#transition metal ion solutions

Explore tagged Tumblr posts

Text

The Science Research Notebooks of S. Sunkavally. Page 289.

#Oenothera#heterozygosity#blood calcium concentration#thermal conduction#electrons#metronidazole#mutagens#fried foods#boiling water#sodium bicarbonate#halothane#carboniferous#nitrate fertilizer#fuel cells#transition metal ion solutions#nitric oxide#copper nitrate

0 notes

Text

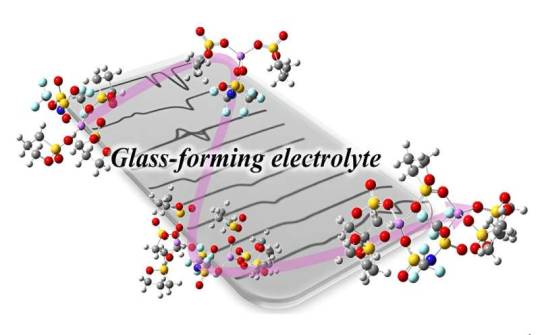

Novel glass-forming liquid electrolyte shows glass transition across broad range

As the world shifts towards a more sustainable future, the development of advanced electrochemical devices, such as rechargeable batteries with higher energy densities and efficient electrodeposition capabilities, has become increasingly crucial. In recent years, ultra-concentrated electrolyte solutions, where metal salts are dissolved at concentrations two to three times higher than those in a single solvent, or mixtures where metal salts are excessively dissolved in a single solvent, have gained attention as new electrolyte solutions. These solutions remain liquid at room temperature and enable high ion conduction and high-efficiency, high-quality metal film formation. However, the physicochemical or thermodynamic definition of these liquids remains unclear. Moreover, identifying the dissolved species and understanding their structures, which are crucial for their use as electrolytes, is extremely challenging.

Read more.

15 notes

·

View notes

Text

(the 2 most voted elements will continue onto round 2!)

More info about each element (and propaganda for the ones I like) under the cut. pleeeeeeeeease read some of them at least the one about francium

(disclaimer: these are based off short wikipedia reads and my crumbling high school chemistry knowledge. correct me if I'm wrong about anything.)

HYDROGEN: Hydrogen is the lightest element (consisting of only one proton and one electron). It is also the most abundant element in the universe, it's a gas (at room temperature) and it can explode. It's also quite representative of acids, having the (Arrhenius) definition of an acid straight up saying that it has to dissociate in water to form H+ ions. It's also quite an efficient fuel. Hydrogen is anywhere and Hydrogen is everywhere. If you like explosions, sour beverages, or acid in general, consider voting Hydrogen!

LITHIUM: Lithium, under standard conditions, is by far the least dense metal and the least dense solid element! You may primarily know him from your phone's Lithium-ion batteries. There are Lithium-based drugs used to treat mental illnesses. You can throw a block of lithium in water and it will make a really big explosion. The metal is soft and silvery. I'm running out of things to say about him. If you like batteries vote Lithium? (edit: just realised lithium is used for batteries, and batteries are connected to robotics and engineering. if you like robots and cool mechanical stuff vote lithium!)

SODIUM: You must know him from table salt. That's actually NaCl, his best known involvement. There are many more very important and very commonplace compounds that involve sodium, such as baking soda (NaHCO3) and sodium hydroxide (NaOH) (that's probably the most famous base?). It's also very important to the human body (you shouldn't eat more than 2300mg a day). If you've ever used table salt or baking soda while cooking, consider voting Sodium!

POTASSIUM: Their name was based on the word potash, which was based on an early and easy way of obtaining potassium, from putting ash in a pot, adding water, heating, and evaporating the solution. It's used in a lot of fertilisers because it's an essential plant nutrient. It's also involved in a ton of important compounds: KOH (a strong base), KNO3 (often used as salt bridges in electrochemical cells), K2CrO7 (an oxidising agent often used in organic synthesis), and K2CrO4 (I don't know what this one does). If you have ever eaten food from fertilisers consider voting Potassium!

RUBIDIUM: Rubidium compounds are sometimes used in fireworks to give them a purple color. They've also got a cool name, based on the latin rubidius, for deep red (the color of its emission spectrum). I'll be real, I don't really know much about them beyond that, but that is one cool name. Vote for Rubidium if you like cool names.

CAESIUM: Caesium is used in the definition for a second, meaning that an entire SI unit is based on it! A second can be defined as "the duration of 9,192,631,770 cycles of microwave light absorbed or emitted by the hyperfine transition of caesium-133 atoms in their ground state undisturbed by external fields". It was also discovered from mineral water. Did you know that they had to use 44000 liters of water to find her? If you've ever experienced time or had a conception of it in terms of units, consider voting Caesium!!!

FRANCIUM!!!: Caesium... TWO! It's sad that no one will probably read this far but this is my favourite element in this poll. This element is characterised by instability. Her longest half-life is 22 minutes. Her entire existence was conjoint with Caesium before they discovered that she was her own element. She has never been seen. They literally never confirmed what color she is. She was born in a wet cardboard box all alone. Through the hands of different scientists, she was going to be named after Russia, Virginia, or Moldavia at different points in time. At one point the name catium was proposed (for "cation", since she was believed to be the most electropositive cation), but was rejected because it sounded like a cat element. Which is so fucking sad. We could've had cat element but we ended up with France element. That's right she's also named after France. Just tragic fascinating existence overall. Also isn't it just insane that her half-life is only 22 minutes? Dude, you don't get it, the most of her that's ever existed in one place is a mere 300000 atoms. She's here and she's gone. What the hell.

The charm of Francium can be summarised by the wise words of my good friend Wolfgang Amadeus Mozart:

20 notes

·

View notes

Text

Recharging the Future: How LOHUM is pioneering a Sustainable Battery Circular Economy

In a world electrifying at unprecedented speed, the lithium-ion battery has become the beating heart of modern technology—from electric vehicles (EVs) and smartphones to renewable energy storage. Yet, the materials powering this transition are finite, and the environmental costs of mining are immense. As nations and industries chase climate goals, sustainable battery production and recycling aren’t just optional—they're urgent.

At LOHUM, our mission is simple: To power the future with circularity, responsibility, and innovation at scale. As one of the world’s leading producers of sustainable battery raw materials through reuse and recycling, LOHUM is addressing the complex, pressing challenge of responsibly sourcing and reusing critical minerals. These include lithium, nickel, cobalt, and manganese—each of which plays a pivotal role in high-performance battery chemistries.

The Growing Strain on Critical Minerals

Lithium-ion battery demand is expected to surge more than tenfold in the next decade, driven by the electrification of transport and the global push for clean energy. However, all of the world’s current mining operations cannot meet this skyrocketing demand. For example, the costs of the three most expensive materials in cathodes—cobalt, nickel, and lithium—have fluctuated by as much as 300% in a single year, underscoring both their scarcity and strategic value.

Meanwhile, mining new resources presents formidable environmental challenges, such as water depletion and pollution from tailings. Over 60% of the global cobalt supply originates from the Democratic Republic of Congo, where the supply chain is often entangled with human rights violations, illegal mining, and regional conflict. Reducing dependence on such volatile and unethical supply chains requires a paradigm shift—and recycling provides that opportunity.

Direct Recycling: A Game-Changer in Battery Circularity

Traditional battery recycling processes—pyrometallurgy and hydrometallurgy—often result in significant energy consumption and environmental burden. Pyrometallurgical methods, in particular, emit toxic pollutants and consume high levels of energy to recover metals, which then require re-refining and resynthesis before reuse.

But direct cathode recycling represents a breakthrough. Unlike older methods that break batteries down into basic elements, direct recycling retains the cathode’s complex crystalline structure. This makes it possible to relithiate and refunctionalize the cathode, preserving its performance and drastically reducing energy usage in the process.

Recent research supports this innovation. A study published in Joule demonstrated that batteries made using recycled cathode materials—not only matched but often outperformed virgin cathode batteries in terms of charge rate and longevity. Recycled cathodes were found to be more porous, allowing lithium ions to move more efficiently, resulting in faster charging and reduced degradation.

At LOHUM, our approach is aligned with these emerging scientific insights. We go beyond basic material recovery to engineer solutions that extend the life and performance of materials, close the loop on battery usage, and reintroduce high-quality components back into the supply chain.

LOHUM’s Role in Driving a Sustainable Battery Ecosystem

LOHUM’s integrated model focuses on reverse logistics, advanced material recovery, and high-value reuse. We’re not only recovering minerals—we’re engineering a circular future. Our proprietary technologies enable us to reclaim up to 95% of valuable materials from end-of-life batteries, supporting the creation of sustainable second-life batteries and precursor materials.

As global markets move toward legislative accountability, EPR for Li-ion battery waste management (Extended Producer Responsibility) is becoming a central pillar in policy design. EPR mandates hold manufacturers accountable for the lifecycle of their products, including end-of-life disposal and recycling. At LOHUM, we’re actively collaborating with regulatory bodies and OEMs to implement EPR frameworks that ensure safe, responsible, and profitable circularity.

Our goal? To make battery material circularity the economical and environmental default—not the exception.

A Policy Moment Not to Miss

California has set the benchmark by initiating policies requiring 100% of EV batteries to be recycled or reused. Other jurisdictions are rapidly following suit. These policies will help standardize practices, facilitate material tracking, and promote domestic value creation.

However, the policy environment must also address gaps in collection, data standardization, and recycling infrastructure. Strategic investments in infrastructure, public-private partnerships, and global harmonization of standards are essential for unlocking the full potential of battery recycling.

And this is where LOHUM's end-to-end model plays a key role—not only do we process batteries, but we also develop next-gen second-life applications, from energy storage systems to re-usable battery modules, creating lasting economic and environmental value.

The Road Ahead: Powering a Trillion-Dollar Opportunity

According to estimates, the global battery market will be worth nearly $1 trillion in the next two decades. However, without circularity, this growth could place unsustainable pressure on virgin resources and fragile supply chains.

The future of energy isn’t just electric—it’s regenerative. Recycling EV batteries could meet up to 40% of new battery material demand by 2040, significantly reducing mining needs and carbon footprints.

At LOHUM, we see critical minerals not as disposable commodities but as long-term assets that must be stewarded, circulated, and optimized. Our technologies, our partnerships, and our philosophy are all built around this conviction.

In Conclusion

The journey toward a sustainable energy future must be paved with accountability, innovation, and circularity. As the world accelerates toward decarbonization, LOHUM stands at the intersection of responsibility and opportunity—powering possibility through sustainable battery materials.

By maximizing recovery, optimizing reuse, and supporting global policies such as EPR for Li-ion battery waste management, LOHUM is building more than just a recycling company—we are engineering the circular energy ecosystem of tomorrow.

LOHUM: Powering Possibility. Circular by Design. Sustainable by Nature.

Visit us at: lithium-ion battery repurposing companies

Originally published on: Blogger

#lohum#critical minerals#li-ion battery waste management#lithium battery reusing and recycling#battery waste management#3 wheeler ev battery#lithium battery waste recycling#reverse logistics for lithium-ion batteries

0 notes

Text

Lithium-Ion Battery Recycling Market Size, Share, and Growth Analysis (2025–2032)

The global shift toward sustainable energy and electrification is driving exponential growth in the lithium-ion battery recycling market. As electric vehicles (EVs), portable electronics, and renewable energy storage systems become increasingly mainstream, the demand for efficient recycling of spent lithium-ion batteries is reaching new heights. Between 2025 and 2032, the lithium-ion battery recycling sector is expected to transition from a niche market to a critical component of the global clean energy ecosystem.

Lithium-Ion Battery Recycling Market size is poised to grow from USD 4.61 Billion in 2024 to USD 18.18 Billion by 2032, growing at a CAGR of 21.6% during the forecast period from 2025 to 2032, depending on technology adoption rates, regulatory enforcement, and supply chain dynamics. This explosive growth is driven primarily by the surge in electric vehicle (EV) usage and the increasing emphasis on circular economy practices across industries.

Request Sample of the Report - https://www.skyquestt.com/sample-request/lithium-ion-battery-recycling-market

Market Segmentation Overview

By Battery Chemistry:

Lithium Nickel Manganese Cobalt Oxide (NMC): Dominates the market due to its widespread application in EVs.

Lithium Iron Phosphate (LFP): Gaining ground, especially in the Chinese market.

Lithium Cobalt Oxide (LCO): Primarily used in portable electronics like smartphones and laptops.

Others: Include lithium manganese oxide (LMO) and lithium titanate (LTO).

By Source:

Electric Vehicles (EVs): Largest and fastest-growing segment, expected to dominate throughout the forecast period.

Consumer Electronics: Includes smartphones, laptops, tablets, and wearables.

Industrial Batteries: Used in energy storage systems (ESS), robotics, and backup power applications.

By Recycling Process:

Hydrometallurgical Processing: Uses aqueous solutions to recover metals. It is more environmentally friendly and energy-efficient.

Pyrometallurgical Processing: Involves high-temperature smelting, less eco-friendly but widely used.

Direct Recycling: An emerging technology that retains cathode structure to save energy and material costs.

Get Customized Reports with your Requirements - https://www.skyquestt.com/speak-with-analyst/lithium-ion-battery-recycling-market

Regional Insights

Asia-Pacific: The Global Leader - Asia-Pacific, led by China, Japan, South Korea, and India, dominates the global lithium-ion battery recycling market. China's aggressive EV targets and control over global battery supply chains have made it a recycling powerhouse. The region accounts for over 50% of global market share and is home to industry leaders like GEM Co., CATL, and BYD.

Europe: Rapid Regulatory and Market Expansion - Europe is expected to see the fastest growth rate during the forecast period, supported by stringent EU regulations, an ambitious Green Deal, and the rising number of EVs on the road. Germany, Norway, and France are at the forefront, investing in closed-loop battery systems and recycling infrastructure.

North America: Investment in Infrastructure - The United States and Canada are investing heavily in recycling facilities to reduce dependence on imported materials. Companies like Redwood Materials, Li-Cycle, and American Battery Technology Company are scaling up domestic recycling operations to support local EV and electronics industries.

Competitive Landscape

The market is highly competitive and fragmented, with a mix of established players and innovative startups. Major players include:

Li-Cycle (Canada)

Umicore (Belgium)

GEM Co. Ltd. (China)

Retriev Technologies (U.S.)

Redwood Materials (U.S.)

Neometals (Australia)

These companies are investing in advanced recycling technologies, strategic partnerships with automakers, and global expansion to capture market share.

Read More for Better Understanding - https://www.skyquestt.com/report/lithium-ion-battery-recycling-market

Key Growth Drivers

Explosive EV Market Growth - Electric vehicles are a primary catalyst behind the rising demand for lithium-ion battery recycling. As EV production ramps up to meet climate goals, millions of batteries are expected to reach end-of-life status over the next decade. Recycling these batteries will be essential not only for sustainability but also for cost reduction and resource conservation.

Rising Demand for Critical Raw Materials - Lithium, cobalt, nickel, and manganese are essential metals used in lithium-ion battery production. However, these materials are limited in supply, expensive to mine, and geographically concentrated in a few countries. Recycling presents a practical and economically viable method for recovering these valuable elements and ensuring a stable supply chain for future battery manufacturing.

Stringent Environmental Regulations - Governments worldwide are introducing legislation mandating the safe disposal and recycling of batteries. Policies such as the EU Battery Directive, the U.S. Department of Energy's battery recycling R&D programs, and various EPR (Extended Producer Responsibility) laws are setting ambitious targets for battery collection and reuse. These initiatives are expected to significantly boost the recycling market.

Sustainability and ESG Goals - Corporate sustainability commitments and investor pressure are prompting automotive and tech companies to adopt circular practices. Recycling lithium-ion batteries aligns with environmental, social, and governance (ESG) goals, helping firms lower their carbon footprints and reduce dependency on raw material mining.

Challenges Facing the Market

Despite its potential, the lithium-ion battery recycling market is not without obstacles:

High Initial Costs: Setting up recycling plants with advanced processing technology requires substantial investment. Smaller companies often face financial hurdles in scaling up operations.

Lack of Standardization: Battery packs vary widely in design, chemistry, and size, making it difficult to implement a one-size-fits-all recycling process.

Collection and Logistics: Efficiently collecting, transporting, and disassembling used batteries is logistically complex and can be hazardous without proper handling procedures.

Regulatory Inconsistencies: Diverse and evolving regulations across countries create compliance burdens and hinder global operational efficiency.

Future Outlook and Opportunities

The future of the lithium-ion battery recycling market is promising, with numerous opportunities for innovation, policy leadership, and market expansion. Advancements in AI-powered battery sorting, robotic disassembly, and eco-friendly chemical processing are expected to transform the industry. Additionally, global cooperation on setting standards and supporting innovation through funding and R&D will be crucial. Governments that incentivize local recycling infrastructure and support circular battery value chains will be better positioned to capitalize on the economic and environmental benefits.

#Lithium-Ion Battery Recycling Market#Lithium-Ion Battery Recycling Industry#Lithium-Ion Battery Recycling Market Size#Lithium-Ion Battery Recycling Market Forecast

0 notes

Text

Investment Insights: Growth Pathways in the Electric Scooter Market

Introduction

The global electric scooter market is riding a wave of innovation, environmental awareness, and urban transformation. As cities become more congested and climate change concerns rise, electric scooters (e-scooters) have emerged as a viable alternative for short-distance commuting. Combining eco-friendliness, affordability, and convenience, these two-wheelers are changing the face of personal mobility.

In the coming decade, the market is expected to witness explosive growth, driven by technological innovation, government incentives, and a shift toward sustainable urban transport systems. From shared micro-mobility platforms to private e-scooter ownership, the demand is surging globally.

Market Overview

Market Size and Forecast

In 2023, the global electric scooter market was valued at approximately USD 25.3 billion. By 2032, it is projected to reach USD 68.9 billion, expanding at a compound annual growth rate (CAGR) of 11.4%. Asia-Pacific dominates the current market, but North America and Europe are rapidly catching up due to supportive regulatory frameworks and urban mobility trends.

Download a Free Sample Report:-https://tinyurl.com/5n82xejv

Key Market Drivers

Environmental Awareness and Sustainability

E-scooters contribute significantly to reducing carbon emissions. With increasing global concern about air quality and fossil fuel dependency, electric scooters are being viewed as a climate-friendly solution to last-mile transportation.

Rising Urbanization and Traffic Congestion

Over 56% of the world's population now lives in urban areas. The resulting traffic congestion has created a demand for compact, efficient, and fast transport solutions. E-scooters provide a seamless alternative for intra-city commuting.

Government Initiatives and Incentives

Many countries are implementing incentives like subsidies, tax rebates, and exemption from registration fees to encourage the adoption of electric vehicles, including scooters. Infrastructure development, such as dedicated lanes and charging points, is also boosting adoption.

Tech-Driven Ecosystem

The integration of IoT, GPS, Bluetooth, and smartphone apps in modern e-scooters is creating a smart, user-friendly experience. Features like anti-theft systems, location tracking, and ride analytics are enhancing value for both private owners and shared fleets.

Market Segmentation

By Product Type

Retro E-Scooters

Folding E-Scooters

Self-balancing E-Scooters

Folding e-scooters are increasingly popular among commuters for their portability and ease of storage, while retro-style models appeal to style-conscious consumers.

By Battery Type

Sealed Lead Acid (SLA)

Lithium-ion (Li-ion)

Nickel Metal Hydride (NiMH)

Lithium-ion batteries dominate the market due to their superior energy density, lightweight design, and long lifecycle. Future innovations are expected to further reduce charging time and improve range.

By Voltage

36V

48V

60V

Above 60V

High-voltage scooters are preferred for better performance, especially in rugged terrains or longer-distance rides.

By End User

Personal Use

Commercial Use (Rental/Sharing Platforms)

While personal use continues to grow, shared e-scooter programs led by companies like Lime, Bird, and Tier are transforming urban mobility in smart cities.

Regional Insights

Asia-Pacific

The APAC region, led by China, India, and Japan, is the largest e-scooter market, driven by dense urban populations, low manufacturing costs, and supportive government policies. China accounts for a majority of global sales, thanks to early adoption and local innovation.

Europe

Europe is seeing robust growth due to sustainability mandates, strong public transit integration, and the rapid expansion of shared mobility ecosystems in countries like Germany, France, and the Netherlands.

North America

North America, particularly the U.S., is witnessing rising e-scooter adoption in metropolitan areas. The micromobility movement and electrification policies are prompting investments in infrastructure and innovation.

Latin America & Middle East and Africa

These regions are emerging markets, with growth expected due to urbanization, affordability of e-scooters, and lack of public transportation in certain areas. Latin America is also showing interest in integrating micromobility with broader transportation networks.

Industry Trends

Shared Mobility Boom

Cities are increasingly partnering with private operators to deploy dockless e-scooters, improving accessibility and reducing reliance on private cars. App-based rentals with pay-per-minute models are gaining traction among tourists and daily commuters.

Battery Swapping Models

Battery swapping stations are emerging as a game-changing innovation, especially in countries with limited charging infrastructure. Players like Gogoro have successfully implemented this model in Taiwan, and others are following suit.

Subscription and Leasing Models

To make e-scooters more accessible, companies are launching subscription-based models, allowing users to lease scooters for a fixed monthly fee, which includes maintenance and insurance.

Enhanced Safety Features

Manufacturers are focusing on integrating advanced braking systems, regenerative braking, anti-lock braking systems (ABS), and rider assistance technologies to improve safety and gain regulatory approvals.

Smart Integration and AI

AI and machine learning are being used for predictive maintenance, route optimization, and fleet management in commercial and shared applications.

Challenges and Restraints

Regulatory Hurdles

The legality and safety of e-scooters vary widely across jurisdictions. Speed limits, helmet mandates, and insurance requirements often create confusion and hinder adoption.

Infrastructure Gaps

Lack of dedicated lanes, charging points, and safe parking zones is a major barrier, particularly in developing countries and high-traffic metro areas.

Battery and Range Anxiety

Despite improvements, limited range and long charging times are still concerns for users, especially in regions with underdeveloped EV charging networks.

Durability and Vandalism in Shared Fleets

Shared e-scooters are often subjected to vandalism, rough usage, and adverse weather, increasing operational costs and reducing fleet longevity.

Competitive Landscape

The electric scooter market is highly fragmented, with global players and regional startups battling for market share. Some key players include:

NIU Technologies

Segway-Ninebot

Yadea Group Holdings Ltd.

Hero Electric

TVS Motor Company

Gogoro Inc.

Lime

Bird Rides, Inc.

Ather Energy

Ola Electric

These companies are investing heavily in R&D, new model launches, geographic expansion, and strategic collaborations to gain a competitive edge.

Future Outlook (2024–2032)

The electric scooter market is on an accelerated growth trajectory as urban transportation continues to shift toward sustainable and efficient alternatives. Future developments will include:

Long-range scooters with fast-charging capabilities

Integration with public transport networks for seamless commuting

AI-powered rider assistance and enhanced safety tech

Global expansion of battery-swapping infrastructure

Wider adoption of recyclable and eco-friendly materials

Conclusion

The electric scooter market is more than just a trend—it represents a fundamental shift in how people move through cities. With increasing demand for clean, cost-effective, and flexible transportation, e-scooters are becoming a core component of future urban mobility ecosystems. As technology matures and infrastructure catches up, the market will not only expand in volume but also in depth, impacting transportation, sustainability, and lifestyle worldwide.Read Full Report:-https://www.uniprismmarketresearch.com/verticals/automotive-transportation/electric-scooter

0 notes

Text

Battery Aging and Testing System for Modern Energy Storage Solutions

In the rapidly evolving field of battery technology, efficient and accurate battery aging and performance testing systems are essential for quality control and R&D. The 60V 20A 40-Channel Battery Charge-Discharge System (BCDS) represents a next-generation solution for comprehensive battery module testing and is ideal for testing pouch cell, li on pouch cell, and lithium pouch cell batteries.

Broad Application Across Battery Chemistries

This system is designed to support a wide array of battery types including lithium-ion (NMC, LFP), lead-acid, nickel-metal hydride, and nickel-cadmium. It accommodates both co-port and split-port battery configurations, making it highly versatile for manufacturers and developers of battery-powered devices, including vacuum cleaners, electric tools, and electric scooters. It is also compatible with lithium battery systems and pouch cell battery pack configurations.

Key Functional Capabilities

The testing system offers an impressive range of functionalities: • Cycle Life Testing to evaluate long-term durability • Capacity Testing for understanding usable energy • Charge/Discharge Characteristic Testing for performance profiling • Thermal Characteristic Testing to monitor battery response under varying temperatures It also works effectively as a lithium-ion battery capacity tester for prismatic cell testing scenarios.

Sophisticated Design and Composition

The system integrates a power module, AC/DC bi-directional inverter, control unit, heat dissipation system, data acquisition hardware, and a software-driven upper computer system for data processing. It supports centralized control via networked management and offers remote monitoring.

Engineered for high-precision tasks, it is especially useful when paired with high voltage prismatic cell tester setups for advanced R&D.

Precision, Protection, and Performance

Engineered for precision, the system achieves ±0.05% accuracy and features independent control across its 40 channels. It includes robust software and hardware protections such as: • Reverse connection protection • Overvoltage and overcurrent cutoffs • Power-off continuation to resume tests after outages • Real-time abnormality captures and alarm features

All operations—from constant current charging to constant voltage transitions—are seamless, eliminating current surges and protecting battery integrity during testing. This precision makes it highly suitable for lithium-ion pouch cell applications.

Intelligent Software Control

Operators benefit from a fully programmable software interface that supports: • Step-by-step test sequence customization • Nested loop test execution • Real-time log tracking and fault detection • Excel-based data exports and multi-parameter graphing • Barcode and QR code integration for traceability

Each channel functions autonomously, allowing fully independent charge-discharge testing with programmable voltage (0V–60V) and current (100mA–10A) ranges.

Technical Specifications

• Channel Count: 40, each operating independently • Voltage Range: 0–60V with 1mV resolution • Current Range: ±10A with 1mA resolution • Response Time: <10ms for rapid current transition • Output Power: 1.2kW per channel with 0.1% FS stability • Data Interval: Configurable, as frequent as every second

Enhanced Safety and Maintenance

Safety is paramount, with built-in hardware for emergency cut-offs and software-based over-temperature and reverse polarity protections. The modular construction supports fast servicing with spare parts availability and regular software updates. Additionally, when integrated with laser welding machine, laser welding equipment, or laser fiber welding machine, the system supports a seamless battery pack production and testing flow.

For manufacturers in India, this system also pairs well with laser welding machine in India options and portable laser welding machine setups for lab or factory environments. It's also a perfect companion to a lithium-ion battery spot welding machine for complete cell assembly and verification.

Conclusion

This battery testing system is tailored for manufacturers aiming to maintain high standards in energy storage products while ensuring safety, traceability, and operational efficiency. Whether for production line QA or R&D labs, it sets a benchmark for comprehensive battery testing—especially for pouch cell battery, prismatic cells, and advanced lithium-ion pouch cell applications.

#high voltage prismatic cell tester#laser fiber welding machine#laser welding equipment#laser welding machine#laser welding machine in India#li on pouch cell#lithium battery systems#lithium pouch cell#lithium-ion battery capacity tester for prismatic cell#lithium-ion battery spot welding machine#lithium-ion pouch cell#portable laser welding machine#pouch cell#pouch cell battery#pouch cell battery pack

0 notes

Text

Zeolites Market Global Size Type Segmentation Regional Analysis Company Share Key Players and Forecast 2025 2035

Zeolite Market Overview: Growth, Trends, and Insights

The global Zeolite Market was valued at USD 14.35 billion in 2024 and is anticipated to reach USD 25.73 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.45% from 2025 to 2035. Zeolites, both natural and synthetic, are crucial materials utilized in various industrial applications, including ion exchange, catalysis, and adsorption. These materials are widely used in industries such as detergents, petrochemicals, water treatment, agriculture, and construction. This steady market growth is largely driven by environmental concerns, especially in the detergent industry, which is transitioning from phosphate-containing products to eco-friendly water purification chemicals.

Get free sample Research Report - https://www.metatechinsights.com/request-sample/2135

Zeolite Applications and Market Demand

The demand for zeolites is growing across multiple industries, with the petrochemical industry being one of the largest consumers. Zeolites are employed as catalysts in refining processes, enhancing the efficiency and quality of petroleum products. Additionally, the increasing use of zeolites in gas separation technologies and carbon capture is expanding their market potential. The Asia-Pacific region leads the market due to the high level of industrialization and the growing demand for environmentally friendly products in countries like China and India. Looking ahead, the adoption of nanotechnology in fields like renewable energy and healthcare is expected to drive further growth in the zeolite market.

Key Drivers of Zeolite Market Growth

Eco-Friendly Detergents and Phosphate-Free Formulations The shift towards phosphate-free detergents is one of the primary drivers of the zeolite market. Phosphates, used traditionally in detergents, have a negative impact on the environment, contributing to water pollution, eutrophication, and the formation of harmful algal blooms. As a result, governments are implementing tighter regulations on phosphate use, prompting the detergent industry to adopt more environmentally friendly alternatives, such as zeolites. These eco-friendly detergents are biodegradable and reduce toxic chemical emissions, aligning with the global trend towards sustainable consumer products.

Increasing Water Treatment Applications The growing need for wastewater purification and softening solutions is significantly driving the demand for zeolites. Industrialization and urbanization have led to higher concentrations of water pollutants, necessitating effective water treatment technologies. Zeolites facilitate the removal of heavy metals, ammonia, and other harmful ions through ion exchange, making them ideal for water purification in both municipal and industrial settings. Additionally, zeolites contribute to improving water quality, reducing scale buildup, and enhancing energy efficiency in various industries. As governments and industries invest in water conservation and treatment technologies, zeolite usage in water purification is expected to rise.

Expanding Petrochemical Industry Usage The petrochemical industry continues to grow, with zeolite catalysts playing a pivotal role in refining processes. Zeolites are extensively used in catalytic cracking (FCC), hydrocracking, and isomerization, which help produce high-quality fuels such as gasoline, diesel, and jet fuel. These catalysts are valued for their high surface area, molecular sieve characteristics, and ability to reduce byproducts during refining. As global energy demand increases, the use of zeolites in petrochemical refining is set to grow, especially in Asia-Pacific countries like China and India, which are experiencing rapid industrial growth.

Challenges and Market Restraints

High Raw Material and Manufacturing Costs One of the key challenges facing the zeolite market is the high cost of raw materials and the capital-intensive processes required for zeolite production. Mining natural zeolites and synthesizing synthetic zeolites require specialized equipment and energy-intensive methods, which contribute to elevated production costs. Furthermore, fluctuating raw material prices, including aluminosilicates, and logistical expenses, add to the final product's price. Manufacturers are under pressure to find cost-effective production methods while maintaining product quality.

Environmental Regulations and Compliance Costs Environmental control measures on mining and emissions are becoming stricter, leading to increased compliance costs for manufacturers. These regulations can negatively impact profit margins and present challenges for small and medium-sized enterprises (SMEs) that may struggle to compete with larger, more established players. However, there is a growing focus on developing more efficient and sustainable manufacturing processes to address these challenges.

Read Full Research Report https://www.metatechinsights.com/industry-insights/zeolites-market-2135

Zeolite Market Segmentation

The zeolite market is segmented by type and function.

By Type: Natural and Synthetic Zeolites Zeolites are classified into natural and synthetic types, each with distinct applications. Natural zeolites, such as clinoptilolite, mordenite, and chabazite, are commonly used in water treatment, agriculture, and gas purification due to their strong ion exchange and adsorption capabilities. Synthetic zeolites, such as zeolite A, X, Y, P, and Beta, are primarily utilized in petrochemical catalysis, detergents, and industrial gas separation because of their high purity and well-defined pore structures. While both types are essential, the natural zeolite segment is expected to grow faster due to its environmentally friendly advantages and lower costs in applications like water purification and soil conditioning.

By Function: Ion Exchange, Catalysis, and Adsorption Zeolites serve three main functions in industrial applications: ion exchange, catalysis, and adsorption/separation. In ion exchange, zeolites are used for water softening, cleaning agents, and water recycling. They also serve as catalysts in the petrochemical industry, particularly in fluid catalytic cracking (FCC) and hydrocracking processes. In adsorption and separation, zeolites are utilized for gas purification, moisture control, natural gas processing, and carbon capture technologies. The demand for zeolites in these functions is growing, especially in light of increasing environmental concerns and the push for more sustainable technologies.

Regional Market Analysis

North America North America is a prominent market for zeolites, driven by strong demand in water treatment, petrochemical refining, and detergent sectors. The region’s advanced oil and gas industry heavily relies on zeolite catalysts for refining processes like fluid catalytic cracking (FCC) and hydrocracking. Additionally, rising water pollution and a growing focus on environmental conservation are boosting the use of zeolites in water purification and air cleaning applications. Consumer preferences for phosphate-free detergents and sustainable products are also contributing to market growth in North America.

Asia-Pacific The Asia-Pacific region is the most promising market for zeolites, thanks to rapid industrialization, urbanization, and increasing environmental concerns. Countries like China, India, and Japan are major consumers of zeolites in water treatment, petrochemical refining, and detergent manufacturing. The region’s burgeoning construction industry is also driving the demand for zeolite-based materials in cement and lightweight concrete. Furthermore, growing calls for cleaner air and water are increasing the use of zeolites in gas and water purification processes. The government’s emphasis on sustainable and green technologies is further accelerating market growth in Asia-Pacific.

Competitive Landscape

The zeolite market is highly competitive, with numerous global and regional players vying for market share. Major companies like Honeywell International Inc., Clariant AG, BASF SE, Tosoh Corporation, and Zeochem AG are leading the market with significant investments in research and development. Manufacturers in the Asia-Pacific region, particularly in China and India, are ramping up production to meet domestic and international demand. With increasing competition and rising consumer preference for sustainable products, companies are focusing on developing advanced zeolite materials for catalysis, adsorption, and water treatment applications.

Buy Now https://www.metatechinsights.com/checkout/2135

Recent Developments in the Zeolite Market

In February 2024, ZEOCHEM announced that its global R&D teams would focus on developing innovative zeolite solutions, including the development of 3A and 4A molecular sieves. This move aims to create tailored solutions and new products to meet specific customer needs.

In March 2023, International Zeolite commissioned a new production plant in Jordan, Ontario. This facility is expected to help the company meet its daily production capacity of 25 tons and enhance its NEREA nutrient delivery products.

0 notes

Text

Global Battery Metals Market Analysis: Key Players and Emerging Opportunities

Surging Electric Vehicle Production and Energy Storage Needs Propel Growth in the Battery Metals Market.

The Battery Metals Market size was USD 10.6 Billion in 2023 and is expected to reach USD 21.3 Billion by 2032 and grow at a CAGR of 8.1% over the forecast period of 2024-2032.

The Battery Metals Market is experiencing rapid growth due to the increasing demand for electric vehicles (EVs), renewable energy storage, and consumer electronics. Battery metals such as lithium, cobalt, nickel, and manganese are essential components in the production of rechargeable batteries, particularly lithium-ion batteries used in EVs and energy storage systems. The shift towards sustainable energy solutions and net-zero carbon goals is driving investments in battery metal extraction, processing, and recycling technologies.

Key Players in the Battery Metals Market

3M (Scotchshield Insulation, Novec Dielectric Fluids)

BASF SE (Cathode Active Materials, Battery Binders)

DowDuPont (BETASEAL Adhesives, Hytrel Resins)

Entek (Separators, AGM Battery Materials)

Ecopro (High-Nickel Cathode Materials, Battery Recycling Systems)

Hitachi Chemical Co. Ltd (Graphite Anodes, Solid-State Electrolytes)

Mitsubishi Chemical Corporation (Electrolytes, Carbon Nanotubes)

Nippon Denko Co. Ltd (Manganese, Lithium Battery Additives)

Solvay (PVDF Binders, Battery Electrolyte Salts)

Celgard LLC (Microporous Separators, Polypropylene Separators)

Future Scope of the Market

The Battery Metals Market is expected to expand significantly due to:

Surging demand for electric vehicles (EVs) and energy storage solutions.

Increased investment in mining and refining projects to secure metal supply chains.

Government policies and incentives supporting battery material production.

Expansion of battery recycling initiatives to ensure a sustainable supply of metals.

Technological advancements in battery chemistry, reducing reliance on scarce materials.

Emerging Trends in the Battery Metals Market

The market is evolving rapidly with a strong focus on supply chain security and sustainability. Governments and companies worldwide are investing in domestic mining and refining operations to reduce dependence on foreign supply chains, particularly from China. The push for ethical and responsible mining is gaining traction, with efforts to develop traceable and conflict-free battery metals. Additionally, solid-state batteries and new cathode chemistries are being researched to reduce reliance on expensive and environmentally challenging metals like cobalt. Battery recycling technologies are also gaining momentum to create a circular economy for battery materials, reducing environmental impact and supply risks.

Key Points:

Surging demand for EVs and energy storage solutions driving battery metal consumption.

Governments and companies investing in local mining and refining capacities.

Focus on sustainable and ethical sourcing of battery metals.

Battery recycling emerging as a critical solution for long-term supply security.

Advancements in battery technology aiming to reduce dependence on scarce metals.

Conclusion

The Battery Metals Market is on a strong growth trajectory, driven by the global transition to clean energy and electric mobility. As demand for EVs and energy storage systems rises, securing a stable and sustainable battery metal supply chain will be crucial. Innovations in battery chemistry, recycling, and responsible sourcing will shape the future of the industry, ensuring long-term sustainability and energy security.

Read Full Report: https://www.snsinsider.com/reports/battery-metals-market-1690

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Battery Metals Market#Battery Metals Market Size#Battery Metals Market Share#Battery Metals Market Report#Battery Metals Market Forecast

0 notes

Text

The Battery Manufacturing Industry: Trends, Technological Advancements, and Regulatory Guidelines

The battery manufacturing industry is experiencing rapid growth, driven by increasing demand for energy storage solutions across various sectors, including electric vehicles (EVs), consumer electronics, and renewable energy systems. This article explores the latest trends, technological advancements, and regulatory guidelines shaping the industry, with a particular focus on battery pack manufacturer.

Trends in the Battery Manufacturing Industry

Rising Demand for Energy Storage Solutions The global transition towards clean energy and the electrification of transportation have significantly boosted demand for advanced batteries. Lithium-ion batteries, particularly those produced by battery pack manufacturers, are the preferred choice for electric vehicles and portable electronic devices due to their high energy density, lightweight design, and extended lifespan.

Shift Towards Sustainability With increased environmental concerns, manufacturers are adopting eco-friendly production methods. Recycling processes and the development of battery chemistries with reduced reliance on rare metals are key focus areas. Companies are also exploring solid-state batteries, which offer improved safety and energy density compared to conventional liquid electrolyte-based batteries.

Integration of AI and IoT The incorporation of Artificial Intelligence (AI) and the Internet of Things (IoT) into battery management systems (BMS) is revolutionizing the industry. Battery pack manufacturers are increasingly equipping their products with AI-powered BMS to optimize charging and discharging cycles, enhance battery efficiency, and predict maintenance needs, thereby prolonging battery life.

Technological Advancements

Battery Pack Manufacturing Innovations Leading battery pack manufacturers are investing in cutting-edge technologies to enhance performance, safety, and efficiency. Smart battery packs with built-in sensors and communication interfaces are becoming increasingly popular in industries where reliability and real-time monitoring are essential.

LFP Batteries (Lithium Iron Phosphate) Lithium Iron Phosphate (LFP) batteries are emerging as a safer and more durable alternative to traditional lithium-ion batteries. Their lower cost, enhanced thermal stability, and longer cycle life make them ideal for energy storage systems and electric vehicles, particularly in applications where safety is a priority.

Solid-State Batteries The development of solid-state batteries is one of the most promising advancements in the industry. These batteries replace the liquid electrolyte with a solid electrolyte, enhancing safety and energy density. Companies like QuantumScape and Toyota are investing heavily in this technology, aiming to bring it to market within the next few years.

Regulatory Guidelines

Safety Standards and Certifications International standards such as IEC 62133 and IEC 62619 are crucial for ensuring the safety and reliability of battery systems. Battery pack manufacturers must adhere to these standards to mitigate risks such as thermal runaway, short circuits, and overcharging.

Environmental Regulations Governments worldwide are implementing stricter regulations to address the environmental impact of battery manufacturing. Policies focus on promoting recycling, reducing hazardous materials, and encouraging the use of sustainable resources in battery production.

Battery Recycling Mandates As the global demand for batteries continues to rise, efficient recycling processes are becoming increasingly important. The European Union’s Battery Directive and similar regulations in other countries aim to establish frameworks for the collection, recycling, and disposal of used batteries.

Conclusion

The battery manufacturing industry is undergoing a transformation fueled by technological advancements, increased demand for energy storage, and stricter regulatory guidelines. Battery pack manufacturers are at the forefront of this evolution, offering improved performance, safety, and sustainability. As the industry continues to innovate, manufacturers, researchers, and policymakers must work together to address emerging challenges and unlock the full potential of modern battery technologies.

0 notes

Text

Isooctanoates and Neodecanoates: Multi-Industry Applications and Watson’s Technological Advantages In modern industrial applications, isooctanoates and neodecanoates are widely used across various industries due to their exceptional chemical stability and excellent solubility. These industries include resins, rubber catalysts, coatings and paint additives, driers, plastic heat stabilizers, and fuel combustion aids. As a leader in advanced chemical solutions, Watson has accumulated extensive technical expertise in these fields and continuously optimizes its production processes to provide high-quality products to global customers. Core Applications of Isooctanoates and Neodecanoates - Resin and Rubber CatalystsIsooctanoates and neodecanoates serve as highly efficient catalysts that facilitate polymerization reactions, increase reaction rates, and enhance the mechanical properties of the final products. For instance, in the synthesis of polyurethane resins and rubber materials, zinc, cobalt, and manganese isooctanoates or neodecanoates are commonly used as catalysts to ensure superior heat and weather resistance. - Coatings and Paint AdditivesThese organic salts function primarily as driers and dispersing agents in the coatings and paint industry, significantly improving the leveling, wear resistance, and corrosion resistance of coatings. For example, cobalt, zirconium, and bismuth isooctanoate driers are widely applied in alkyd resin paints to ensure fast curing while maintaining excellent gloss and adhesion. - Plastic Heat StabilizersIn the plastics industry, isooctanoates and neodecanoates are often combined with metals such as barium, cadmium, and zinc to form high-efficiency heat stabilizers. These stabilizers prevent plastic degradation during high-temperature processing and prolonged use, thereby extending the lifespan of plastic products. - Fuel Combustion AidsDue to their excellent solubility and combustion-promoting properties, isooctanoates and neodecanoates are widely used in fuel combustion aids. These additives enhance fuel combustion efficiency, reduce carbon deposits, lower emissions, and improve engine fuel economy. Watson’s Leading Advantages in This Field - Mature Production Capabilities for Multiple Metal TypesWatson possesses strong technical expertise in synthesizing organometallic compounds of transition metals (cobalt, manganese, copper, zinc, iron, nickel, chromium, zirconium, bismuth), alkali metals (lithium, sodium, potassium, strontium, barium, calcium, magnesium), rare earth metals (scandium, yttrium, lanthanum, cerium, praseodymium, neodymium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium), and noble metals (indium, gallium, gold, silver, antimony, hafnium, vanadium, titanium). This enables Watson to provide customized isooctanoate and neodecanoate products tailored to customer requirements. - Advanced Production Processes and Quality ControlWatson employs cutting-edge process optimization technologies, ensuring rigorous control at every stage from raw material selection to final product refinement. This guarantees outstanding stability, purity, and consistency in its products. Additionally, the company has established a stringent quality control system to ensure that each batch meets international standards and satisfies the high-end demands of various application scenarios. - Customized SolutionsGiven the diverse performance requirements of organic salts in different applications, Watson offers highly targeted customization services to optimize customer production processes. For example, for the high-end coatings industry, Watson provides isooctanoate driers with different metal ion compositions to meet specific drying speed, weather resistance, and environmental requirements. - Global Brand Coverage StrategyWatson actively expands its brand influence worldwide and has registered the ChemWhat brand to further solidify its leadership position in the chemical industry. The establishment of the ChemWhat brand not only enhances Watson’s international market recognition but also facilitates the global promotion and application of its products. Through this brand strategy, Watson can better serve customers in different regions and ensure that its high-quality products and technological solutions meet global market demands. As functional organometallic salts, isooctanoates and neodecanoates play a critical role in various industries. Watson remains at the forefront of this field with its extensive technological expertise, broad product coverage, high-quality control standards, and global brand expansion. Moving forward, Watson will continue to drive innovation, advance organometallic compound technologies, and provide superior and more efficient solutions to customers worldwide. https://www.youtube.com/watch?v=RiE5OJHvr38 References Chromic Octoate CAS 3444-17-5 on Watson Isooctanoate on Watson Read the full article

0 notes

Text

With global warming on the rise, it has become imperative to reduce fossil fuel dependency and switch to alternate green energy sources. The development of electric vehicles is a move towards this direction. However, electric vehicles require high energy density batteries for their functioning, and conventional lithium-ion batteries are not up to the task. Theoretically, lithium-air batteries provide a higher energy density than lithium-ion batteries. However, before they can be put to practical use, these batteries need to be made energy efficient, their cycle characteristics need to be enhanced, and the overpotential needed to charge/discharge the oxygen redox reaction needs to be reduced. To address these issues, a suitable catalyst is needed to accelerate the oxygen evolution reaction (OER) inside the battery. The OER is an extremely important chemical reaction involved in water splitting for improving the performance of storage batteries. Rare and expensive noble metal oxides such as ruthenium(IV) oxide (RuO2) and iridium(IV) oxide (IrO2) have typically been used as catalysts to expedite the OER of metal-air batteries. More affordable catalytic materials include transition metals, such as perovskite-type oxides and hydroxides, which are known to be highly active for the OER. CoSn(OH)6 (CSO) is one such perovskite-type hydroxide that is known to be a promising OER catalyst. However, current methods of synthesizing CSO are slow (require over 12 hours) and require multiple steps.

Read more.

#Materials Science#Science#Energy#Batteries#Lithium air batteries#Efficiency#Catalysts#Reactions#Perovskites#Materials synthesis#Shibaura Institute of Technology

9 notes

·

View notes

Text

The Future of Space Exploration: How Technology is Pushing Boundaries

Space exploration has entered an exciting new era, driven by advancements in technology, robotics, and AI. With missions to Mars, space tourism, and the potential for human settlements on other planets, the future of space travel is closer than ever. Let’s explore how technology is shaping the next frontier of exploration.

1. The Rise of Private Space Companies

Government agencies like NASA and ESA no longer dominate space exploration. Private companies such as SpaceX, Blue Origin, and Virgin Galactic are leading the charge, making space travel more accessible and commercially viable. If you're interested in how technology is revolutionizing space travel, check out Tech in Rush.

Major Private Space Players

SpaceX – Leading in reusable rockets and Mars colonization plans.

Blue Origin – Focused on space tourism and lunar missions.

Virgin Galactic – Bringing commercial space tourism closer to reality.

Rocket Lab – Specializing in small satellite launches.

2. The Mission to Mars: What’s Next?

Mars colonization is one of humanity’s most ambitious goals. NASA’s Artemis program and SpaceX’s Starship mission are setting the foundation for long-term human presence on the Red Planet. If you're interested in Mars exploration advancements, visit Tech Nest.

Key Mars Exploration Technologies

Reusable Rockets – Reduce the cost of deep-space travel.

Autonomous Rovers – AI-powered rovers mapping the Martian surface.

3D-Printed Habitats – Future homes built using Martian soil.

Sustainable Life Support Systems – AI-managed water and oxygen supply.

To explore how space tech is driving scientific discoveries, check out Wizaca UK.

3. AI and Robotics in Space Exploration

Artificial intelligence and robotics play a crucial role in deep-space missions, from autonomous navigation to predictive maintenance. To learn more about how AI is shaping space travel, visit Tech Arps.

AI Innovations in Space

Autonomous Spacecraft Navigation – Reducing human intervention.

AI-Enhanced Satellites – Improving Earth monitoring and weather predictions.

Robotic Arms on Space Stations – Handling maintenance and experiments.

Smart Space Telescopes – AI-powered imaging for deep-space observation.

If you're also interested in how space exploration influences futuristic fashion, check out Baddie Hub.

4. Space Tourism: The Next Big Industry

Space tourism is transitioning from science fiction to reality. Companies are already conducting suborbital flights, with ambitions for orbital hotels and moon tourism. If you're curious about the commercialization of space travel, check out Tech Ion.

Upcoming Space Tourism Milestones

Suborbital Flights – Brief space experiences for civilians.

Luxury Space Hotels – Floating accommodations in orbit.

Moon Base Expeditions – Private lunar tourism in the next decade.

Zero-Gravity Experiences – Commercial flights offering weightless travel.

5. Space Mining: The Future of Resource Extraction

Asteroids contain valuable metals and minerals that could revolutionize industry and space travel. Space mining companies are working on ways to extract these resources efficiently. To explore how asteroid mining is shaping future economies, visit Erome Solutions.

Key Developments in Space Mining

Asteroid Prospecting – AI-driven satellites identifying resource-rich asteroids.

Autonomous Mining Robots – Extracting materials in space.

Lunar Resource Utilization – Using the Moon’s resources for fuel and construction.

Space-Based Manufacturing – Reducing costs by building structures in space.

6. The Future of Space Colonization

Looking beyond Mars, scientists are researching the feasibility of colonizing moons, exoplanets, and even building massive space habitats. If you're interested in what’s next for human expansion beyond Earth, visit Wizaca India.

Potential Space Colonization Plans

Lunar Bases – The Moon as a launchpad for deep-space missions.

O’Neill Cylinders – Large, self-sustaining space habitats.

Terraforming Mars – Modifying the Martian climate for human survival.

Interstellar Travel Concepts – Theoretical spacecraft capable of reaching other stars.

Final Thoughts

Space exploration is evolving at an unprecedented pace. With private companies, AI-driven technologies, and groundbreaking discoveries, the dream of living beyond Earth is becoming a reality. If you’re looking to stay updated on space technology advancements, visit Wizaca UK.

1 note

·

View note

Text

Closing the Loop: Why Lithium Battery Reusing and Recycling Is the Future—and LOHUM Is Leading the Way

The transition to a cleaner, electrified world is no longer on the horizon—it is actively unfolding. From electric scooters and motorcycles to buses, trucks, and even aircraft, the global push for decarbonized mobility is gaining momentum. At the core of this transformation lies the lithium-ion battery, the powerhouse driving electric vehicles (EVs), portable electronics, and grid-scale renewable storage solutions.

However, the rapid adoption of lithium-ion batteries comes with its own set of challenges. One of the most pressing: What happens to these batteries when they reach the end of their first life? As battery deployment accelerates, the volume of spent batteries is projected to skyrocket. By 2030, analysts predict that more than 2 million metric tonnes of batteries could be retired globally each year. And herein lies both the challenge and the opportunity—building a circular economy for lithium batteries through advanced lithium battery reusing and recycling practices.

The Urgent Need for Battery Circularity

Today, global mining operations are already struggling to meet the demand for lithium, cobalt, and nickel—critical minerals used in battery manufacturing. Establishing new mines is not only capital-intensive and time-consuming but also environmentally contentious, often leading to water scarcity and toxic runoff that disrupts ecosystems and communities.

That’s why battery reuse and recycling are not just an environmental necessity—they are an economic imperative. Recovered materials from used batteries can lower manufacturing costs, decrease reliance on volatile foreign supply chains, and significantly reduce the life-cycle impact of battery production.

At LOHUM, we believe that “Every Battery Deserves a Second Life.” Our vertically integrated ecosystem is designed to create sustainable value from battery materials, whether through second-life energy storage systems, refining of precursor materials, or proprietary recycling technologies.

Lithium Battery Reusing: Extending Value Beyond the Road

An EV battery is typically deemed to have reached its end of life when its capacity falls below 80% of its original rating. However, this does not render the battery useless. On the contrary, batteries retired from EVs can still offer 6 to 10 more years of service in stationary energy storage—an opportunity LOHUM is actively harnessing.

Through modular repurposing and diagnostic-driven refurbishing, functioning modules from retired battery packs are integrated into second-life systems. These are then deployed in applications like solar energy storage, off-grid solutions, and peak-shaving energy grids, allowing organizations to reduce their carbon footprint while optimizing energy usage.

Not only does this extend the lifecycle of lithium-ion batteries, but it also reduces the demand for new battery production, which in turn lowers energy consumption and emissions associated with raw material extraction and manufacturing.

Scaling the Circular Supply Chain with Innovation

One of the key bottlenecks in battery recycling today is technological efficiency. Traditional pyrometallurgical methods, which involve high-temperature smelting, recover valuable metals like cobalt and nickel but often lose lithium and aluminum to slag waste. These processes are also energy-intensive, costly, and environmentally taxing.

In contrast, LOHUM leverages hydrometallurgical and direct recycling processes that offer higher recovery rates with lower environmental impact. A standout innovation in this space is direct cathode recycling, a technique that retains the integrity of the cathode compound and refunctionalizes it through relithiation. Recent studies have shown that this method can even enhance battery performance, with recycled cathodes enabling faster charging and longer life compared to those made from virgin materials.

As a result, LOHUM is able to extract high-purity precursor li-ion battery material from used batteries, transforming waste into a resource. These recovered materials are then reintegrated into our manufacturing pipeline, creating a closed-loop supply chain that is both sustainable and scalable.

Economic and Environmental Impact

The economic case for battery recycling is compelling. Mineral costs make up nearly 50% of the total cost of a lithium-ion battery, and their prices have been notoriously volatile—spiking as much as 300% within a single year. Recycling mitigates this risk by creating a stable, domestic supply of critical materials, reducing dependence on imports and improving energy security.

More importantly, recycling reduces the social and environmental harm associated with mining, particularly for cobalt. Over 60% of the world’s cobalt supply comes from the Democratic Republic of Congo, where mining is often linked to human rights abuses and unsafe working conditions. By reducing demand for newly mined materials, LOHUM is helping reshape the global battery value chain with ethics and sustainability at its core.

Policy and Future Outlook

As demand for batteries continues to surge—forecasted to grow tenfold by 2035—governments and industries alike are recognizing the importance of circularity. For instance, California is working toward ensuring that 100% of EV batteries are recycled or reused. Policies around extended producer responsibility, standardized labelling, and domestic recycling infrastructure are essential steps toward this vision.

At LOHUM, we are not just aligned with these goals—we are helping to define them. Through strategic partnerships, cutting-edge research, and our state-of-the-art recycling facilities, we are actively contributing to a future where battery materials are endlessly renewable and carbon footprints are minimal.

Closing Thoughts

As the electrification movement scales globally, so too must our commitment to sustainability. Lithium battery reusing and recycling is no longer a “nice-to-have”—it is the cornerstone of a resilient, responsible energy ecosystem.

At LOHUM, we are proud to be building that ecosystem today. From precursor li-ion battery material refinement to second-life applications and environmentally sound recycling processes, our vision is clear: Powering the future without compromising the planet.

Let’s close the loop. Let’s electrify responsibly.

Visit us at: 3 wheeler EV Battery

Originally published on: Medium

#lohum#critical minerals#lithium battery reusing and recycling#li-ion battery waste management#3 wheeler ev battery#battery waste management#lithium battery waste recycling#reverse logistics for lithium-ion batteries

0 notes

Text

Automotive Packaging Solutions: Enhancing Efficiency and Protection in the Supply Chain

Introduction

The automotive industry relies on a complex supply chain that spans multiple continents, with manufacturers sourcing components from various suppliers before assembling the final product. To ensure the safe transit of delicate parts, automotive packaging solutions play a crucial role in protecting valuable components from damage, contamination, and inefficiencies. As automotive production evolves, so does the need for smarter, more durable, and sustainable packaging solutions.

This article explores the importance of automotive packaging solutions, the different types available, and how the industry is adapting to new challenges in logistics and sustainability.

Why Automotive Packaging Solutions Matter

Automobile manufacturers and suppliers handle a diverse range of parts, from large body panels to small electrical components. Without proper packaging, these components are at risk of damage due to:

Mechanical impact during handling and transportation

Moisture and corrosion, especially for metal components

Electrostatic discharge (ESD), which can affect sensitive electronic parts

Improper stacking and storage, leading to deformation or inefficiency

High-quality automotive packaging solutions address these risks, ensuring that parts arrive at their destination in optimal condition while minimizing waste and unnecessary costs.

Types of Automotive Packaging Solutions

To meet the varied needs of the automotive sector, packaging solutions come in different forms, each designed for specific applications:

1. Returnable Packaging Solutions

Returnable or reusable packaging systems are gaining popularity in the automotive industry due to their cost-effectiveness and sustainability. These packaging options include:

Plastic totes and bins: Ideal for transporting small parts like screws, nuts, and bolts.

Foldable bulk containers: Used for larger components such as engine parts or transmission units.

Steel racks and pallets: Perfect for heavy and oversized automotive components.

These solutions help manufacturers reduce packaging waste, lower costs, and improve supply chain efficiency.

2. Custom Foam Inserts and Protective Cushioning

Delicate components such as sensors, electronics, and fragile automotive parts require cushioning to absorb shock and vibrations. Foam inserts, air pockets, and honeycomb core packaging provide impact resistance, ensuring safe transportation.

3. Corrosion-Resistant Packaging

Many automotive parts, particularly those made of steel or aluminum, require protection against oxidation and rust. Corrosion-resistant packaging includes:

Vacuum-sealed pouches to remove oxygen exposure.

VCI (Volatile Corrosion Inhibitor) bags that prevent rust formation.

Desiccant packs to absorb moisture and maintain a dry environment.

4. ESD-Safe Packaging for Electronics

Modern vehicles rely heavily on electronic components, including control modules, sensors, and lithium-ion batteries. Electrostatic discharge (ESD) can damage these parts, making specialized ESD-safe packaging essential. Materials like conductive plastics, ESD shielding bags, and foam-lined trays protect sensitive electronics from static buildup.

5. Partition Sheets and Layer Pads

Partition sheets and layer pads are widely used in automotive packaging to separate components, prevent shifting during transport, and maximize stacking efficiency. Made from durable materials like corrugated plastic or honeycomb-core polypropylene, these solutions offer both strength and reusability.

Key Benefits of Advanced Automotive Packaging Solutions

Investing in the right automotive packaging solutions offers several advantages, including:

1. Reduced Damage and Product Loss

Proper packaging prevents dents, scratches, and breakage, reducing the risk of costly replacements and delays in production.

2. Improved Supply Chain Efficiency

Standardized, stackable, and returnable packaging enhances logistics efficiency, making it easier to load, unload, and store components.

3. Cost Savings in the Long Run

Although some automotive packaging solutions require higher initial investment, they result in long-term savings through durability, reduced waste, and lower material handling costs.

4. Sustainability and Reduced Environmental Impact

As the automotive industry moves toward greener practices, sustainable packaging options are gaining importance. Recyclable, reusable, and biodegradable materials contribute to a circular economy, reducing waste and carbon footprint.

5. Compliance with Industry Regulations

Many countries and automotive manufacturers have strict packaging regulations regarding hazardous materials, weight limitations, and environmental impact. Using compliant automotive packaging solutions ensures smooth operations without regulatory issues.

The Future of Automotive Packaging

The automotive industry is evolving, and so are its packaging needs. Some key trends shaping the future include:

Smart Packaging: Integration of RFID tags and QR codes to track shipments and manage inventory more efficiently.

Lightweight and High-Strength Materials: Advanced composites that offer both durability and weight reduction for lower shipping costs.

Greater Focus on Circular Economy: Manufacturers are increasingly prioritizing packaging that can be reused, repurposed, or recycled to minimize environmental impact.

Automation and Robotics in Packaging: Automated systems for loading, unloading, and packaging optimization are making processes faster and more efficient.

Conclusion

Automotive packaging solutions are a crucial part of the supply chain, ensuring that components remain undamaged, logistics remain efficient, and manufacturers reduce waste and costs. Whether it’s returnable packaging, protective cushioning, or corrosion-resistant materials, selecting the right packaging solution is vital for the success of the automotive industry.

With a growing emphasis on sustainability and efficiency, companies must continue to innovate and adopt automotive packaging solutions that align with modern industry demands.

0 notes

Text

The Sustainability Impacts of the UK's Disposable Vape Ban

Disposable vape is a product of advanced technology and a blessing for those wanting a smooth and hassle-free vaping experience. It is perfect for vapers seeking a stress-free way to enjoy vaping without any complexities. Disposable vapes are commonly known as e-cigarettes. Lately, they have been under scrutiny by the UK government as they pose an environmental threat and a rise in vaping statistics among youth due to convenience. The government is trying to bring change in the vaping laws and to curb the urge to vape in the youth as it is precarious for their health.

There are various drawbacks to using disposable vapes:

1. Electronic Waste Reduction: A huge quantity of Electronic waste is discarded. It gets accumulated and poses a challenge and threat to the environment. An immense volume of non-recyclable waste enters landfills and alleviates pressure on waste management systems ill-equipped to handle e-waste from disposable vapes. The e-waste contains lithium-ion batteries, plastic casings, and metal components.

2. Conservation of resources: Disposable vapes primarily use lithium for batteries and plastic from fossil fuels. Too much dependency on a single material leads to increased demand and exhaustion.

Impact of a Ban:

With low demand for lithium, a finite resource with environmentally damaging mining practices.

Encourage the industry to invest in reusable devices that minimize resource extraction.

3. Mitigation of Litter Pollution: The problem stems from the irresponsible attitude of people littering disposable vapes in public places contributing to plastic and chemical pollution in urban and natural environments.

Impact of a Ban:

It has helped in a significant reduction in vape-related litter, which has led to urban cleanliness and reduced harm to wildlife.

Vapers have understood their irresponsible attitude and strive to achieve a cleaner environment. Discarding recycled components, such as recycling cartridges and batteries.

4. Encouragement of Industry Innovation

Current Issue: The disposable vape prioritizes convenience over sustainability, with minimal innovation in eco-friendly designs.

Impact of a Ban:

Sustainability has taken precedence over convenience. Manufacturers are bound to develop sustainable vaping solutions, such as biodegradable components or battery recycling programs.

5. Carbon Footprint Reduction

Current Issue: The production and transportation of disposable vapes contribute to greenhouse gas emissions due to their short lifecycle.

Impact of a Ban: