Don't wanna be here? Send us removal request.

Text

Feeling confused about IRS audit. Relax yourself and watch our #livewebinar on "CONTRACTOR VS EMPLOYEE HOW TO TELL THE DIFFERENCE" by industry expert #JasonDinesen. To learn more about the topic sign up for the #livetrainingcourse by clicking the link: https://bit.ly/3pUkNWI

0 notes

Text

Have you noted The Wage and Hour Division's enforcement of the FLSA is carried out by investigators. Find out how to avoid the penalties and fines your company may subject to with our #livewebinar on "WAGE AND HOUR COMPLIANCE FOR 2021" by industry expert #VickiMLambert. Click the link: https://bit.ly/3txRdIK and signup for the webinar to learn more about the topic

0 notes

Photo

Have you paid attention to the updates issued by EEOC under ADA. To know more about the interactive process under ADA join our #livewebinar on "2021 UPDATES ON REASONABLE ACCOMMODATION UNDER ADA) by #DianeLDee. Sign up for #livetrainingcourse by clicking the link: https://bit.ly/2MH7DNT

Description:

Disability accommodation is an important and visible aspect of ethical business practices. Compliance with the Americans with Disabilities Act will ensure your organization is operating in an ethical manner.

The EEOC recently updated its technical guidance on applying the ADA during the COVID-19 pandemic. You need to understand the latest requirements and again update your policies and procedures accordingly.

Non-compliance with the Americans with Disabilities Act (ADA) can prove to be costly for employers. Penalties in excess of hundreds of thousands of dollars for non-compliance put employers at substantial risk. Can your organization afford to be non-compliant?

1 note

·

View note

Photo

Do you aware of then new "FRINGE BENEFITS" trends industry experts are forecasting for the year 2021? Like what fringe benefits fall under the category of levy and what's not. Watch our #livewebinar by industry expert #DAYNAREUM to get the precise idea on the topic "FRINGE BENEFITS IN 2021". Sign up for the #livetrainingcourse by clicking the link: https://bit.ly/2LYHdah

0 notes

Text

Fringe Benefits in 2021: New Changes and more

Participants with walk away with a better understanding of the IRS view on fringe benefits taxation. The details of the IRC exceptions allowed by the IRS will be detailed and explained to participants. Companies are providing more fringe benefits to employers more than ever before, thus reduces company cost but raises employee morale. Because of this the IRS has more to say on what Fringe Benefits are taxable and what is not.

The IRS for non-taxable fringe benefits puts a lot of regulation around how the fringe benefit is given and when that also determines if a thought non-taxable item may end up being taxable.

Session Highlights:

Internal Revenue Code and how to understand how fringe benefits are written

Review taxation of home office and other COVID related benefits

How to calculate the value of a noncash fringe benefit

Review of excludable fringe benefits

Details of how the tax cuts and jobs act impacted fringe benefits

Procedures for recording fringe benefits

Year-end best practices for fringe benefit taxation

Review FMV (Fair Market Value) and how the IRS determines it.

Discussion on No additional cost services, employee discounts, working condition fringe benefits & De minimis Fringe Benefits.

Discuss several excludable fringe benefits such as Retirement planning, athletic facilities, achievement awards etc.

Discuss fringe benefits that should be taxable

Review Moving/Relocation Expenses

Review executive taxation items, like spousal travel. Company aircraft usage etc.

Once a benefit is determined taxable, how to handle it

Why you should Attend:

Participants will be able to better identify and calculate the fair market value of fringe benefits for taxation purposes.

Who should attend:

Payroll Supervisors and Personnel

HR Director, HR manager, HR VP, HR Specialist

HR Supervisors and Personnel

Public Accountants

Internal Auditors

Tax Compliance Officers

Enrolled Agents

Employee Benefits Administrators

Officers and Managers with Tax or Benefits Compliance Oversight Company /

Business Owners

Managers/ Supervisors

Public Agency Managers

Audit and Compliance Personnel / Risk Managers

*Ask your question directly from our expert during the Q&A session following the live event.

**Recorded Version: Unlimited viewing for 365 days ( Access information will be emailed 36 hours after the completion of live webinar).

#irs#hrprofessionals#payroll#professional#supremetrainer#tax#hr#human resources#payrollprofessionals

0 notes

Photo

Hurry up!! Guys. Our #livewebinar is gonna live in just few hours. Sign up for the #livetrainingcourse by industry expert #DIANELDEE. To join click the link: https://bit.ly/35yla0I

Do you aware of the new form I-9 extension? To make sure you follow all the new form I-9 compliance join our #live webinar on “Form I-9 compliance and updates in 2021 by expert speaker Diane L.Dee . To know more, register yourself by clicking the link: https://bit.ly/35yla0I

2 notes

·

View notes

Photo

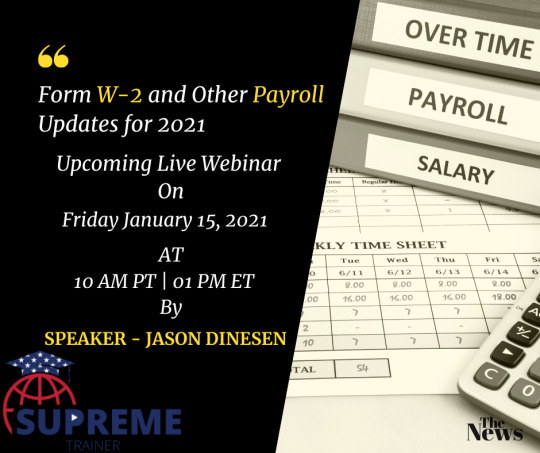

Filing the form W - 2 in 2021. To know more about the deadline and new legislation watch our recorded #webinar on "FORM W - 2 AND OTHER PAYROLL UPDATES". By clicking the link: https://bit.ly/3hRjBzW

#FORMW2#Taxforom#SUPREMETRAINER#JASONDINESEN#Payrollprofessionals#compliance#form941updates#form941#2020taxes#lawmakers#legalprofessionals

1 note

·

View note

Photo

If I can not do great things, I can do small things in a great way. Thank you #MARTINLUTHERKINGJR. You teach us a lot about every aspect of life.

1 note

·

View note

Photo

Are you prepare for the workplace changes under the new administration in 2021? Sign up for our #livewebinar on "workplace changes under the new administration"by industry expert #margiefaulk. Sign up by clicking the link: https://bit.ly/35G1Grc

#supremetrainer#workplacechanges#employers#complianceprofessionals#workplace#HRProfesssionals#businessowners#aca#healthcare#fmla#managers

1 note

·

View note

Photo

Do you aware of the new form I-9 extension? To make sure you follow all the new form I-9 compliance join our #live webinar on "Form I-9 compliance and updates in 2021 by expert speaker Diane L.Dee . To know more, register yourself by clicking the link: https://bit.ly/35yla0I

2 notes

·

View notes

Photo

Ready to fill the form W-2 in 2021. To know what's the latest updates on form W-2. Register yourself by clicking the link: https://bit.ly/3hRjBzW to join our live training course on "Form W-2 and Other Payroll Updates" by #JasonDineson.

#training#hr#payrollcompliance#legalprofessionals#hrmanagers#payrollprofessionals#payrollupdates2021#miscupdates#supremetrainer#1099updates#form941#1099form#w2form

1 note

·

View note

Photo

What are the basic thing to keep in mind while filling form I-9 & W-4 in 2021. To Register for live webinar click here -https://bit.ly/2MEIvY8

2 notes

·

View notes