#venture capital india

Link

These segments witnessed robust venture capital funding India with mega deals in each segment. Nearly $ 3.1 billion were invested in these segments in mega deals. Digital health startups excelled in surpassing early-stage investment and stuck several deals in late-stage with late-stage VC funding. Wellness tech occupied a dominant position in overall funding.

#venture capital funding India#Venture Capital Firm#venture capitalists#venture capitalist india#venture capital india#venture capital finance#venture capital firm india#venture capital stages#venture capital funds in india#type of venture capital#venture capitalist in kolkata#jc team capital

0 notes

Text

Fireside Ventures Team: Diverse Experts Driving Purposeful B2C Brands

Meet the dynamic team behind Fireside Ventures, a leading venture capital firm dedicated to nurturing purpose-driven B2C brands in India. With a mission to enhance consumer experiences and create meaningful societal impact, Fireside Ventures is at the forefront of supporting innovative ventures.

About Fireside Ventures

Fireside Ventures is a visionary venture capital firm that is reshaping the consumer landscape in India. By identifying and supporting purpose-driven B2C brands, Fireside Ventures is not only investing in businesses but also in the betterment of society.

Nurturing Purpose-Driven Brands

Fireside Ventures has carved a niche as d2c investors in India, recognizing the potential of brands that are not only commercially viable but also aligned with a larger societal purpose. By investing in these brands, Fireside Ventures is facilitating a positive shift in consumer experiences.

Expertise in Consumer-Focused Ventures

With a deep understanding of the consumer market, Fireside Ventures is one of the premier consumer venture capital funds in India. The team's expertise lies in identifying brands that resonate with consumers and have the potential to make a significant impact on the market.

Rooted in Bangalore, Impacting India

Based in Bangalore, the heart of India's startup ecosystem, Fireside Ventures is at the epicenter of innovation. The venture capitalist team at Fireside Ventures is dedicated to identifying and nurturing ventures across India, contributing to the growth of the startup ecosystem.

Investing in Visionaries

Fireside Ventures is more than just a venture capital firm; it's a partner to visionaries and innovators. The team understands the unique challenges faced by entrepreneurs and provides not just financial support, but also mentorship and guidance.

Driving Societal Impact through Ventures

Fireside Ventures believes in the power of businesses to drive positive change in society. By supporting purpose-driven ventures, Fireside Ventures is not only creating successful brands but also contributing to a more conscious and impactful consumer culture.

Collaborative Ventures, Collective Impact

Through strategic collaborations and investments, Fireside Ventures is fostering a community of ventures that collectively contribute to a better consumer experience and a more impactful society. The team at Fireside Ventures understands that true change comes through collective effort.

Fireside Ventures and its diverse team of experts are at the forefront of the venture capital landscape in India. By investing in purpose-driven B2C brands, Fireside Ventures is not only shaping the consumer market but also making a tangible impact on society. With their deep expertise and collaborative approach, Fireside Ventures is set to lead the way in driving meaningful change through ventures in India.

#d2c investors india#consumer vc funds#venture capital bangalore#venture india#ventures in india#venture capitalist bangalore#ventures india#consumer venture capital funds#venture companies in india

2 notes

·

View notes

Text

Why do businesses fail even after good seed funding?

Most businesses fail even after receiving excellent seed funding because the management entirely misunderstands the demands and misallocates cash, losing the capital venture partner firm's trust in the process. Therefore, even if they must accept less startup funding, businesses must collaborate with venture capital firms that bring leadership and tested expertise. Truth Ventures is regarded as one of the best venture capital firms as they don't allow their partners to overspend or pay excessive attention to the current situation and only allocate cash by keeping long-term goals in mind.

#Truth vent#Truth ventures#truth venture#capital venture#capital venture fund#varun datta#varun datta ceo#seed funding#truth ventures#varun datta entrepreneur#varun datta founder#venture capital#seed capital#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital#Capital venture fund#venture capital in india#Types of venture capital#Investment Funding#Venture capital startup#Joint venture partner#Venture capital industry

3 notes

·

View notes

Text

Venture capital lawyers in India

We understand the intricacies of the Indian startup landscape. Our venture capital lawyers in India offer strategic counsel to both startups and investors. We navigate funding rounds, draft watertight agreements, and ensure regulatory adherence, empowering clients to make sound investment decisions and achieve successful exits. Contact us now!

0 notes

Text

Indian startup ecosystem is a vibrant hub of innovation. Fuelled by a young and tech-savvy population, Indian startups are disrupting industries and attracting global attention. But like their counterparts worldwide, these startups require funding to navigate the crucial stages of growth. This article explores the funding landscape in India, guiding entrepreneurs through various options available, with a specific focus on compliances and requirements.

0 notes

Text

21BY72 Global Summit Season 3: Special Guest Speaker Anupam Mittal

We are thrilled to announce that Anupam Mittal, the King of Matchmaking and Founder & CEO of Shaadi.com, will be joining us at 21BY72! Don’t miss this exclusive opportunity to connect with one of India’s top business minds.

📅 Save the Dates: 15th & 16th June, 2024

📍 Location: Avadh Utopia, Surat

Prepare yourself for an unforgettable experience filled with innovation, inspiration, and unmatched networking opportunities. Book your passes now at https://www.21by72.com/book/.

At 21BY72 Season 3, we understand the challenges startups face. That’s why we’re here to support you! Showcase your startup, connect with investors, and find a community that believes in your vision. Together, we can turn challenges into triumphs.

Join us at 21BY72 and let’s Connect, Co-Create, Collaborate, and Celebrate the spirit of entrepreneurship!

#startup event india#startup funding#startup india#startup ecosystem#entrepreneurship#venture capital#angel investors#global events#seed funding

0 notes

Text

Grow Your Startup With a Leading Venture Capital Firms in India

Solis Capital & Ventures is the premier venture capital firm in India, providing top-notch incubation, acceleration, and merger & acquisition services. With a proven track record of success, our team of experts helps entrepreneurs turn their visions into thriving businesses. Partner with us for unparalleled support and growth opportunities. visit us: https://solisventures.in/

0 notes

Text

High-Growth Potential: Invest in Startups for Equity India as an Accredited Investor

The Indian startup ecosystem is booming. From innovative solutions in fintech and e-commerce to disruptive ideas in healthcare and cleantech, there's a constant buzz of creativity and potential. As an accredited investor in India, you have the unique opportunity to be a part of this growth story by invest in startups for equity India. This approach offers the chance for high returns while fostering the development of groundbreaking companies that shape the future.

But before diving headfirst, it's crucial to understand the landscape of investing in startups for equity in India. This blog will delve into the benefits, considerations, and resources available to accredited investors seeking promising startups to invest in.

Why Invest in Startups for Equity in India?

For accredited investors, venturing beyond traditional investment avenues can unlock exciting possibilities. Here are some key reasons why investing in startups for equity can be a compelling proposition:

High-Growth Potential: Startups have the potential to disrupt entire industries and experience explosive growth. Early investment in a successful startup can translate to significant returns on your capital.

Diversification: Equity in startups can add a new dimension to your investment portfolio. Unlike established companies, startups offer exposure to innovative ideas and emerging markets, reducing your reliance on traditional assets.

Impact Investing: By supporting promising startups, you contribute to the development of solutions that address critical challenges and create a positive social impact.

Early Access: Accredited investors gain access to exclusive investment opportunities not available to retail investors. You can get in on the ground floor of a promising venture before it goes mainstream.

Considerations for Investing in Startups

While the potential rewards are significant, investing in startups for equity also comes with inherent risks. Here are some key points to consider:

High Risk: Startups are inherently unproven ventures. There's a significant chance of failure, and you could lose your entire investment.

Illiquidity: Unlike stocks on the public market, startup equity is illiquid. It can be difficult to sell your shares quickly, and you may have to wait for an exit event like an acquisition or IPO.

Long Investment Horizon: It typically takes several years for a startup to mature and deliver returns. Be prepared for a long-term commitment.

Extensive Due Diligence: Thorough research and analysis are crucial before investing in a startup. You need to assess the company's business model, team, market potential, and financial projections.

Finding Promising Startups to Invest In

As an accredited investor, you have several options to find promising startups for equity investment in India:

Venture Capital Firms in India: Partnering with established venture capital firms in India is a popular approach. These firms have a proven track record of identifying and investing in high-growth startups. They conduct extensive due diligence and provide valuable guidance to investors.

Angel Investor Networks: Joining an angel investor network allows you to connect with other accredited investors and access a wider pool of potential startups. These networks often organize events and provide resources to help you make informed investment decisions.

Startup Platforms: Several online platforms connect startups with potential investors. These platforms provide information about startups seeking funding, their business models, and funding rounds.

Krystal Ventures Studio: Connecting Investors with Promising Startups

Krystal Ventures Studio understands the challenges and opportunities associated with investing in startups for equity in India. Our platform is designed to bridge the gap between startups seeking funding and accredited investors looking for promising ventures.

By registering with Krystal Ventures Studio, you gain access to a curated network of market-ready startups across various sectors. We provide comprehensive information on each startup, including their business plans, financial projections, and team profiles. Our team also helps investors with due diligence and facilitates connections with the startups they are interested in.

Investing in startups for equity in India offers a unique opportunity for accredited investors to achieve high returns and contribute to the nation's entrepreneurial ecosystem. By understanding the risks and rewards, conducting thorough due diligence, and leveraging the right resources, you can make informed investment decisions and participate in the growth story of promising Indian startups.

0 notes

Text

Venture Debt Company - Valuable Partners

Valuable Partners provides venture debt solutions in India. We fund and guide promising startups and entrepreneurs, fostering growth opportunities and nurturing innovation across various sectors.

1 note

·

View note

Text

Eximius - Venture capital firms play a huge role in the startup ecosystem by providing not just financial support but also strategic guidance and industry connections. In India, where entrepreneurial spirit is on the rise, numerous venture capital firms have emerged as key players in fueling the growth of innovative startups.

Above Is the list of top 15 Venture Capital firms for pre-seed funding in India. These firms understand the unique challenges faced by early-stage ventures and are committed to backing promising ideas with the potential for exponential growth.

1 note

·

View note

Link

The venture capital industry has experienced substantial growth in the last few years. The financial market's most active sector right now is venture capital India. Professional investors known as venture capitalists specialize in providing financing to startups and developing creative. The potential to become important economic contributors

#venture capitalist in india#venture capital market size#venture capitalist#venture capital firms in india#venture capital financing#venture capital india#indian venture capital firms#top venture capital firms in india#venture capitalism meaning#venture capital is

0 notes

Text

As the title I am going to discuss most famous unlisted share app is India, where any one can invest easily and find out some awesome features of the app.

Planify is the name of that app where you can download and explore the features. Planify is the India's best fintech company and private market place. You can invest in top startups.

If you are startup then you also go for funding. There are also some great feature which you should explore.

#share market apps india#Unlisted Stocks#buy pre ipo#Equity Fund Raising#business funding app#upcoming ipo app#angel investors app#Venture Capital

1 note

·

View note

Text

VilCart is thrilled to announce it’s participation in the much-awaited Startup Mahakumbh at Bharat Mandapam, New Delhi from March 18th-20th, 2024!

Join us as we showcase our innovative solutions aimed at revolutionizing rural commerce and empowering rural communities across India.

Discover how VilCart is bridging the gap between rural consumers and manufacturers through the cutting-edge and state - of - art supply chain management system, ensuring access to top-quality products at affordable prices to rural India.

Don't miss out on this incredible opportunity to witness the first hand transformative impact of VilCart. See you there! Visit us at Agritech Pavilion

#StartupMahakumbh#EmpoweringCommunities#InnovationUnleashed#agritech Aavishkaar#b2b#manufacturing#InvestmentTrends#Assocham#nasscom#Small Industries Development Bank of India#National Bank For Agriculture & Rural Development#Indian Venture and Alternate Capital Association - IVCA

0 notes

Text

Venture capital lawyers in IndiaVenture capital lawyers in India, led by Harish Jain & his team, provide expert legal services, ensuring compliance and strategic advice. Their comprehensive support spans fundraising, negotiations, and regulatory matters, empowering startups and investors to navigate India's dynamic venture capital landscape effectively. Contact us now!

0 notes

Text

Navigating Investments: The World of Private Equity Firms

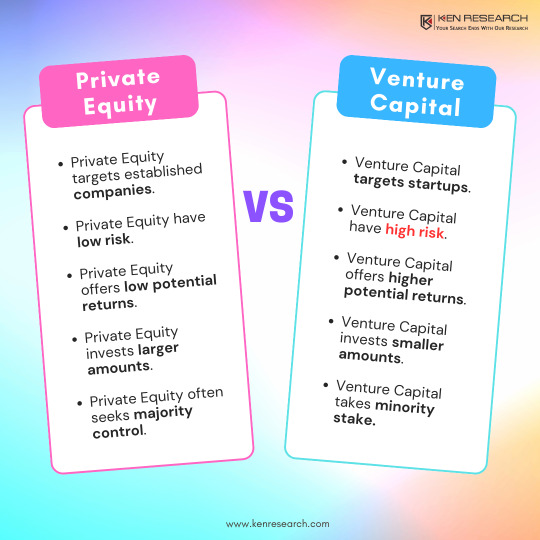

Examine the symbiotic relationship between private equity and venture capital, showcasing how these financial partners collaborate to fuel entrepreneurial ventures.

#Private Equity#private equity firms#private equity firms in india#private equity vs venture capital#private equity and venture capital#private equity venture capital

0 notes

Text

Solis Capital and Ventures | Best Venture Capital in Gurgaon

Aiding visionary entrepreneurs in building successful & profitable startups. We are one of the best technology-focused, early-stage venture capital firms in India. For more information visit us: https://solisventures.in/

#Best early stage venture capital firms in India#Top venture capital Gurgaon#startup investing India#venture capital firms#venture company in Delhi NCR

1 note

·

View note