#virtual chief financial officer

Explore tagged Tumblr posts

Text

Transform Your Business with Virtual CFO Australia: Part-Time CFO Services and Virtual Chief Financial Officer Solutions

The Role of a Chief Financial Officer

A Chief Financial Officer is responsible for overseeing the financial operations of a company, including financial planning, risk management, record-keeping, and financial reporting. They play a critical role in strategic decision-making and ensuring the financial health of the organization. However, the cost of hiring a full-time CFO can be prohibitive for many businesses.

The Challenges of Traditional CFO Roles

High Costs: A full-time CFO commands a significant salary, which can be a substantial burden for SMEs.

Recruitment and Retention: Finding and retaining a highly qualified CFO can be challenging, time-consuming, and expensive.

Scalability: The financial needs of a business can fluctuate, and a full-time CFO may not always be fully utilized.

The Solution: Part-Time CFO Services

Part-time CFO services offer a flexible and cost-effective alternative to hiring a full-time CFO. By engaging a part-time CFO, businesses can access high-level financial expertise without the associated costs and commitments of a full-time position.

Benefits of Part-Time CFO Services

Cost Savings: Pay only for the services you need, reducing overhead costs significantly.

Flexibility: Scale services up or down based on your business needs and financial situation.

Expertise: Gain access to experienced financial professionals with a deep understanding of your industry.

Strategic Insights: Receive valuable strategic advice and insights to drive business growth and profitability.

How Part-Time CFO Services Work

At Virtual CFO Australia, our part-time CFO services are designed to provide your business with the financial leadership it needs. We start by understanding your business goals, challenges, and financial landscape. Based on this understanding, we tailor our services to meet your specific requirements. Our part-time CFOs work closely with your existing team, providing hands-on support and strategic guidance.

Embracing the Future: Virtual Chief Financial Officer (VCFO) Solutions

The rise of digital technology has revolutionized the way businesses operate. Virtual Chief Financial Officer (VCFO) solutions leverage technology to provide remote CFO services, offering businesses even greater flexibility and efficiency.

What is a Virtual Chief Financial Officer?

A Virtual Chief Financial Officer (VCFO) is a remote financial expert who provides the same services as a traditional CFO but operates virtually. This model allows businesses to benefit from high-level financial expertise without the need for physical presence.

Advantages of Virtual CFO Solutions

Remote Accessibility: Access CFO services from anywhere, enabling seamless collaboration and support.

Technology-Driven: Utilize cutting-edge financial software and tools for enhanced accuracy and efficiency.

Scalability: Easily adjust the level of service to match your business needs.

Cost Efficiency: Reduce costs associated with office space, equipment, and full-time salaries.

Virtual CFO Australia: Leading the Way in Virtual CFO Solutions

At Virtual CFO Australia, we are at the forefront of providing virtual CFO services that cater to the evolving needs of businesses in Australia. Our team of experienced financial professionals uses the latest technology to deliver comprehensive financial management solutions, ensuring your business stays ahead of the curve.

Key Services Offered by Virtual CFO Australia

Financial Planning and Analysis

Our virtual CFOs provide detailed financial planning and analysis to help you make informed decisions. This includes budgeting, forecasting, and identifying key performance indicators (KPIs) to track your business’s financial health.

Cash Flow Management

Effective cash flow management is critical for maintaining liquidity and ensuring smooth operations. Our virtual CFOs monitor cash flow, identify potential issues, and implement strategies to optimize cash flow.

Financial Reporting

Accurate and timely financial reporting is essential for transparency and compliance. We prepare detailed financial reports, including balance sheets, income statements, and cash flow statements, to give you a clear picture of your financial position.

Risk Management

Identifying and mitigating financial risks is crucial for long-term success. Our virtual CFOs conduct thorough risk assessments and develop strategies to manage and mitigate risks, ensuring the stability and security of your business.

Strategic Financial Advice

Our virtual CFOs provide strategic financial advice to help you achieve your business goals. This includes investment planning, capital raising, mergers and acquisitions, and growth strategies.

Tax Planning and Compliance

Navigating the complexities of tax regulations can be challenging. Our virtual CFOs ensure your business complies with all tax obligations and develops tax-efficient strategies to minimize liabilities.

Technology Integration

We leverage the latest financial technology to streamline processes, enhance accuracy, and improve decision-making. Our virtual CFOs integrate advanced financial software and tools into your existing systems for seamless operations.

Real-World Impact: Success Stories

Case Study 1: Boosting Profitability for a Retail Business

A mid-sized retail business in Sydney was struggling with declining profitability and cash flow issues. By engaging Virtual CFO Australia, the business received expert financial analysis and strategic advice. Our virtual CFO implemented effective cost-control measures, optimized inventory management, and improved pricing strategies. As a result, the business saw a significant increase in profitability and a healthier cash flow.

Case Study 2: Navigating Growth for a Tech Startup

A tech startup in Melbourne experienced rapid growth but lacked the financial expertise to manage its expanding operations. Virtual CFO Australia provided part-time CFO services, helping the startup with financial planning, capital raising, and risk management. Our virtual CFO developed a scalable financial model and guided the startup through successful funding rounds, positioning it for sustainable growth.

Why Choose Virtual CFO Australia?

Expertise and Experience

Our team comprises seasoned financial professionals with extensive experience across various industries. We bring a wealth of knowledge and insights to help your business thrive.

Personalized Service

We understand that every business is unique. Our services are tailored to meet your specific needs and goals, ensuring you receive the support and guidance you need to succeed.

Commitment to Excellence

At Virtual CFO Australia, we are committed to delivering the highest quality service. Our focus is on achieving the best possible outcomes for our clients, driving growth and profitability.

Cutting-Edge Technology

We utilize the latest financial technology to provide efficient, accurate, and insightful financial management solutions. Our technology-driven approach ensures your business stays ahead of the competition.

Conclusion

In an increasingly complex and competitive business environment, effective financial management is more important than ever. Virtual CFO Australia offers part-time CFO services and virtual chief financial officer solutions that provide the expertise, flexibility, and strategic insights your business needs to succeed. Whether you’re looking to improve profitability, manage growth, or navigate financial challenges, our team is here to help. Contact Virtual CFO Australia today to learn how we can support your business and drive your success.

0 notes

Text

Hiree Financial Solutions: Elevate Your Business with Expert Accounting Consultancy Services

Unlock the full potential of your business with Hiree, your trusted partner in accounting consultancy services. At Hiree Financial Solutions, we understand the complexities of managing finances, and our team of seasoned experts is dedicated to providing tailored solutions for your unique needs. From streamlining financial processes to ensuring compliance, Hiree empowers your business with strategic insights and efficient accounting practices. Experience the difference of precision and professionalism with Hiree - Your pathway to financial success.

#accounting consultancy services#outsourcing finance and accounting services#outsourced cfo services#virtual chief financial officer#australia

0 notes

Text

Navigating Financial Success: Comprehensive CFO Services in Hyderabad

Are you a growing business in Hyderabad looking to navigate the complexities of financial management with precision and foresight? CFO services might just be the missing piece to your entrepreneurial puzzle. In today's dynamic business landscape, having a Chief Financial Officer (CFO) on board can be a game-changer, enabling you to steer your company towards sustainable growth and profitability by cfo service provider company in hyderabad

Understanding CFO Services in Hyderabad

First things first, what exactly do CFO services in Hyderabad? Think of a CFO as your financial strategist in chief, the maestro orchestrating your company's fiscal symphony. They bring to the table a wealth of expertise in financial planning, risk management, and strategic decision making. Whether you're a startup striving for scalability or an established firm seeking optimization, a CFO crafts tailored financial strategies that align with your goals.

Strategic Financial Planning and Chief Financial Officer Services in Hyderabad

One of the primary roles of a CFO is to develop and execute comprehensive financial plans in Hyderabad. This involves forecasting cash flow, budgeting effectively, and setting financial milestones. By meticulously analyzing your company's financial health in Hyderabad, a CFO identifies opportunities for growth and areas needing improvement. Their strategic foresight helps mitigate risks and capitalize on emerging trends, ensuring your financial trajectory remains steady and upward.

Financial Reporting and Analysis, CFO Advisory Services in Hyderabad

Numbers tell a story, and a CFO translates this narrative into actionable insights in Hyderabad. They oversee financial reporting processes, ensuring accuracy and compliance with regulatory standards. Through in depth analysis of financial data and cfo service provider company in hyderabad give clarity on your company's performance metrics. Whether it's profitability margins, cost efficiencies, or revenue growth, their analytical prowess empowers you to make informed decisions that drive bottom line results.

Risk Management Expertise and Chartered Accountant to take up of CFO Services in Hyderabad

Navigating uncertainties is part and parcel of business ownership in Hyderabad. Here's where a CFO shines as your risk management guru. They assess financial risks proactively, implementing strategies to mitigate potential threats. From market volatility to operational challenges in Hyderabad, a CFO develops contingency plans that safeguard your financial stability. This proactive approach not only shields your business from unforeseen crises but also enhances resilience in a competitive marketplace.

Strategic Partnerships and Stakeholder Management, CFO Service Provider Company in Hyderabad

Building bridges is key to business success in Hyderabad, and a CFO serves as your ambassador in financial negotiations. Whether it's forging strategic partnerships or managing relationships with investors and stakeholders in Hyderabad, they articulate your financial strategy with clarity and confidence. Their ability to communicate complex financial insights in a digestible manner fosters trust and credibility, paving the way for collaborative growth opportunities.

Driving Financial Efficiency and CFO Service Providers in Hyderabad

Efficiency is the cornerstone of profitability and a CFO excels in optimizing your financial operations. They streamline processes, identify cost saving opportunities, and enhance resource allocation. By leveraging technology and best CFO Service Providers in Hyderabad, a CFO drives operational efficiency across departments, freeing up resources for strategic initiatives. This operational agility positions your business to adapt swiftly to market changes and capitalize on emerging opportunities.

Scaling for Growth and Best CFO Services for Startups in Hyderabad

As your business scales in Hyderabad, so do its financial complexities. A CFO provides scalability solutions tailored to your evolving needs. Whether it's expanding into new markets, raising capital, or navigating mergers and acquisitions in Hyderabad, they orchestrate financial strategies that support your growth trajectory. Their expertise in financial modeling and forecasting in Hyderabad equips you with a roadmap for sustainable expansion, ensuring every growth milestone is achieved with financial prudence.

Conclusion and CFO Consulting Services in Hyderabad

In essence, CFO services are more than just financial stewardship in Hyderabad they're a strategic imperative for businesses poised for growth. By partnering with a seasoned CFO in Hyderabad, you gain a strategic ally who navigates the complexities of finance with finesse and foresight. Whether you're charting a course for profitability, optimizing operational efficiencies, or forging new pathways for growth in Hyderabad, their expertise fuels your journey towards sustainable success.

Ready to elevate your financial strategy in Hyderabad? Embrace the power of CFO services and unlock the full potential of your business's financial future.

For more information please contact.www.numbro.in

#cfo services in hyderabad#chief financial officer services in hyderabad#cfo advisory services in hyderabad#chartered accountant to take up of cfo services in hyderabad#cfo service provider company in hyderabad#cfo service providers in hyderabad#best cfo services for startups in hyderabad#cfo consulting services in hyderabad#virtual cfo services in hyderabad#interim cfo services in hyderabad#outsourced cfo services in hyderabad#part time cfo services in hyderabad#fractional cfo services in hyderabad#contract cfo services in hyderabad#best fractional cfo companies in hyderabad#temporary cfo services in hyderabad#cfo business advisors in hyderabad#bookkeeper cfo services in hyderabad#shared cfo services in hyderabad#cfo support services in hyderabad#outsourced controller services in hyderabad#fractional controller services in hyderabad

0 notes

Text

0 notes

Text

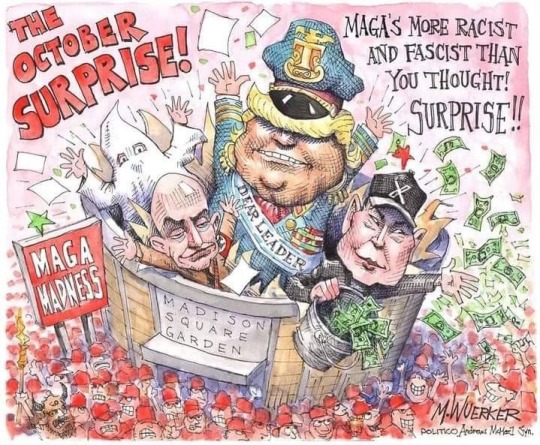

Matt Wuerker, Politico

* * * * *

LETTERS FROM AN AMERICAN

October 30, 2024

Heather Cox Richardson

Oct 31, 2024

On Friday, October 25, at a town hall held on his social media platform X, Elon Musk told the audience that if Trump wins, he expects to work in a Cabinet-level position to cut the federal government.

He told people to expect “temporary hardship” but that cuts would “ensure long-term prosperity.” At the Trump rally at New York City’s Madison Square Garden on Sunday, Musk said he plans to cut $2 trillion from the government. Economists point out that current discretionary spending in the budget is $1.7 trillion, meaning his promise would eliminate virtually all discretionary spending, which includes transportation, education, housing, and environmental programs.

Economists agree that Trump’s plans to place a high tariff wall around the U.S., replacing income taxes on high earners with tariffs paid for by middle-class Americans, and to deport as many as 20 million immigrants would crash the booming economy. Now Trump’s financial backer Musk is factoring in the loss of entire sectors of the government to the economy under Trump.

Trump has promised to appoint Musk to be the government’s “chief efficiency officer.” “Everyone’s going to have to take a haircut.… We can’t be a wastrel.… We need to live honestly,” Musk said on Friday. Rob Wile and Lora Kolodny of CNBC point out that Musk’s SpaceX aerospace venture has received $19 billion from the U.S. government since 2008.

An X user wrote: “I]f Trump succeeds in forcing through mass deportations, combined with Elon hacking away at the government, firing people and reducing the deficit—there will be an initial severe overreaction in the economy…. Markets will tumble. But when the storm passes and everyone realizes we are on sounder footing, there will be a rapid recovery to a healthier, sustainable economy. History could be made in the coming two years.”

Musk commented: “Sounds about right[.]”

This exchange echoes the prescription of Treasury Secretary Andrew Mellon, whose theories had done much to create the Great Crash of 1929, for restoring a healthy economy. “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate,” he told President Herbert Hoover. “It will purge the rottenness out of the system. High costs of living and high living

will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people.”

Mellon, at least, was reacting to an economic crisis thrust upon an administration. Musk is seeking to create one.

Today the Commerce Department reported that from July through September, the nation’s economy grew at a solid 2.8%. Consumer spending is up, as is investment in business. The country added 254,000 jobs in September, and inflation has fallen back almost to the Federal Reserve’s target of 2%.

It is extraordinarily rare for a country to be able to reduce inflation without creating a recession, but the Biden administration has managed to do so, producing what economists call a “soft landing,” rather like catching an egg on a plate. As Bryan Mena of CNN wrote today: “The US economy seems to have pulled off a remarkable and historic achievement.”

Both President Joe Biden and Democratic presidential nominee Vice President Kamala Harris have called for reducing the deficit not by slashing the government, as Musk proposes, but by restoring taxes on the wealthy and corporations.

As part of the Republicans’ plan to take the country back to the era before the 1930s ushered in a government that regulated business and provided a basic social safety net, House speaker Mike Johnson (R-LA) expects to get rid of the Affordable Care Act.

At a closed-door campaign event on Monday in Pennsylvania for a Republican House candidate, Johnson told supporters that Republicans will propose “massive reform” to the Affordable Care Act, also known as “Obamacare,” if they take control of both the House and the Senate in November. “Health-care reform’s going to be a big part of the agenda,” Johnson said. Their plan is to take a “blowtorch to the regulatory state,” which he says is “crushing the free market.” “Trump’s going to go big,” he said.” When an attendee asked, “No Obamacare?” he laughed and agreed: “No Obamacare…. The ACA is so deeply ingrained, we need massive reform to make this work, and we got a lot of ideas on how to do that.”

Ending a campaign with a promise to crash a booming economy and end the Affordable Care Act, which ended insurance companies’ ability to reject people with preexisting conditions, is an unusual strategy.

A post from Trump last night and another this morning suggest his internal polls are worrying him. Last night he claimed there was cheating in Pennsylvania’s York and Lancaster counties. Today he posted: “Pennsylvania is cheating, and getting caught, at large scale levels rarely seen before. REPORT CHEATING TO AUTHORITIES. Law Enforcement must act, NOW!”

Trump appears to be setting up the argument he used in 2020, that he can lose only if he has been cheated. But it is increasingly apparent that the get-out-the-vote, or GOTV, efforts of the Trump campaign have been weak. When Trump’s daughter-in-law Lara Trump and loyalist Michael Whatley became the co-chairs of the Republican National Committee in March 2024, they stopped the GOTV efforts underway and used the money instead for litigation. They outsourced GOTV efforts to super PACs, including Musk’s America PAC.

In Wired today, Jake Lahut reported that door-knockers for Musk’s PAC were driven around in the back of a U-Haul without seats and threatened with having to pay their own hotel bills if they didn’t meet high canvassing quotas. One of the canvassers told Lahut that they thought they were being hired to ask people who they would be voting for when they flew into Michigan, and was surprised to learn their actual role. The workers spoke to Lahut anonymously because they had signed a nondisclosure agreement (a practice the Biden administration has tried to stop).

Trump’s boast that he is responsible for the Supreme Court’s overturning of the 1973 Roe v. Wade decision recognizing the constitutional right to abortion is one of the reasons his support is soft. In addition to popular dislike of the idea that the state, rather than a woman and her doctor, should make decisions about her healthcare, the Dobbs v. Jackson Women’s Health Organization decision is now over two years old, and state examinations of maternal deaths are showing that women are dying from lack of reproductive healthcare.

Cassandra Jaramillo and Kavitha Surana of ProPublica reported today that at least two pregnant women have died in Texas when doctors delayed emergency care after a miscarriage until the fetal heartbeat stopped. The woman they highlighted today, Josseli Barnica, left behind a husband and a toddler.

At a rally this evening near Green Bay, Wisconsin, Trump said his team had advised him to stop talking about how he was going to protect women by ending crime and making sure they don’t have to be “thinking about abortion.” But Trump, who has boasted of sexual assault and been found liable for it, did not stop there. He went on to say that he had told his advisors, “I’m going to do it whether the women like it or not. I am going to protect them.”

The Trump campaign remains concerned about the damage caused by the extraordinarily racist, sexist, and violent Sunday night rally at Madison Square Garden. Today the campaign seized on a misstatement President Biden made when condemning the statement from the Madison Square Garden event that referred to Puerto Rico as a “floating island of garbage.” They tried to turn the tables to suggest that Biden was calling Trump supporters garbage, although the president has always been very careful to focus his condemnation on Trump alone.

In Wisconsin today, when he disembarked from his plane, Trump put on an orange reflective vest and had someone drive him around the tarmac in a garbage truck with TRUMP painted on the side. He complained about Biden to reporters from the cab of the truck but still refused to apologize for Sunday’s slur of Puerto Rico, saying he knew nothing about the comedian who appeared at his rally.

This, too, was an unusual strategy. Like his visit to McDonalds, where he wore an apron, the image of Trump in a sanitation truck was likely intended to show him as a man of the people. But his power has always rested not in his promise to be one of the people, but rather to lead them. The pictures of him in a bright orange vest and unusually dark makeup are quite different from his usual portrayal of himself.

Indeed, media captured a video of Trump’s stunt, and it did not convey strength. MSNBC’s Katie Phang watched him try to get into the truck and noted: “Trump stumbles, drags his right leg, almost falls over, and tries at least three times to open the door…. Some transparency with Trump’s medical records would be nice.”

The Las Vegas Sun today ran an editorial that detailed Trump’s increasingly obvious mental lapses and concluded that Trump is “crippled cognitively and showing clear signs of mental illness.” It noted that Trump now depends “on enablers who show a disturbing willingness to indulge his delusions, amplify his paranoia or steer his feeble mind toward their own goals.” It noted that if Trump cannot fulfill the duties of the presidency, they would fall to his running mate, J.D. Vance, who has suggested “he would subordinate constitutional principles for personal profit and power.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#political cartoon#Matt Wuerker#Politico#Heather Cox Richardson#Letters From an American#Las Vegas Sun#MAGA extremism#garbage truck stunt#women's health#reproductive rights#Musk#Affordable Care Act#Obamacare#project 2025#MAGA's plans for you

25 notes

·

View notes

Text

wasn't a big fan of jezebel myself but this article is really good

Brands, the marketing giants they hire, and the technology companies that enforce “brand safety” are overwhelmingly conservative about advertising against news content, in a way that has been devastating to ad-supported news sites. The “economic headwinds” for the news industry that media execs love to talk about is in reality the complete and utter collapse of the advertising market for news under the sheer cowardice of many brands and marketing firms. “What’s happened is this perfect storm of marketers becoming increasingly wary of getting caught up in the culture wars and being punished for it, even though there’s virtually no evidence that advertising against news leads to that,” Lou Paskalis, chief strategy officer of Adfontes Media, which helps advertisers measure bias among media outlets, told 404 Media. “And so, at the very time when news has become more important to keep the electorate informed, marketers have pulled back from their responsibility.” This means that many brands and the marketing agencies that work for them are scared not just of the important topics that Jezebel covered, but are also scared of having their ads next to news articles about the war in Gaza, coverage of “Free Palestine” protests, coverage of terrorism, extremism, and white nationalism, articles about sex and porn, and so on. (...) It is not an exaggeration to say that the largest companies in the world are colluding to put their thumb on the scales of what types of news is monetized, and which types of news is monetized at lower rates or not monetized at all. The World Federation of Advertisers (WFA) is listed by the World Economic Forum as one of its “projects” and includes every major marketing agency, as well as brands like Nike, Merck, Nestle, Proctor and Gamble, TikTok, Disney, Walmart, Adidas, BP, Shell, Goldman Sachs, Electronic Arts, McDonalds, and more. It represents 90 percent of all advertising dollars spent in the entire world—$900 billion in spend per year.

118 notes

·

View notes

Text

Heather Cox Richardson 10.30.24

On Friday, October 25, at a town hall held on his social media platform X, Elon Musk told the audience that if Trump wins, he expects to work in a Cabinet-level position to cut the federal government.

He told people to expect “temporary hardship” but that cuts would “ensure long-term prosperity.” At the Trump rally at New York City’s Madison Square Garden on Sunday, Musk said he plans to cut $2 trillion from the government. Economists point out that current discretionary spending in the budget is $1.7 trillion, meaning his promise would eliminate virtually all discretionary spending, which includes transportation, education, housing, and environmental programs.

Economists agree that Trump’s plans to place a high tariff wall around the U.S., replacing income taxes on high earners with tariffs paid for by middle-class Americans, and to deport as many as 20 million immigrants would crash the booming economy. Now Trump’s financial backer Musk is factoring in the loss of entire sectors of the government to the economy under Trump.

Trump has promised to appoint Musk to be the government’s “chief efficiency officer.” “Everyone’s going to have to take a haircut.… We can’t be a wastrel.… We need to live honestly,” Musk said on Friday. Rob Wile and Lora Kolodny of CNBC point out that Musk’s SpaceX aerospace venture has received $19 billion from the U.S. government since 2008.

An X user wrote: “I]f Trump succeeds in forcing through mass deportations, combined with Elon hacking away at the government, firing people and reducing the deficit—there will be an initial severe overreaction in the economy…. Markets will tumble. But when the storm passes and everyone realizes we are on sounder footing, there will be a rapid recovery to a healthier, sustainable economy. History could be made in the coming two years.”

Musk commented: “Sounds about right[.]”

This exchange echoes the prescription of Treasury Secretary Andrew Mellon, whose theories had done much to create the Great Crash of 1929, for restoring a healthy economy. “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate,” he told President Herbert Hoover. “It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people.”

Mellon, at least, was reacting to an economic crisis thrust upon an administration. Musk is seeking to create one.

Today the Commerce Department reported that from July through September, the nation’s economy grew at a solid 2.8%. Consumer spending is up, as is investment in business. The country added 254,000 jobs in September, and inflation has fallen back almost to the Federal Reserve’s target of 2%.

It is extraordinarily rare for a country to be able to reduce inflation without creating a recession, but the Biden administration has managed to do so, producing what economists call a “soft landing,” rather like catching an egg on a plate. As Bryan Mena of CNN wrote today: “The US economy seems to have pulled off a remarkable and historic achievement.”

Both President Joe Biden and Democratic presidential nominee Vice President Kamala Harris have called for reducing the deficit not by slashing the government, as Musk proposes, but by restoring taxes on the wealthy and corporations.

As part of the Republicans’ plan to take the country back to the era before the 1930s ushered in a government that regulated business and provided a basic social safety net, House speaker Mike Johnson (R-LA) expects to get rid of the Affordable Care Act.

At a closed-door campaign event on Monday in Pennsylvania for a Republican House candidate, Johnson told supporters that Republicans will propose “massive reform” to the Affordable Care Act, also known as “Obamacare,” if they take control of both the House and the Senate in November. “Health-care reform’s going to be a big part of the agenda,” Johnson said. Their plan is to take a “blowtorch to the regulatory state,” which he says is “crushing the free market.” “Trump’s going to go big,” he said.” When an attendee asked, “No Obamacare?” he laughed and agreed: “No Obamacare…. The ACA is so deeply ingrained, we need massive reform to make this work, and we got a lot of ideas on how to do that.”

Ending a campaign with a promise to crash a booming economy and end the Affordable Care Act, which ended insurance companies’ ability to reject people with preexisting conditions, is an unusual strategy.

A post from Trump last night and another this morning suggest his internal polls are worrying him. Last night he claimed there was cheating in Pennsylvania’s York and Lancaster counties. Today he posted: “Pennsylvania is cheating, and getting caught, at large scale levels rarely seen before. REPORT CHEATING TO AUTHORITIES. Law Enforcement must act, NOW!”

Trump appears to be setting up the argument he used in 2020, that he can lose only if he has been cheated. But it is increasingly apparent that the get-out-the-vote, or GOTV, efforts of the Trump campaign have been weak. When Trump’s daughter-in-law Lara Trump and loyalist Michael Whatley became the co-chairs of the Republican National Committee in March 2024, they stopped the GOTV efforts underway and used the money instead for litigation. They outsourced GOTV efforts to super PACs, including Musk’s America PAC.

In Wired today, Jake Lahut reported that door-knockers for Musk’s PAC were driven around in the back of a U-Haul without seats and threatened with having to pay their own hotel bills if they didn’t meet high canvassing quotas. One of the canvassers told Lahut that they thought they were being hired to ask people who they would be voting for when they flew into Michigan, and was surprised to learn their actual role. The workers spoke to Lahut anonymously because they had signed a nondisclosure agreement (a practice the Biden administration has tried to stop).

Trump’s boast that he is responsible for the Supreme Court’s overturning of the 1973 Roe v. Wade decision recognizing the constitutional right to abortion is one of the reasons his support is soft. In addition to popular dislike of the idea that the state, rather than a woman and her doctor, should make decisions about her healthcare, the Dobbs v. Jackson Women’s Health Organization decision is now over two years old, and state examinations of maternal deaths are showing that women are dying from lack of reproductive healthcare.

Cassandra Jaramillo and Kavitha Surana of ProPublica reported today that at least two pregnant women have died in Texas when doctors delayed emergency care after a miscarriage until the fetal heartbeat stopped. The woman they highlighted today, Josseli Barnica, left behind a husband and a toddler.

At a rally this evening near Green Bay, Wisconsin, Trump said his team had advised him to stop talking about how he was going to protect women by ending crime and making sure they don’t have to be “thinking about abortion.” But Trump, who has boasted of sexual assault and been found liable for it, did not stop there. He went on to say that he had told his advisors, “I’m going to do it whether the women like it or not. I am going to protect them.”

The Trump campaign remains concerned about the damage caused by the extraordinarily racist, sexist, and violent Sunday night rally at Madison Square Garden. Today the campaign seized on a misstatement President Biden made when condemning the statement from the Madison Square Garden event that referred to Puerto Rico as a “floating island of garbage.” They tried to turn the tables to suggest that Biden was calling Trump supporters garbage, although the president has always been very careful to focus his condemnation on Trump alone.

In Wisconsin today, when he disembarked from his plane, Trump put on an orange reflective vest and had someone drive him around the tarmac in a garbage truck with TRUMP painted on the side. He complained about Biden to reporters from the cab of the truck but still refused to apologize for Sunday’s slur of Puerto Rico, saying he knew nothing about the comedian who appeared at his rally.

This, too, was an unusual strategy. Like his visit to McDonalds, where he wore an apron, the image of Trump in a sanitation truck was likely intended to show him as a man of the people. But his power has always rested not in his promise to be one of the people, but rather to lead them. The pictures of him in a bright orange vest and unusually dark makeup are quite different from his usual portrayal of himself.

Indeed, media captured a video of Trump’s stunt, and it did not convey strength. MSNBC’s Katie Phang watched him try to get into the truck and noted: “Trump stumbles, drags his right leg, almost falls over, and tries at least three times to open the door…. Some transparency with Trump’s medical records would be nice.”

The Las Vegas Sun today ran an editorial that detailed Trump’s increasingly obvious mental lapses and concluded that Trump is “crippled cognitively and showing clear signs of mental illness.” It noted that Trump now depends “on enablers who show a disturbing willingness to indulge his delusions, amplify his paranoia or steer his feeble mind toward their own goals.” It noted that if Trump cannot fulfill the duties of the presidency, they would fall to his running mate, J.D. Vance, who has suggested “he would subordinate constitutional principles for personal profit and power.”

—

3 notes

·

View notes

Text

Americans are spending more on virtually everything, from groceries to clothing to appliances. Headlines say those price increases are supposedly a mysterious economic force called “inflation.” But if you compare corporate profits in 2019 to the last four years, you’ll find corporations have gouged their way to an almost unbelievable $1.5 trillion in excess profits since 2020—that’s in addition to their pre-pandemic profit rates.

That means the average American household has paid an eye-popping $12,000 in higher prices solely to pump up quarterly corporate profit margins. To put that figure into perspective, $12,000 could buy the average American household more than two years’ worth of groceries.

Inflation isn’t the problem—it’s corporate greed. And it’s a choice.

. . .

This presents an opportunity for Vice President Kamala Harris to build on the extraordinary economic record of the Biden administration and chart her own path forward. She has already taken a huge step in this direction by launching her economic platform with a promise to make the fight against price gouging a “day one” priority. She has an opportunity to explain why prices are high and to present a plan to fix the problem by centering working Americans, and not the superwealthy and powerful corporations, as the real sources of our economic growth.

Over the last two years, CEOs learned they could get away with padding their profits by keeping prices high. We have really great evidence that this is what’s been happening, because CEOs admitted this is what’s been happening.For example, Procter & Gamble chief financial officer Andre Schulten bragged during a 2023 earnings call that even though the company’s input costs to make diapers had decreased, they were still keeping consumer prices high. And they were making out like bandits because of it.

Even more sharply, a Kroger supermarket chain executive crowed that “a little bit of inflation is always good for our business.” [Democrats accuse Kroger of using digital price tags to gouge consumers]

4 notes

·

View notes

Text

Article: 'EA shuffles leadership team as Samantha Ryan leaves'

Select quotes:

"Electronic Arts announced a shuffle for its management team as longtime executive Samantha Ryan has decided to leave EA. The move follows EA’s previous changes where it replaced its chief financial officer and split the responsibility for managing EA’s studios between COO Laura Miele, who is now in charge of EA Entertainment (as well as technology and central development), and Cam Weber, who was elevated to president of EA Sports. Regarding Ryan, EA said she decided she wanted to change things up, including evaluating some new professional projects. “We are sad to see her go but support her in her decision,” the spokesperson said. As for Motive, Cliffhanger and BioWare, those studios will report to Miele. The studio leads include Patrick Klaus, general manager of Motive; Kevin Stephens, general manager of Cliffhanger; and Gary McKay, general manager of BioWare."

[source]

#dragon age: dreadwolf#dragon age 4#the dread wolf rises#da4#dragon age#bioware#mass effect#next mass effect#video games

10 notes

·

View notes

Text

"Strategic Financial Excellence: Hiree - Your Outsourced CFO Solution"

Unlock unparalleled financial expertise with Hiree, your dedicated outsourced CFO service. Elevate your business strategy, optimize financial performance, and gain a competitive edge as our seasoned CFO professionals seamlessly integrate with your team. Drive success, minimize risks, and achieve sustainable growth with Hiree's strategic financial guidance tailored to your unique needs. Experience the power of outsourced financial leadership and take your business to new heights with Hiree.

0 notes

Text

Unlock Financial Success with Virtual CFO Services by Pivot Advantage Accounting and Advisory Inc.

youtube

In the dynamic landscape of modern business, staying ahead requires strategic financial management. Small and medium-sized enterprises (SMEs) often face challenges in accessing top-tier financial expertise, which can hinder their growth. Enter Pivot Advantage Accounting and Advisory Inc., a leading player in the industry offering Virtual CFO services tailored to empower businesses in their financial journey.

The Rise of Virtual CFO Services As businesses evolve, so do their financial needs. A Virtual CFO acts as a remote, outsourced chief financial officer, providing expert financial guidance without the need for a full-time, in-house CFO. This innovative approach is gaining traction among businesses of all sizes, offering a cost-effective solution and access to high-level financial expertise.

Why Choose Pivot Advantage Accounting and Advisory Inc.?

Customized Financial Strategies: Pivot Advantage understands that each business is unique. Their team of seasoned financial professionals works closely with clients to create customized financial strategies aligned with their specific goals and challenges. Whether it's optimizing cash flow, managing expenses, or planning for future growth, Pivot Advantage tailors its Virtual CFO services to meet the distinct needs of each client.

Strategic Decision Support: In the fast-paced business environment, timely and informed decision-making is crucial. Pivot Advantage's Virtual CFO services go beyond traditional financial reporting. They provide real-time insights and analysis, empowering business owners to make strategic decisions with confidence. This proactive approach ensures that clients stay ahead of the competition and navigate challenges effectively.

Cost Efficiency: Hiring a full-time CFO can be a significant financial burden for SMEs. Pivot Advantage's Virtual CFO services offer a cost-efficient alternative, allowing businesses to access top-tier financial expertise without the overhead costs associated with a full-time executive. This scalability ensures that businesses only pay for the services they need, optimizing their budget for maximum impact.

Technology Integration: Pivot Advantage leverages cutting-edge financial technology to streamline processes and enhance efficiency. By integrating the latest tools and software, they provide clients with real-time financial data and analytics, fostering transparency and accuracy in financial management. This commitment to technology ensures that clients are equipped with the tools needed to adapt to the ever-changing business landscape.

Risk Management: Navigating financial risks is a key aspect of business success. Pivot Advantage's Virtual CFO services include comprehensive risk management strategies. From identifying potential financial risks to implementing risk mitigation plans, their experts work diligently to safeguard the financial health of their clients' businesses.

How to Get Started Getting started with Pivot Advantage Accounting and Advisory Inc.'s Virtual CFO services is a seamless process. The first step involves a comprehensive consultation to understand the unique needs and goals of the client. From there, Pivot Advantage crafts a tailored plan that aligns with the client's business objectives.

Conclusion In the era of remote work and digital transformation, businesses need agile financial solutions that adapt to their evolving needs. Pivot Advantage Accounting and Advisory Inc.'s Virtual CFO services provide a strategic advantage, combining expertise, cost-efficiency, and technology integration. By partnering with Pivot Advantage, businesses can unlock their full financial potential and pave the way for sustained success in today's competitive market.

#Vancouver accounting company#virtual CFO by Pivot Advantage Accounting and Advisory Inc.#Pivot Advantage Accounting and Advisory Inc. part time CFO#Pivot Advantage Accounting and Advisory Inc. CFO service#online accounting firm in Vancouver#accountant#Youtube

3 notes

·

View notes

Text

AI in C-Suite Collaboration: Transforming Leadership and Decision-Making

In today’s fast-paced business environment, leaders in the C-suite must make quick, informed decisions to stay competitive. AI in C-suite collaboration is revolutionizing how top executives work together, enabling faster decision-making, more accurate insights, and better strategies. This article delves into the role of AI in enhancing collaboration among C-suite executives and how it drives organizational success.

What is AI in C-Suite Collaboration?

Artificial intelligence (AI) is reshaping how C-suite executives—such as CEOs, CFOs, COOs, and CIOs—interact and collaborate within an organization. AI tools and technologies empower these leaders to analyze vast datasets, automate processes, and gain deeper insights, allowing them to make more informed, strategic decisions.

Key Features of AI in C-suite Collaboration:

Data-Driven Decision-Making: AI analyzes real-time data, providing executives with actionable insights.

Automated Task Management: AI tools can automate routine tasks, freeing up time for high-level collaboration and innovation.

Predictive Analytics: AI anticipates market trends and potential risks, enabling the C-suite to be proactive rather than reactive.

Related Keywords: AI-driven leadership collaboration, executive decision-making AI, artificial intelligence in business strategy, predictive analytics for executives.

The Importance of AI in C-Suite Collaboration

1. Streamlining Communication

In the past, communication between C-suite leaders could be fragmented and slow. AI enhances communication through advanced collaboration tools like AI-driven chatbots and virtual assistants that can summarize meetings, share critical updates, and even schedule follow-ups.

2. Improving Data Accessibility

With AI, executives can access and interpret vast amounts of data at the click of a button. AI-powered dashboards offer easy-to-read visualizations and real-time analytics, helping leaders stay on top of key performance indicators (KPIs) and strategic objectives.

3. Supporting Strategic Decision-Making

AI’s predictive capabilities allow C-suite leaders to anticipate challenges and opportunities. This foresight leads to smarter, data-backed decisions, which are crucial for long-term business growth.

How AI Enhances C-Suite Collaboration Across Key Areas

1. Financial Planning and Analysis

CFOs are increasingly using AI tools to forecast financial trends, optimize budgets, and reduce risks. AI enables the creation of more accurate financial models, providing leaders with the ability to make real-time adjustments to financial strategies.

Example: AI-powered tools like Tableau and IBM Watson help CFOs analyze financial reports, offering predictive insights into cash flow, profitability, and investment opportunities.

2. Operational Efficiency

COOs are leveraging AI to streamline operations and drive efficiencies. AI tools automate supply chain management, inventory tracking, and process optimization, allowing leaders to focus on strategic growth rather than operational challenges.

Example: AI-driven software, such as SAP’s intelligent enterprise solutions, helps COOs monitor operations in real time and identify areas for improvement.

3. Human Resources and Talent Management

Chief Human Resources Officers (CHROs) use AI to streamline talent acquisition, employee retention, and workforce optimization. AI tools analyze employee performance data to suggest personalized training, career development plans, and succession strategies.

Example: AI tools like Workday and ADP help HR leaders identify high-potential employees and create more effective training programs.

4. Marketing and Customer Insights

Chief Marketing Officers (CMOs) are leveraging AI to gain deeper insights into customer preferences and behavior. By using AI to analyze customer data, CMOs can refine marketing strategies and improve customer engagement.

Example: AI platforms such as Salesforce’s Einstein and Adobe Sensei help CMOs personalize marketing campaigns, improving targeting and conversion rates.

5. IT and Cybersecurity

Chief Information Officers (CIOs) are at the forefront of implementing AI in cybersecurity to protect organizational data and prevent breaches. AI can detect anomalies and predict potential threats, allowing CIOs to take preemptive action.

Example: AI-based cybersecurity solutions like Darktrace use machine learning to detect unusual network activity and respond to threats automatically.

Benefits of AI in C-Suite Collaboration

1. Faster Decision-Making

AI enhances collaboration by providing C-suite executives with real-time data and insights, which accelerates decision-making. This rapid access to information is critical in today’s fast-moving business landscape.

Example: In industries like finance and healthcare, AI is enabling faster, more informed decision-making that can have a direct impact on profitability and patient outcomes.

2. Improved Accuracy

AI reduces human error and bias in decision-making. By analyzing large volumes of data, AI provides more accurate insights and predictions, ensuring that executive decisions are based on facts rather than intuition.

3. Better Risk Management

With AI, C-suite leaders can predict potential risks and disruptions before they occur. AI’s predictive capabilities allow businesses to develop mitigation strategies and avoid costly mistakes.

Example: AI models in retail can predict supply chain disruptions or shifts in consumer demand, allowing businesses to adjust strategies before problems arise.

4. Enhanced Collaboration Across Departments

AI fosters collaboration by breaking down silos between departments. With AI-enabled tools, leaders can share information seamlessly and work together more efficiently, improving cross-functional collaboration.

Example: AI-driven project management tools, such as Monday.com or Asana, facilitate real-time collaboration among C-suite executives, ensuring all leaders are aligned on key initiatives.

Challenges of Implementing AI in C-Suite Collaboration

1. Data Privacy Concerns

With AI relying on large amounts of data, ensuring the privacy and security of sensitive company and customer data becomes a critical issue. C-suite leaders must implement robust data protection policies and ensure compliance with privacy regulations like GDPR and CCPA.

2. High Implementation Costs

Integrating AI technologies can be costly, especially for smaller businesses. The initial investment in AI tools, infrastructure, and training can be a barrier for some organizations.

3. Resistance to Change

Some executives may be hesitant to embrace AI due to fear of change or lack of understanding of the technology. It’s crucial for businesses to foster a culture of innovation and provide adequate training to ensure successful AI adoption.

Best Practices for Using AI in C-Suite Collaboration

1. Start with Small, Measurable Goals

Rather than implementing AI across the entire organization at once, C-suite leaders should start small, focusing on specific areas like customer insights or financial forecasting. This allows businesses to measure the impact of AI and scale up as needed.

2. Foster a Collaborative Mindset

AI should enhance collaboration, not replace human decision-making. C-suite executives should view AI as a tool to empower their teams, not as a threat to their roles.

3. Focus on Data Quality

For AI to be effective, the quality of the data it analyzes is crucial. C-suite leaders must ensure that data is clean, relevant, and accurate to derive meaningful insights.

4. Keep Abreast of AI Trends

The world of AI is evolving rapidly. C-suite executives should stay informed about the latest AI advancements to continuously improve collaboration and decision-making processes.

Conclusion

AI in C-suite collaboration is transforming how top executives work together to drive business success. By enhancing communication, data accessibility, and strategic decision-making, AI empowers the C-suite to make smarter, more informed choices. As AI continues to evolve, its role in business leadership will only grow, helping organizations stay ahead of the competition and thrive in the digital age.

0 notes

Text

virtual chief financial officer

https://abusinessmanager.com/virtual_cfo/ Powerful virtual CFO services from a team of highly experienced management accountants and financial professionals.

1 note

·

View note

Text

Affordable Virtual Cfo Services For Small Businesses

In the dynamic landscape of modern business, companies often navigate complex Virtual CFO Services. Whether you're a startup looking to manage growth effectively or an established firm seeking strategic financial guidance, the role of a Chief Financial Officer (CFO) is indispensable. However, hiring a full-time CFO may only be feasible for some businesses due to cost constraints or scalability concerns, which are where virtual CFO services come into play.

Virtual CFO services offer a flexible and cost-effective solution for businesses of all sizes. Rather than employing a full-time CFO, companies can leverage the expertise of seasoned financial professionals on an as-needed basis. But what exactly do virtual CFO services entail, and how can they benefit your business?

Expert Financial Guidance

One of the primary advantages of virtual CFO services is access to expert financial guidance without the hefty price tag associated with hiring a full-time executive. Virtual CFOs are typically seasoned professionals with extensive experience in financial management, strategic planning, and decision-making. They can provide valuable insights into your company's financial health, identify areas for improvement, and develop actionable strategies to achieve your business objectives.

Cost Savings

Hiring a full-time CFO can be prohibitively expensive for many small and medium-sized businesses, especially those in the early stages of growth. Virtual CFO services offer a more cost-effective alternative by allowing you to pay for only the services you need when you need them. It can result in significant cost savings compared to a full-time employee's salary, benefits, and overhead costs.

Scalability

As your business evolves and grows, so do your financial needs. Virtual CFO services are highly scalable, allowing you to scale up or down based on your changing requirements. Whether you need assistance with financial planning, budgeting, fundraising, or mergers and acquisitions, virtual CFOs can adapt to meet your evolving needs without the constraints of a traditional employment arrangement.

Focus on Core Activities

Outsourcing your financial management to a virtual CFO frees up valuable time and resources to focus on your core business activities. Rather than getting bogged down in financial paperwork and administrative tasks, you can concentrate on driving innovation, serving your customers, and growing your bottom line. It can increase your business's efficiency, productivity, and profitability.

Access to Advanced Technology

Virtual CFOs often leverage advanced financial technology and tools to streamline processes, automate tasks, and generate actionable insights. From cloud-based accounting software to predictive analytics platforms, virtual CFOs can access cutting-edge tools that can help optimise your financial operations and drive better decision-making.

Conclusion:

Virtual CFO services offer a flexible, cost-effective, and scalable solution for businesses seeking expert financial guidance without the overhead of hiring a full-time executive. By partnering with a virtual CFO, you can access the expertise you need to navigate the complexities of modern business, drive growth, and achieve your long-term objectives. Virtual CFO services can provide the strategic financial support you need to succeed in today's competitive marketplace, whether you're a startup, a growing company, or an established enterprise.

0 notes