#tradepolicy

Explore tagged Tumblr posts

Text

The de minimis exemption, update – USPS halts packages from China and Hong Kong? Yes, No… 🇨🇳📦✈️🇺🇸💰 … will talk about on tonight's show 8pm ET! https://blog.adafruit.com/2025/02/05/the-de-minimis-exemption-update-usps-halts-packages-from-china-and-hong-kong-yes-no/

#usps#shippingnews#internationaltrade#deminimis#temu#shein#ecommerce#tariffs#customs#onlineshopping#china#hongkong#importtax#tradepolicy#shippingupdate#retailnews#logistics#globaltrade#smallbusiness#supplychain#tradewar#economy#consumerprices#marketchange#shoppingtrends#breakingnews#postalservice#commerce#governmentpolicy#retail

6 notes

·

View notes

Text

SAPTA Registration: Process, Fees & Documents Required

SAPTA Certificate is required to claim benefits of Free Trade Agreements (FTA) to the importing country, it is an important document which has to be produced at the landing port with commercial invoices. A Certificate of Origin (CoO) registered with (Issued by) Directorate General of Foreign Trade (DGFT) has to be provided by the exporter’s to ensure that the goods are being produced from countries under the trading agreement.

Documents required for SAPTA Registration:

Import Export Code

Registration Certificate of Organization

GST Registration Certificate

Address ID Proof with Detail of each director/Partner/Proprietor

Exporter detail

Commercial Invoice

Organization based Digital signature Certificate

Purchase Bill that has details of origin of inputs/consumables used in export products

Declaration from Manufacturer (Exporter) in Letterhead

Product Details

Purchase order from importer

SAPTA Registration Fees

ID Creation Fee is Rs. 2,000

Certificate generation per Invoice Rs. 1,500/-

Total Fees Rs. 3,500/-

*If you want to know about EPR Registration_ click here

#SAPTARegistration#TradeAgreementCompliance#SAPTACertification#ExportRegulations#CustomsCompliance#InternationalTrade#SAPTAUpdates#TradeWithSAPTA#SAPTAExporters#TradeAlliance#GlobalBusiness#TradeWithNeighbours#TradePolicy#SAPTAMembership#ExportOpportunities#TradeWithAsia#RegionalIntegration#TradeBenefits#SAPTATradeAgreement#ExportSuccess

2 notes

·

View notes

Text

Trump says tariffs coming on steel and aluminum

Read more

0 notes

Text

U.S. Canada Trade Tensions Escalate Amid New Tariffs

Source: news.sky.com

Share Post:

LinkedIn

Twitter

Facebook

Reddit

Pinterest

Rising Friction Between Close Neighbors

The recent decision by the U.S. administration to impose New Tariffs on Canadian imports has sparked concerns and strong reactions across Canada. The 25% tariffs, which also extend to Mexico, are expected to have significant economic repercussions, potentially leading Canada into a financial downturn. Canadian officials and citizens alike have expressed frustration, with political leaders urging strong countermeasures.

Prime Minister Justin Trudeau has voiced his concerns, highlighting the unexpected nature of the tariffs and their potential impact on trade relations. The sentiment has resonated widely, prompting a rare display of unity among Canadian political figures. The opposition leader, Pierre Poilievre, who has previously been more aligned with the U.S. administration, has now called for equivalent retaliatory tariffs, urging Canada to defend its economic interests and sovereignty. The growing tensions have even found their way into public spaces, with Canadian sports fans reportedly expressing their discontent during the U.S. national anthem at events.

Examining the Justifications and Economic Fallout

The U.S. administration has justified the New Tariffs on national security grounds, citing concerns over unauthorized migration and illicit substances crossing the northern border. However, official data suggests that less than 1% of the fentanyl seized in the U.S. originates from Canada. Additionally, while there has been a rise in unauthorized border crossings, they account for only a small fraction of overall cases recorded by U.S. border authorities.

What has particularly unsettled Canadian officials is the sharp contrast in how trade measures are being applied. While the U.S. imposed 10% tariffs on a geopolitical competitor, China, the significantly higher 25% tariff on Canada—a country long regarded as one of the closest U.S. allies—has been met with bewilderment. Given that 75% of Canada’s exports are sent to the U.S., the economic stakes are considerably high, and the tariffs could lead to job losses and economic instability.

Trudeau, in a nationally televised address, announced a series of countermeasures, including over $100 billion in retaliatory tariffs. He made direct appeals to the American public, warning that these trade restrictions could have negative consequences on U.S. jobs as well. Additionally, he encouraged Canadians to show solidarity by reconsidering their consumption of American goods.

Future Implications and Diplomatic Outlook

For most Americans, the impact of these tariffs may initially be felt in the form of increased costs for certain goods, such as lumber and homebuilding materials. However, the effects on Canada are likely to be more severe, given its deep reliance on the U.S. as a trade partner. The U.S. president has asserted that the U.S. does not depend on Canadian goods and has suggested that Canada’s economic stability is tied to its relationship with the U.S. Meanwhile, other American officials have characterized Canada as benefiting disproportionately from its proximity to the U.S.

As tensions escalate due to the New Tariffs, discussions between the U.S., Canada, and Mexico are expected to take place in an attempt to navigate the economic and diplomatic fallout. While Canada and the U.S. have shared one of the world’s longest and most stable borders, this latest development is a reminder that even the strongest partnerships can experience friction.

0 notes

Text

Trump Tariffs on Mexico, Canada, and China Will Take Effect Saturday.

Trump Tariffs on Mexico, Canada, and China Will Take Effect Saturday. Starting this Saturday, President Donald Trump will implement new tariffs on imports from Mexico, Canada, and China. These tariffs include a 25% levy on imports from Mexico and Canada and a 10% tariff on goods from China. The administration has cited national security and economic concerns as the primary reasons for these…

0 notes

Text

The Legal Essence of Tariffs

The Legal Essence of TariffsIntroduction Definition and Nature of Tariffs: A Legal PerspectiveTariffs as an Instrument of Public Law Codification and Predictability: The Harmonized System Legal Mechanisms for Enforcement Non-Arbitrariness and Legal Safeguards Complexities and Challenges The Legal Foundation of TariffsNational Legal Frameworks for Tariffs International Legal Frameworks for Tariffs Balancing National Sovereignty and International Commitments Challenges to the Legal Foundation Purpose and Legal Justifications of Tariffs1. Revenue Generation 2. Protection of Domestic Industries 3. Trade Policy Tool 4. Regulatory Function 5. Correcting Trade Imbalances 6. Retaliatory and Punitive Measures 7. Encouraging Domestic Policy Objectives Legal Safeguards and Challenges Legal Challenges and Disputes Related to Tariffs1. Domestic Legal ChallengesKey Issues in Domestic Challenges Legal Framework and Remedies 2. International Legal ChallengesCommon Grounds for International Challenges Prominent Examples of International Disputes 3. Procedural Framework for International DisputesStages of Dispute Resolution Challenges with WTO Dispute Resolution 4. Broader Implications of Tariff DisputesImpact on Trade Relations: Implications for Multilateralism: Domestic Political Dynamics: 5. Evolving Legal LandscapeFuture Considerations: Tariffs and Emerging Legal Trends Conclusion The Legal Essence of Tariffs Introduction Tariffs are a cornerstone of international trade and an integral component of a nation's economic and trade policy. Legally, they represent a duty or tax imposed by a government on imported or exported goods. While their economic implications are widely discussed, their legal nature and operational framework merit detailed exploration. This essay examines the legal essence of tariffs, addressing their definition, legal foundation, purpose, and interplay with international trade law.

Definition and Nature of Tariffs: A Legal Perspective From a legal standpoint, tariffs are financial charges, duties, or taxes that states impose on goods as they cross national borders, primarily on imports but occasionally on exports as well. They are integral to a country’s regulatory framework for international trade and serve as a manifestation of the sovereign authority of a state to control its economic and trade policies. Tariffs, unlike voluntary trade measures, are legally binding and enforceable obligations that carry significant consequences for non-compliance, such as fines, confiscation of goods, or even criminal sanctions in severe cases. Tariffs as an Instrument of Public Law As a tool of public law, tariffs function within the domain of governmental authority. They are not private contractual obligations but rather state-imposed levies, aimed at achieving public policy objectives. These objectives often encompass revenue generation, economic protectionism, and the regulation of foreign trade. The legal imposition of tariffs is inherently tied to the concept of sovereignty. Under international law, states possess the sovereign right to regulate goods entering and leaving their territories. This includes the power to determine the rate and scope of tariffs, subject to any limitations imposed by international agreements or customs unions. This sovereign right is codified in domestic legislation, often in the form of customs codes or tariff acts, which grant legal authority to customs officials to enforce tariffs and related regulations. Codification and Predictability: The Harmonized System A hallmark of modern tariff systems is their codification within a structured legal framework. Central to this framework is the Harmonized Commodity Description and Coding System, or simply the Harmonized System (HS). The HS, developed by the World Customs Organization (WCO), provides a standardized nomenclature for the classification of goods traded internationally. The legal significance of the HS lies in its universal adoption. Over 200 countries and customs territories use the HS as the basis for their tariff schedules, making it a globally recognized standard. The HS organizes goods into sections, chapters, and subheadings, each assigned a unique six-digit code. National customs authorities can further subdivide these codes to accommodate specific policy needs, but the core structure remains consistent. This legal uniformity serves several purposes: - Predictability for Traders: Businesses can rely on a clear and predictable classification system to determine the applicable tariffs for their goods. This minimizes disputes and fosters compliance. - Legal Consistency: Codification under the HS ensures that tariff laws are applied consistently across jurisdictions, reducing the risk of arbitrary or discriminatory treatment. - Facilitation of Trade Agreements: International trade agreements, including those under the World Trade Organization (WTO), often reference HS classifications to define tariff concessions or prohibitions. This legal standardization simplifies negotiations and enforcement. Legal Mechanisms for Enforcement Tariffs, being enforceable obligations, are implemented through robust legal mechanisms. Customs authorities are typically vested with the power to: - Assess Tariffs: Customs officials determine the correct tariff classification of goods, calculate the applicable duty, and collect payment. - Verify Compliance: Legal procedures mandate the submission of customs declarations, supported by documents such as invoices, bills of lading, and certificates of origin. Non-compliance or misrepresentation can lead to penalties. - Adjudicate Disputes: Disputes over tariff classification, valuation, or origin are common. National laws often provide administrative and judicial avenues for importers to challenge customs decisions. - Impose Penalties: Non-payment or evasion of tariffs triggers legal consequences, including monetary fines, confiscation of goods, and, in extreme cases, criminal prosecution. Non-Arbitrariness and Legal Safeguards A critical feature of tariffs is their non-arbitrariness. Unlike discretionary trade measures, tariffs are subject to legal safeguards that ensure transparency, fairness, and accountability. Key aspects include: - Publication Requirements: National laws and international agreements, such as the WTO’s GATT, require governments to publish their tariff schedules and any changes thereto. This promotes transparency and enables traders to comply with the law. - Bound Rates: Under WTO rules, member states commit to binding their tariffs at specific ceiling rates. These "bound rates" create a legal obligation not to exceed the agreed limits, ensuring predictability for trading partners. - Non-Discrimination: Tariff systems operate under the principles of non-discrimination, as enshrined in the Most-Favored-Nation (MFN) and National Treatment provisions of the GATT. These principles prohibit states from imposing discriminatory tariffs on imports from different countries or treating imported goods less favorably than domestic goods. - Legal Recourse: Importers and exporters have the right to challenge customs decisions through administrative or judicial review, providing a safeguard against misuse of tariff laws. Complexities and Challenges Despite their structured nature, tariffs often give rise to legal complexities. For instance, the classification of goods under the HS can be contentious, particularly for products that incorporate advanced technologies or unconventional features. Similarly, determining the "origin" of goods for preferential tariffs under free trade agreements involves intricate legal criteria, such as "rules of origin" and "substantial transformation." The intersection of tariffs with other areas of law, such as intellectual property (e.g., tariffs on counterfeit goods) and environmental regulations (e.g., carbon tariffs), further underscores their multifaceted legal nature. In essence, tariffs are not merely economic tools but deeply rooted legal instruments that reflect a state’s sovereign right to regulate trade. Their codification within structured systems, such as the Harmonized System, underscores their predictability and transparency, while legal safeguards ensure fairness and accountability. As global trade continues to evolve, the legal essence of tariffs remains a vital area of study, bridging domestic regulatory frameworks with international trade law. The Legal Foundation of Tariffs Tariffs are grounded in a combination of national legislation and international agreements, reflecting the interplay between domestic sovereignty and global trade norms. This dual foundation ensures that tariffs serve as a lawful instrument for regulating trade while adhering to commitments made within the international community. Below, the national and international dimensions of tariffs are examined in detail. National Legal Frameworks for Tariffs At the national level, tariffs are primarily established through legislation enacted by a country's legislature, often referred to as customs laws, tariff acts, or equivalent regulatory statutes. These laws define the scope, rates, and procedural mechanisms for imposing and collecting tariffs, granting the state the authority to regulate the flow of goods across its borders. - Legislative Authority: The authority to impose tariffs usually rests with the government or parliament, as they hold the power to enact laws governing taxation and trade. For instance: - In the United States, tariffs are governed by legislation such as the Tariff Act of 1930 (commonly known as the Smoot-Hawley Act) and subsequent amendments, which delegate specific powers to the President and the U.S. International Trade Commission (USITC). - In the European Union, the EU Common Customs Tariff is regulated under the Union Customs Code, providing a harmonized approach across member states. - Executive Discretion: While legislative bodies define the general framework, executive authorities often have discretionary powers to adjust tariff rates or introduce new tariffs under specific circumstances. For instance: - Many countries authorize their executive branch to impose emergency tariffs in response to sudden market disruptions, such as surges in imports that harm domestic industries. - The Trade Expansion Act of 1962 in the United States grants the President authority to impose tariffs on national security grounds (e.g., Section 232). - Administrative Enforcement: Customs authorities play a central role in the administration and enforcement of tariffs. They are responsible for: - Classification and Valuation: Determining the applicable tariff rate based on the Harmonized System and the declared value of goods. - Collection of Duties: Ensuring that importers pay the requisite tariffs as a condition for the release of goods. - Regulatory Compliance: Verifying that imports comply with other domestic regulations, such as health, safety, and environmental standards. - Judicial Oversight: Legal systems often provide mechanisms for judicial or administrative review to resolve disputes over tariff classifications, valuations, or other customs-related decisions. This ensures accountability and fairness in the application of tariff laws. International Legal Frameworks for Tariffs Tariffs are not solely a matter of domestic policy; they are also governed by international agreements that establish rules and limits to ensure fairness, predictability, and stability in global trade. Chief among these agreements is the General Agreement on Tariffs and Trade (GATT), now overseen by the World Trade Organization (WTO). - The General Agreement on Tariffs and Trade (GATT): GATT, signed in 1947, was the first multilateral agreement to establish rules governing tariffs and trade. It remains the cornerstone of international trade law, forming the basis of the WTO framework. Key legal principles under GATT include: - Most-Favored-Nation (MFN) Treatment (Article I): This principle prohibits countries from discriminating between trading partners. Any tariff concession granted to one member must be extended to all other members. - Tariff Bindings (Article II): Members commit to binding their tariffs at agreed-upon ceiling rates. These "bound rates" are legally enforceable and cannot be exceeded without renegotiation and compensation to affected trading partners. - Transparency (Article X): Members are required to publish their tariff schedules and trade regulations, ensuring that traders have access to clear and predictable information. - The Role of the WTO: The WTO, established in 1995, oversees the implementation of GATT and other trade agreements. It provides a legal framework for negotiating tariff reductions and resolving disputes. - Tariff Reduction Commitments: WTO members periodically negotiate tariff reductions during trade rounds (e.g., the Uruguay Round). These reductions are incorporated into members' schedules of commitments, which are legally binding. - Dispute Settlement Mechanism: The WTO's dispute resolution system adjudicates conflicts over tariff measures, ensuring that members comply with their legal obligations. - Regional and Bilateral Trade Agreements: In addition to the multilateral system, many countries engage in regional or bilateral trade agreements that modify their tariff obligations. Examples include: - Free Trade Agreements (FTAs): FTAs, such as the United States-Mexico-Canada Agreement (USMCA) or the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), often eliminate tariffs among member countries. - Customs Unions: In customs unions, such as the European Union, member states adopt a common external tariff while eliminating internal tariffs. - Special and Differential Treatment: Recognizing the unique challenges faced by developing countries, WTO rules provide for special and differential treatment (S&DT). This includes longer timeframes for tariff reduction commitments and preferential access to developed countries' markets. Balancing National Sovereignty and International Commitments The legal foundation of tariffs illustrates a delicate balance between national sovereignty and international cooperation. On the one hand, states retain the right to regulate their trade policies, including setting tariffs, as an expression of their sovereign authority. On the other hand, international agreements impose legal obligations that limit this discretion to ensure fairness and stability in global trade. This balance is evident in cases where national security or public interest is invoked to justify tariff measures. For example: - Under GATT Article XXI, countries may impose tariffs or trade restrictions for national security reasons. However, this provision is subject to interpretation, and disputes over its use often arise within the WTO framework (e.g., U.S. tariffs on steel and aluminum under Section 232). Challenges to the Legal Foundation Despite their legal grounding, tariffs face several challenges, including: - Trade Wars: Unilateral tariff measures, such as those seen in the U.S.-China trade war, strain the multilateral system and raise questions about compliance with WTO rules. - Preferential Trade Agreements: The proliferation of regional and bilateral agreements creates a fragmented system, complicating the global legal framework for tariffs. - Evolving Trade Practices: The rise of digital trade and services poses new challenges to traditional tariff systems, requiring updates to legal frameworks. The legal foundation of tariffs is a product of both domestic legislative authority and international legal commitments. This dual framework ensures that tariffs are not only a tool of national economic policy but also a regulated mechanism within the global trade system. As the world continues to grapple with economic uncertainties and shifting trade dynamics, the legal principles governing tariffs will remain critical in balancing national interests with the demands of a rules-based international order. Purpose and Legal Justifications of Tariffs Tariffs serve as a versatile instrument of economic regulation and public policy, designed to address a wide array of objectives. Their legal justifications are rooted in both domestic legislation and international trade law, reflecting the balance between a state's sovereign rights and its obligations to the global trade system. Below is a comprehensive exploration of their purposes and the legal rationales behind them. 1. Revenue Generation One of the earliest and most fundamental purposes of tariffs has been revenue generation. Historically, tariffs were a principal source of income for governments before the advent of modern income and corporate taxes. While this role has diminished in developed economies, it remains crucial for many developing nations. - Legal Basis: Revenue-raising tariffs are justified as a legitimate exercise of a state's fiscal sovereignty. Read the full article

0 notes

Text

EU Challenges China at WTO Over High-Tech Patent Royalty Policies

The European Commission has filed a complaint with the WTO, accusing China of unfairly setting global royalty rates for EU standard-essential patents (SEPs) without patent owners' consent. The Commission claims Chinese courts pressure European tech firms, particularly in telecoms, to lower royalty rates, benefiting Chinese manufacturers.

China’s commerce ministry expressed regret over the complaint, stating it would address the issue under WTO rules. The dispute involves SEPs, vital for technologies like 5G, held by companies such as Nokia and Ericsson.

The EU has requested consultations with China, the first step in WTO dispute resolution. If unresolved within 60 days, a panel may be formed to adjudicate, with proceedings typically taking a year. This case also ties to a 2022 EU complaint about Chinese anti-suit injunctions restricting global patent enforcement.

Contact Us DC: +1 (202) 666-8377 MD: +1 (240) 477-6361 FL +1 (239) 292–6789 Website: https://www.ipconsultinggroups.com/ Mail: [email protected] Headquarters: 9009 Shady Grove Ct. Gaithersburg, MD 20877 Branch Office: 7734 16th St, NW Washington DC 20012 Branch Office: Vanderbilt Dr, Bonita Spring, FL 34134

#ipconsultinggroup#EUvsChina#WTO#PatentRights#TechDispute#GlobalTrade#IntellectualProperty#HighTech#SEPs#InnovationMatters#TradePolicy#TelecomPatents#FairCompetition#5GPatents#RoyaltyDispute#EUTrade

0 notes

Text

Canada, Mexico, and China Respond to Trump’s Tariff Threats

Officials from Canada, Mexico, and China have strongly criticized U.S. President-elect Donald Trump’s threat to impose significant tariffs on their goods, warning that such measures could disrupt the economies of all four countries.

Mexico’s President, Claudia Sheinbaum, warned that retaliatory tariffs would follow Trump's proposed 25% tariffs on Mexican and Canadian goods, and 10% on Chinese imports, escalating the trade dispute and potentially endangering shared business interests. "One tariff will lead to another, and so on, until we put our common businesses at risk," Sheinbaum stated.

Trump announced the tariffs on Monday evening, claiming the move was necessary to address issues such as drug trafficking and illegal immigration. In response, Canada’s Prime Minister Justin Trudeau said he had immediately reached out to Trump following the announcement and was planning a meeting with provincial leaders to discuss how Canada would respond to the proposed tariffs.

Meanwhile, China has also expressed concerns about the potential economic impact of the tariffs, with officials stating that they could provoke a trade war with widespread consequences for global trade.

The proposed tariffs have sparked a tense diplomatic exchange, with Canada, Mexico, and China indicating that retaliation could be imminent, as all three countries seek to protect their economies from what they see as harmful trade policies.

0 notes

Text

#sharing A Comprehensive Customs Duty Searching website

#sharing A Comprehensive Customs Duty Tool

Navigating global trade complexities? Look no further! 🌐 The website from China's Ministry of Commerce is a game-changer, offering unparalleled insights into cross-border taxes:

https://wmsw.mofcom.gov.cn/wmsw/

Efficiency ✔️ Authority ✔️ Timeliness ✔️

Simply input your country of origin, destination, and HS code, and voila! 📊 Get direct tax rates, framework-specific accord rates, and an overview of taxed items. The site goes the extra mile, providing a handy tax calculator and historical rate reviews, along with adjacent product tax references. 📈

In a nutshell, it's a one-stop shop for rich information and seamless service, ensuring your business stays informed and compliant. 🌍💼

👍 Like if you find this tool invaluable!

💬 Share your thoughts on simplifying global trade.

🔄 Comment your go-to trade resources!

🌐 Because it primarily caters to Chinese traders, the interface is in Chinese. However, you can easily translate it using Chrome.

#GlobalTrade#CustomsDuty#TradeCompliance#BusinessInsights#CrossBorderTrade#TaxRates#TradeTools#ImportExport#BusinessSolutions#CommerceInnovation#TradeSmart#BusinessCompliance#InternationalBusiness#CustomsClearance#TaxCalculation#TradePolicy#ExportImport#BusinessGrowth#TradeSimplified#TradeRegulations

0 notes

Text

Impact Of Economic Policies On Business: 10 Facts You Need To Know

Economic policies on business refer to government actions that influence a country's economic environment, including taxation, trade regulations, monetary policies, and incentives. These policies can impact business operations, growth, and overall economic stability.The intricate interplay between economic policies and the business landscape has long been a subject of fascination for economists, business owners, and policymakers alike.

The impact of economic policies on business is undeniable, shaping everything from market conditions to consumer behavior. Investors, entrepreneurs, and business owners must grasp the massive impact of these restrictions. The 10 Essential Facts You Need to Know About the Impact of Economic Policies on Businesses are covered in this post.

Economic Policies And Business Landscape

Explanation Of Economic Policies:

Economic policies encompass a range of measures adopted by governments to regulate and influence their country's economic performance. These policies can be broadly categorized into several key types:

Monetary Policies: These policies are enacted by central banks and focus on controlling the money supply and interest rates. The central bank's decisions regarding interest rates impact borrowing costs, affecting businesses' access to capital and consumer spending behavior.

Fiscal Policies: Fiscal policies involve government decisions about taxation and government spending. Lowering taxes can stimulate consumer spending and business investments, while increased government spending can boost demand for goods and services.

Trade Policies: Trade policies encompass international trade regulations, tariffs, and trade agreements. They significantly affect businesses engaged in import/export activities, as changes in tariffs or trade agreements can alter the cost of goods and the competitiveness of domestic industries.

Regulatory Policies: Regulatory policies pertain to rules and regulations governing business operations. These include environmental regulations, labor laws, health and safety standards, and more. Compliance with these policies can impact business costs and operational efficiency.

Influence Of Economic Policies On The Business Environment:

The economic policies adopted by governments wield substantial influence over the business environment, often shaping its dynamics and growth prospects. Here's how these policies impact businesses:

Investment Climate: Monetary policies, such as interest rate adjustments, can impact businesses' decisions to invest in expansion or new ventures. Lower interest rates might encourage borrowing for investment, while higher rates can lead to more cautious investment strategies.

Consumer Behavior: Fiscal policies like tax cuts or stimulus measures can directly influence consumer disposable income. When consumers have more money to spend, businesses across various sectors experience increased demand for goods and services.

Market Competitiveness: Trade policies play a crucial role in determining the competitiveness of domestic industries in the global market. Tariff reductions through trade agreements can provide businesses with access to larger markets and foster international growth.

Operational Costs: Regulatory policies impose standards that businesses must adhere to in their operations. Compliance with these policies can lead to additional costs, impacting profit margins, but can also enhance a business's reputation for responsible practices.

Supply Chain Impact: Trade policies, especially those related to imports and exports, can disrupt supply chains. Businesses relying on global suppliers may experience fluctuations in costs and availability due to changes in trade regulations.

Fact 1: Monetary Policy

Monetary policy stands as a pivotal instrument within a country's economic framework, wielding considerable influence over business dynamics. Monetary policy is the control of the money supply and interest rates by a central bank to promote economic stability and growth. Multidimensional economic governance profoundly affects business environments.

Definition And Role Of Monetary Policy:

Monetary policy guides a nation's economy. Open market activities, reserve requirements, and discount rates help it achieve economic goals. Generally, the primary goals include curbing inflation, stimulating employment, and fostering sustainable economic expansion. By adjusting the availability of money and credit, monetary policy exerts a substantial influence on the overall business landscape.

How Changes In Interest Rates Affect Borrowing And Investment By Businesses:

Interest rates, manipulated through monetary policy, wield substantial influence over the financial decisions of businesses. When central banks alter interest rates, it triggers a domino effect across the business realm. Lowering interest rates encourages borrowing, as the cost of capital decreases. This prompts businesses to undertake more investments, expand operations, and innovate. Conversely, higher interest rates can deter borrowing, potentially stalling business growth and investment.

Case Studies/Examples Illustrating The Impact Of Monetary Policy On Businesses:

Concrete instances of how monetary policy translates into real-world business consequences provide valuable insights into its impact. Consider the aftermath of the 2008 financial crisis when central banks globally slashed interest rates and infused liquidity into the market. This decisive action facilitated businesses' access to capital at lower costs, spurring investments and aiding in the recovery process.

Conversely, during periods of tightened monetary policy, like the 'Volcker Shock' in the early 1980s, businesses faced heightened borrowing costs, leading to reduced investments and, in some cases, contraction.Understanding the intricate relationship between monetary policy and businesses is imperative for entrepreneurs, investors, and policymakers alike. These examples underscore the undeniable role of monetary policy in shaping the fortunes of businesses, underscoring the need for a keen awareness of its mechanics and repercussions.

Fact 2: Fiscal Policy

Fiscal policy is a crucial tool that governments around the world employ to manage their economies. It refers to the use of government spending and taxation to influence economic activity, particularly in terms of aggregate demand and overall economic growth. By altering the levels of government expenditure and taxation, fiscal policy aims to stabilize the economy, encourage investment, and promote sustainable growth.

Definition And Role Of Fiscal Policy:

Fiscal policy involves the government's decisions regarding its expenditures and revenues with the intent of achieving specific economic objectives. This policy can be expansionary or contractionary, depending on the prevailing economic conditions. During periods of economic downturns, governments might increase spending and lower taxes to boost demand and stimulate economic activity. In contrast, governments may cut expenditure and raise taxes to cool the economy during strong inflation or growth.

How Changes In Taxation And Government Spending Impact Business Operations:

Changes in taxation and government spending can significantly impact the operations of businesses. Taxation directly affects a company's profitability by influencing its expenses and overall financial health. Alterations in tax rates can influence consumers' purchasing power and disposable income, consequently affecting demand for goods and services. For businesses, changes in tax policies can lead to shifts in production costs, pricing strategies, and investment decisions.

Government spending plays an equally critical role. Increased government spending, particularly in sectors related to infrastructure, healthcare, and education, can create opportunities for businesses to provide goods and services required for these projects. This injection of demand can lead to increased production and employment in relevant industries.

Case Studies/Examples Illustrating The Impact Of Fiscal Policy On Businesses:

The Great Recession (2007-2009): During this period of economic downturn, many governments implemented expansionary fiscal policies to stimulate economic activity. The American Recovery and Reinvestment Act of 2009, for instance, involved significant government spending on infrastructure projects and tax cuts, indirectly aiding industries involved in construction, manufacturing, and technology.

Austerity Measures in Europe: In contrast to expansionary policies, some European countries implemented austerity measures in response to the Eurozone debt crisis. These measures involved substantial cuts in government spending and increases in taxes. The resulting decrease in consumer spending and demand had negative repercussions for numerous businesses, leading to closures, layoffs, and decreased economic growth.

COVID-19 Pandemic Responses: The global response to the COVID-19 pandemic included various fiscal measures. Governments introduced stimulus packages, tax breaks, and financial assistance to businesses in sectors most affected by lockdowns and reduced consumer activity. These interventions aimed to prevent widespread business closures and maintain economic stability during the crisis.

#economicpolicy#businessimpact#economicgrowth#businessregulation#taxpolicy#laborpolicy#tradepolicy#monetarypolicy#fiscalpolicy#investmentclimate#businessconfidence

0 notes

Video

youtube

(via https://youtube.com/watch?v=DlXcbJ-EMn8&si=IdZ3Rndly-be61oQ)

#youtube#Tariffs TradePolicy GlobalEconomy ImportExport EconomicImpact TradeWar MarketDynamics SupplyChain BusinessInsights CustomsDuties Internation

0 notes

Text

Impact of President Trump's Inauguration on the Indian Stock Market

On January 20, 2025, Donald Trump was inaugurated as the 47th President of the United States, marking the commencement of his second term in office. This political development has significant implications for global economies, including India's, particularly concerning trade policies, currency stability, and stock market performance.

Trade Policies and Tariffs

President Trump's inaugural address emphasized a commitment to "America First" economic strategies, including the imposition of higher tariffs on imported goods to bolster domestic manufacturing. Such protectionist measures are anticipated to affect countries with substantial export relationships with the U.S., including India. The Indian stock market, especially sectors reliant on exports like information technology and textiles, may experience volatility as investors react to potential trade barriers. Analysts suggest that these industries could face reduced profit margins and decreased competitiveness in the U.S. market, leading to stock price fluctuations.

Foreign Institutional Investments (FIIs)

The uncertainty surrounding U.S. trade policies has already influenced investment patterns. In January 2025, foreign investors withdrew approximately $6.5 billion from Indian stocks and bonds, marking the highest outflow since October 2023. This trend reflects growing investor caution amid concerns about the global economic impact of U.S. policy shifts. Sustained FII outflows can lead to decreased liquidity in Indian markets, potentially suppressing stock prices and increasing market volatility.

Currency Fluctuations

The Indian rupee has exhibited sensitivity to global economic cues, particularly those emanating from the U.S. On January 20, 2025, the rupee closed slightly higher at 86.5675 against the U.S. dollar, compared to 86.61 in the previous session. This marginal appreciation was influenced by a dip in the dollar index by 0.2% to 109.1. However, the rupee faces challenges from continuous foreign portfolio outflows, which have reached $6.5 billion in January. The dollar-rupee pair's implied volatility has surged, with the 1-month implied volatility reaching 4.3%, the highest since August 2023, indicating uncertainty around Trump's policies. A depreciating rupee can increase import costs, contribute to inflationary pressures, and affect corporate earnings, thereby impacting stock valuations.

Sectoral Impacts

Information Technology (IT): Indian IT firms, which derive a significant portion of their revenue from the U.S., may face headwinds due to potential changes in visa policies and increased scrutiny on outsourcing. Such factors could lead to higher operational costs and impact profit margins, influencing stock performance in this sector.

Manufacturing and Exports: Sectors such as textiles, automotive, and pharmaceuticals could be affected by new trade policies. Increased tariffs on exports to the U.S. may reduce demand, affecting the financial performance of companies within these industries and leading to stock market adjustments.

Investor Sentiment and Market Outlook

The Indian stock market's response to President Trump's inauguration reflects a blend of cautious optimism and apprehension. While certain sectors have shown resilience, the overarching sentiment is one of vigilance as investors assess the potential ramifications of U.S. policy changes. Market analysts recommend a diversified investment approach, focusing on domestic-oriented sectors less exposed to international trade dynamics. Additionally, close monitoring of policy announcements from the Trump administration will be crucial in anticipating market movements and making informed investment decisions.

Conclusion

President Trump's second-term inauguration introduces a complex set of variables for the Indian stock market. Trade policies, foreign investment trends, and currency fluctuations are key areas that warrant careful observation. Stakeholders, including investors and policymakers, must remain agile, adapting strategies to navigate the evolving economic landscape shaped by U.S. administrative actions.

Sources

Bloomberg

Reuters

Economic Times

Financial Express

Wall Street Journal

#DonaldTrump#Inauguration2025#IndiaStockMarket#TradePolicies#ForeignInvestments#CurrencyFluctuations#USIndiaRelations#FIIs#StockMarketVolatility#IndianRupee#Tariffs#MarketOutlook#GlobalEconomy#EconomicImpact#TrumpSecondTerm#IndiaExporters#IndianITSector#InvestorSentiment#StockMarketTrends#TradeWars#USEconomicPolicy#InflationImpact#ExportMarkets#StockMarketAnalysis#InvestmentStrategies

0 notes

Text

Trump's Ally Endorses Jane Timken for Ohio Senate Race: Will She Stand with the President? #2022midtermelections. #democraticparty #deregulationefforts #economicgrowth #endorsements #immigration #JaneTimken #manufacturingindustry #nationalsecurity #Ohiopolitics #OhioSenaterace #PresidentTrump #republicanparty #SherrodBrown #taxcuts #tradepolicies #Trumpsagenda

#Politics#2022midtermelections.#democraticparty#deregulationefforts#economicgrowth#endorsements#immigration#JaneTimken#manufacturingindustry#nationalsecurity#Ohiopolitics#OhioSenaterace#PresidentTrump#republicanparty#SherrodBrown#taxcuts#tradepolicies#Trumpsagenda

0 notes

Text

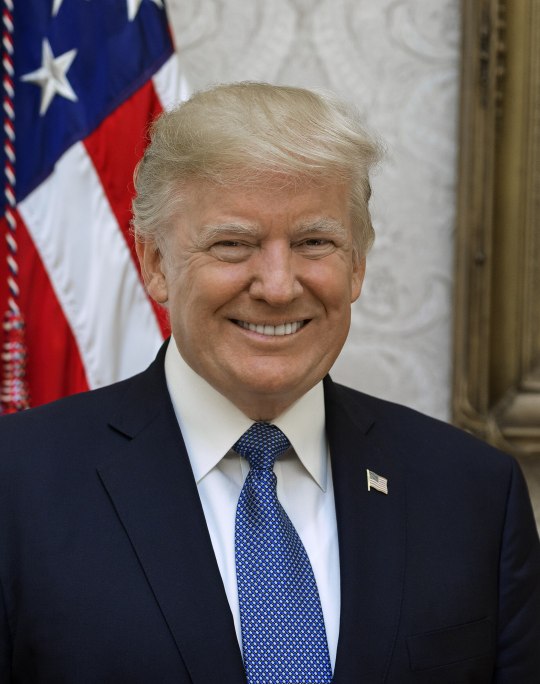

Support for Donald Trump

Economic Growth: Supporters argue that under Donald Trump's presidency, the United States experienced significant economic growth. They point to factors such as reduced regulations, tax cuts, and job creation. The Tax Cuts and Jobs Act of 2017 is often highlighted as a major achievement, which lowered corporate tax rates and provided relief for individuals, resulting in increased business investment and higher employment rates.

Trade Policies: Trump's supporters appreciate his approach to trade, particularly his emphasis on protecting American industries and workers. They argue that his implementation of tariffs aimed at reducing trade deficits and renegotiating trade deals, such as the United States-Mexico-Canada Agreement (USMCA), helped protect domestic industries and promote fairer trade practices.

Criminal Justice Reform: The First Step Act, signed into law during Trump's presidency, received bipartisan support and is praised for its efforts to reform the criminal justice system. Supporters highlight that it aimed to reduce recidivism rates, expand rehabilitative programs, and provide opportunities for nonviolent offenders to reintegrate into society.

Deregulation: Trump's administration was known for its deregulatory agenda, which aimed to reduce the regulatory burden on businesses. Supporters argue that this approach fostered innovation, entrepreneurship, and job creation, allowing the economy to flourish.

Defense and National Security: Trump's supporters often point to his commitment to rebuilding the military and prioritizing national security. They highlight the increase in defense spending, efforts to modernize the military, and the elimination of ISIS's territorial caliphate as significant accomplishments.

Immigration Policies: Supporters appreciate Trump's tough stance on immigration, arguing that his policies aimed to protect national security and prioritize American citizens. They point to measures such as stricter border control, travel restrictions from certain countries, and efforts to end the Deferred Action for Childhood Arrivals (DACA) program as necessary steps to enforce immigration laws and secure the borders.

#AmericanPolitics#USPolitics#DonaldTrump#EconomicGrowth#TradePolicies#CriminalJusticeReform#Deregulation#DefenseAndNationalSecurity#ImmigrationPolicies#Presidency#today on tumblr#Elections#PoliticalParties#Government#PolicyMaking#Campaigns#Voting#Legislation#SupremeCourt#Congress#PresidentialCandidates#PoliticalDebates#PoliticalLeaders#PublicPolicy#Democracy#PoliticalIssues

1 note

·

View note

Text

U.S. Businesses Brace for Potential Trump Tariffs, Opt for Diverse Strategies Amid Uncertainty

Source: intellinews.com

Share Post:

LinkedIn

Twitter

Facebook

Reddit

With President-elect Donald Trump’s proposed tariffs looming, U.S. businesses are strategizing ways to protect their operations from the potential economic ripple effects. Trump’s proposal includes a 10% tariff on all imports and a substantial 60% tariff on goods made in China, a significant trading partner for the U.S. There is also a suggested 25% levy on imports from Mexico. If enacted, these measures could elevate consumer prices and provoke retaliatory tariffs from affected countries, leading to a cascade of economic consequences. Economists warn that Trump’s tariff plan, which may be his most impactful economic policy, could drive inflation, disrupt U.S.-China trade, and revert import duty rates to levels not seen since the 1930s.

Businesses Respond by Front-Loading Inventories

Many U.S. businesses are taking proactive steps to mitigate risks. For example, M.A.D. Furniture Design, based in Hong Kong, is accelerating shipments of its Chinese-manufactured furniture to a warehouse in Minneapolis, anticipating a smoother transition if the tariffs come into effect. Similarly, Joe & Bella, an online clothing retailer based in Chicago, has significantly increased orders for popular Chinese-made items, such as shirts and pants, to ensure supplies last through the upcoming Chinese New Year when factory operations pause for several weeks. “We wanted our merchandise delivered before Chinese New Year to avoid potential delays and tariff impacts,” said co-founder Jimmy Zollo.

Front-loading, or preemptively increasing inventory, has been a common strategy among importers to avoid trump’s tariff costs. However, with the breadth of products that could be affected by Trump’s proposed tariffs, experts speculate that U.S. ports might become congested if many companies employ similar tactics. This strategy requires businesses to invest heavily in storage and logistics, a costly endeavor that some, particularly small businesses, may not be able to afford.

Smaller Businesses Weigh Options Amidst Uncertainty

While larger companies with sufficient resources might lean toward front-loading, some small business owners are adopting a cautious approach, prioritizing cash flow over large, preemptive stockpiling. Hilla Hascalovici, CEO of New York-based Periodally, a company that sells Chinese-made heating patches for menstrual relief, has decided against early orders, citing the high costs of storage and expedited shipping as deterrents. Similarly, Max Lemper-Tabatsky of Denver-based Oaktree Memorials, which imports cremation urns from Asia and Europe, has chosen a “wait-and-see” approach rather than committing significant capital based on potential trump’s tariffs that may not materialize.

Freight companies, too, are preparing for the potential changes. Alan Baer, president of OL USA, a freight handling company, anticipates a slowdown in shipments if the tariffs are enacted, potentially leading to reduced demand for his firm’s services. “Tariffs in shipping are challenging no matter the scenario,” Baer remarked, highlighting the potential for workforce reductions if tariffs lead to decreased import volumes.

In light of Trump’s tariff policies during his presidency from 2017 to 2021, many in the business community remain skeptical but cautious, acknowledging that campaign promises do not always result in implemented policies. However, with the possibility of substantial tariffs, U.S. businesses are adopting a mix of preemptive and conservative strategies to navigate the uncertainty ahead.

#TrumpTariffs#TariffImpact#USTariffs#USBusiness#TradeWar#SupplyChain#InflationConcerns#BusinessStrategy#TariffStrategies#FrontLoading#SmallBusiness#GlobalTrade#ChinaTrade#MexicoTariffs#RetailImports#ShippingLogistics#EconomicImpact#BusinessUncertainty#TradePolicy#ImportTariffs

0 notes

Text

Trump Eyes Lighthizer for U.S. Trade Representative Role Again.

Trump Eyes Lighthizer for U.S. Trade Representative Role Again. In a move that could significantly impact U.S. trade policy, President-elect Donald Trump is reportedly considering reappointing Robert Lighthizer as the U.S. Trade Representative. Lighthizer, who played a pivotal role in shaping Trump’s trade policies during his first term, is known for his staunch advocacy of tariffs and his…

#DonaldTrump#EconomicPolicy#RobertLighthizer#Tariffs#TradeNegotiations#TradePolicy#USTradeRepresentative

0 notes