#zimbabwe gold coins

Explore tagged Tumblr posts

Text

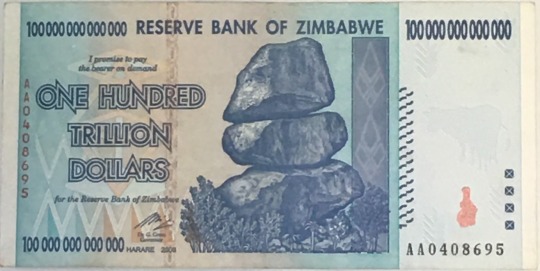

Zimbabwe’s “RTGS Dollar” Can Be Used to Purchase New Gold Coins; Not So for 2008 Zim Inflation Currency

Zimbabwe's Central Bank recently introduced a new set of gold coins in a bid to boost the country's economy. The coins, which come in denominations of 2, 5, 10, and 20 Zimbabwean dollars, are said to be made from locally sourced gold.

The introduction of the new coins has been met with mixed reactions, with some Zimbabweans expressing excitement at the prospect of having a new form of currency, while others have raised concerns about the practicality of using gold coins in everyday transactions.

Which Zim Currencies Can Be Used to Purchase the Coins?

One of the main questions that has been raised is whether RTGS (Real Time Gross Settlement) dollars can be used to purchase the gold coins. RTGS dollars are Zimbabwe's official currency and are used for electronic transactions, but they are not widely accepted by all merchants.

According to the Reserve Bank of Zimbabwe, the new gold coins can be purchased using any form of legal tender, including RTGS dollars. This means that Zimbabweans who have RTGS dollars can use them to buy the gold coins.

What about Zimbabwe’s 2008 Hyperinflation Currency?

Unfortunately for collectors around the world who have made the 2008 $100 Trillion Zimbabwe banknote one of the most popular numismaic collectibles of all-time, they won’t be able to help land the new gold Zimbabwe coins.

The reason is rather simple. 2008 Zimbabwean money cannot be used to buy anything, much less cold coins. In 2008-2009, Zimbabwe experienced hyperinflation, and as a result, the currency became practically worthless. In response, the Zimbabwean government abandoned the Zimbabwean dollar and adopted a multi-currency system. The primary currencies used in Zimbabwe are now the US dollar, the South African rand, and other foreign currencies. At the height of the hyperinflation, Zimbabwe released a $100 trillion dollar bill, which at its height was worth something like $1.36 USD.

Gold coins, like any other goods or services, typically require a recognized currency or a form of payment that is widely accepted. Since the 2008 Zimbabwean money is no longer in use and has no value, it cannot be used to purchase gold coins or any other items. If you're interested in buying gold coins, you would need to use a recognized currency or another form of payment accepted by the seller.

However, while officiallt the RTGS dollar can be used to purchase the coins, some experts have warned that using RTGS dollars to purchase gold coins may not be the most practical option. This is because the value of gold is constantly fluctuating, and it may be difficult for merchants to accurately determine the value of the coins in RTGS dollars.

Despite these concerns, the introduction of the new gold coins is seen as a positive step towards stabilizing Zimbabwe's economy, which has been struggling for years due to hyperinflation and a shortage of foreign currency.

The use of gold as a form of currency is not new in Zimbabwe. The country has a rich history of gold mining, and gold was once used as a medium of exchange before the introduction of paper currency.

In recent years, there has been a renewed interest in gold as a form of currency, with some countries, such as China and Russia, increasing their gold reserves in an effort to diversify their currencies.

The introduction of the new gold coins in Zimbabwe is therefore seen as a step towards aligning the country with this trend. It remains to be seen whether the coins will be widely adopted by Zimbabweans, but for now, they represent a glimmer of hope for a country that has been through so much economic turmoil in recent years.

#zimbabwe currency#zimbabwe#zim#zims#currencies#currency#foreign currency#banknotes#banknote#100 trillion#100trillion#rtgs dollar#money#african money#cash#zimbabwe cash#zimbabwe money#gold#gold coins#zimbabwe gold coins#coins

11 notes

·

View notes

Note

Hi there! I read your post about Egypt and Cleopatra, and now I am really curious about the African Kingdoms you mentioned and was wondering if you could tell us more about them please, they sound really interesting.

Oh, there's SO much I could tell you, and there's so many African kingdoms that have been woefully understudied--and many more aside from the ones I mentioned. They all have their own rich histories, cultures, political intrigue, and it's an actual tragedy that they aren't discussed more. I'm still researching myself, so I'll just review some of my favorite things from each kingdom.

Aksumite/Axumite Empire: Located in modern-day Ethiopia, this empire existed from the 1st to 8th century CE, though its prime was from the 3rd to 6th centuries CE. The Axumites converted to Christianity of their own free will over 1,000 years before colonialism and as a result have ancient churches, some made of stone and carved from the earth itself. They also were the first African kingdom to mint their own coins, and their capital city of Axum had, at its peak, 20,000 people living in it. Also, I love the Dungur palace. Here's a reconstruction of what it looked like:

LOOK AT IT.

Source: x

Kongo: Located in central Africa around modern-day Angola and the Democratic Republic of the Congo from the fourteenth to the twentieth centuries. This kingdom had a rich social hierarchy, apparently had ambassadors to Europe, and some people practiced Catholicism, which led to their own branch of Christianity led by a woman named Beatriz Kimpa Vita in the 1600s who believed she had visions that informed her Jesus actually came from Kongo. Yeah.

Sources: x, x

Loango: A neighbor of Kongo, but one we know much less about due to Kongo having a long, well-documented history of interacting with Europe (see: the ambassadors), and Loango... does not. But we do know they also had a rich social hierarchy, and we have this map of their capital city.

Sources: x, x

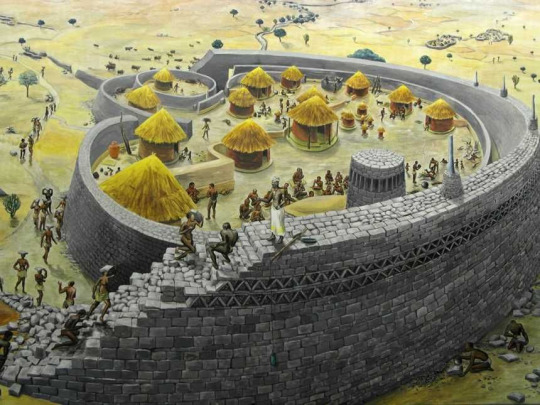

Great Zimbabwe: From 1100- 1500, located in modern-day Zimbabwe, this was a city of the Zimbabwe empire that was either used for storing grain or as a royal residence. Either way, the ruins of said city look like this:

Here's a reconstruction:

Sources: x, x, x, x

Ghana/Mali/Songhai: These were three successive empires from West Africa, with Ghana being the first from the 7th to 13th centuries, Mali being the second from the 13th to 16th centuries, and Songhai being the last one from the 15th to 16th centuries. If you learn about a non-Egyptian African civilization at all in school, chances are it's the Ghana empire and its successive empires, and they're most famous for gold, Timbuktu (with its ancient mosques, library, and university), and Mansa Musa.

Sources: x, x, x, x, x

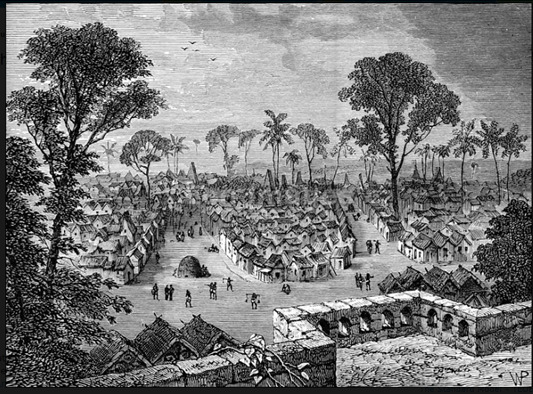

Ashanti/Asante Empire: Located in modern day Ghana, this kingdom lasted from the eighteenth century to the twentieth century. This kingdom is most well-known for its role in the slave trade. The Ashanti had well-built roads and architecture, and a little fun tidbit about them is that, after the introduction of guns, they actually had a minor firearms industry.

Here's their capital, Kumasi:

Source: x, x

Swahili Coastline: The coastline was made up of MANY city-states that saw their prime in the 11th to 15th centuries--including Mombasa, Zanzibar, and Kilwa--that participated in the Indian Ocean trade route, and pottery from as far away as China has been found in these cities. Many of these cities also practiced Islam and had their own mosques. Kilwa is my personal favorite:

These cities were built of stone, but Kilwa's palace, in particular, was built of coral. Its architecture led to the city being described by Ibn Battuta as one of the most beautiful in the world, which is part of why it's so fascinating to me.

Source: x, x

Of course, this barely scratches the surface. There are many more kingdoms all over the continent and a variety from ancient and pre-medieval times that deserve much more love.

And this image doesn't even cover them all!

So yes, ancient and medieval Africa deserve much more love, more research and more hype, and hopefully one day soon they'll get just that.

70 notes

·

View notes

Text

Bitcoin's Role in Times of Financial Crisis: A Beacon of Hope in Turbulent Times

Introduction: Setting the Stage

Imagine this: the economy is unraveling, inflation is soaring, and banks are teetering on the edge of collapse. We've seen this story before. Each time the financial world is shaken, the average person is often left to pick up the pieces. In moments like these, people look for safety. Gold has often been a refuge in times of economic uncertainty, but today, a new kind of "digital gold" has entered the scene—Bitcoin.

Bitcoin isn't just another speculative asset; it's a new form of money created for the very purpose of facing crises like the ones that leave economies in shambles. But how does Bitcoin really function during times of financial turmoil? And why do people increasingly turn to it when traditional systems let them down? Let’s explore.

Historical Context of Financial Crises

The world has witnessed countless financial crises. From the Great Depression to the 2008 Great Recession, from the hyperinflation of Zimbabwe to the recent collapse of banks—economic disasters are not anomalies, they’re almost predictable. These crises share common traits: a loss of trust in financial institutions, erosion of the value of fiat currency, and people scrambling for alternatives to preserve their wealth.

Take the 2008 Great Recession. Banks gambled with people's money, and when they lost, governments stepped in to bail them out, leaving regular folks to face the consequences. It was amidst this backdrop that Bitcoin emerged—a system immune to human manipulation, with no central authority to dilute its value or make decisions in secret.

Bitcoin's Emergence During the 2008 Crisis

Bitcoin was created in response to the failures of traditional finance. Satoshi Nakamoto, the mysterious creator of Bitcoin, embedded a message in the very first block, known as the Genesis Block: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." This wasn’t just a timestamp; it was a clear statement of intent.

Bitcoin aimed to be different—a currency free from the whims of governments, banks, and those who had lost the trust of the public. Its birth was a direct reaction to a broken system, offering an alternative that promised financial freedom, transparency, and true ownership.

Bitcoin's Unique Qualities as a Crisis Hedge

What makes Bitcoin uniquely suited for times of financial crisis? Let’s break down the key qualities:

Decentralization: Bitcoin has no central authority. No government or institution can control its issuance or manipulate its value to serve their own interests. It belongs to the people, run by a network of nodes and miners spread across the globe.

Fixed Supply: Unlike fiat currencies that can be printed at will—as central banks often do in response to crises—Bitcoin has a cap of 21 million coins. This scarcity is fundamental to its value, acting as a hedge against the rampant money printing that often leads to inflation.

Portability and Accessibility: Bitcoin isn’t tied to any one country, and it doesn’t require a physical footprint. It is accessible 24/7, unlike banks that can close, restrict access, or freeze assets during turbulent times. Bitcoin gives people control over their wealth, regardless of where they are or what’s happening around them.

Real Examples of Bitcoin as a Safe Haven

We’ve seen Bitcoin being used as a safe haven asset in various crises:

Venezuela and Argentina: In hyperinflationary economies where local currency loses value rapidly, Bitcoin has provided a crucial way for people to preserve their purchasing power. Venezuelans, for instance, turned to Bitcoin as the bolivar crumbled, finding in it a stable store of value relative to their national currency.

Cyprus Bail-In (2013): In 2013, the Cypriot government froze citizens’ bank accounts and implemented a "bail-in," using their deposits to rescue failing banks. In that same year, Bitcoin’s price saw a surge as people began realizing the power of holding an asset that couldn’t be confiscated by any government.

Recent Banking Concerns (Silicon Valley Bank Collapse): More recently, during times of banking uncertainty, Bitcoin again saw an uptick in interest. People are slowly waking up to the idea that having your wealth in a system controlled by others isn’t always safe. Bitcoin offers an alternative—one where individuals have complete control.

Dollar-Cost Averaging: A Simple Strategy for Uncertain Times

One of the biggest hurdles for people looking to get into Bitcoin is its infamous volatility. This is where Dollar-Cost Averaging (DCA) comes in—a simple yet effective strategy that makes Bitcoin accessible to anyone.

What is DCA? DCA involves investing a fixed amount of money in Bitcoin at regular intervals (e.g., weekly or monthly), regardless of the price. Whether Bitcoin is up or down, you keep investing the same amount.

Why DCA Works Well for Bitcoin:

Mitigating Volatility: Bitcoin’s price can be unpredictable, but DCA helps to average out the highs and lows. Instead of trying to time the market—which even experts struggle with—you gradually accumulate Bitcoin over time, reducing the impact of its swings.

Making Bitcoin Accessible: You don’t need to be wealthy to start accumulating Bitcoin. Even a small amount like $20 a week can add up over time, building a safety net that could one day protect you from economic turmoil.

Examples of DCA Success: Someone who started DCA-ing into Bitcoin during the peak of 2017’s bull run would still be significantly up today. The key is consistency and a long-term view. In times of crisis, DCA can be a powerful way to build a hedge, step by step, without taking on overwhelming risk.

Challenges and Criticisms

It would be disingenuous not to mention Bitcoin's challenges. Its volatility is real, and for some, this is a reason to be hesitant. But it’s crucial to understand that Bitcoin is still a young asset, evolving in a world that’s just beginning to understand its potential.

For those looking at Bitcoin as a hedge against traditional financial instability, the strategy isn't about short-term gains. It's about adopting a different mindset—one focused on time in the market, not timing the market. Volatility is less intimidating when viewed through a long-term lens.

Why Bitcoin is Different from Gold

Bitcoin has often been called "digital gold." While both assets serve as stores of value, Bitcoin has some distinct advantages. Unlike gold, Bitcoin is digital and easily portable. You can carry millions of dollars worth of Bitcoin on a USB-sized hardware wallet or even just in your memory if needed. Bitcoin is also much easier to divide. You can send someone a few dollars' worth instantly, whereas gold needs to be physically divided or tokenized to achieve that same flexibility.

Perhaps most importantly, Bitcoin is resistant to seizure. Throughout history, gold has been confiscated by governments. Bitcoin, on the other hand, can be stored with no physical footprint, making it far harder to seize if managed correctly.

Conclusion: A Modern Solution for Modern Problems

Financial crises are not going away. They are a byproduct of a flawed system that prioritizes short-term solutions over long-term stability. Bitcoin was built as a response to these very issues. It offers an alternative that’s built on transparency, ownership, and the promise of true financial sovereignty.

If you’re looking for a way to protect yourself from the next inevitable crisis, Bitcoin stands as a beacon of hope. And you don’t need to jump in all at once. Start small, consider using Dollar-Cost Averaging, and build a position over time. Bitcoin could be the life raft you need when the storm inevitably comes—a modern solution for modern problems, providing hope and resilience in a world of uncertainty.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FinancialCrisis#DigitalGold#EconomicUncertainty#CryptoResilience#SafeHavenAsset#BitcoinHistory#FinancialFreedom#DecentralizedFinance#DCA#InvestingInBitcoin#CryptoEducation#BitcoinVsFiat#SoundMoney#FutureOfFinance#BlockchainTechnology#Hyperinflation#EconomicCollapse#CrisisInvesting#BitcoinHedge#StoreOfValue#FiatCurrency#BitcoinSovereignty#BitcoinStandard#AlternativeFinance#cryptocurrency#financial empowerment#finance#globaleconomy#blockchain

2 notes

·

View notes

Text

Zimbabwe has officially introduced the world's newest currency, the ZiG, in a bold move to tackle its ongoing money crisis. This innovative step marks the country's latest attempt to stabilize its economy and provide a reliable monetary solution for its citizens. The introduction of the ZiG aims to address the challenges faced by the nation's financial system and encourage economic growth and stability. With this new currency, Zimbabwe hopes to turn a new leaf in its economic recovery efforts, capturing the attention of both local and international observers. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Zimbabwe Introduces New Currency: The ZiG In a significant move to stabilize its economy, Zimbabwe has rolled out a new currency known as the ZiG, stepping away from its troubled Zimbabwe dollar. This development comes after various efforts by the government to combat the persistent currency crisis that has plagued the southern African nation for years. The introduction of the ZiG, fully backed by the country's gold reserves, marks a bold attempt to restore economic stability and confidence among its citizens. Initially launched electronically in early April, the ZiG is now available for use in both banknotes and coins, giving people a tangible sense of this new monetary direction. Despite being rich in resources, Zimbabwe has faced daunting economic challenges, leading to severe currency depreciation and mistrust among the populace. Previous strategies, including the release of gold coins and the exploration of digital currency options, have failed to curb the inflation and economic downturn. The introduction of the ZiG is critical, as Zimbabwe has navigated through several currencies since the Zimbabwe dollar's collapse in 2009, triggered by hyperinflation that reached a staggering 5 billion percent. This hyperinflation episode is etched in the memories of many, recalling times when absurd amounts of money were required for basic purchases, making the U.S. dollar a more stable and preferred option. However, the journey to adopting the ZiG has not been smooth. Reports highlight a visible mistrust toward the new currency, with some government departments even refusing to accept it, and businesses caught in a tug-of-war over currency acceptance policies. Amidst this, the U.S. dollar continues to hold a firm grip on the economy, being the go-to currency for many Zimbabweans for transactions ranging from rent payments to grocery shopping. Economic experts and local voices express mixed feelings about the new currency's potential. While some, like economics professor Gift Mugano, critique the government's handling of the currency launch, others remain hopeful yet cautious, reflecting on past economic upheavals that left savings and pensions worthless. The vivid memory of carrying bags full of worthless banknotes is a stark reminder of the potential pitfalls ahead. Despite the skepticism, authorities are optimistic, believing that the gold-backed ZiG will pave the way for economic revival and national pride. President Emmerson Mnangagwa even emphasized the currency's importance for Zimbabwe's national identity and dignity.

As the country navigates this latest attempt at economic reform, the eyes of the world, and more importantly, the Zimbabwean people, are keenly observing, hoping for a future where the currency in their wallets holds steady value both at home and abroad. In these crucial times, the success of the ZiG could mean a significant turnaround for Zimbabwe's economy, but it will require widespread acceptance and trust from its citizens and the international community. Only time will tell if this new currency will break the cycle of economic challenges or if the shadow of past failures will loom large over its potential. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] Sure! Here are five frequently asked questions about Zimbabwe's ZiG, the world's newest currency meant to address the country's money crisis: 1. What is the ZiG currency in Zimbabwe? The ZiG currency is Zimbabwe's latest attempt to stabilize its economy by introducing a new digital currency. It's part of efforts to resolve the ongoing money crisis in the country. 2. How can people use the ZiG currency? People can use ZiG for various transactions, just like any other currency. It's designed to be digital, so you'll need a smartphone or computer to manage and spend it. 3. Why did Zimbabwe introduce the ZiG currency? Zimbabwe introduced the ZiG currency to tackle hyperinflation and restore trust in the national currency. It's an effort to move away from the instability of traditional money and foreign currencies. 4. Are there any benefits to using the ZiG over other types of money? Yes, one of the main benefits is its convenience and potential to stabilize the economy. Being digital, it also reduces the need for physical cash, which has been scarce in Zimbabwe. 5. Will the ZiG currency replace the Zimbabwean dollar? No, the ZiG is not meant to replace the Zimbabwean dollar but to complement it. It's part of a broader strategy to stabilize the national economy and offer a more secure and reliable form of money. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

BBC 0408 30 Apr 2024

12095Khz 0359 30 APR 2024 - BBC (UNITED KINGDOM) in ENGLISH from TALATA VOLONONDRY. SINPO = 55445. English, ID@0359z pips and newsday preview. @0401z World News anchored by Neil Nunes. An Iranian teenager was sexually assaulted and killed by three men working for Iran's security forces, a leaked document understood to have been written by those forces says. It has let us map what happened to 16-year-old Nika Shakarami who vanished from an anti-regime protest in 2022. Her body was found nine days later. The government claimed she killed herself. The United Nations’ top court is ruling Tuesday on a request by Nicaragua for judges to order Germany to halt military aid to Israel, arguing that Berlin’s support enables acts of genocide and breaches of international humanitarian law in Gaza. New York City's Columbia University has begun suspending students involved in a pro-Palestinian protest on campus after they defied a deadline to disperse. At least four law enforcement officers were killed in a shooting in Charlotte, North Carolina, while trying to serve a warrant Monday afternoon, police said. A suspect was killed in the shootout with police. About 50 people have died in Kenya in a deluge following heavy rains and flooding, a Red Cross official has said. People in villages near Mai Mahiu, about 60km (37 miles) from the capital, Nairobi, were swept away as they slept. Rescue efforts are continuing to pull people out of the mud, with fears that the death toll could rise. More than 100 people have been killed in floods that have devastated parts of Kenya in the last month. The Reserve Bank of Zimbabwe has started distributing the new ZiG banknotes and coins to the commercial banks on Monday, April 29, 2024. The Zimbabwe Gold currency will be distributed with the public set to start withdrawing the cash from their accounts on Tuesday morning i.e. April 30, 2024. Reportedly, the central bank has set a limit for the weekly cash withdrawal at ZiG 3,000 for individuals and the limit of ZiG 30,000 for corporates to manage the initial roll-out. The move was done to fight triple digit inflation, it is the 4th currency in Zimbabwe in 10 years. In Canada, a jury has been selected for the trial of a Winnipeg man accused of killing four homeless indigenous women. Jeremy Skibicki has pleaded not guilty to four counts of first-degree murder. The jury has been told to return to court May 8 for the trial's opening statements. A vaccine patch could be a safe and effective alternative way to protect young children against measles, a trial in The Gambia suggests. The device - the size of a sticking plaster - is easier to transport and store than standard injections, especially in remote areas. @0405z "Newsday" begins. 250ft unterminated BoG antenna pointed E/W w/MFJ-1020C active antenna (used as a preamplifier/preselector), Etón e1XM. 250kW, beamAz 315°, bearing 63°. Received at Plymouth, MN, United States, 15359KM from transmitter at Talata Volonondry. Local time: 2259.

0 notes

Text

Champ Profit

Website: https://www.champprofit.com/

Champ Profit stands as your dedicated Smart Money Team, guiding you toward financial freedom with top money transfer rates and intelligent trading insights. In a domain often clouded by misinformation and complexity, Champ Profit shines by delivering unbiased reviews and clear, reliable insights into brokers and trading platforms, ensuring your decisions in the forex trading world are always well-informed and strategic. Catering to both beginner and seasoned traders, our platform provides easy-to-understand educational content, daily stock trading news, market insights, and real-time updates, all designed to empower you, minimize risks, and maximize gains. Navigate with confidence, leverage expert analyses, and explore diverse investment opportunities with Champ Profit, your authentic ally in maximizing your trading potential.

Facebook: https://www.facebook.com/ChampProfit

Instagram: https://www.instagram.com/champprofit/

Youtube: https://www.youtube.com/channel/UCW_UoCfjy9gON5wK7uBPyLA

Telegram: https://t.me/ChumpProfitForexSignals

Keywords: barakah money transfer ria money transfer near me ria money transfer uk ria money transfer uk baraka money transfer vanguard investments uk aps money transfer transfer money to eur al baraka money transfer worldremit money transfer transfer money to south africa al barakah money transfer mangal money transfer taaj money transfer natwest currency exchange rates transfer money from australia to uk tax efficient investing uk uk trade and investment best investment trusts for income can a power of attorney transfer money to themselves uk barakah money transfer uk john lewis currency exchange rates santander currency exchange rates best currency exchange liverpool mukuru money transfer zimbabwe transfer money from canada to uk best way to invest 20k short term uk invest in mutual funds uk uk tax on investments vanguard minimum investment uk best investment trusts for retirement income currency direct exchange rate does money transfer affect credit score uk al baraka money transfer uk santander currency exchange rate western union currency exchange rates today transferring money to solicitor for house purchase uk can i transfer money from clearpay to bank account uk ria money transfer uk login inward investment uk seed investment uk uk tax free investments bank of scotland currency exchange rates today smart currency exchange rates visa currency exchange rate best currency exchange in edinburgh best currency exchange leeds best currency exchange manchester transfer money to china from uk transfer money from uk to poland transfer money to poland from uk baraka money transfer uk transfer money from south africa to uk transfer money to russia from uk currency xtra exchange rate john lewis currency exchange rate spain currency exchange rate tesco currency exchange rates pound to euro best currency exchange belfast best currency exchange glasgow mukuru money transfer uk money transfer to ghana from uk transfer money from uk to russia transfer money from spain to uk invest in silver uk investment club uk new investment zones uk best way to invest 20k uk how to invest in an index fund uk best currency exchange rates glasgow how to invert currency exchange rate nepal currency exchange rate best currency exchange birmingham best currency exchange bristol best currency exchange cardiff best currency exchange edinburgh best currency exchange newcastle best currency exchange nottingham best currency exchange rates glasgow best currency exchange sheffield what is the best forex trading platform uk transfer money australia to uk money transfer regulations uk best place to buy investment property uk uk real estate investment trust vanguard uk minimum investment best gold coins to buy for investment uk what lot size is good for $5000 forex account best currency exchange aberdeen what is a pip forex trading what is better than forex trading what is gold trading in forex what is liquidity in trading forex what is metatrader 4 forex trading what is the best app for trading forex what is the most profitable forex trading strategy how to activate e commerce payment on icici forex card how to calculate lot size in forex how to calculate pips in forex how to calculate pivot point in forex how to calculate used margin in forex how to check forex card balance hdfc how to check hdfc forex card balance how to choose a forex broker how to get a funded forex account how to open a forex trading account how to read forex market how to start a forex brokerage how to start forex trading uk what is a pip worth in forex trading what is a pivot point in forex trading what is a pullback in forex trading what is a swing trade in forex what is a trade size in forex what is a trading plan in forex

#what is a trading plan in forex#what is a pullback in forex trading#what is a pip worth in forex trading#how to check forex card balance hdfc#how to read forex market#how to calculate lot size in forex#vanguard uk minimum investment

1 note

·

View note

Text

On Oct. 5, the gold-backed digital token under the name Zimbabwe Gold (ZiG) officially kicked off as a payment method. The launch was announced by the Reserve Bank of Zimbabwe (RBZ). The first time the RBZ introduced its new project was in April 2023. The central bank specified that every issued digital token would be backed by a physical amount of gold held in the bank’s reserves. The RBZ started issuing physical gold tokens last year, claiming their successful adoption. The mission behind both physical coins and freshly introduced ZiG is to persuade local investors to put their money into national assets and not American dollars, which is not an easy task in a country with a triple-digit inflation level. As the RBZ Governor, Dr. John Mangudya said earlier: “The issuance of the gold-backed digital tokens is meant to expand the value-preserving instruments available in the economy and enhance divisibility of the investment instruments and widen their access and usage by the public.”Digital tokens can be stored in either e-gold wallets or e-gold cards and are tradeable both for P2P and business transactions. The RBZ reported several levels of prices, for which ZiG could be both, depending on the weight of its gold reserve. Thus, one can buy 1 ounce of ZiG for $1,910 and 0.1 ounce for $191. According to the Bank, on Sept. 28, investors bought the equivalent of 17.65 kg in ZiG, paying with both Zimbabwean and American dollars. The total amount of ZiG, sold since the previous rounds of digital token sales, stands at around 350 kg of gold. Zimbabwe has grappled with currency instability and rising inflation for more than a decade. In 2009, the nation adopted the U.S. dollar as its official currency in response to a period of hyperinflation that had rendered the local currency practically worthless. In an attempt to revitalize the domestic economy, Zimbabwe reintroduced its own currency in 2019. However, this move was followed by a resurgence of currency volatility.

0 notes

Text

Reserve Bank of Zimbabwe Set to Launch Gold-Backed Digital Token (GBDT) for Retail Use Following Successful Investor Interest

Reserve Bank of Zimbabwe Set to Launch Gold-Backed Digital Token (GBDT) for Retail Use Following Successful Investor Interest

Source: Shutterstock

The Reserve Bank of Zimbabwe (RBZ) has announced its advanced plans to launch Gold-Backed Digital Token (GBDT) for retail purposes following its successful reception among investors, a success the Bank hailed as “commendable” in a recent report.

During the presentation of the Mid-Term Monetary Policy Statement (MPS) on Wednesday, August 9, Governor John Mangudya of the RBZ disclosed that efforts are in progress to elevate the GBDTs to the status of a medium of transactions.

According to Mangudya, now the GBDT “shall be scaled up to be used for transactional purposes by the public.”

“The Bank is at an advanced stage in preparing for the eventual rolling out of GBDT for transactional purposes in Phase II of the project under the code or name ZiG, which stands for Zimbabwe Gold.”

“It is envisaged that the transactional phase will see GBDT complementing the use of the US dollar in domestic transactions,” he said.

The RBZ governor also announced plans for nationwide awareness campaigns to educate the public about the benefits of GBDT.

This digital instrument will be the foundation for the country’s central bank digital currency (CBDC), as Zimbabwe Gold closely aligns with CBDC characteristics.

However, the MPS report highlighted the continued importance of Gold Coins as a monetary policy tool, as it backs the GBDTs. It had absorbed over ZW$35 billion from 36,059 coins by July 14, 2023

The first maturity after the 180-day vesting period was January 25, 2023. Only 769 gold coins (2% of total sales) have been redeemed, affirming their value-retention role.

Unveiling Gold-Backed Digital Tokens (GBDTs) as Zimbabwe’s Answer to Inflation

To complement physical gold coin sales, enhance investment instrument divisibility, and broaden public access, the Bank launched Gold-Backed Digital Tokens (GBDT) on May 12, 2023.

According to the Mid-term financial report, by July 21, the Bank had executed 11 GBDT issuances, garnering 590 applications for tokens worth ZW$50.50 billion (US$7,794.87). Consequently, the Bank issued 325,024,524 milligrams, equivalent to 325.02 kg of gold.

These tokenized digital coins aim to strengthen the national currency, and offer an alternative investment, diverging from the common practice of pursuing US dollars on the parallel market.

The tokens will serve as a medium of exchange for both individuals and businesses, playing a crucial role in stabilizing the Zimbabwean dollar and addressing the issue of inflation.

Given Zimbabwe’s track record in successfully managing inflation, there’s no need for apprehension regarding the implementation of the GBDTs .

In June, Zimbabwe witnessed a staggering 175.8% inflation rate due to adopting a new bank benchmark and exchange rate depreciation. Simultaneously, the RBZ set a 150% interest rate.

Source: TradingEconomics

The Government and Bank actions, such as exchange rate liberalization, taking on external liabilities of the Bank, and enforcing local currency payments for duties and taxes, helped ease inflation. These measures appreciated the exchange rate, causing monthly inflation to drop from the June peak to -15.3% in July 2023.

Similarly, annual inflation, which hit 175.8% in June 2023, significantly reversed to 101.3% in July 2023. The positive trend will persist as the effects of these measures take hold, further reducing the risk of adopting GBDTs for local transactions.

The Information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

New Post has been published on https://crynotifier.com/reserve-bank-of-zimbabwe-set-to-launch-gold-backed-digital-token-gbdt-for-retail-use-following-successful-investor-interest-htm/

0 notes

Text

Zimbabwe Central Bank Says Gold-Backed Tokens Set to Be Used for ‘Transactional Purposes’

An ‘Effective Monetary Policy Instrument’ The Reserve Bank of Zimbabwe (RBZ) has said it is now “at an advanced stage in preparations for the rolling out of GBDT for transactional purposes.” The bank said the rollout would see the gold tokens complement the U.S. dollar “in domestic transactions as retailers will be offered a safer, more convenient, and value-preserving medium of exchange.” In a recently released mid-term monetary policy statement, RBZ governor John Mangudya revealed that the central bank will soon kickstart awareness campaigns whose objective is to “educate the public on the use and benefits of GBDT.” Mangudya also revealed that key stakeholders such as the Confederation of Zimbabwe Industries (CZI) have pledged to configure their systems to allow for the issuance of cards denominated in the GBDT. As previously reported by Bitcoin.com News, the RBZ launched the gold-backed tokens in May to counter local residents’ demand for U.S. dollars. However, just a few months after the launch, the central bank governor said the GBDTs have already proved to be an effective monetary policy instrument. “The GBDTs have since proved to be an effective monetary policy instrument with strong potential to help restore normalcy to the domestic financial and capital markets within the short term,” Mangudya said. More Than 70% Willing to Use CBDC The governor claimed that the “divisibility nature” of the digital gold tokens means they can be accessed or acquired by people from all economic backgrounds. Concerning the uptake of physical gold coins, the RBZ boss revealed that out of the 36,059 coins which had been sold by July 14, only 769 gold coins or approximately 2% of the total had been redeemed following the end of the 180-day vesting period. According to Mangudya, the low redemption rate means residents and businesses are indeed using the physical gold coins as an alternative store of value. With respect to the RBZ’s central bank digital currency (CBDC), Mangudya said the results of a consumer survey had shown that residents had limited knowledge about the envisaged digital currency. However, some 71.7% of the respondents expressed their willingness to use a CBDC if the central bank introduces it, Mangudya added. Register your email here to get a weekly update on African news sent to your inbox: What are your thoughts on this story? Let us know what you think in the comments section below. Read the full article

0 notes

Text

Zimbabwe backs its digital currency with gold

Gold-backed Digital Tokens in Zimbabwe

Zimbabwe used nearly 140 kilograms of gold reserves to back the first sale of its digital money. The central bank received 135 applications valued at 14 billion Zimbabwe dollar ($12 million) to purchase the gold-backed digital tokens, it said in an emailed statement on Friday. It plans a second auction on May 18. The southern African nation has turned to the digital money to help ease soaring demand for US dollars in its economy as the value of the local currency plunged. The move was criticized by the International Monetary Fund, which urged the government to rather liberalize its foreign-exchange rate than risk depleting its reserves. The tokens are just one of the measures introduced to shore up a currency that’s weakened more than 40% against the US dollar this year, and amid soaring inflation. It’s also released gold coins and on Thursday warned that short-term interest rates may have to rise. The central bank’s benchmark rate at 140% is the highest in world. This is an article from Bloomberg. Rewrite it using different words and order but include a background about Zimbabwe problem with hyperinflationChatGPT

Zimbabwe, a country plagued by hyperinflation, has resorted to leveraging its gold reserves in a bid to address its economic challenges. In a groundbreaking move, the nation employed approximately 140 kilograms of gold to back its inaugural sale of digital currency.

To purchase the gold-backed digital tokens, the central bank received a significant influx of interest, with 135 applications amounting to a value of around 14 billion Zimbabwe dollars ($12 million). Anticipating continued demand, a second auction is scheduled for May 18.

The introduction of digital money serves as one of the strategies implemented by Zimbabwe to alleviate the surging demand for the US dollar within its economy, which has witnessed a considerable decline in the value of the local currency. Nevertheless, this move has faced criticism from the International Monetary Fund (IMF), which suggests that the government should prioritize liberalizing the foreign-exchange rate instead of risking the depletion of its reserves.

The creation of these tokens represents just one facet of Zimbabwe's multifaceted approach to stabilize its currency, which has witnessed a staggering depreciation of over 40% against the US dollar this year, alongside rampant inflation. The government has also issued gold coins as part of its efforts. Moreover, in a recent announcement, it cautioned that short-term interest rates might need to be increased. Notably, the country's benchmark interest rate of 140% currently stands as the highest in the world.

By utilizing its gold reserves as a backing for digital currency, Zimbabwe aims to combat the challenges associated with hyperinflation and the significant devaluation of its national currency.

0 notes

Text

Pro-XRP Lawyer Opens Up On Buying Supporting XRP Amid Ongoing Court Battle

Pro-XRP Lawyer Opens Up On Buying, Supporting XRP Amid Ongoing Court Battle https://bitcoinist.com/pro-xrp-lawyer-opens-up-on-buying-supporting-xrp/ In a recent tweet, Attorney John Deaton disclosed that XRP’s utility and efficiency for cross-border transactions informed his decision to buy it in 2016. Also, the attorney revealed that Coinbase recommended the cryptocurrency to its customers in 2019 for the same purpose. XRP’s Unique Value Proposition According to John Deaton, his first purchase occurred in 2016 due to the attributes of the coin. However, the attorney revealed that he also bought more XRP coins in 2019, following its listing on the popular San Francisco exchange Coinbase. Notably, the crypto exchange touted the coin as one of the best cryptos for cross-border transactions. One of the benefits of transacting with the digital asset is the lower cost it offers. The coin facilitates seamless cross-border transactions and settlements at low cost. Related Reading: Digital Currency Backed By Gold To Be Introduced By Zimbabwe’s Central Bank In his Tweet, Deaton shared the image showing where Coinbase promoted XRP. The exchange told its users they could send money worldwide with XRP and USDC. Coinbase also pointed out that developers optimized these crypto assets for cross-border transmission. Attorney Deaton’s post reacted to the report that the Chinese Yuan is leading in China’s cross-border payments over the United States dollars. Regarding the report, Deaton stated that China focuses on reducing banknote usage while the US attacks crypto instead of embracing its utility. Notably, a crypto user responded to Deaton’s post about buying the coin in 2016. The user stated that his claims were false, claiming that the attorney only joined the crypto market a few years ago. In response, Deaton referred him to his first interview, where he announced buying Bitcoin (BTC), Ripple (XRP), and Ethereum (ETH) for the first time in 2016. Price Trend Amid Ongoing SEC Lawsuit According to Deaton’s post and the SEC’s lawsuit, the cryptocurrency attracted investors early in the game. Notably, the SEC accused Ripple of raising $1.3 billion by offering unregistered security beginning in 2013. As of then, XRP was below $0.60. The crypto market recorded growth in 2017 due to the entrance of more retail investors. Related Reading: Bitcoin Emerges As Safe-Haven Asset With Correlation To Gold At 2-Year High By 2020, the SEC sued Ripple and two of its executives for the initial coin offering (ICO) held in 2013, causing a downtrend for the coin. But even as the market anticipates the summary judgment, the coin has continued holding the firm to its value leading investors to commend its resilience. As of press time, it trades at $0.4591, indicating a price loss of 3.30%. The coin is reacting to the market-wide downtrend, which has pushed many coins to the red zone. Featured image from iStock and chart from Tradingview via Bitcoinist.com https://bitcoinist.com April 27, 2023 at 06:30PM

0 notes

Text

Bitcoin: The Ultimate Hedge Against Inflation, Tyranny, and Debasement

In an ever-changing financial landscape, finding a reliable hedge against economic uncertainties is more crucial than ever. Bitcoin, often hailed as "digital gold," has emerged as a powerful tool to safeguard against inflation, tyranny, and currency debasement. While not without its challenges, Bitcoin's unique properties make it an increasingly attractive option for those seeking financial security.

Bitcoin Fundamentals

Before delving into Bitcoin's potential as a hedge, it's essential to understand its basic mechanics. Bitcoin operates on a decentralized network called the blockchain, where transactions are verified and recorded by a global network of computers. New bitcoins are created through a process called mining, which also secures the network. Importantly, Bitcoin has a fixed supply cap of 21 million coins, a key feature in its potential as a store of value.

Inflation: The Silent Wealth Destroyer

Inflation erodes the purchasing power of traditional currencies, diminishing the value of savings over time. Central banks' monetary policies, especially the unprecedented levels of money printing in recent years, have fueled inflation rates worldwide. For instance, the U.S. inflation rate hit a 40-year high of 9.1% in June 2022, significantly impacting consumers' purchasing power.

Unlike fiat currencies, Bitcoin's capped supply of 21 million makes it inherently scarce. This fixed supply positions Bitcoin as a potential hedge against inflation, as its value isn't subject to debasement through excessive issuance.

Tyranny: Financial Freedom in the Digital Age

Throughout history, oppressive regimes have exploited financial systems to control and manipulate their populations. Recent examples include the freezing of bank accounts during the 2022 Canadian trucker protests and the severe capital controls imposed in countries like Venezuela and Zimbabwe.

Bitcoin's decentralized nature offers a solution. It operates on a peer-to-peer network, independent of any central authority. This decentralization ensures that no single entity can control or censor transactions, empowering individuals with greater financial autonomy.

Currency Debasement: Protecting Wealth from Devaluation

Currency debasement, the reduction of a currency's value through excessive issuance, has been a recurring theme in economic history. From the Roman Empire's devaluation of its silver coins to the hyperinflation in Weimar Germany and more recently in Venezuela, the consequences of debasement have been disastrous.

Bitcoin's transparent and immutable ledger prevents such practices. Every Bitcoin transaction is recorded and verified by the global network, ensuring trust and integrity in the system.

The Bitcoin Advantage: Beyond Traditional Assets

While traditional assets like gold and real estate have long been considered hedges, Bitcoin offers unique advantages:

Portability: Unlike gold or real estate, Bitcoin can be easily transferred across borders.

Divisibility: Bitcoin can be divided into tiny fractions, allowing for micro-transactions.

Verifiability: The blockchain provides a transparent record of all transactions.

Accessibility: Anyone with internet access can participate in the Bitcoin network.

Challenges and Considerations

Despite its potential, Bitcoin faces several challenges:

Volatility: Bitcoin's price can be highly volatile, which may deter some investors.

Regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving.

Environmental concerns: Bitcoin mining consumes significant energy, though efforts are being made to increase the use of renewable sources.

Adoption hurdles: While growing, Bitcoin's acceptance as a medium of exchange is still limited compared to traditional currencies.

Embrace the Future: Secure Your Financial Sovereignty

As we navigate uncertain economic times, Bitcoin provides a unique tool for those seeking financial security and independence. By potentially hedging against inflation, tyranny, and currency debasement, Bitcoin empowers individuals to take greater control of their financial destiny.

Investing in Bitcoin isn't just about potential gains; it's about exploring new avenues for financial sovereignty in an increasingly unstable world. Stay informed, do your research, and consider how Bitcoin might play a role in your long-term financial strategy. Bitcoin's transformative potential offers a beacon of hope for a more secure and autonomous financial future.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Crypto#Cryptocurrency#DigitalGold#FinancialFreedom#InflationHedge#BitcoinRevolution#Decentralization#Blockchain#EconomicSovereignty#Tyranny#CurrencyDebasement#Investing#FinancialSecurity#BitcoinAdvocate#SoundMoney#BitcoinStandard#FutureOfFinance#CryptoCommunity#DigitalCurrency#HardMoney#EconomicIndependence#InflationProtection#BitcoinEconomics#BitcoinEducation#BitcoinAwareness#financial experts#finance#financial empowerment#financial education

2 notes

·

View notes

Text

Hope to control the situation by introducing gold coins

Hope to control the situation by introducing gold coins

The African country of Zimbabwe is facing severe inflation. While inflation was 191 percent in June this year, it reached 257 percent in July. This rapidly increasing inflation has pushed the common people of the country to face extreme crisis. On the one hand, commodity prices are increasing, on the other hand, currency values are decreasing. Added to this is the acute water crisis. Most…

View On WordPress

0 notes

Text

Zimbabwe introduces gold coin currency— to fight high inflation

Zimbabwe introduces gold coin currency— to fight high inflation

With inflation soaring in Zimbabwe and the country’s currency in free fall as people abandon it for the U.S. dollar, the government of President Emmerson Mnangagwa is fighting back with a novel strategy: gold coins. Starting Monday, Zimbabwe is selling one-ounce, 22-carat gold coins bearing an image of Victoria Falls, its world-famous natural wonder. Each has a serial number, comes with a…

View On WordPress

0 notes

Text

Buy XRP USA Canada UK Australia Worldwide

Looking to Buy XRP, Sell XRP USA Worldwide? XRP Ripple Cryptocurrency for Cash! We also provide reviews for the best XRP exchanges, XRP wallets, and XRP news!

How to Buy Sell XRP Ripple

So, you’ve decided to invest in XRP Ripple. However, you’re confused and don’t know where to start - you're wondering, how to buy XRP? With so many options available, it can be difficult to choose the best option for you. Plus, there are lots of things you need to think about before you start making payments.

Learning how to buy XRP in USA can be a confusing process. It doesn’t have to be, though. In this guide, we will give you the answers!

How to Buy XRP?

The process of buying and selling XRP has been made a lot simpler over the last few months. There are a few important factors that you must think about before buying XRP:

Payment Method

The most common and accepted payment methods to buy cryptocurrency include: credit card, bank transfer, or even cash. Different websites accept different payment methods, so you'll need to choose a website that accepts the payment method you want to use.

Type of Cryptocurrency

Not all cryptocurrencies are available for purchase on every website. You will have to find a website that sells XRP that you want to buy.

Cost of Fees

Each website has different fees. Some are cheap, some are not so cheap. Make sure you know how much the fees cost before setting up an account on any website. You don't want to waste your time verifying yourself and then find out the fees are too high!

How Much You Can Afford

As with any investment, you should never invest more than you can afford. I recommend speaking to a financial adviser first.

With those 4 factors in mind, we can move on. When you buy your XRP, though, where are you going to store it? I'll give you a hint: it's not your bank account.

Cryptocurrencies

Bitcoin BTC | Ethereum ETH | Binance Coin BNB | XRP | Tether USDT | Cardano ADA | Dogecoin DOGE | Polkadot DOT | Uniswap UNI | Litecoin LTC | Bitcoin Cash BCH | Chainlink LINK | USD Coin USDC | VeChain VET | Solana SOL | Stellar XLM | Theta Network THETA | Filecoin FIL | TRON TRX | Wrapped Bitcoin WBTC | Monero XMR | Binance USD BUSD | Terra LUNA | NEO | Klaytn KLAYIOTA MIOTA | Aave AAVE | PancakeSwap CAKE | EOS | Cosmos ATOM | Bitcoin SV BSV | Crypto.com Coin CRO | Polygon MATIC | BitTorrent BTT | FTX Token FTT | OKB | cUSDC CUSDC | Ethereum Classic ETC | cETH CETH | Maker MKR | Tezos XTZ | Algorand ALGO | Avalanche AVAX | Dai DAI | Kusama KSM | cDAI CDAI | Huobi Token HTTHOR | Chain RUNE | Compound COMPE | lrond EGLD | NEM XEM | Dash DASH | Chiliz CHZ | Holo HOT | Decred DCR | Zcash ZEC | Synthetix Network Token SNX | Enjin Coin ENJ | Zilliqa ZIL | Stacks STX | Hedera Hashgraph HBAR | Celsius Network CEL | LEO Token LEO | Sushi SUSHI | NEXO | Amp AMP | Decentraland MANA | TerraUSD UST | Waves WAVES | Fei Protocol FEIS | iacoin SC | The Graph GRT | DigiByte DGB | Basic Attention Token BAT | yearn.finance YFI | Bitcoin Gold BTG | Huobi BTC HBTC | UMA | Fantom FTM | Qtum QTUM | ICON ICX | Liquity USD LUSD | Pirate Chain ARRR | Ravencoin RVN | Helium HNT | Ontology ONT | Horizen ZEN | 0x ZRX | WazirX WRX | Arweave AR | Harmony ONE | Bancor Network Token BNT | Ankr ANKR | Flow FLOW | XDC Network XDC | IOST | ECOMI OMI | SwissBorg CHSB | Reserve Rights Token RSR | Paxos Standard PAX

Nationwide USA

Alabama | Alaska | Arizona | Arkansas | California| Colorado | Connecticut | Delaware | Florida | Georgia | Hawaii | Idaho | Illinois | Indiana | Iowa | Kansas | Kentucky | Louisiana | Maine | Maryland | Massachusetts | Michigan | Minnesota | Mississippi | Missouri | Montana | Nebraska | Nevada | New Hampshire | New Jersey | New Mexico | New York | North Carolina | North Dakota | Ohio | Oklahoma | Oregon | Pennsylvania | Rhode Island | South Carolina | South Dakota | Tennessee | Texas | Utah | Vermont | Virginia | Washington | West Virginia | Wisconsin | Wyoming | Washington DC (District of Columbia)

Worldwide

Afghanistan, Aland Islands, Albania, Algeria, American Samoa, Andorra, Angola, Anguilla, Antarctica, Antigua and Barbuda, Armenia, Aruba, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Belize, Benin, Bermuda, Bhutan, Bolivia, Plurinational State of Bonaire, Sint Eustatius and Saba, Bosnia and Herzegovina, Botswana, Bouvet Island, British Indian Ocean Territory, Brunei Darussalam, Bulgaria, Burkina Faso, Burundi, Cabo Verde, Cambodia, Cameroon, Canada, Cayman Islands, Central African Republic, Chad, Chile, China, Christmas Island, Cocos (Keeling) Islands, Colombia, Comoros, Congo, Congo, The Democratic Republic of The Cook Islands, Costa Rica, Cote D'ivoire, Croatia, Cuba, Curacao, Cyprus, Czech Republic, Denmark, Djibouti, Dominica, Dominican Republic, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Estonia, Ethiopia, Falkland Islands (Malvinas), Faroe Islands, Fiji, Finland, France, French Guiana, French Polynesia, French Southern Territories, Gabon, Gambia, Georgia, Germany, Ghana, Gibraltar, Greece, Greenland, Grenada, Guadeloupe, Guam, Guatemala, Guernsey, Guinea, Guinea-Bissau, Guyana, Haiti, Heard Island and Mcdonald Islands, Holy See, Honduras, Hong Kong, Hungary, Iceland, India, Indonesia, Iran, Islamic Republic of Iraq, Ireland, Isle of Man, Israel, Italy, Jamaica, Japan, Jersey, Jordan, Kazakhstan, Kenya, Kiribati, Korea, Democratic People's Republic of Korea, Republic of Kuwait, Kyrgyzstan, Lao People's Democratic Republic, Latvia, Lebanon, Lesotho, Liberia, Libya, Liechtenstein, Lithuania, Luxembourg, Macao, Macedonia, The Former Yugoslav Republic of Madagascar, Malawi, Malaysia, Maldives, Mali, Malta, Marshall Islands, Martinique, Mauritania, Mauritius, Mayotte, Mexico, Micronesia, Federated States of Moldova, Republic of Monaco, Mongolia, Montenegro, Montserrat, Morocco, Mozambique, Myanmar, Namibia, Nauru, Nepal, Netherlands, New Caledonia, New Zealand, Nicaragua, Niger, Nigeria, Niue, Norfolk Island, Northern Mariana Islands, Norway, Oman, Pakistan, Palau, Palestine, State of Panama, Papua New Guinea, Paraguay, Peru, Philippines, Pitcairn, Poland, Portugal, Puerto Rico, Qatar, Reunion, Romania, Russian Federation, Rwanda, Saint Barthelemy, Saint Helena, Ascension and Tristan Da Cunha, Saint Kitts and Nevis, Saint Lucia, Saint Martin (French Part), Saint Pierre and Miquelon, Saint Vincent and The Grenadines, Samoa, San Marino, Sao Tome and Principe, Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Sint Maarten (Dutch Part), Slovakia, Slovenia, Solomon Islands, Somalia, South Africa, South Georgia and The South Sandwich Islands, South Sudan, Spain, Sri Lanka, Sudan, Suriname, Svalbard and Jan Mayen, Swaziland, Sweden, Switzerland, Syrian Arab Republic, Taiwan, Province of China, Tajikistan, Tanzania, United Republic of Thailand, Timor-Leste, Togo, Tokelau, Tonga, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Turks and Caicos Islands, Tuvalu, Uganda, Ukraine, United Arab Emirates, United Kingdom of Great Britain and Northern Ireland, United States Minor Outlying Islands, United States of America, Uruguay, Uzbekistan, Vanuatu, Venezuela, Bolivarian Republic of Vietnam, Virgin Islands, British, Virgin Islands, U.S., Wallis and Futuna, Western Sahara, Yemen, Zambia, Zimbabwe

Cryptocurrency Wallet

A XRP wallet is where you store your cryptocurrencies after you have bought them. You can compare a cryptocurrency wallet with your bank account. In the same way that you store traditional currencies (USD, JPY, EUR etc.) in your bank account, you will store your cryptocurrencies in your crypto wallet.

There are a lot of easy-to-use and safe options to choose from. It is important that you choose a highly-secure wallet, because if your cryptocurrency gets stolen from your wallet, you can never get it back.

There are three types of wallets:

Online wallets: The quickest to set up (but also the least safe);

Software wallets: An app you download (safer than an online wallet);

Hardware wallets: A portable device you plug into your computer via USB (the safest option).

The wallet you need will depend on which cryptocurrency you want to buy. If you buy Bitcoin, for example, you'll need a wallet that can store Bitcoin. If you buy XRP, you'll need a wallet that can store XRP.

Luckily, there are a lot of good wallets to choose from that can store multiple cryptocurrencies.

Where to Buy Cryptocurrency?

To learn where to buy XRP, you’ll first need to know where to purchase XRP stock. Just a few years ago, there were only a few places to buy and sell cryptocurrencies. Now, though, there are a lot more! Let’s look at the different places and ways you can get your crypto.

How to Buy Cryptocurrency at Cryptocurrency Exchanges?

XRP exchanges are online websites that let you exchange your local currency for cryptocurrency. Exchanges are the most popular way of buying cryptocurrency. I recommend newbies to use these exchange websites as they are easy-to-use and quick to set up.

Payment Method: Most of the exchanges accept payment by bank transfer or credit card, some of them also accept PayPal.

There are a lot of exchanges for you to choose from. Each one of them has different levels of security and they each accept different types of payment methods. Most exchanges will ask you to follow the steps below before you can start buying cryptocurrency.

Check the security of the exchange. This is the most important thing you need to consider as investors have lost lots of money in the past when the exchanges have been hacked.

Transaction fees – the lower, the better.

The number of payment options available: do they accept bank transfer, credit card, PayPal, etc.?

The amount of time it takes to activate your account — if you’re in a hurry, you might not want to wait a long time to get verified!

Which cryptocurrency options they offer. For example, if you want to buy the XRP token then you need be sure that the exchange you choose sells the XRP token.

1 note

·

View note

Text

“Money used to be a reward for value creation. Today, money is used to create value.

Since leaving the gold standard, money has essentially been backed by faith in the issuing government. This would be the preface to now-fashionable Modern Monetary Theory. No longer having to fear the shortage of gold, governments are free to print the money needed to fully employ their available resources. In other words, MMT views currency as a public good rather than a medium of exchange.

In 2008, Bitcoin was created in response to this very concept. Fundamentally different but joint in their controversy, both ideas have re-entered the mainstream conversation as we enter the post-pandemic world. At the moment, there is no consensus on either.

(...)

The essence of MMT is that budget deficits are irrelevant, because sovereign currency-issuing governments cannot default on their sovereign debt as they can always print more money. The only real constraint on governments is the availability of resources. If resources are available, governments can pay for them by printing money. If they aren’t available, printing money to buy goods will cause inflation.

As a consequence, taxes do not finance spending. Instead, the government taxes for two reasons (i) to drain excess money out of the economy to control inflation and (ii) to stimulate the circulation of the government currency. It makes sense to earn and spend euros if you pay taxes in euros. In a no-growth economy, however, that means the money supply would continue to increase, which must be unsustainable.

(...)

Bitcoin and its genesis block were the preface to a digital alternative to traditional central banks and government spending and has since programmatically reformed money as we know it. Instead of governments inflating the supply of money, Bitcoin has introduced an alternative known as a distributed ledger, otherwise known as a blockchain, granting universal access and a predictable and programmable inflation schedule.

In cases of hyperinflation like Venezuela and Zimbabwe, Bitcoin could theoretically become an economic escape-hatch allowing individuals to hedge from a local economic meltdown. Non-sovereign money allows people to reject their local monetary systems. The way countries like Zimbabwe have adopted Bitcoin is not unlike the currency substitution (dollarization) we’ve seen in many emerging countries struggling to maintain the integrity of their monetary systems.

For now, Bitcoin upholds the “digital gold” narrative – a store of value that is easily exchanged and practically impossible to counterfeit. Given its fixed supply, it is deflationary in nature.

Bitcoin is not truly deflationary in the sense that Bitcoin’s supply will not decrease but continue to increase until the block rewards run out approaching the year 2140, when Bitcoin will reach a hard cap of 21 million coins. MMT, on the other hand, promotes the printing press as a cure-all and rejects monetary policies’ relevance to inflation.

(...)

When we understand that the world is structured by belief, we understand that value can be an illusion. Money is an abstract concept. Its value requires us to believe in it, which is why banks use ancestral heroes to make money seem almost holy.

Crypto is as much of an idea as all other money; its value lies merely in belief. But instead of banks and central authorities, it is pure code. Transparent in its mechanism but private in its use, central bank currencies are the exact opposite. Their management is obscured, but our use is surveilled.”

2 notes

·

View notes