#vehicle loans australia

Explore tagged Tumblr posts

Text

Maximize Your Financial Planning with a Car Loan Calculator

Purchasing a car is a significant financial decision, and understanding your repayment options is essential. At Triple M Finance, based in Round Corner, NSW 2158, we offer a user-friendly car loan calculator designed to help you assess your financing options easily. By using this tool, you can make informed decisions and secure a loan that fits your budget.

What Is a Car Loan Calculator?

A car loan calculator is an online tool that helps prospective borrowers estimate their monthly repayments based on specific loan parameters. By inputting details such as the loan amount, interest rate, and loan term, you can quickly visualize how much you’ll need to pay each month. This can aid in budgeting and planning for your new vehicle purchase.

Why Use a Car Loan Calculator?

Budgeting Made Simple: Knowing your estimated monthly repayments helps you create a realistic budget. You can determine how much you can afford each month, ensuring you don’t overextend yourself financially.

Comparing Loan Options: The calculator allows you to experiment with various loan amounts, interest rates, and repayment terms. This feature is invaluable when comparing different financing options to find the most cost-effective solution.

Understanding Total Costs: Besides monthly repayments, the calculator can also provide insights into the total cost of the loan, including interest paid over the term. This information is crucial for assessing the overall financial commitment of your vehicle purchase.

Avoiding Financial Strain: By visualizing your repayment schedule, you can avoid taking on a loan that may lead to financial strain. This foresight allows for better planning and helps you make a sound investment in your vehicle.

How to Use a Car Loan Calculator

Using a car loan calculator is straightforward. Here’s a simple step-by-step guide:

Enter the Loan Amount: Specify how much you wish to borrow for your vehicle. This amount will typically include the purchase price plus any additional costs like taxes or fees.

Input the Interest Rate: Provide the annual interest rate for the loan. If you’re unsure, you can contact lenders for current rates or consult with our team at Triple M Finance.

Select the Loan Term: Choose how long you want to repay the loan. Common terms range from one to seven years.

Calculate: Hit the calculate button, and the tool will generate your estimated monthly repayments, total interest, and overall loan cost.

Benefits of Choosing Triple M Finance

At Triple M Finance, we understand that navigating the world of car loans can be overwhelming. That’s why we provide more than just a car loan calculator; we offer personalized support to guide you through the entire financing process.

Expert Guidance: Our experienced team can help you interpret the results from the calculator and provide insights into your best loan options.

Access to Competitive Rates: We have established relationships with various lenders, allowing us to help you find competitive interest rates that fit your financial situation.

Streamlined Application Process: Once you’ve used the calculator and chosen a loan option, we ensure that the application process is quick and efficient, so you can get on the road faster.

Conclusion

A car loan calculator is an invaluable tool for anyone looking to purchase a vehicle. It allows you to visualize your repayments, assess your budget, and make informed decisions. If you're ready to take the next step in financing your vehicle, contact Triple M Finance at 0422 331 130. Our team in Round Corner, NSW 2158, is here to assist you with all your car loan needs, ensuring a smooth and stress-free experience. Let us help you drive away in your new car with confidence!

0 notes

Text

Dandelion News - October 15-21

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles on Patreon!

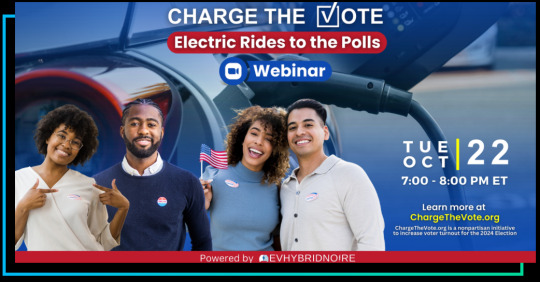

1. EV owners volunteer to drive voters to the polls in 11 states (and you can too)

“ChargeTheVote.org is a nonpartisan voter education and engagement initiative to enhance voter turnout in the 2024 election by providing zero-emission transportation in electric vehicles (EVs) to local polling locations. ChargeTheVote will also host a webinar for those who are interested in participating this coming Tuesday, October 22 at 7pm Eastern time.”

2. Kenya moves 50 elephants to a larger park, says it’s a sign poaching is low

“The elephant population in the […”Mwea National Reserve”…] has flourished from its capacity of 50 to a whopping 156 […] requiring the relocation of about 100 of [them…. The] overpopulation in Mwea highlighted the success of conservation efforts over the last three decades.”

3. Australian start-up secures $9m for mine-based gravity energy storage technology

““We expect to configure the gravitational storage technology [which the company “hopes to deploy in disused mines”] for mid-duration storage applications of 4 to 24 hours, deliver 80% energy efficiency and to enable reuse of critical grid infrastructure.“”

4. Africa’s little-known golden cat gets a conservation boost, with community help

“[H]unting households were given a pregnant sow [… so that they] had access to meat without needing to trap it in the wild. […] To address income needs, Embaka started […] a savings and loan co-op[… and an] incentive for the locals to give up hunting in exchange for regular dental care.”

5. 4.8M borrowers — including 1M in public service — have had student debt forgiven

“That brings the total amount of student debt relief under the administration to $175 billion[….] The Education Department said that before Biden's presidency, only 7,000 public servants had ever received student debt relief through the Public Service Loan Forgiveness program. […] "That’s an increase of more than 14,000% in less than four years.””

6. Puerto Rico closes $861M DOE loan guarantee for huge solar, battery project

“The solar plants combined will have 200 megawatts of solar capacity — enough to power 43,000 homes — while the battery systems are expected to provide up to 285 megawatts of storage capacity. [… O]ver the next 10 years, more than 90 percent of solar capacity in Puerto Rico will come from distributed resources like rooftop solar.”

7. Tim Walz Defends Queer And Trans Youth At Length In Interview With Glennon Doyle

“Walz discussed positive legislative actions, such as codifying hate crime laws and increasing education[.… “We] need to appoint judges who uphold the right to marriage, uphold the right to be who you are [… and] to get the medical care that you need.””

8. Next-Generation Geothermal Development Important Tool for Clean Energy Economy

““The newest forms of geothermal energy hold the promise of generating electricity 24 hours a day using an endlessly renewable, pollution-free resource[… that] causes less disturbance to public lands and wildlife habitat […] than many other forms of energy development[….]”

9. Sarah McBride hopes bid to be first transgender congresswoman encourages ’empathy’ for trans people

““Folks know I am personally invested in equality as an LGBTQ person. But my priorities are going to be affordable child care, paid family and medical leave, housing, health care, reproductive freedom. […] We know throughout history that the power of proximity has opened even the most-closed of hearts and minds.”“

10. At Mexico’s school for jaguars, big cats learn skills to return to the wild

“[A team of scientists] have successfully released two jaguars, and are currently working to reintroduce two other jaguars and three pumas (Puma concolor). [… “Wildlife simulation”] “keeps the jaguars active and reduces the impact of captivity and a sedentary lifestyle[….]””

October 8-14 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#good news#hopepunk#electric vehicles#voting#elephant#kenya#conservation#australia#battery#energy storage#africa#cats#hunting#tw animal death#student loans#student debt#debt relief#education#puerto rico#solar#solar panels#solar energy#solar power#tim walz#lgbt#lgbtq#geothermal#renewableenergy#trans rights#transgender

28 notes

·

View notes

Text

Navigating Car Loans in Melbourne: Consumer and Commercial Loan Solutions by Fundrr

Purchasing a vehicle—whether for personal or business use—can be a significant financial commitment. At Fundrr, we simplify the process with a rapid and transparent approach, connecting you with over 25 lenders to find the best financing options tailored to your needs. Whether you’re looking for a Consumer Car Loan, Personal Loan, Commercial Car Loan, Refinancing, or Insurance, Fundrr ensures a seamless and efficient journey.

Why Choose Fundrr for Your Car Loan Needs?

1. Personalized Interest Rates in 60 Seconds

Through our rapid and straightforward online procedure, we align your profile and the car you’re considering with our extensive lender network. Within just 60 seconds, you can access personalized interest rates with full transparency on fees, rates, and monthly payments.

2. No Impact on Your Credit Score

Fundrr allows you to explore potential financing options without negatively impacting your credit score. If you’re satisfied with the rates, you can proceed with your application, providing additional details for a pre-screening before submission to your selected lender.

3. Car Loan Calculator for Estimations

To make informed decisions, leverage our car loan calculator to estimate potential monthly payments. This tool helps you plan ahead and choose the best financing option that fits your budget.

Commercial Car Loans: Tailored Solutions for Businesses

At Fundrr, we deliver comprehensive Commercial Car Loan solutions for businesses, covering everything from lightweight vehicles to heavy machinery. Whatever moves on wheels, we’ve got you covered!

Benefits of Commercial Car Loans

Streamlined Documentation – Simplified requirements to expedite the financing process.

Flexible Financing Options – Finance a diverse range of vehicle types with ease.

Potential Tax Benefits – Optimize your business expenses and gain financial advantages.

When Should You Consider a Commercial Loan?

When the vehicle is intended for business use at least 50% of the time.

If you’re financing a vehicle or any wheeled equipment for commercial purposes.

When your financing needs are below $250,000 per asset.

Secure the Best Car Loan Rates with Fundrr

If you’re on the hunt for the most favourable interest rates for your upcoming car loan but feel unsure where to start, Fundrr is here to guide you through the process. Our expertise ensures confidence in your approval before advancing further, making your loan application journey hassle-free.

Get started today with Fundrr and drive away with confidence!

#Fundrr Australia#Fundrr#Personal Loan in Truganina#Trade Fundrr#Vehicle & Personal loan Tarneit#Commercial Car Refinance#Refinance Commercial Car Loan#Loan & Financing Services Truganina#Private Money Lenders Truganina#Refinance Services Melbourne#Melbourne Refinancing Services#Credit Scores And Car Loans#Credit Rating For Car Loan#Refinancing Services Melbourne#Car Loans And Credit Scores#Car Loan Commercial Melbourne#Commercial Auto Loan Refinance#Commercial Car Finance#Refinance Commercial Vehicle Loan#Commercial Car Loan Melbourne#Credit Scores And Auto Loans#Refinance Commercial Vehicle#Commercial Car Loans Melbourne#Commercial Auto Refinance#Commercial Car Interest Rate

0 notes

Text

Business & Personal Loans | Mortgage Broker - Fundrr Australia

Business & Personal Loans | Mortgage Broker - Fundrr Australia

Welcome to Fundrr, Your Trusted Partner for Vehicle and Personal Loans

At Fundrr Australia, we are dedicated to supporting your financial journey, whether you're purchasing your dream car or seeking funds for personal milestones. Our goal is to transform your dreams into reality with our comprehensive range of financial services.

Why Choose Fundrr?

With years of industry experience, Fundrr offers hassle-free access to affordable and flexible financing solutions tailored to your unique needs. Our expert team is committed to helping you navigate the complexities of loans and financing, ensuring informed decisions that align with your financial goals.

Our Services:

Consumer Car Loans

Dreaming of driving your ideal vehicle? Our Consumer Car Loans provide competitive rates, ensuring you hit the road with ease. Whether you're in Truganina or Tarneit, we cater to your needs.

Personal Loans

Looking for extra funds to meet important personal milestones? Fundrr offers Personal Loans in Truganina with flexible terms and conditions to suit your requirements.

Commercial Car Loans

For businesses in need of fleet expansion, our Commercial Car Loans in Melbourne offer tailored financing options. We understand the importance of maintaining a robust business fleet.

Refinancing Services

Considering refinancing? Our Refinance Services in Melbourne offer solutions to reduce your financial burden. Whether it’s a Commercial Auto Loan Refinance or a Refinance Commercial Car Loan, we’ve got you covered.

Insurance Services

Protect your investments with our comprehensive Insurance Services. We offer solutions designed to provide peace of mind for both personal and commercial vehicles.

Why Fundrr?

Private Money Lenders in Truganina: We offer personalized lending services to meet diverse financial needs.

Refinancing Services in Melbourne: Lower your financial stress with our Melbourne Refinancing Services tailored to your specific situation.

Commercial Car Finance: Access competitive Commercial Car Interest Rates to grow your business fleet without breaking the bank.

Understanding Credit Scores and Loans

Navigating Credit Scores and Car Loans can be challenging. At Fundrr, we help you understand how your Credit Rating for Car Loans impacts your borrowing potential, ensuring you secure the best possible terms.

Contact Us

Ready to explore your loan options? Trust Fundrr Australia to provide the best Loan & Financing Services in Truganina. Whether you're looking for a Vehicle & Personal Loan in Tarneit or a Commercial Car Loan in Melbourne, we are here to help.

Fundrr Australia – Making your financial dreams a reality.

#Fundrr Australia#Fundrr#Personal Loan in Truganina#Trade Fundrr#Vehicle & Personal loan Tarneit#Commercial Car Refinance#Refinance Commercial Car Loan#Loan & Financing Services Truganina#Private Money Lenders Truganina#Refinance Services Melbourne#Melbourne Refinancing Services#Credit Scores And Car Loans#Credit Rating For Car Loan#Refinancing Services Melbourne#Car Loans And Credit Scores#Car Loan Commercial Melbourne#Commercial Auto Loan Refinance#Commercial Car Finance#Refinance Commercial Vehicle Loan#Commercial Car Loan Melbourne#Credit Scores And Auto Loans#Refinance Commercial Vehicle#Commercial Car Loans Melbourne#Commercial Auto Refinance#Commercial Car Interest Rate

1 note

·

View note

Text

What Does a Mortgage Professional Do?

A mortgage professional is a licensed financial professional who gathers borrowers' financial documentation, compares rates and connects them with lenders. They can help with both residential and commercial mortgages.

Lenders typically require a debt-to-income ratio of 43% or less. However, professionspecific mortgage lenders understand that doctors in residency and attorneys early in their careers may have higher DTIs.

Qualifications

A mortgage professional assists clients with one of the most important investments in their lives. They have a wide range of responsibilities, including preparing loan documents and communicating with lenders, closing agents and real estate professionals. They also help clients choose the right type of loan and negotiate rates. They must be knowledgeable about the mortgage market and have excellent math skills.

Many mortgage brokers have a college degree or a high school diploma, which helps them understand complex data and deal with challenges. In addition, they should have strong reading comprehension and mathematical reasoning skills. The mortgage industry is constantly changing, so it is important to keep up with new regulations and trends. Mortgage professionals should also pursue mentorship opportunities and attend networking events to improve their knowledge of the industry. They should also obtain a license from the National Mortgage Licensing System and Registry (NMLS). This allows them to work in any state and helps ensure compliance with federal laws.

Fees

Mortgage professionals often develop relationships with lenders and have access to different loan programs that are not available to the general public. This means that they are able to help you find the right type of mortgage for your situation. They will also explain the various fees associated with mortgage lending and help you fill out paperwork. They will also communicate with the lender company, closing agent and real estate agent to make sure that all the details are taken care of.

Mortgage fees vary between lenders and brokers, and some are negotiable. Watch out for fees that are redundancies or excessive, and be aware of the ways in which a broker can be compensated for their services. For instance, some lenders may add mortgage broker fees into the loan origination fee. This can be misleading for borrowers. Also, be careful to look at the complete list of mortgage fees on the Loan Estimate and Closing Disclosure.

Loan types

The mortgage loan industry offers a variety of loans to suit different types of homebuyers. These include Conventional Mortgage Loans, FHA-Insured Loans, home loans and Government-Guaranteed Loans.

A professional can help borrowers determine which loan programs will work best for them. These professionals understand mortgage laws and lender guidelines, so they can save borrowers time and money by helping them choose the right loan program for their unique circumstances.

Besides conventional mortgages, there are also loan programs geared towards specific professions. For example, mortgage lenders offer mortgages for doctors, attorneys and other high-income professionals. These mortgages often have a lower down payment and do not require PMI payments.

Before choosing a mortgage broker, be sure to research the various options available. Look for reviews, social media pages and Better Business Bureau profiles. Also, ask for recommendations from friends and family. It is essential to find a broker who can get you the specific loan type you need.

Closing

You wouldn’t make a major financial investment without consulting with a stockbroker, so why would you shop for a home loan without talking to a mortgage professional? They are your resource for answering questions, structuring a financing solution that works best for your goals and closing on time.

During the closing process (also known as consummation), you and your mortgage professional will sign several documents related to the purchase of your home. These documents confirm your agreement to pay a specific sum of money and the terms of your mortgage. You may provide funds in the form of certified checks or wire transfers to fund your mortgage loan, and a closing agent will ensure that these funds are properly disbursed.

Mortgage professionals also prepare and review your Closing Disclosure, ensuring that all necessary fees are included in the final amount you sign for. They are also present during your final walkthrough to address any last-minute concerns you might have about the property.

#mortgage professional#investment property#investment property loan#australian finance group#finance group australia#business loans for new businesses#investment loans#home loans#asset finance#heavy vehicle finance#trailer finance#Cash flow finance#floorplan finance

0 notes

Text

Things Biden and the Democrats did, this week #9

March 9-15 2024

The IRS launched its direct file pilot program. Tax payers in 12 states, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, Arizona, Massachusetts, California and New York, can now file their federal income taxes for free on-line directly with the IRS. The IRS plans on taking direct file nation wide for next year's tax season. Tax Day is April 15th so if you're in one of those states you have a month to check it out.

The Department of Education’s Office of Civil Rights opened an investigation into the death of Nex Benedict. the OCR is investigating if Benedict's school district violated his civil rights by failing to protect him from bullying. President Biden expressed support for trans and non-binary youth in the aftermath of the ruling that Benedict's death was a suicide and encouraged people to seek help in crisis

Vice President Kamala Harris became the first sitting Vice-President (or President) to visit an abortion provider. Harris' historic visit was to a Planned Parenthood clinic in St. Paul Minnesota. This is the last stop on the Vice-President's Reproductive Rights Tour that has taken her across the country highlighting the need for reproductive health care.

President Biden announced 3.3 billion dollars worth of infrastructure projects across 40 states designed to reconnect communities divided by transportation infrastructure. Communities often split decades ago by highways build in the 1960s and 70s. These splits very often affect communities of color splitting them off from the wider cities and making daily life far more difficult. These reconnection projects will help remedy decades of economic racism.

The Biden-Harris administration is taking steps to eliminate junk fees for college students. These are hidden fees students pay to get loans or special fees banks charged to students with bank accounts. Also the administration plans to eliminate automatic billing for textbooks and ban schools from pocketing leftover money on student's meal plans.

The Department of Interior announced $120 million in investments to help boost Climate Resilience in Tribal Communities. The money will support 146 projects effecting over 100 tribes. This comes on top of $440 million already spent on tribal climate resilience by the administration so far

The Department of Energy announced $750 million dollars in investment in clean hydrogen power. This will go to 52 projects across 24 states. As part of the administration's climate goals the DoE plans to bring low to zero carbon hydrogen production to 10 million metric tons by 2030, and the cost of hydrogen to $1 per kilogram of hydrogen produced by 2031.

The Department of Energy has offered a 2.3 billion dollar loan to build a lithium processing plant in Nevada. Lithium is the key component in rechargeable batteries used it electric vehicles. Currently 95% of the world's lithium comes from just 4 countries, Australia, Chile, China and Argentina. Only about 1% of the US' lithium needs are met by domestic production. When completed the processing plant in Thacker Pass Nevada will produce enough lithium for 800,000 electric vehicle batteries a year.

The Department of Transportation is making available $1.2 billion in funds to reduce decrease pollution in transportation. Available in all 50 states, DC and Puerto Rico the funds will support projects by transportation authorities to lower their carbon emissions.

The Geothermal Energy Optimization Act was introduced in the US Senate. If passed the act will streamline the permitting process and help expand geothermal projects on public lands. This totally green energy currently accounts for just 0.4% of the US' engird usage but the Department of Energy estimates the potential geothermal energy supply is large enough to power the entire U.S. five times over.

The Justice for Breonna Taylor Act was introduced in the Senate banning No Knock Warrants nationwide

A bill was introduced in the House requiring the US Postal Service to cover the costs of any laid fees on bills the USPS failed to deliver on time

The Senate Confirmed 3 more Biden nominees to be life time federal Judges, Jasmine Yoon the first Asian-America federal judge in Virginia, Sunil Harjani in Illinois, and Melissa DuBose the first LGBTQ and first person of color to serve as a federal judge in Rhode Island. This brings the total number of Biden judges to 185

#Thanks Biden#Joe Biden#Democrats#politics#US politics#good news#nex benedict#abortion#taxes#climate change#climate action#tribal communities#lithium#electronic cars#trans rights#trans solidarity#judges

367 notes

·

View notes

Text

And the world screws me again... need a new car bc mine is gonna crap itself soon, its a 4wd with a lot of mileage so maintenance was getting expensive... so heres the kicker, about 2 weeks ago im ready to sell for a decent mark due to the modifications on the vehicle, im sitting pretty looking to get something decent, now the Reserve bank of Australia has raised interest rates going from 6.5% to most of the major lenders offering 12-19%.... so when i was 17 and first bought the car i could afford a 20,000 dollar loan, even when earning less that 2k a fortnight, now my car is starting to fail and i cannot afford a loan even now as a 25 year old with full time work which is a higher wage than at 17 i cannot afford the same loan... this is a cruel cycle, im very fortunate to have fall backs but this is what ruins lives, people here depend on cars for work, you dont have a car? Sorry no job for you. How the hell can they justify spending millions of tax payer money on city public transport and infastructure when rural people cant even leave their homes.

6 notes

·

View notes

Text

Secure the Best Loan Solutions with Expert Commercial Loan Brokers

Finding the right monetary aid on your personal and enterprise needs can be hard. Whether you are planning to shop for a home, refinance a automobile, or spend money on business belongings, expert agents can simplify the process and help you steady the satisfactory offers. Working with experienced Commercial Loan Brokers guarantees you access tailor-made mortgage options perfect for your precise necessities.

Why Mortgage Pre Approvals Matter

Getting Mortgage Pre Approvals is an crucial first step while shopping assets. It offers you a clean knowledge of the way a great deal you can borrow and strengthens your function when negotiating with sellers. Pre-approval shows you’re a severe customer, making your gives more attractive in competitive markets.

Benefits of Car Loan Refinancing

If you’re struggling with high vehicle mortgage payments, Car Loan Refinancing offers a practical answer. By refinancing, you could steady lower interest fees, reduce your month-to-month payments, and store money over the lifestyles of your mortgage. It’s a clever monetary pass for the ones seeking to ease their finances and manipulate debt more efficiently.

How a Car Refinance Loan Works

A Car Refinance Loan allows you to replace your existing automobile loan with a new one at higher terms. Whether you need decrease hobby quotes, extended repayment durations, or reduced month-to-month fees, refinancing can help. It’s perfect for anybody looking for economic flexibility and lengthy-time period financial savings.

Choose the Right Business Mortgage Broker

When it comes to business property investment, running with a Business Mortgage Broker makes all of the distinction. They offer professional steering, assisting you locate the excellent mortgage merchandise tailor-made for your enterprise goals. With get admission to to more than one lenders and aggressive quotes, a broking guarantees you stable favorable terms.

Exploring Business Commercial Loan Options

A Business Commercial Loan offers essential funding for increasing your business, shopping belongings, or making an investment in system. These loans provide flexible terms and may be customized to satisfy your employer’s monetary wishes. Consulting with a expert broker simplifies the software method and will increase your possibilities of approval.

Why Commercial Loans Australia Are in Demand

Commercial Loans Australia cater to businesses seeking capital for growth and improvement. Whether you need financing for assets, construction, or operational expenses, business loans offer various options. With aggressive costs and bendy terms, these loans aid enterprise success throughout industries.

Working with Commercial Loan Lenders

Choosing the right Commercial Loan Lenders ensures you acquire the high-quality possible phrases and fees. Experienced creditors offer tailored mortgage products, short approvals, and obvious approaches. Partnering with reliable lenders simplifies the borrowing revel in and enables you reap your financial dreams.

How Commercial Loan Brokers Simplify the Process

Commercial Loan Brokers act as intermediaries among debtors and lenders, negotiating favorable terms to your behalf. Their enterprise understanding and community of monetary institutions provide you with get entry to a huge variety of mortgage products. Brokers deal with the paperwork, making sure a easy and efficient software procedure.

Construction Loans Australia: Build with Confidence

Construction Loans Australia provide the funding you need to begin building your dream property or expand your enterprise premises. These loans cowl land purchases, creation charges, and development costs. With bendy drawdown options and aggressive prices, construction loans provide critical help for huge-scale tasks.

Our Social Media Accounts URL:

0 notes

Text

10kW Solar System with Battery Price in Australia: Cost, Benefits & Savings

Introduction

How Much Does a 10kW Solar System with Battery Cost in Australia?

The cost of a 10kW solar system with battery storage in Australia varies based on several factors, including the quality of solar panels, the type of inverter, the battery capacity, and installation fees.

Here’s a general pricing breakdown:

10kW Solar System Only: $9,000 — $15,000

10kW Solar System with Battery Storage: $18,000 — $30,000

Factors Affecting the Price:

Solar Panel Brand & Efficiency — Premium brands like SunPower or LG cost more than budget options.

Battery Storage Capacity — A 10kWh battery costs around $8,000 — $12,000, while a 13.5kWh Tesla Powerwall is around $13,000 — $16,000.

Inverter Type — Hybrid inverters cost more than standard ones.

Installation Costs — Prices may vary based on the installer, location, and complexity of the job.

Government Rebates & Incentives — The Small-scale Renewable Energy Scheme (SRES) reduces upfront costs through STCs (Small-scale Technology Certificates).

Is a 10kW Solar System with Battery Right for You?

A 10kW solar system with battery storage is ideal for households with high energy consumption or small businesses aiming for energy independence. Here’s what you need to consider:

1. Energy Consumption

A 10kW solar system generates around 35–45kWh per day, depending on sunlight conditions. This is suitable for homes using 30–40kWh per day, typically with large appliances like air conditioners, pool pumps, and electric vehicles.

2. Battery Storage Needs

Adding a 10kWh — 13.5kWh battery allows you to store excess solar energy for night-time use. If your goal is full off-grid living, you may require multiple batteries.

3. Roof Space

A 10kW system requires about 50–60m² of roof space for 24–28 solar panels (depending on panel efficiency).

4. Feed-in Tariffs vs. Self-Consumption

If you don’t have a battery, excess solar energy is exported to the grid at feed-in tariff rates (around 5–12 cents per kWh).

With a battery, you store and use excess power, reducing grid reliance and saving more.

Benefits of a 10kW Solar System with Battery

1. Significant Savings on Electricity Bills

With solar and battery storage, you can cut your electricity bills by up to 80–90%.

Example Savings Breakdown:

Average Daily Usage: 40kWh

Solar Power Generated: 40kWh

Battery Storage for Night Use: 10–13.5kWh

Grid Usage: Minimal to none

Annual Savings: $2,500 — $4,000 (varies by state & energy rates)

2. Energy Independence & Backup Power

With battery storage, you reduce dependence on the grid.

Some batteries provide backup power during blackouts.

3. Reduce Carbon Footprint

A 10kW solar system offsets around 15–18 tonnes of CO2 annually, making a significant impact on sustainability.

4. Increased Property Value

Homes with solar and battery storage sell faster and at higher prices, as buyers value lower energy costs.

Best Solar Battery Options for a 10kW System in Australia

Tesla Powerwall 2 (13.5kWh) — $13,000 — $16,000

LG Chem RESU 10 (9.8kWh) — $8,000 — $10,000

Sungrow SBR (9.6kWh — 25.6kWh) — $8,000 — $12,000

BYD Battery Box Premium (10.2kWh — 22.1kWh) — $8,500 — $11,500

Government Rebates & Incentives for Solar and Battery in Australia

The Australian Government offers incentives to reduce the cost of solar and battery storage:

Small-scale Renewable Energy Scheme (SRES) — Provides STCs (Small-scale Technology Certificates) that reduce upfront costs.

State-Specific Battery Rebates:

Victoria: Solar Battery Rebate (up to $3,500)

South Australia: Home Battery Scheme (up to $2,000 rebate)

New South Wales: Interest-free battery loans under the Empowering Homes Program

ROI & Payback Period for a 10kW Solar System with Battery

The payback period depends on factors like system cost, energy savings, and incentives. Generally:

Without Battery: 3–5 years

With Battery: 7–10 years

However, with rising electricity rates, a battery can become profitable faster.

Choosing the Right Solar Installer in Australia

To get the best 10kW solar system with battery price in Australia, consider these factors:

Accreditation — Choose a CEC-accredited solar installer.

Reputation — Check customer reviews & testimonials.

Warranty — Look for at least 25 years on panels, 10 years on batteries & inverters.

After-Sales Support — Ensure ongoing monitoring & maintenance options.

Conclusion: Is a 10kW Solar System with Battery Worth It?

A 10kW solar system with battery storage is a smart investment for Australian homeowners and businesses looking to cut energy costs, gain energy independence, and reduce carbon emissions. While the upfront cost can be high, rebates, feed-in tariffs, and long-term savings make it a financially sound decision.

Get a Quote Today!

If you’re considering a 10kW solar system with battery storage, get multiple quotes from reputable solar installers to compare pricing and incentives available in your area.

Related Post: 10kW Solar Battery Price Sydney — The Best Energy Solution

1 note

·

View note

Text

How to Get a Car with No Credit Check and No Deposit in Melbourne

Buying a car and having a lease while possessing no credit history or a bad one can sometimes feel impossible. Some lenders evaluate the financial status of a person or offer financial assistance with a deposit. This guide will help them live in Melbourne without imposing restrictions on a vehicle purchase.

My phraseology differs from the mainstream parlance, which has given so many people flexibility and freedom. I shall here explain the concept of finding these new-age offers, qualifying for these, and the red flags that need to be considered.

No Credit Check and No Deposit Car Lease Financing

Before proceeding, I need to explain what these terms mean and how they affect your car financing.

What Does “No Credit Check” Car Financing Mean?

It is also important to explain what is meant by the phrase “no credit check.” It can also be referred to as a “no credit score rating check.” Most lenders will require a FICO to determine loan eligibility. Certain lenders allow you to skip this step and provide loans to clients with very little or no FICO. This, however, benefits those people but does have a catch. These options come up with incredibly high interest rates and repayment terms that can be considered downright suffocating.

What Does “No Deposit” Car Financing Mean?

A deposit reduces the total loan amount while also giving the lender some comfort. While no-deposit financing voids that requirement, it generally leads to higher payments and tougher stipulations like providing proof of stable employment.

Who Offers No Deposit Car Financing?

Car dealerships that deal with clients having a history of bad credit.

Buy here, pay here dealerships that do their financing.

Private sellers who have a lease-to-purchase option.

Lenders on the internet who bring sellers and buyers together with easy financing.

Where To Get No Credit Check And No Deposit Car Deals In Melbourne

If you’re searching for a car with low or no credit in Melbourne, consider these possibilities first.

1. Bad Credit History Dealerships

Certain dealerships offer bad credit auto loans to people with low or no credit standing. Dealerships like these usually have their automobile financing and can bypass credit restrictions.

2. Buy Here Pay Here Dealers

These dealers offer car purchases and financing under one roof. They are less likely to use outside lenders, which means no credit checks. Unfortunately, the interest rates tend to be on the higher end.

3. Renting with a Purchase Option and Private Sellers

The option of car subscription in Melbourne is offered by some private sellers. Instead of making a hefty upfront payment, you can pay in multiple installments. Always make sure you have an agreement in writing to avoid issues in the future.

4. Online Platforms for Car Loans with Bad Credit

Sites like CarLoans.com.au and DriveNow are useful for matching borrowers with lenders willing to provide no-deposit loans. These sites help you quickly identify the best loans for your needs.

5. Car Buying with Peer-to-Peer Lending

There are peer-to-peer lending platforms where individuals can lend out funds for buying a vehicle, often without strict requirements like credit score checks.

6. Vehicle Assistance from Nonprofit Organizations or Government Programs

There are programs in Melbourne focused on people with limited financial resources; however, there are not many, so do your research.

What Is Needed and the Qualification Steps?

Lenders look for the following even if no credit history is needed:

Steady income: Income history or proof of income documents.

Employment confirmation: A reasonable income level has a higher chance of getting approved.

Proof of residency and identity: proof of living in Australia.

Co-signer or guarantor: Some lenders will need a co-signer willing to share the financial burden.

Alternative Financing Solutions with No Credit Check and No Deposit Required

In case the traditional financing methods do not work out for you, consider the following options:

1. Car Subscription Contracts

With Car Subscription, no credit check, and no deposit in Melbourne, you make fixed payments to lease the vehicle first, which will eventually make the car automatically yours.

2. Lease to Own Contracts

Similar to Car Subscription, lease to own cars in Melbourne mean that a lessee will have the option to purchase the vehicle after the leasing term has expired.

3. Unsecured Personal Loans

Other loan providers offer credit-free personal loans. Although, it is worth mentioning that this option provides the borrower with the greatest danger due to the exorbitant interest rates for such types of loans.

4. Subscription-Based Cars

Companies like Carly and Carbar provide subscription-based services that allow customers to pay a monthly fee to use a car without owning it.

5. Car Financing with Salary Deduction

With these strategies, an employer allows an employee to sacrifice some part of their salary to purchase or lease a car without an upfront payment.

6. Asset-Based Secured Loans

In case you have an asset that can serve as security, you can qualify for financing against that asset.

Pros and Cons of Car Financing Without a Credit Check and Deposit

Pros:

✅ Instant approval.

✅ Does not affect credit history.

✅ Access to a new car immediately.

Cons:

❌ Increased rates of interest.

❌ Fewer options to choose from.

❌ May include undisclosed charges or unfavorable conditions.

Tips To Avoid Getting Scammed In High-Risk Deals

Follow these tips to avoid scams and risky financial offers during business transactions with a lender:

Seek to compare several lenders for the most cost-effective offer.

Look through car dealers' reviews and customer ratings.

Make sure you read through the contract to avoid hidden charges.

Get someone in the field to explain terms you do not understand.

Steps Necessary for Financing a Car in the Future

If you can obtain a car with no credit check done on you, focus on improving your credit score for more financing options in the future.

Ways to Improve Credit Scores:

Get a secured credit card to begin a credit history.

Reliable bill paying boosts credit.

Lowering existing overdue payments increases credit ratings.

Using a credit builder loan enables you to show responsibility in borrowing funds.

Summary

Acquiring a car without a down payment and not undergoing a credit check is attainable, although it requires a thorough evaluation of the financing conditions, collateral interest rates, and the lender’s reputation. For dependable vehicle financing in Melbourne, Freedom Cars is the best option that guarantees a straightforward process.

0 notes

Text

On the Road to Success: Navigating Vehicle Loans in Australia

In the vast expanse of the Australian landscape, where distances are vast and opportunities abound, access to reliable transportation is essential for individuals and businesses alike. Whether it's a sleek sedan for city commuting, a rugged 4WD for outback adventures, or a versatile van for business operations, owning a vehicle opens doors to new possibilities. For many Australians, vehicle loans serve as the key to unlocking the freedom and flexibility of vehicle ownership. In this blog post, we'll explore the world of vehicle loans in Australia, their features, benefits, and how they pave the way for individuals and businesses to embark on journeys of success.

Understanding Vehicle Loans in Australia

What are Vehicle Loans?: Vehicle loans, also known as car loans or auto finance, are financial products designed to help individuals and businesses purchase vehicles. In Australia, vehicle loans are offered by banks, credit unions, and other financial institutions, providing borrowers with access to funds to buy new or used vehicles.

Types of Vehicle Loans: Vehicle loans in Australia come in various forms to suit different needs and preferences:

New Car Loans: Financing options specifically tailored for purchasing brand-new vehicles from dealerships.

Used Car Loans: Loans designed for purchasing pre-owned vehicles from dealerships or private sellers.

Secured vs. Unsecured Loans: Secured loans require collateral (the vehicle itself), while unsecured loans do not, offering different risk profiles and interest rates.

Benefits of Vehicle Loans in Australia

Affordable Financing: Vehicle loans offer borrowers access to affordable financing options, allowing them to spread the cost of the vehicle over time through fixed monthly payments. This makes purchasing a vehicle more accessible and manageable, even for those on a tight budget.

Ownership and Equity: Unlike leasing, which involves renting a vehicle for a fixed period, vehicle loans enable borrowers to own the vehicle outright once the loan is fully repaid. Ownership provides borrowers with equity in the vehicle, allowing them to sell or trade-in the vehicle in the future if desired.

Flexible Terms: Vehicle loans offer flexible repayment terms, allowing borrowers to choose the loan duration that best fits their financial situation and budget. Longer loan terms typically result in lower monthly payments, while shorter terms may lead to quicker loan payoff and reduced interest costs.

Convenience and Accessibility: Vehicle loans are readily available from a variety of lenders, including banks, credit unions, and online lenders. With streamlined application processes and quick approval times, borrowers can secure financing for their vehicle purchase with ease and convenience.

Qualifying for Vehicle Loans in Australia

Credit History: Lenders evaluate borrowers' creditworthiness based on factors such as credit score, credit history, and payment history. A strong credit profile increases the likelihood of loan approval and may qualify borrowers for lower interest rates and better loan terms.

Income and Employment: Lenders may require proof of income and employment to ensure borrowers have the financial means to repay the loan. Stable employment and sufficient income are important factors in qualifying for vehicle loans and determining loan amounts.

Down Payment: While not always required, a down payment can help reduce the loan amount and lower monthly payments. Lenders may offer more favorable loan terms to borrowers who can provide a larger down payment upfront.

Conclusion

Vehicle loans in Australia pave the way for individuals and businesses to access reliable transportation and embark on journeys of success. By offering affordable financing options, flexible terms, and convenient access to capital, vehicle loans empower borrowers to hit the road with confidence and seize new opportunities. Whether purchasing a new or used vehicle, financing a fleet for business operations, or exploring refinancing options, vehicle loans provide Australians with the financial resources needed to navigate the highways of life. Let's embrace the benefits of vehicle loans as a valuable tool for achieving mobility, independence, and prosperity on the road ahead.

At Triple M Finance, our experience and a wealth of industry connections allow us to assist you with your application from start to finish and make the process simple. We take the time to get to know each and every client’s indvidual needs and circumstances to ensure we provide you with your ideal financial solution.

0 notes

Text

Get the Best Truck Loans in Melbourne, Australia

For businesses in Melbourne, owning a truck can be a pivotal move toward increasing operational efficiency, expanding delivery capabilities, and enhancing service offerings. Whether you need a truck for transporting goods, catering to a niche market, or scaling up operations, the right financing can make all the difference. Truck Loans in Melbourne Australia offer a practical and affordable way to make this investment a reality.

Securing a truck loan in Melbourne is easier than ever, thanks to a variety of financial institutions and lenders offering tailored solutions to meet your unique needs. The process of obtaining a loan is streamlined, with flexible repayment terms and competitive interest rates, ensuring that businesses of all sizes can access the vehicles they need without compromising their financial stability.

One of the main advantages of opting for a truck loan is the ability to maintain cash flow. Purchasing a truck outright can tie up significant capital that could be better utilized in other areas of your business. By taking out a loan, you can spread the cost over an extended period, making it easier to manage your business's finances. The monthly repayments can be planned and budgeted for, providing you with greater control over your cash flow.

When applying for a truck loan in Melbourne, it's essential to choose a lender that offers a smooth and efficient application process. Many lenders have simplified their application procedures to ensure that business owners can apply online or in person with minimal hassle. This means you can spend less time filling out forms and more time focusing on running your business.

The eligibility criteria for a truck loan are typically straightforward, requiring applicants to have a stable business history, a good credit score, and the ability to demonstrate that they can make regular repayments. Lenders will also want to ensure that the truck you're looking to purchase meets certain standards and that it aligns with the type of business you're running. This can include everything from the truck's size and condition to its anticipated lifespan and resale value.

Interest rates on Truck Finance and Loans in Melbourne Australia can vary depending on the lender and the specifics of your application. While some businesses may qualify for lower rates, others may face slightly higher rates based on factors like creditworthiness or the type of loan they choose. However, with many lenders offering fixed-rate loans, you can benefit from predictable repayments throughout the term of the loan, which can help with long-term financial planning.

Another option to consider is whether you want a secured or unsecured truck loan. A secured loan is one where the truck itself is used as collateral, which may allow you to secure a lower interest rate. On the other hand, unsecured loans typically don’t require collateral, but the interest rates may be higher to offset the increased risk to the lender. The choice between secured and unsecured loans depends on your business's financial position and your willingness to pledge assets as security.

In addition to the traditional truck loan options, there are other financing solutions available for Melbourne businesses. Leasing and hire purchase arrangements are popular alternatives that can help businesses manage cash flow while still acquiring a truck. These options allow you to either lease a truck for a set period or purchase it outright at the end of the lease term. The advantage of these arrangements is that they often come with flexible terms and lower upfront costs, which may appeal to businesses that don’t want to commit to long-term ownership.

As the Australian economy continues to recover and grow, the demand for trucks remains high. Businesses in Melbourne are increasingly looking for reliable, cost-effective financing options to help them take advantage of growth opportunities. Whether you're looking to purchase a new truck or upgrade your existing fleet, taking out a truck loan could be the right step toward achieving your business goals.

The process of securing a truck loan in Melbourne has never been more accessible. By comparing your options and working with a trusted lender, you can find a financing solution that aligns with your needs and budget. With affordable loan terms and the ability to invest in a quality truck, your business can continue to grow and thrive in the competitive Melbourne market.

In conclusion, truck loans in Melbourne offer an effective and convenient way for businesses to own the trucks they need to succeed. With competitive interest rates, simple application procedures, and flexible repayment options, it’s easier than ever to turn your truck ownership dreams into a reality. So, if you’re ready to make an investment in your business, consider applying for a truck loan today.

0 notes

Text

Car Buyers Australia: A Complete Guide to Buying a Car in Australia

Contact Us On: 0418 127 775

Buying a car in Australia can be both exciting and overwhelming, whether you're a first-time buyer or looking to upgrade your current vehicle. With numerous options available—new or used, dealership or private seller, financing or outright purchase—it’s essential to understand the process to make an informed decision.

In this guide, we'll walk you through everything you need to know as a car buyer Australia, from choosing the right vehicle to finalizing the purchase.

1. Understanding the Australian Car Market

The Australian car market is diverse, with options ranging from brand-new models to affordable second-hand vehicles. Some of the most popular car brands in Australia include Toyota, Ford, Mazda, Hyundai, and Holden.

Types of Vehicles Available

Sedans and Hatchbacks – Suitable for city driving and small families.

SUVs and Crossovers – Popular among families due to their spaciousness and safety features.

Utes (Utility Vehicles) – Ideal for tradespeople and off-road enthusiasts.

Electric and Hybrid Cars – Growing in popularity due to environmental concerns and fuel efficiency.

Understanding your needs will help you choose the right car for your lifestyle and budget.

2. Buying a New vs. Used Car in Australia

One of the biggest decisions car buyers in Australia face is whether to buy a new or used vehicle. Each option has its pros and cons.

New Cars: Pros & Cons

✅ Comes with a manufacturer’s warranty. ✅ No previous history of wear and tear. ✅ Latest safety and technology features. ❌ More expensive than used cars. ❌ Depreciates quickly in the first few years.

Used Cars: Pros & Cons

✅ More affordable with lower depreciation. ✅ A wider range of models and brands to choose from. ✅ Lower insurance costs. ❌ Might come with hidden mechanical issues. ❌ Limited or no warranty, depending on where you buy from.

If you're buying a used car, always get a vehicle history report to check for past accidents, repairs, and legal status.

3. Where to Buy a Car in Australia

There are several places to buy a car in Australia, each with its own advantages and risks.

Dealerships

Offer both new and certified pre-owned cars.

Usually provide warranties and financing options.

Prices may be higher compared to private sellers.

Private Sellers

Often cheaper than dealerships.

More room for negotiation.

No warranty, so buyers need to inspect the car carefully.

Online Car Marketplaces

Popular websites like Carsales, Gumtree, and Facebook Marketplace allow buyers to browse thousands of car listings. However, always verify the seller's credibility before making a payment.

4. Car Financing and Payment Options

Not everyone can afford to pay for a car upfront, so financing is a common option for car buyers in Australia.

Financing Options

Car Loans – Offered by banks and credit unions with fixed or variable interest rates.

Dealer Financing – Some dealerships offer in-house financing with promotions.

Novated Lease – A salary-sacrifice option where payments are deducted before tax.

Tips for Financing a Car

✅ Check your credit score before applying. ✅ Compare interest rates from different lenders. ✅ Read the loan terms carefully to avoid hidden fees.

5. Essential Checks Before Buying a Car

Before committing to a purchase, ensure you inspect the car thoroughly, whether it’s new or used.

For Used Cars

Check the PPSR (Personal Property Securities Register) – Ensures the car isn’t stolen or has outstanding finance.

Inspect for Damage – Look for rust, dents, and paint inconsistencies.

Test Drive the Vehicle – Check braking, acceleration, and handling.

Ask for a Mechanic’s Inspection – A professional can spot hidden issues.

For New Cars

Compare Prices Between Dealerships – Some dealers offer better discounts or add-ons.

Check Warranty Coverage – Ensure it includes servicing, parts, and repairs.

Confirm Roadside Assistance – Some brands offer complimentary roadside assistance with new purchases.

6. Registration and Insurance Requirements in Australia

In Australia, all vehicles must be registered and insured before they can be legally driven on the road.

Car Registration

Each state has its own registration process, and fees vary depending on location and vehicle type. Registration is usually valid for 6 to 12 months and must be renewed on time.

Compulsory Third-Party (CTP) Insurance

CTP insurance is required by law and covers injuries caused to others in an accident. It does not cover damage to your car or others’ property.

Additional Insurance Options

Third-Party Property Insurance – Covers damage to other people’s property.

Comprehensive Car Insurance – Covers both your car and others in case of an accident.

Roadside Assistance – Optional, but useful in case of breakdowns.

7. Negotiating the Best Deal on a Car

Negotiation is key to getting the best price, whether you're buying from a dealer or a private seller.

Tips for Negotiation

✅ Research the car’s market value beforehand. ✅ Be willing to walk away if the deal isn’t right. ✅ Ask for extra perks like free servicing, accessories, or extended warranties. ✅ If paying in cash, use it as leverage for a discount.

8. Finalizing the Purchase and Ownership Transfer

Once you’ve agreed on a price, the final step is completing the paperwork and transferring ownership.

For Private Sales

Ensure both parties fill out the Vehicle Transfer Form (available through your state’s transport authority).

Check that all necessary documents (service history, roadworthy certificate, etc.) are provided.

Pay any necessary fees to register the car in your name.

For Dealership Purchases

Review and sign the sales contract carefully.

Confirm all warranties and financing terms.

Take delivery of your car with all necessary keys and manuals.

Conclusion

Car buying service Australia requires careful planning, research, and financial consideration. Whether you choose a new or used car, buy from a dealer or a private seller, always do your due diligence to avoid costly mistakes. With the right approach, you can drive away with a reliable vehicle that suits your needs and budget.

0 notes

Text

Business & Personal Loans | Mortgage Broker - Fundrr Australia

Welcome to Fundrr, your trusted partner for all your vehicle and personal loan needs.

Fundrr Australia

At Fundrr, we understand that life's journey often requires financial support, whether you're looking to hit the open road in your dream car or need some extra funds for those important personal milestones. That's why we're here to make your dreams a reality.

Fundrr Australia offers a wide range of financial solutions, including consumer car loans, commercial car loans, personal loans, refinancing options, insurance, and more.

At Fundrr, we understand that life's journey often requires financial support, whether you're looking to hit the open road in your dream car or need some extra funds for those important personal milestones. That's why we're here to make your dreams a reality.

Our mission is simple: to provide you with hassle-free access to affordable and flexible financing solutions tailored to your unique needs. With years of experience in the industry, our team of experts is dedicated to helping you navigate the complex world of loans and financing, ensuring you make informed decisions that align with your financial goals.

Services:

Consumer Car Loan, Personal Loan, Commercial Car Loan, Refinancing Services, Insurance Services, Financing Solutions, Mortgage Broker

#Fundrr Australia#Vehicle & Personal Loan Australia#Vehicle & Personal Loan Melbourne#Vehicle & Personal loan Tarneit#Personal Loan Australia#Personal Loan in Victoria#Personal Loan Melbourne#Personal Loan in Tarneit#Personal Loan in Truganina#Consumer Car Loan Melbourne#Commercial Car Loan Melbourne#Business Car Loan Tarneit#Refinance Services Australia#Refinance Services Melbourne#Business Loan Melbourne#Mortgage Broker in Australia#Online Insurance in Australia#Loan & Financing Services Truganina#Financing Solutions Melbourne#Business Financing Partner

1 note

·

View note

Text

Loan processing services Australia for Seamless Financial Solutions

In today’s fast-paced financial world, businesses and individuals require efficient and reliable loan processing services Australia to secure funding without delays. Whether you need a home loan, personal loan, business loan, or any other financing solution, professional loan processing services Australia streamline the process and ensure timely approvals.

Why Choose Professional Loan processing services Australia? Securing a loan can be complex, involving extensive paperwork, documentation, and compliance checks. Professional loan processing services Australia simplifies this process by managing everything from document verification to lender negotiations. Here’s why you should consider these services: • Faster approvals: Reduce waiting times by ensuring all necessary paperwork is in order. • Expert guidance: Benefit from financial experts who understand lender requirements. • Reduced errors: Avoid delays caused by incomplete or incorrect documentation. • Access to multiple mortgage brokers: Compare options to secure the best interest rates. Types of Loan processing services Australia 1. Home Loan Processing Buying a home is a significant investment, and professional loan processing services Australia help you navigate mortgage options, pre-approvals, and lender requirements efficiently.

2. Business Loan Processing Entrepreneurs and businesses rely on loan processing services Australia to secure funding for expansion, equipment purchases, or working capital. Experts ensure businesses get the best loan terms.

3. Personal Loan Processing From debt consolidation to emergency expenses, loan processing services Australia help individuals obtain personal loans with minimal hassle and favorable interest rates.

4. Car Loan Processing Owning a vehicle is easier with streamlined loan processing services Australia, ensuring quick approvals and affordable repayment plans.

How Loan processing services Australia Work 1. Initial Consultation: Experts assess your financial needs and suggest suitable loan options. 2. Document Collection: Gather necessary documents like income proof, credit history, and identification. 3. Application Submission: Professionals submit error-free applications to lenders. 4. Lender Evaluation: Banks and financial institutions review applications and conduct credit assessments. 5. Approval & Disbursement: Upon approval, funds are disbursed promptly.

Benefits of Outsourcing Loan processing services Australia Outsourcing loan processing services Australia to experts ensures higher approval rates, faster loan disbursals, and less stress for borrowers. It eliminates the burden of dealing with lenders and allows you to focus on your financial goals.

Choose the Best Loan processing services Australia When selecting a loan processing services Australia provider, ensure they have: • A proven track record with successful loan approvals. • Strong lender relationships to secure the best d eals. • Transparent pricing with no hidden costs. • Excellent customer support for smooth communication.

Finding the right loan processing services Australia can make all the difference in securing hassle-free loans. Whether you need a mortgage, business financing, or personal loan, expert assistance simplifies the process, ensuring quick approvals and better financial outcomes. Opt for professional loan processing services Australia today and experience seamless lending solutions tailored to your needs.

0 notes

Text

Secure a Commercial Car Loan online in Sydney with Blue Loans. Our digital platform streamlines the process, providing blue loans solutions for your commercial vehicle needs. Benefit from competitive rates, enabling you to swiftly acquire the necessary vehicles to drive your business forward in the dynamic cityscape of Sydney, Australia. For more details Call now 0485 936 655

0 notes