Text

Principles for Survival

Background

I’m breaking my nearly three years of silence on Humanizing Tech. I started this publication as a resource for those who shared my lifelong mission of “building the world’s most advanced technology and using it to help people”. Because of the clear and present dangers that continue to present themselves as we’ve crossed the threshold into this new decade, I feel a responsibility to share a few primary principles on how to think in order to protect yourselves and loved ones in a constantly evolving and unforgiving universe.

Believability

Whenever anyone communicates anything, the first thing you should assess is whether they are believable in what they are saying. Said differently, do they have the expertise, education, or understanding that makes them a resource you should listen to. If not, you should simply ignore it.

Therefore, you must analyze this content and decide for yourself whether you should believe it or ignore it. To help, I’ve provide the background necessary so you can make an informed decision.

The first 20 years of my life was primarily focused on physical achievement, while the last 20 years on intellectual achievement, though I’ve maintained both over all four decades of life.

I’ve been studying mathematics seriously since I began advanced classes in the 6th grade (from about 10 years old onwards). Mathematics is focused on a single study: encoding the universe into symbols that can be manipulated spatially in order to solve difficult problems in how the universe actually behaves. Said more simply, “solving problems”.

I leveraged my mathematics education into something called Actuarial Science, which is the study of risk. Insurance companies, financial firms, and pension funds hire Actuaries in order to make sense of uncertainty. They calculate the probability of events (including death), and their financial impact, using sophisticated mathematical models. During my time as an undergraduate, I passed two Actuarial exams and worked for well-known companies in the space: PricewaterhouseCoopers, Mellon Financial.

I would later leverage that to work for Watson Wyatt, which has gone through multiple mergers (Towers Watson, then Willis Towers Watson), and now Aon after its acquisition for $30 billion. I designed incentives for the largest global companies, creating systems for boards, executives, employees, and sales people to achieve agreed upon financial and operational goals.

For approximately the last 15 years, I’ve been operating high technology companies, building large global teams (remotely) across cultures, languages, time zones, tech stacks, customer profiles, and markets in order to build the world’s most advanced technologies, even before Big Tech firms had done so, and commercialize them for a broad population of people and businesses.

The focus of my adult life has been on creating systems for how to achieve the second and third principles listed below. Over the last few years, however, I’ve been focusing primarily on the first principle, which I believe supersedes the other two, and is arguably more important.

Principles

Adapt faster.

Find risks, then remove them.

Prioritize problems, then solve them.

Situation

Today, the entire world is experiencing an elegant technology that any Venture Capitalist would salivate to invest in and operators would compete to work on. Without any PR or marketing budget, it has made headlines globally because it is a disruptor the likes of which we have never experienced. Not Uber, not AirBnB, not Digital Transformation, and not even the Internet can hold a candle to its speed of adoption.

It has been installed by people across nearly every geographic boundary and gives every user equal opportunity to experience it regardless of education, wealth, social status, sexual orientation, race, or age. It has disrupted people’s daily lives, the global financial system, and the global healthcare system. Users didn’t have to change any of their daily habits to experience it, it’s completely free, and takes up no space so it can be carried anywhere. It’s completely decentralized, low-power, can upgrade itself in real-time in response to market conditions, and is highly scalable.

It is a self-replicating, biologic intelligence that is invisible, viral, and non-discriminatory. Of course, I’m talking about the Coronavirus.

If it had a positive impact on humanity, we would be marveling at its features, celebrating its creator, and leveraging the technology for every other product.

But it’s not.

Strategy

And so, as a human species, who have three of our own features (survival, intelligence, opposable thumbs) we must use in order to compete against it and win. This is Uber vs Lyft, Coke vs Pepsi, and a Space Race with stakes higher than we have dealt with before.

For all of human history, people have designed and changed our environments for habitability. As we face this novel technology, and a guarantee of even more elegant ones in the future, we must create and use tools to evolve our environments at a faster rate than the threats that seek to disrupt them, either within our outside our bodies.

If our iteration speed is higher than our competitors, we will win. If not, we will lose. But it requires a 100% execution of fundamentals. Like a professional tennis player, it is the competitor who makes a mistake first that loses. As such, it requires that we develop systems that guarantee we do not make a mistake while also iterating faster. Which brings us to another principle that’s taken me decades to develop and describe succintly:

Quality at Speed.

Tactics

From a product management perspective, once you understand a problem, you need to prioritize and begin executing a solution immediately while systematically removing risks that could stop you from execution. Maslow’s Hierarchy of Needs holds true here.

Continual clean air supply: you only have a few minutes to remove this risk.

Continual clean water supply: you have a few days to remove this risk.

Continual food supply, ideally fresh superfoods like broccoli, bananas, tomatoes, nuts, along with specific supplements (Turmeric, Chondroitin, Glucosamine, Vitamin B/D, Cinnamon, Copper, plus the more popular ones): you have a few weeks to remove this risk.

Strengthen your immune system: get a full night’s sleep as a primary priority, drink fluids to maintain hydration and expell , reduce stress as much as possible, and continue to get exercise (both cardio and strength).

Strengthen your mind: figure out a system for maintaining mental fortitude so you can continue to perform at a high-level under extreme duress and circumstances.

Sustainable shelter: protect yourself from any harsh environment, including other people who may be dangerous with or without them knowing.

Sustainable energy collection and storage: hand cranks, leg power, solar cells, batteries, and generators.

As Ryan Holiday wrote, “the obstacle is the way”.

Mindset

In addition to Intelligence, Heart is another superpower of humanity.

It enables us to connect to one another on a personal basis, which is the first half of the equation. The second half is about compounding our collective strength by acting together on unified goals, but doing so without threatening our survival.

Please remember, the internet is not a guaranteed resource, nor is food or water supply chains, and you certainly can’t eat or drink money. Invest in the right things, in the right order.

Next

We are have been preparing for years, from a variety of perspectives. If you need help preparing you and your family, please reach out. I will do my best to give you the information you needed to keep you strong regardless of what the universe puts in your way.

Stay calm. Nothing grows forever and most growth is defined by s-curves so all you really have to worry about is protecting yourself until you find the inflection point.

Sean

Citations

Getting Enough Fluids, U.S. Department of Health & Human Services, 4/30/2019

Stress Research, The American Institute of Stress, 3/16/2020

Superfoods: Recent Data on their Role in Prevention of Diseases, Current Research in Nutrition and Food Science, 9/14/2018

How to Boost Your Immune System, Harvard Medical School, 9/1/2014

Internet Sacred Text Archive, 3/16/2020

Office of Dietary Supplements, National Institutes of Health, 3/16/2020

Principles for Survival was originally published in Humanizing Tech on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Stories by Sean M Everett on Medium https://ift.tt/2x1dCp3

1 note

·

View note

Text

I have a client who’s working on a new, multi-modal infrared sauna hardware.

I have a client who’s working on a new, multi-modal infrared sauna hardware. It’s really compelling stuff for the wellness community that solves a lot of the problems with current solutions and improves upon other sensory modalities to round out the experience.

Interestingly, we used some of this same research in the pitch deck.

from Stories by Sean M Everett on Medium http://bit.ly/2XZPJXs

1 note

·

View note

Text

I just came across your book.

I just came across your book. Reading voraciously. This highlight stood out as an important entrepreneurial principle.

from Stories by Sean M Everett on Medium http://bit.ly/2FeAfY6

2 notes

·

View notes

Text

Emerging Trends of Master Product Management

What you need to be at the top of your game in 2019

I. THE WORLD HAS CHANGED

The world of Product Management is no longer changing. It has changed. At some point over the last few years we transitioned into a new way of thinking when it comes to technology. Let’s review the situation as we move into the last year of this decade.

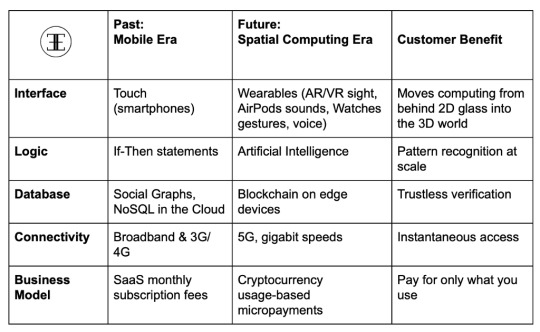

What used to be emerging tech a decade ago has now become the de facto standard. VCs used to be enamored by SoMoLo (Social, Local, Mobile) and Gamification, but the new emerging technologies revolve around Spatial Computing. The focus now is about taking computing from behind a rectangular piece of glass and bringing it into the real world. This includes Augmented and Virtual Reality as the interface layer, Artificial Intelligence as the logic layer, and Blockchain as the emerging database layer. With 5G connectivity and the proliferation of IoT devices and sensors, we enable new things like self-driving and Pokémon or Amazon Go.

The future of Humanizing our Tech

Our interfaces are becoming ever more invisible as we begin to wear our computers. AirPods in the ear and speaking to voice assistants like Siri and Alexa our in the world or at home. Even physical touch interfaces went from some-of-the-time with smart phone taps to all-of-the-time with vibrating wearables and always-on heart rate monitoring.

Meanwhile, blue chip industrial companies are investing in SAAS-based technologies and because Wall Street no longer rewarding a gigantic sales team that has to start each quarter from zero. The sawtooth revenue curve of the past is being replaced by curves that look more like hockey sticks. It’s not just software that’s eating the world, it’s also their business models. Namely, moving from one-time payments to Monthly Recurring Revenue from Software as a Service. Did you know Salesforce got its start by convincing customers they shouldn’t use installable CDs, but rather a website that gives them updates every day? Now this is taken for granted but changing software buying patterns was hard in the beginning.

Today, everyone has a startup or a side hustle. What we used to hear five years ago, “I’ve got an idea for an app”, is now, “I’m raising $1M on a $5M pre- and have traction with 100,000 users”. Wait, what? You’re only 15 years old? Which brings us to our next point. Digital Natives, Gen Z, and yes, Millennials, have overtaken mindshare, marketing, and advertising share from the Baby Boomers. Many of us with decades of Product experience merely adopted the tech, but these individuals were born into it. Christopher Nolan, eat your heart out.

Valuations have soared since 2008, and new millionaires are minted so regularly that we now collective keep count in billions. Growth at all costs, even profits, have created an irrational exuberance the likes of which Greenspan could hardly comprehend during the go go dot-com days.

Even retailing has changed. The anchors of malls aren’t seeing the foot traffic they once did, Sears is shuttering its doors and Best Buy is struggling. The reason is because we get free shipping and cheaper prices shopping online, and at least in the US, eCommerce executive’s go-to-market strategy is simply www.amazon.com.

As we transition into the mindset of investors, we see a more modern Private Equity, new family offices sprouting up in record numbers, new regulations like the JOBS Act, and new funding mechanisms like Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) enabling much more capital flowing into tech than ever before. Because traditional LPs have been reading the same blogs and would rather source and diligence their own deals than pay a middle man their 2-and-20 fees, we see more demand than ever for the best deals and unique deal flow as a competitive differentiator. The leveraged buyouts of yore targeting low-growth manufacturing firms are now targeting niche software companies because the economics and multiples are better with the same consistent cash flow.

As we turn our attention to go-to-market strategies, the traditional ad budgets spent on TV and display continue to evolve more towards a universal view of a person. Spend on Influencers have shifted from Movie Stars and Athletes to the Kardashians, and then to micro-influencers, and now to pico-influencers with 500 followers who are all personal connections. It’s the word-of-mouth virality that spells success for many products, after all. GDPR regulations that came online in mid 2018 means every website we now visit has a horribly thick bottom bar overtaking our screens. As a result of all this hypertargeting, user tracking, and dynamic content, the user experience of the web has decreased dramatically, especially when including abysmal loading times resulting from excessive overuse of Javascript. Did you know there are now 7,000 MarTech startups, up from 5,000 only a few short years ago, creating a bewildering amount of programmatic ad choices, and ever-increasing customer acquisition costs. The result being building quality product mechanics for incenting organic virality and engagement are 10x harder than they used to be.

Finally, there’s a resurgence of interest around outer space and private rocket companies. Space Tech is a thing and with falling prices of launches by Blue Origin and SpaceX, the cubesat subsector will ultimately enable next-generation cellular connectivity from space. This is how the other 50% of humanity gets internet access while also being a source of cash for the burgeoning New Space industry in desperate need of investment.

II. THE WINNERS & THE LOSERS

Taken together, we’re all playing a whole new ballgame. The playing field has become shorter while the game has become faster, and harder. Greenfield opportunities where you used to be competitive with a buggy LAMP stack and lackluster UX has even stopped working in the Enterprise. High-quality consumer apps that everyone now uses means we expect the same from all our software, including what we use at work. And desktop apps are no longer enough. The world has become smaller but we’re traveling more often and so we’d rather lose our luggage than our smart phone. We expect our work software to be just as efficient as the apps we use for play. Customers and users don’t care that it takes 320 different video encoding renditions for a single video file shared behind a firewall. “It’s just a play button, why is that so hard?” They don’t care how the sausage is made, expect perfect connectivity and high-resolution streaming. And expect it to be as cheap as YouTube.

We have reached a significant milestone for humanity. Half the human population is connected to the internet, mostly with mobile phones, and everyone is in search of the next gigantic growth product. Skill and talent has blossomed in unexpected markets around the world. France is a key global spot for world-class software development, Africa is emerging as a new startup capital learning from the likes of the Valley and Singapore, while China and the US are in an AI arms race for powering the world of our future. Information is shared in tiny bursts through text messages and short-form videos, with the entire world is trying to steal market share of eyeball for their Monthly Active Users.

At this point you may be feeling a bit down, wondering why you should even consider starting a new project. With the degree of difficulty steadily marching up-and-to-the-right, what hope do you have for standing out in a sea of competing projects, apps, sites, and initiatives?

The winners will be the ones who both Accept & Acclimate to this new world quickly. There’s no time to debate. The winners take action. The losers, on the other hand, will continue to exist in the Web 2.0 or, even worse, pre-connected world. It’s true that legacy business models and declining markets have a much longer tail than anyone realizes, but it’s getting shorter.

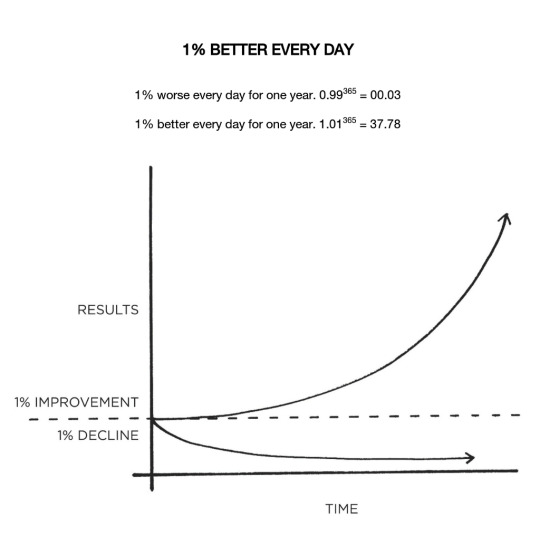

In either case, you’re either compounding in a positive direction or a negative direction. The graphic below from Farnam Street tells the story better than any amount of words could.

Source: Farnam Street

The key insight here is that it doesn’t require organization-wide adoption to reap the benefits. It only takes a single “2-pizza team”, as Jeff Bezos famously states, to kickstart action in the right direction. But whom you pick for those teams makes all the difference in the world.

So it begs the question: with a discipline as varied and misunderstood as Product Management, how can we begin to slice the skill sets required to determine the right person for the first project but also the second? Is it a mini-CEO, a turnaround genius, a mobile app maven with hundreds of daily builds, or a growth hacking expert who’s earned the stripes from a decade in the trenches? As a high-performing Product Officer, you need all of these next-level skills to stay at the top of the capabilities mountain.

The Product winners understand the importance of spending the time and budget to go find the right talent before doing anything else. The team is the single biggest difference maker between 2x and 10x. The Product losers, on the other hand, focus on business as usual and going with whomever is a phone call away, whether or not they have the requisite skills required to execute in this new world.

III. THE PROMISED LAND

But what does it look like to win? It means you’ve got a successful project on your hands. Your KPIs are up, the product is working, the team is energized, and the kudos stream in from around the internal organization and external community. Most importantly, your revenue and/or users are growing with a healthy k-factor above 1. The A/B testing and Cohort analysis is paying off once you found the correlation between Retention and Engagement. You’ve maintained quality and are in a great repeating cadence of 1) customer development, 2) agile design and development, and 3) continuous deployment and retrospectives.

Master-level Product Management means that the compounding flywheel effect applies to your product, but also the operations of your team, whether that’s a small 3-person group or a large 10,000 person global conglomerate.

A well-run machine is the opposite of chaos. You’ve developed esoteric metrics, like how many Slack messages are sent and how many files are sent back and forth to tell you how good the team is working together and how high-quality the work product is. And of course, that the entire group works backwards from the customer or user, and not forwards from the technology, unless we’re in Hard Tech territory like Quantum Computing.

Master Product Managers have been doing all these things for years but as we move towards 2020, a new set of skills has emerged.

IV. TOP 3% PRODUCT MANAGEMENT MASTERY FEATURES

Below are the top things you need to execute on to maintain your role as one of the best Product Managers in the world, or in identifying them for your next project.

Focus on one KPI: Revenue. Paul Graham of YC fame said a Startup could be defined by a sigle word: growth. Projects and businesses can also be defined by such a word. If the business is not making money, then eventually it ceases to exist. So, for any Master Product Manager, the starting base-level KPI for any project must have Revenue in it somewhere. Even a consumer app with MAU as a metric eventually needs to become self-sufficient at some point. You can choose a monthly subscription fee (Netflix) which has gained popularity above the one-time purchase to match ongoing revenue with ongoing costs, or an ad-supported model (Facebook) to sustain itself. Pricing strategy is understood as a key component of this. If you double the price and demand decreases by less than half, then you just created additional revenue growth with nearly zero marginal cost. In short, the right Product also has the right Price. Note that we’re leaving aside Not-for-Profits as they have a different motivation and core KPI, which would typically center around positive impact, measured by Human, Animal, or Environmental improvement.

Understand and design business models, especially applying them in new ways. A project starts by answering the question of “Who buys what from whom, for how much, and why?” For a lemonade stand, the answer is: a customer buys lemonade from us for $1 because she’s thirsty and we’re located right next to the park she walks her dog at. There are a limited set of business models that exist, like Remove-the-Middle-Man or Give-Away-the-Razor-To-Sell-the-Blade. Flipping standard business models on their head creates new insights and the Master Product Manager has a list of them at the ready with examples. One such example is the new online school that kept the definition of the customer the same (the student), but shifted when the student pays. Instead of paying every semester for classes as a big up-front cost for a buyer with very little money, this startup shifted the cost for the student to a percentage of salary for the first two years after graduation. Of course, the school makes a promise that they will help the student get placed. So, the novel insight here was shifting the business model to a transaction fee of the benefit rather than an up-front fixed cost. Payment processors have been using this model for some time. You submit an invoice to someone and in return for a company processing that payment, you’re willing to give them a fee because it’s small compared to the amount of money you just earned. It’s the same concept, now applied to a different industry: education. Gamification and Incentive design also play a part and have been recognized widely in the tech community since the days of Foursquare and Gowalla. Today, with the emergence of Initial Coin Offerings and its successor, Security Token Offerings, creating an app that becomes an economy means a Master Product Manager needs to understand the intricacies of micro and macroeconomics down to the granular level of “How do users earn tokens?” and “Where do users spend tokens?”. In the beginning of Bitcoin, for instance, it was much easier to acquire the cryptocurrency than it was finding who would accept it as payment. Thus, supply, demand, and transactions are important for unleashing value creation and developing a healthy economy. See Metcalfe’s Law for more.

Position Brand as a key differentiator. A brand is not a logo or a design. A brand is how it makes you feel. Apple feels different than Google which feels different than Facebook or Amazon. They do different jobs for their users, but it’s wisely said that the money in a company’s bank account is really just a physical measure of the trust that their customers or users have in the organization. People spend more money and return more often to brands they love. Today, when consumers are much less brand loyal and are willing to switch providers and products on a dime based on the service they receive (i.e., how it makes them feel), getting Brand right is a big deal.

Executes as CEO of the Product and the real CEO. As the world moves faster, demands of shareholders and the team become larger, and quality-at-speed becomes the new standard, CEOs and Founders are spread more thin than ever. Master Product Managers understand the intricacies of the entire business, not just their own product, in order to successfully deliver on where the puck is heading. They can run the business if the CEO was on leave for a month, they see around corners, understand where the industry is headed, talk with the Board and investors, raise capital while maintaining cost controls, hire grade-A talent, work with adjacent industries to establish new critical Business Development opportunities, and execute capital allocation strategies. See the book Outsiders by William Thorndike for more on how the top 8 public company CEOs over the last half century allocate capital.

Embed social and moral ethics into the atomic unit of the product. MNI Targeted Media’s study showed that more than 50% of Gen Z (i.e., between age 3 and 23) favor a brand who is socially conscious, so the $4B in buying power they have today will transform into tens of billions more when they reach full maturity. Master Product Managers not only act as technology builders, but as an ethical voice of the product and organization as well. They are not afraid to raise a red flag, take a stand, and stick to what’s right and just. Even the CEO of the most valuable brand in the world, Tim Cook, has taken stands for human rights and privacy, total shareholder return be damned (though studies have shown it actually helps). In addition, while operating ethically within business has long been a subset of the standard CFA exam, it is a growing requirement when news spreads around the world in an hour, and talent has the ability leave in a moment’s notice to work for anyone from anywhere. Long-term relationships matter because the apprentice of today will be the master of tomorrow, and reputations are written in stone on the internet.

Has smooth PR and media presentation skills. Master Product Managers know how to talk to the media about the product succinctly. A “repeatable sound bite” is just another way of saying “viral marketing”. Because if the viewer can’t remember it and repeat it, that alone can negatively impact the product’s k-factor. Today, the builder is more important than ever, as it’s less the CEO talking about the product and more about the the trade-offs the people building it had to make. Jony Ive is a hot commodity because the way he thinks is a leading indicator of what gets built. Great Product people are comfortable on camera, and don’t use the “ums”, “ya knows”, and “likes” that have become so prevalent in spoken conversation. As the steward of the product, you represent the product both on camera and on social, whether or not your profile says, “my thoughts don’t reflect my employer”. Again, who you are definitely becomes what you build, especially when customers and users care so much about what Products do with their data, they research who the people are behind them. In terms of efficient communication, a former McKinsey consultant, Barbara Minto, literally wrote the book on it, called “The Minto Pyramid Principle”. She teaches you the way to craft concise memos, reports, presentations, and talking points for a short attention span audience. World-class product people study not just the art of Judo, but also the subtle art of communication.

Exist outside the tech bubble. There are 7.5 billion human beings in the world. These are the users and customers of your product. They have feelings, stresses, and relationships that machines don’t have. Understanding consumer behavior is arguably the most critical aspect of any product. The Job-To-Be-Done framework must also include something new called The-Feeling-It-Creates framework. Is your product about saving time, money, and stress, or is it about escape, fun, and entertainment? As an example, BJ Fogg’s Behavior Model was used almost entirely as the core product mechanic for Instagram, because Kevin Systrom took his class at Stanford and remembered it when investing his product from location-centric to image-centric. Dale Carnegie’s famous book, “How to Win Friends and Influence People” is another great resource as is Chip Heath’s book, “Made to Stick”. These are all now table stakes. Understanding human consciousness, and the move towards mindfulness are necessary requirements for building a product that moves past addiction, and into transcendence. Technology always changes, but humans never do.

IV. IS THIS POSSIBLE & WHAT’S NEXT?

What we’ve laid out here may seem overwhelming, especially for those Product people just entering the discipline. But because the best Product people are ruthless prioritization experts, and agile enough to climb seemingly insurmountable challenges, we believe this gets the best and the brightest excited.

This is a juicy new problem to solve, and a new vector for investing in ourselves and our discipline. “Give me more to learn!” we hear some of our close friends in the industry constantly saying.

So, yes, it is possible. Similar to the documentary, Jiro Dreams of Sushi, the mountain of mastery reaches ever higher, and even after seven decades spent as a master, it’s an unreachable target. So, if you’re more junior, or know nothing about Product, but need someone who does, you’ve come to the right place.

The subtleties in Products often end up making the most difference but can take decades of experience to uncover. Thankfully, this is where many of the top Product people in the world call home, to work together, and learn from each other.

We are equally as excited as we are humbled, to build the products that influence future generations.

— Sean

Emerging Trends of Master Product Management was originally published in Humanizing Tech on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Stories by Sean M Everett on Medium http://bit.ly/2Cw8at5

0 notes

Text

Dave, brilliant work here and kudos on such an awesome space you’re inventing in.

Dave, brilliant work here and kudos on such an awesome space you’re inventing in. Have a question for you as we start to go deeper into the cryptocurrency world with private key pairs. Have you folks thought about more secure identity management systems? Could we get there and implement today? If so would love to chat more about how we integrate into Verses and Biologic Intelligence. Would love to connect offline if so. Thanks!

from Stories by Sean M Everett on Medium https://ift.tt/2w2mzKC

0 notes

Text

I think it has its place.

I think it has its place. TV walls inside stores is more about branding and priming for purchase. But most retail stores are focused on the primary purpose of getting someone to buy, so anything digital could be a distraction from that goal if not used appropriately.

from Stories by Sean M Everett on Medium https://ift.tt/2LN2ZIU

0 notes

Text

Why have I continued to see nobody working on this major broken arm problem to consumer adoption?

Why have I continued to see nobody working on this major broken arm problem to consumer adoption? Identity theft is your phone number now, that’s how they drained my Coinbase last fall.

from Stories by Sean Everett on Medium https://ift.tt/2lSMEqU

0 notes

Text

I just use email and Evernote.

I just use email and Evernote. When things get REALLY overwhelming, I add Trello until I get it under control. Even managing large global teams with multiple products, a simple one-page spreadsheet that shows red, yellow, green with status and next step. That covers a $100M global company. No issues. So I’m with you. It’s the ping, ping, ping of distractions that are the problem. And trying to treat everything as priority. Focus on P1 and if any leftover time, get to the P2s. Otherwise forget about it :)

from Stories by Sean Everett on Medium https://ift.tt/2MyNKDe

0 notes

Text

Fund of the Future: 2018 Portfolio Update

A very happy 2018 to everyone who’s been following along with Humanizing Tech over the last few years. As most people are putting out their 2018 predictions now, we figured we’d do something else. We’d describe not just predictions, but where we’ve placed technology bets over the last year in preparation for 2018 and beyond. Thus, it’s less of a prediction and more of a “put your money where your mouth is” kind of thing.

I. Augmented Reality: RealWear

I have been talking with the investors, the Board, the management team and employees for about five months. I spent three months doing diligence on the product, the market, the team to get a sense of how this new approach to Augmented Reality in the Industrial space would play out.

To repeat a friend’s words that keep echoing in my mind, “I remain ridiculously impressed”.

It combines the team from Sonim, a global leader in rugged smart phones, Metaio which Apple acquired in 2015 to form ARKit, and Daqri which was an original AR hardware and software startup.

So, suffice to say, I’ve joined the team full time as an operator to help execute against the vision. It’s going to capture almost all of my time and will be traveling frequently so if I’m in your location, perhaps it’s worth a coffee.

RealWear’s got product market fit, revenue is growing at a pretty astounding clip, are shipping production units to 32 countries globally, and have 100 brand name customers. After only 18 months in existence. Crazy.

More announcements to come but if you’re going to be at CES or Distributech, stop by our booth (#21536, Las Vegas Convention Center South Hall 1) or give me a shout to meet in our private suite.

In the meantime, have a look at our Data Sheet.

Visit our booth at CES (#21536, Las Vegas Convention Center South Hall 1, Jan 9 to 12) and at Distributech (Booth #1669, San Antonio Gonzalez Convention Center, Jan 23 to 25).

II. Artificial Intelligence: PROME

Comparing Deep Learning with Biologic Intelligence. You tell me which one is better at adapting to Black Swan events like humans.

PROME has been an R&D labor of love for the entire team for many years. Connectomics is the keyword here, though we call it Biologic Intelligence.

I spent a year talking to everyone I could get my hands on: venture capitalists, angel investors, management consultants, investment bankers, startup people, AI experts, software engineers, neuroscientists, self-driving pros, you name it. And wouldn’t you know it, only about 5 people out of thousands had ever heard of the term “connectome”.

That’s when you know the world hasn’t caught up to the right answer yet. Whenever everyone is so focused on mathematic approaches and a global PR engine that tells you that Level 5 self-driving is here and ready today, yet no vehicles exist or are operating as such, you know something’s amiss.

So, our technology will remain in incubation mode until the rest of the world catches up. We’ve added another engineer to the team and are making daily progress on self-driving in a rover setting. Autonomous Service Bots on Earth and in Space is the future.

You can view our technical presentation on Basic Plasticity by our CTO Timothy Busbice, or check out our previously unreleased demo video below (without voice over). The big thing to note here is that this self-driving rover and pattern matching test has never been turned on before nor has had any previous training data. It learns on the fly based on the sensory input it experiences in real time.

Finally, I’ll be contributing to a new book, backed by a major publisher, on self-driving operating systems and user interfaces, which should hit shelves the back half of this year. So, the work continues and PROME ain’t going anywhere. We still own the IP, after all.

III. Media: The Mission & Humanizing Tech

Writing my unadulterated thoughts onto the internet for the last decade has been the catalysts for some of the best things I’ve ever done in my career. Everything you see in this letter can be traced back to something I wrote or some relationship I met through Humanizing Tech. The pen is mightier than the sword, I suppose.

One of those relationships is with Chad Grills, the founder of The Mission who I’m also a very close advisor and frequent contributor to. The Mission is the fastest-growing and #1 publication on Medium, even beating The Economist and The Washington Post in numbers of subscribers. We which just passed 400,000 subs on Medium but includes millions of unique viewers every month.

So, in the new era of media, where Millennials and Gen Z are sick of negative news, fake or otherwise, this is one of the only places where you can accelerate your learning faster (news with a purpose, if you will) in a more friendly place.

I’ve been so busy over the last 6 months that the public writing has slowed significantly. I doubt 2018 will be less busy, but as I get my feet back under me, expect some additional updates.

As always, if you have compelling knowledge to share (not promotional content), let me know, we can get you some exposure.

IV. Software Development: SSI Decisions

I met the folks at SSI almost a year ago during an Industrial IoT conference in the Valley for senior execs. I bumped into the founder (the company’s been going for 25 years now) and realized after 30 minutes talking that we both graduated from Chicago Booth’s business school. I ended up getting closer to the team, doing diligence on the quality of their software and made the determination that they are incredibly high-quality software people that I enjoyed working with closely for many months.

They have about 200 people spread across Chicago, Germany, Pakistan and a few smaller locations like Kuala Lumpur and NYC, of course. Their model is not like other software agencies: they don’t do one-off projects, and they damn sure don’t do crap quality. Rather, they have become the outsourced development team (from about 3 FTEs startups up to 90 FTEs for the likes of Thompson Reuters) and they’ve even taken startups through two acquisitions.

I’ve worked with them closely on a few projects and will continue to do so as an Advisor. If you have software needs for scaling your product, and you don’t want to get burned again by low-quality development like what’s happened to you in the past, let me know, I can fast track you. You can also have a look at a case study deck that just keeps going, and going, and going, and going. They’re growing by about 5 FTEs per month so to say it’s going well is an understatement.

Their main expertise is on big data, optimization, IoT, and machine learning problems across FinTech, HealthTech, and yes they’re even exploring Crypto at my pressing :)

V. Cryptocurrency: Not Disclosed

I’m considering advising a few companies in the space that I’m not ready to announce yet. However, over the last year I have:

Put together a private 20-page Long-Term Valuation whitepaper in Q3 2017 with the help of a friend.

Written a book on Bitcoin.

Had the September 2017 feature in Fortune’s magazine cover story that I worked with the reporter on for months.

A video profile by CNBC.

At this point I still don’t feel anyone in the entire space has solved the absolute #1 problem: trust like a bank, required for the entire crypto space to Cross the Chasm to normal people.

VI. Mentorship

If any of this aligns with what you’re working on, feel free to reach out. I’m already mentoring a number of younger entrepreneurs so the time, as you might imagine, is in short supply.

But I’m of the belief that at any point in your life you should both mentor someone and have someone mentor you. A good rule of thumb is someone 10 years younger than you and someone 10 years older than you.

Passing along the knowledge from generation to generation is important. I’d urge you to do the same.

Besides, the people you work with in the future are likely the people you’re already friends with today.

Here’s to a 2018 that’s up-and-to-the-right to you all as we move ever closer to the 12 Tech Theses of the 2030s.

— Sean

Fund of the Future: 2018 Portfolio Update was originally published in Humanizing Tech on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Stories by Sean Everett on Medium http://ift.tt/2E4Y55N

0 notes

Text

Give me a shout when this goes live.

Give me a shout when this goes live. What I’m really looking for is a consumer friendly “bank” where they can just store their money and not have to think about or worry about any other details. Is what you are working on that easy?

from Stories by Sean Everett on Medium http://ift.tt/2CoaOkw

0 notes

Text

I’d be curious of what the plan is.

I’d be curious of what the plan is. I’m not quite sure how it could be solved where you have the worry free safety of a bank when you have to secure it yourself. Can you make an intro by chance? Talking to CNBC tomorrow about this exact topic.

from Stories by Sean Everett on Medium http://ift.tt/2yq2wpX

0 notes

Text

But I’m still looking for a solution that guarantees my coins / investments won’t get stolen.

But I’m still looking for a solution that guarantees my coins / investments won’t get stolen. What startup is laser focused on the single biggest problem in the entire ecosystem? A wallet is not a bank.

from Stories by Sean Everett on Medium http://ift.tt/2zpExaG

0 notes

Text

To give, is to get. Nicely done.

To give, is to get. Nicely done.

from Stories by Sean Everett on Medium http://ift.tt/2yqBduA

0 notes

Text

10 Best Podcasts of September 2017

First listen from The Mission

In no particular order, below are the best of the best podcasts for the month of September 2017, curated by the Editors here at The Mission to help make your morning wake up, back-and-forth commute, and general entertainment listening experience better.

The New York Times Daily: it’s a new property for the venerable NY Times, with a daily program giving you a 30-minute rundown of what’s happening around the world. If reading the paper and blog posts just seems to take too much time, let this be a more efficient mechanism for staying caught up.

My Dad Wrote A Porno. You can’t make this stuff up. Which is also why it’s so interesting. The guy’s dad actually did write an erotic novel and published it on Amazon for the entire world to read with reckless abandon. It even has a few celebrity appearances because they’re such big fans of the show (i.e., Elijah Wood, Daisy Ridley, Michael Sheen). If you’re into the softer side of Sears, this one might be right up your alley.

74 Seconds: this is the real MPR podcast, not to be confused with NPR because it’s Minnesota, not national. It follows trial story of Jeronimo Yanez. He is a police officer who shot and killed Philando Castile, who was a 32-year-old black motorist. The incidence occurred in July 2016 in the Twin Cities. We highly suggest the opening episodes, which hit you like a brick to the face. It’s going to be hard to put this one down. Or un-hear it. Whatever the analogy is for sound.

Food 4 Thot: A great conversational podcast that describes itself as, “A new podcast discussing sex, relationships, race, identity, what we like to read, & WHO we like to read.” And don’t think that Thot reference got past us. It’s a place for real talk and no holds bar commentary about popular culture. Their email sign up form is pretty great too (we won’t spoil it for you). This podcast got no chill. “It’s like NPR, on poppers.”

Pod Save America: Let’s just say they’re no fans of Donald Trump. A few staffers from the Obama administration started this podcast after the most recent election to focus on “a political conversation for people not quite ready to give up or go insane.” Equal parts humor and rage, they pump out one to two shows a week. If you’re into politics and you were a fan of Hillary, this one might be for you.

The Bill Simmons Podcast: HBO and The Ringer’s Bill Simmons interviews Kevin Durant across three episodes. Why listen if you watch ESPN and already have heard Kevin’s thoughts? Well, this one is a deeper dive into the consciousness of athlete celebrity as it nears the peak of his career. The first two episodes track the Golden State Warrior star during the regular season, while the final episode happened after he had won the NBA Finals. Pay attention to the subtleties between the two. That’s where the nuggets are.

Mogul: The Life & Death of Chris Lightly: Music is a massive part of most of our lives whether we consciously know it or not. In this documentary series, it teaches you about the music industry and the business of hip-hop through the lens of one of its legendary music executives.

A Cast of Kings (Game of Thrones): HBO’s entertainment phenomenon, Game of Thrones, has taken the world by storm. There are a number of GOT-focused pods out there, but we like this one. It might take you awhile to catch up. There are nearly 100 episodes to listen to. So go make some coffee and make a start, friends.

S Town. This show keeps popping up everywhere so we’d be remiss if we didn’t include it on our own Best Of roundup. It’s from the same team as Serial and is about a man who was bragging about town that he got away with murder. Maybe it’s just me, but if you want to get away with murder, you probably shouldn’t talk about it. Because now you’ve got one of the world’s most popular podcast people covering it. If you like character studies, you’ll like this. Be sure to check out their website as well, the glorious animations and visual graphics make for an enticing entry into their curvy S world.

Serial. You didn’t think we’d leave this one out did you? It single handedly restarted the podcast movement based on the movie-theater like storytelling about investigative journalism for a murder trial in the year 2000. If that doesn’t get you going, then how about a stat. It has over 100 million downloads. If that was a music album, it would make it the highest selling in history.

— Sean Everett

If you enjoyed this story, please click the 👏 button and share to help others find it! Feel free to leave a comment below.

The Mission publishes stories, videos, and podcasts that make smart people smarter. You can subscribe to get them here. By subscribing and sharing, you will be entered to win three (super awesome) prizes!

10 Best Podcasts of September 2017 was originally published in The Mission on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Stories by Sean Everett on Medium http://ift.tt/2xtJdgC

0 notes

Text

The Story of Your Future Retirement

Where you place your bets today will matter tremendously in 30 years

I. The Future Is Your Past

Last weekend, I had the distinct pleasure to spend a Saturday morning with an old mentor and friend. He retired about the same year I started my professional career, so I always found it interesting to look at the world through his eyes, while he was looking at the world through mine.

You can learn a tremendous amount of wisdom by sitting quietly and listening to one of your elders regale you of stories when they were coming up. How to make good decisions. Where to place your value in life. How they handled struggle. And what life after work is really like.

His advice was as simple as can be, but powerful as hell:

“Don’t give up on yourself.”

He’s right. Without yourself, you’ll never get anywhere. You have to get out of bed, walk somewhere, talk to someone, send a note. People aren’t going to just show up knocking on your door.

The atomic unit of this entire thing called life could be broken down into something equally as simple: make good choices. Easier said than done. How do you know up front what’s a good choice and what’s a bad choice?

Read on to find out how to invest best for your future, both in life and with your money.

II. Making Good Choices

I want you to imagine a simple mechanic. You make a single choice today. You make another choice tomorrow. You make a third choice the day after. Each of those choices compound on each other and at some point in the future you see the result and impact of that choice.

Let me give you a very simple example.

You know you need to save for retirement, but you also want to go on vacation because you work hard and dang it, you earned it.

So this year, you decide to spend $5,000 taking the family to Disney World for a week. If you didn’t go, you could have invested that money. So the question you have to ask yourself is how much is that experience worth to you. We can actually model that out financially and tell you.

There are a number of stats that show the average annual stock market return is 7% after inflation from 1950 to about 2009. It’s a nice round number and relatively accurate for the S&P 500 so lets just go with it.

If you’d have taken that $5,000 and invested in the stock market for 30 years, that money would be worth nearly $40,000 (remember we removed inflation from the return calculation so this is in present value, not future value, dollars).

Thus, that vacation you took today didn’t cost $5K, but rather about 8x more than that. It cost you $40,000 which you will need to help you survive after you retire and no longer have an income from working. You only have an income from what you saved.

Based on your standard monthly living expenses, how long would that $40K let you survive? Call that your monthly burn rate. Depending on your lifestyle, maybe you can stretch that out for 6 months to a year with house, car, food, entertainment, travel, etc.

So that 1 week vacation could have cost you a year of living in the future.

I bet you never thought of it this way, but that’s the power of compound interest and investing properly.

III. “Don’t Be Stupid”

There’s this great philosophy employed by Jeff Bezos of Amazon fame and Warren Buffett and Charlie Munger of Berkshire Hathaway fame. In both cases, these gentlemen pass any choice they make through the “is this a stupid move?” test.

Bezos will tell you that Amazon will always spend money investing in R&D on things that make prices cheaper and deliveries faster. What customer is going to complain about faster and cheaper? Nobody. So it’s a sure bet. It’s not being stupid.

As you think about decision-making for your own lifestyle and consider the choices you will make for investing in your future, it’s an apt framework to test anything against.

Investing for the future doesn’t always have to mean putting money into a CD, Bitcoin, Stocks, Real Estate, or Bonds. It can also mean the job that you take. Or the partner you choose to live your life with.

But the one that we will focus on here is specific to investing for retirement because without that burdensome thing called money, you simply can’t survive.

Charlie Munger (left) and Warren Buffett (right) of Berkshire Hathaway fame. Jeff Bezos of Amazon fame.

IV. The New Retirement Savings Game

One of our favorite apps is Robinhood. It has turned saving for retirement nearly into a game. With zero trading fees (everyone else charges $10 per trade), it’s an easy way to onboard new customers.

And onboard people they did. The team, product, and funding is growing like crazy. They just raised another $110M in a Series C round bringing their total funding to $176M.

The impact it’s having, however is more remarkable. Young professionals just entering the workforce are saving more, more often. Instead of relying on a corporate 401K program with 10 incredibly bad mutual fund options that they never tell you what is actually being invested in, the new way is to take the after tax money and invest it yourself in places like Apple.

There’s even a bit of Fantasy Football style competitiveness where friends are sharing their returns with other friends, much like how the people in the 90s would brag about how their dot com investments were doing during the bubble.

Of course, now that’s been replaced with ICOs but we’ll get to that in a minute.

The more you invest, the closer attention you pay, the more you see your balance going up sheerly from you putting more and more money into it. It becomes your own viral mechanism for retirement saving. And you’re doing it all on your own, with a little competition from friends using as little as $25 for the cheaper stocks.

So, instead of buying that t-shirt for $25, the choice becomes “Do I buy this stock for $25 and get a return on it”. It’s like the Disney World vacation analogy up top, but now brought down to everyday life.

The more you choose to invest today, the more money you will have that can compound in the market over decades. Time, when it comes to investing, is your best friend.

Holding your savings in cash is the worst possible decision you can make over the long term. Because every year that cash is guaranteed to be worth almost 3% less than it was the year before. That’s this little devil called inflation eating away at your hard-earned money, day after day, year after year, decade after decade, until it’s finally all gone. Nasty little trickster.

The only way you can combat inflation is by investing it in something that gets a return greater than that.

From 1950 to 2009, the median annual rate of inflation was 2.7%.

Some years more, some years less, but overall that’s what you can expect for how much less your money will be worth next year as it is this year. So, if you made $100,000 this year, without a raise it means you’re making $97,300. That’s nearly $3000 per year! That’s $225 per month. So basically a car payment.

Every year, it’s like giving away your car with nothing in return! Jeez, that sure makes this situation real doesn’t it.

What are we to do about it?

V. New Apps for Investing

If you’re going to beat back the cold shrew called inflation, and begin making money with your money, you’re going to need some help. So let’s do a little round-up of how the state of Saving For Retirement has shifted in recent years with the push towards mobile for digital natives.

Robinhood. First up is Robinhood as we’ve mentioned above. Zero trading fees. Makes investing fun. But you have to do your own analysis. We’ve helped you with that in the past on The Base Code, but ultimately you need to do your own valuation analysis, Warren Buffett style if you want to pick the right stocks. Or, you could just invest in the S&P500, which has handily beat the best hedge funds on Wall St over a long time horizon.

Robinhood

Stash. Next up is Stash, which doesn’t let you invest in a single stock directly like Robinhood. Instead they let you put in as little as $5 and invest in one of 30 ETFs (Exchange Traded Fund). If you don’t know what that means think of it like a mutual fund, where you’re getting a portfolio of stocks. Sometimes that could be hundreds, other times only a handful. But their value proposition is that you choose your risk tolerance and they select the right group of stocks best suited to that.

Of course, we believe investing is about something different. You either invest in the entire market at large (i.e., the S&P 500) or you find a single stock or two that you’ve valued appropriately and know that it’s undervalued by the market, then invest in that until the price increases to reflect what you think it should be. Truthfully, we do both. It helps reduce risk while also giving you exposure to the large upside.

Stash

Acorns. This is similar in concept to Stash in that they offer a number of ETFs that track the S&P 500 or smaller portfolios of stocks and bonds. But the main difference here is that you can invest your spare change and set up recurring monthly investments to get money into your account. They round up your credit/bank card purchases to the nearest dollar and invest that small difference. Over time, that starts to add up.

If you find you always seem to spend all your money, then this could be a good solution to start saving for retirement. A few cents here, a few cents there, over the years adds up and you’d be surprised how much money you can earn over time.

Acorns

Betterment. This exists more like the classic model of investing. You have real human people to help you plan for, and invest for, retirement. Of course, they also offer the mobile and web apps. It’s a more full-service type of product.

You can solicit unlimited expert advice from professionals. But be careful, not all investors are created equal, so it pays to understand how they make decisions. Most credible people will tell you that success in the past doesn’t predict success in the future, but what does work is a way of thinking. If you utilize the same frameworks and models for what you invest in, and they prove to be right, then you’re in for something good.

Betterment

AI Investing. There are also some apps and startups out there who claim to do all the investing on your behalf using mathematic AI equations. Don’t get caught in this trap. It’s algorithmic trading, and in order to do it right, you need incredibly high speed, technical analysis, colocation at the exchanges, and a $250M infrastructure, plus an experienced team to do it like the big boys. They are so good that they have algorithms that are built just to identify the novices in the space and take advantage of them. You lose, they win.

Either get smart and do it yourself, or invest in the S&P 500. Or have someone you trust an incredible amount to manage it for you. But even then, we’ve seen how that can go haywire with Bernie Madoff. Just be careful, and do your homework. You’ll be fine.

VI. Getting Educated

If you’re not familiar with the name Ray Dalio, that’s okay, not too many people outside the finance community. But he owns the largest hedge fund of all time and is worth a cool $17 billion. Not bad for 68 years old and heading into retirement.

But the reason we’re reading him is because he just released a new book, which is really an update to Principles that he’s been writing his entire life. It’s a set of, ahem, principles to help you make better decisions, whether in life or investing money. You can watch his TedX talk to see how he developed a system where even a new intern can call out his ideas as garbage. Pretty radical, but clearly effective.

Go buy the book. And you’ll learn how to make better decisions in life and in investing. It’s not going to hurt. And it might open your mind to do-it-yourself investing that will protect your family for years after you’re gone.

Good luck. Godspeed. And stay thirsty for knowledge. It’s the one tool you can invest in that will never hurt you. It’s a “don’t be stupid” kind of thing. See you soon.

— Sean Everett

If you enjoyed this story, please click the 👏 button and share to help others find it! Feel free to leave a comment below.

The Mission publishes stories, videos, and podcasts that make smart people smarter. You can subscribe to get them here. By subscribing and sharing, you will be entered to win three (super awesome) prizes!

The Story of Your Future Retirement was originally published in The Mission on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Stories by Sean Everett on Medium http://ift.tt/2wBNIa7

0 notes

Text

Seriously digging this type of story format my friend.

Seriously digging this type of story format my friend. I find myself reading, reading, reading know that the grand reveal is going to have some famous person that I had no idea about their backstory. And then, bang! You surprise me every time and I’m forced to go click the claps button a bunch of times. Ghandi is the man. Can’t wait for the next one!

from Stories by Sean Everett on Medium http://ift.tt/2wEMvKD

0 notes

Text

14 Billionaires & Celebrities Get Coached

Helping you get to where you want to go in life, faster.

Read this story, and many others like it, in our parent publication, The Mission:

14 Billionaires & Celebrities Get Coached

— Sean Everett

14 Billionaires & Celebrities Get Coached was originally published in Humanizing Tech on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Stories by Sean Everett on Medium http://ift.tt/2wscO6v

0 notes