#venture india

Explore tagged Tumblr posts

Text

Fireside Ventures Team: Diverse Experts Driving Purposeful B2C Brands

Meet the dynamic team behind Fireside Ventures, a leading venture capital firm dedicated to nurturing purpose-driven B2C brands in India. With a mission to enhance consumer experiences and create meaningful societal impact, Fireside Ventures is at the forefront of supporting innovative ventures.

About Fireside Ventures

Fireside Ventures is a visionary venture capital firm that is reshaping the consumer landscape in India. By identifying and supporting purpose-driven B2C brands, Fireside Ventures is not only investing in businesses but also in the betterment of society.

Nurturing Purpose-Driven Brands

Fireside Ventures has carved a niche as d2c investors in India, recognizing the potential of brands that are not only commercially viable but also aligned with a larger societal purpose. By investing in these brands, Fireside Ventures is facilitating a positive shift in consumer experiences.

Expertise in Consumer-Focused Ventures

With a deep understanding of the consumer market, Fireside Ventures is one of the premier consumer venture capital funds in India. The team's expertise lies in identifying brands that resonate with consumers and have the potential to make a significant impact on the market.

Rooted in Bangalore, Impacting India

Based in Bangalore, the heart of India's startup ecosystem, Fireside Ventures is at the epicenter of innovation. The venture capitalist team at Fireside Ventures is dedicated to identifying and nurturing ventures across India, contributing to the growth of the startup ecosystem.

Investing in Visionaries

Fireside Ventures is more than just a venture capital firm; it's a partner to visionaries and innovators. The team understands the unique challenges faced by entrepreneurs and provides not just financial support, but also mentorship and guidance.

Driving Societal Impact through Ventures

Fireside Ventures believes in the power of businesses to drive positive change in society. By supporting purpose-driven ventures, Fireside Ventures is not only creating successful brands but also contributing to a more conscious and impactful consumer culture.

Collaborative Ventures, Collective Impact

Through strategic collaborations and investments, Fireside Ventures is fostering a community of ventures that collectively contribute to a better consumer experience and a more impactful society. The team at Fireside Ventures understands that true change comes through collective effort. Fireside Ventures and its diverse team of experts are at the forefront of the venture capital landscape in India. By investing in purpose-driven B2C brands, Fireside Ventures is not only shaping the consumer market but also making a tangible impact on society. With their deep expertise and collaborative approach, Fireside Ventures is set to lead the way in driving meaningful change through ventures in India.

#d2c investors india#consumer vc funds#venture capital bangalore#venture india#ventures in india#venture capitalist bangalore#ventures india#consumer venture capital funds#venture companies in india

2 notes

·

View notes

Text

What are the best business ideas for a small city according to India?

There are millions of ideas even for a small city in India. One of my students has recently published a Worth to Apply book on this subject: Innovative Indian Venture.

This Book Innovative Indian Ventures compiles 30 innovative business ideas, each of which is designed to provide fresh perspectives on how modern-day entrepreneurs can leverage India's vast cultural and economic landscape.

From reviving traditional games to creating virtual experiences, these ideas are bound to inspire individuals seeking to combine their entrepreneurial spirit with a deep respect for India's heritage.

2 notes

·

View notes

Text

Investment Options in India: Diversify Your Portfolio in 2024

Diversification is a fundamental principle of investing, essential for managing risk and optimizing returns. In 2024, as investors navigate an ever-changing economic landscape, diversifying their portfolios becomes even more critical. India, with its vibrant economy, diverse markets, and growth potential, offers a plethora of investment options for both domestic and international investors. In this comprehensive guide, we explore various investment avenues in India in 2024, from traditional options like stocks and real estate to emerging opportunities in startups and alternative assets.

1. Equities: Investing in the Stock Market

Investing in equities remains one of the most popular ways to participate in India's economic growth story. The Indian stock market, represented by indices such as the Nifty 50 and Sensex, offers ample opportunities for investors to capitalize on the country's booming sectors and emerging companies.

- Blue-Chip Stocks: Invest in established companies with a proven track record of performance and stability.

- Mid and Small-Cap Stocks: Explore growth opportunities by investing in mid and small-cap companies with high growth potential.

- Sectoral Funds: Diversify your portfolio by investing in sector-specific mutual funds or exchange-traded funds (ETFs) targeting industries such as technology, healthcare, and finance.

2. Mutual Funds: Professional Fund Management

Mutual funds provide an excellent avenue for investors to access a diversified portfolio managed by professional fund managers. In India, mutual funds offer a range of options catering to different risk profiles and investment objectives.

- Equity Funds: Invest in a diversified portfolio of stocks, including large-cap, mid-cap, and small-cap companies.

- Debt Funds: Generate stable returns by investing in fixed-income securities such as government bonds, corporate bonds, and treasury bills.

- Hybrid Funds: Combine the benefits of equity and debt investments to achieve a balanced risk-return profile.

- Index Funds and ETFs: Track benchmark indices like the Nifty 50 and Sensex at a lower cost compared to actively managed funds.

3. Real Estate: Tangible Assets for Long-Term Growth

Real estate continues to be a popular investment option in India, offering the dual benefits of capital appreciation and rental income. While traditional residential and commercial properties remain attractive, investors can also explore alternative avenues such as real estate investment trusts (REITs) and real estate crowdfunding platforms.

- Residential Properties: Invest in apartments, villas, or plots of land in prime locations with high demand and potential for appreciation.

- Commercial Properties: Generate rental income by investing in office spaces, retail outlets, warehouses, and industrial properties.

- REITs: Gain exposure to a diversified portfolio of income-generating real estate assets without the hassle of direct ownership.

- Real Estate Crowdfunding: Participate in real estate projects through online platforms, pooling funds with other investors to access lucrative opportunities.

4. Startups and Venture Capital: Betting on Innovation and Entrepreneurship

India's startup ecosystem has witnessed exponential growth in recent years, fueled by a wave of innovation, entrepreneurial talent, and supportive government policies. Investing in startups and venture capital funds allows investors to participate in this dynamic ecosystem and potentially earn high returns.

- Angel Investing: Provide early-stage funding to promising startups in exchange for equity ownership, betting on their growth potential.

- Venture Capital Funds: Invest in professionally managed funds that provide capital to startups and emerging companies in exchange for equity stakes.

- Startup Accelerators and Incubators: Partner with organizations that support early-stage startups through mentorship, networking, and access to resources.

5. Alternative Assets: Diversification Beyond Traditional Investments

In addition to stocks, bonds, and real estate, investors can diversify their portfolios further by allocating capital to alternative assets. These assets offer unique risk-return profiles and can act as a hedge against market volatility.

- Gold and Precious Metals: Hedge against inflation and currency fluctuations by investing in physical gold, gold ETFs, or gold savings funds.

- Commodities: Gain exposure to commodities such as crude oil, natural gas, metals, and agricultural products through commodity futures and exchange-traded funds.

- Cryptocurrencies: Explore the emerging asset class of digital currencies like Bitcoin, Ethereum, and others, which offer the potential for high returns but come with higher volatility and risk.

Conclusion

Diversifying your investment portfolio is essential for mitigating risk, maximizing returns, and achieving long-term financial goals. In 2024, India offers a myriad of investment options across various asset classes, catering to the preferences and risk profiles of different investors.

Whether you prefer the stability of blue-chip stocks, the growth potential of startups, or the tangible assets of real estate, India provides ample opportunities to diversify your portfolio and capitalize on the country's economic growth story. By carefully assessing your investment objectives, risk tolerance, and time horizon, you can construct a well-diversified portfolio that withstands market fluctuations and delivers sustainable returns in the years to come.

This post was originally published on: Foxnangel

#best investment options in india#diversify portfolio#share market#stock market#indian stock market#mutual funds#real estate#startups in india#venture capital#foxnangel#invest in india

4 notes

·

View notes

Text

Top investors in space in India

Why Venture Capitalists Are Betting Big on India’s Space Sector

A Thriving Ecosystem of Space Startups: India’s space ecosystem is no longer limited to government-run entities like the Indian Space Research Organisation (ISRO). Today, a surge of innovative space startups are taking the stage, offering cutting-edge solutions in satellite technology, launch services, space data analytics, and more. Companies like Skyroot Aerospace, Agnikul Cosmos, and Pixxel lead the charge, each carving out a unique niche. These startups are pushing the boundaries of what’s possible, driving investor interest with the potential for high returns in a relatively untapped market.

Strong Government Support and Policy Reforms: One of the key reasons behind the surge in space venture capital in India is the proactive stance taken by the Indian government. Recent policy reforms have opened the doors for private players to participate in space activities, previously dominated by ISRO. Establishing IN-SPACe (Indian National Space Promotion and Authorization Center) is a significant step, providing a regulatory framework that encourages private sector involvement. Such government support has given investors in space in India the confidence to back ambitious projects, knowing there’s a clear path for private ventures.

Cost-Effective Innovation as a Competitive Edge: India’s reputation for cost-effective innovation is another major attraction for investors. Launching satellites at a fraction of the cost compared to global competitors has positioned India as a hub for affordable space technology. This competitive edge not only allows Indian space startups to thrive domestically but also makes them attractive on the international stage. Investors are keen to support companies that can deliver world-class technology with lower capital outlays, reducing investment risks while promising impressive returns.

Global Interest in Indian Talent and Expertise: India’s space sector is not just about affordability; it’s about world-class talent. The country boasts a deep pool of highly skilled engineers, scientists, and entrepreneurs with expertise in aerospace and technology. This talent pool has been instrumental in driving innovation and attracting global attention. International investors are increasingly looking to partner with Indian space startups, recognizing the country’s unique blend of technical prowess and entrepreneurial spirit.

A Growing Market for Space-Based Services: The market for space-based services, including satellite communications, Earth observation, and data analytics, is expanding rapidly. In India, this growth is driven by rising demand from industries such as agriculture, telecommunications, logistics, and defense. With space technology playing a crucial role in optimizing these sectors, investors see an opportunity to capitalize on the potential for domestic and international applications. Space-based services represent a lucrative market, attracting space venture capital in India to back startups that can cater to these needs.

Strategic Partnerships and Collaborations: Indian space startups are not working in isolation; they are forming strategic partnerships with global companies and space agencies. Collaborations with NASA, ESA (European Space Agency), and private companies have opened up new opportunities for technology sharing, funding, and market access. These partnerships have also strengthened investor confidence, as they reduce risks and validate the technology being developed by Indian companies. For investors in space in India, such collaborations signal a promising future, driving more venture capital into the sector.

A New Era of Commercial Space Exploration: The idea of commercial space exploration, once confined to science fiction, is now becoming a reality. From reusable rockets to satellite constellations, Indian space startups are exploring new frontiers that were once considered out of reach. This new era of commercial space exploration has piqued the interest of venture capitalists who see the potential for profitable exits through IPOs, acquisitions, and global partnerships. With private space missions no longer just a dream, space venture capital in India is ready to fuel the next big leap.

Encouraging Signs from Successful Fundraising Rounds: The confidence in India’s space sector is evident from the successful fundraising rounds by leading space startups. Companies like Skyroot Aerospace and Agnikul Cosmos have secured millions in funding from top-tier venture capital firms. These funding rounds not only provide the necessary resources for scaling but also act as a signal to other investors that the Indian space market is mature and ready for high-stakes investment. The momentum created by these early successes is a clear indicator of why investors in space in India are increasingly willing to place their bets.

Conclusion: A Promising Orbit for Investment India’s space sector is on an exciting trajectory. With a favorable policy environment, a surge of innovative startups, and a proven track record of cost-effective solutions, it’s no wonder that space venture capital in India is booming. As the country continues to explore new frontiers and expand its role in global space exploration, venture capitalists are set to play a pivotal role in shaping the future. For those looking to invest in the final frontier, India’s space industry presents a unique opportunity to be part of a revolution that’s only just beginning.

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

5 Ring Road, Lajpat Nagar 4, 3rd Floor, New Delhi-110024

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india#business investors in kerala#venture capital company#semiconductor startups#semiconductor venture capital#investors in semiconductors#startup seed funding in India#deep tech venture capital#deeptech startups in india#semiconductor companies in india#saas angel investors#saas venture capital firms#saas venture capital#b2b venture capital#space venture capital in india

2 notes

·

View notes

Note

Random fact that I love about Gladiator: It is one of the first films settled in that period I remember that has scenes in the cold.

It's such specific fact, but you rarely see winter in swords and sandals films. Looking at that picture you reblogged of Maximus with the fur and I realized most films settled in ancient greece or rome are like touristical promo showcasing beaches, for some reason characters are always in spring or summer. I have rarely seen greek or roman period costumes for the cold weather on movies.

Of course, this has to be with the fact that the movie starts at the end of Maximus' campaing in the north, but is a very refreshing visual.

Oh that’s such an interesting observation! You’re right — other than Viking / Celtic epic movies, we don’t really see winter scenes in period epics. It really makes the rawness of the opening battle more interesting and striking! Also ignites my brain on ways to stay warm with my favorite general 👀

#i wonder if this is because people associate greece and italy with vacation in the modern era#and filmmakers rarely have the characters venture outside those countries#unless it’s to an equally hot place like egypt or india lol#but i love the brutality of germania to contrast with the warmth of zucchabar and rome#i wonder if maximus ever felt the cold#he looks like such a space heater#i fantasize about this constantly#as a person who’s too small to stay warm during the winter i need someone like him to keep me warm#warm me up maximus in whatever way you please#anyway#yes! i love this observation!#opening scenes of gladiator are among my favorites in the whole movie#thank you for sharing this :)#my asks#gladiator

5 notes

·

View notes

Text

Equity vs. Contractual Joint Ventures: Understanding the Legal Differences

When businesses collaborate to achieve common goals, joint ventures (JVs) often come into play. However, not all joint ventures are structured the same way. Broadly, joint ventures can be divided into two primary types: equity joint ventures and contractual joint ventures. Understanding the key differences between these structures is crucial for businesses to determine which model best aligns with their objectives, legal requirements, and financial resources.

At LawChef, we specialize in providing expert legal services for joint ventures. Our team of lawyers for joint venture in Delhi, corporate lawyers in Noida, and joint venture law firm in Delhi helps businesses navigate the complexities of joint venture agreements, ensuring that the terms and structures are aligned with your goals. In this blog, we’ll explore the legal distinctions between equity and contractual joint ventures, helping you make an informed decision for your business partnership.

What is a Joint Venture?

A joint venture is a strategic partnership where two or more businesses come together to work on a specific project or business activity. While the goal of a JV is to combine resources and expertise for mutual benefit, the structure of the venture can vary depending on how the parties wish to collaborate. These structures are typically categorized into equity joint ventures and contractual joint ventures.

1. Equity Joint Ventures: Definition and Legal Structure

An equity joint venture (EJV) involves the creation of a separate legal entity, typically a new company, that is jointly owned and operated by the business partners. The partners contribute capital, assets, or other resources to the new entity and share in the ownership, profits, and losses based on their equity stake.

Key Features of Equity Joint Ventures:

New Entity Creation: The joint venture partners create a new legal entity, often in the form of a limited liability company (LLC) or corporation.

Ownership Stake: Each partner holds a specific equity stake in the JV, which represents their ownership share and entitlement to profits.

Limited Liability: As with any corporation or LLC, the liability of the partners is typically limited to their investment in the JV.

Governance: The management and operations of the JV are governed by the shareholders or members based on their ownership interest.

Long-Term Commitment: EJVs are generally designed for long-term business ventures, often lasting for the duration of a project or an ongoing partnership.

Legal Considerations for Equity Joint Ventures:

Equity joint ventures require careful legal planning and structuring. A joint venture contract lawyer will draft the JV agreement, which should outline the following key legal elements:

Contributions and ownership percentages of each partner

The governance structure and decision-making process

Profit and loss distribution

Exit strategies and dissolution procedures

Dispute resolution mechanisms

At LawChef, our team of corporate lawyers in Noida is experienced in advising on and drafting equity joint venture agreements that protect the interests of all parties involved.

2. Contractual Joint Ventures: Definition and Legal Structure

A contractual joint venture (CJV), on the other hand, is based on a legal agreement rather than the creation of a separate entity. In this structure, the partners work together on a specific project or business activity under the terms of a contract, without forming a new company. The partners remain separate entities but agree to pool their resources and collaborate for the duration of the project.

Key Features of Contractual Joint Ventures:

No New Entity: Unlike equity joint ventures, a CJV does not require the creation of a separate legal entity. Instead, the partners work together under a contract.

Shared Resources: The partners contribute resources, expertise, and capital to achieve the shared goal, but they do not own a separate entity.

Flexible Structure: The contractual agreement can be tailored to the specific needs of the parties, with fewer legal formalities compared to an EJV.

Short-Term Collaboration: CJVs are often used for specific projects, and the collaboration may have a defined timeline or be limited to a particular business activity.

Joint Liabilities: Partners in a CJV may share joint liabilities, depending on the terms of the contract.

Legal Considerations for Contractual Joint Ventures:

Although a CJV does not involve the creation of a new legal entity, it still requires a well-drafted contract to ensure the protection of each party's interests. A joint venture contract lawyer will help draft an agreement that includes key clauses such as:

The purpose and scope of the collaboration

The roles and responsibilities of each partner

The contribution of resources and capital

The distribution of profits and losses

Confidentiality and intellectual property protection

Dispute resolution processes

LawChef’s team of lawyers for joint venture in Delhi can provide legal guidance on structuring and negotiating contractual joint ventures to ensure your business interests are fully protected.

Key Legal Differences Between Equity and Contractual Joint Ventures

1. Entity Formation

Equity JV: A new legal entity is created, such as a corporation or LLC.

Contractual JV: No new legal entity is formed. The partners operate under a contract.

2. Ownership Structure

Equity JV: The ownership is divided based on the partners’ equity stakes in the new entity.

Contractual JV: There is no shared ownership of a separate entity, but resources and profits are shared according to the terms of the agreement.

3. Liability

Equity JV: Liability is generally limited to the partners' contributions in the new entity.

Contractual JV: Liability is often shared according to the contract, and partners may be jointly liable for obligations arising from the project.

4. Governance and Control

Equity JV: Governance and decision-making are typically based on the ownership structure, with voting rights and control aligned with ownership percentages.

Contractual JV: Governance is defined by the contract terms, and decision-making can be more flexible.

5. Duration

Equity JV: Typically long-term, especially if it is designed to operate for the life of a project or the joint business.

Contractual JV: Often short-term, defined by the duration of a specific project or business activity.

Which Type of Joint Venture is Right for Your Business?

Choosing between an equity joint venture and a contractual joint venture depends on various factors, including the nature of the business, the level of collaboration required, the desired level of liability protection, and the duration of the partnership.

If your business is looking for long-term growth and a shared entity to manage operations, an equity joint venture might be the right choice. On the other hand, if the collaboration is for a specific project or a shorter-term initiative, a contractual joint venture might provide the flexibility and simplicity you need.

At LawChef, our team of joint venture contract lawyers and corporate lawyers in Noida can help you understand the pros and cons of each option, tailoring a legal structure that aligns with your business goals and risk appetite.

Why Choose LawChef for Your Joint Venture Needs?

LawChef is a trusted joint venture law firm in Delhi with expertise in structuring and negotiating both equity and contractual joint ventures. Our experienced lawyers ensure that your JV is legally sound and provides the protection and flexibility your business needs.

Expertise in Joint Venture Law

Our lawyers have deep experience in joint venture law and can guide you through the complexities of both equity and contractual joint ventures, ensuring that the legal framework is tailored to your specific business requirements.

Customized Legal Solutions

We provide personalized legal solutions based on the unique needs of your business. Whether you're looking to enter into a long-term partnership or engage in a short-term project, our team will create a JV agreement that supports your objectives.

Risk Management

Our lawyers are committed to minimizing your risks and ensuring that your joint venture is compliant with all applicable laws and regulations. We provide proactive legal advice to help you avoid potential legal issues and disputes.

Conclusion

Understanding the differences between equity joint ventures and contractual joint ventures is crucial for any business looking to collaborate on new projects. Both structures offer unique advantages and are suitable for different types of partnerships. The key is to align the structure with your business goals, operational needs, and legal requirements.

At LawChef, our team of lawyers for joint venture in Delhi and corporate lawyers in Noida is ready to assist you in structuring the perfect joint venture. Contact us today to discuss how we can help you navigate the complexities of joint venture law and secure the right legal foundation for your business

0 notes

Text

Seed Investors in India | UnicornIVC

UnicornIVC connects startups with seed investors in India, offering early-stage funding to help entrepreneurs scale and grow their businesses. Learn More:

#seed investors in india#venture capital in india for seed funding#venture capital fund in india#venture capitalist in india

0 notes

Text

#venture capital#venture capital fund india#venture capital investors india#venture capital providers in india#venture capitalist bangalore#venture capitalist companies in india

0 notes

Text

Our Team - Valuable Partners

Our team of seasoned professionals and industry experts is the driving force behind our success. We bring a wealth of experience and passion to every project at Valuable Partners. We believe in the growing start-up culture in India, especially the ones that are positively impacting our environment and life forces, and strive to support them by providing debt funds and initiating a successful business culture.

0 notes

Text

#international maritime investments#women and entrepreneurship in india#Venture Capital Funding for Startup

0 notes

Text

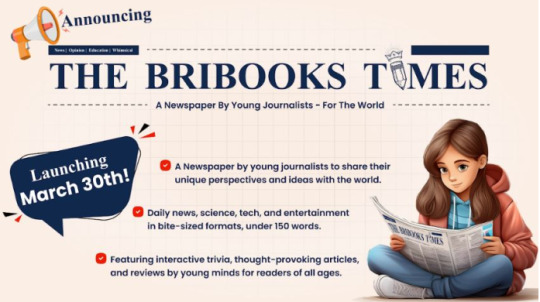

BriBooks Group launches The BriBooks Times

BriBooks, the world’s largest book writing and publishing platform for students, has announced the launch of its newest venture, The BriBooks Times – a concise newspaper crafted entirely by the platform's top young authors. This innovative publication aims to empower young journalists as creators and inform readers with fresh perspectives, all while promoting a culture of learning and curiosity.

At The BriBooks Times, young journalists follow a strict format to ensure clarity and impact: Title + What Happened + Why is it Important + Learn More (links)-all under 150 words! This concise approach ensures the content is engaging and easy to understand for readers of all ages.

“The BriBooks Times is more than a newspaper; it’s a platform for young minds to share their voice and inspire a global audience,” said Ami Dror, founder of BriBooks. “It’s our gift to these young journalists-an opportunity to showcase their talent and make a difference in the world.” The newspaper features diverse sections.

Top of the News: The main story of the day (local to India); International: Key global events; Technology: Explained by kids, for kids (video); Sports: Local and global highlights; Trivia Question of the Day: Interactive and thought-provoking; Science Story of the Day: Captivating discoveries (video); Entertainment: The latest in movies, music, and more; Book of the Day: Reviews of BriBooks-authored works and; Game of the Day: Video game reviews (video).

Videos are an integral part of the publication, with three sections daily featuring 59-second videos created by the young authors. These segments tackle intriguing questions like “What is the PillCam?”, “How can you predict an earthquake?”, or “When will the first human walk on Mars?”, designed to make creators shine and leave viewers feeling smarter.

The daily publication will rotate its sections to maintain variety and encourage creativity. With each article, The BriBooks Times strives to engage readers with fresh insights and empower the next generation of creators and thinkers.

#BriBooks#the world’s largest book writing and publishing platform for students#has announced the launch of its newest venture#The BriBooks Times – a concise newspaper crafted entirely by the platform's top young authors. This innovative publication aims to empower#all while promoting a culture of learning and curiosity.#At The BriBooks Times#young journalists follow a strict format to ensure clarity and impact: Title + What Happened + Why is it Important + Learn More (links)-all#“The BriBooks Times is more than a newspaper; it’s a platform for young minds to share their voice and inspire a global audience#” said Ami Dror#founder of BriBooks. “It’s our gift to these young journalists-an opportunity to showcase their talent and make a difference in the world.”#Top of the News: The main story of the day (local to India); International: Key global events; Technology: Explained by kids#for kids (video); Sports: Local and global highlights; Trivia Question of the Day: Interactive and thought-provoking; Science Story of the#music#and more; Book of the Day: Reviews of BriBooks-authored works and; Game of the Day: Video game reviews (video).#Videos are an integral part of the publication#with three sections daily featuring 59-second videos created by the young authors. These segments tackle intriguing questions like “What is#“How can you predict an earthquake?”#or “When will the first human walk on Mars?”#designed to make creators shine and leave viewers feeling smarter.#The daily publication will rotate its sections to maintain variety and encourage creativity. With each article#The BriBooks Times strives to engage readers with fresh insights and empower the next generation of creators and thinkers.

0 notes

Text

CIRP (Corporate Insolvency Resolution Process) - FinLender

FinLender has more than 10 partners, all senior professionals and Ex Bankers having combined experience of more than 100 years in various fields. The knowledge pool and experience of these partners can handle all kinds of challenges that come under IBC 2016 and providing meaningful resolution to stressed assets.

#bankloan#business#Debt Resolution#Debt Restructuring#Finlender#investment#LoanforNPA#NPA#NPA and OTS Finance#PreparationofResolutionPlan#Venture Capital Funding#Equity Capital in India#NPA Resolution & Restructuring#NPA Resolution#OT

0 notes

Text

The East India Company: The First Startup of Imperialism

The East India Company (EIC) is often hailed as a groundbreaking entity in the realm of trade and commerce. However, its significance extends far beyond mere economic activities; it can be viewed as the first "startup" of imperialism, blending entrepreneurial zeal with colonial ambition. This article explores how the EIC exemplifies the startup model of innovation, risk-taking, and market disruption, while simultaneously laying the groundwork for imperialism in the modern world...click here to read more

#East India Company#startup of imperialism#economic history#colonialism#entrepreneurial venture#trading company#industrial revolution#imperial expansion and governance#Insightful take on start ups#1st startup of the world#a journey of start up to imperialism#market strategies of startups#trade routes.

1 note

·

View note

Text

Top investors in space in India

Why Venture Capitalists Are Betting Big on India’s Space Sector

In recent years, India’s space sector has captured global attention. The successful launch of ambitious missions like Chandrayaan-3 and the expansion of private space initiatives have firmly placed India on the space exploration map. But beyond these headlines lies a deeper trend: space venture capital in India is witnessing a boom, with a growing number of investors in space in India willing to place substantial bets on space startups. Let’s explore why the Indian space industry is becoming a hotbed for venture capital.

A Thriving Ecosystem of Space Startups : India’s space ecosystem is no longer limited to government-run entities like the Indian Space Research Organisation (ISRO). Today, a surge of innovative space startups are taking the stage, offering cutting-edge solutions in satellite technology, launch services, space data analytics, and more. Companies like Skyroot Aerospace, Agnikul Cosmos, and Pixxel are leading the charge, each carving out a unique niche. These startups are pushing the boundaries of what’s possible, driving investor interest with the potential for high returns in a relatively untapped market.

Strong Government Support and Policy Reforms : One of the key reasons behind the surge in space venture capital in India is the proactive stance taken by the Indian government. Recent policy reforms have opened the doors for private players to participate in space activities, previously dominated by ISRO. The establishment of IN-SPACe (Indian National Space Promotion and Authorization Center) is a significant step, providing a regulatory framework that encourages private sector involvement. Such government support has given investors in space in India the confidence to back ambitious projects, knowing there’s a clear path for private ventures.

Cost-Effective Innovation as a Competitive Edge : India’s reputation for cost-effective innovation is another major attraction for investors. Launching satellites at a fraction of the cost compared to global competitors has positioned India as a hub for affordable space technology. This competitive edge not only allows Indian space startups to thrive domestically but also makes them attractive on the international stage. Investors are keen to support companies that can deliver world-class technology with lower capital outlays, reducing investment risks while promising impressive returns.

Global Interest in Indian Talent and Expertise : India’s space sector is not just about affordability; it’s about world-class talent. The country boasts a deep pool of highly skilled engineers, scientists, and entrepreneurs with expertise in aerospace and technology. This talent pool has been instrumental in driving innovation and attracting global attention. International investors are increasingly looking to partner with Indian space startups, recognizing the country’s unique blend of technical prowess and entrepreneurial spirit.

A Growing Market for Space-Based Services : The market for space-based services, including satellite communications, Earth observation, and data analytics, is expanding rapidly. In India, this growth is driven by rising demand from industries such as agriculture, telecommunications, logistics, and defense. With space technology playing a crucial role in optimizing these sectors, investors see an opportunity to capitalize on the potential for domestic and international applications. Space-based services represent a lucrative market, attracting space venture capital in India to back startups that can cater to these needs.

Strategic Partnerships and Collaborations : Indian space startups are not working in isolation; they are forming strategic partnerships with global companies and space agencies. Collaborations with NASA, ESA (European Space Agency), and private companies have opened up new opportunities for technology sharing, funding, and market access. These partnerships have also strengthened investor confidence, as they reduce risks and validate the technology being developed by Indian companies. For investors in space in India, such collaborations signal a promising future, driving more venture capital into the sector.

A New Era of Commercial Space Exploration : The idea of commercial space exploration, once confined to science fiction, is now becoming a reality. From reusable rockets to satellite constellations, Indian space startups are exploring new frontiers that were once considered out of reach. This new era of commercial space exploration has piqued the interest of venture capitalists who see the potential for profitable exits through IPOs, acquisitions, and global partnerships. With private space missions no longer just a dream, space venture capital in India is ready to fuel the next big leap.

Encouraging Signs from Successful Fundraising Rounds : The confidence in India’s space sector is evident from the successful fundraising rounds by leading space startups. Companies like Skyroot Aerospace and Agnikul Cosmos have secured millions in funding from top-tier venture capital firms. These funding rounds not only provide the necessary resources for scaling but also act as a signal to other investors that the Indian space market is mature and ready for high-stakes investment. The momentum created by these early successes is a clear indicator of why investors in space in India are increasingly willing to place their bets.

Conclusion: A Promising Orbit for Investment India’s space sector is on an exciting trajectory. With a favorable policy environment, a surge of innovative startups, and a proven track record of cost-effective solutions, it’s no wonder that space venture capital in India is booming. As the country continues to explore new frontiers and expand its role in global space exploration, venture capitalists are set to play a pivotal role in shaping the future. For those looking to invest in the final frontier, India’s space industry presents a unique opportunity to be part of a revolution that’s only just beginning.

#Keywords#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#popular venture capital firms#startup seed funding india#seed investors in bangalore#deep tech investors india#venture capital firms in india#best venture capital firms in india#seed investors in delhi#semiconductor startups#semiconductor venture capital#saas venture capital#b2b venture capital#saas angel investors#saas venture capital firms#deep tech venture capital#deeptech startups in india#semiconductor companies in india#investors in semiconductors#space venture capital in india#space startups#investors in space in India#venture capital investment Bangalore#venture capital firm#venture capital firms in India

0 notes

Text

At LawChef, we understand that the legal landscape can be complex, especially when it comes to drafting agreements. Two common types of contracts that businesses frequently encounter are employment contracts and service agreements. While they may seem similar at first glance, they serve different purposes and contain distinct legal provisions. In this blog, we will explore the key differences between these two types of contracts and emphasize the importance of seeking professional legal help.

Understanding Employment Contracts

Definition and Purpose

An employment contract is a formal agreement between an employer and an employee outlining the terms of employment. This contract typically includes details about job responsibilities, salary, benefits, and working conditions. Its primary purpose is to establish a clear framework for the employer-employee relationship.

Key Components of Employment Contracts

Job Title and Description: Clearly defines the role and responsibilities of the employee.

Compensation and Benefits: Outlines salary, bonuses, and other perks.

Work Hours and Location: Specifies working hours, remote work options, and office location.

Termination Clause: Details the conditions under which either party can terminate the contract.

Confidentiality and Non-Compete Clauses: Protects the employer’s sensitive information and limits the employee’s ability to work for competitors after leaving the company.

Understanding Service Agreements

Definition and Purpose

A service agreement is a contract between a service provider and a client that outlines the terms of the services being provided. Unlike employment contracts, service agreements can involve individuals or businesses that are not in an employer-employee relationship. They are commonly used in freelance, consulting, and contractor arrangements.

Key Components of Service Agreements

Scope of Services: Clearly defines the services to be provided, including deliverables and timelines.

Payment Terms: Outlines how and when the service provider will be compensated.

Confidentiality Clause: Protects proprietary information shared during the course of the service.

Termination Conditions: Specifies how either party can terminate the agreement.

Liability and Indemnity Clauses: Addresses liability for any potential issues arising from the service provided.

Key Differences Between Employment Contracts and Service Agreements

1. Nature of Relationship

Employment Contracts: Establish an employer-employee relationship, where the employer has control over the employee's work and provides benefits.

Service Agreements: Define a client-service provider relationship, where the service provider operates independently and is typically not entitled to employee benefits.

2. Legal Protections

Employment Contracts: Employees are often afforded more legal protections, such as rights to minimum wage, overtime pay, and unemployment benefits.

Service Agreements: Service providers generally have fewer legal protections, relying on the contract terms for recourse.

3. Tax Implications

Employment Contracts: Employers are responsible for withholding taxes and providing employee benefits.

Service Agreements: Service providers are typically responsible for their own taxes and benefits, operating as independent contractors.

4. Flexibility and Duration

Employment Contracts: Often have fixed terms or are indefinite, requiring notice for termination.

Service Agreements: Can be more flexible, with shorter durations and specific project-based terms.

Importance of Professional Assistance

When drafting either type of contract, it is essential to consult with experienced lawyers for drafting agreements. Their expertise ensures that your contracts comply with legal standards and adequately protect your interests.

Specialized Support in Delhi

For businesses in need of tailored legal support, consider seeking deed lawyers for rent deed drafting in Delhi or agreement drafting services in Delhi. Professional assistance can help you navigate the nuances of contract law, ensuring that both employment contracts and service agreements are comprehensive and enforceable.

Conclusion

Understanding the differences between employment contracts and service agreements is crucial for any business. At LawChef, we are committed to providing expert guidance and drafting services tailored to your specific needs. Whether you need assistance with employment contracts, service agreements, or other legal documents, our experienced team is here to help.

0 notes

Text

How Businesses Can Contact Venture Capital in India for Seed Funding

Discover the steps for startups and businesses to approach venture capital in India for seed funding. Learn how to connect with leading VC firms like UnicornIVC and secure early-stage funding for your business.

Title: How Businesses Can Contact Venture Capital in India for Seed Funding

Description: Discover the steps for startups and businesses to approach venture capital in India for seed funding. Learn how to connect with leading VC firms like UnicornIVC and secure early-stage funding for your business.

Content:

For startups and small businesses, securing seed funding is a pivotal step in turning ideas into reality. This initial round of funding helps companies develop products, hire key team members, and scale operations. But navigating the venture capital landscape, especially in India, can be challenging. Knowing how to approach and contact the right venture capital firm is crucial for businesses looking to secure seed funding.

What is Seed Funding?

Seed funding is typically the first official round of equity funding that a startup raises. This early-stage capital is provided by investors in exchange for equity or partial ownership in the business. For Indian startups, seed funding can come from various sources, including angel investors, family offices, and venture capital firms like UnicornIVC.

Seed funding is essential as it allows startups to validate their product, achieve early growth, and prepare for future funding rounds like Series A or B. Venture capital firms that specialize in seed funding, such as UnicornIVC, play a significant role in providing this critical support.

Steps to Approach Venture Capital Firms for Seed Funding

Research the Right VC Firm:The first step in contacting venture capital firms is to identify those that align with your industry, business model, and funding needs. In India, venture capital firms often specialize in particular sectors, such as technology, healthcare, or fintech. Finding the right match increases your chances of getting funded.For example, UnicornIVC is a well-known VC firm focusing on early-stage startups, particularly those with innovative solutions and high growth potential. Researching their portfolio and investment thesis will help you determine whether your business fits their criteria.

Prepare a Compelling Pitch Deck:Before reaching out to venture capitalists, ensure you have a well-structured pitch deck. This document should cover key aspects of your business, including the problem you're solving, your product or service, market opportunity, financial projections, and how you plan to use the seed funding.Investors want to see a clear path to growth, profitability, and scalability. Your pitch deck should demonstrate why your business is a viable investment and how it stands out from competitors.

Build Relationships and Networks:Networking plays an essential role in accessing venture capital. Attend startup events, conferences, and pitch competitions where you can meet venture capitalists and industry professionals. Many VC firms, including UnicornIVC, often have representatives present at such events, offering founders opportunities to pitch their ideas directly.Additionally, leveraging existing connections can help you get an introduction to investors. Founders who are referred by someone in the VC’s network are more likely to get their foot in the door.

Cold Emails and Online Platforms:If you don’t have a direct connection, cold emailing venture capital firms is a common method for introducing your business. When reaching out, personalize the email by mentioning why you think the firm is a good fit and how your business aligns with their investment focus. Keep the email brief but compelling, and include your pitch deck.Many VC firms also use online platforms like LinkedIn and AngelList to find promising startups. These platforms allow you to submit your business for review, making it easier for investors to discover you.

Follow-Up and Be Persistent:Venture capital firms review numerous business pitches daily, so it’s crucial to follow up if you don’t hear back initially. A polite and persistent approach shows your commitment and enthusiasm for your business. It’s not uncommon to receive feedback or requests for additional information after your first contact.

Prepare for Due Diligence:If a venture capital firm expresses interest, they will conduct due diligence to assess the feasibility of your business. This process involves evaluating your team, financials, legal structure, and market positioning. Being transparent and having your documentation in order will help speed up this process.

Contact Details of Unicornivc

Website: https://www.unicornivc.com/

Contact Us Page: https://www.unicornivc.com/contact.php

#Unicorn#Unicornivc#How Businesses Can Contact Venture Capital in India#seed funding for startup#seed funding company for startups

0 notes