#usa july inflation

Text

US inflation rate hits 2-year low | World Business Watch|good news for us government|

#us inflation#usa#usa news#usa latest news#us#usa inflation data#usa inflation data news#usa inflation data latest news#usa inflation latest news#usa inflation news#usa inflation news today#usa inflation#usa july inflation data#usa july inflation news#usa july inflation down#usa july inflation#dow jones#dow jones future

0 notes

Text

Happy 4th of July ArtFighters, All the Characters was celebrating 4th of July in USA.

From Left to Right.

The Earnest is slicing a Patriotic Cake with the Message. “Happy Birthday, Uncle Sam!”.

Glorp doing a Barbecue.

Mage Kitten singing Yankee Doodle.

TeruTeru, Mocha, and Corn holding Red, White, and Blue Sparklers.

Blue Spots are waving the USA Flag.

Little Guy is Wearing Uncle Sam Hat.

Dandy Lion licking a Firecracker Popsicle.

Quackity swimming in Stars and Stripes Inflatable Pool.

Sugar Cat was eating Apple Pie.

The Cherry Twins are Taking Picture with a Phone holding a Photo Ops of Lady Liberty Hat.

Mi is Singing Party in the USA!

Along with Red, White, and Blue Fireworks at Night.

Happy July 4th Folks!

#4th of July#ArtFight#Attack#Uncle Sam#Apple Pie#Lady Liberty#USA#Singing#Yankee Doodle#Stars and Stripes#Inflatable Pool#Barbecue#Popsicle#Red#White#Blue#Stars#Stripes#Fireworks#Photo Ops#Cake

1 note

·

View note

Text

How Saudi Arabia Drives the Gold Price?

The wealth built on oil in Saudi Arabia is legendary. For a long time, the kingdom has been preparing for a post-oil era. There are hardly any sectors of the economy or major players in big business in which the Arabs have not been invested for a long time, constantly seeking new investments.

Officially, the kingdom ranks 15th in gold reserves with 3,231 tonnes (as of December 2023), but the official declaration of gold reserves may not be 100% reliable in all countries.

As the USA has recently refrained from disclosing its gold reserves, and external audits of US depots are often very difficult, it is quite possible that there are less than the assumed 8,133 tonnes from 2023.

It is assumed that China and Russia possess significantly more yellow metal than they officially report.

Gold remains the only money, free from debt and inflation. The old JP Morgan made this clear.

But why the thesis that the Saudis drive the gold price? After all, they do not stand out through disproportionate purchases, nor are they among the producers.

Nevertheless, they leverage the gold price by devaluing paper money, particularly the dollar and the euro, through their financial and global political activities.

One factor is the petrodollar. Over 50 years ago, the USA (after abandoning the gold price peg) and the royal house agreed to primarily settle their oil in dollars. In return, the USA promised military protection and access to technologies.

All the dollars the Saudis received for their oil were exchanged at the Fed for US bonds. They received and still receive ongoing interest and eventually the principal amount. This made them a significant financier of the USA; they were and are already a major supplier of black gold. However, they were increasingly troubled by importing inflation with the dollar. They preferred to sell off US bonds, reducing their holdings, and furthermore, to move away from the petrodollar by selling their oil in other currencies. Understandably, they were also disturbed by the fact that the USA, through sanction mechanisms, dictates to whom one may sell oil and to whom not.

The fact that they joined the BRICS alliance in 2024 is also a strong signal towards independence.

All these are not new issues, but now it gets interesting.

While the EU and the USA have been talking for some time about expropriating Russian assets, there is now a backtrack. The current discussion is about “merely” freezing the payment of interest and profits. What and who is behind this?

Russia is a significant creditor of the USA and European countries through its holdings of government bonds. They have thus provided a large sum of loans, which are nothing more than bonds. This money and the due interest are to be withheld from the Russians because they do not comply with the political demands of the debtors.

While it might be a windfall for the cash-strapped European and American treasuries, it increasingly cuts them off from the trust that underpins monetary transactions. And that worldwide. Thus, besides Russia, China and other BRICS countries, as well as England and other industrial nations and partly allies, are observed diversifying their currency reserves at the expense of the dollar and moving further away from the still-world-leading currency. While in 2010, 75% of global trade was settled in dollars, currently it is about 55%! For countries like the USA, which have more debt than GDP, this is a severe blow. Not only do they have to pay significantly higher interest rates to get fresh loans, which are then financed by new loans, but a debtor who uses his debt as leverage for compliance is also less likely to receive money from solvent actors who are unwilling to risk their political independence.

On July 8, 2024, news agencies worldwide reported that Saudi Arabia had announced it would sell off its European bonds if Russian assets were expropriated. This would particularly hit the French hard, who would lose a reliable creditor. With a national debt of over 110%, 50% above the Euro stability criteria, this is a harsh blow. The simple path of new borrowing would have to be replaced by financial restructuring, but the socialist majority in France’s political system knows as much about business economics as a donkey does about algebra.

The French cannot turn to the Russians and Chinese, and they do not trust the USA themselves.

By turning away from the Western credit and sanctions path, the Saudis ultimately promote the rise of real inflation-free exchange mediums like gold, goods, and services. The steady rise in the gold price is quite convenient for them. Because for gold, they can get anything they need worldwide.

Joining BRICS, which is known to be strategically working on a gold-backed trade currency, fuels this process and also shows the future economic orientation of the desert kings. The bulk of the world population and thus future consumption and prosperity lie neither in North America nor Europe. The action is in Asia and the Southern Hemisphere. Russia was forced onto this path and, with only 15% national debt and growing GDP with decreasing import dependency from the West, has no motivation to make a 180-degree turn. When the great partners from the West blow up their pipelines and cut them off from the payment system, they seek new horizons and have already found them with China, India, the Arabian Peninsula, Africa, South America, and many other Asian countries. With a reliable supplier, even during political conflicts like in the Cold War, who also has a full range of natural resources in abundance, one is happy to trade.

If more and more countries decouple from the credit financing system and trade with hard exchange mediums, this naturally means a significantly higher weight for gold. Credit currencies might possibly only be traded with large premiums to offset the many risks.

The military might of the USA loses its terror. Whoever presses the red button first dies second but does not survive; this rule applies in the nuclear age.

The financing of over 800 (!) military bases plus aircraft carrier fleets as visible power presence increasingly bursts the US budget, just like the proxy wars overseas.

In anticipation of a collapsing financial system, not only states but also companies and private individuals are increasingly securing their ships.

So that you are not left in the rain when it crashes, continuously stock up on gold and silver; this has financially secured people well for thousands of years, today and especially in the future.

#gold invest company berlin#gold online kaufen#edelmetalle kaufen#gold invest berlin#gold invest edelmetalle#edelmetalle verkaufen#kaufen gold#kaufen silber#verkaufen gold#verkaufen silber

0 notes

Text

Die Präsidentschaftswahlen 2024 stehen vor der Tür und bringen wie immer eine Welle von Spekulationen und Unsicherheit auf den Finanzmärkten mit sich. Ein Vermögenswert, der in solchen Zeiten genau beobachtet wird, ist Gold. Gold ist bekannt für seinen Status als sicherer Hafen und reagiert häufig auf politische und wirtschaftliche Ereignisse, einschließlich Wahlen. Wie könnten sich also die Präsidentschaftswahlen 2024 auf den Goldpreis auswirken?

Im Juli 2024 sind die amerikanischen Präsidentschaftswahlen in vollem Gange. Der republikanische Kandidat Trump hat spektakulär ein Attentat überlebt, Präsident Joe Biden ist aus dem Rennen ausgestiegen und hat die Vizepräsidentin Kamala Harris unterstützt, die nun gegen den ehemaligen Präsidenten Donald Trump als wahrscheinlichen Kandidaten der Republikaner antritt. Zudem hat Trump mit J.D. Vance einen möglichen Vizepräsidenten nominiert, der konträre Standpunkte in der Ukraine-Politik vertritt.

Historischer Kontext: Gold und Wahlen

In der Vergangenheit haben sich die Präsidentschaftswahlen in den Vereinigten Staaten unterschiedlich auf den Goldpreis ausgewirkt. Zwar ist keine Wahl wie die andere, doch haben sich im Laufe der Jahre bestimmte Muster herausgebildet:

Ungewissheit und Volatilität: Wahlen bringen oft Unsicherheit mit sich, und die Märkte mögen keine Unsicherheit. In Zeiten politischer Instabilität können Anleger in Scharen zu Gold als sicherem Hafen flüchten, was zu einem Anstieg der Goldpreise führt.

Erwartungen an die Politik: Die Programme und politischen Strategien der Präsidentschaftskandidaten können die Stimmung der Anleger erheblich beeinflussen. Eine Politik, die zu höherer Inflation oder höheren Staatsausgaben führen könnte, könnte die Anleger dazu bringen, Gold als Absicherung gegen mögliche wirtschaftliche Instabilität zu kaufen.

Marktstimmung: Die allgemeine Marktstimmung und das Vertrauen der Anleger in das Wahlergebnis können eine entscheidende Rolle spielen. Eine hart umkämpfte Wahl oder ein Ergebnis, das vom Markt als ungünstig angesehen wird, kann zu einer erhöhten Nachfrage nach Gold führen. Zinssenkungen in den USA werden erwartet und sind notwendig, weil bei weiterhin hohen Zinsen eine Beschleunigung von Kreditausfällen im privaten und gewerblichen Sektor drohen. Niedrige Zinsen und hohe Inflation waren zu allen Zeiten ein Grund, verstärkt in Sachwerte zu investieren.

Es ist zwar schwierig, genau vorherzusagen, wie der Goldmarkt auf die Präsidentschaftswahlen 2024 reagieren wird, aber historische Muster und aktuelle Wirtschaftsindikatoren bieten einige Einblicke. Anleger sollten die Wirtschaftspolitik der Kandidaten, die geopolitischen Entwicklungen, die Maßnahmen der Federal Reserve und die allgemeine Marktstimmung genau im Auge behalten.

Folgen Sie uns für weitere interessante Informationen aus der Finanzwelt:

#GoldPrice#Election2024#FinancialMarkets#SafeHaven#PoliticalImpact#EconomicUncertainty#Investing#GoldInvestments#MarketTrends#PresidentialElection#GoldMarket#financenews

0 notes

Text

Mark Cuban Forecasts Promising Bitcoin Future During Trump’s Reign

Key Points

Mark Cuban expresses a positive outlook for Bitcoin if Trump returns to the presidency.

Cuban believes Bitcoin could become a global safe haven currency.

Billionaire Mark Cuban has offered a positive perspective on Bitcoin if former US President Donald Trump returns to office. Cuban, a well-known tech entrepreneur, shared his views on the potential impacts on the cryptocurrency market if Trump is re-elected as US President.

Cuban stated, “It’s a Bitcoin play.” He highlighted that while Trump’s support for Bitcoin and other cryptocurrencies is significant, its direct effect on prices is not the primary factor. Instead, Cuban focused on the substantial regulatory changes that could arise within the cryptocurrency industry.

Anticipated Regulatory Changes

Cuban anticipates that the Securities and Exchange Commission (SEC) would collaborate with a Trump administration to create a more crypto-friendly regulatory environment. Market analysts have speculated that a Trump victory in the 2024 US elections could potentially drive Bitcoin prices to over $100,000.

Nevertheless, Cuban noted that the main factors influencing Bitcoin’s price trajectory are broader economic elements, such as lower tax rates and tariffs, which are traditionally seen as inflation triggers. He also emphasized the international uncertainty around the USA’s geopolitical role and its potential impact on the US Dollar’s status as a reserve currency. Cuban suggested that these factors combined could potentially boost Bitcoin’s value.

Bitcoin as a Global Safe Haven Currency

Cuban maintains a bullish stance on Bitcoin, given its global reach and limited supply of 21 million, which he believes makes it a strong store of value. He also appreciates that Bitcoin is available to everyone, even in small denominations.

Cuban recently speculated on Bitcoin’s role amid geopolitical uncertainty and the potential decline of the dollar as the world’s reserve currency. He suggested that Bitcoin could emerge as a global “safe haven” for countries and individuals seeking to protect their savings. He pointed to current use cases in economies experiencing hyperinflation as indications of wider adoption.

While Cuban remains cautious about speculative extremes, he acknowledged the possibility that Bitcoin could meet the expectations of its advocates by becoming a universally accepted global currency. As of the latest update, the Bitcoin price is experiencing a slight pullback after reaching a high of $65,500. The total inflows into the spot Bitcoin Exchange Traded Funds (ETFs) also slowed down on Wednesday, July 17.

0 notes

Text

‘Norway to stockpile 82,500 tons of grain to prepare for famine and war’ & ‘If The High Cost Of Groceries Makes You Feel Sick, You Are Not Alone’

@bible-news-prophecy-radio

COGWriter

The government of Norway is storing food:

Norway to stockpile 82,500 tons of grain to prepare for famine and war

July 1, 2024

Norway’s finance minister, Trygve Slagsvold Vedum, and Agriculture and Food Minister Geir Pollestad signed a deal with four private companies to store 30,000 tons of grain in 2024 and 2025.

The companies involved will reportedly store the grain in existing facilities throughout the country, but it will be the property of the Norwegian government.

In a statement, the Agriculture and Food Ministry noted: “The building up of a contingency stock of food grains is about being prepared for the unthinkable.”

The government stated that the companies “are free to invest in new facilities and decide for themselves where they want to store the emergency grain, but they must make the grain available to the state if needed.”

They are apparently anticipating a potentially prolonged war or famine as they intend to sign additional stockpiling contracts that will help them reach their goal of stockpiling 82,500 tons of grain for their population of 5.6 million by the end of this decade. Pollestad said the idea is to “have enough grain for three months’ consumption by Norway’s population in a crisis situation that may arise.” https://www.naturalnews.com/2024-07-01-norway-stockpile-grain-famine-war.html

The Norwegian government … signed a deal to start stockpiling grain, saying the COVID-19 pandemic, a war in Europe and climate change have made it necessary.

The deal to store 30,000 tons of grain in 2024 and 2025 was signed by agriculture and food minister Geir Pollestad, finance minister Trygve Slagsvold Vedum and four private companies. The wheat, which will belong to the Norwegian government, will be stored in already existing facilities by the companies in facilities across the country. Three of the companies will store at least 15,000 tons this year. …

Norway will sign further stockpiling contracts in the coming years, with the goal of building up the reserve until 2029. The aim is to have some 82,500 tons of grain in storage by the end of the decade “so that we then have enough grain for three months’ consumption by Norway’s population in a crisis situation that may arise,” Pollestad told Norwegian broadcaster NRK.

Norway has 5.6 million people.

Last year, the Scandinavian nation said it would spend 63 million kroner ($6 million) per year on stocking up on grain.

Norway had stored grain in the 1950s but closed down its storage sites in 2003 after deciding they were no longer needed. … When announcing their intention to ramp up their stockpiling efforts last year, Pollestad told the Norwegian news agency NTB: “In a situation with extreme prices on the world market, it will still be possible to buy grain, but if we have done our job, we will not be so dependent on the highest bidder at auction. We can help keep prices down.”06/25/24 https://apnews.com/article/norway-stockpiling-grain-ukraine-food-security-ac874122f2f2fb43e7d1332c1a51f0e6

This, in my view, is a wise move by Norway.

Jesus prophesied war and famines (Matthew 24:7) and it is wise to prepare by having stored food–even ants do that:

6 Go to the ant, you sluggard! Consider her ways and be wise, 7 Which, having no captain, Overseer or ruler, 8 Provides her supplies in the summer, And gathers her food in the harvest. (Proverbs 6:6-8)

Let’s look at food price inflation as reported in the UK (which is holding its elections tomorrow) and the USA:

3 July 2024

Food prices today are about 31 percent higher than they were three years ago, according to data from the Office for National Statistics (ONS). https://www.aljazeera.com/economy/2024/7/3/thirty-one-percent-the-jump-in-food-prices-as-uk-goes-to-the-polls

July 3, 2024

Cookout staples are up 5% from last year but up a whopping 30% from five years ago, according to the American Farm Bureau’s annual survey. https://www.axios.com/2024/07/03/july-4th-food-prices-cookout-inflation

Michael Snyder put out the following on the rising cost of food:

If The High Cost Of Groceries Makes You Feel Sick, You Are Not Alone

If you are really struggling with the high cost of living, I want you to know that you aren’t alone. In recent months, I have been hearing from so many people that feel like they are drowning financially. Have you experienced a palpable sense of panic when you compare your rising bills to the level of income that you are currently bringing in? So many people out there are stressed out of their minds because it has become such a struggle to pay the bills each month. … a typical U.S. household must now spend $1,069 more a month just to buy the exact same goods and services that it did three years ago. Over the course of an entire year, that is almost an extra $13,000 dollars. Month after month, prices just keep going higher, but those that are running things continue to insist that everything is just fine.

No, everything is not just fine.

Last week, a TikTok video about rising grocery prices at Walmart quickly garnered more than a million views. The person that made the video found a grocery order that he had placed two years ago, and he decided to hit the “Reorder All” button to see what that same order would cost today…

A recent TikTok video has gone viral, showing a user’s surprising experience with Walmart’s grocery prices. The user explained in his video that he tried to use the “Reorder All” button for an order he placed two years ago, which originally cost $126.67. To his shock, the same order would now cost $414.39.

I was quite stunned by this video.

Many of the things that I regularly purchase at the grocery store have doubled or more than doubled in price, but in this case the total cost of the grocery order had more than tripled…

Another person hit the “Reorder All” button on an old order, and that order went from $180 back then to $430 today…

A fellow shopper said they used to spend $180 for two weeks’ worth of groceries and are now spending over $430 for the same amount.

If you think that the price of groceries is not a problem, I have a challenge for you.

Fill up a grocery cart all the way to the very top with items that you typically eat, and try to keep the final bill under 300 dollars. …

The last three years have been an inflationary nightmare, and no matter how much our leaders try to deny it, a lot more inflation is on the way. 06/30/24 https://theeconomiccollapseblog.com/if-the-high-cost-of-groceries-makes-you-feel-sick-you-are-not-alone/#google_vignette

Of course with the accumulation of more and more debt, that helps drive price inflation and the cost of items like food to rise.

The Book of Revelation says that there will be more food price inflation:

5 When He opened the third seal, I heard the third living creature say, “Come and see.” So I looked, and behold, a black horse, and he who sat on it had a pair of scales in his hand. 6 And I heard a voice in the midst of the four living creatures saying, “A quart of wheat for a denarius, and three quarts of barley for a denarius; and do not harm the oil and the wine.” (Revelation 6:5-6)

Food price inflation has hit in many places, but will worsen.

We put together the following related video:

youtube

14:44

3rd Horseman of the Apocalypse and Food

There are reports about food price inflation around the world. While it is worsening in many areas, some believe it will improve in 2023. Instead, could prices continue to rise in 2023 and get much worse in 2024 and thereafter? What are the causes of food price inflation? Is there any connection between weather, government policies, fertilizer prices, energy costs, economic sanctions and food price inflation? What are we seeing in reports from the United Kingdom, Hungary, and South Africa? What about impacts from Russia’s ‘special military operation’ into Ukraine? Could EU and/or USA policies be effecting any of this? Is the ‘black horse’ the one associated with famine, food shortages, and food price inflation in the Book of Revelation? Are there any physical lessons we can learn from ants according to the Book of Proverbs? What are some spiritual steps we should take according to Jesus? Dr. Thiel and Steve Dupuie address these matters and more.

Here is a link to our video: 3rd Horseman of the Apocalypse and Food.

Remember that Jesus said:

34 “But take heed to yourselves, lest your hearts be weighed down with carousing, drunkenness, and cares of this life, and that Day come on you unexpectedly. 35 For it will come as a snare on all those who dwell on the face of the whole earth. 36 Watch therefore, and pray always that you may be counted worthy to escape all these things that will come to pass, and to stand before the Son of Man.” (Luke 21:34-36)

Do not be part of those who will not be ready.

While having some food stored is normally wise, do not deceive yourself that simply storing food for yourself will get you through what is coming. A while back, the Continuing Church of God (CCOG) put a prepper-related video on our Bible News Prophecy YouTube channel:

youtube

18:48

Doomsday Preppers and Preparation

A study came out in August of 2019 showing that so many Americans are so fearful from news reports that more have become doomsday preppers. Meaning that they are storing up food, weapons, and other supplies for an apocalyptic type event to hit the USA. Jesus said sorrows and troubles would come, then a tribulation so bad that unless God intervened, no flesh would be saved alive. Is physical preparation the answer? Should Christians do any type of disaster preparations? Does God have a plan to protect some or all Christians from the coming “hour of trial” that Jesus spoke of? Who is promised protection and who is not? Is keeping the commandments enough? What has Jesus said His people should do? Are you supporting the work that needs to be completed before the end comes? Dr. Thiel addresses these issues and more.

Here is a link to the sermonette video: Doomsday Preppers and Preparation.

Put your confidence in God, not bunkers.

Related Items:

There is a Place of Safety for the Philadelphians. Why it May Be Petra This article discusses a biblical ‘place of safety’ and includes quotes from the Bible and Herbert W. Armstrong on this subject–thus, there is a biblically supported alternative to the rapture theory. There is also a video on the subject: Might Petra be the Place of Safety? Here is something related in the Spanish language: Hay un lugar de seguridad para los Filadelfinos. ¿Puede ser Petra?

When Will the Great Tribulation Begin? 2024, 2025, or 2026? Can the Great Tribulation begin today? What happens before the Great Tribulation in the “beginning of sorrows”? What happens in the Great Tribulation and the Day of the Lord? Is this the time of the Gentiles? When is the earliest that the Great Tribulation can begin? What is the Day of the Lord? Who are the 144,000? Here is a version of the article in the Spanish language: ¿Puede la Gran Tribulación comenzar en el 2020 o 2021? ¿Es el Tiempo de los Gentiles? A related video is: Great Tribulation: 2026 or 2027? A shorter video is: Tribulation in 2024? Here is a video in the Spanish language: Es El 2021 el año de La Gran Tribulación o el Grande Reseteo Financiero.

Could God Have a 6,000 Year Plan? What Year Does the 6,000 Years End? Was a 6000 year time allowed for humans to rule followed by a literal thousand year reign of Christ on Earth taught by the early Christians? Does God have 7,000 year plan? What year may the six thousand years of human rule end? When will Jesus return? 2031 or 2025 or? There is also a video titled: When Does the 6000 Years End? 2031? 2035? Here is a link to the article in Spanish: ¿Tiene Dios un plan de 6,000 años?

Is There A Secret Rapture for the Church? When and Where is the Church Protected? What does the Bible really teach? Does the Church flee or is it taken up just prior to the great tribulation? Who really is left behind? There is also a YouTube video with information Did Jesus Teach a Pre-tribulation Rapture?

Is God Calling You? This booklet discusses topics including calling, election, and selection. If God is calling you, how will you respond? Here is are links to related sermons: Christian Election: Is God Calling YOU? and Predestination and Your Selection; here is a message in Spanish: Me Está Llamando Dios Hoy? A short animation is also available: Is God Calling You?

Christian Repentance Do you know what repentance is? Is it really necessary for salvation? Two related sermons about this are also available: Real Repentance and Real Christian Repentance.

About Baptism Should you be baptized? Could baptism be necessary for salvation? Who should baptize and how should it be done? Here is a link to a related sermon: Let’s Talk About Baptism and Baptism, Infants, Fire, & the Second Death.

Physical Preparation Scriptures for Christians. We all know the Bible prophecies famines. Should we do something? Here is a version in the Spanish language Escrituras sobre Preparación física para los Cristianos. Here is a link to a related sermon: Physical preparedness for Christians.

LATEST NEWS REPORTS

LATEST BIBLE PROPHECY INTERVIEWS

0 notes

Text

Hello World

Hello and happy 4th of July!

As we all come together to celebrate USA Independence Day, we’re thrilled to officially introduce Rooh Dynamics. Today is a perfect day to share our story because our entire movement, “Rooh,” is about breaking the chains of high prices, much like how we celebrate breaking free from old constraints on this historic day.

In today’s fast-paced world, we all feel the pinch of rising living costs, especially when it comes to everyday essentials. This frustration has been a longstanding issue for many of us, and it’s high time we addressed it head-on. Drawing inspiration from my Ukrainian friends and my background in an ex-Soviet country, we named our company “Rooh,” which literally means “movement” in Ukrainian. Our mission is to create a movement that delivers high-quality products directly from the factory at factory prices.

This project is a labor of love for us. We’re driven by a passion for helping people get the best value for their hard-earned money. Like many of you, we’ve been juggling full-time work and life’s demands, making it increasingly challenging to navigate the market’s inflated prices. We ask for your patience and understanding as we grow and refine our offerings.

At Rooh Dynamics, we rigorously select suppliers who maintain at least a 4.5-star rating for reliability and product quality. We’re committed to finding the best deals and innovative designs, often bypassing the years of corporate red tape that keep such products out of reach. This approach ensures you get the latest and greatest without the middleman markup.

We streamline the search for unique, cost-effective items by eliminating unnecessary costs, offering products at prices significantly lower than local retailers. Additionally, we provide free shipping, and hey, if you really need something but can’t pay in full today, you can now take installments on that patio set—even though it is a lot less than available in the stores. We also offer hassle-free returns for damaged items. Our transparency and commitment to quality are paramount, and we’re dedicated to earning your trust.

We’re starting our journey with an exceptional line of kitchen products. Imagine equipping your kitchen with high-quality cast iron skillets, non-stick pans, and versatile cookware—all at a fraction of the usual cost. Our kitchen collection includes:• Cast Iron Skillets: Perfect for searing, frying, and baking, ensuring even heat distribution for consistently delicious meals. • Non-Stick Pans: Easy to clean and ideal for health-conscious cooking with minimal oil. • Versatile Cookware: From woks to griddles, we have everything you need to elevate your culinary skills.

And that’s just the beginning! Our vision encompasses every room in your home—from dining and living spaces to bedrooms, bathrooms, patios, gardens, and even fitness and wellness products. Our aim is to furnish your home with high-quality, affordable items.

As we all relax at home today with our loved ones, we wanted to take this moment to share who we are and where we’re from. Stay tuned as we continually expand our product range and update you through our blog. We value your feedback and suggestions. Remember, even if there are criticisms, we appreciate your support and commitment to our cause.

Join us on this exciting journey. Here’s to providing high-quality products at unbeatable prices and making each purchase a smart investment!

RoohDynamics #AffordableLiving #KitchenEssentials #CastIronCookware #NonStickPans #HomeGoods #SmartShopping #FreeShipping

Follow us on our blog for updates and new product launches. Let’s make home living affordable and stylish again!

1 note

·

View note

Text

Bounce House Rentals Cedar Park TX

Bounce houses, those colorful inflatable structures that bring joy to children and nostalgia to adults, have become a staple of parties and events. In Cedar Park, TX, they're not just entertainment; they're a symbol of celebration and community. Bounce House Rentals in Cedar Park, TX, offer a myriad of options for hosting unforgettable gatherings. From birthdays to block parties, these inflatable wonders add an extra layer of fun and excitement to any occasion.

Cedar Park, a vibrant suburb nestled in the beautiful Texas Hill Country, boasts a rich tapestry of parks, recreational areas, and family-friendly attractions. Amidst this lively landscape, bounce house rentals have emerged as a popular choice for event planners and parents alike. Whether you're organizing a backyard barbecue or a school fundraiser, these inflatable attractions elevate the atmosphere, turning ordinary gatherings into extraordinary experiences.

One of the key players in the Cedar Park bounce house rental scene is Jumping Jacks Party Rentals. With a diverse range of bounce houses, water slides, and interactive games, they cater to events of all sizes and themes. From classic castle designs to whimsical obstacle courses, their collection ensures there's something for everyone. Moreover, their commitment to safety and cleanliness ensures peace of mind for parents, making them a trusted choice in the community.

For those seeking a one-stop solution for party planning, Bounce Across Texas offers comprehensive packages that include not only bounce houses but also tables, chairs, and concessions. Their customizable options allow customers to tailor their rentals to suit specific preferences and budgets. Whether it's a superhero-themed birthday bash or a carnival extravaganza, Bounce Across Texas helps bring visions to life, ensuring every detail is covered.

In addition to private events, bounce house rentals play a vital role in community gatherings and festivals. Cedar Park's annual Fourth of July celebration, for instance, features an array of inflatable attractions that captivate children and families throughout the day. These communal events foster a sense of unity and camaraderie, bringing neighbors together to celebrate shared traditions and create lasting memories.

Beyond entertainment value, bounce houses offer numerous benefits for children's physical and social development. Jumping, sliding, and climbing promote gross motor skills and coordination, while interactive games encourage teamwork and communication. In a world increasingly dominated by screens and sedentary activities, bounce houses provide a refreshing outlet for active play, fostering healthy habits from an early age.

youtube

Featured Business:

Hop A Lot Moonwalks offers premier bounce house rentals in Cedar Park, TX, providing the ultimate entertainment solution for any occasion. With a wide selection of vibrant and meticulously maintained bounce houses, Hop A Lot Moonwalks ensures a safe and enjoyable experience for all attendees. From classic bounce houses to interactive obstacle courses and themed inflatables, their offerings cater to diverse preferences and event themes. With convenient delivery, setup, and takedown services, Hop A Lot Moonwalks takes the stress out of event planning, allowing you to focus on creating lasting memories for your guests. Choose Hop A Lot Moonwalks for your next event and elevate the fun factor with top-quality bounce house rentals in Cedar Park, TX.

Contact:

Hop A Lot Moonwalks

1101 S Industrial Blvd, Round Rock, TX 78681, United States

G8C4+2M Round Rock, Texas, USA

(979) 399-8337

https://www.hopalotmoonwalks.com/bounce-house-rentals-cedar-park/

YouTube Video:

https://www.youtube.com/watch?v=pJaTAmUvqP8

YouTube Playlist:

https://youtube.com/playlist?list=PL-3cH_cLy0NL7g-zZ4zinoORPJRICpaJl

Soundcloud:

https://soundcloud.com/hop-a-lot-moonwalks/bounce-house-rentals-cedar-park-tx

Soundcloud Playlist:

https://soundcloud.com/hop-a-lot-moonwalks/sets/bounce-house-rentals-cedar-park-tx

Medium Post:

Weebly:

Tumblr Post:

Google My Map:

https://www.google.com/maps/d/viewer?mid=17zYlI-H8txA4_g6_yMgJWkgoJpOPIpY

Google Map CID:

https://www.google.com/maps?cid=2829675049153904565

Google Site:

https://sites.google.com/view/bounce-house-cedar-park-tx/

Twitter List:

https://twitter.com/i/lists/1786262868834537626

Twitter Tweets:

https://x.com/HopALotMoonwlk/status/1786263476887056536

https://x.com/HopALotMoonwlk/status/1786263594977652833

https://x.com/HopALotMoonwlk/status/1786263696710484449

https://x.com/HopALotMoonwlk/status/1786263811231748129

https://x.com/HopALotMoonwlk/status/1786263924364726652

https://x.com/HopALotMoonwlk/status/1786264051280163039

https://x.com/HopALotMoonwlk/status/1786264144620163333

https://x.com/HopALotMoonwlk/status/1786264280956068301

https://x.com/HopALotMoonwlk/status/1786264401127059464

https://x.com/HopALotMoonwlk/status/1786264494991462538

https://x.com/HopALotMoonwlk/status/1786264588285350055

0 notes

Text

Benzyl Salicylate Market 2024-2036 | Size, Growth, Industry Trends and Report

Asia Pacific Benzyl Salicylate Market is projected to view noteworthy growth during the forecast period on the back of the presence of a large number of consumers present in the region. The market in North America region is also expected to witness growth over the forecast period owing to the higher disposable income of the people.

Further, for the in-depth analysis, the report encompasses the industry growth indicators, restraints, and supply and demand risk, along with a detailed discussion on current and future market trends that are associated with the growth of the market.

The global benzyl salicylate market is expected to grow at a CAGR of 2% during the forecast period. The market is segmented by end-user into hair care products, skin-care products, and pharmaceuticals & nutraceuticals, out of which, the skincare products sub-segment is expected to acquire a larger share on account of the growing demand for the cosmetics. The benzyl salicylate is also utilized as a UV ray absorber in sunscreens. The increasing usage of sunscreen lotion is estimated to add to the demand for benzyl salicylate.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-4103

The global benzyl salicylate market is projected to grow over the forecast period on the back of the proliferating fragrance and cosmetic industry. People are using a myriad of self-care products, such as musk, soaps, sunscreens, perfumes, and lotions. Benzyl salicylate is the key ingredient in making such products; owing to this the global salicylate market is estimated to witness exemplary growth over the forecast period.

In Q4 2021, USA current-account deficit widened stood at $224.8 billion. However, in Q1 22, CAD rose by 29.6%, reached to $291.4 billion, adding $66.6 billion to the gap. Export of good and services increased by $25.7 billion to reach $1.03 trillion in the first quarter of 2022. However, goods and services deficit were $79.6 billion in June, down $5.3 billion from $84.9 billion in May, revised- reflecting some sight of relief. On the other hand, annual inflation rate in the country hit 8.5%. Energy CPI surged by 32.9% in July 2022, inflating the cost of logistic and some signs to disrupt supply chain whilst electricity cost upsurged by 15.2%, highest since Feb 2006. Apart from that, In July 2022, existing US home sales declined 5.9% to 4.81 million (seasonally adjusted annual rate), the lowest since May of 2020 and below market expectations of 4.89 million. As mortgage rate touches to peak 6%, sales for houses declined for a sixth consecutive month. Global energy crises to remain at focal point, pushing consumers to spend less on the products and services and save more.

On the other hand, the worst is expected to be seen in the European countries especially during 2022 winters. The energy and gas crises has already started grappling the region where in many Western European countries including Germany is looking for coal fired solutions to tackle the gas supply shortage, created by Russian-Ukraine conflict.

Amidst global concerns, market players have started looking for safe investments by holding on to the new technology and product launches. Factors like currency translation, disruption in global supply chain, Anti-China sentiments brewing across the globe, slowdown in Chinese economy, inflated products prices, USD getting stronger every week, decreasing purchasing power and strict measures taken by central banks/institutions across the world to ensure less spending and more saving, could hit the demand for the product and service badly in near future.

Request for customization @ https://www.researchnester.com/customized-reports-4103

The research is global in nature and covers detailed analysis on the market in North America (U.S., Canada), Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC [Finland, Sweden, Norway, Denmark], Poland, Turkey, Russia, Rest of Europe), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), Asia-Pacific (China, India, Japan, South Korea, Indonesia, Singapore, Malaysia, Australia, New Zealand, Rest of Asia-Pacific), Middle East and Africa (Israel, GCC [Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman], North Africa, South Africa, Rest of Middle East and Africa). In addition, analysis comprising market size, Y-O-Y growth & opportunity analysis, market players’ competitive study, investment opportunities, demand for future outlook etc. has also been covered and displayed in the research report.

Growing Awareness for Hygiene and Grooming to boost the Market Growth

The global benzyl salicylate market is estimated to witness remarkable growth on the back of growing awareness for hygiene and grooming amongst the people. With the advent of the pandemic, world organizations are campaigning to convey the message of the importance of cleanliness. Additionally, benzyl salicylate is a key ingredient in making products such as soaps and lotions. Owing to this, the global benzyl salicylate market is estimated to witness remarkable growth during the forecast period.

However, the related health hazards are expected to operate as a key restraint to the growth of the global benzyl salicylate market over the forecast period.

This report also provides the existing competitive scenario of some of the key players of the global benzyl salicylate market which includes company profiling of Zhenjiang Gaopeng Pharmaceutical CO,. Ltd, Jiangsu Puyuan Chemical Co., Ltd, JQC (Huayin) Pharmaceuticals Co., Ltd., ECSA Chemicals AG, LLUCH ESSENCE S.A de C.V., OQEMA AG., Glentham Life Sciences Limited., Taytonn ASCC Pte Ltd, Whole Chem, LLC. and The Lermond Company, LLC. The profiling enfolds key information of the companies which encompasses business overview, products and services, key financials and recent news and developments. On the whole, the report depicts detailed overview of the global benzyl salicylate market that will help industry consultants, equipment manufacturers, existing players searching for expansion opportunities, new players searching possibilities and other stakeholders to align their market centric strategies according to the ongoing and expected trends in the future.

Access our detailed report @ https://www.researchnester.com/reports/benzyl-salicylate-market/4103

About Research Nester-

Research Nester is a leading service provider for strategic market research and consulting. We aim to provide unbiased, unparalleled market insights and industry analysis to help industries, conglomerates and executives to take wise decisions for their future marketing strategy, expansion and investment etc. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds. Our out of box thinking helps our clients to take wise decision in order to avoid future uncertainties.

Contact for more Info:

AJ Daniel

Email: [email protected]

U.S. Phone: +1 646 586 9123

U.K. Phone: +44 203 608 5919

0 notes

Text

Glyoxal Prices, Demand & Supply | ChemAnalyst

In the fourth quarter of 2023, Glyoxal prices in the USA rose due to increased demand and supply dynamics. Although feedstock Ethylene glycol prices declined in production, this did not significantly impact Glyoxal pricing. The region's supply chain faced challenges, including concerns over overall supply levels.

The downstream construction sector, a major Glyoxal consumer, showed little improvement compared to the previous month, keeping demand moderate and stable. According to Fred's data, the Producer Price Index (PPI) for cement remained unchanged at 240.35 in October, affecting goods consumption in November. Despite the stable PPI for cement, Glyoxal prices increased due to a significant rise in production costs.

Furthermore, private sector output expansion accelerated, marking the fastest growth since July, which further propelled Glyoxal prices through October and November. Globally, Glyoxal prices rose independently of downstream demand, driven primarily by sustained high production costs and specific supply chain challenges, shaping the market dynamics in the fourth quarter of 2023.

Track Real Time Glyoxal Prices: https://www.chemanalyst.com/Pricing-data/glyoxal-1568

During the fourth quarter of 2023, the Glyoxal market experienced a significant shift, with prices decreasing after a consistent rise in the previous quarter. In Germany, merchants adjusted operations based on existing stock levels, which led to a reduction in new orders. Downstream sectors such as cement, paints and coatings, and textiles saw a major decline in activity toward the end of the quarter, with sharp drops across all areas. The manufacturing Purchasing Managers' Index (PMI) in Germany stayed below the threshold limit, reflecting low Glyoxal consumption during this period.

Domestic key players tried to raise product prices due to long-standing high production costs and inflation, which eased as demand fell in both domestic and international markets in November. Nonetheless, the last month of the quarter saw a significant decrease in Glyoxal prices in Germany, mainly due to lower demand in the downstream construction industry amid economic challenges and subdued purchasing. Additionally, security concerns increased in mid-December following attacks on commercial vessels in the southern Red Sea, raising global fears about potential supply chain disruptions. This crisis, occurring just before the Christmas holidays, notably affected market dynamics.

About Us:

Welcome to ChemAnalyst, the future of chemical and petrochemical market intelligence, where innovation meets insight. Awarded the prestigious titles of ‘The Product Innovator of the Year, 2023’ and recognized among the "Top 100 Digital Procurement Solutions Companies," we stand at the forefront of the digital transformation in the chemical industry. Our cutting-edge online platform revolutionizes the way companies approach the volatile chemical market, offering an unparalleled depth of market analysis, real-time pricing, and the latest industry news and deals from around the globe. Dive into the future with us, where tracking over 500 chemical prices across more than 40 countries is not just possible—it's effortless.

With ChemAnalyst, you gain a strategic advantage. Our expansive database covers over 500 chemical commodities, providing detailed insights into Production, Demand, Supply, Plant Operating Rates, Imports, Exports, and beyond. Our forecasts stretch up to a decade, offering not just historical data analysis but a glimpse into the future of the chemical markets. Supported by local field teams in over 40 countries, we ensure the data you receive is not only comprehensive but also meticulously verified, offering you reliability unmatched in the industry.

Contact US:

420 Lexington Avenue, Suite 300

New York, NY

United States, 10170

Email-id: [email protected]

Mobile no: +1- 3322586602

#Glyoxal#Glyoxalprices#Glyoxalmarket#Glyoxaldemand#Glyoxalsupply#Glyoxalpricetrend#Glyoxalpriceforecast#Glyoxalnews#Glyoxalmarketprice#priceofGlyoxal

1 note

·

View note

Text

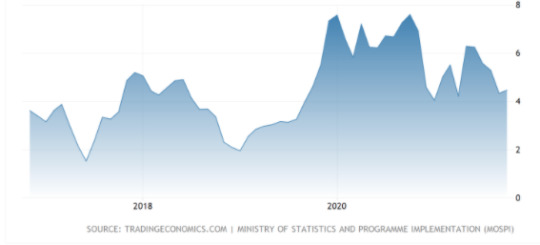

Upcoming Monetary Policy Committee Meeting and it’s Dilemma

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) will meet between 6-8 December 2021 to take stock of the unfolding macroeconomic conditions and to debate and decide on the future monetary policy direction. Though for the last four months (July to October 2021) the consumer price inflation (CPI) is well within the target of the RBI (Figure 1; inflation within 2 to 6%) there is pressure on the central bank to normalize its monetary policy given the fact that there is excess liquidity in the banking system. The RBI had created this excess liquidity to ease the government borrowing in wake of Covid’19 but keeping the system in high liquidity for long may lead to asset price bubbles in stock and bond markets.

On the other hand, bank loan growth which may be taken as a proxy to gauge investment demand in the economy has just started to take off (Figure 2) and any increase in the repo rate (the RBI’s policy rate) will adversely affect loan demand.

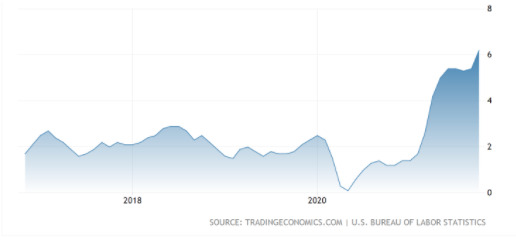

Complicating the matter for the RBI is the high inflation rate in the USA (Figure 3) which may force the Fed Reserve to tighten its monetary policy much before what the Fed Governor Dr. Jay Powell earlier communicated to the market. With the tightening of the USA monetary policy, there may begin a great Indian sale in the stock and bond market resulting in a significant depreciation of the Indian rupee (remember Taper tantrum of 2013).

Under this prevailing scenario, the MPC will meet to decide the future monetary policy path in India. If the bond market is to be believed, it is already preparing for higher interest rates in the future as the 10-year government bond yield has increased from 6% on Jun 1, 2021, to 6.33% on 26 November 2021.

0 notes

Text

Zinswende - Welche Anlageklassen sind die Gewinner des rapiden Zinsanstiegs

Die Europäische Zentralbank (EZB) hat erst im Juli 2023 die Leitzinsen auf 4,25 Prozent erhöht. Dies ist der höchste Stand seit Beginn der Finanzkrise im Jahr 2008. Der rapide Anstieg der Zinsen über die letzten 18 Monate in Europa und auch in den USA hat die Finanzmärkte zwischenzeitlich durcheinandergewirbelt. Grund genug, im Folgenden auf diese Entwicklungen zurückzublicken und Schlüsse für die Zukunft zu ziehen. Denn eines ist sicher: Die Zeit wieder sinkender Zinsen kommt bestimmt!

Die Leitzinsen sind ein zentrales Instrument der Geldpolitik

Deshalb werden die Leitzinsen in jeder Volkswirtschaft im Kampf gegen Inflation (Zinserhöhungen) oder zur Stützung der Konjunktur (-senkungen) als Steuerungsinstrument herangezogen. Bei Zinserhöhungen steigt der Kostenaufwand für Geschäftsbanken, wenn sie sich bei ihrer Zentralbank Geld leihen. Diese zusätzlichen Kosten werden in der Regel von den Geschäftsbanken auf ihre Kunden (Privatleute und Unternehmen) übertragen. Verändert eine Zentralbank ihre Leitzinsen, hat das aber nicht nur direkte Effekte auf den Finanzsektor, sondern zieht auch weitreichende Konsequenzen für alle Anlageklassen wie Aktien, Anleihen, Rohstoffe und Edelmetalle nach sich.

Nach mehreren Zinserhöhungen im Verlauf dieses Jahres zeichnet sich laut Marktexperten langsam das Ende des Zinserhöhungszyklus ab. Angesichts der zurückgehenden Kerninflation in den USA wird es immer unwahrscheinlicher, dass die Federal Reserve System (Fed) weitere Zinserhöhungen durchführt. Im Gegensatz dazu wird in Europa mindestens ein weiterer Zinsschritt im laufenden Jahr erwartet. Einige Wirtschaftswissenschaftler haben jedoch jüngst für die Idee einer Zinspause im September plädiert. Ulrich Kater, Chefvolkswirt der Dekabank, sowie Friedrich Heinemann, Ökonom am Mannheimer Wirtschaftsforschungsinstitut ZEW, sprachen sich dafür aus, die Wirkung der jüngsten Zinserhöhungen abzuwarten und ihre Auswirkungen auf die Inflationsentwicklung zu beobachten. Im Oktober könnte die Europäische Zentralbank (EZB) dann immer noch mit einem Zinsschritt reagieren.

Für eine Trendumkehr frühzeitig die Anlagestrategie anpassen

Anleger, die von einer möglichen Trendumkehr bei den Zinsen profitieren möchten, sollten frühzeitig ihre Anlagestrategie anpassen, um auf potenziell fallende Zinsen vorbereitet zu sein. Hierbei ist es entscheidend, die Reaktion verschiedener Anlageklassen auf Zinsänderungen genau zu analysieren. Und selbst innerhalb der einzelnen Kategorien kann es deutliche Unterschiede in der Stärke der Reaktion geben.

1. Anlageklasse Anleihen:

Anleihen sind festverzinsliche Wertpapiere, und ihre Rendite steht in direktem Zusammenhang mit den aktuellen Zinssätzen. Steigende Leitzinsen führen dazu, dass neu emittierte Anleihen höhere Zinsen bieten müssen, um Anleger anzulocken. Bestehende Anleihen mit niedrigeren Zinssätzen verlieren daher an Attraktivität und könnten an Wert verlieren, wenn Anleger auf dem Sekundärmarkt höhere Renditen verlangen. So geschehen im Jahr 2022, als steigende Zinsen zu massiven Verlusten bei langlaufenden Anleihen führten. Anleihen mit kürzeren Laufzeiten wurden hingegen deutlich weniger von Zinsschwankungen beeinflusst – egal ob nach oben oder nach unten.

Umgekehrt könnten sinkende Leitzinsen die Nachfrage nach bestehenden Anleihen erhöhen, da sie im Vergleich zu neuen Anleihen mit niedrigeren Zinssätzen attraktiver werden. Dies kann zu steigenden Anleihepreisen führen, was zu Kapitalgewinnen für Anleiheinvestoren führt. Allerdings könnten stark sinkende Zinsen auch zu einem Punkt kommen, an dem die Renditen auf Anleihen so niedrig sind, dass Investoren nach alternativen Anlageklassen suchen.

Aktuell bewegen sich Anleihe (noch) in einem besonderen Umfeld: Die Zinsstruktur ist invers! Das bedeutet, dass die Renditen für kurzlaufende Anleihen höher sind als die Renditen für langlaufende Anleihen. Es sollte also noch eine Weile vorteilhaft sein, sogenannte „Kurzläufer“ zu bevorzugen. Erst wenn die Zinsen wieder fallen oder sich die Konjunktur deutlich aufhellt, könnte die Situation wieder zu Gunsten der „Langläufer“ kippen.

2. Anlageklasse Aktien:

Steigende Leitzinsen belasten in der Regel den Aktienmarkt. Investoren könnten ihre Kapitalallokation überdenken und vermehrt in festverzinsliche Anlagen umschichten, die nun attraktivere Renditen bieten. Die höheren Opportunitätskosten für den Besitz von Aktien können zu einem Rückgang der Nachfrage führen, was wiederum die Aktienkurse unter Druck setzt. Unternehmen könnten auch mit steigenden Zinskosten für Schulden konfrontiert werden, was ihre Gewinnmargen reduzieren könnte. Niedrige Leitzinsen haben tendenziell positive Effekte auf den Aktienmarkt. Sie verringern die Attraktivität von Anleihen und anderen festverzinslichen Anlagen, da diese im Vergleich zu Aktien niedrigere Renditen bieten.

Investoren könnten daher vermehrt in Aktien investieren, um höhere Erträge zu erzielen. Dies kann zu einer erhöhten Nachfrage nach Aktien führen, was wiederum die Kurse steigen lässt. Darüber hinaus können niedrige Zinsen die Kosten für Unternehmenskredite reduzieren. Unternehmen können günstiger Kapital aufnehmen, um Investitionen zu tätigen und zu wachsen. Dies kann sich positiv auf die Gewinne und somit auf die Aktienkurse auswirken. Gemeinhin zählen in Zeiten niedriger Zinsen insbesondere Wachstums-Aktien zu den Gewinnern. Diese profitieren oft stärker als Value-Aktien von den niedrigen Finanzierungskosten.

Darüber hinaus steigen die Bewertungen der Wachstumsunternehmen stärker, da die zukünftig erwarteten Erträge weniger stark abdiskontiert werden. Gerade Nebenwerte und Technologieaktien werden in Zeiten fallender Zinsen damit wieder besonders attraktiv. Die Entscheidung zwischen Value- und Growth-Aktien hängt aber letzten Endes von den individuellen Anlagezielen und der Risikobereitschaft ab. Während Value-Aktien in einem unsicheren Marktumfeld Stabilität bieten könnten, könnten Growth-Aktien mit ihrem Potenzial für zukünftiges Wachstum locken.

3. Anlageklasse Rohstoffe und Edelmetalle:

Leitzinsänderungen haben auch Einfluss auf Rohstoffmärkte, insbesondere auf Rohstoffe, die in US-Dollar gehandelt werden. Sinken die Leitzinsen in den USA schneller und stärker als in anderen Währungsregionen, schwächt dies den US-Dollar und kann den Preis von Rohstoffen steigen lassen. Da Rohstoffe auf den internationalen Märkten in Dollar notieren, können sie für Inhaber anderer Währungen günstiger werden, was die Nachfrage befeuert. Stärker als von der Zins- oder Währungsentwicklung sind Rohstoffe aber von der Konjunktur abhängig. Kommt die Wirtschaft – dank fallender Zinsen – besser in Schwung und die Auftragslage der Unternehmen verbessert sich, so steigt auch die Rohstoffpreise.

Im Segment der Rohstoffe nehmen Edelmetalle eine Sonderrolle ein. Gold wird oft als "sicherer Hafen" betrachtet, der in Zeiten wirtschaftlicher Unsicherheit und hoher Inflation Schutz bieten kann. Bleiben die Notenbanken im Kampf gegen die Inflation erfolgreich, könnte dies Gold also weniger attraktiv machen. Auf der anderen Seite reduzieren fallende Zinsen auch die Opportunitätskosten für den Besitz von Gold, da es im Gegensatz zu Aktien und Anleihen keine laufenden Erträge wie Zinsen oder Dividenden generiert.

Fazit

Die Auswirkungen von Zinsänderungen sind nicht immer vorhersehbar und werden von einer Vielzahl von Faktoren beeinflusst, einschließlich wirtschaftlicher Bedingungen und globaler Ereignisse. Eine kontinuierliche Überwachung der Marktentwicklungen und eine Anpassung der Anlagestrategie sind daher von großer Bedeutung. Mit einem Mix aus Aktien und Anleihen sollten Anleger aber gut auf die Zinswende vorbereitet sein. Bei größerer Risikoneigung kann der Anteil von Aktien und insbesondere Wachstumswerten in den Portfolios erhöht werden. Im Anleihesegment ist bei der Auswahl auf die Laufzeit (Duration) der Wertpapiere zu achten. Kippt die Zinskurve, können langlaufende Anleihen wieder stärker gewichtet werden.

Beim Blick auf die möglichen Gewinner der Zinswende sollte aber auch eine breite Streuung der Anlagen nicht vernachlässigt werden. Diese bleibt auch in Zeiten sinkender Zinsen der beste Schutz vor bösen Überraschungen.

Leseempfehlungen

Lesen Sie doch auch diese Artikel rund um das Thema Finanzen, wofür sich auch andere Leser interessierten:

Stromanbieter beim Umzug ummelden und mitnehmen oder besser wechseln?

Als Geldanleger Renditen durch Unternehmensübernahmen erzielen

Der Durchschnittskosteneffekt

Bildnachweis

0 notes

Text

Evangelicals love to bear false witness via /r/atheism

Evangelicals love to bear false witness

This is a bit of a rant about this case of religious hypocrisy.

Just saw a video of a pastor of a church in my city, rant about how gay people get a whole month but military members and those who died in wars don’t - and how the culture is rotten. The congregation seemed to vocally agree based off the sounds they made when he was ranting.

Except that’s a complete fucking lie. May is military appreciation month in Canada and USA, and if that pastor really cared about military people, I’m sure he would know that. But he spread misinformation to hate on the queer community and push his agenda - he doesn’t actually give a shit about vets - otherwise he’d know that.

Not only does the military get may, but in October and November in Canada people wear poppies, and celebrate fallen service people who died in wars. April is also a month with military holidays - and some even put it under the umbrella of a military celebration month. And don’t even get me started on Independence Day 4th of July, Memorial Day, Veterans Day, - way more celebrated than say international day against homophobia and transphobia. Oh, and don’t get me started about veterans discounts and how the military is pretty much celebrated everywhere with patriotic songs and flags waving everywhere.

And even if all of that wouldn’t exist - still doesn’t mean pride month is wrong - all it would mean is we also need to celebrate vets as well. Kind of like women’s month is not bad because movember doesn’t get as much attention.

But evangelicals don’t care about being liars. I remember so many times when evangelicals spread straight up misinformation about abortions. I’ve heard evangelicals claim that seeing an ultrasound stops 90% of abortions. I’ve seen evangelicals slander lgbt people as having a huge pedo problem when most pedos are statistically not lgbt. I’ve heard them over-inflate statistics about atheist depression, ignoring statistics about the rates of anxiety in believers who feel like god is judging their every move.

These people lie all the time, disgusting lies to push their agenda, and yet they don’t see how they’re committing the sin of bearing false witness. Isn’t that a sin? Lying is a sin isn’t it? Or it’s not a sin if it’s for Jesus.

Submitted November 07, 2023 at 02:43AM by SeaworthinessRich646

(From Reddit https://ift.tt/ALvkVnp)

0 notes

Text

Ransomware: Steigende Zahlen, steigende Lösegeldforderungen

Im ersten Halbjahr 2023 sind Ransomware-Angriffe um 46 % gestiegen. Hauptangreifer ist weiterhin Lockbit, Hauptopfer sind KMUs. Das zeigt der Incident Response Ransomware Report mit seinem Dark Web Monitoring.

Im Incident Response Ransomware Report von Arctic Wolf teilt das Unternehmen aktuelle Incident Response (IR) Falldaten seiner Security Operations Platform und neueste Erkenntnisse der Dark Web-Überwachung der Arctic Wolf Labs.

Dark Web Monitoring zeigt starken Anstieg der Ransomware-Angriffe

Im Dark Web unterhalten Bedrohungsakteure sogenannte Leak- oder auch Shame-Sites. Auf diesen Seiten drohen sie ihren Opfern mit der Veröffentlichung ihrer Daten und setzen sie so unter Druck, Lösegeldforderungen nachzukommen. Obwohl diese Sites keine exakte Dokumentation aller globalen Cyberangriffe darstellen, sind sie dennoch ein guter Indikator für Aktivitäten im Dark Web und ermöglichen es, die aktuelle Bedrohungslandschaft zu kontextualisieren. Arctic Wolf überwacht aktiv bekannte Leak-Sites, um die Dynamik der Bedrohungslandschaft besser zu verstehen.

Die deutlich gestiegene Zahl der Ransomware-Angriffe und Dark Web-Aktivitäten in der ersten Jahreshälfte 2023 (H1) ergab den größten Datensatz, den Arctic Wolf jemals über seine Dark Web-Überwachung und IR-Falldaten gesammelt hat. So beobachtete der Security Operations-Experte im H1 2023 einen Anstieg der Ransomware-Vorfälle um 43 % im Vergleich zur zweiten Jahreshälfte 2022.

Führende Bedrohungsakteure

- Lockbit war die Bedrohungsgruppe, die im H1 2023 am häufigsten auf Shame Sites im Dark Web gepostet hat, wobei das Volumen ihrer Postings im Vergleich zum Vorjahreszeitraum noch einmal um mehr als 17 % anstieg. Nach einem Aktivitätshoch in den ersten vier Monaten des Jahres ging die Zahl der Dark-Web-Posts im Mai und Juni jedoch zurück und die Gruppe wurde von der Spitzenposition verdrängt.

- MalasLocker tauchte im Mai auf. In ihren ersten Dark-Web-Posts veröffentlichte die Gruppe Daten einer großen Zahl von in Russland ansässigen Opfern. Ob dies Zufall oder Absicht ist, kann nicht mit Gewissheit gesagt werden. Die geographische Lage der Opfer ist jedoch eher ungewöhnlich. Außerdem enthalten sowohl die Shame Site als auch die Lösegeldforderungen von MalasLocker Botschaften, die auf eine „hacktivistische“ Motivation schließen lassen.

- CI0p, eine Ransomware-Gruppe, die erstmals im Februar 2019 auftauchte, wurde im Juni als Urheber hinter den groß angelegten MOVEit Transfer-Exploits (CVE-2023-34362, CVE-2023-35036, CVE-2023-35708 und CVE-2023-36934) bestätigt. Arctic Wolf verfolgte deren Aktivitäten auf Leak Sites zwischen dem 14. Juni und 14. Juli 2023 und konnte 169 Fälle beobachten, davon 120 in den USA, neun im Vereinigten Königreich und acht in Deutschland.

Abgesehen von MalasLocker, die anscheinend politisch motiviert ist, sind Cl0p, Lockbit und die große Mehrheit der Angriffsgruppen finanziell getrieben. Unabhängig von der Branche, dem Umsatz oder der Anzahl der Mitarbeitenden der Opferunternehmen starten viele Bedrohungsakteure ihre Angriffe dabei, indem sie, wie CI0p, nach außen gerichtete Schwachstellen ausnutzen oder massenhaft ausgeklügelte Phishing-E-Mails an Organisationen weltweit senden.

Fertigungsindustrie im Visier von Ransomware-Gruppen

Im gesamten H1 2023 wurden Fertigungsunternehmen mit deutlichem Abstand am häufigsten Opfer von Ransomware-Angriffen. Trotz der hohen Anzahl an Postings auf Dark Web Shame Sites im Vergleich zu anderen Branchen lag der Median* der Ransomware-Forderungen von Betroffenen aus der Fertigungsindustrie unter dem Median der gesamten Forderungen der erfassten IR-Fälle. Das zeigt, dass die Manufacturing-Branche für Bedrohungsakteure zwar nicht die höchste Rentabilität aufweist, aufgrund des Umfangs und der Komplexität ihrer Geschäftstätigkeit jedoch leichter auszunutzen ist.

Lösegeldforderungen steigen branchenübergreifend an: Inflation?

Die durchschnittliche Lösegeldforderung bei allen Ransomware-Vorfällen, auf die Arctic Wolf in der ersten Jahreshälfte reagiert hat, betrug 600.000 US-Dollar, ein Anstieg um 43 % im Vergleich zum Vorjahreszeitraum.

Ist der Inflationsdruck auch im Cyber Crime Business angekommen? Eher nicht. Wahrscheinlicher ist ein Zusammenspiel mehrerer Faktoren: Zum einen versuchen Ransomware-Gruppen, den Umsatzeinbruch zu kompensieren, nachdem sie ihre Aktivitäten 2022 aufgrund des russischen Angriffskriegs drosseln mussten. Zum anderen sind Kryptowährungen im vergangenen Jahr im Wert gestiegen. So ist der Kurs des Bitcoin von etwa 25.000 US-Dollar am 30. Juni 2022 auf über 40.000 US-Dollar am 30. Juni 2023 angestiegen.

Betrachtet man die einzelnen Branchen, so zeigt sich im Vergleich zum Vorjahr eine gewisse Varianz bei den Lösegeldforderungen in bestimmten Branchen, wobei der Medianwert* der Forderungen im Technologiebereich erneut am höchsten und im Bauwesen am niedrigsten war. Diese stagnierenden Positionen spiegeln die Raffinesse der Bedrohungsakteure wider und zeigen, dass sie sehr gut wissen, wie viel welche Branchen zahlen können. Und das sowohl auf Grundlage öffentlich zugänglicher Finanzdaten der Unternehmen als auch auf Basis der Informationen, die sie bei Angriffen auf Tausende von Unternehmen jedes Jahr sammeln.

KMU am stärksten von Ransomware betroffen

Kleine und mittelständische Unternehmen (KMU) sind besonders von dem Anstieg der Ransomware betroffen. 82 % der Opfer in H1 2023 hatten weniger als 1.000 Mitarbeitende.

Obwohl auch Großunternehmen und Konzerne nicht davor gefeit sind, Opfer zu werden, verfügen sie häufiger über größere Sicherheitsbudgets. KMUs sind aufgrund mangelnder finanzieller Ressourcen und interner Sicherheitsexpertise daher oft stärker gefordert, ein effektives Security Operations-Programm zu implementieren. Im Vergleich zu großen Unternehmen mit Milliardenumsätzen sind KMUs zudem weniger in der Lage, die finanziellen Auswirkungen von Betriebsunterbrechungen als Folge eines Cybervorfalls zu verkraften. Deshalb sind Eigentümer eher bereit, schnell Lösegeld zu zahlen, um den Betrieb wieder aufzunehmen. Das macht sie zu einem attraktiven Ziel.

Passende Artikel zum Thema

Lesen Sie den ganzen Artikel

0 notes

Text

McDonald’s to eliminate self-serve soda machines at U.S. locations

Bid farewell to the days of refilling your Coke at McDonald’s. The fast-food giant is phasing out self-serve soda stations.

This week, McDonald’s confirmed its plans to discontinue self-service soda machines at its U.S. restaurants by 2032. The fate of such machines at international locations remains uncertain.

Financial Considerations or Sanitation Concerns

According to McDonald’s USA, the objective behind this change is to establish uniformity for customers and staff members across the entire spectrum of the chain’s services, ranging from dine-in experiences to online orders and drive-thru options. However, the company did not specify whether other factors, such as financial considerations or sanitation concerns, contributed to the decision to bid farewell to self-serve machines. For years, patrons of McDonald’s have utilized these machines to fill and refill their beverages without the need to visit a cashier.

Some other fast-food chains already employ behind-the-counter soda machines, and a few McDonald’s outlets across the country have initiated the transition. For example, several Illinois locations, as reported by The State Journal-Register last week, are gradually phasing out self-serve soda.

In recent times, industry analysts have noted shifts in consumer behavior precipitated by the COVID-19 pandemic, including an increase in digital and online delivery sales at fast-food establishments. Consequently, certain chains have explored ways to enhance their drive-thru services or strengthen partnerships with food delivery applications. For instance, Chipotle has expanded its Carside pickup locations, and Domino’s has entered into a new collaboration with Uber Eats. In McDonald’s case, digital sales, encompassing app usage, delivery orders, and kiosk purchases, accounted for nearly 40% of systemwide sales in the second quarter of 2023. The company reported a 14% increase in revenue, reaching $6.5 billion for the period, and net income nearly doubled to $2.3 billion for the quarter, surpassing analysts’ expectations.

Beverage Stations

However, some of these gains may taper off in the latter half of the year. Chief Financial Officer Ian Borden indicated during the Q2 earnings call in July that the price hikes that have boosted McDonald’s sales in recent quarters will ease as inflation subsides.

McDonald’s, as confirmed by the company to CBS News on Tuesday, intends to phase out self-service “beverage stations” at its U.S. establishments by 2032. There is no information available regarding the potential impact on international branches.

Observant customers on social media have noted that certain locations have already removed their self-serve soda machines. For instance, a customer on Twitter’s platform, now called X, shared that this change recently occurred at their usual McDonald’s spot. According to the customer, when they requested a refill from an employee, it took more than five minutes to receive their drink.

0 notes

Text

USA decline and more inflation

COGwriter

ZeroHedge and NewsMax reported the following:

Consumer Prices Hold At Record Highs – Up 20% Since Biden Elected

June 12, 2024

Core CPI has not had a down-month since President Biden was elected. …

We note that consumer prices have not fallen in a single month since President Biden’s term began (July 2022 and May 2024 was the closest with ‘unchanged’), which leaves overall prices up over 19.5% since Bidenomics was unleashed (compares with +8% during Trump’s term).

And prices have never been more expensive…

That is an average of 5.4% per annum (almost triple the 1.9% average per annum rise in price during President Trump’s term). …

Since President Biden was elected, food prices at home are up around 21% and food prices away from home are up almost 23%… https://www.zerohedge.com/markets/consumer-prices-hold-record-highs-20-biden-elected

June 12, 2024

U.S. consumer prices were unexpectedly unchanged in May amid cheaper gasoline, but inflation likely remains too high for the Federal Reserve to start cutting interest rates before September against the backdrop of a persistently strong labor market. …

Though the annual increase in consumer prices has slowed from a peak of 9.1% in June 2022, inflation continues to run above the U.S. central bank’s 2% target. https://www.newsmax.com/finance/streettalk/inflation-3-4-percent/2024/06/12/id/1168435/

James Hickman of Schiff Sovereign sent out an email with the following:

June 11, 2024

There is a well-known modern proverb (often attributed to the novelist G. Michael Hopf) that goes, “Weak men create hard times, hard times create strong men, strong men create good times, good times create weak men.”

The saying sums up the cyclical nature of the rise and fall of societies– and it’s a topic in which I have tremendous personal interest.

Having recently reached middle age, I can comfortably say with the benefit of hindsight that I was born and grew up during the American prime time– the time at which the wealthiest and most powerful country in the history of the world was at its peak.

The US is still an incredible country with so much prosperity and opportunity. But it would be completely naive and ignorant to claim that America is not in substantial decline.

Its standing in the world has waned, much of it just over the past few years. …

And social divisions, many of which have been bizarrely self-inflicted, seem to grow more tense by the day.

Fortunately, America’s decline began from a historically high peak. …

Joseph Tainter. … his analysis shows that one of the key culprits in collapse is the inability of a government to recognize problems… or to solve them. …

The government’s own projections forecast an extra $20 trillion in new debt over the coming decade, and frankly that’s optimistic.

History shows that explosions in national debt are financed by the Federal Reserve creating new money– which ultimately causes inflation.

When the Fed created $5 trillion of new money during the pandemic, we got 9% inflation. How much inflation will $20+ trillion cause?

And the worse inflation becomes, the more urgency the rest of the world will have to replace the dollar as the global reserve currency… which will result in even MORE inflation in the US.

It’s a vicious cycle in which inflation will create more inflation. We project this is 5-7 years away.

Increasing debt continues to happen. I suspect the collapse will be less than the 5-7 years that James Hickman and his company are pointing to.

The USA continues to increase its debts and not pay enough attention to getting its fiscal house in order.

Sadly, that is not a surprise as increased debt as well as risk of inflation were included as part of my 24 items to prophetically watch in 2024:

11. Debt

The Bible teaches that the result of debt accumulation will be far worse than even many pessimists believe. Here is an end-time prophecy given to the prophet Habakkuk by God over 2600 years ago:

2 And the Lord answered me:

“Write the vision;

make it plain on tablets,

so he may run who reads it.

3 For still the vision awaits its appointed time;

it hastens to the end—it will not lie.

If it seems slow, wait for it;

it will surely come; it will not delay.

4 “Behold, his soul is puffed up; it is not upright within him,

but the righteous shall live by his faith.

5 “Moreover, wine is a traitor,

an arrogant man who is never at rest.

His greed is as wide as Sheol;

like death he has never enough.

He gathers for himself all nations

and collects as his own all peoples.”

6 Shall not all these take up their taunt against him, with scoffing and riddles for him, and say,

“Woe to him who heaps up what is not his own—

for how long?—

and loads himself with pledges!”

7 Will not your debtors suddenly arise,

and those awake who will make you tremble?

Then you will be spoil for them.

8 Because you have plundered many nations,

all the remnant of the peoples shall plunder you,

for the blood of man and violence to the earth,

to cities and all who dwell in them. (Habakkuk 2:2-8; English Standard Version)

The USA is the most indebted nation in the history of humanity and those in it should try to understand this prophecy. Perhaps it should be noted that the United Kingdom and Canada have about a similar massive per capita debt to that of the USA.

Notice the following levels of official US debt:

January 20, 2009, $10,626,877,048,913.08, date Obama-Biden Administration inaugurated.January 19, 2017, $19,944,429,217,106.77, date Obama-Biden leave office, replaced the next day when Trump-Pence inaugurated.January 19, 2021, $27,752,835,868,445.35, date Trump-Pence leave off, replaced the next day when Biden-Harris inaugerated. https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-pennyDecember 16, 2021 $29,206,281,597,429.63 https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-pennyDecember 8, 2022 $31,310,795,117,652.48 https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-pennyDecember 27, 2023 $33,896,083,378,248.05 https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

Official US debt nearly doubled under the Obama-Biden Administration. It also greatly increased in four years under the Trump-Pence Administration. It has also increased in that nearly three years of the Biden-Harris Administration–and further increases are expected. There is also Federal Reserve balance sheet debt that is not counted these figures.

Expect official US debt to increase in 2024.

The USA is walking a dangerous line on its debt that will not end well.

The Anglo-American world order will come to an end. Accumulation of debt, and then having to pay historically ‘normal’ interest rates will strain the national economies of the USA and UK more than almost anyone will believe.

Those who think the current world order with the USA’s dollar on top will last through the end of this century are in error.

Those who will believe the Bible will take the words that God spoke to the prophet Habakkuk seriously

The Bible warns that debt, and having to borrow from foreigners, is a curse that would hit those who received various biblical blessings as they became more disobedient (Deuteronomy 28:15,43-46).

Debt will increase in 2024.

Have you been paying attention to this?

12. US Dollar Dominance will Decrease

Consider the following curse from the Book of Leviticus:

19 I will break the pride of your power; (Leviticus 26:19)

While the above undoubtedly has military & economic possibilities, consider that the US dollar is the pride of the USA’s power.

It is backed by nothing.

So, it is a prideful thing–plus it does project US power around the world.

Debt, trade, weather, morality, leadership, sanctions, and other issues have given various nations motivations to work to dethrone the US dollar as the world’s primary trade and reserve currency.

The economy of the USA has been financed, to a significant degree, by foreigners willing to provide goods to the USA on credit as well as the USA profiting from much of the rest of the world’s international trade that is dollar-based.