#TaxSecurity

Explore tagged Tumblr posts

Text

1099 vs W-2 Forms: Key Differences Explained Clarifying the key differences between 1099 and W-2 forms to ensure you’re using the right one for your employees or contractors.

#Form1099#W2#TaxTips#Form1099Online#SecureFiling#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

Understanding the IRS IP PIN Program Enhance your tax security with the IRS IP PIN Program, a six-digit code protecting taxpayers from identity theft during the filing process. Learn about its significance in the collaborative Security Summit Partnership and the proactive measures against tax-related identity theft.

1 note

·

View note

Photo

If your client receives a call from someone claiming to be an #IRS representative but suspects otherwise, encourage him report it to [email protected]. #TaxSecurity IRS.gov/phishing #anointedforprosperity #onestoptaxes https://www.instagram.com/p/B3uYmv3leXX/?igshid=epzzrhu2jrs6

0 notes

Photo

Repost from @vspcompany "Налоговая безопасность вашего бизнеса": Коммерческий директор ВСП, Марина Смирнова, принимает участие в работе конференции в Москве. "Tax security of your business": VSP Commercial Director, Marina Smirnova, participates in the conference work in Moscow. #tax #taxsecurity #conference #налоговаябезопасность #конференция2017 #commercialdirector (at Belgorod)

0 notes

Photo

NEW SCAM: Criminals file fraudulent #IRS returns and later ask taxpayers to hand over tax refunds supposedly issued in error. #TaxSecurity NEW SCAM: Criminals file fraudulent #IRS returns and later ask taxpayers to hand over tax refunds supposedly issued in error. #TaxSecurity

0 notes

Photo

#TaxSecurity: Never reply to emails, texts or pop-up messages requesting #tax or financial info. http://go.usa.gov/x8nSh #IRS #taxpapers #TaxPros #digitalpayments #taxseason2017 #money #instantcash #j3solutuons #j3essentials #j3financialservices #employers #moremoneyback #allidoistaxes #taxreturns #accountants #taxpreparer #taxseason #Millions #Millionaire #Cash #Check #taxes #moneymaker #taxbosslady #WorkingWomen #WorkingWithTaxes (at Jacksonville, Florida)

0 notes

Text

1099 vs W-2 Forms: Key Differences Explained

Clarifying the key differences between 1099 and W-2 forms ensures you’re using the right one for your employees or contractors.

#Form1099#W2#TaxTips#Form1099Online#SecureFiling#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

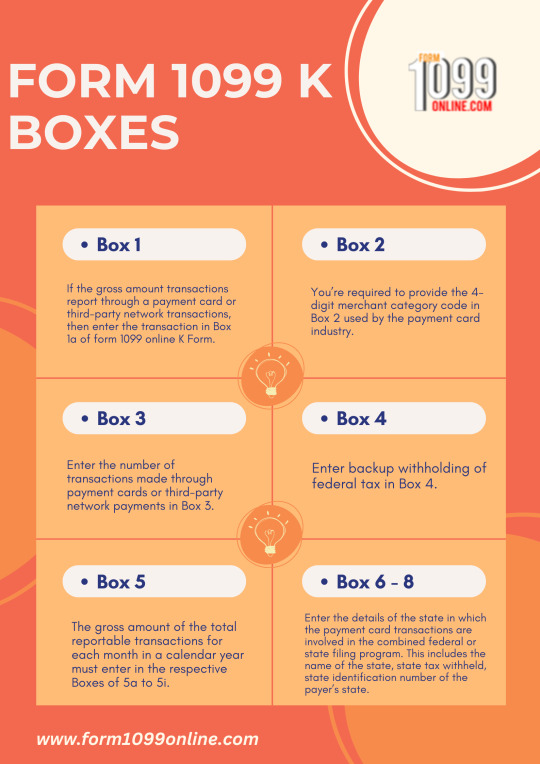

Form 1099 K Boxes

Form 1099-K includes various boxes for reporting different types of transactions and information. Box 1a is for the gross amount of transactions processed through payment cards or third-party networks, while Box 1b is specifically for transactions where the card was not present. Box 2 requires the 4-digit merchant category code, and Box 3 records the number of such transactions. Boxes 4 to 8 capture backup withholding, monthly gross transaction amounts, and state-related details such as tax withheld and payer's state identification number.

#1099K#TaxFiling#EFile1099#SecureFiling#Form1099Online#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

What Instigated Changes in Form 1099-K Reporting?

The American Rescue Plan Act of 2021 (ARPA) instigated significant alterations in the reporting requirements associated with Form 1099-K. Preceding ARPA, the threshold triggering reporting by third-party settlement organizations (TPSOs) stood at receiving gross payments surpassing $20,000, coupled with over 200 transactions for a payee. However, ARPA redefined this threshold, mandating reporting by TPSOs upon receipt of gross payments exceeding $600 for goods or services for a payee, without any transaction count limitation.

#1099K#TaxFiling#EFile1099#SecureFiling#Form1099Online#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

How the 1099-K Tax Form is calculated?

Understanding how the 1099-K tax form is calculated is essential for accurate tax reporting. It includes all your sales through payment services from January 1 to December 31 of a given year. This form is similar to the W-2 form issued by employers to employees, providing a summary of your sales transactions processed by a third-party payment service.

#1099K#TaxFiling#EFile1099#SecureFiling#Form1099Online#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Text

Filing 1099 K Tax Forms online with Form1099online.com is 100% safe & secure

Filing 1099 K tax forms online with Form1099online.com is 100% safe and secure. Our platform ensures your data is protected while simplifying the filing process. Trust us for a hassle-free and secure tax filing experience.

#1099K#TaxFiling#EFile1099#SecureFiling#Form1099Online#TaxCompliance#SafeFiling#OnlineTaxServices#1099Forms#TaxSecurity

0 notes

Photo

#IRS does not initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. Stay on guard for #TaxSecurity ##anointedforprosperity #onestoptaxes #TaxPros https://www.instagram.com/p/B2w0rLjlGgs/?igshid=1qi6t9t3at87s

0 notes

Photo

#TaxSecurity: Links may open official-looking sites asking for SSNs…

0 notes

Photo

Safeguarding Taxpayer Data – Avoid Scams http://go.usa.gov/x8w8f #TaxSecurity #IRS #tax #taxpapers #TaxPros #digitalpayments #taxseason2017 #money #instantcash #j3solutuons #j3essentials #j3financialservices #employers #moremoneyback #allidoistaxes #taxreturns #accountants #taxpreparer #taxseason #Millions #Millionaire #Cash #Check #taxes #moneymaker #taxbosslady #WorkingWomen #WorkingWithTaxes

0 notes