#ATM Services Market

Explore tagged Tumblr posts

Text

ATM Services Procurement Intelligence, 2030: Key Factors to Consider

The ATM Services category is anticipated to grow at a CAGR of 5.6% from 2023 to 2030. Asia Pacific region accounts for the highest ATM usage. According to Asian Banking & Finance, the Asia Pacific region accounted for more than 40% of the number of automated teller machines globally in 2021. Owing to technological advancement, the category has seen a drastic transformation and has changed the cash systems. Banks are aiming to enhance the speed, security, and user-friendliness of their ATMs. Some of the key trends in the industry include cash recycler, contactless transactions, cash withdrawals, more appealing user interfaces, mobile integration, biometric identification, and remote teller assistance to name a few. Cash recycling would help the machines to accept, sort, validate, and store banknotes. This can enable customers to use machines to withdraw and deposit cash eventually reducing labor costs. According to UK’s RBR 2023 report, from 2020 to 2021, the number of cash-recycling ATMs installed globally grew from 973,000 to more than a million.

Cardless ATMs technology, an emerging feature, allows users to withdraw money through apps installed on their mobiles without the necessity to physically operate the machines. In June 2023, the Bank of Baroda, a nationalized bank in India, announced the launch of a cardless cash withdrawal facility, where users can withdraw cash using the UPI system at the bank’s ATM. Additionally, face biometrics at cardless machines is enabling face-based authentication in order to avoid fraud through the use of stolen cards or fake cards. According to biometric update.com’s June 2023 report, around 13,000 of Japan’s seven bank ATMs possess face biometric technology.

Full-service machines can act as a customer's initial point of contact with the bank. Rather than solely performing transactions, ATMs have the potential to become instruments for fostering relationships between banks and customers by offering services such as opening accounts, issuing cards instantly, printing checkbooks, and utilizing other versatile technologies. Through Remote Teller Technology, video banking allows customers to engage with the bank and carry out a majority of branch activities using real-time communication and video.

Order your copy of the ATM Services Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Manufacturing and installation of the machines may cost around USD 50,000 to 55,000. Cash services such as transporting cash between points, which is the major cost component, account for around 35 to 50% of the total cost. In-house service may cost up to 35% of the entire annual operational cost for the financial institutions whereas outsourcing the entire operations can save them up to 25%. ATM installation, maintenance, security, cash management, and compliance are some of the major cost components. Maintenance charges may vary on the basis of where the machine is located, and how much traffic it generates. Installation of ATMs may range from USD 200 to 300 per machine. ATM machine prices can range from USD 2,000 to 8,000. Carefully evaluating the nature of the service provider and the expenses associated can help the vendor to save on overall costs.

The threat of substitutes is moderate. Although advancements in digital banking and online payment systems have reduced the dependence on physical cash, ATMs still play a crucial role in providing convenient access to cash withdrawals, balance inquiries, and other services. However, the emergence of alternative payment methods like mobile payment apps and digital wallets could potentially pose a substitute threat in the long run.

The category saw a slight reduction during the COVID-19 pandemic owing to lockdowns, travel restrictions, and social distancing measures that resulted in reduced foot traffic at ATMs. According to the Payments Industry Intelligence 2022 report, it is observed that there was a reduction in the number of ATMs by 2% in 2021 worldwide. Post-pandemic, as everything normalized, ATM usage saw an increase but precautions such as contactless transactions gained momentum which has resulted in the implementation of cardless services.

Outsourcing of ATM software development, testing, and distribution is the most preferred type of sourcing by banks. Banks, financial institutions, and other users are continuously seeking to outsource their category operations to third-party operators who can handle maintenance, cash management, and other responsibilities. This enables the banks, and financial institutions staff to deal with other priorities along with significantly saving on cost. Shifting the managing task to a third party can also boost customer satisfaction. Maintaining long-term relationships with the service provider is also considered to be beneficial as it helps the vendor such as banks, and financial institutions to know the service provider better and save on searching and evaluating new service providers. The use of such practices in sourcing the services can ensure customer satisfaction, and quality services over the long run.

ATM Services Procurement Intelligence Report Scope

• ATM Services Category Growth Rate: CAGR of 5.6% from 2023 to 2030

• Pricing growth Outlook: 5 - 10% (annual)

• Pricing Models: Full Service Outsource Pricing, Price for services offered, Competition based pricing

• Supplier Selection Scope: End-to-end service, cost and pricing, compliance, security and data protection, service reliability and scalability

• Supplier selection criteria: Machine quality, services offered, post-sale services, end to end services, track record and reputation, cash management, traffic handling capacity, technical support, upgrade timeline and options, multifunctional machine

• Report Coverage: Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Browse through Grand View Research’s collection of procurement intelligence studies:

• Debt Collection Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Accounting Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Key companies profiled

• Diebold Nixdorf

• AGS Transact Technologies Ltd.

• Brink’s Incorporated

• AEPS India

• NCR Corporation

• Loomis Armored US, LLC

• Prineta LLC

• NationalLink Inc.

• ATM USA, LLC

• Hyosung Global

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

#ATM Services Procurement Intelligence#ATM Services Procurement#Procurement Intelligence#ATM Services Market#ATM Services Industry

0 notes

Text

Banking Made Easy With Our Digital Signage

Banking was never something we found exciting. We always dreaded it when our grandparents sent us to the bank for withdrawals, cheque book collections, or deposits.

However, with the advent of new technologies, the banking experience has completely transformed. Today, digital signage and other innovations have made banking much more convenient, turning a once tiresome task into a seamless and hassle-free experience.

Digital Signage empowers all the customers with great knowledge of personalized offers, loan products and investment opportunities based on customer profiles and location resulting in conversions.

Say goodbye to long queues and bulky paperwork. Now, you can showcase your most attractive offers on large LED screens in centralized locations, easily accessible to all.

Training customers to use the bank’s mobile app helps them handle their banking needs quickly and easily. By focusing on customer care, we show how the app makes banking more convenient, letting them manage their accounts anytime. The app is designed with innovation in mind, constantly improving with features that make it secure and easy to use. Customers can track their transactions clearly, ensuring transparency. With strong security measures, their data stays protected, building trust. By empowering customers to manage simple tasks on their own, staff can focus on more complex issues, making the overall experience faster and more efficient for everyone.

Digital signage for banks

Bank digital signage solutions

Digital signage for bank branches

Interactive digital signage for banks

Digital signage displays for banks

Bank digital menu boards

Digital signage for bank promotions

Digital signage for financial institutions

Digital signage for bank marketing

Digital signage for customer engagement in banks

Digital signage for banking services

Smart digital signage for banks

Digital signage for ATM displays

Digital signage for bank advertising

Digital signage for bank branding

Digital signage for loan services in banks

Digital signage for bank communication

Digital Signage for Bank in Delhi

Digital Signage For Bank in India

Bank Digital Signage in India

Visit

Add: MNG Tower, 2nd Floor, Plot no. A-2, Sector-17, Dwarka,

South West Delhi, New Delhi-110078

Call: 08046045687

#Digital signage for banks#Bank digital signage solutions#Digital signage for bank branches#Interactive digital signage for banks#Digital signage displays for banks#Bank digital menu boards#Digital signage for bank promotions#Digital signage for financial institutions#Digital signage for bank marketing#Digital signage for customer engagement in banks#Digital signage for banking services#Smart digital signage for banks#Digital signage for ATM displays#Custom digital signage for banks#Digital signage for bank advertising#Digital signage for bank branding#Digital signage for loan services in banks#Digital signage for bank communication

0 notes

Text

#ATM Managed Services Market Size#ATM Managed Services Market Share#ATM Managed Services Market Research

0 notes

Text

ATM Market: Trends, Players, Market Size, Share and Challenges

The automated teller machine (ATM) market has been a crucial component of the global financial ecosystem for decades, providing convenient access to cash and banking services for consumers worldwide. However, the ATM market has been undergoing significant changes in recent years, driven by advancements in technology, shifting consumer preferences, and evolving regulatory landscapes. In this blog, we will explore the current state of the ATM market, including its size, share, growth, trends, key players, and challenges.

Market Size, Share, and Growth

The global ATM market was valued at $19.7 billion in 2021 and is expected to reach $25.1 billion by 2026, growing at a CAGR of 5.1% during the forecast period. The Asia-Pacific region, led by countries like China and India, is the largest market for ATMs, accounting for over 40% of the global market share. The Indian ATM market, in particular, has been experiencing significant growth, with a market size of $1.2 billion in 2021 and a projected growth rate of 8-10% in the coming years. The country's rapidly growing economy and increasing financial inclusion have been driving the demand for ATM services.

Market Trends

Shift towards cash recycling ATMs: The growing demand for efficient cash management has led to the adoption of cash recycling ATMs, which can both dispense and accept cash, reducing the need for frequent cash replenishment and maintenance.

Integration of biometric authentication: ATM manufacturers are increasingly integrating biometric authentication technologies, such as fingerprint and iris scanners, to enhance security and prevent fraud.

Deployment of off-site and off-branch ATMs: To reach underserved areas and reduce operating costs, ATM deployers are focusing on installing off-site and off-branch ATMs in high-traffic locations like shopping malls, airports, and universities.

Adoption of mobile and digital banking: The rise of mobile and digital banking has led to a decline in ATM usage in some regions, as consumers increasingly prefer to conduct transactions through their smartphones and online platforms.

Key Players and Market Share

Diebold Nixdorf: The American Multinational Corporation is a leading player in the ATM market, with a market share of around 25%.

NCR Corporation: The American Technology Company is another major player in the ATM market, with a market share of approximately 20%.

GRG Banking: The Chinese ATM manufacturer has a market share of around 10%, with a strong presence in the Asia-Pacific region.

Hitachi-Omron Terminal Solutions: The Japanese joint venture between Hitachi and Omron has a market share of approximately 8%, with a focus on advanced ATM technologies.

Triton Systems: The American ATM manufacturer has a market share of around 5%, with a strong presence in the North American market.

Market Challenges

Declining ATM usage: The rise of mobile and digital banking has led to a decline in ATM usage in some regions, posing a challenge to ATM deployers and manufacturers.

Regulatory changes: Stricter regulations on ATM fees and surcharges have led to increased pressure on ATM deployers to reduce operating costs and maintain profitability.

Cybersecurity threats: ATMs are vulnerable to cyber-attacks, and deployers must invest in robust security measures to protect their systems and customers' data.

Maintenance and servicing costs: The high costs associated with maintaining and servicing ATMs, particularly in remote locations, can impact the profitability of ATM deployers.

Conclusion The ATM market is undergoing a significant transformation, driven by advancements in technology, shifting consumer preferences, and evolving regulatory landscapes. While the market continues to grow, particularly in emerging economies, ATM deployers and manufacturers face challenges such as declining ATM usage, regulatory changes, cybersecurity threats, and high maintenance and servicing costs. To succeed in this dynamic market, players must focus on innovation, cost-efficiency, and strategic partnerships to deliver secure, convenient, and accessible ATM services to consumers worldwide.

#top atm manufacturers#ATM Market#ATM industry trends#atm servicing companies#ATM Managed Services Market#ATM market analysis#ATM market growth#ATM market share#ATM market size

0 notes

Text

The global ATM managed services market size reached US$ 8.2 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 12.5 Billion by 2032, exhibiting a growth rate (CAGR) of 4.6% during 2024-2032.

0 notes

Text

Serbia sets up dinar ATMs near border with Kosovo

The Serbian government’s Kosovo Office announced on Monday that the Serbian Postal Bank has opened four improvised bank branches near border crossings with Kosovo where Kosovo Serbs can withdraw their income from the Serbian state, such as salaries and pensions in dinars.

According to the statement, the Post Bank of Serbia opened branches in the Serbian part of the Jarinje, Bërnjak, Končulj and Merdare border crossings. The statement said:

In support of citizens, the bank sent two mobile branches with wheels that will be available at these locations according to the citizens’ needs.

It adds that “this technical solution is temporary until the normal functioning of payment transactions in the Serbian areas of Kosovo is established”.

Read more HERE

#world news#world politics#news#europe#serbia#serbia 2024#kosovo#atm machine#atm services#atm market#atm placement#dinar#euro#currency exchange#currency

0 notes

Text

Navigating Tomorrow: Dynamics and Innovations in the Latin America ATM Services Market

The Latin America ATM Services Market, a vital component of the region's financial infrastructure, witnessed substantial growth, reaching a value of USD 2.76 billion in 2023. Projections indicate a promising trajectory, with an estimated Compound Annual Growth Rate (CAGR) of 5.10% between 2024 and 2032. This anticipates a market expansion, reaching a value of USD 4.32 billion by 2032. This article explores the historical evolution, technological advancements, market dynamics, and key factors propelling the growth of the Latin America ATM Services Market.

Historical Evolution:

The inception of Automated Teller Machines (ATMs) in Latin America marked a transformative shift in the banking landscape. Introduced to enhance accessibility to banking services, ATMs became instrumental in providing 24/7 convenience to customers. Since their introduction, ATMs have evolved from simple cash dispensers to multifunctional terminals offering a range of financial services.

Technological Advancements:

The Latin America ATM Services Market reflects the rapid pace of technological advancements. ATMs have evolved beyond basic cash withdrawal, incorporating features such as fund transfers, bill payments, and mobile top-ups. Integration of biometric authentication, contactless transactions, and real-time account updates showcase the market's commitment to providing secure, efficient, and modern financial services.

Market Dynamics and Industry Players:

The market operates within a dynamic ecosystem, with financial institutions, independent ATM deployers, and technology providers playing pivotal roles. Major banks invest in expanding their ATM networks to enhance customer accessibility, while independent deployers contribute to the market's diversity by offering services in various locations. Technology providers continually innovate to meet evolving security and operational standards.

Financial Inclusion Initiatives:

ATMs play a crucial role in financial inclusion initiatives across Latin America. By providing banking services in remote and underserved areas, ATMs bridge the gap between traditional banking and unbanked populations. Governments and financial institutions collaborate to deploy ATMs strategically, ensuring broader access to financial services for all segments of society.

Security Measures and Fraud Prevention:

As the Latin America ATM Services Market expands, so does the focus on security measures and fraud prevention. Advanced encryption, biometric authentication, and real-time monitoring systems are deployed to safeguard transactions and protect user data. Collaborative efforts between industry stakeholders and regulatory bodies contribute to the development and implementation of robust security standards.

Cashless Trends and ATM Innovation:

While cashless transactions gain popularity, ATMs continue to innovate to stay relevant. Some ATMs now facilitate cardless transactions, allowing users to withdraw cash using mobile apps. The market adapts to changing consumer behaviors, ensuring that ATMs remain a convenient and flexible financial service option.

Impact of Digital Banking and ATMs:

The rise of digital banking has influenced the role of ATMs, creating a symbiotic relationship between digital channels and physical ATMs. ATMs serve as touchpoints for users who prefer a blend of online and offline banking services. Financial institutions leverage this convergence to offer seamless and integrated banking experiences across platforms.

Financial Literacy and User Education:

The Latin America ATM Services Market actively engages in financial literacy and user education initiatives. Educational campaigns inform users about the various functionalities of ATMs, safe transaction practices, and the importance of securing personal identification numbers (PINs). By fostering financial literacy, the market aims to empower users with the knowledge needed to make informed and secure transactions.

Remote Monitoring and Maintenance:

To ensure the reliability and optimal performance of ATMs, remote monitoring and maintenance systems have become integral to the market. Advanced technologies enable real-time monitoring of ATMs, allowing for proactive issue resolution and preventive maintenance. This approach minimizes downtime, enhances operational efficiency, and contributes to a seamless user experience.

Cash Management Strategies:

Efficient cash management is a critical aspect of the Latin America ATM Services Market. Financial institutions and independent deployers employ sophisticated cash forecasting and replenishment systems to optimize ATM cash levels. By adopting data-driven strategies, the market minimizes cash-outs, reduces operational costs, and ensures that ATMs are adequately stocked to meet user demand.

Interconnected Payment Ecosystems:

The Latin America ATM Services Market is increasingly integrated into broader payment ecosystems. Collaborations with payment networks, fintech companies, and digital wallet providers enable ATMs to support a diverse range of transactions beyond traditional cash withdrawals. This interconnected approach aligns with the region's evolving payment landscape.

Biometric Authentication Adoption:

Biometric authentication, including fingerprint and palm vein scanning, is gaining traction within the market as an additional layer of security. The adoption of biometrics enhances user identification and authentication processes, contributing to fraud prevention and reinforcing the trustworthiness of ATM services. This innovative approach aligns with global trends in enhancing transaction security.

Customer-Centric Design and Accessibility:

The design of ATMs is evolving to become more customer-centric and accessible. User-friendly interfaces, clear signage, and features catering to individuals with disabilities contribute to an inclusive banking experience. The market recognizes the importance of creating ATMs that are not only secure and efficient but also user-centric in design.

Green and Sustainable ATMs:

Sustainability considerations are influencing the Latin America ATM Services Market, leading to the development of green and sustainable ATM solutions. Energy-efficient technologies, recyclable materials, and environmentally friendly practices contribute to reducing the ecological footprint of ATMs. Sustainable initiatives align with the region's commitment to responsible business practices.

Fintech Integration for Innovation:

The integration of fintech solutions within the Latin America ATM Services Market fosters innovation and expands service offerings. Collaboration with fintech firms enables the introduction of advanced functionalities, such as real-time account updates, instant issuance of prepaid cards, and integration with digital wallets. This synergy enhances the overall value proposition of ATMs in the evolving financial landscape.

0 notes

Text

Navigating the Future: Trends and Insights in the ATM Industry

The world of Automated Teller Machines (ATMs) is undergoing a transformation, and understanding the dynamics of the ATM Cash Management Market and ATM Managed Services Industry is key to staying ahead. In this comprehensive article, we explore industry trends, major players, and the crucial role of managed services in the evolving ATM landscape.

ATM Cash Management Market: Unveiling Opportunities

Industry Research Report Insights

The ATM Cash Management Market is dynamic, with constant shifts and opportunities. Our in-depth research report provides key insights into market trends, emerging opportunities, and the factors driving the evolution of cash management in ATMs.

ATM Managed Services: A Strategic Approach

Major Players in the Market

The landscape of ATM Managed Services is shaped by major industry players. We delve into the profiles and strategies of key players, offering a comprehensive overview of the competitive dynamics within the market.

Market Research Report Exploration

Our exploration extends to a detailed analysis of the ATM Managed Services Market. We uncover market trends, growth projections, and the role of managed services in optimizing ATM performance and reliability.

ATM Industry Trends: Riding the Wave of Innovation

Emerging Trends in the ATM Industry

The ATM industry is not stagnant; it's evolving. We dissect the latest trends, from technological advancements to customer-centric innovations, providing a roadmap for industry players to adapt and thrive.

ATM Servicing Companies: Powering the ATM Ecosystem

An in-depth look at the companies dedicated to servicing ATMs. We highlight their roles, contributions, and how they are crucial cogs in the smooth operation of the ATM ecosystem.

Conclusion: Charting the Course Ahead

In conclusion, the ATM Industry is at a crossroads, where innovation and strategic management play pivotal roles. Whether you are an industry veteran or a newcomer, staying informed about market trends, major players, and the impact of managed services is crucial. The future of ATMs is dynamic, and those who navigate it wisely will reap the benefits.

FAQs: Unveiling Insights

What sets apart the ATM Managed Services Market from traditional ATM services?

The focus on managed services is proactive rather than reactive, ensuring optimal ATM performance through strategic planning and continuous monitoring.

Who are the major players in the ATM Managed Services Market?

Explore the profiles and strategies of major players shaping the ATM Managed Services landscape.

How do industry trends impact the future of the ATM Cash Management Market?

Dive into the emerging trends that are reshaping the landscape of ATM cash management.

What role do ATM servicing companies play in the overall functioning of ATMs?

Learn about the integral role played by ATM servicing companies in maintaining and optimizing the performance of ATMs.

How can businesses leverage the latest trends in the ATM industry for strategic advantage?

Gain insights into how businesses can adapt and thrive by embracing the latest trends and innovations in the ATM industry.

Get Informed for Tomorrow: Explore the Future of ATMs

Embark on a journey through the evolving world of ATMs and managed services. Stay informed, adapt to industry trends, and position your business for success in the dynamic landscape of ATM Cash Management and Managed Services.

#ATM Cash Management Market#ATM managed services Industry Research Report#ATM Managed Services Market

0 notes

Text

The global ATM managed services market size was valued at USD 6.96 billion in 2021 and is estimated to reach an expected value of USD 12.48 billion by 2030, registering a CAGR of 6.7% during the forecast period (2022 – 2030).

For more useful Insights visit : https://straitsresearch.com/report/atm-managed-services-market

1 note

·

View note

Text

FCC strikes a blow against prison profiteering

TOMORROW NIGHT (July 20), I'm appearing in CHICAGO at Exile in Bookville.

Here's a tip for policymakers hoping to improve the lives of the most Americans with the least effort: help prisoners.

After all, America is the most prolific imprisoner of its own people of any country in world history. We lock up more people than Stalin, than Mao, more than Botha, de Klerk or any other Apartheid-era South African president. And it's not just America's vast army of the incarcerated who are afflicted by our passion for imprisonment: their families and friends suffer, too.

That familial suffering isn't merely the constant pain of life without a loved one, either. America's prison profiteers treat prisoners' families as ATMs who can be made to pay and pay and pay.

This may seem like a losing strategy. After all, prison sentences are strongly correlated with poverty, and even if your family wasn't desperate before the state kidnapped one of its number and locked them behind bars, that loved one's legal defense and the loss of their income is a reliable predictor of downward social mobility.

Decent people don't view poor people as a source of riches. But for a certain kind of depraved sadist, the poor are an irresistible target. Sure, poor people don't have much money, but what they lack even more is protection under the law ("conservativism consists of the principle that there is an in-group whom the law protects but does not bind, and an out-group whom the law binds but does not protect" -Wilhoit). You can enjoy total impunity as you torment poor people, make them so miserable and afraid for their lives and safety that they will find some money, somewhere, and give it to you.

Mexican cartels understand this. They do a brisk trade in kidnapping asylum seekers whom the US has illegally forced to wait in Mexico to have their claims processed. The families of refugees – either in their home countries or in the USA – are typically badly off but they understand that Mexico will not lift a finger to protect a kidnapped refugee, and so when the kidnappers threaten the most grisly tortures as a means of extracting ransom, those desperate family members do whatever it takes to scrape up the blood-money.

What's more, the families of asylum seekers are not much better off than their kidnapped loved ones when it comes to seeking official protection. Family members who stayed behind in human rights hellholes like Bukele's El Salvador can't get their government to lodge official complaints with the Mexican ambassador, and family members who made it to the USA are in no position to get their Congressjerk to intercede with ICE or the Mexican consulate. This gives Mexico's crime syndicates total latitude to kidnap, torture, and grow rich by targeting the poorest, most desperate people in the world.

The private contractors that supply services to America's prisons are basically Mexican refugee-kidnappers with pretensions and shares listed on the NYSE. After decades of consolidation, the prison contracting sector has shrunk to two gigantic companies: Securus and Viapath (formerly Global Tellink). These private-equity backed behemoths dominate their sector, and have diversified, providing all kinds of services, from prison cafeteria meals to commissary, the prison stores where prisoners can buy food and other items.

If you're following closely, this is one of those places where the hair on the back of your neck starts to rise. These companies make money when prisoners buy food from the commissary, and they're also in charge of the quality of the food in the mess hall. If the food in the mess hall is adequate and nutritious, there's no reason to buy food from the commissary.

This is what economists call a "moral hazard." You can think of it as the reason that prison ramen costs 300% more than ramen in the free world:

https://pluralistic.net/2024/04/20/captive-market/#locked-in

(Not just ramen: in America's sweltering prisons, an 8" fan costs $40, and the price of water went up in Texas prisons by 50% during last summer's heatwave.)

It's actually worse than that: if you get sick from eating bad prison food, the same company that poisoned you gets paid to operate the infirmary where you're treated:

https://theappeal.org/massachusetts-prisons-wellpath-dentures-teeth/

Now, the scam of abusing prisoners to extract desperate pennies from their families is hardly new. There's written records of this stretching back to the middle ages. Nor is this pattern a unique one: making an unavoidable situation as miserable as possible and then upcharging people who have the ability to pay to get free of the torture is basically how the airlines work. Making coach as miserable as possible isn't merely about shaving pennies by shaving inches off your legroom: it's a way to "incentivize" anyone who can afford it to pay for an upgrade to business-class. The worse coach is, the more people you can convince to dip into their savings or fight with their boss to move classes. The torments visited upon everyone else in coach are economically valuable to the airlines: their groans and miseries translate directly into windfall profits, by convincing better-off passengers to pay not to have the same thing done to them.

Of course, with rare exceptions (flying to get an organ transplant, say) plane tickets are typically discretionary. Housing, on the other hand, is a human right and a prerequisite for human thriving. The worse things are for tenants, the more debt and privation people will endure to become home-owners, so it follows that making renters worse off makes homeowners richer:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

For Securus and Viapath, the path to profitability is to lobby for mandatory, long prison sentences and then make things inside the prison as miserable as possible. Any prisoner whose family can find the funds can escape the worst of it, and all the prisoners who can't afford it serve the economically important function of showing the prisoners whose families can afford it how bad things will be if they don't pay.

If you're thinking that prisoners might pay Securus, Viapath and their competitors out of their own prison earnings, forget it. These companies have decided that the can make more by pocketing the difference between the vast sums paid by third parties for prisoners' labor and the pennies the prisoners get from their work. Remember, the 13th Amendment specifically allows for the enslavement of incarcerated people! Six states ban paying prisoners at all. North Carolina caps prisoners' wages at one dollar per day. The national average prison wage is $0.52/hour. Prisoners' labor produces $11b/year in goods and services:

https://www.dollarsandsense.org/archives/2024/0324bowman.html

Forced labor and extortion are a long and dishonorable tradition in incarceration, but this century saw the introduction of a novel, exciting way of extracting wealth from prisoners and their families. It started when private telcos took over prison telephones and raised the price of a prison phone call. These phone companies found willing collaborators in local jail and prison systems: all they had to do was offer to split the take with the jailers.

With the advent of the internet, things got far worse. Digitalization meant that prisons could replace the library, adult educations, commissary accounts, letter-mail, parcels, in-person visits and phone calls with a single tablet. These cheaply made tablets were offered for free to prisoners, who lost access to everything from their kids' handmade birthday cards to in-person visits with those kids.

In their place, prisoners' families had to pay huge premiums to have their letters scanned so that prisoners could pay (again) to view those scans on their tablets. Instead of in-person visits, prisoners families had to pay $3-10/minute for a janky, postage-stamp sized video. Perversely, jails and prisons replaced their in-person visitation rooms with rooms filled with shitty tablets where family members could sit and videoconference with their incarcerated loved ones who were just a few feet away:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

Capitalists hate capitalism. The capital classes are on a relentless search for markets with captive customers and no competitors. The prison-tech industry was catnip for private equity funds, who bought and "rolled" up prison contractors, concentrating the sector into a duopoly of debt-laden companies whose ability to pay off their leveraged buyouts was contingent on their ability to terrorize prisoners' families into paying for their overpriced, low-quality products and services.

One particularly awful consequence of these rollups was the way that prisoners could lose access to their data when their prison's service-provider was merged with a rival. When that happened, the IT systems would be consolidated, with the frequent outcome that all prisoners' data was lost. Imagine working for two weeks to pay for a song or a book, or a scan of your child's handmade Father's Day card, only to have the file deleted in an IT merger. Now imagine that you're stuck inside for another 20 years.

This is a subject I've followed off and on for years. It's such a perfect bit of end-stage capitalist cruelty, combining mass incarceration with monopolies. Even if you're not imprisoned, this story is haunting, because on the one hand, America keeps thinking of new reasons to put more people behind bars, and on the other hand, every technological nightmare we dream up for prisoners eventually works its way out to the rest of us in a process I call the "shitty technology adoption curve." As William Gibson says, "The future is here, it's just not evenly distributed" – but the future sure pools up thick and dystopian around America's prisoners:

https://pluralistic.net/2021/02/24/gwb-rumsfeld-monsters/#bossware

My background interest in the subject got sharper a few years ago when I started working on The Bezzle, my 2023 high-tech crime thriller about prison-tech grifters:

https://us.macmillan.com/books/9781250865878/thebezzle

One of the things that was on my mind when I got to work on that book was the 2017 court-case that killed the FCC's rules limit interstate prison-call gouging. The FCC could have won that case, but Trump's FCC chairman, Ajit Pai, dropped it:

https://arstechnica.com/tech-policy/2017/06/prisoners-lose-again-as-court-wipes-out-inmate-calling-price-caps/

With that bad precedent on the books, the only hope prisoners had for relief from the FCC was for Congress to enact legislation specifically granting the agency the power to regulate prison telephony. Incredibly, Congress did just that, with Biden signing the "Martha Wright-Reed Just and Reasonable Communications Act" in early 2023:

https://www.congress.gov/bill/117th-congress/senate-bill/1541/text

With the new law in place, it fell to the FCC use those newfound powers. Compared to agencies like the FTC and the NLRB, Biden's FCC has been relatively weak, thanks in large part to the Biden administration's refusal to defend its FCC nomination for Gigi Sohn, a brilliant and accomplished telecoms expert. You can tell that Sohn would have been a brilliant FCC commissioner because of the way that America's telco monopolists and their allies in the senate (mostly Republicans, but some Democrats, too) went on an all-out offensive against her, using the fact that she is gay to smear her and ultimately defeat her nomination:

https://pluralistic.net/2023/03/19/culture-war-bullshit-stole-your-broadband/

But even without Sohn, the FCC has managed to do something genuinely great for America's army of the imprisoned. This week, the FCC voted in price-caps on prison calls, so that call rates will drop from $11.35 for 15 minutes to just $0.90. Both interstate and intrastate calls will be capped at $0.06-0.12/minute, with a phased rollout starting in January:

https://arstechnica.com/tech-policy/2024/07/fcc-closes-final-loopholes-that-keep-prison-phone-prices-exorbitantly-high/

It's hard to imagine a policy that will get more bang for a regulator's buck than this one. Not only does this represent a huge savings for prisoners and their families, those savings are even larger in proportion to their desperate, meager finances.

It shows you how important a competent, qualified regulator is. When it comes to political differences between Republicans and Democrats, regulatory competence is a grossly underrated trait. Trump's FCC Chair Ajit Pai handed out tens of billions of dollars in public money to monopoly carriers to improve telephone networks in underserved areas, but did so without first making accurate maps to tell him where the carriers should invest. As a result, that money was devoured by executive bonuses and publicly financed dividends and millions of Americans entered the pandemic lockdowns with broadband that couldn't support work-from-home or Zoom school. When Biden's FCC chair Jessica Rosenworcel took over, one of her first official acts was to commission a national study and survey of broadband quality. Republicans howled in outrage:

https://pluralistic.net/2023/11/10/digital-redlining/#stop-confusing-the-issue-with-relevant-facts

The telecoms sector has been a rent-seeking, monopolizing monster since the days of Samuel Morse:

https://pluralistic.net/2024/07/18/the-bell-system/#were-the-phone-company-we-dont-have-to-care

Combine telecoms and prisons, and you get a kind of supermonster, the meth-gator of American neofeudalism:

https://www.nbcnews.com/news/us-news/tennessee-police-warn-locals-not-flush-drugs-fear-meth-gators-n1030291

The sector is dirty beyond words, and it corrupts everything it touches – bribing prison officials to throw out all the books in the prison library and replace them with DRM-locked, high-priced ebooks that prisoners must toil for weeks to afford, and that vanish from their devices whenever a prison-tech company merges with a rival:

https://pluralistic.net/2024/04/02/captive-customers/#guillotine-watch

The Biden presidency has been fatally marred by the president's avid support of genocide, and nothing will change that. But for millions of Americans, the Biden administration's policies on telecoms, monopoly, and corporate crime have been a source of profound, lasting improvements.

It's not just presidents who can make this difference. Millions of America's prisoners are rotting in state and county jails, and as California has shown, state governments have broad latitude to kick out prison profiteers:

https://pluralistic.net/2023/05/08/captive-audience/#good-at-their-jobs

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/19/martha-wright-reed/#capitalists-hate-capitalism

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

Flying Logos (modified) https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

--

kgbo (modified) https://commons.wikimedia.org/wiki/File:Suncorp_Bank_ATM.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#prison tech#fcc#martin hench#marty hench#the bezzle#captive audiences#carceral state#worth rises#bezzles#Martha Wright-Reed Just and Reasonable Communications Act#capitalists hate capitalism#shitty technology adoption curve

348 notes

·

View notes

Note

Sex Love Lit girlies! I watched Crash Landing On You (my first k-drama) and now I have a conundrum: A) I want to watch more k-dramas, and B) No k-drama can seem to measure up to CLOY 😭 Could you put together a playlist of entry-level k-dramas for new fans that capture the CLOY magic? Bonus points if they’re on Netflix

@sliceoflifegirl thanks for the ask!

(Corinne here) First of all, welcome to KDrama land! Crash Landing on You was my second ever KDrama, and the one that really got me hooked. I’m gonna be honest, it’s a hard one to top when you’re mid emotional hangover! That said, I love this ask and recommending KDramas to people, so I’m more than happy to recommend some. My strategy here, rather than recommend something that exactly mimics CLoY (because imo, there’s nothing exactly like it), is to recommend dramas that I think are some of the best of their genre—with some aspect that might help scratch that CLOY itch ;) So, without further ado, here is your KDrama Starter Pack:

Goblin aka Guardian: The Lonely and Great God—This fantasy romance is a classic for a reason. The set-up: 900+ year old goblin Kim Shin is on a quest to find the goblin bride to pull the sword out of his chest and finally let him die. The catch: when he finds goblin bride Eun-tak and starts to fall in love with her, he wonders if there might be something to this whole “life” thing after all. Also featured: a glum Grim Reaper, with whom Kim Shin has a top tier bromance, who has a doomed romance of his own. Goblin gave me one of the biggest emotional hangovers post-CLOY in my early KDrama days. One caveat: Kim Shin meets Eun Tak when she’s in high school, so if huge age gaps in fantasy romances give you the ick, maybe give this one a pass (in which case the fantasy romances I recommend checking out instead are Alchemy of Souls and Doom at Your Service, both on Netflix atm). (On Viki)

Mr. Sunshine—My pick for one of the best historical (aka sageuk) KDramas out there. Set in early 1900’s Joseon, just before/in the early days of Japanese occupation, this drama follows the lives of five equally compelling characters as they navigate the political turmoil of the time. At the center are Lady Ae-sin, an aristocratic lady with a tendency for dressing up as a man and sneaking around at night on missions for the rebels, and Eugene Choi, an American Marine now stationed in Joseon who escaped enslavement there as a child and has mixed feelings about the land of his birth. This one resonates with the forbidden/doomed love of people from different classes and cultures from CLOY. (On Netflix)

Reply 1988—This slice of live drama set in Seoul in 1988 follows five families who live in the same neighborhood, and especially five of their high school aged children as they grow up during a particularly vibrant time in South Korea’s recent history. Like the other installments in the Reply series, the series uses two of the main characters in the present day (or present to when it was released, anyway) looking back—which means that viewers know the Deok-sun ends up married to one of her four besties, but which one?? Still, while the love triangle mystery is fun, at its heart, this story is about community. It’ll scratch the CLoY itch for the North Korean market lady shenanigans, and a few others as well (especially if you like intense yearning in your dramas). (On Netflix)

Business Proposal—If you’d like romance of a completely different genre than CLOY, look no further than Business Proposal! In this KDrama, Shin Ha-ri goes on a blind date in place of her friend as a favor only find out that the date is with her boss. This tightly plotted romantic comedy plays with more rom com tropes than you can shake a stick at, but never sits with one so long that it gets old. The B couple is also fire, and helps move things along whenever the A couple gets into a rut. This drama also features some chaebol (rich business family) shenanigans a la CLOY. (On Netflix)

Extraordinary Attorney Woo–If you’re in the mood for a workplace comedy/drama, look no further than Extraordinary Attorney Woo. Featuring the incandescent Park Eun Bin as rookie attorney Woo Young Woo, this legal drama features about a case per episode as Attorney Woo finds her way in the world alongside a delightful main cast of characters. (On Netflix)

Little Women—My choice for the makjang to include on this list (a genre in which extreme storylines are treated very seriously), this drama focuses on the three Oh sisters as the oldest finds that her friend who died under mysterious circumstances has left her 70 billion that a powerful political family will stop at nothing to get their hands on. Will the story always make complete sense? No. But will the stellar performances, fast-paced, genre-mixing drama, and wild cliffhangers keep you on the edge of your seat as you binge the whole thing? Absolutely. (On Netflix)

Extraordinary You—Youth dramas may or may not be your thing, but if you have the patience for the shenanigans of high schools, Extraordinary You is my top pick. In this fantasy romance, Eun Dan-Oh discovers that she is actually a character in a comic–and she’s not even the main one! While still high school appropriate, Eun Dan-oh’s literally doomed-by-the-narrative and impossible circumstances romance with Haru, another side character, is another one from my early KDrama days to stick with me just as much as Yoon Se-ri and Ri Jeong-hyeokk’s. (On Viki)

Search: WWW—Ayanni’s particular contribution to this list, this modern romantic drama focuses on intersecting lives of three women working in the fast-paced tech industry at the top two competing web portal companies. Just as interesting as each woman’s various romantic entanglement are their entanglements with each other as they put their careers ahead of just about everything else. Ayanni says she especially appreciates this one because it focuses specifically on three women (also in this genre are Be Melodramatic and Because this is My First Life).

Happy watching--and do let us know if you pick any of these up!

#crash landing on you#goblin#guardian: the lonely and great god#mr. sunshine#reply 1988#business proposal#kdrama recommendations#extraordinary attorney woo#woo young woo#little women kdrama#extraordinary you#search: www#korean drama#korean dramas#kdrama#asks#kdrama list

48 notes

·

View notes

Text

NOW EDUCATE YOUR CUSTOMERS & INVESTORS INSTANTLY

Now, drive your Bank’s revenue by displaying most knowledgeable content on the most captivating screens and empower your Customers to help themselves, while allowing your staff to handle more complex matters. Display your Bank’s core values instantly! Boost your conversions in the process alongwith Customer retention.

Our Digital Signage Solutions will benefit not only your external customers, but also your internal staff with continued updates & internal alerts meant to increase efficiency and enhance productivity.

We help you update your Bank’s content remotely with ease thus allowing you to stay ahead of your competition and technological trends.

Create trust -by displaying a financially secured future, as visuals tend to make an everlasting impression- inspiring people and customers to act alike!

Get ready to witness the positive change while we install the most attractive Digital Signage Solutions in your Bank- from Front Office to Lobbies!

Digital signage for banks

Bank digital signage solutions

Digital signage for bank branches

Interactive digital signage for banks

Digital signage displays for banks

Bank digital menu boards

Digital signage for bank promotions

Digital signage for financial institutions

Digital signage for bank marketing

Digital signage for customer engagement in banks

Visit

Add: MNG Tower, 2nd Floor, Plot no. A-2, Sector-17, Dwarka,

South West Delhi, New Delhi-110078

Call: +91-9650082579

#Digital signage for banks#Bank digital signage solutions#Digital signage for bank branches#Interactive digital signage for banks#Digital signage displays for banks#Bank digital menu boards#Digital signage for bank promotions#Digital signage for financial institutions#Digital signage for bank marketing#Digital signage for customer engagement in banks#Digital signage for banking services#Smart digital signage for banks#Digital signage for ATM displays#Custom digital signage for banks#Digital signage for bank advertising#Digital signage for bank branding#Digital signage for loan services in banks#Digital signage for bank communication

0 notes

Text

I have sort of made fun of Eisenberg’s philosophy as a quirk of crypto, but I guess that’s not really right. It’s a quirk of music streaming platforms too, and online advertising markets, and financial markets. Basically much of modern economics, and life, has the following characteristics:

1 Everything is intermediated through some depersonalized automated electronic exchange. 2 The automated electronic exchange has a mechanism — how it actually works, what the exchange’s software allows you to do — and also rules, the terms of service regulating how you can use the mechanism, which are fuzzier than the mechanism and written in small print, things like “don’t do fraud” or “you have to be a human” or whatever. 3 The mechanism is much more legible and salient than the rules, and in a depersonalized electronic world people treat the mechanism as the rules: They don’t believe that the rules exist, because the rules seem to contradict how the service works. The basic description of Spotify’s mechanics suggests Smith’s alleged arbitrage; if he didn’t do it surely someone else would.

Everything is like this. We talked last week about the “infinite free money Chase ATM glitch,” in which people on TikTok discovered that if they wrote themselves a fake check and deposited it in an ATM and then withdrew the money, they’d have “free money.” Everyone used to know that (1) one way to get free money was to write a fake check and trick someone into cashing it but (2) that was obviously a crime. But now you don’t have to trick anyone into cashing the check: You just go to a machine and put the check into the machine, and if the machine gives you back money then surely that’s just how the machine is supposed to work?

14 notes

·

View notes

Text

ATM Market: Trends, Players, Market Size and Growth

The Automated Teller Machine (ATM) market has undergone significant transformations over the years, driven by advancements in technology, changing consumer behavior, and the need for enhanced security measures. As the demand for cashless transactions continues to rise, the ATM market is poised for growth, with key players vying for market share. In this blog, we will delve into the current market size, share, and growth prospects, as well as highlight the major players and their market share.

Market Size and Growth

The global ATM market size was valued at USD 14.4 billion in 2020 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% from 2021 to 2028, reaching USD 19.4 billion by 2028. The growth is driven by the increasing adoption of digital payments, the need for enhanced security measures, and the expansion of the financial services sector.

Market Share

The ATM market is dominated by a few key players, with the top five companies accounting for over 70% of the market share. The market share of the top players is as follows:

Diebold Nixdorf: 24.1%

NCR Corporation: 20.5%

Hyosung: 12.3%

GRG Banking: 8.1%

Euronet Worldwide: 5.5%

These companies have established themselves as leaders in the ATM market through their strong product offerings, extensive distribution networks, and significant investments in research and development.

Market Trends

Several trends are shaping the ATM market, including:

Cashless Transactions: The rise of digital payments is driving the demand for cashless transactions, leading to an increase in the adoption of ATMs that support contactless and mobile payments.

Security: The need for enhanced security measures is a major concern for ATM operators, driving the adoption of advanced security features such as biometric authentication and encryption.

Cloud-Based Solutions: The shift towards cloud-based solutions is enabling ATM operators to reduce costs, improve efficiency, and enhance customer experience.

Smart ATMs: The integration of smart technologies, such as artificial intelligence and the Internet of Things (IoT), is transforming the ATM experience, enabling real-time monitoring and improved customer service.

Regional Analysis

The ATM market is geographically diverse, with different regions exhibiting varying growth rates. The key regions and their market share are as follows:

Asia-Pacific: 34.5%

North America: 26.2%

Europe: 20.5%

Latin America: 8.5%

Middle East and Africa: 10.3%

The Asia-Pacific region is expected to experience the highest growth rate due to the rapid expansion of the financial services sector and the increasing adoption of digital payments.

Conclusion The ATM market is poised for growth, driven by the increasing adoption of digital payments, the need for enhanced security measures, and the expansion of the financial services sector. The market is dominated by a few key players, with Diebold Nixdorf, NCR Corporation, Hyosung, GRG Banking, and Euronet Worldwide accounting for over 70% of the market share. The market trends, including cashless transactions, security, cloud-based solutions, and smart ATMs, are shaping the future of the ATM industry. As the demand for cashless transactions continues to rise, the ATM market is expected to experience significant growth, with the Asia-Pacific region leading the charge.

#ATM Managed Services Industry#UAE ATM Managed Services Market#future of ATM industry#ATM Managed Services Market#ATM Cash Management Market

0 notes

Text

Gas Station Stream of Consciousness Post

Gas Stations as Liminal Spaces

I've had quite a few hyperfixations in my day - ATMs, laundry detergents, credit cards - so my current one pertaining to gas stations is fitting considering my affinity for liminal spaces and the dedication of this blog to them. Liminal spaces are transitory in nature, hence their portrayal in online circles through photos of carpeted hallways, illuminated stairwells, dark roads, and backrooms, among other transitional points.

Gas stations are posted online as well; images of their fuel pumps or neon signage photographed through a rainy car window communicate their liminality and the universal experiences they provide to all of society. Perhaps they are the ultimate specimen of a liminal space. The machines they are created for, automobiles and tractor trailers alike, themselves are tools for motion, vestibules that enable travel and shipment across long distances at high speeds. Cars and roads are liminal spaces, albeit in different formats, and gas stations serve as their lighthouses. Vehicles at filling stations, therefore, are in a sense liminal spaces within liminal spaces within liminal spaces.

The uniqueness of a gas station as a liminal space, however, is its intersection with the economics and aesthetics of capitalism. Gasoline (and diesel fuel) is a commodity, downstream from crude oil, merely differentiated by octane ratings. Some argue that minute distinctions between agents, detergents, and additives make some brands better than others. Indeed, fuels that are approved by the Top Tier program, sponsored by automakers, have been shown to improve engine cleanliness and performance, but this classification does not prefer specific refiners over others; it is simply a standard. To a consumer, Top Tier fuels are themselves still interchangeable commodities within the wider gasoline commodity market.

The Economics of Gas Stations

The market that gas stations serve is characterized by inelastic demand, with customers who reckon with prices that fluctuate day in and day out. This is not to say that consumer behavior does not change with fuel prices. It has been observed that as prices rise, consumers are more eager to find the cheapest gas, but when prices fall, drivers are less selective with where they pump and are just happy to fill up at a lower price than last week. In response, gas stations lower their prices at a slower rate than when increasing prices, allowing for higher profit margins when wholesale prices fall. This has been dubbed the "rockets and feathers" phenomenon.

When portrayed as liminal spaces, gas stations are most often depicted at night, places of solitude where one may also enter the adjacent convenience store and encounter a fellow individual who isn't asleep, the modern day lightkeeper. The mart that resides at the backcourt of a gas station is known to sell goods at higher prices than a supermarket, simultaneously taking advantage of a captive customer, convenient location, and making up for the inefficiencies of a smaller operation. It may come as no surprise, then, that gas stations barely make any money from fuel sales and earn their bulk through C-store sales. This is a gripe I have with our economic system. Business is gamified, and in many cases the trade of certain goods and services, called loss leaders, is not an independent operation and is subsidized by the success of another division of a business, a strategy inherently more feasible for larger companies that have greater scale to execute it.

Nevertheless, most gas station owners, whether they have just one or hundreds of sites, find this method fruitful. Even though most gas stations in the US sell one of a handful of national brands, they operate on a branded reseller, or dealer, model, with oil companies themselves generally not taking part in the operations of stations that sell their fuels. The giants do still often have the most leverage and margin in the business, with the ability to set the wholesale price for the distributor, which sells at a markup to the station owner, which in turn will normally make the least profit in the chain when selling to the end customer at the pump. This kind of horizontal integration that involves many parties lacks the synergies and efficiencies of vertical integration that are so applauded by capitalists, but ends up being the most profitable for firms like ExxonMobil, who only extract and refine oil, and on the other end of the chain merely license their recognizable brands to the resellers through purchasing agreements. Furthermore, in recent years, independent dealers have sold their businesses to larger branded resellers, in many cases the ones from whom they had been buying their fuel.

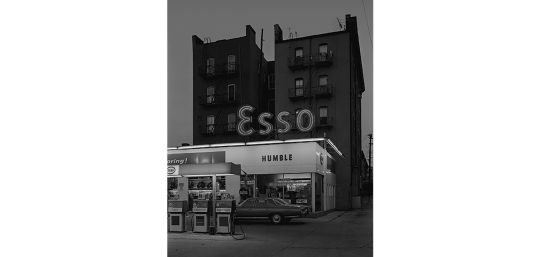

A Word on ExxonMobil's Branding Potential

The largest publicly traded oil company in the world is Exxon Mobil Corporation. It is a direct descendent of the Rockefeller monopoly, Standard Oil, which was broken up in 1911 into 34 companies, the largest of which was Jersey Standard, which became Exxon in 1973. This title was generated by a computer as the most appealing replacement name to be used nationwide to unify the Humble, Enco, and Esso brands, decades before AI was spoken of. The latter brand is still used outside of the United States for marketing, arising from the phonetic pronunciation of the initials of Standard Oil. In 1999, Exxon and Mobil merged, and the combined company to this day markets under separate brands. Exxon is more narrowly used, to brand fuel in the United States, while Mobil has remained a motor oil and industrial lubricant brand, as well as a fuel brand in multiple countries.

Mobil originated in 1866 as the Vacuum Oil Company, which first used the current brand name for Mobiloil, and later Mobilgas and Mobilubricant products, with the prefix simply short for "automobile". Over time, Mobil became the corporation's primary identity, with its official name change to Mobil Oil Corporation taking place in 1966. Its updated wordmark with a signature red O was designed by the agency Chermayeff & Geismar, and the company's image for service stations was conceived by architect Eliot Noyes. New gas stations featured distinctive circular canopies over the pumps, and the company's recognizable pegasus logo was prominently on display for motorists.

I take issue with the deyassification of the brand's image over time. As costs were cut and uniformity took over, rectangular canopies were constructed in place of the special ones designed by Noyes that resembled large mushrooms. The pegasus remained a prominent brand icon, but the Mobil wordmark took precedence, which I personally believe to be an error in judgement. This disregard for the pegasus paved the way for its complete erasure in 2016 with the introduction of ExxonMobil's "Synergy" brand for its fuel. The mythical creature is now much smaller and appears only at the top right corner of pumps at Mobil gas stations, if at all.

Even into the 90s and the 21st century the Pegasus had its place in Mobil's marketing. In 1997, the company introduced its Speedpass keytag, which was revolutionary for its time and used RFID technology, akin to mobile payments today, to allow drivers to get gas without entering the store or swiping a card. When a Speedpass would be successfully processed, the pegasus on the gas pump would light up red.

When Exxon and Mobil merged in 1999, the former adopted the payment method too, with Exxon's less iconic tiger in place of the pegasus.

The program was discontinued in 2019 in favor of ExxonMobil's app, which is more secure since it processes payments through the internet rather than at the pump.

What Shell has done with its brand identity is what Mobil should've done for itself. The European company's logo was designed in 1969 by Raymond Loewy, and is a worth contender for the "And Yet a Trace of the True Self Exists in the False Self" meme. In recent years, Shell went all in on its graphic, while Mobil's pegasus flew away. I choose to believe that the company chose to rebrand its stations in order to prevent the malfunction in the above image from happening.

ExxonMobil should have also discontinued the use of the less storied Exxon brand altogether, and simplifying its consumer-facing identity to just the global Mobil mark. Whatever, neither of the names are actual words. As a bonus, here is a Google map I put together of all 62 gas stations in Springfield, MA. This is my idea of fun. Thanks for reading to the end!

#exxonmobil#exxon#mobil#gas station#gas stations#liminal space#liminal spaces#liminal#liminalcore#liminal aesthetic#justice for pegasus#shell#corporations#capitalism#branding#marketing#standard oil#economics#gas#gasoline#fuel#oil companies

110 notes

·

View notes

Note

For the meme, 7, 33, 50!

7. Any groceries you’ve been getting into lately?

at some point i became a potato salad snob. i used to be fine with the kroger brand mass-produced stuff but now i'm pretty much like Met Market's Red White & Bleu Potato Salad Or Bust. so when i need to get myself a little treat i go to their lil deli department and load up on that potato salad specifically. i expect at some point i will become too snobby even for this and then have to figure out how to make my own damn potato salad to meet my own highly specific tastes

also pita is pretty great??? i love lazy dinners and pita + hummus, muhammara, pimento cheese dip, etc, is just. a+++, most loved bread in our house atm

33. What’s something you collect?

i already collected stuffed animals at an alarming rate prior to meeting my partner and fortunately/unfortunately he is the worst enabler so like. i have Opinions on the best plushie brands. i have paid remailer services more than once to get me a cool plushie that was only sold in Norway or Japan or whatnot. literally this weekend i was killing time in a mall, and was about to buy the CUTEST lil woodpecker stuffed animal b/c he was just a lil guy and he was going to look great on the dashboard of my car... and then my partner had to be like "lua, don't buy it, i actually already bought one for you when you weren't looking and was planning to gift it to you as soon as we left the store" lmao

anyway yeah i thought i would grow out of stuffed animals once i was no longer a kid but turns out the only thing that's changed is better finances with which to buy more stuffed animals lol

50. Pro or anti throw pillows?

i guess i'm not anti in the sense of i think they look nice in other people's places but uhhhh. i don't think i've owned one since college and i probably haven't made my bed in like a month lmao, so yeah, no throw pillows here

10 notes

·

View notes