#trading stock options

Explore tagged Tumblr posts

Text

Down in Costa Mesa trading before helping my friend move. Been going crazy since spring break started. This like my 8th consecutive $150+ day…🎯📈📉

#stocks#stock trading#stock market#day trading#options#options trading#costa mesa#milligram cafe#coffee

21 notes

·

View notes

Text

Pinch myself everyday that this is home 🤗

#cryptocurrency#crypto#stock market#learn forex trading#invest#trending#donald trump#taylor swift#eurovision#binary options#lotr

9 notes

·

View notes

Text

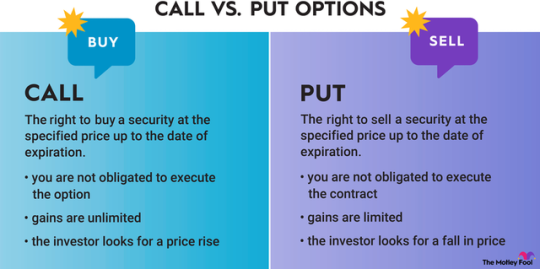

Call vs. Put Options

This guide will give you a complete rundown of call options and put options.

A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date.

That's the short summary of these options contracts. Now, let's take a closer look at how call and put options work, as well as the risks involved with options trading.

How does a call option work?

A call option is a contract tied to a stock. You pay a fee, called a premium, for the contract. That gives you the right to buy the stock at a set price, known as the strike price, at any point until the contract's expiration date.

You're not obligated to execute the option. If the price of the stock increases enough, then you can execute it or sell the contract itself for a profit. If it doesn't, then you can let the contract expire and only lose the premium you paid.

The breakeven point on a call option is the sum of the strike price and the premium. When you have a call option, you can calculate your profit or loss at any point by subtracting the current price from the breakeven point.

As an example, let's say that you're bullish on Apple (AAPL -0.54%) and it's trading at $150 per share. You buy a call option with a strike price of $170 and an expiration date six months from now. The call option costs you a premium of $15 per share. Since options contracts cover 100 shares, the total cost would be $1,500.

The breakeven point would be $185 since that's the sum of the $170 strike price and the $15 premium. If Apple reaches a price of $195, your profit would be $10 per share, which is $1,000 total. If it only goes to $175, you'd have a loss of $10 per share. Your maximum potential loss would be the $1,500 you paid for the premium.

How does a put option work?

A put option is a contract tied to a stock. You pay a premium for the contract, giving you the right to sell the stock at the strike price. You're able to execute the contract at any point until its expiration date.

If the price of the stock decreases enough, then you can sell your put option for a profit. You're not obligated to execute the contract, so if the price of the asset doesn't drop enough, you can let the contract expire.

The breakeven point on a put option is the difference between the strike price and the premium. When you have a put option, you can calculate your profit or loss at any point by subtracting the breakeven point from the current price, or by using the calculator at the bottom of this page.

To give you an example, imagine Netflix (NFLX -0.51%) trades at $500 per share. You think it's overvalued, so you buy a put option with a strike price of $450 and an expiration date three months away. The premium costs $10 per share, which is a total price of $1,000 for the contract.

The breakeven point would be $440, the difference between the $450 strike price and the $10 premium. If Netflix plummets to $400, then you're up $40 per share ($4,000 total) on your put option. If it doesn't drop below $450 at all, then you'd only be able to let the option expire and eat the cost of the premium.

Risks of call vs. put options

The risk of buying both call and put options is that they expire worthless because the stock doesn't reach the breakeven point. In that case, you lose the amount you paid for the premium.

It's also possible to sell call and put options, which means another party would pay you a premium for an options contract. Selling calls and puts is much riskier than buying them because it carries greater potential losses. If the stock price passes the breakeven point and the buyer executes the option, then you're responsible for fulfilling the contract.

The benefit of buying options is that you know from the beginning the maximum amount you can lose. This makes options safer than other types of leveraged instruments such as futures contracts.

However, options can be riskier than simply buying and selling stocks because there's a greater possibility of coming away with nothing. When investing in stocks, you only need to predict whether the stock goes up or down. For options trading, you need to predict three things correctly:

The direction the stock will move.

The amount the stock will move.

The time period of the stock movement.

If you're wrong about any of those, then the options contract will be worthless. While there's the potential for greater returns with options, they're also harder to trade successfully.

Despite the challenge of successfully trading call and put options, they provide an opportunity to amplify your returns. That can make them a valuable addition to a balanced portfolio. For investors interested in options, there are also more advanced strategies that go beyond buying calls and puts.

#kemetic dreams#call option#options#put options#money#stocks#stock market#markets#investing stocks#stock trading#nasdaq#balanced portfolio#money talk

13 notes

·

View notes

Text

Got my 2nd Car, more on the way y'all!

Keep sleeping, imma keep winning

2 notes

·

View notes

Text

Stocks to buy today-

1] ADSL: Buy at ₹182.70, target ₹192, stop loss ₹175; & 2] Mahindra Logistics: Buy at ₹525, target ₹550, stop loss ₹505; 3] OCCL: Buy at ₹810, target ₹850, stop loss ₹780; 4] Canara Bank: Buy at ₹119, target ₹126, stop loss ₹115; 5] Indian Terrain Fashions: Buy at ₹75.40, target ₹79, stop loss ₹72.75; 6] Vardhman Holdings: Buy at ₹4043.35, target ₹4250, stop loss ₹3900.

Get comprehensive insights from SEBI Registered Experts FILL https://intensifyresearch.com/web/landingpage NOW & avail 3 Days FREE TRIAL

#stock market#banknifty#investing#economy#nifty50#nse#sensex#nifty prediction#share market#finance#bse#bse sensex#bseindia#niftytrading#nifty#nseindia#nifty today#trading tips#option trading#investors#investment#investing stocks#financial#financial freedom#income#invest#fintech#blockchain#crypto#stock trading

2 notes

·

View notes

Text

𝗜 𝗖𝗮𝗻 𝗛𝗲𝗹𝗽 𝗬𝗼𝘂 𝗔𝗰𝗵𝗶𝗲𝘃𝗲 𝗦𝘂𝗰𝗰𝗲𝘀𝘀

But first, I'm going to be 100% honest with you…successful trading is hard. It's easy to make one successful trade or make a month's profit, but doing it consistently for years is something only a few can do. In order to be successful, you must overcome common problems that most traders face, and I will try my best to help you solve them.

– Josh Dennis, 10-year stock trading expert 𝗦𝘁𝗮𝗿𝘁𝗶𝗻𝗴 𝘁𝗼𝗱𝗮𝘆, 𝘄𝗲'𝗹𝗹 𝗵𝗲𝗹𝗽 𝘆𝗼𝘂 𝗰𝗿𝗲𝗮𝘁𝗲 𝗺𝘆 𝘄𝗲𝗲𝗸𝗹𝘆 𝘁𝗿𝗮𝗱𝗶𝗻𝗴 𝗽𝗹𝗮𝗻. 𝗖𝗹𝗶𝗰𝗸 𝘁𝗵𝗲 𝗹𝗶𝗻𝗸 𝘁𝗼 𝗲𝗻𝘁𝗲𝗿

#US stocks#stock portfolio#quotes#biden#harris#kamala harris#economy#us economy#stock market#politics#democrats#liberals#liberalism#socialism#government#failure#stock market news#stock market today#stock market trading#stock market institute#investing#finance#option trading#investors#stock market courses#invest#fail#lol#VOTE TRUMP#bitcoin

3 notes

·

View notes

Text

IS TRADING GOOD FOR YOU?

I am Paramveer, Working in a Recruitment company basically a corporate employee who does 9-5 job spend time with family & friends and quite ecstatic with this life as i have all the necessary things which is needed for a common man to live in a metro city.

But there is one thing which most of the people wants and not at all satisfied with, which is their earning. No matter how much you earn but people think they are not being paid enough which is very common and so it does happen with me.

So i thought to start doing trading, it was a trial and error for me but still i wanted to try. There was so much to learn and research before entering in to the trading, that's why i had to be meticulous on each aspects of it.

I took some time understanding how to do trading and what sort of things i have to keep in mind and within 1 months i started doing it. I am only doing Options trading because that is what i learned.

When i started making money i started feeling good and it was beyond the shadow of doubts. Although i was doing it conscientiously and not going circuitous things were started falling in my ways so nicely, now i have the purchasing power so i can buy all i want.

It was abstruse while deciding how much money should be the right amount but then i realized it on me how much loss i can bare and everyone should know it and imminently i got so much to learn and made money out of it. Trading is something i can never leave because it strengthen my mind and makes my analysis more stronger.

16 notes

·

View notes

Text

Why Gen Z Should Start Learning About the Stock Market: Top 5 Reasons to Invest

Discover the top 5 reasons why Gen Z should start investing in the stock market today. From building wealth to gaining financial independence, learn why stocks are a smart choice for young investors.

Hello, Gen Zers!

You’re already a generation known for disrupting norms and rewriting rules.

Why not apply that fearless energy to conquering the stock market?

With today’s technology, investing is at your fingertips, and starting young gives you a massive advantage. Think about it: more time for your investments to grow, early lessons in financial resilience, and the first steps towards an abundant future.

Ready to see why the stock market could be your new playground?

Let’s dive into the five irresistible reasons you should start investing now.

1. Harness the Power of Compounding Early- The sooner you start, the richer you get. Compounding means making money on your initial investment and then making more money on the earnings. Starting in your teens or early twenties means you have time on your side. Imagine this: invest $1,000 now with an average growth of 8% annually, and by the time you hit 50, that could swell into a sizable nest egg without adding another dollar. Now, imagine making regular contributions. We’re talking serious money!

2. Tech-Savvy Advantage- You’re digital natives. Use it. Gen Z is the first generation to grow up with technology from the get-go. You’re already adept at navigating apps and online platforms, which are essential tools in today’s trading world. Tools like Robinhood, Acorns, or E*TRADE are designed for intuitive navigation and making trading a breeze. Plus, you have access to heaps of online resources and communities to learn from and share trading tips.

3. Economic and Social Change- Invest in what you believe. More than any previous generation, Gen Z investors are likely to align their investments with their social and environmental values. Whether it’s renewable energy, tech innovations, or companies with strong ethics, your investments can reflect your commitment to making the world a better place, all while growing your wealth.

4. Financial Independence- Break free from the 9-to-5 grind. Understanding and participating in the stock market can be your ticket to financial independence. Mastering investing now could mean the option to retire early or pursue a passion project without financial constraints. Imagine living life on your terms, powered by smart, early investments.

5. Weather Economic Storms- Build your financial umbrella. The reality is, economic downturns, recessions, and market volatility are part of life. By investing young, you learn to ride out these storms without panic. Diversifying your investments in stocks, bonds, and other assets can protect you from financial rain and help you learn critical lessons about risk and resilience.

Ready to Rule the Market?

Alright, Gen Z, the ball is in your court. Investing in the stock market is not just about making money; it’s about building a secure, independent, and empowered future.

Start small, learn continuously, and stay committed.

The journey to financial freedom and becoming a savvy investor begins with your decision to act now. Are you ready to make your mark and watch your fortunes grow?

Frequently Asked Questions (FAQs):

Q1: How much money do I need to start investing?

You can start with as little as $50 or $100. Many platforms allow fractional shares, so even a small amount can get you started.

Q2: Isn’t investing risky?

All investments carry some risk, but diversifying your portfolio and investing for the long term can help manage and mitigate these risks.

Q3: How do I choose what stocks to invest in?

Start by researching companies or funds that align with your interests and values. Consider using tools and resources like financial news, investment apps, and financial advisors to make informed decisions.

#investing stocks#stock trading#option trading#share market#nseindia#stock tips#trading tips#investing#gen z humor#finance#income#profit

3 notes

·

View notes

Text

Options Trading Guide

Options trading guide can be a versatile and powerful way to manage risk and potentially profit from financial markets. Here's a comprehensive guide to get you started.

For more details visit here - https://hmatrading.in/options-trading/

Address: Ground Floor, D - 113, D Block, Sector 63, Noida, Uttar Pradesh 201301

Phone: 9625066561

#angel broking login in#gold rate forecast in India#gold price forecast in India#gold price forecast in India 2024#gold price predictions for next 5 years#angel one login#angel broking login#angel one login process#crude oil price forecast for today#crude oil price prediction tomorrow in India#crude oil trend today in India#crude oil price forecast for next week#trading in stocks for beginners#learn trading in stock market#best way to learn how to trade options

2 notes

·

View notes

Text

JULY SERIES BOOKING OPEN FOR ALL PREMIUM SERVICES 👇 👇👇👇 ❤️❤️INTRADAY/BTST ❤️❤️STOCKS AND INDEX OPTION ❤️❤️OPERATOR POSITIONAL(VST/SHORT-TERM) ❤️❤️MULTIBAGGER POSITIONAL(SHORT/MEDIUM/LONG/SWING) ❤️❤️FUTURE POSITIONAL ❤️❤️OPTION SELLING ❤️❤️HERO OR ZERO OPTIONS ❤️❤️COMBO SERVICES :ALL IN ONE❤️❤️ONE TO ONE TRAINING ❤️❤️ALGO

🏄🏄🗣🗣FOR ANY ENQUIRY ,ALGO RELATED INFORMATION : :: Telegram:@mausumip visit:https://www.stockyfly.com/ MESSAGE IN "WHATSAPP" 👇👇 https://wa.me/+918658013933 *FOR ALL SERVICES EMI FACILITIES THROUGH CREDIT CARD IS AVAILABLE *

4 notes

·

View notes

Text

How? Experience and a profitable trade plan that

actually works in the live markets. It's not a

coincidence price reversed and rejected where I

forecasted.

Does your mentor share their setups prior to entry

and share their targets before they hit?

The purpose of my channel isn't to give signals or

spoon-feed you (I can't stand lazy people) but it is

here to help you speed up your own trading journey

and show you what's possible with trading if you put

in the work. The past few trades I've taken and

shared in my channel have reached over 10% which

is the typical number to pass a prop firm challenge.

I've been trading for over 4 years now and sharing

my analysis in my channel everyday for almost 2

years. It's not been an easy journey to get to where I

am today and it's taken a lot of sacrifice and

perseverance but I'm proud of where I am and I love

that I can now help all of you win too.

A lot of people in this space lack transparency. When

I got into SMC I saw all of these 'traders' catching

100R trades which initially drew me in but looking

back now it is not realistic and doesn't mean they

made 100% profit (most of them would have banked

considerable partials before it ever reached that

level). However, with that said, there is a lot of

potential with this style of trading, endless

opportunities and uncapped returns which is why I

love it so much. Trades like todays do to show vou don't need huge RR to make significant, life changing

returns. Greed never ends well in the markets.

If you want to be a consistently profitable trader, you

need to build a trade plan, set realistic targets, have

good risk management, stop getting shiny ball

syndrome and just stick to one strategy. You will also

need to work on your mindset to flawlessly execute

your trade plan and you need to give it time to play

out. You're going to having losing weeks, you may

even have losing months which will make you

question everything but you need to trust in your plan

and journal everything along the way. If you believe

in yourself and follow your trade plan, everything

you've ever wished for will follow

Remember, mastery takes time ♡

#trending#invest#stock market#crypto#cryptocurrency#coinbase#binary options#trade#learn forex trading

7 notes

·

View notes

Text

How To Use Triple Leverage and Buying A Call Option

$TQQQ $NVDA #stocks #options #investing #NASDAQ #Nvidia #technology #trading #NASDAQ100

How To Use Triple Leverage and Buying A Call Option

Brian Benson, the Options Trading Specialist at The Technical Traders, shares some insight into his most recently closed trade.

Using TQQQ as an example, learn:

How Brian structured the trade to risk a small amount and still have a nice trade.

How to protect capital while still leaving space for price movement.

How long should a triple leveraged ETF trade be held?

How to add additional leverage by using options and buying a call.

Watch The Free Video Here

3 notes

·

View notes

Text

Join Live Stream On Option Trading (Specially NIFTY & BANKNIFTY) Today On My YOUTUBE Channel and Start Learning The Important Supports and Resistance In The Live Stream Itself and Improve Your Trading Journey...........................JOIN NOW..................

#Option Trading#NIFTY Live Trading#Banknifty Live Trading#Live Trading Today#Leverage Research#Live Stock Market Today#Nifty Prediction For Tommorw#Banknifty Prediction For Tomorrow

2 notes

·

View notes

Text

US stock trading sharing

As long as you have any investment questions, you can ask me and I can help you solve any investment problems. My confidence comes from the recognition of my abilities

#donald trump#finance#investing#nyc#stock market#ask#answered#ask game#stock trading#shares#stock tips#stockstowatch#stockstobuy#stockholm#investment#investors#real estate investing#investing stocks#savings#options#opportunities

4 notes

·

View notes

Text

01 APR 2024 IRCTC 930 CE TGT HIT PROFIT Rs. 46,113.

www.goldenoptions.in https://wa.me/6379365521

2 notes

·

View notes

Text

What makes the bearish harami a weak bearish reversal indicator?

A bearish harami is one of the weakest bearish trend reversal candlestick.It is due to the psychology behind it.

In simple terms, it is the bears and bull's behaviour in the market that makes the bearish harami a weak trend reversal pattern.

The above picture depicts the behaviour of bulls and bears in the market that leads to the formation of bearish harami and also makes it a weak indicator.

Click here to read the explaination about their behaviour.

#stock trader#investing stocks#stock market#future and option trading#forex trading#forex#earn money online#investor#candlestick pattern#crypto traders

12 notes

·

View notes