#with trying to build up my savings and start my roth ira

Explore tagged Tumblr posts

Text

I've had a full time job for like a month and a half now and I'm ready for a raise please pay me more please <3

#according to [city] my salary is low income for the area#which is insane to me because its more than my dad made while i was growing up#but ueagh its not going great in terms of being able to afford things#with trying to build up my savings and start my roth ira#explodes

0 notes

Text

How I Built an Emergency Fund, inspiration I deeply hope is helpful

As the blog URL says, this is not financial advice. This is how I did this thing, and I am posting it here, publicly, in hopes that it helps you should you need this information.

In short: Remix this advice to what fits your life + do not sue me if this goes poorly for you. This is for Americans, if you do not live in America and/or your money is not in America, I hope this is a useful base.

None of these links are affiliate links.

I write these things as a mental shift. I like to ramble and I wish I had someone tell me this stuff 20+ years ago. I'm hoping this helps you.

This is an incredibly long post so I'm putting it under a KEEP READING.

This post goes over two stages: "short term + not life-or-death" and "long term + actual life or death"

Part 01: SHORT TERM + NOT LIFE-OR-DEATH FUND

You need to find a high yield savings account that is FDIC insured. Ally is a popular bank for this.

Functionally, the only difference between a "high yield savings account" and "savings account" from the giant conglomerate bank down the street is the interest rate.

I do not know why non-high-yield savings accounts exist. I'm guessing because legally they can, and I hate it.

Moving away from my personal socioeconomic views to return to advice.

"FDIC insured" is not something you pay for. It is nearly universal on savings accounts. If a savings account, or a checking account, does NOT have it, then you should not put your money there. Something is wrong with that bank.

FDIC means if your bank goes out of business, your account is insured up to $250,000, per account, by the government. So if your bank goes out of business, the government makes sure you still have your cash (up to $250k).

A high-yield savings account means your cash is available whenever you need it.

Other products, like CDs, exist, but this ramble is designed to be as simple and starter as possible. Begin with a high yield savings account, build up from there as you do your own research + compare this to your needs.

Do not accept an account that has minimum balances. Do not open an account with monthly fees.

Touch this account as little as possible.

For every $1 you put in, every month, a few pennies will materialize. It's not much, but the main point is at every level, your money works for you.

Rich people do this. You can too.

Touch this account as little as possible.

You can have multiple savings accounts.

I personally have a savings account in the above structure designed for "oh hell I am kinda screwed, but will be okay, just need a buffer."

"How much should I have in there?" you might ask. Common advice says "3-6 months expenses" which is a lot. I say "start with literally $1 and continue as you can until comfortable with what is possible, for you, at this time."

Will $1 make you rich? No.

Will it save your life in a bad situation? Probably not.

Does this $1 essentially become a tiny robot that is making you money for as long as it is docked into its cargo bay? ...weird metaphor but we'll go with it, sure.

Ultimately is it a start? Yes.

You can have multiple savings accounts. You can have a savings account "this is for short term emergencies" and "this is for... slightly less short term" etc.

It costs you nothing to have multiple. They all operate in the same way. It's handy to have them all at the same bank because it can make transferring cash easier.

Part 02: LONG TERM + ACTUAL LIFE-OR-DEATH FUND WITH RISK SO BE CAREFUL

Once you have your savings account set up, and it's being funded on a regular basis (every week, every paycheck, every month, every quarter -- whatever works for you), look into creating a second, bigger, more dangerous-term cash reserve.

I like my Roth IRA. This is a link to a proper finance blog that has a lot of details. I am trying to make this handy/simple to get started.

401ks and (non-Roth) IRAs are funded with pre-tax dollars, frequently in conjunction with your job.

Normally, cash goes from job -> government takes a slice -> you.

Pre-tax retirement accounts, cash goes from job -> retirement takes the percentage you decide -> government takes a slice of what is left -> you

Roth IRAs, job -> government takes a slice -> you -> Roth IRA

The benefit to pre-tax retirement accounts being, because the cash going in is pre-tax, there is more of it.

It can grow faster in the stock market or other places your particular fund allows you to put cash into.

The taxes come out when you withdraw -- usually retirement -- because if you withdraw before you retire, you are heavily penalized with extra fees.

That's why Part 02 is a ROTH IRA. Your money has already been taxed -- job -> government's slice -> you -> Roth IRA.

This means the money is yours, already taxed. If you withdraw the gains, those get taxed, but the base, that's yours.

If you invest $100 and it grows to $105, you can withdraw $100 without paying fees or taxes. If you withdraw that extra $5, that is when taxes start to come into play. If you withdraw $100, and leave the $5, the $5 continues to grow, and that extra growth is taxed if withdrawn. So try not to touch it (ideally you leave all of it until retirement).

This is why this is an emergency, life-or-death only, account. You tap it only when you need to when all other choices are wretched and ruinous.

There is an annual limit as to how much money you can put into a Roth IRA (several thousand bucks).

You can start them very small. Like $20 or maybe less.

Look for a bank or institution that does not charge fees to open and maintain one.

AT EVERY STEP YOU SHOULD BE AVOIDING FEES

Here are smart people talking about ideas on how to get started.

Okay, so, what do we do now with this fancy roth thing.

Here is where things get... uncomfortable.

A Roth IRA is an account type.

You need to do something with your money.

The reason you have this in addition to, and secondary to, your high-yield savings account is because this is an investment vehicle, the balance is going to go up and down, and may reach $0.00.

For my Roth IRA, I like "exchange traded funds" -- ETFs.

There are a lot of options -- you can invest in most anything

Because my Roth IRA is built for "help me I'm dying" emergencies, I invest in a mix of S&P 500 index funds and small-cap funds.

SO MANY WORDS.

Let's break this down what this means.

S&P 500 index funds: This is an index fund of giant, giant, giant companies.

An index fund is like a stock. But instead of a single company, it tracks (owns shares of) an index -- like the DOW or Nasdaq. Or countries. Or... the entire market for oil. Etc.

The metaphor isn't completely accurate, but I like to think of it as "an index fund is a company that owns tiny bits of other companies."

Like, okay, say you have SlimeIndexFund and a share price is $40.

In this example, SlimeIndexFund owns $10 worth of "BardCo" and $10 of "ThiefCo" and $10 of "MermaidCo" and $10 of "EvilCo".

Let's say EvilCo does a lot of evil and is now worth $15, and MermaidCo does a lot of mermaid stuff and is now worth $15, and BardCo sings out of tune so is now worth $5. ThiefCo is oddly at the same $10 but we're scared so we're leaving ThiefCo to stay at $10.

A share in SlimeIndexFund is now worth $45. ($5 BardCo + $10 ThiefCo + $15 EvilCo + $15 MermaidCo)

This is diversification

Because I bought an index fund, instead of just buying BardCo, my risk is less.

Had I bought all MermaidCo, my return would be higher -- but this is a much bigger risk.

The entire purpose of this set up of a Roth IRA is TO MINIMIZE RISK.

Your Roth IRA should allow you to buy "fractional shares" and if it doesn't fuck that bank, go somewhere that does.

In the above example, SlimeIndexFund is $40/share and at that price you are getting the full benefit of 1 share.

Let's say you have $10.

You buy a fractional share of SlimeIndexFund for $10, which is 25% of 1 share.

So when SlimeIndexFund shares raise from $40 -> $45, your fractional share goes from $10 -> $12.50.

Not all funds and stock shares (etc) have fractional shares, most do.

It's a great way to start and build.

Small-cap funds: These operate in literally the same way. The difference is the companies are (in comparison) much smaller. They tend to be more nimble.

So I am diversifying between "here is a fund, it has a lot of large companies" and "here is a fund, it has a lot of small companies."

Let's say Big Office Building real estate goes down, but the sale of Small Company Making waffles goes up. This mixes together and I'm less in danger of losing money, or losing much money.

You can pick individual stocks.

The reason it is not recommended, by nearly everyone, is because the market has incredible tools and power over individual stocks.

By using any kind of fund that bundles things together, you are thereby automatically using these tools by proxy

It is critical to understand this is the stock market. Your account will go up and down. It may go down A LOT, like 25%, and take years to recover. Maybe it goes down 100% to literally $0.00.

That's why this is the LAST RESORT EMERGENCY FUND.

So why are we doing this.

This feels... wrong?

The potential for growth is significantly higher than a savings account. Adjusted for inflation, somewhere in between 6-7%.

At this rate, if you can leave your initial deposit alone for somewhere between 10 - 13 years, it has doubled.

This equation recalculates every time you make a deposit. So if you can deposit $20 every pay check, it has the potential to grow very quickly.

As above, this is the stock market, so it can also get wiped out.

But given the stock market has historically always recovered, though it may take several years, the risk is worth it to me + a lot of other people.

The reason this is built as a last-resort cash bucket is because of this risk. Before moving into this arena, you should have other cash buckets as a buffer.

Your RISK is it goes down. Which it will frequently.

Your REWARD is if it goes up. Which historically it has far more than it went down.

The PURPOSE of using funds as described above is so you don't have try to guess who the next Amazon is and wind up picking the next Pets.com (which went out of business, like, a long... long time ago).

The people making the funds figure out who is Amazon and who is Pets.com and work, day and night, to make your money grow and/or protect it when outside influences are hurting the market.

They are incredibly equipped to do this and their literal livelihood is on the line when they do it poorly.

Which is a polite way of saying, they are continuously incentivized above all else to work for the fund you're investing in.

The reason you're doing this in a Roth IRA specifically is you're hoping to keep as much of it intact, as possible, until you retire, at which point -- if you've followed fairly simple rules -- you withdraw the base and gains tax-free.

Whereas money in a normal stock account? Those gains are taxable every year.

"I have literally $20 I can save per pay check! Can I put in $15 into a high-yield savings account and $5 into a Roth IRA to get started?!"

Yes!

Also, congrats! You're diversifying already!

Your Roth IRA broker should allow you to invest a minimum of $1 at a time, and buy fractional shares. If they don't, don't sign up with them!

Lean heavily into your high-yield savings account until that is very comfortable and thick, then push money into the Roth IRA.

Your goal is to build a system that works for you -- both literally (money working for you) and emotionally ("this is comfortable")

"Should I pay off debt before proceeding? A lot of people say to pay off excess debt first."

This is up to you.

Most financial blogs etc. do say "focus on paying off debt first" -- it's good advice, your returns are risk-free and permanent, since the lower your debt is, the less you have to pay over time.

Interest -- working for you or against you -- is continuous and eternal.

Personally, I like to diversify everything, so I not-financial-advice ramble "do all three -- pay down debt, throw a little cash into a high-yield savings, throw a little cash into a Roth IRA"

The problem with "pay off debt first" is that it misses out any occasional giant gains the stock market makes (Roth IRA) and introduces the risk of "I have paid this credit card on time for 5 years, I'm short on change for 3 months due to a situation that gets resolved quickly, and now I have a late payment fee, and a higher interest rate."

Look at your life, finances, and potential future and make decisions!

And also:

Always be on the look out for deals with banks. Sign up bonuses, referral links from friends, etc. Think of it as a money sale.

If you are not comfortable with the idea of a Roth IRA hitting $0.00 potentially, do not do step 02. These are ideas, not directives.

All financial tools can be used for different purposes. All of them. Thus -- these are ideas, not directives.

I am listing a few examples of banks, funds, etc. These are not recommendations nor are they affiliate links. They are listed because I want to maximize your start on this path, but caution, in strongest possible terms, you must do your own research and figure out what makes sense for you.

There are a lot of nuances I am paving over for the sake of simplicity, which is why I am continually saying...

...c'mon say it with me...

...you must do your own research before continuing

Smart, free sites that cover this + a lot of other stuff:

NerdWallet

Bank Rate

One final note about Roth IRAs:

Robinhood currently is offering a 1% match on an IRA. Considering the strict limits of how much an IRA can intake per year, it's not much, but it doesn't cost you anything. Money on sale!

As a final note -- always feel comfortable asking people handling your money for help. They are working for you. Your money works FOR YOU.

If you are uncomfortable, leave, immediately, without concern.

At the retail level, there are hundreds of banks and financial institutions clamoring for your business. If someone makes you uncomfortable for not knowing something, or getting a term wrong, or asking "too many" questions -- go somewhere else.

It doesn't matter if your account is literally worth $20.

They are working for you.

This is a business transaction, and if they make you feel like your time isn't worth their business, I promise you there is someone else who will gladly take care of you.

I end with -- whenever someone is giving you financial advice, always ask why. It helps ensure they aren't scamming you, it's just a good business practice.

I like to ramble, it helps me mentally

I like to be useful, I want the world to be significantly more balanced in terms of who is doing okay

I like to write, this is all good practice for me in doing Various Other Things I do

I fucking hate predatory financial practices. I was gatekept out of financial literacy for decades and so every time I help someone else figure out how to set up their own life and protect themselves it is a giant "fuck you" to the systems and directly to the people who stood in my way.

567 notes

·

View notes

Text

Femme Fatale Guide: How To Master Your Money & Tips On Financial Literacy

Understanding and taking control of your finances improves your quality of life in many ways. Making strides toward better financial literacy can save you a lot of stress, unnecessary fees and helps you play a more active role in taking control over this aspect of adulthood. Once you understand the game of money, saving, and investing, it becomes infinitely simpler to devise a plan to set yourself up for a more financially-free future. Here are some practical tips to keep your finances streamlined, secure, and systemized to help you gain more financial literacy and win in this area of life.

Overview:

Track Your Income & Expenses

Set Financial Goals & Realistic Limitations

Invest Higher-Quality Items To Save Later

Educate Yourself On Different Types of Banking & Investment Accounts

Establish Credit, But Know Yourself

Create An Emergency Fund

Leverage Credit Card Benefits

Understand The Power of A Roth IRA (or Backdoor Roth IRA) & HSA

Automate Whenever Possible

Get Familiar With Taxes & Write-offs

Stay Informed About Employer Benefits

Purchase Seasonally & With Discount Codes (When Available)

Protect Yourself

Read Books

Seek Expert Advice

TIPS ON MASTERING FINANCIAL LITERACY:

Track Your Income & Expenses: Always have a record of all of the money going in and out of your accounts. Use the tool on your banking account app(s) to confirm your monthly income and expenses. Tools like Mint also are great to track your spending to see where every dollar is going all in one place. Aside from personal use, for small business owners, Quickbooks is my favorite invoicing and expense-tracking option.

Set Financial Goals & Realistic Limitations: Once you know your exact monthly income, budget your essentials, savings, investments, and fun money accordingly. Make sure necessities like rent, food, health insurance, electricity, WiFi, toiletries, etc. are accounted for before anything else. Depending on your financial situation, experts (not me – I try to educate myself as best as I can, but am no expert!) recommend trying to save and invest between 15-30% of your pre-tax income. Give yourself the liberty to spend the rest (say 15-20%) of your income, so you don’t feel deprived and stay on track with your goals.

Invest Higher-Quality Items To Save Later: Initially purchasing a higher-quality item often cuts your overall expenses in a certain area over the long run. (Ex: Well-made clothing, shoes, furniture, kitchen appliances, coffee maker, hair dryer, etc.). If you invest upfront on an item you regularly use, there’s a lower chance that it will deteriorate, rip, break, or otherwise become unusable for the next few years. When you opt for the cheaper option, this practice might save you a few bucks in the short term, but you will probably end up having to replace it a few times over time and spend more in the long run. This tip might seem counterintuitive to some, but it truly does save you a lot of money (and frustration). However, I will place a caveat here and say that this advice comes from a place of privilege. Never purchase something you can’t afford. If you have the means, spend a bit more upfront - it is better for your future wallet, allows you to indulge in a better quality of life, and helps you let go of any scarcity mindset/financial limiting beliefs.

Educate Yourself On The Different Types of Banking & Investment Accounts: Know the differences between and the use purpose of different accounts: Checking, Savings, CDs, 401K, Roth IRA, HSA, etc. Always opt for a high-yield savings account option to help preserve your money’s value over time with rising living costs and inflation.

Establish Credit, But Know Yourself: Your credit score is like your adult report card. It’s essential for so many aspects of life, like renting or buying a home, insurance, cell phone plans, etc., so it’s important to start building your credit as early as you can. However, if you know you’re the type of person to overspend with a credit card, look into secured credit card options (you deposit the money that acts as a credit limit, so it’s like a debit card with credit-building benefits).

Create An Emergency Fund: Pay yourself first. Have between 3-12 months of expenses available in a high-yield savings account at all times. If you have a family or are self-employed, aim for 6-12 months of necessary savings to stay sane. Saving this amount of money takes time. Be patient, and cut back on frivolous expenses if needed for the short term.

Leverage Credit Card Benefits: If you have enough self-control, always use a credit card instead of a debit card – but spend in the same way you would as though the money is coming directly out of your bank account. This gives you additional flight and other purchasing perks, such as cashback and exclusive discounts. Using a credit card provides additional security, too.

Understand The Power of A Roth IRA (or Backdoor Roth IRA, depending on your income) & HSA: Compound interest is your best friend financially. Depending on your income, invest as much as you can into a Roth IRA account or set up a backdoor Roth IRA through your brokerage firm (I use Vanguard!). HSA (Health Saving Accounts) accounts offer so many benefits – they can serve as a tax write-off, lower your overall healthcare costs, and be leveraged to use as an additional retirement investment account, too (I use Fidelity).

Automate Whenever Possible: Automate a portion of your paycheck to savings and your investments, so you never see this money. Pay yourself first before spending (on anything but necessities).

Get Familiar With Taxes & Write-offs: This mainly applies to anyone self-employed or a small business owner (been in the game for 5 years!). However, this point can also potentially be beneficial for students who can leverage an education credit for tax purposes. Explore all of your options to see what write-offs are available in your specific situation. Understand how your income and expenses influence your tax bracket. Investing in a CPA can save you a considerable amount of money and all of your sanity if you’re not a salaried employee. Look over the standardized section C document, and speak with a professional to help maximize your write-off potential (legally and honestly, of course). My CPA is my lifeline!

Stay Informed About Employer Benefits: Always maximize your 401K match (whatever percentage that is at your company), any wellness perks (like a gym membership or massage credit), or any meals and car services credits for late nights/work trips.

Purchase Seasonally & With Discount Codes (When Available): Try to purchase items off-season when you can (e.g. purchase classic winter closet staples in the summer when they’re on sale). Utilize plug-ins like Honey or Cently on your browser to have discount codes for any site readily available.

Protect Yourself: Stay on top of fraud alerts. Freeze your credit bureau accounts if necessary.

Read Books: Educate yourself on saving, investing, budgeting, building a business, etc. See the ‘Finance’ section of my Femme Fatale Booklist for some recommendations. I also love Graham Stephan’s Youtube channel – his videos are highly useful and practical for beginners in this life arena!

Seek Expert Advice: Use licensed professionals (CPAs, brokerage firms, your bank, etc.) as a resource, too, for your personal goals.

This is a lot to take in, so try to implement one action item (or a few) at a time, so you can work towards your goals without getting overwhelmed. Also, for reference, I’m in the United States, so all of these tips are focused on how the system works in my country - if you know of any international equivalents, feel free to drop them in the comments to guide others.

Hope this helps xx

#life advice#finance#adulting#femme fatale#dark femininity#dark feminine energy#it girl#hypergamy#high value woman#divine feminine#high value mindset#hypergamous#the feminine urge#success mindset#productivity#spending habits#entreprenuership#level up#self improvement#ideal self#female power#female excellence#personal growth#investing#girl advice#that girl#femmefatalevibe

1K notes

·

View notes

Text

This is How I Made $40k In Passive Income By Age 26

I’m talking here about real passive income, not the kind where you spend years writing a book. There’s one caveat though and you need money to make money.

I started investing part of my income every month at age 23. Three years later, I had made $40k in profit tax-free and could put down a deposit on my first house. All with less than an hour of effort per year. $13k per hour of work doesn’t sound bad, does it?

It’s not sexy but I relied on getting a professional job and investing my excess income. Many in my position don’t do this and sacrifice future financial freedom. You can take the profits to start up your own business with less reliance on outside help. Self-funding the initial stages gives you more credibility when asking others for more money.

My Economics bachelors and central bank experience made me confident to invest responsibly. Yet the steps I took weren’t complex and here I break down what I did.

NOTE: Lucky factors went my way with exchange rates, freak performance, and government bonus schemes amongst others. Do not read this and think similar performance can be produced reliably in the future. This is a high-level overview and I do not go into blow-by-blow detail.

Surrendered my arrogance

One of the biggest mistakes I see is people thinking they are exceptional. Investment funds have whole teams of hyperqualified people and complex algorithms. Yet 85.1% of active funds have failed to beat the S&P 500 in the last 10 years. How can you honestly believe you can win?

I bought index and active funds from the major economies rather than individual stocks. This takes the decision making out of my hands. As I’m from the UK, I invested through an ISA (the equivalent of a superpowered Roth IRA) to earn tax-free.

I spread myself out geographically with stocks in the USA, UK, mainland Europe, and Asia. My risk was dramatically reduced as I owned shares in thousands of companies. By using index funds, my fees were far lower than buying individual stocks. When I wanted exposure and index funds were unavailable, I found funds by managers with long histories.

Invested first and spent afterward

Every month, the same amount left my account automatically. I never considered this as spending money so it never factored into my buying decisions. I could start the account with significant savings from 1.5 years of working that were sitting in a low-interest current account.

There are all kinds of apps to encourage people to invest their savings. One of the tricks I dislike is rounding up purchases to send to the pot. You buy a cookie for 20 cents and 80 cents goes straight into your fund. This takes control away from you and leaves your input reliant on chance events. The return is already based on chance so why make it even more uncertain!

Some portray compounding as a type of sorcery. Yet 7% return per year for ten years on ten dollars is $9.67 profit. On a thousand dollars it is $967. Don’t make the excuse of something is better than nothing when you can put away more. It takes time to build a portfolio to the point where it can make a difference in your life. I had a massive advantage by living with my parents.

If you truly want passive income, you need to examine your spending habits too and decide if anything is a luxury you are happy to be without.

Never invested if I couldn’t afford to lose 50%

I could invest more than I did but I always kept some in reserve. If anything happened to me, I could cope with losing half the value of my investments. The amount you’re willing to risk can change over time and change your plans in line with this.

The worst crashes in the S&P history have taken the value to around half but they have always bounced back. We still didn’t fall below this even when news of the pandemic hit or when the financial crisis of 2008 struck. You can be confident a developed country’s stock market won’t completely self-destruct. Only a massive event could do this and then you’d have bigger problems!

Individual stocks can go to zero but it is harder for a fund to do so. You must feel comfortable with the unlikely worst-case scenario for peace of mind. There’s always a chance of great losses and you can’t blame anyone else if you lose more than you can handle. It is possible to lose everything!

Examined my opportunity costs

Let’s not pretend it isn’t a privilege to invest. Not only must you cover your expenses but also your debts. I was fortunate to have student loan debt with an interest of less than 2%. As long as I believed I could beat this rate, it made sense to invest extra money rather than paying off debts early.

Yet I know others are not as lucky. The average stock market return in the long-run has been 7% for the S&P. If the interest on your debt is higher than this, pay it off first! You have to decide your willingness to take the risk if your interest is less than this. I cannot tell you how much. I took a risk by investing in emerging economies and those paid off.

For entrepreneurs, when starting a business you should believe you can beat this rate in the long run. At the time, I didn’t have a business idea I thought would be a better path. You should be confident in forecasting significantly more than this to make the extra effort worth it.

Allowed the money to do its thing

There’s a secret of investing many people seem to forget. Looking at the numbers doesn’t magically make them increase. Interfering too much will backfire.

I thought about taking my money out several times when it looked like the peak. I thought about adding more whenever it looked like the bottom. Every time I was wrong. I would have lost wealth if I had acted. Trying to perfectly time the market will leave you anxious and constantly checking the news. Not to mention the lost income by needing to pay fees for every trade.

What you need to take with you

Investing in the way I did gave me much greater financial freedom. I did it while working a 9–5 and fresh out of university. The hardest part is working to get the money to invest but once you have this, it’s about making the strategy as easy as possible. These are the steps I took and can help you too.

1. Surrendered my arrogance — I bought funds, not individual stocks.

2. Invested first then spent afterward — I could only spend what I hadn’t invested.

3. Never invested if I couldn’t afford to lose 50% — I didn’t put my security at risk.

4. Examined my opportunity costs — I was sure it was the best use of my money.

5. Allowed the money to do its thing — I didn’t obsessively check on it.

Thank you for reading and have a wonderful day! Remember this is my story and you must examine the risks for yourself. I have intentionally not given the exact funds because they may not perform the same in the future.

Any actions taken are completely at your own risk, this should not be considered financial or legal advice. I am not a financial advisor. Please consult a financial professional before making major financial decisions.

#digitalmarketing#ibrahimkhalil#digitalmarketingagency#digital marketing#social media marketing#social media#onlinebusiness#make money for free#make money today#make money as an affiliate#makemoneyathome#make money step by step#passiveincome#passive investing#passive influence

2 notes

·

View notes

Note

I just read your post about finances and investment properties and found it very interesting! I'm wondering, if you don't mind, what advice would you have for an 18 year old college student (me!) with little to no knowledge of finances, loans, real estate, etc, and only about 4k in savings. Any smart moves I should be making with my money now that will help me later in life? Tips on setting up a passive income? Thank you so so so much!

1. Study to get a practical degree. That means no communication or gender studies degree. Even my hippie friends are forbidding their children from pursuing liberal arts degrees. An art professor I have business with straight up tell his students they should not get an art degree but study business instead because if they are serious about being a professional artist then they will be entrepreneurs and need to know financial management. So while you're in school take a course on investing or money management or accounting or economics or all of them.

2. Have an emergency fund that covers 3 to 6 months of living expenses: rent, food, and utlity. Other people say it's 3 to 6 months of your salary. I have 13 months emergency fund that my financial planner is trying to wean me off of because that much sitting in the bank is not growing money (Oprah used to paranoidly keep $50 million in savings that she called her bag lady fund in case her career implodes). As a college student I'm assuming your expenses are already paid for - housing, meal plan, etc, that said, you should have at least $1,000 in your emergency fund so you're off to a very good start with your $4,000.

3. Track your spending by using a spreadsheet or anything on paper. Have all your expenses in it: food, rent, utility, phone contracts, utility, Netflix, Prime, etc. Also have an area for income and all it’s sources (savings, job, stipends from your parents) and a total. This starts to give you an idea of your income vs expenditures. Use this to aid you in living beneath your means by living off of beans and rice that you buy in bulk and prepre meals yourself. Avoid spending money on alcohol if you can, brew your own coffee.

4. If possible, NO student loans. Apply for scholarships, grants, fellowships.

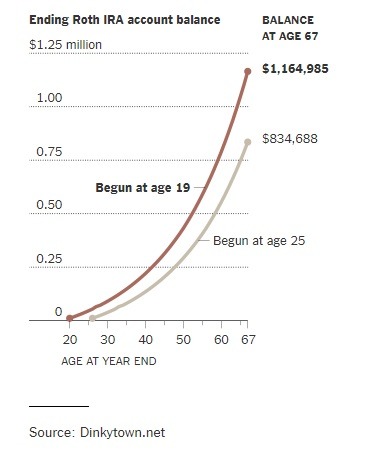

5. Get a part time paying job, whether during school or a summer internship. From having an earned income you can open a Roth IRA account because though you may not have much money at your age, but what you do have is TIME. Invest now for your retirement and it accumulates far faster when you start early than when you start later. Read this New York Times “Roth IRAs for teenagers” article.

"A person who contributes the maximum to a Roth IRA beginning at age 19 will have accumulated $330,000 more than one who begins contributing at age 25, by the time each person is 67."

See that? A 19 years old will have six more figures by the time he retires than the other guy who did the same thing 6 years later.

You can open an IRA account with your bank, though they are more about saving your money than growing your moneny. You can go with a brokerage companies like Charles Schwab, Fidelity, and Vanguard.

If you want to just put money in it and forget about it then use a Target Date Fund, you pick when you want to retire and it will re-allocate itself to become more conservative the closer you get to retirement. Charles Schwab is probably the easist, here is there their target date funds. You'll most likely want to use the SWYNX fund since you're so far away from retirement. It's a pretty good way to get started if you're still learning or don't care to learn and just want to save for retirement.

If you want to be more hands-on, they have other mutual funds and you should consider building a portfolio out of low-cost index funds and exchange-traded fund (ETFs), this approach makes it easier to ensure adequate diversification in your portfolio and lower your investing risks and helps minimize the fees you’ll pay.

I usually don’t advice reddit for advices but here is a good beginner’s guide to IRA.

Reminder, it must be "earned income" in order to open a Roth IRA account, though that hasn't stopped a friend from opening a Roth IRA for his granddaughter who is four years old, naturally the problem is how to create her "earned income" status, and asked me if my former collegues would hire her as a model. I can't fault him, it's best to open a Roth IRA AS SOON AS POSSIBLE because not only is it the best retirement plan now, but it could get pulled at any time by the government.

To summerize:

Find a good job that pays well.

Cut down expenses, live within your means.

Destroy high interest debt as much as possible, ideally to have no bad debt

Invest and max out in tax efficiency retirement accounts, put rest into taxable accounts

Time, maintain #2 and #4 for decades

Retire with $1.5 to $3 million dollars to live the rest of your years in a comfortable middle class style

Noticed that I didn’t say that you retire wealthy even though you will have anywhere from $1.5 million to $3 million dollars. That’s because those millions need to last you 20 to 30 years after you retire. This is why I’ve said bonds, stocks, and indexes are for maintaining your wealth, it’s not a quick rich scheme. Sure some people strike it rich with stocks but those are exceptions not the norm, like how lottery winners are rare.

Part II of Buildng your wealth: Real Estate. For beginners like yourself I suggest this book “ How to Find, Buy, and Rent Houses for Wealth” , it’s sound and detailed without overcomplicating things. It assumes the readers are looking at buying rental properties the "normal" way and not as a full time gig. Next find a local mentor that already owns property in the area you would like to own. Real estate investment requires local insight and if you move into commercial investment, things are still very much word-of-mouth and referral-based.

If you’re serious about real estate as a full time gig then find the real estate investors club (REIC) in your area, people get together and throw ideas around, just be mindful that they are also your competition when it comes to buying a piece of property.

Until then you can listen to real estate podcast here to get a feel of the industry.

41 notes

·

View notes

Note

Hey, BGR (sue me I acronymed it. Please don't.), What are your wise ways of making yourself financial secure before you hit 30? What's the best way to start financially at limited experienced 17-year-old who hasn't any have the knowledge of what to do on her own?

The fact that you’re even thinking about this at 17 means you win ALL THE AWARDS! Seriously, this is a great time to start prepping for your future, and you’re way ahead of the game by even reading finance blogs and trying to get your shit together.

Here’s our advice:

Get a job. Right now. You can wait tables or work retail or do manual labor. Or you can start your own money-making venture: babysitting, yard work for your neighbors, tutoring, walking dogs, running errands for the elderly, selling crafts. Whatever. Just get an income stream that’s all your own and start adding to it aggressively.

If you don’t yet have your own bank accounts, get them. You’ll want a checking account (where you can withdraw money regularly to pay for your expenses) and a high yield savings account (which will earn literally 1000% more interest than a standard savings account at your regional bank). We recommend Ally for a high yield savings account.

Start building credit. It’s harder than ever to get approved for a credit card, so at your age you might need to start with a secured credit card. That’s ok, as it’ll be a really safe way to build credit without living outside your means. Use it to buy gas or your bus ticket or another regular expense you have to pay for anyway.

Create a budget. The easiest way to do this is to track your expenses and income for a few months. From there, you can see about how much you need to live on from month to month. Assuming you’re still living with your parents, your expenses should be very low. Put the rest of your income into your savings account.

Think carefully on whether or not you’ll go to college immediately after graduating high school, or if you’ll take a year off to continue earning money and real world experience. There’s no right answer here--but I do think getting an education eventually will be incredibly valuable to you. And yes, I mean that literally, financially.

Determine the return on investment (ROI) of various college degrees and schools before you decide where you’re going to study. By which I mean: a degree in English might cost X, and the average job salary you can expect to earn by age 30 with that degree might be Y. Whereas a degree in Engineering might be Z, and the average salary $160,000 by age 30. If financial security by 30 is your goal, minimize your college expenses and maximize your potential earnings by choosing a field of study and school with a high ROI. I... didn’t do this. And I regret it.

Continue working after high school. Keep putting money away in your savings account even if you need to adjust your budget when you leave home. (I’m assuming you live with your parents now, and won’t after you graduate high school.) I worked as a nanny making $20 an hour all during college and graduated with enough of a nest egg to afford to move across the country and cover my expenses for a few months while I got my career going.

If you can avoid it, don’t buy a fucking car. They’re money pits. If you absolutely need one, buy used. Otherwise, public transit is your friend.

Embrace the roommate lifestyle. You’ll save more of your money and be able to afford a better lifestyle if you join forces with other young people after college. I lived with 6 people and 2 dogs in a 4-bedroom house my first two years after college and my rent and utilities were a fraction of what they would’ve been if I lived in a studio or one bedroom apartment by myself.

Start a Roth IRA. This is basically the independent retirement account of choice for lower income people, and you can start one regardless of your employment status. You need $1,000 to start it, so save that up in your savings account, then transfer it over. You can’t touch this money until you retire, so factor that into your budget.

Join your grocery store’s loyalty program. It’ll give you access to sales and coupons non-members don’t have, and it costs you nothing. So without it you’re literally leaving free money on the table.

Live frugally. This means buying generic instead of name brand products, shopping at thrift stores, and being intentional about your entertainment costs. The hardest part here will be saying no to your friends when they want to spend a lot of money to hang out. Be strong.

Stay healthy. Things like cancer, chronic disease, and accidents are beyond your control. But outside of these factors, if you treat your body well it will be much cheaper to maintain. So eat lots of vegetables, drink lots of water, and establish a reasonable exercise regime that doesn’t involve a gym membership. Barring the unavoidable, this will keep you healthy and out of the hospital... where they’ll bleed you dry of your savings.

Learn to cook. Sweet fucking crispy jibbers, you will save SO MUCH MONEY by making the majority of your food at home. Eating out is unnecessarily expensive.

Get a grown up job. Life isn’t fair, and the plain and simple truth of the matter is that some jobs pay more than others. If you made a wise choice on the ROI of your college education, you could be making a lot of money by the time you’re 30. Push yourself to apply for high paying jobs, even if you’re not 100% qualified. Get your foot in the door at companies in high-paying industries. You’ll start at an entry level job, but you shouldn’t stay there for longer than 2 years. And on that note...

Ask for a raise every 6 months. Studies show that people who ask for raises get them more often than people who don’t. So you have nothing to lose and so much to gain by asking, even if it’s terrifying and nerve-wracking.

Keep applying for a better job. If you’re going to be financially flush by 30, you need to move up the ladder as quickly as possible. And this means job hopping your way to prosperity. Even if you’re employed, apply for at least one job a month that could increase your salary or put you on a direct path to a higher salary. Nothing will make your salary and career stagnant like staying in one place too long.

Use your company’s 401(k) and/or 403(b) program. If you don’t, you’re losing money in three ways. So just fucking sign up for it as soon as you’re hired. You won’t miss the little bit of money that’s not going to your paycheck.

Don’t rush into marriage or children. If you want to get married or have kids, that’s totally fine. But there’s absolutely no need to rush, as both of these things come with all kinds of expenses. It will be monumentally harder to be financially secure by 30 if you have to do it with dependents or another person affecting your personal finances.

Stay out of credit card debt. Once you’re in your mid-twenties and you have a solid track record of paying bills, you’ll be in a much better position to apply for a regular credit card. I recommend you get a rewards card that offers you cash back or travel reimbursement (I have the Capital One Venture card and love it). BUT... you have to be responsible with it. Pay it off in full and on time every month and you’ll easily build credit without going into debt.

That’s it for now. I’ve peppered this answer with links to longer articles on various topics for you to read. You’re going to be great, so...

602 notes

·

View notes

Text

Finding the Right Yoga Teacher

In our last episode, we spoke to Humble Wave founder, Illi Stovall about uncertainty + life transitions = exponential growth

When we understand how mindset shifts go from performance to practical application and physiological well-being, we begin to discover the truth that is within ourselves and how to culture the inner guru. (teacher within).

I began yoga as a “workout,” like many others. I had that moment of seeing the “Olympic try-outs” in a yoga class and I was stunned at what these practitioners were able to do.

Sure, I went through the intimidation and the self-doubt, but I worked through it and turned it into aspirations and goals to practice, play, and strive towards. (I use the wordplay, as to not make it an expectation, but enjoyment in my evolution).

What was most fascinating was that initial moment, it gave me an opportunity to approach these- what I thought were “advanced yogis”- and ask how the heck…?

In this episode, we take what we learned from last week, and apply it to how we will "find the right yoga teacher," to assist in navigating these new waters exactly where you are at right now.

A few questions to ask yourself is:

What are your needs?

What is your goal for practicing yoga?

What style of yoga are you seeking? Is it a variety?

What are the tone of voice that you align with and the pace?

Do you want to practice at home, online, or with a group of students?

We have all had our fair share of complacent yoga teachers, the one that has said some messed up "ish" that left an impression, some that may have violated some ethics and morals, stigmas of others, and so on…

We have also had our fair share of teachers that are new to the practice and simply are growing in their journey and learning as they progress, and we have also discovered some of the most incredible teachers in the world that have emerged almost from the divine grace of God, some that you have never met in person and still practice with online and a variety of others.

Whatever your experience has been, it’s time to start the journey again, or take the journey to the next level and expand.

We all start with the one teacher that changed our lives.

For me, it was a synchronous lineage of incredible teacher after incredible teacher, each building on the next…, from Ira Ohm (my first teacher), Yogananda, Kelly Brookbank, Corbin Stacy, Jai Uttal, Russill Paul, Erika Lima, Judy Weaver, Kino MacGregor, Moses Love, Sean Johnson, Mitchel Blier, Brett Larkin, Baron Baptiste, Bob Roth, and Malova Elena and most recently Maharishi Mahesh Yogi to name a few of my teachers. (links below).

"What made the biggest impact for me on my yoga journey, was immersing myself in spiritual and emotional wellbeing."

Once you determine the teacher or lineage you want to follow, take action, put it in as a non-negotiable, “hot date” and cOMmit.

It takes 66 days to instill a consistent habit. Let’s start today!

For this week’s journal entry:

Ask yourself:

What lineage or practice of yoga are you most curious about,

Does it resonate?

How will you take the time to integrate that self-care to support your mental, emotional and physical well-being?

Below are the links to a few of my teachers I have had the opportunity to study under.

Always remain a student, even when you are a teacher or visionary.

I’d love to hear from you, so please be sure to comment and post below.

My 200 Hour Ayurveda and Yoga Teacher Training Cohort is closed but the Self-paced journey is available. Use JBY10 to save 10% on the course tuition. Use this link: jbyf.teachable.com

Subscribe to YouTube for Free Classes

Follow on IG for Free Tutorials and this Weekly Chat on all things Yoga, Ayurveda, and Wellness

Follow/Like on Facebook to be Notified for Weekly Live Saturday Morning class

Here are some resources to get you started along your journey:

Hemelaya Embody Retreat

NAMI

Jai Bhakti Yoga

jbyf.teachable.com

YouTube

New Orleans Musicians Clinic

RootedU Yoga

MAPI.com

Yoga Alliance

Yoga U

Accessible Yoga

TM.org

Ira Ohm (my first teacher)

Yogananda

Kelly Brookbank and her former partner

Corbin Stacy

Jai Uttall

Russill Paul

Erika Lima

Judy Weaver

Kino MacGregor

Moses Love

Dan Nevins

Sean Johnson

Mitchel Blier

Brett Larkin

Baron Baptiste

Bob Roth

Elena Malova

Maharishi Mahesh Yogi

0 notes

Text

Automate Your Finances Using Technology and Psychology

Learning how to automate your finances has the potential to be a money game-changer.

Why? Because on a daily basis, we face too many choices. Using automation to reduce choices sets you up for success with money, without even having to think about it on a daily basis.

Why is automating your finances important?

Think about the 50+ money decisions you have to make today: Should you save more? What should you cut down on? What about investing – real estate or stocks or index funds? Pay off debt? Did you send in that Comcast bill on time? Is it time to rebalance your portfolio?

Faced with an overwhelming number of choices, most people respond in the same way: They do nothing. As Barry Schwartz wrote in The Paradox of Choice: Why More is Less,

“…as the number of mutual funds in a 401(k) plan offered to employees goes up, the likelihood that they will choose a fund — any fund — goes down. For every 10 funds added to the array of options, the rate of participation drops 2 percent. And for those who do invest, added fund options increase the chances that employees will invest in ultraconservative money-market funds.”

Why do so many people believe that personal finance is only about willpower? The idea goes like this: “If I just try harder, I’ll start saving more, pay off my debt, stop spending all that money, keep a budget, learn about investing, start investing, rebalance ever year…” Unlikely. In fact, go ask your friends if they’re taking full advantage of their employer’s 401(k) match. The vast majority of people are not – even though it’s literally free money. Their answer? “Yeah…I really should do that…”

It’s not about willpower. More than anything else, the psychology of automation is critical to successfully getting control of your finances.

In one study, researchers found that making 401(k) accounts opt-out instead of opt-in — in other words, making employees automatically participate, although they could stop at any time – raised contribution rates from less than 40% to nearly 100%.

How to automate your finances

Using “The Next $100” Principle, which I’ll show you below, your automated money flow will automatically route money where it needs to go – investments, paying bills, savings, and guilt-free spending.

And you can focus on the things that matter to you, instead of constantly worrying about your personal finances.

Bonus: This week, I’m launching Automate Your Money, a brand new program that walks you through, step-by-step, how to automate your personal finances. Everything you need to know and do is included.

This is the exact system I spent years testing and perfecting and which I’ve taught to hundreds of thousands of people.

Time-sensitive: I’m only letting new students in for three days – sales start on August 18th 2021 and end at 11:59 PST on August 20th 2021. Join today!

Case study: Michelle’s Automation System

To see how this will work, let’s use Michelle as an example:

Michelle gets paid once a month. Her employer deducts 5 percent of her pay automatically and puts it in her 401(k). The rest of Michelle’s paycheck goes to her checking account by direct deposit.

About a day later, her Automatic Money Flow begins transferring money out of her checking account. Her Roth IRA retirement account will pull 5 percent of her salary for itself. Her savings account will pull 5 percent, automatically breaking that money into chunks: 2 percent for a wedding sub-account, 2 percent to a house down-payment sub-account, and 1% for an upcoming vacation. (That takes care of her monthly savings goals.)

Her system also automatically pays her fixed costs like Netflix, cable, and insurance. She’s set it up so that most of her subscriptions and bills are paid by her credit card. Some of her bills can’t be put on credit cards—for example, utilities and loans—so they’re automatically paid out of her checking account. Finally, she’s automatically e-mailed a copy of her credit card bill for a monthly five-minute review. After she’s reviewed it, the bill is also paid from her checking account.

The money that remains in her account is used for guilt-free spending money.

To make sure she doesn’t overspend, she’s focused on two big wins: eating out and spending money on clothes.

She sets alerts in her Mint account if she goes over her spending goals, she keeps a reserve of $500 in her checking account just in case. (The couple of times she went over her spending, she paid herself back using her “unexpected expenses” money from her sub-savings account.) To track spending more easily, she uses her credit card as much as possible to pay for all of her fun stuff. If she uses cash for cabs or coffee, she keeps the receipts and tries to enter them into Mint as often as possible.

In the middle of the month, Michelle’s calendar reminds her to check her Mint account to make sure she’s within her limits for her spending money. If she’s doing fine, she gets on with her life. If she’s over her limit, she decides what she needs to cut back on to stay on track for the month. Luckily, she has fifteen days to get it right, and by politely passing on an invitation to dine out she gets back on track.

By the end of the month, she’s spent less than two hours monitoring her finances, yet she’s invested 10 percent, saved 5 percent (in sub-buckets for her wedding and down payment), paid all of her bills on time, paid off her credit card in full, and spent exactly what she wanted to spend. She had to say “no” only once, and it was no big deal. In fact, none of it was.

Bonus: This week, I’m launching Automate Your Money, a brand new program that walks you through, step-by-step, how to automate your personal finances. Everything you need to know and do is included.

This is the exact system I spent years testing and perfecting and which I’ve taught to hundreds of thousands of people.

Time-sensitive: I’m only letting new students in for three days – sales start on August 18th 2021 and end at 11:59 PST on August 20th 2021. Join today!

“The Next $100” Principle Applied: Automating your Finances

Too many people try to save money on 50 things and end up saving 5% on everything — and causing themselves a huge amount of stress that makes them give up entirely. Instead, I prefer focusing on my top two discretionary expenses (for me, eating out and going out), and cutting 25%-33% off over a period of six months. This generates hundreds of dollars of extra cash flow that I re-route to investing and travel.

To show you how automating your accounts works, I’ve prepared a 12-minute video that shows you how to build a personal-finance infrastructure that automates your money so you can spend less than 1 hour per week monitoring your money. Everything will be done automatically – investment, savings, bills paid. Everything.

Ramit’s 12-Minute Guide to Automating Your Finances

youtube

1. Log into all of your accounts

First, you’ll need to log in to each account and link your accounts together so you can set up automatic transfers from one account to another. When you log in to any of your accounts, you’ll usually find an option called something like “Link Accounts,” “Transfer,” or “Set Up Payments.”

These are the links you need to make:

Examples: Your 401(k) should be connected to your checking account via direct deposit (talk to your HR rep about setting this up — it takes 10 minutes to fill out a form). Then log into your Roth IRA, savings account, and credit card, where you can link your checking account to them. Finally, there are some bills that can’t be paid through your checking account, like your rent. For those, use your checking account’s free bill-pay feature so they automatically issue your landlord a check on the precise date it’s due. Now, you never have to manually write a check again.

2. Set up automatic transfers

Now that all your accounts are linked, it’s time to go back into your accounts and automate all transfers and payments. This is really simple: It’s just a matter of working with each individual account’s website to make sure your payment or transfer is set up for the amount you want and on the date you want.

Most people neglect one thing when automating: dates. If you set automatic transfers at weird times, it will inevitably necessitate more work, which will make you resent and eventually ignore your personal-finance infrastructure. For example, if your credit card is due on the 1st of the month, but you don’t get paid until the 15th, how does that work? If you don’t synchronize all your bills, you’ll have to pay things at different times and that will require you to reconcile accounts. Which you won’t do.

The easiest way to avoid this is to get all your bills on the same schedule.

3. Get all of your bills on the same schedule

To accomplish this, get all your bills together, call the companies, and ask them to switch your billing dates. Most of these will take five minutes each to do. There may be a couple of months of odd billing as your accounts adjust, but it will smooth itself out after that. If you’re paid on the 1st of the month, I suggest switching all your bills to arrive on or around that time, too.

Call and say this: “Hi, I’m currently being billed on the 17th of each month, and I’d like to change that to the 1st of the month. Do I need to do anything besides ask right here on the phone?” Of course, depending on your situation, you can request any billing date that will be easy for you.

Now that you’ve got everything coming at the beginning of the month, it’s time to actually go in and set up your transfers. Here’s how to arrange your Automatic Money Flow, assuming you get paid on the 1st of the month.

2nd of the month

Part of your paycheck is automatically sent to your 401(k). The remainder (your “take-home pay”) is direct-deposited into your checking account. Even though you’re paid on the 1st, the money may not show up in your account until the 2nd, so be sure to account for that.

Remember, you’re treating your checking account like your e-mail inbox— first, everything goes there, then it’s filtered away to the appropriate place. Note: The first time you set this up, leave a buffer amount of money—I recommend $500—in your checking account just in case a transfer doesn’t go right. And don’t worry: If something does go wrong, use the negotiation tips above to get any overdraft fees waived.

5th of the month

Automatic transfer to your savings account. Log in to your savings account and set up an automatic transfer from your checking account to your savings account on the 5th of every month. Waiting until the 5th of the month gives you some leeway. If, for some reason, your paycheck doesn’t show up on the 1st of the month, you’ll have four days to correct things or cancel that month’s automatic transfer.

Don’t just set up the transfer. Remember to set the amount, too. Use the percentage of your monthly income that you established for savings in your Conscious Spending Plan (from Chapter 4 of my book; typically 5 to 10 percent). But if you can’t afford that much right now, don’t worry—just set up an automatic transfer for $5 to prove to yourself that it works. The amount is important: $5 won’t be missed, but once you see how it’s all working together, it’s much easier to add to that amount.

Automatic transfer to your Roth IRA. To set this up, log in to your investment account and create an automatic transfer from your checking account to your investment account. Refer to your Conscious Spending Plan to calculate the amount of the transfer. It should be approximately 10 percent of your take-home pay, minus the amount you send to your 401(k).

7th of the month

Auto-pay for any monthly bills you have. Log in to any regular payments you have, like cable, utilities, car payments, or student loans, and set up automatic payments to occur on the 7th of each month. I prefer to pay my bills using my credit card, because I earn points, I get automatic consumer protection and little-known benefits, and I can easily track my spending on online sites like Mint, Quicken, or Wesabe.

But if your merchant doesn’t accept credit cards, they should let you pay the bill directly from your checking account, so set up an automatic payment from there if needed.

Automatic transfer to pay off your credit card. Log in to your credit card account and instruct it to draw money from your checking account and pay the credit card bill on the 7th of every month— in full. (Because your bill arrived on the 1st of the month, you’ll never incur late fees using this system.) If you have credit card debt and you can’t pay the bill in full, don’t worry. You can still set up an automatic payment; just make it for the monthly minimum or any other amount of your choice. (Incidentally, paying your bills on time is the one of the top factors in determining and improving your credit score.)

By the way, while you’re logged in to your credit card account, also set up an e-mail notification (this is typically under “Notifications” or “Bills”) to send you a monthly link to your bill, so you can review it before the money is automatically transferred out of your checking account. This is helpful in case your bill unexpectedly exceeds the amount available in your checking account—that way you can adjust the amount you pay that month.

Tweaking Your System: Freelancers, irregular income, and unexpected expenses

That’s the basic Automatic Money Flow schedule, but you may not be paid on a straight once-a-month schedule. That’s not a problem. You can just adjust the above system to match your payment schedule

How to automate your finances if you’re paid twice a month

I suggest replicating the above system on the 1st and the 15th—with half the money each time. This is easy enough, but the one thing to watch with this is paying your bills. If the second payment (on the 15th) will miss the due dates for any of your bills, be sure that you set it so that those bills are paid in full during the payment on the 1st. Another way to work your system is to do half the payments with one paycheck (retirement, fixed costs) and half the payments with the second paycheck (savings, guilt-free spending), but that can get clunky.

How to automate your finances if you have irregular income

Irregular incomes, like those of freelancers, are difficult to plan for. Some months you might earn close to nothing, others you’re flush with cash. This situation calls for some changes to your spending and savings. First—and this is different from the Conscious Spending Plan—you’ll need to figure out how much you need to survive on each month. This is the bare minimum: rent, utilities, food, loan payments—just the basics. Those are your bare-bones monthly necessities.

Now, back to the Conscious Spending Plan. Add a savings goal of three months of bare-bones income before you do any investing. For example, if you need at least $1,500/month to live on, you’ll need to have $4,500 in a savings buffer, which you can use to smooth out months where you don’t generate much income. The buffer should exist as a sub-account in your savings account. To fund it, use money from two places:

1. Forget about investing while you’re setting up the buffer, and instead take any money you would have invested and send it to your savings account. 2. In good months, any extra dollar you make should go into your buffer savings.

Here’s an example of how I set up my sub-savings accounts:

Once you’ve saved up three months of money as a cushion, congratulations! Now go back to a normal Conscious Spending Plan where you send money to investing accounts. Because you’re self-employed, you probably don’t have access to a traditional 401(k), but you should look into a Solo 401(k) and SEP-IRA, which are great alternatives.

Just keep in mind that it’s probably wise to sock away a little more into your savings account in good months to make up for the less profitable ones.

If you have an irregular income, I highly recommend using YouNeedABudget as a planning tool. It uses a forward-looking system that’s very helpful if you don’t know what you’re going to make next month.

Your money is now automatic

Congratulations! Your money management is now on autopilot. Not only are your bills paid automatically and on time, but you’re actually saving and investing money each month. The beauty of this system is that it works without your involvement and it’s flexible enough to add or remove accounts any time. You’re accumulating money by default.

Most importantly, whenever you’re eating out, or you decide to buy a new pair of shoes or fly out to visit your friends or get the “Pro” version of that web app you’ve been eyeing, you won’t feel guilty because you’ll KNOW that your finances are being handled — automatically.

Excerpt from Ramit Sethi’s new book, I Will Teach You To Be Rich. Used with permission.

###

Bonus: This week, I’m launching Automate Your Money, a brand new program that walks you through, step-by-step, how to automate your personal finances. Everything you need to know and do is included.

This is the exact system I spent years testing and perfecting and which I’ve taught to hundreds of thousands of people.

Time-sensitive: I’m only letting new students in for three days – sales start on August 18th 2021 and end at 11:59 PST on August 20th 2021. Join today!

Do you know your earning potential?

Take my earning potential quiz and get a custom report based on your unique strengths, and discover how to start making extra money — in as little as an hour.

Start The Quiz

Automate Your Finances Using Technology and Psychology is a post from: I Will Teach You To Be Rich.

from Money https://www.iwillteachyoutoberich.com/blog/the-psychology-of-automation-building-a-bulletproof-personal-finance-system/ via http://www.rssmix.com/

0 notes

Text

Agilenano - News: Commission Free Trade