडान की डिलीवरी इस साल के अंत में शुरू होने की उम्मीद है। यह टाटा मोटर्स के लिए एक प्रमुख इलेक्ट्रिक वाहन आपूर्ति सौदे का प्रतीक है।

विप्रो ने घोषणा की कि उसे नॉर्वे की सबसे बड़ी कृषि आपूर्ति सहकारी संस्था फेलेस्कजोपेट एग्री एसए द्वारा एक बहु-वर्षीय अनुबंध से सम्मानित किया गया है। इस अनुबंध के हिस्से के रूप में, विप्रो एक डिजिटल प्लेटफॉर्म तैनात करके फेलेस्कजोपेट के आईटी संचालन को बदल देगा। यह सौदा नॉर्डिक क्षेत्र में विप्रो के लिए एक बड़ी जीत का प्रतिनिधित्व करता है।

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

अडाणी समूह ने मीडिया समूह एनडीटीवी में अतिरिक्त 26% हिस्सेदारी हासिल करने के लिए खुली पेशकश की है। यह अडानी द्वारा सहायक कंपनियों के माध्यम से एनडीटीवी में अप्रत्यक्ष 29.2% हिस्सेदारी हासिल करने के बाद आया है। खुली पेशकश का मूल्य लगभग 62 मिलियन डॉलर है। एनडीटीवी के संस्थापकों ने दावा किया है कि हिस्सेदारी बिक्री पर उनसे सलाह नहीं ली गई।

कथित तौर पर भारती एयरटेल लगभग 35 मिलियन डॉलर में ब्रॉडबैंड सेवा प्रदाता नेटप्लस ब्रॉडबैंड में 9.5% ��िस्सेदारी हासिल करने के लिए शुरुआती बातचीत कर रही है। एयरटेल के पास पहले से ही नेटप्लस में अल्पमत हिस्सेदारी है और आगे के अधिग्रहण से इसकी ब्रॉडबैंड सेवाओं को मजबूत करने में मदद मिलेगी।

एसबीआई ने अवैतनिक ऋणों की वसूली के लिए 7,379 करोड़ रुपये की गैर-निष्पादित परिसंपत्तियों को बिक्री के लिए रखा है। खुदरा, कृषि और एसएमई क्षेत्र के खराब ऋणों को लेने के लिए परिसंपत्ति पुनर्निर्माण कंपनियों और वित्तीय संस्थानों से बोलियां आमंत्रित की गई हैं। एसबीआई रणनीतिक हिस्सेदारी बिक्री के जरिए अपनी बैलेंस शीट को दुरुस्त करना चाहता है।

youtube

शेयर बाज़ार समाचार तकनीकी विश्लेषण

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

निफ्टी ने दैनिक चार्ट पर एक बुलिश कैंडल बनाया और 15,800 प्रतिरोध स्तर के ऊपर बंद हुआ। यह ब्रेकआउट बाजार में तेजी का संकेत देता है।

सूचकांक वर्तमान में 20-दिवसीय और 50-दिवसीय चलती औसत से ऊपर कारोबार कर रहा है, जो एक तेजी का संकेत है। आरएसआई संकेतक 60 से ऊपर है, जो मजबूत तेजी दिखा रहा है। एमएसीडी ने सिग्नल लाइन के ऊपर एक सकारात्मक क्रॉसओवर दिया है, जो अपट्रेंड की निरंतरता की ओर इशारा करता है।

प्रति घंटा चार्ट पर, निफ्टी एक सममित त्रिकोण पैटर्न से बाहर निकल गया है, जो एक तेजी से जारी रहने वाला पैटर्न है। देखने लायक ब्रेकआउट स्तर नीचे की ओर 15,800 है, जो अब समर्थन के रूप में कार्य करेगा, और ऊपर की ओर 15,900 है जो प्रतिरोध के रूप में कार्य करेगा।

सूचकांक को 15,700 के करीब मजबूत समर्थन प्राप्त है जो कि पिछला ब्रेकआउट स्तर है। जब तक निफ्टी 15,700 से ऊपर बना रहेगा, तब तक 16,000 के स्तर तक बढ़त जारी रहने की संभावना है। नीचे की ओर, 15,600 महत्वपूर्ण समर्थन है जिसके नीचे सूचकांक पर बिकवाली का दबाव देखा जा सकता है।

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

जब तक निफ्टी 15,700 के स्तर से ऊपर कारोबार कर रहा है, तब तक व्यापारियों को गिरावट पर खरीदारी करनी चाहिए। ऊपरी लक्ष्य 15,900 और उसके बाद 16,000 का स्तर है। लॉन्ग पोजीशन पर ट्रेडिंग के लिए स्टॉपलॉस 15,600 से नीचे रखा जा सकता है।

शेयर बाज़ार समाचार बाज़ार दृष्टिकोण

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

प्रमुख सूचकांकों के सर्वकालिक उच्चतम स्तर के करीब कारोबार करने के साथ, नए महीने में भारतीय इक्विटी का दृष्टिकोण सावधानीपूर्वक आशावादी बना हुआ है। हालाँकि वैश्विक विकास संबंधी चिंताएँ बनी हुई हैं, घरेलू मैक्रो डेटा काफी हद तक सकारात्मक रहा है।

Q3FY23 के आय सीजन में अनुमान से बेहतर प्रदर्शन करते हुए निफ्टी का कुल मुनाफा साल-दर-साल 6% बढ़ा। ऑटो, एफएमसीजी, रिटेल और ड्यूरेबल्स जैसे उपभोग क्षेत्रों में टॉपलाइन वृद्धि मजबूत थी। पूंजीगत व्यय पर बजट के फोकस से निवेश और रोजगार सृजन को भी बढ़ावा मिलने की उम्मीद है।

हालाँकि, उच्च मुद्रास्फीति और बढ़ती ब्याज दरें उपभोक्ताओं और कॉरपोरेट्स दोनों के लिए प्रतिकूल परिस्थितियां पैदा कर सकती हैं। मुद्रास्फीति की उम्मीदों को नियंत्रित करने के लिए आरबीआई द्वारा 2023 में दरों में और बढ़ोतरी की उम्मीद है। यदि वैश्विक मंदी का जोखिम बढ़ता है तो एफआईआई प्रवाह जो जनवरी में सकारात्मक हो गया था, पलट सकता है।

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

Video Player

00:00

00:06

आगे चलकर, स्टॉक चयन महत्वपूर्ण होगा। निवेशकों को घरेलू चक्रीय, पूंजीगत वस्तुओं और विनिर्माण क्षेत्र में गुणवत्ता वाले नामों की तलाश करनी चाहिए जो पूंजीगत व्यय चक्र से लाभान्वित हों। यदि वैश्विक वृद्धि धीमी होती है तो निर्यातकों और वैश्विक वस्तुओं को आय में गिरावट का सामना करना पड़ सकता है। ~17x FY24 निफ्टी ईपीएस पर मूल्यांकन उचित दिखता है, लेकिन आगे पी/ई विस्तार को सीमित किया जा सकता है। बाजार की दिशा 1) मुद्रास्फीति/ब्याज दर दृष्टिकोण 2) आय वितरण और 3) वैश्विक संकेतों से संचालित होने की संभावना है।

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

#best demat account in india#demat#best demat account#demat account#demat account charges#best broker for demat account#demat account india#basics of stock market#benefits of demat account#demat account for beginners#Youtube

2 notes

·

View notes

Text

STOCK MARKET FREE WEBINARS.

eStock Studies: free Online Stock Market Trading webinars from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading webinars#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading webinars#expert trading institute

1 note

·

View note

Text

Essential stock market tips for beginners to help you get started with investing🎯

Are you starting your stock market journey? Follow these 5 essential tips to avoid common pitfalls and build a strong foundation for investing success. Remember: patience, strategy, and diversification are key. Learn the basics of the Share Market for beginners 📈from the Bharti Share Market Institute in Pune and Pimpri. Is there a share market course for beginners and advanced traders with options for online and offline training in Marathi, Hindi, and English? Start trading smartly with the right tools and strategies! 🚀

#basic of stock market#best share market course in pune#stock market training institute in pune#trading classes in pune#share market classes#online share market course for beginners in pune#bharti share market

1 note

·

View note

Text

ok what

#maybe it’s j the fact that my uni is full of ppl smarter than me#but I come back home then I remember that a good amt of ppl are genuinely not intelligent#or respectful#I told the chat my dad isn’t free till 4 bc that’s when the stock market closes and my car is getting repaired so he’s my only ride#and I get a complaint of *but it gets dark after that let’s meet at 1* like I’m sorry did YOU THINK ID PICK 4:30 IF I WANTED TO ?#she blatantly disregards other ppl as well every time we go out to eat I already feel bad enough for being the only vegetarian in that grou#and she goes *nooo there’s sm veg stuff and it’s cheap !!* it’s avocado rice and carrots in a California roll plus spring rolls for 15.99#pls do your research#she always picks restaurants closest to her house too even tho most of the group lives in a clustered area further away from her#and everyone in this group is spineless asf other than me and one other girl who’s the only person I respect#if I haven’t known these ppl since I was basically 10 I wouldn’t keep them around I’m sick of ppl either being passive or j plain rude#.text

2 notes

·

View notes

Text

www.SURDASHERY.com

Converse Run Star Hike Canvas Platform

Sneakers

A chunky platform and jagged rubber sole put an unexpected twist on your everyday

Chucks. Details like a canvas build, rubber toe cap and Chuck Taylor ankle patch stay true to the original, while a molded platform, two-tone outsole and rounded heel give off futuristic vibes.

#country girls#fast weight loss#workout#running#marathon#basic training#marines#top gun#race car#nba#nfl#stock market#Tesla

1 note

·

View note

Text

besides it being evil to evict basically every public housing tenant in the state, i really like the look of flemmo flats and the other commission towers, i think itd be a shame if they were knocked down

#they need rennovation but doing this instead is basically just turning over responsibility for public housing to the private sector#more and more sections of the state are cannibalised to create new markets so on and so forth#who is this extra guy? we don't need this extra guy.#a day in the life#also saying the flats will be demolished bc rennos would be disruptive to the lives of the tenants#like... and knocking down their house isnt?#you literally dont have replacement stock...

1 note

·

View note

Text

...The main vampire antagonist of Nocturne in Sol Major has this precise energy, and he is as detestable as you imagine.

3K notes

·

View notes