#American Recovery and Reinvestment Act

Explore tagged Tumblr posts

Text

Epic Systems, a lethal health record monopolist

Epic Systems makes the dominant electronic health record (EHR) system in America; if you're a doctor, chances are you are required to use it, and for every hour a doctor spends with a patient, they have to spend two hours doing clinically useless bureaucratic data-entry on an Epic EHR.

How could a product so manifestly unfit for purpose be the absolute market leader? Simple: as Robert Kuttner describes in an excellent feature in The American Prospect, Epic may be a clinical disaster, but it's a profit-generating miracle:

https://prospect.org/health/2024-10-01-epic-dystopia/

At the core of Epic's value proposition is "upcoding," a form of billing fraud that is beloved of hospital administrators, including the "nonprofit" hospitals that generate vast fortunes that are somehow not characterized as profits. Here's a particularly egregious form of upcoding: back in 2020, the Poudre Valley Hospital in Ft Collins, CO locked all its doors except the ER entrance. Every patient entering the hospital, including those receiving absolutely routine care, was therefore processed as an "emergency."

In April 2020, Caitlin Wells Salerno – a pregnant biologist – drove to Poudre Valley with normal labor pains. She walked herself up to obstetrics, declining the offer of a wheelchair, stopping only to snap a cheeky selfie. Nevertheless, the hospital recorded her normal, uncomplicated birth as a Level 5 emergency – comparable to a major heart-attack – and whacked her with a $2755 bill for emergency care:

https://pluralistic.net/2021/10/27/crossing-a-line/#zero-fucks-given

Upcoding has its origins in the Reagan revolution, when the market-worshipping cultists he'd put in charge of health care created the "Prospective Payment System," which paid a lump sum for care. The idea was to incentivize hospitals to provide efficient care, since they could keep the difference between whatever they spent getting you better and the set PPS amount that Medicare would reimburse them. Hospitals responded by inventing upcoding: a patient with controlled, long-term coronary disease who showed up with a broken leg would get coded for the coronary condition and the cast, and the hospital would pocket both lump sums:

https://pluralistic.net/2024/06/13/a-punch-in-the-guts/#hayek-pilled

The reason hospital administrators love Epic, and pay gigantic sums for systemwide software licenses, is directly connected to the two hours that doctors spent filling in Epic forms for every hour they spend treating patients. Epic collects all that extra information in order to identify potential sources of plausible upcodes, which allows hospitals to bill patients, insurers, and Medicare through the nose for routine care. Epic can automatically recode "diabetes with no complications" from a Hierarchical Condition Category code 19 (worth $894.40) as "diabetes with kidney failure," code 18 and 136, which gooses the reimbursement to $1273.60.

Epic snitches on doctors to their bosses, giving them a dashboard to track doctors' compliance with upcoding suggestions. One of Kuttner's doctor sources says her supervisor contacts her with questions like, "That appointment was a 2. Don’t you think it might be a 3?"

Robert Kuttner is the perfect journalist to unravel the Epic scam. As a journalist who wrote for The New England Journal of Medicine, he's got an insider's knowledge of the health industry, and plenty of sources among health professionals. As he tells it, Epic is a cultlike, insular company that employs 12.500 people in its hometown of Verona, WI.

The EHR industry's origins start with a GW Bush-era law called the HITECH Act, which was later folded into Obama's Recovery Act in 2009. Obama provided $27b to hospitals that installed EHR systems. These systems had to more than track patient outcomes – they also provided the data for pay-for-performance incentives. EHRs were already trying to do something very complicated – track health outcomes – but now they were also meant to underpin a cockamamie "incentives" program that was supposed to provide a carrot to the health industry so it would stop killing people and ripping off Medicare. EHRs devolved into obscenely complex spaghetti systems that doctors and nurses loathed on sight.

But there was one group that loved EHRs: hospital administrators and the private companies offering Medicare Advantage plans (which also benefited from upcoding patients in order to soak Uncle Sucker):

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8649706/

The spread of EHRs neatly tracks with a spike in upcharging: "from 2014 through 2019, the number of hospital stays billed at the highest severity level increased almost 20 percent…the number of stays billed at each of the other severity levels decreased":

https://oig.hhs.gov/oei/reports/OEI-02-18-00380.pdf

The purpose of a system is what it does. Epic's industry-dominating EHR is great at price-gouging, but it sucks as a clinical tool – it takes 18 keystrokes just to enter a prescription:

https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2729481

Doctors need to see patients, but their bosses demand that they satisfy Epic's endless red tape. Doctors now routinely stay late after work and show up hours early, just to do paperwork. It's not enough. According to another one of Kuttner's sources, doctors routinely copy-and-paste earlier entries into the current one, a practice that generates rampant errors. Some just make up random numbers to fulfill Epic's nonsensical requirements: the same source told Kuttner that when prompted to enter a pain score for his TB patients, he just enters "zero."

Don't worry, Epic has a solution: AI. They've rolled out an "ambient listening" tool that attempts to transcribe everything the doctor and patient say during an exam and then bash it into a visit report. Not only is this prone to the customary mistakes that make AI unsuited to high-stakes, error-sensitive applications, it also represents a profound misunderstanding of the purpose of clinical notes.

The very exercise of organizing your thoughts and reflections about an event – such as a medical exam – into a coherent report makes you apply rigor and perspective to events that otherwise arrive as a series of fleeting impressions and reactions. That's why blogging is such an effective practice:

https://pluralistic.net/2021/05/09/the-memex-method/

The answer to doctors not having time to reflect and organize good notes is to give them more time – not more AI. As another doctor told Kuttner: "Ambient listening is a solution to a self-created problem of requiring too much data entry by clinicians."

EHRs are one of those especially hellish public-private partnerships. Health care doctrine from Reagan to Obama insisted that the system just needed to be exposed to market forces and incentives. EHRs are designed to allow hospitals to win as many of these incentives as possible. Epic's clinical care modules do this by bombarding doctors with low-quality diagnostic suggestions with "little to do with a patient’s actual condition and risks," leading to "alert fatigue," so doctors miss the important alerts in the storm of nonsense elbow-jostling:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5058605/

Clinicians who actually want to improve the quality of care in their facilities end up recording data manually and keying it into spreadsheets, because they can't get Epic to give them the data they need. Meanwhile, an army of high-priced consultants stand ready to give clinicians advise on getting Epic to do what they need, but can't seem to deliver.

Ironically, one of the benefits that Epic touts is its interoperability: hospitals that buy Epic systems can interconnect those with other Epic systems, and there's a large ecosystem of aftermarket add-ons that work with Epic. But Epic is a product, not a protocol, so its much-touted interop exists entirely on its terms, and at its sufferance. If Epic chooses, a doctor using its products can send files to a doctor using a rival product. But Epic can also veto that activity – and its veto extends to deciding whether a hospital can export their patient records to a competing service and get off Epic altogether.

One major selling point for Epic is its capacity to export "anonymized" data for medical research. Very large patient data-sets like Epic's are reasonably believed to contain many potential medical insights, so medical researchers are very excited at the prospect of interrogating that data.

But Epic's approach – anonymizing files containing the most sensitive information imaginable, about millions of people, and then releasing them to third parties – is a nightmare. "De-identified" data-sets are notoriously vulnerable to "re-identification" and the threat of re-identification only increases every time there's another release or breach, which can used to reveal the identities of people in anonymized records. For example, if you have a database of all the prescribing at a given hospital – a numeric identifier representing the patient, and the time and date when they saw a doctor and got a scrip. At any time in the future, a big location-data breach – say, from Uber or a transit system – can show you which people went back and forth to the hospital at the times that line up with those doctor's appointments, unmasking the person who got abortion meds, cancer meds, psychiatric meds or other sensitive prescriptions.

The fact that anonymized data can – will! – be re-identified doesn't mean we have to give up on the prospect of gleaning insight from medical records. In the UK, the eminent doctor Ben Goldacre and colleagues built an incredible effective, privacy-preserving "trusted research environment" (TRE) to operate on millions of NHS records across a decentralized system of hospitals and trusts without ever moving the data off their own servers:

https://pluralistic.net/2024/03/08/the-fire-of-orodruin/#are-we-the-baddies

The TRE is an open source, transparent server that accepts complex research questions in the form of database queries. These queries are posted to a public server for peer-review and revision, and when they're ready, the TRE sends them to each of the databases where the records are held. Those databases transmit responses to the TRE, which then publishes them. This has been unimaginably successful: the prototype of the TRE launched during the lockdown generated sixty papers in Nature in a matter of months.

Monopolies are inefficient, and Epic's outmoded and dangerous approach to research, along with the roadblocks it puts in the way of clinical excellence, epitomizes the problems with monopoly. America's health care industry is a dumpster fire from top to bottom – from Medicare Advantage to hospital cartels – and allowing Epic to dominate the EHR market has somehow, incredibly, made that system even worse.

Naturally, Kuttner finishes out his article with some antitrust analysis, sketching out how the Sherman Act could be brought to bear on Epic. Something has to be done. Epic's software is one of the many reasons that MDs are leaving the medical profession in droves.

Epic epitomizes the long-standing class war between doctors who want to take care of their patients and hospital executives who want to make a buck off of those patients.

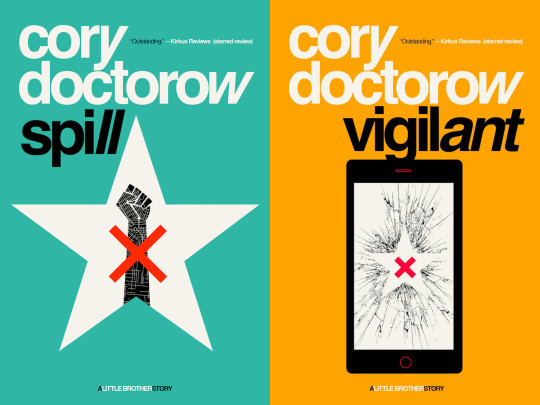

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/02/upcoded-to-death/#thanks-obama

Image: Flying Logos (modified) https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#ehrs#robert kuttner#tres#trusted research environments#ben goldacre#epic#epic systems#interoperability#privacy#reidentification#deidentification#thanks obama#upcoding#Hierarchical Condition Category#medicare#medicaid#ai#American Recovery and Reinvestment Act#HITECH act#medicare advantage#ambient listening#alert fatigue#monopoly#antitrust

818 notes

·

View notes

Text

After roughly 20 years of development, HrSR (higher-speed rail)* with speeds up to 110 mph will be in effect as of June 26 on Amtrak’s 284-mile Chicago-St. Louis corridor, on Lincoln Service and Missouri River Runner trains (300, 301, 302, 305, 306, 307, 318 and 319), as well as on the Texas Eagle. Trip time is reduced by 15 minutes from 90-mph run times and 30 minutes from 79-mph run times—less than two hours from Chicago to Bloomington-Normal and less than three hours to Springfield, with end-to-end St. Louis-Chicago schedules of under five hours. HrSR was a joint effort of the Illinois DOT, Amtrak and primary host Class I Union Pacific, plus numerous consultants led by WSP USA. Other host railroads on the corridor are CN, Canadian Pacific Kansas City (CPKC), and Terminal Railroad Association of St. Louis (TRRA). The project involved track upgrades, double-tracking, PTC and other infrastructure improvements. The shorter schedules, combined with new Siemens Charger diesel-electric locomotives and state-owned Amtrak Midwest Venture cars, also from Siemens, “we are completing a full makeover of this corridor service,” said Amtrak President Roger Harris. Project cost came in just under $2 billion, including $1.66 billion in funding from a 2010 American Recovery and Reinvestment Act grant.

41 notes

·

View notes

Text

The 2009-2010 Olympian financial crisis vs. our 2007-2008 financial crisis

It occurred to me that our fave middle-grade book series was in need of an in-universe banking crisis—and a silly fanfic about that banking crisis, with comments and cursing by a petulant Hades (whom I obviously had to make Olympus’s central bank).

*Below includes some spoilers for chapters I’m still working on*

The parallel to 2007-2008:

Olympus = the US

The “Olympian [i.e., godly] world” = the entire mortal world

The defense projects bubble = the housing bubble

Defense entrepreneurs = American homeowners

The belief that the war would continue for many years = the belief that housing prices would rise forever

Defense loan-backed securities (DLBS) = mortgage-backed securities (MBS)

The Community Protection Act = The Community Reinvestment Act

Atlantis’s situation = Canada’s situation. Ish.

Etc.

Everything else is basically the same as 2007-2008, down to the names of all the financial institutions and regulators, which are just the slightest bit off. The derivatives were exactly the same (... as I understand them).

I went with the defense idea because I needed to make a bubble with a shit ton of debt. It had to be something that would’ve made many people get huge loans that would default en masse at the same time and that basically everyone would consider a safe investment.

A few big differences, though:

In our world, most people got mortgages just to *buy* housing. In the Olympian world, people were pushed to get loans to create weapons etc. to use and to *sell*. These people would have made some money and would’ve created jobs using the loans. It’s not as bad—so I compensated by making the Olympian world hold proportionally more in derivatives than we mortals did leading up to 2008.

I also had to account for the 4-ish months between PJO and HOO, so I made up the stuff about the recovery after the first banks collapsed.

I made Hades how I wanted to. His actions and attitudes do not represent the Federal Reserve, but I did mirror what the Fed did and tried to parallel their responsibilities. My being very sympathetic to Hades is not really me being sympathetic to the Fed.

3 notes

·

View notes

Text

Disability Rights RANT AND ITS TIME TO ADVOCATE:

To those who do not understand what dismantling the department of education (DOE) will do to students like me relied on IEPs and the IDEA program which is governed by the DOE. Let me give you a lesson so sit back and read on. Class is in session and I want you to realize why I am fearful for the future of my disabled community.

So first, what does IDEA stand for? Individuals with Disabilities Education Act. IDEA governs how states and public education systems provides service intervention, special education and related services for those with disabilities.

Now, what does that entail? Well for me it was providing an aide who assisted me in transferring out of my chair for bodily functions as I couldn’t do that for myself, when I had my spine surgery it provided a home educator who helped me continue my education while I was homebound, and set me up for success with Texas Workforce Solutions formerly known as DARS. I got to graduate and then move forward with my education. I received a Bachelors in Mass Communication (focused in Public Relations and journalism) and hell yeah I’m about to use it for advocacy.

Here are just four important components of the IDEA:

1. Least Restrictive Environment (LRE): Ensuring the environment where these students will learn is ACCESSIBLE

2. Free Appropriate Public Education: This requires states to provide a free education and not discriminate against disabled students

3. Individualized Education Plan (IEP): This is a document that describes a child’s set education goal, and outlines the services the district will provide to help said student reach these goals. Without this, I never would have succeeded in school.

4. Procedural Safeguards: This guarantees for parents and their children with disabilities, and provides options for resolving disagreements. My parents would know this as they had several meetings to ensure they met my needs

Now, when did all this begin and what is the developmental timeline?

1975: (EAHCA) Education for All Handicapped Children Act was passed by congress. This gave rights to disabled students who by STATE law were discriminated against access to education

1990: EAHCA was renamed to IDEA and amended to include children with autism and traumatic brain injury as eligible to receive these benefits.

1997: IDEA was amended to expand the definition of disabled children to include developmental delayed children between three and nine years of age.

2004: The Individuals with Disabilities Education Improvement Act (IDEIA) amended IDEA, aligning it with the No Child Left Behind Act of 2001

2009: The American Recovery and Reinvestment Act (ARRA) included $12.2 billion in additional funds for IDEA

2015: Congress reauthorized the IDEA.

In the Law, Congress states: “Disability is a natural part of the human experience and in no way diminishes the right of individuals to participate in or contribute to society. Improving educational results in children with disabilities is an essential element of out national policy of ensuring equality of opportunity, full precipitation, independent living, and economic self-sufficiency for individuals with disabilities.” This is federal law.

No STATE should have the right to take this away. Hell, it shouldn't even be debatable! Making this federal law means NO GOVERNMENT can deny a child with disability an education. The (DOE) Department of Education has been the governing body of IDEA. If it is dismantled, what will take over as a governing body if the DOE is gone?

So far I haven’t seen a plan for this and that terrifies me. I will fight tooth and nail so the disabled students that come after me can have access to FREE education without being discriminated against.

Why do you think I am talking about this?

We all say “oh, the government wouldn’t do that!” I will tell you, “Oh, yes they will.”

Newsflash the republican party has stated over and over again they want to get rid of Obama care that is the Affordable Care Act. I feel like I have to state that as on X many people are now realizing that the ACA and Obama care are the same damn thing! Trump during his last presidency wanted to go after Obama care but the acting senate which was democratic ruled stopped it from going anywhere. That was in 2017. In 2020 Trump went to the supreme court in which the court dismissed the case. We now have both the house and senate republican majority ruled. I have the receipts for those who refuse to see this as a problem. This upcoming administration has been unclear on what the plans are for the ACA. It is inconsistent and I will be watching closely so stay tuned for a disability rights rant and call to action. But they have made it abundantly clear DOE is what they will go after.

If this were truly about values we’d be standing up to ensure this does not happen otherwise thousands if not millions of disabled Americans will suffer. So, I pray that you will do the good work and actually stand up for once. Disabled people NEED you to help fight for them. Be the voice for the voiceless. For those who are here now and are SCARED of losing their healthcare and right to an education. Call your representatives, get out and advocate, donate to organizations who support Disability Rights. DO SOMETHING.

We are the one minority that anyone can join.

Let that sink in.

We are the one minority that anyone can join at any point in their lifetime and before the ACA you could be discriminated against by insurance companies for just having a pre-existing disability. Pregnancy was even seen as a pre-existing condition. I don’t want to go back to that and neither should you. Disabilities are expensive and anyone could have a disability. Sometimes a tree falls on you while running (Yeah, I’m looking at a certain Governor) or you are in a car accident that paralyzes you or you get so sick to the point it starts doing permanent damage to your brain/body.

Disability doesn’t discriminate.

WE ARE THE ONE MINORITY THAT ANYONE CAN JOIN AND IT DOESN’T DISCRIMINATE

Okay, my TED talk is over.

#people with disabilities#disabled people#disabled#disability rights#department of education#IDEA#students with disabilities#human rights

0 notes

Text

Lithium-ion Battery Market 2030 Size Outlook, Growth Insight, Share, Trends

In 2023, the global lithium-ion (Li-ion) battery market was estimated to be worth USD 54.4 billion and is projected to grow at a compound annual growth rate (CAGR) of 20.3% from 2024 to 2030. This growth is largely driven by rising demand for electric vehicles (EVs), supported by the cost-effectiveness and energy efficiency of Li-ion batteries. The automotive sector, in particular, is expected to see significant expansion due to the increasing global registration of EVs, as more consumers seek cleaner and more sustainable transport options. In the United States, the largest North American market for Li-ion batteries in 2023, federal policies and the presence of key industry players are anticipated to drive further product demand. Government policies, such as tax incentives for EV purchases under the American Recovery and Reinvestment Act of 2009, as well as fuel efficiency standards introduced by the Corporate Average Fuel Economy (CAFE) regulations, have accelerated the shift towards electric drive technologies in both passenger cars and light commercial vehicles (LCVs).

In addition to the automotive sector, the demand for Li-ion batteries in consumer electronics is also driving market growth. As consumers seek more durable and energy-efficient devices, lithium-ion batteries are becoming a preferred choice for smartphones, tablets, and other electronics due to their long lifespan and high performance. The demand for EVs is similarly bolstered by growing awareness of carbon emissions and the environmental impact of traditional gasoline-powered vehicles, which motivates consumers to adopt cleaner alternatives. This trend is supported by regulatory pressures on lead-acid batteries due to environmental concerns. Specifically, regulations set by the Environmental Protection Agency (EPA) aim to reduce lead contamination and govern the storage, disposal, and recycling of lead-acid batteries, prompting a shift towards safer Li-ion battery solutions for automotive applications.

Gather more insights about the market drivers, restrains and growth of the Lithium-ion Battery Market

Mexico has also emerged as a strategic center for the global automotive industry, attracting investments from companies worldwide due to its large automotive production capacity. As the fourth-largest exporter of vehicles globally, following Germany, Japan, and South Korea, Mexico's automotive production is expected to further stimulate demand for lithium-ion batteries in the region. However, the market faced challenges during the COVID-19 pandemic. Battery providers had to adapt by reducing operational costs due to lower demand and by managing disruptions in the supply of spare parts caused by reduced manufacturing activity and logistical issues. To maintain service quality for clients with long-term contracts, suppliers turned to digital tools and implemented strict health and safety measures, including social distancing and personal protective equipment, to ensure safe on-site maintenance and repair services where necessary.

Application Segmentation Insights:

The Li-ion battery market is categorized into several application segments: automotive, consumer electronics, industrial, medical devices, and energy storage systems. In 2023, the consumer electronics segment led the market, accounting for over 31% of total revenue. Portable lithium-ion batteries are widely used in consumer electronics due to their compact size, high energy density, and rechargeability. They are incorporated into various devices, including mobile phones, laptops, tablets, LED lighting, digital cameras, wristwatches, hearing aids, and other wearable gadgets. This high demand for portable devices has positioned the consumer electronics segment as a dominant sector in the market.

The electric and hybrid EV market is anticipated to be the fastest-growing application segment over the forecast period. Rising fossil fuel prices and increased awareness of the environmental benefits of battery-operated vehicles are expected to drive this growth, especially in emerging markets across Asia-Pacific, Europe, and North America. Moreover, Li-ion batteries are widely utilized for backup power solutions in commercial settings, such as data centers, office buildings, and institutions. In residential applications, Li-ion batteries are becoming popular for energy storage in solar photovoltaic (PV) systems, enhancing the growth potential of the energy storage segment.

Li-ion batteries are also gaining traction in various industrial applications. They are commonly used in power tools, cordless tools, marine equipment, agricultural machinery, industrial automation systems, aviation, military & defense, civil infrastructure, and the oil and gas sector. The versatility of Li-ion batteries, combined with their ability to deliver consistent power across diverse conditions, makes them ideal for these industries. Their use in such a broad range of applications is projected to further boost market demand as industries seek reliable and efficient energy solutions that can support both heavy-duty equipment and everyday electronic devices.

In summary, the lithium-ion battery market is poised for rapid growth across multiple sectors. The automotive and consumer electronics segments, in particular, are driving demand, supported by governmental policies, environmental concerns, and technological advancements. The expansion into applications like energy storage and industrial machinery further underscores the adaptability and efficiency of Li-ion batteries, positioning them as a critical component of future energy solutions across the globe.

Order a free sample PDF of the Lithium-ion Battery Market Intelligence Study, published by Grand View Research.

0 notes

Text

They didn't just pass the ACA, they were considered the second most productive congress in history right after the time before that Democrats had a supermajority and the presidency in 1965. (Which gave us Social Security, Medicare, Medicaid, and the Voting Rights Act to name a few.) In 72 days, they passed the Lilly Ledbetter Fair Pay Act, the American Recovery and Reinvestment Act, the Patient Protection and Affordable Care Act, the Dodd–Frank Wall Street Reform and Consumer Protection Act, and the New START treaty.

The reason they didn't codify Roe was because back then it wouldn't have made any sense. Roe v Wade was the law of the land and back by tons of precedent. The idea of Roe being overturned back in 2008 was laughable. They only had 72 days and then needed to focus on things that were impossible without a supermajority in 2008, not things that they'd have no reason to believe Republicans wouldn't play ball because they were more open to bipartisanship pre-Obama.

"Why didn't the Democrats codify Roe v Wade?"

They didn't have enough votes to bypass the filibuster because of Joe Manchin

"Why didn'-"

The answer is probably Joe Manchin.

"They had 60 votes in-"

For a few months and that entire time was spent wrestling with like 11 Joe Manchins from a bunch of red states in the senate to get health care reform passed.

"What about the Filibuster-"

JOE FUCKING MANCHIN

#vote#vote down ballot#a democratic president cant do anything with a republican congress#tired of people who have no concept of checks and balances having loud opinions on democrats efficacy#if you want the president to be a permanent god king who rules with impunity theres someone on the ballot for you#if you want a democracy where your voice has impact vote democrat

11K notes

·

View notes

Text

Lithium-ion Battery Industry Strategies With Forecast Till 2030

In 2023, the global lithium-ion (Li-ion) battery market was estimated to be worth USD 54.4 billion and is projected to grow at a compound annual growth rate (CAGR) of 20.3% from 2024 to 2030. This growth is largely driven by rising demand for electric vehicles (EVs), supported by the cost-effectiveness and energy efficiency of Li-ion batteries. The automotive sector, in particular, is expected to see significant expansion due to the increasing global registration of EVs, as more consumers seek cleaner and more sustainable transport options. In the United States, the largest North American market for Li-ion batteries in 2023, federal policies and the presence of key industry players are anticipated to drive further product demand. Government policies, such as tax incentives for EV purchases under the American Recovery and Reinvestment Act of 2009, as well as fuel efficiency standards introduced by the Corporate Average Fuel Economy (CAFE) regulations, have accelerated the shift towards electric drive technologies in both passenger cars and light commercial vehicles (LCVs).

In addition to the automotive sector, the demand for Li-ion batteries in consumer electronics is also driving market growth. As consumers seek more durable and energy-efficient devices, lithium-ion batteries are becoming a preferred choice for smartphones, tablets, and other electronics due to their long lifespan and high performance. The demand for EVs is similarly bolstered by growing awareness of carbon emissions and the environmental impact of traditional gasoline-powered vehicles, which motivates consumers to adopt cleaner alternatives. This trend is supported by regulatory pressures on lead-acid batteries due to environmental concerns. Specifically, regulations set by the Environmental Protection Agency (EPA) aim to reduce lead contamination and govern the storage, disposal, and recycling of lead-acid batteries, prompting a shift towards safer Li-ion battery solutions for automotive applications.

Gather more insights about the market drivers, restrains and growth of the Lithium-ion Battery Market

Mexico has also emerged as a strategic center for the global automotive industry, attracting investments from companies worldwide due to its large automotive production capacity. As the fourth-largest exporter of vehicles globally, following Germany, Japan, and South Korea, Mexico's automotive production is expected to further stimulate demand for lithium-ion batteries in the region. However, the market faced challenges during the COVID-19 pandemic. Battery providers had to adapt by reducing operational costs due to lower demand and by managing disruptions in the supply of spare parts caused by reduced manufacturing activity and logistical issues. To maintain service quality for clients with long-term contracts, suppliers turned to digital tools and implemented strict health and safety measures, including social distancing and personal protective equipment, to ensure safe on-site maintenance and repair services where necessary.

Application Segmentation Insights:

The Li-ion battery market is categorized into several application segments: automotive, consumer electronics, industrial, medical devices, and energy storage systems. In 2023, the consumer electronics segment led the market, accounting for over 31% of total revenue. Portable lithium-ion batteries are widely used in consumer electronics due to their compact size, high energy density, and rechargeability. They are incorporated into various devices, including mobile phones, laptops, tablets, LED lighting, digital cameras, wristwatches, hearing aids, and other wearable gadgets. This high demand for portable devices has positioned the consumer electronics segment as a dominant sector in the market.

The electric and hybrid EV market is anticipated to be the fastest-growing application segment over the forecast period. Rising fossil fuel prices and increased awareness of the environmental benefits of battery-operated vehicles are expected to drive this growth, especially in emerging markets across Asia-Pacific, Europe, and North America. Moreover, Li-ion batteries are widely utilized for backup power solutions in commercial settings, such as data centers, office buildings, and institutions. In residential applications, Li-ion batteries are becoming popular for energy storage in solar photovoltaic (PV) systems, enhancing the growth potential of the energy storage segment.

Li-ion batteries are also gaining traction in various industrial applications. They are commonly used in power tools, cordless tools, marine equipment, agricultural machinery, industrial automation systems, aviation, military & defense, civil infrastructure, and the oil and gas sector. The versatility of Li-ion batteries, combined with their ability to deliver consistent power across diverse conditions, makes them ideal for these industries. Their use in such a broad range of applications is projected to further boost market demand as industries seek reliable and efficient energy solutions that can support both heavy-duty equipment and everyday electronic devices.

In summary, the lithium-ion battery market is poised for rapid growth across multiple sectors. The automotive and consumer electronics segments, in particular, are driving demand, supported by governmental policies, environmental concerns, and technological advancements. The expansion into applications like energy storage and industrial machinery further underscores the adaptability and efficiency of Li-ion batteries, positioning them as a critical component of future energy solutions across the globe.

Order a free sample PDF of the Lithium-ion Battery Market Intelligence Study, published by Grand View Research.

0 notes

Text

Lithium-ion Battery Industry Size & Share Analysis by Type and Region, Forecast Report, 2030

The global lithium-ion battery market, valued at approximately USD 54.4 billion in 2023, is set to expand significantly, with a projected compound annual growth rate (CAGR) of 20.3% from 2024 to 2030. This growth is driven primarily by the automotive sector, which is poised for notable expansion due to the cost-effectiveness of lithium-ion batteries. The adoption of electric vehicles (EVs) worldwide is anticipated to surge throughout the forecast period, further boosting demand for lithium-ion batteries.

The United States led the North American lithium-ion battery market in 2023, largely due to increasing EV sales supported by favorable federal policies and the presence of numerous industry players. U.S. federal policies encouraging EV adoption include the American Recovery and Reinvestment Act of 2009, which offers tax credits for electric vehicle purchases. Additionally, updated Corporate Average Fuel Economy (CAFE) standards have introduced stricter fuel economy requirements for passenger cars and light commercial vehicles (LCVs), promoting the expansion of electric drive technologies.

Gather more insights about the market drivers, restrains and growth of the Lithium-ion Battery Market

The rising demand for lithium-ion batteries extends beyond the automotive sector to the electronics industry, where these batteries are widely used in smartphones. Lithium-ion batteries provide longer shelf life and greater efficiency for devices, further propelling market growth. Furthermore, increasing consumer awareness about carbon emissions is driving demand for EVs, which is expected to fuel lithium-ion battery market growth. Regulatory restrictions on lead-acid batteries in response to environmental concerns such as the Environmental Protection Agency's (EPA) restrictions on lead contamination and regulations regarding the storage, disposal, and recycling of lead-acid batteries are contributing to the shift towards lithium-ion batteries in automotive applications. Mexico, as a significant hub in the global automotive industry, is becoming a focal point for international investments, adding further momentum to the growth of the lithium-ion battery market.

Product Segmentation Insights:

The lithium-ion battery market is segmented by product types, which include Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate (LTO), and Lithium Nickel Manganese Cobalt (NMC). Among these, the LCO segment held the largest market share, accounting for over 30% of total revenue in 2023. This strong demand for LCO batteries is largely driven by their high energy density and safety features, making them ideal for use in mobile devices like smartphones, tablets, laptops, and cameras.

Lithium iron phosphate (LFP) batteries are gaining popularity due to their excellent safety profile and long lifespan, which make them suitable for high-load and enduring applications in both portable and stationary devices. The demand for NCA batteries is also rising due to their high specific energy, specific power, and long-life span, qualities that make them a preferred choice in electric vehicles, medical devices, and various industrial applications. Lithium titanate (LTO) batteries are increasingly being utilized in applications such as electric powertrains, street lighting, uninterruptible power supplies (UPS), and solar-powered streetlights. LTO batteries are known for their superior safety, strong performance at low temperatures, and long life, which is expected to bolster their market share over the forecast period.

Order a free sample PDF of the Lithium-ion Battery Market Intelligence Study, published by Grand View Research.

#Lithium-ion Battery Market Share#Lithium-ion Battery Market Trends#Lithium-ion Battery Market Growth#Lithium-ion Battery Industry

0 notes

Text

Lithium-ion Battery Market 2030: Report Focusing on Opportunities, Revenue & Market Driving Factors

The global lithium-ion battery market, valued at approximately USD 54.4 billion in 2023, is set to expand significantly, with a projected compound annual growth rate (CAGR) of 20.3% from 2024 to 2030. This growth is driven primarily by the automotive sector, which is poised for notable expansion due to the cost-effectiveness of lithium-ion batteries. The adoption of electric vehicles (EVs) worldwide is anticipated to surge throughout the forecast period, further boosting demand for lithium-ion batteries.

The United States led the North American lithium-ion battery market in 2023, largely due to increasing EV sales supported by favorable federal policies and the presence of numerous industry players. U.S. federal policies encouraging EV adoption include the American Recovery and Reinvestment Act of 2009, which offers tax credits for electric vehicle purchases. Additionally, updated Corporate Average Fuel Economy (CAFE) standards have introduced stricter fuel economy requirements for passenger cars and light commercial vehicles (LCVs), promoting the expansion of electric drive technologies.

Gather more insights about the market drivers, restrains and growth of the Lithium-ion Battery Market

The rising demand for lithium-ion batteries extends beyond the automotive sector to the electronics industry, where these batteries are widely used in smartphones. Lithium-ion batteries provide longer shelf life and greater efficiency for devices, further propelling market growth. Furthermore, increasing consumer awareness about carbon emissions is driving demand for EVs, which is expected to fuel lithium-ion battery market growth. Regulatory restrictions on lead-acid batteries in response to environmental concerns such as the Environmental Protection Agency's (EPA) restrictions on lead contamination and regulations regarding the storage, disposal, and recycling of lead-acid batteries are contributing to the shift towards lithium-ion batteries in automotive applications. Mexico, as a significant hub in the global automotive industry, is becoming a focal point for international investments, adding further momentum to the growth of the lithium-ion battery market.

Product Segmentation Insights:

The lithium-ion battery market is segmented by product types, which include Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate (LTO), and Lithium Nickel Manganese Cobalt (NMC). Among these, the LCO segment held the largest market share, accounting for over 30% of total revenue in 2023. This strong demand for LCO batteries is largely driven by their high energy density and safety features, making them ideal for use in mobile devices like smartphones, tablets, laptops, and cameras.

Lithium iron phosphate (LFP) batteries are gaining popularity due to their excellent safety profile and long lifespan, which make them suitable for high-load and enduring applications in both portable and stationary devices. The demand for NCA batteries is also rising due to their high specific energy, specific power, and long-life span, qualities that make them a preferred choice in electric vehicles, medical devices, and various industrial applications. Lithium titanate (LTO) batteries are increasingly being utilized in applications such as electric powertrains, street lighting, uninterruptible power supplies (UPS), and solar-powered streetlights. LTO batteries are known for their superior safety, strong performance at low temperatures, and long life, which is expected to bolster their market share over the forecast period.

Order a free sample PDF of the Lithium-ion Battery Market Intelligence Study, published by Grand View Research.

#Lithium-ion Battery Market Share#Lithium-ion Battery Market Trends#Lithium-ion Battery Market Growth#Lithium-ion Battery Industry

0 notes

Text

Lithium-Ion Battery Market Size, Share, Growth and Industry Trends 2024 - 2030

The global lithium-ion battery market size was estimated at USD 54.4 billion in 2023 and is projected to register a compound annual growth rate (CAGR) of 20.3% from 2024 to 2030.

Automotive sector is expected to witness significant growth owing to the low cost of lithium-ion batteries. Global registration of electric vehicles (EVs) is anticipated to increase significantly over the forecast period. The U.S. emerged as the largest market in North America in 2023. Increasing EV sales in the country owing to supportive federal policies coupled with the presence of several players in the U.S. market are expected to drive product demand. Federal policies include the American Recovery and Reinvestment Act of 2009, which established tax credits for purchasing electric vehicles.

New Corporate Average Fuel Economy (CAFE) standards mandated fuel economy standards for passenger cars and Light Commercial Vehicles (LCVs) resulting in the expansion of electric drive technologies. Increasing product demand in smartphones owing to their extended shelf life and enhanced efficiency is expected to drive market growth. The increasing demand for EVs owing to growing consumer awareness about carbon emissions is expected to fuel market growth. A decline in the demand for lead-acid batteries, owing to EPA regulations on lead contamination and resulting environmental hazards coupled with regulations on lead-acid battery storage, disposal, and recycling, has led to an increase in the demand for Li-ion batteries in automobiles. Mexico has been a center of the global automotive industry as companies worldwide are eyeing to invest here.

Gather more insights about the market drivers, restrains and growth of the Lithium-Ion Battery Market

Lithium-ion Battery Market Report Highlights

• In 2022, the consumer electronics application segment held the largest revenue share of over 39.13%. Portable batteries are incorporated in portable devices and consumer electronic products. The applications of portable batteries include mobile phones, laptops, computers, tablets, and other wearable devices

• In 2022, the LCO product segment accounted for the largest revenue share of over 31.17%. High demand for LCO batteries in mobile phones, tablets, laptops, and cameras on account of their high energy density and high safety level is expected to augment the market growth over the forecast period

• The U.S. emerged as the largest market in North America in 2021. Increasing electric vehicle sales in the country owing to supportive federal policies, coupled with the presence of several players in the U.S. market, are expected to drive the demand for lithium-ion batteries

• In CSA, lithium-ion batteries are frequently used battery types for Electrical Energy Storage (EES) owing to applications including stand-alone systems with PV, emergency power supply systems, and battery systems for the mitigation of output fluctuations from wind and solar power

• In Brazil, the government is taking various initiatives to support the electric vehicle market by exempting annual car ownership tax and import tax on electric vehicles. This is expected to fuel the demand for lithium-ion batteries over the coming years

Browse through Grand View Research's Conventional Energy Industry Research Reports.

• The global digital oilfield market size was valued at USD 27.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030.

• The global energy harvesting system market size was valued at USD 452.2 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2020 to 2028.

Lithium-ion Battery Market Segmentation

Grand View Research has segmented the global lithium-ion battery market report based on product, application and region

Lithium-ion Battery Product Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

• Lithium Cobalt Oxide (LCO)

• Lithium Iron Phosphate (LFP)

• Lithium Nickel Cobalt Aluminum Oxide (NCA)

• Lithium Manganese Oxide (LMO)

• Lithium Titanate

• Lithium Nickel Manganese Cobalt (LMC)

Lithium-ion Battery Application Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

• Automotive

• Consumer Electronics

• Industrial

• Energy Storage Systems

• Medical Devices

Lithium-ion Battery Regional Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Russia

o Spain

o France

o U.K.

o Germany

o Italy

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

• Central & South America

o Brazil

o Paraguay

o Columbia

• Middle East & Africa

o South Africa

o UAE

o Egypt

o Saudi Arabia

Order a free sample PDF of the Lithium-Ion Battery Market Intelligence Study, published by Grand View Research.

#Lithium-Ion Battery Market#Lithium-Ion Battery Market size#Lithium-Ion Battery Market share#Lithium-Ion Battery Market analysis#Lithium-Ion Battery Industry

0 notes

Text

Lithium-ion Battery Market - Changing Supply and Demand Scenarios By 2030

Lithium-ion Battery Industry Overview

The global lithium-ion battery market size was estimated at USD 54.4 billion in 2023 and is projected to register a compound annual growth rate (CAGR) of 20.3% from 2024 to 2030.

Automotive sector is expected to witness significant growth owing to the low cost of lithium-ion batteries. Global registration of electric vehicles (EVs) is anticipated to increase significantly over the forecast period. The U.S. emerged as the largest market in North America in 2023. Increasing EV sales in the country owing to supportive federal policies coupled with the presence of several players in the U.S. market are expected to drive product demand. Federal policies include the American Recovery and Reinvestment Act of 2009, which established tax credits for purchasing electric vehicles.

Gather more insights about the market drivers, restrains and growth of the Lithium-ion Battery Market

New Corporate Average Fuel Economy (CAFE) standards mandated fuel economy standards for passenger cars and Light Commercial Vehicles (LCVs) resulting in the expansion of electric drive technologies. Increasing product demand in smartphones owing to their extended shelf life and enhanced efficiency is expected to drive market growth. The increasing demand for EVs owing to growing consumer awareness about carbon emissions is expected to fuel market growth. A decline in the demand for lead-acid batteries, owing to EPA regulations on lead contamination and resulting environmental hazards coupled with regulations on lead-acid battery storage, disposal, and recycling, has led to an increase in the demand for Li-ion batteries in automobiles. Mexico has been a center of the global automotive industry as companies worldwide are eyeing to invest here.

Mexico is the fourth-largest exporter in automotive industry, after Germany, Japan, and South Korea. Growing automobile production in the country is anticipated to drive product demand. The COVID-19 pandemic has been a major restraint to market growth owing to several factors including reduced operational cost by end-users, coupled with disruption in the availability of spare parts due to sluggish manufacturing activities and logistics issues. Battery providers have taken subsequent steps to ensure efficient services to end-users that have signed long-term contracts with them. Vendors are opting for digital tools and are following prescribed preventative measures including social distancing norms and the use of protective kits in case of an on-site inspection and repair services required by end-users on a case-to-case basis.

Lithium-ion Battery Market Segmentation

Grand View Research has segmented the global lithium-ion battery market report based on product, application and region:

Product Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

Lithium Cobalt Oxide (LCO)

Lithium Iron Phosphate (LFP)

Lithium Nickel Cobalt Aluminum Oxide (NCA)

Lithium Manganese Oxide (LMO)

Lithium Titanate

Lithium Nickel Manganese Cobalt (LMC)

Application Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

Automotive

Consumer Electronics

Industrial

Energy Storage Systems

Medical Devices

Regional Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

North America

US

Canada

Mexico

Europe

Russia

Spain

France

UK

Germany

Italy

Asia Pacific

China

India

Japan

South Korea

Australia

Central & South America

Brazil

Paraguay

Columbia

Middle East & Africa

South Africa

UAE

Egypt

Saudi Arabia

Browse through Grand View Research's Conventional Energy Industry Research Reports.

The global shore power market size was estimated at USD 2.0 billion in 2023 and is expected to grow at a CAGR of 10.4% from 2024 to 2030.

The global gas turbine market size was estimated at USD 10.19 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 4.0% from 2024 to 2030.

Key Companies & Market Share Insights

The industry is extremely competitive with key participants involved in R&D and constant product innovation. Key manufactures include Samsung, BYD, LG Chem, Johnson Controls, Exide, and Saft. Several companies are engaged in new product development to improve their global market share. For instance, BYD and Panasonic hold a strong position on account of its increased manufacturing capacities and large distribution network.

Key Lithium-ion Battery Companies:

BYD Co., Ltd.

A123 Systems LLC

Hitachi, Ltd.

Johnson Controls

LG Chem

Panasonic Corp.

Saft

Samsung SDI Co., Ltd.

Toshiba Corp.

GS Yuasa International Ltd.

Order a free sample PDF of the Lithium-ion Battery Market Intelligence Study, published by Grand View Research.

0 notes

Text

Understanding how Congress interacts with economic devastation is key to preventing and responding to crises like the current COVID-19 pandemic. Throughout history, Congress has played a critical role in guiding the nation out of destructive economic cycles. The power of their oversight is especially evident in times of disaster, when rapid legislative action is often necessary to prevent and respond to the destruction.

Congress’s role in influencing economic devastation starts with its ability to pass legislation. It can approve laws that provide relief and certainty during difficult economic times. For instance, during the 2008 financial crisis, Congress passed the Emergency Economic Stabilization Act to provide financial assistance, shore up the banking and housing institutions, and protect millions of Americans from losing their homes.

Congress’s other primary role is to appropriate funds for economic relief and stimulus packages. During the Great Recession, for example, Congress passed the American Recovery and Reinvestment Act, which was used to provide hundreds of billions of dollars in tax relief, unemployment benefits, and infrastructure funding.

Congress also has the power to hold government agencies and business entities accountable for their activities that contribute to economic devastation. During the financial crisis, Congress held extensive hearings to investigate how banks and other financial institutions misused their power to take advantage of consumers.

Ultimately, Congress must ensure that it has the necessary laws, resources, and oversight in place to respond to economic destruction and mitigate its long-term consequences. With the COVID-19 pandemic continuing to ravage the world's economies, understanding the role that Congress plays in economic devastation and devising effective measures to protect citizens across the globe are paramount.

0 notes

Text

Benefits / Cost vs. Value Impact / Tax Break Factors of Remodeling Your Home

There are many benefits to remodeling your home; at the top of the list is pride of homeownership. For so many of us, we have to remodel our home in stages or as various home products reach obsolescence or disrepair. If you do not have an urgent need to remodel due to unexpected events (ie. leaking roof, structural damage, etc.), how do you decide what takes priority? Lets review some of the relevant factors to consider when evaluating renovation needs.

Benefits of Remodeling

Increasing the Value of Your Home

Reduce Utility Cost by Increasing Your Homes Energy Efficiency

Make Your Home More Comfortable

Reduce Maintenance Repair Cost

More Effective Use of Space and Storage

Correct Obsolete Products or Home Disrepair

Correct Poor or Ineffective Home Design

Create a Safer Environment for Aging Members

Fit Your Lifestyle Better

Greater Homeowner Pride

Cost v Value Relationship on Major Remodeling

According to REMODELING magazine, the following home improvement areas were measured to reflect the cost vs value relationship within the same year of completing. These pricing matrix were measured for the national housing remodeling market and the Houston housing remodeling market analyzing both midrange projects and upscale projects. The national average for payback for a composite of renovation projects range was 64% - 74% in the same year.

Project Improvements Cost Recouped (same year)

Window Replacement (vinyl or wood) 74%

Bathroom Remodel 60%

Major Kitchen Remodel 66%

Two Story Addition 71%

Master Suite Addition 60%

Family Room Addition 69%

Marwood Construction cost vs value advise for their clients, based on these results, that it is best if you are planning a major remodeling project that you consider living in your home for at least 5 years after your remodel. Beyond 5 years the effects of inflation on new construction cost and the rising cost of land in most metro areas, remodeling can show an attractive return on investment.

There are many other cost factors to consider as part of the home remodeling investment equation when assessing your renovation needs. This is such a case when you are considering alternatives such as moving instead of remaining in your home and remodeling. The cost associated with placing your home for sale on the market include sales commissions, closing cost and moving expenses should be weighed as part of the entire financial picture.

Another major financial disadvantage of selling your existing home is that the accumulated capital gains you experience from your existing home are lost in the transaction of buying a new home. Whereas if you were to remain in your home and remodel or build on an addition, your existing homes appreciated value would increase at a greater rate amount.

Other considerations of remodeling are the current tax breaks that should be considered when evaluating financial considerations of different renovation project needs.

Current Tax Breaks

Cash for Clunker Appliances

Starting this fall, as part of the economic stimulus plan under the American Recovery and Reinvestment Act, the “Cash for Clunkers” extends to Appliances. Basically, purchase a new energy efficient appliance and get a tax credit of $200. Just like the “Cash for Clunker Automobiles” there is a set dollar amount set aside for this program and once the money is gone, the program is over.

Appliance companies should have available to you the list of products they carry that qualify. You may have to surrender your existing appliance in order to receive the benefit.

Energy Efficiency Tax Break

Install a solar panel to provide your home energy and not only will you see a substantial tax credit and your electric usage drop, but you may even be able to sell energy back to the electric company.

For those of us who are less adventurous – upgrade your boiler, heater, furnace, air conditioner, windows, roof, or insulation and you will not only see savings on your gas and electric bills.

The credit covers 30% of the energy saving improvements, capping at $1,500 for 2009 and 2010. The credit may no longer be available after 2010. When you complete your tax return be sure to include Form 5695. The IRS website gives more information.

Potential Future Tax Breaks (Pending Extension 2017)

The Home Improvements Revitalize the Economy (HIRE) Act of 2009

Provides a tax deduction of up to $2,000 per family, or a tax credit of $500, for the purchase of certain materials and home furnishings. If you use green products that meet LEED (or other recognized standards) the tax deduction would actually double. Purchases excluded from the HIRE Act are major appliances, house wares and electronics.

Source URL. https://www.marwoodconstruction.com/wp-content/uploads/2017/01/Benefits-of-Remodeling-Your.pdf

0 notes

Text

Stimulus Package: Definition, Benefits, Types, and Examples

What Is a Stimulus Package?

A stimulus package is a comprehensive set of economic measures implemented by a government to stimulate economic growth and counteract the effects of a recession or economic downturn. These packages are designed to boost consumer spending, business investment, and overall economic activity.

Stimulus packages typically involve a combination of monetary and fiscal policies. Monetary policies involve actions taken by a country's central bank, such as adjusting interest rates or implementing quantitative easing (buying financial assets to inject money into the economy). Fiscal policies involve actions taken by the government, such as reducing taxes, increasing government spending, or providing direct financial assistance to individuals or businesses.

The goal of a stimulus package is to revive economic activity during periods of economic hardship. This may include creating or preserving jobs, preventing deflation (a sustained decrease in prices), and restoring consumer and business confidence in the economy.

Stimulus packages are often implemented in response to various economic challenges, such as recessions, financial crises, or external shocks like natural disasters or pandemics. They are a crucial tool in economic policy that governments use to support their economies during difficult times.

Understanding Stimulus Packages

Understanding stimulus packages involves grasping the key components, goals, and potential impacts of these economic interventions. Here's a breakdown:

**1. Components of Stimulus Packages:

Monetary Policies: These involve actions taken by a country's central bank. Examples include adjusting interest rates, conducting open market operations, and implementing quantitative easing to influence the money supply, interest rates, and credit availability.

Fiscal Policies: These are measures taken by the government, primarily through its budget. This includes changes in taxation, government spending, and borrowing. For example, tax cuts, increased public spending on infrastructure, or direct cash transfers to individuals.

2. Goals of Stimulus Packages:

Economic Recovery: The primary goal is to kickstart economic activity during a period of slowdown, recession, or crisis.

Job Creation: By stimulating economic activity, businesses are more likely to hire new employees or retain existing ones, reducing unemployment rates.

Consumer Confidence: Providing financial assistance or tax breaks encourages people to spend money, which in turn boosts business activity.

Preventing Deflation: In times of economic downturn, prices may fall, potentially leading to a deflationary spiral. Stimulus measures aim to prevent or mitigate this.

Support for Vulnerable Populations: Stimulus packages often include provisions to support individuals and families facing financial difficulties, such as unemployment benefits or direct cash payments.

3. Potential Impacts:

Positive Economic Growth: Well-implemented stimulus packages can lead to an increase in Gross Domestic Product (GDP), indicating a healthier and growing economy.

Job Creation and Reduced Unemployment: Stimulus measures can lead to new job opportunities and help stabilize employment levels.

Improved Consumer and Business Confidence: Injecting funds into the economy can boost consumer and business sentiment, leading to increased spending and investment.

Preventing Long-Term Economic Damage: Timely stimulus can prevent the deepening of economic recessions or crises, potentially leading to quicker recovery.

4. Examples of Stimulus Packages:

American Recovery and Reinvestment Act (ARRA) (2009): In response to the global financial crisis, the U.S. government passed this package, which included a combination of tax cuts, government spending, and direct payments.

COVID-19 Stimulus Packages:

CARES Act (2020) in the U.S.: Provided direct payments to individuals, expanded unemployment benefits, and offered loans to businesses.

European Union's NextGenerationEU (2020): A €750 billion recovery plan to support EU member states in overcoming the economic impacts of the COVID-19 pandemic.

Japanese Stimulus Packages (Various): Japan implemented multiple stimulus packages in response to its economic challenges, including measures like infrastructure spending and monetary easing.

Australian Economic Stimulus Packages (Various): Australia implemented several stimulus packages, including measures like cash payments to households, infrastructure projects, and support for small businesses.

It's essential to note that the effectiveness of stimulus packages can vary depending on specific economic conditions, the measures implemented, and how well they're executed. Moreover, they can have long-term implications for a country's fiscal health and may need to be balanced with strategies for long-term economic stability.

Types of Stimulus Packages

Stimulus packages can take various forms, depending on the economic conditions, policy goals, and the tools available to the government. Here are some common types of stimulus packages:

Monetary Stimulus:

Interest Rate Reduction: Central banks can lower interest rates to make borrowing cheaper. This encourages businesses and individuals to take out loans for investments and spending.

Quantitative Easing (QE): The central bank buys financial assets (like government bonds) to inject money into the economy. This increases liquidity and lowers interest rates.

Credit Easing: Central banks may provide targeted support to specific sectors or markets, making it easier for them to access credit.

Fiscal Stimulus:

Tax Cuts: Lowering taxes, especially on income or consumption, puts more money in the hands of consumers. This can lead to increased spending and investment.

Government Spending: Increasing public spending on infrastructure projects, healthcare, education, and other areas can create jobs and stimulate economic activity.

Direct Cash Transfers: Governments may provide direct financial aid to individuals or households. This can be in the form of one-time payments, unemployment benefits, or subsidies.

Infrastructure Investment: Funding large-scale infrastructure projects like roads, bridges, and public transportation can create jobs and boost demand for construction materials and services.

Sector-Specific Stimulus:

Industry Bailouts: In times of crisis, governments may provide financial assistance or bailouts to specific industries that are particularly hard-hit (e.g., airlines, automotive).

Support for Small Businesses: Governments may offer grants, loans, or tax breaks to small and medium-sized enterprises (SMEs) to help them weather economic challenges.

Social Welfare Programs:

Unemployment Benefits: Expanding or extending unemployment benefits provides a safety net for individuals who have lost their jobs.

Food Assistance Programs: Increasing funding for programs like food stamps or meal assistance can help vulnerable populations meet their basic needs.

Housing Assistance: Providing rental subsidies or mortgage relief can help individuals and families stay in their homes during economic hardships.

Central Bank Lending Programs:

Special Lending Facilities: Central banks may establish special lending programs to provide liquidity to banks or specific industries facing financial stress.

Tax Incentives for Investment:

Investment Tax Credits: Offering tax credits to businesses for making investments in new equipment, technology, or infrastructure can encourage capital expenditure.

Training and Education Programs:

Skills Development Initiatives: Providing funding for training and education programs can help workers acquire new skills to adapt to changing economic conditions.

Green Stimulus:

Environmental Initiatives: Investing in green infrastructure, renewable energy projects, and sustainable technologies can create jobs and promote environmental sustainability.

Debt Relief and Moratoriums:

Debt Payment Deferrals: Providing temporary relief from debt payments (e.g., mortgages, student loans) can free up cash for spending elsewhere in the economy.

These types of stimulus packages can be implemented individually or in combination to address specific economic challenges and achieve targeted policy objectives. The choice of measures depends on the unique circumstances of each situation.

Monetary Stimulus

Monetary stimulus is a type of economic policy implemented by a country's central bank to stimulate economic activity, particularly during periods of economic downturn or recession. It primarily involves actions related to the money supply, interest rates, and credit availability. Here are some common forms of monetary stimulus:

Interest Rate Reduction:

Lowering the policy interest rates, such as the federal funds rate in the U.S., encourages borrowing and spending. When interest rates are low, it becomes cheaper for businesses and individuals to take out loans for investments, mortgages, or other expenditures.

Quantitative Easing (QE):

Quantitative easing involves the central bank purchasing financial assets, typically government bonds, from the market. This injects money into the economy and increases the liquidity of banks. It aims to lower long-term interest rates and boost lending.

Credit Easing:

In times of credit crunches or financial stress, central banks may implement measures to make credit more accessible to specific sectors or markets. This can involve targeted lending programs or asset purchases.

Forward Guidance:

Central banks may provide forward guidance on their future policy intentions. This information helps shape market expectations, influencing interest rates and investment decisions.

Negative Interest Rates:

Some central banks, particularly in Europe, have experimented with negative interest rates. This means that commercial banks are charged for holding excess reserves, which can incentivize them to lend more to the broader economy.

Currency Interventions:

Central banks may directly intervene in currency markets to influence the exchange rate. This can help exporters by making their products more competitively priced in international markets.

Lender of Last Resort:

Central banks act as the lender of last resort to provide liquidity to financial institutions in times of crisis. This ensures that banks can meet their short-term obligations and maintain stability in the financial system.

Reserve Requirement Changes:

Adjusting the reserve requirements for banks can influence the amount of money banks are required to hold in reserves, affecting their lending capacity.

Special Lending Facilities:

Central banks may establish special lending programs or facilities to provide financial support to banks or specific industries facing difficulties.

Currency Swaps:

Central banks may engage in currency swap agreements with foreign central banks. This can help stabilize foreign exchange markets and provide liquidity in times of stress.

Open Market Operations:

These involve buying or selling government securities in the open market. When the central bank buys securities, it puts money into the banking system, increasing liquidity.

Monetary stimulus is one tool in a government's toolkit to manage the economy. It works in conjunction with fiscal policies (government spending and taxation) to influence economic activity. The effectiveness of monetary stimulus can depend on a variety of factors, including the overall economic conditions, the specific measures implemented, and how well they are communicated and executed.

Fiscal Stimulus

Fiscal stimulus refers to the use of government spending and taxation policies to influence a country's economy. It is a tool that governments use to boost economic activity, particularly during periods of economic downturn, recession, or crisis. Here are some common forms of fiscal stimulus:

Tax Cuts:

Lowering taxes, especially on income or consumption, puts more money in the hands of consumers and businesses. This can lead to increased spending and investment.

Government Spending Increases:

Governments can increase spending on various areas, such as infrastructure projects, healthcare, education, defense, and social welfare programs. This can directly create jobs and stimulate demand in the economy.

Direct Cash Transfers:

Providing direct financial aid to individuals or households can quickly inject funds into the economy. This can be in the form of one-time payments, unemployment benefits, or subsidies for specific needs.

Infrastructure Investment:

Funding large-scale infrastructure projects like roads, bridges, public transportation, and energy projects can create jobs and boost demand for construction materials and services.

Sector-Specific Support:

Governments may provide targeted financial assistance or bailouts to specific industries that are particularly hard-hit by economic challenges, such as airlines, automotive, or hospitality.

Support for Small Businesses:

Offering grants, loans, or tax breaks to small and medium-sized enterprises (SMEs) can help them weather economic challenges and maintain employment.

Social Welfare Programs:

Expanding or extending unemployment benefits provides a safety net for individuals who have lost their jobs. Additionally, programs like food stamps or meal assistance can help vulnerable populations meet their basic needs.

Housing Assistance:

Providing rental subsidies, mortgage relief, or other housing support can help individuals and families stay in their homes during economic hardships.

Green Stimulus:

Investing in green infrastructure, renewable energy projects, and sustainable technologies can create jobs and promote environmental sustainability.

Training and Education Programs:

Providing funding for training and education programs can help workers acquire new skills, adapt to changing economic conditions, and improve their employability.

Debt Relief and Moratoriums:

Offering temporary relief from debt payments (e.g., mortgages, student loans) can free up cash for spending elsewhere in the economy.

Fiscal stimulus measures are typically implemented through the government's budgetary process. The effectiveness of fiscal stimulus depends on factors like the timing, magnitude, and targeted allocation of resources. Additionally, it's crucial to balance short-term stimulus efforts with long-term fiscal sustainability to ensure economic stability in the future.

Fiscal Stimulus Downside

While fiscal stimulus can be an effective tool for boosting economic activity, it is not without its potential downsides. Here are some of the drawbacks associated with fiscal stimulus:

1. Budget Deficits and National Debt:

Implementing fiscal stimulus often requires increased government spending, which can lead to budget deficits. This means the government is spending more money than it is collecting in revenue. Over time, persistent deficits can contribute to a growing national debt, which may need to be managed to maintain long-term economic stability.

2. Inflationary Pressures:

When an economy is already operating at or near full capacity, injecting additional funds through fiscal stimulus can lead to increased demand for goods and services. If the supply cannot keep pace with this heightened demand, it can lead to inflation, eroding purchasing power.

3. Crowding Out Private Investment:

Increased government borrowing to finance fiscal stimulus can raise interest rates. This can make it more expensive for private businesses and individuals to borrow money for investments, potentially crowding out private sector activity.

4. Misallocation of Resources:

If fiscal stimulus measures are not well-targeted or properly designed, there is a risk that resources may be allocated inefficiently. For example, funds might be directed towards projects with limited economic impact, resulting in a suboptimal use of public resources.

5. Dependence on Government Support:

Relying too heavily on fiscal stimulus can create a culture of dependency on government intervention in the economy. This may disincentivize businesses and individuals from making necessary adjustments to adapt to market conditions.

6. Political Considerations:

Decisions regarding the allocation and distribution of fiscal stimulus funds can be influenced by political considerations. This may lead to less efficient allocation of resources and favoritism towards certain groups or industries.

7. Unequal Distribution of Benefits:

Depending on how fiscal stimulus measures are structured, there is a risk that benefits may not be evenly distributed across the population. Certain groups or regions may receive a disproportionate share of the support.

8. Long-Term Fiscal Sustainability:

While fiscal stimulus can be important during times of economic crisis, it is crucial to consider the long-term fiscal health of a country. Overreliance on stimulus measures without a plan for fiscal consolidation can lead to sustainability challenges down the line.

9. Potential for Policy Mistakes: