#us cpa course full details

Explore tagged Tumblr posts

Text

youtube

US CPA is evolving in 2024

🔵 Are you ready for the major changes coming to US CPA in 2024? Stay ahead of the game with our US CPA Course. As major changes loom for the accounting industry in 2024, Join us and explore the latest developments in the field!🏆✨

#us cpa major changes#changes in us cpa 2024#us cpa change 2024#us cpa#us cpa jobs in india#us cpa course#us cpa course details#us cpa course full details#us cpa course material#cpa#cpa careers#cpa lecture videos#cpa job opportunities in india#becker cpa#becker cpa content#cpa webinar#live webinar#cpa course#cpa course in india#cpa course details#cpa pankaj dhingra#cpa change in 2024#cpa evolution#cpa jobs in india#fintram cpa#fintram cpa course#Youtube

0 notes

Text

What is the Minimum Salary of an Accountant in India?

In India, the minimum salary for accountants is subject to a myriad of factors that contribute to the wide spectrum of compensation within this profession. Typically, an accountant entry-level, particularly those with minimal experience, can expect annual salaries ranging from INR 2.5 lakh to INR 5 lakh. However, these figures are approximate and can vary significantly based on several variables.

Location plays a pivotal role in determining an accountant's salary, with metropolitan areas often offering higher compensation due to increased living costs. The size and industry of the employing organization also influence earnings, with larger firms or those in specialized sectors often providing more competitive salaries. Additionally, the economic climate and demand for accounting professionals can impact pay scales.

It is crucial to note that these figures are based on general trends and may not accurately represent individual circumstances. Factors such as educational qualifications, professional certifications, and specific skill sets can further influence salary negotiations. For the most accurate and up-to-date information, individuals aspiring to or working in the accounting field should refer to recent salary surveys, job portals, and professional associations to understand the prevailing standards and expectations in the dynamic landscape of Accounting jobs in India.

#cpa exam#certified public accountant#cpa full form#cpa in India#CPA review#cpa training institute#cpa salary in India#cpa syllabus#cpa license#cpa cost#cpa fees#us cpa exam#cpa exam fees in India#cpa details#cpa average salary in India#cpa highest salary India#best institute for CPA in India#cpa course details and fees#US Certified Public Accountant Exam

0 notes

Text

Tips to Understand the Tax Code for Businesses

Navigating the tax code can be overwhelming for many business owners. The complexity of these regulations often leaves even seasoned entrepreneurs scratching their heads. However, understanding the tax code is essential to ensure compliance, optimize tax benefits, and avoid costly penalties. Here are tips to help business owners decode the intricacies of tax laws, along with insights into why some tax codes are particularly perplexing.

Why is the Business Tax Code So Complicated?

The complexity of the tax code is a result of multiple factors:

Diverse Business Structures Tax laws must address various business types—sole proprietorships, partnerships, LLCs, and corporations—each with unique tax obligations. These distinctions create layers of complexity.

Frequent Updates Governments often revise tax codes to reflect economic, social, or political changes. Staying updated can be challenging, particularly for small business owners.

Specialized Deductions and Credits Tax incentives like the Research & Development Tax Credit or Section 179 deductions provide significant benefits but come with intricate eligibility requirements.

State vs. Federal Tax Laws Businesses must comply with federal tax laws and those specific to their state, which may have conflicting regulations or additional complexities.

Tips for Understanding the Tax Code

1. Start with the Basics

Begin by understanding fundamental concepts like taxable income, deductions, credits, and tax brackets. Resources like IRS guides or online business tax courses can help build foundational knowledge.

2. Hire a Professional Accountant

A certified public accountant (CPA) can provide tailored advice and simplify tax filing. The best CPA firms, like More Than Numbers CPA, specialize in helping businesses navigate complex tax laws, ensuring compliance while maximizing benefits.

3. Use Accounting Software

Tools such as QuickBooks or Xero can automate calculations, categorize expenses, and generate reports. Many software options include tax-specific features that simplify tracking and compliance.

4. Stay Organized Throughout the Year

Keeping detailed records of income, expenses, payroll, and inventory helps streamline the tax preparation process and reduces the risk of errors.

5. Learn About Common Deductions

Research business-specific deductions, such as those for office supplies, travel expenses, and home offices. Ensure you understand eligibility criteria to avoid disallowed claims.

6. Take Advantage of Educational Resources

The IRS offers publications and workshops for small businesses, covering topics like estimated taxes, recordkeeping, and employment tax. Many local chambers of commerce also provide similar resources.

Most Confusing Tax Codes for Businesses

1. Section 179 Deductions

This tax code allows businesses to deduct the full purchase price of qualifying equipment or software in the year it is purchased. However, its limitations—such as caps on spending and specific eligible items—can be perplexing.

2. Qualified Business Income (QBI) Deduction

Introduced under the Tax Cuts and Jobs Act, the QBI deduction allows eligible businesses to deduct up to 20% of their qualified business income. The fine print, however, includes thresholds, phase-outs, and exclusions that confuse many business owners.

3. Depreciation Rules

Understanding how to depreciate assets over time, including choosing between straight-line and accelerated methods, can be daunting. Special rules, like bonus depreciation, add further complexity.

4. Payroll Taxes

Payroll tax regulations vary depending on the type of employees and independent contractors. Calculating withholding for Social Security, Medicare, and unemployment taxes can be time-consuming and error-prone.

5. International Tax Laws

Businesses operating internationally face additional challenges, such as understanding foreign tax credits, transfer pricing rules, and treaties that affect cross-border transactions.

Why Must Tax Codes Be So Difficult?

1. Fairness Across Businesses

The tax system aims to be equitable, considering the wide variety of industries, sizes, and structures. Unfortunately, ensuring fairness adds layers of complexity.

2. Revenue Generation and Incentives

Tax codes are designed not only to generate revenue but also to encourage behaviors beneficial to the economy, such as investing in clean energy or hiring veterans. This dual purpose results in complex incentive programs.

3. Economic and Political Influences

Tax laws often reflect broader economic policies and political compromises. For example, new tax credits might be introduced to stimulate economic growth, adding to the already intricate code.

4. Risk Mitigation

Detailed rules help prevent tax evasion and ensure compliance. However, the granularity required to address all potential scenarios increases the difficulty for non-experts.

Simplifying Your Tax Strategy

1. Outsource to Experts

Partnering with a reputable accounting firm like More Than Numbers CPA ensures your tax strategy is aligned with current laws. With expertise in various industries, they can demystify tax codes while safeguarding your business interests.

2. Automate Tax Tasks

Many accounting software platforms integrate directly with the IRS and state tax systems, making it easier to calculate and file taxes. Automation minimizes errors and improves efficiency.

3. Attend Industry-Specific Tax Seminars

Certain tax laws are more relevant to specific sectors. Attending niche workshops can provide valuable insights tailored to your business.

4. Plan Ahead

Meet with your accountant regularly to review your finances and develop a proactive tax strategy. This can help you take full advantage of deductions and credits while staying compliant.

Conclusion

Understanding the business tax code might seem like an impossible task, but breaking it into manageable steps can make a world of difference. Start by mastering the basics, leveraging professional advice, and using technology to stay organized. With the right approach, you can navigate even the most confusing tax codes with confidence and focus on growing your business.

For expert guidance, reach out to More Than Numbers CPA, the best CPA firm in Greater Toronto Area. Their team specializes in simplifying tax compliance and helping businesses unlock their full potential.

1 note

·

View note

Text

Which study material is ideal for the CPA exam?

Selecting appropriate CPA samples and CPA study materials is very important for your performance in the examination. Since there are so many types of resources out there, it can be rather confusing as to what is going to work best for you and how you can learn. If you are in for a detailed view of the available CPA study material and the principles to guide your choices, continue reading the blog post below.

Understanding Your Learning Style

Whenever one is choosing CPA study material it is wise that one first determines his/her mode of learning. Do you prefer listening to someone, or do you learn better when the information is presented in a diagram, a chart, or an infographic? Would you like to engage in aural learning through having lectures, downloading podcasts, or listening to audiobooks? Or are you a touch-kinesthetic learning type who works well with models, the use of objects and simulating, or role-playing? Noticing how you learn is equally important so that you can select a material that you are most comfortable with and that will suit your understanding most.

Graphic organizers satisfy the need of visual-spatial learners to arrange content in a series of cards, maps, or diagrams, with connections between content. Auditory learners may find it useful to listen to a lecture, podcast, or audiobook and take notes or summarize what has been taught. Thus, it may be beneficial for kinesthetic learners to solve more problems, use role-play, or engage in the discussion to consolidate the material.

Key Factors to Consider

When evaluating CPA study material, keep the following factors in mind:

Coverage of Exam Topics: Make sure the content of the material is very extensive to accommodate all aspects tested in the CPA examination. These are audit, financial accounts, and reporting, regulation, and taxation.

Quality of Content: It is possible to search for quality material that is well-written by professionals, including doctors, and up-to-date. Convincing arguments will explain the material comprehensively, support them with examples, discuss the examples, and do examples of practice problems.

Practice Questions and Exams: We need to have several practice questions and answers useful for the exam. The material should comprise different forms of questions and they should cover different levels of difficulty so as to prepare the candidates for the exam.

Instructor Support: It’s important to check if the CPA study material incorporates the support of the instructor, for instance, live lessons, discussion boards, or private lessons. It can also be useful for defining the topic or getting a unique bit of advice.

Flexibility and Accessibility: Select the type of material that is appropriate in terms of time, which you can spend on learning and the type of learning you prefer. Some areas will give you the flexibility of the time and place when you can study.

Popular CPA Study Material Options

Becker CPA Review: Becker is a reputable course preparer for CPA exams. They provide an extensive course list, live classes over the net, and multiple aids to learning.

Wiley CPAexcel: Wiley CPAexcel is one of the most acclaimed tools that offer an intuitive design and a vast number of practice questions. They also have the option of full online, live, online, and classroom courses.

Roger CPA Review: Roger CPA Review gives usual lectures and uses them to teach interesting techniques. They tutor a range of course packages and they have a great customer care service.

Conclusion

Lastly, the selection of the best CPA study material is critical to your achievement on the exam. While analyzing the components of your learning style as presented in this blog post, you can decide on materials that are most suitable for you.

Ensure optimization for subject and course comprehensiveness, quality, number and variety of questions and exams offered, instructor engagement, and accessibility. Ultimately, the best CPA study material is the one that works best for you. Experiment with different options to find the one that aligns with your learning style and helps you achieve your CPA exam goals. By investing time and effort into your preparation, you can increase your chances of success on the exam and open doors to new career opportunities.

1 note

·

View note

Text

Does CPA Have a Future? A Guide for BCom Graduates Considering Additional Qualifications

In today's competitive job market, having a Bachelor of Commerce (BCom) degree is often just the first step. To stand out and advance in your career, additional qualifications can be crucial. One such qualification that has gained significant traction is the Certified Public Accountant (CPA) certification. This article explores the future of the CPA, particularly for BCom graduates, by detailing the CPA course, its benefits, and the opportunities it can unlock.

What is a CPA?

The CPA, or Certified Public Accountant, is a globally recognized professional designation in the field of accounting. The CPA course full form stands for Certified Public Accountant, which signifies a high level of competence in accounting, auditing, and finance. This certification is considered the gold standard in the accounting profession, especially in the United States.

CPA Course Details

The CPA course is designed to provide extensive knowledge and skills in various accounting disciplines. It covers topics such as financial accounting and reporting, auditing and attestation, regulation, and business environment and concepts. Here are some key CPA course details:

Financial Accounting and Reporting (FAR): Focuses on financial statements, transactions, and reporting.

Auditing and Attestation (AUD): Covers audit procedures, standards, and ethics.

Regulation (REG): Includes tax laws, business law, and ethics.

Business Environment and Concepts (BEC): Encompasses business concepts, financial management, and information technology.

CPA Course Eligibility

To enroll in the CPA course, certain eligibility criteria must be met. Here are the primary CPA course eligibility requirements for Indian students:

Educational Qualifications:

A Master’s Degree in Commerce, Accounting, or Finance.

First-division graduates of a three-year degree from NAAC-A accredited universities in India.

BCom graduates who have cleared the CA IPCC (Intermediate level).

BCom graduates who are qualified CAs or CMAs.

Credit Hours: Candidates must have completed 150 semester hours of college coursework. This requirement often necessitates additional coursework beyond a typical BCom degree.

Experience: Although not mandatory for taking the exam, 1-2 years of work experience under a licensed CPA is often required to obtain the CPA license.

CPA Course Duration

The CPA course duration varies depending on individual circumstances, including prior education and the pace at which one studies. Generally, it takes about 18 months to 2 years to complete all four sections of the CPA exam. Here's a breakdown of the timeline:

Preparation Time: 6-12 months of dedicated study time per section.

Exam Scheduling: Exams are available in testing windows throughout the year, allowing flexibility in scheduling.

Overall Duration: Typically, candidates aim to complete the course within 18 months, although some may take up to 2 years.

CPA Certification India

For BCom graduates in India, obtaining a CPA certification can be a game-changer. The CPA certification India process involves passing the Uniform CPA Exam administered by the American Institute of Certified Public Accountants (AICPA). Here’s how Indian students can approach it:

Choose a State Board: Each US state has its own CPA licensing requirements. Indian students should select a state board that aligns with their educational background.

Apply for the Exam: Submit your application to the chosen state board along with required documents and fees.

Prepare for the Exam: Enroll in a reputable CPA review course that provides comprehensive study materials, practice questions, and mock exams.

Take the Exam: Schedule and take the four sections of the CPA exam at authorized Prometric centers.

License Application: After passing the exam, apply for licensure, fulfilling any additional state-specific requirements such as ethics exams or work experience.

Future Prospects of CPA Certification

The future of the CPA certification is bright, especially for BCom graduates. Here are some reasons why pursuing a CPA is a smart move:

Global Recognition: The CPA is recognized worldwide, opening up international career opportunities.

High Demand: CPAs are in high demand across various sectors, including public accounting, corporate finance, consulting, and government.

Lucrative Salaries: CPAs often command higher salaries compared to their non-certified counterparts. In the US, the average salary for a CPA is significantly higher than the average salary for accountants without a CPA.

Career Advancement: A CPA certification can fast-track career advancement, leading to senior positions such as CFO, controller, or audit partner.

Versatile Skills: The CPA course equips you with a broad set of skills, from auditing and tax planning to strategic financial management and business consulting.

Conclusion

For BCom graduates looking to add a powerful credential to their qualifications, the CPA certification offers a promising future. With its rigorous curriculum, global recognition, and high demand in various industries, becoming a CPA can significantly enhance your career prospects. By understanding the CPA course details, eligibility requirements, and the certification process in India, you can make an informed decision to pursue this prestigious designation.

In a world where professional excellence and specialization are increasingly valued, the CPA certification stands out as a testament to one's expertise and commitment to the field of accounting. Whether you aim to work in India or abroad, the CPA opens doors to a world of opportunities, making it a worthy addition to your qualifications.

#cpa course details#cpa certification#cpa course full form#Best cpa institute in India#cpa subjects#cpa registration fees#cpa course qualification#cpa certification#cpa course full form#accounting jobs for indians in usa

0 notes

Text

7 Advantages Of Having A CPA Prepare Your Taxes

There are many benefits of working with CPA services, and most individuals find them to be well worth the cost. While anyone can file taxes on their own or use another tax preparation answer, it is not always the most cost-effective alternative. As the saying goes, just because you can do something does not necessarily mean you should.

CPAs are tax professionals who can file your business’s taxes, answer required financial queries, and save your business money. While CPAs have accounting degrees, their certification varies from traditional accountants.

Here are reasons why you will want to consider hiring a CPA:

Licensing

Practicing CPAs are needed to hold a license through their respective state. For the CPA to maintain this license, they must generally do two things: (1) complete a certain number of continuing education hours (for example, taking a course on the latest tax deductions, and (2) run their business according to specific standards.

These standards assure you that you are getting quality service. If you ever have a question about your CPA's rightfulness, you can contact your state’s board of public accountancy and request knowledge about your CPA.

Consistency and Stability

Practicing CPAs have committed to earning the Certified Public Accountant which involves a strict test, professional, and continuous comprehensive continuing education. Tax preparers who hold the CPA identification are in it for the long run.

Doors are Always Open

A CPA acts on many kinds of financial services, not just taxes. Thus, their doors are always open for tax queries, tax planning, and any audit help you require. Different tax preparation services close their doors at tax time. Who is going to assist you when you get that audit note? Your CPA is a full-time expert.

Record Retention

A CPA is going to maintain your tax knowledge much like a physician holds on the patient’s medical records. Your CPA will act as your filing cabinet through the years. You will even get your copy of the return and keep documents in a nice little folder for you to file away yourself if you like. Digital formats are also becoming more general.

Tax Planning

One of the best parts about having a CPA is the tax planning guidance they can provide throughout the year. There are basic year-end tax moves you can make that will save you hundreds in tax dollars.

Professionalism

A CPA is licensed by the state. They have gone through a ton of accounting classes, and a hard exam, and must maintain continuing education credits per year. Only a person who wants to be a professional is able to go through what it takes to be a CPA. Of course, CPAs are still just individuals.

Your Time

The last good reason to give you is your time. There is no lie in this and you would not have to spend a little time preparing your tax files to bring to a CPA. But these professionals will save you the time it takes to enter all the details and file your return. Every year, the process also gets fast as you learn exactly what you need to bring to your CPA.

0 notes

Text

CPA Course Details: Exploring the Key Components and Preparation for the CPA Examination

Introduction

CPA, which stands for Certified Public Accountant, is a prestigious designation in the field of accounting. To become a CPA, individuals are required to pass a comprehensive examination. However, success in the CPA examination is not solely dependent on innate accounting knowledge. It also necessitates a strong foundation in various accounting subjects and an understanding of key components in a CPA course curriculum. In this article, we will delve into the CPA course details the subjects covered, and how these components prepare students for the CPA examination.

CPA Full Form: Unveiling the Meaning

Before we delve into the intricacies of the CPA course curriculum, it's essential to understand the CPA full form. CPA is an abbreviation for Certified Public Accountant. A Certified Public Accountant is a licensed professional who has met specific education and experience requirements and has passed the CPA examination. This designation is highly respected and sought after in the field of accounting, as it signifies expertise in various accounting areas.

Key Components of a Typical CPA Course Curriculum

A CPA course curriculum is meticulously designed to cover a broad spectrum of accounting subjects and provide students with the necessary knowledge and skills to excel in the CPA examination. Let's break down the key components of a typical CPA course curriculum:

1. Core Accounting Subjects

Financial Accounting

Financial accounting is a fundamental subject in the CPA curriculum. It focuses on the preparation and interpretation of financial statements, including balance sheets, income statements, and cash flow statements. Students learn the principles and standards of financial reporting, as well as how to analyze and evaluate financial data.

Managerial Accounting

Managerial accounting delves into the internal financial management of organizations. This subject covers cost analysis, budgeting, performance measurement, and decision-making using accounting information. Students acquire skills to help organizations optimize their resources and make informed decisions.

Auditing and Attestation

Auditing and attestation is a critical component of the CPA curriculum. It teaches students how to examine and verify financial statements and internal controls. Auditors play a crucial role in ensuring the accuracy and reliability of financial information, making this subject vital for CPA candidates.

Regulation

The regulation component of the CPA curriculum focuses on federal taxation, business law, and ethics. Students learn about tax laws and regulations, legal responsibilities, and ethical considerations in the field of accounting. A strong foundation in regulation is essential for CPAs, as they often provide tax and legal advice to clients.

2. Business Environment and Concepts

This component of the CPA course curriculum provides a broader perspective on business operations and concepts. It covers topics such as business ethics, corporate governance, economic concepts, information technology, and financial management. Understanding the business environment is crucial for CPAs, as they often work closely with organizations to address financial challenges and achieve their goals.

3. Professional Ethics and Responsibilities

CPAs are held to high ethical standards, and this component of the curriculum emphasizes the importance of ethical behavior in the accounting profession. Students learn about the AICPA (American Institute of Certified Public Accountants) Code of Professional Conduct and various ethical dilemmas they may encounter in their careers. Ethical training is critical, as CPAs are entrusted with sensitive financial information and must maintain the public's trust.

4. CPA Examination Review Courses

In addition to the core subjects, CPA course curricula often include review courses specifically designed to prepare students for the CPA examination. These review courses focus on exam format, content, and test-taking strategies. They help students practice with sample questions and simulate exam conditions to enhance their chances of success.

5. Practical Experience

To become a CPA, candidates are typically required to gain practical experience in the field of accounting. This can include working under the supervision of a licensed CPA or in a related accounting role. Practical experience is essential to apply the theoretical knowledge gained in the classroom to real-world situations.

Subjects Covered in a Typical CPA Course Curriculum

Now that we've explored the key components of a CPA course curriculum, let's delve into the specific subjects covered within these components:

1. Financial Accounting and Reporting (FAR)

FAR is a comprehensive section of the CPA examination, and the corresponding course curriculum covers topics such as:

Generally Accepted Accounting Principles (GAAP)

Financial statement preparation

Revenue recognition

Leases

Accounting for income taxes

Business combinations and consolidations

Governmental and nonprofit accounting

2. Auditing and Attestation (AUD)

The AUD section of the CPA examination and its associated course curriculum focus on:

Auditing procedures and standards

Internal controls

Risk assessment

Ethics and independence

Reporting and communication

3. Regulation (REG)

The REG section of the CPA examination and the corresponding course curriculum encompass:

Federal Taxation

Business law

Professional responsibilities and ethics

Individual and entity taxation

Tax planning and compliance

4. Business Environment and Concepts (BEC)

The BEC section of the CPA examination covers a wide range of topics, including:

Business structure and operations

Economic concepts and analysis

Information technology

Corporate governance

Financial management

Risk management

How These Components Prepare Students for the CPA Examination

A CPA course curriculum is specifically designed to equip students with the knowledge and skills required to excel in the CPA examination. Here's how each component contributes to their preparation:

1. Core Accounting Subjects

Financial Accounting: Provides a solid foundation for the FAR section of the exam, where candidates must demonstrate their understanding of financial reporting and analysis.

Managerial Accounting: Helps candidates in the BEC section by covering financial management topics and decision-making using accounting information.

Auditing and Attestation: Prepares candidates for the AUD section by teaching them auditing procedures, internal controls, and ethical considerations.

Regulation: Offers the necessary knowledge for the REG section, which focuses on federal taxation, business law, and professional ethics.

2. Business Environment and Concepts

This component enhances candidates' understanding of the broader business environment, which is critical for success in the BEC section. It covers topics such as corporate governance, economic concepts, and financial management, all of which are relevant to the exam.

3. Professional Ethics and Responsibilities

Ethical considerations are not only crucial for the ethics portion of the REG section but also for the entire CPA examination. Understanding ethical principles and responsibilities is essential for maintaining the integrity of the profession.

4. CPA Examination Review Courses

These courses are specifically tailored to simulate the CPA examination experience. They provide practice exams, sample questions, and test-taking strategies to help students become familiar with the exam format and improve their performance.

5. Practical Experience

Practical experience complements classroom learning by allowing candidates to apply their knowledge in real-world situations. It enhances their problem-solving skills and provides valuable context for the concepts covered in the CPA course curriculum.

Conclusion

In conclusion, a typical CPA course curriculum is a comprehensive program that covers core accounting subjects, business concepts, professional ethics, and examination review courses. These components work in harmony to prepare students for the challenging CPA examination. Success in the CPA examination not only validates their accounting expertise but also opens up rewarding career opportunities in the field of accounting and finance. Aspiring CPAs should diligently follow their course curriculum, engage in exam preparation, and gain practical experience to achieve their goal of becoming a Certified Public Accountant.

1 note

·

View note

Text

BEC Exam 2023 — Important Dates

Important dates to remember if you plan to take the BEC Exam in 2023

If you are presently preparing for the CPA Exam or intend to begin your preparations before the conclusion of 2023, it is highly recommended to prioritize your efforts on successfully completing the Business Environment and Concepts (BEC) Exam, as the new CPA Exam is set to launch on January 10, 2024.

Let’s understand the significance of taking and passing the BEC in 2023.

Under the upcoming CPA Development, the BEC Exam will be replaced in 2024 by three fresh Discipline sections as part of the new CPA Exam’s Core-Plus-Discipline model. To meet the requirements, candidates need to pass one Discipline exam in addition to the three Core Exams. However, many candidates might prefer to avoid the uncertainty associated with these new sections. The advantage is that if you take and pass the BEC Exam by December 15, 2023 (the last testing date in 2023), you will be exempt from having to take one of the new, more advanced Discipline sections in 2024.

Another reason to complete BEC Exam in 2023 is that, according to numerous students, BEC Exam is considered the least challenging among the current exam sections.

Also in 2024, the new Discipline sections will have limited testing availability, with only one month per quarter dedicated to testing for each section.

The BEC exam covers the concepts and skills related to the business environment, including financial management, information technology, and economics. The test format is made up of multiple-choice questions, task-based simulations, and written communication tasks.

Key dates to remember when scheduling the BEC Exam in the year 2023.

Recently, the National Association of State Boards of Accountancy (NASBA) published the precise dates for applying and testing for the BEC section during the latter half of 2023.

Key Dates:

4 Aug 2023 — Deadline for first-time international candidates (for BEC or any other exam section) to apply with NIES to complete the international evaluation report

1 Oct 2023 — Deadline for first-time BEC candidates to apply for a Notice to Sit (NTS)

12 Nov 2023 — Deadline for BEC re-exam candidates (or those pre-approved for a prior NTS any section) to apply for an NTS

15 Dec 2023 — Last day to take and pass BEC in 2023 to avoid taking one of the new Discipline sections

For candidates testing in states with a Board of Accountancy not utilizing CPAES, the final application deadline for first-time or re-exam BEC sections may vary. Each state board will establish its specific deadline, and these details will be made available on NASBA’s website as they are released.

The deadline to apply for a BEC NTS in Texas, as determined by the Texas State Board of Public Accountancy is 15 Sept, 2023.

If you wish to sit for the BEC exam in 2023 and pursue CPA US from India, you can do so by choosing Fintram Global in association with Becker. They offer CPA coaching in the most efficient manner.

Here are some tips for candidates appearing for the BEC exam in 2023:

Understand the Exam Format: Familiarize yourself with the structure of the BEC section.

Review Content and Syllabus: Thoroughly review the BEC syllabus and understand the topics covered in the exam.

Practice Time Management: Practice solving questions within the time constraints to improve your speed.

Review Writing Skills: BEC includes written communication tasks. Improve your writing skills, including proper grammar, sentence structure, and clarity of expression.

Focus on Conceptual Understanding: Don’t just memorize information; aim to understand the underlying concepts and principles.

Take Mock Exams: Simulate the exam experience by taking full-length mock exams.

I hope all your Doubts are clear and this blog really helped out in every aspect but If you still have any queries. Reach us at

Website — https://fintram.com/us-cpa-course/

Call:- 8882677955

Whatsapp:- https://wa.link/znyuon

0 notes

Text

Ink AI Review - Full Upsells Details + Bonus

Are you sick of outdated, boring eBook layouts and designs? Are you prepared to step it up and produce eBooks that genuinely enthrall your readers? Ink AI is come to save the day, so stop searching! I'll be delving into the specifics of this amazing AI-powered eBook maker in my Ink AI Review and sharing my personal experience with it. Now fasten your seatbelts and let's explore Ink AI's universe together!

Ink AI Review - Overview

Vendor: Seyi Adeleke

Product: INK AI

Launch Date: Apr-06-2023

Front-End Price: $17

Official Website: Click Here

Ink AI Review - What is Ink AI?

The first AI-powered app in the world, Ink AI, lets you create ebooks, flipbooks, reports, whitepapers, and sales presentations with material that is 100% human-like. It has an integrated marketplace where you can sell your ebooks and get immediate money using a variety of channels, including Paypal, Stripe, Cards, and Bank Accounts.

You can quickly convert anything into an ebook or flipbook using Ink AI. Ink AI can create a completely designed ebook or flipbook from a keyword, URL, blog post, any website, article, questions, or even your voice in a matter of seconds. You may quickly and easily monetize your work with the help of this ground-breaking platform while expanding your audience.

Ink AI Review - Features

World’s First Voice-To-eBook App. Turn your voice into a stunning ebooks & flipbooks.

Instantly Generate 100% Human-like And Unique eBooks

Instantly Generate 3D eCover for your eBook.

Capitalize On The AI Wave With Just 1 Click

Create eBooks, FlipBooks, PDFs, Presentations, Reports, And More…

Instantly Publish Your eBooks In Our Marketplace.

Syndicate Your E-book to 50+ Publication For Instant Buyers Traffic

Start Your Publishing Business Today

100% Cloud-Based Nothing To Install Or Configure

No Experience Is Required To Use It

ZERO Upfront Cost

30 Days Money-Back Guarantee

Ink AI Review - How it works?

It works in just 4 simple steps:

Step 1: Sign in to the Ink AI Cloud-Based Dashboard.

Step 2: Make: Enter One Keyword and Get a Fully Designed eBook, Reports, Flipbook, PDF, Lead Magnet, and More…

Step 3: Syndicate: With a single click, AI may distribute your eBook to millions of buyers in any niche…

Step 4: Profit – That’s all there is to it.

Ink AI Review - Who should buy it?

Ink AI is for you if you are:

Affiliate marketers

Email marketers

CPA marketer

Coaches

E-commerce

Crypto

Blogger

Influencers

Course owners

Local businesses

Ink AI Review - Pros and Cons

Pros:

Generates 100% human-like content

Turns anything into an eBook or flipbook

Wide range of content creation options

Built-in marketplace and syndication features

Advanced language model surpasses ChatGPT 4

Time-saving and efficient

Cons:

I haven’t found any cons

My experience with Ink AI:

For my company, I tried utilizing Ink AI to make an eBook, and I must admit that I was impressed by how simple it was to use. All I had to do was enter a keyword, and Ink AI's AI took care of the rest. I was able to instantaneously post the eBook in the marketplace after the app created one that was 100 percent unique and human-like. Millions of people visit the market each month, making it a great venue to promote your eBooks and flipbooks.

How can Ink AI benefit your business?

Your company can gain from Ink AI in a number of ways. First off, you can save time and money by not having to hire writers, proofreaders, designers, or formatters. You can make appealing presentations, flipbooks, eBooks, and more with only one software. With only one click, Ink AI enables you to profit from the AI wave as well. This programme doesn't require any prior expertise to use, and since it is entirely cloud-based, there is nothing to install or configure. Finally, Ink AI has a 30-day money-back guarantee so you may test it out without risk.

>>>Get Instant Access Now<<<

Ink AI Review - FAQs:

Q: Can Ink AI generate content for any niche?

A: Yes, Ink AI has a library of over 190 niches, so it can generate content for any niche.

Q: Can I sell my eBooks in the Ink AI marketplace?

A: Yes, Ink AI comes with a built-in marketplace where you can sell your eBooks and flipbooks.

Q: Is Ink AI easy to use?

A: Yes, Ink AI is very easy to use, and you don't need any experience to use it.

Q: Is there a limit to the number of eBooks I can create with Ink AI?

A: No, there's no limit to the number of eBooks you can create with Ink AI.

Ink AI Review - Pricing & Upsells:

INK AI FRONT-END ($17)

World’s First Voice-To-eBook App. Turn your voice into stunning ebooks & flipbooks.

Instantly Generate 100% Human-like And Unique eBooks

Instantly Generate 3D eCover for your eBook.

Capitalize On The AI Wave With Just 1 Click

Create eBooks, FlipBooks, PDFs, Presentations, Reports, And More…

Instantly Publish Your eBooks In Our Marketplace.

Syndicate Your E-book to 50+ Publication For Instant Buyers Traffic

Start Your Publishing Business Today

100% Cloud-Based Nothing To Install Or Configure

No Experience Is Required To Use It

ZERO Upfront Cost

30 Days Money-Back Guarantee

OTO 1: INK AI UNLIMITED ($67) – DOWNSELL TO $47

Remove ALL The Limits From Your Account And Put Ink AI On Auto-pilot

Unlock Unlimited ‘ChatGPT-like’ AI Chatbots Under Your Own Branding

Unlock Unlimited Question & Answer

Unlock Unlimited AI Content, Articles, Facebook/YouTube Ads, VSL & Blog Post

Unlock Unlimited AI Graphics, Voiceover & Videos Generation

Unlock Unlimited Code Generation In Any Programming Language

Unlimited Alexa & Siri-like Voice Commands & Language Translation

Export Unlimited Bot Conversation As PDF & Images

Unlock Commercial License & Make CRAZY Profits Like Never Before

Maximize Ink AI To Its Fullest & Avoid Leaving Profits On The Table

It Gives Massive Unfair Advantage Over Other Members of Ink AI

Unlimited Ink AI Bot Campaigns = More Autopilot Profits Flowing In

OTO2: INK AI DFY ($197) – DOWNSELL TO $97

They’ll set up Premium AI Chatbot

They’ll Monetize Your AI Chatbot With Hot Offers

They’ll Set The Right Target Audience

They’ll Select The Most Profitable Niche & Configure It For Huge Profit

They’ll Fine Tune The Settings

They’ll Do The Techy Stuff

OTO3: INK AI AUTOMATION ($47) – DOWN-SELL TO $27

Automate Your Ink AI Account & AI Chatbot With FRESH AI Contents, Graphics, Arts, Animation Videos, Ads, Email Swipes & Much More Daily

Receive Payment On Complete Autopilot

Automation Saves Your Time

With Ink AI Automation, Make Profits Nonstop, 24/7, Every Possible Second Of The Day

OTO4: INK AI SWIFT PROFITS ($67) – DOWN-SELL TO $47

With this upgrade, you can expedite your results by over 100X.

Allowing you to profit within 1 hour.

And the best part? It only takes 30 seconds to put this upgrade into action

BONUS #1: $900 Per Day Sharing TikTok Videos

BONUS #2: Make $750 by Downloading YouTube Videos

OTO5: INK AI LIMITLESS TRAFFIC ($97) – DOWN-SELL TO $67

They’ll Send You Our Own Personal Buyers Traffic That’s Making Us Money

An Easy Way To Make Additional Income…

They’re Making MILLIONS Of Dollars With This Targeted Traffic

OTO6: INK AI AGENCY ($167) – DOWN-SELL TO $67

Create Unlimited accounts for Clients

Manage the client's account from your own Dashboard

Easy to use Agency Dashboard

Agency License Features

Manage Users, Add or Delete them

Charge Monthly or One time at your own pricing

Start making profits Today!

OTO7: INK AI FRANCHISE LICENSE ($167) – DOWN-SELL TO $67

Sell Ink AI To Others And Make Over $550 Per Click

Sell Ink AI & keep 100% of profits to yourself

Use High Converting Pages, Design, And Sales Material

OTO8: INK AI MULTI-INCOME ($47) – DOWN-SELL TO $27

Virtually Effortless To Setup

Make More Money Without Working Extra

Enjoy Automated Income From 10 New Income Streams

Ink AI Review - Bonuses:

Conclusion:

Ink AI is the ideal tool for producing engaging eBooks, flipbooks, and other material with little work and waits time. This software definitely stands out from the competition thanks to its sophisticated language model, human-like content generating, and the broad range of content creation possibilities.

While the 50+ AI functions offer countless options for content production, the built-in marketplace and syndication capabilities make it simple to sell your work and reach a larger audience. Despite a possible learning curve for some users, Ink AI's advantages significantly exceed its drawbacks.

Ink AI is a strong, adaptable, and user-friendly solution that can completely change how you produce and market digital content. Don't pass up the chance to use this cutting-edge AI tool to up your eBook game. To experience the difference for yourself, try Ink AI today!

>>>Get Instant Access Now<<<

#ink ai review#ink ai#ink ai review and bonus#ink ai bonus#ink ai demo#ink ai oto#ink ai upesells#ink ai software review

0 notes

Text

youtube

CA vs US CPA | US CPA Qualification

CA vs US CPA | US CPA Qualification | Difference between US CPA and CA | Is CPA better than CA 🔴 CPA Course Details @FinTramGlobal CA & US CPA are two professional qualifications which are very well known in the field of accounting and finance. The key differences between both are explained in this video - Eligibility, Subjects, Exam Pattern, Exam Fees, Total Cost, Jobs in India and many more... Do let us know in the comments if you guys have any doubts! To know more about US CPA Visit: https://fintram.com/us-cpa-course/ Also contact us on: +91-8882677955

#us cpa jobs in usa#us cpa jobs in india#us cpa course#us cpa course details#us cpa course full details#us cpa course material#ca vs cpa in india#ca vs cpa vs acca#cpa vs ca india#difference between ca and cpa qualification#cpa jobs in india#cpa jobs in usa#us gaap#us cpa syllabus#us cpa#cpa or ca#Youtube

0 notes

Text

What is CMA Salary Per Month?

The Certified Management Accountant (CMA) designation is increasingly recognized for its emphasis on strategic financial management and decision-making skills. In terms of salary, CMAs are well-positioned to earn competitive remuneration. The monthly salary for a CMA varies based on factors such as experience, location, and industry.

On average, entry-level CMAs with 1-3 years of experience can expect a monthly salary ranging from $3,500 to $6,000. Mid-level professionals with 4-7 years of experience may command salaries between $6,000 and $10,000 per month. Senior-level CMAs, possessing over 8 years of experience, can enjoy monthly earnings exceeding $10,000, depending on their role and responsibilities.

Industries such as finance, manufacturing, and consulting often offer higher salaries for CMAs, recognizing the strategic financial insights they bring to the table. Additionally, geographic location plays a role, with metropolitan areas generally offering higher compensation to reflect the cost of living.

In conclusion, the monthly salary for CMAs is influenced by factors such as experience, industry, and location. The CMA designation continues to be a valuable asset for professionals seeking rewarding careers in management accounting and financial leadership roles.

#Indiacpa exam#certified public accountant#cpa full form#cpa in India#CPA review#cpa training institute#cpa salary in India#cpa syllabus#cpa license#cpa cost#cpa fees#us cpa exam#cpa exam fees in India#cpa details#cpa average salary in India#cpa highest salary India#best institute for CPA in India#cpa course details and fees#US Certified Public Accountant Exam

0 notes

Text

My CPA Journey

I originally decided to start my CPA (certified public accountant) journey in my senior year of high school in 2001. Unknown at the time, my inattentive ADHD derailed me in college. I still managed to graduate in 2009 with my B.S. in accounting and started work at a public accounting firm. Still needing about 20 credit hours, I enrolled in a B.S. in finance program in 2011 and in 2013 I was then eligible to sit for the 4 CPA exam sections.

My whole post high school life I was always reminded on how hard it was to pass the exam sections and since each section cost around $230, I didn't want to register for the exams until I was ready. With ADHD, I realized I would never be ready. When you qualify to sit for the exam you have to register and take at least 1 section of the exam within 18 months of being registered... so at the 17th month I took my first section, Audit in 2017. I failed. This was the section I was supposed to be an "Expert" in since I handled audit matters at my firm. This devastated me and drove me into depression.

In January of 2018 I purchased Rogers CPA review program that included video lectures, text book and practice exams. I took AUD again in October of 2018. I studied about 30+ hours watching mostly Rogers lectures and I passed! I didn't find out right away, after around 40+ days of waiting, I found out right after dropping my kids off with their Nana. I wish I'd found out just an hour earlier so I could have celebrated with them but nonetheless, I was so excited.

This left me with three more sections to pass (BEC, FAR and REG). I was motivated. When you pass a section, you have to pass the remaining three within 18 months or you lose credit for the one that you passed 18 months ago. Obviously, this meant I would quickly schedule the remaining exams ASAP.

Wrong... I waited about 8 months before taking another section, BEC and I failed. I studied less than 2 hours for that section. Then in October of 2019 I passed FAR (I studied 30+ hours). However, I scheduled my REG just two weeks after FAR and I was so burned out that I didn't study at all for REG and I failed it. So at this point I passed 2 exams out of 5 total attempts with my BEC retake coming up in December. I failed my BEC retake (studied 2 hours). Now I passed 2 exams out of 6 total attempts.

I was distraught, my window to passing the remaining two (BEC and REG) was quickly closing before I'd lose credit for passing AUD (meaning I'd have to retake AUD). I'd have to pass the remaining two by March of 2020 and if I failed just one of them, I wouldn't have enough time to retake them before losing credit on my AUD exam. I was depressed and demotivated, believing I was a crappy accountant and dumb as a bag of rocks. Compounding my negative emotional state was the fact that now my Rogers exam prep course subscription was now passed the 18 month window that I purchased a couple years ago. Additionally, the fact that I didn't really use Rogers that much in studying for REG or BEC prior to this point just fed into my depression. I called them and they graciously allowed me to have a 6 month extension. I finally took advantage of those video lectures this time!

I then changed my mindset, I went full throttle and scheduled my BEC exam for the middle of January of 2020 and my REG exam at the middle of February. I decided I was going to study 30+ hours for each, came up with a detailed study strategy and watched hours of the Rogers video and audio lectures while taking notes.

It takes about 20-30 days to get your score back after taking a section of the exam, this period of time was excruciating. My ADHD couldn't properly handle this period of time. My BEC score release was a day after the Super Bowl. I am a HUGE Chiefs fan, this is the Super Bowl they WON!! The very next day I found out I passed BEC with a total of 10 hours of study time. I was on cloud 9, I was motivated. I was happy, really happy!

This momentum propelled me through my study time with REG which I took on February 13th wearing my Chiefs dress shirt. If I failed, I'd have to retake not only REG but also AUD.

On February 24, 2020 I learned that I passed REG (with 20+ hours of study time). It took me 8 attempts to pass the 4 sections and yes, I know if I'd spend at least 30 hours studying for each of them then I'd most likely would have passed all on the first attempt. However, I'm not built like that, and working 50+ hours a week in public accounting at the time didn't help either.

To be fully honest, I didn't accomplish any work between February 13th and February 24th as I refreshed the score release website at least a million times. I've finally done it. This realization didn't sink in right away, I was so overwhelmed with emotion, joy and relief.

The process wasn't fully over yet, as I had to wait for the paperwork from the state's accountancy board and to finish the experience verification process and complete the ethics 8 hour CPE course. Besides the lack of publicly available information on this process as a whole that left me with huge amounts of anxiety, I found it very difficult to focus at work. Ethics exam was the worst part, having to get a 90% or higher just seemed tedious to me. Finally forced myself to take it in April and was officially awarded my CPA license on May 15th of 2020.

My only wish would be to have my Mother alive and with me to share in the celebration and because I know this would have made her so happy. However, some of my good friends here threw me a surprise party and I am so blessed to be surrounded by awesome people like them!

Normally this would result in me attending the initiation of new CPA members at the state Captiol but due to Covid, this was instead turned into a youtube digital video of just my picture and my name.

Looking back on it now, I am very proud of my journey. Finally accomplishing a goal that I've had for almost 20 years and at the same time seeing my beloved Chiefs win the Super Bowl is a memory that will never leave me.

My only advise for those trying to get their CPA is to take care of your mental health, be proactive in trying to avoid burn out and do not let the statistics intimidate your mindset. Use a study strategy that works best for you. For me, the video lectures was a far superior study method than spending hours on practice exam questions. But that's just for me and ignore the critics.

3 notes

·

View notes

Photo

Certified Public Accountant is the title of qualified accountants in numerous countries in the English-speaking world. Each of these CPA jurisdictions has its own requirements for licensing CPA’s. Each year the International Federation of Accountants (IFAC), headquartered in New York, releases internationally acceptable professional designations. IFAC’s List of Recognised Professional Accounting Designations contains those deemed equivalents worldwide with appropriate qualifications. Neither AIPA nor any other organization or association can assert equivalence with this list. Over 50,000 practicing CPAs; have been granted sole authority by their respective state or territory governments to audit most public sector organizations and many private companies within those states/territories. CPAs also play a significant role in assisting charities and not-for-profit organizations to fulfill their reporting requirements. The UNSA Institute of Certified Public Accountants (AICPA) represents and supports the interests of CPAs, provides services to members, and sets a Code of Ethics for public accountants that regulate the conduct of members. In addition to their regulatory role, AICPA also provides accounting education programs, including continuing professional development (CPD), designed to increase technical knowledge among practicing CPAs. What Is A CPA? CPAs are licensed by state or territory government regulators as Chartered Accountants in each state/territory. The primary authority for CPAs is granted by state or territory governments who act on behalf of the Federal Government to regulate public practice accountancy activities. This means that although some may have a national title, only the state or territory in which you are practicing can take action against you. CPAs earned their credentials by either attending an accounting university or college that has met specific academic standards to be authorized by AICPA to administer examinations and award certificates of qualification. They gained their certification through relevant experience as determined by examiners from CPAA. The latter attend examination sessions at colleges and universities. The CPA credential is one of the most respected certifications globally and obtained by passing examinations developed jointly with partners from each country where this credential exists. All jurisdictions accept each other’s exams as meeting their requirements for licensure as a CPA. However, there may be some areas around the world where it will not be used or where it is not well known. Numerous organizations certify CPAs in many countries. CPA License The CPA credential itself has no limitations on its use geographically, but each jurisdiction may determine what activities can be performed by a licensed CPA within its borders. For example, those permitted to practice accountancy are either Chartered Accountants or Public Accountants, depending on local licensing law and their area(s) of competence. Local limits on public accounting usually require completion of university courses in ethics, attestation standards, and evidence-based auditing, and some form of experience working under direct supervision, which could include an internship or apprenticeship period while still attending university. A Chartered Accountant with additional expertise (usually gained through experience) in a particular accounting field can obtain the title Chartered Professional Accountant (CPA). CPAs perform various functions depending on their role and that of the employer. For example, the public accountant is subject to regulation and has, generally speaking, broader responsibilities, including attestation standards in financial statements or evaluating transactions. CPAs who work for large organizations may also have tax-related responsibilities. Others focus on one area: consulting with clients about their finances, including making recommendations regarding investments and insurance plans. Some CPAs specialize in auditing or taxation, while others are accountants generalists who aid the human resources department, systems analysts, or finance directors in managing budgets, reporting on financial performance, developing strategy, and determining whether businesses can continue to operate or must restructure. Accounting for Small Business Many CPAs work with small businesses providing a full range of services, from preparing tax returns to giving information on licensing requirements for various authorities such as the liquor and public health departments. At first glance, it may appear that only one person in the organization should be qualified as a CPA (or perhaps none) since they are so independent. However, this is not always true, especially when deciding whether to file an income tax return each year. If there is just one owner, they need to be a licensed accountant because they must sign the return. However, some jurisdictions require that all owners have the same “title” as employees must if they are involved in any management decisions affecting their company’s financial status. For example, suppose all owners in the organization are CPAs. In that case, they must manage the company’s finances through a business trust (or some similar mechanism) to make their decisions separately from any personal financial considerations. Suppose just one owner is licensed as an accountant. In that case, they could not participate in decision-making about financing or acquisition of inventory and would have to hire someone else to manage those portions of the operation. In jurisdictions with three owners or fewer who are actively involved with management but do not qualify for licensing, services may be provided by setting up a partnership that would include both partners and employees being licensed accountants. In other jurisdictions, it may be possible to set up a corporation whose board consists only of officers and directors who are not required to qualify as accountants. Accounting for small businesses (or sole proprietors) can begin with a simple list of income and expenses annually, or even less frequently in some cases, such as seasonal businesses. Still, to avoid penalties for late filing of tax returns, it is advisable to keep more detailed records if there are proper deductions. Tax Preparer Near Me The accountant for a small business would want to know about sources of revenue, including sales, fees, and other items such as gifts or donations. Management decisions about pricing, products offered (whether it is a retail shop, restaurant, or financial services), expansion of the operation through purchasing new property or equipment will also affect operating income and thus taxes payable in any year. CPAs charge varying amounts depending on their expertise and length of experience, and the complexity of the records required by each client. Still, they usually charge by the hour even if many hours are not worked during a day. It is therefore essential that clients understand what level of service they can expect when negotiating a fee agreement with an accountant who must be paid whether he is busy or not. For some clients, this may be the only time they have had an encounter with a CPA. However, they should understand that he needs their cooperation to provide them with any services and that he will always respect the limits of what is allowed by law in his dealings with other people and businesses under most circumstances since his license as an accountant would be at risk if he does not. Most CPAs are very professional people but can sometimes take advantage of clients’ unfamiliarity with accounting principles or regulations to take actions that seem reasonable on the surface but raise questions about propriety later. Therefore, clients should make sure that even though there are parts of financial management that seem straightforward, they fully understand their obligations and rights will be affected by decisions being made on their behalf. Search On Nearme.vip For CPA Near Me CPA Near Me The services provided by a CPA might include the following: Tax Services – CPAs can help prepare and file both corporate as well as individual income tax returns. Many of these will be simple forms that can be calculated with software or perhaps only a spreadsheet program, but other businesses, significantly larger corporations, need to have professionals calculate their taxes with more in-depth work being required. There are many different types of taxes to consider, including sales tax, property tax, state and local business taxes for companies registered to do business there, employment taxes for those employing workers either directly or through contractors who are not employees of the company themselves. CPAs are also involved in creating financial projections used in loan applications or planning future operations if they have an existing client who is considering expanding. Audit Services may be a business owner’s accountant, but that doesn’t mean he is automatically qualified to confirm the financial information his company has provided for any legal or regulatory purpose such as tax purposes or even for stockholders if the small business is incorporated. Public accounting firms like those providing auditing services are independent of any other party. Therefore, they must confirm what amounts have been reported in the necessary documents and not just rely on trust between management and employees or shareholders, which can lead to problems when all parties are trying to act in their own best interest. Financial Statement Preparation: An accountant will prepare financial statements primarily for shareholders who wish to base their decisions on this data rather than going with the management’s projections or promises. These statements provide information about the financial health and performance of the business by describing its assets, liabilities, equity, revenue, and expenses for a period to give investors an idea of what it has done and how successful it may have been with this activity. Depending on the simplicity or complexity of the business, these statements might be reasonably simple or will need to be much more detailed. Bookkeeping CPAs are typically the people who keep a set of account books for businesses and individuals, which are meant to provide information about amounts received and spent or invested after being recorded in separate accounts. For this activity, they will work with employees who can record incoming or outgoing cash, including checks, credit card transactions, or other forms of payments received by the business. This is part of an accounting system usually used by the CPA to see how successful the company has been during particular periods and if it needs any adjustments to stay on track during future years when making financial projections for investors. These records also form the basis for any tax returns that the company or business is obliged to make. Accounting Software As technology has advanced, so have accounting software programs that can now handle simple bookkeeping tasks and more complex financial reporting and tax preparation work. These programs will provide a better understanding for the CPA of what is going on within the business, with regular reports being created and sent to everyone involved with using this information to make necessary adjustments to stay on track or, if appropriate, plan for expansion. Although some may want an automatic program like Quickbooks or Mint because they see it as more straightforward than dealing with an accountant directly, this means you don’t know where your money is going at all times since all transactions might be automatically recorded without having to provide any instruction about how they should be handled. Accountants have the legal obligation to adhere to a code of ethics that involves avoiding conflicts of interest and being transparent with all parties involved with their client’s business. This can prevent any fraud from happening since it is easy for the CPAs to be held accountable if anything happens, especially if they are preparing financial statements or tax returns on behalf of clients. Accounting firms also help businesses find ways to simplify their accounting systems so that it is easier to keep track of day-to-day activities and make predictions about future performance based on these numbers instead of guesses or promises that aren’t backed by proof. To find a premium CPA near you, search on NearMe.Vip for a CPA or Public Accountant

2 notes

·

View notes

Text

The Nobel Prize in Physics 2018

Tools made of light

The inventions being honoured this year have revolutionised laser physics. Extremely small objects and incredibly fast processes now appear in a new light. Not only physics, but also chemistry, biology and medicine have gained precision instruments for use in basic research and practical applications.

Arthur Ashkin invented optical tweezers that grab particles, atoms and molecules with their laser beam fingers. Viruses, bacteria and other living cells can be held too, and examined and manipulated without being damaged. Ashkin’s optical tweezers have created entirely new opportunities for observing and controlling the machinery of life.

Gérard Mourou and Donna Strickland paved the way towards the shortest and most intense laser pulses created by mankind. The technique they developed has opened up new areas of research and led to broad industrial and medical applications; for example, millions of eye operations are performed every year with the sharpest of laser beams

Travelling in beams of light

Arthur Ashkin had a dream: imagine if beams of light could be put to work and made to move objects. In the cult series that started in the mid-1960s, Star Trek, a tractor beam can be used to retrieve objects, even asteroids in space, without touching them. Of course, this sounds like pure science fic- tion. We can feel that sunbeams carry energy – we get hot in the sun – although the pressure from the beam is too small for us to feel even a tiny prod. But could its force be enough to push extremely tiny particles and atoms?

Immediately after the invention of the first laser in 1960, Ashkin began to experiment with the new instrument at Bell Laboratories outside New York. In a laser, light waves move coherently, unlike ordinary white light in which the beams are mixed in all the colours of the rainbow and scattered in every direction.

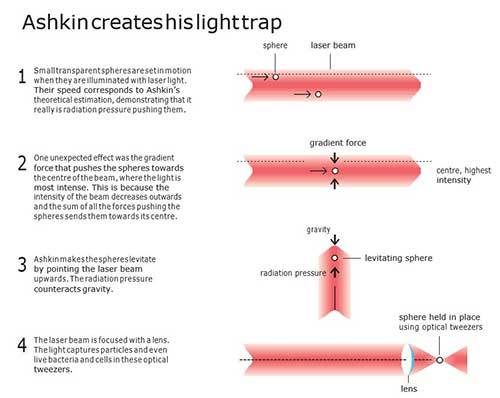

Ashkin realised that a laser would be the perfect tool for getting beams of light to move small particles. He illuminated micrometre-sized transparent spheres and, sure enough, he immediately got the spheres to move. At the same time, Ashkin was surprised by how the spheres were drawn towards the middle of the beam, where it was most intense. The explanation is that however sharp a laser beam is, its intensity declines from the centre out towards the sides. Therefore, the radiation pressure that the laser light exerts on the particles also varies, pressing them towards the middle of the beam, which holds the particles at its centre.

To also hold the particles in the direction of the beam, Ashkin added a strong lens to focus the laser light. The particles were then drawn towards the point that had the greatest light intensity. A light trap was born; it came to be known as optical tweezers.

Figure 1. Ashkin creates a light trap, which becomes known as optical tweezers.

Living bacteria captured by light

After several years and many setbacks, individual atoms could also be caught in the trap. There were many difficulties: one was that stronger forces were needed for the optical tweezers to be able to grab the atoms, and another was the heat vibrations of the atoms. It was necessary to find a way of slowing down the atoms and packing them into an area smaller than the full-stop at the end of this sentence. Everything fell into place in 1986, when optical tweezers could be combined with other methods for stopping atoms and trapping them.

While slowing down atoms became an area of research in itself, Arthur Ashkin discovered an entirely new use for his optical tweezers – studies of biological systems. It was chance that led him there. In his attempts to capture ever smaller particles, he used samples of small mosaic viruses. After he happened to leave them open overnight, the samples were full of large particles that moved hither and thither. Using a microscope, he discovered these particles were bacteria that were not just swimming around freely – when they came close to the laser beam, they were caught in the light trap. Howe- ver, his green laser beam killed the bacteria, so a weaker beam was necessary for them to survive. In invisible infrared light the bacteria stayed unharmed and were able to reproduce in the trap.

Accordingly, Ashkin’s studies then focused on numerous different bacteria, viruses and living cells. He even demonstrated that it was possible to reach into the cells without destroying the cell membrane.

Ashkin opened up a whole world of new applications with his optical tweezers. One important breakthrough was the ability to investigate the mechanical properties of molecular motors, large molecules that perform vital work inside cells. The first one to be mapped in detail using optical tweezers was a motor protein, kinesin, and its stepwise movement along microtubules, which are part of the cell’s skeleton.

Figure 2. The optical tweezers map the molecular motor kinesin as it walks along the cell skeleton.

From science fiction to practical applications

Over the last few years, many other researchers have been inspired to adopt Ashkin’s methods and further refine them. The development of innumerable applications is now driven by optical tweezers that make it possible to observe, turn, cut, push and pull – without touching the objects being investigated. In many laboratories, laser tweezers are therefore standard equipment for studying biological processes, such as individual proteins, molecular motors, DNA or the inner life of cells. Optical holography is among the most recent developments, in which thousands of tweezers can be used simultaneously, for example to separate healthy blood cells from infected ones, something that could be broadly applied in combatting malaria.

Arthur Ashkin never ceases to be amazed over the development of his optical tweezers, a science fiction that is now our reality. The second part of this year’s prize – the invention of ultrashort and super-strong laser pulses – also once belonged to researchers’ unrealised visions of the future.

New technology for ultrashort high-intensity beams

The inspiration came from a popular science article that described radar and its long radio waves. However, transferring this idea to the shorter optical light waves was difficult, both in theory and in practice. The breakthrough was described in the article that was published in December 1985 and was Donna Strickland’s first scientific publication. She had moved from Canada to the University of Rochester in the US, where she became attracted to laser physics by the green and red beams that lit the laboratory like a Christmas tree and, not least, by the visions of her supervisor, Gérard Mourou. One of these has now been realised – the idea of amplifying short laser pulses to unprecedented levels.

Laser light is created through a chain reaction in which the particles of light, photons, generate even more photons. These can be emitted in pulses. Ever since lasers were invented, almost 60 years ago, researchers have endeavoured to create more intense pulses. However, by the mid-1980s, the end of the road had been reached. For short pulses it was no longer practically possible to increase the intensity of the light without destroying the amplifying material.

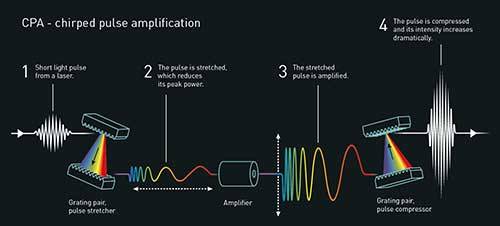

Strickland and Mourou’s new technique, known as chirped pulse amplification, CPA, was both simple and elegant. Take a short laser pulse, stretch it in time, amplify it and squeeze it together again. Whena pulse is stretched in time, its peak power is much lower so it can be hugely amplified without damaging the amplifier. The pulse is then compressed in time, which means that more light is packed together within a tiny area of space – and the intensity of the pulse then increases dramatically.

It took a few years for Strickland and Mourou to combine everything successfully. As usual, a wealth of both practical and conceptual details caused difficulties. For example, the pulse was to be stretched using a newly acquired 2.5 km-long fibre optic cable. But no light came out – the cable had broken somewhere in the middle. After a great deal of trouble, 1.4 km had to be enough. One major challenge was synchronising the various stages in the equipment, getting the beam stretcher to match the compressor. This was also solved and, in 1985, Strickland and Mourou were able to prove for the first time that their elegant vision also worked in practice.

The CPA-technique invented by Strickland and Mourou revolutionised laser physics. It became standard for all later high-intensity lasers and a gateway to entirely new areas and applications in physics, chemistry and medicine. The shortest and most intense laser pulses ever could now be created in the laboratory.

The world’s fastest film camera

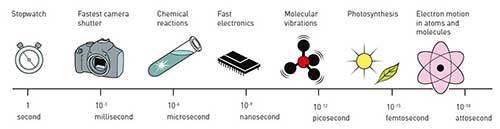

How are these ultrashort and intense pulses used? One early area of use was the rapid illumination of what happens between molecules and atoms in the constantly changing microworld. Things happen quickly, so quickly that for a long time it was only possible to describe the before and after. But with pulses as short as a femtosecond, one million of a billionth of a second, it is possible to see events that previously appeared to be instantaneous.

A laser’s extremely high intensity also makes its light a tool for changing the properties of matter: electrical insulators can be converted to conductors, and ultra-sharp laser beams make it possible to cut or drill holes in various materials extremely precisely – even in living matter.

For example, lasers can be used to create more efficient data storage, as the storage is not only built on the surface of the material, but also in tiny holes drilled deep into the storage medium. The technology is also used to manufacture surgical stents, micrometre- sized cylinders of stretched metal that widen and reinforce blood vessels, the urinary tract and other passageways inside the body.

There are innumerable areas of use, which have not yet been fully explored. Every step forward allows researchers to gain insights into new worlds, changing both basic research and practical applications.

One of the new areas of research that has arisen in recent years is attosecond physics. Laser pulses shorter than a hundred attoseconds (one attosecond is a billionth of a billionth of a second) reveal the dramatic world of electrons. Electrons are the workhorses of chemistry; they are responsible for the optical and electrical properties of all matter and for chemical bonds. Now they are not only observable, but they can also be controlled.

Image above: The faster the light pulses, the faster the movements that can be observed. The almost inconceivably short laser pulses are as fast as a few femtoseconds and can even be a thousand times faster, attoseconds. This allows sequences of events, which could once only be guessed at, to be filmed; the movement of electrons around an atomic nucleus can now be observed with an attosecond camera.

Towards even more extreme light

Many applications for these new laser techniques are waiting just around the corner – faster electronics, more effective solar cells, better catalysts, more powerful accelerators, new sources of energy, or designer pharmaceuticals. No wonder there is tough competition in laser physics.