#vegetables export data

Explore tagged Tumblr posts

Text

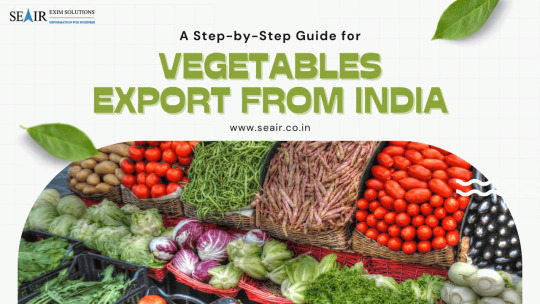

India's Flourishing Vegetables Export Industry: A Detailed Insight

India, with its vast agricultural resources and diverse climate, has established itself as a significant player in the global vegetables market. The country's vegetables export from India has seen remarkable growth, contributing to the economy and meeting international demand for fresh and dehydrated vegetables. This article delves into the nuances of vegetables export from India, examining key data, leading exporters, and major importing countries.

The Significance of Vegetables Export from India

India's agriculture sector plays a crucial role in the economy, with vegetables forming a substantial part of the export portfolio. The country's rich soil and varied climatic conditions allow for the cultivation of a wide range of vegetables, which are exported to numerous countries worldwide.

Overview of Vegetables Export Data

Vegetables export data indicates a robust and growing industry. In recent years, India has exported millions of tonnes of vegetables, generating substantial revenue. The vegetables hs code, which is the harmonized system code used to classify goods in international trade, for fresh and dehydrated vegetables falls under chapters 07 and 20 respectively, helping streamline and categorize the export process.

List of Vegetables Exported from India

India exports a diverse range of vegetables, both fresh and dehydrated. The list of vegetables exported from India includes:

Onions

Potatoes

Tomatoes

Green chilies

Okra

Eggplants

Carrots

Spinach

Cabbages

Cauliflowers

Most Exported Vegetables from India

Among these, the most exported vegetables from India are onions, potatoes, and tomatoes. These vegetables are in high demand due to their versatility, nutritional value, and extensive use in various cuisines around the world.

Export of Dehydrated Vegetables from India

In addition to fresh vegetables, the export of dehydrated vegetables from India has also gained momentum. Dehydrated vegetables, such as dried onions, garlic, and green beans, offer longer shelf life and ease of transport, making them a preferred choice for many international markets. Dehydrated vegetables exporters in India have capitalized on this demand, ensuring high-quality products through advanced processing techniques.

Vegetables Exporters in India

India boasts numerous reputable vegetables exporters who have established a strong presence in the global market. These exporters ensure that Indian vegetables meet international quality standards and are delivered fresh. Some of the leading names include:

Allanasons Pvt Ltd

Tirupati Balaji Agro Products Pvt Ltd

Atmiya International

S K Fresh Produce

K M Exports

Major Vegetable Importing Countries

The list of vegetable importing countries from India includes several major economies and emerging markets. The primary vegetable importing countries from India are:

United Arab Emirates

Saudi Arabia

Bangladesh

Malaysia

Sri Lanka

United Kingdom

Netherlands

Nepal

Qatar

Germany

These countries import significant quantities of Indian vegetables due to their high quality, competitive pricing, and the reliability of Indian exporters.

India's Position Among Top Vegetable Exporting Countries

India is consistently ranked among the top 10 vegetable exporting countries in the world. The country's strategic advantage lies in its ability to produce a wide variety of vegetables throughout the year, ensuring a steady supply to international markets.

Challenges Faced by Vegetable Exporters in India

Despite the success, vegetables exporters in India face several challenges, including:

Quality Control: Maintaining consistent quality to meet international standards.

Logistics: Ensuring efficient cold chain logistics to preserve the freshness of vegetables.

Regulatory Compliance: Navigating various international trade regulations and phytosanitary standards.

Climate Variability: Dealing with the impact of climate change on crop yields.

Government Support and Initiatives

The Indian government has implemented several initiatives to support vegetables export from India. Schemes such as the Agricultural and Processed Food Products Export Development Authority (APEDA) provide financial assistance, quality control support, and market access initiatives to boost exports.

Sustainability and Organic Farming

Sustainability is becoming a focal point in the agriculture sector. Many Indian farmers and exporters are adopting organic farming practices to meet the growing global demand for organic produce. This shift not only enhances the marketability of Indian vegetables but also promotes environmental conservation and soil health.

Technological Advancements in Vegetable Farming

Technological advancements are playing a pivotal role in enhancing the efficiency and productivity of vegetable farming in India. Innovations such as precision farming, drip irrigation, and controlled environment agriculture are helping farmers increase yields and improve quality.

Future Prospects of Vegetables Export from India

The future of vegetables export from India looks promising, with increasing global demand for fresh and high-quality produce. Expanding market access, improving logistics infrastructure, and adopting sustainable farming practices are expected to drive growth in this sector. Additionally, the rise of e-commerce platforms is opening new avenues for direct-to-consumer sales, further boosting exports.

Conclusion

The vegetables export industry in India is a dynamic and vital component of the agricultural sector. With a diverse range of high-quality vegetables, reliable exporters, and strong government support, India continues to strengthen its position in the global market. As the industry navigates challenges and embraces innovation, the future of vegetables export from India looks bright and full of potential.

#vegetables export from india#vegetables export data#vegetables hs code#india vegetable export#vegetables exporters in india#vegetables importers#vegetable importing countries#top 10 vegetable exporting countries#list of vegetables exported from india#export of dehydrated vegetables from india#vegetable importing countries from india#dehydrated vegetables exporters india#most exported vegetables from india

0 notes

Text

Discover India's flourishing vegetable export market. Learn about production statistics, top exporters, HS codes, and how to start exporting vegetables from India. Explore key markets and trends driving India's green gold industry.

#vegetables export from india#vegetables export data#vegetables hs code#india vegetable export#vegetables exporters in india#vegetables importers#vegetable buyers#vegetable importing countries#top 10 vegetable exporting countries

0 notes

Text

Discover the flourishing vegetable export market in India with our comprehensive guide. Learn about production statistics, key exporters, HS codes, top export destinations, and how to get started in the lucrative vegetable export market. Unlock the potential of India's green gold today!

#vegetables export from india#vegetables export data#vegetables hs code#india vegetable export#vegetables exporters in india#vegetables importers#vegetable buyers#vegetable importing countries#top 10 vegetable exporting countries

0 notes

Text

#Fresh Vegetables#Organic Vegetables#Vegetables#natural vegetables#supplier#Exporter#Maharashtra#Mumbai#India#Tomatoes#Potatoes#Carrots#Bell Peppers#India export data of Vegetables

2 notes

·

View notes

Text

How to Export from India to Dubai, UAE: A Step-by-Step Guide

Exporting from India to Dubai, UAE, is a great opportunity for businesses. Dubai is a major global trade hub, and Indian products are in high demand. If you want to start an export business, this guide will help you understand the process.

Step 1: Select Your Product for Export

The first step is to choose the right product. Research the market and find out which Indian products have high demand in Dubai. Some popular export items include:

Spices and food products

Textiles and garments

Handicrafts and jewelry

Machinery and electronic goods

Pharmaceuticals and medical supplies

Make sure your product meets the quality standards and regulations of Dubai.

Step 2: Register Your Export Business

To become an exporter, you must register your business in India. Follow these steps:

Get a Permanent Account Number (PAN) for your business.

Register with the Directorate General of Foreign Trade (DGFT) and obtain an Import Export Code (IEC).

Register with the GST Department to get a Goods and Services Tax (GST) number.

If you are exporting agricultural or food products, register with the Food Safety and Standards Authority of India (FSSAI).

Step 3: Find Buyers in Dubai

Finding buyers is important for a successful export business. Here are some ways to connect with buyers:

Use B2B websites for export like Alibaba, IndiaMART, and ExportersIndia.

Participate in trade fairs and exhibitions in Dubai.

Network with exporters in India and international traders.

Contact Indian business associations and chambers of commerce in Dubai.

Step 4: Understand Export Documentation

Exporting requires proper documentation. Some key documents include:

Proforma Invoice – A document that includes details of the product, price, and terms.

Commercial Invoice – The final invoice sent to the buyer.

Packing List – Details about packaging and quantity.

Bill of Lading (BOL) or Airway Bill – A shipping document.

Certificate of Origin – Confirms the product is made in India.

Customs Declaration Form – Required for customs clearance.

FSSAI Certificate (for food products).

Step 5: Choose the Right Shipping Method

You can export products via air, sea, or land. Choose the right method based on your product and budget:

Air Freight – Fast but expensive. Best for perishable goods.

Sea Freight – Cost-effective for bulk shipments.

Courier Services – Best for small parcels and urgent deliveries.

Check shipping companies like Maersk, DHL, FedEx, and Emirates Cargo for reliable services.

Step 6: Complete Customs Clearance in India

Before shipping, your goods must clear customs in India. Follow these steps:

Submit all required export documents.

Pay export duties (if applicable).

Get approval from Indian customs authorities.

Hiring a customs clearance agent can simplify the process.

Step 7: Complete Customs Clearance in Dubai

Once your shipment reaches Dubai, it must clear customs. The buyer in Dubai must:

Submit an Import Declaration Form.

Pay import duties and taxes.

Obtain necessary approvals from Dubai Customs.

Dubai has free trade zones (FTZs) where import duties are lower or exempt. Exporters in India can benefit by working with companies in these zones.

Step 8: Receive Payment and Grow Your Business

Once your products reach the buyer, you receive payment. The most common payment methods are:

Letter of Credit (LC) – A secure payment method through banks.

Advance Payment – The buyer pays before shipment.

Open Account – Payment after delivery (less secure for exporters).

To grow your business, build strong relationships with buyers, maintain product quality, and use B2B websites for export to expand your reach.

Conclusion

Exporting from India to Dubai is a profitable opportunity for exporters in India. By following these steps, you can start and grow your export business successfully. Research the market, follow export regulations, and use reliable shipping and payment methods. Exporters India have great potential in Dubai, and with the right strategy, you can become a successful international trader.

If you are looking for trusted exporters worlds, networking with industry experts and using online platforms can help you find global business opportunities. Start today and take your business to the next level!

#exporters#exporters india#b2b website for export#exporters in india#India to Dubai export items list#Dubai export products list#Vegetables export from India to Dubai#India to Dubai export data#India to Dubai export charges#Dubai import products list from India#Export food products from India to Dubai#Exporters worlds Dubai#exporters worlds

0 notes

Text

अपेडा’च्या आर्थिक सहाय्य योजनांमुळे देशातील फळे आणि भाजीपाला निर्यातीत 47.3% ने वाढ

नवी दिल्ली – कृषी आणि प्रक्रियाकृत अन्न उत्पादने निर्यात विकास प्राधिकरणाच्या (अपेडा) माध्यमातून वाणिज्य विभाग, देशभरातील अपेडा’च्या सदस्य निर्यातदारांना 15 व्या वित्त आयोग चक्रासाठी (2021-22 ते 2025-26) अपेडा’च्या कृषी आणि प्रक्रियाकृत अन्न निर्यात प्रोत्साहन योजनेअंतर्गत, फळे आणि भाज्यांसह त्यांच्या विशेष उत्पादनांच्या निर्यात प्रोत्साहनासाठी तीन व्यापक क्षेत्रांमध्ये आर्थिक सहाय्य प्रदान करतो…

#agro export#Apeda#export data#fruit and vegetable#Iye Marathichiye Nagari#Mango#Onion#इये मराठीचिये नगरी

0 notes

Text

#Fresh Garlic#Organic Garlic#Garlic#premier Garlic#top Garlic#Vegetables#India export data of Garlic#natural Garlic#Garlic Exporter#Garlic in India#Spices#Indian Masala#Exporter#Supplier#Uttar Pradesh#India

0 notes

Text

#Fresh Bell Pepper#Organic Bell Pepper#Bell Pepper#premier Bell Pepper#top Bell Pepper#Vegetables#supplier#Exporter#Gujarat#India#India export data of Bell Pepper#natural Bell Pepper#Bell Pepper export data

0 notes

Text

Understanding the Dynamics of Vegetable Export from India

India, a country renowned for its agricultural prowess, has been making significant strides in the vegetable export sector. With its diverse climate and fertile soil, India produces a wide range of vegetables that are in high demand across the globe. The vegetable export industry not only boosts the nation's economy but also supports the livelihoods of millions of farmers. In this article, we'll delve into the various facets of vegetable export from India, including key data, major players, top exported vegetables, and the process of exporting vegetables from India.

The Growth of Vegetable Export from India

The vegetable export from India has seen a remarkable increase over the past few decades. According to the Agricultural and Processed Food Products Export Development Authority (APEDA), India exported vegetables worth approximately USD 1.62 billion in the financial year 2022-23. This figure underscores the significant role that vegetable export plays in India's overall agricultural export portfolio. The rising demand for Indian vegetables in international markets is driven by their quality, diversity, and competitive pricing.

Analyzing Vegetable Export Data

Examining vegetable export data provides valuable insights into trends and growth patterns. For instance, in 2022-23, the export volume of vegetables from India stood at around 2.6 million metric tons. This data indicates a steady increase in both the volume and value of vegetable exports over the years. The top destinations for Indian vegetables include the United Arab Emirates, Bangladesh, Malaysia, Sri Lanka, and the United Kingdom. These countries appreciate the freshness and quality of Indian produce, making them major importers.

Major Players in the Vegetable Export Industry

When it comes to the top vegetable exporters in India, several companies have established themselves as leaders in the industry. Organizations like Mother Dairy, Mahindra Agri Solutions, and ITC Limited have made significant contributions to the vegetable export market. These companies have developed robust supply chains, ensuring that vegetables reach international markets in the best possible condition. Additionally, numerous small and medium enterprises (SMEs) are also making their mark by exporting niche and organic vegetables, thus contributing to the sector's growth.

Top 10 Vegetables Exported from India

India's vast agricultural landscape allows it to produce a variety of vegetables that are popular in global markets. Here are the top 10 vegetables exported from India:

Onions: India is one of the largest exporters of onions, known for their pungency and flavor. Indian onions are particularly popular in Southeast Asia and the Middle East.

Potatoes: Indian potatoes are in demand due to their versatility and quality, finding markets in countries like Nepal, Sri Lanka, and the UAE.

Tomatoes: Both fresh and processed tomatoes from India are sought after in the Middle East and European countries.

Okra (Lady Finger): Okra is a staple in many African and Middle Eastern cuisines, making it a significant export item.

Cabbage: Indian cabbage is appreciated for its quality and is exported mainly to Asian countries.

Carrots: With high demand for fresh and processed carrots, India exports them to various countries, including Malaysia and Bangladesh.

Green Peas: Frozen green peas from India are popular in Western markets due to their quality and availability.

Eggplants (Brinjal): Indian eggplants are favored for their taste and are exported to Asian and European markets.

Bitter Gourd: Known for its health benefits, bitter gourd has a niche market, particularly in Asian countries.

Spinach: Both fresh and frozen spinach from India cater to health-conscious consumers worldwide.

Steps to Export Vegetables from India

For those looking to enter the vegetable export business, understanding the process is crucial. Here’s a step-by-step guide on how to export vegetables from India:

Obtain Required Licenses and Registrations: The first step is to get an Importer Exporter Code (IEC) from the Directorate General of Foreign Trade (DGFT). Additionally, registering with APEDA is essential for certification and other support.

Ensure Quality Control: Maintaining high quality is vital. This involves proper farming practices, hygienic packaging, and adherence to international standards such as HACCP and ISO.

Market Research: Conduct thorough research to identify potential markets. Analyze the demand, competition, and pricing strategies in different countries.

Develop a Supply Chain: Establish a robust supply chain to ensure that vegetables remain fresh from the farm to the international markets. This includes efficient logistics, cold storage facilities, and reliable transportation.

Build Networks: Establish connections with international buyers, distributors, and wholesalers. Participating in trade fairs and exhibitions can help in building these networks.

Compliance with Regulations: Ensure compliance with the export regulations of both India and the importing country. This includes proper documentation like the shipping bill, certificate of origin, and phytosanitary certificate.

Financial Management: Arrange for secure payment methods and be aware of foreign exchange regulations to mitigate financial risks.

Challenges in the Vegetable Export Sector

Despite its growth, the vegetable export industry in India faces several challenges. Perishability is a major concern, requiring efficient cold chain logistics. Quality control is another critical issue, as international markets have stringent standards. Additionally, competition from other vegetable-exporting countries and fluctuating global prices add to the complexities. Addressing these challenges requires investment in infrastructure, adoption of advanced technologies, and continuous market research.

Conclusion

Vegetable export from India is a vibrant and expanding industry with immense potential. The country's diverse agricultural resources, coupled with increasing global demand, position India as a significant player in the international vegetable market. By focusing on quality, efficient supply chain management, and understanding market dynamics, Indian exporters can continue to thrive. The vegetable export sector not only contributes to the economy but also showcases India's agricultural expertise on a global platform.

#Vegetable export from India#Vegetable export data#Vegetable export#Top vegetable exporters in India#Top 10 vegetables exported from india#How to export vegetables from India

0 notes

Text

[ID: A bowl of avocado spread sculpted into a pattern, topped with olive oil and garnished with symmetrical lines of nigella seeds and piles of pomegranate seeds; a pile of pita bread is in the background. End ID]

متبل الأفوكادو / Mutabbal al-'afukadu (Palestinian avocado dip)

Avocados are not native to Palestine. Israeli settlers planted them in Gaza in the 1980s, before being evicted when Israel evacuated all its settlements in Gaza in 2005. The avocados, however, remained, and Gazans continued to cultivate them for their fall and winter harvest. Avocados have been folded into the repertoire of a "new" Palestinian cuisine, as Gazans and other Palestinians have found ways to interpret them.

Palestinians may add local ingredients to dishes traditionally featuring avocado (such as Palestinian guacamole, "جواكامولي فلسطيني" or "غواكامولي فلسطيني"), or use avocado in Palestinian dishes that typically use other vegetables (pickling them, for example, or adding them to salads alongside tomato and cucumber).

Another dish in this latter category is حمص الافوكادو (hummus al-'afukadu)—avocado hummus—in which avocado is smoothly blended with lemon juice, white tahina (طحينة البيضاء, tahina al-bayda'), salt, and olive oil. Yet another is متبّل الأفوكادو (mutabbal al-'afukadu). Mutabbal is a spiced version of بابا غنوج (baba ghannouj): "مُتَبَّل" means "spiced" or "seasoned," from "مُ" "mu-," a participlizing prefix, + "تَبَّلَ" "tabbala," "to have spices added to." Here, fresh avocado replaces the roasted eggplant usually used to make this smooth dip; it is mixed with green chili pepper, lemon juice, garlic, white tahina, sumac, and labna (لبنة) or yoghurt. Either of these dishes may be topped with sesame or nigella seeds, pomegranate seeds, fresh dill, or chopped nuts, and eaten with sliced and toasted flatbread.

Avocados' history in Palestine precedes their introduction to Gaza. They were originally planted in 1908 by a French order of monks, but these trees have not survived. It was after the Balfour Declaration of 1917 (in which Britain, having been promised colonial control of Palestine with the dissolution of the Ottoman Empire after World War 1, pledged to establish "a national home for the Jewish people" in Palestine) that avocado agriculture began to take root.

In the 1920s, 30s, and 40s, encouraged by Britain, Jewish Europeans began to immigrate to Palestine in greater numbers and establish agricultural settlements (leaving an estimated 29.4% of peasant farming families without land by 1929). Seeds and seedlings from several varieties of avocado were introduced from California by private companies, research stations, and governmental bodies (including Mikveh Israel, a school which provided settlers with agricultural training). In these years, prices were too high for Palestinian buyers, and quantities were too low for export.

It wasn't until after the beginning of the Nakba (the ethnic cleansing of Palestinians from "Jewish" areas following the UN partition of Palestine in 1947) that avocado plantings became significant. With Palestinians having been violently expelled from most of the area's arable land, settlers were free to plant avocados en masse for export, aided (until 1960) by long-term, low-interest loans from the Israeli government. The 400 acres planted within Israel's claimed borders in 1955 ballooned to 2,000 acres in 1965, then 9,000 by 1975, and over 17,000 by 1997. By 1986, Israel was producing enough avocados to want to renegotiate trade agreements with Europe in light of the increase.

Israeli companies also attained commercial success selling avocados planted on settlements within the West Bank. As of 2014, an estimated 4.5% of Israeli avocado exports were grown in the occupied Jordan Valley alone (though data about crops grown in illegal settlements is of course difficult to obtain). These crops were often tended by Palestinian workers, including children, in inhumane conditions and at starvation wages. Despite a European Union order to specify the origin of such produce as "territories occupied by Israel since 1967," it is often simply marked "Israel." Several grocery stores across Europe, including Carrefour, Lidl, Dunnes Stores, and Aldi, even falsified provenance information on avocados and other fruits in order to circumvent consumer boycotts of goods produced in Israel altogether—claiming, for example, that they were from Morocco or Cyprus.

Meanwhile, while expanding its own production of avocados, Israel was directing, limiting, and destabilizing Palestinian agriculture in an attempt to eliminate competition. In 1982, Israel prohibited the planting of fruit trees without first obtaining permission from military authorities; in practice, this resulted in Palestinians (in Gaza and the West Bank) being entirely barred from planting new mango and avocado trees, even to replace old, unproductive ones.

Conditions worsened in the years following the second intifada. Between September of 2000 and September of 2003, Israeli military forces destroyed wells, pumps, and an estimated 85% of the agricultural land in al-Sayafa, northern Gaza, where farmers had been using irrigation systems and greenhouses to grow fruits including citrus, apricots, and avocados. They barred almost all travel into and out of al-Sayafa: blocking off all roads that lead to the area, building barricades topped with barbed wire, preventing entry within 150 meters of the barricade under threat of gunfire, and opening crossings only at limited times of day and only for specific people, if at all.

A July 2001 prohibition on Palestinian vehicles within al-Sayafa further slashed agricultural production, forcing farmers to rely on donkeys and hand carts to tend their fields and to transport produce across the crossing. If the crossing happened to be closed, or the carts could not transport all the produce in time, fruits and vegetables would sit waiting in the sun until they rotted and could not be sold. The 2007 blockade worsened Gaza's economy still further, strictly limiting imports and prohibiting exports entirely (though later on, there would be exceptions made for small quantities of specific crops).

In the following years, Israel allowed imports of food items into Gaza not exceeding the bare minimum for basic sustenance, based on an estimation of the caloric needs of its inhabitants. Permitted (apples, bananas, persimmons, flour) and banned items for import (avocados, dates, grapes) were ostensibly based on "necessary" versus "luxury" foods, but were in fact directed according to where Israeli farmers could expect the most profit.

Though most of the imports admitted into Gaza continued to come from Israel, Gazan farmers kept pursuing self-sufficiency. In 2011, farmers working on a Hamas-government-led project in the former settlements produced avocados, mangoes, and most of the grapes, onions, and melons that Gazans ate; by 2015, though still forbidden from exporting excess, they were self-sufficient in the production of crops including onions, watermelon, cantaloupe, grapes, almonds, olives, and apples.

Support Palestinian resistance by calling Elbit System’s (Israel’s primary weapons manufacturer) landlord, donating to Palestine Action’s bail fund, and donating to the Bay Area Anti-Repression Committee bail fund.

Ingredients:

2 medium avocados (300g total)

1/4 cup white tahina

2 Tbsp labna (لبنة), or yoghurt (laban, لبن رايب)

1 green chili pepper

2 cloves garlic

2 Tbsp good olive oil

Juice of 1/2 lemon (1 1/2 Tbsp)

1 tsp table salt, or to taste

Pomegranate seeds, slivered almonds, pine nuts, chopped dill, nigella seeds, sesame seeds, sumac, and/or olive oil, to serve

Khubiz al-kmaj (pita bread), to serve

Instructions:

1. In a mortar and pestle, crush garlic, pepper, and a bit of salt into a fine paste.

2. Add avocados and mash to desired texture. Stir in tahina, labna, olive oil, lemon juice, and additional salt.

You can also combine all ingredients in a blender or food processor.

3. Top with a generous drizzle of olive oil. Add toppings, as desired.

4. Cut pita into small rectangles or triangles and separate one half from the other (along where the pocket is). Toast in the oven, or in a large, dry skillet, stirring occasionally, until golden brown. Serve dip alongside toasted pita chips.

489 notes

·

View notes

Text

National Onion Day

Today, farmers in the United States are collecting millions of onions. They will be heading for store shelves to provide families with the fresh, nutritional, tasty power to improve meals and boost the body’s immunity. Onions have numerous advantages, such as enhancing meals with a variety of flavors. According to recent research, consuming onions also helps the body fight colorectal cancer and breast cancer, as well as heart disease and diabetes.

National Onion Day commemorates the incorporation of the National Onion Association in 1913. The organization was created to protect the interests of America’s onion growers, and onions remain their business to this day. Today, the group represents over 500 onion producers, shippers, packers, and suppliers across the country.

History of National Onion Day

In June 2022, the National Onion Association established National Onion Day to commemorate the organization’s 53rd anniversary. They officially incorporated on June 27, 1913, in Ohio, and represent almost 500 onion farmers, shippers, packers, and allied members across the U.S.

Onions are one of the world’s oldest cultivated vegetables, having originated in Central Asia and spread around the world. Some researchers believe the onion has been cultivated for at least 5,000 years. Onions were possibly eaten for thousands of years and cultivated all over the world at the same time, since they grew wild in different locations.

We rely on the onion to improve the flavor of our savory meals, whether we use a sweet, white, red, or ever-popular yellow onion. They complement meats and salads, making the versatile onion a culinary powerhouse. It’s the needed seasoning alongside our salt and pepper, whether added to eggs or pickled. While the onion is low in calories, it is also high in vitamin C and antioxidants, and can increase your dietary fiber and vitamin B6 intake. Unlike many other low-calorie ingredients, onions provide a high nutritional content without compromising flavor. And it makes no difference what you do to it; pickled or raw, caramelized, sauteed, or pureed — the onion adds a lot of flavor to a dish. With so many types to choose from, onions present numerous opportunities to reap the benefits.

National Onion Day timeline

3500 B.C. The Onion is First Traced in Egypt

The history of the onion can be traced back to this period, with a Sumerian document describing someone being in awe of the city governor’s onion garden.

1500 B.C. Ancient Egypt Worships Onions

To those who bury onions alongside their pharaohs, onions are a sign of eternity.

1913 National Onion Association Is Founded

On June 2, the National Onion Association is formally incorporated in Ohio.

2019 National Onion Day is First Celebrated

The National Onion Association establishes National Onion Day on June 27, to honor onion producers.

National Onion Day FAQs

Is an onion a vegetable or a fruit?

The vegetables are classified based on the edible part of the plant: leaves (like lettuce), roots (like carrot), bulbs (such as onions), and many others. Alternatively, fruits such as tomatoes and seeds such as peas are commonly referred to as vegetables.

Which country is the largest onion exporter?

According to FY18 data, China appears to be the top onion producer, but the Netherlands is the largest onion exporter.

Do onions aid in the treatment of infections?

Onions were worshiped for their medicinal powers by various civilizations. They have anti-inflammatory properties, relieve joint pain, treat ear infections, work as an antibiotic, and are an excellent expectorant for loosening up thick phlegm.

National Onion Day Activities

Add fresh onion to your favorite recipe

Learn how to grow onions in your backyard

Share the celebration on social media

For a flavor boost, be sure to add some onion in there. No matter how you slice it, onion pulls together some of the greatest flavors! Tell us how you like to cook your onions!

Gardening is fun! Furthermore, if you can cultivate some veggies like onions in your backyard, you can reduce the cost of your monthly groceries by harvesting them yourself.

Be sure to spread the word about National Onion Day by using the hashtag #NationalOnionDay on social media. Also, don’t forget to brag about your onion recipe or how you harvested your own onions.

5 Interesting Facts About Onion

They’ve been around for thousands of years

Sulfuric acid

Onions were worshiped by Ancient Egyptians

The biggest onion ever

The Big Onion

Onions have been present for thousands of years and, around 3,500 B.C, onions were harvested for the first time.

The reason you become teary-eyed when cutting onions is because of the sulfuric acid they contain.

They claimed that the spherical shape and concentric circles represented eternity — onions were used to cover the tombs of their monarchs and were important in ritual burials.

According to ‘The Guinness Book of World Records’, the biggest onion ever was cultivated by Peter Glazebrook, a British farmer, who grew a massive onion in 2011 that weighed just under 18 pounds.

Before it was known as the Big Apple, New York was known as the Big Onion, because it was a place where you could peel layer after layer without touching the center, kind of like an onion.

Why We Love National Onion Day

It encourages cultivation

It promotes culinary creativity

It boosts the immune system

Onions are an important, and healthy part of our diet. Why not grow and cultivate your own in your backyard?

Who would have thought onions, known for making us cry, could be so sweet and delectable with some creativity? These days, almost all culinary innovations use onion for a unique flavor.

Onions are rich in prebiotics. This helps to increase friendly bacteria in your guy, which helps to build immunity against viruses.

Source

#Ginger & Green Onion Beef#Honey Pepper Chicken#Szechuan Beef#Bacon Mushroom Mike Burger#Lemongrass Chicken Bowl#Full Back Ribs Rack#Brisket Burger#BBQ Bacon Burger#Colossal Supreme Burger#Chicken Lickin' Good Burger#Lomo Saltado#vacation#USA#food#Chow Line#Pho Tai#Beef Black Pepper#Crispy Rice Noodle Tower#Pavla Plate#Green Chile Burger#National Onion Day#27 June#travel#original photography#Canada#Fire Jumper Burger#Roast beef with remoulade & fried onions Smörrebröd#NationalOnionDay

3 notes

·

View notes

Text

CHAINMAIL VEILS

Star Wars- The Mandolorian Fic

Din Djarin/Female OC

Tags/Warnings (some not in this chapter): Some Angst, Body Guard/Guarded kinda (actually idk what that tropes called), Canon Divergence, Descriptions of violence and war, Descriptions of heavy facial scarring, Self-hate, Bounty hunting, Weapons dealing, PTSD, Din Djarin has anxiety, Masked Characters, Mutual Pining, PG-13 No Smut, Tags will update when I realize I missed one, first time writing in years so it’s pretty cheeks, I’m sorry, currently on ao3

Summary: Bored of life on Nevarro, Din takes a quick bodyguard job for the leader of a weapons-dealing city and finds that she, like him, hides her face. He’s curious to find out why.

CHAPTER 2

After they made the jump to hyperspace and Din put Grogu to sleep, he decided to do some research on his employer. It could come in handy later, he supposed. Carefully scrolling through the data pad, he found an old report of an unknown origin:

“Specializing in the construction of slugthrowers, the capital city Morrow has built a reputation of creating strong, reliable weapons. Since the liberation of its planet, the underground network has been exporting weapons to nearby systems, acting as a third party dealer with no formal alliance.

Duchess Cassandra is the current overseer of all decisions made regarding trade, and in the past oversaw in the battle to free her planet, earning her the nickname “Mother Gore.” A commanding figure, she negotiates all deals herself.”

The report ended there. Strange. Looking through the archives, Din couldn’t find any other information on the city, or even who they dealt with. No other mentions of “Mother Gore,” either. His mind tracked through the possibilities of how such an influential planet had almost zero intel about them, but came up empty.

Giving up on his search, Din put down the data pad and tried to rest, leaning back into the old leather of the pilot chair.

A few hours later, the Razor Crest finally exited hyperspace, and Emmorey was clear in view. The planet was lush with vegetation, with vast oceans and swirls of clouds dotting the surface. It was beautiful.

Greef had told them the city was mostly hidden from view, which was already strange for a capital, but there seemed to be no sign of civilization on the entire planet, not even any clearings in the forest that could have been artificial. It seemed completely untouched.

Breaking through the atmosphere, a control contacted him, requesting identification- the first sign of people on this planet. Responding to the signal, he confirmed his identity and purpose and turned the Razor Crest to head toward an area where the forest seemed to part- revealing a large, wide crack in the earth that looked like an angry God had split it. Tall, dark rock spires that resembled teeth around a Sarlacc pit’s mouth lined the sides, tilting inward. It certainly seemed like a well fortified city from the outside. But what of within? A few ships were flowing in and out, narrowly avoiding the rocks, and Din merged the ship into traffic.

As he entered the cave, the city of Morrow was fully revealed: a vast underground cavern with towering, sharp buildings that reached toward the rocky ceiling, and narrow streets full of markets and people, much more colorful and lively than those on Nevarro. The city was mostly lit by intricate stained glass windows on buildings, giving off a multicolored light. At the far end, a large, dark, angular structure that could only be the Duchess’s castle overlooked it all.

Din had thought the untouched surface was beautiful, but what lay underneath was unlike anything he had seen before.

“Patoo,” Grogu chirped from the passenger seat, large brown eyes wide with wonder. He couldn’t help but smile underneath his helmet.

Turning the ship toward a landing pad to the left of the castle, it touched down on a large metal platform.

Picking up Grogu from the neighboring seat, they left the cockpit and lowered the ramp, and were unfortunately greeted by a protocol droid painted black. As it clumsily waddled toward them, Din’s gloved hand gripped his blaster almost subconsciously.

“Greetings and welcome to Morrow, Mandolorian! Her Grace, Duchess Cassandra, has instructed me to direct you to her as soon as you land. Please follow me.” It’s voice was mechanical and high pitched, and it grated his ears even through the helmet.

“I don’t deal with droids. Is there someone else to guide me?”

“Not at this moment, however I will inform the Duchess of your preference. Follow me, please.” With that, the droid turned and hobbled toward an exit.

Din hesitated before moving, but after glancing down at Grogu in the satchel he followed after it.

After some walking down a dark stone hallway only lit by glass encased candles, they arrived at what Din assumed to be the main entrance.

It was large, with great black arches that looked to be carved from glass lining the walls and ceiling, hauntingly resembling a rib cage. The chamber was dimly lit by several stained glass chandeliers that gave off red and green light, and at the far end, he could see two guards with chain mail draped over their faces holding rifles next to a sharp throne that loomed over a small set of stairs. It was unoccupied.

“Her Grace will greet you shortly. I will exit now,” the droid said, and promptly left.

Now alone, Din turned and further examined his surroundings.

Every window had a delicate stained glass design, some of vibrant forests and others of fire and ruin. They were so detailed they could have been mistaken for paintings from afar, had the soft light glowing through them giving off entirely new colors been absent. Each was a work of art, clearly having months, possibly even years, of hard work and talent put into it. Carefully, Din reached out a gloved hand to trace the delicate metal lines of a flower.

“Beautiful, aren’t they?”

He whipped around, grabbing his blaster but not unholstering it, and was met with a woman wearing a very wide brimmed, veiled hat standing several feet away. She did not react to his sudden movement, standing still like a marble statue.

This had to be the Duchess.

She wore a black dress with swirling black velvet designs and long, loose sleeves that fell far past her hands. Her frame was lean, but the slight muscles showing through her dress revealed her true strength. Just as Greef had said, her face was completely obscured. The veil lining all the way round her hat was a dark red, and upon further inspection, he saw it had other layers of fabric in lighter shades of blood orange and of varying opacity. Gold charms on chains dangled down like teardrops, each metal piece a small work of art. He could barely even make out a fuzzy silhouette of her head through the veil in the light, which casted a glow from behind her that nearly resembled a halo.

Din had to admit, she was hauntingly beautiful.

“Duchess Cassandra.” Din bowed slightly at the waist, placing a closed fist over his heart. Grogu looked up at the woman with interest.

The woman looked toward the windows, ignoring him.“They made these windows almost a hundred years ago, Mando. When we were still under Imperial rule.”

“They’re amazing,” He slightly shifted his feet awkwardly

She chuckled at his response, or maybe at his demeanor. How did she read me that fast? his body stilled. Normally he kept a closed wall on his body language, but she had seen right through it. Perhaps she's particularly observant. What else did I expect from a gang leader?

“They are. It’s Morrow’s second top export, stained glass.” Her voice was smooth and elegant, projected clearly through her veil. She stopped moving her hand to turn and look at him seriously, the veil of her hat swaying. “But you know the first.”

Din paused, and nodded. He remained silent.

She looked toward the window. “You understand what the job is?”

Another nod.

“Excellent. The meeting isn’t for two days, but we leave for Jarrok tomorrow. You needn’t do much there, just stand behind me and look scary, I suppose,” she said with a light laugh. “To be honest, I really wasn’t expecting a Mandolorian to take the job, but it certainly helps keep up appearances.”

The Duchess paused, suddenly walking towards him, to look at Grogu in the satchel. “Your child, I presume?”

Din stilled, but quickly regained his composure. “Yes.” It wasn’t often that people saw Grogu as his child and not a pet, some even going as far as to attempt to kick him out of an establishment because of it. It never did end well for the offender.

The Duchess leaned forward, veil swaying with the movement, and gently waved out a gloved finger at the child. Din had to stop himself from shielding him away from her.

“Why, hello little one,” she said quietly. Grogu curiously reached for her hand, and held on, prompting her to laugh.

Din definitely wasn’t expecting the Duchess to be this… relaxed. He couldn’t get a full reading on her through her body language, but she seemed normal and calm- kind, even. It was a stark contrast from the several other royals and weapons dealers he had met in his lifetime. Grogu seemed to like her, too.

Straightening her posture, she tilted her head at Din. “We have nearly a whole day to kill, would you like a tour of the city?” She asked politely.

To tell the truth, he would rather go find his room and nap, but he felt strangely compelled to say yes anyways. It could be rude if he said no, too. He nodded at her.

“Excellent!” Clasping her hands in excitement, she turned toward a hallway, which he assumed to be another exit. Before they could walk far, the two guards by the throne made a move as if to follow, but she waved her hand to stop them.

“My apologies, but we won’t be needing you to follow today. Take a break today, you deserve it,” she ordered.

Din was slightly taken aback. He hadn’t known a royal to be this considerate to their staff. To be fair, the royals he knew were also severely corrupted and cold-hearted killers , but still. For a weapons dealing mastermind nicknamed ‘Mother Gore,’ she was awfully kind.

Following her through several long hallways, they finally exited the castle through what turned out to be a back door. They were dumped right on a busy market street rich with color, and immediately the Duchess melted into the crowd and began walking at a leisurely pace. Just like Greef had said, the amount of droids carelessly roaming around was nearly overwhelming, but Din remembered what he was doing and turned to follow her.

Walking to her right and a little bit behind, Din saw her wave at a few people, who greeted her back happily.

“I make an effort to come out here often,” she turned to him and explained, as if sensing his confusion.

“That’s… very kind of you, Your Grace,” he said, and she laughed.

“Please, just call me Cassandra. And it’s my basic duty to care for them, Mandolorian,”

Din tilted his helmet at her. This whole situation was making his head spin- why would a former planet-freeing warrior gang leader nicknamed ‘Mother Gore’ be this nice? He wasn’t sure why this idea confused him as much as it did, but he couldn’t help it. Perhaps he just wasn’t used to it, having normally dealt with vile criminal warlords.

Lost in thought, Din hadn’t realized that Cassandra was no longer walking with them. Panicking, he turned around to find her crouched down at what could be eye level underneath her veil with a small Togrutan child.

“Why, hello my dear! That’s a very nice doll you have, what’s your name?” he heard her say as he approached, stopping to awkwardly stand to her right.

“Mira.”

“Hi, Mira,” she said, and Din could hear the smile in her voice. “It’s very nice to meet you!”

Mira nervously smiled and held out the stuffed doll. It looked to be hand sewn to resemble the Duchess herself, veil and all- albeit rather poorly, but Din could tell effort was put into it.

“For you,” she said nervously, avoiding looking at the woman in front of her.

The Duchess tilted her head up in surprise. “Really? Oh my, how thoughtful of you! I love it, thank you!” Carefully, she took the doll from the child, and reached out her hand to squeeze Mira’s, who smiled happily.

“Mira? Mira!” A woman called from afar.

“I have to go. My mom is calling me. Goodbye!” With a little more confidence, the child waved her farewell.

“Goodbye, Mira! Be safe!” The Duchess stood, doll still in hand, and watched her weave through the crowd towards an older Togrutan woman, who saw her and waved with excitement.

“You really are good to these people, Cassandra,” Din blurted without thinking. His face burned, and he was grateful for the helmet. Why would I say that? Dark Farrik, I used her first name, too. I’m getting fired. His mind was racing.

The Duchess tilted her hat in surprise at first, making his heart sink, but to his relief she laughed. He definitely wasn’t expecting that to happen.

“Mandalorian, I’m not sure where you have been to think a royal doing their basic duties is seen as kind”-she walked towards him, the tilt of her hat making the veil slant- “but I appreciate it nonetheless.” A satin gloved hand lightly laid on his right pauldron, the weight of it making his brain stop working.

Turning away again, Din watched her dark form once again melt into the crowd. Quickly following close behind, they settled into a comfortable silence. Continuing like this for several minutes, they simply walked through the busy market and observed the people and the items they sold, until Cassandra finally broke the quiet.

“Would you like to see the cave systems?”

He had never said yes faster, he thought.

Just like the city and the Duchess herself, the caves were hypnotizingly beautiful.

Tall, jagged stalagmites reached toward the rocky ceiling, some stalagmites growing down to meet them halfway. Large pools of water seemed to glow orange in the dark of the cavern, and through the visor of his helmet Din could see small white fish quickly swimming around, some even jumping out of the water briefly, falling back in with a quiet splash. Echoing through the tunnels, he could faintly hear a waterfall crashing down on stone.

Grogu looked around in wonder, large eyes staring to pick up details in the dark. Cassandra turned to look at them, tilting her hat in what could have been amusement.

“This is one of my favorite places to go after meetings, Mando. I find it quite soothing. Wouldn’t you agree?” her voice echoed throughout the cave, surrounding him in her words.

“It’s amazing,” he breathed quietly, the vocoder of his helmet barely picking up the sound. Carefully reaching out to touch a nearby stalagmite, he felt its rocky surface through the glove.

Grogu wiggled in his pouch, a sign he wanted out. Din picked him up and carefully placed him near the edge of the pool, watching closely. Immediately Grogu dipped a clawed finger into the water, sending ripples spreading outward. The algae seemed to react to it, the glow fading in and out in time- it was mesmerizing.

The Duchess watched quietly from a few feet away, hands clasped in front of her neatly. “Your son…is he adopted? Or do you have great big ears underneath that shiny helmet of yours?” she joked, tone lighthearted like it always was.

Din only hesitated a moment before answering. “Yes- I mean- he's a foundling. Adopted. I…found him while hunting for a bounty.” Shame rolled throughout his body at the thought of admitting the bounty had been on Grogu himself.

She seemed to notice his discomfort, her hat tilting in an almost knowing look, but she said nothing of it, instead turning away to face the pool. “May I ask why you wear that helmet so adamantly?” She asked without hesitation. It seemed she was not one to avoid confrontation.

Din hesitated before replying, “I'll tell you if you tell me why you hide your face.” His palms got sweaty fast. Surely he was overstepping his bounds as a bodyguard asking such a personal question. Not for the first time that day, he was sure he’d be fired. But to his surprise, she only laughed.

“You first, Mandalorian,” she chuckled, squatting down at the edge of the pool to watch the fish, pulling off a glove to touch the water. Din ignored the way his heart fluttered when he saw her bare hand.

“My creed prevents me from showing my face to any living being.” They were words he’d said many times before to many people, but the sense of pride he felt each time had never lessened. The awkward questions never got easier, though. Shifting nervously, he waited for her to ask.

To his surprise, she only titled her hat in mild shock, staying quiet. She didn’t prod at him for information like many others had, and it was a nice change. Maybe she knew the answers, being somewhat like him.

“I suppose it’s my turn to share now, huh?” she huffed a humorless laugh. Leaning back on a rock, she fidgeted with the glove in her hand. She hesitated before speaking, and Din got nervous he’d pushed her to share.

“You don’t have to tell me if you don’t want to.”

But she only shook her head, the veil of her hat swaying. “No, I want to tell you. Really. There’s just a lot you need to know first.” Tipping her hat to look in his direction, she continued:

“When I was a young girl, the war was still going on. There were constant Imperial bombings both on the surface and below, and it was destroying our beautiful city. There were fires constantly raging and battles being fought everywhere- it was a difficult time, and my parents tried to keep me in the safest parts of the castle at all times. Back then, I didn’t see sunlight for weeks at a time. Believe me, it was because they cared. But I was young and stupid, and didn’t want to listen, and I went outside.

“I snuck out through the dumb waiter in the kitchen and managed to get out the back entrance; I headed towards the caves, and before I knew it, an undetonated bomb had gone off in the house I was walking past. It took hours for the guards to find me underneath the wreckage.”

Cassandra got very quiet, turning her head to once again face the water, and Din worried he had pushed her into confessing. Before he could take a breath to begin to apologize, she cut him off- “It left… several scars. My parents were quite ashamed of them, and of me, because in their eyes, I represented their failures to protect their city. They made me hide behind a veil, but to tell the truth, I don’t mind it anymore.” She leaned forward to lightly trace the outline of Grogu's ear, to which he cooed and swatted at her hand, while she laughed quietly at his antics.

If she had been upset with the memories of before, Din couldn’t tell now. She seemed to have gotten over it quickly. “I…appreciate you telling me. I understand that this must have been hard for you, and I’m sorry.” He sat down a few feet away from her, watching carefully.

The soft orange light cast a warm glow through her veil and made the golden charms shine, but the darkness of his visor made it difficult to see her silhouette. For the first time, he wanted to take off his helmet to really look at her.

The thought scared him more than he thought it would.

“You’re staring, Mando.” When he came back to reality Cassandra’s veil was turned directly towards him, and he felt his face turn hot under the helmet. Turning away with embarrassment, he heard him giggle.

“Din,” he said suddenly, looking back. He saw her lovely crimson veil tilt in confusion. “My name, it’s Din Djarin.”

She nodded, and he could almost feel the warmth of her smile through the veil. “Well, it’s a pleasure to meet you, Din.”

Maybe this bodyguard job wasn’t so bad after all.

#the mandolorian#how do i tag help#ao3#oc x canon#din djarin#mild angst#pg13#no smut#I’m getting lazy with tags

2 notes

·

View notes

Text

https://www.seair.co.in/blog/vegetables-export-from-india.aspx

India, the land of farmers, has a perfect climate for farming. India's agricultural sector is very vast, which makes India a prime producer and exporter of many agricultural products. One of the main agricultural products, vegetables, is rising as the green gold of India due to its high export value and economic support for the nation in many ways. This blog will teach about vegetable export data, Vegetables export from India, and more.

#vegetables export from india#vegetables export data#vegetables hs code#india vegetable export#vegetables exporters in india#vegetables importers#vegetable buyers#vegetable importing countries#top 10 vegetable exporting countries

0 notes

Text

Brazil’s corn exports to Egypt up by 174%

Brazil’s corn exports to Egypt alone grossed USD 1.1 billion in 2024.

Brazil’s corn exports to Egypt grew by 174.2% in 2024 compared to 2023, to USD 1.103 billion, making the Arab country the world’s top buyer of Brazilian-produced corn. According to data from the Agrostat platform managed by the Latin American giant’s Ministry of Agriculture and Livestock, and ComexStat managed by its Ministry of Development, Industry, Trade, and Services, these exports significantly influenced the trade performance with Egypt.

In 2024 Egypt imported USD 3.3 billion worth of agribusiness goods from Brazil, an increase of 91.4% compared to 2023. The sector accounts for 82.9% of all Brazilian exports to Egypt. Of this, 33.3% corresponded to corn purchases (excluding for planting). Sugar and meat and offal, primarily beef, were among the other top-grossing products in exports to Egypt.

Egypt, in turn, exported USD 152.5 million to Brazil, primarily in preparations of vegetables and fruits (mainly preserved or frozen potatoes), frozen strawberries, and temporarily preserved olives still unsuitable for consumption.

Continue reading.

#brazil#brazilian politics#politics#economy#egypt#farming#image description in alt#mod nise da silveira

2 notes

·

View notes

Text

#Fresh Vegetables#Organic Vegetables#Vegetables#natural vegetables#supplier#Exporter#Maharashtra#Mumbai#India#Tomatoes#Potatoes#Carrots#Bell Peppers#India export data of Vegetables

0 notes

Text

Excerpt from this story from PV Magazine:

In the United States, regulations require that gasoline contains about 10% ethanol, a biofuel made from corn. About 29.7 million acres of farmland are dedicated to corn growing for ethanol fuel in the U.S. Roughly 38% of U.S. corn harvested is used for ethanol fuel, rather than food.

A study from Department of Natural Resources and the Environment of Cornell University published in Proceedings of the National Academy of Sciences found that solar PV generates the same amount of energy as corn ethanol in just 3.2% of the land-use footprint. In other words, the energy generated by one hectare of utility-scale solar would require about 31 hectares of corn-ethanol to produce the same amount energy. Find the methodology here.

“Social opposition to solar development in croplands persists, and moratoriums on solar development are underpinned by the argument that prime agricultural land should be left to produce food,” said the Cornell study. “Meanwhile, approximately 12 million hectares of croplands (an area about the size of New York State), are cultivated for energy production in the form of corn ethanol.”

The study identified target locations where corn for ethanol could be strategically converted to solar PV within a “technically feasible proximity to electrical transmission (≤3.3 km or 2 miles).”

The research found that using just 3.2% of the land currently used for corn ethanol could increase the share of utility-scale solar energy in the U.S. from 3.9% to 13%.

The researchers noted that solar and ethanol are not a perfect one-to-one swap in end-use, as ethanol is primarily used as a gasoline additive while solar production is exported to the electricity grid. However, electricity demand from the grid is expected to grow 33% to 75% by 2050, based on Energy Information Administration data, and 33 million electric vehicles are expected to be on the road by 2030, according to the National Renewable Energy Laboratory.

The researchers suggested perennial vegetation could be planted beneath the solar arrays. The “ecovolatic” solar arrays could “filter excess nutrients transported from adjacent farm runoff, diversify and connect agricultural landscapes, and provide local wildlife habitat.”

Fertilizer runoff from ethanol corn farming causes water quality issues and ecological damage. The researchers targeted locations for conversion that were the highest contributors to nutrient runoff in the Mississippi River System. It found that solar coupled with perennial vegetation, could reduce nutrient runoff by as much as 85% in the river system by stabilizing soils, retaining sediments and filtering runoff. It estimated that about 391,000 hectares of converted ethanol fields could reduce nitrogen and phosphorus runoff by about 54.8 million kg and 26.3 million kg, respectively.

The 391,000 hectares would generate about 380,000 GWh of electricity annually while improving the quality of the Mississippi River System.

Moreover, the researchers found that if 46% of the land currently used to farm corn for ethanol was converted to solar, the projects would generate enough electricity for the United States to decarbonize its electricity system by its 2050 goal.

1 note

·

View note