#they individually did not have the productive power to create the billions of coins that they have but used the productive power of others

Explore tagged Tumblr posts

Text

so you cant get phases to start early, but you can get to phases before they start. you can do 2 of the devices in phase 3 before the phases actually starts (the ones in 3.2 and 3.3) and since healer is pretty much useless in m7 the healer goes into phase 3 and does devices before phase 3 actually starts.

and can you just skip the entire dungeon?

so there's 0 second blood and blood skip. 0 second is starting with someone in the blood room, and blood skip is starting the dungeon in boss. somewhat recently they made it so that you get instantly killed if you're outside of the start room when the dungeon starts, but you can still 0 second using some tactical insertion trollage.

I don't really know how blood skip worked

backwards predev goes hard

#I'd argue that youtubers are the closest thing to bourgeoisie that skyblock has#since people like refraction or swavy have gained their wealth primarily from gifts#they individually did not have the productive power to create the billions of coins that they have but used the productive power of others#each player in skyblock is in control of their own means of production#the main thing separating you and I is that I have more capital thus greater productive power#marx said tradespeople's diminutive capital does not suffice for the scale on which Modern Industry is carried on#refractions 'capital' is his status as a youtuber#and my productive capacity (however large it may be) is not enough to compete with the donations that he receives

16 notes

·

View notes

Link

In 1992, a Canadian ecologist named William Rees coined the term “ecological footprint,” a measurement of how much any entity was impacting the planet’s ecology. A decade later, British Petroleum started promoting a new term: “carbon footprint.” In a splashy ad campaign, the company unveiled the first of its many carbon footprint calculators as a way for individuals to measure how their daily actions—what they eat, where they work, how they heat their home—impact global warming.

BP did not adopt the footprint imagery by accident. In the 30 years prior to the carbon footprint campaign, polluting companies had been using advertising to link pollution and climate change to personal choices. These campaigns, most notably the long-running Keep America Beautiful campaign, imply that individuals, rather than corporations, bear the responsibility for change.

“It was done so intentionally,” says Susan Hassol, director of the nonprofit science outreach group Climate Communication. “It’s a deflection.”

The universal adoption of the term “carbon footprint” hasn’t just changed how we speak about climate change. It’s changed how we think about it. Climate change has become an individual problem, caused by our insatiable appetite for consumption, and therefore a war that must be waged on our dinner plates and gas tanks, a hero’s journey from consumer to conservationist.

Yet the reality is that the future of civilization is being decided at a political and corporate level that no individual can impact. Just 100 companies are responsible for 71% of global emissions. Fossil fuel giants are funding climate change skepticism while simultaneously lobbying for tens of billions of dollars in subsidies. Big corporate names like Costco and Netflix are loudly committing to reduce emissions but unable to set meaningful targets or put plans in place. The Trump administration rolled back more than 100 environmental rules and regulations.

The reality is that the future of civilization is being decided at a political and corporate level that no individual can impact.

The same way that you give your child a toy to play with so you can finish your task uninterrupted, everyday citizens are busy changing out lightbulbs and buying electric cars while the true cause of global warming continues uninterrupted: a civilization dependent on fossil fuels. As Mike Tidwell, the executive director of the Chesapeake Climate Action Network, wrote in a 2007 op-ed, “every time an activist or politician hectors the public to voluntarily reach for a new bulb or spend extra on a Prius, ExxonMobil heaves a big sigh of relief.” A complete paradigm shift is needed—both in the way we conceptualize our individual climate impact and in the ways we calculate the emission impacts of those ultimately responsible: corporations and governmental systems.

One of the challenges with the carbon footprint measurement is how few of the factors an individual controls. Most of us have limited options for where we live, how far we have to commute to get to work, what kind of energy is available to heat our homes, etc. If we don’t own our home (and more than 30% of Americans don’t), we may not be able to properly insulate or install high-efficiency appliances. One research report from the Norwegian University of Science and Technology found that roughly one third of a city dweller’s carbon footprint is determined by public transportation options and building infrastructure. “We build our cities this way,” Hassol says. “It’s system change that’s really needed so that people have better choices.”

The inadequacy of our carbon footprint as a driver of change is painfully highlighted when you look at single-use plastics. Much attention has been given to how much plastic Americans consume (35.3 million tons per year, enough to fill the 104 million-cubic-foot AT&T Stadium in Dallas every 16 hours) and how each individual should be changing their behavior to help combat this waste. Everywhere you look, there’s a campaign to recycle more, or use metal straws, or bring your own bag to the grocery store.

In contrast, there are no public campaigns about the fact that packaging, an area where consumer control is limited, is the top driver of plastic production by a significant margin. The emissions impact of plastic manufacturing itself is rarely mentioned, along with the fact that much of our recycling still ends up in landfills. Some of the poorest nations are left to deal with hundreds of thousands of tons of soft drink bottles. The plastics are often just incinerated, creating serious environmental and health consequences. It’s a question as to whose carbon footprint is making a deeper impact on the environment: the family whose lettuce comes sealed in plastic (and who pays, not only for the product, but also for the waste collection and management services), or the company that is continuing to package food products in plastic materials, and then opting out of responsibility for their disposal.

Even if we just wanted to measure individual impact on climate change, the carbon footprint falls painfully short: “The current concept of a carbon footprint is too narrowly drawn,” Hassol explains. “It’s only the things I’m actively using and doing in my personal life and it doesn’t draw on other actions that are perhaps more important in the big picture as far as addressing climate change.”

For example, the average American has a carbon footprint of 16 tons. The average individual footprint globally is 4 tons. But that calculation doesn’t include who you vote for, how you invest your money, who you work for (and how much you travel for work, versus for leisure), or how you talk about climate change and influence others to get involved. “All of that should be part of the way we conceptualize our impact,” Hassol says.

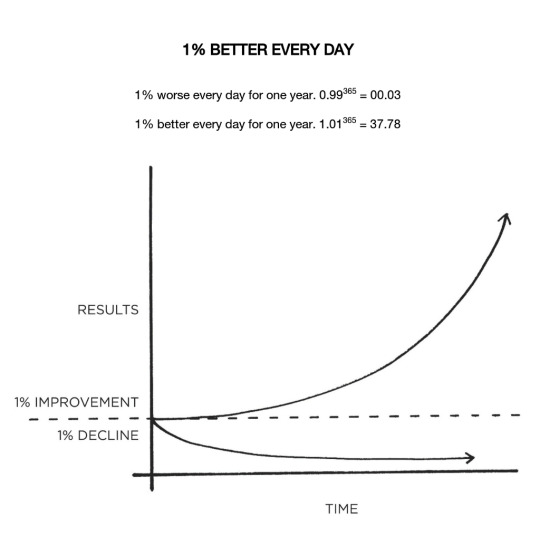

Instead of obsessing over a single metric, Cameron Brick, a social psychologist from the University of Amsterdam, says he urges people to have an ongoing and evolving conversation between themselves and their chosen lifestyle. “It’s not a single number, because anytime you pick a metric, then we will begin to game it,” he says. Instead, a minimal-carbon lifestyle is a process—one that involves community-building and continuing to make improvements over time, he says. “My lifestyle is not perfect either, but probably better each year.”

Hassol points out that one of the most important ways that an individual can impact emissions on a wider scale is also the hardest to calculate: social contagion. “When people do something, it affects others around them and their emissions,” she says.

Studies have shown that energy-related behaviors are heavily influenced by peer groups, even more than cost or convenience. A study in California showed that every time a solar panel was installed within a certain ZIP code, the probability of another installation in that area increased by 0.78%. Similarly, if you know somebody who has given up flying because of climate change, you are 50% more likely to also reduce your own air travel.

“Your individual footprint is not the full measure of your contribution because you’re encouraging other people through your personal actions,” explains Hassol. She recommends that people who want to do more should research community solar options and ways to buy into clean energy in their communities, and then publicize those options among their families, friends and social networks, in order to create that initial momentum for change.

But what could system change look like? For starters, using measurements that actually hold the decision makers responsible for their emissions impacts, for the entire lifecycle of their product or service. That might look like Big Soda being held accountable not only for the manufacturing and transportation of their single-use plastics, but also for each and every bottle that ends up in somebody’s recycling bin (Coca-Cola is the top producer of plastic waste in the world). The shift also might look like emissions information being printed on product labels and unbiased regulatory bodies certifying the accuracy of corporate emissions reports.

On the policy level, interest in a carbon tax is growing. The Break Free From Plastic Pollution Act was reintroduced in Congress this year (as Senate bill 984 and House Resolution 2238), and would force a temporary moratorium on virgin plastic production, require minimum recycled content, and ban some single-use plastic food service items. Many states already have some form of a producer responsibility program, where the producer of hard-to-dispose products such as paints, batteries, and other hazardous materials, must finance proper disposal. This creates an incentive to design reusable or less-toxic products.

When we shift the focus from changing consumer behavior to changing producer behavior, we see where true change happens: in corporate boardrooms and among political leaders. The irony of the carbon footprint is that individual action does have the power to change the world, just not on the lightbulb and recycling level.

“This problem is too big to solve voluntarily one person at a time,” Hassol says. “We need to change the system and you have a role in changing that system.”

5 notes

·

View notes

Note

Genuine question what is billions even about I see clips all the time and I cannot figure out what the plot is besides like “business” but I am very much in love w Taylor Mason (i think that’s their last name?) so I am intrigued ...

oh i’m so glad you asked

yeah it’s not at all a Just You thing, not only do we often only post about a particular slice of the series, it’s just REALLY difficult to get (or provide. but i’m always up for the challenge) a sense of what Billions is like as a series like, genre wise, and re: the plot, my god, every [usually more than 50 min but less than an hour] episode is a journey, in that So much will have happened. it moves at a Pace, i can tell you. but you know, good news in that it’s not really necessary to explain every plot thread ever, b/c it’s as much about its Themes or what have you

the stats rundown is billions is a weekly showtime tv series partway through its 5th season (12 episodes per season, currently they are producing the last half of s5 but had been on pandemic production hiatus for the past year, we do not yet know when the rest of s5 will air, s6 was greenlit a while ago) this isn’t really need to know for this question lol, but you don’t need to Not know either

the like, content Rundown is that yeah, it’s business, mostly high finance, although one of the main characters is always doing Legal Stuff (don’t care really b/c that side of things is not generally as relevant to, yes, taylor mason, who Makes the series). the kind of overarching Theme / premise is that the show is about like, here’s these Conflicts between people who are wielding some power in various ways, looking at the motivations of the individuals involved / the Cause And Effect web of these conflicts between them, e.g. how the consequences / fallout of one Power Play Maneuver will affect someone else’s storyline and result in them executing their own maneuvers, and of course, the pitfalls of all of this. more specifically, the series kicks off with the two (then (taylor is introduced in season 2) mainest characters, Axe, ceo of a hedge fund, and Chuck, some kind of lawyer who decides to go after axe b/c axe thinks he’s hot shit (true) and chuck is like ohhh i gotta do something about this guy. so there’s an Unending Conflict, axe vs chuck, an ongoing back and forth series of small or more overarching battles, and of course sometimes alliances, because there’s a Lot of characters on this show and we’re in season 5 so there’s been plenty of other Conflicts introduced besides this particular ongoing war. also, uh oh, chuck’s wife wendy works for the hedge fund axe runs! that’s just a whole wrench in things. as some sort of like, in house therapist performance coach sort of deal, thanks wendy, she’s also fairly a Main Character

axe is somewhat more relevant for our purposes b/c that’s that Finance side of the show via which taylor is introduced. but yeah both axe and chuck are exasperating lmfao like, this isn’t a show where it’s about the Likeability of whatever main character where like, you’re rooting for the obviously righteous / justified person or anything, it’s more about being along for the ride where you get to know Why people are engaging in these conflicts for sure, but like, unless you’re one of plenty of fans who maybe aren’t bringing the most Insight to the show who find any of this like, aspirational Epic Winner stuff like hell yeah axe or chuck as the Cool Guy Who Deserves To Win lmfao, being along for the ride is knowing that you’re just getting to watch this unfolding mess, so that’s “fun” lol

to get more to the point, yeah Taylor Mason is again the best part of the series lol, they’re introduced early in s2 as a Very Talented young iintern at axe capital (axe’s hedge fund) who, yknow, part of what makes axe an Eventful character to center things around is he’s (sometimes) capable re: all these strategic finance maneuvers, and also all “i don’t play by the rules,” which can often mean like, the actual rules like “no insider trading please” or more kinda implicit moral rules like “don’t keep taking Business Advantage over people’s deaths,” and here means that even though taylor is this early to mid 20something intern with no experience in finance who’s not even, at that juncture, necessarily planning to stay in the industry, he’s like yeah they’re valuable and i’m not gonna hold them back from that potential / opportunities * just because they’re a 20something new to the industry intern who definitely doesn’t behave in the Usual Way around here and is also a canon nonbinary character, thanks ( * you might not believe it, but axe does not proceed to only ever be a potential encouraging, opportunity creating ally* (*although, one nice thing is that they....almost always....have axe adamantly hold everyone who works with him to respecting taylor as a nonbinary person, at least in how they address taylor. b/c taylor Does get misgendered periodically, which can be exhausting, but they also aren’t exactly striving to hold it to what might be most “””realistic””” so like, taylor isn’t subject to transphobia and misgendering All The Time either) and so taylor very quickly goes beyond internship at axe cap, to the extent that when, at the end of season 2, axe effectively leaves them in charge of the whole fund when his own fuckups mean he temporarily Can’t helm axe cap

aaand then s3 starts off with taylor running things but has axe return Officially in charge soon enough, so there’s problems there, in that axe is now pulling taylor Back, and like, axe is alllllll about his ego, so it’s like, of course he’d Want taylor to have been able to successfully run axe cap while he couldn’t, since it’s his fund, but then of course he’s also mad about it b/c he needs everyone, like taylor, to know he’s better & more winning than them. and taylor doesn’t appreciate now being more sabotaged and stifled and that, like, if they’re mad about being treated this way, axe is just gonna be mad about That b/c you know, why aren’t they Only grateful to their mentor or deferential to his Skill And Experience, as well as the fact that no matter how much of an Ally you are to him, he’ll be mad if you’re not unilaterally loyal, aka if he fucks you over you can’t be mad about it or that’s actually a way you’re wronging Him, and you’re also wronging him if yknow, you say he can’t/shouldn’t just do what he wants, or do anything that to him implies you don’t think he’s objectively the Best most Winning and Deserving guy in whatever regards, like, if you’re associated with someone who makes him feel insecure in his superiority for one moment, and/or who he thinks doesn’t also recognize his superiority or something, he’ll be mad at you.......the Conflicts can arise v easily around here with this beloved character walking around. so, yeah, whereas season 2 for taylor is more like wow taylor you’ve got all this potential and value here, in season 3 taylor’s sure got reason to question their future at axe cap (see this post resident Billions / Taylor Mason Pro soph made last night) and, when not only are they and axe just more often going head to head over what they want here, there’s also this added egregious conflict of “taylor starts seeing this guy oscar who’s also in finance (but not at axe cap) and when they ask axe for some input on a matter via which they intended to help oscar out, axe uses that Information taylor just used to fuck oscar over to his own advantage, and when taylor is like ‘what the hell’ axe is just like ‘what’d you expect!! i gotta be me!!! if you expected anything different, that’s on you, and if you Did expect me to do this, that’s also on you’ because i’m sure it’s a surprise to hear that axe considers himself this like, force of nature where all his feelings and motivations and justifications are Objective and Correct, and then taylor has to tell oscar what happened and naturally this ends the relationship, to their evident further unhappiness” and oops, season 3 ends with taylor having started their own hedge fund.

i could give a tl;dr for what happens over the course of s4 & (so far in) s5, but i think the s2/s3 arcs are kinda the Essential Lore for explaining this character who crashes into the show (not in that their character tends to crash, their arrival and presence is clearly somewhat of a shakeup re: the norm, but they themself are all about staying balanced and Not being driven by tumultuous emotional impulses or anything like that, *cough, the characters they are quite a Foil to in this way*) and quickly ascends to Main Charactership. (also just remembered the other stats note that taylor is played by asia kate dillon, who is themself nonbinary.) another element that is a lot of fun re: taylor is that they have like, the series’ best Friendship lol, the show is not very conducive to a bunch of characters having a bunch of heartwarming relationships, though they sure Do appreciate those characters and let us see a lot of Dynamics at play even beyond the “these people are locked in conflict” plots and characterful interactions and moments for their own sakes, and Alliances, even friendships, sure are the other side of the Ongoing Conflicts coin here. but what i’m getting around to is that taylor gets to be good buds with mafee, a Guy who was working at axe cap already in season 1, who, along with ben kim (Another Guy At Axe Cap in S1, who we are also fans of) is like, one of the actually nice(r) people around there, and who is just like. such this Hapless Cishet Dude lmfaooo but he also happens to be the guy overseeing taylor’s (and presumably others’) internship, and is yknow, maybe kinda conflicted about “i’ve Been an actual employee this whole time and there goes an intern rocketing past me” but is also Supportive towards taylor, and taylor in turn is an Ally to him, and they are Friends, and when taylor starts their own fund, Taylor Mason Capital, mafee is the person from axe cap who helps them do it and leaves axe cap to work for them there. there’s also a part in s4, after an arc in the middle of the season ended up with taylor taking quite an emotional L, mafee has gone and confronted Responsible Parties over it and, naturally, ended up in a charity interfund Boxing Match (which, a] billions is deliberately Wild plenty of times in both its Elevated Dialogue style but also just like, things that happen lol but b] apparently that’s something that can & does happen in real life in hedge fund world. absolutely bizarre to learn this kind of stuff) taylor kinda gives him this pep talk including “asking you to come with me (to TMC, mase cap, their fund) was the best decision i ever made” and even back then, when we’d just started paying attention to the show fairly recently and weren’t exactly familiar with everyone and everything going on, it was like oh i Gotta post that clip lmao

there are many other side characters, this is a very Populated show, including like, recurring characters, people liable to be introduced at various points who might become regulars Or make repeat appearances but more periodically Or be around for part of a season, but naturally also i am mentioning one specific side character of Winston (No Official Last Name), who is a Quant, aka a quantitative rather than fundamental analyst, who first appeared in One Scene at the start of season 3 when taylor was looking to hire some quants for a project, but did not succeed, and the character (then only Quant Kid 2) was only meant to have that one appearance, but delightfully everyone wanted him back and they wrote more material for him asap. taylor later brings him on to their quant project, which is revealed to be part of what ensures they can start their own fund, and in season 4 winston is apparently the head of the quant team at mase cap, and he continues to appear as taylor’s main Quant. could go into a long (and, as he’s not a Main Character and it’s easier to cover his material, very thorough) tangent there lol but you’re asking about taylor and i’m only bringing up winston b/c technically he Is relevant there lmfao but also, i have to, and [tfw this side character quant who was originally only going to appear in one brief scene was the reason you got into this series in the first place and now it’s like well, We’re Here Forever, and also, taylor mason is The character]

natch you must’ve noticed if you’re sending me an ask about billions, but if you like taylor mason you Gotta be following @nothingunrealistic the #1 Tayficianado and who has also recently nobly finished Actually Properly Watching Billions and who can give you all kinds of info about the character / series, there’s A LOT to cover and it’s kinda impossible to convey some stuff w/o simply experiencing things yourself firsthand lmfao but also, we think about these characters and this show every day for like, two years and running, so. as you can see......totally willing to talk about it at any time to any extent lol

#anonymous#winston billions#So glad to get asks like this at any point lmfao like#oh someone's asked me about My Interest huh lol. here we go babeyyy

6 notes

·

View notes

Text

Just How Cryptocurrency Works

In other words, cryptocurrency is digital cash, which is developed in such a way that it is safe and secure as well as anonymous in some circumstances. It is carefully connected with net that makes use of cryptography, which is basically a process where readable details is converted into a code that can not be cracked so as to tack all the transfers and purchases made. Buy Ethereum Creditcard

Cryptography has a background going back to the The second world war, when there was a need to communicate in one of the most safe way. Since that time, an advancement of the very same has taken place and also it has ended up being digitalized today where various components of computer science and mathematical concept are being made use of for purposes of securing interactions, money as well as details online.

The initial cryptocurrency

The very initial cryptocurrency was introduced in the year 2009 and is still well known throughout the world. Much more cryptocurrencies have given that been presented over the past couple of years and today you can discover many offered online Buy Bitcoin EU.

Just how they function

This type of electronic money utilizes innovation that is decentralized so regarding enable the different customers to make payments that are secure and likewise, to store cash without necessarily making use of a name or perhaps going through a banks. They are generally operated on a blockchain. A blockchain is a public ledger that is distributed openly.

The cryptocurrency devices are normally created using a procedure that is described as mining. This usually involves making use of a computer power. Doing it in this manner resolves the mathematics issues that can be very complicated in the generation of coins. Customers are only permitted to acquire the currencies from the brokers and after that store them in cryptographic pocketbooks where they can invest them with excellent convenience.

Cryptocurrencies and also the application of blockchain innovation are still in the infant phases when thought about in financial terms. Even more uses might emerge in the future as there is no informing what else will be created. The future of negotiating on supplies, bonds as well as various other types of monetary assets might very well be traded utilizing the cryptocurrency and blockchain modern technology in the future EU.

Why use cryptocurrency?

Among the main characteristics of these currencies is the truth that they are secure and that they provide a privacy degree that you may not obtain anywhere else. There is no way in which a transaction can be reversed or forged. This is without a doubt the greatest reason that you must consider utilizing them Acquire Bitcoin EU.

The fees charged on this kind of money are likewise fairly low as well as this makes it an extremely trusted alternative when contrasted to the traditional currency. Given that they are decentralized in nature, they can be accessed by any individual unlike banks where accounts are opened up just by consent.

Cryptocurrency markets are offering a new money kind as well as sometimes the rewards can be fantastic. You might make a really small financial investment just to find that it has mushroomed into something terrific in a really short period of time. Nevertheless, it is still important to note that the market can be unpredictable too, and there are threats that are connected with getting EU.

Why Should You Sell Cryptocurrency?

The modern-day idea of cryptocurrency is coming to be incredibly popular amongst traders. An innovative principle introduced to the world by Satoshi Nakamoto as a side item came to be a hit. Decoding Cryptocurrency we comprehend crypto is something hidden as well as currency is a cash. It is a kind of money utilized in the block chain developed as well as stored. This is done through file encryption techniques in order to regulate the production and also confirmation of the money negotiated. Bit coin was the initial cryptocurrency which began Buy Bitcoin EU.

Cryptocurrency is just a part of the procedure of a digital database running in the virtual globe. The identification of the genuine person right here can not be figured out. Also, there is no centralized authority which regulates the trading of cryptocurrency. This currency amounts difficult gold maintained by people and the value of which is supposed to be getting raised by jumps and bounds. The digital system established by Satoshi is a decentralized one where just the miners deserve to make adjustments by validating the purchases launched. They are the only human touch carriers in the system.

Imitation of the cryptocurrency is not feasible as the whole system is based on tough core math and cryptographic problems. Only those people who can resolving these problems can make modifications to the database which is beside impossible. The deal once verified enters into the data source or the block chain which can not be turned around after that EU.

Cryptocurrency is just electronic money which is created with the assistance of coding method. It is based upon peer-to-peer control system. Allow us now understand just how one can be benefitted by trading in this market.

Can not be reversed or forged: Though lots of people can rebut this that the deals done are irreversible, however the best feature of cryptocurrencies is that once the purchase is confirmed. A brand-new block obtains added to the block chain and then the purchase can not be built. You become the proprietor of that block Purchase Bitcoin EU.

Online purchases: This not only makes it suitable for anyone being in any part of the globe to transact, yet it likewise relieves the speed with which purchase gets processed. As compared to actual time where you need 3rd parties to find right into the photo to get home or gold or take a loan, You only require a computer and a possible purchaser or seller in instance of cryptocurrency. This idea is simple, rapid and full of the leads of ROI.

The fee is reduced per purchase: There is reduced or no cost taken by the miners throughout the purchases as this is dealt with by the network EU.

Ease of access: The principle is so useful that all those people that have access to smartphones and also laptops can access the cryptocurrency market and also trade in it anytime anywhere. This access makes it even more rewarding. As the ROI is good, lots of nations like Kenya has presented the M-Pesa system permitting bit coin device which now allows 1 in every three Kenyans to have a bit coin budget with them Acquire Bitcoin EU.

Exactly How to Trade Cryptocurrencies - The Fundamentals of Buying Digital Currencies

Whether it's the idea of cryptocurrencies itself or diversification of their profile, people from all profession are investing in electronic currencies. If you're brand-new to the idea as well as questioning what's taking place, below are some fundamental principles and considerations for investment in cryptocurrencies EU.

What cryptocurrencies are offered and also just how do I get them?

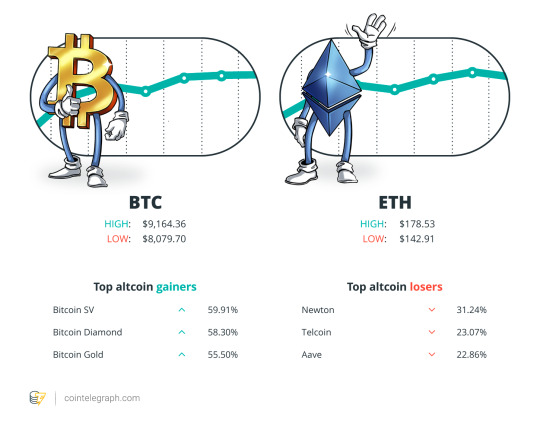

With a market cap of about $278 billion, Bitcoin is one of the most well-known cryptocurrency. Ethereum is second with a market cap of over $74 billion. Besides these two currencies, there are a variety of various other alternatives too, consisting of Surge ($ 28B), Litecoin ($ 17B) and also MIOTA ($ 13B).

Being initially to market, there are a lot of exchanges for Bitcoin profession all over the world. BitStamp and Coinbase are two widely known US-based exchanges. Bitcoin.de is a well established European exchange. If you want trading other digital money in addition to Bitcoin, after that a crypto marketplace is where you will certainly find all the digital money in one location. Below is a checklist of exchanges according to their 24-hour profession volume Get Bitcoin EU.

What options do I have to store my cash?

Another essential factor to consider is storage space of the coins. One option, certainly, is to keep it on the exchange where you buy them. However, you will certainly have to be careful in picking the exchange. The popularity of digital money has caused numerous brand-new, unknown exchanges turning up anywhere. Make the effort to do your due persistance so you can prevent the scammers.

Another choice you have with cryptocurrencies is that you can keep them yourself. One of the best options for saving your investment is hardware purses. Business like Journal permit you store Bitcoins and also several various other electronic currencies also.

What's the marketplace like and also how can I learn more concerning it?

The cryptocurrency market rises and fall a lot. The volatile nature of the marketplace makes it much more suited for a long-lasting play.

6 Advantages of Buying Cryptocurrencies

The birth of bitcoin in 2009 opened up doors to investment chances in an entirely new sort of possession class - cryptocurrency. Lots got in the space method very early Buy Bitcoin EU.

Fascinated by the enormous capacity of these fledgling but appealing assets, they got cryptos at cheap costs. As a result, the bull run of 2017 saw them become millionaires/ billionaires. Also those that really did not risk much enjoyed decent revenues.

Three years later cryptocurrencies still stay rewarding, and the market is right here to stay. You might already be an investor/trader or perhaps considering attempting your luck. In both instances, it makes good sense to know the benefits of buying cryptocurrencies Purchase Bitcoin EU.

Cryptocurrency Has a Brilliant Future

According to a record entitled Imagine 2030, released by Deutsche Bank, credit report and debit cards will certainly become obsolete. Smart devices and various other digital tools will replace them.

Cryptocurrencies will no more be viewed as outcasts however choices to existing monetary systems. Their benefits, such as security, speed, minimal transaction costs, convenience of storage, and also significance in the electronic period, will be acknowledged.

Concrete governing standards would promote cryptocurrencies, as well as enhance their adoption. The report projections that there will certainly be 200 million cryptocurrency pocketbook users by 2030, as well as nearly 350 million by the year 2035.

Chance to be part of an Expanding Community

WazirX's #IndiaWantsCrypto campaign just recently completed 600 days. It has actually ended up being a massive motion sustaining the adoption of cryptocurrencies and blockchain in India.

Likewise, the recent Supreme Court judgment nullifying RBI's crypto banking restriction from 2018 has actually instilled a brand-new rush of confidence among Indian bitcoin and also cryptocurrency financiers.

The 2020 Edelman Count on Barometer Report additionally mentions individuals' increasing belief in cryptocurrencies and blockchain technology. According to the searchings for, 73% of Indians depend on cryptocurrencies and also blockchain technology. 60% say that the influence of cryptocurrency/blockchain will be positive.

By being a cryptocurrency investor, you stand to be a component of a successful as well as quickly expanding community Buy Bitcoin EU.

Boosted Earnings Potential

Diversification is a necessary financial investment thumb policy. Particularly, throughout these times when most of the possessions have incurred hefty losses due to economic challenges spurred by the COVID-19 pandemic.

While financial investment in bitcoin has actually offered 26% returns from the starting of the year to date, gold has returned 16%. Numerous various other cryptocurrencies have registered three-digit ROI. Securities market as we all recognize have posted depressing efficiencies. Petroleum costs infamously crashed below 0 in the month of April.

Consisting of bitcoin or any kind of various other cryptocurrencies in your portfolio would shield your fund's worth in such unpredictable worldwide market circumstances. This truth was likewise impressed upon by billionaire macro bush fund supervisor Paul Tudor Jones when a month back he revealed plans to purchase Bitcoin.

Cryptocurrency and Taxation Difficulties

Cryptocurrencies have remained in the news recently because tax obligation authorities think they can be used to launder cash and also avert taxes. Also the Supreme Court appointed an Unique Investigating Group on Black Cash advised that trading in such money be discouraged. While China was reported to have actually banned some its biggest Bitcoin trading operators, nations such as the UNITED STATES and Canada have laws in place to restrict supply trade in cryptocurrency.

What is Cryptocurrency?

Cryptocurrency, as the name recommends, utilizes encrypted codes to effect a purchase. These codes are acknowledged by various other computer systems in the user community. As opposed to utilizing fiat money, an on the internet ledger is upgraded by regular accounting entries. The purchaser's account is debited and also the seller's account is attributed with such currency.

Exactly How are Transactions Made on Cryptocurrency?

When a transaction is initiated by one individual, her computer system sends a public cipher or public key that interacts with the personal cipher of the person receiving the currency. If the receiver approves the deal, the initiating computer connects a piece of code onto a block of a number of such encrypted codes that is understood to every user in the network. Special users called 'Miners' can affix the added code to the publicly shared block by solving a cryptographic challenge and earn more cryptocurrency in the process. As soon as a miner verifies a deal, the record in the block can not be altered or erased.

BitCoin, as an example, can be utilized on mobile devices as well to establish purchases. All you need do is let the receiver check a QR code from an app on your mobile phone or bring them in person by using Near Field Communication (NFC). Keep in mind that this is very similar to ordinary on the internet pocketbooks such as PayTM or MobiQuick Acquire Bitcoin EU.

Die-hard customers speak highly of BitCoin for its decentralized nature, international approval, anonymity, permanence of transactions and also data security. Unlike paper currency, no Central Bank controls inflationary pressures on cryptocurrency. Purchase journals are stored in a Peer-to-Peer network. That suggests every computer chips in its computer power as well as copies of databases are stored on every such node in the network. Financial institutions, on the other hand, shop deal data in central repositories which remain in the hands of exclusive individuals worked with by the firm.

How Can Cryptocurrency be used for Money Laundering?

The very reality that there is no control over cryptocurrency purchases by Central Banks or tax obligation authorities indicates that transactions can not constantly be labelled to a certain individual. This suggests that we do not understand whether the transactor has acquired the shop of worth legitimately or not. The transactee's store is likewise suspect as no one can inform what consideration was provided for the currency got.

What does Indian Law State concerning such Virtual Currencies?

Virtual Money or cryptocurrencies are generally seen as items of software program and hence classify as a good under the Sale of Item Act, 1930.

Being an excellent, indirect tax obligations on their sale or purchase as well as GST on the solutions supplied by Miners would certainly apply to them.

There is still quite a bit of complication regarding whether cryptocurrencies stand as money in India as well as the RBI, which has authority over clearing up and settlement systems and also pre-paid negotiable tools, has absolutely not accredited buying and selling by means of this medium of exchange.

Any kind of cryptocurrencies gotten by a local in India would therefore be governed by the Fx Management Act, 1999 as an import of items right into this nation.

India has actually enabled the trading of BitCoins in Unique Exchanges with integrated safeguards for tax evasion or money-laundering tasks as well as enforcement of Know Your Consumer norms. These exchanges consist of Zebpay, Unocoin as well as Coinsecure.

Those investing in BitCoins, as an example, are liable to be charged on dividends received.

Capital gains received because of sale of securities entailing Virtual currencies are also reliant be tired as earnings and also following online filing of IT returns.

1 note

·

View note

Text

Electrum Reddcoin Wallet

Reddcoin are simple to shift no matter what device you can be employing. They have absolutely no fees, are safe thanks for you to the security of the blockchain, and they can be eco-friendly because they offer you the likelihood to earn without power consumption. Electrum ReddCoin Pocket, also acknowledged as �lite ReddCoin wallets�, provide some sort of variety associated with benefits over the typical ReddCoin budget. Electrum ReddCoin wallet offload much involving the regular processing the fact that a pocket must do right up to servers that we all manage in the cloud, making them speedier, in a lot of cases more secure, together with much lighter on your own computer to run.. About Electrum Reddcoin Wallet originated back with January something like 20, 2014, in addition to released for the public around Feb of this same calendar year after that raised $22.99, 000 from the company�s Primary Public Coin Offering (IPCO). The crypto at first employed a PoW (Proof associated with Work) method, buy with April 29, 2014, that made this switch in order to PoSV (Proof of Share Velocity) Reddcoin is really a decentralized social cryptocurrency that enables people to instantly mail plus get RDD cryptocurrency bills on social networks together with having to pay financial transaction charges. It is identical to Venmo, Myspace Money, or maybe Snapchats Snapcash, most of which let anyone transfer money to different people via their own individual social media platforms. But not like these major social press networks, Reddcoin does not necessarily need you to apply it is local platform to help send together with receive dollars, permitting you to faultlessly combine its payment attributes on platforms like Reddit, Facebook, Twitter, and many other folks. Also, in add-on to instantly sending plus receiving money in people along with Reddcoin: you can as well give tips to content inventors similar to exactly how you give �likes� or �favorites� to a post. Reddcoin employs a method called Proof-of-Stake-Velocity (PoSV) which is completely different from Bitcoin�s proof-of-work protocol (PoW) which will needs huge amounts associated with energy for it has the exploration operations. Each Reddcoin consumer automatically mints Reddcoins mainly because the staking function is integrated the downloadable open wallet (which you has to own personal before using RDD). So how exactly does Reddcoin Work? Reddcoin hooks up to your respected social media networks and lets this sender carry out instant, absolutely no fee RDD payments to any individual that will he / she chooses to be able to socialize on the network. Just click the �tip� button plus the micropayment is sent to someone you desire to receive it. Reddcoin employs PoSV, which was formerly created by the particular Reddcoin developers to exchange its former PoW protocol. Electrum Reddcoin Wallet is definitely, in essence, a new strategy for Proof-of-Stake (PoS) of which address the requirements of the social currency to boost �both ownership (stake) plus activity (velocity)�. The crew stated the fact that adjustments to be able to the PoS �were required to promote more productive network participation. � The main difference between the two is usually that while PoS has linear gold coin aging method, PoSV�s or maybe aging provides non-linear. Lieu age will be resulted by simply multiplying the particular number of coins by their age i. e. time that passed since their very own last transaction. This suggests that contributions to the particular network can be produced without requiring any pc electricity. PoSV rewards customers that have more active wallets plus transact more compared to those that own wallets that are left heavy. Electrum Reddcoin Wallet -of-Stake offers benefits every pocket book equally as their very own coin age group grows. ReddCoin�s PoSV will be an ideal technique which can be implemented efficiently for marketing. People that transact a lot more typically by using their own wallets and handbags are entitled to get more incentives. How Do You Make ReddCoins? One other notable distinction involving ReddCoin as well as the other cryptocurrencies is that the money are not generated by means of mining but through minting. To be able to mint ReddCoin a person just have to visit our website and a wallet that features RDD coin in the idea. Typically the minting process initiates any time a wallet is in service and even online. ReddCoin minting eradicates the coin gold mining charges, increases the gold mining speed plus the need for expensive mining hardware. RDD Coin Supply If RDD transited from PoW in order to PoSV on September one, 2014, there were almost 27 billion RDD. During the time of writing, ReddCoin has the going around supply of 36, 808, 713, 174 RDD. Minting creates an inflation of up to 5% inflation per 12 months, even though the maximum supply of RDD doesn�t occur. RDD Value Investigation Up until December 2017, Reddcoin remained reasonably flat using very reduced values. On The month of january 7th, it increased to help its all-time high value involving $0. 03 cents, next like the rest associated with the crypto market, it plunged. On some time connected with writing, RDD is usually listed in $0. 004680 CHF. Where Can You Retailer Reddcoin? The Reddcoin backed wallet can be downloaded from the formal Reddcoin web page, or RDD money can be stored for the Coinomi mobile wallet. Conclusion Reddcoin is a piece using an ambiguous purpose, like it would seem a new tad odd to provide tips intended for social advertising content if we could just present appreciation by way of �liking� once we did up until these days. Nevertheless this tactic has been recently successful for that Steemit sociable media platform, as it put in place a comparable have, which usually pays rewards nearly all people around STEEM tokens for producing plus curating content, so is considered quite likely for typically the trend to find usage amid a larger target audience.

1 note

·

View note

Text

Electrum Reddcoin Wallet

Reddcoin are easy to exchange no make any difference what device you can be using. They have zero fees, secure thanks to the security of our blockchain, and they will be eco-friendly because they give you the chance to gain without power consumption. Electrum ReddCoin Finances, also identified as �lite ReddCoin wallets�, provide some sort of variety regarding benefits over the normal ReddCoin pocket book. Electrum ReddCoin wallet offload much connected with the typical processing the fact that a finances must do upward to servers that all of us run in the fog up, making them faster, around several cases more secure, plus much lighter on your computer to work.. About Electrum Reddcoin Wallet originated back with January something like 20, 2014, and even released on the public around March of this same year after that raised hundred buck, 000 through the company�s Preliminary Public Tableau Offering (IPCO). The crypto in the beginning employed a PoW (Proof associated with Work) process, buy about April 28, 2014, the idea made this switch to be able to PoSV (Proof of Risk Velocity) Reddcoin is really a decentralized social cryptocurrency that enables end users to instantly give and receive RDD cryptocurrency installments on social networks with acquiring to pay financial transaction charges. It is related to Venmo, Twitter Funds, as well as Snapchats Snapcash, all of of which let you transfer finances to some other people via their own own social media platforms. Yet not like these major interpersonal mass media networks, Reddcoin does not necessarily require you to make use of its indigenous platform in order to send out plus receive dollars, letting you to seamlessly incorporate its payment capabilities on platforms like Reddit, Facebook, Twitter, and numerous other individuals. Also, in Electrum Reddcoin Wallet to instantly giving and even obtaining money in order to together with Reddcoin: you can also give tips to information creators similar to exactly how you give �likes� as well as �favorites� to a posting. Reddcoin employs a process called Proof-of-Stake-Velocity (PoSV) which can be completely different from Bitcoin�s proof-of-work protocol (PoW) which often needs huge amounts regarding energy for its mining operations. Each Reddcoin end user automatically mints Reddcoins mainly because the staking function is integrated the downloadable official wallet (which you must possess before using RDD). So how does Reddcoin Work? Reddcoin connects to your particular social advertising networks and even lets the sender execute instant, zero fee RDD payments to any individual that he / she chooses to be able to have interaction on the network. Just click the �tip� key and the micropayment is directed to the person you desire to receive it. Reddcoin employs PoSV, which has been formerly created by often the Reddcoin coders to substitute its past PoW protocol. PoSV will be, in essence, a new technique with regard to Proof-of-Stake (PoS) that details the requirements of it has the social currency to boost �both ownership (stake) together with task (velocity)�. The staff stated of which adjustments to the PoS �were required to promote more productive network participation. � The main difference between the two is that when PoS comes with linear lieu aging program, PoSV�s tableau aging has non-linear. Gold coin age is usually resulted by multiplying the number of coins by their age i. e. time that passed since their own last transaction. This means that input to the network can be designed without requiring any computer energy. PoSV rewards customers who have more active purses and even transact more in comparison with those that personal wallets and handbags that are left foul. The regular Proof-of-Stake presents rewards every finances both equally as their particular coin get older grows. ReddCoin�s PoSV is usually an ideal system which might be implemented efficiently for networking. People that transact more generally by using his or her billfolds have entitlement to obtain a lot more incentives. How can you Make ReddCoins? A further noteworthy distinction concerning ReddCoin as well as the other cryptocurrencies is that the gold and silver coins are not generated by way of mining but through minting. To be able to mint ReddCoin you just have to open a wallet that possesses RDD coin in the idea. The minting process triggers every time a wallet is dynamic and online. ReddCoin minting eliminates the coin exploration charges, increases the gold mining speed as well as the need to get expensive mining hardware. RDD Coin Supply Whenever RDD transited from PoW to be able to PoSV on August one, 2014, there were almost 27 billion RDD. In the time writing, ReddCoin has a good distributing supply of twenty-eight, 808, 713, 174 RDD. Minting builds a great inflation of up to 5% inflation per calendar year, while maximum supply of RDD does not necessarily are present. RDD Value Investigation Up until December 2017, Reddcoin remained comparatively flat with very very low values. On Electrum Reddcoin Wallet is shown 7th, it increased to be able to the all-time high value regarding $0. 03 cents, subsequently like the rest involving the crypto market, this plunged. With enough time connected with writing, RDD is definitely cost from $0. 004680 UNITED STATES DOLLAR. Where Can You Retail outlet Reddcoin? The Reddcoin supported budget can be downloaded from the formal Reddcoin website, or RDD coins can be stored around the Coinomi mobile wallet. Final result Reddcoin is a piece with the ambiguous purpose, like it seems a tad odd to present tips to get social media content any time we could just show appreciation by simply �liking� like we did up until at this point. Nevertheless this strategy has been successful for that Steemit interpersonal media platform, mainly because it put in place a similar attribute, which in turn pays rewards people within STEEM tokens for creating plus curating content, hence it is quite likely for the style to find re-homing amid an increased viewers.

1 note

·

View note

Text

What is decentralized money (DeFi)?

Defi staking platform services In the previous ten years we have perceived how computerized development was extraordinary of plans of action, yet it didn't assume a problematic part. The environment was restricted to reordering the plans of a customary monetary framework intended for the simple world, superimposing computerized points of interaction to make it more open to a group of people with its focal point of gravity on portable and PC. Nothing like what occurs and will occur in the computerized world and really taking into account decentralized finance.

What do we mean by the idea of decentralized finance or DeFi?

Short for decentralized finance, DeFi is an umbrella term for an assortment of blockchain-situated public space applications and tasks that are set to upset the universe of customary money intensely. DeFi comprises of distributed applications and conventions created on decentralized blockchain networks that don't need access freedoms to work with loaning, protection, prophets, digital currencies, trades, subsidiaries, resource the executives, or monetary device exchanging. . Most DeFi applications today are constructed utilizing the Ethereum organization, yet numerous elective public organizations are arising that give speed, adaptability, security, and lower costs.

How did DeFi begin?

People at first traded labor and products. However, as economies have advanced as well: we designed money to work with the trading of labor and products. In this way, the coins assisted with presenting advancements and made better degrees of economies. In any case, progress includes some significant downfalls. Focal specialists have generally given monetary forms that support our economies, which eventually gave them more power as additional individuals confided in them. defi staking platform services Be that as it may, trust has been parted from time to time, making individuals question the capacity of unified specialists to oversee such cash, as well as their job and capability.

DeFi gave a plenty of chances to accomplish a straightforward and powerful monetary framework that no single element controls all alone. In any case, the defining moment for monetary applications started in 2017, with projects that worked with more usefulness than essentially moving cash.

Monetary business sectors can produce good thoughts and drive flourishing in the public eye. In any case, power in these business sectors is unified. At the point when individuals put resources into the ongoing monetary framework, they move their resources for mediators, like banks and monetary establishments; this keeps chance and control at the center of these frameworks.

By and large, we have seen brokers and foundations that didn't see the dangers in that frame of mind, as was found in the monetary emergency of 2008. No ifs, ands or buts, when focal specialists control cash.

Bitcoin and the early digital currencies, which were at first evolved to give individuals unlimited authority over their resources, possibly became decentralized when it came to issuance and capacity. Giving admittance to a more extensive arrangement of monetary instruments stayed a test, until the coming of savvy agreements and that empowered DeFi.

DeFi conventions and how they work

DeFi has developed into a total environment of working applications and conventions that offer some benefit to a huge number of clients. Resources worth more than $30 billion are as of now secured in DeFi biological systems, making it quite possibly of the quickest developing section inside the public blockchain space.

The most well known DeFi use cases and conventions that anyone could hope to find available today are:

DeFi loaning and acquiring

DeFi provided finance another guidance by permitting decentralized loaning and acquiring, charged as 'Open Money', to offer digital currency holders loaning open doors for yearly returns. Decentralized loaning permits individuals to get cash at a particular financing cost, addressing the necessities of the digital currency holder local area.

Best DeFi Getting and Loaning Stage: Compound Subsidizing

Sent off in 2018, Compound Money is the brainchild. The undertaking is a loaning convention created on the Ethereum blockchain that permits clients to procure interest by loaning resources or getting against security. The accumulate convention makes this conceivable by making liquidity for digital currencies through financing costs set by PC calculations. Build clients acquire interest while keeping cryptographic forms of money. Whenever digital currencies are provided on the Compound stage, clients can involve them as insurance for advances.

decentralized trades

Decentralized Trades (DEx) are one of the fundamental elements of DeFi, with the most extreme measure of capital secured contrasted with other DeFi conventions. DExes permit clients to trade tokens with different resources, without an incorporated mediator or overseer. Customary trades (unified trades) offer comparable choices, however the ventures offered are dependent upon the will and expenses of that trade. The extra expense in every exchange is one more regrettable part of CEx, which DEx addresses.

Top Decentralized Trade: Uniswap

Established in 2018 by Hayden Adams, UniSwap is the biggest mechanized symbolic trade by exchanging volume executed on the Ethereum blockchain. The task was sent off subsequent to getting awards from various investment firms, including the Ethereum Establishment. UniSwap computerized exchanges between cryptographic forms of money through savvy contracts.

today offers three functionalities: trade tokens, add liquidity and eliminate liquidity.

Token trade:

Clients should make a Metamask record to utilize this help. When a Metamask account is made, clients can choose the tokens they own to trade for one more kind of digital currency.

Adding liquidity:

To give liquidity, clients store an identical worth of tokens into the trade contract related with the token. When you have liquidity tokens, you can add them to a "pool" in the UniSwap interface. Clients who give liquidity on UniSwap acquire trade expenses, determined by the worth of the tokens presented for liquidity.

Dispensing with liquidity:

You can eliminate liquidity on UniSwap by just picking the 'Eliminate Liquidity' choice from a drop down menu.

Stablecoins are a feasible answer for the instability issues encompassing digital currencies and are assisting DeFi with acquiring conspicuousness. The name says everything: the worth of stablecoins is attached to a generally steady resource that tries to keep its cost consistent, like gold or the US dollar. Stablecoins have proved to be useful during seasons of chance in the crypto space, giving a place of refuge to financial backers and dealers. Security makes them a solid insurance resource. Stablecoins additionally assume a significant part in liquidity pools, a necessary piece of the DeFi and DEx environment.

0 notes

Text

Robinhood App

Robinhood App Windows 10

Robinhood App Stock

Robinhood App Download

Robinhood App Windows 10

Excellent, but improvement idea First off, using the app now for years and loving it. Excellent idea also to add option trading and crypto. I very much enjoy the margin account under Gold (well done and conditions are fair) and I see how Robinhood is constantly improving it. What is Robinhood? Robinhood is a broker-dealer app that allows users to trade stocks, options, and ETFs with zero commission fees. You can also buy and sell cryptocurrencies on Robinhood App. Robinhood allows users to trade cryptos like Bitcoin, Ethereum and Litecoin. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may apply.

We all have to start somewhere as a beginner stock trader, but we want to make sure you understand how to use the Robinhood App for beginners, and to start buying and selling stocks. The stock market can be confusing for a beginner and even more so when you are dealing with options trading, cryptocurrency trading, a mutual fund or trading fractional shares.

Robinhoodoffers free trades and no minimums and is easily the best brokerage for beginner investors and one of the main reasons we think its the best investing app for first time investors. Robinhood allows you to trade real time at market price.

Is Robinhood a bank? Like other cash management products, Robinhood Cash Management is not a bank account, despite its features being similar to those of a checking or savings account. While having similar features of a savings account, the Robinhood Checking & Savings is not insured by the Federal Deposit Insurance Corp. (FDIC) Instead, the service is backed by the Securities Investor Protection Corporation (SIPC). Robinhood InstantAccess is available when you confirm your transactions for bank transfers through the mobile app.

While most trading platforms make money on every trade you make, Robinhood makes money from its premium subscription service. Robinhood Gold subscription costs $5 per month and includes more than margin trading capabilities. Additional research tools are also provided in the fee.

Robinhood App Windows 10

Robinhood Review

Robinhood‘s story begins practically a decade ago at Stanford, where Baiju and Vlad fulfilled as roommates and classmates. After graduation they loaded their bags for New York and developed a financing business, selling trading software to hedge funds. 93 spo2. With their newfound experience they understood that huge Wall Street companies pay absolutely nothing to trade stocks, while most Americans were charged commission for every trade. They soon decided it was more crucial to build products that would offer everyone with access to the monetary markets, not simply the wealthy. Two years after heading to New York City, they moved back to California and developed Robinhood– a business that leverages technology to motivate everybody to participate in investing in stocks.

And it’s a model that’s working for people. A little over four years after launch, the company has a $5.6 billion valuation four times more than its 2017 valuation of $1.3 billion.

The app very first released in December 2014 and rapidly became a favorite among more youthful people looking to invest. It enables users the flexibility to finish a transaction without paying a processing charge, and ended up being the very first financing app to win an Apple Style Award thanks to its simple-but-stylish design.

In other words: It makes stock trading cheap, user-friendly, and mobile, which is apparently precisely what young investors were looking for. It began as invite-only, and by the time it opened to the general public in March 2015, the waiting list rose above 700,000 according to Fortune. By November of that year, TechCrunch reported that it had facilitated over $1 billion in transactions.

Robinhood App Setup?

The process from downloading, installing and setting up your account shouldn’t take more than four or five minutes. It will take you a few days before you will be able to trade as there are verification processes before you can fund your account and start trading on the Robinhood App.

Download and Installing

Robinhood has created an app for just about every mobile deviceplatform. The majority of users have Android or Apple iPhones and the app can found in Google Play or the Apple App Store. Click the button below to create your account, download the app and get a FREE stock from Robinhood

Creating Account

After you sign up with email, it asks you to create a password (at least 10 characters), and then you have to share some personal information: your legal name, email address, phone number, date of birth, residential address (U.S. law apparently requires that brokerages collect this information), citizenship, and social security number.

It also asks you how much investment experience you have. I selected None. Then a few more questions about your employer and ties to companies or brokerages, review, and submit.

After you are finished creating your Robinhood Account, the next step will be to start the process of funding the account.

Funding RobinhoodAccounts

To start trading with Robinhood, you must first link your bank account. Robinhood uses Plaid to link your bank which means your transactions are secure, transfer of your information is encrypted end-to-end and they also keep your information private, meaning that your credentials will never be made accessible to Robinhood.

Linking Your Bank

In the United States you will find that just about every major bank is listed and can be added by clicking the name of the bank. If your bank isn’t listed, don’t’ worry, there is an option for you as well by clicking “Don’t see your bank? Search instead” at the bottom of the screen. I found my bank by doing a quick search but if yours is not there, click on “Link Manually”, choose Checking or Savings, enter your routing number and account numbers and click the checkmarks to complete.

Funding your Robinhood account can take a few days because a couple of deposits will be made to your bank in 2-5 business days and you will have to verify the deposit amounts in order to start adding funds to your account. After completing the deposit verifications, you will have instant access to deposits and begin stock trading.

Transferring Funds

Once verified you will be able to click the person icon in the options at the bottom of your app and choose “Transfers”. You can fund your Robinhood account by clicking “Transfer to Robinhood” for a one time transfer. You will be taken to a screen that allows you to enter the amount you would like to transfer from your bank to your Robinhood account and click the checkmark.

You can also schedule regular automatic deposits into your brokerage account. Options for automatic deposits include weekly, twice a month, monthly and quarterly.

Robinhood Instant Transfer Limits

Instant Deposit Limit – Your instant access limit is determined based on whether you are a Robinhood Gold member and on your current account value. For example, I subscribe to Robinhood Gold (more details on Robinhood Gold Subscription below) and my current instant deposit limit is $5,000 Total Pending Deposits – The amount of money still on its way from your bank. It takes 3-5 days to transfer money from your bank after you initiate your deposits. Make sure to maintain this balance in your bank account until the transfer is complete.

Instant Deposits – The amount of money available for you to invest instantly while your money is still on its way from the bank. You can always click on the account settings and view your “Buying Power”. Buying Power is the amount of funds you can currently invest into stocks and cryptocurrencies at the current moment.

Beginners Guide to Trading Stocks

There are ton of different investment options on Robinhoodmobile app and we will do our best to keep it from being overwhelming and answer all the important questions that a new investor might have. Tip: Options trading and margins can get you in a lot of trouble if you don’t know what you are doing. Until you become more educated on options trading, it is suggested to not activate that options.

Investment Types

Investors commonly invest in stocks but there are other options for investing. Robinhood also offers the ability to invest in cryptocurrencies and ETFs. Onenote for outlook. Crypto is considered riskier but the most popular coins are available at the time of writing this article and include Bitcoin, Ethereum and Litecoin. If you just aren’t sure about choosing a company’s stock to purchase but you like a certain industry, then consider ETFs. Recently I made an investment into an Electric Vehicle ETF because I do think there is a great future for these stocks but it can be less risky than choosing an individual stock. Robinhood also offers options and margin trading but seeing as this is an article for beginners, more knowledge and experience is needed before considering these types of investments.

Finding and Researching Stocks

Many people choose to invest in companies and industries they’re passionate about and believe will be successful in the long-term. The reason is that when you invest in a company, you own a piece of that company. The value of your investment will depend on how that company is doing. If the company is doing well, your piece of that company becomes worth more.

Step 1 : Find a Company Think about different products and brands you can’t live without:

What products did you use today?

What stores do you visit regularly?

Talk to friends and family:

What industries do they work in?

What do they invest in and why?

Think about causes that are important to you:

Are there companies or industries that support these causes?

Stay up to date on the news:

What companies and industries are doing well?

Step 2: Do Your Research If there’s a specific company you want to invest in, you may want to learn more about:

Robinhood App Stock

Their annual profits and losses

Consumer demand for their product or service

Their executive team

You can do some of this research on Robinhood by scrolling down on a company’s page. If what you learn gives you confidence in a company’s long-term performance, you may consider investing in it.

If there’s a specific industry that you feel has significant growth potential or room for innovation, you may consider investing in a fund. Funds (ETFs) are a great way to invest in an industry or group of companies at once. https://engineerload207.tumblr.com/post/654169397384134656/evernote-tools.

Buying Stocks

Buying stocks on Robinhood is much simpler than you might expect. There is only one thing you should probably know before you start trading stocks. As a beginner you are going to focus on two different types of buys called “Market Order” and “Limit Order”. A market order will set a buy the stock at the current asking price (price a seller is willing to sell at). A limit order will allow you to set a price at which you want to buy the stock. I prefer to use limit orders because I can determine a price I want to pay, but there are occasions when my order doesn’t fill because the stock price doesn’t hit my target.

Steps to buying stocks using the Robinhood App on IOS and Android Devices

Navigate to the stock’s Detail page.

Tap Trade.

Tap Buy.

Tap Order Types in the upper right order.

Select your preferred order type.

Confirm your order.

Swipe up to submit your order.

Selling Stocks

Everyone wants to buy at the bottom and sell at the top but that rarely ever happens. I can’t give you financial advice but I can tell you my strategy for determining when to sell my stocks. I set prices in my mind of where I am willing to sell my investments. My goal is to be able to pull my original investment out and hold the remaining shares for a long term.

An example would be that I buy 100 shares at $10 per share with a total of $1,000 investment. If my goal is to sell at $20.00 then I would sell 50 shares at $20.00 to recoup my investment and keep the remaining 50 shares long term.

Steps to selling stocks using the Robinhood App on IOS and Android Devices

Navigate to the stock’s Detail page.

Tap Trade.

Tap Sell.

Tap Order Types in the upper right order.

Select your preferred order type.

Confirm your order.

Swipe up to submit your order

Dividends

A dividend is the distribution of some of a company’s earnings to a class of its shareholders, as determined by the company’s board of directors. Common shareholders of dividend-paying companies are typically eligible as long as they own the stock before the ex-dividend date. Dividends may be paid out as cash or in the form of additional stock.

Dividend-Paying Companies

Larger, more established companies with more predictable profits are often the best dividend payers. These companies tend to issue regular dividends because they seek to maximize shareholder wealth in ways aside from normal growth. Companies in the following industry sectors are observed to be maintaining a regular record of dividend payments:

Basic materials

Oil and gas

Banks and financial

Healthcare and pharmaceuticals

Utilities

Collecting and Investing Dividends

Robinhood App Download

Robinhood processes your dividends automatically. Cash dividends will be credited as cash to your account by default. If you have Dividend Reinvestment enabled, you can choose to automatically reinvest the cash from dividend payments back into individual stocks or ETFs.

You can view your received and scheduled dividends in your mobile app:

Tap the Account icon in the bottom right corner.

Tap Statements & History.

Tap Show More.

Tap Dividends on the top of the screen.

Robinhood App Windows 10

Get Started Trading on Robinhood App

Now that you have some great knowledge on trading stocks on Robinhood, you shouldn’t feel like a beginner any longer. We would love to hear about the your experience on Robinhood and what your favorite stocks are.

One Last Tip: Continue to research and educate yourself on stock trading and investments!

High-yield savings: In December 2019, Robinhood started offering a cash management account that currently pays 0.30%. The account comes with a debit card and free ATM withdrawals from more than 75,000 ATMs, and offers up to $1.25 million of FDIC insurance thanks to Robinhood’s agreements with several banks. (nerdwallet.com)

Access is rolling out on a state-by-state basis. Currently, about 50% of the U.S. population can use Robinhood Crypto. (investorjunkie.com)

Gold starts $5 per month for up to $1,000 margin. Anything over $1,000 is charged 5% interest. (investorjunkie.com)

They key is to realize that the patterns are higher probabilitytrading setups – they might work 70% of the time. But they will never work 100% of the time. (fitnancials.com)

Robinhood is a free, US-based stock trading app that allows 100% commission-free stock, options, cryptocurrency and ETF trades. This guide will teach you everything you need to know about Robinhood so you can trade effectively. (tradingstrategyguides.com)

0 notes

Text

Which Types of Gaming Are Appropriate in Louisiana?

A mother had finished putting on a costume her 2 daughters for school by 5 in the morning. After this, she'll head for the casino for an amount of some gaming activity.Does it sound like a too ludicrous to be real situation? Think againToday, gaming seems like a daily task that folks neglect too easily. But, they cannot understand the potential damage being triggered with their lives because of gambling.Usually, gaming also known as betting is a form of sport that involves valuables and money being set at risk. All the valuables or money are at a risk while the chances of wining is really reduced or is completely influenced by chance. But, you are able to generally use some sort of evil ways to gain, but nevertheless you are able to never be entirely certain of winning the game.

Gaming are of numerous types: 1 of the types is beatable while one other is unbeatable.The games that may quickly be trampled ergo creating a exact good likelihood through utilization of strategy are named as beatable games. A few of them are poker, even though it may be labeled as sport requiring skill; Pai Gow poker, Tiles, video poker, slot products, horse race, activities bets.

If none of the strategies in the overall game assists the gamer to gain the overall game, then it becomes an irresistible game. Some typically common instances on these types are baccarat, roulette, keno, slot products, craps, casino war, pachinko, faro, 3card poker, 4 card poker, chart poker, red dog, Spanish 21, Caribbean stud poker.

Equally unbeatable gaming and beatable gaming can be found at the casinos. You will find however a lot more gaming games that aren't being performed in the casinos like mahjong, backgammon, lottery, coin tossing games like head and end, a couple of carnival games such as for instance Hanky Pank and The Razzle.Another kind of gaming sport is the fixed chances gaming which can be noticed in activities such as for instance football, hors race, golf, baseball, golf and many other activities that attract thousands of individuals on betting on the winning team.

Still exactly the same, they are all several types of gaming which does not have the opportunity of having constant wins.In gaming, individuals usually decide to try to have back what and all they missing through the length of the game. Some people continue steadily to enjoy the overall game having a opinion which they shouldn't slice the indifference of their luck. Using this method, they keep betting and find yourself putting themselves at a risk of having a loss rather than a gain.

Many people who enjoy gaming state which they enjoy simply for joy and for a recreation. Numerous others state which they enjoy it to make some money and gaming is a very easy way to do make money.Since gaming involves plenty of forms of mental task, along side strain and mindset of success, it is probable to become addicted to the game. In the future, it may affect the one who is involved in the sport of gambling.