#Futures Trading

Explore tagged Tumblr posts

Text

youtube

Benzinga Interviews NVSTly: The Future of Social Investing

Join Benzinga as they sit down with NVSTly, the cutting-edge platform revolutionizing social trading and investing. In this exclusive interview, NVSTly shares insights on empowering retail traders, fostering transparency, and building a thriving community for investors of all levels. Discover how NVSTly is shaping the future of trading with innovative features, real-time trade tracking, and global collaboration.

Join NVSTly:

Website: nvstly.com

Mobile App: Available on Google Play and App Store

Discord Community: Join Now

#crypto#cryptocurrency#finance#fintech#forex#futures#investing#investors#stock market#startup#business#Youtube#stocks#nasdaq#financial#investing stocks#investment#blockchain#personal finance#finances#economy#economic#forextrading#forex market#futures trading#stock trading#markets#invest#awards#award winning

3 notes

·

View notes

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

11 notes

·

View notes

Text

This betting market names itself "Will Trump take back the Panama Canal?" and at first glance the probability seems way too high.

But the specific phrasing is "For the purposes of this market, control means the United States assumes new primary operational authority over some part of the canal" and the 'outcome verification' for deciding who gets paid is left to the fucking NYT.

Trump's whole thing is to claim victory no matter what actually happened and the NYT has been happy to launder those lies. Do you really want to tie up your money for the next four years just to hope this gets interpreted in your favor?

3 notes

·

View notes

Text

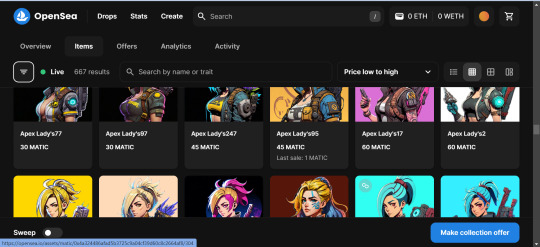

🌟 Apex Lady's NFT! Your chance to snag limited edition Apex Legends-inspired collectibles. @ApexLadys

Floor; 0.3 Matic

Blockchain; Polygon

https://magiceden.io/collections/polygon/0x4a324486afad5b3725c9a04cf39d60c8c2664af8

https://opensea.io/collection/apex-lady-s

#ApexLegendsArt #NFTs #NFT #NFTCollection #NFTMarketplace #opensea #poygon #trading #ETH

🧹🧹🧹🧹 🧹🧹Sweep!!!

#nft#crypto currency#apex legends#crypto#cryptocurreny trading#traditional art#forex#futures trading

7 notes

·

View notes

Text

How to Use CoinW Futures Bonus & Earn with the Affiliate Program

Cryptocurrency trading has evolved beyond simple buying and selling, with various platforms offering incentives to attract and retain traders. CoinW, a well-known digital asset exchange, provides two key opportunities for users to maximize their earnings: the Futures Bonus and the Affiliate Program. These features allow traders to explore USDT perpetual swaps without risking their own money while also enabling affiliate marketers to generate passive income by referring new users.

For traders looking to build their expertise in futures trading, the CoinW Futures Bonus provides a valuable starting point. It allows users to open positions using bonus funds, making it an excellent risk-free way to experience leveraged trading. Meanwhile, the CoinW Affiliate Program rewards users for bringing in new traders, with generous commissions on trading fees.

Understanding the CoinW Futures Bonus

What is the CoinW Futures Bonus?

The CoinW Futures Bonus is a promotional incentive that allows traders to experience futures trading without using their own capital. It is specifically designed for new users who want to explore futures trading and for experienced traders looking to enhance their strategies with extra funds.

This bonus can be used to open positions in CoinW Futures, and any profits made from these trades are withdrawable. However, if the trade results in a loss, the loss is deducted from the bonus itself rather than the trader’s personal funds.

This system makes the Futures Bonus an excellent tool for users who want to practice trading strategies, test CoinW’s platform, or increase their trading volume without financial risk.

How to Obtain the CoinW Futures Bonus

CoinW offers multiple ways for users to claim Futures Bonuses. Below are some of the most common methods:

Mission Center: Complete specific tasks within the CoinW Mission Center to earn Futures Bonus rewards. These tasks may include depositing funds, making a first trade, or completing a specific trading volume.

Platform Promotions: CoinW frequently runs promotional events where users can earn Futures Bonuses by participating. These may include trading competitions, limited-time events, and referral-based rewards.

Referral Program: By referring new users to the platform, traders can earn Futures Bonuses as an additional incentive.

Once a user receives the bonus, it will be credited directly to their CoinW Futures account, where it can be used to trade USDT perpetual contracts.

Rules and Conditions of the CoinW Futures Bonus

Before using the Futures Bonus, traders must understand the specific conditions set by CoinW:

Each bonus has a validity period – Users must utilize the bonus within a specific timeframe, or it will expire.

Leverage restrictions may apply – Some bonuses limit the maximum leverage that can be used.

Trading pairs may be limited – The bonus can only be used on certain USDT-margined perpetual contracts.

Positions must be closed within 24 hours – Trades using the Futures Bonus must be closed within a day, or CoinW will automatically liquidate them.

By understanding these rules, traders can strategically use the bonus to explore futures trading without unexpected restrictions.

How to Use the CoinW Futures Bonus Effectively

To make the most of the Futures Bonus, consider the following strategies:

Use low leverage for risk management – Since the bonus acts as free capital, taking highly leveraged positions may lead to unnecessary liquidations.

Trade liquid pairs – Select popular and highly liquid trading pairs to ensure smoother trade execution.

Monitor expiry dates – The bonus must be used before the expiration date, or it will be forfeited.

Combine bonuses for larger trades – If you have multiple bonuses, you can stack them strategically to open bigger positions.

By following these guidelines, traders can maximize the potential of their Futures Bonus and build experience in future bonus exchange trading without putting their funds at risk.

How to Earn with the CoinW Affiliate Program

What is the CoinW Affiliate Program?

The CoinW Affiliate Program is designed to help users generate passive income by referring traders to the platform. Affiliates earn a percentage of the trading fees generated by their referrals, creating a steady income stream without the need to actively trade.

This program is especially beneficial for:

Crypto influencers who have a following and can introduce new traders.

Content creators who can produce guides, videos, or blog posts about CoinW.

Traders who want to earn additional income by referring their peers.

Affiliates are rewarded based on the trading volume of their referrals, meaning the more active their referrals are, the higher their commissions.

How to Join the CoinW Affiliate Program

Becoming an affiliate is straightforward:

Sign up for a CoinW account (if you don’t already have one).

Visit the Affiliate Program section on the CoinW website.

Generate a referral link and share it with potential users.

Earn commissions on trading fees from referred users.

Earning Potential & Commission Structure

CoinW offers competitive commissions for affiliates, allowing them to earn up to 50% of their referral’s trading fees. Additional rewards include:

Performance-based bonuses – Top-performing affiliates can receive up to 5,000 USDT in bonuses.

Extra referral rewards – Affiliates who bring in other qualified affiliates can earn additional bonuses of up to 500 USDT.

Real-time earnings tracking – Affiliates can monitor their commission earnings through their CoinW dashboard.

With this scalable earning model, dedicated affiliates can generate consistent and high passive income from their referrals’ trading activities.

How to Succeed as a CoinW Affiliate

To maximize success as an affiliate, follow these best practices:

Utilize multiple marketing channels – Promote CoinW through social media, YouTube, blogs, and crypto forums.

Educate your audience – Create tutorials and guides on how CoinW works to attract serious traders.

Offer value-driven content – Focus on providing insights, market analysis, and trading tips to build trust.

Engage with crypto communities – Participate in Reddit discussions, Telegram groups, and Discord channels to reach a wider audience.

By implementing these strategies, affiliates can increase their conversions and boost their commission earnings significantly.

Conclusion

CoinW provides two powerful earning opportunities for traders and marketers:

The CoinW Futures Bonus, which allows users to experience futures trading risk-free and withdraw profits.

The Affiliate Program, which enables participants to earn passive income by referring traders to the platform.

Whether you’re a trader looking for risk-free ways to explore futures trading or an affiliate searching for a profitable referral program, CoinW offers structured rewards that cater to both.

By leveraging these programs strategically, users can enhance their trading experience while building multiple income streams within the cryptocurrency ecosystem.

For those ready to take action, sign up on CoinW today, claim your Futures Bonus, and start earning with the Affiliate Program.

0 notes

Text

A futures trading platform is a website or online platform, which permits users to purchase and sell future, contracts effectively. Hillbilly is the best futures trading platform where you can learn how to trade professionally in futures market. You will also get to know about different types of futures contracts. With Hillbilly, you can select the futures market, then can create an account, choose the trading platform, choose the limit orders.

0 notes

Text

NVSTly Named Finalist in Prestigious Benzinga FinTech Awards 2024

We are thrilled to announce that NVSTly, our innovative social investing platform, has been named a finalist in two categories at the highly anticipated Benzinga FinTech Awards 2024: Best Social Investing Platform and the coveted People's Choice Award. This recognition reflects the hard work and dedication of our team, our community, and the exciting growth we’ve experienced since NVSTly's inception.

The winners of these awards will be announced on November 19th, and we’re buzzing with excitement to attend the event and see if we can bring home one (or both!) of these prestigious honors.

A Platform for Everyone

NVSTly has always been about empowering retail traders to not only track and share their trades but also learn from others, copy strategies, and grow within a transparent, data-driven ecosystem. Whether you’re an experienced trader showcasing your portfolio or a beginner discovering top traders to follow, NVSTly provides the tools, insights, and community to elevate your trading journey.

We’re especially proud of our seamless integration with Discord, where our community can access real-time trade feeds, get live notifications, and manage their portfolios. It’s this dedication to innovation, transparency, and community building that has led us to become one of the fastest-growing social trading platforms.

What Makes This Nomination Special

Being a finalist in the Best Social Investing Platform category highlights the heart of NVSTly’s mission: fostering collaboration, sharing knowledge, and celebrating genuine trading performances. NVSTly’s focus on preventing fraud, delivering accurate market data validation, and rewarding real traders for their performance has set a new standard in social trading.

The People's Choice Award nomination is particularly special to us. This category is driven by the voices of our users and the broader community, a testament to the positive impact NVSTly has had on retail traders across the globe. The support from our user base is what drives us to continuously improve, and this nomination validates that our efforts are resonating.

Looking Ahead to the Big Night

As we approach the Benzinga FinTech Awards on November 19th, we can’t help but feel a mix of excitement and pride. Regardless of the outcome, being named a finalist alongside some of the most innovative financial platforms is an incredible achievement in itself. We look forward to attending the event, connecting with industry leaders, and celebrating the growth and evolution of FinTech.

We’ll keep you posted on the results—and who knows, maybe we’ll be bringing home an award or two! Thank you to everyone who has been a part of this journey. Let’s continue to build something great together!

Stay tuned for more updates and thank you for your continued support!

Join NVSTly:

Website: nvstly.com

Mobile App: Available on Google Play and App Store

Discord Community: Join Now

#crypto#cryptocurrency#finance#forex#futures#investing#stock market#benzinga#fintech#investors#stocks#nasdaq#financial#investing stocks#investment#blockchain#personal finance#finances#economy#economic#forextrading#forex market#futures trading#stock trading#markets#invest#award winning#social media#social networks#awards

3 notes

·

View notes

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

4 notes

·

View notes

Text

5X Trade Meta5 trading - The Greatest Way to Start Trading

https://member.5xtrade.com/loginAs a modern trader, Meta5 Trading is the best solution for you. As a multi-functional platform for online trading and a comfortable experience, you can start a successful trading career easily. On this platform, you will get the best trading tools and outstanding possibilities that can help you earn a lot. No matter whether you are interested in Futures Trading, Options Trading, or Stock Trading in India 5XTrade meta trading 5 platform gives you a huge range of options to choose from.

Advantages of choosing 5XTrade’s Multi Tools Integrated Meta Trading 5 Software

You can get the feel of what Meta Trading 5 is really like by just creating an account easily. With a demo account, you can easily decide whether choosing MT5 is better for you or not.

Get top-quality technical tools for analysis. When you are trading in our meta-trading platforms then these tools can be very helpful in making informed and accurate decisions.

As a multi-asset platform for trading, you can get high benefits from analytical objects given with it.

You can easily avoid potential loss and do a balanced trading by using the hedge financial strategy in our meta trading 5 platform

You can also get ready to use applications with the Meta5 Trading platform, these applications can be used as a boost in your meta-training journey.

Get the best digital technology and high-tech trading tools with 5XTrade meta-trading brokers.

We also serve each trader with complete advanced security features, including a powerful and advanced encrypted environment.

One of the most useful features of Meta Trading 5 software is its advisory experts. In this platform, every trader can create their advisory expert and download them very easily

Get a highly effective trading experience and save time with modern tradable tools available on it. While maintaining tight security this tool can easily help an individual to boost and gain better financial goals.

Best Meta5 Trading software in India – 5XTrade

5XTrade is among one of the best Meta5 Trading platforms in India, which makes us the best forex broker. From the availability of opening a free account with all the technology and tools you may need our services are designed perfectly for you.

#Futures Trading#stock trading in india#stock trading platform in india#Meta5 Trading platforms in India

0 notes

Text

I want a quarter million end of the next quarter.

#futures#tradehybrid#tradingmindset#leo energy#futures trading#prop firms#tradingforex#trading for beginners

1 note

·

View note

Video

youtube

support everyone gets! #funny #financialmarket

#youtube#socialstockmarket#stock trading#day trading#futures trading#nifty50#nifty prediction#nifty fifty#memes#funny memes#funny post#shorts#reels#viralpost#profit#motivation#success#laugh#laughter

1 note

·

View note

Text

Crypto Futures Trading

Crypto futures trading allows investors to speculate on the future prices of cryptocurrencies without owning the underlying assets. This trading method provides opportunities for hedging risks and leveraging positions to achieve higher potential profits. By utilizing advanced tools and strategies, traders can capitalize on market volatility, whether prices are rising or falling. Enhance your trading experience with the trusted Excent Capital platform, offering robust analytics and effective risk management techniques.

0 notes

Text

Escorts Kubota down nearly 10% on its railway business sale

0 notes

Text

How GameStop and WallStreetBets Ignited a Retail Trading Movement, Led by Communities Like NVSTly

Exploring the Retail Investor Surge Sparked by GameStop, WallStreetBets, and the Power of Communities Like NVSTly in Transforming the Trading Landscape.

Retail traders unite: A digital revolution sparked by GameStop, WallStreetBets, and communities like NVSTly, where traders of all experience levels collaborate, learn, and shape the future of investing.

In the last few years, retail trading has exploded in popularity, shaking up financial markets in ways few could have predicted. The surge in retail investors—everyday people buying and selling stocks—has been driven by multiple factors, from the rise of user-friendly trading platforms to the global shift toward digital communities where trading ideas, strategies, and financial tips are freely shared. Perhaps no event epitomizes this trend more than the GameStop short squeeze of January 2021, a moment that not only shook Wall Street but also changed the culture of trading forever.

The GameStop Short Squeeze: A Catalyst for Retail Traders

The GameStop saga was a defining moment for retail traders and a turning point in how ordinary investors engage with the stock market. At the heart of the drama was a group of retail traders on the subreddit /r/WallStreetBets, who rallied around GameStop ($GME), a struggling video game retailer that institutional investors had heavily shorted. In a coordinated effort, these traders started buying up shares and call options, driving the price higher and causing what’s known as a short squeeze—a situation where short sellers are forced to buy back shares at inflated prices to cover their positions, further pushing the price up.

The GameStop short squeeze was a retail trading revolution in real time. Between January and February 2021, GameStop's stock skyrocketed from under $20 to an all-time high of $483, stunning financial experts and exposing weaknesses in the traditional hedge fund model. Retail traders had managed to outmaneuver Wall Street’s elite, and suddenly, the world was paying attention.

The Role of /r/WallStreetBets and RoaringKitty

At the heart of this retail trader uprising was the /r/WallStreetBets subreddit, a chaotic, meme-filled forum where irreverent traders shared strategies, analysis, and sometimes wild speculation. Prior to the GameStop short squeeze, the subreddit had a relatively modest following, but it quickly grew to over 10 million users at its peak, as new retail investors flocked to it, hoping to get in on the action. The community embraced the ethos of high-risk, high-reward trading, and GameStop became its battle cry.

One key figure in the GameStop movement was Keith Gill, better known by his online persona RoaringKitty on YouTube. Gill had been publicly bullish on GameStop for months, frequently sharing his analysis in videos and on /r/WallStreetBets, where he posted his impressive options position in $GME. His deep-dive analysis showed his belief that GameStop was undervalued and that institutional investors were wrong in their shorting strategy. However, it wasn't widely known that RoaringKitty and DeepFuckingValue—Gill's username on the subreddit—were the same person until much later. Once the connection was made, it further galvanized the community, with many seeing Gill as a sort of folk hero for the retail trader movement.

Gill's straightforward analysis and calm demeanor during the frenzy resonated with thousands of new investors, many of whom were drawn to the stock market for the first time, inspired by his passion and belief in retail power. His transparency in sharing his trades and insights emboldened others to do the same, building trust within the retail community and further strengthening the resolve of /r/WallStreetBets users to hold onto their GameStop shares despite mounting pressure to sell.

Robinhood: Enabling and Undermining Retail Traders

Much of this retail trading boom was made possible by platforms like Robinhood, which democratized stock trading with a commission-free, easy-to-use app designed for beginners. By removing traditional barriers to entry, Robinhood allowed everyday people to start buying and selling stocks with just a few taps on their smartphone. This accessibility was a major factor in the rise of retail trading, as millions of users, many with little to no prior experience, could suddenly participate in the stock market.

However, Robinhood's role in the GameStop story would ultimately tarnish its reputation. In the midst of the GameStop short squeeze, as prices soared, Robinhood made the controversial decision to disable the "buy" button for certain stocks, including GameStop. This effectively halted new purchases of the stock, and retail traders were left with only one option—selling. The move caused panic among investors, many of whom feared they were being manipulated or abandoned by the platform. The inability to buy more shares caused the stock's price to plummet, leading to massive losses for those holding GameStop, as some were forced to sell at much lower prices than they had hoped.

The backlash was immediate and intense. Robinhood's actions were viewed by many as a betrayal of the very retail traders it had empowered, and it faced numerous accusations of market manipulation. During a subsequent U.S. House Financial Services Committee hearing, Robinhood CEO Vlad Tenev was questioned about the decision, but his evasive answers only fueled public distrust. He failed to provide clear "yes" or "no" responses to direct questions, leaving users feeling even more skeptical about the platform's transparency and motives. Since then, Robinhood's reputation has been deeply damaged, with many retail traders abandoning the platform in favor of alternatives.

The Rise of Social Trading Communities and Platforms like NVSTly

As retail traders became more engaged and sought new ways to share information, many flocked to Discord, a platform originally designed for gamers, to join real-time trading communities. NVSTly, one of the largest and most vibrant of these communities, has become a hub for traders of all experience levels. With over 45,000 users, NVSTly provides a space where newcomers can learn about investing and trading through its education center, packed with materials and resources designed to help users navigate the financial markets.

The community thrives on collaboration, with traders discussing the latest market trends, analyzing charts, and sharing their thoughts on potential investments. The platform also offers a team of analysts who provide trade signals and guidance to help users make more informed decisions. Whether you’re a seasoned trader or just getting started, NVSTly’s combination of real-time market analysis, discussion, and education creates a dynamic environment for learning and growth.

What sets NVSTly apart is the shared enthusiasm for trading across all financial markets, from stocks and options to cryptocurrencies, forex, and more. Unlike some platforms that cater primarily to one type of investor, NVSTly covers the entire spectrum, allowing users to explore different markets and strategies. This comprehensive approach makes it an ideal community for both beginners and experienced traders looking to sharpen their skills or share insights with others.

A New Era of Retail Power

The retail trading boom has fundamentally changed how individuals interact with the stock market. No longer are everyday investors confined to the sidelines, watching institutional investors dominate the trading landscape. Events like the GameStop short squeeze, combined with the rise of social communities like /r/WallStreetBets and NVSTly, have empowered retail traders to challenge the status quo and take control of their financial future.

Though platforms like Robinhood played a significant role in making stock trading accessible to millions, their actions during the GameStop saga revealed some of the limitations and challenges retail traders face. In response, traders have sought out new platforms and communities that better align with their values of transparency, collaboration, and empowerment.

As retail trading continues to grow, it's clear that the influence of everyday investors will be felt in financial markets for years to come. From meme stocks to cryptocurrencies, this new generation of traders is here to stay, armed with the tools, knowledge, and community support to navigate the ever-changing world of finance. Whether you're an experienced investor or just starting, platforms like NVSTly are leading the charge, creating a new wave of retail traders ready to take on the markets.

Join NVSTly:

Website: nvstly.com

Mobile App: Available on Google Play and App Store

Discord Community: Join Now

#crypto#cryptocurrency#fintech#finance#forex#futures#investing#investors#stock market#stocks#financial#social media#social networks#cryptocurrencies#day trading#social trading#social investing#retail trading#retail investing#nasdaq#investing stocks#investment#blockchain#personal finance#finances#economy#economic#forextrading#forex market#futures trading

1 note

·

View note