#taxation software

Explore tagged Tumblr posts

Text

Smooth out Your Funds with Taxation Software by Taxxbook

In the present quick moving world, overseeing funds effectively is vital for people and organizations the same. With charge regulations continually advancing and turning out to be progressively perplexing, having the right devices available to you is fundamental for exact and opportune assessment arrangement. This is where taxation software by Taxxbook becomes possibly the most important factor, offering a complete answer for smooth out your monetary cycles and guarantee consistence with charge guidelines.

Taxxbook has been a confided in name in the business for a really long time, giving imaginative programming arrangements customized to address the issues of experts and organizations, all things considered. Their taxation software programming is planned in light of ease of use and effectiveness, permitting clients to explore through the complexities of assessment regulations effortlessly.

One of the champion elements of Taxxbook product is its high-level duty estimation abilities. Whether you're recording individual assessments or overseeing complex corporate government forms, the product can deal with everything. Via robotizing computations and staying up with the latest with the most recent assessment guidelines, it disposes of the gamble of mistakes and guarantees exact outcomes like clockwork.

Besides, the product offers a scope of customization choices to suit your particular necessities. From customized allowances to industry-explicit tax breaks, you can tailor the product to line up with your extraordinary monetary circumstance. This degree of adaptability saves time as well as boosts your duty investment funds, at last adding to your primary concern.

Notwithstanding its expense computation abilities, Taxxbook product likewise succeeds in report the board and association. With worked in archive capacity and recovery highlights, you can safely store all your monetary records in one unified area. This improves on the expense readiness process as well as works with reviews and guarantees consistence with record-keeping prerequisites.

Besides, the product gives continuous announcing and examination, giving you important experiences into your monetary exhibition. Whether you're observing costs, following income, or assessing venture valuable open doors, you can get to extensive reports at the snap of a button. This perceivability empowers informed navigation and enables you to guide your funds in the correct bearing.

One more key benefit of Taxxbook product is its reconciliation capacities. Whether you're utilizing bookkeeping programming, finance frameworks, or banking stages, the product consistently incorporates with your current devices to smooth out information sharing and wipe out repetitive errands. This interoperability improves productivity and decreases the gamble of information section blunders, eventually saving you time and assets.

Besides, Taxxbook product is upheld by devoted client care, guaranteeing that you approach help at whatever point you want it. Whether you have inquiries concerning programming elements or need specialized help, their group of specialists is dependably prepared to help. This obligation to consumer loyalty separates them from the opposition and guarantees a smooth client experience.

All in all, taxation software by Taxxbook is a distinct advantage for people and organizations hoping to smooth out their monetary cycles. With its high-level elements, adaptable choices, and consistent coordination capacities, it offers an extensive answer for meet your expense planning needs. Express farewell to monotonous desk work and estimation mistakes - with Taxxbook product, dealing with your funds has never been simpler.

0 notes

Text

#digital marketing#full stack course#full stack developer#full stack training#internet marketing#online training#seo#seo services#tally software#tallyprime#digital marketing training#training institute#professional courses#professional certification#punjab#accounting#taxation#gst

0 notes

Text

Essential Tricks to Simplify GST Registration and e-Filing

Introduction

In today’s digital era, understanding GST registration and e-filing is crucial for businesses, professionals, and students pursuing careers in taxation and finance. Whether you are a beginner or looking to refine your skills, mastering GST filing can save you time and prevent unnecessary errors. Here are some essential tricks to help simplify the process.

1. Understand GST Basics Before You Begin

Before jumping into GST e-filing, it’s important to have a strong foundation in e-taxation courses in Delhi, GST training in Uttam Nagar, and e-filing training in Yamuna Vihar. These courses provide a clear understanding of tax laws, compliance requirements, and how the GST system works.

Key Areas to Focus On:

GST Structure – CGST, SGST, IGST

GST registration eligibility and documents required

Input Tax Credit (ITC) and its benefits

Tax slabs and applicable GST rates

For those who want to go beyond theory, enrolling in e-accounting courses in Delhi or GST coaching institutes in Yamuna Vihar can be a great way to gain practical experience.

2. Organize Your Documents Properly

One of the biggest challenges in GST registration is handling paperwork. If your documents are not in place, your application might get delayed or even rejected.

Checklist for GST Registration:

PAN Card – Mandatory for registration

Aadhaar Card – Identity verification

Business Registration Documents – Partnership deed, incorporation certificate, etc.

Bank Account Details – For refunds and transactions

Proof of Business Address – Electricity bill, rent agreement, etc.

Students learning from GST training institutes in Uttam Nagar can benefit from practice sessions on documentation and e-filing procedures.

3. Use Reliable Accounting Software

Manual tax filing can be complex and time-consuming. Using accounting software like Tally ERP 9 can simplify calculations, invoice management, and tax computation.

Benefits of Using Tally ERP for GST Filing:

Auto-calculates GST liability

Generates GST-compliant invoices

Reduces errors in tax calculations

Eases filing of GSTR-1, GSTR-3B, and GSTR-9

If you're new to Tally, you can explore Tally classes in Uttam Nagar or Tally training institutes in Yamuna Vihar to enhance your skills. Additionally, Tally ebooks free download and Tally ERP 9 book PDFs are excellent resources for self-learning.

4. File GST Returns on Time

Missing deadlines for GST return filing can lead to penalties and interest charges. It’s crucial to be aware of GST return filing dates and prepare documents in advance.

Tips to Avoid Late Filing Penalties:

Set calendar reminders for GSTR-1, GSTR-3B, and GSTR-9 filing dates Maintain updated sales and purchase records Reconcile data monthly using e-accounting training in Yamuna Vihar Double-check entries before submission to prevent errors

For in-depth learning, GST certification courses in Delhi and GST return courses in Uttam Nagar offer hands-on practice on real-world GST filing scenarios.

5. Take Advantage of Free Learning Resources

If you're just starting with GST and e-filing, there are several free resources available. You can download free Tally study materials, access GST training PDFs, or watch Tally ERP 9 video tutorials online.

Some Useful Free Learning Resources:

GST filing courses in Yamuna Vihar

E-taxation training in Uttam Nagar

Professional courses in financial e-accounting

Tally ERP 9 free ebooks and video tutorials

These resources help students and professionals enhance their expertise in e-taxation, e-accounting, and GST compliance.

Final Thoughts

Mastering GST registration and e-filing is essential for tax professionals, business owners, and students aspiring to build a career in financial e-accounting. By following these essential tricks—understanding GST basics, organizing documents, using software like Tally, filing returns on time, and utilizing free learning resources—you can simplify the entire process and stay compliant.

For those looking to gain practical expertise, GST coaching centers in Yamuna Vihar and Tally Prime training institutes in Uttam Nagar offer structured learning programs to ensure success in GST compliance.

To Start learning from today and stay ahead in the field of taxation and e-accounting! Visit us.

Suggested Links

TallyPrime With GST

BUSY Accounting Software

e Accounting

0 notes

Text

Buy Affordable Digital Signature Certificates Online

e-Solutions Digital offers the best-priced digital signature certificates online. Perfect for e-filing, GST, and MCA compliance.

1 note

·

View note

Text

Diploma in Taxation

#Title : What is computer accounting course#1. Introduction to Computer Accounting Course#What is Computer Accounting?#In today’s fast-paced world#businesses rely heavily on technology for their financial operations. A computer accounting course teaches individuals how to use computer#prepare reports#and ensure compliance with financial regulations. The shift from traditional manual accounting to computerized accounting has revolutionize#bookkeepers#and financial analysts.#The Importance of Computer Accounting in Modern Business#Computerized accounting has simplified tasks that once took hours or even days to complete. Instead of using paper ledgers and manual entri#businesses can now perform tasks like invoicing#payroll management#financial reporting#and budgeting with the help of accounting software. This digital transformation ensures more accuracy#efficiency#and speed in business operations.#2. Key Features of Computer Accounting Courses#Course Structure and Duration#A computer accounting course typically covers a wide range of topics#from basic accounting principles to advanced financial software applications. The course duration can vary based on the level of depth and#while diploma and degree programs may take months or even years to complete.#Basic Level: Introduction to Accounting Software#Intermediate Level: Managing Accounts#Transactions#and Reports#Advanced Level: Auditing#Taxation#and Financial Planning#Software Covered in the Course

1 note

·

View note

Text

Global Taxman india Ltd - Our Services

Business Registrations

GST registration

MSME Registration

Importer License

FSSAI Registration

Shop Act Registration

Trademark

ISO Registration

ESIC/EPF

Services Area

Ranchi

Delhi NCR

Ghaziabad

Patna

Company Registrations

Private Limited Company

One Person Company

Nidhi Company

Section 8 Company

Startup Registration

Producer Company

Public Limited Company

Sole Proprietorship

Partnership Registration

MCA Compliances

ROC Annual Filing

GST Return Filing

Audit of Business

Income Tax Return (ITR)

Quick Links

Home

About

Contact

career

Team

Blog

Portfolio

Site Map

All Services

Frequently Asked Questions

CA

More Services

Our Office Locations

Bihar Jharkhand

Delhi Uttar Pradesh

Ghaziabad Office Address

+91-9811099550 +91-9911878735

C-19, Second Floor, near Vasundhara Hatt Complex, Sector 13, Vasundhara, Ghaziabad, Uttar Pradesh 201012

#accounting#finance#success#gst registration#taxation#gst#itr filing#company registration#marketing#economy#business growth#business development#business listings#startup#sales#services#business news#gstfiling#accounting services#gst compliance#gstreturns#chartered accountant#income tax#gst billing software#ahmedabad#income tax filing

0 notes

Text

#GST login#GST return filing online#GST return filing date#GST return filing status#GST Portal#GST return filing fees#How to file GST return PDF#Types of GST returns#gst services#gst registration#income tax login#income tax audit#income tax return#income tax#itr filing#taxring#gst compliance#tax#gst billing software#concerns#profit#usd#taxation#accounting services#tax refund#GST Return filing service near me#GST accounting

1 note

·

View note

Text

At Pacific Group of Companies, we believe that a fulfilling workplace is essential for both personal and professional growth. Our mission is to create a supportive environment that values work-life balance, celebrates individual achievements, and fosters a culture of positivity. We are committed to developing an inclusive culture that nurtures growth, encourages collaboration, and brings positivity into the lives of our employees.

#pacific group of companies#accounting#outsourcing#accounting services#accounting and bookkeeping services#taxation#bookkeeping services#marketing services#software solutions#software services

0 notes

Text

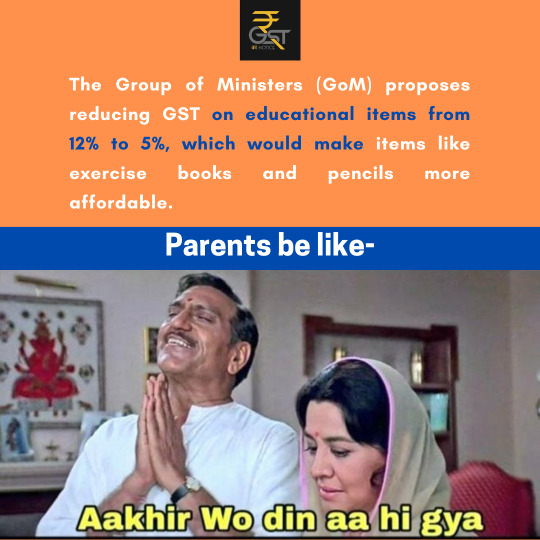

GoM purposes reducing GST on educational items... Find your information...

For more information visit- gstkanotice.com or DM GST ka Notice

#gom #gst #gommeeting #gst #gstkanotice #gstnotice #gstnoticereply #gstregistration #school #books #education #gsthelp #apperal #gstassistance #gstfact #gstupdates #gstcircular #gstcouncilmeeting #gstcouncil #gstn #gstindia #cbic #icai #business #profit #nirmalasitharaman #narendramodi #budget

#best gst consultation in india#best gst services in india#best gst lawyers in india#corporate lawyer in india#gst#best taxation law firm#gst consultation firm#gst experts in india#gst help#gst india#gstreturns#gst billing software#gstfiling#gst registration#gst assistance#gst services#gst services in india#taxation#education#school#books#school supplies

0 notes

Text

Serviceplus is a dynamic digital marketing agency offering a wide range of services including IT support, taxation solutions, and ERP software. Our team of experts is committed to helping businesses succeed in the digital world by providing customized marketing strategies, advanced tech support, and efficient resource planning systems. At Serviceplus, we blend innovation with expertise to boost your business and ensure smooth operations in all areas.

1 note

·

View note

Text

GovReports - cloud accounting and taxation portal make your process stress - free

Affordable tax return platform client lodgment management solution for tax agents who want to streamline their practice. GovReports takes the stress out of tax season with its intuitive and powerful tax platform. Whether you're a seasoned tax professional or an individual filer, GovReports provides the tools and resources you need to navigate the complexities of tax filing. Reachout to us for more info: https://www.govreports.com.au/tax-agent

0 notes

Text

Streamline Your Finances with Top UK Bookkeeping Software

In today's fast-paced business environment, efficient financial management is crucial for success. Whether you're a small business owner, freelancer, or entrepreneur, keeping accurate records of your income and expenses is essential for making informed decisions and staying compliant with tax regulations. Fortunately, with the advancement of technology, managing your finances has become more accessible and streamlined than ever before, thanks to top-notch UK bookkeeping software.

UK bookkeeping software offers a comprehensive solution for managing your finances effectively. From tracking expenses and invoicing clients to generating financial reports and managing payroll, these software solutions are designed to simplify complex financial tasks and save you time and effort. Let's explore how leveraging UK bookkeeping software can benefit your business:

Enhanced Accuracy: Manual bookkeeping processes are prone to errors, which can lead to financial discrepancies and compliance issues. UK bookkeeping software automates tedious tasks and performs calculations accurately, reducing the risk of human error. By maintaining precise records of your financial transactions, you can make informed decisions and ensure the financial health of your business.

Time-saving Features: Time is a precious resource for any business owner. With UK bookkeeping software, you can streamline repetitive tasks such as data entry, invoicing, and reconciliation, allowing you to focus on growing your business. Automated reminders for overdue invoices and upcoming expenses help you stay organized and ensure timely payments, improving cash flow management.

Real-time Financial Insights: One of the key advantages of UK bookkeeping software is the ability to access real-time financial data from anywhere, at any time. Cloud-based solutions allow you to monitor your finances on-the-go using your computer, smartphone, or tablet. Instant access to financial reports, dashboards, and analytics empowers you to make data-driven decisions and adapt to changing market conditions swiftly.

Seamless Integration: Most UK bookkeeping software integrates seamlessly with other business tools and applications, such as payment processors, banking institutions, and customer relationship management (CRM) systems. This integration eliminates the need for manual data entry and ensures data consistency across different platforms, improving workflow efficiency and collaboration within your organization.

Compliance and Security: Maintaining compliance with HMRC regulations and ensuring data security are top priorities for businesses operating in the UK. Leading bookkeeping software solutions adhere to strict security protocols and comply with industry standards to protect your sensitive financial information. Additionally, these platforms are regularly updated to reflect changes in tax laws and regulations, keeping you compliant and minimizing the risk of penalties.

In conclusion, UK bookkeeping software offers a myriad of benefits for businesses of all sizes. By automating financial tasks, providing real-time insights, and ensuring compliance with tax regulations, these software solutions empower you to manage your finances more efficiently and effectively. Whether you're a sole proprietor or a growing enterprise, investing in top-notch bookkeeping software is a smart decision that can help you achieve your financial goals and propel your business forward.

#uk bookkeeping software#basic bookkeeping software#taxation software#corporation tax software#accounting software cheap

0 notes

Text

#accounting#commercial#finance#business#investing#software#accounting services#tax services#bookkeeping#taxation#payroll#marketing#tax

0 notes

Text

Navigating Financial Success: Your Trusted Partner in Accounting Excellence

Embark on a journey of financial empowerment with Geoff Cottle & Associates, your dedicated ally in the realm of accounting and financial expertise. Our commitment goes beyond numbers; we're here to guide you through the intricacies of financial management, ensuring a pathway to success.

At Geoff Cottle & Associates, our seasoned team of accounting professionals brings decades of experience to the table. Whether you're a business owner seeking strategic financial planning or an individual navigating personal finances, our comprehensive suite of services is tailored to meet your unique needs.

Discover the peace of mind that comes with expert tax advice and compliance services. Our meticulous approach ensures that you maximize your returns while adhering to regulatory requirements. We understand that every dollar counts, and our goal is to optimize your financial position.

As a client-centric accounting firm, communication is at the heart of our service. We prioritize transparency, providing clear insights into your financial standing and offering strategic advice to fuel your financial growth.

Geoff Cottle & Associates specializes in a wide range of accounting services, including bookkeeping, payroll, business advisory, and more. Our holistic approach allows us to address every facet of your financial landscape, fostering stability and growth.

What sets us apart is our unwavering commitment to client satisfaction. We recognize that your success is our success, and our team goes the extra mile to ensure your financial goals are not just met but exceeded.

Ready to elevate your financial journey? Contact Geoff Cottle & Associates at 02 4577 6911 or via email at [email protected]. Explore our services and learn more about how we can be your strategic partner in financial excellence by visiting our website at https://www.geoffcottle.com.au/.

#accounting & taxation services#accounting services#auditing services for businesses#best accounting firm#bookkeeping and accounting services#bookkeeping services#bookkeeping services for small business#business software training

0 notes

Text

Expert Digital Signature Consultancy Services

e-Solutions Digital provides expert consultancy services for digital signatures, ensuring secure and compliant solutions for your business.

1 note

·

View note

Text

Unlock Financial Clarity with Geoff Cottle: Your Trusted Sydney Accountant Discover financial clarity with Geoff Cottle, the trusted Sydney accountant. From taxes to business growth, we provide efficient solutions with transparency and professionalism.

#accounting & taxation services#accounting services#auditing services for businesses#best accounting firm#bookkeeping and accounting services#bookkeeping services#bookkeeping services for small business#business software training

0 notes