#usaa bank

Explore tagged Tumblr posts

Text

The Downfall of USAA under Wayne Peacock's Leadership

In recent years, USAA, once revered for its unwavering commitment to serving military members and their families, has faced a profound shift in reputation under the leadership of Wayne Peacock. This blog delves into the critical analysis of USAA's challenges, dissatisfactions among its members, and the repercussions of decisions made during Peacock's tenure.

youtube

The exploration begins with an overview of USAA's historical standing, rooted in trust, reliability, and a commitment to exceptional service. Founded in 1922, the institution initially provided auto insurance, expanding its offerings to encompass a comprehensive range of financial products tailored to the unique needs of military personnel and their families.

Wayne Peacock's ascension to the CEO position in 2020 was anticipated to sustain USAA's legacy of excellence. However, the realities under his leadership revealed deviations from the institution's cherished values. The blog scrutinizes Peacock's leadership style and decision-making, highlighting a shift in priorities toward cost-cutting measures and operational changes that seemed to compromise service quality.

Under Peacock's guidance, USAA faced a multitude of challenges, encapsulated in four primary areas:

Customer Service Failures: Members reported a decline in responsiveness and empathy from USAA's customer support, leaving many feeling neglected and unheard.

Decline in Financial Services: Increased fees and reduced benefits stemming from policy changes disillusioned members, challenging the institution's commitment to its customers' financial well-being.

Technological Lags and Security Concerns: Outdated technology and security vulnerabilities heightened frustrations, impacting user experience and raising concerns about data safety.

Impact on Individuals and Families: Testimonials underscored the emotional and financial toll these shortcomings took on members, once reliant on USAA's unwavering support.

The blog corroborates these observations with credible sources, including Forbes, Consumer Reports, The Wall Street Journal, and J.D. Power & Associates, validating the outlined issues and dissatisfactions experienced by USAA members.

Further analysis incorporates links to testimonials and reviews from members sourced from platforms like Reddit, Trustpilot, and ConsumerAffairs. These real-life accounts vividly illustrate the frustrations and disappointments faced by individuals and families relying on USAA for their financial needs, corroborating the outlined challenges.

The assessment extends to public perception and reactions, examining online reviews, feedback, and social media sentiment. It becomes evident that the sentiment on these platforms echoes the dissatisfaction expressed by members, signaling a significant departure from the institution's once-revered service standards.

In the concluding section, the blog emphasizes the imperative need for USAA to address these challenges. It offers recommendations, advocating for enhanced customer service, policy reassessments, technological advancements, and a renewed focus on member-centricity. It emphasizes the pivotal role of leadership in restoring trust, underlining the importance of aligning decisions with members' best interests.

The blog envisions a path forward for USAA, urging a collective effort involving leadership commitment, member engagement, and a renewed dedication to the institution's founding principles. It asserts that by embracing transparency, accountability, and a renewed focus on members, USAA can navigate these challenges and regain its standing as a trusted financial institution serving the military community.

In essence, this comprehensive analysis provides a critical examination of USAA's challenges under Wayne Peacock's leadership, supported by credible sources and member testimonials. It illuminates the path for USAA's future revival, emphasizing the crucial role of leadership in restoring the institution's trust and commitment to its members' well-being.

#usaa#usaa wayne peacock#wayne peacock#usaa review#usaa reviews#usaa reviewed#united services automobile association#usaa insurance#usaa banking#usaa bank#usaa credit#usaa rates#usaa casualty insurance#usaa car insurance#usaa auto insurance#Youtube

1 note

·

View note

Text

It is WILD how heavily subsidized and incentivized the US military is. Our nation's most costly social welfare program is actually the United States military.

I think about this a lot.

#been thinking abt it bc i qualify to use USAA because of my father#also other reasons#(for those who dont know usaa is a bank only available to service members veterans and their children/spouses)#(they typically have very competitive rates for basically everything)

5 notes

·

View notes

Text

What Are the Benefits and Services of the United Services Automobile Association (USAA) In 2024

Are you seeking a financial institution tailored to meet the unique needs of military personnel and their families? Look no further than the United Services Automobile Association (USAA). In this comprehensive guide, we'll delve into the wealth of benefits and services offered by USAA, highlighting why it stands out as a go-to financial institution for the military community.

youtube

Understanding USAA:

Established nearly a century ago in 1922, USAA was founded by military members to provide financial services exclusively to their fellow service members and their families. Over the years, USAA has evolved into a multifaceted institution offering a wide range of services including banking, insurance, investments, and retirement planning.

Membership Eligibility:

One of the primary factors setting USAA apart is its strict eligibility criteria. Membership is open to active, retired, and honorably separated officers and enlisted personnel of the U.S. military. Additionally, family members of current USAA members, including spouses, children, and widows, are also eligible to join.

Products and Services Offered:

USAA prides itself on offering an extensive suite of financial products and services tailored specifically to the needs of the military community. These include:

Insurance: USAA offers various insurance options such as auto, home, renters, life, and more, often with exclusive rates and benefits for military members.

Banking: From checking and savings accounts to loans and credit cards, USAA provides comprehensive banking services designed to meet the unique financial needs of military families.

Investments: USAA offers investment opportunities, including brokerage services, mutual funds, retirement accounts, and financial planning tools.

Retirement Planning: USAA provides retirement planning services aimed at ensuring financial security for military personnel after their years of service.

Benefits for Military Members:

USAA goes the extra mile in supporting its military members with numerous benefits. This includes competitive insurance rates, special financial assistance programs during deployments, and personalized financial advice geared towards military-specific situations. USAA is renowned for its exceptional customer service, providing 24/7 support to its members.

Joining USAA:

Joining USAA is a straightforward process. Eligible individuals can apply for membership online through the USAA website. The application typically requires verification of military status or family relationship to a current or former USAA member.

Customer Satisfaction and Testimonials:

Countless satisfied customers attest to the reliability and quality of USAA's services. Testimonials often highlight USAA's commitment to its members, responsive customer support, and the institution's understanding of the unique challenges faced by military families.

In Conclusion:

The United Services Automobile Association (USAA) stands as a beacon of financial support and security for the military community. With a steadfast commitment to serving those who serve our country, USAA continues to provide a wide array of comprehensive and tailored financial services.

Final Thoughts:

USAA's unwavering dedication to its members and its array of specialized financial products and services make it a trusted and highly sought-after institution within the military community. Whether it's insurance coverage, banking solutions, investment opportunities, or retirement planning, USAA remains a top choice for those seeking financial stability and support.

Keywords: United Services Automobile Association, USAA, military financial services, insurance for military, banking for veterans, USAA membership, financial security for military families.

Ready to experience the difference USAA can make in your financial life? Explore their website to learn more about their services and membership options.

#united services automobile association#usaa#usaa insurance#usaa banking#usaa investments#usaa retirement#usaa review#usaa reviews#Youtube

2 notes

·

View notes

Text

What is the maximum money that can be sent via Zelle?

What is the maximum money that can be sent via Zelle?

Zelle has managed to become one of the new alternatives to sending and receiving money in the United States. It has gained users as an easy-to-use application that helps customers facilitate transfers regardless of the bank to which users belong.

One of the characteristics of Zelle is the immediacy that characterizes this new service because, in a matter of minutes, transfers are made regardless of where they are.

One of the most common questions from Zelle customers in the United States is about the maximum limit that can be sent in a transfer daily, weekly or even monthly.

We will clarify the general aspects of the limits established by Zelle for the money transfers depending on the financial institution to which you belong and the limits established by the banks themselves.

What is the limit of money that can be sent by Zelle in the United States?

If your bank does not yet offer the Zelle service, the weekly allowable limit is $500, which cannot be increased or decreased regardless of conditions.

However, if your bank offers the Zelle service, the sending limits are established specifically by each financial institution, which we detail below.

Wells Fargo, Bank of America

These two institutions tell us that the daily limit to send money through Zelle is $3,500, although if you usually send money monthly, the maximum you can transfer will be $20,000.

Capital One, CitiBank, and US Bank

In these three banks, the figures vary, and their daily limit is lower than that offered by other institutions, although higher than that offered by Zelle to customers who do not yet have the service. The daily maximum varies between $1,500 to $2,500, depending on the client’s account type.

Finally, other banks like TD Bank have daily minimums of $1,000 and monthly maximums of $10,000.

Zelle Limits at Top Banks: Daily and Monthly

Mobile payment tools make it faster and more convenient for you to send and receive money for personal, professional or small business purposes. Along with PayPal, Cash App and Venmo, Zelle is a platform that allows you to send money from your bank account to an intended recipient with no fees attached.

Here’s a closer look at how Zelle works, its limits at many of the country’s top banks and what you can do if you reach these monthly and daily limits.

More From Your Money: Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today.

What Are Zelle Limits at National Banks?

Banks often have different limits on how much users can receive or send. The following table lists the daily and monthly Zelle limits at some of the country’s largest banks.

What Are Some Alternative Options if You Hit Your Zelle Limit?

There are other ways to send money if you hit the Zelle limits. Here are some alternatives to consider.

Try another payment platform: Some popular payment platforms include Venmo, PayPal and Square. Many of these services charge a small fee to send money, and users need an account to receive the money.

Write a personal check: While personal checks may seem outdated, they are an excellent alternative to peer-to-peer transfer apps if you need to send a large sum of money.

Withdraw cash: People typically do not have a lot of cash on hand because of the popularity of debit cards, but you can always make a trip to the ATM to withdraw some money.

Use a payment retailer: Western Union and MoneyGram allow you to send money by visiting an authorized retailer and funding the transaction with cash or a debit card. Your recipients can pick up the money by visiting a retailer and providing their name and the transaction number.

Wait a few days: Waiting 24 hours or 30 days until you are back under Zelle’s payment limits is the slowest strategy, but it may be necessary if you want to send a large payment.

How Does Zelle Work?

Here are the steps for sending or receiving money through Zelle.

Step 1: Choose your recipient. Due to increasing Zelle fraud, you should only send money to people you know and trust, like repaying a family member or friend or paying a service provider.

Step 2: Obtain the recipient’s phone number or email address. Anyone with an account at a U.S. financial institution can receive money through Zelle with their phone number or email.

Step 3: Decide your payment amount. Your Zelle limit depends on your bank or credit union. If you want to send a large amount consistently, you may need to find an alternative payment option.

Step 4: Send the money. Your recipient will typically receive the money in minutes if they are already a member of Zelle. They’ll receive instructions on obtaining the funds via email or text if they are not enrolled.

Step 5: Verify the payment. You should always follow up, contacting the recipient to make sure they received the money. You should also check your bank account to ensure it deducted the proper amount from your account.

What Are the Benefits of Using Zelle?

One of the biggest benefits of using Zelle is that it is free and there are no fees to send or receive money. Most competitors charge a small fee if you use a Visa, Mastercard, debit card or credit card to send money, while others charge to transfer funds received to a bank account. Zelle can offer the service at no cost to customers because money is sent directly between bank accounts with no middleman.

While there’s no cost to use Zelle, you can only use your checking, savings or debit card to send or receive money, and you can’t make credit card payments. To be sure, you should check with your bank or credit union to make sure it doesn’t charge extra fees for using the Zelle feature.

An additional benefit of using Zelle over another payment application is the instant nature of the service. The money is immediately transferred to your recipient’s bank account because there’s no intermediary. It takes a few days to transfer funds from the app to a bank account with other services. Other platforms that do offer instant transfers charge a fee for the service.

Final Take To GO

Your bank must have a partnership with Zelle for you to access its features. More than 1,000 financial institutions in the U.S. offer Zelle to their customers. Financial institutions typically incorporate Zelle’s capabilities into their mobile banking apps.

If your financial institution offers Zelle, you should contact it directly to inquire about its daily and monthly sending limits. If your bank or credit union does not provide the service, you must download the Zelle app to send and receive payments.

FAQ

Can I get paid with Zelle?

While Zelle is a popular way to send money, it's also an easy way to receive money from individuals, companies, government agencies and even academic institutions. For instance, it may be possible to request payment via Zelle if you are owed a refund from a university or government agency. Sending money through Zelle is free for both parties and quickly ensures you get the funds.

Can businesses use Zelle?

Just like PayPal, any individual or business with an account at an institution that uses Zelle can use the feature to send or receive money. Many business owners use the service to send and receive money because there are no fees involved. You may want to encourage your customers to send payments via Zelle if the amount is within their daily Zelle transfer limits. It may be necessary to accept other methods for large payments.

What is the maximum you can send with Zelle?

The maximum amount you can send through Zelle depends on what bank you use as the cap will vary both daily and monthly by each financial institution. For example, Bank of America and Wells Fargo have a maximum daily limit of $3,500 whereas TD Bank has a daily limit of $2,500.

Can you send $5,000 through Zelle?

Yes, you can send $5,000 through Zelle if you have a private client or business checking account with Chase.

Can you send $10,000 through Zelle?

The amount you are able to send through Zelle depends on your bank's set limits. Many banks allow you to send $10,000 in a month, but not in one day. Check with your financial institution to find out your daily and monthly sending limits.

How do I increase my Zelle limit?

There is no way to increase your Zelle limit. If you find their limits to be too confining for your needs, you can try another payment platform such as Venmo or PayPal.

#limit zelle#zelle transfer limit#zelle limits#zelle daily limit#zelle limit per day#bank of america zelle limit#zelle maximum transfer#chase zelle limits#zelle weekly limit#zelle transfer limit bank of america#zelle sending limit#zelle transaction limit#zelle limits bank of america#zelle transfer limit 2023#maximum zelle transfer#zelle daily transfer limit#zelle daily limit bank of america#usaa zelle limit#zelle account limit email#zelle monthly limit#zelle payment limits#zelle business account limits#zelle limits chase#zelle maximum amount

2 notes

·

View notes

Text

Find a USAA ATM Near You

Looking for a USAA ATM? Here’s how you can easily locate one nearby! 🏦💳

USAA provides convenient banking solutions for its members, and finding an ATM shouldn’t be a hassle. Here’s how to locate a USAA ATM near you:

1. Use the USAA Mobile App: 📱 The USAA mobile app is a handy tool for finding the nearest ATM. Simply open the app, go to the ATM locator feature, and it will guide you to the closest one.

2. Visit the USAA Website: 🌐 Head to the official USAA website and use their ATM locator tool. Enter your location details, and it will provide a list of nearby ATMs.

3. Partner ATMs: 🤝 USAA partners with several ATM networks to offer free access for their members. Look for ATMs in networks like Allpoint and MoneyPass to avoid additional fees.

4. Google Maps: 🗺️ A quick search on Google Maps can help you find the nearest USAA or partner network ATM. Simply type "USAA ATM near me" and follow the directions.

5. Call Customer Service: 📞 If you prefer, you can call USAA’s customer service, and they can assist you in finding the nearest ATM location.

Finding a USAA ATM is simple and convenient, ensuring you can access your money whenever needed. For more information, visit: Find a USAA ATM Near You

0 notes

Text

#latest news#news#bbc#u.s strike#u.s.#uaart#usa news#us army#usa#cnc free use#‘i’m crying’ after usaa ‘closed my account without any warning’ – i won’t bank with them again

0 notes

Text

The story includes corporate America, companies like AT&T, USAA, Allstate, Chase, Exxon, and others who, through their PACs, donated millions to the GOP, and through their ad budgets, millions to Fox News. Even today as Fox is being outed as true propaganda machine most knew it was, and as the GOP cranks up their fascist policies, these companies CONTINUE to fund the GOP and Fox News

White wealthy men made sure white wealthy men were never held accoubtable.

It's a separate reality.

Trump is the patriarchy. He is given chance after chance to fail. He is a rapist. He is a Russian money launderer. He is an abuser. He is a wife-cheater. Above all, he is a radicalizing racist.

All these negative constructs protect Trump so all the racists, cheaters, abusers, and rapists can be rewarded for their complicity.

653 notes

·

View notes

Text

I hate banks, credit, loans, medical/dental industry, and capitalism.

#why do i bank with you usaa#you reject me for everything#i need 3/4 wisdom teeth out so insurances itsnt paying a fucking dime#and i do not have 3k lying around#so i applied for a loan. i have 4 year old credit with nothing on my cards#and they rejected me for age of credit and#too much debt on revolving credit???#at the time there was 61 dollars!!! on a 3k limit card!!#i hate everything.#they do not do payment plan’s either#plans*#and told me to get a care credit card#which i looked up and is TERRIBLE#ramblings#i want to die everything sucks and i also have a broken strut on my car

0 notes

Text

Just got this email from my bank.

Thank you USAA, very cool

55 notes

·

View notes

Text

Okay. My local vet said the price of vaccinations and testing would be about $110 per cat. Not counting the kittens, that would be $330 for the adults. If we assume that getting a mobile vet out here would be twice as expensive as a brick and mortar vet, that puts me at $660. Let's round up to $700. I currently have $250 in my account, with $200 squirreled away for taxes... and I should get a further $900 in a few weeks when a check from a client arrives and I can mail my checks to be deposited to my bank.

Hmm. Maybe I should open a new bank account with a local bank. I don't have a smartphone anymore, so I can't deposit my checks through the app and USAA doesn't have physical branches.

I had wanted to buy furniture and clothes, both desperately needed... Why does it feel like the minute I run into even the smallest amount of money, life conspires to take it away again? I am constantly orbiting $0 in my account and the stress is absolutely killing me.

5 notes

·

View notes

Text

How to Change Weekly Limit In Zella

How to Change Weekly Limit In Zella

Zelle is a digital payment network connecting millions of people to safely and securely process peer-to-peer payments. Since it’s incredibly useful for many reasons, it can be very easy to accidentally hit your weekly Zelle spending limit without even trying. With Zelle processing so many of your payments, it’s likely necessary for you to raise your weekly spending limit.

If you want to learn more about Zelle’s weekly spending limits and how to raise yours, keep reading.

How to Change Weekly Limit on Zelle

The amount of funds you can send using Zelle during a given period depends on some key factors. Zelle’s primary concern when limiting your spending via their platform is fraud protection. Keep reading to understand the various factors playing into our spending limit.

Raising the Limit

The biggest concern you may have is how to raise your Zelle limit. If you use just the Zelle app without going through a bank, you have a $500/week spending limit. This cannot be raised or lowered at any time.

However, if you use Zelle through your bank, either on the banking mobile app or website, you have much more freedom on your spending limit. To raise your limit, you will have to contact your bank directly. They will assess your accounts and spending to provide a fair, safe limit raise in your Zelle account.

Spend Factors

The bank will look at various factors to set your Zelle spending limit. This is done much the same as a credit card limit. The bank looks at your accounts when determining your Zelle limit. Factors such as account and online banking history, your spending activity, and even who you send your Zelle payments to.

The fastest way to raise your Zelle account spend limit is to maintain good account health. For more information about increasing your weekly spend limit, you will need to contact your bank directly.

Account Upgrades

The best way to raise your Zelle spending limit would be to upgrade your bank account. Many banks tie the Zelle spending limit with your account type. The more junior or basic your account, your spending limit will be lower. A bank account that has a maintenance fee is also more likely to have a higher limit.

An excellent example of this would be for Zelle customers with Citibank accounts. If you have a Basic Citibank account, you’re Zelle spending limit would be around $2,000/day or $10,000/month. Likewise, the Priority Citibank account could have a Zelle spending limit of about $5,000/day or $15,000/month.

Upgrading your account within the bank would increase your Zelle account limit. However, ask your bank for the specifics in the account limit raise. Every customer could have a different experience based on their account history.

You should also consider moving banks if possible. You may be able to find a bank account similar to what you already have, but that has a higher Zelle spending limit than the one you currently have.

Time In, Time Out

A final way of increasing your Zelle spending limit is simply time.

Some banks require that customer accounts reach a certain age before they are willing to give a higher Zelle spending limit. The example above quoted several Zelle spending limits for accounts at Citibank. However, those limits were for accounts that have been with Citibank for more than 90 days.

For Citibank accounts younger than 90 days, the Zelle spending limit was significantly reduced.

Luckily, most banks have a short waiting period for accounts to reach maturity and gain a significant increase in Zelle spending limits. The most common is 90 days, but you shouldn’t be surprised if you see time limits of 120 days or longer. It all depends on the bank, account type, and the individual customer.

Going FasterAccount spending limits can be frustrating, especially if you’re trying to send a single, once-in-a-lifetime style payment. Perhaps this payment is far more than you usually send through Zelle, and you don’t plan on making this payment frequently. You may wonder if there is a way to skip past the waiting period after you hit your spending limit.

Unfortunately, there is not. Even if you contact the bank directly, there is nothing they can do to speed up the waiting period to when you’re eligible to spend again.

Zelle & Spending Freely

Zelle can provide remarkable financial freedom and security with fast cash-only transactions and an easy-to-use system. While spending limits may occasionally cause a nuisance, they are ultimately there to protect your money. The best way to raise your Zelle spending limit would be to call your bank and see what they recommend.

Have you ever successfully raised your Zelle spending limit at your bank? Tell us in the comments how you did it!

#limit zelle#zelle transfer limit#zelle limits#zelle daily limit#zelle limit per day#bank of america zelle limit#zelle maximum transfer#chase zelle limits#zelle weekly limit#zelle transfer limit bank of america#zelle sending limit#zelle transaction limit#zelle limits bank of america#zelle transfer limit 2023#maximum zelle transfer#zelle daily transfer limit#zelle daily limit bank of america#usaa zelle limit#zelle account limit email#zelle monthly limit#zelle payment limits#zelle business account limits#zelle limits chase#zelle maximum amount

1 note

·

View note

Link

Fox doesn’t want to hurt the feewings of da baby reichwingers. They would rather shake a rattle of lies to entertain and sooth the crying infants who are their viewers. They are like WWE. Their “newscasters” should be considered ACTORS, reading from a fictitious script in order to soothe and entertain their audience.

Why does USAA continue to fund Fox lies by buying advertising on Fox? Their members DIED for the freedoms USAA is paying to undermine.

Eric Kleefeld at MMFA:

Fox News anchors Bret Baier and Martha MacCallum argued in the weeks following the 2020 presidential election that the network should consider a “layer” beyond “statistics and numbers” when projecting the election results, and instead take into account how its conservative audience would react to the network’s calls.

The New York Times reviewed a recording of a Zoom meeting held on November 16, 2020, over a week after the network’s decision desk had projected Joe Biden as the winner of the 2020 presidential election. The article details discussions between Fox News CEO Suzanne Scott and the two purported straight news anchors on the continued political fallout over the network’s correct projection on election night that Joe Biden had won the swing state of Arizona. (Fox News later fired two key news executives who had presided over the call, which was factually correct and never reversed by any real-life developments.)

[..]

By the time of the Zoom meeting on November 16, there could not have been any remaining doubt over the fundamental accuracy of the Arizona call. Baier and MacCallum, however, were still arguing that it had been a political mistake for the network to be first on the air with this truthful story.

This newest reporting further reveals the extent to which Fox does not have a “straight news” side, but instead is just another cog in a right-wing propaganda machine.

The New York Times’ report on a Zoom meeting held on November 16th, 2020– 9 days after many media outlets called the election for Joe Biden– revealed that Fox’s supposed “straight news” anchors Bret Baier and Martha MacCallum argued that the channel’s viewer reactions to calls of key states should take priority over data and statistics.

#Fox News#sean hannity#desantis2024#tucker carlson#usaa auto insurance#usaa#usaa term life insurance quotes#usaa federal savings bank

29 notes

·

View notes

Text

4 notes

·

View notes

Text

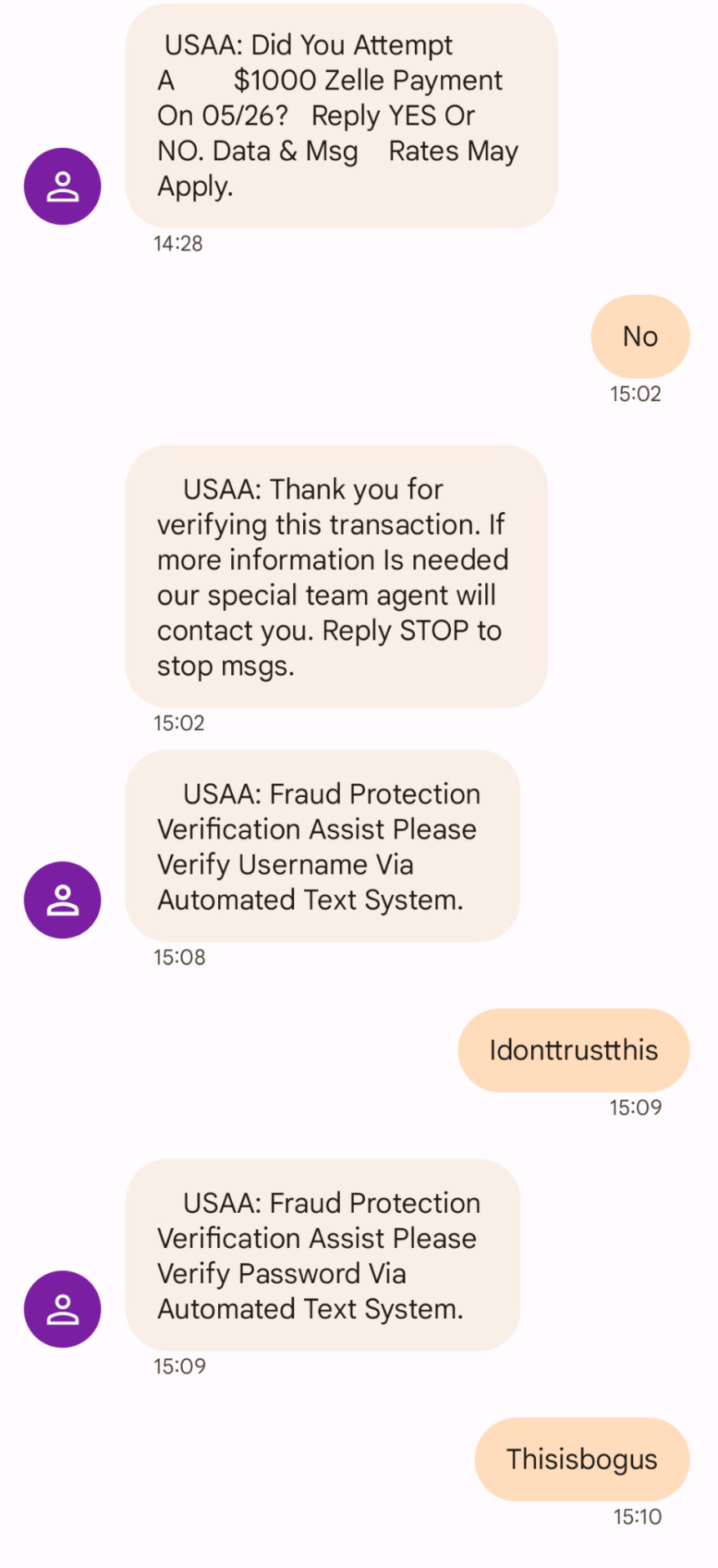

I just got a pretty crafty phish attempt from someone trying to get into my bank account. They first sent an official-looking text asking me to verify if I sent $1000 using zelle, which struck me as possibly being bogus (USAA doesn't use normal phone numbers for text messages). The format was not expected though, and occasionally I've gotten messages that are identical to this questioning some credit card activity - sometimes it's something we bought, sometimes it's someone who's stolen the credit card number.

Someone then called me asking me to verify the zelle transaction and asked me to follow the instructions on the text... and what did it ask? User name and password.

Strange but the fellow hung up the call once I sent the "password"...

The important thing is that if you ever get a text or phone call that asks for any account information - particularly user name and/or password - it's bogus.

If you have any doubts, contact your bank directly, specifically not using any links provided by a message supposedly from them that you may be concerned about; go to yourbankname.com or whatever (like usaa.com) typing it carefully (common misspellings may go to malicious password-grabbing sites).

19 notes

·

View notes

Text

Today I got scammed by an Instagram ad and I didn't notice until I got the checkout email and the mailto was wrong. I did my due diligence and reported the ad and informed the real company (Unique Vintage), then I sheepishly closed my bank card (shout out to the wonderful USAA employee for not judging me). I made a scam alert Insta Story and then immediately got another, different scam advert with the exact same scam but spoofing a different site (Killstar).

I might be done with Instagram as a platform. It seems to be swiftly going the way of Facebook when it comes to scams and incessant advertising of the same things over and over. I almost never feel like posting art there. The only problem is that I have actual friends on Insta that I stay in contact with and like seeing the art of.

I may just have to consciously change the way I interact with the app, and see if that mitigates the problem. (Also, I shouldn't make any monetary decisions with a migraine hangover.)

#there's some deeper stuff here wrt capitalism and growing up in poverty that i don't have the energy to get into#capitalism continues to suck#just text today lads#Instagram scams#advertising isn't inherently evil but it sure is annoying

2 notes

·

View notes

Text

USAA told me I couldnt transfer any funds into my new account from any source for 1-2 months after opening it but the guy on the phone told me to use Zelle to circumvent it since I stressed how vital it was I be able to, you know, have money and spend it. So I install Zelle and empty my bank accounts into my husbands. Now he can send it back to me. And then USAA tells me I cant connect my Zelle to my new acct either. Because its a fund transfer. So now. I have literally no access to any of my money for an unknown amount of time.

2 notes

·

View notes