#trade fx

Explore tagged Tumblr posts

Text

KNIGHT FROM DARKEST HELL – A BIOENGINEERED, HULKING, MARTIAN MONSTROSITY.

PIC(S) INFO: Mega spotlight on concept art for the Hell Knight, a.k.a., "The Baron," artwork by Aaron Sims (supervised by John Rosengrant), from the “DOOM” 2005 movie trading card series by Artbox.

Source: www.ebay.com/itm/153909442003.

#Hell Knight#Concept Art#DOOM 2005#2005#DOOM 2005 Movie#DOOM#Trading Cards#Sci-fi Art#Sci-fi horror#Sci-fi Fri#Horror Art#The Baron#Aaron Sims Art#Creature FX#Stan Winston Studio#Artbox Trading Cards#Sci-fi/Action#Aaron Sims#Science Fiction#DOOM Hell Knight#Monster Art#Monsters#Sci-fi#DOOM Movie 2005#Pre-production Art#DOOM Movie#Hell Knight DOOM#Artbox#2000s

3 notes

·

View notes

Text

PrimeXAlgo's innovative AI trading signal technology. Boasting impressive results with 27, 17, 18, and 20 consecutive successes

#PrimeXAlgo#AITrading#RealTimeSignals#TradingTechnology#GoldInvestment#BitcoinTrading#AIPrediction#TradingSuccessStories#FX#FOREX#GOLD#Chart#Trading Chart#Stock#Finance#Investment

2 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

Với hơn 10 năm kinh nghiệm thực tiễn, chúng tôi mang đến thông tin về tài chính và Forex chất lượng cao. Diễn đàn của chúng tôi là nơi lý tưởng để khám phá và học hỏi về cơ hội đầu tư trong thị trường tài chính.

Website: https://forexforums.org/

2 notes

·

View notes

Text

one of the things I think about in tgcf is how the characters' friend circles actually function. like as it is in the novels, everything circles around xl (main character, duh) but we do get glimpses of other cliques (3 tumors, ghost city, banyue) and I'm so interested in whatever else they might have going on. do the martial gods hang out with each other (especially during the rebuilding since they're all stuck in a palace)? what's lqq's situation. does qyz have any friends?? what are the dynamics there. do either mq or fx hang out with other people?? because if they don't that seems like just such a terribly lonely godhood for all of them

#hewwo#MY headcanon: although mq doesn't have f-f-f-friends per se he has amicable connections with the civil gods#they see him as the Jock Exception and there's probably favor trading going on#meanwhile fx drinks with the martial gods and he does have ''friends'' but none that are as close to him as xianle trio were#lqq is Friendly with people but sees no need to have a Best Friend. just hangs out with his middle court officials and mingles with others#qyz is the loneliest according to canon 😔 just hold on king a true clown is on his way to u!!!!#well i don't think qyz even cares to have friends unless they're yy but we know how that went

16 notes

·

View notes

Text

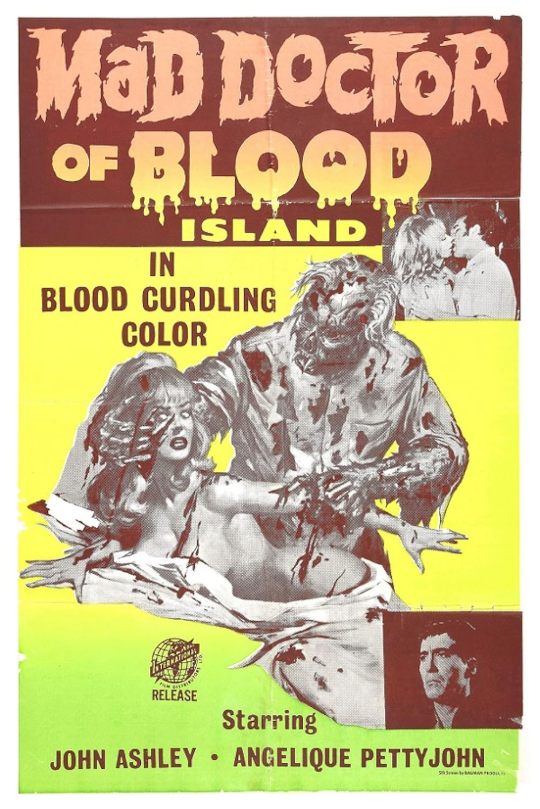

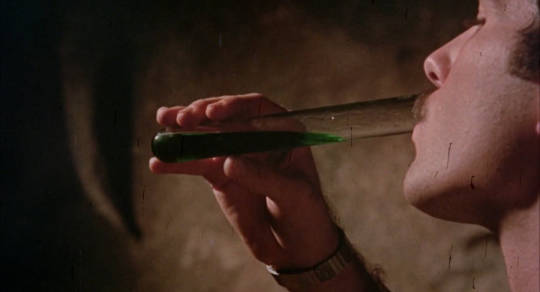

Mad Doctor of Blood Island (Tomb of the Living Dead, 1969)

"You are quite mad."

"Then you should be very careful, doctor. Both of you. Mad people can be quite unpredictable."

#mad doctor of blood island#tomb of the living dead#horror imagery#filipino cinema#video nasty#1969#eddie romero#gerardo de leon#reuben canoy#john ashley#angelique pettyjohn#ronald remy#alicia alonzo#ronaldo valdez#tita muñoz#tony edmunds#alfonso carvajal#bruno punzalan#edward murphy#tito arevalo#unarguably a pretty bad film but not without its own unlikely charm‚ as John Ashley's beautifully sculpted hair and sharp suits help him#investigate a bad case of Monstrous Green Man running riot on a beautiful island in the Philippines. performances are wooden‚ fx are as#ropey as expected‚ and the script is mostly dreadful (excepting a few isolated scenes which transcend into a kind of wonderful weirdness‚#particularly any scenes between Alicia Alonzo and Ronald Remy‚ where they dispassionately discuss the nature of love‚ madness and death#or trade threats in utter calmness). for a late 60s film the levels of gore‚ sex and nudity are surprisingly high tho tempered by the#director's irritating habit of rapidly zooming in and out during any moment of grue. oh and a very real tw that this contains some needless#and horrible animal cruelty (presumably what got this on the DPP list) altho it's brief and easily excised so maybe there exist cuts of the#film without those scenes. altho this is admittedly a little dull beneath the grotesquerie and a fairly badly made bit of cheapo indie#schlock so probably not really worth chasing down that imaginary cruelty free cut (unless you're a freak trying to watch every video nasty)#(i am that freak)

6 notes

·

View notes

Text

Unlock the potential of your investments with Capital Street FX! 📈 Enjoy a generous 650 deposit bonus that propels your trading journey to new heights. Don't miss out on this exclusive opportunity to amplify your gains. Join us now and let your investments thrive!

5 notes

·

View notes

Text

Get The Best Signals of Gold With TP and SL And Gain More Than 5% Daily

Follow Me on MQL5

تداولالأسهم, #فوركس, #تداولالعملات, #تداولالسلع, #تحليلفني, #تحليلأساسي, #استر��تيجياتالتداول, #إدارةرأسالمال, #تجارةيومية, #تعلمالتداول, #اقتصادياتعالمية, #تداولعب��_الإنترنت.

GoldTrading #PreciousMetals #InvestInGold #Bullion #GoldPrice #GoldMarket #GoldInvestment #Commodities #TradingStrategy #GoldAnalysis #GoldBullion #BullionTrading #GoldCoins #GoldCharts #GoldFutures #GoldSpot #GoldStocks #GoldNews #GoldInvestor #MetalTrading #trick #xauusd #gold #Forex #forextrading #PriceAction #priceactionstrategy

#forex live#live forex signals#live forex trading#forex signals live#eurusd live#live trading#forex live trading#live forex trading session#live signals forex#xauusd#gold#trade#fx#trading ideas#forex trading ideas#supply and demand#xauusd analysis today#gold forecast#gold price#gold live#xauusd forecast#forex signal#live trading forex#live forex#gold usd#gold xauusd indicator#xauusd live#gold trading live#forex trading live#xauusd live signal

4 notes

·

View notes

Photo

Join our group for FOREX update https://chat.whatsapp.com/I5Sy9JNOqX85GG6HwgTamb

#xauusd forex gold USDJPY dax18 forex trade gold تداول تداول_عملات تداول_ myfxbook forex portfolio USDJPY forex trader fx dax#xauusd#forex#gold#dax18#usdjpy#trade#تداول_عملات#تداول#dax

4 notes

·

View notes

Text

Start your prop firm -

In the fast-evolving landscape of financial markets, the concept of prop trading (proprietary trading) has gained significant traction. Aspiring traders are increasingly drawn to the idea of establishing their prop firms, leveraging technology and funded trading opportunities. This article delves into the world of FXPropTech, prop firms, and the journey to becoming a funded trader.

1. Understanding Proprietary Trading (Prop Trading): Proprietary trading, often referred to as prop trading, involves financial firms trading their own capital in the markets. This approach differs from traditional trading where institutions trade on behalf of clients. Prop trading firms seek to generate profits directly from market movements, utilizing various strategies and tools.

2. The Rise of FXProptech: FXProptech, the fusion of foreign exchange (FX) trading and financial technology (fintech), represents a new frontier in the trading landscape. These technologies empower traders with advanced analytics, algorithmic trading, and risk management tools. The marriage of FX and technology has given rise to innovative platforms and strategies, enabling traders to navigate the complex currency markets efficiently.

3. Prop Firms and Funded Trader Programs: Many traders embark on their journey by joining prop firms or participating in funded trader programs. These initiatives provide aspiring traders with an opportunity to trade firm capital, often with minimal personal risk. In return, traders share a percentage of their profits with the sponsoring firm. This arrangement aligns the interests of traders and firms, creating a mutually beneficial partnership.

4. The Benefits of Joining a Prop Firm: Joining a prop trading firm offers several advantages. Traders gain access to substantial capital, advanced trading tools, and often benefit from mentorship programs. Prop firms, in turn, diversify their trading strategies and tap into the potential of skilled and emerging traders.

5. My Funded FX Journey: A Personal Account: In this section, we explore real-life success stories of individuals who have embarked on their funded FX journeys. Understanding the experiences and challenges faced by funded traders can provide valuable insights for those considering a similar path.

6. Steps to Start Your Prop Firm: For those aspiring to establish their prop firms, this section provides a step-by-step guide. From legal considerations to technology infrastructure, we cover the essential elements required to launch and run a successful proprietary trading business.

Conclusion: Starting your prop firm is an exciting venture that combines financial acumen with technological innovation. With the rise of FXPropTech and the opportunities presented by prop firms and funded trader programs, aspiring traders have a unique chance to make their mark in the dynamic world of proprietary trading. Whether you're a seasoned trader or a newcomer to the industry, exploring these avenues can open new doors to success.

#proptech#forex prop firms funded account#ftmo#funded#fxproptech#prop firm#props firms#the funded trader#my funded fx#best trading platform#best prop firms#Start your prop firm

3 notes

·

View notes

Text

Read Business News Daily To Keep up with the Markets

The companies with net worth are referred to as Stock Market Quotes on the market. They are constantly in the news through Business News. Gillette, Microsoft, Wall Mart and Citigroup are a few that usually beat market's expectations.

The companies are evaluated for their marketing strategies, sales and product launches, as well as international investments, and profits and losses. Each one of these could create a rally, increase the market indices upwards and contribute to economic growth. Business News also provides the economic perspective of the government which aids the investor in weighing the risks based on market's sentiment.

Many people are unable to discern through the text of Finance News flashed or published in the media. It's an art. The ability to look past the words to understand what's really happening on the market or in the economy, or even with the stock is a matter of an analytical mindset. If you see a headline article about Facebook in its announcement of a new mobile phone in the midst of the Facebook IPO crisis A discerning reader needs to inquire if it is an unintentional tactic used by the clever PR company or is it actually a brand new innovation that could boost the value of the stock. These kinds of questions are not mentioned in the majority of the stories we read within Finance News.

What role will the most recent information on the market have in the lives of a typical investor? Does any significance to him when stocks fall? Does it matter if the market prices go up the charts?

The issue becomes more relevant in light of the stories in the press that claim investors have lost millions in the market as it fell 200 points- that show the massive impact of the fluctuation and rise of the markets for stocks.

An investor who is speculative gets directly affected by these changes However, a committed investor is able to record a nominal loss. The most current market information provide an estimate of our holdings and helps us assess our investment strategies in the future.

#Investors News#Stock Market Quotes#Financial News#Fx News#Commodities News#Cryptocurrency News#Fx Strategies#Stock Investors#Tips Stock#New Stocks Trading Today#Today's Market News#Financial Quotes#Shares Quotes

4 notes

·

View notes

Text

Atlas Funded specializes in prop firms with instant funding, giving you immediate access to capital. Start trading without delays and make the most of market opportunities right away.

#forex trading with leverage#leveraged fx trading#forex funded trader#funded forex trader#best prop firms forex#best futures prop firms#best proprietary trading firms#futures proprietary trading firms#best forex prop firms#best funded account forex

1 note

·

View note

Video

youtube

Happy Birth Day Lavish Sir BotBro CEO Yorker FX Forex Trading | TLC Coin...

#youtube#Happy Birth Day Lavish Sir BotBro CEO Yorker FX Forex Trading | TLC Coin |Real Or Fake Business Plan

0 notes

Text

Investment Analysis - Guide

Investment analysis is a critical process used by investors to assess and evaluate potential investment opportunities. This process involves studying various financial metrics, trends, and data to make informed decisions about whether to invest in specific assets, projects, or securities. The ultimate goal is to ensure that investments align with an individual’s or an organization’s financial goals while minimizing risks and maximizing returns. In this article, we will explore what investment analysis entails, its importance, different approaches, and tools used in this field.

What is Investment Analysis?

Investment analysis refers to the process of evaluating an investment for profitability and risk. This involves assessing the asset's potential return and determining how it fits into the broader financial strategy of an investor or a business. It typically involves financial modeling, technical analysis, and qualitative assessments.

Investment analysis plays a critical role in decision-making processes, especially for investors who need to choose between various options such as stocks, bonds, mutual funds, real estate, and other assets.

Importance of Investment Analysis

Risk Management: The primary goal of investment analysis is to assess the risk associated with any investment. Whether it is evaluating a company’s financial stability or predicting market trends, investors use analysis to determine the potential risks of investments. This helps to prevent significant financial losses.

Maximizing Returns: Investors use analysis to identify opportunities that can generate high returns. A thorough investment analysis can point out undervalued assets or growth potential in a sector, allowing investors to capitalize on favorable trends.

Informed Decision-Making: With so many investment options available, proper analysis allows investors to make informed decisions based on data rather than emotions. This systematic approach increases the likelihood of successful investments.

Portfolio Diversification: Investment analysis helps in the creation of diversified portfolios by evaluating different assets and identifying how each one contributes to overall risk and return. A diversified portfolio minimizes the impact of poor-performing assets and reduces risk.

Forecasting Future Trends: By studying historical data, economic indicators, and financial reports, investment analysis can help predict future market conditions and guide long-term investment strategies.

Key Approaches to Investment Analysis

Investment analysis can be broadly divided into three key approaches: Fundamental Analysis, Technical Analysis, and Quantitative Analysis. Each of these has its unique set of principles, tools, and strategies.

1. Fundamental Analysis

Fundamental analysis focuses on the intrinsic value of an asset or a company. Investors assess the underlying factors that influence an asset's performance, including financial health, management quality, and economic conditions. It involves reviewing a company's financial statements, such as balance sheets, income statements, and cash flow statements, to determine its value. The primary objective is to understand whether the asset is undervalued or overvalued based on these factors.

Key Components of Fundamental Analysis:

Revenue and Earnings: The company's revenue growth and profitability are essential indicators of its future potential. Analysts assess the company's ability to generate profit from its operations.

Price-to-Earnings (P/E) Ratio: This ratio compares a company's share price to its earnings per share (EPS), helping investors assess how much they are paying for a dollar of the company's earnings.

Debt Levels: High levels of debt relative to equity can be a red flag, as it suggests that the company is over-leveraged and might face difficulties in servicing its debt.

Management and Corporate Governance: A company’s leadership can make or break its success. Investors look at the track record and experience of a company’s management to predict future performance.

Industry and Economic Trends: Analysts also look at the broader economic conditions and industry-specific factors that may impact a company’s performance.

2. Technical Analysis

Technical analysis is focused on price movements and trading volume. Unlike fundamental analysis, it does not concern itself with a company's intrinsic value. Instead, it analyzes price charts and uses historical data to predict future price movements. Traders who engage in short-term investments, such as stocks, forex, or commodities, often rely on technical analysis.

Key Components of Technical Analysis:

Price Trends: Analysts look for consistent patterns in the asset’s price movements, such as upward or downward trends. These trends can give insights into future performance.

Support and Resistance Levels: These are specific price points where an asset typically does not fall below (support) or rise above (resistance). These levels can indicate when to buy or sell.

Moving Averages: This technical tool smooths out price data to identify the direction of a trend. The two most common types are simple moving averages (SMA) and exponential moving averages (EMA).

Relative Strength Index (RSI): RSI is a momentum indicator that measures the speed and change of price movements. It helps to identify overbought or oversold conditions in an asset.

Volume: The number of shares or contracts traded over a specific time period. A high volume indicates strong market activity and can be a signal of future price changes.

3. Quantitative Analysis

Quantitative analysis employs mathematical and statistical models to evaluate investments. This approach is data-driven and often relies on complex algorithms to identify patterns, correlations, and trends. Quantitative models can be used to simulate different market scenarios and predict potential returns and risks.

Key Components of Quantitative Analysis:

Financial Ratios: Quantitative analysis involves using ratios such as Return on Investment (ROI), Return on Equity (ROE), and Debt-to-Equity to measure financial performance and risks.

Monte Carlo Simulation: This is a statistical method used to predict the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables.

Risk Modeling: Investors use models like Value at Risk (VaR) and Conditional Value at Risk (CVaR) to estimate the potential losses in their portfolios over a given period.

Performance Metrics: Sharpe ratio, Alpha, and Beta are commonly used to measure the risk-adjusted performance of investments. These metrics help to compare the expected return of a portfolio to the risk taken to achieve that return.

Tools Used in Investment Analysis

Investment analysts use a wide array of tools to aid their decision-making processes. These tools range from basic financial statements to sophisticated software solutions that crunch large volumes of data.

1. Financial Statements

Financial statements are the foundation of investment analysis. The balance sheet, income statement, and cash flow statement offer insights into a company’s financial health and are essential for fundamental analysis.

2. Stock Screeners

Stock screeners are online tools that allow investors to filter stocks based on specific criteria, such as P/E ratio, market capitalization, dividend yield, and more. These tools are widely used by both fundamental and technical analysts to identify potential investment opportunities.

3. Bloomberg Terminal

The Bloomberg Terminal is a powerful tool that provides real-time financial data, news, and analytics. It’s a staple for investment professionals who require comprehensive market data and sophisticated charting capabilities.

4. Trading Platforms

Most online trading platforms offer basic charting and technical analysis tools. More advanced traders may use platforms like MetaTrader, TradingView, or NinjaTrader for in-depth technical analysis.

5. Spreadsheet Software (Excel)

Excel remains a popular tool for investment analysis due to its versatility. Analysts often use Excel to build financial models, perform data analysis, and create forecasts.

6. Quantitative Software Tools

Tools like MATLAB, Python, and R are commonly used by quantitative analysts to develop algorithms, backtest trading strategies, and perform advanced statistical analysis.

Steps Involved in Investment Analysis

The investment analysis process involves several key steps:

Goal Setting: Before analyzing any investments, investors must define their financial goals, risk tolerance, and investment horizon.

Data Collection: This involves gathering relevant financial statements, market data, and other quantitative metrics to analyze.

Analysis: Depending on the approach (fundamental, technical, or quantitative), the investor or analyst will conduct their analysis by evaluating trends, ratios, financial performance, and risks.

Valuation: The next step is to determine the intrinsic value of the investment or asset. This helps to identify whether the asset is overvalued or undervalued in the market.

Decision-Making: Based on the analysis, the investor decides whether to buy, hold, or sell the investment.

Monitoring: Investment analysis doesn’t end after making a purchase. Investors need to continuously monitor the performance of their investments and the broader market to make timely decisions when necessary.

Challenges in Investment Analysis

While investment analysis is a powerful tool, it is not without challenges:

Uncertainty: Financial markets are unpredictable, and no analysis method guarantees accuracy.

Complexity: Some investments require complex analysis that may not be easy for all investors to understand or implement.

Data Overload: With so much data available, it’s easy for investors to get overwhelmed and misinterpret information.

Emotional Bias: Even with thorough analysis, emotions can cloud judgment and lead to poor investment decisions.

#launchfxm#forex#fx#trade#forex broker#forex market#forextrading#forexbrokerage#liquidity#prop trading firms

0 notes

Text

Top Investment Strategies for Prop Firm Startups

The Rise of Prop Firm Startups

Proprietary trading firms, commonly known as prop trading firms, are quickly gaining traction by providing new traders with the necessary capital and platform to trade, all while minimizing their personal financial risk. Starting a prop firm can be a profitable opportunity for those eager to tap into this expanding market. However, like any business, having a robust investment strategy is crucial for success. In this article, we will delve into the best investment strategies to help your prop firm flourish in a competitive landscape.

1. Strategic Capital Allocation

For any prop firm startup, effective capital management is crucial for success. Here are several strategies to ensure that capital is allocated in a way that maximizes returns while minimizing risks:

Leverage and Risk Management: Invest in top-notch risk management tools and systems that enable you to effectively monitor traders' performance. It's essential to enforce proper leverage ratios to ensure that traders do not take on excessive risks that could jeopardize the firm’s capital.

Diverse Market Exposure: Avoid limiting your prop traders to just one market or asset class. Give them access to equities, forex, commodities, and futures. This approach will not only attract a wider range of traders but also help mitigate the risk of capital erosion due to market fluctuations.

Capital Scaling Based on Performance: Establish a tiered funding structure where successful traders receive additional capital. This strategy incentivizes high-performing traders while managing the firm's risk exposure to less experienced traders.

2. Investing in Advanced Trading Technology

Technology serves as the foundation for any contemporary prop trading firm. For startups in this sector, making the right technological investments is vital for achieving long-term success. This encompasses:

Proprietary Trading Software: Creating or acquiring sophisticated proprietary trading software can provide your traders with a significant advantage. Essential elements include custom-built algorithms, risk management systems, and real-time market data feeds, all of which are crucial for effective trading operations.

Automated Trading Systems: The rise of automated and algorithmic trading is a significant trend within the prop trading industry. Investing in automation technology can empower your traders to capitalize on rapid execution opportunities.

Data Analytics Tools: Utilizing real-time data analytics enables traders to make well-informed decisions based on market trends. Consider investing in AI-driven analytics platforms that offer in-depth insights into trading patterns, trader behavior, and risk exposure.

3. Talent Acquisition and Development

A prop firm thrives on the quality of its traders. Attracting, retaining, and nurturing top trading talent should be a fundamental aspect of your investment strategy.

Recruiting Top Traders: Rather than limiting your search to those with traditional finance backgrounds, consider expanding your criteria to include tech-savvy individuals who can easily adapt to algorithmic trading systems. This wider talent pool can bring in fresh ideas and innovative trading strategies.

Trader Development Programs: Establish comprehensive training and mentorship initiatives to help traders maximize their potential. This approach not only fosters internal talent but also encourages loyalty among traders. Think about providing financial incentives, like profit-sharing arrangements or performance-based bonuses, to keep traders engaged and motivated.

Leveraging Demo Accounts for Talent Identification: A practical strategy is to invest in simulated trading environments where potential traders can showcase their abilities. This low-risk approach enables you to spot promising talent without putting your firm’s capital at stake.

4. Building a Strong Risk Management Framework

Risk management is essential for the success of a prop firm startup. Without a solid framework, the firm’s capital faces unnecessary risks, potentially leading to significant losses. Important elements of an effective risk management strategy include:

Setting Risk Limits: Each trader should have a defined risk limit that is monitored and enforced by the firm’s technology. This may include daily drawdown limits, loss caps per trade, and maximum leverage ratios.

Stress Testing: Regularly conduct stress tests on the firm's trading strategies and risk exposure under different market conditions, such as high volatility and market crashes. This process helps identify weaknesses and enhances risk management protocols.

Capital Cushion: Always keep a substantial capital buffer to absorb losses during unavoidable market downturns. This ensures that the firm can continue to operate even during times of high market stress.

5. Diversification of Trading Strategies

A crucial investment approach for any prop firm startup is to maintain a diverse portfolio of trading strategies. Depending on a single strategy can expose your firm to market conditions that may undermine its effectiveness. Consider diversifying across:

Day Trading vs. Swing Trading: Incorporate various time horizons in your trading strategies. Day traders can yield steady returns, while swing traders can take advantage of longer-term market trends.

Quantitative vs. Discretionary Trading: Promote the use of both quantitative (algorithm-based) and discretionary (human-based) strategies. Each type has its own advantages and disadvantages, and balancing between them can help mitigate risk.

Volatility Trading Strategies: Since markets frequently move sideways or experience significant volatility, implementing strategies specifically aimed at trading volatility (like options trading or volatility arbitrage) can boost the firm’s overall profitability.

6. Focus on Sustainable Growth and Scaling

To successfully scale a prop firm startup, it's essential to adopt a sustainable approach. Rapid expansion can result in operational inefficiencies and increased risk, making it vital to manage growth strategically.

Gradual Scaling: As your firm’s trading capital increases, its infrastructure and risk management protocols should evolve accordingly. A gradual scaling plan helps ensure that the firm remains within its technological and operational limits.

Expanding Global Presence: Think about broadening your prop firm’s reach by attracting traders from around the world. This strategy exposes your firm to a variety of market conditions and trading styles. Expanding internationally can also mitigate the risks tied to being overly reliant on a single region's economic landscape.

Outsource Non-Core Functions: Consider outsourcing administrative tasks like payroll, compliance, and IT. This allows your core team to concentrate on growth and trading, helping your startup maintain a streamlined operational model while optimizing returns.

7. Long-Term Capital Partnerships and Investor Relations

While many prop firms rely on self-funding, partnering with long-term capital providers can enhance stability and drive growth. Access to additional capital enables the firm to:

Expand Trader Base: With increased funding, your firm can support more traders, which boosts the potential for higher returns.

Attract Larger Talent: Top traders are more inclined to join a firm with substantial resources, as it indicates stability and growth opportunities.

Build Investor Relations: Forge connections with institutional investors, hedge funds, and family offices. These partnerships not only bring in capital but also provide access to valuable resources like risk management expertise, trading infrastructure, and legal support.

Conclusion:

Crafting a Winning Strategy for Prop Firm Startups

Starting a prop firm requires thoughtful planning and strategic investments in areas like capital management, technology, talent, and risk management. By diversifying your trading strategies, utilizing advanced technology, and promoting a strong culture of risk control, your prop firm can succeed in a competitive market.

Keep in mind that achieving success in prop trading goes beyond just trading skills; it involves creating a solid infrastructure that fosters growth, attracts top talent, and ensures lasting profitability.

By implementing these key investment strategies, you’ll set your prop firm up for long-term success and resilience in the dynamic world of proprietary trading.

#proptech#fxproptech#best prop firms#prop firms#prop trading firms#forex prop firms funded account#funded trading accounts#my funded fx#best trading platform#funded

0 notes

Text

Boost Your Currency Trading with the Best Forex Signal Providers

Unlock your trading potential with the best forex signal providers offering expert insights for fx currency trading and international currency trading. Optimize your forex trading account using advanced forex trading strategies and real-time live forex signals for successful trades.

#best forex signal providers#Forex trading consultant#forex trading account#international currency trading#fx currency trading#Online Forex Trading in India#forex trading strategies#best forex trading signals providers#best forex signals#live forex signals#forex signal provider

0 notes