#copy trade

Explore tagged Tumblr posts

Text

Struggling with forex charts? 🚀 Try VT Markets’ copy trading on VTrade—follow pro traders, start with just $100, and watch the magic happen. Perfect for beginners or busy folks! Check it out: vtmarkets.com

1 note

·

View note

Text

EBC Salary Scheme Program

Salary Scheme: Be Signal Provider and receive Trading Rewards Plan, $100-$10000/Monthly.

*1. You can be signal provider from other brokers.

EBC Financial Group Rebate 80%: https://forexrebatehub.com/ebc-financial-group-rebate/

0 notes

Text

Kính gửi các nhà đầu tư thân mến,

FRACTAL ELASTICITY SYSTEMTôi xin chia sẻ với các bạn về hệ thống giao dịch Fractal Elasticity System mà tôi đang áp dụng. Hệ thống này dựa trên nguyên tắc breakout-pullback kết hợp với các tín hiệu kỹ thuật như đường Stochastic và mô hình nến Fractal V-shape. Điểm mạnh của hệ thống này là khả năng xác định các điểm vào lệnh có xác suất thắng cao, đồng thời quản lý rủi ro chặt chẽ thông qua các…

View On WordPress

0 notes

Text

The Benefits of Using DamasFX Forex Signals for Passive Income

Forex trading has become increasingly popular as a means to generate passive income. One effective tool that traders can utilize is DamasFX Forex Signals. These signals provide valuable insights and recommendations for trading in the foreign exchange market. By following these signals, traders can potentially increase their chances of making profitable trades and earning passive income. In this…

View On WordPress

#copy trade#Damasfx#finance#FOREX#forex signals#investment#leverage#myFXbook#passive income#social trade

1 note

·

View note

Text

In the ever-evolving landscape of financial markets, a groundbreaking trend has emerged – social trading. This innovative approach to trading has democratized the investment landscape, allowing individuals to harness the wisdom of the crowd and leverage the expertise of seasoned traders. Social trading platforms, encompassing features such as copy trading and PAMM trading, are at the forefront of this revolution. Let’s delve into how these platforms are reshaping the way we engage with the markets and empowering traders of all levels.

Understanding the Dynamics of Social Trading

Social trading is a paradigm shift in the world of finance, transcending traditional barriers and fostering a collaborative environment. At its core, social trading enables users to observe, follow, and even replicate the trading strategies of experienced investors in real-time. This democratization of trading insights has brought financial markets closer to individuals, irrespective of their experience level.

Key Features of Social Trading Platforms

Copy Trading – Embracing the Wisdom of Experts

Copy trading, a flagship feature of social trading platforms, allows users to replicate the trades of successful and experienced investors automatically. By simply selecting a trader to follow, users can mirror their trading activity, making it an ideal option for those who may lack the time or expertise to actively manage their portfolios.

PAMM Trading – Professional Asset Management

Percentage Allocation Management Module (PAMM) trading is another integral component of social trading platforms. PAMM accounts enable users to allocate funds to experienced fund managers who then make trading decisions on their behalf. This hands-off approach to investing provides a level of professional asset management previously accessible only to institutional investors.

How to Get Started with Social Trading

Step 1: Choose a Reputable Social Trading Platform

The first step on the social trading journey is selecting a platform that aligns with your trading goals. Consider factors such as user interface, available features, security measures, and the diversity of traders on the platform. Popular social trading platforms include Exclusive Markets, eToro, ZuluTrade, and NAGA.

Step 2: Create an Account and Verify

After carefully selecting a platform, the subsequent course of action is to establish an account. This involves furnishing the necessary details and, usually, undergoing a verification procedure to guarantee adherence to regulatory benchmarks. It is imperative to comprehend that this phase holds immense significance in safeguarding both your financial resources as well as your personal information.

Step 3: Explore Traders and Strategies

Social trading platforms offer a diverse pool of traders, each with their unique strategies and risk profiles. Take the time to explore and analyse the performance statistics, risk factors, and trading styles of different traders. Look for consistency in performance over time.

Step 4: Allocate Funds and Set Parameters

For copy trading or PAMM trading, the allocation of funds is a critical decision. Determine the amount of capital you’re comfortable investing and allocate it to the selected trader or PAMM account. Additionally, set parameters such as risk tolerance and investment goals to guide the automated trading process.

Advantages of Social Trading Platforms

Accessibility and Inclusivity

One of the significant advantages of social trading platforms is their accessibility. They break down traditional barriers to entry, allowing individuals with varying levels of experience to participate in financial markets. Novice traders can learn from seasoned professionals, and experienced investors can diversify their strategies.

Diversification and Risk Management

Social trading platforms inherently promote diversification. By following multiple traders or allocating funds to different PAMM accounts, users can spread risk across various assets and trading styles. This diversification enhances risk management and reduces exposure to the volatility of any single investment.

Considerations in Social Trading

Risk Awareness and Due Diligence

While social trading platforms offer opportunities, they also come with risks. Users should be aware that past performance is not indicative of future results, and losses are possible. Conduct due diligence on the traders or fund managers you choose, considering factors such as trading history, risk management practices, and market conditions during their trading periods.

Platform Fees and Costs

Social trading platforms typically charge fees for their services. These fees may include spreads, performance fees for successful trades, or subscription fees for premium features. Understand the fee structure of the platform you choose to ensure that it aligns with your budget and trading goals.

The Future of Social Trading

As technology continues to advance, the future of social trading holds exciting possibilities. The integration of artificial intelligence and machine learning algorithms may further enhance the capabilities of these platforms. Advanced analytics and predictive tools could provide users with more comprehensive insights and personalized recommendations.

In Conclusion

The emergence of social trading platforms has brought about a fresh era of ease and cooperation in the financial markets. Through methods like copy trading or PAMM trading, regular people now have the chance to get involved with the markets in a more knowledgeable and less hands-on way. All types of trading, like any activity demand careful consideration of the risks involved. Like any endeavour it is essential to research and continuously learn. A notable transformation, in how we engage with and navigate the evolving realm is the emergence of social platforms tailored for traders. This shift is undeniably significant.

Source: https://ipsnews.net/business/2024/01/09/the-rise-of-social-trading-copy-trading-and-pamm-trading/

#social trading#copy trading platform#copy trade#copytrading#pamm trading account#pamm account#pamm trading

0 notes

Text

Artificial Intelligence (AI Trade) Copy Trading

Ai Trading Shape The Future Of Forex Copy TradingAI in Forex Copy Trading: A Transformative Force Advanced Analytics and Predictive Modeling With Forex AI Risk Management and Portfolio Optimization Emotion-Free With AI Trading The Role of Machine Learning Future Possibilities With AI Trade Benefits of AI Trading: Disadvantages of AI Trading:

Ai Trading Shape The Future Of Forex Copy Trading

Artificial Intelligence (AI) is poised to revolutionize the world of trading and, by extension, copy trading. As we delve into the future possibilities of forex AI trade, we discover a landscape filled with unprecedented opportunities and advancements in the realm of financial markets.

AI in Forex Copy Trading: A Transformative Force

The integration of AI trading into copy trading platforms brings forth a myriad of benefits. AI-driven strategies can process vast amounts of data with lightning speed, identifying trends and market opportunities that might elude human traders. This not only enhances the accuracy of trade decisions but also allows for real-time adjustments to market conditions.

Advanced Analytics and Predictive Modeling With Forex AI

One of the most compelling aspects of AI trade is its ability to employ advanced analytics and predictive modeling. These technologies enable AI ( Artificial Intelligence ) systems to analyze historical data, identify patterns, and make predictions about future market movements. This predictive capability can be leveraged by copy traders to make informed decisions with a higher probability of success.

Risk Management and Portfolio Optimization

AI-driven automated copy trading systems excel at risk management. They can automatically adjust trade sizes, set stop-loss orders, and diversify portfolios based on predefined risk parameters. This level of automation ensures that your investments are managed precisely, reducing the potential for substantial losses.

Emotion-Free With AI Trading

One of the significant challenges human traders face is emotional bias. AI trade systems are devoid of emotions, ensuring that decisions are made based on data and algorithms rather than fear or greed. This leads to more consistent and disciplined trading, a crucial factor in achieving long-term success.

The Role of Machine Learning

Machine learning, a subset of AI, plays a pivotal role in the evolution of copy trading. These systems can adapt and learn from past trading experiences, continuously improving their strategies. As a result, your AI-driven copy trading portfolio becomes increasingly fine-tuned over time.

Future Possibilities With AI Trade

The future of AI trade and copy trading is brimming with exciting possibilities. Here are a few glimpses of what lies ahead:- Personalized AI Traders: Imagine having a personal AI trader that tailors its strategies to your specific financial goals and risk tolerance. - Interconnected AI Networks: AI systems communicating and collaborating with each other to optimize trading decisions collectively. - Enhanced Predictive Accuracy: AI algorithms becoming even more proficient at predicting market movements with greater accuracy. - Broader Asset Coverage: Expanding AI trade to encompass a broader range of assets, including cryptocurrencies, commodities, and stocks.

Benefits of AI Trading:

- Speed and Efficiency: AI-powered trading systems can analyze vast amounts of data and execute trades at lightning speed, taking advantage of even the most fleeting market opportunities. - 24/7 Operation: AI doesn't sleep. It can trade around the clock, reacting to global market developments, news events, and price movements in real-time. - Emotion-Free Trading: AI eliminates the emotional biases that often affect human traders. Decisions are based on data and algorithms, leading to consistent and disciplined trading. - Advanced Data Analysis: AI can process and analyze diverse data sources, including news, social media, and market indicators, enabling more comprehensive market analysis. - Risk Management: AI systems can automatically manage risk by setting stop-loss orders, adjusting position sizes, and diversifying portfolios, reducing the potential for significant losses. - Scalability: AI trading strategies can be easily scaled up or down to accommodate different investment sizes, making them suitable for a wide range of traders. - Backtesting and Optimization: Traders can backtest AI strategies against historical data to assess performance and fine-tune them for better results.

Disadvantages of AI Trading:

- Complexity: Developing and maintaining AI trading systems can be complex and requires expertise in programming and data analysis. - Overfitting Risk: AI systems can be prone to overfitting, where they perform exceptionally well on historical data but struggle in real-market conditions. - Costs: Building and operating AI trading systems can be expensive, including data access fees, computing power, and ongoing maintenance. - Lack of Understanding: Traders may not fully understand the algorithms driving AI systems, leading to a potential loss of control over their investments. - Technical Failures: AI systems are not immune to technical glitches or errors, which can result in unexpected trading outcomes. - Market Conditions: AI systems may struggle during unprecedented market conditions or black swan events that deviate significantly from historical data. - Regulatory Challenges: The regulatory landscape for AI trading is evolving, and compliance can be a challenge for traders and institutions. In conclusion, AI trading offers numerous advantages, including speed, efficiency, and emotion-free decision-making. However, it also comes with complexities, costs, and potential risks. Successful AI trading requires a deep understanding of the technology and its limitations, as well as careful risk management. Traders should weigh these benefits and disadvantages when considering the adoption of AI trading strategies.In other words, the convergence of AI and copy trading is ushering in a new era of possibilities. These technologies are set to reshape the landscape of financial markets, offering traders innovative tools to grow their wealth. As AI trade continues to evolve, the future holds immense potential for those seeking to harness its transformative power in the realm of copy trading. Read the full article

0 notes

Text

Is It Profitable To Use Traderviet For Intra-Day Investors?

Online trading helps you make the best of the dynamic activities of the foreign market and Forex factory. One can earn in doubles by utilizing online trading solutions and making the best choice. In the long run, intra-day investors can find an efficient outcome with virtual trading platforms.

Ease your needs with the one-click solutions!

The integrated and improved interface of Traderviet makes it the best choice for all investors. You can place several orders to purchase and sell without hassles. Enjoy the one-click benefits of the modern platform and make more money without much effort!

0 notes

Text

Some recent bust commissions for @billie-cardboard and @/blazingkyatto! 🦈💛😺

#reksu draws#commission#furry#anthro#furry art#anthro art#shark furry#cat furry#these commissions were traded for 2 copies of Space Marine 2 for myself and a friend hehehehehehe

481 notes

·

View notes

Text

this is a really good thread on bluesky on how to AI proof your ao3 fics (to some extent)!!!

#I love when people copy parts of my fic to tell me what they liked in the comments#but maybe the trade off isn’t worth it

149 notes

·

View notes

Text

This is an art trade I did with a moot on TikTok- her Handle is luxlett3 and y’all should check her out

I’m pretty happy with how this one came out so I’m posting itttttt ✨✨✨

#art#myart#my art#digtal art#digtalart#undertale#undertaleau#sans#undertale au#horror sans#horror#horrortale#sans x oc#but like not my oc obvi#art trade#also like- you guys could totally get something like this if you commissioned me teehee#sorry I just want some before I’m thrown back to the wolves that us work#really happy with the hair shading-#leaning into the anime aspect of my artstyle#fan fact she’s actually supposed to have a side ponytail but I uh forgot it-#another fun fact is that horror’s fur is copy n pasted from another drawing I did#and inspired by arcane and how they did fur

212 notes

·

View notes

Text

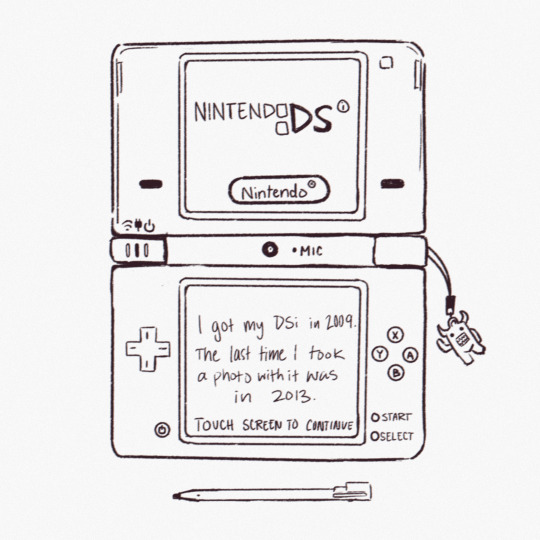

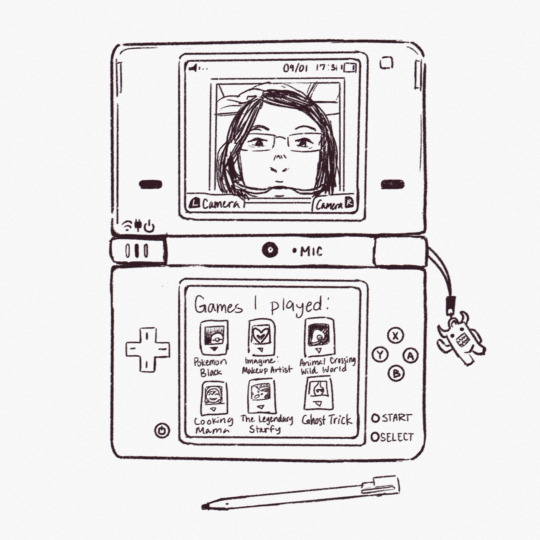

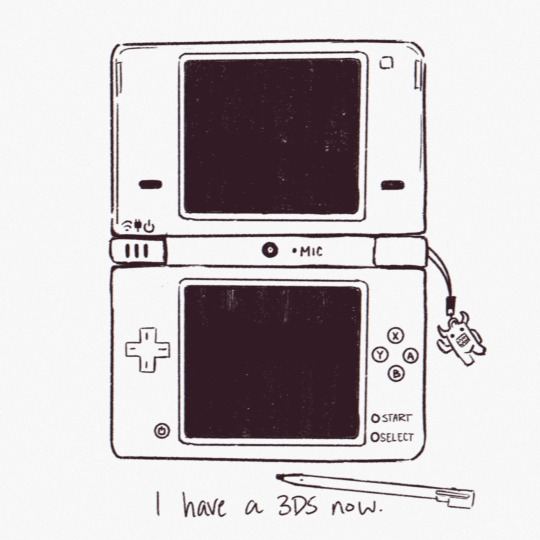

My baby blue DSi - online version of a zine i made for sfzinefest

#my art#original art#zine#the selfie on the top screen is a real photo of me that i took on my dsi when i had neckgear in elementary school lol#making a few copies of this for trades hehe

2K notes

·

View notes

Text

Hướng dẫn cách Copy Trade Exness chi tiết cho người mới bắt đầu

Exness hiện là sàn giao dịch Forex uy tín hàng đầu hiện nay và tính năng Copy Trade được các trader sử dụng phổ biến, hỗ trợ hiệu quả trong quá trình giao dịch. Nội dung dưới đây sẽ giúp bạn hiểu rõ hơn về cách thức hoạt động, cách đăng ký và sử dụng hình thức này nhé! Exness copy trade là g��? Copy Trade Exness là một tính năng cho phép các nhà giao dịch (người có kinh nghiệm và thành tích tốt…

View On WordPress

0 notes

Text

#the locked tomb#tlt#nona the ninth#nona tlt#zine#fanzine#tlt fanart#noodle tlt#my art#my zine#this was a silly little idea I had like months ago#took me forever to get it put together#coloring was hard but I think it worked out#I even have some print copies now!!#not perfect quality but they're pretty good#I'll see if I can trade/sell some of them..

394 notes

·

View notes

Text

Key to investment success

s many of you know we at DamasFX investing our own funds and manage clients funds with our strategies on FOREX market. But to be successful on high risk market as FOREX, main key is diversification. That’s why our own investment portfolio include other traders strategies. Here are some of the best strategies in CopyFX from ROBOFOREX that we have investments: Continue….

View On WordPress

1 note

·

View note

Text

In the dynamic world of finance, where every second counts, staying ahead is not just a choice but a mere necessity. A revolutionary change came after the evolution of social trading, blending the realms of social media and financial markets. Imagine a world where investors come together, share insights, and collectively influence financial decisions. Here, in this article, we will explore social trading, its intricacies, benefits, and potential challenges.

What is Social Trading?

Social trading is a collaborative approach to financial markets that incorporates the principles of social media and trading platforms. The sole objective of it is to connect investors, allowing them to share strategies, analyses, and market insights in real-time. Social trading platforms provide a platform where traders can highlight their skills while investors can replicate the strategies of successful traders effortlessly.

PAMM trading brings together the traders and investors in a mutually beneficial way. It allows experienced traders to become managers and generate profits by attracting investors. At the same time, traders can become investors and gain income without having extensive knowledge of training.

In copy trading, investors follow the approach of successful traders and automate their trading without having to constantly monitor the markets. One has to follow the selected experienced investor and replicate their best strategies to achieve similar returns.

How Does Social Trading Work?

Transparency and accessibility are the key elements of social trading. Specialized platforms work as the meeting ground for traders and investors. Here, traders will share their strategies, allowing investors to replicate their trades. This real-time mirroring ensures that followers can utilize market opportunities without actively managing their portfolios. It has a bidirectional communication flow as the traders share their insights, and investors provide feedback and engage in discussions.

This involves selecting a trader to follow based on their past performance, risk tolerance, and market strategies. Once a follower chooses a trader, the platform automatically executes the actions of the chosen trader’s accounts. This replication ensures that the followers can benefit from the expertise of seasoned traders.

Who Can Benefit from It?

Social trading caters to a diverse audience, offering opportunities for both novice and experienced investors. Social trading serves as an educational tool for those who recently started trading. Novice investors can learn and observe the strategies of more experienced traders. They can gain valuable insights into market dynamics and trading techniques.

On the other hand, experienced traders can leverage social trading to diversify their income streams. By attracting novice investors, professional traders can earn an additional income based on their success strategies.

Tips for Successful Social Trading

Diversify Your Portfolio:

To reduce risk, spread your investments across different asset classes. Diversification is a fundamental principle of risk management that helps in safeguarding your capital.

Choose Your Traders Wisely:

Before selecting a trader that you wish to follow, perform a thorough conduct. Analyse their trading history, risk tolerance, and overall performance. Besides this, look for consistency and a proven record of accomplishment.

Stay Informed:

It is essential to be informed on current trends, economic indicators, and global events that can impact on your investments because of the constantly evolving market dynamics.

Define Realistic Goals:

Set clear and achievable financial goals to guide your trading strategy. Establishing realistic expectations will help you stay focused and avoid making any impulsive decisions.

Risk Management:

To protect your capital and minimize potential losses, it is crucial to develop a robust risk management strategy. This includes setting stop-loss orders, diversifying your investments, and avoiding excessive leverage.

Advantages of Social Trading

What is it that you need to look for when you are choosing a social trading platform?

Accessibility:

Social trading eliminates the barriers to entry by allowing anyone to participate. Thus, opening the doors to financial markets for individuals with limited financial knowledge.

Learning Opportunities:

Unseasoned traders have the unique opportunity to learn from professionals in a practical and real-world context. The transparency nature offered by copy trading platforms facilitates the transfer of knowledge.

Time Efficiency:

Traditional trading methods can be time-consuming and challenging at times. Without devoting extensive time to the market, social trading allows followers to benefit from the expertise of others. This is particularly beneficial for those with busy schedules or very little to no market knowledge.

Diversification:

Social trading enables investors to build a diversified portfolio without the need for in-depth knowledge of the market.

Risks and Challenges of Social Trading

Dependency Risk:

Relying solely on the strategies of others leads to its own risk. While social trading offers the opportunity to benefit from the expertise of experienced traders, it is only possible to follow with an understanding of the underlying strategy, which can result in financial losses.

Market Volatility:

The inherent risks of trading remain in social trading. Followers are not immune to market fluctuations, and sudden changes in market conditions can impact on the performance of both traders and followers.

Risk of Fraud:

The online nature of social trading platforms makes them susceptible to scams and fraudulent activities. Investors should exercise caution and conduct thorough due diligence before committing to any trading activity.

Conclusion

Social trading is a paradigm shift in the financial world, offering an innovative and inclusive approach to investment. While it presents exciting opportunities, participants must approach it with a discerning perspective. By examining the mechanics, conducting thorough research, and implementing prudent risk management, investors can leverage the full potential of social trading to navigate the financial markets effectively. As technology progresses, social trading is a testament to the transformative power of collaboration in the finance sector.

0 notes

Text

Top 10 Copy Trading Strategy : Step-by-Step Guide

Introduction:Step 1: Define Your Goals and Risk Tolerance:Step 2: Choose Your Copy Trading Platform:Step 3: Research and Select Traders Or Strategies:Step 4: Set Allocation and Risk Parameters:Step 5: Monitor and Adjust:Step 6: Stay Informed and Educated:Step 7: Emotion Control and Discipline:Step 8: Risk Management:Step 9: Review and Adjust Your Strategy:Conclusion:

Introduction:

Copy trading is a powerful tool that allows individuals to participate in the forex market by replicating the trades of experienced traders or strategies from trading robot ( EA ) to boost your passive income profit. However, success in copy trading requires more than just blindly following others; you need to understand the basic knowledge of forex trading and copy trade. It demands a well-structured strategy that aligns with your goals and risk tolerance.

In this step-by-step guide, we'll take you through the process of building your own copy trading strategy, helping you make informed decisions and increase your chances of success.

Step 1: Define Your Goals and Risk Tolerance:

Before diving into copy trading, setting clear objectives and understanding your risk tolerance is essential. Ask yourself: - What are my financial goals? Do I seek long-term growth, regular income, or a balanced approach? - How much risk can I comfortably tolerate? Consider your financial situation and emotional resilience. Example: If you're a conservative investor nearing retirement, your goal might be capital preservation with low risk tolerance. On the other hand, a younger investor may aim for aggressive growth with higher risk tolerance.

Step 2: Choose Your Copy Trading Platform:

Selecting the right forex broker platform is crucial to your copy trading success. Consider the following factors: - Research and choose a reputable copy trading platform. - Evaluate platform features like trader selection, risk management tools, and fees. Example: You might opt for a platform with a diverse pool of experienced traders, transparent fee structures, and robust risk management features.

Step 3: Research and Select Traders Or Strategies:

Picking the right strategies & traders to copy is the heart of your strategy; always check the trading performance before deciding. Conduct thorough research by: - Examining trader profiles, including their trading history and strategies. - Considering their risk levels and historical performance. Example: You could choose a mix of traders or strategies, including a conservative trader focused on steady gains and a high-risk trader aiming for substantial profits.

Step 4: Set Allocation and Risk Parameters:

To safeguard your capital, define allocation and risk parameters: - Determine the percentage of your capital to allocate to each trader. - Set stop-loss and take-profit levels to manage potential losses and secure profits. Example: You may allocate 30% of your capital to a low-risk trader with a 10% stop-loss, while allocating 20% to a higher-risk trader with a 20% stop-loss.

Step 5: Monitor and Adjust:

Active monitoring of your copy trading portfolio is essential: - Regularly review trader performance and adherence to your strategy. - Be prepared to make adjustments if a trader's strategy or performance deviates from your goals. Example: If a trader consistently underperforms or changes their strategy, consider reallocating funds to align with your objectives.

Step 6: Stay Informed and Educated:

Successful copy trading requires ongoing learning: - Attend webinars, read educational material, and stay informed about market news and trends. Example: Continuously educating yourself about the forex market helps you make informed decisions and adapt to changing market conditions.

Step 7: Emotion Control and Discipline:

Emotions can disrupt your strategy. Maintain discipline by: - Avoiding impulsive decisions driven by fear or greed. Example: Stick to your pre-defined risk parameters and avoid panic-selling during market fluctuations.

Step 8: Risk Management:

Implement risk management techniques: - Set a maximum drawdown limit to protect your capital. - Diversify your copy trading portfolio to spread risk across different assets and trading styles. Example: By limiting your maximum drawdown to 20%, you reduce the risk of significant capital loss.

Step 9: Review and Adjust Your Strategy:

Periodically review your strategy: - Assess whether your financial goals and risk tolerance have changed. - Make necessary adjustments based on your evolving objectives. Example: If you decide to shift from aggressive growth to income generation, reallocate funds accordingly.

Conclusion:

Building a successful copy trading strategy requires careful planning, ongoing education, and unwavering discipline. By following these steps and tailoring your strategy to your unique circumstances, you can create a roadmap for achieving your financial goals through copy trading. Remember that while copy trading offers opportunities, it also carries risks, and past performance is not indicative of future results. Stay committed to continuous improvement, adapt to changing market conditions, and make informed decisions along your copy trading journey. Happy and responsible copy trading! Read the full article

1 note

·

View note