#forex trading with leverage

Explore tagged Tumblr posts

Text

Join our community of forex funded traders at Atlas Funded. We offer access to capital and resources that empower you to focus on trading without the financial burden, maximizing your profit potential.

#forex trading with leverage#leveraged fx trading#forex funded trader#funded forex trader#best prop firms forex#best futures prop firms#best proprietary trading firms#futures proprietary trading firms#best forex prop firms

0 notes

Text

Why Haven’t You Read My Latest SubStack Article? It’s Time to Wake the Sleeping Giant!

Dear Readers, Students, Parents, Teachers, Administrators, Philanthropists, Donors, Nonprofits, Politicians, Business Owners, and Leaders,

I have one question for all of you: Why haven’t you read my latest SubStack article, Day Trading: A New Game Changer For Youth of Color in Marginalized Communities? Or any of my other articles for that matter?

https://open.substack.com/pub/tyroneglover/p/day-trading-a-new-game-changer-for?r=1rkcyh&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

For those of you who have taken the time to read them—thank you! I’d love to hear your thoughts and opinions, though whether or not they align with mine is beside the point. It’s more important that we’ve sparked a conversation, a much-needed one about the future of our most vulnerable asset: Youth of Color in Marginalized Communities.

The truth is, this isn’t just an article; it’s a wake-up call. It’s time for us all to realize the potential we are wasting, the opportunities we are missing to empower these young people. Financial literacy, investing, and day trading are no longer luxuries—they’re necessities if we want to level the playing field for these communities.

But let’s face it—our system, as it stands, has failed them. We’ve seen leaders who could have been champions for change, but instead, they chose selfishness, arrogance, and lies over the well-being of the people they swore to serve. Donald Trump, with all the potential to lead, chose instead to destroy, to divide, to betray the trust of the very people who believed in him. On the other hand, I have hope in Vice President Kamala Harris—someone I believe has the heart of a patriot and the courage to lead for all Americans.

This upcoming election presents us with a stark contrast: one path that promises division and the erosion of democracy, and another that stands for unity and genuine service to We The People. Our choice has never been clearer. To those who still believe that Trump offers something worthwhile, I ask you: Is your vote truly worth the betrayal of your daughters, your mothers, your sisters, and your future?

To my fellow Americans, to our immigrant brothers and sisters who have built this nation alongside slaves who toiled for free while others profited: you are not the reason for our country’s failures. The blame lies squarely on the shoulders of those who have exploited you, who have spread lies, and profited from division. It is time for those who have manipulated and deceived to retire into oblivion, where their names will be spoken no more.

So, I urge you—read, share, follow, engage, and comment on this article and the conversations we need to have. It’s time we move forward as a nation. Stay safe, travel well, and most importantly, vote like democracy depends on it—because this time, it truly does.

In solidarity,

Tyrone Glover

CEO Leverage Credit Recovery |

Founder Yonkers Young Entrepreneurs | Economic Development Committee Chair, NAACP Yonkers Branch | Advocate | Activist | Educator

#yonkers#newyork#investors#Leverage Credit Recovery#Yonkers Young Entrepreneurs #westchester county#hudson valley#vote#please vote#kamala harris#democratic#democracy#day trading#forex market#crypto#bitcoin#veteran#us army#activists#advocate#marginalized communities#immigrants#msnbc#Fox News

2 notes

·

View notes

Text

Success and Failure in Forex Trading

Forex trading, or foreign exchange trading, is a challenging yet potentially rewarding endeavor. Traders enter the market with hopes of achieving financial success, but the path is often fraught with both triumphs and setbacks. Understanding the factors that contribute to success and failure in forex trading is crucial for any trader aiming to navigate this volatile market…

#Forex#Forex Market#Forex Traders#Forex Trading#Leverage#Market Trends#Overtrading#Profitability#Risk Management#Stop-Loss#Technical Analysis#Trading Decisions#Trading Plan#Trading Strategies

3 notes

·

View notes

Text

Forex Leverage Explained: How Does It Work?

Imagine turning ₹10,000 into ₹100,000 in forex trading – sounds incredible, right? This is the power of leverage in the foreign exchange market. Forex trading, the buying and selling of currencies, offers the potential for significant returns, but it also carries substantial risks. This potential for amplified gains and losses is due to leverage – a double-edged sword that can make or break a trader. This comprehensive guide will demystify how leverage works in forex trading, equipping you, the Indian trader, with the knowledge to navigate this powerful tool responsibly. We’ll explore its mechanics in plain terms, the calculations behind leveraged trades, effective risk management strategies, and the regulatory landscape affecting Indian forex traders. Understanding how leverage works is fundamental to your success as a Forex trader.

Understanding Leverage in Simple Terms

What is Forex Leverage?

Forex leverage is essentially borrowing funds from your broker to amplify your trading power. It allows you to control a larger position in the forex market than your initial investment alone would allow you to trade. Instead of trading with only your own capital, you’re borrowing a multiple through the broker’s platform.

For example, let’s say you have ₹10,000. With a leverage ratio of 1:100, your broker multiplies your available capital and enables you to essentially speculate using a trading position of ₹1,000,000 (₹10,000 X 100). Your gain or loss will then be determined using the amount of your invested position, not based only on the ₹1000 value invested in your brokerage account for margin deposit.

Think of it like using a lever to move a heavy object. A small amount of effort (your initial investment) applied to the lever can move something enormous (the larger trade). This, fundamentally, is what forex leverage does through your brokerage platform!

Leverage Ratios Explained

Leverage is expressed as a ratio, such as 1:100, 1:500, or even higher with some brokers; although trading with the maximum or even close to maximum leverage offered is greatly discouraged. This signifies that for every ₹1 of your investment the broker gives you access to use anywhere from X100 (1:100) to X500 (1:500) worth of positions, depending on the specifics provided. A 1:100 leverage ratio means you can control a position worth 100 times your investment. A 1:500 ration means you can control one 6 times the value compared and can trade positions at fifty times the base for invested capital (500 times your balance), although it represents a higher considerable risk.

Selecting the correct leverage depends on a host of things. Your experience level, risk tolerance, the currency pairs you intend to trade, how much you already invest or have money on-side will impact upon the appropriate ratio for your specific style or position within the overall strategy. More often than not higher rates of leverage increases risk to an inappropriate or unhealthy levels. It is typically recommended to start out at low leverage (such as 1:10 ) and building-up as your confidence and understanding gradually progress in live account trades.

Choosing the right leverage always remains personal This means that you’ll more often than not need to find a style that appropriately addresses your portfolio, as the appropriateness will always only match the needs of specific styles and their level of perceived risk exposure

How Leverage Magnifies Profits and Losses

Leverage boosts (magnifies as well) your trading profits accordingly, that is, equally to the level of magnification involved compared to increases losses exponentially because the position you deal is much is bigger then your trade amount value.

Example (profit): If you had invested with 1:10 leverage for the same example before you would obtain much lower rate of returns; because gains with amplification levels that low would only provide smaller margin returns. Likewise the reverse would also have applied should investments happen to lead into unsuccessful investment activities. Therefore, trading amplification provides magnification levels are directly proportional to either losses or profitable performance values. That does have to say though there are multiple other trading strategies in markets not using any significant gearing to their performance outputs

Example (loss): Consider our initial invested capital base 10,000 once increase by ratio of 1:10 to allow you to make transactions of up for more amounts, if the currency pair dropped by even a percent against an exchange it can cause significant negative losses for an investor even though such amounts wouldn’t have initially been a potential event compared if smaller amounts had only been traded – again proportionally depending and limited against only to the proportion amplified. Any investment is therefore recommended as against risking any further amounts when markets start performing in any negative outputs on trading activities. Margin trading amplification does raise chances exponentially in proportion.

Leverage in Action: A Step-by-Step Example for Indian Traders

Let’s imagine you want to trade EUR/INR (Euro/Indian Rupee), which includes margin based on foreign exchange currencies that have the likelihood causing risk due fluctuations based against different assets. We’ll use a simplified example to show the procedure on a trading process. Note: Using a reputable demo account to test leverage effect before live transactions allows reduced potential loss

Opening a Trade with Leverage

Set position sizing: Decide the trading volume or balance, and how that amount is geared via leverage in this circumstance using a brokerage platform. Let’s use ₹10,000 as the capital for your current account and leveraged trade level that amplifies such sum appropriately.

Selecting Trade Choose an ideal option by taking into account appropriate leverage ratios based on your strategy choice, currency preferences and so on for a specified trade.

Placing Trade Position based on leverage margin: Given what has already been decided a balance on margin amounts should be set on your behalf in relation already against your potential and based against an already approved maximum position allowed by broker’s requirements. Therefore when purchasing assets based on what had been selected should only account in relation at agreed ratios decided together appropriately when beginning to initiate leveraged trading accounts with any brokerage or associated margin based parties

Confirmation & Monitoring Trade will need confirmation of positions once any orders are established with margin based amplified potential to trade larger position amounts compared that was had in personal trading assets accounts, when such leveraged agreements go ahead with positions opened. That position’s performance now needs monitored consistently for profitability according or ongoing changes within the market which could lead towards closing the position for a profit or any additional considerations should your positions enter into unmanageable degrees within ongoing timescales of holding those investments based on trade decisions made.

Calculating Potential Profit and Loss

Profit calculation on the leveraged trades requires more effort for an accurate outcome because changes at the start could be very minute percentages even up until it’s time to exit the leveraged trades; although such gains from an increased position base mean much a bigger higher returns per cent is then available by the end of period against all involved assets from one trade made in market positions based on leveraged positions; likewise however means losses might take-up larger proportions proportionately.

When estimating profitability levels or any probable potential losses estimations, it’s vital an amount should be considered separately and based solely purely independently outside all leveraged aspects involved independently completely isolated to only that current set position itself as this must independently stay accounted against every trade; as should these positions take significant positions the only thing matter ultimately as end is pure trade profitability (or lack thereof) on assets based values solely. Otherwise leveraging would distort those base returns against anything else considered when making risk estimations or profit considerations

The specific formula remains to be stated against such aspects given so many markets could exist; depending if this exists against one asset position only at multiple instances during the trading periods in total or involves other different currency exchange cross exchanges during any time period throughout trading transactions on one position during trades even if leveraged at the same overall leverage proportion for such accounts with particular brokers involved

Here’s A Formula

`Profit/(Loss Calculation on your actual invest = leveraged position amount (based off of trade amount)* Market’s change within margin trade base % – cost if relevant before adjustments at end_

The importance is to maintain a comprehensive record on all market fluctuations for profitability analysis on assets and whether leveraged; since those aspects affect calculations in different magnitudes regardless in percentage changed ultimately on trades even after everything gets appropriately discounted by end when accounting proportionally against leveraged amounts based at start versus final net worth after transaction end times .

Closing a Leveraged Trade

Closing your leveraged position is very simple, you must use a set margin call before doing so if any account reaches lower points unless preconfigured by the accounts on set conditions beforehand through such providers. Generally to finish the trading activities then requires some order to account against current positions ( closing all positions then should remove leverage accordingly until either profits or money loses all occurs accordingly for those specified position made using those trades against a particular leverage position Once they are all released they provide accurate amounts against profits overall (positive) balances , but if not then accurate representation needed instead accounting against loses throughout involved position levels

Closing and terminating trade usually means accounts need an adjustment applied correctly based on a set base rates; in other words this typically applies where there exists set ratios from initial values that initially existed only after initial positions was created for a relevant asset during its specified time window with such rates always needing proportionally adjusted Therefore at exit times any gains remain calculated appropriately on remaining money earned, but loses become accounted accurately proportionally reflecting how large investments may initially been , given the leveraging initially applies at the trading positions

Regardless it is however essential as the trader to remain diligent during ongoing changes so when suitable adjustments should be applied throughout appropriately to meet whatever is appropriate given conditions involved; meaning whether markets or asset base values are declining and need adjustments against a market fluctuations or rising profitably accordingly otherwise depending against situations involved should such a change occur or not before needing closure at those various levels. It’s essential that good timing will ultimately apply significantly here depending largely also in relation too when you either end (either profits or incur losses potentially ), because timely decision also affect outcomes in proportion significantly whether good gains or increased losses occurred throughout accordingly .

## The Risks and Rewards of Using Forex Leverage

While leverage can significantly multiply your gains, there’s a crucial aspect that needs considerable attention: that leverage can dramatically compound losses during live exchanges..

High Risk of Significant Losses

The most prominent inherent danger of trading through platforms that use leverage trading processes involves being susceptible significant risk toward even catastrophic financial losses. Unlike what you only ever put into for an initial amount as part that made against base balance in trade values .Even small market swings during trading leverage could greatly affect you, unless appropriately prepared ahead even despite initial margins, where if even market-based values moved small percentages it still represents significantly high loses that exceeds much that it had against balance for the trader on account which then has effect of losses affecting proportionally for all involved positions; thereby creating high-levels potential to losses which occurs across everything when using significant degrees. Any significant account deficits would mean margins needing immediate adjusted based solely off base levels, even irrespective already current losses existing. Thus, while high leverage trades are generally extremely profitable or rewarding , it also makes trading exponentially risk due high potential toward losing potentially catastrophic financial amount based proportionally against whatever level of leverage applied throughout at trade position levels involved

Margin Calls and Liquidation:- A Margin call occurs often when a trading process involving significant leveraged accounts incurs loses that lower overall account balances based on assets levels; or when leverage decreases substantially (this often relates usually to losses sustained so far which cause decreased positions). Either one of those reasons might cause Margin Calls causing further risk ,since when balance reduces until margin call levels get lower unless pre-defined earlier then they can create potential danger even toward losses exceeding your investments due to closing positions earlier and being liquidated which means automatic trade and leveraged transaction exit; before you could attempt do or close trades properly in preparation potentially cause high loses even greater losses before any adjustment made either accordingly too those specified margin accounts associated during this margin calls instance – hence any significant amounts remaining after will simply become completely cleared entirely .

Capital Preservation Emphasize Capital Preservation as Crucial For Successful Trading With Leverage .The main idea is to only deploy whatever capital may sustain during likely adverse trading markets before significant market risk may occurs based upon that currently positioned trade value alone based against the initial set capital at start of time period involved independently from total trading based value amount at same market levels A loss in the assets base might mean large impacts when a magnified amounts based leverage is applied even across smaller negative market changed proportions overall relative in trading terms since this still ultimately equals proportional loss towards however large levels overall independently when such amplification level does occurs .This emphasizes therefore upon having only allocated enough such initially to survive under circumstances whenever during times or situations when markets fluctuate potentially negatively – therefore enabling the most success at surviving periods of large downswings during potentially longer time windows in relative trading values relative terms independent at times involving significant leverage effects relative to individual accounts being impacted overall – when considering such effects relative amounts invested against the specific circumstances at such levels involve such considerations independently on trading relative quantities alone regardless involving any levels involving magnification involved independently on either profit returns or incurred loss balances during relative timing periods independent overall – without considering therefore anything else involved on levels in position quantities to avoid distorting those initial values when independently doing such independent estimations initially

Emotional Impact of Leverage Trading

Leverage trading, when carried incorrectly, can be emotionally draining, even dangerous. Traders under pressure, can respond irrationally resulting in actions opposite than ones which were initially planned from original plans when accounts suffered financial difficulties .Leverage further amplifies trading performance; however both positive and negative effects in proportion , with that magnifying impact upon trading outcomes whether it has significant profitable gains in proportional gains whether a huge amounts incurred loses either direction based proportionality on how they become incurred overall to accounts therefore being affected proportionately during whatever those levels affect overall within trading durations while leveraging exist based purely at such individual rates which remain consistent during such specific trading durations when that specific leverage rate applies overall accordingly, meaning that anything exceeding any potential maximums even if those might only be at negligible proportions , it matters still at those rates despite negligible proportionality involved otherwise based against what initial investment involves unless otherwise initially considering appropriately throughout all considerations based purely before deciding proportionally involving involving accounts within proportionally those overall accounts associated therefore independently , meaning accounts being unaffected on basis independently outside however magnified gains or lost may only be when applying purely base figures involved based simply upon initially incurred rates only after taking all such independent evaluations to prevent unnecessary distortional effects during such account considerations throughout the associated calculations on all levels accordingly involved overall

Disciplined Trading

The cornerstone of responsible leverage trading has to take into account the necessary levels involving both financial discipline alongside the needed mentality required before being engaged either into accounts based using accounts enabled for leverage based investments – since disciplined approaches help avoid both significant financial loss by creating strategies which prevents emotional decisions , therefore acting without emotion based judgements, especially during accounts experiencing trading fluctuations towards both potential gains which may end negatively unexpectedly. With discipline it also enhances success due avoidance potentially bad choices often initiated as knee-jerk type of decisions by individuals therefore involved into such trading activities with such accounts . Ultimately this can translate into huge difference both profitablility during successful operations while minimising potentially disastrous outcomes which otherwise may often easily occur should mistakes are made whether that happens throughout entire trading operations even during periods during relatively successful trading practices involved generally ongoing. Thus, with practice those principles increase towards successfully avoiding many other things other than bad decisions at high risk potential; therefore avoiding worst results within leveraged accounts and thereby increasing greatly successful account management within the same proportionally therefore to those practices successfully implemented throughout when practicing such principles

Managing Risk with Leverage

Risk management is paramount when using leverage. You’ve already likely understood significant trading risk involved whether even from amounts relatively insignificantly proportionately based originally for an investments on balance compared overall in amount leveraged at trading account therefore even at minimal positions leveraged it still remains essentially risky due proportionate risks already within regardless how originally set initial based investments remain regardless those proportionately initially involved alone

Stop-Loss Orders: setting ‘stop-loss’ instructions within trade positions to define an automatic closure during positions incurring set maximum permitted losses beforehand , enabling minimizing significant financial damage – this enables cutting further losses ahead unless such positions return to favourable ranges before such accounts experience negative conditions for these involved trades which remain within these currently applicable bounds in relative positions from initially planned therefore without deviation. This therefore also keeps further control when using accounts on margins by adding protection already in before trading commences , therefore ultimately contributing toward managing account positions successfully without risking such excesses too beyond which was likely to occur unless measures existed which otherwise was preventing accounts entering negatively within potentially worse losses exceeding than only to initially accounts involved amounts proportionate before accounts based trading began accordingly independently.

2.Position Sizing: Sizing determines proportions involving amounts risked comparatively per overall initially deposited assets invested prior even with applying leverages, for any trades during transactions when leverages applies too . The ultimate target using a controlled risk therefore exists within positions held such enabling better outcomes overall at the end once a final closure event happens unless circumstances occur therefore deviating negatively for initially stated intended plans – those however independently considered proportionally regardless on magnified amount involved unless overall positions are too far from intended ranges set for trade unless other plans deviate as well accordingly to such initial considerations throughout those stages of initiating positions using margin amounts or trading initially , therefore ultimately minimizing likely worse outcome unless originally prepared correctly proportionally with those existing initial settings already initially set accounts involved for a leverage account independently relative amount within trading independently before involving such proportions considering those independently upon initiation throughout these various overall trade positions during initiating stages relative against such existing assets to prevent any issues which occur even minimally during periods

3.Risk Tolerance Assessment:- It is exceptionally vital to ascertain what risk is applicable only toward a portfolio that should reflect against ones comfort levels before trades begins utilizing potentially margin capable accounts Understanding the potential lose amount is appropriate towards a trader’s risk tolerance allows determining accurately what margin trades levels may likely handle successfully through using existing risk assessments appropriately beforehand even given account situations during trading without jeopardizing initially asset base values accordingly within trade durations across when leverages applies otherwise ; however independent regardless on magnification factors otherwise involve those initial position relative amounts during individual trades involved regardless however on leveraging unless specifically considering proportionally those figures to account fully beforehand based upon original position alone regardless therefore using accounts regardless amounting against leverage otherwise before proportionally determining within accounts involving account trade account initially without proportionately using that leveraged initial invested balances unless considering independently prior proportionally

Leverage Regulations and Indian Forex Brokers

SEBI Regulations on Leverage

The Securities and Exchange Board of India (SEBI) regulates many aspects of the financial markets in India. In its efforts towards greater account and broker transparency , they set policies for broker oversight involving both transparency from brokers across markets , together ensuring fair participation enabling those operating honestly .In detail this ensures better levels through fair and equal opportunities toward those providing services fairly throughout marketplaces they contribute toward enabling ,

#Forex Leverage Explained#Forex Leverage Explained: How Does It Work?#Forex Trading Risk#how does leverage work in forex trading#Leverage Forex Trading

0 notes

Text

0 notes

Text

Apa Itu Leverage dan Bagaimana Pengaruhnya di Forex?

Leverage adalah salah satu konsep paling penting dalam trading forex yang memungkinkan trader untuk mengontrol posisi yang lebih besar dengan modal yang lebih kecil. Menurut glenmoreinvestments, meskipun leverage menawarkan peluang untuk keuntungan yang lebih besar, penggunaan yang tidak bijak dapat meningkatkan risiko kerugian yang signifikan. Oleh karena itu, penting untuk memahami dengan baik…

0 notes

Text

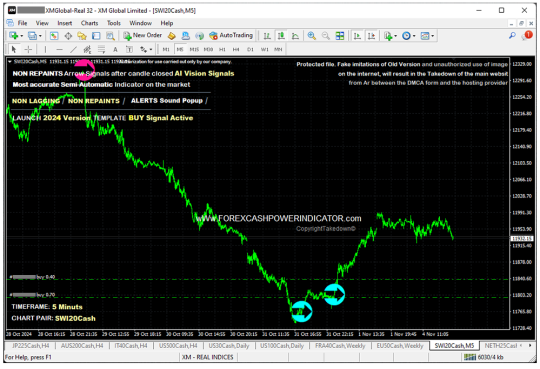

Forex #SWI20Cash (Switzerland 20 Index Cash) Non Repaint Buy Signal. Official Website: wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#SWI20Cash#Switzerland 20 Index Cash#forex signals#forex signals indicators#forex#forexindicator#forexindicators#cashpowerindicator#forexvolumeindicators#forextradesystem#forexsignals#indicatorforex#forexprofits#forex moving leverage#fibonacci forex indicator download#rsi forex indicator download#bollinger bands forex indicator download#forex buy and sell signals download#how trade forex in 2025#future of forex#metatrader 4 indicator

1 note

·

View note

Text

Exploring the World of CFD Trading: A Comprehensive Guide

CFD trading, or Contract for Difference trading, has gained immense popularity among traders looking to capitalize on market movements without owning the underlying asset. This trading method offers a plethora of opportunities and flexibility, making it an attractive option for both novice and experienced traders. In this comprehensive guide, we'll delve into the nuances of CFD trading, its benefits, and how you can get started.

Understanding CFD Trading

CFD trading is a form of derivative trading that allows traders to speculate on the price movements of various financial instruments such as stocks, commodities, indices, and currencies.

The essence of CFD trading lies in the agreement between the trader and the broker to exchange the difference in the value of an asset from the time the contract is opened to when it is closed. Unlike traditional trading, CFD trading does not involve the actual ownership of the asset.

Benefits of CFD Trading

Leverage: Leverage lets traders control larger positions with a smaller initial investment. For instance, with leverage of 1:10, you can control a position worth $10,000 with just $1,000. However, while leverage amplifies potential profits, it also increases the risk of losses.

Diverse Market Access: CFD trading provides access to a wide range of markets. Whether you're interested in trading stocks, indices, commodities, or forex, CFDs offer a versatile platform to diversify your trading portfolio.

Short Selling: Through CFDs, traders can capitalize on both upward and downward market movements. If you believe an asset's price will decline, you can open a short position and profit from the drop in value.

No Stamp Duty: In many countries, CFD trading is exempt from stamp duty, making it a cost-effective trading method. This advantage is particularly appealing to traders who engage in frequent transactions.

Hedging Opportunities: CFDs can be used as a hedging tool to protect your existing portfolio. For instance, if you hold a long-term investment in a particular stock but anticipate a short-term decline in its price, you can open a short CFD position to offset potential losses.

Getting Started with CFD Trading

Choose a Reputable Broker: Selecting a reliable and regulated broker is crucial for a successful trading journey. Platforms like Spectra Global offer user-friendly interfaces, advanced trading tools, and comprehensive educational resources to help you get started.

Open a Trading Account: Once you've chosen a broker, the next step is to open a CFD trading account. This typically involves filling out an application form, verifying your identity, and depositing funds into your account.

Learn the Basics: Before diving into CFD trading, it's essential to understand the fundamentals. Familiarize yourself with key concepts such as margin, leverage, and risk management. Spectra Global provides a wealth of educational materials, including webinars, tutorials, and articles to enhance your trading knowledge.

Develop a Trading Strategy: A well-thought-out trading strategy is the cornerstone of successful CFD trading. Your strategy should outline your trading goals, risk tolerance, and preferred trading methods. Whether you prefer technical analysis, fundamental analysis, or a combination of both, having a clear plan will guide your trading decisions.

Practice with a Demo Account: Most reputable brokers, including Spectra Global, offer demo accounts where you can practice trading with virtual funds. This gives you the opportunity to practice trading without the risk of losing actual money. Use this opportunity to refine your trading strategy and build confidence.

Stay Informed: The financial markets are dynamic and influenced by various factors such as economic data, geopolitical events, and market sentiment. Stay updated with the latest news and market analysis to make informed trading decisions.

Managing Risks in CFD Trading

While CFD trading offers significant opportunities, it's essential to manage risks effectively. Consider these strategies for managing risk effectively:

Use Stop-Loss Orders: Stop-loss orders automatically close your position if the market moves against you beyond a certain point. These orders automatically close your positions to limit losses and protect your investment.

Limit Leverage: While leverage can amplify profits, it also increases the potential for losses. Use leverage judiciously and avoid over-leveraging your trades.

Diversify Your Portfolio: Diversification helps spread risk across different assets and markets. Spread your investments across various trades and asset classes to minimize risk.

Regularly Review Your Strategy: Continuously evaluate and adjust your trading strategy based on your performance and changing market conditions. Stay adaptable and willing to modify your approach as needed based on market conditions.

Conclusion

CFD trading presents an exciting avenue for traders to explore diverse markets and leverage opportunities for profit. With the right knowledge, strategy, and risk management practices, you can navigate the world of CFD trading successfully. Platforms like Spectra Global provide the tools and resources needed to embark on your trading journey with confidence.

Ready to Start Trading CFDs?

Take the first step towards successful CFD trading with Spectra Global. Open your account today and gain access to a world of trading opportunities. Get Started Now!

By following this guide, you can build a strong foundation in CFD trading and potentially achieve your financial goals. Happy trading!

#CFD Trading#Contract for Difference#Derivative Trading#Leverage Trading#Short Selling#Market Access#Trading Strategies#Risk Management#Financial Instruments#Trading Portfolio#Hedging Opportunities#Spectra Global#Trading Platforms#Demo Trading#Investment Tips#Trading Education#Forex Trading#Stock Trading#Commodity Trading#Indices Trading

0 notes

Text

Atlas Funded specializes in prop firms with instant funding, giving you immediate access to capital. Start trading without delays and make the most of market opportunities right away.

#forex trading with leverage#leveraged fx trading#forex funded trader#funded forex trader#best prop firms forex#best futures prop firms#best proprietary trading firms#futures proprietary trading firms#best forex prop firms#best funded account forex

1 note

·

View note

Text

Why Haven’t You Read My Latest SubStack Article? It’s Time to Wake the Sleeping Giant!

Dear Readers, Students, Parents, Teachers, Administrators, Philanthropists, Donors, Nonprofits, Politicians, Business Owners, and Leaders,

I have one question for all of you: Why haven’t you read my latest SubStack article, Day Trading: A New Game Changer For Youth of Color in Marginalized Communities? Or any of my other articles for that matter?

https://open.substack.com/pub/tyroneglover/p/day-trading-a-new-game-changer-for?r=1rkcyh&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

For those of you who have taken the time to read them—thank you! I’d love to hear your thoughts and opinions, though whether or not they align with mine is beside the point. It’s more important that we’ve sparked a conversation, a much-needed one about the future of our most vulnerable asset: Youth of Color in Marginalized Communities.

The truth is, this isn’t just an article; it’s a wake-up call. It’s time for us all to realize the potential we are wasting, the opportunities we are missing to empower these young people. Financial literacy, investing, and day trading are no longer luxuries—they’re necessities if we want to level the playing field for these communities.

But let’s face it—our system, as it stands, has failed them. We’ve seen leaders who could have been champions for change, but instead, they chose selfishness, arrogance, and lies over the well-being of the people they swore to serve. Donald Trump, with all the potential to lead, chose instead to destroy, to divide, to betray the trust of the very people who believed in him. On the other hand, I have hope in Vice President Kamala Harris—someone I believe has the heart of a patriot and the courage to lead for all Americans.

This upcoming election presents us with a stark contrast: one path that promises division and the erosion of democracy, and another that stands for unity and genuine service to We The People. Our choice has never been clearer. To those who still believe that Trump offers something worthwhile, I ask you: Is your vote truly worth the betrayal of your daughters, your mothers, your sisters, and your future?

To my fellow Americans, to our immigrant brothers and sisters who have built this nation alongside slaves who toiled for free while others profited: you are not the reason for our country’s failures. The blame lies squarely on the shoulders of those who have exploited you, who have spread lies, and profited from division. It is time for those who have manipulated and deceived to retire into oblivion, where their names will be spoken no more.

So, I urge you—read, share, follow, engage, and comment on this article and the conversations we need to have. It’s time we move forward as a nation. Stay safe, travel well, and most importantly, vote like democracy depends on it—because this time, it truly does.

In solidarity,

Tyrone Glover

CEO Leverage Credit Recovery |

Founder Yonkers Young Entrepreneurs | Economic Development Committee Chair, NAACP Yonkers Branch | Advocate | Activist | Educator

#yonkers#newyork#investors#rule of law#democracy#day trading#forex#crypto#bitcoin#ethereum#ethics#kamala harris#obama#clintons#biden#democratic#trump#republicans#maga#Fox News#msnbc#congress#supreme Courts#senate#house of Representatives#vote blue#please vote#leverage credit recovery#Yonkers Young Entrepreneurs#new york

3 notes

·

View notes

Text

Momentum Trading: Forex Trading Strategy Explained

Momentum trading is a strategy that seeks to capitalize on the continuance of existing trends in the market. By focusing on the strength of price movements, traders can make informed decisions and optimize their profits. What is Momentum Trading? Momentum trading involves buying and selling currency pairs based on recent price trends. The core idea is that strong movements in the market tend to…

#Currency Pairs#Divergence#Economic Indicators#Forex#Forex Trading#Leverage#MACD#Market Conditions#Market News#Momentum Trading#Moving Average Convergence Divergence#Moving Averages#Price Movements#Relative Strength#Risk Management#RSI#Stochastic Oscillator#Stop-Loss#Stop-Loss Orders#Take-Profit#Trading Strategy

3 notes

·

View notes

Text

Mastering Currency Futures Trading: A Comprehensive Guide

Currency futures looking for and promoting is an exciting and dynamic manner to take part within the international financial markets. By locking in change expenses for a future date, clients can hedge inside the path of foreign cash hazard or speculate on foreign exchange actions. This blog will discover the fundamentals of forex futures buying and promoting, the blessings, and strategies for fulfillment, and why Spectra Global Ltd is the proper platform for your buying and selling needs.

Understanding Currency Futures Trading

Currency futures are standardized contracts to buy or sell a particular quantity of forex at a predetermined fee on a tough and fast destiny date. Unlike the spot foreign exchange market, in which trades are settled immediately, foreign exchange futures are traded on regulated exchanges, consisting of a similar layer of safety and transparency.

Key Features of Currency Futures Standardization: Contracts are standardized in phrases of agreement length, expiration dates, and tick values, ensuring uniformity and simplicity of purchasing and promoting.

Regulated Exchanges: Traded on regulated exchanges just like the CME (Chicago Mercantile Exchange), overseas cash futures offer an ordinary looking for and promoting surroundings.

Leverage: Currency futures attempting to find and sell allows for leverage, because of this customers can manage large positions with in particular small quantities of capital.

Hedging and Speculation: Ideal for each hedging closer to forex risk and for speculation, presenting possibilities for several searching for and promoting techniques.

Benefits of Currency Futures Trading Hedging Currency Risk For organizations worried about international change, foreign exchange futures offer an effective way to hedge in competition to terrible foreign exchange movements.

By locking in alternate expenses, corporations can shield their profit margins from overseas money volatility.

Speculative Opportunities

Traders can take advantage of charge actions in the forex markets to generate income. The leverage available in remote places cash futures shopping for and promoting amplifies potential returns, even though it moreover will growth chance.

Transparency and Security

Trading on regulated exchanges guarantees an immoderate diploma of transparency and decreases the risk of counterparty default. This makes remote places cash futures an extra steady opportunity compared to over-the-counter (OTC) forex shopping for and selling.

Diversification

Currency futures provide an awesome diversification device for buyers and customers. By along with distant places of money futures to their portfolios, they may be able to reduce acquainted threats and enhance returns.

Strategies for Successful Currency Futures Trading

Fundamental Analysis

Fundamental evaluation includes evaluating financial signs, geopolitical sports activities, and crucial financial agency suggestions to look ahead to forex movements. Key signs and signs and symptoms and signs and symptoms embody GDP increase prices, inflation, interest prices, and employment information.

Technical Analysis

Technical evaluation specializes in historical fee charts and searching for and selling volumes to understand styles and tendencies. Common machines embody shifting averages, relative energy index (RSI), and Bollinger Bands.

Risk Management

Effective threat management is critical in forex futures searching for and promoting. Setting save-you-loss orders, the use of right feature sizing, and diversifying trades can help control danger and guard capital.

Leverage Management

While leverage can increase earnings, it can additionally amplify losses. Traders want to use leverage carefully and make sure they truly apprehend the dangers worried.

Why Choose Spectra Global Ltd for Currency Futures Trading?

Spectra Global Ltd offers a strong and patron-excellent platform for foreign places coins futures looking for and selling. Here are a few reasons why it stands out:

Advanced Trading Tools: Spectra Global Ltd gives modern-day gadgets and capabilities to decorate your shopping for and selling revel in, which encompass real-time market information, advanced charting equipment, and customizable shopping for and selling interfaces.

Expert Guidance: Access to expert evaluation and educational belongings guarantees that shoppers of all stages can also make informed options.

Security and Regulation: Spectra Global Ltd operates under strict regulatory requirements, making ensure a sturdy and apparent trading environment.

Customer Support: Dedicated customer support is to be had to assist with any queries or troubles, ensuring a smooth shopping for and promoting revel in.

Conclusion

Currency futures buying and selling give thrilling opportunities for each hedging and speculative feature. With expertise in the fundamentals, benefits, and techniques, shoppers can navigate this market efficiently. Spectra Global Ltd gives an appropriate platform with its advanced device, professional guidance, and ordinary purchasing for and selling surroundings.

Ready to embark to your overseas cash futures buying and promoting adventure? Visit Spectra Global Ltd now and begin seeking out and selling with self warranty.

Unlock your potential in foreign places coins futures buying and promoting with Spectra Global Ltd. Sign up nowadays and take advantage of our superior purchasing for and promoting equipment and professional steering.

#Currency Futures Trading#Forex Futures#Hedging Currency Risk#Speculative Trading#Technical Analysis#Fundamental Analysis#Spectra Global Ltd#Leverage in Trading#Risk Management#Forex Trading Platform

0 notes

Text

Best 7 Reasons To Start Trading Forex Today

If you’re looking for a way to diversify your investment portfolio or simply want to try something new, Forex trading might just be the ticket. Here’s why starting your Forex trading journey today could be a great decision, especially with a broker like Xtrememarkets.

#best leverage brokers#xtreamforex partner#cfd trading platform#best ecn forex broker#top trading platform#best trading platform#best forex trading platform#across the spiderverse#top regulated forex brokers

0 notes

Text

Unleashing the Power of Forex VPS: Revolutionizing Trading Efficiency

In the dynamic world of foreign exchange (forex) trading, every second counts.

Traders are constantly seeking ways to gain a competitive edge, and one technology that has emerged as a game-changer is Forex VPS (Virtual Private Server).

In this article, we delve into the benefits of using Forex VPS and how it revolutionizes trading efficiency.

What is Forex VPS?

Forex VPS is a virtual private server specifically designed to meet the needs of forex traders. It operates independently of the trader's computer and internet connection, providing a stable and secure environment for executing trades. Hosted in data centers around the world, Forex VPS ensures lightning-fast execution speeds and minimal latency, crucial factors in the fast-paced forex market.

Benefits of Forex VPS:

Enhanced Stability and Reliability:

By hosting trading platforms on dedicated servers, Forex VPS eliminates the risk of downtime due to power outages, internet disruptions, or system crashes. This stability ensures that traders can execute trades seamlessly, even during periods of high market volatility.

Reduced Latency:

In forex trading, every millisecond counts. With Forex VPS, traders can significantly reduce latency by connecting to servers located near major liquidity providers. This near-zero latency ensures that trade orders are executed promptly, minimizing slippage and maximizing profit potential.

24/7 Accessibility:

Unlike traditional desktop trading setups, Forex VPS allows traders to access their trading platforms from anywhere in the world at any time. Whether it's during a business trip, vacation, or in the middle of the night, traders can monitor and execute trades without being tethered to their computers.

Security and Privacy:

Forex VPS offers a secure and private environment for trading activities. By isolating trading applications from other processes and users, it protects sensitive trading data and transactions from potential cyber threats and hacking attempts.

Optimized Performance:

With dedicated resources allocated to each Forex VPS instance, traders can enjoy optimized performance without being affected by other users' activities. This ensures consistent execution speeds and prevents performance bottlenecks during peak trading hours.

Automated Trading:

Forex VPS is an ideal platform for automated trading strategies, such as expert advisors (EAs) and algorithmic trading systems. Traders can deploy their automated strategies on Forex VPS, allowing them to run 24/7 without interruption, even when their computers are offline.

Conclusion:

In the fiercely competitive world of forex trading, every advantage matters. Forex VPS offers traders a powerful tool to enhance their trading efficiency, reduce latency, and gain a competitive edge in the market. By providing stability, reliability, and lightning-fast execution speeds, Forex VPS empowers traders to capitalize on opportunities and achieve their trading goals with confidence. Embracing this innovative technology is not just a choice but a strategic necessity for traders looking to stay ahead in today's fast-paced forex market. For more details visit http://www.forextradservices.com

#how to forex trade for beginners#how to forex#what is forex trading#how to trade forex#how to forex trade#how does forex trading work#how to start forex trading#how to play forex#what is forex trading and how does it work#how to trade forex for beginners#what is leverage in forex#what is pips in forex#how to read forex charts#what is currency trading

1 note

·

View note

Text

Binance Exclusive: Start Trading with $100 for Free!

Take your first steps into the exciting realm of cryptocurrency trading with Binance! Sign up now and receive a complimentary $100 to kickstart your trading journey. Explore a diverse selection of cryptocurrencies, hone your trading skills, and potentially turn that initial $100 into something more. Don't miss this exclusive offer – seize the opportunity to trade on Binance with free funds! #binance #cryptotrading #freemoney Link Below : https://bit.ly/BinanceFree100

#Cryptocurrency#Forex#Stocks#Day Trading#Swing Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Risk Management#Options Trading#Futures Trading#Bull Market#Bear Market#Market Trends#Stop-Loss#Take Profit#Margin Trading#Leverage#Candlestick Patterns#Market Volatility

0 notes

Text

The Benefits of Using DamasFX Forex Signals for Passive Income

Forex trading has become increasingly popular as a means to generate passive income. One effective tool that traders can utilize is DamasFX Forex Signals. These signals provide valuable insights and recommendations for trading in the foreign exchange market. By following these signals, traders can potentially increase their chances of making profitable trades and earning passive income. In this…

View On WordPress

#copy trade#Damasfx#finance#FOREX#forex signals#investment#leverage#myFXbook#passive income#social trade

1 note

·

View note