#unitedhealthcare community plan

Explore tagged Tumblr posts

Text

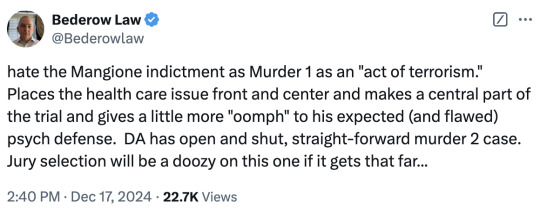

By Mark Bederow Mr. Bederow is a criminal defense lawyer and a former Manhattan assistant district attorney. The murder of the health care executive Brian Thompson on a Midtown sidewalk was shocking, brazen and seemingly methodical, but it wasn’t all that sophisticated. It didn’t take long for the authorities to identify Luigi Mangione as the likely murderer and arrest him. They had surveillance videos and various sightings. They are said to have forensic evidence linking him to the crime. A gun he had when he was arrested in Pennsylvania is said to be the same type of gun as the murder weapon. A notebook attributed to Mr. Mangione is said to have mentioned Mr. Thompson’s company, UnitedHealthcare, and that he planned to shoot a C.E.O. “These parasites had it coming,” he wrote, condemning health care companies for callous greed. In other words, Manhattan prosecutors have what looks to be a pretty straightforward case of second-degree murder, the charge that is almost always filed in New York State in cases of intentional murder.

But the Manhattan district attorney, Alvin Bragg, instead has charged Mr. Mangione with first-degree and second-degree murder in furtherance of terrorism (among other charges), which requires lifetime imprisonment in the event of a conviction. (The maximum sentence for second-degree murder without the terrorism charge would be 25 years to life.) By complicating a simple case, Mr. Bragg has increased the risk of acquittal on the most serious charge and a hung jury on any charge. Since Mr. Mangione is already being celebrated by some as a folk hero because of his rage against the American health care system, the terrorism charge, which alleges that Mr. Mangione “intended to intimidate or coerce a civilian population, influence the policies of a unit of government” and “affect the conduct of a unit of government,” almost certainly will turn the case into political theater. By charging Mr. Mangione as a terrorist, prosecutors are taking on a higher burden to support a dubious theory. In trying to prove that Mr. Mangione killed Mr. Thompson to “intimidate or coerce a civilian population,” prosecutors will presumably argue that the civilian population comprises health care executives and employees. But New York appellate courts have taken a very limited and fairly traditional view of what constitutes a civilian community under the terrorism law that was enacted within days of the Sept. 11 attacks.

The evidence appears to suggest that Mr. Mangione was bent on assassinating Mr. Thompson rather than intending “to sow terror,” as Mr. Bragg alleged in his news conference unsealing Mr. Mangione’s indictment. Mr. Mangione’s notebook reportedly says that he planned a targeted assassination because he did not want to “risk innocents.” So while this statement incriminates Mr. Mangione as a murderer, it appears to undermine the terrorism charge. By taking on the burden of trying to prove Mr. Mangione’s essentially political intent, prosecutors could amplify the criticisms of the American health care system that have made Mr. Mangione so alarmingly popular. The district attorney would provide Mr. Mangione a soapbox upon which he will be allowed to rail against the American health care system while trying to garner sympathy. Given the national debate over the role of insurance companies like Mr. Thompson’s, prosecutors will have a hard time, in any case, weeding out jurors who have some sympathy for the defendant. By turning Mr. Mangione’s supposed intent into a central element of the trial they invite juror nullification, in which jurors ignore their instructions to focus on the facts and instead let their points of view influence their verdict, leading to a hung jury, if not a full acquittal. At a standard second-degree murder trial, the jury would be instructed that the prosecution need only prove that Mr. Mangione committed the crime. Motive does not need to be considered. Perhaps Mr. Mangione’s most feasible defense would be a psychiatric one, alleging that he is not criminally responsible “by reason of mental disease or defect.” Unless there is persuasive evidence that has yet to be revealed, such a defense would be fairly easily undermined by evidence of Mr. Mangione’s detailed planning, concealment and flight. But the terrorism charge could slightly enhance such a defense if a jury is subjected to Mr. Mangione testifying about his grievances against the health care system and how it led a seemingly intelligent and grounded young man to assassinate an individual he didn’t know simply because he was a top executive at the nation’s largest insurance company.

And if the threat of life without parole is simply being used as a cudgel to leverage a plea to second-degree murder, how would Mr. Bragg justify wiping away the terrorism charge? It brings to mind the Daniel Penny case, in which Mr. Bragg brought a manslaughter charge, then dismissed it when jurors deadlocked, leading to an outright acquittal on even the lesser charge. The bottom line is that by choosing to make an open-and-shut murder case into a complicated debate on the health care industry, the district attorney risks highlighting the most troubling aspects of the case and making a conviction more difficult.

31 notes

·

View notes

Text

By: Yascha Mounk

Published: Dec 21, 2024

After Donald Trump won reelection, scores of Americans once again failed to make good on their loudly shared and oft-repeated plan of moving to Canada; but a good number of them did partake in a different, rather less cumbersome, exodus. Complaining that Twitter had been unrecognizably transformed under the ownership of Elon Musk—whom they also blame for supporting Trump—hundreds of thousands of progressives decamped to Bluesky.

Widely touted as a “kinder, gentler” alternative to X, Bluesky aims to emulate the up-to-date news and specialized information-sharing in which Twitter has traditionally excelled. It also promises to cut all the toxicity. In the past weeks, the platform announced plans to quadruple the number of moderators it employs. "We’re trying to go above what the legal requirements are, because we decided that we wanted to be a safe and welcoming space,” Aaron Rodericks, the head of the Trust and Safety Team at Bluesky Social, vowed.

The platform has some features that really do put the user in charge in appealing ways. In traditional social media networks, the executives of profit-driven companies control the algorithm that governs the content which is presented to individual users. Especially on micro-blogging platforms like Twitter, this feature—since well before Musk turned it into X—meant privileging controversial posts that elicit angry debate over milder, more consensual ones. On Bluesky, each user can choose between a great variety of open-source algorithms, which theoretically makes it possible to curate a less rage-inducing experience.

When Bluesky launched, I hoped that it would succeed. But the platform has quickly shown that it is hard for any social network to deliver on its promise of being the place for a kinder or gentler discourse. At its best, Bluesky has become a giant progressive echo chamber, with Blue MAGA accounts freely sharing “misinformation” such as the notion that the vote count in the 2024 election was fraudulent because millions of Democratic votes inexplicably went missing. At its worst, it openly revels in violence—so long as that violence can make a claim, however tenuous, to defend or avenge righteous victims.

In accordance with the platform’s policy of moderating content much more aggressively than X has done under Musk, Bluesky’s moderators have been quick to act when users flout the site’s ideological consensus. In the last weeks, both small accounts with few followers and well-known writers with an established audience have seemingly been banned for such trivial “infractions” as suggesting that the Democratic Party leaving X would be a counterproductive form of “purity politics.” And yet, it was on Bluesky that prominent journalists—including, but not limited to, the infamous Taylor Lorenz—openly rejoiced in the murder of Brian Thompson, the CEO of UnitedHealthcare. As long as progressives perceive the victim of a crime to be morally evil, the moderators on Bluesky appear to believe that threatening violence against them is justifiable.

More recently, Bluesky users with major followings reveled in the prospect of violence against Jesse Singal, a center-left journalist who has ended up in progressive crosshairs because of his reporting about detransitioners and involvement in other heated debates regarding trans issues. Some consisted in crude death threats: “I think Jesse Singal should be beat to death in the streets,” one wrote. But a surprising number explicitly justified calls for violence as being necessary to defend themselves against the ways in which he supposedly put them at risk. “Jesse Singal and assorted grifters want us dead so i similarly want him dead,” another user wrote.1

Though they blatantly violated Bluesky’s restrictive community guidelines, the platform hardly took action against such accounts. It even failed to ban users who shared what they believed to be Singal’s private address or made especially graphic threats against him. Evidently, the people making decisions for the kinder, gentler platform don’t mind actual death threats—as long as they are directed against those who, in their judgment, have it coming to them.

What can possibly explain the descent of a platform populated by progressives who claim to abhor all forms of violence into an echo chamber that revels in violence against anyone who defies its taboos or threatens its ideological conformity?

Some of the dynamic likely has to do with the nature of social media in general, and of microblogging platforms like Twitter and Bluesky in particular. There is also an ideological element—a justification of violence has been interwoven with far-left ideology for well over a century. But as I puzzled over the strange transformation of Bluesky, I was also reminded of a series of interesting social science papers published over the course of the last years. They suggest that the tendency to justify violence by the need to help virtuous victims serves a strategic purpose that is less than benign—and may even have worrying psychological roots.

-

Traditionally, most people have wanted to avoid being seen as a victim.

In “honor” societies, like the aristocratic milieus of early modern Europe, the impression that you could not defend yourself spelled dishonor and invited further attacks. When someone failed to pay you the respect to which you believed to be entitled, you did not claim to be a victim; you challenged them to a duel.

The same aversion to casting yourself as a victim persisted even after feudalism gave way to capitalism, and aristocratic “honor cultures” transformed into bourgeois “dignity cultures.” For much of the 19th and 20th centuries, people who were maltreated in some way would insist that such forms of disrespect did not have the power to undermine the dignity we all have as humans. If the duel is the canonical encapsulation of honor culture, the canonical encapsulations of dignity culture are an adult’s determination to keep a “stiff upper lip” in the face of adversity or a child’s resolve that “sticks and stones may break my bones but words shall never hurt me.”

But as Bradley Campbell and Jason Manning have argued in The Rise of Victimhood Culture, we are now entering a new era. Dignity culture is waning rapidly. In its place, we are witnessing the rise of victimhood culture. This new dispensation “differs from both honor and dignity cultures in highlighting rather than downplaying the complainants’ victimhood.” Under these circumstances, people who portray themselves as victims enjoy an elevated moral status. And that, Campbell and Manning write in one of their papers, “only increases the incentive to publicize grievances, and it means aggrieved parties are especially likely to highlight their identity as victims, emphasizing their own suffering and innocence.” (Anyone who has spent time on social media—whether it be Bluesky or Instagram or TikTok—in the decade since Campbell and Manning first wrote that line can’t help but feel that it has proven to be prophetic.)

Ekin Ok and three co-authors from the University of British Columbia pick up on this thread in a 2021 paper published in the Journal of Personality and Social Psychology. Because of the spread of egalitarian values and the paramount importance they give to alleviating suffering, Ok et al argue, contemporary Western democracies have become highly responsive to people who are perceived as victims. Under these circumstances, making a claim to victim status may allow a great variety of people “to pursue an environmental resource extraction strategy that helps them survive, flourish, and achieve their goals.” As a result, “claiming one is a victim has become increasingly advantageous and even fashionable.”

But being a victim may not be enough. Even in contemporary Western societies, the perceived moral status of the victim is likely to influence how much assistance they will receive. As Ok et al demonstrate, for example, respondents are more likely to offer financial assistance to a man who gets shot while volunteering at a charity softball game than they are to a man who gets shot while patronizing a strip club. For “victim-signalling” to have the desired effect, it needs to be accompanied by “virtue-signalling.”

Some people, of course, really are “virtuous victims.” They have suffered genuine injustice. But since managing to establish your status as a virtuous victim is potentially lucrative, it also stands to reason that others will falsely claim to fall into this category. As Ok et al write, some people “intentionally and repeatedly convey their victim status as a manipulative strategy with the explicit aim of altering the behavior of receivers to the signaler’s advantage.”

The authors of the study even have a hypothesis about who is most likely to do that. People with Dark Triad traits such as narcissism, Machiavellianism, and psychopathy, they argue, are especially likely to engage in “self-promotion, emotional callousness, duplicity and [a] tendency to take advantage of others.” Narcissists seek the limelight. Machiavellians are obsessed with gaining and exercising power over others. Psychopaths don’t care about social norms and disregard others’ emotions. People with all three traits are thus likely to be hugely overrepresented in the “subset of the population both adept at and comfortable with using deception and manipulation to attain personal goals.”

In a succession of clever tests, Ok et al provide plausible evidence that their theory is borne out by reality. Their first striking empirical finding is that people with dark personality traits are also more likely to falsely portray themselves as victims. In one of their studies, they ask you to imagine that you are an intern who is asked to work closely on a project with a peer who is competing for the same full-time job. The other intern is friendly to your face but you get a bad vibe from him. He doesn’t take your suggestions seriously, and you suspect that he may be talking badly about you behind your back. How do you respond?

That seems to depend on who you are. Asked to report on the behavior of the other intern, most participants in the experiment shared some negative opinions but refrained from making false or exaggerated statements. Respondents who had scored high on the dark personality triad, by contrast, were more likely to falsely report that the other intern had engaged in discriminatory behaviour such as making “demeaning or derogatory comments.”

The paper’s second striking empirical finding shows that the tendency of people with dark personality traits to falsely claim being a virtuous victim may also give them cover for engaging in bad behavior. In another experiment, they asked respondents to play a simple coin flip game, which was manipulated in such a way that its participants could easily use deception to increase their monetary payoff. It turns out that people who have portrayed themselves as virtuous victims were far more likely than their peers to lie and to cheat.

This helps to explain some of the features about Bluesky and other social media platforms that might otherwise feel puzzling. The kinds of claims to virtuous victimhood that are so common on that forum don’t just create cover for manipulative people to serve their own ends; they also seem to create license for disregarding moral norms—whether these consist in a prohibition of lying about others to ostracize them or (apparently) even calling for them to be killed.

-

When the study by Ok et al first came out, it made some minor waves. My fellow Substacker and recent podcast guest Rob Henderson argued that people with dark personality traits do what they can in any particular social environment to obtain benefits like prestige or material wealth. In current circumstances, he concluded, “those with dark triad traits might find that the best way to extract rewards is by making a public spectacle of their victimhood and virtue.” The psychologist and podcaster Scott Barry Kaufman put a similar conclusion even more starkly: “Some people,” he wrote, just “aren't good-faith actors in this ‘victimhood space.’”

At the time, I found the paper by Ok et al to be intriguing. And I knew that both Henderson and Kaufman usually have a good nose for bullshit. And yet, I have refrained from writing about its findings until now. After all, social psychology suffers from a serious replication crisis. Time and again, findings that are a little too neat or pleasing—from the idea that a child’s ability to resist the temptation of eating a marshmallow predicts later life outcomes to the promise that striking a “power pose” can set you up for success in a job interview—turned out to be dubious or outright false. And isn’t there something a little too neat about the idea that all of those people attesting to their superior virtue are secretly just narcissists and psychopaths trying to manipulate you?

It also seemed to me that a piece of the puzzle was still missing. Some of the people who target others on social media really do portray themselves as virtuous victims. They claim that they are part of the group which the victim of their attacks has supposedly targeted. And many of them clearly have self-serving goals, ranging from increasing their social clout to asking followers to donate cold, hard cash. But others who gang up on, or even threaten violence against, anybody who breaks perceived community norms don’t claim to be victims themselves; rather, they invoke the existence of supposed victims as an excuse to engage in cruel behavior. For all of its strength, there is something about the phenomenon I’ve been trying to make sense of that Ok’s paper can’t quite explain.

But then my research assistant sent me a new paper about the same subject. In a major effort, Timothy C. Bates and five of his colleagues at the University of Edinburgh set out to test whether the finding by Ok et al would replicate. Based on a larger dataset and employing alternative ways to measure key concepts like virtuous victim signalling, they came to an unambiguous conclusion: virtuous victim signalling really does seem to be driven by what they call “narcissistic Machiavellianism.”

More importantly, the paper by Bates et al also adds the missing piece of the puzzle. The “willingness to assert victimhood,” they hypothesize, may also “be amplified by the motive of sadistic pleasure in the downfall of weakened opponents.” In other words, the people who invoke the need to defend victims in order to justify treating others poorly don’t necessarily have a concrete strategic goal in mind; some of them do so because they are looking for a socially sanctioned outlet for their sadistic instincts. In those cases, the cruelty is the point.

To demonstrate that this is indeed the case, Bates et al use a standard battery of questions to measure respondents’ tendencies towards sadism, asking them such questions as whether they would be willing to purposely hurt people if they didn’t like them. They then test whether people with such sadistic tendencies are also more likely to score high on what they call the “victimizer scale,” which asks them to report on such questions as whether they have recently “enjoyed helping cancel someone;” whether they have “joined in on the persecution and condemnation of an individual or group accused of victimizing others;” and whether they have “sought to hurt the reputation of someone accused by others of victimizing.”

Two things are especially notable about this. First, not all sadists claimed that they themselves were virtuous victims. But second, the claim that they were acting on behalf of such victims—whether themselves or others—was the crucial fig leaf they needed to get away with their behavior. This finding, Bates et al argue, supports

the suggestion that sadism may be adapted to exploit strategic opportunities, specifically the legitimization of punishing and inflicting harm on individuals or groups which is created by successful virtuous victim signalling. If individuals high on Machiavellianism and narcissism exploit the resource-release response of nonvictims, sadism appears, as predicted, to exploit the opportunity created by victims in the form of the moral license granted by non-victims, legitimizing attacks on the victimizer by removing moral protection from those accused.

-

Many people really do suffer genuine injustices. It is on the whole a good thing that contemporary societies are much more likely to give people who claim to have suffered undeserved misfortune a respectful hearing than they might have gotten in the past. While trying to keep a “stiff upper lip” may have its uses, we certainly wouldn’t want people to fear advocating for a more just society, or coming forward about ways in which they have been maltreated, because doing so might undermine their dignity or bring shame upon them.

But to be sensible and sustainable, every social dispensation—whether it consists in an explicit set of rules or an implicit set of norms—must protect itself against bad actors. When a platform or political subculture allows anyone to portray themselves as victims without any real evidence, bad actors will recognize an opportunity to swoop in. And then these bad actors will quickly weaponize false claims to victimization as an excuse to harass or physically threaten people who supposedly have it coming to them. In a culture of victimhood that has no inbuilt defenses against bad actors, things will—as the recent blowup on Bluesky reminds us—always eventually get out of hand.

Every community, however noble its stated intentions and however progressive its purported values, needs a mechanism for defending itself against the small minority of people who are prone to exploit and manipulate their social environment. If yours doesn’t have one, it’s inviting the sadists, the narcissists and the psychopaths to run the show.

-

1 Like many of the things that are said or written about Singal, this claim of course lacks any basis in objective reality.

==

When victimhood is currency, expect counterfeiters.

We must fully depreciate "victimhood" as a form of social currency.

#Yascha Mounk#Jesse Singal#Bluesky#victimhood culture#victimhood#death threats#right side of history#cancel culture#Dark Triad#narcissism#machiavellianism#psychopathy#psychology#deception#manipulation#virtuous victim#virtuous victimhood#dark personality traits#religion is a mental illness

7 notes

·

View notes

Text

united healthcare ceo

Police in New York City are on a manhunt for a gunman following the shocking death of UnitedHealthcare CEO Brian Thompson. Thompson was fatally shot in what police are calling a premeditated, pre-planned, and targeted attack.

read more in google news

The tragic incident took place in broad daylight in the bustling streets of New York City, sending shockwaves through the community and leaving many wondering about the safety of the city's residents. According to reports, the assailant had been lying in wait for Thompson, carefully planning and executing the attack with precision.

read more in google news

Authorities are now working tirelessly to track down the gunman and bring him to justice for his heinous crime. The NYPD has launched a full-scale investigation, combing through surveillance footage and interviewing witnesses in a bid to piece together the events leading up to Thompson's untimely death.

In a statement released by the NYPD, Chief of Detectives Rodney Harrison urged anyone with information about the incident to come forward and assist in the investigation. "We are committed to bringing the perpetrator to justice and ensuring that the family of Brian Thompson receives the closure they deserve," he said.

Thompson's death has sent shockwaves throughout the business community, with many expressing their condolences and disbelief at the tragic loss. UnitedHealthcare released a statement mourning the loss of their beloved CEO, describing him as a visionary leader who made a significant impact on the healthcare industry.

As the manhunt for the gunman continues, the city remains on edge, with residents urged to remain vigilant and report any suspicious activity to the authorities. The senseless violence that claimed the life of Brian Thompson serves as a grim reminder of the need for heightened security measures and vigilance in today's society.

read more in google news

Our thoughts and prayers are with Thompson's family and loved ones during this difficult time. May justice be served, and may his memory be honored and cherished by all whose lives he touched.

Sure! Here is an expanded version of the answer:

Grammarly is a popular digital writing assistant that helps individuals enhance their writing skills by providing grammar, punctuation, and spelling corrections, as well as stylistic suggestions. These suggestions are based on advanced algorithms and artificial intelligence to ensure that users produce clear and coherent content.

In addition to basic grammar and spelling checks, Grammarly offers a range of advanced writing tools, such as tone detection and style recommendations, to help users refine their writing style and communicate more effectively. The platform also provides insights on sentence clarity, readability, and engagement, allowing users to tailor their writing to their intended audience.

read more in google news

Grammarly is available as a browser extension, desktop app, and mobile app, making it convenient for users to access and use across different devices. The tool is widely used by students, professionals, and writers to improve their writing skills, enhance their communication, and boost their confidence in their writing.

Overall, Grammarly is a valuable tool for anyone looking to elevate their writing and produce high-quality content. Its user-friendly interface, intuitive features, and personalized feedback make it a must-have tool for anyone who wants to become a better writer.

#united healthcare ceo#healthcare#ceo#Police hunt for gunman after UnitedHealthcare CEO killed in New York City

2 notes

·

View notes

Text

15 health systems dropping Medicare Advantage plans | 2024

Medicare Advantage provides health coverage to more than half of the nation's older adults, but some hospitals and health systems are opting to end their contracts with MA plans over administrative challenges.

Among the most commonly cited reasons are excessive prior authorization denial rates and slow payments from insurers.

In 2023, Becker's began reporting on hospitals and health systems nationwide that dropped some or all of their Medicare Advantage contracts.

In January, the Healthcare Financial Management Association released a survey of 135 health system CFOs, which found that 16% of systems are planning to stop accepting one or more MA plans in the next two years. Another 45% said they are considering the same but have not made a final decision. The report also found that 62% of CFOs believe collecting from MA is "significantly more difficult" than it was two years ago.

Fifteen health systems dropping Medicare Advantage plans in 2024: Editor's note: This is not an exhaustive list. It will continue to be updated this year 1. Canton, Ohio-based Aultman Health System's hospitals will no longer be in network with Humana Medicare Advantage after July 1, and its physicians will no longer be in network after Aug. 1.

2. Albany (N.Y.) Med Health System stopped accepting Humana Medicare Advantage on July 1.

3. Munster, Ind.-based Powers Health (formerly Community Healthcare System) went out of network with Humana and Aetna's Medicare Advantage plans on June 1.

4. Lawton, Okla.-based Comanche County Memorial Hospital stopped accepting UnitedHealthcare Medicare Advantage plans on May 1.

5. Houston-based Memorial Hermann Health System stopped contracting with Humana Medicare Advantage on Jan. 1.

6. York, Pa.-based WellSpan Health stopped accepting Humana Medicare Advantage and UnitedHealthcare Medicare Advantage plans on Jan. 1. UnitedHealthcare D-SNP plans in some locations are still accepted.

7. Newark, Del.-based ChristianaCare is out of network with Humana's Medicare Advantage plans as of Jan. 1, with the exception of home health services.

8. Greenville, N.C.-based ECU Health stopped accepting Humana's Medicare Advantage plans in January.

9. Zanesville, Ohio-based Genesis Healthcare System dropped Anthem BCBS and Humana Medicare Advantage plans in January.

10. Corvallis, Ore.-based Samaritan Health Services' hospitals went out of network with UnitedHealthcare's Medicare Advantage plans on Jan. 9. Samaritan's physicians and provider services will be out of network on Nov. 1.

11. Cameron (Mo.) Regional Medical Center stopped accepting Aetna and Humana Medicare Advantage in 2024.

12. Bend, Ore.-based St. Charles Health System stopped accepting Humana Medicare Advantage on Jan. 1 and Centene MA on Feb. 1.

13. Brookings (S.D.) Health System stopped accepting all Medicare Advantage plans in 2024.

14. Louisville, Ky.-based Baptist Health went out of network with UnitedHealthcare Medicare Advantage and Centene's WellCare on Jan. 1. 15. San Diego-based Scripps Health ended all Medicare Advantage contracts for its integrated medical groups, effective Jan. 1.

2 notes

·

View notes

Text

Open Your Career: Top Phlebotomy Jobs in Tampa, FL-- Opportunities Await!

Unlock Your Career: Top Phlebotomy Jobs in Tampa, FL – Opportunities Await!

Phlebotomy, the practice of drawing blood for tests, transfusions, donations, or research, is a vital part of the healthcare system. With the increasing demand for skilled professionals in this field, the job market in Tampa, FL, is ripe with opportunities. Whether you’re a seasoned phlebotomist or just starting your career, this article will guide you through the top phlebotomy jobs in Tampa and provide valuable insights into making the most of your career.

The Growing Demand for Phlebotomists

As healthcare continues to evolve, the need for qualified phlebotomists is on the rise. Factors contributing to this demand include:

Increasing patient populations in hospitals and clinics

Advancements in medical technology

Growing emphasis on preventive care and routine screenings

In Tampa, FL, several healthcare facilities are expanding their services, leading to a surge in phlebotomy job openings. Now is the perfect time to consider a career in phlebotomy!

Top Phlebotomy Employers in Tampa, FL

Below are some of the leading employers offering phlebotomy positions in Tampa:

Employer

Position Title

Location

Job Type

Tampa General Hospital

Phlebotomist

Tampa, FL

Full-Time

LabCorp

Phlebotomy Technician

Tampa, FL

Part-Time

Florida Hospital

Blood Draw Specialist

Tampa, FL

Full-Time

UnitedHealthcare

Mobile Phlebotomist

Tampa, FL

Full-Time

Potential Salary and Benefits

The financial remuneration for phlebotomists in Tampa, FL, is competitive. Here’s what you can expect:

Average Salary Range: $35,000 to $45,000 annually

Benefits: Health insurance,dental plans,retirement savings plans,and paid time off.

Opportunities for overtime and additional certifications,which can increase earning potential.

Essential Skills and Qualifications

To excel in the phlebotomy field, consider developing the following skills and qualifications:

Certification from a recognized phlebotomy program (e.g., American society for Clinical Pathology, National Phlebotomy Association)

effective interaction skills

Strong attention to detail

Ability to work well under pressure

Practical Tips for Landing the Best Phlebotomy Jobs

Here are some tips to enhance your job search in Tampa’s phlebotomy sector:

Networking: Connect with professionals in the industry through social media platforms like LinkedIn.

Tailor Your Resume: Highlight relevant skills and experience, focusing on your phlebotomy training and certifications.

Stay Updated: Regularly check job boards and local healthcare facility websites for new openings.

Prepare for Interviews: Be ready to discuss your experience,customer service skills,and patient interactions.

Case Studies: Successful Phlebotomists in Tampa

Learning from real-life experiences can be inspiring. Here are a couple of phlebotomy professionals who have carved successful paths in Tampa:

Case Study 1: Maria, the Community Health Phlebotomist

Maria began her career as a part-time phlebotomist at a local clinic. Through dedication and continuous professional development, she secured a position as a mobile phlebotomist, allowing her to engage with various communities, promote health awareness, and increase her income.

Case Study 2: John, the Laboratory Phlebotomist

Starting as an intern at a prestigious hospital, John learned from seasoned technicians. He took additional courses which led him to a full-time position as a laboratory phlebotomist.His journey reflects how ongoing education can considerably boost career prospects.

First-Hand Experience: A Day in the Life of a Phlebotomist

Understanding the daily responsibilities and experiences of a phlebotomist can provide insights into this fulfilling career. Here’s a snapshot:

Morning: Preparing equipment and reviewing patients’ details.

Midday: Collecting blood samples and ensuring patient comfort.

Afternoon: Entering data into electronic health records and interacting with lab staff for processing samples.

Every day in the life of a phlebotomist can vary, but the core focus remains the same: providing quality care and ensuring patient safety.

Conclusion

The phlebotomy field in Tampa, FL, is brimming with opportunities for those looking to make a mark in healthcare. With competitive salaries, a variety of job roles, and the potential for growth, pursuing a career as a phlebotomist coudl be the answer to unlocking your career potential. Equip yourself with the right skills, network with professionals, and keep an eye on job opportunities. The future is bright for aspiring phlebotomists in Tampa — opportunities await!

youtube

https://phlebotomycareertraining.net/open-your-career-top-phlebotomy-jobs-in-tampa-fl-opportunities-await/

0 notes

Text

THE NEW YOK TIMES

By Wendell Potter

Mr. Potter is the former vice president for corporate communications at Cigna.

I left my job as a health insurance executive at Cigna after a crisis of conscience. It began in 2005, during a meeting convened by the chief executive to brief department heads on the company’s latest strategy: “consumerism.”

Marketing consultants created the term to persuade employers and policymakers to shift hundreds, and in many cases thousands, of dollars in health-care costs onto consumers before insurance coverage kicks in. At the time, most Americans had relatively modest cost-sharing obligations — a $300 deductible, a $10 co-payment. “Consumerism” proponents contended that if patients had more “skin in the game” they would be more prudent consumers of health care, and providers would lower their prices.

Leading the presentation was a newly hired executive. Onstage, he was bombarded with questions about how plans with high deductibles could help the millions of Americans with chronic conditions and other serious illnesses. It was abundantly clear that insurance companies would pay far fewer claims but many enrollees’ health care costs would skyrocket. After about 30 minutes of nonstop questions, I realized I’d have to drink the Kool-Aid and embrace this approach.

And I did, for a while. As head of corporate communications at Cigna from 1999 until 2008, I was responsible for developing a public relations and lobbying campaign to persuade reporters and politicians that consumerism would be the long-awaited solution to ever-rising insurance premiums. But through my own research and common sense, I knew plans requiring significant cost sharing would be great for the well-heeled and healthy — and insurers’ shareholders — but potentially disastrous for others. And they have been. Of the estimated 100 million Americans with medical debt, the great majority have health insurance. Their plans are simply inadequate for their medical needs, despite the continuing rise in premiums year after year.

I grew uneasy after the company retreat. But it took an impromptu visit to a free medical clinic, held near where I grew up in the mountains of East Tennessee, to come face to face with the true consequences of our consumerism strategy.

At a county fairground in Wise, Va., I witnessed people standing in lines that stretched out of view, waiting to see physicians who were stationed in animal stalls. The event’s organizers, from a nonprofit called Remote Area Medical, told me that of the thousands of people who came to this three-day clinic every year, some had health insurance but did not have enough money in the bank to cover their out-of-pocket obligations.

That shook me to my core. I was forced to come to terms with the fact that I was playing a leading role in a system that made desperate people wait months or longer to get care in animal stalls, or go deep into medical debt.

The tragic assassination of the UnitedHealthcare chief executive Brian Thompson has reinvigorated a conversation that my former colleagues have long worked to suppress about an industry that puts profits above patients. Over 20 years working in health insurance, I saw the unrelenting pressure investors put on insurers to spend less paying out claims. The average amount insurers spent on medical care dropped from 95 cents per premium dollar in 1993, the year I joined Cigna, to approximately 85 cents per dollar in 2011, after the Affordable Care Act restricted how much insurers can profit from premiums. Since then, big insurers have bought physician practices, clinics and pharmacy middlemen, largely to increase their bottom line.

Meanwhile, the barriers to medical care have gotten higher and higher. Families can be on the hook for up to $18,900 before their coverage kicks in. Insurers require prior authorization more aggressively than when I was an industry spokesman, which forces patients and their doctors through a maze of approvalsbefore getting a procedure, sometimes denying them necessary treatment. Sure, the insurance industry isn’t to blame for all the problems with our health system, but it shoulders much of them. (In response to a request for comment, Cigna told The Times that Mr. Potter’s views don’t reflect the company’s and that Cigna is constantly working to improve its support for patients.)

At Cigna, my P.R. team and I handled dozens of calls from reporters wanting to know why the company refused to pay for a patient’s care. We kept many of those stories out of the press, often by telling reporters that federal privacy laws prohibited us from even acknowledging the patient in question and adding that insurers do not pay for experimental or medically unnecessary care, implying that the treatment wasn’t warranted.

One story that we couldn’t keep out of the press, and that contributed most to my decision to walk away from my career in 2008, involved Nataline Sarkisyan, a 17-year-old leukemia patient in California whose scheduled liver transplant was postponed at the last minute when Cigna told her surgeons it wouldn’t pay. Cigna’s medical director, located 2,500 miles away from Nataline, said she was too sick for the procedure. Nataline’s family stirred up so much media attention that Cigna relented, but it was too late. Nataline died a few hours after Cigna’s change of heart.

Nataline’s death affected me personally and deeply. As a father, I couldn’t imagine the depth of despair her parents were facing. I turned in my notice a few weeks later. I could not in good conscience continue being a spokesman for an industry that was making it increasingly difficult for Americans to get often lifesaving care.

One of my last acts before resigning was helping to plan a meeting for investors and Wall Street financial analysts — similar to the one that UnitedHealthcare canceled after Mr. Thompson’s horrific killing. These “annual investor days,” like the consumerism idea I helped spread, reveal an uncomfortable truth about our health insurance system: that shareholders, not patient outcomes, tend to drive decisions at for-profit health insurance companies.

https://www.nytimes.com/2024/12/18/opinion/health-insurance-united-ceo-shooting.html

0 notes

Text

The Case of Luigi Mangione: A Shocking Indictment in the Healthcare Industry

In a shocking turn of events that has gripped the nation, Luigi Mangione has been indicted for the murder of UnitedHealthcare CEO Brian Thompson. This tragic incident, which occurred on December 4, has both sparked outrage and ignited a broader discussion on the issues plaguing the healthcare industry.

Overview of the Incident

Brian Thompson, a prominent figure in the healthcare sector and CEO of UnitedHealthcare, was fatally shot in what authorities are describing as a “brazen, targeted, and premeditated shooting.” Surveillance footage captured the ambush, leading investigators to suggest that the attack was deliberately planned. The nature of this crime has shocked many, given Thompson’s influential role in a major healthcare organization.

The Indictment

Mangione faces serious charges, including first-degree murder, second-degree murder, and various weapon-related felonies. Some reports have labeled this act as a crime of terrorism, which highlights the severe implications of the violence associated with this case. As per the Manhattan District Attorney’s office, the charges reflect the premeditated nature of the act, categorizing it as a heinous crime against a significant leader in the healthcare sector.

read more in google news

Mangione was arrested in Pennsylvania, where he contested his extradition to New York. However, reports suggest that he may soon waive his rights to fight the extradition process. His current legal battles are closely monitored, as the repercussions of this case are likely to echo throughout the industry and society at large.

Public Reaction and Implications

The murder of Brian Thompson has drawn widespread attention, particularly from the healthcare community. It has sparked conversations around the immense pressures and frustrations individuals may feel within the industry. The act of violence raises critical questions regarding mental health, access to care, and the systemic frustrations that may lead someone to resort to such extreme measures.

Many experts argue that this incident is a reflection of larger societal issues within healthcare, including the growing dissatisfaction with the existing systems and the ramifications it has on individuals. As healthcare reform discussions become increasingly prominent, this case highlights a critical need for understanding the emotional and psychological toll that the system can impose.

A System in Crisis?

This incident serves as a stark reminder that the healthcare system is under immense strain. With rising costs, accessibility issues, and the ongoing challenges posed by the global pandemic, the emotional and mental health of individuals involved in healthcare — whether as providers or patients — needs urgent attention. The implications of this case may serve as a catalyst for more in-depth dialogues around healthcare policies and mental health support.

Conclusion

The indictment of Luigi Mangione in the murder of UnitedHealthcare CEO Brian Thompson brings to light not only the tragic loss of a life but also the urgent need for a comprehensive conversation about the state of healthcare in the United States. As the trial unfolds, it will be vital to monitor the legal proceedings and consider the broader societal implications of this case. It is imperative that, as a society, we address these systemic problems to prevent further tragedies in the future.

#LuigiMangione#HealthcareIndustry#MedicalEthics#HealthcareFraud#Indictment#HealthPolicy#PatientSafety#MedicalMalpractice#HealthcareReform#LegalIssues#PublicHealth#HealthcareAccountability#HealthcareScandal#EthicalHealthcare#JusticeInHealthcare

1 note

·

View note

Text

Top 10 Health Insurance Companies in the United States (2024)

Health Insurance Companies

In the realm of healthcare, choosing the right health insurance provider is paramount for ensuring comprehensive coverage and peace of mind. As of 2024, the landscape of health insurance companies in the United States reveals a variety of options, each with distinct offerings. Below is a professional overview of the top 10 health insurance companies recognized for their reliability, customer service, and range of plans.

UnitedHealthcare

UnitedHealthcare is renowned for its vast network of providers and a wide range of plans, catering to both individuals and businesses. Their innovative health programs often improve patient outcomes.2AnthemOperating in multiple states, Anthem is known for its tailored plans and widespread accessibility, particularly in the Blue Cross Blue Shield network. They emphasize preventive care and wellness initiatives.3AetnaAetna excels in offering comprehensive services including medical, dental, and pharmacy coverage. The company is also noted for its health management programs, aimed at improving member health.4CignaCigna stands out with its focus on global health, offering extensive international coverage options. The company is committed to wellness initiatives and personalized care management.5HumanaHumana offers a variety of plans with a strong emphasis on senior health services. Their commitment to promoting healthy lifestyles through various programs has earned them a loyal customer base.6Kaiser PermanenteKaiser Permanente is recognized for its integrated care model, which includes both insurance and healthcare services. This model allows for seamless coordination and access to high-quality care.7Blue Cross Blue ShieldA federation of independent companies, Blue Cross Blue Shield offers a wide array of plans with extensive provider networks. Their long-standing reputation is rooted in reliability and local accessibility.8Oscar HealthOscar Health is known for its tech-driven approach, offering user-friendly digital platforms to manage care. This modern take on health insurance attracts younger consumers seeking convenience.9Centene CorporationCentene specializes in government-sponsored programs such as Medicaid and Medicare. Their unique focus on underserved populations has set them apart in the health insurance sector.10Molina HealthcareMolina Healthcare primarily serves low-income populations, providing targeted services and plans tailored to meet the specific needs of its members. Their community-centric approach is highly commendable.

Conclusion

The top health insurance companies in the United States for 2024 reflect a diverse range of offerings and cater to various populations. Individuals and businesses seeking health insurance should assess their specific needs, budget, and preferences when selecting a provider. In an ever-evolving healthcare landscape, staying informed about the offerings of these companies can significantly enhance personal health and financial security.

1 note

·

View note

Text

[ad_1] UnitedHealthcare has launched thrilling modifications for his or her Medicare Benefit Plans in 2025. These updates goal to make healthcare extra accessible and inexpensive. Whether or not you might be an present member or contemplating enrolling, understanding what’s new and the way these modifications can influence your protection is necessary. Let’s dive into essentially the most important updates for 2025. Expanded Protection for Telehealth Telehealth companies turned essential in the course of the pandemic and are right here to remain. For 2025, UnitedHealthcare has expanded its telehealth choices, making it simpler to attach with docs from the consolation of your own home. Whether or not it’s routine check-ups, psychological well being help, or specialist visits, telehealth companies can be a extra inexpensive and handy possibility. That is particularly useful for these in rural areas or people with restricted mobility. Decrease Prescription Drug Prices The price of prescription medicines has all the time been a priority for a lot of. In 2025, UnitedHealthcare is addressing this problem by decreasing out-of-pocket prices for a lot of frequent medicines. They’ve expanded the listing of generic medicine coated beneath their Medicare Benefit plans, making it simpler so that you can entry the treatment you want with out breaking the financial institution. Enhanced Wellness Packages Well being isn’t nearly visiting the physician—it’s about staying wholesome. UnitedHealthcare is specializing in preventive care by enhancing their wellness applications. In 2025, members can have entry to new health applications, vitamin teaching, and personalised well being assessments. These applications are designed to maintain you more healthy, longer. In addition they supply rewards for staying lively, encouraging members to take management of their well-being. Elevated Entry to Specialists Ready months to see a specialist will be irritating. UnitedHealthcare is enhancing entry to specialists in 2025 by increasing their community. This implies shorter wait occasions and extra choices if you want specialised care. Whether or not it’s cardiology, oncology, or orthopedics, you’ll have entry to high-quality care if you want it essentially the most. Simplified Plan Choices Selecting the best Medicare Benefit plan can really feel overwhelming with so many choices. In 2025, UnitedHealthcare is simplifying their plan constructions, making selecting a plan that matches your healthcare wants simpler. The plans will supply extra flexibility, permitting you to pick protection matching your life-style and medical necessities with out confusion. Particular Deal with Persistent Situations Managing power circumstances like diabetes or coronary heart illness will be difficult. United Healthcare Medicare Benefit Plans 2025 will embrace extra tailor-made help for people with power well being circumstances. From specialised care groups to illness administration applications, they're dedicated to offering the instruments and sources you have to keep wholesome. Improved Dental, Imaginative and prescient, and Listening to Advantages In 2025, UnitedHealthcare is increasing its dental, imaginative and prescient, and listening to advantages, making these important companies extra inexpensive and accessible. Routine dental check-ups, eye exams, and listening to support protection can be obtainable in additional plans, guaranteeing you may preserve all features of your well being. Conclusion With these updates, UnitedHealthcare is making it simpler to handle your well being in 2025. There are numerous causes to contemplate these new choices, from decrease drug prices to enhanced wellness applications. Take time to evaluation the modifications and be sure to select the fitting plan in your wants. [ad_2] Supply hyperlink

0 notes

Text

Medicare Plans Deliver Awesome Wellness Benefits You’ll Love

Medicare Advantage (MA) is projected to continue growing in 2025, with over 35.7 million beneficiaries enrolled, accounting for more than 51% of the Medicare market. The Medicare annual enrollment period (AEP), from October 15 to December 7, 2024, gives seniors the chance to choose between traditional Medicare and Medicare Advantage plans, with new coverage starting January 1, 2025. Leading insurers like UnitedHealthcare, Humana, Aetna, Elevance Health, Cigna, and Wellcare are offering expanded benefits and new incentives to attract enrollees. Highlights include expanded coverage areas, increased access to dual special needs plans, added dental, vision, and hearing benefits, and innovative tools like digital health apps. With new options and improved services, Medicare beneficiaries will have more choices than ever before to find the plan that best fits their needs.

Stay updated with the latest payer industry news by following **DistilINFO HealthPlan** today!

Read more: https://distilinfo.com/healthplan/medicare-plans-offer-for-wellness/

Discover the latest payers’ news updates with a single click. Follow DistilINFO HealthPlan and stay ahead with updates. Join our community today!

0 notes

Text

UnitedHealthcare Community Plan – MO HealthNet Managed Care

0 notes

Text

The Importance of Support Coordination for People with Disability

Support coordination services provide people with the tools they need to use their NDIS plan effectively. These include identifying goals and developing an individualised support plan.

The best support coordinators should put participants in the driver’s seat and make them a full part of the planning process. They should also be free from bias when recommending services, including those funded by the NDIS.

Individualised Support Plans

Individualised support coordination disability plans help people with disability gain more control of their lives and journey towards a brighter future. These plans are designed to assist individuals in navigating the complex service systems, and are a crucial tool for building capacity and empowering participants to achieve their goals.

The first step in developing an ISP is collecting information on the individual’s strengths, challenges and needs, focusing on their areas of functioning. For example, this may include their physical abilities, dietary needs and responses to sensory stimulation.

ISPs are reviewed regularly, and reassessed at least once annually. Each reassessment involves the individual, their family/carer and providers, as well as any other interested parties (eg advocates). During this process, the ISP will incorporate risk assessment results and a comprehensive review of the person’s needs. This includes a detailed list of the services they are authorised to receive. It will also include a description of the level of support they require, as well as what their aspirations are.

Collaborative Planning

Collaboration has many benefits and can help to address gaps in service delivery. For example, it can enable access to technology and expert support that is unavailable in certain contexts. It also provides opportunities for learning and exchange of best practices in the area of disability services, thereby increasing the reach of the available supports to underserved populations.

The first step in the collaborative planning process is to identify the high-level plan. This involves selecting a colour for each sticky note and identifying milestones. Milestones are tasks that have zero duration and serve as important markers of progress. These are used to provide a sense of movement and momentum, a key feature of the UnitedHealthcare Enhanced Support Coordination model.

The Tools to Plan Support Webinar Series is an opportunity for participants to learn about person-centered planning tools and how they can be used by a variety of stakeholders including people with disabilities, families, schools, community groups and professionals.

Identifying Resources

A support coordinator's skills include a deep understanding of disability services, funding options, and relevant policies. They must be able to build a strong rapport with participants and their families, and provide guidance and valuable information that empowers them.

They help people with intellectual and developmental disabilities (IDD) and their families to navigate complex service systems, finding appropriate services and supports within the community that match their goals and aspirations. They also work to improve the quality of existing service systems and make them more responsive to the needs of individuals and their families.

A good support coordinator will be able to help you understand your NDIS plan, and connect you with a range of providers that can offer support. However, they are not a replacement for formal disability advocacy services. To find out how to evaluate your support coordination provider, see A Tool for Evaluating Support Coordination Services.

Supporting Self-Advocacy

As a self-advocate, you have the power to speak up for your own needs and wants. But this isn’t always easy, especially in adulthood. Self-advocates must be able to understand their own interests and needs, and be able to clearly communicate those to others. They must also be able to identify and understand the available services and Support coordination options in their community.

They need to know how to access generic resources like non-profit organisations and other local service providers, as well as formal supports/services provided with funding through the public Intellectual Disability System (Office of Developmental Programs). They should also be able to understand the rules and conditions of those services.

A good inclusive organisation will teach people with disabilities how to advocate for themselves, and will encourage self-advocacy groups and activities. It will use person-first language, respect people’s own identifiers for gender, and involve selfadvocates in policy development. In addition, it will provide self-advocacy training for people with disabilities and their families.

0 notes

Text

Biting into Dental Insurance: Trends and Transformations

The dental insurance market plays a vital role in ensuring access to quality oral healthcare for millions of individuals worldwide. As oral health awareness continues to rise, the dental insurance industry is undergoing significant changes, driven by evolving consumer needs, advancements in technology, and shifting market dynamics. In this article, we will explore the current landscape of the dental insurance market, examine the trends shaping its future, and discuss the challenges and opportunities that lie ahead.

The Dental Insurance Market Today

The dental insurance market is a dynamic sector within the broader insurance industry. It offers a range of policies designed to help individuals and families cover the costs of preventive, routine, and major dental care procedures. In the United States alone, approximately 77% of the population has dental insurance, reflecting the importance of oral health coverage.

The global dental insurance market size was valued at $152.26 billion in 2019 and is projected to reach $237.11 billion by 2027, growing at a CAGR of 10.7% from 2020 to 2027.

Key Players and Competition:

The market is characterized by a competitive landscape, with both standalone dental insurance providers and larger health insurance companies offering dental coverage. Some prominent players include Delta Dental, UnitedHealthcare, Cigna, and Aetna, among others. This competition has led to a variety of plan options and pricing structures, allowing consumers to select plans tailored to their specific needs.

Download Sample@ https://www.alliedmarketresearch.com/request-sample/7193

Trends Shaping the Dental Insurance Market

Increased Emphasis on Preventive Care: There is a growing recognition of the importance of preventive dental care in maintaining overall health. Dental insurance providers are responding by offering plans that cover routine check-ups, cleanings, and preventive treatments with low or no out-of-pocket costs. This trend aims to reduce the prevalence of costly dental problems that could have been prevented.

Telehealth and Digital Dentistry: Telehealth and digital dentistry have gained prominence, especially in the wake of the COVID-19 pandemic. Dental insurance companies are incorporating telehealth options into their coverage, allowing patients to consult with dentists remotely for advice, follow-up appointments, and even minor treatments.

Flexible and Customizable Plans: Consumers are seeking flexibility in their dental insurance plans. Many insurance providers are now offering customizable options, allowing individuals to choose the coverage that suits their unique needs. This personalization enhances the value of dental insurance for policyholders.

Integration with Overall Health: The line between dental and overall health is blurring, with increasing evidence linking oral health to conditions such as heart disease, diabetes, and even Alzheimer's disease. Dental insurance companies are integrating their offerings with broader health insurance plans to provide comprehensive coverage and address the interconnected nature of health issues.

Challenges and Opportunities

While the dental insurance market is evolving positively, it also faces several challenges and opportunities:

Challenges:

Affordability: Dental care can still be expensive, even with insurance. Many individuals may not seek necessary dental treatment due to cost concerns. Balancing the need for comprehensive coverage with affordability remains a challenge for the industry.

Access Disparities: Disparities in access to dental care persist, particularly in underserved communities. Addressing these disparities and ensuring equitable access to dental services is a critical challenge.

Increasing Regulatory Complexity: Dental insurance providers must navigate a complex web of regulations and compliance standards. Keeping up with evolving regulations can be resource-intensive.

Opportunities:

Technological Advancements: Advancements in technology, such as artificial intelligence and data analytics, can help dental insurance companies streamline operations, enhance customer experience, and make more informed decisions about coverage and pricing.

Prevention-Oriented Models: Emphasizing preventive care can lead to long-term cost savings and improved overall health. Dental insurance providers can explore innovative models that reward policyholders for maintaining good oral health.

Partnerships and Collaborations: Collaboration between dental insurance companies, dental providers, and healthcare systems can lead to more coordinated care, better outcomes, and improved patient experiences.

0 notes

Text

Choosing health insurance can be a daunting task given the wide variety of plans and complex information. At SportyConnect, we're committed to not only being a reliable resource for sports news but also empowering our readers with essential life aspects like health insurance. This article explores the most cost-effective health insurance options available in Minnesota. We'll unpack the factors that influence cost, the various plans available, and where to find them. Our focus is on achieving affordability without compromising quality. What Shapes Health Insurance Costs in Minnesota? Several variables influence the cost of health insurance. As we've previously analyzed in California and Texas, your age, income, and health status significantly impact insurance costs in Minnesota. Age: Generally, premiums increase with age. Income: Depending on your income, you might qualify for subsidies that can substantially lower your insurance costs. Health needs: If you frequently require medical services, a plan with higher premiums but lower out-of-pocket costs could be more cost-effective over time. There's no universal health insurance solution; your specific needs and circumstances should guide your choice. This situation is akin to selecting the right sports gear, a decision SportyConnect readers are all too familiar with! Considering these factors when seeking affordable health insurance in Minnesota, like we've done in Pennsylvania and New York, is crucial. With this foundation, let's examine the types of health insurance available in Minnesota. Understanding the Most Affordable Health Insurance Options in Minnesota Several affordable health insurance plans are available in Minnesota, with the specific cost depending on various factors, including age, income, and health needs. The most economical options typically include: Medicaid: As a government-funded health insurance program, Medicaid provides for low-income individuals and families. It's often the most affordable health insurance option in Minnesota, possibly free or low-cost based on your income. Bronze plans: On the ACA marketplace, Bronze plans offer the lowest cost. These plans come with high deductibles but also lower monthly premiums compared to other plans. Catastrophic plans: Available to individuals under 30 or those qualifying for a hardship exemption, Catastrophic plans have very high deductibles. Despite this, they also feature very low monthly premiums. Insurance plans vary in their service coverage, but most include doctor visits, hospital stays, prescription drugs, and other medical services. Some plans also offer preventive care, including annual checkups and vaccinations. To utilize these insurance plans, most require you to see in-network doctors and hospitals, and some may impose additional requirements, such as a waiting period before you can use your insurance. Finding the most affordable health insurance in Minnesota requires a careful comparison of plans from various insurers, taking into account your individual needs. The ACA marketplace and health insurance brokers can provide quotes and help compare plans. Several resources can be beneficial during your health insurance journey, including the Minnesota Department of Human Services, Healthcare.gov, and the Insurance Information Institute. Below are a few specific examples of affordable health insurance plans in Minnesota: UnitedHealthcare Community Plan of Minnesota - UnitedHealthcare Silver PPO plan: With a monthly premium of $392 and a deductible of $2,000, this plan covers doctor visits, hospital stays, prescription drugs, and other medical services. Blue Cross Blue Shield of Minnesota - Blue Cross Blue Shield Silver HMO plan: This plan carries a monthly premium of $397 and a deductible of $3,000, covering doctor visits, hospital stays, prescription drugs, and other medical services. Aetna Better Health of Minnesota - Aetna Silver

HMO plan: With a monthly premium of $402 and a deductible of $3,000, this plan covers doctor visits, hospital stays, prescription drugs, and other medical services. Evaluating Health Insurance Providers in Minnesota Making the right health insurance choice often requires a look into specific health insurance providers and their offerings. Let's consider some providers offering affordable plans in Minnesota, as we've done with other states like New Jersey and Massachusetts. UnitedHealthcare Community Plan of Minnesota UnitedHealthcare, a familiar name across the United States, offers the UnitedHealthcare Silver PPO plan in Minnesota. With a monthly premium of $392 and a deductible of $2,000, this plan provides coverage for doctor visits, hospital stays, prescription drugs, and other essential medical services. Just like in sports, knowing your team or, in this case, your provider, is crucial. Blue Cross Blue Shield of Minnesota Blue Cross Blue Shield of Minnesota offers the Blue Cross Blue Shield Silver HMO plan. Carrying a monthly premium of $397 and a deductible of $3,000, this plan covers a range of medical services, including doctor visits, hospital stays, and prescription drugs. We can liken it to choosing a sports equipment brand you trust, such as for football boots or tennis rackets. Aetna Better Health of Minnesota Aetna Better Health of Minnesota provides the Aetna Silver HMO plan. This plan features a monthly premium of $402 and a deductible of $3,000. Like the plans above, it covers doctor visits, hospital stays, prescription drugs, and other medical services. It's reminiscent of deciding which sports league to follow, a choice that hinges on understanding the league's players and games. These examples show a range of affordable health insurance providers available in Minnesota. As you make your decision, be sure to consider your individual health needs and budget. After all, just like selecting the right training routine or diet, personalization is key. Remember that while we've spotlighted a few plans here, numerous others are available through various insurance providers in Minnesota. Taking the time to investigate these other options could lead to finding a plan that fits your needs even better. Similar to how a runner may prefer a particular brand of running shoes or a specific workout routine, the ideal health insurance plan for you is a highly individual choice. Useful Resources for Navigating Health Insurance in Minnesota As you explore your options for affordable health insurance in Minnesota, you may find the following resources helpful. Remember, information is power, especially when navigating complex areas like health insurance, much like understanding the complex strategies in sports. Minnesota Department of Human Services The Minnesota Department of Human Services provides an array of information and services related to health care in the state. It's a resource as essential as knowing the rules of the game in any sport. Visit their website for more details. Healthcare.gov Healthcare.gov is an invaluable resource for comparing health insurance plans. You can evaluate plans based on factors such as price and services covered. It's like your playbook for understanding the game of health insurance. Insurance Information Institute The Insurance Information Institute offers a wealth of knowledge about various aspects of insurance, including health insurance. You can visit their website to get a better understanding of the health insurance landscape, much like gaining insight into the dynamics of your favorite sports team. When searching for the cheapest health insurance in Minnesota, remember that "cheapest" does not necessarily mean "best." What matters most is finding a plan that offers the coverage you need at a price you can afford. It's like finding the right balance in a sports team – cost efficiency matters, but so does performance.

The journey to finding the perfect health insurance plan can be likened to training for a major sports event – it takes time, research, and careful consideration. But with the right resources and a clear understanding of your needs, you can make the process smoother and more manageable. Just like in sports, victory in finding the right health insurance comes from careful planning, execution, and determination. FAQs How much does Minnesota state health insurance cost? The cost of Minnesota state health insurance, commonly known as MinnesotaCare, is dependent on your income and family size. For instance, a single adult earning $25,000 annually would have a monthly premium of around $80 for MinnesotaCare. Which is the least expensive type of health insurance? Typically, the least expensive type of health insurance is a catastrophic plan. Although these plans have very high deductibles, they tend to have very low monthly premiums. Catastrophic plans are a good fit for individuals who are generally healthy and don't anticipate needing substantial medical care. How much does Obamacare cost in Minnesota? The cost of Obamacare in Minnesota varies depending on the type of plan you opt for and your income. A Silver plan, for instance, could be available for a single adult earning $25,000 annually at a monthly premium of around $346. Is Obamacare available in Minnesota? Yes, Obamacare is available in Minnesota. You can procure an Obamacare plan via the Minnesota Health Exchange or through a private health insurance firm. Is there free healthcare in Minnesota? Yes, free healthcare is available in Minnesota through Medicaid and the Children's Health Insurance Program (CHIP). Qualification is based on certain income and residency prerequisites. Applications for Medicaid or CHIP can be made online at the Minnesota Department of Human Services website or via phone call at 1-800-552-6993. Is Minnesota good for healthcare? Minnesota boasts a commendable healthcare system. With a high rate of insured residents and generally high-quality care, the state stands out. It also offers innovative healthcare initiatives, including the MinnesotaCare program. #SportyConnect

0 notes

Text

AARP Medicare Supplement: Hidden Gems For Seniors