#venture capital firm India

Explore tagged Tumblr posts

Text

What is Pre Seed Investors in India? JC Team Capital

Seed funding is an early stage of investment in a startup company, usually given in exchange for equity. It is the initial capital used to help a new business get off the ground and begin its operations. The purpose of seed funding is to help the company validate its business idea, build its initial product or service, and attract more investment to support its growth. Seed funding can come from a variety of sources, including angel investors, venture capitalists, and government grants. The amount of seed funding can vary greatly, but it typically ranges from a few tens of thousands of dollars to a few million dollars.

#seed funding In India#venture capital firm India#start up funding in india#funding for startups in india

1 note

·

View note

Text

Top investors in space in India

Why Venture Capitalists Are Betting Big on India’s Space Sector

A Thriving Ecosystem of Space Startups: India’s space ecosystem is no longer limited to government-run entities like the Indian Space Research Organisation (ISRO). Today, a surge of innovative space startups are taking the stage, offering cutting-edge solutions in satellite technology, launch services, space data analytics, and more. Companies like Skyroot Aerospace, Agnikul Cosmos, and Pixxel lead the charge, each carving out a unique niche. These startups are pushing the boundaries of what’s possible, driving investor interest with the potential for high returns in a relatively untapped market.

Strong Government Support and Policy Reforms: One of the key reasons behind the surge in space venture capital in India is the proactive stance taken by the Indian government. Recent policy reforms have opened the doors for private players to participate in space activities, previously dominated by ISRO. Establishing IN-SPACe (Indian National Space Promotion and Authorization Center) is a significant step, providing a regulatory framework that encourages private sector involvement. Such government support has given investors in space in India the confidence to back ambitious projects, knowing there’s a clear path for private ventures.

Cost-Effective Innovation as a Competitive Edge: India’s reputation for cost-effective innovation is another major attraction for investors. Launching satellites at a fraction of the cost compared to global competitors has positioned India as a hub for affordable space technology. This competitive edge not only allows Indian space startups to thrive domestically but also makes them attractive on the international stage. Investors are keen to support companies that can deliver world-class technology with lower capital outlays, reducing investment risks while promising impressive returns.

Global Interest in Indian Talent and Expertise: India’s space sector is not just about affordability; it’s about world-class talent. The country boasts a deep pool of highly skilled engineers, scientists, and entrepreneurs with expertise in aerospace and technology. This talent pool has been instrumental in driving innovation and attracting global attention. International investors are increasingly looking to partner with Indian space startups, recognizing the country’s unique blend of technical prowess and entrepreneurial spirit.

A Growing Market for Space-Based Services: The market for space-based services, including satellite communications, Earth observation, and data analytics, is expanding rapidly. In India, this growth is driven by rising demand from industries such as agriculture, telecommunications, logistics, and defense. With space technology playing a crucial role in optimizing these sectors, investors see an opportunity to capitalize on the potential for domestic and international applications. Space-based services represent a lucrative market, attracting space venture capital in India to back startups that can cater to these needs.

Strategic Partnerships and Collaborations: Indian space startups are not working in isolation; they are forming strategic partnerships with global companies and space agencies. Collaborations with NASA, ESA (European Space Agency), and private companies have opened up new opportunities for technology sharing, funding, and market access. These partnerships have also strengthened investor confidence, as they reduce risks and validate the technology being developed by Indian companies. For investors in space in India, such collaborations signal a promising future, driving more venture capital into the sector.

A New Era of Commercial Space Exploration: The idea of commercial space exploration, once confined to science fiction, is now becoming a reality. From reusable rockets to satellite constellations, Indian space startups are exploring new frontiers that were once considered out of reach. This new era of commercial space exploration has piqued the interest of venture capitalists who see the potential for profitable exits through IPOs, acquisitions, and global partnerships. With private space missions no longer just a dream, space venture capital in India is ready to fuel the next big leap.

Encouraging Signs from Successful Fundraising Rounds: The confidence in India’s space sector is evident from the successful fundraising rounds by leading space startups. Companies like Skyroot Aerospace and Agnikul Cosmos have secured millions in funding from top-tier venture capital firms. These funding rounds not only provide the necessary resources for scaling but also act as a signal to other investors that the Indian space market is mature and ready for high-stakes investment. The momentum created by these early successes is a clear indicator of why investors in space in India are increasingly willing to place their bets.

Conclusion: A Promising Orbit for Investment India’s space sector is on an exciting trajectory. With a favorable policy environment, a surge of innovative startups, and a proven track record of cost-effective solutions, it’s no wonder that space venture capital in India is booming. As the country continues to explore new frontiers and expand its role in global space exploration, venture capitalists are set to play a pivotal role in shaping the future. For those looking to invest in the final frontier, India’s space industry presents a unique opportunity to be part of a revolution that’s only just beginning.

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

5 Ring Road, Lajpat Nagar 4, 3rd Floor, New Delhi-110024

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india#business investors in kerala#venture capital company#semiconductor startups#semiconductor venture capital#investors in semiconductors#startup seed funding in India#deep tech venture capital#deeptech startups in india#semiconductor companies in india#saas angel investors#saas venture capital firms#saas venture capital#b2b venture capital#space venture capital in india

2 notes

·

View notes

Text

Why do businesses fail even after good seed funding?

Most businesses fail even after receiving excellent seed funding because the management entirely misunderstands the demands and misallocates cash, losing the capital venture partner firm's trust in the process. Therefore, even if they must accept less startup funding, businesses must collaborate with venture capital firms that bring leadership and tested expertise. Truth Ventures is regarded as one of the best venture capital firms as they don't allow their partners to overspend or pay excessive attention to the current situation and only allocate cash by keeping long-term goals in mind.

#Truth vent#Truth ventures#truth venture#capital venture#capital venture fund#varun datta#varun datta ceo#seed funding#truth ventures#varun datta entrepreneur#varun datta founder#venture capital#seed capital#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital#Capital venture fund#venture capital in india#Types of venture capital#Investment Funding#Venture capital startup#Joint venture partner#Venture capital industry

3 notes

·

View notes

Text

Venture Capital India: Growth of the Indian E-commerce Landscape

India's startup scene has been fueled by a thriving venture capital (VC) ecosystem, with venture capital India playing a crucial role in scaling the country's e-commerce sector. As startups bloom across cities, fueled by innovation and technology, the Indian e-commerce landscape has become one of the fastest-growing in the world.

Why Venture Capital is Driving Indian E-commerce Growth

Venture capital’s presence in India is more than just financial backing; it's a catalyst for revolutionising the startup landscape. Here’s how VC drives growth:

Scaling with Speed: E-commerce startups like Flipkart, and Messho are shining examples of how strategic VC investments accelerate growth. Flipkart, after receiving early-stage funding, grew into a unicorn and was later acquired by Walmart. Venture capital empowers startups with the capital needed to scale operations, hire talent, and improve their technological capabilities.

Market Penetration: Swiggy, initially a small food delivery service, grew to dominate the food-tech industry in India, thanks to rounds of VC funding. They are now even into quick commerce. These investments allowed it to expand rapidly across cities and develop a robust logistical network.

Venture capital is all about strategic partnerships and mentorship that fosters growth, innovation, and competitiveness in a densely populated e-commerce market.

Top Venture Capital Trends in India’s E-commerce Sector

B2B E-commerce Booming: India’s B2B sector is rising, with platforms like Udaan attracting significant VC interest. Investors are seeing growth potential beyond consumer e-commerce and targeting businesses that serve other businesses.

Sustainability-Focused Investments: There is a rising trend among VCs toward funding eco-conscious and sustainable e-commerce ventures. These companies, like BigBasket, appeal to new generations of consumers looking for convenience with a purpose.

Tech-Driven Solutions: From artificial intelligence to blockchain, VCs are heavily funding startups that implement cutting-edge technology in e-commerce. These solutions offer scalability, customer engagement, and personalised experiences, giving Indian e-commerce companies a competitive edge globally.

Key Benefits of Venture Capital in E-commerce

Access to Significant Capital: Startups can raise large sums in funding rounds, which is essential for scaling and expansion.

Strategic Mentorship: VCs bring industry expertise and guidance, offering startups invaluable strategic input.

Scalability & Rapid Growth: With capital in hand, startups can swiftly increase market penetration.

Competitive Edge: Well-funded companies can outcompete others through marketing, better products, and operational efficiency.

Challenges

While India’s startup scene is booming, significant hurdles are encumbering the growth potential:

Regulatory Challenges: Limitations on foreign direct investment (FDI) in ecommerce, particularly in the B2C segment. Flipkart's $16B Walmart acquisition faced regulatory hurdles due to FDI norms. Also, there are strict data localization norms and Personal Data Protection (PDP) Bill requirements. Zomato faced backlash over data sharing practices, highlighting PDP Bill concerns.

Market Volatility: E-commerce is an unpredictable space where customer preferences shift rapidly, creating high risks for venture capitalists.

Exit Challenges: Finding a profitable exit in India, either through IPOs or mergers and acquisitions, is still challenging compared to more mature markets like the U.S.

Conclusion

Venture capital in India has been a transformative force in the e-commerce landscape, driving innovation, rapid growth, and global competitiveness. By providing financial backing, mentorship, and strategic insights, VCs are shaping the future of Indian e-commerce. With trends focusing on B2B platforms, sustainable startups, and technology-driven solutions, the partnership between VCs and e-commerce companies creates an environment where startups can thrive.

0 notes

Text

High-Growth Potential: Invest in Startups for Equity India as an Accredited Investor

The Indian startup ecosystem is booming. From innovative solutions in fintech and e-commerce to disruptive ideas in healthcare and cleantech, there's a constant buzz of creativity and potential. As an accredited investor in India, you have the unique opportunity to be a part of this growth story by invest in startups for equity India. This approach offers the chance for high returns while fostering the development of groundbreaking companies that shape the future.

But before diving headfirst, it's crucial to understand the landscape of investing in startups for equity in India. This blog will delve into the benefits, considerations, and resources available to accredited investors seeking promising startups to invest in.

Why Invest in Startups for Equity in India?

For accredited investors, venturing beyond traditional investment avenues can unlock exciting possibilities. Here are some key reasons why investing in startups for equity can be a compelling proposition:

High-Growth Potential: Startups have the potential to disrupt entire industries and experience explosive growth. Early investment in a successful startup can translate to significant returns on your capital.

Diversification: Equity in startups can add a new dimension to your investment portfolio. Unlike established companies, startups offer exposure to innovative ideas and emerging markets, reducing your reliance on traditional assets.

Impact Investing: By supporting promising startups, you contribute to the development of solutions that address critical challenges and create a positive social impact.

Early Access: Accredited investors gain access to exclusive investment opportunities not available to retail investors. You can get in on the ground floor of a promising venture before it goes mainstream.

Considerations for Investing in Startups

While the potential rewards are significant, investing in startups for equity also comes with inherent risks. Here are some key points to consider:

High Risk: Startups are inherently unproven ventures. There's a significant chance of failure, and you could lose your entire investment.

Illiquidity: Unlike stocks on the public market, startup equity is illiquid. It can be difficult to sell your shares quickly, and you may have to wait for an exit event like an acquisition or IPO.

Long Investment Horizon: It typically takes several years for a startup to mature and deliver returns. Be prepared for a long-term commitment.

Extensive Due Diligence: Thorough research and analysis are crucial before investing in a startup. You need to assess the company's business model, team, market potential, and financial projections.

Finding Promising Startups to Invest In

As an accredited investor, you have several options to find promising startups for equity investment in India:

Venture Capital Firms in India: Partnering with established venture capital firms in India is a popular approach. These firms have a proven track record of identifying and investing in high-growth startups. They conduct extensive due diligence and provide valuable guidance to investors.

Angel Investor Networks: Joining an angel investor network allows you to connect with other accredited investors and access a wider pool of potential startups. These networks often organize events and provide resources to help you make informed investment decisions.

Startup Platforms: Several online platforms connect startups with potential investors. These platforms provide information about startups seeking funding, their business models, and funding rounds.

Krystal Ventures Studio: Connecting Investors with Promising Startups

Krystal Ventures Studio understands the challenges and opportunities associated with investing in startups for equity in India. Our platform is designed to bridge the gap between startups seeking funding and accredited investors looking for promising ventures.

By registering with Krystal Ventures Studio, you gain access to a curated network of market-ready startups across various sectors. We provide comprehensive information on each startup, including their business plans, financial projections, and team profiles. Our team also helps investors with due diligence and facilitates connections with the startups they are interested in.

Investing in startups for equity in India offers a unique opportunity for accredited investors to achieve high returns and contribute to the nation's entrepreneurial ecosystem. By understanding the risks and rewards, conducting thorough due diligence, and leveraging the right resources, you can make informed investment decisions and participate in the growth story of promising Indian startups.

0 notes

Text

Eximius - Venture capital firms play a huge role in the startup ecosystem by providing not just financial support but also strategic guidance and industry connections. In India, where entrepreneurial spirit is on the rise, numerous venture capital firms have emerged as key players in fueling the growth of innovative startups.

Above Is the list of top 15 Venture Capital firms for pre-seed funding in India. These firms understand the unique challenges faced by early-stage ventures and are committed to backing promising ideas with the potential for exponential growth.

1 note

·

View note

Text

Navigating Investments: The World of Private Equity Firms

Examine the symbiotic relationship between private equity and venture capital, showcasing how these financial partners collaborate to fuel entrepreneurial ventures.

#Private Equity#private equity firms#private equity firms in india#private equity vs venture capital#private equity and venture capital#private equity venture capital

0 notes

Text

Fireside Ventures: Pioneering Growth for Consumer Brands in India

In the dynamic landscape of consumer brands, Fireside Ventures stands out as a beacon of support, propelling businesses to new heights through strategic investments. As a dedicated venture capital partner in India, Fireside Ventures has been instrumental in the success stories of numerous thriving brands. Let's delve into the realm of Fireside Ventures and explore how it's igniting success for consumer brands.

Fireside Ventures has earned its reputation as a leading venture capital fund in India, specializing in fueling the growth of consumer brands. With a keen focus on innovation and market disruption, Fireside Ventures has become the go-to partner for businesses aiming to elevate their presence in the competitive consumer landscape.

1. Venture Capital for Consumer Brands: A Tailored Approach

Fireside Ventures takes pride in offering more than just financial support. Their approach involves a deep understanding of the unique challenges and opportunities within the consumer brand sector. By tailoring their investments to align with the specific needs of each brand, Fireside Ventures becomes a strategic partner rather than just a source of funds.

2. Social Venture Funds: Impactful Investments for a Better Tomorrow

Beyond financial success, Fireside Ventures believes in the power of consumer brands to make a positive impact on society. Social venture funds underpin their commitment to supporting businesses that not only thrive commercially but also contribute to social and environmental betterment.

3. Food and Beverage Venture Capital: Nourishing Innovation

In the ever-evolving food and beverage industry, Fireside Ventures identifies and nurtures innovation. By investing in promising F&B ventures, they play a crucial role in bringing novel products and experiences to consumers, fostering a culture of culinary exploration.

4. D2C Investors: Fostering Direct-to-Consumer Disruption

Fireside Ventures recognizes the transformative potential of direct-to-consumer (D2C) models. As avid D2C investors, they support brands in establishing direct connections with consumers, reshaping traditional distribution channels, and creating personalized, engaging experiences.

5. Building Portfolios, Cultivating Success

The success of Fireside Ventures is reflected in its robust venture capital portfolios. The firm strategically curates a diverse range of brands under its umbrella, creating a network where each brand benefits from shared insights, resources, and the collective expertise of Fireside Ventures.

For aspiring and established consumer brands in India, Fireside Ventures represents more than just a financial backer; it’s a dedicated partner in growth. By embracing innovation, social responsibility, and a tailored approach to investments, Fireside Ventures continues to be a driving force behind the success of consumer brands in the dynamic Indian market.

As businesses look toward the future, Fireside Ventures stands ready to ignite the next wave of success stories, shaping the consumer landscape in India for years to come.

#vc fund india#vc for consumer brands#social venture funds#food and beverage venture capital#venture capital portfolios#consumer venture capital funds#list of venture capital#firms in bangalore#venture company in india#venture capitalists in india#d2c investors#consumer brand venture capital#best venture capital firms in india#venture capitalists for startups

0 notes

Text

The Evolving Landscape of Venture Capital Firms in India

Introduction

India's startup ecosystem has been witnessing an unprecedented boom in recent years, and this has been fueled in large part by the influx of venture capital firms. These entities play a pivotal role in the growth and success of tech startups across the country. In this blog, we will explore the evolving landscape of venture capital firms in India, discuss how to find investors for startups in India and shed light on some promising tech startups that are worth investing in. As the market continues to evolve, one venture capital firm, Krystal Ventures, stands out as a key player in the Indian startup ecosystem.

The Rise of Venture Capital Firms in India

Venture capital firms in India have come a long way in the past few decades. Initially, the Indian startup landscape faced challenges in attracting funding due to risk-averse investors and limited access to capital. However, the liberalization of the Indian economy, coupled with a thriving IT industry and a growing pool of skilled entrepreneurs, laid the foundation for a more robust startup ecosystem.

Today, India boasts a diverse and active network of venture capital firms that cater to a wide range of sectors and stages of startup development. With the increasing number of success stories and strong government support for startups, both domestic and international venture capital firms are keen to invest in India's entrepreneurial ventures.

Finding Investors for Startups in India

While the opportunity for startups to secure funding has improved significantly, finding the right investors remains a critical challenge. Startups must approach investor networks, attend pitch events, and leverage online platforms to connect with potential investors. Additionally, angel investors, crowdfunding campaigns, and incubators/accelerators can also serve as valuable sources of funding and mentorship for early-stage startups.

To attract investors, startups need to have a compelling business model, a well-defined growth strategy, and a clear vision of how their product or service addresses a significant market gap. Building a strong network within the industry and showcasing a committed and competent team also go a long way in gaining investor confidence.

Tech Startups to Invest in India

India's tech startup landscape offers a plethora of opportunities for investors looking to diversify their portfolios and tap into the country's burgeoning digital market. Some sectors that have shown remarkable growth potential include e-commerce, fintech, health tech, edtech, agritech, and SaaS-based solutions.

For instance, the edtech sector has witnessed an exponential rise in demand, driven by the adoption of online learning during the pandemic. Similarly, health tech startups that provide innovative solutions for healthcare access and management have gained significant traction. Investors seeking to make a positive impact while achieving financial success can find tremendous potential in these sectors.

Krystal Ventures: Pioneering the Future

Among the plethora of venture capital firms operating in India, Krystal Ventures has emerged as a prominent player in the startup ecosystem. With a focus on identifying disruptive tech startups with the potential for rapid growth, Krystal Ventures has successfully invested in and nurtured numerous ventures across various sectors.

Krystal Ventures distinguishes itself through its hands-on approach to mentoring startups, offering valuable industry insights, and providing access to an extensive network of business partners. Their commitment to fostering long-term relationships with their portfolio companies sets them apart as an investor that truly believes in the potential of Indian startups.

Conclusion

The evolution of venture capital firms in India has significantly impacted the startup ecosystem, providing startups with the much-needed funding and support to flourish. As the Indian market continues to grow and mature, the role of venture capital firms becomes even more crucial in shaping the landscape of innovation.

For startups looking to secure funding, building a solid business model and actively networking within the investor community are essential steps. Simultaneously, investors keen on tapping into India's dynamic tech startup space should keep a close eye on burgeoning sectors like edtech, health tech, and fintech.

Among the many venture capital firms in India, Krystal Ventures stands out for its dedication to nurturing disruptive tech startups. By investing in Krystal Ventures, entrepreneurs and investors alike can contribute to the transformational journey of India's startup ecosystem, fostering innovation and driving economic growth for the nation.

0 notes

Text

LIST OF INDIA’S TOP VENTURE CAPITAL FIRMS FOR STARTUPS

Capital is one of the major components to start a business. Well-established businesses found it easier to avail capital for the expansion of its business but a small business and new startups found it very difficult to avail required capital for the business. That’s why the importance of venture capital is increasing nowadays. Venture capital firms provide the required capital to the start-ups that have the potential of growing in the coming future.

Venture capital is necessary to encourage entrepreneurial talent among youth. These venture firms not only provide the required capital for business but also gives meaningful advice and guidance to the business. These investments are too risky as the returns totally depend on the performance of the startups. Yet, some businesses don’t opt for this option because of the dilution of ownership and control in the business.

To read more click the link shown below.

0 notes

Text

0 notes

Text

Top saas venture capital firms in India 2024

SEAFUND, one of the prominent SaaS venture capital firms in India, has strategically invested in Finsall, a cutting-edge SaaS startup transforming insurance premium financing.

This innovative platform bridges the gap between insurers and customers through seamless technology solutions, making premium financing more accessible and efficient. With SEAFUND’s support, Finsall is set to expand its footprint and enhance its offerings in the financial technology sector.

As a leader in SaaS venture capital, SEAFUND focuses on fostering startups that bring groundbreaking ideas to market.

Their commitment to innovation solidifies their position among the top SaaS venture capital firms in India, enabling transformative growth in the startup ecosystem.

Learn more about this exciting collaboration of SEAFUND’s investment on FINSAL.

#Keywords#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#popular venture capital firms#startup seed funding india#seed investors in bangalore#deep tech investors india#venture capital firms in india#best venture capital firms in india#seed investors in delhi#semiconductor startups#semiconductor venture capital#saas venture capital#b2b venture capital#saas angel investors#saas venture capital firms#deep tech venture capital#deeptech startups in india#semiconductor companies in india#investors in semiconductors#space venture capital in india#space startups#investors in space in India#best venture capital firm in india#venture capital firm#funding for startups in india#fintech funding#india alternatives investment advisors

0 notes

Text

Capital Venture Funds: Investing in Growth and Innovation for High Returns

Welcome to the world of capital venture funds! If you are looking to explore investment opportunities with high growth potential, capital venture funds can be an exciting avenue to consider. In this article, we will dive deep into the concept of capital venture funds, how they work, their benefits and risks, and provide valuable insights to help you make informed investment decisions.

What is a Capital Venture Fund?

A capital venture fund, also known as a venture capital fund, is a pool of money collected from various investors, such as individuals, institutions, or corporations, with the aim of investing in startups and early-stage companies. These funds are managed by professional venture capitalists who have expertise in identifying promising investment opportunities.

How Does a Capital Venture Fund Work?

Capital venture operate by raising capital from investors and using that money to provide funding to startups and emerging companies in exchange for equity stakes. The fund managers evaluate business proposals, conduct due diligence, and select ventures with significant growth potential. They offer financial and strategic support to these companies, with the ultimate goal of generating substantial returns on investment when the invested companies succeed.

Benefits of Investing in a Capital Venture Fund

Investing in a capital venture fund offers several benefits. Firstly, it provides access to high-growth opportunities that are typically unavailable in traditional investment options. Venture funds often invest in innovative and disruptive technologies, which have the potential to reshape industries and generate substantial returns. Additionally, investing in a capital venture fund allows diversification across a portfolio of startups, spreading the risk associated with investing in Truth Venture companies.

Risks Associated with Capital Venture Funds

While capital venture funds offer attractive prospects, it’s essential to consider the associated risks. Startups and early-stage companies are inherently risky investments, and not all ventures may succeed. The failure rate can be relatively high, and investors should be prepared for potential losses. Additionally, capital venture funds are illiquid investments, meaning that the invested capital may be tied up for a significant period before any returns can be realized.

How to Choose a Capital Venture Fund

When selecting a capital venture fund to invest in, thorough due diligence is crucial. Consider factors such as the fund’s track record, the expertise of its management team, the fund’s investment focus, and its alignment with your investment goals and risk appetite. Look for funds that have a diversified portfolio, an established network within the industry, and a robust investment strategy. Seeking advice from financial professionals can also provide valuable insights.

Top Capital Venture Funds in the Market

The capital venture fund landscape is diverse, with numerous reputable funds operating globally. Some of the top capital venture firms in the market include Sequoia Capital, Andreessen Horowitz, Accel Partners, and Benchmark Capital. These funds have a strong track record of successful investments and have been instrumental in supporting groundbreaking companies.

Steps to Invest in a Capital Venture Fund

Startup investing in a capital venture financing typically involves a structured process. Firstly, research various funds to identify the ones that align with your investment preferences. Contact the fund managers or reach out through a financial advisor to initiate the investment process. Complete the necessary paperwork, provide the required information, and transfer the investment amount as per the fund’s requirements. It’s important to review the terms and conditions of the fund carefully before committing your capital.

Tax Implications of Investing in a Capital Venture Fund

Tax implications of investing in capital venture funds vary depending on the jurisdiction and the specific regulations in place. In some cases, investments in venture capital funds may qualify for tax incentives or capital gains tax exemptions. However, it’s essential to consult with a tax professional or seek guidance from the fund managers to understand the specific tax implications and benefits associated with your investment.

Success Stories of Capital Venture Fund Investments

Capital venture funds have been behind some of the most successful and influential companies in the world. From early investments in companies like Google, Facebook, and Amazon, to the recent breakthroughs in innovative technologies, venture capital has played a crucial role in driving economic growth and fostering entrepreneurship. These success stories highlight the potential for substantial returns that can be achieved through astute venture capital investments.

Future Trends in Capital Venture Funding

The capital venture funding landscape is dynamic and constantly evolving. Several trends are shaping the future of venture capital, including the rise of impact investing, increased focus on diversity and inclusion, and the emergence of new industries and technologies. Artificial intelligence, blockchain, and clean energy are areas that are expected to attract significant venture capital investments in the coming years. Staying informed about these trends can help investors identify promising opportunities.

Conclusion

In conclusion, capital venture funds offer a unique investment avenue with the potential for high returns. While they carry inherent risks, the diversification, access to innovative companies, and strategic support provided by venture capital funds can outweigh the downsides for the right investors. Conducting thorough research, understanding the risks, and aligning your investment goals are key to making successful investments in capital venture funds.

FAQ

What is the minimum investment amount for a capital venture fund?

The minimum investment amount for capital venture funds varies depending on the fund. It can range from a few thousand dollars to several million. How long does it typically take to realize returns from capital venture fund investments?

The timeframe for realizing returns from capital venture fund investments can vary widely. It can take several years, often around five to ten years, for startups to reach a stage where they generate significant returns or undergo an exit event.

Can individual investors invest in capital venture funds?

Yes, individual investors can invest in capital venture funds. However, some funds may have specific requirements or minimum investment thresholds for individual investors.

What is the difference between a capital venture fund and private equity?

While both capital venture funds and private equity funds invest in companies, the key difference lies in the stage of the companies they invest in. Venture capital funds primarily focus on early-stage companies and startups, while private equity funds typically invest in more mature companies with established operations. Are capital venture funds suitable for risk-averse investors?

Capital venture funds are generally not suitable for risk-averse investors due to the higher level of risk associated with investing in startups and early-stage companies. Investors with a lower risk tolerance may prefer more conservative investment options.

Share this:

#Capital venture#Venture Capital#Capital venture fund#Seed funding#Seed capital#Venture capital firms#Startup funding#Venture capital fund#Venture capital financing#Seed funding for startups#truth ventures#Venture capital firms in US#Venture capital firms in UK#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital

0 notes

Text

Grow Your Startup With a Leading Venture Capital Firms in India

Solis Capital & Ventures is the premier venture capital firm in India, providing top-notch incubation, acceleration, and merger & acquisition services. With a proven track record of success, our team of experts helps entrepreneurs turn their visions into thriving businesses. Partner with us for unparalleled support and growth opportunities. visit us: https://solisventures.in/

0 notes

Text

Is a Financial Venture Studio Right for Your Fintech Startup?

The fintech industry is booming, with innovative startups disrupting traditional financial services models. But for aspiring entrepreneurs, navigating the complexities of launching a successful fintech startup can be daunting. Here's where Financial Venture Studio (FVS) emerge as a compelling option.

What is a Financial Venture Studio?

Unlike traditional venture capital (VC) firms that invest in existing startups, FVSs are essentially startup factories specifically focused on the fintech space. They act as a one-stop shop, providing not just funding but also critical resources like:

Idea generation and validation: FVSs often have a team of experienced professionals who identify promising fintech opportunities, conduct market research, and validate ideas before taking them to market.

Founding team support: They may help assemble a founding team with the necessary expertise in finance, technology, and entrepreneurship.

Operational expertise: FVSs provide access to experienced personnel in marketing, legal, human resources, and other crucial functions, allowing founders to focus on product development and growth.

Network and connections: FVSs leverage their network to connect startups with potential customers, partners, and investment partners in the fintech industry.

Benefits of Partnering with a Financial Venture Studio

For early-stage fintech startups, partnering with an FVS offers a multitude of benefits:

Reduced Time to Market: FVSs can fast-track the launch process by providing access to shared resources and expertise, allowing startups to get their product or service to market faster.

Increased Success Rates: FVSs have a vested interest in the success of their ventures and may offer guidance and support throughout the startup journey, potentially leading to higher success rates.

Reduced Risk and Costs: By leveraging shared resources across multiple startups, FVSs can help startups reduce operational costs and mitigate some of the inherent risks associated with launching a new venture.

Access to Expertise and Networks: FVSs provide valuable mentorship and connect startups with industry experts, potential customers, and investment partners, all of which are crucial for scaling a fintech business.

Are Financial Venture Studios Right for Everyone?

While FVSs offer a plethora of advantages, they might not be the perfect fit for all fintech startups. Here are some things to consider:

Loss of Control: Since FVSs are actively involved in the startup process, founders may need to cede some control over decision-making.

Equity Dilution: In exchange for the support provided, FVSs will take an equity stake in the startup, potentially diluting the founders' ownership.

Focus on Specific Areas: Some FVSs may specialize in specific fintech niches like payments, lending, or wealth management. If your idea falls outside their focus area, it might not be a good fit.

Exploring Financial Venture Studios in India

The Indian fintech landscape is witnessing a surge in FVS activity. With a large and growing population eager to adopt digital financial services, India presents a fertile ground for innovative fintech startups. Partnering with a venture studios in India can be particularly beneficial as they can provide:

Local Market Expertise: Indian FVSs understand the nuances of the domestic fintech market, regulatory landscape, and consumer behavior, giving your startup a competitive edge.

Network of Investors: They can connect you with a network of local and international investment partners who are familiar with the Indian fintech ecosystem.

Finding the Right Financial Venture Studio Partner

Before jumping into a partnership, it's crucial to do your research and find the right FVS for your fintech startup. Here are some key considerations:

Track Record: Look for FVSs with a proven track record of success in the fintech space.

Investment Focus: Ensure their investment focus aligns with your specific fintech niche.

Team Expertise: Evaluate the experience and expertise of the FVS team, especially in areas relevant to your startup's needs.

Culture Fit: Finding an FVS with a culture that aligns with your vision and values is crucial for a successful partnership.

Financial Venture Studios offer a compelling value proposition for aspiring fintech entrepreneurs. By providing comprehensive support, resources, and access to networks, FVSs can significantly increase the chances of a startup's success. However, it's crucial to carefully weigh the benefits and drawbacks and find a studio that aligns with your specific needs and vision.

For startups seeking a knowledgeable and well-connected partner in the Indian fintech landscape, Krystal Ventures Studio is worth exploring. Krystal Ventures Studio connects the startups' needs and investor's interests, fostering a supportive ecosystem for innovative fintech ventures.

0 notes

Link

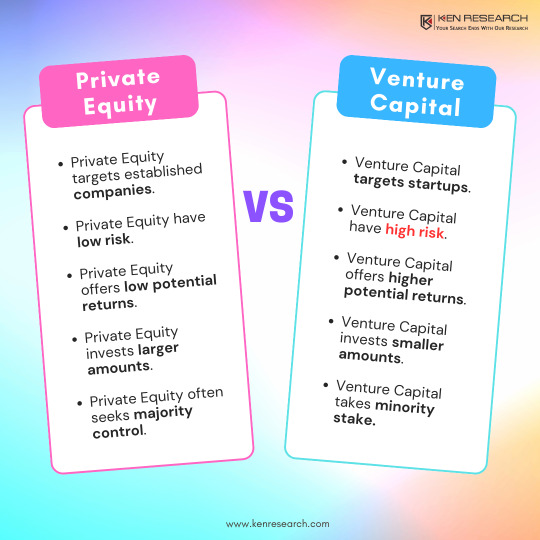

Private Equity vs. Venture Capital: 4 Ways To Tell The Difference

Most of the time Private Equity is considered synonymous with Venture Capital. But, there is a huge difference between the two. Private Equity is a bigger concept while Venture Capital is a subset of Private Equity.

Private Equity

Private Equity firms invest in businesses that have promising growth potential and exit the company at a higher valuation multiple. They generally invest in businesses through Leveraged Buyout strategy. According to this, a major investment is made by the private equity through debt and the rest is funded through PE’s own funds. The debt is taken by keeping the assets of the investee company as collateral. The future cash flows generated will be used to reduce the proportion of debt eventually. This will automatically increase the value of the equity stake held. Most PE firms follow this strategy for investment. Apart from this, another method is growth equity and Venture Capital.

Venture Capital

Venture Capital firms also invest in businesses that have huge growth potential. They mostly invest in startups that have a promising business idea or an established target market. There are various rounds of VC funding depending on the business stage of the startup. Most of the VCs aim to either exit from the company through IPO or by Mergers and acquisitions.

Here Are the Key Differences Between PE and VC

Type of Investment There is a huge difference between the type of companies that a PE and a VC firm choose. For investment. PE firms invest in already successful companies that already have a well-established brand name in the market and it is looking to launch another segment of product or services. Some PEs also invest in companies which are facing thunder due to operational inefficiencies or any other structural challenge. Since PE firms are involved in aggressively managing the company, they believe to overcome these efficiencies to make the company highly profitable.

On the other hand, VCs mostly invest in startups that have innovative business ideas and business models. These companies need to develop a product or want to expand their market.

Also, PE firms buy companies across industries whereas Venture capitalists do theme-based investing.

Capital Structure PEs generally hold more than 50% stake in the company while VCs hold a minority stake in the investee company. Private Equity firms use a combination of Equity and Debt which is called Leveraged Buyout whereas VCs only invest through equity.

Risk Appetite Venture Capital firms invest on the assumption that only the handful of companies that they are investing in will earn returns and the rest will fail. The goal here is not to target the company rather it is to target the industry. They invest in some promising startups in a booming industry so even if one or two startups become industry leaders, they will generate huge profits. This explains their theme-based investing. So, they take more risk than a private equity firm. Therefore, they buy a minority stake in the company to balance the risk.

0 notes