#the future of crypto mining

Explore tagged Tumblr posts

Text

From Hype to Reality: Future Of Crypto In The Next 5 Years

Since the arrival of bitcoin in 2009, the cryptocurrency market has come a long way, in which sometimes this market has been up and sometimes down. From the beginning of bitcoin till now we have seen very rapid development of crypto currency market but it is necessary to recognize what will be the future of crypto currency in the coming 5 years. However, predicting the future in such a dynamic…

View On WordPress

#benzinga future of crypto#future of bitcoin in the next 5 years#future of crypto#future of crypto currency#Future Of Crypto In The Next 5 Years#the future of crypto#the future of crypto mining#the future of crypto money#what is the future of crypto currency#what is the future of crypto mining#whats the future of crypto#why crypto is not the future

0 notes

Text

“Hatsune Miku villain vers. noodle stopper figure (black)” by FuRyu

#pngs#editing#transparent#png#mine#transparent png#cute#noodle stopper figure#villain hatsune miku#crypton future media#crypto network#furyu#noodle stopper#hatsune miku#nightmareseditingpngs

28 notes

·

View notes

Text

Invitation code: missiongd

Today you can participate with us in mining information - Earn crypto tokens without paying money according to the words of this platform cPen Network. Their account on the X platform: https://x.com/cpencoreteam

The content of the words of this platform cPen Network builds a professional network to be a platform that benefits people in exchanging currency or value ( I mean where the benefit is reflected in human life ) .

I mean they are striving towards that.

Of course, it is your duty to search and read because each person is responsible for his own decision.

A simple method. There are many explanations on this topic - Online like YouTube.

#cPen#platform#professional network#exchanging currency#resolution#mining#Cryptocurrency#striving#Perseverance#Invitation code#Youth of today#Technical solutions#Here the future is#Earn crypto tokens#Start today

2 notes

·

View notes

Text

Mining investment in Qatar

Hi there, thank you for your interest in mining investment in Qatar. Qatar is a country with abundant mining potential, as it is home to some of the world's largest gas and oil reserves. The Qatar Mining Company (QM) is the government-owned company responsible for overseeing mining operations in the country. QM has several investment programs that can provide potential investors with the opportunity to explore Qatar's mining potential. Additionally, Qatar's Ministry of Energy and Industry provides information about the sector and offers assistance to those interested in investing in mining operations in the country. We hope this information has been helpful in providing you with an overview of the opportunities available for mining investment in Qatar. Thank you for your inquiry.

#Mining investment in Qatar#best way to investment Money in Qatar#Crypto investment in Qatar#Crypto currency in Qatar#best crypto exchange in Qatar#crypto market in Saudi Qatar#crypto currency trading strategies#in Qatar#Mining in Qatar#Best Future of crypto currency in Qatar#Crypto investment benefits in Qatar#Crypto currency in Russia#Crypto investment in Russia#Mining investment in Russia#best way to investment Money in Russia#best crypto exchange in Russia#crypto market in Saudi Russia#inRussia#Mining in Russia#Best Future of crypto currency in Russia#Crypto investment benefits in Russia

2 notes

·

View notes

Link

🚀 Russia is paving the way for the future of digital finance! 🏦 From legalizing crypto mining to launching an experimental digital currency regime, major changes are coming. 📈 Get ready for a new era! 🌐

#crypto reveolution#digital currency#crypto mining#blockchain#russia#crypto news#digital finance#crypto regulation#crypto future#cryptocurrency#finance

1 note

·

View note

Text

"Mastering the Markets: Your Ultimate Guide to Day Trading Success"

Unlocking the World of Day Trading: A Beginner's Guide

Within the finance industry, day trading is a vibrant and thrilling activity in which traders purchase and sell financial assets all within the same trading day. It's an endeavor that has hazards in addition to being alluring and daunting because it promises instant rewards. This article is your compass if you've ever been interested in learning more about day trading. It walks you through the fundamentals and reveals the tactics that can help you succeed in this competitive market.

What is Day Trading?

Fundamentally, day trading is the quick purchase and sale of financial instruments, such as futures contracts, options, stocks, or currencies, with the intention of making money on transient price changes. In contrast to traditional investing, which involves holding assets for weeks, months, or even years, day traders try to profit from price changes that occur within a single day.

To Get Enrolled In Advance Trading Course, Get Free Signup Here

Getting Started: Tools of the Trade

Before embarking on your day trading journey, it's essential to equip yourself with the right tools. These include:

1. A Stable and Fast Internet Connection: Because day trading is done in real time, you need a steady and fast internet connection to make sure you have the most recent market information and can place transactions quickly.

2. A Trading Platform: Select a trustworthy trading platform with quick execution times, real-time market data, and sophisticated charting features. Popular choices include Interactive Brokers, Thinkorswim from TD Ameritrade, and Robinhood.

3. Educational Resources: Devote some time to gaining knowledge on technical analysis, risk management, and trading tactics. Books, seminars, and online courses can all offer insightful information on the nuances of day trading.

4. Risk Capital: Set aside a certain percentage of your portfolio for day trading, and only use money you can afford to lose. Although the prospect of financial gain is alluring, day trading

Understanding Market Dynamics

Successful day traders possess a deep understanding of market dynamics and employ various strategies to capitalize on price movements. Some common strategies include:

1. Scalping: In order to profit from modest price movements, this approach entails placing a number of small trades throughout the day. Typically, scalpers concentrate on assets with high liquidity and depend on narrow spreads to generate profits.

2. Trend Following: Traders that use this technique recognize current market trends and take positions in the trend's direction. Trend followers hope to make significant gains by riding the momentum as prices continue to move in their favor.

3. Range Trading: Range traders pinpoint the support and resistance levels, or price channels, that an asset's price varies within. They take advantage of the price fluctuations inside the range by buying at the lower boundary and selling at the upper boundary.

Risk Management: Protecting Your Capital

Effective risk management is paramount in day trading, as it safeguards your capital against significant losses. Consider implementing the following risk management techniques:

1. Placing Stop Loss Orders: If the price goes against you by more than a predefined amount, you can use stop-loss orders to instantly terminate a transaction. This lessens the possibility of losses and keeps people from making rash decisions.

2. Position Sizing: Take into account your account size and risk tolerance while determining the right size for each transaction. To lessen the impact of losses, try not to risk more than a small portion of your wealth on any one trade.

3. Upholding Discipline: Follow your trading strategy and refrain from making snap judgments motivated by greed or fear. Emotions have the potential to impair judgment and cause unfavorable results during day trading.

Conclusion

A fun way to profit from brief price changes in financial markets is through day trading. With the right information, resources, and techniques, you can confidently negotiate the challenges of day trading. But it's crucial to approach day trading sensibly and cautiously, putting disciplined execution and risk management first. In the fast-paced world of day trading, you may unlock the potential for gains with commitment and persistence.

For Advance trading Course, Get Free Signup Here

#digitalcurrency#binance#bitcoin mining#day trading#cryptocurreny trading#ethereum#blockchain#crypto#cryptoexchange#investors#futures trading#investments#digital currency#technology#trading tips#stock market

0 notes

Text

"🐧 Dive into unbeatable deals with Penguin Company! Special offer: Enjoy up to 90 days FREE hosting when you purchase Canaan Avalon devices. 🖥️💡 #PenguinDeals #CanaanAvalon #FreeHosting #TechSavings #SpecialOffer"

1 note

·

View note

Text

0 notes

Photo

In the play-to-earn world, the line between work and play blurs into a realm of endless possibilities. 𝐃𝐚𝐫𝐞 𝐭𝐨 𝐃𝐫𝐞𝐚𝐦, 𝐃𝐚𝐫𝐞 𝐭𝐨 𝐏𝐥𝐚𝐲, 𝐚𝐧𝐝 𝐃𝐚𝐫𝐞 𝐭𝐨 𝐄𝐚𝐫𝐧!Join Our WhatsApp Community To Stay Updated: https://chat.whatsapp.com/JkAdOX58mGY7pujRImTdci#Metaverse

1 note

·

View note

Text

#btc news#BTC#bitcoin bitcoin price bitcoin trading btc coinbase crypto trading ethereum bitcoin bot bitcoin miner bitcoin mining bittrex coinbase trading#cryptonews#crypto projects#crypto currency#futurism#technology#futuristic#futurology

0 notes

Text

The ability to create something which is not duplicable in the digital world has enormous value… Lot’s of people will build businesses on top of that. – Eric Schmidt

1 note

·

View note

Text

Best Future of crypto currency in India

Cryptocurrencies have become a popular investment option in recent years, and India is no exception. With the growth of digital currencies and blockchain technology, more and more investors in India are considering investing in cryptocurrencies as a way to diversify their portfolios and potentially earn high returns. One platform that has gained popularity in the Indian market is MIR-Token.com, which offers a range of crypto investment options. In this article, we will explore the benefits of crypto investment in India with MIR-Token.com.

Diversification

Diversification is a key strategy in any investment portfolio. It is important to spread risk across different assets to minimize losses and maximize returns. One of the benefits of crypto investment with MIR-Token.com is that it allows investors to diversify their portfolios beyond traditional assets such as stocks, bonds, and real estate.

With MIR-Token.com, investors can access a range of digital currencies, including Bitcoin, Ethereum, Litecoin, and many others. This diversity of crypto assets allows investors to spread their risk across different currencies, minimizing the impact of any single currency's performance on their overall investment.

High Returns

Crypto investment can offer high returns compared to traditional investments. While it is true that the crypto market can be volatile, it is also true that many investors have made significant gains through crypto investment. For example, Bitcoin's price has increased from less than $1 in 2010 to over $50,000 in 2021, representing a huge return for early investors.

MIR-Token.com offers investors the potential for high returns through its crypto investment options. With its user-friendly platform and a wide range of digital currencies, MIR-Token.com enables investors to access the crypto market and take advantage of potential growth.

Low Fees

One of the benefits of crypto investment with MIR-Token.com is its low fees. Traditional investment options such as mutual funds and stocks often come with high fees, which can eat into investors' returns. In contrast, MIR-Token.com charges low fees for its crypto investment services.

This low fee structure is possible because crypto investment is a decentralized market, meaning there are no intermediaries such as brokers or middlemen. As a result, investors can save on fees and keep more of their returns.

Security

Security is a key concern for any investor, especially when it comes to digital currencies. The crypto market has been plagued by security breaches and hacking attacks in the past, leading to the loss of millions of dollars. However, MIR-Token.com takes security seriously and employs various measures to protect investors' assets.

MIR-Token.com uses advanced encryption and security protocols to ensure that investors' funds and personal information are secure. The platform also offers two-factor authentication and other security features to prevent unauthorized access to investors' accounts.

Ease of Use

One of the benefits of crypto investment with MIR-Token.com is its ease of use. The platform is designed to be user-friendly, even for investors who are new to the world of digital currencies. MIR-Token.com offers a simple and intuitive interface that allows investors to buy, sell, and trade digital currencies with ease.

Additionally, MIR-Token.com offers a range of educational resources to help investors learn more about crypto investment and the crypto market. These resources include articles, videos, and tutorials, which can help investors make informed investment decisions.

Liquidity

Liquidity is another benefit of crypto investment with MIR-Token.com. In traditional investments such as real estate or mutual funds, it can be difficult to access funds quickly in case of an emergency. However, crypto investments are highly liquid, meaning they can be bought and sold quickly.

With MIR-Token.com, investors can buy and sell digital currencies at any time, giving them the

Read more:-

Crypto currency in India

Crypto investment in India

Mining investment in India

best way to investment Money in India

best crypto exchange in India

crypto market in India

crypto currency trading strategies,in India

Mining in India

Best Future of crypto currency in India

Crypto investment benefits in India

Source:- https://mirtoken.blogspot.com/2023/02/best-future-of-crypto-currency-in-india.html

#Crypto investment benefits in India#Best Future of crypto currency in India#Mining in India#crypto currency trading strategies#in India#crypto market in India#best crypto exchange in India#best way to investment Money in India#Mining investment in India#Crypto investment in India#Crypto currency in India

1 note

·

View note

Note

have you seen the articles on ai supposedly eating up tons of water a day on continuous use? bc ive only seen those articles circulate in spaces where they also think ai doesnt have a soul and is stealing art so. i was wondering if you had any thoughts. i tried to go through and compare them w the water usage of other common things (ie normal office laptops, planes, etc) but stats of this kind isnt really my strong suit

to my knowledge, those articles are true, but a bit misleading in that they don't tend to discuss the context (resource use for computing in general). i think the implicit argument is that, when it's 'ai' using water, this is a particular travesty because 'ai' is particularly stupid / useless / unethical. which is not really a good way to frame this discussion because it evades a broader conversation about resource use and technology. i think the tech sector is like the meat industry in that the current consumption levels by a very small number of wealthy westerners are simply unsustainable and will not scale; that doesn't mean that in a communist future no computers or animal foods will exist, but the idea that it's normal to eat meat daily or replace a smartphone every 24 months or whatever is pretty blatantly predicated on imperial relations of exploitation and resource extraction.

so just to say that i don't know what is the place of 'ai' in a just and sustainable degrowth communism, but determining that requires a much broader conversation about technology and access to it. it's silly to act like 'ai' is uniquely a problem in terms of the tech sector's resource consumption (i think people are modelling this on the wave of similr articles about cryptocurrency, but many of those were also silly and the ones that weren't, were pointing out that crypto mining requires massive amounts of redundant work to be done, and in that sense actually is more wasteful than other comtech).

i'm also not sure that the comparisons to, like, pouring out a bottle of water are accurate because can't the cooling water be reused? i don't know enough about data facility practices to answer that though lol

302 notes

·

View notes

Text

Understanding Cryptography: How to Get Started and What It Is

Understanding Cryptography: How to Get Started and What It Is

Cryptocurrency is frequently described as “digital money.” This description might also be true, however it fails to seize what makes cryptocurrency special and so attractive to many investors.

What is cryptocurrency? At its core, cryptocurrency is a machine of value. When buyers purchase a cryptocurrency, they are making a bet that the cost of that asset will expand in the future, simply as inventory market buyers purchase securities when they agree with the agency will develop and share fees will increase. Stock valuations boil down to discounted estimations of a company’s future cash flows. There is no similar valuation metric for cryptocurrencies due to the fact there is no underlying company; the price of a cryptocurrency is tied solely to investor appetite. Cryptocurrency valuations boil down to one of two factors: the probability of different traders shopping for the asset or the utility of the cryptocurrency’s blockchain.

How does cryptocurrency work? Cryptocurrency runs on blockchain technology, however what precisely is a blockchain? The time period has grow to be so commonplace, its that means and magnitude are regularly blurred. A blockchain is absolutely a digital ledger of transactions. This ledger (or database) is dispensed throughout a community of laptop systems. No single device controls the ledger. Instead, a decentralized community of computer systems maintains a blockchain going for walks and authenticates its transactions. Proponents of blockchain technological know-how say that it can enhance transparency, enlarge have faith and bolster protection of statistics being shared throughout a network. Detractors say that blockchain can be cumbersome, inefficient, expensive, and can use too a whole lot energy. Rational crypto traders purchase a digital asset if they accept as true with in the energy and utility of its underlying blockchain. All cryptocurrencies run on blockchain, which potential crypto traders are having a bet (whether they comprehend it or not) on the resiliency and beauty of that blockchain.

Cryptocurrency transactions are recorded in perpetuity on the underlying blockchain. Groups of transactions are brought to the ‘chain’ in the structure of ‘blocks,’ which validate the authenticity of the transactions and maintain the community up and running. All batches of transactions are recorded on the shared ledger, which is public. Anyone can go and seem to be at the transactions being made on the foremost blockchains, such as Bitcoin (BTC) and Ethereum (ETH). But why do humans commit computing electricity to validating blockchain transactions? The reply is, they are remunerated with the underlying cryptocurrency. This incentive-driven machine is known as a proof-of-work (PoW) mechanism. The computer systems ‘working’ to ‘prove’ the authenticity of blockchain transactions are acknowledged as miners. In return for their energy, miners acquire freshly minted crypto assets. Investors in cryptocurrencies don’t keep their belongings in normal financial institution accounts. Instead, they have digital addresses. These addresses come with non-public and public keys -- lengthy strings of numbers and letters -- that allow cryptocurrency customers to ship and get hold of funds. Private keys enable cryptocurrency to be unlocked and sent. Public keys are publicly accessible and allow the holder to get hold of cryptocurrency from any sender. It is honest to say that Bitcoin has modified the paradigm -- there has been nothing pretty like it before, and it has unleashed an absolutely new technology, a new platform for investing, and a new way of questioning about money. Cryptocurrency started out as a grassroots motion with an anti-establishment ethos, however today, companies and economic institutions are embracing cryptocurrencies for their plausible to disrupt clunky legacy structures and diversify funding portfolios. As improvements proceed to reshape the cryptocurrency sector, which include interesting new initiatives like decentralized finance (“DeFi”), the that means of cryptocurrency will proceed to evolve.

Source:- https://emileparfaitsimb.blogspot.com/2023/02/understanding-cryptography-how-to-get.html

#Crypto investment benefits in Russia#Best Future of crypto currency in Russia#Mining in Russia#crypto currency trading strategies#inRussia#crypto market in Saudi Russia#best way to investment Money in Russia#Mining investment in Russia#Crypto investment in Russia#Crypto currency in Russia#Best Future of crypto currency in Qatar#Mining in Qatar#in Qatar#crypto market in Saudi Qatar#best crypto exchange in Qatar#Mining investment in Qatar#Crypto investment in Qatar#Crypto currency in Qatar

1 note

·

View note

Text

The number of commercial-scale Bitcoin mining operations in the U.S. has increased sharply over the last few years; there are now at least 137. Similar medical complaints have been registered near facilities in Arkansas and North Dakota. And the Bitcoin mining industry is urgently trying to push bills through state legislatures, including in Indiana and Missouri, which would exempt Bitcoin mines from local zoning or noise ordinances. In May, Oklahoma governor Kevin Stitt signed a “Bitcoin Rights” bill to protect miners and prevent any future attempts to ban the industry. Much of the American Bitcoin mining industry can now be found in Texas, home to giant power plants, lax regulation, and crypto-friendly politicians. In October 2021, Governor Greg Abbott hosted the lobbying group Texas Blockchain Council at the governor’s mansion. The group insisted that their industry would help the state’s overtaxed energy grid; that during energy crises, miners would be one of the few energy customers able to shut off upon request, provided that they were paid in exchange. After meeting with the lobbyists, Abbott tweeted that Texas would soon be the “#1 [state] for blockchain & cryptocurrency.” Technically there is federal mandate to regulate noise, which stems from the 1972 Noise Control Act—but it was essentially de-funded during the Reagan administration. This leaves noise regulation up to states, cities, and counties. New York City, for instance, has a noise code which officially caps restaurant music and air conditioning at 42 decibels (as measured within a nearby residence). Texas’s 85 decibels, in contrast, is by far the loudest state limit in the nation, says Les Blomberg, the executive director of the nonprofit Noise Pollution Clearinghouse. “It is a level that protects noise polluters, not the noise polluted,” he says. The residents of Granbury feel they’ve been lied to. In 2023, the site’s previous operators, US Bitcoin Corp, constructed a wall around the mine almost 2,000 feet long and claimed that they had “solved the concern.” But Shirley says that the complaints from the community about the sound actually increased when the wall was nearing completion last fall. Since Marathon bought the facility outright in December, its hash rate, or computational power expended, has doubled. Any statewide legislation is sure to hit significant headwinds, because the very idea of regulation runs contrary to many Texans’ political beliefs. “As constitutional conservatives, they have taken our core values and used that against us,” says Demetra Conrad, a city council member in the nearby town of Glen Rose. In the week before this article’s publication, two more Granbury residents suffered from acute health crises. The first was Tom Weeks. “This whole thing is an eye opener for me into profit over people,” Weeks says in a phone call from the ICU. The second person affected was the five-year-old Indigo Rosenkranz. Her mother, Sarah, was terrified and now feels she has no choice but to get a second mortgage to move away from the mine. “A second one would really be a lot,” she says. “God will provide, though. He always sees us through.”

shocking! texans suffer from deregulation and ineffective walls

93 notes

·

View notes

Text

how much power does tech really use, compared to other shit?

my dash has been full of arguing about AI power consumption recently. so I decided to investigate a bit.

it's true, as the Ars Technica article argues, that AI is still only one fairly small part of the overall tech sector power consumption, potentially comparable to things like PC gaming. what's notable is how quickly it's grown in just a few years, and this is likely to be a limit to how much more it can scale.

I think it is reasonable to say that adding generative AI at large scale to systems that did not previously have generative AI (phones, Windows operating system etc.) will increase the energy cost. it's hard to estimate by how much. however, the bulk of AI energy use is in training, not querying. in some cases 'AI' might lead to less energy use, e.g. using an AI denoiser will reduce the energy needed to render an animated film.

the real problem being exposed is that most of us don't really have any intuition for how much energy is used for what. you can draw comparisons all sorts of ways. compare it to the total energy consumption of humanity and it may sound fairly niche; compare it to the energy used by a small country (I've seen Ireland as one example, which used about 170TWh in 2022) and it can sound huge.

but if we want to reduce the overall energy demand of our species (to slow our CO2 emissions in the short term, and accomodate the limitations of renewables in a hypothetical future), we should look at the full stack. how does AI, crypto and tech compare to other uses of energy?

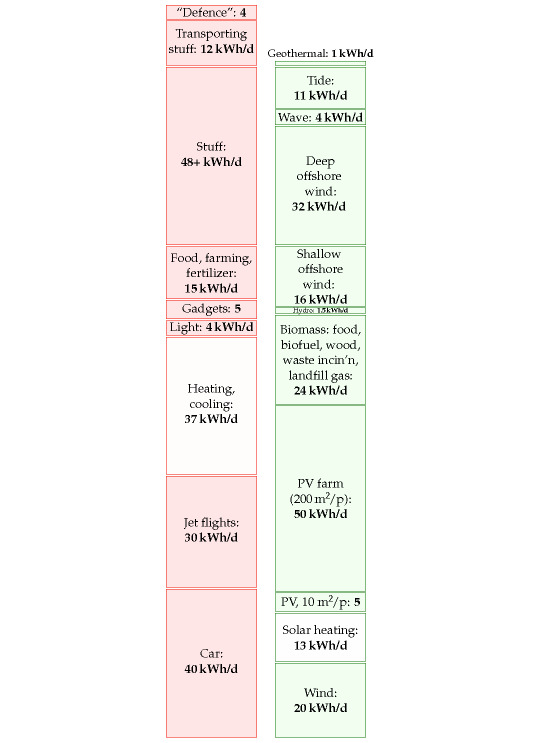

here's how physicist David McKay broke down energy use per person in the UK way back in 2008 in Sustainable Energy Without The Hot Air, and his estimate of a viable renewable mix for the UK.

('Stuff' represents the embedded energy of manufactured goods not covered by the other boxes. 'Gadgets' represents the energy used by electronic devices including passive consumption by devices left on standby, and datacentres supporting them - I believe the embodied energy cost of building them falls under 'stuff' instead.)

today those numbers would probably look different - populations change, tech evolves, etc. etc., and this notably predates the massive rise in network infrastructure and computing tech that the Ars article describes. I'm sure someone's come up with a more up-to-date SEWTHA-style estimate of how energy consumption breaks down since then, but I don't have it to hand.

that said, the relative sizes of the blocks won't have changed that much. we still eat, heat our homes and fly about as much as ever; electric cars have become more popular but the fleet is still mostly petrol-powered. nothing has fundamentally changed in terms of the efficiency of most of this stuff. depending where you live, things might look a bit different - less energy on heating/cooling or more on cars for example.

how big a block would AI and crypto make on a chart like this?

per the IEA, crypto used 100-150TWh of electricity worldwide in 2022. in McKay's preferred unit of kWh/day/person, that would come to a worldwide average of just 0.04kWh/day/person. that is of course imagining that all eight billion of us use crypto, which is not true. if you looked at the total crypto-owning population, estimated to be 560 million in 2024, that comes to about 0.6kWh/day/crypto-owning person for cryptocurrency mining [2022/2024 data]. I'm sure that applies to a lot of people who just used crypto once to buy drugs or something, so the footprint of 'heavier' crypto users would be higher.

I'm actually a little surpised by this - I thought crypto was way worse. it's still orders of magnitude more demanding than other transaction systems but I'm rather relieved to see we haven't spent that much energy on the red queen race of cryptomining.

the projected energy use of AI is a bit more vague - depending on your estimate it could be higher or lower - but it would be a similar order of magnitude (around 100TWh).

SEWTHA calculated that in 2007, data centres in the USA added up to 0.4kWh/day/person. the ars article shows worldwide total data centre energy use increasing by a factor of about 7 since then; the world population has increased from just under 7 billion to nearly 8 billion. so the amount per person is probably about a sixfold increase to around 2.4kWh/day/person for data centres in the USA [extrapolated estimate based on 2007 data] - for Americans, anyway.

however, this is complicated because the proportion of people using network infrastructure worldwide has probably grown a lot since 2007, so a lot of that data centre expansion might be taking place outside the States.

as an alternative calculation, the IEA reports that in 2022, data centres accounted for 240-340 TWh, and transmitting data across the network, 260-360 TWh; in total 500-700TWh. averaged across the whole world, that comes to just 0.2 kWh/day/person for data centres and network infrastructure worldwide [2022 data] - though it probably breaks down very unequally across countries, which might account for the huge discrepancy in our estimates here! e.g. if you live in a country with fast, reliable internet where you can easily stream 4k video, you will probably account for much higher internet traffic than someone in a country where most people connect to the internet using phones over data.

overall, however we calculate it, it's still pretty small compared to the rest of the stack. AI is growing fast but worldwide energy use is around 180,000 TWh. humans use a lot of fucking energy. of course, reducing this is a multi-front battle, so we can still definitely stand to gain in tech. it's just not the main front here.

instead, the four biggest blocks by far are transportation, heating/cooling and manufacturing. if we want to make a real dent we'd need to collectively travel by car and plane a lot less, insulate our houses better, and reduce the turnover of material objects.

117 notes

·

View notes