#Bank account opening

Explore tagged Tumblr posts

Text

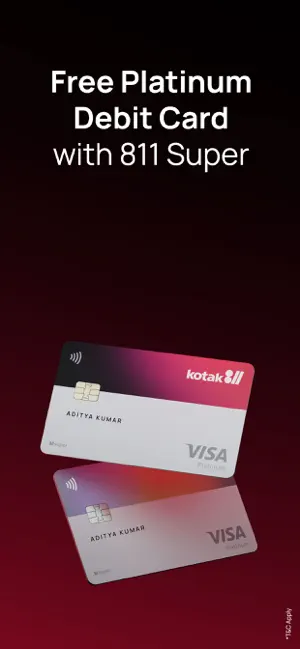

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#account upi payments#app upi mobile banking#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account app#bank account check#bank account check app#bank account kholna#bank account online#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank account with zero balance#bank app upi#bank balance app#bank balance app download#bank balance check karne wala app

2 notes

·

View notes

Text

Kotak 811 – A one-stop destination for all your banking needs.

Make Money Transfers Smooth & Easy

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

Kotak811 mobile banking app is your one-stop solution for managing your bank account anytime, anywhere. Kotak811caters to your needs with its easy-to-use interface and wide range of features.

#bank account app#0 account opening bank#0 balance account open online#0 balance account opening#0 balance account opening bank#0 balance bank account open online#0 bank account opening#account balance check#account check karne wala app#account online open#account open 0 balance#account opening#account opening app#account upi payments#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process

0 notes

Text

Why keep salary and savings account separate from each other?

Getting your financial affairs in order is crucial to building and protecting your money. Separate your savings and checking accounts to maximize your rewards. A salary account is a bank account that is essential for receiving a salary from your employer. Start saving account apply online to store your savings money and make daily transactions. There are many benefits you can enjoy if you only do what the account is intended for.

So examine the advantages of maintaining separate savings and checking accounts:

Organized finances

Your budget can be made more efficient by having a separate salary and savings account. It will make tracking spending simple. For example, if you pay your utility bills with one account, you can track all of your payments through that account. Instead, if you conduct all of your transactions through a single account, it could become challenging to track your finances at the end of the month. It might be easier for you to handle your money if you have different accounts.

More savings

You can set a monthly savings target if your salary and savings accounts are separate. Depending on the goal, you could routinely transfer funds each month from your salary account to your savings account.

Having a saving account in bank will enable you to visualize how much money you are saving. In an emergency, you can check your savings account balance to see how much money you have available to spend. If you didn't have a second account, you would have to put in the extra work of figuring out how much instant liquidity you could afford from your single account.

Keeping your regular withdrawals to your payment account only may be made easier if you have a separate account for savings. Your savings account balance would increase as a result.

Increased rewards and benefits

These days, salary accounts automatically include a variety of features like mobile banking, Net banking, an ATM, internet banking, and more are helpful in making transactions easier. These features are available with a savings account. The identical facilities would consequently be available to you on two accounts. You might use both of your accounts to benefit from discounts and benefits that come with a debit card or net banking. Therefore, you might increase the benefits twofold by properly utilizing the features.

Higher interest/profit rate

The different interest rates on your savings account or checking account may be advantageous to you. You can profit from one of the accounts have a higher interest rate depending on the banks where you keep your accounts. You might increase your earnings on your money by moving it to an account with a greater interest rate. Different interest rates for a salary and savings account could be provided by the same bank. It is possible to open a second account with the same bank and then transfer funds to the one that offers a better interest rate.

Final thoughts

A sound financial strategy is crucial to building and protecting your wealth. To maximize advantages and improve money management, keep your salary account and savings account separate. You can use your saving account in bank to purchase daily items and enjoy surprising discounts.

#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app

0 notes

Text

Amazing benefits of having a good CIBIL score as a bank customer

CIBIL score is something that can give you various advantages if taken care of properly. You can maintain your credit score successfully if you are aware of the CIBIL score range. The total range of CIBIL scores is between 300 and 900. Making on-time payments and avoiding penalties at all costs is crucial for maintaining a decentCIBIL Score. This will not only increase your chances of receiving loans but will also establish you as a trustworthy lender if you decide to submit a loan application in the future.

A lender won't just base their decision on your credit score when considering your loan or credit card application.

The following are some advantages of having a high score:

Low-interest rates

Rates of interest are lower for those with better credit scores. Lenders will provide you with a credit product with a cheaper interest rate, such as a personal loan, house loan, or credit card if your credit score is high. Your EMIs and, in turn, your finances could be impacted by an increase in interest rates of even 0.5 percentage points. Thus, one advantage of having a high credit score is being able to borrow money at cheap interest rates.

Loan with long term

You can obtain a loan with a longer repayment time if you have a high credit score. Lower monthly payments might be obtained by choosing a loan with a longer term. This will assist you in lessening your payback obligations and allow you to make timely loan payments.

Additional credit card benefits:

Before approving a credit card application, lenders consider your EMI and income ratio to determine your ability for payments. They also evaluate your CIBIL score and report to determine your credit profile. Good credit behavior is indicated by a high CIBIL Score. This aids lenders in making crucial underwriting decisions like increasing the credit limit on your credit card or providing a reward program like cashback.

Increase your opportunities to get pre-approved loans from banks.

A wonderful approach to receiving a personal loan from the bank right away is with a pre-approved loan from the bank. These loans aren't offered to every customer. Before making a pre-approved offer, there is a minimum required credit score and extensive account balance examination. A good credit score may increase your chances of receiving a "pre-approved" and "personal" loan from your bank or credit card.

Better negotiating power with your lenders

All lenders prefer to work with borrowers that have good credit and a track record of timely loan repayment. Customers with excellent CIBIL scores have a better chance of being accepted as borrowers. As a result, you may be able to bargain with the lender for a reduced processing charge or a better interest rate, giving you an advantage over other clients.

Final thoughts

Over time, it is possible to increase and keep a decent credit score. All you have to do to qualify for credit is to maintain good credit behavior. This will not only help you obtain credit but will also enable you to be rewarded for your credit-conscious behavior with a variety of pre-approved loan offers, etc. Remember to choose Video KYC when opening an account because it is easy and secure.

#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app

0 notes

Text

Mistakes you ought to avoid when paying online bills:

Everyone hates paying bills, but chances are you have a couple, at least. Naturally, the restrictions vary depending on who is collecting the money. You may mail checks or set up autopay or bot using your bank's bill payment services. A proper strategy when paying bills will significantly reduce unnecessary fees and double charges. Internet banking has benefited people a lot, even in terms of online billing. Here are several errors to keep away from when paying your invoices.

Not reading your statement.

You already have the bill and can pay it, right? More so if your payment schedule is automatic. Reviewing your statement is still a good idea, even if you use autopay. Your statement contains details regarding charges, fees, and other information. Check your statement carefully to make sure you are not getting charged for services you are not utilizing. Additionally, you can check your bill to determine if any unauthorized charges have been made.

Set it and forget it:

To ensure you don't skip or pay late, autopay can be a great tool. However, it's a good idea to double-check your payments, particularly your first payment, when setting up autopay in your Internet banking statement. Depending on the firm, your autopay account setup may take several business days. You might have to pay something in the interim. In some situations, it's conceivable that you will find out about a missing payment the following billing cycle.

Confirm that the business has the correct information and learn when the first payment will be deducted from your account. After that, confirm that the payment was successfully deducted from your account. Once your autopay is set up, ensure the money is deducted on time by checking in frequently.

Assuming a grace period:

Some businesses provide you with a grace period to make your payment. Therefore, even if you are late, you won't be penalized if you pay within a few days. But only some businesses provide this. There is no guarantee that your current landlord will be as understanding as your previous landlord started collecting a late charge on the fifth day of the month. A daily late fee could be assessed right away.

Not reviewing the price you are paying:

Remember that you can always shop around for a better deal. Never assume you are receiving the best deal. Consider various plans and prices before committing to a bill. Remember to routinely check to see if you are still getting the most outstanding value once you have committed to service. You can find a lower cost if you compare expenses for insurance.

Additionally, you can research several internet and mobile service providers. Check for a better offer, and inform your present provider that you could cancel. They might equal the cost of a rival. You can switch and save money if they don't.

Bottom line:

Online billing is made easy since the internet and mobile phones have given a significant breakthrough in people's lives. By following the above points, you can avoid billing mistakes. So, an online account opening in any indian bank is highly recommended.

#0 account opening bank#0 balance account open online#0 balance account opening#0 balance account opening bank#0 balance bank account open online#0 bank account opening#account balance check#account check karne wala app#account online open#account open 0 balance#account opening#account opening app#account upi payments#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure

0 notes

Text

Why fixed deposits are a smart choice for vacation?

Dreaming of a vacation but concerned about the costs? No more delays! Fixed Deposits could be your ticket to a stress-free getaway. Yes! They offer a smart and secure way to save for your travel plans. Fixed Deposits are a popular savings instrument where you deposit a lump sum amount for a fixed period and earn a guaranteed interest rate. FDs offer higher returns, making them ideal for planning major expenses like vacations. Here, we will discuss why FDs are an excellent choice for vacation planning and how they can help turn your travel dreams into reality.

Attractive Interest Rates

One of the biggest advantages of Fixed Deposits is their attractive interest rates. Compared to a standard savings account, FDs offer a significantly higher return on your investment. The interest is compounded annually. This allows your savings to grow more rapidly. Imagine having a substantial amount saved up just by letting your money work for you!

Guaranteed Returns

FDs offer guaranteed returns, which means you don’t have to worry about market volatility or fluctuations. Your returns are fixed and risk-free, providing peace of mind. When you open an FD, you are informed about the maturity amount in advance. This predictability helps you plan your vacation budget with confidence, knowing exactly how much you will have when the time comes.

Flexible Tenure

Planning a vacation often requires a timeline that aligns with your trip. Fixed Deposits offer flexible tenures, ranging from 12 months to several years. For example, if you are planning a holiday in two years, you can open a 24-month FD to accumulate the necessary funds. This flexibility allows you to tailor your savings plan according to your travel schedule.

Easy Access to Your Funds

While FDs offer fixed returns, they also provide easy access to your funds when needed. You can check balance and transaction history of your FD account online or through your bank’s app. This ensures you’re always updated on your savings. This transparency helps you manage your funds efficiently and stay on track with your vacation planning.

How to Get Started

Getting started with an FD is straightforward. Here is how you can plan your vacation using Fixed Deposits:

Estimate the total cost of your trip, including travel, accommodation, and other expenses.

Select an FD tenure that matches your vacation timeline. For instance, if your trip is in 18 months, consider an 18-month FD.

Visit your bank or use their online platform to open an FD account. Deposit the amount you have planned and start earning interest.

Regularly check your FD balance and transaction history to stay informed about your investment. This will help you manage your savings effectively and make any necessary adjustments.

Ensure that you understand the terms of premature withdrawal if needed. Some banks may allow partial withdrawals or offer loans against FDs.

Final thoughts

Before making any adjustments to your Fixed Deposit, check transaction history to understand how your funds have been managed. So, why wait? Secure your future travel plans with Fixed Deposits and make your dream vacation a reality!

#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app#bank balance enquiry#bank balance enquiry app#bank best fixed deposit rates#bank fd#bank fd interest rates#bank fd rates#bank fixed deposit rates#bank khata#bank online#bank online account open#bank online application#bank saving account open

1 note

·

View note

Text

What is POS in debit card? Why it matters?

In recent days, convenience and security in transactions have never been more crucial. This is where POS systems come into play. Mobile banking apps also play a major part in digital transactions. You may swipe your debit card at a retail store or enter your PIN at a restaurant. POS systems are the backbone of modern transactions. But what exactly is POS in a debit card, and why is it so important? Let us explore the details and how they impact your banking experience.

What is POS?

POS stands for Point of Sale. It refers to the location or system where a transaction takes place. When you use your debit card at a checkout counter, the POS system is the technology that processes the payment. It involves a combination of hardware and software. This enables merchants to accept payments from customers easily. This includes card readers, terminals, and the accompanying software that communicates with your bank to authorize and complete the transaction.

How Does POS Work?

When you make a purchase with your debit card, the POS terminal captures your card details and sends them to your bank for authorization. The bank checks your account to ensure you have sufficient funds and whether the transaction is legitimate. If everything is in order, the bank returns an authorization code to the POS system. This will complete the transaction. The entire process usually happens in a matter of seconds. This provides a smooth and quick payment experience.

Why Does POS Matter?

POS systems modernize transactions, making it easy for you to pay for goods and services quickly. With just a swipe or tap, your payment is processed. It will save you time and effort.

Modern POS systems come equipped with advanced security features like encryption and tokenization. This means your card details are protected during the transaction.

Using your debit card with a POS system lets you track your spending. With mobile banking apps, you can check bank balance and review your transaction history.

Many POS systems now integrate with UPI payment apps. This integration allows for smooth transactions between various payment methods and simplifies payment.

POS systems provide a smoother checkout experience. It will improve customer satisfaction. Faster transactions and reliable processing help ensure a positive shopping experience.

The Future of POS Systems

As technologies advance, POS systems are evolving to offer more features. With the rise of mobile payments and digital wallets, the role of POS systems is expanding to include various payment options. Advancements in AI and machine learning are enhancing the security and efficiency of POS systems. These technologies can detect and prevent fraudulent activities. This makes transactions safer and more reliable.

To conclude

Point-of-sale systems are a vital component of the modern payment setting. With the integration of UPI payment apps and the ongoing evolution of technology, POS systems offer enhanced features and improved security. So, next time you swipe your debit card, you will know that the POS system is working diligently behind the scenes to ensure a smooth and secure transaction.

#zero balance bank account open#zero balance account opening#0 account opening bank#bank account opening#open a zero balance account#open zero balance account#banking upi mobile#saving account opening zero balance#0 balance account opening#open new savings account#instant account opening zero balance#zero balance open bank account#bank account with zero balance#online zero balance account#open online zero balance account#zero balance account saving account#khata kholne wala app#online 0 balance account opening#open instant zero balance account#open a zero balance account online#new account opening#instant zero balance account opening#zero account opening online#zero account open online#instant zero balance account opening online#online savings account opening#online zero balance bank account opening#account open 0 balance#instant account opening#open zero balance account online instantly

1 note

·

View note

Text

An Overview of Hong Kong's Banking System: Types of Banks and Their Roles

As a global financial hub, Hong Kong offers a diverse and dynamic banking landscape designed to serve individuals, businesses, and investors. From traditional retail banks to innovative virtual banks, the city’s financial institutions provide a wide range of services. This guide will explore the various types of banks in Hong Kong and explain how MCKALLEN can help businesses navigate the financial ecosystem, including services like Hong Kong bank internet banking, money transfer services, and more.

Hong Kong’s Banking System: Stability and Innovation

Hong Kong's banking system is known for its stability, efficiency, and innovation. The Hong Kong Monetary Authority (HKMA) ensures that banks operate under strict regulatory guidelines regarding risk management, governance, and capital adequacy, making the system secure and efficient. With a combination of traditional and emerging institutions, Hong Kong’s banking sector continues to evolve, offering numerous options for individuals and businesses alike. Understanding the different types of banks is crucial for selecting the right services, whether you’re interested in bank account opening in Hong Kong or exploring the best online bank accounts.

Types of Banks in Hong Kong

1. Retail Banks: Supporting Personal Financial Needs

Retail banks are the backbone of personal banking in Hong Kong. They offer a broad range of services such as savings accounts, loans, mortgages, credit cards, and essential money transfer services. Retail banks are adapting to the digital era by offering Hong Kong bank internet banking, allowing customers to manage their accounts, pay bills, and make transfers from anywhere. Whether you're considering Citi bank account opening or exploring other banks, retail institutions provide the convenience of both branch and online services for everyday banking.

2. Corporate Banks: Driving Business Success

Corporate banks in Hong Kong are essential for businesses of all sizes. They provide business accounts, commercial loans, trade finance, and cash management solutions that support the growth and operations of companies. Corporate banks are vital for businesses engaged in international trade, offering money transfer services and financial tools to help businesses manage cash flow and capital needs. Hong Kong's role as a global trading hub ensures that corporate banks are well-equipped to handle the demands of companies operating across borders.

3. Investment Banks: Enhancing Wealth and Strategy

Investment banks in Hong Kong focus on wealth management and financial advisory services for high-net-worth individuals, institutional investors, and corporations. They offer investment strategies, securities trading, and advisory services for mergers and acquisitions. These banks play a key role in facilitating wealth growth and strategic investments, making them critical for those seeking to optimize their financial portfolios and participate in large-scale deals.

4. Virtual Banks: A Digital-First Approach

Virtual banks are transforming Hong Kong’s banking landscape by offering a fully digital experience. With no physical branches, these best online banks provide services like mobile banking, online account management, and innovative financial products. Virtual banks are attractive to tech-savvy individuals and businesses due to their convenience, lower fees, and easy access to the best online bank accounts.

MCKALLEN: Helping Businesses Navigate Banking

MCKALLEN is a leading financial advisory service in Hong Kong that helps businesses find the right banking solutions. Whether your company needs assistance with bank account opening, securing financing, or managing liquidity, MCKALLEN’s expertise in the local banking ecosystem ensures businesses are matched with the right banking partners. Their personalized approach helps businesses streamline operations and optimize financial strategies in Hong Kong's competitive market.

#bank account opening#setting up business in hong kong#hong kong company formation and incorporation services#banking system#hong kong banks

0 notes

Text

Cracking the Code: Your Guide to Opening a Business Bank Account in the UAE

Opening a business bank account is a crucial step when setting up your company in the UAE. With its strategic location, business-friendly policies, and booming economy, the UAE is a hotspot for global entrepreneurs. However, navigating the business bank account opening process can be a bit complex, especially for those unfamiliar with the local system. In this guide, we’ll walk you through the essentials of opening a business bank account in the UAE, as well as highlight key aspects to consider when you setup Dubai business ventures.

Why Opening a Business Bank Account in the UAE Is Essential

Opening a business bank account in the UAE is mandatory for conducting business transactions, managing company finances, and maintaining compliance with local regulations. It also ensures transparency, accountability, and credibility in your business dealings. Whether you’re looking to setup a Dubai business or expand your operations in the UAE, a business bank account is critical for maintaining proper financial management and accessing the many services offered by UAE banks.

Step 1: Choose the Right Bank for Your Business

The UAE is home to a wide range of local and international banks, all offering diverse services tailored to various types of businesses. Some of the most popular choices for business banking include Emirates NBD, Mashreq Bank, First Abu Dhabi Bank (FAB), and international institutions like HSBC and Citibank.

When selecting the right bank, consider the following factors:

Type of Business: Some banks cater better to specific industries, like startups, SMEs, or large corporations.

Transaction Volume: Evaluate whether the bank offers solutions that suit the size and scale of your business.

Global Reach: If your business operates internationally, you may prefer a bank with strong international capabilities.

Customer Service: Look for a bank that provides excellent customer support and easy access to account managers.

Step 2: Get the Required Documents in Order

Once you’ve selected your bank, the next step in the business bank account opening process is to gather the necessary documentation. Banks in the UAE typically require a comprehensive set of documents to ensure that your business is legitimate and compliant with regulatory requirements.

Commonly requested documents include:

Trade License: Issued by the relevant UAE authorities, this is a fundamental document that proves your company’s legal standing.

Certificate of Incorporation: This proves that your company is officially registered in the UAE.

Shareholder and Director Information: Detailed profiles and passport copies of the company’s shareholders and directors.

Memorandum of Association (MOA): This document outlines the structure, purpose, and rules governing your business.

Proof of Address: A utility bill or lease agreement that verifies the company’s physical location.

Personal Identification: Passports, visas, and Emirates ID for the company’s shareholders and directors.

Additional documents such as business plans, financial statements, or contracts with suppliers or clients may also be required depending on the nature of your business.

Step 3: Understand the KYC (Know Your Customer) Process

UAE banks adhere to strict anti-money laundering (AML) regulations, which means they implement a thorough Know Your Customer (KYC) process during the business bank account opening stage. As part of this process, banks will verify your business’s background, transaction history, and potential risk factors.

Expect the bank to ask for detailed information about your:

Business Activities: The nature of your business, including industry, market, and operational details.

Revenue Projections: Expected turnover and revenue sources.

Client Base: Key customers and geographical markets.

Business Plan: A document outlining your company’s growth strategy and financial projections.

Being transparent and providing clear, accurate information during the KYC process will expedite the opening of your business bank account.

Step 4: Comply with Minimum Balance Requirements

Most UAE banks have minimum balance requirements for business accounts. Depending on the bank and the type of account, these requirements can vary significantly. Be prepared to maintain a minimum balance that may range from AED 20,000 to AED 250,000 or more, depending on the bank’s policies and the account type.

Failing to meet the minimum balance requirement can result in monthly fees, so it’s important to choose an account that aligns with your business’s cash flow and financial capabilities.

Step 5: Take Advantage of Business Banking Services

Once your account is active, UAE banks offer a wide array of business banking services that can support your company’s growth. These services may include:

Corporate Credit Cards: Offering flexible spending limits for your business.

Online Banking: Managing finances remotely and conducting transactions with ease.

Merchant Accounts: Enabling your company to accept credit card payments from customers.

Multi-Currency Accounts: Ideal for businesses with international clients, these accounts allow you to hold multiple currencies and avoid conversion fees.

These services are designed to simplify your financial management and support the expansion of your Dubai business setup.

Challenges and Tips for a Smooth Account Opening

While the process of opening a business bank account in the UAE can be straightforward, there are a few challenges to keep in mind:

Time Frame: The process can take anywhere from 1 to 4 weeks depending on the bank and the completeness of your documentation.

Local Presence: Some banks may require a personal visit from the business owner or directors, so be prepared for this if you’re setting up remotely.

Account Rejections: Some banks are cautious about opening accounts for certain industries considered high-risk. To avoid rejections, ensure that your business is clearly presented as compliant with UAE regulations.

Conclusion

Opening a business bank account in the UAE is an essential part of the process when you setup Dubai business ventures. By selecting the right bank, preparing the necessary documents, and understanding the KYC process, you can streamline the account-opening procedure and start managing your company’s finances in one of the world’s most attractive business environments. With the right approach, you’ll be well on your way to leveraging the benefits of Dubai’s robust economy and business-friendly infrastructure.

Take the first step and unlock your business potential in the UAE today!

#business consulting#business setup in dubai#business setup in uae#business setup company in dubai#bank account online#bank Account opening

0 notes

Text

Sparta Management Consultancies offers specialized services related to the Golden Visa program in Dubai, catering to individuals seeking long-term residency in the United Arab Emirates. This program is designed to attract foreign investors, entrepreneurs, and skilled professionals by providing them with the opportunity to secure residency in one of the most dynamic and rapidly growing cities in the world. With a deep understanding of the local regulations and requirements, Sparta Management Consultancies ensures that clients receive comprehensive guidance throughout the application process.

The Golden Visa initiative in Dubai is a strategic move by the UAE government to enhance its appeal as a global business hub. Sparta Management Consultancies plays a pivotal role in facilitating this process for potential applicants by offering tailored solutions that address their unique needs and circumstances. The firm’s expertise encompasses not only the intricacies of the visa application but also the broader implications of living and working in Dubai, including investment opportunities and lifestyle considerations.

#business setup in dubai#law firms in dubai#pro services in dubai#Bank account opening#Trade license renewal dubai#new company formation#Business cancelation dubai#Online bank account opening dubai#Business bank account dubai#business setup services dubai#mainland company formation in dubai#offshore formation dubai#out source pro services in dubai

1 note

·

View note

Text

At present, Shanghai is vigorously developing its economy and encouraging domestic and foreign investors to take root in Shanghai. I'm here to share the various matters of Shanghai companies registration .

#shanghai#wfoe shanghai#company registration#company services#companystartup#accounting#work visa#bank account opening#auditing

1 note

·

View note

Text

Why savings account is so vital for an individual?

One of the most well-liked bank accounts that one might open is a savings account. Open new bank account as a saving account will be a single account that may be utilized for numerous reasons. In actuality, multiple varieties of savings accounts can be used for various needs. In this situation, many people are engaging with the banking and financial system for the first time. A savings account is losing its luster, though, as several other investment options become more alluring than them. Here is a helpful post to understand the importance of a savings account:

Safe Parking Place for the Money:

You have a secure option to store your extra money with a savings bank account. Easy withdrawal and deposit options are available for your savings account. You no longer need to carry cash with you at all times and are no longer concerned about potential cash theft. As you open a new bank account as a savings bank account, you benefit from excellent flexibility and security for your money.

Unique value-added services are offered:

Nowadays, a savings account comes with value-added services and incentives from many banks. Numerous banks provide discounts when purchasing from retailers, rebates, or reward points when using an ATM or debit card. Additionally, many banks offer some basic form of health or accident insurance, international travel insurance, and other insurance coverages when opening a bank account. You can obtain more value if you choose a statement with these advantages. Additionally, a savings account provides a passbook, online banking, and checkbook facilities.

Benefits of Government Programmes:

You must have a savings account to participate in government programs and receive subsidies. The government is pushing direct benefit transfer programs, and the only way to get payments is through a savings account. A Zero Balance Savings Account is another option many banks provide; these accounts are not subject to any requirements to keep a sufficient balance.

Income from Interest:

Your home will only bring in money if you have extra cash. However, if you deposit this money in a savings account, it will be secure and earn interest for you. Each bank has a different rate of interest on savings accounts. While some banks only provide 4% interest, some go as high as 6%.

Planning Your Money:

You can correctly arrange your budget with the use of a savings account. A bank account can help you comprehend your financial situation and subsequently enable you to plan your investments by giving you a clear image of your savings. While you find suitable investment opportunities, you can use the savings account to keep your money secure.

Cash is not Required:

Every Savings Account has the option of a Debit Card. You can buy things thanks to this without having to carry cash. When paying using debit cards, many merchants offer various discounts and promotions. Additionally, you can easily withdraw money from your account because of the vast ATM network.

Bottom Line:

The significance of the savings account is well articulated in the above points. To begin your banking journey well, open online savings accountalready to have a pleasant experience today and in the long run.

#online open account bank#account open instantly#account opening online#bank account online application#bank account open instantly#bank account opening

0 notes

Text

What is the importance of a savings account in money management?

A large number of people follow budgeting for a good reason. By considering your current spending, budgeting is intended to assist you in making larger future savings. Now that you are familiar with the budgeting procedure, you must also understand the value of a savings account in order to build your savings.

For you to save more and budget more effectively, savings accounts are crucial for the following reasons:

You can increase your savings by using a bank with a greater interest rate.

You can avail of discounts by using Money Transfer apps from your bank.

Many reputed banks give you monthly interest credits to encourage you to save more money.

You can begin saving sooner by taking advantage of paperless and easy savings account opening services in banks. Today, many people seeking growth choose online savings accounts due to the high and competitive interest rate and the monthly interest credit.

Budgeting

Long-term investors recognize the value of saving in a person's investment path and make it a point to educate and re-assure younger investors of this. Experts will talk about budgeting and a savings account that works for your benefit in this article. Those are considered two key pillars on which you can build your savings. Experts also offer advice on creating a better budget and explain why having a savings account is essential for growing your money. Making Money Transfer actions using a mobile app from your bank is the best option for customers.

What is budgeting?

The act of regularly tracking all of your costs over a specified period of time is known as budgeting. A month, a year, or even several years at once could be included in your budget. To boost their savings, the majority of people use monthly budgeting. Learn about budgeting by comprehending its steps given below.

Build an emergency fund.

Prepare yourself for an emergency as the first step in creating a budget. An "emergency fund" can provide you with the additional funds you'll need in case of an emergency. If you have steady work, you can set aside enough money for an adequate emergency fund to last you six months. It is advised to have savings equivalent to one year's worth of pay if your employment is uncertain.

Calculate your monthly income.

A working professional who receives a monthly wage can easily calculate their monthly revenue. To determine your monthly income, you can take the average of the money you've made over the previous three to six months if you work a variety of side jobs to supplement your salary.

Other things to do:

Factor in the additional expenses

Focus on paying off your debt first

Allot money for the ‘wants.’

Infer learnings from your budget

Tips that can help you budget well

Finally, in order to help you save more money, here are three recommendations for creating an effective budget and tracking all of your costs each month:

Periodically review your budget by contrasting it with an earlier budget. When creating your first budget, examine your expenses and contrast them with your monthly revenue.

With the expense tracking feature in your mobile banking app or website, you can easily track your spending.

Final thoughts

Don’t change the strategy you've developed as part of your budget. Consistency is the key to saving money using a savings account in a banking Mobile App.

This article on setting a budget is meant to be helpful. Don't forget to select the appropriate savings account for your budgeting process.

#0 account opening bank#0 balance account open online#0 balance account opening#0 balance account opening bank#0 balance bank account open online#0 bank account opening#account balance check#account check karne wala app#account online open#account open 0 balance#account opening#account opening app#account upi payments#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure

0 notes

Text

Short-Term vs. Long-Term Fixed Deposit

When it comes to financial planning, choosing the right investment option can make a big difference in achieving your financial goals. For these reasons, fixed deposits are the popular choice. You know what? You can watch your money grow steadily with predictable returns from your fixed deposit. They come with short-term and long-term options. But what are the advantages and which one should you choose? Instead of confusing yourself, continue to read this article to find out.

What are Short-Term and Long-Term FD?

Short-term deposits are investment accounts requiring a minimum investment of 7 days up to a maximum of 2 years. They allow you to deposit a specific amount of money for a short duration, enabling it to grow over time.

Long-term deposits are the type of investment where you can deposit your money for an extended duration ranging from 5 to 10 years.

Short Term vs. Long-Term FDs

Investing your money is about choosing the financial instrument and determining the duration you invest your funds. Short-term deposits offer minimal interest amounts compared to long-term fixed deposits.

However, they provide more flexibility and liquidity, which allows you to access your funds whenever needed. In the same way, long-term fixed deposits also offer higher liquidity and more gainful returns.

Advantages of Short-Term FD

Below are the most important advantages of short-term fixed deposits.

Liquidity

Because of the higher liquidity, short-term deposits will be the best choice for accessing your funds shortly. You can also break your short-term FD account without getting any severe penalties. This makes it an ideal choice for dealing with unexpected financial needs. You can easily check balance to monitor your investments.

Lowered Interest Rate Risk

With the short-term fixed deposits, you are less exposed to the interest fluctuations. If interest rates decline, your investments will not be locked for an external period. This allows you to reinvest with higher interest rates when the market grows.

Interest Rate Adaptability

They provide the benefit of being able to change your interest rates. If there are any rises in the interest rates, you can reinvest your funds in a new and higher interest rate after the maturity of your short-term fixed deposits.

Advantages of Long-Term FD

While short-term FDs have their own benefits, long-term benefits have more advantages.

Consistency and Predictability

Long-term FDs offer a consistent and predictable source of interest rates. You can benefit from this predictability if you search for a regular income stream or plan for a long-term financial goal.

Increasing Growth

The long-term FD allows your money to grow with the help of compounding. The interest amount you have earned from this is reinvested in your cash and increases growth over the period.

Increased Interest Rates

Compared to short-term FDs, long-term FDs offer higher interest rates. Thus resulting in higher interest rates over the period. This increase in interest rate helps you to grow your money effectively.

Wrapping It Up

Ultimately, the choice between long-term and short-term FDs varies depending on your needs and preferences. Short-term FD will be helpful for you if you need flexibility and access to your money in a short period. You can alsocheck transaction history to manage and review your investments. Long-term FDs will suit you if you want to grow your wealth over time, are looking for a steady income, or are planning your retirement. Choose wisely and enjoy the utmost benefit of FD it offers.

#bank account check#bank account check app#bank account kholna#bank account online#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank account with zero balance#bank app upi#bank balance app#bank balance app download#bank balance check karne wala app#bank balance enquiry#bank balance enquiry app#bank best fixed deposit rates#bank fd#bank fd interest rates#bank fd rates#bank fixed deposit#bank fixed deposit rates

0 notes

Text

0 notes

Text

crypto license in dubai

Gatwick Law offer expert legal services for acquiring a crypto license in Dubai, providing comprehensive guidance and support throughout the entire process. Our experienced team of professionals understands the intricacies of the crypto industry and the regulatory landscape in Dubai, ensuring a smooth and efficient licensing process. Trust Gatwick Law to navigate the legal requirements and help you establish a compliant and successful crypto business in Dubai. Contact us today to get started.

0 notes