#1099Forms

Explore tagged Tumblr posts

Text

#1099Forms#TaxCompliance#IRSReporting#CorrectYour1099#TaxFiling#BusinessTaxes#FreelancerTaxes#TaxMistakes#FileAccurately#CPATips

0 notes

Text

#1099Forms#TaxCompliance#IRSReporting#CorrectYour1099#TaxFiling#BusinessTaxes#FreelancerTaxes#TaxMistakes#FileAccurately#CPATips

0 notes

Text

1099 vs W-2 Forms: Key Differences Explained Clarifying the key differences between 1099 and W-2 forms to ensure you’re using the right one for your employees or contractors.

#Form1099#W2#TaxTips#Form1099Online#SecureFiling#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

Filing your 1099 forms online?

Filing your 1099 forms online? Trust the experts at File 1099 Forms Online for a seamless experience. Say goodbye to paperwork and hello to convenience

#taxfiling#onlinefiling#IRSforms#form1099online#1099Forms#TaxReporting#1099NEC#1099MISC#IncomeReporting

0 notes

Text

youtube

Understanding employment's tax implications and forms is crucial in any profession, including veterinary medicine. #shorts This video addresses explicitly whether veterinary associates typically receive a 1099 form, diving into the nuances of employment status and tax obligations in the veterinary field. It's an essential resource for veterinary associates, practice owners, and accounting professionals in veterinary medicine. 🔍 Key Insights You'll Discover: -1099 Form Explained: A clear explanation of what a 1099 form is and who typically receives it. -Employment Status in Veterinary Practices: Discussing how employment status (independent contractor vs. employee) affects whether a veterinary associate receives a 1099. -Tax Obligations for Veterinary Associates: Insight into the tax responsibilities associated with different types of employment in veterinary medicine. -Best Practices for Veterinary Associates and Employers: Advice for associates and practice owners on managing tax documentation and compliance. 👩⚕️ Ideal for: Veterinary associates, veterinary practice owners, and financial professionals specializing in veterinary medicine. 🌟 Strengthen Your Veterinary Practice with Expert Legal Support! 🌟 At Chelle Law, we understand the unique challenges veterinary practice owners face. That's why we specialize in crafting comprehensive Veterinary Associate Contracts to ensure your practice operates smoothly and securely. Protect your practice and uphold the highest standards of veterinary care with contracts tailored to your specific needs. Trust us to handle the legal intricacies, freeing you to focus on providing exceptional animal care. 🐾✅ 🔗 Engage With Our Community: Chelle Law 480-716-9030 https://veterinarian-contract-attorney.com/ Facebook Group: https://www.facebook.com/veterinarycontractattorney/ [email protected] #VeterinaryFinance #1099Form #VeterinaryCareer The information contained in this video is provided for informational purposes only and should not be construed as legal advice on any subject matter. You should not act or refrain from acting based on any content included in this video without seeking legal or other professional advice. This video contains general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content on this site. The operation of this site does not create an attorney-client relationship between you and Chelle Law. Do Veterinary Associates Receive a 1099? published first on https://www.youtube.com/@chellelaw/

0 notes

Text

Demystify the complexities of 1099 Forms with our comprehensive guide! From decoding each variant to utilizing them for tax success, this handbook simplifies tax reporting. Master the art of income reporting effortlessly. #1099Forms #TaxTips #FinancialLiteracy

#1099 Forms#Tax Reporting#Income Reporting#Taxation#Financial Literacy#Freelancing#Investments#Tax Compliance

0 notes

Photo

Ready to fill the form W-2 in 2021. To know what's the latest updates on form W-2. Register yourself by clicking the link: https://bit.ly/3hRjBzW to join our live training course on "Form W-2 and Other Payroll Updates" by #JasonDineson.

#training#hr#payrollcompliance#legalprofessionals#hrmanagers#payrollprofessionals#payrollupdates2021#miscupdates#supremetrainer#1099updates#form941#1099form#w2form

1 note

·

View note

Link

(Forbes) - IRS Form 1099 season is here. Some people can't wait for those annoying little tax reports to come in the mail. They remind you that you earned interest, received a consulting fee, or were paid some other kind of income

0 notes

Text

1099 vs W-2 Forms: Key Differences Explained

Clarifying the key differences between 1099 and W-2 forms ensures you’re using the right one for your employees or contractors.

#Form1099#W2#TaxTips#Form1099Online#SecureFiling#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

#1099Form#OnlineFiling#TaxFiling#EFile1099#Form1099Online#TaxPreparation#TaxSeason#SecureFiling#IRSCompliance

0 notes

Text

youtube

Understanding employment's tax implications and forms is crucial in any profession, including veterinary medicine. This video addresses explicitly whether veterinary associates typically receive a 1099 form, diving into the nuances of employment status and tax obligations in the veterinary field. It's an essential resource for veterinary associates, practice owners, and accounting professionals in veterinary medicine. 🔍 Key Insights You'll Discover: -1099 Form Explained: A clear explanation of what a 1099 form is and who typically receives it. -Employment Status in Veterinary Practices: Discussing how employment status (independent contractor vs. employee) affects whether a veterinary associate receives a 1099. -Tax Obligations for Veterinary Associates: Insight into the tax responsibilities associated with different types of employment in veterinary medicine. -Best Practices for Veterinary Associates and Employers: Advice for associates and practice owners on managing tax documentation and compliance. 👩⚕️ Ideal for: Veterinary associates, veterinary practice owners, and financial professionals specializing in veterinary medicine. 🌟 Strengthen Your Veterinary Practice with Expert Legal Support! 🌟 At Chelle Law, we understand the unique challenges veterinary practice owners face. That's why we specialize in crafting comprehensive Veterinary Associate Contracts to ensure your practice operates smoothly and securely. Protect your practice and uphold the highest standards of veterinary care with contracts tailored to your specific needs. Trust us to handle the legal intricacies, freeing you to focus on providing exceptional animal care. 🐾✅ 🔗 Engage With Our Community: Chelle Law 480-716-9030 https://veterinarian-contract-attorney.com/ Facebook Group: https://www.facebook.com/veterinarycontractattorney/ [email protected] #VeterinaryFinance #1099Form #VeterinaryCareer The information contained in this video is provided for informational purposes only and should not be construed as legal advice on any subject matter. You should not act or refrain from acting based on any content included in this video without seeking legal or other professional advice. This video contains general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content on this site. The operation of this site does not create an attorney-client relationship between you and Chelle Law. Do Veterinary Associates Receive a 1099? published first on https://www.youtube.com/@chellelaw/

0 notes

Text

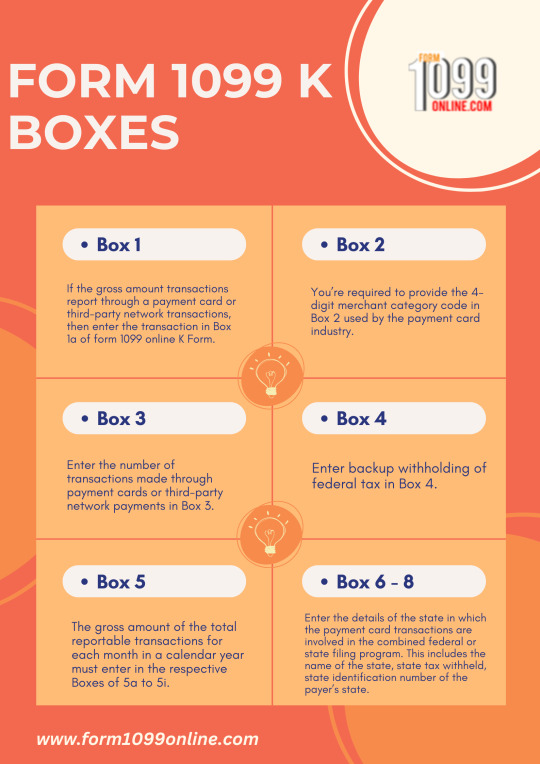

Form 1099 K Boxes

Form 1099-K includes various boxes for reporting different types of transactions and information. Box 1a is for the gross amount of transactions processed through payment cards or third-party networks, while Box 1b is specifically for transactions where the card was not present. Box 2 requires the 4-digit merchant category code, and Box 3 records the number of such transactions. Boxes 4 to 8 capture backup withholding, monthly gross transaction amounts, and state-related details such as tax withheld and payer's state identification number.

#1099K#TaxFiling#EFile1099#SecureFiling#Form1099Online#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

What Instigated Changes in Form 1099-K Reporting?

The American Rescue Plan Act of 2021 (ARPA) instigated significant alterations in the reporting requirements associated with Form 1099-K. Preceding ARPA, the threshold triggering reporting by third-party settlement organizations (TPSOs) stood at receiving gross payments surpassing $20,000, coupled with over 200 transactions for a payee. However, ARPA redefined this threshold, mandating reporting by TPSOs upon receipt of gross payments exceeding $600 for goods or services for a payee, without any transaction count limitation.

#1099K#TaxFiling#EFile1099#SecureFiling#Form1099Online#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

How the 1099-K Tax Form is calculated?

Understanding how the 1099-K tax form is calculated is essential for accurate tax reporting. It includes all your sales through payment services from January 1 to December 31 of a given year. This form is similar to the W-2 form issued by employers to employees, providing a summary of your sales transactions processed by a third-party payment service.

#1099K#TaxFiling#EFile1099#SecureFiling#Form1099Online#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

Filing 1099 K Tax Forms online with Form1099online.com is 100% safe & secure

Filing 1099 K tax forms online with Form1099online.com is 100% safe and secure. Our platform ensures your data is protected while simplifying the filing process. Trust us for a hassle-free and secure tax filing experience.

#1099K#TaxFiling#EFile1099#SecureFiling#Form1099Online#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

Looking for a reliable partner for tax filing?

Rely on File 1099 Forms Online for trusted expertise in tax filing. Our dedicated team guarantees accuracy and efficiency in handling your forms. Simplify your tax process with confidence, knowing your forms are in reliable hands.

#1099forms#taxfiling#onlinetaxfiling#easytaxfiling#paperlessfiling#efiling#taxseason2024#Form1099online

0 notes