#visa fraud scheme

Explore tagged Tumblr posts

Text

0 notes

Text

Negatives of Mercury in Each House

Mercury in 1st House: Overthinker, mental overload, takes things too literally, impatient, not a good listener, interrupts while talking, opinionated, critical, argumentative, fussy with details, nervous.

Mercury in 2nd House: Does not keep promises, mismanages money, financial trickster, bad salesman, lies about money matters, stammering.

Mercury in 3rd House: Too much into details, information gatherer, thinks but not acts, cluttered mind, breathing and lungs issues, smoker, loses the big picture, media addict, smartphone addicts.

Mercury in 4th House: Unsettled mind, emotional issues, analyses feelings than feeling them, not able to settle at one place /city, frequent mover, shy outside home, nervous, anxious mother, tension at home, sibling quarrels, property troubles, documentation troubles.

Mercury in 5th House: flirtatious, casual lover, critical of children's education, too mental in love and expressing affections, takes risk with speculation, poor gambler, worried over children, micromanages children's life.

Mercury in 6th House: Argumentative, picks intellectual fights, overzealous in health matters, troubles with co worker, gossips at office/ workplace, criticizes others work, perfectionist, makes mistakes at work, skin eruptions.

Mercury in 7th House: changes partners frequently, falls in love then discards, trouble with contracts, marries for documents purpose(like spouse sponsoring a visa), mental relationships, not serious in love, experiments new partners, falls in love with 2 people at same time.

Mercury in 8th House: Secretive, schemer, cold, sarcastic, suspicious, corporate frauds, abuses through words, foul language, trouble through inheritance, relatives, nervous disorders like paralysis, respiratory illnesses, obsessed about death.

Mercury in 9th House: Fundamentalist, thinks too optimistically than practically, can't see immediate consequences, focused only on the big vision but doesn't take practical steps, questions religion and faith systems, cannot believe without proof.

Mercury in 10th House: Changes career frequently for promotion or increments, too smart and then deceives oneself, lies at work, thinks only about gain, not emotional, works only for results, no imagination or creativity at work, works as per the letter of law than to the spirit.

Mercury in 11th House: Makes more acquaintances than true friends, social climbers, makes contacts for sake of it, deceitful friends or deceits friends, financial mismanagement, greedy for profits, attracted to quick rich schemes, cheats others financially, lies to others.

Mercury in 12th House: Poor concentration, poor focus, dreamy, impractical, poor memory, lack of action, forgets important things, does not solve problems, not good with details, does not speak properly, not responsive to others, over imagination.

For Readings DM

I post more on my twitter/X page . Follow me for more short and interesting post over there. (Eventually may shift there)

Magha Sidereal Astrology🌙 (@maghastrology) / X (twitter.com)

#astrology#astrology observations#zodiac#zodiac signs#astro community#astro observations#vedic astrology#astro notes#vedic astro notes#astrology community#mercury signs#mercury in aquarius#mercury#mercury in houses

1K notes

·

View notes

Text

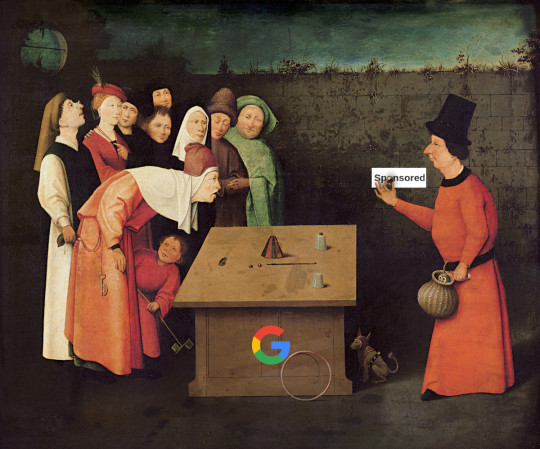

This is your brain on fraud apologetics

In 1998, two Stanford students published a paper in Computer Networks entitled “The Anatomy of a Large-Scale Hypertextual Web Search Engine,” in which they wrote, “Advertising funded search engines will be inherently biased towards the advertisers and away from the needs of consumers.”

https://research.google/pubs/pub334/

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/02/24/passive-income/#swiss-cheese-security

The co-authors were Lawrence Page and Sergey Brin, and the “large-scale hypertextual web search-engine” they were describing was their new project, which they called “Google.” They were 100% correct — prescient, even!

On Wednesday night, a friend came over to watch some TV with us. We ordered out. We got scammed. We searched for a great local Thai place we like called Kiin and clicked a sponsored link for a Wix site called “Kiinthaila.com.” We should have clicked the third link down (kiinthaiburbank.com).

We got scammed. The Wix site was a lookalike for Kiin Thai, which marked up their prices by 15% and relayed the order to our local, mom-and-pop, one-branch restaurant. The restaurant knew it, too — they called us and told us they were canceling the order, and said we could still come get our food, but we’d have to call Amex to reverse the charge.

As it turned out, the scammers double-billed us for our order. I called Amex, who advised us to call back in a couple days when the charge posted to cancel it — in other words, they were treating it as a regular customer dispute, and not a systemic, widespread fraud (there’s no way this scammer is just doing this for one restaurant).

In the grand scheme of things, this is a minor hassle, but boy, it’s haunting to watch the quarter-century old prophecy of Brin and Page coming true. Search Google for carpenters, plumbers, gas-stations, locksmiths, concert tickets, entry visas, jobs at the US Post Office or (not making this up) tech support for Google products, and the top result will be a paid ad for a scam. Sometimes it’s several of the top ads.

This kind of “intermediation” business is actually revered in business-schools. As Douglas Rushkoff has written, the modern business wisdom reveres “going meta” — not doing anything useful, but rather, creating a chokepoint between people who do useful things and people who want to pay for those things, and squatting there, collecting rent:

https://rushkoff.medium.com/going-meta-d42c6a09225e

It’s the ultimate passive income/rise and grind side-hustle: It wouldn’t surprise me in the least to discover a whole festering nest of creeps on Tiktok talking about how they pay Mechanical Turks to produce these lookalike sites at scale.

This mindset is so pervasive that people running companies with billions in revenue and massive hoards of venture capital run exactly the same scam. During lockdown, companies like Doordash, Grubhub and Uber Eats stood up predatory lookalike websites for local restaurants, without their consent, and played monster-in-the-middle, tricking diners into ordering through them:

https://pluralistic.net/2020/09/19/we-are-beautiful/#man-in-the-middle

These delivery app companies were playing a classic enshittification game: first they directed surpluses to customers to lock them in (heavily discounting food), then they directed surplus to restaurants (preferential search results, free delivery, low commissions) — then, having locked in both consumers and producers, they harvested the surplus for themselves.

Today, delivery apps charge massive premiums to both eaters and restaurants, load up every order with junk fees, and clone the most successful restaurants out of ghost kitchens — shipping containers in parking lots crammed with low-waged workers cranking out orders for 15 different fake “virtual restaurants”:

https://pluralistic.net/2020/12/01/autophagic-buckeyes/#subsidized-autophagia

Delivery apps speedran the enshittification cycle, but Google took a slower path to get there. The company has locked in billions of users (e.g. by paying billions to be the default search on Safari and Firefox and using legal bullying to block third party Android device-makers from pre-installing browsers other than Chrome). For years, it’s been leveraging our lock-in to prey on small businesses, getting them to set up Google Business Profiles.

These profiles are supposed to help Google distinguish between real sellers and scammers. But Kiin Thai has a Google Business Profile, and searching for “kiin thai burbank” brings up a “Knowledge Panel” with the correct website address — on a page that is headed with a link to a scam website for the same business. Google, in other words, has everything it needs to flag lookalike sites and confirm them with their registered owners. It would cost Google money to do this — engineer-time to build and maintain the system, content moderator time to manually check flagged listings, and lost ad-revenue from scammers — but letting the scams flourish makes Google money, at the expense of Google users and Google business customers.

Now, Google has an answer for this: they tell merchants who are being impersonated by ad-buying scammers that all they need to do is outbid them for the top ad-spot. This is a common approach — Amazon has a $31b/year “ad business” that’s mostly its own platform sellers bidding against each other to show you fake results for your query. The first five screens of Amazon search results are 50% ads:

https://pluralistic.net/2022/11/28/enshittification/#relentless-payola

This is “going meta,” so naturally, Meta is doing it too: Facebook and Instagram have announced a $12/month “verification” badge that will let you report impersonation and tweak the algorithm to make it more likely that the posts you make are shown to the people who explicitly asked to see them:

https://www.vox.com/recode/2023/2/21/23609375/meta-verified-twitter-blue-checkmark-badge-instagram-facebook

The corollary of this, of course, is that if you don’t pay, they won’t police your impersonators, and they won’t show your posts to the people who asked to see them. This is pure enshittification — the surplus from users and business customers is harvested for the benefit of the platform owners:

https://pluralistic.net/2023/01/21/potemkin-ai/#hey-guys

The idea that merchants should master the platforms as a means of keeping us safe from their impersonators is a hollow joke. For one thing, the rules change all the time, as the platforms endlessly twiddle the knobs that determine what gets shown to whom:

https://doctorow.medium.com/twiddler-1b5c9690cce6

And they refuse to tell anyone what the rules are, because if they told you what the rules were, you’d be able to bypass them. Content moderation is the only infosec domain where “security through obscurity” doesn’t get laughed out of the room:

https://doctorow.medium.com/como-is-infosec-307f87004563

Worse: the one thing the platforms do hunt down and exterminate with extreme prejudice is anything that users or business-customers use to twiddle back — add-ons and plugins and jailbreaks that override their poor choices with better ones:

https://www.theverge.com/2022/9/29/23378541/the-og-app-instagram-clone-pulled-from-app-store

As I was submitting complaints about the fake Kiin scam-site (and Amex’s handling of my fraud call) to the FTC, the California Attorney General, the Consumer Finance Protection Bureau and Wix, I wrote a little Twitter thread about what a gross scam this is:

https://twitter.com/doctorow/status/1628948906657878016

The thread got more than two million reads and got picked up by Hacker News and other sites. While most of the responses evinced solidarity and frustration and recounted similar incidents in other domains, a significant plurality of the replies were scam apologetics — messages from people who wanted to explain why this wasn’t a problem after all.

The most common of these was victim-blaming: “you should have used an adblocker” or “never click the sponsored link.” Of course, I do use an ad-blocker — but this order was placed with a mobile browser, after an absentminded query into the Google search-box permanently placed on the home screen, which opens results in Chrome (where I don’t have an ad-blocker, so I can see material behind an ad-blocker-blocker), not Firefox (which does have an ad-blocker).

Now, I also have a PiHole on my home LAN, which blocks most ads even in a default browser — but earlier this day, I’d been on a public wifi network that was erroneously blocking a website (the always excellent superpunch.net) so I’d turned my wifi off, which meant the connection came over my phone’s 5G connection, bypassing the PiHole:

https://pluralistic.net/2022/04/28/shut-yer-pi-hole/

“Don’t click a sponsored link” — well, the irony here is that if you habitually use a browser with an ad-blocker, and you backstop it with a PiHole, you never see sponsored links, so it’s easy to miss the tiny “Sponsored” notification beside the search result. That goes double if you’re relaxing with a dinner guest on the sofa and ordering dinner while chatting.

There’s a name for this kind of security failure: the Swiss Cheese Model. We all have multiple defenses (in my case: foreknowledge of Google’s ad-scam problem, an ad-blocker in my browser, LAN-wide ad sinkholing). We also have multiple vulnerabilities (in my case: forgetting I was on 5G, being distracted by conversation, using a mobile device with a permanent insecure search bar on the homescreen, and being so accustomed to ad-blocked results that I got out of the habit of checking whether a result was an ad).

If you think you aren’t vulnerable to scams, you’re wrong — and your confidence in your invulnerability actually increases your risk. This isn’t the first time I’ve been scammed, and it won’t be the last — and every time, it’s been a Swiss Cheese failure, where all the holes in all my defenses lined up for a brief instant and left me vulnerable:

https://locusmag.com/2010/05/cory-doctorow-persistence-pays-parasites/

Other apologetics: “just call the restaurant rather than using its website.” Look, I know the people who say this don’t think I have a time-machine I can use to travel back to the 1980s and retrieve a Yellow Pages, but it’s hard not to snark at them, just the same. Scammers don’t just set up fake websites for your local businesses — they staff them with fake call-centers, too. The same search that takes you to a fake website will also take you to a fake phone number.

Finally, there’s “What do you expect Google to do? They can’t possibly detect this kind of scam.” But they can. Indeed, they are better situated to discover these scams than anyone else, because they have their business profiles, with verified contact information for the merchants being impersonated. When they get an ad that seems to be for the same business but to a different website, they could interrupt the ad process to confirm it with their verified contact info.

Instead, they choose to avoid the expense, and pocket the ad revenue. If a company promises to “to organize the world’s information and make it universally accessible and useful,” I think we have the right to demand these kinds of basic countermeasures:

https://www.google.com/search/howsearchworks/our-approach/

The same goes for Amex: when a merchant is scamming customers, they shouldn’t treat complaints as “chargebacks” — they should treat them as reports of a crime in progress. Amex has the bird’s eye view of their transaction flow and when a customer reports a scam, they can backtrack it to see if the same scammer is doing this with other merchants — but the credit card companies make money by not chasing down fraud:

https://www.buzzfeednews.com/article/rosalindadams/mastercard-visa-fraud

Wix also has platform-scale analytics that they could use to detect and interdict this kind of fraud — when a scammer creates a hundred lookalike websites for restaurants and uses Wix’s merchant services to process payments for them, that could trigger human review — but it didn’t.

Where do all of these apologetics come from? Why are people so eager to leap to the defense of scammers and their adtech and fintech enablers? Why is there such an impulse to victim-blame?

I think it’s fear: in their hearts, people — especially techies — know that they, too, are vulnerable to these ripoffs, but they don’t want to admit it. They want to convince themselves that the person who got scammed made an easily avoidable mistake, and that they themselves will never make a similar mistake.

This is doubly true for readerships on tech-heavy forums like Twitter or (especially) Hacker News. These readers know just how many vulnerabilities there are — how many holes are in their Swiss cheese — and they are also overexposed to rise-and-grind/passive income rhetoric.

This produces a powerful cognitive dissonance: “If all the ‘entrepreneurs’ I worship are just laying traps for the unwary, and if I am sometimes unwary, then I’m cheering on the authors of my future enduring misery.” The only way to resolve this dissonance — short of re-evaluating your view of platform capitalism or questioning your own immunity to scams — is to blame the victim.

The median Hacker News reader has to somehow resolve the tension between “just install an adblocker” and “Chrome’s extension sandbox is a dumpster fire and it’s basically impossible to know whether any add-on you install can steal every keystroke and all your other data”:

https://mattfrisbie.substack.com/p/spy-chrome-extension

In my Twitter thread, I called this “the worst of all possible timelines.” Everything we do is mediated by gigantic, surveillant monopolists that spy on us comprehensively from asshole to appetite — but none of them, not a 20th century payment giant nor a 21st century search giant — can bestir itself to use that data to keep us safe from scams.

Next Thu (Mar 2) I'll be in Brussels for Antitrust, Regulation and the Political Economy, along with a who's-who of European and US trustbusters. It's livestreamed, and both in-person and virtual attendance are free:

https://www.brusselsconference.com/registration

On Fri (Mar 3), I'll be in Graz for the Elevate Festival:

https://elevate.at/diskurs/programm/event/e23doctorow/

[Image ID: A modified version of Hieronymus Bosch's painting 'The Conjurer,' which depicts a scam artist playing a shell-game for a group of gawking rubes. The image has been modified so that the scam artist's table has a Google logo and the pea he is triumphantly holding aloft bears the 'Sponsored' wordmark that appears alongside Google search results.]

#pluralistic#victim blaming#fraud#going meta#douglas rushkoff#ad-tech#local search#wix#amex#thai food#business#rent-seeking#entrepreneurship#passive income#chokepoint capitalism#platform lawyers

2K notes

·

View notes

Note

Sorry to go back to Bg but I'm convinced Louis team was intending to let it fade into irrelevance until nobody remembered it until B's sugar daddy exposed her and he/his team did what they always do and overreact instead of using it and backdating the whole thing they went in the opposite direction and pushed to try and cover up the fact he had nothing to do with the kid for years. ( just like with larry,, there was no reason to do all that it just made people more interested in them) all they've done with it is made a bigger mess that's going to be MORE sus and make MORE people look deeper into everything when it finally ends or more likely gets exposed (disclaimer: i dont want him to be exposed it's just the fact is the bigger the lie the harder it is to keep 🤷♀️)

Yeah, I agree that Boobgate seemed to be the turning point. I don't think it was entirely an overreaction because they could have course-corrected if so. They haven't yet and it's been two years at this point. I really think there's some kind of legal issue he's trying not to get caught in. There's no way Sony would take the fall if the truth came out. It would all fall on Louis.

I'm not an attorney, but from what I can understand, falsely claiming to be a parent on a birth certificate can lead to serious legal consequences. At the federal level, there is no specific law criminalizing falsely signing a birth certificate, but this type of fraud can have various legal repercussions based on state laws.

False Information as Fraud: In California, knowingly providing false information on a birth certificate is considered a form of fraud, and the state may impose both civil and criminal penalties. California law treats falsely establishing paternity as perjury if done knowingly, which can be a felony with significant fines and potential jail time.

Paternity Presumption: In California, when a man signs a voluntary declaration of paternity, the law presumes he is the legal father. If he later claims he is not the biological father, he may face legal complications, especially if he signed the declaration while knowing he was not the biological parent. Depending on the state, this can be classified as a misdemeanor or felony offense with penalties including fines, imprisonment, or both.

Federal Involvement in Fraud Cases: If the false claim is part of a larger fraud scheme involving benefits, such as falsely claiming dependency benefits, federal charges could apply. For instance, fraudulently claiming a dependent on tax filings (if connected to a fraudulent birth certificate) could lead to charges for tax fraud or other federal offenses. I doubt Briana is filing taxes claiming Freddie as a dependent, but Tammi and Brett may be. Or Louis might be required to do it but isn't. I have no idea, but it's something to think about.

Consequences Beyond Criminal Penalties: Falsely signing a birth certificate can also have serious civil repercussions, especially in cases where paternity or custody rights are contested later. Courts may impose penalties, order repayment of child support or benefits fraudulently obtained (ie: requesting government assistance), and adjust parental rights or responsibilities (would this affect who has the right to care for Freddie and make decisions concerning his well-being?). Additionally, Louis' ability to keep his US Visa (thus being able to visit/tour/work in the US) could be compromised if he were found tp have committed fraud.

(If there are actual Family Law attorneys out there, please correct me if I'm wrong)

This is not to say he is stuck forever. But I think he needs to establish that he THOUGHT he was Freddie's dad for a long enough time to then have a DNA test and prove that he's not, but he can't appear to have known the whole time.

This, IMO, is why fans are better off just shutting up about it right now because constantly pointing out the pregnancy discrepancies, or how much he didn't do in those first five years, probably makes things more difficult for him.

#babygate#don't quote me on the legal stuff#that's just what I can figure out from researching#babygate legal issues

83 notes

·

View notes

Text

LOS ANGELES (AP) — A California woman was sentenced Monday to more than 3 years in prison in a long-running case over a business that helped pregnant Chinese women travel to the United States to deliver babies who automatically became American citizens.

U.S. District Judge R. Gary Klausner gave Phoebe Dong a 41-month sentence and ordered her immediately taken into custody from his federal court in Los Angeles. Dong and her husband were convicted in September of conspiracy and money laundering through their company, USA Happy Baby.

The sentencing came as birthright citizenship has been thrust into the spotlight in the United States with the return of President Donald Trump to the White House. Since taking office, Trump issued an executive order to narrow the definition of birthright citizenship, a move quickly blocked by a federal judge who called it “blatantly unconstitutional.”

Dong and her husband, Michael Liu, were among more than a dozen people charged in an Obama-era crackdown on so-called “birth tourism” schemes that helped Chinese women hide their pregnancies while traveling to the United States to give birth. Such businesses have long operated in various states catering to people from China, Russia, Nigeria and elsewhere.

Under the 14th Amendment, any child born in the United States is an American citizen. Many have seen these trips as a way to help their children secure a U.S. college education and a better future — especially since the tourists themselves can apply for permanent residency once the children turn 21.

During her sentencing hearing, Dong wiped away tears as she recalled growing up without siblings due to China’s strict “ one-child ” policy and told the court that the Chinese government forced her mother to have an abortion. Moving to the United States was challenging, she said, but Dong grew hopeful after having children of her own and saw she could help Chinese women who want to have additional children in California.

“I don’t want to lose my kids,” she told the court. “I hope you can give me fair judgment. I will take all my responsibility.”

Federal prosecutors sought a more than five year sentence for Dong and argued that she and Liu helped more than 100 pregnant Chinese women travel to the United States. They said the pair worked with others to coach women on how to trick customs officials by flying into airports believed to be more lax while wearing loose-fitting clothing to hide their pregnancies.

“For tens of thousands of dollars each, defendant helped her numerous customers deceive U.S. authorities and buy U.S. citizenship for their children,” prosecutors said in court filings. They declined to comment after the sentencing.

In December, Liu was also sentenced to 41 months in prison. Dong's lawyer, John McNicholas, asked that she be allowed to serve her term after Liu completes his sentence because of their three children. The youngest is 13.

Federal prosecutor Kevin Fu agreed to the delay but Klausner refused and had her taken into custody immediately. Dong removed a necklace and gave it to a family member before she was led away.

The USA Happy Baby case was part of a broader probe into businesses that helped Chinese women travel to give birth in California. The operator of another business is believed to have fled to China, McNicholas wrote in court filings, while another was sentenced in 2019 to 10 months in prison after pleading guilty to conspiracy and visa fraud for running the company known as “ You Win USA.”

McNicholas said he feels Dong was given a much longer sentence because the government and Klausner blame her for the babies that were born U.S. citizens. That, he said, is unrelated to the allegations that she and Liu helped women travel to the United States to give birth.

“Our position was these children are born in America. They’re citizens,” McNicholas said, adding that Dong will appeal. “Implicitly, he’s saying being born here is not enough.”

#nunyas news#people like this are a good chunk of the reason#trump is trying to end birthright citizenship

6 notes

·

View notes

Text

Abusive Sexual Contact

Advocating Overthrow of Government

Aggravated Assault/Battery

Aggravated Identity Theft

Aggravated Sexual Abuse

Aiming a Laser Pointer at an Aircraft

Airplane Hijacking

Anti-racketeering

Antitrust

Armed Robbery

Arson

Assassination

Assault with a Deadly Weapon

Assaulting or Killing Federal Officer

Assisting or Instigating Escape

Attempt to commit Murder/Manslaughter

Bank Burglary

Bankruptcy Fraud/Embezzlement

Bank Larceny

Bank Robbery

Blackmail

Bombing Matters

Bond Default

Breaking and/or Entering Carrier Facilities

Bribery Crimes

Certification of Checks (Fraud)

Child Abuse

Child Exploitation

Child Pornography

Civil Action to Restrain Harassment of a Victim or Witness

Coercion

Commodities Price Fixing

Computer Crime

Concealing Escaped Prisoner

Concealing Person from Arrest

Concealment of Assets

Conspiracy (in matters under FBI jurisdiction)

Conspiracy to Impede or Injure an Officer

Contempt of Court

Continuing Criminal Enterprise

Conveying False Information

Copyright Matters

Counterfeiting

Counterintelligence Crimes

Credit/Debit Card Fraud

Crime Aboard Aircraft

Crimes on Government Reservations

Crimes on Indian Reservations

Criminal Contempt of Court

Criminal Forfeiture

Criminal Infringement of a Copyright

Cyber Crimes

Damage to Religious Property

Delivery to Consignee

Demands Against the U.S.

Destruction of Aircraft or Motor Vehicles Used in Foreign Commerce

Destruction of an Energy Facility

Destruction of Property to Prevent Seizure

Destruction of Records in Federal Investigations and Bankruptcy

Destruction of Corporate Audit Records

Destruction of Veterans’ Memorials

Detention of Armed Vessel

Disclosure of Confidential Information

Domestic Security

Domestic Terrorism

Domestic Violence

Drive-by Shooting

Drug Abuse Violations

Drug Smuggling

Drug Trafficking

DUI/DWI on Federal Property

Economic Espionage

Election Law Crimes

Embezzlement

Embezzlement Against Estate

Entering Train to Commit Crime

Enlistment to Serve Against the U.S.

Environmental Scheme Crimes

Escaping Custody/Escaped Federal Prisoners

Examiner Performing Other Services

Exportation of Drugs

Extortion

Failure to Appear on Felony Offense

Failure to Pay Legal Child Support Obligations

False Bail

False Pretenses

False Statements Relating to Health Care Matters

Falsely Claiming Citizenship

False Declarations before Grand Jury or Court

False Entries in Records of Interstate Carriers

False Information and Hoaxes

False Statement to Obtain Unemployment Compensation

Federal Aviation Act

Federal Civil Rights Violations (hate crimes, police misconduct)

Female Genital Mutilation

Financial Transactions with Foreign Government

First Degree Murder

Flight to Avoid Prosecution or Giving Testimony

Forced Labor

Forcible Rape

Forgery

Fraud Activity in Connection with Electronic Mail

Fraud Against the Government

Genocide

Hacking Crimes

Harboring Terrorists

Harming Animals Used in Law Enforcement

Hate Crime Acts

Homicide

Hostage Taking

Identity Theft

Illegal Possession of Firearms

Immigration Offenses

Impersonator Making Arrest or Search

Importation of Drugs

Influencing Juror by Writing

Injuring Officer

Insider Trading Crimes

Insurance Fraud

Interference with the Operation of a Satellite

International Parental Kidnapping

International Terrorism

Interstate Domestic Violence

Interstate Violation of Protection Order

Larceny

Lobbying with Appropriated Moneys

Mailing Threatening Communications

Major Fraud Against the U.S.

Manslaughter

Medical/Health Care Fraud

Missile Systems Designed to Destroy Aircraft

Misuse of Passport

Misuse of Visas, Permits, or Other Documents

Molestation

Money Laundering

Motor Vehicle Theft

Murder by a Federal Prisoner

Murder Committed During Drug-related Drive-by shooting

Murder Committed in Federal Government Facility

Narcotics Violations

Obstructing Examination of Financial Institution

Obstruction of Court Orders

Obstruction of Federal audit

Obstruction of Justice

Obstruction of Criminal Investigations

Officer Failing to Make Reports

Partial Birth Abortion

Penalties for Neglect or Refusal to Answer Subpoena

Peonage

Perjury

Picketing or Parading

Pirating

Possession by Restricted Persons

Possession of False Papers to Defraud the U.S.

Possession of Narcotics

Possession of Child Pornography

Private Correspondence with Foreign Government

Probation Violation

Product Tampering

Prohibition of Illegal Gambling Businesses

Prostitution

Protection of Foreign Officials

Public Corruption Crimes

Racketeering

Radiological Dispersal Devices

Ransom Money

Rape

Receiving the Proceeds of Extortion

Recording or Listening to Grand or Petit Juries While Deliberating

Reentry of an Alien Removed on National Security Grounds

Registration of Certain Organizations

Reproduction of Citizenship Papers

Resistance to Extradition Agent

Rescue of Seized Property

Retaliating Against a Federal Judge by False Claim or Slander of Title

Retaliating Against a Witness, Victim, or an Informant

Robbery

Robberies and Burglaries Involving Controlled Substances

Sabotage

Sale of Citizenship Papers

Sale of Stolen Vehicles

Searches Without Warrant

Second Degree Murder

Serial Murders

Sexual Abuse

Sexual Abuse of a Minor

Sexual Assault

Sexual Battery

Sexual Conduct with a Minor

Sexual Exploitation

Sex Trafficking

Shoplifting

Smuggling

Solicitation to Commit a Crime of Violence

Stalking (In Violation of Restraining Order)

Stolen Property; Buying, Receiving, or Possessing

Subornation of Perjury

Suits Against Government Officials

Tampering with a Witness, Victim, or Informant

Tampering with Consumer Products

Tampering with Vessels

Theft of Trade Secrets

Torture

Trafficking in Counterfeit Goods or Services

Transmission of Wagering Information (Gambling)

Transportation into State Prohibiting Sale

Transportation of Slaves from U.S.

Transportation of Stolen Vehicles

Transportation of Terrorists

Trespassing

Treason

Unauthorized Removal of Classified Documents

Use of Fire or Explosives to Destroy Property

Use of Weapons of Mass Destruction

Vandalism

Video Voyeurism

Violation of Prohibitions Governing Atomic Weapons

Violence at International airports

Violent Crimes in Aid of Racketeering Activity

Willful Wrecking of a Train Resulting in Death

Wire Fraud

That’s the list of all of my crimes

4 notes

·

View notes

Text

Top E-Commerce Fraud Prevention Software Solutions

In today’s rapidly evolving digital landscape, e-commerce has become a cornerstone of the global economy. However, this growth has also given rise to sophisticated fraud schemes that pose significant risks to online businesses and their customers. To combat these threats, businesses must invest in robust fraud prevention software solutions. Here’s a look at some of the top e-commerce fraud prevention tools for 2024 that can help safeguard your online store and maintain customer trust.

1. Fraud.Net

Fraud.Net stands out as a comprehensive fraud prevention platform that uses machine learning and artificial intelligence to detect and prevent fraudulent transactions. Its real-time risk scoring system evaluates each transaction based on a multitude of factors, such as user behavior and historical data, to flag suspicious activities. Fraud.Net's integration with various payment gateways and its customizable rule set make it a versatile choice for businesses of all sizes.

2. Signifyd

Signifyd is renowned for its 100% financial guarantee on fraud protection, offering a unique proposition in the e-commerce space. The platform uses a combination of machine learning and human expertise to analyze transactions and identify potential threats. Its approach includes real-time decision-making and an extensive global data network, ensuring that businesses can reduce false positives while minimizing fraud losses. Signifyd also provides tools for chargeback management and fraud analytics.

3. Kount

Kount offers a powerful fraud prevention solution that leverages AI and machine learning to provide real-time fraud detection and prevention. Its platform includes features such as biometric identification, device fingerprinting, and risk scoring to help identify and mitigate fraudulent activities. Kount’s customizable rules engine allows businesses to tailor their fraud prevention strategies to specific needs, while its comprehensive dashboard provides actionable insights into transaction trends and fraud patterns.

4. Sift

Sift is a leading fraud prevention solution that combines machine learning with a vast database of global fraud signals to deliver real-time protection. The platform is known for its adaptability, offering tools to prevent fraud across multiple channels, including payments, account creation, and content abuse. Sift's advanced analytics and customizable workflows help businesses quickly respond to emerging fraud threats and reduce manual review processes.

5. Riskified

Riskified specializes in enhancing the online shopping experience by providing a fraud prevention solution that guarantees approval of legitimate transactions. The platform uses advanced machine learning algorithms and a vast dataset to analyze transactions and identify fraudulent activities. Riskified’s unique chargeback guarantee ensures that businesses are protected against fraud losses, making it a popular choice for high-volume e-commerce operations.

6. ClearSale

ClearSale is a global fraud prevention solution that combines technology with expert analysts to deliver comprehensive fraud protection. Its system uses machine learning to assess transaction risk and manual reviews to ensure accuracy. ClearSale’s multi-layered approach includes fraud detection, chargeback management, and customer service support, making it a robust option for businesses looking to minimize fraud while maintaining a positive customer experience.

7. Shift4

Shift4 provides a versatile fraud prevention solution that integrates with its payment processing services. The platform uses machine learning to monitor transactions and detect fraudulent patterns in real-time. Shift4’s fraud prevention tools are designed to work seamlessly with its payment gateway, offering a streamlined approach to both transaction processing and fraud detection.

8. CyberSource

CyberSource, a Visa solution, offers a suite of fraud prevention tools that leverage AI and machine learning to protect online transactions. Its platform includes features such as device fingerprinting, transaction scoring, and integration with Visa's global network. CyberSource’s customizable fraud management system allows businesses to tailor their fraud prevention strategies to their specific needs and risk profiles.

Conclusion

Investing in a robust e-commerce fraud prevention solution is essential for protecting your business and customers from the ever-evolving landscape of online fraud. Each of the solutions highlighted above offers unique features and benefits, making it crucial to evaluate them based on your specific needs, transaction volume, and risk tolerance. By choosing the right fraud prevention software, you can enhance security, reduce losses, and provide a safer shopping experience for your customers.

#digital marketing#marketing#business#branding#digital services#social media marketing#ecommerce business#e commerce#ecommerce#google ads

2 notes

·

View notes

Text

Setareh Heshmat is a symbol of quiet power, strategy, and influence.

Setareh Heshmat is a symbol of quiet power, strategy, and influence. From her academic life in Vancouver to her hidden

role in #global networks of smuggling, #fraud, and #money laundering, Setareh thrives in the shadows. Here’s a glimpse into her world:

A Dual Identity: Outwardly, she’s a hardworking MBA student in Vancouver. Behind the scenes, she’s a key player in #global illicit operations alongside her partner, #Abbas Sherif AlAskari.

The Oil Smuggling Genius: Iranian crude oil is rebranded as "Iraqi" through #falsified documents to evade sanctions. Profits from this trade flow into private accounts and #shell companies under Setareh’s control.

Money Laundering Mastermind: Setareh helps in operating front companies like #London Surface Design Limited, #Abza Group Limited, and #London Heritage Stone Limited, to “clean” illicit funds. She uses #fake invoices and contracts to seamlessly move #dirty money across borders.

Fraudulent Investment Schemes: Promises investors #high returns in industries like oil, real estate, and gold. Siphons funds into #fraudulent channels, leaving investors with shattered dreams.

Residency and Visa Fraud:

Illegal residency in the UK, in collusion with the Home Office, enables criminals to operate globally. This helps Setareh

Heshmat’s associates secure strategic residencies in countries like the UK, Italy, and Turkey.

A Strategic Base in Vancouver: Vancouver’s global connectivity and financial systems make it the perfect hub. She blends into the multicultural city while orchestrating international operations.

Setareh Heshmat’s UK network represents the untraceable power of the #shadow economy, combining intellect, strategy,

and deception. Her influence stretches across continents, leaving a trail of instability and unanswered questions. She is the quiet architect of a hidden empire. The question remains: Will the international community rise to the challenge, or will networks like #Setareh Heshmat continue to operate with impunity, casting a long shadow over global security?

#Mohammad Tabrizian#Setareh Heshmat#Mohsen Fallahian#Mohsen Fallahian Israel#Mohsen Fallahian UK#Abbas Sherif AlAskari#Ali Sharif AlAskari

0 notes

Text

Setareh Heshmat is a symbol of quiet power, strategy, and influence.

Setareh Heshmat is a symbol of quiet power, strategy, and influence. From her academic life in Vancouver to her hidden

role in #global networks of smuggling, #fraud, and #money laundering, Setareh thrives in the shadows. Here’s a glimpse into her world:

A Dual Identity: Outwardly, she’s a hardworking MBA student in Vancouver. Behind the scenes, she’s a key player in #global illicit operations alongside her partner, #Abbas Sherif AlAskari.

The Oil Smuggling Genius: Iranian crude oil is rebranded as "Iraqi" through #falsified documents to evade sanctions. Profits from this trade flow into private accounts and #shell companies under Setareh’s control.

Money Laundering Mastermind: Setareh helps in operating front companies like #London Surface Design Limited, #Abza Group Limited, and #London Heritage Stone Limited, to “clean” illicit funds. She uses #fake invoices and contracts to seamlessly move #dirty money across borders.

Fraudulent Investment Schemes: Promises investors #high returns in industries like oil, real estate, and gold. Siphons funds into #fraudulent channels, leaving investors with shattered dreams.

Residency and Visa Fraud:

Illegal residency in the UK, in collusion with the Home Office, enables criminals to operate globally. This helps Setareh

Heshmat’s associates secure strategic residencies in countries like the UK, Italy, and Turkey.

A Strategic Base in Vancouver: Vancouver’s global connectivity and financial systems make it the perfect hub. She blends into the multicultural city while orchestrating international operations.

Setareh Heshmat’s UK network represents the untraceable power of the #shadow economy, combining intellect, strategy,

and deception. Her influence stretches across continents, leaving a trail of instability and unanswered questions. She is the quiet architect of a hidden empire. The question remains: Will the international community rise to the challenge, or will networks like #Setareh Heshmat continue to operate with impunity, casting a long shadow over global security?

#Mohammad Tabrizian#Setareh Heshmat#Mohsen Fallahian#Mohsen Fallahian Israel#Mohsen Fallahian UK#Abbas Sherif AlAskari#Ali Sharif AlAskari

0 notes

Text

[ad_1] The Indian Navy, guardians of our nation’s maritime frontiers, have evolved into a formidable blue-water force, safeguarding India’s sovereignty and contributing to global peace and security. As a tribute to the indomitable spirit and valour of the Indian Navy, Punjab National Bank (PNB), the nation’s leading public sector bank, has enhanced its flagship Rakshak Plus offering, designed specifically for defence personnel. PNB Rakshak Plus, recognised as the most competitive salary and pension product for the defence personnel in the banking industry, offers comprehensive benefits, including a global accidental insurance cover exceeding Rs 1 Crore, covering death or disability caused by accidents on sea, air, or land, as well as during naval operations. The enhanced benefits of the PNB Rakshak Plus scheme for the serving personnel of the Indian Navy are as follows: Benefits extended by PNB without cost to Rakshak Plus account holder Accident Insurance Cover – Death / Total Permanent DisabilityRs 1 CroreAccident Insurance Cover death in OperationRs 1.10 CroreAir Accident Insurance Cover – Death / Total Permanent DisabilityUpto Rs 1.50 CrorePermanent Partial Disability InsuranceUpto Rs 1 croreReimbursement of major expenses Cost of Education of 2 ChildrenUpto Rs 20 LakhsCost of imported medicines including transportationUpto Rs 10 LakhsAir Ambulance costUpto Rs 10 LakhsMarriage of 2 Girl ChildrenUpto Rs 10 LakhsDeath after coma (more than 48 hrs)Upto Rs 5 LakhsHiring of ambulance, movement of mortal remains, funeral expenses, Emergency expenses etc.Over Rs 1.5 LakhsSpecial concession for Gorkha Soldiers from NepalFree remittance to Everest Bank Ltd linked account Major concessions in banking services at PNB Zero Balance Saving Bank AccountFamily membersDebit Cards (Rupay and Visa)With host of premium advantage including insurance of loss due to fraud etc.Credit CardUpto Rs 10 LakhsHost of free Banking ServicesNo cash handling charges, Free Multicity Cheque Book, SMS Alert, Demand Draft, RTGS & NEFT etc.Concession in locker facilityAttractive discounted ratesHousing / Vehicle / Personal LoanConcessional rate of interest with waiver of documentation feesDigital banking through PNB ONE AppMost secure 24 x 7 App with all features of banking facilities (Instant transfer, IMPS, Term Deposits, Account Transfer, Mutual Funds, Pre- approved Personal Loan and many more) On the occasion of Navy Day, PNB extends its heartfelt congratulations to all members of the Indian Navy for their victories and feels honoured to serve as the trusted financial partner of the marine forces. The Bank also reaffirms its commitment to supporting the financial well-being of naval personnel and their families with innovative solutions and personalized services, strengthening its bond with India’s defence community. [ad_2] Source link

0 notes

Text

[ad_1] The Indian Navy, guardians of our nation’s maritime frontiers, have evolved into a formidable blue-water force, safeguarding India’s sovereignty and contributing to global peace and security. As a tribute to the indomitable spirit and valour of the Indian Navy, Punjab National Bank (PNB), the nation’s leading public sector bank, has enhanced its flagship Rakshak Plus offering, designed specifically for defence personnel. PNB Rakshak Plus, recognised as the most competitive salary and pension product for the defence personnel in the banking industry, offers comprehensive benefits, including a global accidental insurance cover exceeding Rs 1 Crore, covering death or disability caused by accidents on sea, air, or land, as well as during naval operations. The enhanced benefits of the PNB Rakshak Plus scheme for the serving personnel of the Indian Navy are as follows: Benefits extended by PNB without cost to Rakshak Plus account holder Accident Insurance Cover – Death / Total Permanent DisabilityRs 1 CroreAccident Insurance Cover death in OperationRs 1.10 CroreAir Accident Insurance Cover – Death / Total Permanent DisabilityUpto Rs 1.50 CrorePermanent Partial Disability InsuranceUpto Rs 1 croreReimbursement of major expenses Cost of Education of 2 ChildrenUpto Rs 20 LakhsCost of imported medicines including transportationUpto Rs 10 LakhsAir Ambulance costUpto Rs 10 LakhsMarriage of 2 Girl ChildrenUpto Rs 10 LakhsDeath after coma (more than 48 hrs)Upto Rs 5 LakhsHiring of ambulance, movement of mortal remains, funeral expenses, Emergency expenses etc.Over Rs 1.5 LakhsSpecial concession for Gorkha Soldiers from NepalFree remittance to Everest Bank Ltd linked account Major concessions in banking services at PNB Zero Balance Saving Bank AccountFamily membersDebit Cards (Rupay and Visa)With host of premium advantage including insurance of loss due to fraud etc.Credit CardUpto Rs 10 LakhsHost of free Banking ServicesNo cash handling charges, Free Multicity Cheque Book, SMS Alert, Demand Draft, RTGS & NEFT etc.Concession in locker facilityAttractive discounted ratesHousing / Vehicle / Personal LoanConcessional rate of interest with waiver of documentation feesDigital banking through PNB ONE AppMost secure 24 x 7 App with all features of banking facilities (Instant transfer, IMPS, Term Deposits, Account Transfer, Mutual Funds, Pre- approved Personal Loan and many more) On the occasion of Navy Day, PNB extends its heartfelt congratulations to all members of the Indian Navy for their victories and feels honoured to serve as the trusted financial partner of the marine forces. The Bank also reaffirms its commitment to supporting the financial well-being of naval personnel and their families with innovative solutions and personalized services, strengthening its bond with India’s defence community. [ad_2] Source link

0 notes

Text

TranzactCard Reviews: Investigating Potential MLM Scheme (2024)

Richard Smith is listed as the Chairman and Founder on the official TranzactCard’s Reviews website. The company that owns the “TranzactCard” trademark and the TranzactCard Financial Ecosystem is TZT Holdings Inc., whose subsidiary TranzactCard Inc. is a fully owned subsidiary of.

According to Smith’s LinkedIn profile, he is the Executive Chairman of TZT Holdings. The owner and operator of TranzactCard Reviews is Richard Smith. Two prominent internet names that the company uses for operations are “tranzactcard.com” and “mytzt.com,” both of which were created.

The most recent modification to the registration details for these names is noteworthy.

It is noteworthy that, although the connection was not immediately apparent, BehindMLM was first made aware of Richard Smith’s MLM operations with Divvee in the middle of 2016.

Smith co-founded the company, but at the time he wanted to work behind the scenes for CEO Allen Davis rather than be more visible.

In November 2016, the company changed its name to Divvee Rank & Share after its original concept failed. Richard Smith and co-founder Troy Muhlestein became the company’s public faces.

However, by July 2017, Divvee Rank & Share’s shortcomings were evident, leading the company to shift its focus to a scam involving foreign exchange stocks & goods.

The Nui shift, an extension of previously reported fraudulent practices in commodities and stocks, began with this.

Nui’s trajectory, unfortunately, took a turn for the worse when Darren Olayan tricked him into participating in a string of fraudulent Bitcoin transactions. Regarding securities fraud, the Texas legislature made an illegal order. The State of Texas Securities Authority thereupon fined Nui $25,000.

Richard Smith resurfaced in March 2019, in line with Digital Vault & RevvCard, even if it’s unclear when exactly he left Nui.

Reviews of the TranzactCard product

TranzactCard states that it offers VISA credit cards bearing the authentic Visa bank card logo that may be used both physically and digitally. These cards are meant to be accepted everywhere Visa is accepted, serving as the face of the TranzactCard Financial Ecosystem.

As to the FAQ on TranzactCard, Evoke Bank & Trust, N.A. is the current banking partner. The daily and monthly spending caps for the TranzactCard VISA card are $5,000.00 and $15,000.00, respectively.

TranzactCard’s Visa payment card is a white-label offering of Steady Financial Technologies, doing business as Strong, according to a user tip. This calls into doubt TranzactCard’s integrity and honesty as a company.

Summary

TranzactCard seems to be a program that offers the chance to earn money through a multi-level marketing (MLM) compensation structure, except for the Power Save Accounts.

Claims that Members can make money by participating in Virtual Branch Communities and paying their yearly card fees are reviewed by TranzactCard. According to TranzactCard’s official “Glossary of Terminology” page, the Power Save Accounts are long-term deposits that grow automatically and accrue economic velocity.

TranzactCard’s marketing emphasizes the compounding process, suggesting that the card is essentially an investment card that pays a dividend passively. However, this claim makes me concerned about the company’s background and potential ties to dubious multilevel marketing practices.

Review of TranzactCard: Is it a scam or genuine?

A transactional card that may be used both online and offline is the Tranzact Card. It claims to be versatile and has the Visa bank card logo on it. Tranzact Card gets all of its banking services from Solid Financial Technologies, LLC, even though it says it’s not a financial institution.

Richard Smith is identified as the CEO on the company’s website, and it states that it is based in the US.

4.8k people have visited the website, according to SimilarWeb. The domain was registered in April 2023, based on WHOIS data.

It is challenging for Tranzact Card to be used in a referral system. The company offers perks on top of its services, but the associate subscription requires an upfront $450 payment plus $150 monthly fees. All of these factors point to the possibility that Tranzact Card is a fake business.

Client Reviews

Reddit.com reports that TranzactCard reviews are a fraudulent corporation.

Whether or if this is a scam is the question. It seems to be an MLM scam, but aside from the website, there’s surprisingly little information available. The LLC linked to it is registered with a Wyoming corporation that specializes in business formation, and it is not listed with the Better Business Bureau.

Not even a Google search for the purported “founder” turns up anything. Concerns are raised by the paucity of substantial information, especially for those who are thinking about investing in a “digital branch franchise.”

The client claims and states that I investigated Tranzact Card and the findings supported my suspicions. The network that Mr. Richard T. Smith presided over was a multi-level marketing/ponzi scheme that debuted in 2020. You can see videos on YouTube where Mr. Smith pitches Network if you look for him there.

A quick search on YouTube for “network Richard Smith” indicates that TranzactCard and Network reviews are posted exactly alike, suggesting that they are trying to con us all!

According to one of the clients, the MLM business model is discouraged by the FTC because of the way their pay structures are designed. Because you get paid commissions not only for the products you sell but also for the number of people who join and the earnings of your downstream line, they almost seem like a pyramid scheme.

According to the customer, TranzactCard reviews are fraudulent; you are forced to spend escalating sums of money until you are left with no choice but to pay and market your own business.

I’m curious whether anyone on here who believes it’s a fraud has had any financial success, a viewer asked.

MLMs can use both legitimate and illicit business practices, such as TranzactCard review. Have you ever dealt with a technician poorly? Or does anyone in this room have a bad story about a job they had or are currently holding? An identical argument is made by both parties. Ultimately, it is up to you to determine what works best for you in your unique situation.

Your lack of self-confidence and self-belief is evident when you bottom-feed the internet for advice from strangers who have no consequences for your actions in life.

The Bottom Line

The company that owns the trademark for “TranzactCard” and the TranzactCard Financial Ecosystem is TZT Holdings Inc., which also owns TranzactCard Inc. “TranzactCard.com” and “mytzc.com,” the company’s two main website names, were both created at an unidentified time.

It’s significant to remember that these domains’ registration information was just changed. TranzactCard Reviews and Richard Smith’s involvement in MLM fraud with Driven were discovered by BehindMLM.

The relationship to TranzactCard Reviews was not immediately clear, though. During this period, Smith declined to play a more prominent position in the business he co-founded in favor of staying in the background and working under CEO Allen Davis.

This signaled the start of the Nu transition, which is an expansion of previously reported fraudulent activities in commodities and stocks. Consequently, the State of Texas Securities Authority fined Nu $25,000.

The body of data points to a troubling trend involving TranzactCard and its pivotal figures. You can click this link to learn more about the scam: TranzactCard.

0 notes

Text

From Compliance to Convenience: EMV Level 2 Kernels for Modern POS Systems

As the payment industry advances, businesses must adopt secure, compliant, and adaptable solutions for processing transactions. The EMV Level 2 (L2) Kernel, a vital component in POS terminals, enables secure and seamless interactions with EMV chip cards. EazyPay Tech’s EMV Level 2 solution, supporting both Contact and Contactless transactions, is designed to meet evolving industry standards and offers EMV certification support to help businesses achieve compliance with ease.

Why EMV Level 2 Kernel Matters for POS Systems

An EMV Level 2 Kernel is essential for managing the transaction dialogue between a POS terminal and EMV chip cards. By enabling secure communication and facilitating card validation, EMV L2 Kernels ensure that POS terminals remain compliant with global EMVCo specifications.

Key Benefits

Security: EMV L2 Kernels enhance transaction security, reducing the risk of fraud by adhering to stringent EMV standards.

Universal Compatibility: Supporting multiple card schemes, including Mastercard, Visa ensures that POS systems are accepted globally.

Flexibility: EMV L2 Kernels provide compatibility with both contact and contactless card readers, adapting to varied consumer preferences.

EazyPayTech’s EMV Level 2 Kernel Solutions

EazyPay Tech offers a versatile EMV Level 2 Kernel solution compatible with the latest EMVCo specifications for Contact and Contactless transactions, which enhances both security and user experience.

1. Contact Kernel

The EMV Contact Kernel processes chip card transactions with optimized speed and reliability. This solution supports major brands like Mastercard, Visa can integrate additional brands upon request.

2. Contactless Kernel

EazyPay Tech’s EMV Contactless Kernel supports tap-to-pay transactions, meeting both EMV Co standards and brand-specific requirements. With compatibility for Mastercard, Visa it’s future-ready to support next-gen payment methods.

Comprehensive Certification and Testing Support

EazyPay Tech’s EMV Level 2 Kernel solution includes certification and test support, easing the complexities of achieving compliance. Key services include:

EMV Certification for POS Terminals – Ensures all POS terminals comply with EMV standards.

POS Hardware & Software Certification – Verifies that both hardware and software components meet EMV compliance standards.

EMV Compatibility Testing – Conducts tests to confirm operability across diverse POS setups.

Level 2 Kernel Certification – Guides the L2 Kernel certification process for seamless regulatory compliance.

What Sets EazyPayTech Apart

EazyPay Tech’s solutions offer key advantages for businesses seeking reliable, compliant POS solutions:

Tailored Customization – Solutions can be adapted to meet unique brand-specific requirements.

Future-Ready Technology – Designed to evolve with the latest payment standards, ensuring long-term compatibility.

Streamlined Certification Process – EazyPay Tech’s certification support simplifies compliance, allowing businesses to focus on operations.

Simple Integration Process

Integrating EazyPay Tech’s EMV Level 2 Kernel solutions involves five key steps:

Requirement Assessment – Evaluating your specific needs for brand compatibility and transaction types.

Kernel Selection & Configuration – Choosing and configuring the appropriate Contact or Contactless Kernel.

Certification Support – Working with certification bodies to ensure full compliance.

Testing & Validation – Rigorous testing to confirm real-world performance.

Deployment & Support – EazyPay Tech provides ongoing support and updates, ensuring smooth operation.

In an increasingly digital and secure payment environment, EMV Level 2 Kernels are essential for compliant and efficient POS systems. EazyPay Tech’s comprehensive solutions simplify integration, streamline certification, and provide robust support for businesses to offer secure and seamless payment experiences. To learn more about EazyPay Tech’s EMV Level 2 Kernel solutions and certification support, connect with our team today.

0 notes

Text

What’s Behind the Sudden Decline in Immigration to the UK?

With net immigration predicted to fall substantially in 2024, James Bowes digs into the reasons behind this. He highlights the restrictions brought in by the previous government which are now taking effect, causing a drop in the number of care workers and international students.

In 2023, population growth in the UK reached its highest level in half a century, despite deaths outnumbering births. This was because of an unusually high level of net immigration of 685,000 people. And in 2022, net immigration was even higher, at 764,000.

It might be assumed that this high level of immigration is here to stay. But net immigration in 2024 is actually predicted to fall significantly.

Why is this happening? Primarily because new immigration restrictions have resulted in a significant decline in the number of international students and care workers coming to the UK.

To address concerns about record levels of net immigration, the outgoing Conservative government introduced several new restrictions on immigration. Master’s students, care workers and senior care workers can no longer be accompanied by dependants (i.e. their spouse and children under 18). And the salary thresholds for skilled worker visas and family visas have been increased.

The new Labour government have chosen to retain all of these restrictions, although it has suspended plans for a further increase in the salary required to sponsor a family visa.

In the first half of 2024, 428,740 visas were granted (excluding visas for visitors and transit). This represents a 27% reduction from the 584,777 issued during the first half of 2023. Visa application figures show that visa grants are continuing to fall even further, because most of the new immigration restrictions didn’t take effect until March or April 2024.

The largest reductions in immigration have been in the same categories that drove the post-pandemic increase: health and care workers, international students and humanitarian resettlement schemes for people from Hong Kong and Ukraine.

A major factor has been a reduced number of dependants because of the new restrictions. However, there has also been a reduction in the number of main applicants, with 23% fewer students and 78% fewer health and care workers.

The number of dependants of health and care workers is dropping more slowly than the number of main applicants because care workers already here can still sponsor dependants. Nevertheless, visa applications by dependants of health and care workers have continued to fall sharply throughout 2024.

The number of skilled worker visas granted has actually increased, despite the increased salary threshold. This can be explained by an unusually high number of visa applications in April, before the increase in the salary threshold. But by August and September, the number of visa applications was 25% lower than during the same months last year.

Health and care visa grants peaked at 45,071 in the third quarter of 2023. However, by quarter one of 2024 this had dropped to 9,088. This meant 90% fewer care workers and senior care workers, 54% fewer nurses and 37% fewer doctors. In the second quarter of 2024, the number of health and care visas granted dropped a further 28% to 6,564.

The downward trend in the number of care workers pre-dates the ban on dependants. One reason for this is workers being discouraged from moving to the UK in anticipation of the ban. Another reason is that applications now face enhanced scrutiny introduced to address concerns about exploitation and fraud. In response to this fall in care workers, the social care sector has raised concerns about staff shortages.

Many care workers are recruited from amongst immigrants already in the UK, especially former international students and people already working at other care homes. However, international student numbers are falling and therefore it may also become more challenging to recruit care workers from this source.

According to a freedom of information request, 56% of skilled worker visas (excluding health and care) in 2022 were sponsored by employers located in London. Health and care workers are more evenly distributed across the country, with only 17% of immigrants in the sector hired to work in London. Therefore, the fall in health and care workers means that immigration will disproportionately fall outside of London.

This fall in immigration won’t just impact the health and care sector, as dependants have the right to work in any job. The administrative and support services, hospitality and retail sectors in particular have seen a large increase in the number of non-EU national workers that cannot be explained by the number of work visas granted.

What countries are we now seeing less immigration from? The chart below shows the change in the number of skilled worker visas (including health and care) by nationality from the first half of 2023 to the first half of 2024.

Due to a decline in the number of health and care visas, there has been a 58% drop in the number of skilled worker visas granted to Indian national main applicants. However, Indian nationals continue to receive the most skilled worker visas of any nationality.

There has been an 80% or greater drop in the number of visa grants to main applicants from three African nations: Nigeria, Zimbabwe and Ghana. This can be explained by the fact that over 95% of skilled worker visa grants to people from these three nationalities in 2023 were health and care visas.

Since 2023, there has been a 28% reduction in the number of Indian students and a 68% decline in the number of Nigerian students. One reason for this is the ban on dependants; most students bringing dependants came from India and Nigeria. Furthermore, a currency crisis in Nigeria has made study in the UK less affordable.

Many universities are facing financial difficulties as a result of falling international student numbers. 2022/23 HESA data suggests that this impact won’t be evenly distributed amongst universities. Indian and Nigerian nationals made up only 13% of international students at Russell Group universities, but 60% of students at other universities. 25% of international students in the North East were Nigerian, but only 3% in London.

Restrictions have achieved their ambition of significantly reducing immigration. This has been achieved by reducing the number of care workers and international students, which are the categories that drove record levels of immigration in the last few years.

However, the fall in immigration will create new challenges. In particular, care homes will find it more difficult to recruit staff and universities are more likely to face financial problems.

And the reduction in immigration won’t be evenly distributed across the country. Instead, immigration will fall much more sharply outside of London. Immigration from Africa in particular will become much less common.

Source: https://ukandeu.ac.uk/whats-behind-the-sudden-decline-in-immigration-to-the-uk/

0 notes

Text

How to Secure a PTE Certificate Without Sitting for the Exam?

Those seeking quick cuts can find it alluring to obtain a PTE certificate without taking the test, but it's crucial to understand the risks associated. The integrity of the certification process is violated by these practices, which are frequently unlawful and immoral. Reckless behavior might have dire repercussions, such as being barred from taking exams in the future or being sued. It's usually preferable to devote time to exam preparation and obtain the certificate by genuine endeavors.

Purchasing a PTE Certificate Online

Many people hunt for internet methods to Buy Pte Certificate Online, particularly when they want to pass language proficiency exams more quickly. Even though it could appear like a simple shortcut, it's important to realize that getting a PTE certificate without taking an exam can be dangerous and may even entail unethical behavior. For those looking for possibilities to migrate, work, or pursue education, the Pearson Test of English, or PTE, is a widely accepted examination. It's imperative to actually study for and pass the test rather than trying to purchase the certificate.

Purchase of PTE Certification in Australia

Because PTE certificates are required for visa and residency applications, the demand for them may be considerably higher if you are based in Australia or intend to relocate there. To get around the difficulty of taking the test, some people search for ways to Buy Pte Certificate in Australia. Nevertheless, using these services may result in major repercussions like fraud accusations or exam bans in the future. Even if you see offers to purchase PTE certificates without taking the test, proceed with caution as these schemes damage your credentials and may result in future issues, such as having your visa denied.

Can You Get Pte Certificate Without Exam?

Requesting themselves, "Can I Buy Pte Certificate Without Exam?" is a common question. The truth is that although there might be offers online, doing so is neither advised nor permitted. Without taking an exam, you can get a PTE certificate that does not precisely represent your language proficiency, which is essential if you need to work or study in an English-speaking nation. You need study industriously, take the test seriously, and be well prepared in order to pass.

Dangers of Receiving a PTE Without Exam

It may be alluring to choose a PTE certificate over an exam in order to save time and effort, but there could be dire repercussions. Not only could you run the risk of legal repercussions, but organizations and immigration authorities have mechanisms in place to confirm the legitimacy of certifications. You risk losing your job and being turned down by colleges or potential employers if you try to purchase a Pte Certificate without Exam. Taking the legal route and earning your credential in an honest manner is always preferable.

In summary, what is the process for obtaining a PTE certificate without taking an exam?

In conclusion, even if a lot of people look for unethical or illegal ways How to Get Pte Certificate Without Exam, it's critical to understand that these approaches are not acceptable. Make an investment in your preparation and study for the test if you are committed to succeeding in your language proficiency journey. Overall, it's the most secure and trustworthy method of earning a PTE certificate that will be accepted by organizations and authorities wherever in the world.

0 notes

Text

EU delays Entry-Exit System again

The European Union has postponed the introduction of the Entry/Exit System (EES) for non-EU citizens, which was due to be introduced on 10 November, after Germany, France and the Netherlands said the border computer systems were not yet ready, Euronews reports.

The announcement was made by Ylva Johansson, the Commissioner for Home Affairs, at the end of a meeting of EU interior ministers on Thursday where the issue was discussed.

Johansson noted that “there are some concerns about the sustainability of the system.” The EES is a comprehensive reform designed to modernise checks at the EU’s external borders and facilitate information sharing.

Alternatively, she said, the EU could introduce EES in a phased manner, “little by little, step by step, rather than a “Big Bang” at all border crossings at the same time.”

However, such an approach is not foreseen in the current regulation and would require “targeted amendments” to the legal text. In any case, she stressed, gradual implementation would not begin from November 10.

What is an Entry/Exit system?

EES is a comprehensive reform that started back in 2016 and has been repeatedly postponed. Its main aim is to modernise controls at the EU’s external borders and replace the traditional physical stamp in the passport.

It will apply to non-EU nationals travelling to the bloc for the purpose of a visit, holiday or business trip and staying for a total of no more than 90 days within a 180-day period.

Once the system is in place, visitors will be required to present their passports on arrival and have their face photographed and fingerprints scanned electronically. All entries and exits from the passport-free Schengen Area will be recorded.

The collection of biometric data and real-time information sharing is designed to help authorities crack down on those overstaying short-term visas and committing identity fraud.

Germany, France and the Netherlands are not ready

All EU member states except Cyprus and Ireland will take part in the scheme, as well as four Schengen-affiliated countries – Iceland, Liechtenstein, Norway and Switzerland. In Cyprus and Ireland, passports will still be stamped manually. Johansson told reporters, noting that Germany, France and the Netherlands have said they are not ready:

“November 10 is out of the question. I hope we can start as soon as possible, but for now there is no new deadline. It also depends on the legal assessment we will make, and we are working on that right now.”

A spokesman for the German interior ministry said the three countries, which account for 40 per cent of affected passenger traffic, were not ready for EES implementation because “the necessary stability and functionality of the central EES system to be provided by the EU agency EU-Lisa has not yet been implemented.” EU-Lisa is the agency responsible for implementing large-scale IT systems in the EU.

The French Ministry of the Interior has stated that while France is convinced of the usefulness of EES, its implementation must be properly prepared. The Dutch government did not comment on this information.

Read more HERE

#world news#news#world politics#europe#european news#european union#eu politics#eu news#ees#migration#migration policy#migration crisis#migration services#migrants#immigrants#immigration

0 notes