#xero tutorial

Explore tagged Tumblr posts

Text

youtube

Setting up Direct and Indirect Payroll cost in Xero | Xero Payroll

In this comprehensive tutorial, we delve into the world of Xero Payroll and uncover the secrets to effectively setting up direct and indirect payroll costs. Whether you're a seasoned Xero user or just getting started, this video will provide you with valuable insights and step-by-step guidance to optimize your payroll processes. Learn how to streamline your financial operations and maximize efficiency.

#Payroll#Accounting#Xero#Bookkeeping#xero payroll#direct costs#indirect costs#payroll management#xero tutorial#cost strategies#business finance#direct expenses#indirect expenses payroll management#direct cost and indirect cost#direct expenses list#payroll management system#cost efficiency#payroll systems#cost management#cost control#pmp certification cost#cost and management accounting#indirect payroll cost in xero#Youtube

0 notes

Text

Hollow Knight Fight Round 1, Wave 2

Xero Propoganda:

Listen, this man is a icon, he’s the dreamer tutorial boss, he was incredibly loyal to the pale king until the infection took him but he believed he was in the right, his design is also iconic cmon chat like hello I love me a bug in armour, he’s just a icon

Submit your propaganda here or in the tags/comments/reblogs!

#hollow knight#hollow knight poll#hollow knight game#tumblr poll#tumblr polls#tumblr competition#hollow knight fight#hkf#round one#wave two#xero#xero ghost#spiny husk#propagandized

17 notes

·

View notes

Note

Oi, oi. Tudo bem? Eu vim tirar umas dúvidas com você. Como você finaliza suas capas mais 'cleans'? Elas ficam bem suaves mas não tão suaves como um topaz, e não tão 'marcada' como a nitidez. Se for um programa específico poderia me mandar? Amo seu trabalho. ❤

A-yo, broto! Tudo bem? Espero que sim.

Peço mil perdões pela demora para responder, sério mesmo. Quase não entro no Tumblr mais… Mas vamos às respostas!

No caso, você menciona sobre finalização da capa, pelo que entendi. Nesse caso, a resposta é um tanto engraçada: uso ambos, tanto o Topaz, quanto nitidez. Não é um programa específico.

Antigamente, eu utilizava apenas o Topaz, mas, para alguns estilos de capa, não estava mais gostando do aspecto plastificado forte que eu costumava usar. Dessa forma, tentei até migrar para nitidez e, ainda, sim, não gostava totalmente do resultado tão "granulado". Por isso, comecei a balancear ambos. Continuo usando a minha configuração normal do topaz em uma camada e nitidez em outra, regulando a opacidade de uma ou de outra para ficar do jeito que eu ache melhor, conforme o estilo. Por fim, mesclo tudo e aplico o RGB.

Vou deixar um tutorial abaixo para ficar mais explicativo. Segue a quebra.

Já estamos com nossa cobaia. Irei duplicar e mesclar esse grupo base onde montei a capa, fazendo uma camada apenas com a capa:

Irei duplicar essa camada da capa, para ficarem duas camadas: uma aplico topaz (você encontra minha configuração no meu tutorial de finalização antigo), outra nitidez (aqui vario entre 15-20 de intensidade). E vou regulando a opacidade do jeito que acho melhor. Depois que encontro o jeito que gosto, mesclo ambas as camadas e duplico para fazer o RGB:

Para dar um "tach!" final, dou uma iluminação/escureço o que acho que merece uma ajeitada e está pronto! Dá um trabalhinho a mais, mas vale pelo resultado. E vamos vê-lo:

Outras dicas, você acha no meu último tutorial e em outros que deixo no meu perfil (qualquer coisa, só me perguntar, também). Espero que tenha ajudado. Um xero no cangote!

4 notes

·

View notes

Text

How to Choose the Right CRM for Your Small Business?

In today’s competitive business landscape, small businesses must effectively manage customer relationships, automate sales processes, and keep track of leads. the Right CRM for Your Small Business can help streamline operations, enhance customer interactions, and boost revenue.

However, with numerous options available, choosing the best CRM software for small businesses can be daunting. This guide will assist you in understanding how to select the ideal CRM system that fits your business needs.

What is a CRM System for Small Business?

A CRM (Customer Relationship Management) system is software designed to help businesses manage their interactions with customers, automate workflows, and store crucial customer data. Whether you’re a startup or an expanding small business, utilizing a CRM system can:

Organize and track leads

Automate follow-ups and emails

Improve team collaboration

Provide valuable insights through reports

Enhance customer relationships

Selecting the best CRM for small businesses is vital for growth, efficiency, and customer satisfaction.

Key Factors to Consider When Choosing the Right CRM for Your Small Business:

1. Business Needs and Goals

Before you choose a CRM software for small businesses, clarify your goals. Do you need it for:

Lead tracking and management?

Automating email campaigns?

Customer support and engagement?

Sales and revenue reporting?

Understanding your specific needs will guide you in selecting a straightforward CRM for small businesses that aligns with your objectives.

2. Budget: Free vs. Paid CRM Software

If you’re working with a limited budget, you might want to explore free CRM options for small businesses such as:

HubSpot CRM – The top choice for free CRM software, allowing unlimited users

Zoho CRM – Free for up to three users

Bitrix24 – Comes with free project management tools

MUN-C – Comes with free Employee management tools

However, if you require advanced features like automation, reporting, and integrations, it’s wise to consider investing in a paid CRM.

3. Ease of Use

An ideal CRM for small businesses should be:

User-friendly with an intuitive design

Simple to set up without needing technical skills

Accessible on mobile devices for convenience

CRMs like Freshsales and Pipedrive provide easy-to-navigate dashboards that are perfect for beginners.

4. Customization and Scalability

As your business expands, your CRM should be able to grow with it. Look for:

🔹 Custom fields and workflows

🔹 Scalable plans that evolve alongside your business

🔹 Integration capabilities with third-party tools (like email and accounting software)

Zoho CRM and Salesforce Essentials deliver highly customizable options for small businesses.

5. Integration with Other Tools

A good CRM should integrate smoothly with tools such as:

📧 Email marketing platforms (like Mailchimp and Constant Contact)

📊 Accounting software (like QuickBooks and Xero)

📞 Communication apps (like WhatsApp and Slack)

The best CRM for startups should easily connect with your current business tools.

6. Automation and AI Features

Automation can help small businesses save time by managing repetitive tasks. Key features to consider include:

🔄 Automatic lead assignment

📩 Email follow-up automation

🔍 AI-driven analytics

HubSpot CRM and Freshsales provide outstanding automation features for startups and small businesses.

7. Customer Support

Dependable customer support is crucial for a smooth CRM setup. Look for:

💬 24/7 support through chat, phone, or email

📚 A comprehensive knowledge base and tutorials

👨💼 A dedicated account manager for premium plans

Salesforce and Zoho CRM are known for their excellent customer support and onboarding help.

Top 5 CRM Software for Small Businesses

1. Zoho CRM (Ideal for Indian Small Businesses)

✅ Offers a free plan for up to 3 users

✅ Features AI-powered automation

✅ Mobile-friendly and highly customizable

2. HubSpot CRM (Top Free CRM for Small Business)

✅ Completely free with no user limits

✅ Includes email tracking and pipeline management

✅ Seamlessly integrates with marketing tools

3. Freshsales (Best CRM for Startups)

✅ Provides a free plan option

✅ Utilizes AI for lead scoring

✅ Supports multi-channel engagement

4. Salesforce Essentials (Best for Scalability)

✅ Priced at ₹2,000 per user/month

✅ Allows customizable workflow automation

✅ Comes with advanced reporting tools

5. MUN-C (Best for Team Collaboration)

✅ Free plan includes CRM and project management

✅ Integrates with social media platforms

✅ Features customizable dashboards

FAQs About Choosing the Right CRM for Your Small Business.

1. What is the best CRM software for small businesses?

Zoho CRM, HubSpot CRM, and Freshsales are among the top choices for small businesses due to their affordability, ease of use, and automation features.

2. Can I get a free CRM for my small business?

Yes! HubSpot CRM, Zoho CRM, and MUN-C offer free plans that include essential CRM functionalities.

3. Which CRM is best for startups?

Freshsales and MUN-C are excellent for startups, as they offer automation, AI features, and scalable pricing plans.

4. What are the key features of a CRM for small business?

Look for contact management, automation, email tracking, mobile access, and third-party integrations.

5. How do I choose between a free and paid CRM?

If you need basic features, go for a free CRM software for small business. For advanced features like automation and reporting, a paid CRM is a better option.

6. How long does it take to implement a CRM system?

Most simple CRM for small business solutions take just a few hours to set up, while more complex ones may take weeks.

0 notes

Text

Smoothly Transitioning from Reckon to Xero

Switching accounting software can be a daunting task, but moving from Reckon to Xero is an upgrade that offers significant advantages for business efficiency and financial management. With its intuitive interface, powerful reporting tools, and seamless integrations, Xero is a top choice for businesses of all sizes. This guide will help you understand the Reckon to Xero conversion process, ensuring a smooth and stress-free transition.

Why Switch from Reckon to Xero?

1. Cloud-Based Flexibility

Xero operates entirely in the cloud, allowing you to access your financial data anytime, anywhere, from any device. Reckon’s desktop-focused approach can feel limiting in comparison.

2. Automation Features

Xero simplifies repetitive tasks such as invoicing, reconciliation, and payroll, saving time and reducing errors.

3. Integrations

With over 1,000 apps in Xero’s ecosystem, including inventory management and CRM tools, you can build a fully integrated business system.

4. User-Friendly Interface

Xero’s intuitive design makes it easier for non-accountants to navigate compared to Reckon.

5. Improved Collaboration

Xero allows multiple users, including accountants and bookkeepers, to access real-time data, enhancing collaboration.

Steps for Reckon to Xero Conversion

1. Evaluate Your Needs

Before converting, identify your goals. Are you looking for better reporting, easier reconciliation, or improved collaboration? Knowing your priorities will guide the process.

2. Back Up Your Reckon Data

Always create a secure backup of your Reckon files before starting the conversion process. This ensures you have a fallback if needed.

3. Choose a Conversion Method

You can handle the conversion yourself or work with a professional service. Using a certified Xero advisor or bookkeeping expert can save time and minimize errors.

4. Prepare Your Data

Review and clean your data in Reckon:

Reconcile accounts to ensure accuracy.

Archive old or irrelevant transactions.

Organize customer, supplier, and inventory lists.

5. Set Up Xero

Create a Xero account and customize settings such as chart of accounts, tax rates, and invoice templates.

6. Migrate Data

Use Xero’s built-in tools or third-party conversion software to import your Reckon data. This typically includes:

Chart of accounts

Opening balances

Customer and supplier details

Unpaid invoices and bills

Bank transactions

7. Verify the Data

After migration, compare reports in Reckon and Xero to ensure all data has been accurately transferred.

8. Train Your Team

Familiarize your team with Xero’s interface and features. Xero offers excellent online tutorials and support to help users get started.

9. Close Reckon

Once you’re confident with Xero, finalize and archive your Reckon data. Ensure all new transactions are recorded in Xero moving forward.

Tips for a Successful Reckon to Xero Conversion

Plan Around Deadlines: Avoid converting during peak business periods or tax deadlines to reduce stress.

Leverage Professional Help: Certified Xero advisors can streamline the process, especially for complex conversions.

Start Fresh: If your Reckon data is disorganized, consider starting fresh in Xero with only essential information.

Use Add-Ons: Enhance Xero’s functionality with tools that suit your business needs, such as inventory or payroll software.

Benefits of Converting to Xero

Real-Time Financial Insights Access up-to-date financial reports and dashboards that empower better decision-making.

Streamlined Processes Automate tasks like bank reconciliation, invoicing, and payroll for maximum efficiency.

Scalability Xero grows with your business, offering tools for startups, SMEs, and larger enterprises.

Compliance Made Easy Stay on top of tax obligations and regulatory compliance with Xero’s built-in features.

Reckon to Xero Conversion Cost

Costs vary depending on the complexity of your conversion and whether you use professional services. While DIY conversion might save money upfront, investing in expert help often leads to better results and less downtime.

Make the Switch Today

Transitioning from Reckon to Xero may seem challenging, but the benefits far outweigh the effort. With proper planning and support, you’ll enjoy a more efficient, flexible, and collaborative accounting experience.

Ready to make the leap? Contact a Xero advisor or bookkeeping service today to start your Reckon to Xero conversion journey!

Your financial future starts with smarter software—make the move to Xero now.

0 notes

Text

Smoothly Transitioning from Reckon to Xero

Switching accounting software can be a daunting task, but moving from Reckon to Xero is an upgrade that offers significant advantages for business efficiency and financial management. With its intuitive interface, powerful reporting tools, and seamless integrations, Xero is a top choice for businesses of all sizes. This guide will help you understand the Reckon to Xero conversion process, ensuring a smooth and stress-free transition.

Why Switch from Reckon to Xero?

1. Cloud-Based Flexibility

Xero operates entirely in the cloud, allowing you to access your financial data anytime, anywhere, from any device. Reckon’s desktop-focused approach can feel limiting in comparison.

2. Automation Features

Xero simplifies repetitive tasks such as invoicing, reconciliation, and payroll, saving time and reducing errors.

3. Integrations

With over 1,000 apps in Xero’s ecosystem, including inventory management and CRM tools, you can build a fully integrated business system.

4. User-Friendly Interface

Xero’s intuitive design makes it easier for non-accountants to navigate compared to Reckon.

5. Improved Collaboration

Xero allows multiple users, including accountants and bookkeepers, to access real-time data, enhancing collaboration.

Steps for Reckon to Xero Conversion

1. Evaluate Your Needs

Before converting, identify your goals. Are you looking for better reporting, easier reconciliation, or improved collaboration? Knowing your priorities will guide the process.

2. Back Up Your Reckon Data

Always create a secure backup of your Reckon files before starting the conversion process. This ensures you have a fallback if needed.

3. Choose a Conversion Method

You can handle the conversion yourself or work with a professional service. Using a certified Xero advisor or bookkeeping expert can save time and minimize errors.

4. Prepare Your Data

Review and clean your data in Reckon:

Reconcile accounts to ensure accuracy.

Archive old or irrelevant transactions.

Organize customer, supplier, and inventory lists.

5. Set Up Xero

Create a Xero account and customize settings such as chart of accounts, tax rates, and invoice templates.

6. Migrate Data

Use Xero’s built-in tools or third-party conversion software to import your Reckon data. This typically includes:

Chart of accounts

Opening balances

Customer and supplier details

Unpaid invoices and bills

Bank transactions

7. Verify the Data

After migration, compare reports in Reckon and Xero to ensure all data has been accurately transferred.

8. Train Your Team

Familiarize your team with Xero’s interface and features. Xero offers excellent online tutorials and support to help users get started.

9. Close Reckon

Once you’re confident with Xero, finalize and archive your Reckon data. Ensure all new transactions are recorded in Xero moving forward.

Tips for a Successful Reckon to Xero Conversion

Plan Around Deadlines: Avoid converting during peak business periods or tax deadlines to reduce stress.

Leverage Professional Help: Certified Xero advisors can streamline the process, especially for complex conversions.

Start Fresh: If your Reckon data is disorganized, consider starting fresh in Xero with only essential information.

Use Add-Ons: Enhance Xero’s functionality with tools that suit your business needs, such as inventory or payroll software.

Benefits of Converting to Xero

Real-Time Financial Insights Access up-to-date financial reports and dashboards that empower better decision-making.

Streamlined Processes Automate tasks like bank reconciliation, invoicing, and payroll for maximum efficiency.

Scalability Xero grows with your business, offering tools for startups, SMEs, and larger enterprises.

Compliance Made Easy Stay on top of tax obligations and regulatory compliance with Xero’s built-in features.

Reckon to Xero Conversion Cost

Costs vary depending on the complexity of your conversion and whether you use professional services. While DIY conversion might save money upfront, investing in expert help often leads to better results and less downtime.

Make the Switch Today

Transitioning from Reckon to Xero may seem challenging, but the benefits far outweigh the effort. With proper planning and support, you’ll enjoy a more efficient, flexible, and collaborative accounting experience.

Ready to make the leap? Contact a Xero advisor or bookkeeping service today to start your Reckon to Xero conversion journey!

Your financial future starts with smarter software—make the move to Xero now.

0 notes

Text

Smoothly Transitioning from Reckon to Xero

Switching accounting software can be a daunting task, but moving from Reckon to Xero is an upgrade that offers significant advantages for business efficiency and financial management. With its intuitive interface, powerful reporting tools, and seamless integrations, Xero is a top choice for businesses of all sizes. This guide will help you understand the Reckon to Xero conversion process, ensuring a smooth and stress-free transition.

Why Switch from Reckon to Xero?

1. Cloud-Based Flexibility

Xero operates entirely in the cloud, allowing you to access your financial data anytime, anywhere, from any device. Reckon’s desktop-focused approach can feel limiting in comparison.

2. Automation Features

Xero simplifies repetitive tasks such as invoicing, reconciliation, and payroll, saving time and reducing errors.

3. Integrations

With over 1,000 apps in Xero’s ecosystem, including inventory management and CRM tools, you can build a fully integrated business system.

4. User-Friendly Interface

Xero’s intuitive design makes it easier for non-accountants to navigate compared to Reckon.

5. Improved Collaboration

Xero allows multiple users, including accountants and bookkeepers, to access real-time data, enhancing collaboration.

Steps for Reckon to Xero Conversion

1. Evaluate Your Needs

Before converting, identify your goals. Are you looking for better reporting, easier reconciliation, or improved collaboration? Knowing your priorities will guide the process.

2. Back Up Your Reckon Data

Always create a secure backup of your Reckon files before starting the conversion process. This ensures you have a fallback if needed.

3. Choose a Conversion Method

You can handle the conversion yourself or work with a professional service. Using a certified Xero advisor or bookkeeping expert can save time and minimize errors.

4. Prepare Your Data

Review and clean your data in Reckon:

Reconcile accounts to ensure accuracy.

Archive old or irrelevant transactions.

Organize customer, supplier, and inventory lists.

5. Set Up Xero

Create a Xero account and customize settings such as chart of accounts, tax rates, and invoice templates.

6. Migrate Data

Use Xero’s built-in tools or third-party conversion software to import your Reckon data. This typically includes:

Chart of accounts

Opening balances

Customer and supplier details

Unpaid invoices and bills

Bank transactions

7. Verify the Data

After migration, compare reports in Reckon and Xero to ensure all data has been accurately transferred.

8. Train Your Team

Familiarize your team with Xero’s interface and features. Xero offers excellent online tutorials and support to help users get started.

9. Close Reckon

Once you’re confident with Xero, finalize and archive your Reckon data. Ensure all new transactions are recorded in Xero moving forward.

Tips for a Successful Reckon to Xero Conversion

Plan Around Deadlines: Avoid converting during peak business periods or tax deadlines to reduce stress.

Leverage Professional Help: Certified Xero advisors can streamline the process, especially for complex conversions.

Start Fresh: If your Reckon data is disorganized, consider starting fresh in Xero with only essential information.

Use Add-Ons: Enhance Xero’s functionality with tools that suit your business needs, such as inventory or payroll software.

Benefits of Converting to Xero

Real-Time Financial Insights Access up-to-date financial reports and dashboards that empower better decision-making.

Streamlined Processes Automate tasks like bank reconciliation, invoicing, and payroll for maximum efficiency.

Scalability Xero grows with your business, offering tools for startups, SMEs, and larger enterprises.

Compliance Made Easy Stay on top of tax obligations and regulatory compliance with Xero’s built-in features.

Reckon to Xero Conversion Cost

Costs vary depending on the complexity of your conversion and whether you use professional services. While DIY conversion might save money upfront, investing in expert help often leads to better results and less downtime.

Make the Switch Today

Transitioning from Reckon to Xero may seem challenging, but the benefits far outweigh the effort. With proper planning and support, you’ll enjoy a more efficient, flexible, and collaborative accounting experience.

Ready to make the leap? Contact a Xero advisor or bookkeeping service today to start your Reckon to Xero conversion journey!

Your financial future starts with smarter software—make the move to Xero now.

0 notes

Text

Smoothly Transitioning from Reckon to Xero

Switching accounting software can be a daunting task, but moving from Reckon to Xero is an upgrade that offers significant advantages for business efficiency and financial management. With its intuitive interface, powerful reporting tools, and seamless integrations, Xero is a top choice for businesses of all sizes. This guide will help you understand the Reckon to Xero conversion process, ensuring a smooth and stress-free transition.

Why Switch from Reckon to Xero?

1. Cloud-Based Flexibility

Xero operates entirely in the cloud, allowing you to access your financial data anytime, anywhere, from any device. Reckon’s desktop-focused approach can feel limiting in comparison.

2. Automation Features

Xero simplifies repetitive tasks such as invoicing, reconciliation, and payroll, saving time and reducing errors.

3. Integrations

With over 1,000 apps in Xero’s ecosystem, including inventory management and CRM tools, you can build a fully integrated business system.

4. User-Friendly Interface

Xero’s intuitive design makes it easier for non-accountants to navigate compared to Reckon.

5. Improved Collaboration

Xero allows multiple users, including accountants and bookkeepers, to access real-time data, enhancing collaboration.

Steps for Reckon to Xero Conversion

1. Evaluate Your Needs

Before converting, identify your goals. Are you looking for better reporting, easier reconciliation, or improved collaboration? Knowing your priorities will guide the process.

2. Back Up Your Reckon Data

Always create a secure backup of your Reckon files before starting the conversion process. This ensures you have a fallback if needed.

3. Choose a Conversion Method

You can handle the conversion yourself or work with a professional service. Using a certified Xero advisor or bookkeeping expert can save time and minimize errors.

4. Prepare Your Data

Review and clean your data in Reckon:

Reconcile accounts to ensure accuracy.

Archive old or irrelevant transactions.

Organize customer, supplier, and inventory lists.

5. Set Up Xero

Create a Xero account and customize settings such as chart of accounts, tax rates, and invoice templates.

6. Migrate Data

Use Xero’s built-in tools or third-party conversion software to import your Reckon data. This typically includes:

Chart of accounts

Opening balances

Customer and supplier details

Unpaid invoices and bills

Bank transactions

7. Verify the Data

After migration, compare reports in Reckon and Xero to ensure all data has been accurately transferred.

8. Train Your Team

Familiarize your team with Xero’s interface and features. Xero offers excellent online tutorials and support to help users get started.

9. Close Reckon

Once you’re confident with Xero, finalize and archive your Reckon data. Ensure all new transactions are recorded in Xero moving forward.

Tips for a Successful Reckon to Xero Conversion

Plan Around Deadlines: Avoid converting during peak business periods or tax deadlines to reduce stress.

Leverage Professional Help: Certified Xero advisors can streamline the process, especially for complex conversions.

Start Fresh: If your Reckon data is disorganized, consider starting fresh in Xero with only essential information.

Use Add-Ons: Enhance Xero’s functionality with tools that suit your business needs, such as inventory or payroll software.

Benefits of Converting to Xero

Real-Time Financial Insights Access up-to-date financial reports and dashboards that empower better decision-making.

Streamlined Processes Automate tasks like bank reconciliation, invoicing, and payroll for maximum efficiency.

Scalability Xero grows with your business, offering tools for startups, SMEs, and larger enterprises.

Compliance Made Easy Stay on top of tax obligations and regulatory compliance with Xero’s built-in features.

Reckon to Xero Conversion Cost

Costs vary depending on the complexity of your conversion and whether you use professional services. While DIY conversion might save money upfront, investing in expert help often leads to better results and less downtime.

Make the Switch Today

Transitioning from Reckon to Xero may seem challenging, but the benefits far outweigh the effort. With proper planning and support, you’ll enjoy a more efficient, flexible, and collaborative accounting experience.

Ready to make the leap? Contact a Xero advisor or bookkeeping service today to start your Reckon to Xero conversion journey!

Your financial future starts with smarter software—make the move to Xero now.

0 notes

Text

Tips for Choosing the Best Business Bank Account for Online Businesses

Choosing the right business bank account is crucial for the success of any online business. It helps manage cash flow, handle transactions efficiently, and keep personal and business finances separate. Here are some key tips to help you choose the best business bank account for your online business:

1. Consider Online Banking Features

For an online business, strong online banking capabilities are essential. Look for accounts that offer:

24/7 access to your account via a mobile app or web platform.

Easy-to-use mobile banking apps for making deposits, transfers, and payments on the go.

Real-time transaction alerts and notifications for better control over your finances.

Integration with accounting software such as QuickBooks or Xero to simplify bookkeeping and tax preparation.

Also read- how to unfreeze bank account from cyber cell

2. Look for Low Fees and Transparent Pricing

Bank fees can add up quickly for an online business, especially if you have frequent transactions. Compare the following fees before opening an account:

Monthly maintenance fees: Some banks charge a monthly fee, while others offer free business checking accounts. Look for accounts with no or low fees.

Transaction fees: Consider how many transactions (deposits, withdrawals, transfers) you expect to make and ensure the account allows enough free transactions. Exceeding the limit can result in fees.

ATM fees: If you need to access cash, choose a bank with a large ATM network or one that reimburses ATM fees.

International fees: If your business deals with international clients or suppliers, check for foreign transaction fees and wire transfer charges.

Minimum balance requirements: Some banks require maintaining a minimum balance to avoid fees, so make sure this aligns with your financial situation.

Also read- how to unfreeze bank account from gujarat cyber crime

3. Access to Merchant Services

If your online business involves e-commerce, having easy access to merchant services is vital. Look for accounts that:

Provide payment processing solutions for accepting credit card payments, debit card payments, and online payments (e.g., PayPal, Stripe).

Offer point-of-sale (POS) systems integration, allowing seamless processing of online and offline transactions.

Have low merchant processing fees, especially if you handle high transaction volumes.

4. Account Scalability

Choose a bank account that can grow with your business. As your online business expands, your banking needs will evolve. Look for an account that offers:

Multiple account options (e.g., checking, savings, credit lines) to cater to both small and large businesses.

Access to business loans, lines of credit, or credit cards for future financing needs.

Higher transaction limits or premium features for growing businesses.

Also read- how to unfreeze bank account from agra cyber cell

5. Customer Support and Service Quality

Given that your business operates online, it’s essential to have reliable customer support. Evaluate the bank’s:

Availability of customer service, including 24/7 support via phone, chat, or email.

Dedicated small business support teams who can address your unique needs as an online business owner.

Online resources and tutorials for business banking, such as video guides, webinars, and FAQs.

Also read- bank account unfreeze

6. International Banking Capabilities

If your online business has international clients, suppliers, or partners, choose a bank account that supports global transactions. Consider:

Currency exchange services with competitive rates.

Support for international wire transfers with minimal fees.

Integration with platforms like Wise or Payoneer to handle international payments efficiently.

Also read- bank account freeze

7. Interest-Bearing Accounts

Some business bank accounts offer interest on balances, which can help your business earn a little extra from idle funds. If you regularly maintain a high balance in your account, an interest-bearing checking or savings account might be a good option. Compare the interest rates offered and ensure that the account aligns with your transaction needs.

8. Security Features

Security is paramount when handling online business finances. Look for accounts that provide:

Fraud detection and monitoring, such as real-time alerts for suspicious transactions.

Two-factor authentication (2FA) for added security when logging in.

Deposit protection through government schemes like FDIC insurance (in the U.S.) or FSCS protection (in the U.K.), ensuring your deposits are safe up to a certain limit.

9. Reputation and Reviews

Research the bank’s reputation by:

Reading customer reviews to assess their service quality, especially regarding online and mobile banking.

Checking whether the bank is known for being small-business friendly and has experience working with online businesses.

Asking for recommendations from other online business owners or professionals in your network.

10. Promotions and Perks

Some banks offer incentives such as cash bonuses or free banking services for new business accounts. Look for promotions that can save you money during the initial phase of opening your account. Additionally, some banks may offer cash-back rewards or discounts on business-related expenses, such as office supplies, if you use a linked credit card.

Conclusion:

Choosing the right business bank account for your online business requires careful consideration of your unique needs, from online banking features and fees to customer support and international capabilities. By selecting a bank account that offers flexibility, low fees, and the right services for your business type, you can ensure smooth financial operations and set your business up for success.

0 notes

Text

Bookkeeping Company Business Plan: A Comprehensive Guide

Establishing a bookkeeping business can be financially rewarding because companies of all sizes require precise financial records to comply with regulations and make well-informed choices. Your bookkeeping firm will not succeed unless it has a strong business plan. It offers a precise road map for your company's objectives, tactics, and day-to-day activities. You can use this tutorial to grasp better the essential elements of a business plan for a bookkeeping company.

1. Synopsis

The executive summary provides a brief synopsis of your bookkeeping company. Although it comes first, this part is usually written last to fully express your plan. Important things to remember are:

Company name: Name and address of the company.

Mission statement: What is your company's aim?

Services: Describe the bookkeeping services you will provide, including payroll processing, financial statement preparation, and record-keeping.

Target market: Identify your target market by listing the companies or people you hope to assist.

Goals: List your immediate and long-term objectives, such as signing up 20 new clients in the first year.

Financial overview: Briefly summarise your projected expenditures, revenues, and profit margins.

2. Overview of the Company

Give a thorough description of your bookkeeping business in this section:

Business structure: Do you conduct business as a partnership, LLC, or sole proprietorship? Describe the legal framework you have.

History of the company: If your business is already running, give a brief history and accomplishments. If this is your first business venture, describe your motivations.

Core competencies: Emphasize the particular abilities, background, or credentials (such as Certified Bookkeeper or QuickBooks ProAdvisor) that distinguish your company from rivals.

Business location: Specify if you will work remotely, from an actual workplace, or a combination of the two.

3. Analysis and Research on the Market

It's critical to comprehend the market before launching a bookkeeping business. Provide your research results in this section.

Overview of the industry: Draw attention to your area's expansion and need for bookkeeping services. The field is steady because bookkeeping is necessary for companies of all kinds.

Target market: Clearly state who your perfect customer is. This could apply to freelancers, nonprofits, and small enterprises. Explain their requirements, areas of discomfort, and how your services will satisfy their demands.

Analyze your competition: Determine the main rivals in your field. Examine their advantages, disadvantages, costs, and services provided. Emphasize the unique features that will make your bookkeeping services stand out, such as the provision of tax preparation or cloud-based bookkeeping.

Market trends: Talk about any developments impacting the bookkeeping sector, such as the emergence of remote services and digital accounting tools, and how your business plans to adjust.

4. Services Provided

Give a thorough explanation of the bookkeeping services your business will offer in this section, including:

General bookkeeping: General bookkeeping includes keeping track of everyday financial transactions, managing ledgers, and reconciling accounts.

Financial reportingt involves creating cash flow, income, and balance sheets.

Payroll services: handling benefits, taxes, and payroll for employees.

Tax preparation: Helping customers file and plan their taxes.

Consulting services: Giving small firms financial guidance on financial planning, forecasting, and budgeting.

Cloud bookkeeping: Giving customers quick access to financial data through cloud-based accounting programs like Xero or QuickBooks Online.

5. Sales and Marketing Plan

You need a carefully considered marketing strategy to draw in customers. This part ought to describe your marketing strategy for your bookkeeping business:

Branding: Building a professional brand that exudes competence, dependability, and trust is essential for branding. This covers your website, logo, and business name.

Website: It's essential to have an easy-to-use website that highlights your offerings, costs, and contact details. Make search engine (SEO) friendly to attract nearby companies looking for bookkeeping services.

Social media: Use sites like Facebook, Instagram, LinkedIn, and others to connect with potential customers, provide insightful material, and establish your brand.

Networking: Contact accountants, financial experts, and business consultants to get referrals for your accounting company. You may also join industry associations and attend local business events.

Referral program: Provide rewards to existing customers who recommend new clients.

6. Plan of Action

Describe the day-to-day activities of your bookkeeping company in this area, including:

Setting up an office: Tell us if you plan to work from home or a dedicated workplace. Provide information regarding the required hardware, such as computers, accounting software, and office supplies.

Technology: Name the software programs, such as Sage, Xero, FreshBooks, or QuickBooks, that you plan to employ to manage your clients' financial data. For effective operations, also list any cloud-based or automated technologies.

Hiring plan: If you intend to hire employees, describe your hiring procedure, the positions that will be filled (such as administrative assistants and bookkeepers), and any necessary training.

Client onboarding: During the onboarding process, outline your plan for handling new client intake, including contract negotiations, initial consultations, and setting up financial systems.

7. Budgetary Scheme

The financial plan is one of the most essential parts of your business strategy. It highlights your bookkeeping company's anticipated economic performance and proves its viability. Important components consist of:

Start-up costs: Include all out-of-pocket expenses, including those for office supplies, software, marketing collateral, and expert certifications.

Approach to pricing: Describe your pricing strategy (hourly rates, monthly retainers, or per-service prices) for your services. Make sure your rates generate a profit while also covering your costs.

Revenue projections: Calculate your anticipated revenue using your customer acquisition objectives as a guide. Consider several pricing structures and the number of customers you hope to acquire in the first year.

Expenses: Include all out-of-pocket costs, including rent, utilities, insurance, payroll, and software subscriptions.

Analysis of break-even: Calculate the time it will take for your bookkeeping business to turn a profit.

Profit and loss statement: To provide a realistic image of prospective profitability, project your revenue and expenses for the first one to three years.

8. Supplementary Materials

Add any supporting materials for your business strategy in this last area, such as:

Key members of the team's resumes.

Agreements or contracts.

Marketing collateral, such as brochures or flyers.

Licenses or certifications pertinent to bookkeeping.

FAQs

1. What is a business plan for a bookkeeping firm?

A business plan is a formal document that describes your bookkeeping business's objectives, plans, financial projections, and organizational structure. It acts as a road map for the company and a manual for marketing, expansion, and financial planning.

2. Why is a business plan necessary for my bookkeeping firm?

A company plan aids in establishing your objectives, target market, services, and organizational structure. It is necessary to ensure the long-term profitability of your bookkeeping business, attract investors or finance, and make well-informed judgments. It also acts as a road map for monitoring advancement and modifying your plan.

3. How can I set my bookkeeping business apart from rivals?

Offering specialist services like cloud-based bookkeeping, individualized financial counselling, or knowledge of a particular industry will help you stand out. You can also concentrate on offering top-notch customer support, competitive pricing, and using the newest technologies to guarantee accuracy and efficiency.

Summary

Your bookkeeping business will not succeed unless you have a well-written business strategy. You may position your business to succeed in the cutthroat bookkeeping market by carefully analyzing your target audience, describing your offerings, and making plans for both operational and financial success. In addition to acting as a road map, your business plan will support you in obtaining capital when necessary and direct your strategic choices as your enterprise expands.

0 notes

Text

Why Online Billing Software is Essential for Every Business

We'll delve into why online billing software is essential for every business, big or small. We'll answer your burning questions, provide expert advice, and leave you feeling satisfied with all the knowledge you need to make an informed decision. So let's dive in!

What exactly is online billing ?

Let's start with the basics. Online billing software is like having a virtual assistant for your invoicing needs. It automates the entire invoicing process, from creating and sending invoices to tracking payments and generating reports. With just a few clicks, you can manage your finances more efficiently and effectively.

Why Online Billing Software Matters

Now, let's talk about why online billing software is a game-changer for businesses:

Save Time and Effort: Say goodbye to manual invoicing! With online billing software, you can create and send invoices in minutes, freeing up valuable time to focus on growing your business.

Reduce Errors: Manual invoicing is prone to mistakes, but online billing software ensures accuracy in your invoices, minimizing the risk of errors and disputes with clients.

Faster Payments: Offer your clients multiple payment options, such as credit cards and PayPal, to speed up the payment process and improve cash flow for your business.

Enhanced Financial Visibility: Gain insights into your business finances with comprehensive reporting and analytics tools provided by online billing software. Track revenue, monitor outstanding payments, and make informed decisions about your financial strategy.

Integration with Accounting Systems: Seamlessly integrate online billing software with popular accounting systems like QuickBooks and Xero to streamline your financial workflows and ensure data consistency across platforms.

Scalability and Flexibility: Whether you're a freelancer or a growing enterprise, online billing software scales with your business needs, offering flexible pricing plans and customizable features to accommodate your growth.

Improved Customer Experience: Simplify the billing experience for your clients with easy-to-understand invoices and convenient payment options, enhancing overall satisfaction and loyalty.

How to Choose the Right Online Billing Software

Now that you're convinced of the benefits of billing software, it's time to choose the right solution for your business. Here's how:

Assess Your Needs: Consider your business size, industry, and specific invoicing requirements to determine what features are essential for you.

Research Options: Explore different online billing software providers, read reviews, and request demos to find the best fit for your business.

Evaluate Ease of Use: Choose a user-friendly interface that makes it easy for you and your team to navigate the software without any hassle.

Consider Integration: Ensure that the billing software integrates seamlessly with your existing tools and systems to avoid any compatibility issues.

Check Pricing and Support: Compare pricing plans and look for providers that offer excellent customer support to assist you whenever you need help.

Expert Tips for Success

Here are some additional tips to make the most of your online billing software:

Take Advantage of Training Resources: Many online billing software providers offer tutorials and training materials to help you maximize the use of their platform. Take advantage of these resources to become a pro in no time!

Stay Up to Date: Keep an eye out for software updates and new features released by your provider. Staying up to date ensures that you're always using the latest and greatest version of the software.

Customize Your Invoices: Personalize your invoices with your brand logo, colors, and custom messaging to make a lasting impression on your clients.

Why Online Billing Software is Essential for Every Business Make it a habit to regularly review your financial reports and analytics to identify trends, track your progress, and make informed decisions about your business.

Conclusion:

In conclusion, online billing software is a must-have tool for every business looking to streamline their invoicing processes, improve financial management, and enhance customer satisfaction. With its automation capabilities, multiple payment options, and integration with accounting systems, online billing software offers numerous benefits that can help your business thrive in today's competitive landscape. So why wait? Invest in online billing software today and take your business to the next level of success!

0 notes

Text

Everything is you need to know about PLS SBR Software in Australia — GovReports

PLS SBR (Payroll, Taxation, Superannuation, Standard Business Reporting) software is designed to simplify and streamline the reporting process for businesses in Australia. Here’s everything you need to know about PLS SBR software, particularly GovReports:

1. What is GovReports?

· GovReports is an online platform that allows businesses to prepare, lodge, and manage their business activity statements (BAS), tax file number declarations (TFND), taxable payment annual reports (TPAR), and other compliance reports with the Australian Taxation Office (ATO) and other government agencies.

2. Features of GovReports:

· GovReports offers a range of features to help businesses manage their reporting obligations, including:

· Easy online lodgment of BAS, TFND, TPAR, and other reports.

· Integration with accounting software such as Xero, MYOB, and QuickBooks for seamless data transfer.

· A secure platform that complies with Australian taxation and privacy laws.

· Automatic updates to ensure compliance with the latest ATO requirements.

· Reporting templates and tools to simplify the reporting process.

3. Benefits of Using GovReports:

· Using GovReports can help businesses save time and reduce the risk of errors in their reporting.

· The platform provides a user-friendly interface that makes it easy for businesses to navigate and use.

· GovReports offers a cost-effective solution for businesses of all sizes, with different pricing plans to suit various needs.

· By using GovReports, businesses can ensure that their reporting is accurate and compliant with ATO requirements, reducing the risk of penalties or audits.

4. How to Get Started with GovReports:

· To get started with GovReports, businesses can sign up for an account on the GovReports website.

· Once registered, businesses can access the platform and begin preparing and lodging their reports online.

· GovReports offers a range of support options, including online tutorials, user guides, and customer support, to help businesses get started and navigate the platform.

In conclusion, GovReports is a comprehensive PLS SBR software solution that can help businesses in Australia simplify and streamline their reporting processes. By using GovReports, businesses can save time, reduce errors, and ensure compliance with ATO requirements.

0 notes

Text

How does Xero Bookkeepers Compare to Other Bookkeepers in the Market?

In the evolving landscape of financial management and accounting, the selection of proficient bookkeeping services is paramount for businesses. Xero Bookkeepers Toronto have emerged as a significant contender in this arena. This discourse aims to analyze the comparative standing of Xero Bookkeepers in relation to their market contemporaries, scrutinizing aspects such as service scope, interface usability, cost efficiency, client support, integration potential, and overall client satisfaction.

Comprehensive Range of Services

Xero Bookkeepers distinguish themselves by offering an expansive array of services that cater to the multifaceted requirements of small to medium-sized enterprises. They adeptly manage conventional bookkeeping tasks like ledger maintenance, payroll administration, and financial reporting. Notably, their expertise extends to handling intricate accounting functions, including foreign currency dealings, inventory management, and project-based accounting, thereby affirming their versatility.

User Interface and Accessibility

The accessibility of a bookkeeping service is a crucial determinant in its selection. In this regard, Xero Bookkeepers excel with an intuitive and user-centric interface. The platform is tailored for individuals with limited accounting expertise, facilitating the management of financial processes without the necessity for extensive training. This contrasts with some alternatives in the market that may present more complex interfaces requiring advanced technical understanding.

Cost-Effectiveness

Budget considerations, particularly for startups and smaller businesses, are pivotal. Xero Bookkeepers provide competitively priced services without sacrificing service quality. Their subscription-based model enables businesses to select plans aligning with their financial limitations. Although some competitors may offer lower initial pricing, Xero’s transparent fee structure and absence of concealed charges yield long-term financial advantages.

Superior Customer Support

In the realm of customer support, Xero Bookkeepers Toronto often surpass their competitors. They offer extensive support resources, including online tutorials, webinars, and a dedicated customer service team. This commitment to customer assistance ensures prompt issue resolution and maximizes the utility of the bookkeeping software for clients.

Integration Capabilities

In the current interconnected business ecosystem, the capacity for integration with other tools and systems is imperative. Xero Bookkeepers boast robust integration with over 800 third-party applications, encompassing CRM systems, e-commerce platforms, and payment processors. This level of integration is not consistently matched by other bookkeeping services, endowing Xero with considerable versatility and functionality.

High Client Satisfaction

Client satisfaction is a critical indicator of a service’s efficacy. Xero Bookkeepers have achieved high client satisfaction ratings, attributable to their user-friendly design, comprehensive features, and exemplary customer support. While other bookkeeping services also maintain satisfied clientele, Xero’s continual innovation and responsiveness to client feedback have cultivated a loyal and expanding user base.

In summary, Xero Bookkeepers Toronto have established themselves as prominent players in the bookkeeping service market. Their broad service spectrum, accessible interface, cost efficiency, unparalleled client support, extensive integration capabilities, and high client satisfaction rates position them as a preferred choice for businesses seeking effective and reliable bookkeeping solutions. While other bookkeepers provide valuable services, Xero’s comprehensive approach to fulfilling diverse client needs solidifies their status as a market leader.

0 notes

Text

How to Track Your Recurring Expenses

Any business owner must keep track of their recurrent expenses. You can obtain important insights into your cash flow, spot potential for cost-savings, and keep accurate financial records by effectively tracking and categorising these expenses. In this post, we'll give you a thorough tutorial on keeping track of your recurring costs effectively so you can better manage the money you spend running your business.

Establish a Solid Foundation

A)Create a separate bank account for your business transactions to keep things organised and to distinguish between personal and professional spending.

B) Select accounting programme: Choose a trustworthy accounting programme that can track expenses and meets your company's requirements. Popular choices consist of FreshBooks, Xero, or QuickBooks.

Create a Comprehensive Expense Categories List

A) Examine your previous outlays: Investigate recurrent patterns in your past cost records by analysing them. Sort them into broad categories like labour costs, utilities, rent, subscriptions, and software.

B) Make your spending categories unique: Adapt the list of categories to the particular requirements of your company. For finer-grained spending tracking, take into account additional subcategories.

Recording Expenses Automatically:

A) Link credit cards and bank accounts: Integrate your company's accounts with the accounting programme of your choice to import transactions automatically.

B) Configure filters and rules: In your accounting programme, create rules to automatically classify recurring expenses. For instance, you could create a rule to label all purchases made from a particular vendor as "Office Supplies.”

Review and Update Frequently:

A) Check transactions for accuracy: Ensure that your expenses are properly classified by periodically checking your transactions. Any misclassified costs should be quickly adjusted.

B) Update categories as necessary: Your spending categories might need to be modified as your firm develops. Be adaptable and make the necessary updates.

Leverage Reporting and Analysis:

A) Create expense reports: Create expense reports using the reporting tools in your accounting programme. To spot areas of overspending, spot trends, and make wise financial decisions, analyse these reports.

B) Track budgeted and actual spending: To keep on target and make adjustments as needed, compare your budgeted expenses with your actual spending.

Stay Organized and Store Documentation:

A) Keep invoices and receipts current: For tax purposes, keep a digital or physical record of your receipts and invoices to substantiate your expense claims.

B) Use document management or cloud storage services: To ensure simple access and backup, store your expense-related documents safely in the cloud or with a reputable document management system.

Maintaining sound financial management in your company requires tracking your recurring spending. You take charge of your company's finances and acquire useful insights by setting up a reliable monitoring system, customising spending categories, automating recording procedures, and routinely evaluating and analysing your expenses. You will benefit from tracking your recurring spending by having a more accurate financial picture and better decision-making skills.

0 notes

Text

Streamline Your Finances: The Benefits of Using Business Accounting Software

As a business owner, keeping track of finances can be a daunting task. With so many transactions, expenses, and invoices to manage, it's easy to become overwhelmed. However, with the right accounting software, managing your business's finances can be simple and stress-free. In this article, we'll explore the benefits of using accounting software for your business and how it can help you save time and money in the long run.

What is business accounting software?

Business accounting software is a computer program designed to manage a company's financial transactions. It tracks income and expenses, generates invoices, and produces financial reports such as balance sheets and income statements.

There are many different types of accounting software available, ranging from basic programs for small businesses to complex systems for larger companies. Some of the most popular accounting software programs include QuickBooks, Xero, and FreshBooks.

There are many benefits to using accounting software for your business. Here are just a few of the most significant advantages:

· Time-saving: One of the most significant benefits of using accounting software is the time it saves. With a few clicks, you can create invoices, track expenses, and generate financial reports. This frees up time for you to focus on other important aspects of your business.

· Accuracy: Accounting software is designed to be precise, reducing the risk of human error. This can help ensure that your financial records are accurate, which is essential for making informed business decisions.

· Organisation: Keeping track of finances manually can be chaotic and disorganised. Accounting software organises all your financial information in one place, making it easy to access when you need it.

· Cost-effective: Although there is an initial cost to purchase accounting software, it can save you money in the long run. By keeping accurate financial records, you can identify areas where you can cut costs and increase revenue.

· Scalability: As your business grows, so does the need for effective financial management. Accounting software can be scaled up or down to meet the changing needs of your business.

Choosing the right accounting software for your business

With so many accounting software options available, it can be challenging to choose the right one for your business. Here are some factors to consider when selecting accounting software:

· Features: Consider the features that are most important to your business, such as invoicing, expense tracking, and payroll management.

· Ease of use: Choose software that is easy to navigate and user-friendly, even if you don't have an accounting background.

· Cost: Determine your budget for accounting software and look for options that fit within your price range.

· Integration: If you use other software programs in your business, such as CRM or project management software, look for accounting software that can integrate with them.

· Support: Make sure the software provider offers excellent customer support, including phone and email support, as well as online tutorials and resources.

Conclusion

In conclusion, using accounting software for your business can save you time, money, and stress. By organising your financial information in one place, providing accuracy and scalability, and offering a range of features that can help you manage your finances more effectively, accounting software can help you make informed business decisions and achieve your financial goals. When selecting accounting software for your business, consider your budget, required features, ease of use, and customer support. With the right accounting software, you can streamline your financial management processes and focus on growing your business.

0 notes

Text

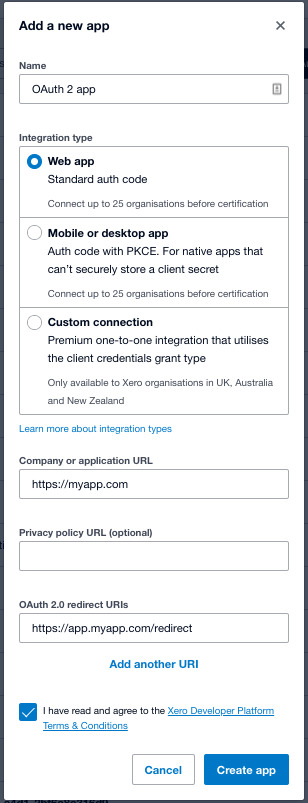

How to Integrate Salesforce with Xero

How to Integrate Salesforce with Xero

Hi #Trailblazers, Welcome to my blog. In this blog post, we will learn how to integrate Salesforce with Xero. Whenever we talk about integration, the very important thing is how securely connect to the third party system and then make the communication secure. You can use below link to know all about Xero Authentication. Note: – Xero Uses OAuth 2.0 and OAuth 1.0 for authentication and we will…

View On WordPress

#how to integrate salesforce with xero#integrate xero with salesforce using named credentials#Salesforce#Salesforce Tutorials#salesforce xero integration#sfdc integration with xero#xero integration with salesforce

0 notes