#Aadhaar number

Explore tagged Tumblr posts

Text

उत्तर बस्तर कांकेर: महतारी वंदन योजना के हितग्राहियों को आधार नंबर सक्रिय कराने कहा गया

उत्तर बस्तर कांकेर, 26 फरवरी 2024 महतारी वंदन योजना के अंतर्गत आवेदन करने वाले ऐसे हितग्राही जिनके आधार नंबर सक्रिय नहीं हैं, उन्हें नजदीकी आधार केंद्र से संपर्क करके अपने आधार नंबर को सक्रिय कराने कहा गया है। जिला कार्यक्रम अधिकारी महिला एवं बाल विकास विभाग ने कहा है कि इसी तरह कुछ हितग्राहियों के आधार नंबर उनके बैंक खातों से लिंक नहीं हैं वह भी आवेदन में जिस बैंक खाते का उल्लेख किया है, उस…

View On WordPress

#Aadhaar number#activate#kanker#Mahtari Vandan Yojana#North Bastar#ताजा खबर#ताजा न्यूज#ताज़ा समाचार#देश हिंदी समाचार#बड़ी खबर#लेटेस्ट समाचार#समाचार#हिंदी समाचार

0 notes

Text

Grievance Report: Aadhaar OTP Authentication Failure in Uttar Pradesh

Grievance Status for registration number : GOVUP/E/2025/0001030Grievance Concerns ToName Of ComplainantYogi M. P. SinghDate of Receipt03/01/2025Received By Ministry/DepartmentUttar PradeshGrievance DescriptionMost respected sir the following message sent by the department of unique identification authority of India on the email address of the applicant.Dear Mahesh Pratap Singh,Your Authentication…

#business#education#Fraudulent attempt to authenticate aadhaar number#india#Misuse of Aadhaar#news#politics#Unique identification authority of India

0 notes

Text

Guide On How To Link Your Mobile Number With Aadhaar

Linking Aadhaar with your mobile number is necessary for accessing various government services, receiving subsidies, and ensuring seamless communication with service providers. It also makes accessing your Aadhaar easier. In this article, you will get the step-by-step process on how to link the Aadhaar card with a mobile number.

0 notes

Text

Aadhaar verification API is vital for any business, financial institutions or entity in determining the credibility of their customers. Aadhar card is the universal identification in India for any citizen. Signzy’s Online Aadhaar Verification Resource will help you verify your customers, swift and safe. Issued by the Government of India, Aadhaar cards contain information about your Full Name, Address, Mobile Number, and other data that could be used to verify an individual.

0 notes

Text

If you have forgotten your Aadhaar number then find it out like this

0 notes

Text

My Aadhaar - Latest News, Update & Changes 2023-24

Aadhar ENrollement form.

A crucial piece of documentation that has significantly aided India's digitization efforts is the Aadhaar Card. The person receives a digital identity as a result. Indian nationals receive this identification card from the Unique Identification Authority of India (UIDAI). The entire My Aadhaar part of the official UIDAI website allows users to access a variety of Aadhaar services without logging in. One person may only apply for this ID card once, although there are features to make adjustments and get it back if it becomes lost.

What is myAadhaar?

The initial tab on the UIDAI website that users can access to access a variety of Aadhaar services without having to log in is called My Aadhaar. When you place your mouse over it, a dropdown menu containing all of its services organised by categories displays.

You can retrieve your lost Aadhaar card, validate your Aadhaar number, produce VID (Virtual ID), and learn more about Aadhaar in its knowledge centre using the My Aadhaar portion of the UIDAI website. Even an appointment can be scheduled there.

How to Download Aadhaar Online?

Using your Aadhaar or Enrolment number, you can access the UIDAI website and get your Aadhaar card. The steps are listed below.

Step 1: Navigate to the My Aadhaar tab on the official UIDAI website.

Step 2: Select Download Aadhaar from the Get Aadhaar menu.

Step 3: Scroll down to the Download Aadhaar option from the options that are given after being redirected to a new website.

Step 4: On the screen, a brief form will appear. You must provide both your Aadhaar number and the security code.

Step 5: Go to the menu and choose Send OTP.

Step 6: Complete the OTP that UIDAI sent to your registered phone number.

Step 7: Tap the Verify and Download button, and your Aadhaar will be downloaded to your phone or computer instantly.

Step 8: To read the password-protected file, you must type the password, which consists of your first four names in capital letters (just as they appear on your Aadhaar), and your birth year in YYYY format. As an illustration, your e-Aadhaar password would be SHIV1980 if your name is Shivam Singh and your birth year is 1980.

Step 9: To view your Aadhaar Card, press enter.

How to Verify Email/Mobile using My Aadhaar?

To verify your 16-digit Aadhaar number, along with your registered email address and phone number, on the UIDAI official website, follow the steps listed below.

Step 1: Navigate to My Aadhaar on the Unique Identification Authority of India (UIDAI) website.

Step 2: Click the Verify Email/Phone Number option under Aadhaar Services.

Step 3: After a brief form displays on your screen, choose the option that best suits your needs between Verify Mobile Number and Verify Email Address.

Enter your Aadhaar number in Step 4. Enter your registered phone number if you selected Verify Mobile Number. Enter your registered email address if you selected Verify Email Address.

Step 5: Enter the security code and select Send OTP from the menu.

Step 6: Correctly enter the OTP or verification code you were sent through email or smartphone (depending on what you are validating).

Step 7: After inputting the verification code, the following page will display the following text: The provided phone number and/or email address have been validated.

How to Verify Aadhaar?

The methods to use My Aadhaar to verify your Aadhaar on the UIDAI official website are shown below.

Step 1: Click on Verify An Aadhaar Number in the Aadhaar Services section of the My Aadhaar tab on the official UIDAI website.

Step 2: Enter your Aadhaar Number on the new page after being routed there, enter the security code, and then select the Proceed And Verify Aadhaar option.

Step 3: The message "Aadhaar Verification Completed" will appear on the following page.

How to Locate an Aadhaar Enrolment Centre?

On the UIDAI website, there are three ways to find the enrollment centre. By state, postal code, or search box, you can do a search. We will go over each of these three methods for finding an enrollment centre nearby in this section.

Search by State

To find the nearby enrolment centres in your state, follow these instructions:

Step 1: Click Locate an Aadhaar Enrolment Centre in the Get Aadhaar column of the My Aadhaar tab on the UIDAI website.

Step 2: On the new page that appears after being redirected, choose the State option under Search By.

Step 3: Enter the necessary information, including the name of your state, your district, subdistrict, village, town, or city, and check the box next to Show only permanent centres.

Step 4: Enter the security code, then click Find a Centre. Your screen will show a list of every permanent enrolment centre nearby.

Search by Postal (PIN) Code

To find the closest enrollment centres by state, follow these instructions:

Step 1: You will be taken to a new page after choosing Locate an Enrolment Centre from the Get Aadhaar column under My Aadhaar.

Step 2: Select "Postal (PIN) Code" under "Search By."

Step 3: Enter the security code and 6-digit postal code, then click "Locate a Centre." On your screen, a list of enrollment centres will appear.

Search by Search Box

If you want to use the Search Box to find the closest Aadhaar Enrolment Centre, follow the instructions below.

Step 1: You will be taken to a new website after clicking on Locate an Enrolment Centre in the Get Aadhaar column under the My Aadhaar button.

Step 2: Under Search By, choose the Search Box option.

Step 3: Type in your neighbourhood, city, and location.

Step 4: Correctly enter the security code and tap Find a Centre. On your screen, a list of enrollment centres will appear.

How to Book an Appointment via My Aadhaar?

The My Aadhaar option on the UIDAI website allows you to schedule an appointment with the closest Aadhaar Seva Kendra. An Aadhaar Seva Kendra offers a variety of services, including the following:

New Aadhaar enrolment

Updations of:

Gender

Email ID

Name

Address and Phone Number

Date of Birth

Biometric Update (Iris + Fingerprints + Photo).

To make an appointment at the closest Aadhaar Seva Kendra, follow these steps:

Step 1: Go to My Aadhaar on the official UIDAI website and select the Book an Appointment option under the Get Aadhaar column.

Step 2: Pick your city or location on the redirected Aadhaar Seva Kendra page, then press the Proceed to Book Appointment button.

Step 3: Select the cause for your appointment from the three options (Aadhaar Update, New Aadhaar, Manage Appointments) when a new page opens on the screen.

Step 4: Type in the phone number you registered.

Step 5: Enter the security code and select Generate OTP from the menu.

Step 6: Complete the OTP and select the option to verify the OTP.

Step 7: Enter the information.

Step 8: Decide which field needs updating.

Step 9: Choose the date of your appointment based on your preferences.

Review the application in Step 10 and then click the "Submit" button. Your attempt to arrange a meeting was successful.

Page URL : https://www.bigproperty.in/blog/my-aadhaar-latest-news-update-changes-2023-24/

0 notes

Text

Aadhaar Card Update : आधार कार्डवर मोबाईल क्रमांक अपडेट करणे अत्यंत आवश्यक आहे, अन्यथा तुम्ही कोणत्याही सरकारी सेवेचा लाभ घेऊ शकणार नाही.

Aadhaar Card Update :सर्वप्रथम, आम्ही तुम्हाला सांगतो की तुम्ही तुमचा मोबाइल नंबर ऑनलाइन अपडेट करू शकत नाही. तुम्हाला ही संपूर्ण प्रक्रिया ऑफलाइनच करावी लागेल. तुमच्या आधार कार्डवर मोबाईल नंबर अपडेट करण्यासाठी, सर्वप्रथम तुम्हाला तुमच्या जवळच्या आधार कार्ड सेवा केंद्राला ( Aadhaar Seva Kendra near me ) भेट द्यावी लागेल. तुम्हाला Aadhaar Card Center वर आधार अपडेट आणि सुधारणा फॉर्म दिला…

View On WordPress

#Aadhaar Card Mobile Number update#Aadhaar Card status#Aadhaar updates#Aadharcard Updates#E-KYC#KYC Updates

0 notes

Text

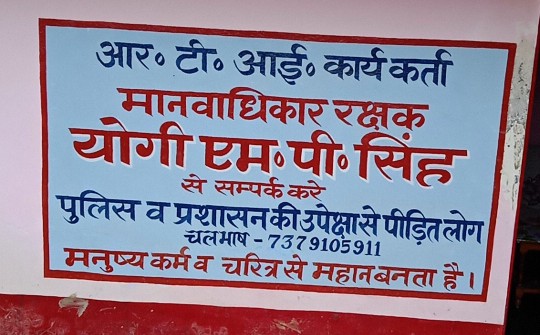

Navigating Tax Misuse: Lessons from Yogi M. P. Singh's Appeal

Appeal Details Appeal Number CBODT/E/A/24/0001791 Name Yogi M. P. Singh Appeal Recieved Date 09/06/2024 Reason Of Appeal The mobile number and email belong to the fraudulent person who opened the account through this email and mobile number. Mobile Number-7024188072, E-mail [email protected] Account Number (PAN)-GSWPS0850Q Info Icon, Aadhaar Number-XXXX XXXX 9009,…

View On WordPress

#corruption in income tax#crime#DG Income tax#finance#human rights#income tax#india#law#news#politics#supreme-court#tax#taxes

7 notes

·

View notes

Text

Another alarming digital ID and KYC data breach has once again exposed the vulnerabilities of digital identity systems, proving why they remain a significant privacy nightmare. A security flaw in the Indian Post Office portal has led to the exposure of thousands of Know Your Customer (KYC) records, demonstrating the ongoing risks of centralized digital ID infrastructure. The breach was caused by an Insecure Direct Object Reference (IDOR) vulnerability, which allowed unauthorized access to sensitive customer data by manipulating the document_id parameter in API requests.

The flaw, discovered by cybersecurity analyst Gokuleswaran, exposed confidential information including Aadhaar numbers, PAN details, usernames, and mobile phone numbers of postal service users. The vulnerability stemmed from a weakness in the portal’s URL structure, enabling direct access to customer records without proper authentication. This breach is particularly alarming given India’s rapid expansion of Aadhaar-based authentication across multiple sectors, amplifying the potential for misuse of exposed data.

3 notes

·

View notes

Text

How to Protect Yourself from Personal Loan Phishing Scams

In today’s digital world, personal loans have become more accessible, allowing borrowers to apply online and receive funds quickly. However, this convenience has also led to a rise in phishing scams, where fraudsters attempt to steal your personal and financial information by posing as legitimate lenders. These scams can result in identity theft, financial loss, and fraudulent loan applications in your name.

If you’re planning to apply for a personal loan, it is essential to understand how phishing scams work, the warning signs to look for, and the best ways to protect yourself.

1. What Are Personal Loan Phishing Scams?

A phishing scam is a fraudulent attempt to trick individuals into providing sensitive information such as bank details, Aadhaar number, PAN card, OTPs, or login credentials. Scammers typically impersonate banks, NBFCs, or online lending platforms and contact borrowers via emails, phone calls, SMS, or fake websites.

Once they obtain your information, they can:

Steal money from your bank account

Take a loan in your name

Misuse your identity for financial fraud

Access and sell your personal data on the dark web

2. Common Types of Personal Loan Phishing Scams

2.1 Fake Loan Approval Emails & SMS

Fraudsters send emails or SMS messages claiming that your loan has been pre-approved or that you qualify for a low-interest personal loan. These messages often contain links leading to fake lender websites designed to steal your personal information.

2.2 Fake Loan Websites & Apps

Scammers create websites and mobile apps that look like real financial institutions. They trick users into entering personal and banking details, which are then used for fraudulent activities.

2.3 Fraudulent Customer Service Calls

You may receive a phone call from a scammer pretending to be a bank representative. They claim you must provide your OTP, Aadhaar, PAN, or bank details to complete your loan application. Once you share these details, scammers can withdraw money or take loans in your name.

2.4 Loan Processing Fee Scams

Fraudsters promise quick loan disbursal with no documentation but demand advance processing fees or a loan insurance fee. Once the fee is paid, the scammer disappears, and no loan is disbursed.

2.5 Social Media Loan Scams

Some scammers advertise fake loans on Facebook, Instagram, or WhatsApp and ask potential borrowers to contact them privately. Once engaged, they request confidential details, leading to identity theft.

3. Red Flags to Identify Loan Phishing Scams

3.1 Offers That Sound Too Good to Be True

If you receive an offer promising guaranteed loan approval with no credit check, zero documentation, or extremely low-interest rates, it’s likely a scam.

3.2 Unsolicited Loan Messages

Legitimate lenders do not send random SMS, WhatsApp messages, or emails offering personal loans. Be cautious if you receive messages from unknown numbers or email addresses.

3.3 Fake Loan Websites

Before applying for a loan online, always verify the website’s domain name. Scammers often create fake websites with slightly modified spellings of real lenders to trick borrowers.

3.4 Requests for Upfront Payments

No genuine lender will ask for advance processing fees before loan approval. If a lender insists on upfront payments via UPI, Paytm, or Google Pay, it’s a scam.

3.5 Pressure to Act Immediately

Scammers create urgency by saying things like, "Limited offer – Apply now!" or "Your loan will be canceled if you don’t act fast." A real lender will give you time to review the terms.

3.6 Request for Personal Information Over the Phone

A legitimate bank or NBFC will never ask you for OTPs, passwords, or CVVs over the phone. If someone does, hang up immediately.

4. How to Protect Yourself from Loan Phishing Scams

4.1 Apply for Loans Only from Trusted Lenders

Always apply for a personal loan through registered banks, NBFCs, or reputed online lenders. Here are some safe options:

🔗 IDFC First Bank Personal Loan 🔗 Bajaj Finserv Personal Loan 🔗 Tata Capital Personal Loan 🔗 Axis Finance Personal Loan 🔗 Axis Bank Personal Loan 🔗 InCred Personal Loan

4.2 Verify the Lender’s Website

Check if the website URL starts with "https://" (secure site).

Look for official lender details on the RBI website or lender’s official website.

Avoid websites with poor design, spelling errors, or unusual domain names (e.g., "axisbankloans.xyz" instead of "axisbank.com").

4.3 Never Click on Suspicious Links

Do not click on links in unsolicited emails or messages claiming to be from a bank or NBFC. Instead, visit the official website by typing the URL manually.

4.4 Avoid Sharing Personal Information Online

Scammers may ask for your Aadhaar, PAN, or bank details via email, phone, or WhatsApp. Never share sensitive information with unknown sources.

4.5 Enable Two-Factor Authentication (2FA)

Use 2FA on your banking and email accounts to protect against unauthorized access. This adds an extra layer of security if your password is compromised.

4.6 Check Reviews & Ratings Before Downloading Loan Apps

Before installing a loan app, check:

App permissions (Avoid apps that ask for access to contacts, photos, and messages).

Reviews and ratings on Google Play or App Store.

If the app is registered with an RBI-approved lender.

4.7 Monitor Your Bank & Credit Report Regularly

Check your credit report and bank statements for unauthorized loan applications or suspicious transactions. If you spot any fraudulent activity, report it immediately.

5. What to Do If You Are a Victim of Loan Phishing?

If you have fallen victim to a loan phishing scam, take these steps:

1️⃣ Contact Your Bank Immediately – Report any unauthorized transactions and request to block your account if necessary. 2️⃣ Change Your Passwords – Update your internet banking, email, and loan account passwords immediately. 3️⃣ File a Cyber Crime Complaint – Report the fraud to the Cyber Crime Portal (www.cybercrime.gov.in) or call the National Cyber Crime Helpline (1930). 4️⃣ Report to RBI & Consumer Forum – If you have been tricked into a fake loan scheme, report it to the RBI and National Consumer Helpline (1800-11-4000). 5️⃣ Monitor Your Credit Report – Check for unauthorized loans taken in your name and dispute them with credit bureaus like CIBIL and Experian.

Stay Alert & Borrow Safely

Personal loan phishing scams are on the rise, but you can stay protected by being vigilant. Always verify loan offers, apply only through trusted lenders, and avoid clicking on suspicious links.

For safe and secure personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By staying cautious and informed, you can protect yourself from loan fraud and ensure a safe borrowing experience.

#nbfc personal loan#bank#loan services#personal loans#fincrif#personal loan#personal laon#loan apps#personal loan online#finance#fincrif india#Personal loan phishing scams#Loan fraud protection#How to avoid loan scams#Safe personal loan application#Phishing scams in personal loans#Fake loan offers#Online loan scams#Fraudulent loan websites#Personal loan safety tips#How to identify loan scams#Signs of a loan scam#Avoiding personal loan fraud#Phishing emails from loan providers#Loan application fraud prevention#How scammers trick loan applicants#Secure loan application process#Fake personal loan SMS and calls#Online loan phishing protection#Tips to protect against loan fraud

3 notes

·

View notes

Text

Simplifying GST Registration: A Comprehensive Guide by GTS Consultant

Introduction

With the economy adopting a dogfight-like pace, organisations face the need to become agile enough to grow unhindered. As goods and services tax (GST) is one of the most important reforms in the Indian tax system, it means the inclusion of indirect tax in a single tax. Understanding and filling the GST Registration is the dire straits that every company will have to face because it is to operate within the law and take the advantage. Holding a reputable GTS Consultant AB, with a past period of more than 12 years of combine experience. We are combining our expertise to offer businesses a hassle- free expedition.

In this blog, we will provide an in-depth look at GST registration, its importance, process, benefits, and the expertise GTS Consultant brings to the table.

What is GST Registration?

The identification of goods and services that require a business to be in line with local legislation by obtaining registration under the GST Act is called the process of GST registration. It authorizes the entities to not only collect tax from their clients but also to claim Input Tax Credit (ITC) for the taxes that were paid on their purchases. Depending upon the limit of the prescribed turnover or the activities engaged in, the businesses are obliged to get registered for GST

Who Needs GST Registration?

GST registration is mandatory for:

Businesses with Aggregate Turnover:

₹20 lakhs (₹10 lakhs for special category states): For service providers.

₹40 lakhs (₹20 lakhs for special category states): For goods suppliers.

Interstate Suppliers: Businesses involved in the interstate supply of goods and services.

E-commerce Operators: Platforms facilitating sales of goods and services.

Casual Taxable Persons: Individuals undertaking occasional transactions involving the supply of goods or services.

Input Service Distributors: Businesses distributing input tax credits to their branches.

Documents Required for GST Registration

For the smooth registration process, be sure to gather the following documents:

PAN Card: It's essential for the business and for the owner and owner(s) of the business to have a PAN card.

Proof of Business: This along with partnership deeds, incorporation certificates, as well as, registration certificates.

Identity and Address Proof of Promoters: The Aadhaar card, the passport, or the voter ID should be provided.

Business Address Proof: Lease agreements, contract transit costs, or utility bills.

Bank Account Details: One may use the copy of a canceled cheque, a bank statement, or a passbook copy.

Digital Signature: It is required to be electronically signed prior to online submission.

Authorization Letter: For the account signatories that are authorized to, if applicable.

Benefits of GST Registration

Legal Compliance: Penalty prevention and adherence to Indian tax laws.

Input Tax Credit (ITC): The ITC claim should be able to reduce the total tax burden by this method.

Market Expansion: GST registration will help in the inter-State sales and e-commerce trade.

Credibility: A registered GST number enhances the credibility of a business and makes it more trustworthy in the eyes of their clients.

Ease of Doing Business: One consolidated tax system offers several advantages such as easier filing of tax returns and tax payments.

Why Choose GTS Consultant for GST Registration?

GTS Consultant, located in Bhiwadi, Alwar, Rajasthan is a determined and particular accounting and tax services company dedicated to offering the best services Imagine why the companies would trust us:

Expert Guidance: Our group of skilled public accountants and chartered accountants guarantees a mistake-free and effective GST registration.

Comprehensive Support: From preparation to submission and post-registration help, we include each and every part of it.

Time-Saving: You focus on your operations, we refine your registration business process.

Cost-Effective Solutions: Services of high rank at budget prices.

Client-Centric Approach:We will customize our services so that they match your requirements and bring you the best possible benefits.

Frequently Asked Questions (FAQs)

1. What is the penalty for not registering under GST?

A penalty of the greater of ten percent of the tax due or ten thousand rupees is paid for non-registration. If a taxpayer evades tax on his own volition, DRI is supposed to impose a penalty equal to the tax that was evaded, i.e. 100%

2. Can I voluntarily register for GST?

Yes, turnover not reaching the requirement limit, businesses can choose to register at their own discretion and thus gain great benefits such as ITC and market credibility.

Contact GTS Consultant Today

Certainly, getting through the GST registration process be a hard time, however, if your partner is GTS Consultant, you can rest assured you will be guided thoroughly through the process. Be it a new business venture or an already existing set up, we, the team at GTS Consultant, will get you the best service by ensuring that we register you without pain points.

Reach us at:

Address: TC-321-325, R-Tech Capital Highstreet, Phool Bagh, Bhiwadi, Alwar (RJ) - 301019

Email: [email protected]

Website: Explore our services and resources on our official website GTS Constultant india

2 notes

·

View notes

Text

GST Registration Services in Delhi by SC Bhagat & Co.

Navigating the complex world of taxation in India can be challenging, especially for businesses in a dynamic city like Delhi. One critical aspect of compliance is GST registration, a mandate for businesses exceeding specific turnover thresholds. SC Bhagat & Co., a trusted name in accounting and taxation, offers seamless and reliable GST registration services in Delhi to help businesses stay compliant and thrive.

Why GST Registration is Crucial The Goods and Services Tax (GST) is a unified tax structure introduced to simplify India’s taxation system. GST registration is mandatory for businesses that:

Have an annual turnover exceeding ₹40 lakhs (₹20 lakhs for service providers). Are engaged in inter-state supply of goods or services. Operate under specific sectors requiring GST compliance (e.g., e-commerce, exporters). Failing to register for GST can lead to penalties, restricted operations, and reputational damage. This is where SC Bhagat & Co. steps in with expert assistance.

GST Registration Services by SC Bhagat & Co. SC Bhagat & Co. provides end-to-end GST registration solutions tailored to the unique needs of your business. Their services include:

Eligibility Assessment The experts at SC Bhagat & Co. assess whether your business falls under the mandatory GST registration criteria and advise accordingly.

Document Preparation and Submission Their team ensures that all necessary documents, including PAN, Aadhaar, business registration certificates, and bank statements, are prepared and submitted correctly.

GST Identification Number (GSTIN) Generation Once registered, SC Bhagat & Co. helps you obtain your unique GSTIN, ensuring compliance with Indian tax laws.

Post-Registration Compliance Support GST registration is just the beginning. The team provides ongoing support, including:

Filing GST returns Addressing notices from GST authorities Maintaining compliance records Benefits of Choosing SC Bhagat & Co. Here’s why SC Bhagat & Co. is the go-to partner for GST registration services in Delhi:

Expertise in Tax Laws With years of experience, the firm offers in-depth knowledge of GST regulations, ensuring accurate and hassle-free registration.

Personalized Solutions They understand that every business is unique. SC Bhagat & Co. provides tailored solutions to meet specific requirements.

Timely and Efficient Service Their streamlined processes ensure quick GST registration, enabling businesses to operate without delays.

Cost-Effective Services SC Bhagat & Co. offers affordable services without compromising on quality, making them a trusted partner for businesses of all sizes.

Why Delhi Businesses Trust SC Bhagat & Co. Delhi’s diverse business landscape demands a taxation partner that understands its challenges. SC Bhagat & Co. has established itself as a reliable ally for startups, SMEs, and large enterprises, helping them navigate GST complexities with ease. Conclusion GST compliance is a non-negotiable aspect of running a business in India. With SC Bhagat & Co.’s GST registration services in Delhi, you can ensure seamless compliance while focusing on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

6 notes

·

View notes

Text

2 notes

·

View notes

Text

Understanding Privacy Breaches in India: A Growing Concern

Privacy breaches are becoming a prevalent yet gravely worrisome problem in today's increasingly digital world, especially in India, where a plethora of new cyber threats have been brought about by fast digitization. Data breaches are more dangerous than ever as more people rely on digital platforms for banking, retail, communication, and even government functions. Protecting personal information is essential for both individuals and businesses and not doing so can have dire repercussions. This blog explores the definition of privacy breaches, their effects, and self-defence measures. Any unauthorized access, sharing, or theft of personal information constitutes a privacy breach. This may occur as a result of a deliberate hacking attempt or an unintentional disclosure. Privacy breaches are frequently more personal in nature, focusing on sensitive information like your name, financial information, or private chats, in contrast to data breaches, which usually involve the exposure of vast amounts of data. Millions of people have been impacted by these breaches, which have increased in frequency in India, where internet penetration is rising quickly.

Data leaks are among the most prevalent kinds of privacy violations. When private information is unintentionally made public by inadequate security measures, it is referred to as a data leak. These breaches can happen when businesses neglect to encrypt private information, making it open to illegal access. For instance, millions of people's names, addresses, and identification numbers were made public in 2021 due to a huge database leak in India, raising serious concerns about fraud and identity theft. Unauthorized access is another frequent way that privacy is violated. Cybercriminals obtain unauthorized access to networks or accounts using a variety of methods. For example, phishing is a popular technique where attackers deceive victims into disclosing personal information or login passwords. The attacker can access private accounts, steal information, or even perpetrate financial fraud once they have this data. Phishing assaults have increased in India, where the perpetrators frequently impersonate reputable organizations, such as banks or government offices, in order to trick their victims. In India, identity theft is yet another common privacy violation. To impersonate someone, criminals take their personal information, including their Aadhaar number. They can start phony bank accounts, commit crimes, or make purchases using the victim's name using this stolen identity. This kind of privacy violation has become especially harmful to the victims, both financially and emotionally, as a result of the increased reliance on digital identification and financial systems.

Another important factor in privacy violations is social media. By excessively disclosing personal information on social media sites like Facebook, Instagram, and Twitter, many Indians unwittingly jeopardize their privacy. Social media breaches happen when hackers make use of publicly accessible information to obtain additional private information or coerce users into disclosing even more private information. Alarming facts support the growing trend of privacy breaches in India. Over 1.16 million cybercrimes were reported in India in 2020 alone, a large percentage of which entailed privacy breaches, according to recent data. Victims may suffer terrible financial and psychological costs, and the consequences are frequently permanent. Since more personal information is being kept online than ever before, there is a greater chance of breaches, which makes cybersecurity a critical concern for both individuals and companies. The effects of privacy violations are extensive. Individuals may experience financial loss, reputational harm, or identity theft as a result of data breaches. Knowing that criminals have access to their personal information frequently causes victims to feel anxious or distressed. The repercussions are just as bad for corporations. Legal issues, significant fines, and a decline in customer trust might result from a privacy violation. After a major breach, some businesses may be compelled to close since the harm to their brand is irreversible.

Preventive actions are crucial in the fight against privacy violations. People should exercise caution when using the internet by creating strong, one-of-a-kind passwords for every account, turning on two-factor authentication, and being careful about what they post on social media. In order to guard against vulnerabilities, it's also essential to update programs and software often. Businesses need to make investments in robust cybersecurity procedures, like encrypting confidential information, carrying out frequent security audits, and teaching staff members how to spot phishing scams.

In conclusion, privacy violations are becoming a bigger issue in India that impacts both people and businesses. The threats of cybercrimes will only rise as long as we continue to rely on digital platforms. We can reduce the possibility of falling victim to a privacy breach by being aware of the risks and adopting preventative measures to safeguard personal data. Keep yourself informed, remain safe, and safeguard your online privacy.

2 notes

·

View notes

Text

Aadhaar Card गुम हो जाए और Aadhaar Number भी भूल जाए तो ऐसे में आधार नंबर कैसे पता करें ?

0 notes