#private equity venture capital

Explore tagged Tumblr posts

Text

Semiconductor Venture Capital for Innovative Startups

SEAFUND is strategically positioning itself as a leader in semiconductor venture capital in India, focusing on providing essential funding and mentorship to innovative startups in the semiconductor sector.

The firm is particularly drawn to deep tech investments, which include semiconductors, AI, energy, and climate solutions. By investing in these cutting-edge sectors, SEAFUND aims to support technologies that can address complex, long-term global challenges while providing value to India’s growing tech ecosystem.

SEAFUND’s expertise extends beyond just financial backing. The firm actively collaborates with founders to refine strategies and accelerate growth. Through its network of experts in semiconductor engineering, financial management, and industry connections, SEAFUND helps startups scale effectively.

As the semiconductor sector faces high entry barriers and technological complexity, SEAFUND’s support offers a crucial edge to emerging companies that are poised to make significant impacts. Their investments are aimed at fostering sustainable growth, particularly for businesses that need time to build innovative semiconductor technologies.

Their approach, known as “patient capital,” emphasizes long-term support to ventures with high capital demands and slow initial returns, making it an ideal model for semiconductor startups.

By focusing on semiconductor venture capital, SEAFUND is contributing to the development of India’s technological infrastructure. The semiconductor industry, being vital to future technological advancements, requires significant investment to realize its full potential. SEAFUND’s commitment to this sector reflects a belief in the transformative power of deep tech, which can drive economic growth and global competitiveness.

For more information on SEAFUND’s work in semiconductors and other deep-tech ventures, you can visit their official page

Seafund

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

5 Ring Road, Lajpat Nagar 4, 3rd Floor, New Delhi-110024

#Keyword#venture capital company#investment in startups#funding for startups#private equity venture capital#capital venture investors#stages of venture capital financing#venture capital investment#venture capital investors#venture capital firm#venture capital firms in india#leading venture capital firms#india alternatives investment advisors#best venture capital firms in india#early stage venture capital firms#venture capital investors in india#early stage investors#seed investors in bangalore#invest in startups bangalore#business investors in kerala#funders in bangalore#startup investment fund#seed investors in delhi#private equity firms investing in aviation#venture investment partners#venture management services#defense venture capital firms#popular venture capital firms#funding for startups in india#early stage funding for startups

0 notes

Text

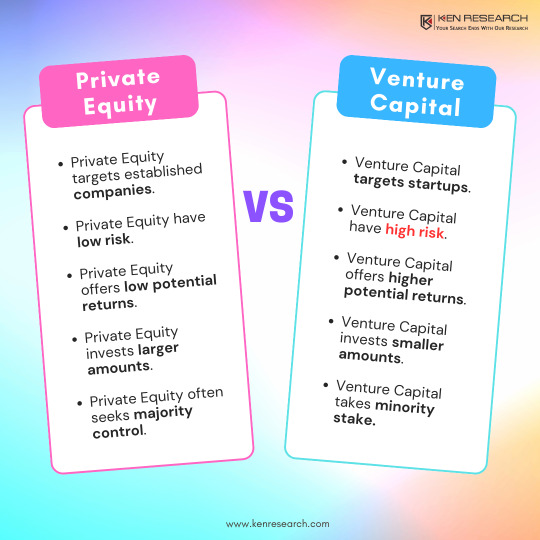

Navigating Investments: The World of Private Equity Firms

Examine the symbiotic relationship between private equity and venture capital, showcasing how these financial partners collaborate to fuel entrepreneurial ventures.

#Private Equity#private equity firms#private equity firms in india#private equity vs venture capital#private equity and venture capital#private equity venture capital

0 notes

Text

Ko-Fi prompt from @dirigibird:

I've been looking at investment options but I don't want to be messing around too much with the stock market, and a co-worker suggested exchange traded funds. Would love to know your opinions!

LEGALLY NECESSARY DISCLAIMER: I am not a licensed financial advisor, and it is illegal for me to advise anyone on investment in securities like stocks. My commentary here is merely opinion, not financial advice, and I urge you to not make any decisions with regards to securities investments based on my opinions, or without consulting a licensed advisor. I am also going to be talking this all over from an American POV, which means some of these things may not apply elsewhere.

So instead of letting you know what to pick or how to organize your securities, I'm going to go through the definitions of what various investment funds are, how they compare functionally, and maybe rant about how I disagree with the stock market on a fundamental ethical level if I have word count left over.

If you want more information, and are okay with jargon, I'd suggest hitting up investopedia. That is where I will be double-checking most of my information for this one.

I also encourage folks who know more about the stock market specifically to jump in! I like to think I'm good at research and explaining things, but I'm still liable to make mistakes.

Mutual Funds: A mutual fund is a pool of money and resources from multiple individuals (often vast numbers of people, actually) being put together and managed as a group by investment specialists. The primary appeal of these is that the money is professionally managed, but not personally so; it gives smaller investors access to professional money managers that they would not have access to on their own, at cheaper rates than if they tried to hire one for just their own assets. The secondary appeal is that, due to the sheer number of people, and thus capital, that is being invested at once, the money can be invested in a wide variety of industries, and is generally more stable than investing in just one company or industry. Low risk, low reward, but overall at least mostly reliable. Retirement plans are often invested in mutual funds by employer choice, through companies like Fidelity or John Hancock.

Hedge Funds: A hedge fund is a high risk, high reward mutual fund. Investors are generally wealthy, and have the room and safety to lose large amounts of money on an investment that has no promise of success, especially since money cannot be withdrawn at will, but must remain in the fund for a period of time following investment. It gets its name from "hedging your bets," as part of the strategy is to invest in the opposition of the fund's focus in order to ensure that there is a backup plan to salvage at least some money if the main plan backfires. Other strategies are also on the riskier side, often planning to take advantage of ongoing events like buyouts, mergers, incumbent bankruptcy, and shorting stocks (that's the one that caused the gamestop incident).

Private Equity: Private equity is... a nightmare that got its own incredibly good Hasan Minhaj episode of Patriot Act, so if you've got 20 minutes, an interest in comedically-delivered, easily-digestible, Real Information, and an internet connection, take a watch of that one. (If it's not available on YouTube in your country, it's originally from Netflix, or you can probably access it by VPN.) Private equity companies are effectively hedge funds that purchase entire companies, rebuild them in one way or another, and then sell them at (hopefully) a profit. Very often, the companies purchased by private equity are very negatively impacted, especially if the private equity group is a Vulture Fund. Sometimes, it's by taking it apart to sell off; sometimes it's by just bleeding it for cash until there's nothing left. Sometimes, it's taking over a hospital and overcharging the patients while also abusing the staff! (Glaucomflecken has a lot of videos on the topic of private equity in the medical industry, check him out.)

Venture Capital: In contrast to private equity, which purchases more mature companies, venture capital is focused on startups, or small businesses that have growth potential. These are the kinds of hedge funds that are like a whole group that you'd see some random tv character calling an Angel Investor (they're not actually the same thing, but they overlap by a lot). I'd hesitantly call these less ethically dubious than private equity, but I'm still suspicious.

And finally, to answer your question on what ETFs are and how they fit into the above.

Exchange Traded Funds: ETFs are... sort of like a mutual fund. Sort of. You are, to some extent, pooling your money... ish.

An ETF is like a stock that is made out of partial stocks. So instead of paying $100 for stock A, and not getting stocks B/C/D that all cost the same, you buy $100 of the ETF, which is $25 each of stocks A/B/C/D. You are getting a quarter of a unit of stock, which isn't normally an option, but because you are purchasing through an ETF that officially already bought those Whole stocks, you can now purchase the partial stocks through them.

They buy the whole stocks, then they resell you mixes of those stocks. They still officially own the whole stocks themselves, but you now own parts of the stocks. Basically, you own "stock" in a company that owns stock in other companies, and in that process you own partial stocks in those other companies.

I'm going to re-explain this using fruit.

Imagine you can buy apples, oranges, melons, grapes, etc. You can also buy fruit cups. You can only buy the individual fruits in big batches or you can pool your money with a few other people, hand it to a chef. The chef will decide which fruits look like they'll taste the best by lunch time, buy a bunch of those fruit pallets with your combined money, and plan out the best possible fruit salad for you to share with a bunch of people once lunch rolls around.

You could also buy a fruit cup. You don't have a lot of control over what's already in the fruit cup, but there are a few different mixes available--that one has strawberries, but that one over there uses kiwi, and the other one that way has pineapple--and you can pick which mix you want. It's a pretty small fruit cup, and it's predesigned, but you can choose the one you want without having to pool money with everyone else. You just first have to let someone else design the fruit cups you choose from, and you don't know which ones are probably going to survive the best to lunch time unless you ask a chef (which defeats the purpose of buying a fruit cup instead of pooling your money, and asking the chef costs money).

That's the ETF. The ETF is the fruit cup.

The upside is that you can now just track the prices of your fruit cup, instead of tracking the prices of four different fruits, and so if the price of one fruit drops, you can just... let the other three buoy it.

Of course, in the real world, there are more than just four stocks involved in an ETF. This part of the Investopedia article lists a few examples, and they're usually themed and involve anywhere from 30 (DOW Jones) to thousands (Russell) of shares by stock type, or by commodity/industry. So with the ETF, you can invest in an entire industry, like technology, and just keep track of that single "stock" in the industry game.

They do cost less in brokerage/management fees than regular mutual funds, and they have a slightly lower liquidity (slower to cash out). There also exist actively managed ETFs, which are basically mutual funds for ETFs. You are paying the chef to buy you premade fruit cups.

(Prompt me on ko-fi!)

#economics#stock market#etfs#etf#mutual funds#hedge funds#venture capital#private equity#capitalism#phoenix talks#ko fi#ko fi prompts#economics prompts

51 notes

·

View notes

Text

Access private and public company data, PE, VC, M&A, ECM, debt transactions and advanced tools on VCCEdge for India's investment ecosystem.

#private equity research#venture capital data#mergers and acquisitions#financial analysis#company profiles#investment insights#sector intelligence#market research#due diligence#deal pipeline

1 note

·

View note

Text

📊Summary of M&A activity 2019-2024YTD by deal size and count (Looking at the top 5 largest acquisitions, 2024YTD has seen an uptick in acquisition size vs 2023, more in line with 2020/2021/2022, despite there being fewer deals in 2024YTD vs 2023)

📰US set for IPO comeback as private equity firms seek to offload holdings. Bankers hope strong 2024 gains for Wall Street equities (the S&P 500 rising almost 70 per cent from its 2022 lows) and pro-business policies will drive listings rebound

https://www.ft.com/content/5dcf3d4e-8e16-470b-b33d-fc73d3043f58

#equity #debt #fund #investor #interestrate #Fed M&A

#investor#privateequity#ennovance#economy#debt#loan#pe#equity#ipo alert#venture capital#private equity

1 note

·

View note

Text

One Equity Partners Completes Acquisition of EthosEnergy

Investment Supports Company’s Continued Growth as Global Electricity Demands Increase Press Release – January 02, 2025 – NEW YORK – One Equity Partners (“OEP”), a middle market private equity firm, today announced that it has completed an investment in EthosEnergy, a global independent service provider focusing on rotating equipment for customers in the power generation, energy, industrial, and…

0 notes

Text

#Private Equity vs. Venture Capital#Roundhere#Michigan#startup#Funding#entrepreneur#michigan entrepreneurs#small business

1 note

·

View note

Text

Unlock Extraordinary Growth with Cutting-Edge Tech in Alternative Investments

In this rapidly evolving landscape, the adoption of technology is not merely an option but a necessity for staying competitive. One of the primary drivers of this transformation is the ability of technology to streamline processes, reduce overhead costs, and provide deeper insights into market dynamics.

Fund managers are now utilizing software that allows for real-time data analysis, enabling them to respond swiftly to market changes and capitalize on emerging opportunities. This agility is crucial in a market where timing can significantly impact returns.

Moreover, technology facilitates enhanced collaboration and communication among stakeholders. Through cloud-based platforms, team members can access and share information seamlessly, irrespective of their geographic location. This interconnectedness not only fosters a more cohesive team environment but also ensures that decisions are made with the most up-to-date information.

As alternative investment strategies grow more complex, the role of technology in risk management becomes increasingly vital. Advanced algorithms and predictive models provide managers with comprehensive risk assessments, helping them to devise strategies that mitigate potential downsides while optimizing returns.

In this blog, we explore how technology is revolutionizing alternative investment management and providing unprecedented opportunities for stakeholders in the industry.

The Current Landscape of Alternative Investment Management

Understanding Alternative Investments

Alternative investments encompass a broad range of asset classes beyond traditional equities and bonds. These include:

Private Equity: Investments in privately held companies.

Hedge Funds: Pooled investments employing diverse strategies for high returns.

Real Estate: Direct or indirect investments in property markets.

Commodities: Physical goods like gold, oil, and agricultural products.

Venture Capital: Funding for early-stage startups with high growth potential.

Due to their complexity, illiquidity, and unique risk-return profiles, managing these investments demands advanced tools and methodologies.

Challenges in Alternative Investment Fund Management

Data Fragmentation: Data originates from multiple sources and is often siloed, making it difficult to consolidate and analyze.

Regulatory Compliance: Increasing scrutiny and evolving regulations place immense pressure on fund managers to maintain transparency.

Operational Inefficiency: Manual processes can lead to errors and reduce overall productivity.

Investor Expectations: Investors demand personalized reports, real-time insights, and consistent performance.

Risk Management: Complex portfolios require sophisticated tools to identify and mitigate risks.

Technological innovations are addressing these challenges and positioning alternative investment management for a future marked by growth and resilience.

Technologies Transforming Alternative Investment Fund Management

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are revolutionizing the decision-making process for portfolio managers and investment analysts.

Predictive Analytics: AI models analyze historical data to predict market trends and asset performance.

Sentiment Analysis: ML algorithms evaluate market sentiment by analyzing news, social media, and economic indicators.

Risk Assessment: AI-driven models provide dynamic risk profiling for portfolios, enabling better mitigation strategies.

For example, hedge fund managers are leveraging AI to refine trading algorithms, optimize asset allocation, and reduce human bias in decision-making.

Big Data Analytics

The alternative investment industry generates massive amounts of data, from transaction records to market analysis reports. Big data technologies allow portfolio managers to:

Aggregate Data Seamlessly: Combine data from various sources for a unified view.

Gain Real-Time Insights: Monitor portfolio performance and market trends as they happen.

Enhance Decision-Making: Use analytics to identify lucrative opportunities and emerging risks.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain is creating a secure, transparent, and efficient environment for alternative investment fund management.

Smart Contracts: Automate administrative tasks such as fee calculations and compliance reporting.

Enhanced Security: Protect sensitive transaction data from fraud and cyberattacks.

Improved Transparency: Provide investors with immutable records of fund transactions and performance.

Private equity and venture capital funds are increasingly adopting blockchain to streamline fundraising, track ownership, and ensure regulatory compliance.

Cloud Computing

Cloud computing provides scalable and cost-effective solutions for fund administrators and portfolio managers.

Data Storage and Access: Securely store and access vast amounts of data from anywhere in the world.

Collaborative Tools: Enable seamless communication between stakeholders across geographies.

Cost Efficiency: Reduce the need for expensive on-premises infrastructure.

Cloud-based platforms are becoming indispensable in managing alternative investments.

Robotic Process Automation (RPA)

RPA automates repetitive tasks, freeing up time for fund managers to focus on strategic decisions.

Transaction Processing: Handle large volumes of transactions with speed and accuracy.

Compliance Monitoring: Automatically generate and file compliance reports.

Client Reporting: Create personalized performance reports for investors.

The adoption of RPA is growing in hedge funds and private equity, where operational efficiency is paramount.

Cybersecurity Tools

With increased reliance on digital platforms comes the need for robust cybersecurity measures. Fund managers are implementing tools to:

Protect Sensitive Data: Encrypt investor information and financial records.

Prevent Cyberattacks: Detect and respond to threats in real-time.

Ensure Compliance: Adhere to regulatory requirements for data protection.

Sophisticated cybersecurity solutions are essential to maintaining trust in the digital era.

The Role of Portfolio Managers in a Tech-Driven Landscape

Evolving Responsibilities

As technology automates routine tasks, portfolio managers are taking on more strategic roles:

Data Interpretation: Analysing outputs from AI models and analytics tools.

Client Engagement: Providing personalized investment strategies and transparent reporting.

Innovation Adoption: Identifying and implementing technologies that align with fund objectives.

Collaboration with Technology Providers

Portfolio managers are increasingly collaborating with fintech companies to co-develop customized solutions. This partnership ensures that technology tools address specific challenges in alternative investment management.

Benefits of Technology in Alternative Investment Management

Increased Efficiency: Automation reduces manual errors and accelerates processes.

Enhanced Decision-Making: Advanced analytics and AI provide actionable insights.

Improved Compliance: Automated monitoring ensures adherence to regulations.

Better Risk Management: Sophisticated tools enable dynamic risk assessment.

Superior Client Experience: Real-time reporting and personalized strategies build investor trust.

Future Trends in Alternative Investment Fund Management

ESG Integration

Technology is facilitating the integration of environmental, social, and governance (ESG) factors into investment strategies. AI-powered tools evaluate ESG metrics, enabling fund managers to make sustainable investment decisions.

Tokenization of Assets

Blockchain-based tokenization is democratizing access to alternative investments. By dividing assets into digital tokens, fund managers can attract a broader investor base while enhancing liquidity.

Hybrid Human-Tech Models

The future of alternative investment management lies in combining human expertise with technological capabilities. This hybrid approach ensures that the emotional intelligence of portfolio managers complements the computational power of machines.

Key Considerations for Adopting Technology

Customization

Not all technologies suit every fund. Portfolio managers must assess their unique needs and select tools accordingly.

Training and Development

Technology adoption requires upskilling teams. Fund managers should invest in training programs to ensure smooth transitions.

Scalability

As funds grow, so do their technological requirements. Scalable solutions are crucial for long-term success.

Rewind-Up

Technology is transforming the alternative investment fund management industry, providing solutions to long-standing challenges while creating new avenues for growth. With innovations such as AI-driven insights and blockchain-enhanced transparency, portfolio managers are now equipped with essential tools to thrive in a more complex market.

As the industry continues to advance, fund managers who adopt technology will be in a stronger position to deliver exceptional results, attract investors, and maintain a competitive advantage. The future of alternative investment management is digital, and the time to adapt is now.

By staying updated on the latest developments and utilizing them effectively, alternative investment fund managers can navigate obstacles, capitalize on opportunities, and achieve sustainable growth.

#cart#fintech#account aggregator#bfsi#myconcall#novel patterns#finance#wealth management#credit underwriting#genesis#asset management#saas#investment management#portfolio#portfolio management#hedge fund#mutual fund#mutual funds#venture capital#private equity#alternative investment fund

0 notes

Text

Navigating the Landscape of Private Equity and Venture Capital: Strategies for Startups and Investors

Private equity and venture capital are not unfamiliar to professionals in the financial advisory and wealth management world. Those investments let startups and established private companies get help from investors searching for high growth and returns. Both private equity (PE) and venture capital or VC focus on companies across all stages of development. Still, their strategies, structures, risk-reward combinations, goals, and suitability are remarkably different.

This post will explore private equity and venture capital strategies for investors and startups so as to empower them to maximize success. These strategies let investors improve startup discovery and ownership dynamics. Likewise, they boost the growth potential a startup might realize in some years based on mentorship by venture capitalists.

Private Equity Strategies for Investors and Startups

Private equity firms focus predominantly on already well-recognized and systematically developed businesses. Their scope extends to multiple strategies that focus on value creation or business enrichment after each deal closes.

Several private equity strategies share a few commonalities, viz., operational efficiency metrics, cost-cutting measures, and strategic growth initiatives. Among the most prominent strategies in private equity outsourcing, the following ones are worth referencing. Additionally, you must take into account the appropriateness of these strategies for startups that want to raise PE funding.

PE Investment Strategy 1: Leveraged Buy-Ins (LBOs)

The most common private equity strategy is the LBO. A leveraged buyout is essentially the private equity firm buying a majority interest in the company. In this case, the PE professionals will finance much of the purchase through the use of high amounts of debt. Financing for the acquisition may then be provided using the firm's assets and cash flows.

Strategy for Investors

The PE investors target those companies that have stable cash flows. In other words, they must be confident that the target businesses' growth potential is feasible. Furthermore, they want to minimize the equity demanded initially by leveraged finance mechanisms.

This approach increases the potential return on equity. Accordingly, investment research services can streamline the required company screening and risk-reward assessments. Following the acquisition, PE firms focus on profitability optimization. To this end, they will likely seek improvements in operations. At the same time, management restructuring and financial adjustments will occur at the acquired company.

Strategy for Startups

LBOs are generally found more often in developed companies. Nevertheless, imagine a startup has entered the growth phase with sound and well-predictable cash flows. This situation makes the private equity route available for fundraising.

That being said, the following note of caution might be necessary.

Before joining hands with private equity, all startups must be ready for changes in ownership and how they lead operations.

PE Investment Strategy 2: Growth Equity

Growth equity is a category of private equity that invests in growing companies that still require capital to achieve growth goals. Unlike LBOs, growth equity investments are not heavy in leverage. It is no wonder that, typically, they are minority investments.

Strategy for Investors

Growth equity investors focus on proven business models requiring capital to scale in one of three major areas. Those business aspects are market share, production, and strategic mergers and acquisitions (M&A). Accordingly, investors provide capital, along with strategic advice. These proactive support activities will guide the company through its growth cycle and toward profitability.

Strategy for Startups

Growth equity is best for startup companies that have gained substantial traction. These startups are willing to scale. Simultaneously, they do not want to give up all control of the company. Growth equity is something for which startups can be rewarded in more than one way.

After all, the investor will have expertise in scaling operations. Each investor will, therefore, become a good partner to share entrepreneurs' long-term vision.

Private Equity Investment: Exit Strategies

Private equity firms generally have short or medium-term investment horizons. It is the norm that most PE stakeholders have the intention to exit the investment after 3 to 7 years per business engagement. Some of the commonly practiced exit strategies are given below.

Option I

The exit can be extremely lucrative and attractive should market conditions permit the company to be taken public. Initial public offerings (IPOs) would help here.

Option II

Selling the company to another company or a strategic buyer in the same industry is a very common way of exit.

Option III

Selling the company to another private equity firm via a secondary buyout is also another potential exit. However, the first PE firm that wants to sell the business must have effectively improved its performance.

Venture Capital Strategies for Investors and Startups

Venture capital is among the popular sources of financing that lots of startups are finding helpful. Entrepreneurs in high-growth industries like technology, biotechnology, and clean energy especially seek VCs' help. Typically, VC firms adopt a long-term approach to growth. They work with their startup partners to achieve their goals.

VC Investment Strategy 1: Seed and Early-Stage Funding

Seed funding is often the first stage of institutionalized financing for a startup. It lets stakeholders make sure that the business model and venture idea are feasible. They might want the startup to create the initial prototypes of a product.

Doing so allows the venture to go into the market and capture actual demand or customer satisfaction (CSAT) data. Early-stage funding, such as series A and B funding, should help a startup scale its operations and expand its market outreach.

Strategy for Investors

The venture capitalists are looking for unique concepts that can be impactful and exponentially scalable industry disruptors. Being early movers can translate to exceptional rewards if the venture succeeds in scaling.

They invest in startups with strong founding teams. These startups must embrace a distinct value proposition and a scalable business model. Venture capitalists are known to actively assist the startup in its own product development. They can guide entrepreneurs throughout the refinement of the go-to-market strategy. Besides, most VC stakeholders have solid connections with domain or subject matter experts (SMEs). So, they assist startups in instituting key partnerships within the target industry.

Strategy for Startups

Startups that are focused on seed or early-stage funding need to work on the development of a business model. Once they have demonstrated some reasonable traction across product development, acquisition of customers, or first-phase revenue, it is time to find more vibrant capital and knowledge exchange partners.

Startup founders must be prepared for an extended period of relationship with VC investors. They must recognize that these supporters or mentors are going to play an integral part in key decision-making events during the startup's journey.

VC Investment Strategy 2: Late-Stage Funding

As the startups are expanding, they require more funding to expand. Otherwise, they will encounter multiple obstacles when trying to seek new markets.

For example, they might struggle to develop new products or overcome regulatory, supply-related, and global geopolitical pressures due to funding constraints. For such purposes, a later series of fundraising is considered. That is what "late-stage funding" or series C often indicates.

Strategy for Investors

VCs in late-stage rounds require businesses that have thoroughly tested their business models. These companies must have generated substantial revenue. As a result, their performance will eliminate all doubts about whether it is heading toward profitability. These investors extend a hand of capital assistance. Their support enables fast scale-up business development for early-stage startups. Eventually, these startups will be ready for an IPO or acquisition deal.

Strategy for Startups

Late-stage funding means you can quickly scale and even become a market leader. However, it also means that investors will magnify each performance report. They want to get a closer look at your fundamentals. They will look for a straightforward path to profitability and inspect opportunities for a viable exit strategy after business value enrichment.

Venture Capital Investment: Exit Strategies

VC firms, like PE firms, typically have a short investment horizon. They often wish to exit their investments in 5-10 years. Venture capital commonly has the following exit options.

Option I

Many VCs target an IPO. They believe it can generate the highest returns. Therefore, startups will be required to have excellent financials. Besides, having a strong growth trajectory and market readiness to go public are not to be neglected.

Option II

Many startups are acquired by other larger entities. These commercial organizations are in the pursuit of expanding their capabilities. Their leaders might want to enter new markets or reduce competition. That is why this option provides an attractive exit. It can indeed be a huge win-win for all parties involved based on the vision alignment of startups and venture capitalists.

Option III

The VCs may sell out their shares. In short, other investors on the secondary market will make more liquidity available. Consequently, having to list on the stock market is more of a non-issue.

Why Do Different Investment Strategies Matter to Private Equity and Venture Capital?

Private equity and venture capital offer specific opportunities both for the investors and for the startups. Each of them has a different strategy. Both differ across the target company's growth stage, scalability, and profitability.

PE investments center on established businesses. Moreover, they make use of leveraged buyouts (LBOs) and growth equity to maximize returns. These measures are quintessential to improving the operational function of a company.

VCs invest in early-stage startups. They often start by offering capital as well as strategic guidance. Their proactive involvement helps ensure the startups' rapid expansion.

The Bottom Line

The above points offer only a summary of how PE differs from VC. That is why comprehensively understanding the difference will guide the startup or a company owners' group when choosing one type of funding suitable for their goals.

Private equity and venture capital strategies help investors and startups witness high growth. However, depending on the business model or industry, impactful operational improvement could take shorter or longer stakeholder engagement. No wonder determining whether their business stage is suitable for those processes is vital. It can be done by identifying the startups' market feasibility and finding the right investor profile that can best suit their journey.

With adequate strategic investment research, startups, as well as investors, will achieve maximum value creation for the best possible mutually beneficial outcomes.

0 notes

Text

Deep Tech Investors India | Seafund Portfolio: Clootrack

Seafund connects deep tech investors with innovative opportunities for strategic growth in India's dynamic tech landscape. Clootrack is an intelligent customer experience analytics platform for enterprises and high-stakes decision-makers.

Our powerful AI-driven engine gathers and analyzes billions of customer reviews to help you understand why your customer experience drops. All in real-time

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#private equity venture capital#capital venture investors

0 notes

Text

Navigating Success: The Role of Venture Capital Deal Flow Management Software

In the fast-paced world of venture capital (VC), effectively managing deal flow is critical for success. Deal flow refers to the rate at which investment opportunities come to a firm, and managing this flow efficiently can significantly impact a firm’s ability to identify and secure promising investments. Venture capital deal flow management software has emerged as a vital tool for firms looking to streamline their processes, enhance decision-making, and ultimately achieve better investment outcomes.

Understanding Deal Flow Management

Deal flow management involves tracking, analyzing, and optimizing the investment opportunities that come to a venture capital firm. It encompasses everything from sourcing potential deals to evaluating them, negotiating terms, and finally, closing investments. Properly managing this flow is essential, as it enables firms to quickly respond to opportunities, conduct thorough due diligence, and maintain a competitive edge in the market.

The Importance of Deal Flow Management Software

Venture capital deal flow management software is designed to help firms streamline their deal sourcing and evaluation processes. Here are several reasons why this software has become indispensable:

1. Centralized Data Management

One of the primary benefits of deal flow management software is centralized data management. This software allows firms to store all relevant information about potential investments in one accessible location. This centralization includes details about startups, founders, financials, and communications, enabling team members to collaborate effectively and make informed decisions.

2. Enhanced Tracking and Organization

With numerous deals being evaluated simultaneously, keeping track of each opportunity can be overwhelming. Deal flow management software provides tools for organizing deals by various criteria such as industry, stage of development, and funding requirements. This organization allows firms to prioritize opportunities, ensuring that high-potential deals receive the attention they deserve.

3. Streamlined Communication

Effective communication is crucial in venture capital, where timely discussions can make or break a deal. Deal flow management software facilitates seamless communication among team members and external stakeholders. Features such as comments, notifications, and integrated email systems keep everyone informed and engaged throughout the investment process.

4. Improved Analytics and Reporting

Data-driven decision-making is essential in venture capital. Deal flow management software typically includes analytics tools that allow firms to assess the performance of their deal flow over time. By analyzing historical data, firms can identify trends, measure success rates, and refine their investment strategies. Customizable reporting features also enable firms to present insights to stakeholders in a clear and concise manner.

5. Enhanced Due Diligence

Due diligence is a critical aspect of the investment process, requiring extensive research and analysis. Deal flow management software can streamline this process by providing templates, checklists, and integrated research tools. This automation reduces the time spent on due diligence, allowing teams to focus on higher-value tasks and make faster, more informed decisions.

6. Integration with Other Tools

Most venture capital firms utilize various software solutions for accounting, customer relationship management (CRM), and project management. Deal flow management software often integrates seamlessly with these tools, ensuring a smooth workflow across different platforms. This integration reduces manual data entry and enhances overall efficiency.

Key Features to Look for in Deal Flow Management Software

When selecting a deal flow management software solution, venture capital firms should consider several key features:

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that all team members can navigate the software easily. A well-designed platform minimizes the learning curve and encourages team adoption.

2. Customization Options

Every venture capital firm has unique needs and processes. Look for software that offers customization options, allowing you to tailor workflows, reports, and data fields to match your firm’s specific requirements.

3. Mobile Access

In today’s mobile-centric world, having access to deal flow management software on-the-go is crucial. Look for solutions that offer mobile access, enabling team members to review opportunities and communicate while away from the office.

4. Security Features

Given the sensitive nature of investment data, robust security features are a must. Ensure that the software includes encryption, user authentication, and data backup options to protect your firm’s information.

5. Customer Support and Training

Transitioning to a new software solution can be challenging. Choose a provider that offers comprehensive customer support and training resources to help your team adapt quickly and effectively.

The Future of Venture Capital Deal Flow Management Software

As technology continues to evolve, the capabilities of venture capital deal flow management software are expected to expand further. Artificial intelligence (AI) and machine learning are likely to play increasingly important roles, allowing firms to analyze vast amounts of data and identify promising investment opportunities more efficiently.

Additionally, as remote work becomes more common, the demand for software that supports virtual collaboration will continue to grow. Solutions that incorporate advanced communication and project management tools will be essential for teams working in distributed environments.

Conclusion

Venture capital deal flow management software is no longer just a nice-to-have; it’s a necessity for firms looking to thrive in a competitive landscape. By centralizing data, streamlining processes, and providing valuable insights, this software enables venture capitalists to make more informed investment decisions and manage their portfolios effectively.

As the investment landscape continues to evolve, adopting the right deal flow management software can help firms stay ahead of the curve, maximize their opportunities, and drive long-term success. Whether you’re a seasoned investor or just starting in the venture capital world, leveraging technology to enhance your deal flow management will be a game changer.

Ready to streamline your venture capital deal flow management? Fundwave, offers cutting-edge software designed to centralize data, enhance collaboration, and improve decision-making for your investment team. Don’t let opportunities slip through the cracks—contact Fundwave today to schedule a demo and discover how Fundwave can transform your investment strategy!

Connect with Fundwave on Facebook for more information.

0 notes

Text

The speed to market and unfinished product development is driven by investor demands for high rate of return in a short period of time required by Private Equity source of funds.

#vital information exchange#vital community#vitalportal#thevitalportal#additional information#vital media#blacklivesmatter#vital politics#blacktwitter#myvitaltv#private equity#venture capital

0 notes

Text

The Strategic Role of Sell-Side Research in Investment Banking

#magistralconsulting#outsourcing services#buy side research#venture capital#private equity#investment banking#financialservices

0 notes

Text

Is Venture Capital Right for You? A Mid-Career Professional's Guide

The world of Venture Capital (VC) is fast paced, so making a mid-career switch can be challenging. If you are a person with the prospect of fostering innovation and want to invest in the future, then a career in VC can present a remarkable private equity career path. However, switching to venture capital requires careful consideration and strategic planning.

This blog post highlights the critical factors you need to consider while entering the private equity industry. Conducting a comprehensive evaluation can help you make a precise decision that aligns with your professional aspirations and personal goals.

Venture Capital Landscape: What you need to know?

Venture capital firms are involved in both risk and reward business. They invest in high-potential startups with the firm hope of significant future payouts. However, making a successful investment decision involves various factors:

Knowledge of the market

Strong networking skills

Ability to predict trends

Identify growth potential

Therefore, before you make a move, ensure to do thorough research on the industry. This will help you understand various perspectives like how venture funds operate, their investment strategies, and the latest industry trends. Another important factor is identifying your niche. As mentioned earlier, the world of Venture capital is vast. Hence, focus on the areas where your experience and interests align with market needs.

Key Evaluation Factors for Mid-Career Transitions into Venture Capital

Here's a more detailed version that includes key evaluation factors. These factors can help guide your transition into venture capital, ensuring a thorough assessment of your readiness and fit for this dynamic and challenging field.

Make a Complete Assessment of Your Transferable Skills

Mid-career professionals often have a wealth of experience and skills incredibly valued in VC. Ensure to evaluate your strengths on the below measures:

Strategic Thinking: It is the ability to predict investments 'big picture' and long-term potential.

Analytical Skills: It demonstrates proficiency in evaluating potential investments' financial health and growth metrics.

Negotiation and Persuasion: It involves expertise in closing deals and influencing others.

Industry Expertise: Shows your level of understanding about specific sectors or markets that can be a game-changer.

Therefore, it becomes crucial to reflect on your previous roles and consider how your experience can benefit a VC firm. Can your technology, healthcare, or finance background provide you with an edge?

Training and Education

There is no pre-defined educational qualification for venture capitalists, but certain qualifications can help you understand the industry better. Obtaining a master's degree helps in entering VC. Courses with a focus on entrepreneurship or finance are especially highly valuable. You may also consider enrolling in special Venture Capital Executive Programs that are designed to teach venture funding principles and processes. You can also obtain a private equity certificate to gain more knowledge.

Networking and Brand Building

When it comes to the private equity industry, your ability to network becomes your net worth. Hence, you should develop the ability to build robust relationships within the startup ecosystem and among other investors.

Attend Industry Events: Enroll in conferences/seminars or other business events, making it a prime networking opportunity.

Build Online Presence: Start contributing to discussions on platforms like LinkedIn. This helps to establish thought leadership.

Connect with VC Firms: You can contact Venture Capitalists for informational interviews and insights.

The Long-term Play

Venture Capital is not a get-rich-quick career. You should understand that it is an investment that can take years before yielding returns. Also, remember that the work often involves nurturing startups through ups and downs. Another important aspect is the financial consideration. Unlike some mid-career roles, VC positions may start with lower compensation packages, banking on long-term performance incentives.

Considering Cultural Fit and Work Environment

VC firms have distinct cultures, from corporate to startup-like environments. Often, the size and reputation of the firm can greatly impact your role and work style. So, consider the work environment and choose a firm whose values resonate with your personal beliefs and professional ethics.

Wrapping Up

Transitioning the mid-career into venture capital is an enlivening prospect filled with potential growth. You can witness enormous growth by thoroughly evaluating the industry landscape and aligning your skillset with VC demands. Remember, you can have a successful career by committing to continuous learning and recognizing the importance of networking and culture fit.

Choosing to step into the private equity career path is more than a career change. It's a commitment to fostering innovation and shaping the future. If you are ready for the challenge, then the opportunities in venture capital can be exceptionally rewarding.

0 notes

Text

XPRIZE and IMAGINE Accelerate Global Innovation and Impact with Strategic Partnership

IMAGINE Grants XPRIZE a 1% Equity Stake as Founder Ani Chahal Honan Joins XPRIZE’s Board of Trustees XPRIZE CEO Anousheh Ansari and IMAGINE Founder Ani Chahal Honan unveil their partnership on stage during XPRIZE’s 30th Anniversary Visioneering event in Los Angeles (photo credit: XPRIZE Foundation) Press Release – December 10, 2024- LOS ANGELES – IMAGINE, an ecosystem supporting impact-driven…

#AI#Artificial Intelligence#Impact#Impact investments#Investment#Investment Management#Private Equity#Venture Capital

0 notes