#vanguard uk minimum investment

Explore tagged Tumblr posts

Text

Champ Profit

Website: https://www.champprofit.com/

Champ Profit stands as your dedicated Smart Money Team, guiding you toward financial freedom with top money transfer rates and intelligent trading insights. In a domain often clouded by misinformation and complexity, Champ Profit shines by delivering unbiased reviews and clear, reliable insights into brokers and trading platforms, ensuring your decisions in the forex trading world are always well-informed and strategic. Catering to both beginner and seasoned traders, our platform provides easy-to-understand educational content, daily stock trading news, market insights, and real-time updates, all designed to empower you, minimize risks, and maximize gains. Navigate with confidence, leverage expert analyses, and explore diverse investment opportunities with Champ Profit, your authentic ally in maximizing your trading potential.

Facebook: https://www.facebook.com/ChampProfit

Instagram: https://www.instagram.com/champprofit/

Youtube: https://www.youtube.com/channel/UCW_UoCfjy9gON5wK7uBPyLA

Telegram: https://t.me/ChumpProfitForexSignals

Keywords: barakah money transfer ria money transfer near me ria money transfer uk ria money transfer uk baraka money transfer vanguard investments uk aps money transfer transfer money to eur al baraka money transfer worldremit money transfer transfer money to south africa al barakah money transfer mangal money transfer taaj money transfer natwest currency exchange rates transfer money from australia to uk tax efficient investing uk uk trade and investment best investment trusts for income can a power of attorney transfer money to themselves uk barakah money transfer uk john lewis currency exchange rates santander currency exchange rates best currency exchange liverpool mukuru money transfer zimbabwe transfer money from canada to uk best way to invest 20k short term uk invest in mutual funds uk uk tax on investments vanguard minimum investment uk best investment trusts for retirement income currency direct exchange rate does money transfer affect credit score uk al baraka money transfer uk santander currency exchange rate western union currency exchange rates today transferring money to solicitor for house purchase uk can i transfer money from clearpay to bank account uk ria money transfer uk login inward investment uk seed investment uk uk tax free investments bank of scotland currency exchange rates today smart currency exchange rates visa currency exchange rate best currency exchange in edinburgh best currency exchange leeds best currency exchange manchester transfer money to china from uk transfer money from uk to poland transfer money to poland from uk baraka money transfer uk transfer money from south africa to uk transfer money to russia from uk currency xtra exchange rate john lewis currency exchange rate spain currency exchange rate tesco currency exchange rates pound to euro best currency exchange belfast best currency exchange glasgow mukuru money transfer uk money transfer to ghana from uk transfer money from uk to russia transfer money from spain to uk invest in silver uk investment club uk new investment zones uk best way to invest 20k uk how to invest in an index fund uk best currency exchange rates glasgow how to invert currency exchange rate nepal currency exchange rate best currency exchange birmingham best currency exchange bristol best currency exchange cardiff best currency exchange edinburgh best currency exchange newcastle best currency exchange nottingham best currency exchange rates glasgow best currency exchange sheffield what is the best forex trading platform uk transfer money australia to uk money transfer regulations uk best place to buy investment property uk uk real estate investment trust vanguard uk minimum investment best gold coins to buy for investment uk what lot size is good for $5000 forex account best currency exchange aberdeen what is a pip forex trading what is better than forex trading what is gold trading in forex what is liquidity in trading forex what is metatrader 4 forex trading what is the best app for trading forex what is the most profitable forex trading strategy how to activate e commerce payment on icici forex card how to calculate lot size in forex how to calculate pips in forex how to calculate pivot point in forex how to calculate used margin in forex how to check forex card balance hdfc how to check hdfc forex card balance how to choose a forex broker how to get a funded forex account how to open a forex trading account how to read forex market how to start a forex brokerage how to start forex trading uk what is a pip worth in forex trading what is a pivot point in forex trading what is a pullback in forex trading what is a swing trade in forex what is a trade size in forex what is a trading plan in forex

#what is a trading plan in forex#what is a pullback in forex trading#what is a pip worth in forex trading#how to check forex card balance hdfc#how to read forex market#how to calculate lot size in forex#vanguard uk minimum investment

1 note

·

View note

Text

How to get Investment Visa?

The main points of this type of investment are: the quota must be 500 thousand, 900 thousand or 1.8 million dollars; must generate a minimum of 10 jobs for US citizens in a minimum period of 2 years; the investment does not need to have financial guarantees of return on invested capital, but it needs to guarantee safety and quality in the execution of the project.

EB-2 NIW: Extraordinary Qualification Visa:

It would be the most economical way to acquire a Green Card, but it is not the easiest. This visa requires the applicant — a qualified professional or academic — to demonstrate for US immigration that he or she is a necessary potential for the US market. The process has 1 important points, and the candidate must complete 4.

Property investments:

There are several real estate investments in the United States. They are called “REITs” (Real Estate Investment Trust): they are companies that have their shares traded on the stock exchange. There are more than 250 REITs on the US stock exchange. “It's a simpler, faster and more accessible way to make real estate investments in the country”.Economist, chief strategist and partner at Avenue Securities. To know more about us

“The investor opens an account with a North American brokerage and can start by buying shares or participation in companies, as is done in UK real estate funds. You can buy and sell shares normally on the market through ETFs, an exchange-traded fund”, explains Castro. The largest ETF bundled with REITs is the Vanguard Real Estate ETF (VNQ). Among the largest real estate holding companies that have a stake in this investment fund are American Tower Corporation. . “Another option is to buy a property in the USA, however, it is more appropriate for those who really want to live, since a property has less liquidity than investments”, he says.

An important point for those planning this move: “any type of visa, whether for an investor or immigration to reside in the United States, requires staying in the country for at least 18 days a year. Otherwise, they may understand that there was no interest in living in the country and withdrawing their residence”..

The professional also warns that investing for the sake of investing does not qualify a UK to be entitled to a Green Card, regardless of the size of capital or properties in the United States. To be a resident, you need to meet the requirements of each visa. “Investors need to be aware of misleading promises, so as not to fall into scams. Research serious immigration lawyers and it is essential to have a reserve of 50 thousand dollars”.

0 notes

Text

Expanding on stocks, bonds, and funds terminology

This post isn’t necessary for a basic investment plan/philosophy. It’s most practical for feeling less overwhelmed when browsing/selecting funds. We’ll define more common terms so you can understand what to/not to care about. If you’d like to skip ahead, the next post is: Investment philosophy/plan.

Fund turnover

When someone leaves a mutual fund, they must be paid in cash. Depending on the size of the fund, there might not be cash on hand to pay them directly.

If there’s not enough cash available, then assets must be sold -- this event can cause a distribution of excess cash to all fund shareholders.

Turnover rate is how much/often funds buy/sell assets so it includes large unexpected sells consequently. As an investor, a turnover rate under 10% is good -- anything above that should be a consideration before investing in a fund.

Morningstar shows turnover rate on their site:

Source: https://www.morningstar.com/funds/xnas/vtsax/quote

One way to avoid turnover is to use an ETF which we’ll cover next.

ETF pros and cons

As covered in Investing terminology and advanced basics, traditional mutual funds and ETFs both operate similarly. Here’s their differences:

ETF pros:

Can pass-through securities to seller on sale, thus removing possibility for unexpected distributions/turnover

No 30 day waiting period after selling; most mutual funds disallow buying again for 30 days after selling, ETFs don’t have this

Minimum investment is price of share (e.g. $40-150) whereas mutual funds often have larger minimums (e.g. $3,000 in Vanguard)

Occasionally lower expense ratios than mutual funds

ETF cons:

Traded at a market rate during the day (can have small premium/discount (more/less expensive)) whereas mutual funds are priced/transacted at the end of the day at their Net Asset Value (NAV)

Takes 2 days to settle after transaction date (T+2) whereas mutual funds take 1 day (T+1)

Requires buying/selling full shares (e.g. if price is $50, then can’t buy $40) whereas mutual funds allow any dollar amount (e.g. can buy $40)

Note: Some brokerage firms are starting to allow fractional shares (i.e. can actually buy $40 of a $50 ETF (0.8 shares)) (e.g. Schwab, Robinhood, SoFi)

Vanguard allows converting mutual funds to ETFs but not vice versa, https://investor.vanguard.com/etf/faqs#convert

Stock investing

I don’t partake in stock investing because, according to research, I must select stocks correctly 65% of the time to beat an index fund.

Source: https://news.morningstar.com/classroom2/course.asp?docId=2873&page=2&CN=COM

That being said, there’s 2 common non-speculative methods:

Value investing - Invest in a stock whose price is below its actual value

Growth investing - Invest in a stock which is growing rapidly or you expect to be growing soon

There’s more considerations to make for these investments (e.g. market emotions/corrections, comparing stock price to earnings/other numbers from SEC documents, considering moats). If you’d like to read more, I suggest Morningstar classroom’s stock section:

https://news.morningstar.com/classroom2/home.asp?colId=397&CN=COM

General fund terminology

Investor vs admiral vs institutional shares - Same underlying investments with larger minimum investment in exchange for lower expense ratio ETFs don’t have this distinction and Vanguard has phased out many investor funds (i.e. now many admiral funds have low minimum investment). Examples:

Investor: https://investor.vanguard.com/mutual-funds/profile/VFISX

Admiral: https://investor.vanguard.com/mutual-funds/profile/VFIRX

Institutional: https://investor.vanguard.com/mutual-funds/profile/VSBIX

ETF: https://investor.vanguard.com/etf/profile/VGSH

US/domestic vs international/foreign vs global/world - Investments inside US, outside US, or a mixture of both Global/world funds will often state their breakdown -- e.g. Vanguard Total World Stock Index Fund, VTWAX, below:

Source: https://investor.vanguard.com/mutual-funds/profile/VTWAX

Developed vs emerging - International fund with different sets of countries Developed countries are ones with “proven economies” (e.g. Japan, France, UK) Emerging countries are ones with “developing economies” (e.g. India, Brazil, Taiwain) Reference: https://investor.vanguard.com/mutual-funds/international

Balanced - Mixture of stocks and bonds in fund These will often state their breakdown -- e.g. Vanguard Balanced Index Fund, VBIAX, below:

Source: https://investor.vanguard.com/mutual-funds/profile/VBIAX

Stock fund terminology

Value vs growth vs blend - Fund that invests in value stocks, growth stocks, or a mixture of both (blend)

Large vs mid vs small cap - Fund that invests in companies with a market cap over $10B (large), between $10B and $2B (mid), or under $2B (small) As one might expect, these all move similarly but small cap sees bigger fluctuations than large cap

Comparison of VLCAX, VIMAX, and VSMAX in Morningstar (large, mid, small cap funds respectively)

These two comparisons are often used in a style box:

Source: https://investor.vanguard.com/mutual-funds/profile/portfolio/vtsax

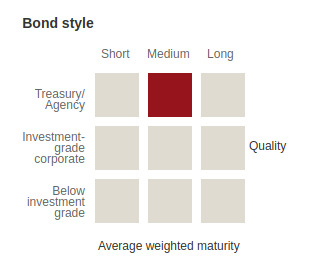

Bond fund terminology

Short vs intermediate vs long term - Time until a bond matures (i.e. stops paying out and is cashed in, if not done sooner) Short is 1-5 years, intermediate is 5-10 years, long is over 10 years. Other timeframes include: money market (0-1 year), ultra-short (0-3 years). Reference: Summaries for VUBFX (ultra-short), VBIRX (short), VBILX (intermediate), VBLAX (long) and https://www.investopedia.com/terms/m/moneymarket.asp

Government vs corporate - Loan created by different entities Government bonds are very secure as taxes can always be raised to pay off the loan. Corporate bonds receive a rating from an independent agency to determine how likely the loan will be paid back (i.e. risk). Example ratings are: AAA, AA, A, BBB, etc. There’s additional factors that can be used to improve a rating (e.g. collateralizing a bond) but I won’t be diving any deeper. Further reading: https://news.morningstar.com/classroom2/home.asp?colId=167&CN=COM

Municipal/Tax-exempt - Government bond which has tax exemption at federal and possibly state level (depends on fund and state of residence) Yields aren’t always as high but depending on your income, it can yield more after taxes. Example: California Municipal Money Market, VCTXX, https://investor.vanguard.com/mutual-funds/profile/VCTXX

GNMA (Ginnie Mae), FNMA (Fannie Mae), FHLMC (Freddie Mac) - Federal programs for mortgages/mortgage pools (i.e. investing in these is effectively investing mortgages/real estate)

Bonds are more nuanced than stocks due to being individualized (e.g. a 20 year bond/note is different than the same 30 year version) but there’s a style box for them regardless. Investment grade means the credit rating is good enough for the maturity (time frame) that it’s a good investment. Note: Style box is colored for the majority of investments not all (i.e. 43.7% treasury bonds, 22.0% government mortage-backed, 16.4% industrial, 8.4% finance, etc).

Source: https://investor.vanguard.com/mutual-funds/profile/portfolio/vbtlx

Up next will be a post covering investing philosophy (e.g. goals/horizons, writing a plan).

Further reading:

Morningstar classroom: https://news.morningstar.com/classroom2/home.asp

Vanguard mutual fund/ETF list (Google anything you’re curious about): https://investor.vanguard.com/mutual-funds/list

Next post: Investment philosophy/plan

0 notes

Text

Soil Treatment Industry: Future Demand, Market Analysis & Outlook to 2024

Latest Research on Soil Treatment Market 2019: The report attempts to offer a high-quality and accurate analysis of the global Soil Treatment Market keeping in view market forecasts, competitive intelligence, and technological risks and advancements, and other important subjects. Its carefully crafted market intelligence allows market participants to understand the most significant developments in the global Soil Treatment market that are impacting their business. Readers can become aware of crucial opportunities available in the global Soil Treatment market as well as key factors driving and arresting market growth. The report of global Soil Treatment market includes the competitive landscape section which provides the full and in-depth analysis of the current market trends, changing technologies and developments that will be beneficial for the companies, which are competing in the market. The report offers an overview of revenue, demand, and supply of data, futuristic cost, and growth analysis during the projected the year. Get Access to sample pages @ https://www.acquiremarketresearch.com/sample-request/172460/ The research covers the current market size of the Global Soil Treatment market and its growth rates based on 5 year history data along with company profile of key players/manufacturers. The in-depth information by segments of Soil Treatment market helps monitor future profitability & to make critical decisions for growth. The information on trends and developments, focuses on markets and materials, capacities, technologies, CAPEX cycle and the changing structure of the Global Soil Treatment Market. Market Players: Syngenta AG, BASF SE, ADAMA Agricultural Solutions Ltd., Solvay S.A., Monsanto Company, American Vanguard Corporation, Arkema S.A., Novozymes A/S, PlatForm: Specialty Products, Kanesho Soil Treatment Technology Physiochemical Treatment, Biological Treatment, Thermal Treatment Type: Organic Amendments, pH Adjusters, Soil Protection What this Research Study Offers: Market share analysis of the top industry players Strategic recommendations for the new entrants Global Newborn Screening Instruments Market share assessments for the regional and country level segments Market forecasts for a minimum of 5 years of all the mentioned segments, sub segments and the regional markets Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations) Strategic recommendations in key business segments based on the market estimations Competitive landscaping mapping the key common trends Company profiling with detailed strategies, financials, and recent developments Supply chain trends mapping the latest technological advancements Check the Best Discount on This Report@https://www.acquiremarketresearch.com/discount-request/172460/ For further clarification, analysts have also segmented the market on the basis of geography. This type of segmentation allows the readers to understand the volatile political scenario in varying geographies and their impact on the global Soil Treatment market. On the basis of geography, the global market for a Soil Treatment has been segmented into: • North America (United States, Canada, and Mexico) • Europe (Germany, France, UK, Russia, and Italy) • Asia-Pacific (China, Japan, Korea, India, and Southeast Asia) • South America (Brazil, Argentina, Colombia, etc.) • The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa)

Reasons for Buying this Report - This report provides pin-point analysis for changing competitive dynamics - It provides a forward looking perspective on different factors driving or restraining market growth - It provides a six-year forecast assessed on the basis of how the market is predicted to grow - It helps in understanding the key product segments and their future - It provides pin point analysis of changing competition dynamics and keeps you ahead of competitors - It helps in making informed business decisions by having complete insights of market and by making in-depth analysis of market segments Read Detailed Index of full Research Study at @ https://www.acquiremarketresearch.com/industry-reports/soil-treatment-market/172460/ About us : Acquire Market Research, is a one stop solution for market research reports in various business categories. We are serving 100+ clients with 10000+ diverse industry reports and our reports are developed to simplify strategic decision making, on the basis of comprehensive and in-depth significant information, established through wide ranging analysis and latest industry trends. For more information or any query mail at [email protected]

0 notes

Text

A Person of Interest

B2B marketers are widely considered to be deeply rational and practical thinkers – but that doesn’t mean we’re immune to twisted logic when it comes to some things. If the latest report from McKinseyis anything to go by, ‘personalisation’ is one of those areas where we appear to have a mental blind spot.

Despite advances in technology, data and analytics – personalisation stubbornly remains ‘too hard’ or ‘too expensive’. A nice thing to do, but not an essential many would argue. Contrast this viewpoint with the bounty on offer at the other end of the rainbow and the logic seems deeply flawed.

For those ‘doing personalisation’ the rewards are a 5-15% increase in marketing efficiency and revenue. Yet, these market leaders remain in the minority with fewer than 10% of businesses deploying personalisation in a systematic way.

Start with the holy trinity

Outside of this small number of vanguards in the B2B marketing space, personalisation hasn’t really progressed much beyond the realm of email marketing. Much of this is down to poor data quality, lack of technology know-how and inadequate planning processes.

These are the ‘Big 3’ foundational elements of marketing and if you don’t have them, there’s very little chance of making personalisation a success. In fact, you even argue you have very little chance of making marketing a success without some basic competency in these areas. So, why is this holy trinity so important?

Data pools, lakes and oceans

When it comes to decision-making and accountability, the conversation tends to start and finish with data – and quite rightly so. The best creative, content and go-to-market plans in the world are rendered impotent if the data to target on a personal level is absent. If you’re looking to be hyper-targeted – now or in the future – you’re going to need a data strategy that covers first, second and third party sources.

First party data is simple enough – it’s the stuff held in your CRM, or on spreadsheets, and is hopefully GDPR-compliant. This is gold dust and it should be your aspiration to build a high-quality customer database for as long as humans communicate by conventional methods. Yes, email as a B2B channel ain’t going to die anytime soon – no matter what the doom-merchants predict.

Second party data is leveraged less frequently in B2B than consumer, but is still worth understanding. This is effectively shared data between two parties. For example two complementary brands sharing a digital cookie so they can both market to the same prospect across both of their websites. One rents its data to the other, which is relatively common in the transport and retail industries. Think AirMiles and British Airways or Sainsbury’s and Argos as part of the Nectar points scheme.

Arguably, the most interesting area of innovation for B2B marketers is in the field of third party data. This is both simple and complex at the same time. The easy bit to grasp is the email and postal address lists you rent from a professional data provider like Experian or Blue Sheep. You blast a few email campaigns out and what you capture is yours. The rest goes in Room 101.

The complex bit is that third party data also now incorporates data warehouses who aggregate it in enormous volumes from multiple sources and make it anonymous to advertisers. These third parties are called DMPs or data management platforms and they sell their data to advertisers who are looking to expand their reach. By using ‘look-alike’ modelling they can help you reach identikit prospects to the ones that have become your customers in the past.

Select your audience segments, just like you would with a paid social campaign, and off you go. If your target audience, and budget, is big enough then this form of ‘programmatic’ advertising could very well be up your street.

Take a look at what Oracle is doing, for example. It has a suite of apps that can help you deploy personalised campaigns across all inbound and outbound channels, while enabling you to track and score prospects in real-time. It can be used to automate campaigns, nurture prospects at scale and hand-off leads instantly to sales. It’s about as sophisticated and expensive as it gets.

The point is not to say “buy it”, but to suggest that you imitate it. But at a level of monetary and resource investment that you can tolerate. It’s not easy, but it is worthwhile. The first step is understanding it (technology). The second is doing it (personalisation) and the third is repeating it ad infinitum (scalability).

To attempt personalisation without some form of technology infrastructure and automation in mind is a foolhardy endeavour. Some have tried. Almost all have failed or given up. Given that a CMO’s shelf life is about three-years, the need to upskill knowledge and skill sets quickly is a race against time. ‘Digital transformation’ is all the rage right now, but this is what it means when it comes to marketing. Data and technology know-how is mission critical.

Don’t just plan to personalise. Plan to measure it.

It’s a disconcerting thing to admit that most planning processes have failed before they have started. In marketing, the planning phase tends to be rushed and therefore poorly conceived. Others argue it’s the other way around, but when it comes to personalisation this is very rarely the case.

Deciding at what level to personalise is all-critical. And it’s actually not difficult decide. Start with the budget – yes, I know every agency bod says this but we truly, madly, deeply believe it. What is the point of planning to personalise to a certain level of granularity if you don’t have the money to do it?

Take this scenario. You want to deploy a three-step buyer journey campaign to sell concrete into the bridge and tunneling sector. That’s a minimum of three items of content and possibly an equal number of emails, landing pages, web pages, ads and anything else you use to go-to-market.

Now add in one category of personalisation – let’s say job function. We now have contractors, consultants and end-clients as a bare minimum. You’ve potentially just multiplied the number of deliverables by a factor of three. Is that extra workload built into the budget and the production lead times? It’s simple mathematics that can be determined at the start of the conversation. It sounds obvious, but my advice is not to start any audience messaging work until this is defined. Planners are intelligent folk, but as far as I’m aware they are not Claire Voyant.

Okay, so now we decide that job function level segmentation is good but we also want to target by business size as well. We think that there’s no real need to further segment the content or promotional assets, but our prospect database doesn’t split by turnover and we’ve discovered that third party data is only available for multinational parent companies. This means we can’t rely on the data quality and could incur the cost of acquiring leads that are not relevant to the regionally-focused UK sales team. In this instance, it’s not a just a budget issue but a practical one in terms of targeting and effective lead generation.

We could apply many more instances of personalisation (vertical sector, interest area, key account etc), but the same rules apply. Do we have the data split by these criteria? Is data available to buy or rent? How many content and promotional assets do we need? Can we afford to create them? Do we have sufficient lead time and skills to produce them? Can we track, score and follow up on leads in this way?

Only when these questions have been asked, answered and budgeted for is it appropriate to start writing a campaign brief, let alone putting subject matter experts through planning workshops and much more besides.

Targeting a person of interest demands much more than a ‘spray and pray’ approach. Get your data, technology and planning processes in shape and you’ll be armed with the ability to turn unknown suspects into known leads in no time at all.

#b2b marketing#lead generation#lead nurturing#personalisation#personalization#demand generation#database marketing

0 notes

Text

Babies and mothers worldwide failed by lack of investment in breastfeeding

CLICK HERE for UNICEF analysis of Press coverage

JOINT PRESS RELEASE

1 August 2017

New analysis shows an investment of US$4.70 per newborn could generate US$300 billion in economic gains by 2025

GENEVA/NEW YORK, 1 August 2017 – No country in the world fully meets recommended standards for breastfeeding, according to a new report by UNICEF and the World Health Organization (WHO) in collaboration with the Global Breastfeeding Collective, a new initiative to increase global breastfeeding rates.

The Global Breastfeeding Scorecard, which evaluated 194 nations, found that only 40 per cent of children younger than six months are breastfed exclusively (given nothing but breast milk) and only 23 countries have exclusive breastfeeding rates above 60 per cent.

Evidence shows that breastfeeding has cognitive and health benefits for both infants and their mothers. It is especially critical during the first six months of life, helping prevent diarrhoea and pneumonia, two major causes of death in infants. Mothers who breastfeed have a reduced risk of ovarian and breast cancer, two leading causes of death among women.

“Breastfeeding gives babies the best possible start in life,” said Dr. Tedros Adhanom Ghebreyesus, Director-General of WHO. “Breastmilk works like a baby’s first vaccine, protecting infants from potentially deadly diseases and giving them all the nourishment they need to survive and thrive.”

The scorecard was released at the start of World Breastfeeding Week alongside a new analysis demonstrating that an annual investment of only US$4.70 per newborn is required to increase the global rate of exclusive breastfeeding among children under six months to 50 per cent by 2025.

Nurturing the Health and Wealth of Nations: The Investment Case for Breastfeeding, suggests that meeting this target could save the lives of 520,000 children under the age of five and potentially generate US$300 billion in economic gains over 10 years, as a result of reduced illness and health care costs and increased productivity.

“Breastfeeding is one of the most effective – and cost effective – investments nations can make in the health of their youngest members and the future health of their economies and societies,” said UNICEF Executive Director Anthony Lake. “By failing to invest in breastfeeding, we are failing mothers and their babies – and paying a double price: in lost lives and in lost opportunity.”

The investment case shows that in five of the world’s largest emerging economies—China, India, Indonesia, Mexico and Nigeria—the lack of investment in breastfeeding results in an estimated 236,000 child deaths per year and US$119 billion in economic losses.

Globally, investment in breastfeeding is far too low. Each year, governments in lower- and middle- income countries spend approximately US$250 million on breastfeeding programs; and donors provide only an additional US$85 million.

The Global Breastfeeding Collective is calling on countries to:

Increase funding to raise breastfeeding rates from birth through two years.

Fully implement the International Code of Marketing of Breast-milk Substitutes and relevant

World Health Assembly resolutions through strong legal measures that are enforced and independently monitored by organizations free from conflicts of interest.

Enact paid family leave and workplace breastfeeding policies, building on the International

Labour Organization’s maternity protection guidelines as a minimum requirement, including provisions for the informal sector.

Implement the Ten Steps to Successful Breastfeeding in maternity facilities, including providing breastmilk for sick and vulnerable newborns.

Improve access to skilled breastfeeding counselling as part of comprehensive breastfeeding policies and programmes in health facilities.

Strengthen links between health facilities and communities, and encourage community networks that protect, promote, and support breastfeeding.

Strengthen monitoring systems that track the progress of policies, programmes, and funding towards achieving both national and global breastfeeding targets.

Breastfeeding is critical for the achievement of many of the Sustainable Development Goals. It improves nutrition (SDG2), prevents child mortality and decreases the risk of non-communicable diseases (SDG3), and supports cognitive development and education (SDG4). Breastfeeding is also an enabler to ending poverty, promoting economic growth and reducing inequalities.

Notes to editors

Multimedia content is available here.

Visit http://uni.cf/breastfeeding to download The Global Breastfeeding Scorecard and The Investment Case for Breastfeeding.

About the Global Breastfeeding Scorecard

The Scorecard compiles data from countries all over the world on the status of seven priorities set by the Global Breastfeeding Collective to increase the rate of breastfeeding.

The 23 countries that have achieved exclusive breastfeeding rates above 60 per cent are: Bolivia, Burundi, Cabo Verde, Cambodia, Democratic People’s Republic of Korea, Eritrea, Kenya, Kiribati, Lesotho, Malawi, Micronesia, Federated States of Nauru, Nepal, Peru, Rwanda, São Tome and Principe, Solomon Islands, Sri Lanka, Swaziland, Timor-Leste, Uganda, Vanuatu, and Zambia.

About the Global Breastfeeding Collective

Co-led by UNICEF and WHO, the Global Breastfeeding Collective’s mission is to rally political, legal, financial, and public support for breastfeeding, which will benefit mothers, children, and society.

For more information contact:

Yemi Lufadeju, UNICEF New York, +1 917 213 4034, [email protected]

Kimberly Chriscaden, WHO Geneva, tel: +41 22 791 2885, mob: +41 79 603 1891, [email protected]

Olivia Lawe Davies, WHO Geneva, tel: +41 22 791 1209, mob: +41 79 475 5545, [email protected]

Media coverage:

Breastfeeding: a missed opportunity for global health: http://www.thelancet.com/journals/lancet/article/PIIS0140-6736(17)32163-3/fulltext?elsca1=etoc Reuters: Rich or poor, all countries fail to support breastfeeding: UN (Also on Reuters Africa and The Globe and Mail)The Guardian: UK attitudes to breastfeeding must change, say experts

USA Today: Breastfeeding: Not a single country in the world meets WHO, UNICEF standards

Jakarta Globe: New UNICEF, WHO Initiative Calls on Governments to Increase Investment, Support for Breastfeeding

DPA (German Press Agency): UN: Breastfeeding can boost economies and save children’s lives

Fast Company: Can Encouraging Breastfeeding Around the World Boost the Global Economy? (refers to the “Global Breastfeeding Initiative/GBI” Rather than “Global Breastfeeding Collective” but will be corrected)

New York Daily News: All countries are failing when it comes to breastfeeding: World Health Organization

Huffington Post (Mama Bean Parenting): Babies and Mothers Failed by lack of Investment in Breastfeeding

Premium Times (Nigeria): Breastfeeding can boost economies, save children’s lives – UN

Outlook (India): Lack of investment in breastfeeding results in around 3 lakh child deaths per year: Report

Kaiser Family Foundation (Kaiser Daily Global Health Policy Report): Breastfeeding Mothers Need More Support In All Nations, WHO/UNICEF Report Says; WHO, UNICEF Launch Global Breastfeeding Collective

La Nacion (Mexico): Para los expertos debe ser una política pública

El Debate (Mexico): Lactancia materna para salvar más vidas

Business Standard (India): Lack of investment in breastfeeding results in around 3 lakh child deaths per year: Report

Romper: Investing In Breastfeeding Could Make Us Richer & Healthier, Report Finds, So Why Aren’t We?

Daily Trust (Nigeria): No country in the world meets breastfeeding recommendation – UNICEF

National Accord (Nigeria): Nigeria losing US$21bn yearly to inadequate breastfeeding- UNICEF

Healio: WHO, UNICEF stress seven ways to invest in breast-feeding initiatives

Vanguard (Nigeria): Breastfeeding: Nigeria, four others lose $119bn annually – WHO

CTV News (Canada): Countries failing to meet breastfeeding targets, new global report finds

Huffington Post Australia: Breastfeeding Mothers Aren’t Getting The Support They Need

Daily Post (Nigeria): Breastfeeding can boost economies, save children’s lives – UN

The Less-Refined Mind: UNICEF, WHO release New Breastfeeding Research

Babies and mothers worldwide failed by lack of investment in breastfeeding was originally published on Baby Milk Action

1 note

·

View note

Text

Nematicides -Market Demand, Growth, Opportunities and Analysis Of Top Key Player Forecast To 2025

Nematicides Industry

Description

Wiseguyreports.Com Adds “Nematicides -Market Demand, Growth, Opportunities and Analysis Of Top Key Player Forecast To 2023” To Its Research Database

Global Nematicides market is expected to grow from $1.19 billion in 2016 to reach $1.62 billion by 2023 with a CAGR of 4.5%. Increasing focus on soil health, growing investments in research & development, and raising market for bionematicides are some of the major factors boosting the market growth. On the other hand, various environmental regulations among countries, high costs are the restraints limiting the market growth.

Fumigants nematicides segment is projected to command the global market with large market revenue due to huge adoption in vegetables & fruit crop production. Liquid form segment is expected witness higher CAGR during the forecast period. North America is accounted for the largest share in global nematicides market followed by Europe. Asia Pacific is expected to witness fastest growth over the forecast period. The growth is attributed to increasing agriculture sector led to adopt crop protection techniques.

Since the COVID-19 virus outbreak in December 2019, the disease has spread to almost 100 countries around the globe with the World Health Organization declaring it a public health emergency. The global impacts of the coronavirus disease 2019 (COVID-19) are already starting to be felt and will significantly affect the Nematicides market in 2020.

COVID-19 can affect the global economy in three main ways: by directly affecting production and demand, by creating supply chain and market disruption, and by its financial impact on firms and financial markets.

Some of the key players in global nematicides market include BASF SE, ADAMA Agricultural Solutions Ltd. (Makhteshim-Agan), American Vanguard Corporaton, Bayer Cropscience AG Bioworks Incorporated, E.I. Du Pont De Nemours and Company, FMC Corporation, Isagro Group Spa, Ishihara Sangyo Kaisha Ltd., Monsanto Company, Nufarm Ltd, Syngenta AG, The DOW Chemical Company, UPL Limited, and Valent USA.

Nematicides Types Covered: • Bionematicides • Carbamates • Fumigants • Organophosphates

Form Types Covered: • Liquid Form • Granular or Powder Form

Request for Sample Report @ https://www.wiseguyreports.com/sample-request/2101680-nematicides-global-market-outlook-2017-2023

Method of Applications Covered: • Spraying • Irrigation • Seed Treatment • Fumigation

Applications Covered: • Industrial • Agricultural

Regions Covered: • North America o US o Canada o Mexico • Europe o Germany o UK o Italy o France o Spain o Rest of Europe • Asia Pacific o Japan o China o India o Australia o New Zealand o South Korea o Rest of Asia Pacific • South America o Argentina o Brazil o Chile o Rest of South America • Middle East & Africa o Saudi Arabia o UAE o Qatar o South Africa o Rest of Middle East & Africa

Leave a Query @ https://www.wiseguyreports.com/enquiry/2101680-nematicides-global-market-outlook-2017-2023

What our report offers: – Market share assessments for the regional and country level segments – Market share analysis of the top industry players – Strategic recommendations for the new entrants – Market forecasts for a minimum of 7 years of all the mentioned segments, sub segments and the regional markets – Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations) – Strategic recommendations in key business segments based on the market estimations – Competitive landscaping mapping the key common trends – Company profiling with detailed strategies, financials, and recent developments – Supply chain trends mapping the latest technological advancements

Table of Content

1 Executive Summary

2 Preface

3 Market Trend Analysis

4 Porters Five Force Analysis

5 Global Nematicides Market, By Nematicides Type

6 Global Nematicides Market, By Form

7 Global Nematicides Market, By Method of Application

8 Global Nematicides Market, By Application

9 Global Nematicides Market, By Geography

10 Key Developments

11 Company Profiling

Buy Now @ https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=2101680

Continued…

Contact Us: [email protected] Ph: +1-646-845-9349 (Us) Ph: +44 208 133 9349 (Uk)

NOTE : Our team is studying Covid-19 and its impact on various industry verticals and wherever required we will be considering Covid-19 footprints for a better analysis of markets and industries. Cordially get in touch for more details.

0 notes

Text

The Slow and Steady passive portfolio update: Q4 2018

The trouble started just after the last update of our Slow & Steady passive portfolio. We took a hit in October, staggered on through November, then went down like a sack in December.

News reports made the market turmoil sound like the Charge of the Light Brigade.

The result of this butchery? Our passive portfolio turned in its worst ever annual performance. We were down 3% on the year.

Quick, send in the trauma counsellors!

Do not adjust your sets

As a rule of thumb, we should expect our equities to be down one in every three New Year Eves. Sure, 2017 was all champagne corks and 2018 was nose pegs – but this is situation normal.

The fact is we’ve had an easy ride since the Global Financial Crisis. This is only the second negative year recorded by the Slow & Steady portfolio since its debut eight years ago. We’re still growing at 7.95% annualised and we’ve yet to take anything worse than a noogie from the market.

You can inspect this latest Chinese burn for yourself in Retina-Blitz-Super-Gore-o-vision:

The Slow and Steady portfolio is Monevator’s model passive investing portfolio. It was set up at the start of 2011 with £3,000. An extra £955 is invested every quarter into a diversified set of index funds, tilted towards equities. You can read the origin story and catch up on all the previous passive portfolio posts.

It’s always salutary to see how diversification dilutes the pain. This time our global property and UK government bond funds closed the year in positive territory – just. That salved our portfolio from the deeper cuts borne by emerging markets, UK equities, and global small caps. They’re showing annual losses of around minus 10% at the time of writing.

Diversification doesn’t always work immediately – sometimes it doesn’t work at all – but our bonds take the edge off more often than not. If you’ve been chewing your fingernails over the last three months, upping your bonds is the answer. Read up on risk tolerance.

As it is, the Monevator reader ranks seem to be holding the line and dreaming of cheap equities.

Elsewhere, the doom-mongers hold court. We’re at the mercy of Brexit, Trump’s next tweet, the Fed turning the interest rate screw. Take your pick.

A couple of those woes illustrate why you can’t profit from prophets. Does anyone know how Brexit will end? No. Does anyone know what Trump will do next? No. Even he doesn’t know.

Portfolio maintenance

Moving on, it’s annual portfolio service time. Our plan commits us to reducing equity exposure as our investing clock runs down. Every year we move 2% from the risky equities side to the defensive bond side of our portfolio.

This is conventional and sensible risk management. As we age, we have less time to recover from a market-quake. More wealth in bonds means more wealth in recession-resistant assets.

Our asset allocation is now 64:36 equities vs bonds, very close to the classic 60:40 mix. The portfolio started on 80:20 back in 2011, when we had little to lose and two decades stretching ahead. With 12 years to go it’s still a pro-growth portfolio, but with plenty of padding should markets crash.

So this time around we just shave 1% from a couple of our spicier asset classes and buy more bonds, right?

If only!

Prepare yourself for a rejig more complicated than the pasodoble:

Global small cap: -1%

Global property: -1%

UK equities: -1%

UK inflation-linked bonds: -1%

Developed world equities: +1%

UK conventional government bonds: +3%

Why so fiddly? Allow me…

Firstly, our equity diversifiers (global small cap and property) are set at 10% of our total equities allocation. Meanwhile our equities allocation downsized from 66% to 64% of our portfolio pie. The effect on global small cap was: 10% x 64% = 6.4% total allocation.

Decimal points have no place in asset allocation but now we’re rounding down not up. Hence global small cap and global property got 1% sliced off.

Ideally we’d end it there, but we also try to keep our main equity holdings in line with global market allocations. Star Capital helps us do that with their regular updates on the weights of world stock markets.

The UK’s share of global markets was about 5% (from around 8% in 2o11, incidentally, economic decline fans). That translates to a 3% share of our equity allocation.

However there’s little point to sub-5% holdings in relatively small portfolios – it just doesn’t make enough difference. Instead we’ll reduce the UK to 5% of our overall portfolio and that will be our bottom line. This makes us overweight UK (crack open the Union Jack underpants) but we’ll let that pass – the UK market seems quite cheap and it’s our home currency, for better or worse.

We should have knocked back emerging markets, too. They’ve had a rough year and their wedge is smaller now. But emerging economies themselves are under-represented by the capital markets and valuations are favourable, so we’ll hold our overall allocation at 10%.

Finally, I’m now broadcasting from the outer reaches of interest but if anyone wants to know why I’ve trimmed our UK inflation-linked government bonds then it’s because the available linker funds have structural issues.

The short version is there’s mucho interest rate risk embedded in these products. We only carry them as a diversifier and I’d prefer to do that at the minimum practical level of 5%.

What no robot?

You can see how even a committed passive investor like myself needs to make all kinds of judgement calls. It’s hardly day-trading, but it isn’t pure mathematics, either.

In my view, rules only fit reality if you bend them a bit.

There’s no guarantee that any of my tilts will play out better than buying an all-in-one, Vanguard LifeStrategy fund – but this kind of portfolio maintenance only takes a few hours a year. And I like being invested in my investments.

Increasing our quarterly savings

Now we need to face one more fact of life – inflation. Each year we adjust our regular contributions by the Office for National Statistics’ RPI inflation report. This tells us we have to find another 3.2% this year to ensure our plan keeps pace with the cost of living.

In 2011 we were investing £750 every quarter. That had ballooned to £935 by 2018. That’s £955 in 2019 money.

So £955 it is this quarter, which merges with our annual rebalancing move to generate the following hot buy and sell action:

UK equity

Vanguard FTSE UK All-Share Index Trust – OCF 0.08%

Fund identifier: GB00B3X7QG63

Rebalancing sale: £204.82

Sell 1.107 units @ £185.08

Target allocation: 5%

Developed world ex-UK equities

Vanguard FTSE Developed World ex-UK Equity Index Fund – OCF 0.15%

Fund identifier: GB00B59G4Q73

New purchase: £827.85

Buy 2.595 units @ £318.97

Target allocation: 37%

Global small cap equities

Vanguard Global Small-Cap Index Fund – OCF 0.38%

Fund identifier: IE00B3X1NT05

Rebalancing sale: £162.22

Sell 0.633 units @ £256.21

Target allocation: 6%

Emerging market equities

iShares Emerging Markets Equity Index Fund D – OCF 0.27%

Fund identifier: GB00B84DY642

New purchase: £310.74

Buy 208.554 units @ £1.49

Target allocation: 10%

Global property

iShares Global Property Securities Equity Index Fund D – OCF 0.22%

Fund identifier: GB00B5BFJG71

Rebalancing sale: £455.15

Sell 229.756 units @ £1.98

Target allocation: 6%

UK gilts

Vanguard UK Government Bond Index – OCF 0.15%

Fund identifier: IE00B1S75374

New purchase: £1,100.92

Buy 6.721 units @ £163.80

Target allocation: 31%

UK index-linked gilts

Vanguard UK Inflation-Linked Gilt Index Fund – OCF 0.15%

Fund identifier: GB00B45Q9038

Rebalancing sale: £462.33

Sell 2.425 units @ £190.64

Target allocation: 5%

New investment = £955

Trading cost = £0

Platform fee = 0.25% per annum.

This model portfolio is notionally held with Cavendish Online. Take a look at our online broker table for other good platform options. Look at flat fee brokers if your ISA portfolio is worth substantially more than £25,000. The Slow & Steady portfolio is now worth over £41,000 but the fee saving isn’t juicy enough for us to push the button on the move yet.

Average portfolio OCF = 0.18%

If all this seems too much like hard work then you can buy a diversified portfolio using an all-in-one fund such as Vanguard’s LifeStrategy series.

Take it steady,

The Accumulator

The Slow and Steady passive portfolio update: Q4 2018 published first on https://justinbetreviews.weebly.com/

0 notes

Text

The lazy investor’s 5-step guide to retiring with a million

If you’re looking to begin building a sizeable pot of money from the market with the minimum of effort in 2018, you’ve come to the right place. On this most festive of days, I present the lazy investor’s strategy for building a million-pound portfolio.

Step 1: Make full use of tax-efficient accounts

Making sure that you hold the vast majority, if not all, of your investments in a stocks and shares ISA might come across as a dull first step but it’s also one of the most important. Put simply, any gains you make are protected from the taxman. The impact of this may be fairly negligible in the early days but over the course of an investing lifetime, it could mean the difference between achieving millionaire status and not.

Thanks to sizeable increases in the annual allowance over the last few years, you can now stash up to £20,000 in a single ISA in 2017/18. Don’t waste the opportunity.

Step 2: Spend less than you earn

The second step should appeal to lazy investors since it involves doing a lot less of something, namely spending money on things you probably don’t need. And yes, that could include an iPhone X.

Having spent less than you earn, the next half of the step is simple: put the difference in your stocks and shares account. For added laziness, consider automating the process via a monthly direct debit if you suspect you might forget to do it manually.

Step 3: Buy trackers

We’re big fans of stock picking at the Fool. Nevertheless, those with no interest in the stock market beyond recognising it as a vehicle to grow rich over time should give consideration to investing in a basket of index trackers or exchange-traded funds. Not only do these wonderfully low-cost alternatives to managed (and usually worse-performing) funds allow you to capture the same returns as the markets, they’re also a brilliant way of building a diversified portfolio.

If you’re seriously attracted to the idea of spending as little time on your investments as possible, a simple global equity tracker or exchange-traded fund, such as those provided by Vanguard or iShares should suffice. Those wanting a more balanced portfolio, giving exposure to other asset classes may prefer the fuss-free Life Strategy funds offered by the former. Whatever you decide, by investing at regular intervals — pound cost averaging — you also reduce the chance of buying at the top of the market.

Step 4: Avoid temptation

Receiving dividend payments from the companies or funds we own is one of life’s little pleasures. That said, an even greater pleasure is seeing your wealth grow significantly faster through the reinvestment of these regular payouts and the power of compounding (interest on interest).

So long as you’re not relying on your portfolio to generate an income, you’d do well to avoid the temptation to withdraw this money. Why bother anyway? It’s too much effort.

Step 5: Be patient

The final step in the strategy is perhaps the most difficult of them all since it requires something that many of us lack, namely patience. So long as there isn’t a clear reason to question your holdings, cultivating the ability to put your feet up when those around you are making impulsive, emotion-fuleled decisions is critical if you’re to emerge from the markets a far wealthier individual.

Like that? Read this

A lazy investment strategy such as that outlined above has the power to be life-changing so long as you're willing to stick with it.

If you're interested in learning more about how to increase your chances of walking away from the stock market with a cool million in your back pocket, don't leave before downloading this special report from the Motley Fool's analysts. It's completely FREE to read, comes with no obligation and is an ideal way to begin the new investing year.

Just click here and it's yours.

More reading

2 great growth stocks I’d buy right now

Which is the better oil play: Royal Dutch Shell plc or Premier Oil plc?

Carillion plc isn’t the only stock I’ll be avoiding in 2018

A FTSE 100 value stock I’d buy and hold forever

Why I’d avoid Centrica plc for this dividend share you might regret not buying

Paul Summers has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

0 notes

Text

Gordon Brown and the TOBA that shafted the Navy

In this guest article, Jag Patel considers if Gordon Brown’s reputation as a prudent politician is deserved and the impact his policies are still having on the RN today.

During his 10 years as Chancellor of the Exchequer and then as Prime Minister, Gordon Brown cultivated a carefully crafted reputation as a prudent politician and trustworthy custodian of the public purse. Indeed, such was his penchant for using the word ‘prudence’ that political journalists took to playing a fun game of counting the number of times it was mentioned in his budget speeches. Some even jokingly suggested that Prudence was the name of his girlfriend, who had been kept out of the public eye. Either way, Brown’s record in office, as a “fiscally prudent politician”, does not tally with the evidence.

In his autobiography My Life, Our Times, Brown discusses among other things the financial crises, his economic record and that fateful promise made by Tony Blair. Not surprisingly, there is no mention of one of most disgraceful actions of his government. It concerns state-sponsored protectionism, and failure to install genuinely independent regulatory bodies. This shameful episode, which marred Brown’s time in office, relates to the procurement of military equipment.

What has been clear for many years is that, public subsidies handed out to defence equipment manufacturers over several decades, is the reason why they have failed so miserably, to deliver equipment to the Armed Forces which is fit for purpose, adequately sustained in-service and constitutes value for money through-life.

Means of defence production in the hands private interests

In the UK, as in many western countries, the means of defence production, distribution and exchange is exclusively in the hands of private interests, that is to say, the State is entirely dependent on for-profit organisations for the design, development, manufacture and delivery of new military equipment to the Armed Forces. Consequently, the government has no choice but to rely on the Private Sector for all its military equipment needs, including its subsequent upkeep when in-service with the user. The harsh reality is that, no department of state in Whitehall is as dependent on the Private Sector, as is the Ministry of Defence – putting it at serious risk of capture by private interests (if it hasn’t already been) which allows them to bend policy to their will, as it relates to the expenditure of public funds. Equally, these private interests are entirely dependent upon a steady flow of taxpayer funds for their very survival – no least, because they have not bothered to diversify at all.

For those not familiar with this concept of state capture, Transparency International, the anti-corruption watchdog, defines it as “a situation where powerful individuals, institutions, companies or groups within or outside a country use corruption to shape a nation’s policies, legal environment and economy to benefit their own private interests”.

The shipbuilding Terms of Business Agreement (TOBA)

The Terms of Business Agreement on naval shipbuilding was signed in secret by the Brown government with BAE Systems during the dying days of the 2005-10 Parliament. It locked the government into an appallingly poor 15-year commercial arrangement laced with a punitive get-out clause which, if made public, would have attracted an outcry during the run-up to the 2010 general election. The agreement left the incoming administration no room to manoeuvre at all, as it set about started the 2010 SDSR, the first defence review in 12 years.

The existence of the TOBA was only revealed to Parliament in 2011 by the coalition government, when it was confronted with the undeniable truth that MoD finances were in bad shape and needed to be declared publicly, to garner public support for deep cuts in the defence budget that ensued.

It is an open secret that the even the most fiscally prudent people in government are prone to softening their stance just before a general election, when they are up for re-election, which makes them more likely to open-up the public purse. Equally, defence contractors are aware of this weakness in top politicians and will take full advantage, by surreptitiously intensifying their lobbying efforts (in concert with trade unions), to apply political pressure spliced with threats of massive lay-offs, timed to coincide with the electoral cycle, to relieve politicians off taxpayers’ money and maximise their take – which is exactly what happened with this TOBA.

TOBA – What it is all about

Briefly, the TOBA commits the government to guaranteeing BAE Systems a minimum level of surface ship construction and support activity of about £230 million a year. Apparently, this level of work was independently verified as the minimum level of work required to sustain a credible warship building industry in the UK, and thus avoid the delays encountered during the Astute class submarine build programme, caused in part by the loss of skilled staff, which arose due to the gap between Astute and the Vanguard class submarine builds. MoD claims that the TOBA was designed in such a way as to incentivise major reductions in the size of the shipbuilding industry, on a managed basis, to minimise the rationalisation cost which MoD was liable to pay for, under historic Yellow Book rules.

However, delay after delay in letting the build contract for the Type 26 frigate, largely due to the considerable pressure on MoD finances brought on by the appearance of the so-called ‘black hole’, resulted in a gap in orders opening up between completion of the second aircraft carrier and the start of the Type 26 construction programme. It was to avoid exactly this type of situation from arising in the first place, that the TOBA was established!

So, in an attempt to fill this gap, the government agreed to buy five Offshore Patrol Vessels from BAE Systems, for a price of £348 million. But because the TOBA required £230 million to be spent with BAE Systems each year, the government ended up paying an additional £100 million, on top of the agreed price for the OPVs – making them the most expensive OPVs in the world. Worse still, these are ships the RN did not especially need as it already had 4 relatively modern OPVs.

The staggering incompetence of people in government who negotiated and then gave the green light to this agreement, that is, elite politicians, their special advisers, senior civil servants and military top brass, knows no bounds – it is there for all to see!

TOBA finds no mention in the National Shipbuilding Strategy

To be fair, this government inherited the TOBA from the last government. Notwithstanding, it is so embarrassed by the existence of the TOBA, that it couldn’t even bring itself to mention it in its new National Shipbuilding Strategy, released in September 2017 – yet the National Shipbuilding Strategy was shaped by the terrible experience of the TOBA.

Most notably, the National Shipbuilding Strategy abandons the failed policy of intervening in the market to dictate the composition of the shipbuilding industry and also extends (finally) use of the instrument of fair and open competition, to select the Prime Contractor for the new generation of Type 31e general purpose frigates, to be built for a fixed, not-to-exceed price of £250 million each.

What’s more, for the first time in the history of defence procurement in the UK, it will be mandatory for the ship to be designed with exports in mind from the outset, and accordingly, bidders will be required to prove that they have secured the commitment of potential export customer(s) which the government will verify, before placing the shipbuilding contract with the winning Prime Contractor, on the basis of best value for money. This requirement will also serve to achieve the government’s wider goal of a Global Britain in the post-Brexit era, so that it can pay its way in the world.

The only saving grace about this TOBA is that it has a sunset clause built into it, that is to say, it expires after 15 years, in 2024 – otherwise, it could have quite easily been much worse for taxpayers!

Protectionism and favouritism

So, instead of exposing defence equipment manufacturers to the full rigours of the free market, the Brown government chose to engage in protectionism and favouritism by handing out uncontested, long-term shipbuilding contracts worth billions of pounds – with virtually no checks and controls, or even guarantees, which has come to haunt this minority government. Nevertheless, it has decided to honour the TOBA because it simply has no choice.

What’s more, in the military equipment market, it has been long-standing policy to combine the role of the sponsoring agency and regulatory authority in a single department of state, the Ministry of Defence – which means that the crucial independent scrutiny function, free from political interference, is non-existent. So, capture of one amounts to taking control over both!

The revolving door

Worse still, people at the Ministry of Defence are, without exception, favourably disposed towards the defence industry because they are completely dependent upon it for their subsequent career when their time in public service comes to an end sometimes by political edict. Indeed, it is very hard to find anyone at MoD who will aggressively defend taxpayers’ interests, once they have enjoyed a cosy relationship with contractors.

A modern Defence Industrial Strategy

An innovative proposal (download the paper here) on how to go about eliciting Private Sector investment capital in defence procurement programmes is set out in a written submission to the Business, Energy and Industrial Strategy Committee, which reported on its inquiry into Industrial Strategy in the last Parliament. It introduces a modern Defence Industrial Strategy that puts financial security and the national interest first, not military equipment manufacturers’ commercial interests.

The signing of this TOBA is another contributing factor to the pressure the defence budget is now under. It is understandable why Treasury Ministers are disinclined to increase the MoD’s budget, given their historic record of mismanagement, with this TOBA being another example.

Jag Patel is an independent Defence Procurement Adviser with over 30 years experience of researching, analysing, publicising and solving a wide range of entrenched procurement problems. He tweets as @JagPatel3

(Opinions expressed here are not necessarily that of Save the Royal Navy. We also recognise Conservative administrations have made just as many mistakes with defence as Labour)

Related articles

Three expensive new OPVs being built for the RN (Save the Royal Navy 2014)

Minister opens up about his shipbuilding heartache (Save the Royal Navy 2016)

from Save the Royal Navy http://www.savetheroyalnavy.org/gordon-brown-and-the-toba-that-shafted-the-navy/

0 notes

Text

ETFs do the hard work for expat investors like you

There is a revolution going on, one that is transforming the way ordinary investors build their wealth.

Exchange traded funds, or ETFs, have steadily been growing in popularity for years and are now hitting critical mass as people recognise their benefits

The total invested in ETFs and exchange traded products (ETPs) globally hit a new high of US$3.844 trillion at the end of February 2017, according to London-based research consultancy ETFGI. This followed record inflows of $68 billion in February.

Steve Cronin, founder of Wise (wiseuae.com), a non-profit organisation to help UAE residents invest their wealth, says ETFs have exploded in popularity with the main attraction being able to invest on your own. With a diversified portfolio, investors can sit back and take the passive approach.

“ETFs are great for expat investors,” says Mr Cronin.

“I like to keep my investing simple, so I can get on with the rest of my life – ETFs are ideal for this.”

ETFs allow you to build a flexible, low-cost portfolio of investment funds that you are free to buy and sell at any time. They are traded on the stock market like ordinary shares, quickly and easily, with standard share dealing charges.

BlackRock’s iShares is the biggest provider with $1.351tn of assets under management, followed by Vanguard with $675bn, State Street Global Advisors’ SPDR with $550 million and Invesco PowerShares with $120m, according to ETFGI.

ETFs may be traded like stocks but are passive investment funds that track a chosen index, sector, region, asset class or commodity, in fact pretty much anything you can imagine.

Private investors can build a balanced portfolio from thousands of ETFs which they can adjust at minimal cost as investment goals change.

You are not locked in at any stage or committed to funding a plan that no longer suits your needs, and there are no penalties when you sell.

You can make your own investment decisions or invest through one of the growing number of independent financial advisers who are switching on to ETFs. You will pay a fee for their advice but save money because your funds go into ETFs rather than pricier mutual funds or inflexible insurance-based plans.

Mr Cronin says that because ETFs can be traded like a share, it makes them easy to deal in. “There is always a price available and you can buy or sell them immediately.”

However, there is a bewildering choice of funds available. Most of the world’s ETFs are traded on exchanges – New York, Tokyo and in Europe – but increasingly they are popping up on smaller exchanges like Dubai and Cairo. The global ETF/ETP industry now has 6,699 products with 12,646 listings, offered by 298 providers on 65 exchanges in 53 countries, according to ETFGI.

Mr Cronin says 80 per cent of his core portfolio is invested in the Vanguard FTSE All-World UCITS ETF.

“For an annual fee of 0.25 per cent, it tracks the performance of 3026 stocks in 47 countries,” he says. “I might check the progress about once a month, sometimes less – it’s up 16 per cent from last year in dollar terms.”

And his advice for others: passive index tracking ETFs should make up the core of your portfolio. “This gives you exposure to an entire index in just one fund,” he adds.

Some ETFs let you invest in more than one index, giving you access to all the world’s major stock markets within a single trade.

You can invest in any major index for an annual charge of between 0.1 and 0.3 per cent per year, says Mr Cronin, ensuring your profits aren’t eaten up by fees.

You also have to pay a share dealing fee when you buy or sell, which ranges from $5 to $25, or a percentage charge, which differs according to the platform and trading package. You may also have to pay stamp duty on share transactions, which ranges from 0.15 per cent on a Swiss-based exchange to 0.5 per cent in the UK. There should be no other upfront fees or exit fees.

Overall fees are far lower than on most mutual funds, which carry initial charges of up to 5 per cent, plus an annual management charge of up to 1.5 per cent. You then have to pay advisory and platform commission or fees on top of that, while insurance plans can charge even more. Mr Cronin says that ETFs labelled “UCITS” are ideal for most UAE investors as they are based in the EU, whereas US-based ETFs may trigger an inheritance tax charge.

Andrew Hallam, author of The Global Expatriate’s Guide To Investing, recommends including a stock index from your home country as well as a global stock index, which provides exposure to stocks in every geographic sector.

“It would include developed and emerging market stocks,” says Mr Hallam. “Investors should also add a bond market ETF to add stability.”

You also have to choose a dealing platform; the UAE has several options, notably Interactive Brokers, Saxo Bank, Swissquote Bank and TD Direct Investing International. Alternatively, UAE-based independent financial advisers AES International also offers ETFs to clients, with advice.

And while too many mutual fund managers regularly underperform the stock market, the best can beat the market. Terry Smith at Fundsmith Equity has returned almost 170 per cent over the past five years.

Justin Modray, head of UK-regulated adviser Candid Financial Advice, therefore recommends using ETFs for exposure to heavily researched stock markets where outperformance is rare, such as the US S&P 500 and FTSE 100. “Reserve an actively-managed fund for specialist sectors such as smaller companies, technology, commodities or property.”

BROKERAGE OPTIONS

These five brokers all offer UAE investors access to ETFs. Here we compare the options:

Interactive Brokers (interactivebrokers.com) – online account

Currencies: There are multiple currencies on offer from the US dollar to sterling, the euro, Hong Kong dollar, Indian rupees and many more.

Account set-up: It’s all online and can be funded by wire transfer or bank automated clearing house transfer. You cannot fund an account with a debit or credit card.

Minimum balance: $10,000 or currency equivalent. Accounts showing no balance will be closed.

Investment range: Thousands of different ETFs across North America, Europe, Asia Pacific, emerging markets and the full range of specialist sectors.

Charges and dealing costs: Choice of fixed and tiered pricing. Minimum dealing charge is $1, with a maximum 0.5 per cent of any trade value. For US ETFs it charges a fixed rate of $0.005 per share. It also offers 41 commission-free ETFs. There is a $10 monthly fee for inactive accounts.

Site extras: Online webinars or trading education events with more than 400 planned for 2017 and new users have a free trial with virtual money.

Saxo Bank (saxobank.ae) – classic trading account

Currencies: Trade with US dollars, while clients with a Premium and Platinum account can request a sub-account in a different currency.

Account set-up: Either an online or paper application. You must fund using a bank transfer initially but can register a credit card afterwards.

Minimum balance: $10,000 or equivalent for Classic account. $100,000 for Premium service level and $500,000 for Platinum.

Investment range: More than 3,000 ETFs and exchange traded commodities (ETCs).

Charges: A range of charging options, depending on your personal usage patterns. Dealing costs can be charged either as a flat fee, percentage charge or both. Minimum commission ranges from €12 (Dh47) to $15, depending on the exchange. There are no account administration charges, the site also offers a six months’ inactivity “grace period” and an annual custody fee of 0.12 per cent.

Site extras: Investment seminars in local offices, simulation accounts, a free demo account, and equity research.

Swissquote Bank (swissquote.ae) – the expat account

Currencies: Multiple currencies including the US dollar, Swiss franc, euro, Mexican peso and South African rand.

Account set-up: New users can register an account via the website. They can fund the account with a bank transfer or credit card denominated in US dollars, euros or swiss francs.

Minimum balance: none.

Investment range: Global trading platform includes more than 2.7 million financial products including ETFs.

Charges: ETF trading costs 0.25 per cent of the invested amount, with a minimum fee of $35 but no maximum charge. You may also have to pay Swiss federal stamp duty of 0.15 per cent on some assets.

Site extras: Performance charts, Morning Star fund ratings, news, corporate calendar and currency calculator. The site combines an online bank account with a currency platform and global multi-asset trading service on a single platform.

TD Direct Investing International (tddirectinvesting.lu) – online investment account

Currencies: US dollar, euro, sterling, Canadian dollar, Swiss franc, Swedish krone, Australian dollar, Hong Kong dollar and Singapore dollar. Users can hold up to nine currencies at no extra charge in a multi-currency account. Foreign exchange fees start from 0.2 per cent.

Account set-up: New users can apply for an account online, funded by a bank transfer.

Invest and trade in more than 9,000 ETFs in 15 different countries including New York, London, Zurich, Singapore and Sydney.

Charges: Commission on US, UK and Canada trades start at €14.95 per trade plus a charge of 0.10 per cent, or just €14.95 if trading more than 10 times per month. No account administration fees for customers who place 12 or more trades over a three-month period. For clients who trade at least once (but less than 12 times) in a three-month period, the quarterly account maintenance fee is €25. Inactive clients pay a €45 quarterly fee.

Site extras: ETF selector and stock selector tool and Morning Star’s equity research. Its Active Trading platform offers technical analysis research. Portfolio X-Ray tool allows customers to identify their portfolio’s strengths and weaknesses.

AES International – The Index Account (aesinternational.com)

Currencies: US dollars, sterling and euros, with Swiss francs added soon.

Account set-up: Via a one-page application form, although online account opening is under construction. Funded by bank transfer.

Source: The National

ETFs do the hard work for expat investors like you was originally published on JMM Group of Companies

0 notes

Text

ETFs do the hard work for expat investors like you

There is a revolution going on, one that is transforming the way ordinary investors build their wealth.

Exchange traded funds, or ETFs, have steadily been growing in popularity for years and are now hitting critical mass as people recognise their benefits

The total invested in ETFs and exchange traded products (ETPs) globally hit a new high of US$3.844 trillion at the end of February 2017, according to London-based research consultancy ETFGI. This followed record inflows of $68 billion in February.

Steve Cronin, founder of Wise (wiseuae.com), a non-profit organisation to help UAE residents invest their wealth, says ETFs have exploded in popularity with the main attraction being able to invest on your own. With a diversified portfolio, investors can sit back and take the passive approach.

"ETFs are great for expat investors," says Mr Cronin.

"I like to keep my investing simple, so I can get on with the rest of my life - ETFs are ideal for this."

ETFs allow you to build a flexible, low-cost portfolio of investment funds that you are free to buy and sell at any time. They are traded on the stock market like ordinary shares, quickly and easily, with standard share dealing charges.

BlackRock's iShares is the biggest provider with $1.351tn of assets under management, followed by Vanguard with $675bn, State Street Global Advisors' SPDR with $550 million and Invesco PowerShares with $120m, according to ETFGI.

ETFs may be traded like stocks but are passive investment funds that track a chosen index, sector, region, asset class or commodity, in fact pretty much anything you can imagine.