#tesla shares price rise

Explore tagged Tumblr posts

Text

Elon Musk, the CEO of Tesla and SpaceX, has hit a new personal wealth milestone, becoming the richest he has ever been with a net worth of $334.3 billion, according to sources.

His wealth surged after a 3.8% increase in Tesla's stock price, which reached a 3.5-year high of $352.56 per share. The rise in Tesla shares is driven by investor optimism about favorable regulatory conditions under a potential Trump presidency.

Musk's stake in Tesla is valued at $145 billion, and his new AI venture, xAI, has added $13 billion to his fortune. Musk’s investments in SpaceX, Neuralink, and X (formerly Twitter) further secure his position as the world's wealthiest individual.

#ElonMusk#Tesla#SpaceX#xAI#NetWorth#Billionaire

20 notes

·

View notes

Note

If you correctly believe that a $10 stock will be valued at $100 five years from now, you can make a killing. If you correctly believe that a $100 stock will be valued at $10 five years from now - but you don't know when it'll drop, or whether it'll rise before then - you probably can't make money off of that.

Both buying and short-selling are in some sense predictions about what other market participants will believe, yes, but successful short-selling requires a lot more knowledge about the market and when its opinions will change, in addition to predicting the fate of the company itself.

This brings us back to the original issue of the original thread: the asymmetry between buying and short-selling means that people with optimistic views of a company can drive its stock up without people with pessimistic views of the company being able to bring its stock back down, even if the pessimists have as much money as the optimists, and even if they're much more grounded in reality. Smart money can't drive out dumb.

lol, I guess this discussion devolved because the original thread contains all kind of issues and it's unclear what kind of point I was trying to make.

I think the very original thing was @raginrayguns obliquely saying that he doesn't think Tesla is overpriced, or at least, that there is no obvious reason why it would be. I have no opinion about that.

In the middle of the thread @raginrayguns comments that "dumb money" is a good explanation for why Tesla was heavily shorted in 2022. I guess that makes some sense? and in fact the price then did go down in 2023, so shorting it back then probably was a smart move.

Then @centrally-unplanned said that "shorts can't mechanically drive down the price of stocks". I disagree with this! I claim that if the SEC made a new rule that "you can't short Tesla" the share price would go up, and if they abolished the rule the price would go down again. Since Elon's wealth is in Tesla stocks, and directly proportional to the share price, it seems fair enough for him to be obsessively angry about short selling. And like @unreliabledragon said, you can get this effect just from the "effective supply": even if nobody changes their mind about the long-term prospects of Tesla in (say) the weeks after the rule change, the price should still move just because of supply and demand. That's what the example I posted is meant to illustrate.

10 notes

·

View notes

Text

In the stock market, a short squeeze is a rapid increase in the price of a stock owing primarily to an excess of short selling of a stock rather than underlying fundamentals. A short squeeze occurs when demand has increased relative to supply because short sellers have to buy stock to cover their short positions.

What's a Short Squeeze and Why Does It Happen?

Key Points

A stock that rallies hyperbolically when there are no obvious current events driving the response, could be experiencing a short squeeze.

A short squeeze can potentially be worth trading, but only if you exercise great care.

The aim of short selling is to generate profit from a stock that declines in value. (Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. Your plan is to then buy the same stock back later—hopefully for a lower price than you initially sold it for—and pocket the difference after repaying the initial loan.) While there are potential benefits to going short, there are also plenty of risks. One big risk is when a bullish catalyst (earnings, news, technical event, etc.) pushes the stock price higher, prompting short sellers to "head for the exits" all at once. As the shorts scramble to buy back and cover their losses, upward momentum can build on itself, causing the stock to move sharply higher. This is known as a short squeeze.

Understanding the short squeeze

What makes a short squeeze so dangerous? Think of it this way: When you buy a stock, the worst thing it can do is drop to zero. But the upside is unlimited. If a stock has a growth narrative and there are enough believers, the share price can go well beyond what looks reasonable by traditional fundamental metrics.

Classic signs of a short squeeze can include:

A security has a significant amount of short sellers (short interest) who believe the stock price is going to fall, and then instead the stock price sharply rises, forcing many of these leveraged short sellers to quickly exit their positions, buying back the stock in the face of potentially increasing losses.

A dynamic narrative that tries to justify the detachment of share prices from a company's intrinsic value

A case for massive growth as well as for financial stress

Traders with deep pockets aligned on both sides of the trade, often using options and other leveraged instruments

With GameStop (GME) in 2021 and Tesla (TSLA) in 2020, there were many classic signs of a short squeeze. Traders with short positions were covering because they had to, either because they had sustained large losses or shares were no longer available to be borrowed. In 2022, short sellers targeted troubled companies such as Bed, Bath & Beyond (BBBY) and Carvana (CVNA). In early 2023, the most heavily shorted companies included Coinbase Global (COIN), a cryptocurrency firm, and Occidental Petroleum (OXY).

When a stock suddenly experiences a dramatic climb, with or without good news, it's important to ask yourself, "Who would buy shares up here?" The answer? Someone who doesn't have enough money to hold on any longer, or someone whose pain threshold has finally been crossed.

Proceed with caution

If you're a long-term investor who happens to own a stock that's getting squeezed, it's probably not a good time to trade. Instead of acting on emotions, remember what got you to where you are in your investing journey—and where you'd like to be. If buying a stock that's in squeeze territory doesn't fall within your long-term objectives, you might want to step aside and not trade. If you do decide to venture in, make sure you have no illusions and no misconceptions of the dangers. Understand that when you’re dealing with a stock that’s being squeezed, you're taking a big risk.

Identifying a short squeeze can be relatively simple—after the fact. The trick is to identify the conditions that could lead to a squeeze ahead of time, and then determine how you might want to play it (or not).

Shorting a stock is a complicated business. Because you can't sell something you don't own, shorting requires the seller to "borrow" the stock (and pay interest to the stock lender), then sell it. Locating the shares can sometimes be difficult for your clearing firm because of high demand or a small number of outstanding shares.

Measuring a short squeeze can involve a metric called the short interest ratio, a.k.a. "days to cover." It indicates, in days, how long it would take to cover or buy back all the shorted shares. Basically, you divide the number of shares sold short by the average daily trading volume. The more days to cover, the more pronounced the effect can be.

Another measure is "short interest as a percentage of float," which reflects the number of short-sold shares in proportion to the total number of shares available for trading in the public markets. Most stocks have a small amount of short interest, usually in the single digits. The higher that percentage, the greater the bearish sentiment may be around that stock. If the short % of the float reaches 10% or higher, that could be a warning sign.

Consider the fundamentals

If you're buying a stock that seems to be in the throes of a short squeeze, especially at high levels, it helps to understand other potential reasons why the stock might be moving.

Consider checking the fundamentals. Is there anything that would make you want to own the stock? Are you tempted to buy it because everyone else is? It's important to always do your homework, and remember it's never wise to go all in. A stock that's in a short squeeze may still have a long way to climb, and if you don't think the fundamentals support higher prices, then perhaps you should look elsewhere.

In the case of TSLA in 2020, there were some positive fundamentals underlying the short squeeze, including the company's more consistent profitability and hopes of it being included in the S&P 500 Index (SPX). The stock saw its share price run up to new highs, then decline nearly 60%.

But then TSLA rallied again and split its shares, and its addition to the SPX became a reality, illustrating that a short squeeze doesn't always have to end badly. Other stocks that were caught up in short squeezes haven't always fared so well, in part because they didn't have the fundamental support.

Playing the squeeze on the long side?

If you want to trade a stock during what might be a short squeeze—that is, buying a stock with a higher short interest in order to potentially play the upside of a squeeze—here are some things to consider:

Trading such a stock may be okay as long as you understand the risk and how to control it. Whether you make small or large trades, you have to control and limit the risk. Decide how much money you would be comfortable losing in any trade ahead of time.

Don't underestimate how high the stock can go and how long it can take. When a stock gets caught up in a short squeeze, analysts generally expect it to correct eventually, but no one knows to what price and when; if it happens at all.

If the stock still has very weak fundamentals, yet is moving significantly higher without any real, structural changes in the corporation, then be extremely careful buying on this type of upward momentum. The markets may run out of new buyers willing to pay higher and higher prices and the stock may in the end fall quickly.

The bottom line

A short squeeze is a high-risk situation and it may cause havoc in the market, but most don't last forever. Most eventually subside.

#kemetic dreams#the big short#finance#financial#short squeeze#stocks#financialnews#investing#earningsreport#stockmarket#market#money#make money online#earn money online#make money from home#old money#millionaire#profit#finances#income

11 notes

·

View notes

Text

Bitcoin Going Parabolic: A Closer Look at the Factors Driving the Surge

Bitcoin has been a subject of fascination and debate for over a decade. Recently, the buzz around its potential parabolic rise has reached new heights. With multiple presidential nominees proposing to make Bitcoin a strategic reserve asset and groundbreaking legislative efforts, the cryptocurrency is poised for a significant breakthrough. In this blog post, we will explore the factors contributing to Bitcoin's potential meteoric rise and what this could mean for the future of finance.

Current Market Overview

The Bitcoin market has seen remarkable stability and growth over the past year. Despite global economic uncertainties, Bitcoin's price has maintained an upward trajectory, driven by increased adoption and growing institutional interest. The market's resilience has only strengthened the belief that Bitcoin is here to stay.

Factors Driving Bitcoin's Potential Parabolic Rise

Institutional Adoption Institutional investment in Bitcoin has been one of the most significant drivers of its price surge. Companies like MicroStrategy, Tesla, and Square have made substantial Bitcoin purchases, demonstrating their confidence in its long-term value. Recently, MicroStrategy announced plans to raise $2 billion to buy more Bitcoin, adding to its already significant holdings of 226,500 BTC. This move exemplifies the growing trend of institutions recognizing Bitcoin as a hedge against inflation and economic instability.

Regulatory Developments Positive regulatory changes are also contributing to Bitcoin's upward momentum. Notably, several presidential nominees in the upcoming election have expressed their support for Bitcoin, proposing to make it a strategic reserve asset for the United States. Additionally, Senator Cynthia Lummis has introduced a groundbreaking bill to establish a U.S. Bitcoin reserve. This legislation aims to treat Bitcoin like gold or oil, strengthening the country's economy and positioning Bitcoin as a permanent national asset. Such initiatives could legitimize Bitcoin on a national level, potentially triggering a wave of similar actions from other countries.

Monetary Policy Shifts The Federal Reserve is expected to cut interest rates in September, a move that historically leads to Bitcoin price pumps. Lower interest rates often result in increased liquidity in the financial system, driving investors to seek alternative stores of value like Bitcoin. Moreover, the global M2 money supply is skyrocketing, indicating a significant increase in the amount of money in circulation. This surge in money supply can lead to inflation, further underscoring the appeal of Bitcoin as a deflationary asset.

Technological Advancements Bitcoin's underlying technology continues to evolve, enhancing its security, efficiency, and scalability. Innovations such as the Lightning Network and Taproot upgrade are making Bitcoin transactions faster and more cost-effective, further cementing its position as a superior financial instrument.

Historical Parabolic Trends in Bitcoin

Bitcoin's history is marked by several parabolic rises, each driven by different factors but sharing common themes of increased adoption and market maturation. The 2017 bull run, fueled by retail investor interest, and the 2020-2021 surge, driven by institutional adoption, provide valuable insights into the current trend. Studying these patterns helps us understand the potential trajectory of Bitcoin's price movement.

Expert Predictions and Analysis

Experts in the field of cryptocurrency are making bold predictions about Bitcoin's future. Influential figures like Michael Saylor, CEO of MicroStrategy, and Cathie Wood, CEO of ARK Invest, have forecasted Bitcoin reaching new all-time highs. Their analyses are based on Bitcoin's scarcity, growing adoption, and its role as digital gold.

Potential Challenges and Risks

While the outlook for Bitcoin is promising, it is essential to acknowledge the potential challenges and risks. Regulatory hurdles, market volatility, and technological vulnerabilities could impact Bitcoin's growth. Investors must remain vigilant and informed to navigate these challenges effectively.

Conclusion

Bitcoin's potential to go parabolic is underpinned by strong institutional support, favorable regulatory developments, and continuous technological advancements. As multiple presidential nominees propose to make Bitcoin a strategic reserve asset and Senator Lummis's groundbreaking bill aims to establish a U.S. Bitcoin reserve, the stage is set for a significant transformation in the financial landscape. With MicroStrategy's aggressive strategy to raise $2 billion for more Bitcoin purchases and the expected interest rate cuts by the Federal Reserve, the momentum is undeniable. Additionally, the skyrocketing global M2 money supply highlights the growing need for a deflationary asset like Bitcoin. Whether you're an investor, a crypto enthusiast, or a curious observer, staying informed about these developments is crucial as we witness the evolution of Bitcoin.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Crypto#Cryptocurrency#BTC#Blockchain#FinancialRevolution#DigitalGold#Investing#InstitutionalAdoption#Regulation#BitcoinNews#CryptoMarket#BitcoinPrice#BitcoinInvestment#FederalReserve#MonetaryPolicy#InterestRates#M2Supply#SenatorLummis#MicroStrategy#ParabolicRise#FinancialFreedom#financial experts#digitalcurrency#unplugged financial#globaleconomy#financial education#financial empowerment#finance

5 notes

·

View notes

Text

Top 5 US Stocks to buy for Long Term | 2023

Hey Everyone . So , Today In this Article We Are Going To Talk About the Top 5 US Stocks For Long Term . The Shares Which I will Tell You Today Are the Best Us Stocks That Will Definitely Gives You Profit . So , Don't Just Invest By Reading My Article , You Can Invest But Try To Gain Some Knowledge about The Company . So Let's Begin The Topic :

TOP 5 US STOCKS TO BUY FOR LONG TERM :

NO 1 . APPLE

NO 2 . AMAZON.COM

NO 3 . TESLA

NO 4 . MICROSOFT CORPORATION

NO 5 . VISA

WHY I PICKED THESE 5 STOCKS ?

APPLE :

The Apple Stock Price Is Continuously Rising . If You will Checks the Last 6 Month Result You Will See That It Has Rise from $159 To $174 Approx $16 Rise In Just Last 6 Month And That's a Good Thing . Apple Stock Price Rises Every Year Because Of Company Value As It Bring Amazing Phone With Amazing Features .

If You See 1 Year Back The Price Of Apple Stock Was $125 And Now Currently It's $174 and Soon It Will Reach $200 . I Recommend you To Invest In This Stock Because it Will Give You a Huge Profit In Future ...

AMAZON.COM :

Everybody Knows Amazon Right ? . So , Currently The Price Of Amazon Is Falling And It's a Great Opportunity To Buy The Stock In Low Price . What You Think Amazon Price will Not Rise ? . As We The Technology Is Rapidly Growing and Everyone Is Busy In Their Life . So , In Future You Will See a Huge Rise in Amazon Stock Because Of The Rise In Population And Everybody Wants The Thing Just by Sitting Instead Of Going Out And Purchasing It ...

So , Currently The Price of Amazon Stock is $129 . If You will See It's Chart To Google You will Find That It's Price is Falling From Last 1 Month . So , I 100% Recommend You To Buy This Stock And In Last 1 Year it Has Rise From $114 to $129 . I know It's Not a Huge Rise in Price But In Future It Will Be On the Top .

TESLA :

Who Don't Know Elon Musk . The Richest Person in the World And the Owner Of Spacex And Tesla . Tesla Stock Price is Falling From Last 20-25 Days . On 18 September 2023 The Stock Price Was $271 And Now It's $241 . What a Huge Fall in Tesla Stock Price . Many People Will Sell It Because the Price Is Falling But The Intelligent Investor's Will Buy It Right Now Because the Price has Fallen .

The Last Year Company Was in Loss And The Share Price Went Down Approx $50 in a Year . See , As You Know The Petrol Cars will Be Getting Banned In Future Because Of So Much Pollution and ELECTRIC CAR OF ELECTRIC VEHICLE Are Launched . So , it's 99% Confirmed that The Price Of Tesla Will Increase In Future .

MICROSOFT CORPORATION :

Microsoft Corporation Is a Huge and Oldest Company And Currently It's Price Is Also Falling From Last 1 Month It Has Fall About $10 in The Last 1 Month . The Current Stock Price is $317 .

But In The Last 6 Months It Has Rise About $40 and It's a Good Rise in Price And In Last 1 Year It Has Rise About $80 . That's a Huge Rise in Price . Imagine This Is The Price Of One Stock And If You Have Hundreds or Thousands of Stocks It Will Make You Rich In Future .

VISA :

The Stock Price Of Visa Is Also Falling From Last 1 Month . It has Fallen About $7 Last Month . The Current Stock Price is $235 And May Be It Will Rise In Future . I am Saying This Because Of It's Company Performance In Last Year . But I Recommend You To Buy It For Atleast 4 - 5 Years . Hold Your Stock For 4 - 5 Year's And Then It Will Give You a Good Profit .

So , These are the Top 5 US Stocks For Long Term . Please Remember We Don't Have Any Exact Information That It Will 100% Rise . We Say This By Analysing The Market And The Performance Of The Company In Last Few Years . So , Invest At Your Risk .

But Yes , According To Our Research We are Sure That in 4 - 5 Year's The Price of These Stocks Will Go Very High .

Thanks For Reading ...

Earn Money With Shaan

3 notes

·

View notes

Text

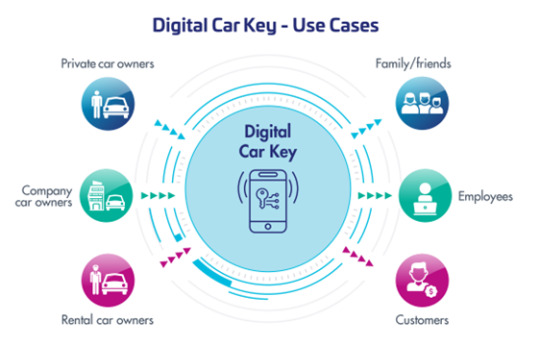

Automotive Digital Key Market To Witness the Highest Growth Globally in Coming Years

The report begins with an overview of the Automotive Digital Key Market 2025 Size and presents throughout its development. It provides a comprehensive analysis of all regional and key player segments providing closer insights into current market conditions and future market opportunities, along with drivers, trend segments, consumer behavior, price factors, and market performance and estimates. Forecast market information, SWOT analysis, Automotive Digital Key Market scenario, and feasibility study are the important aspects analyzed in this report.

The Automotive Digital Key Market is experiencing robust growth driven by the expanding globally. The Automotive Digital Key Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. Automotive Digital Key Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing. Automotive Digital Key Market Size, Share & Industry Analysis, By Type (Near Field Communication (NFC), Bluetooth, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles) And Regional Forecast 2021-2028

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/105490

Key Strategies

Key strategies in the Automotive Digital Key Market revolve around optimizing production efficiency, quality, and flexibility. Integration of advanced robotics and machine vision technologies streamlines assembly processes, reducing cycle times and error rates. Customization options cater to diverse product requirements and manufacturing environments, ensuring solution scalability and adaptability. Collaboration with industry partners and automation experts fosters innovation and addresses evolving customer needs and market trends. Moreover, investment in employee training and skill development facilitates seamless integration and operation of Automotive Digital Key Market. By prioritizing these strategies, manufacturers can enhance competitiveness, accelerate time-to-market, and drive sustainable growth in the Automotive Digital Key Market.

Major Automotive Digital Key Market Manufacturers covered in the market report include:

Major players operating in the global automotive digital key market include Hyundai Mobis, Volkswagen AG, Denso Corporation, Samsung Electronics Co. Ltd., HELLA, Robert Bosch GmbH, Tesla Inc., Infineon Technologies, BMW AG, STMicroelectronics, Continental AG, Daimler AG, Ericsson, and Valeo SA among others.

Manufacturers are developing car digital keys, which offer more advanced functions than traditional keys, such as keyless entry functions, connected cars, enhanced driver safety functions, etc. Moreover, the leading players in the automotive digital key market have been working on developing smart key fobs, key cards, and wearable smart keys with RFID technology. Several original equipment manufacturers (OEMs) are committed to increase the production of vehicles with this advanced feature in response to increase the customer demand.

Trends Analysis

The Automotive Digital Key Market is experiencing rapid expansion fueled by the manufacturing industry's pursuit of efficiency and productivity gains. Key trends include the adoption of collaborative robotics and advanced automation technologies to streamline assembly processes and reduce labor costs. With the rise of Industry 4.0 initiatives, manufacturers are investing in flexible and scalable Automotive Digital Key Market capable of handling diverse product portfolios. Moreover, advancements in machine vision and AI-driven quality control are enhancing production throughput and ensuring product consistency. The emphasis on sustainability and lean manufacturing principles is driving innovation in energy-efficient and eco-friendly Automotive Digital Key Market Solutions.

Regions Included in this Automotive Digital Key Market Report are as follows:

North America [U.S., Canada, Mexico]

Europe [Germany, UK, France, Italy, Rest of Europe]

Asia-Pacific [China, India, Japan, South Korea, Southeast Asia, Australia, Rest of Asia Pacific]

South America [Brazil, Argentina, Rest of Latin America]

Middle East & Africa [GCC, North Africa, South Africa, Rest of the Middle East and Africa]

Significant Features that are under offering and key highlights of the reports:

- Detailed overview of the Automotive Digital Key Market.

- Changing the Automotive Digital Key Market dynamics of the industry.

- In-depth market segmentation by Type, Application, etc.

- Historical, current, and projected Automotive Digital Key Market size in terms of volume and value.

- Recent industry trends and developments.

- Competitive landscape of the Automotive Digital Key Market.

- Strategies of key players and product offerings.

- Potential and niche segments/regions exhibiting promising growth.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2025 to 2032?

► What are the key market dynamics influencing growth in the Global Automotive Digital Key Market?

► Who are the prominent players in the Global Automotive Digital Key Market?

► What is the consumer perspective in the Global Automotive Digital Key Market?

► What are the key demand-side and supply-side trends in the Global Automotive Digital Key Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Automotive Digital Key Market?

Table Of Contents:

1 Market Overview

1.1 Automotive Digital Key Market Introduction

1.2 Market Analysis by Type

1.3 Market Analysis by Applications

1.4 Market Analysis by Regions

1.4.1 North America (United States, Canada and Mexico)

1.4.1.1 United States Market States and Outlook

1.4.1.2 Canada Market States and Outlook

1.4.1.3 Mexico Market States and Outlook

1.4.2 Europe (Germany, France, UK, Russia and Italy)

1.4.2.1 Germany Market States and Outlook

1.4.2.2 France Market States and Outlook

1.4.2.3 UK Market States and Outlook

1.4.2.4 Russia Market States and Outlook

1.4.2.5 Italy Market States and Outlook

1.4.3 Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

1.4.3.1 China Market States and Outlook

1.4.3.2 Japan Market States and Outlook

1.4.3.3 Korea Market States and Outlook

1.4.3.4 India Market States and Outlook

1.4.3.5 Southeast Asia Market States and Outlook

1.4.4 South America, Middle East and Africa

1.4.4.1 Brazil Market States and Outlook

1.4.4.2 Egypt Market States and Outlook

1.4.4.3 Saudi Arabia Market States and Outlook

1.4.4.4 South Africa Market States and Outlook

1.5 Market Dynamics

1.5.1 Market Opportunities

1.5.2 Market Risk

1.5.3 Market Driving Force

2 Manufacturers Profiles

Continued…

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

US:+18339092966

UK: +448085020280

APAC: +91 744 740 1245

0 notes

Text

UK Stocks Hit New High, GBPUSD Steady

UK blue-chips hit new highs on Thursday as investors digested a big batch of corporate earnings, as well as interest rate decisions from the European Central Bank (ECB) and, overnight, by the US Federal Reserve.

After the Fed, as expected, kept its monetary policy unchanged on Wednesday night, the ECB reduced its key interest rate by 25 basis points to 2.75%, also as anticipated, on the back of figures showing the eurozone economy flatlined late last year.

UK100Roll Daily

Meanwhile, Fed chair Jerome Powell dialled back the hawkish tone taken on inflation in the US central bank’s latest policy statement. In his post-meeting press conference, Powell clarified that the change in statement language was not a signal, adding that the Fed sees no cause to adjust rates again until data shows risks to the job market or a fresh drop in inflation.

US data on Thursday saw fourth-quarter economic growth miss expectations, with gross domestic product up by 2.3% over the final three months of 2024, a marked slowdown against the 3.1% seen over the third quarter, and lower than analysts’ expectations of 2.7%.

Meanwhile, US initial jobless claims dropped by 16,000 to a seasonally adjusted 207,000 for the week ended January 25, well below forecasts for 220,000 claims.

On foreign exchanges, sterling was mixed, gaining 0.08% to 1.2461 versus the US dollar after the hawkish Fed statement on inflation, but slipping 0.01% against the euro to 1.1948 following the ECB news.

GBPUSD H1

US stocks were higher in morning trading on Thursday as investors assessed Jerome Powell’s less hawkish comments, as well as quarterly earnings reports last night from Big Tech companies, including Tesla, Microsoft, and Meta Platforms, with iPhone maker Apple due to report after the Wall Street close on Thursday.

At the stock market finish in London, the FTSE 100 index was up 1.1% at 8,646, a closing high and just below a new all-time peak at 8,655, having breached the 8600 level for the first time ever. Meanwhile, the FTSE 250 index jumped 1.2% to 20,805.

Precious metals miners Endeavour Mining jumped 7.2% after it reported solid 2024 production results. The boost also came after gold prices hit a record high.

The busy day for blue-chip earnings also saw Shell add 2.6% as the oil major maintained its US$3.5 billion pace of share buybacks despite weaker-than-expected fourth quarter earnings, which reflected write-offs in its exploration business and lower crude prices.

Wealth manager St James’s Place added 10.2% as it saw its assets under management hit a record last year, with 2024 net inflows of £4.33 billion, after the fourth quarter brought in £1.5 billion.

Airtel Africa gained 9.0% as the mobile telecoms firm reported a strong third-quarter operating performance and launched a second $100 million (£80 million) share buyback.

But BT Group shed 1.6% as the telecoms giant said third-quarter revenues had fallen amid weaker phone sales and a struggling business unit.

And Sage Group shed 0.6% as the accounting software firm only maintained its revenue forecast for fiscal 2025 even after posting 10pc growth in first-quarter underlying revenue.

Elsewhere, FTSE 100-listed discount airline easyJet rose 4.3% and British Airways-owner IAG added 1.2%, supported by London airports expansion plan hopes.

But Wizz Air dropped 5.5% as the FTSE 250-listed group cut its annual net income forecast for the second time in six months, as it grapples with rising costs related to the grounding of planes due to engine problems and economic uncertainties.

Meanwhile, on AIM, Fevertree Drinks jumped 20.2% after signing a long-term strategic partnership in the US. As part of the deal, brewer Molson Coors is to buy an 8.5pc stake in the posh tonic firm for £71 million in cash, with the proceeds set to be returned to shareholders via a share buyback programme.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Despite the disappointing sales and deliveries, Tesla saw its stock price quadruple over the past year to that extent, revealing the electrical vehicle market's depth of unpredictability. Tesla reported its fourth-quarter earnings for 2024 on Wednesday after the US stock markets closed. While the financial results for the company indicated a tough sale, the story told by its stock price was different. The company reported $0.73 per share in earnings and revenue of $25.71 billion, which fell short of the expectations of Wall Street, who had projected revenue to be at $27.22 billion. Profit margins also decreased compared to last year. Shares of Tesla slumped by some 4 percent in after-hours trading following the announcement, revealing investor concerns regarding its performance.Elon Musk took the platform to unveil his Tesla Cybercab, a self-driving taxi which he claims to be ready for production by 2026, but given the history of delay of Tesla on so many counts, skepticism was there. Musk also revealed that the robotaxi business of the company would be launched in June this year, but the details of its operations are still unknown. Another updated version of the Model Y sedan will be released into the market in March. The company is, however, under federal scrutiny on the alleged involvement of its full self-driving feature in multiple fatal crashes across the United States. Larry D. Moore, CC BY 4.0 https://creativecommons.org/licenses/by/4.0, via Wikimedia Commons "This is not some far-off, mythical situation," Musk said. "2025 is going to be a pivotal year for Tesla." Tesla has faced rising competition, most notably from BYD of China, which dethroned it in the fourth quarter of 2023 to become the world's leading electric vehicle manufacturer. But Tesla regained the title for the first three quarters of 2024, largely due to aggressive price cuts. According to its latest earnings report, Tesla recorded 495,570 vehicle deliveries in the fourth quarter and 1.8 million for the entire year. This marked the company’s first annual decline in deliveries after repeatedly failing to meet its quarterly targets throughout 2024. Challenges in international markets have also contributed to Tesla's problems. European government subsidies for electric vehicles have been reduced, significantly affecting Tesla's sales in the region. Tesla registrations in Europe dropped by 24% in October alone. On the other hand, some analysts expect a surge in demand for Tesla once the US Federal Reserve is expected to implement interest rate cuts that will make auto financing more appealing to consumers. Added to this is the fact that with the latest model, Cybertruck, not so much attracting new customers as it has been touted but in reality very poorly performed since its release. The vehicle was finally unveiled last November 2023 after being delayed for so many years. And at $80,000 per unit, its sales have not recovered the decline in interest in the company's older models. Elon Musk has also hinted at the possibility of stepping away from Tesla, following a prolonged legal dispute over his compensation package, initially valued at $56 billion but twice rejected by a judge. His potential departure could have significant implications for Tesla’s leadership and future direction. Nevertheless, Tesla's shares have shown impressive resilience. While the company saw a rise of more than 100% over the past year, its value has grown 75% within the last six months. Analysts believe investors are optimistic about the long-run prospects of the company, partly because of political connections of its CEO, Musk. His familiarity with Donald Trump has strengthened expectations that Tesla is likely to profit from friendly regulation and business circumstances. However, Republicans in Congress had threatened to take away tax credits from electric cars previously. Those measures could potentially raise new headwinds against Tesla.President Biden has promised to impose duties on imports in different categories and on Chinese autos in particular. When that actually happens, a drastic change can occur in the automotive world stage and give the competitive edge over international producers again. The coming months will tell whether the company's strategic changes, new products, and factors in the market can help Tesla regain its footing. While analysts may be disappointed with Tesla's latest earnings report, the company's trajectory is still unpredictable. Read the full article

0 notes

Text

Tesla Raises Prices in Canada: Key Details You Need to Know

Tesla, the world’s leading electric vehicle manufacturer, has once again captured the spotlight with its decision to significantly raise prices on its cars in Canada. As revealed on the company’s Canadian website, prices for all Tesla models will see an increase starting February 1. This move has already generated widespread interest in global markets and has become a key topic among automotive enthusiasts and investment analysts alike.

Key Price Adjustments for Tesla Models

Tesla is implementing substantial price increases across its Canadian lineup, a strategy that has drawn significant attention from experts analyzing its potential impact on demand.

Model 3 — Tesla’s most affordable and popular model will see a remarkable price increase of CAD 9,000, equivalent to approximately USD 6,254.78.

Model Y — A crossover SUV favored by families will experience a CAD 4,000 price hike.

Model S and Model X — Tesla’s premium flagship models will each see their prices rise by CAD 4,000.

The sharp price hike for the Model 3, Tesla’s entry-level vehicle, represents a much higher percentage increase compared to its premium offerings like the Model S and Model X. This discrepancy has raised questions about Tesla’s evolving pricing strategy, especially for its budget-friendly options.

Why Is Tesla Raising Prices?

Industry experts point to several possible reasons behind Tesla’s decision to raise prices in the Canadian market:

Increased production costs: Global supply chain challenges, along with rising costs for essential materials, have impacted the production expenses of electric vehicles. Lithium, a crucial component in Tesla’s batteries, has seen a significant price surge over the past year, directly affecting overall production costs.

Currency exchange rates: Fluctuations between the U.S. dollar and the Canadian dollar could have played a major role in the company’s decision to adjust prices for the local market.

Demand-supply management: Tesla is known for using pricing as a tool to manage demand, particularly in markets where demand may exceed supply. This increase may help stabilize delivery timelines and ensure operational efficiencies.

Market Implications

Tesla’s price hike in Canada has far-reaching implications for the electric vehicle (EV) market, its competitors, and Tesla’s own market position.

Improved profit margins: By raising prices, Tesla can safeguard its profit margins despite rising production and logistics costs, ensuring healthy financial performance.

Impact on buyer sentiment: While demand for Tesla vehicles remains strong, the CAD 9,000 increase on the Model 3 could deter some cost-sensitive buyers, especially first-time EV customers.

Competitors’ response: Tesla’s move presents an opportunity for competitors to attract entry-level consumers by offering more competitively priced EVs, potentially capturing a portion of Tesla’s market share.

Outlook for the EV Market

The global EV market is expanding rapidly, and Tesla remains the undisputed leader due to its innovative technologies and adaptive strategies. However, experts emphasize that Tesla’s long-term success will hinge on its ability to balance rising production costs with consumer satisfaction and demand management.

Our website: https://goldriders-robot.com/

Follow us on Facebook: https://www.facebook.com/groups/goldridersfb

Follow us on Pinterest: https://ru.pinterest.com/goldridersrobot/

Follow us on X: https://x.com/goldridersx?s=21

Follow us on Telegram: https://t.me/+QtMMmyyVhJExZThi

0 notes

Text

Stocks Slide as Earnings Reports Weigh on Markets

Source: investopedia.com

Share Post:

LinkedIn

Twitter

Facebook

Reddit

Pinterest

Major Indices Experience Decline

On January 16, 2025, U.S. stocks experienced a downturn as investors processed a flurry of quarterly earnings reports. The Dow Jones Industrial Average and the S&P 500 both fell by 0.2%, while the Nasdaq Composite saw a larger decline of 0.9%. This slip followed a strong performance on Wednesday, driven by optimistic inflation data and solid bank earnings, which had initially raised hopes for continued interest rate cuts by the Federal Reserve.

Bank earnings were under the spotlight, with mixed results influencing market movements. Morgan Stanley’s shares surged 4% to reach an all-time high, buoyed by better-than-expected earnings. Conversely, Bank of America saw its shares dip by 1%, despite exceeding earnings estimates. Other financial institutions, including U.S. Bancorp and PNC Financial Services, experienced declines of 5.6% and 2%, respectively, after releasing their earnings reports.

Tech Giants and Healthcare Struggles

The technology sector, which had seen significant gains in the previous session, was among the hardest hit. Apple and Tesla led the decline, with shares dropping 4% and 3.4%, respectively. Other major tech companies such as Nvidia, Microsoft, Alphabet, Amazon, and Meta Platforms also saw their stock prices decrease.

In the healthcare sector, UnitedHealth Group experienced a sharp drop of 6%, making it the biggest decliner in both the S&P 500 and the Dow. This was attributed to disappointing quarterly results, which revealed lower-than-expected revenue and rising medical costs, despite surpassing profit expectations.

Chip Stocks and Economic Indicators

Meanwhile, semiconductor stocks showed resilience, with Taiwan Semiconductor Manufacturing Co. (TSM) reporting robust earnings and an optimistic outlook for AI demand. This positive sentiment lifted shares of chip equipment makers such as KLA Corp, Lam Research, and Applied Materials, which all saw gains of over 4%. U.S.-traded shares of Taiwan Semi also rose nearly 4%.

Economic data released on the same day showed weekly jobless claims and retail sales figures aligning with expectations, providing investors with critical information regarding the Federal Reserve’s potential interest rate decisions. The 10-year Treasury yield slightly decreased to 4.61%, reflecting ongoing market adjustments to inflation data.

Cryptocurrency and Commodity Movements

In the cryptocurrency market, Bitcoin fluctuated, trading at $99,600 in the late afternoon. Although it had earlier dipped to $97,300, it remained below the previous day’s high of $100,900, marking a notable period of volatility for the digital currency.

Commodities saw mixed movements, with gold futures rising by 1.3% to approximately $2,750 an ounce, indicating strong demand for the precious metal. In contrast, WTI crude oil futures fell by 1.6%, reversing some of the gains from the previous day.

Other Notable Stock Movements

Dexcom emerged as the top performer in the S&P 500, with shares climbing 5.5% following positive analyst reports and a stable outlook for its durable medical equipment channel. Estee Lauder also saw a boost, with shares rising 4.8% after JPMorgan raised its price target, anticipating significant discussions on consumer behavior and industry outlooks during the earnings season.

Overall, the day reflected a cautious market environment, with investors closely monitoring earnings reports and economic indicators for cues on future market trends.

0 notes

Text

The Ultimate Guide for Car Buyers Australia: Tips, Trends, and Advice

Contact Us On: 0418 127 775

When it comes to car buyers Australia, the journey can be both exciting and overwhelming. Whether you're looking for a shiny new ride or a reliable second-hand vehicle, understanding the market, your needs, and the buying process is crucial. This guide will provide everything you need to make an informed decision and drive away with confidence.

Understanding the Australian Car Market

Australia boasts a dynamic car market, offering something for everyone—from budget-friendly hatchbacks to luxury SUVs. With a growing trend toward electric vehicles (EVs) and hybrid cars, buyers are spoilt for choice. However, navigating the market requires awareness of your budget, lifestyle, and long-term goals.

Key Statistics About Car Buyers Australia

Diverse Preferences: Australians have a strong preference for SUVs, which make up nearly half of the market share.

Growing EV Demand: EV sales in Australia are climbing, driven by environmental concerns and government incentives.

Second-Hand Market: The used car market has grown significantly due to rising new car prices and delayed deliveries.

Step 1: Define Your Needs

Before you step into a dealership or browse online listings, assess your requirements. Consider factors like:

Purpose: Will the car be used for city driving, long commutes, or family trips?

Budget: Factor in the purchase price, ongoing costs like fuel, insurance, and maintenance.

Space Needs: For families, SUVs or station wagons might be ideal, while solo drivers could opt for compact cars.

Step 2: Research Popular Car Brands in Australia

Australia is home to some well-loved car brands, with Toyota, Mazda, Hyundai, and Kia consistently topping the charts. If you're considering an EV, Tesla and BYD have made significant inroads, while traditional brands like Hyundai and Nissan also offer competitive electric models.

Top-Selling Car Models in 2024

Toyota Hilux

Ford Ranger

Tesla Model Y

Mazda CX-5

Hyundai i30

Step 3: New vs. Used Cars

Choosing between new and used cars depends on your budget and preferences.

Pros of Buying a New Car

Comes with a manufacturer’s warranty.

Latest features and technology.

Lower maintenance needs initially.

Pros of Buying a Used Car

Lower upfront cost.

Slower depreciation.

Wider variety within your budget.

Regardless of your choice, always inspect the car thoroughly and request a pre-purchase inspection if buying used.

Step 4: Financing Your Car Purchase

Not everyone can pay for a car upfront, so understanding financing options is essential.

Common Car Financing Options in Australia

Car Loans: Offered by banks and lenders, typically with fixed interest rates.

Dealer Financing: Convenient but may come with higher rates.

Novated Leases: A tax-effective option where payments are made from your pre-tax salary.

Personal Savings: If you can buy outright, you’ll save on interest.

Make sure to compare interest rates and fees across lenders.

Step 5: Inspect and Test Drive the Car

Whether buying new or used, inspecting and test-driving a car is non-negotiable. Check for:

Smooth engine performance and transmission shifts.

Interior and exterior condition.

Any visible signs of wear or damage.

A test drive lets you gauge comfort, handling, and the vehicle’s overall feel.

Step 6: Negotiation and Paperwork

Negotiation is an art, but it’s a skill every car buyer should master. Start by researching the car’s market value through platforms like Redbook or CarsGuide. Be polite but firm when negotiating with dealers or private sellers.

Key Paperwork to Check

Vehicle Identification Number (VIN) history report.

Registration and roadworthy certificates.

Sales agreement or contract.

Emerging Trends for Car Buyers Australia

The auto industry is evolving, with several trends shaping the future of car buying.

Electric Vehicles (EVs)

With growing government support, EVs are becoming increasingly popular. Charging infrastructure is expanding, making EVs more practical for Australians.

Car Subscriptions

A flexible alternative to owning, car subscriptions allow users to access a car for a monthly fee, covering insurance and maintenance.

Online Car Purchases

Platforms like Carsales and Gumtree make it easier to buy cars online, offering transparency and convenience.

Common Mistakes to Avoid When Buying a Car

Skipping Research: Always compare models, prices, and reviews before committing.

Ignoring Total Costs: Don’t forget expenses like insurance, registration, and servicing.

Rushing the Process: Take your time to find the right car and deal.

Conclusion

Car buying service Australia can be an exciting journey if approached with the right mindset. By defining your needs, researching the market, and exploring financing options, you can make a purchase that suits your lifestyle and budget. Keep an eye on emerging trends like EVs and subscriptions to ensure your choice remains future-proof.

0 notes

Text

Electric Vehicle Charging Station Market Financial Health and Key Investment Opportunities for Sustainable Growth

The growth of electric vehicles (EVs) has transformed transportation industries worldwide, and the charging infrastructure is at the heart of this revolution. A key player in the EV ecosystem, the electric vehicle charging stations market is crucial in determining the industry's financial health. As demand for EVs continues to surge, it’s essential to understand the economic viability and financial sustainability of these charging networks. The electric vehicle charging stations market is rapidly evolving, driving investment and innovation to ensure that the infrastructure keeps up with the needs of the growing EV population.

Growing Demand for EVs and Impact on Charging Station Market

The rise of electric vehicles, powered by governments' stringent environmental policies and a global shift toward cleaner energy, has generated unprecedented demand for electric vehicle charging stations. With major automotive manufacturers making significant investments in the production of EVs and governments offering subsidies, the demand for convenient charging locations is expanding at a fast pace.

Global EV sales exceeded 10 million units in 2022, a notable leap that is only expected to grow. The International Energy Agency (IEA) projects EVs will make up 30% of the global car fleet by 2030. However, this rapid rise in vehicle numbers puts immense pressure on the existing charging infrastructure, pushing operators to scale up quickly.

Financial Health of EV Charging Operators

To evaluate the financial health of the charging station market, it is important to look at various factors, such as investment opportunities, returns on investment (ROI), business models, and market maturity. This sector has attracted significant funding from private and public investors, indicating a growing confidence in the industry's potential. Many companies—new startups and established energy players alike—are entering the charging market, presenting numerous business opportunities but also increasing the risk of oversaturation in some regions.

One of the largest financial challenges that operators face is the heavy initial capital investment required to establish a robust and expansive charging network. The costs of constructing and maintaining charging stations, including high-quality infrastructure, labor, and the integration of renewable energy solutions, are substantial. Governments worldwide have introduced incentives and rebates, but operators still face difficulties with securing consistent and scalable financial backing.

The EV charging business can be divided into several key revenue streams. The most significant one is the sale of electricity, which can vary depending on the region and pricing policies. Additionally, some operators are leveraging value-added services like membership programs, subscription-based services, and advertisements within the stations to supplement income. More advanced business models also include partnerships with retail, hospitality, and commercial real estate sectors, offering new avenues for growth.

Key Players and Market Competition

Leading players in the electric vehicle charging station market include both energy giants and specialist companies that specialize in charging solutions. From Tesla’s Supercharger network to BP Pulse, Shell Recharge, and the ubiquitous ChargePoint, the competition is intense. While competition brings innovation and improved service standards, it also drives up the overall costs of gaining market share. Companies with better financing mechanisms—through either government partnerships, international joint ventures, or better-managed financial resources—have a higher likelihood of overcoming market barriers.

The technology underlying EV charging is also changing at a rapid pace. As infrastructure continues to evolve, the transition to faster charging technology such as ultra-fast DC chargers means that market players must continually invest in upgrading their charging stations. Additionally, there is also a significant push towards integrating charging networks with renewable energy sources like solar and wind power to meet growing sustainability goals, which further impacts operators’ financials due to higher upfront costs.

Sustainability and Future Outlook

Sustainability will be one of the defining factors influencing the market's financial future. The push for green energy is not just political but a practical requirement. As EV adoption increases and charging stations face pressure to stay competitive, integrating clean energy solutions like solar can improve their sustainability. Financial institutions are also increasingly looking at sustainability scores when considering funding or financing opportunities for such projects.

The long-term forecast for the financial health of the EV charging station market looks positive, but companies must adapt to various market conditions and handle competition and high overheads carefully. Operators that make smart investments in technology, land acquisition, sustainability solutions, and establish effective pricing strategies stand to emerge as industry leaders.

Additionally, collaboration between governments, utility companies, and automakers can further alleviate the financial burdens associated with establishing a comprehensive EV charging infrastructure. On the whole, the growth prospects appear solid, but prudent financial management and continued investment in innovation will be essential for ensuring the longevity and sustainability of the market.

0 notes

Text

Biggest movers before the market opens: Abercrombie & Fitch, Pinterest, Hilton Grand Vacations

Top News in the Stock Market Today Quantum Stocks Plunge After Zuckerberg's Comments Quantum stocks took a hit following remarks from Mark Zuckerberg and Nvidia CEO Jensen Huang, with Rigetti Computing and D-Wave Quantum seeing significant drops. Managed Care Stocks on the Rise Managed care stocks saw gains after the US government proposed a reimbursement rate increase for Medicare Advantage plans, with Humana, UnitedHealth, and CVS Health all rising. Boot Barn Guides Higher Boot retailer Boot Barn's guidance for third-quarter earnings exceeded expectations, leading to a 4% jump in its stock price. Pinterest Slides After Downgrade Pinterest shares dropped after a downgrade from Jefferies, citing underwhelming growth forecasts for the company. Crypto Stocks Decline with Bitcoin Stocks tied to the price of bitcoin fell as the cryptocurrency dipped, affecting companies like Coinbase and MicroStrategy. Lululemon Sees Strong Demand Lululemon reported strong holiday sales, leading to a 3% increase in shares and an upward revision of its sales and earnings guidance. Macy's Issues Lackluster Guidance Macy's shares fell after issuing a disappointing update to its fourth-quarter guidance, with revenue expected to fall below previous estimates. Abercrombie & Fitch Raises Outlook Despite a plunge in premarket trading, Abercrombie & Fitch raised its fourth-quarter sales outlook on strong holiday sales expectations. Howard Hughes Holdings Soar Shares of real estate developer Howard Hughes Holdings jumped 9% after a proposal from Bill Ackman's Pershing Square for a new entity merger. Tech Stocks Tumble as Treasury Yields Rise Megacap tech stocks like Nvidia, Tesla, and Palantir Technologies saw losses as US Treasury yields increased. Moderna Lowers Sales Guidance Biotech firm Moderna saw a 20% drop after lowering its 2025 sales guidance, citing potential headwinds in the coming year. Intra-Cellular Therapies Acquired by Johnson & Johnson Intra-Cellular Therapies' stock surged after an announcement of an acquisition by Johnson & Johnson for $132 per share. Contributing reporting by Michelle Fox, Alex Harring, Yun Li, Tanaya Macheel, Sarah Min, Jesse Pound, and Pia Singh. #Money #Abercrombie #AbercrombieFitchCo #Biggest #BootBarnHoldingsInc #breakingnews #BreakingNewsMarkets #BroadcomInc #Business #businessnews #CoinbaseGlobalInc #CoreScientificInc #CVSHealthCorp #DPCMCapitalInc #economy #Fitch #Grand #Hilton #HumanaInc #IntraCellularTherapiesInc #IONQInc #JohnsonJohnson #LululemonAthleticaInc #MacysInc #MarathonDigitalHoldingsInc #market #MarketInsider #markets #MetaPlatformsInc #MicronTechnologyInc #MicrostrategyInc #ModernaInc #movers #NVIDIACorp #opens #PalantirTechnologiesInc #Pinterest #PinterestInc #QuantumComputingInc #regwallmarketmovers #RigettiComputingInc #Stockmarkets #TeslaInc #UnitedHealthGroupInc #vacations #WD40Co https://tinyurl.com/2anpls3u

#Abercrombie#Abercrombie & Fitch Co#Biggest#Boot Barn Holdings Inc#breaking news#Breaking News Markets#Broadcom Inc#Business#business news#Coinbase Global Inc#Core Scientific Inc#CVS Health Corp#DPCM Capital Inc#economy#Fitch#Grand#Hilton#Humana Inc#Intra-Cellular Therapies Inc#IONQ Inc#Johnson & Johnson#Lululemon Athletica Inc#Macys Inc#Marathon Digital Holdings Inc#market#Market Insider#markets#Meta Platforms Inc#Micron Technology Inc#Microstrategy Inc

0 notes

Text

Tesla Shares Reach Record High Amid Post-Election Surge

Source: forbes.com

Tesla’s stock has soared to a new all-time high, surpassing its previous record from 2021. This significant rise comes in the wake of Donald Trump’s election victory and heightened investor confidence in Elon Musk’s electric vehicle company.

The stock closed at $424.77 on Wednesday, breaking the prior peak of $409.97 achieved on November 4, 2021. Tesla’s market value has increased by about 71% this year, with the majority of the gains occurring after Trump’s election win last month. The 38% rally in November was the company’s best monthly performance since January 2023 and ranked as its 10th best on record.

Musk’s Role in the Election and Beyond

Elon Musk played a prominent role in supporting Trump’s election campaign, contributing $277 million to a pro-Trump effort, according to Federal Election Commission filings. Musk also leveraged his social media platform, X, to advocate for Trump, often sharing controversial and, at times, misleading information.

Following Trump’s victory, Musk has been named to lead the administration’s Department of Government Efficiency, alongside former Republican presidential candidate Vivek Ramaswamy. In this position, Musk is expected to influence federal agency budgets, staffing, and regulations. During Tesla’s earnings call in October, Musk stated his intention to use his influence to streamline the federal approval process for autonomous vehicles, which is currently managed at the state level.

Wall Street’s Growing Optimism

Analysts have attributed Tesla’s stock surge to what they call the Trump bump. Many believe Musk’s public support for Trump has expanded Tesla’s appeal and bolstered its credibility. One analyst noted that Musk’s alignment with Trump likely doubled Tesla’s pool of supporters and increased market optimism about its future.

In response to the stock’s strong performance, several financial institutions have raised their price targets for Tesla. Analysts at Goldman Sachs highlighted that the market is now taking a more forward-looking approach to Tesla, particularly with regard to its artificial intelligence potential. Other firms, including Morgan Stanley and Bank of America, have also issued bullish reports on Tesla in recent weeks.

A Remarkable Turnaround

Tesla’s recent record-breaking performance marks a dramatic reversal from its struggles earlier in the year. In the first quarter of 2024, the company’s stock fell by 29%, the worst quarterly drop since late 2022 and the third worst since Tesla went public in 2010. Concerns at the time centered on declining revenue, driven partly by increasing competition from Chinese electric vehicle manufacturers.

However, Tesla’s fortunes began to shift in October, when the company reported its third-quarter earnings. While revenue grew 8% year-over-year, slightly missing analysts’ expectations, Tesla posted better-than-expected profits. Musk also projected a strong outlook for the company, predicting 20% to 30% vehicle growth in the coming year, fueled by lower-cost vehicles and advancements in autonomous driving technology.

Looking Ahead

Since Trump’s election win, Musk has joined the president-elect in meetings with world leaders and has been advising Congress on budgetary and regulatory changes. This close association with the new administration has further solidified Tesla’s position as a market leader and innovator.

Despite its earlier challenges, Tesla’s stock has rebounded impressively, fueled by investor confidence in Musk’s leadership and the company’s long-term growth potential. With Musk’s involvement in shaping government policies and Tesla’s focus on innovation, the company is poised for continued success in the years to come.

#stockstowatch#stockstobuy#stockstotrade#stockstohold#dividendgrowthinvesting#hustle#dividendyield#dividend#nasdaq#elonmusk#tesla#stockmarketnews#growthstocks#investingeducation#dividendinvesting#dividends

0 notes

Text

If Bitcoin Is a Bubble, Why Hasn't It Popped?

They've been calling Bitcoin a bubble since it was $1. Through bull runs and bear markets, crashes and recoveries, the "bubble" narrative has persisted. Yet here we are, over a decade later, and Bitcoin isn't just surviving—it's thriving. So, what's going on? If Bitcoin is truly a bubble, why hasn't it popped?

To answer this question, we need to understand what actually constitutes a financial bubble, and why Bitcoin's behavior over the past 15 years tells a very different story.

What Makes a Real Financial Bubble?

Traditional financial bubbles follow a predictable pattern: rapid price inflation driven by speculation, followed by a catastrophic collapse when reality catches up with expectations. Think of the Dutch Tulip Mania of the 1630s, where single tulip bulbs sold for more than houses, only to become worthless virtually overnight. Or consider the Dot-Com Bubble of the late 1990s, when companies with ".com" in their name could see their stock prices soar without any viable business model.

These classic bubbles share several key characteristics:

A short, intense period of price appreciation

Widespread speculation disconnected from fundamental value

A sudden, terminal crash that ends the mania

No meaningful recovery after the collapse

Why Bitcoin Breaks the Bubble Mold

1. Unprecedented Longevity

If Bitcoin were truly a bubble, it would have followed the same pattern as tulips, Beanie Babies, or countless other manias—a quick rise followed by a permanent collapse. Instead, Bitcoin has demonstrated remarkable resilience over its 15-year history. While it has experienced multiple significant corrections, each "pop" has been followed by new heights, demonstrating a clear long-term upward trajectory.

2. The Power of Decentralization

Unlike traditional bubbles, which are often centered around a single company, product, or market, Bitcoin is a decentralized network owned and operated by no single entity. Its value proposition stems from its network effect—the same principle that makes the internet valuable. As more people join the network, its utility and value increase organically, following an S-curve adoption pattern rather than a bubble's sharp rise and fall.

3. Scarcity as a Feature, Not a Bug

Traditional bubbles often involve assets that can be created or replicated indefinitely. During the Tulip Mania, farmers could simply grow more tulips. During the housing bubble, developers could build more houses. Bitcoin, however, has a fixed supply cap of 21 million coins, written into its very code. This programmatic scarcity isn't a marketing gimmick—it's a fundamental property that becomes more relevant as fiat currencies face unprecedented inflation.

4. Smart Money Gets Smarter

Perhaps the most compelling argument against the bubble narrative is the increasing institutional adoption of Bitcoin. When companies like MicroStrategy and Tesla add billions in Bitcoin to their treasuries, when BlackRock launches a Bitcoin ETF, and when nations like El Salvador adopt Bitcoin as legal tender, we're clearly dealing with something more substantial than a speculative mania. These sophisticated players aren't known for investing in tulip bulbs.

5. Evolution, Not Extinction

Unlike historical bubbles, which typically freeze in time once they pop, Bitcoin continues to evolve technically. The development of Layer 2 solutions like the Lightning Network, ongoing security improvements, and growing developer activity all point to a technology that's maturing rather than dying. This continuous innovation strengthens Bitcoin's foundation and expands its utility.

Understanding Bitcoin's Volatility

Critics often point to Bitcoin's price volatility as evidence of its bubble status. However, volatility itself doesn't indicate a bubble—Amazon's stock price was notoriously volatile in its early years, yet few would call Amazon a bubble today. Bitcoin's volatility stems from its youth as an asset class, its growing liquidity, and its position at the frontier of technological and financial innovation.

Why Does the Bubble Narrative Persist?

The persistence of Bitcoin bubble theories says more about human psychology and institutional resistance than about Bitcoin itself. Traditional financial institutions, threatened by Bitcoin's potential to disrupt their business models, find it easier to dismiss it as a speculative mania. Media outlets, driven by clicks and controversy, repeatedly predict Bitcoin's demise because fear sells better than understanding.

Moreover, people who've missed out on Bitcoin's rise often cling to the bubble narrative as a form of psychological self-defense. It's more comforting to believe you've avoided a scam than to admit you've missed an opportunity.

The Revolution Will Not Be Centralized

As we look to the future, the question isn't whether Bitcoin is a bubble—it's whether we're witnessing the early stages of a fundamental transformation in how humanity thinks about and uses money. Bitcoin's persistence, growth, and evolution suggest we're dealing with something far more significant than a speculative mania.

Every transformative technology faces skepticism and ridicule before it reaches widespread acceptance. The internet was dismissed as a fad, email was considered a toy, and social networks were seen as a passing trend. Bitcoin follows this pattern of disruptive innovation, challenging our preconceptions about money and value in the digital age.

So the next time someone calls Bitcoin a bubble, ask them this: If it's really just a bubble, why does it keep coming back stronger? The answer might just change how they think about the future of money.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Crypto#FinancialRevolution#SoundMoney#BTC#Money#Finance#Blockchain#Decentralization#Freedom#BitcoinIsNotABubble#HODL#TickTockNextBlock#SovereignMoney#MonetaryRevolution#FUD#Investing#DigitalGold#HardMoney#Hyperbitcoinization#Economics#WeAreEarly#FutureOfMoney#financial education#globaleconomy#digitalcurrency#financial empowerment#financial experts#cryptocurrency#unplugged financial

0 notes

Text

$TSLA: Tesla shares rise slightly after a 6% drop tied to disappointing Q4 deliveries and first annual sales decline. Analysts adjust price targets amid mixed short-term and long-term outlooks.

0 notes