#best accounting firm

Explore tagged Tumblr posts

Text

How to Find the Right Accounting Firm in Mumbai for Your Industry

Introduction

Mumbai, the financial capital of India, is home to a diverse business ecosystem. Whether you're a startup or a well-established enterprise, having a reliable accounting firm Mumbai is essential to your business’s success. An accounting firm ensures that your financial operations are managed efficiently and in compliance with Indian regulations. However, with so many options available, selecting the right one for your specific industry can be a daunting task.

This blog will guide you through the process of finding the best accounting firm in Mumbai for your industry needs. From evaluating expertise to considering local knowledge and industry-specific services, this comprehensive guide will help you make an informed decision. Let’s dive into the steps that will help you choose the perfect accounting firm for your business.

Key Factors to Consider When Selecting an Accounting Firm in Mumbai

1. Industry Experience and Specialization

When selecting an accounting firm Mumbai, the first factor you should consider is whether the firm has experience working with businesses in your industry. Each industry has its own unique financial requirements, regulations, and reporting standards, and a firm with specialized experience in your field will understand these nuances better.

For example, if you run a manufacturing business, you might need a firm that is familiar with cost accounting, inventory management, and manufacturing-specific financial regulations. Similarly, if you're in the tech industry, look for a firm with experience handling R&D tax credits, software capitalization, and intellectual property matters.

How to Evaluate Industry Experience

Review the firm’s portfolio and client list to see if they have worked with businesses in your industry.

Ask about specific challenges they’ve encountered and how they’ve addressed them.

Check references and case studies to get a better understanding of their expertise.

2. Services Offered by the Accounting Firm in Mumbai

Different accounting firms offer different services, so it's important to find one that can cater to all your financial needs. An ideal firm should offer a comprehensive range of services that go beyond just bookkeeping and tax preparation. These services might include financial planning, audit and assurance, risk management, payroll processing, and business advisory.

Common Services Provided by Accounting Firms in Mumbai

Tax Advisory and Compliance: Helps ensure that your business is in line with local tax laws.

Auditing and Assurance: Essential for businesses to maintain transparency and accountability.

Financial Planning and Analysis: Helps in long-term growth planning and investment strategies.

Payroll Services: Essential for handling employee salary and tax deductions.

Business Consulting and Risk Management: Crucial for identifying business risks and creating strategies to mitigate them.

3. Location of the Accounting Firm in Mumbai

Mumbai is a sprawling metropolis, and the location of your accounting firm can play a significant role in the quality of service you receive. Ideally, your accounting firm should be easily accessible, either in a central location or close to your business. This ensures that communication is quick and efficient and that you can easily meet with the team if needed.

Benefits of Choosing a Local Accounting Firm in Mumbai

Proximity: Easier face-to-face meetings and quick resolution of issues.

Knowledge of Local Regulations: Accounting firms based in Mumbai are more likely to be up-to-date with local business laws and regulations.

Understanding of Local Market Conditions: A local firm can better assess the business environment in Mumbai, which can be crucial for industries like retail, real estate, and finance.

4. Reputation and Credibility

The reputation of an accounting firm speaks volumes about its professionalism and reliability. Look for firms with strong industry recognition and a reputation for integrity, quality, and client satisfaction. The best way to assess a firm’s reputation is by checking online reviews, testimonials, and ratings from platforms such as Google Reviews, LinkedIn, and other trusted sources.

How to Assess Reputation

Client Testimonials: Reach out to current or past clients to get feedback on their experience.

Online Reviews: Check reviews on trusted platforms and assess both positive and negative feedback.

Awards and Certifications: Look for industry awards or professional certifications like CPA (Certified Public Accountant), CA (Chartered Accountant), or ISO certifications.

5. Technology and Tools Used

With the growing reliance on technology in the financial industry, the accounting firm you choose should be proficient in using modern accounting software and tools. This includes using cloud-based accounting systems, financial management tools, and analytics platforms. These technologies can help streamline your financial processes, improve data accuracy, and provide real-time insights.

Technologies to Look for

Cloud-Based Accounting Software: Software like QuickBooks, Xero, or Tally can make it easier to access your financial data from anywhere.

Automation Tools: Automation can reduce human error and ensure that tasks like invoicing, payroll, and tax filing are streamlined.

Data Security Protocols: Ensuring that the firm uses robust security systems to protect sensitive financial data is crucial.

6. Fee Structure and Transparency

Understanding the fee structure of an accounting firm is essential before making any decisions. Some firms charge hourly rates, while others might offer flat fees for specific services. It's important to ensure that the pricing is transparent and within your budget, without any hidden costs.

Key Considerations About Pricing

Hourly Rates vs. Fixed Fees: Understand the pricing model the firm uses and how it fits with your budget.

Additional Fees: Ask about any potential hidden costs for services like consultation, emergency support, or additional reports.

Value for Money: While the lowest price might be appealing, make sure the firm provides good value by offering high-quality services.

7. Availability and Communication

When you’re running a business, timely communication with your accounting firm is crucial. You want a firm that is responsive to your needs and available when you need them. Before choosing an accounting firm, assess their communication style and availability.

Questions to Ask About Communication

Response Time: How quickly do they respond to emails, phone calls, or requests for meetings?

Communication Channels: Do they offer multiple ways to reach them, such as phone, email, or online chat?

Accessibility: How often are they available for consultation, and what is their policy for urgent matters?

8. Trust and Confidentiality

Trust is the foundation of any professional relationship, especially when dealing with sensitive financial information. Make sure the accounting firm you choose has a solid track record of maintaining client confidentiality and adheres to industry standards for data protection.

How to Assess Trustworthiness

Non-Disclosure Agreements (NDAs): Check if the firm is willing to sign an NDA to protect your business information.

Compliance with Regulations: Ensure the firm adheres to data privacy laws and financial reporting standards.

Client References: Speak with past clients to gauge the firm’s reliability and trustworthiness.

Frequently Asked Questions

1. What is the role of an accounting firm in Mumbai for small businesses?

An accounting firm in Mumbai plays a crucial role in helping small businesses manage their finances, taxes, and compliance. They assist with bookkeeping, financial reporting, tax returns, and business advisory, ensuring that small businesses follow all necessary regulations and can focus on growth.

2. How do I choose the best accounting firm for my startup?

For startups, it’s important to choose an accounting firm that understands the challenges of starting a new business. Look for a firm with experience working with early-stage companies, offering services like business advisory, tax planning, and fundraising support.

3. Are accounting firms in Mumbai familiar with international business practices?

Yes, many accounting firms in Mumbai are well-versed in international accounting standards, as Mumbai is a global business hub. If you plan to expand globally, choose a firm with experience in handling international taxation, cross-border transactions, and compliance.

4. How do accounting firms in Mumbai ensure compliance with Indian tax laws?

Accounting firms in Mumbai are well-equipped to handle compliance with Indian tax laws by staying up-to-date with changes in the taxation system. They assist with tax filings, tax planning, and ensuring that all financial practices are in line with Indian regulations.

5. Can an accounting firm in Mumbai help with financial planning and investment?

Yes, many accounting firms in Mumbai offer financial planning services, helping businesses make sound investment decisions. These services may include cash flow management, capital budgeting, and financial forecasting, ensuring that businesses are well-positioned for growth.

6. How much do accounting firms charge for services in Mumbai?

The fees charged by accounting firms in Mumbai vary depending on the services offered and the complexity of the tasks. Some firms charge hourly rates, while others offer fixed pricing. It’s important to discuss pricing upfront to avoid any surprises.

7. What should I look for in a tax advisor from an accounting firm in Mumbai?

Look for a tax advisor who has experience with your industry’s specific tax needs, such as deductions, credits, and compliance. They should be proactive, keeping you informed about changes in tax laws that may impact your business.

8. How can I assess the credibility of an accounting firm in Mumbai?

You can assess the credibility of an accounting firm by checking their client testimonials, industry certifications, and online reviews. It’s also beneficial to ask for references from current clients to get a better understanding of their reputation.

9. Can accounting firms in Mumbai handle audits for large corporations?

Yes, most accounting firms in Mumbai are capable of handling audits for large corporations. They have the resources and expertise to conduct thorough audits, ensuring that the company’s financial statements are accurate and compliant with Indian standards.

10. What are the advantages of outsourcing accounting services to a firm in Mumbai?

Outsourcing accounting services to a firm in Mumbai provides several advantages, including cost efficiency, access to expert knowledge, and the ability to focus on core business activities while leaving financial management to professionals.

Conclusion

Finding the right accounting firm in Mumbai is a critical decision for any business. By considering factors such as industry experience, service offerings, technology, and trustworthiness, you can ensure that your business receives the best financial guidance and support. Take the time to assess your options, ask the right questions, and choose a firm that aligns with your business goals and values. With the right accounting firm by your side, your business will be well-equipped to navigate the complex financial landscape in Mumbai.

#best accounting firm#accounting firm mumbai#top accounting firm#accounting firm in mumbai#accounting firm near me

0 notes

Text

Top Accounting Firm in UAE: Expert Financial Solutions for Your Business

Looking for a reliable accounting firm in the UAE? then this article is for you. Given the knowledge of the UAE’s financial laws, the leading accounting companies offer a full range of services, including basic accounting, VAT services, audit, and consultation. They provide services in areas such as financial reporting, compliance with the legislation of the United Arab Emirates and financial planning to support firms and companies of any scale in achieving positive results in the conditions of strengthening competition in the UAE. For a start-up, and even for a big conglomerate, teaming up with an expert accountancy firm guarantees that your enterprise is on the right side of the law and that your financials remain healthy.

2 notes

·

View notes

Text

Premier Accounting & Taxation Services Windsor | Expert Solutions

Elevate your business with top-notch accounting, taxation, and auditing services in Windsor. Trust our expertise for comprehensive solutions tailored to your needs.

#accounting services#accounting & taxation services#bookkeeping services#best accounting firm#bookkeeping and accounting services#auditing services for businesses

0 notes

Text

Top Accounting Services in UAE: Navigating Financial Excellence

In the thriving business landscape of the United Arab Emirates (UAE), securing top-notch accounting services is imperative for businesses aiming for financial success. This article explores the diverse range of services offered by leading accounting firms in the UAE, emphasizing their crucial role in navigating the complexities of financial management.

Introduction

The UAE's dynamic economy, characterized by its rapid growth and diverse business landscape, demands meticulous financial management. Top accounting services in the UAE play a pivotal role in providing businesses with the expertise needed to navigate financial challenges and capitalize on opportunities.

1. Comprehensive Financial Consultancy

Leading accounting firms in the UAE offer comprehensive financial consultancy services. This includes strategic financial planning, budgeting, and forecasting, providing businesses with a roadmap for sustainable growth. The expertise of financial consultants contributes to informed decision-making and long-term financial success.

2. Auditing Excellence

Audit services are a cornerstone of top accounting firms in the UAE. These firms conduct thorough examinations of financial records to ensure accuracy, compliance with regulations, and financial transparency. The meticulous auditing process provides businesses with a clear understanding of their financial health and instills confidence in stakeholders.

3. VAT Consultancy and Compliance

With the introduction of Value Added Tax (VAT) in the UAE, businesses need expert guidance to navigate the complexities of compliance. Top accounting services include VAT consultancy, helping businesses understand and adhere to VAT regulations, ultimately avoiding penalties and ensuring seamless operations.

4. International Tax Planning

In an increasingly globalized business environment, international tax planning is crucial. Leading accounting firms in the UAE provide expertise in optimizing tax liabilities, ensuring businesses operate efficiently on an international scale while remaining compliant with tax regulations.

5. Efficient Bookkeeping Services

Accurate and efficient bookkeeping is fundamental to sound financial management. Top accounting services in the UAE offer meticulous bookkeeping services, maintaining organized and up-to-date financial records. This not only facilitates day-to-day operations but also forms the basis for informed decision-making.

6. Outsourced Accounting Solutions

Outsourcing accounting functions to professionals allows businesses to focus on their core operations. Top accounting firms provide outsourced accounting services, offering expertise in managing financial tasks such as payroll, accounts payable, and accounts receivable. This approach enhances efficiency and cost-effectiveness for businesses.

7. Personalized Financial Advisory

Every business is unique, and top accounting services recognize this by offering personalized financial advisory services. Tailored advice and strategies catered to the specific needs and goals of a business contribute to its overall financial well-being.

8. Corporate Finance Expertise

Corporate financial management requires specialized knowledge, and top accounting services in the UAE excel in this domain. These firms provide expertise in areas such as financial planning, risk management, and capital budgeting, contributing to the strategic financial success of businesses.

Conclusion

In conclusion, top accounting services in the UAE go beyond traditional bookkeeping and auditing. They serve as strategic partners, offering a comprehensive suite of services that contribute to the financial health and growth of businesses. Whether it's navigating tax regulations, conducting thorough audits, or providing personalized financial advice, these services are instrumental in ensuring financial excellence in the UAE's dynamic business landscape.

FAQs

Why is auditing important for businesses in the UAE?

Auditing ensures financial transparency, compliance with regulations, and instills confidence in stakeholders.

How do top accounting services assist businesses in VAT compliance?

They provide expert guidance on understanding and adhering to VAT regulations, avoiding penalties and ensuring seamless operations.

What does international tax planning involve?

International tax planning optimizes tax liabilities for businesses operating on a global scale while remaining compliant with tax regulations.

How can outsourced accounting solutions benefit businesses?

Outsourced accounting enhances efficiency and cost-effectiveness, allowing businesses to focus on their core operations.

Why is personalized financial advisory crucial for businesses?

Personalized financial advisory provides tailored advice and strategies to meet the specific needs and goals of a business, contributing to its overall financial well-being.

0 notes

Text

Geoff Cottle Chartered Accountant: Your Partner in Efficient Tax Handling for Businesses

Navigate tax complexities with ease. Geoff Cottle, your trusted accountant in Sydney, ensures accuracy, professionalism, and transparent services. Let us empower your business decisions.

#accounting & taxation services#accounting services#auditing services for businesses#best accounting firm#bookkeeping and accounting services

0 notes

Text

Consult Best Accounting Firm in Quebec for Financial Advice

Get excellence in financial expertise with JD Orvil, the best accounting firm in Quebec. Contact us for comprehensive accounting solutions tailored to your needs.

1 note

·

View note

Text

Best Accounting Services in UK

Your trusted partner for comprehensive accounting solutions in the UK. We are offering the best accounting services in UK. With a commitment to excellence, we provide a wide range of services including bookkeeping, tax preparation, financial analysis, and payroll management. Our experienced team ensures accurate, efficient, and reliable financial support for businesses and individuals. Contact us today for personalized accounting support.

#best accounting services in UK#best accounting firm#Accounting services#Small business accounting#accounting services company#accounting consultant

1 note

·

View note

Text

Certified public accountants UAE

Unlock financial success with certified public accountants in the UAE! From expert auditing to strategic tax planning, trust the pros to ensure compliance, accuracy, and growth for your business.

2 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

How an Accounting Firm in Mumbai Helps You Save on Taxes

Introduction

In today's fast-paced business environment, effective financial management is key to success. Taxation, one of the most critical aspects of business finance, can be both complex and time-consuming. For businesses and individuals in Mumbai, where taxes and regulatory compliance are stringent, working with an accounting firm can be a game-changer. An accounting firm in Mumbai can help you navigate through the complexities of tax planning and filing, ensuring that you maximize your savings while staying compliant with the law.

This blog explores the various ways an accounting firm in Mumbai can assist in saving taxes, optimizing your finances, and achieving greater business efficiency. We will also answer some of the most frequently asked questions (FAQs) about accounting and tax-related services.

Why Choosing the Right Accounting Firm in Mumbai Matters

Before we delve into the specific ways an accounting firm can help you save on taxes, it’s essential to understand why working with a professional accounting firm is so important.

Benefits of Hiring an Accounting Firm in Mumbai

Mumbai, the financial capital of India, is home to various industries and businesses. From startups to established corporations, the tax landscape can be overwhelming, and staying on top of regulatory changes is crucial. Here’s why hiring an accounting firm is a wise choice:

Expertise and Knowledge: A skilled accounting firm in Mumbai can provide expert advice on tax regulations, helping you avoid costly mistakes and ensure full compliance with local and national tax laws.

Time-Saving: Managing taxes can take up a lot of your valuable time, especially for business owners who have to handle several other aspects of their operations. An accounting firm can free up your time by taking care of all your tax-related concerns.

Customized Tax Solutions: The right accounting firm will work with you to create a tailored tax strategy based on your specific financial situation, business needs, and goals.

Now that we understand the importance of an accounting firm, let’s explore the ways in which they can help you save on taxes.

1. Tax Planning and Structuring

How Tax Planning Helps You Save on Taxes

One of the most significant advantages of hiring an accounting firm in Mumbai is its ability to offer expert tax planning services. Tax planning involves organizing your finances and structuring your business in a way that minimizes tax liabilities.

Creating Tax-Efficient Business Structures

An accounting firm can help you decide on the most tax-efficient business structure, whether it's a sole proprietorship, partnership, or private limited company. The right structure can lead to significant tax savings, particularly in terms of exemptions, deductions, and credits that apply to different business entities.

Leveraging Tax Deductions and Exemptions

In India, businesses and individuals can avail various tax deductions and exemptions under the Income Tax Act. An experienced accounting firm in Mumbai will ensure you take advantage of these opportunities, such as deductions for business expenses, depreciation, and Section 80C deductions for investments.

2. Strategic Tax Filing and Compliance

How Professional Filing Ensures Compliance and Saves Money

Another way an accounting firm in Mumbai can help you save taxes is by handling your tax filing and ensuring that all returns are accurate and filed on time. Many businesses end up paying hefty penalties due to late filing or incorrect returns, which can be easily avoided with professional help.

Timely Filing to Avoid Penalties

An accounting firm ensures that your tax returns are filed well before the deadline, avoiding late fees and interest charges. Additionally, the firm can guide you in choosing the best tax filing status to reduce liabilities.

Optimizing Tax Benefits for Small Businesses

Small businesses often miss out on tax-saving opportunities, such as Section 44AD and 80G benefits, due to lack of knowledge or time. Accounting professionals can guide small businesses in optimizing these tax-saving schemes and ensure that they claim every available benefit.

3. Tax Audits and Assessments

How Tax Audits Help Uncover Potential Savings

Tax audits are an essential process for businesses, ensuring that all financial statements and tax returns are accurate. A good accounting firm in Mumbai will assist in preparing for tax audits and assessments, ensuring that you pay only what you owe and nothing more.

Analyzing Tax Liabilities During Audits

During a tax audit, your accounting firm will carefully analyze your tax liabilities and ensure that all the expenses, credits, and deductions are appropriately accounted for. If any discrepancies are found in previous returns, they can take corrective actions, potentially lowering your tax burden.

Handling Scrutiny with Expertise

Dealing with tax authorities can be a stressful process, but an accounting firm can represent you during audits or assessments. Their expertise ensures that you provide the necessary documentation and make the case for any tax savings or adjustments.

4. Advisory Services for Long-Term Tax Savings

How Tax Advisory Services Help in Long-Term Planning

A skilled accounting firm doesn’t just help with short-term tax filing; it provides long-term tax advisory services that can help minimize future tax liabilities and promote wealth-building strategies.

Guidance on Investment and Taxation

Accounting firms offer insights on tax-efficient investment strategies, including tax-saving instruments like PPFs, ELSS, and NPS. These investments can not only help you save taxes but also grow your wealth over time.

Succession and Estate Planning

For high-net-worth individuals and business owners, an accounting firm in Mumbai can also help with succession planning, ensuring that assets are transferred efficiently to heirs while minimizing estate taxes.

5. Business Expenses and Deductions

Maximizing Business Expenses to Save on Taxes

An accounting firm can help you maximize your business expenses, ensuring that you’re claiming all the deductions you’re entitled to. This can include everything from office supplies to employee benefits.

Accurate Expense Tracking for Deductions

Accounting professionals ensure accurate tracking of business expenses, which is vital for claiming deductions. They can also guide you on what qualifies as a deductible expense under the Income Tax Act, thus reducing your taxable income.

Reviewing and Managing Cash Flow

Managing cash flow is essential for tax savings, and an accounting firm helps businesses maintain proper records of income and expenses. This allows businesses to adjust their strategies to make tax-efficient decisions.

6. GST and Other Indirect Taxes

How GST Services Help in Saving on Taxes

An accounting firm in Mumbai also assists businesses with Goods and Services Tax (GST) compliance. By ensuring your business complies with GST rules, an accounting firm can help you claim input tax credits and avoid penalties for non-compliance.

GST Filing and Returns

Professional accountants ensure that your GST returns are filed accurately and on time, preventing any fines. Additionally, they help you determine whether you qualify for input tax credit, which can lower your overall GST burden.

FAQs About Tax Savings with Accounting Firms in Mumbai

Q1: How can an accounting firm help me with tax planning?

An accounting firm can help structure your finances in a tax-efficient manner, ensuring you take full advantage of available deductions and exemptions. They also provide customized advice based on your specific situation.

Q2: Are accounting services in Mumbai expensive?

The cost of accounting services in Mumbai varies based on the complexity of the services you need. However, considering the long-term savings they can offer, it’s a worthwhile investment for your business.

Q3: How do I know if I’m getting the best tax advice?

A reliable accounting firm in Mumbai will offer clear, transparent advice and ensure that all their suggestions are backed by applicable laws and regulations. They will also keep you informed about any changes in tax policies.

Q4: Can an accounting firm help me with tax audits?

Yes, accounting firms are highly skilled at preparing for and managing tax audits. They help you compile all the necessary documents, respond to audit notices, and negotiate with tax authorities.

Conclusion

Working with an accounting firm in Mumbai is an excellent strategy for businesses and individuals looking to save on taxes and ensure compliance with the complex Indian tax system. By providing tax planning, filing, audit support, and long-term advisory services, these firms help you maximize your savings while ensuring you stay on the right side of the law. With their expertise, you can make informed financial decisions that drive success for your business.

This comprehensive guide provides valuable insights into the many ways an accounting firm in Mumbai can help you save on taxes. Whether you're a small business owner, an entrepreneur, or an individual looking to optimize your finances, partnering with an accounting firm can lead to significant tax savings and long-term financial success.

#best accounting firm#top accounting firm in mumbai#accounting firms#accounting firm in mumbai#benefits of accounting firm

0 notes

Text

I snapped today at work, and by snapped I mean I politely commented on a help desk ticket by summing up an mess of an (type of) issue that's come up for at least the fourth time in the 2+ months I've been managing user accounts, and asked the person responsible to fix it (himself for once) because last time I fixed his mess-up it took me two whole days to work out the details with at least four other colleagues from different departments and I really don't want to do it again. there's other shit that needs doing, I've been working 10+ hour days for most of this week already, so I need to cut down not add on more.

(good thing tho - at least we managed to fix the issue where the dataset of a newer employee got mixed up with another one of the same name and therefore wasn't able to apply for any of the access/accounts she needed. technically not entirely my area but it does impact us not being allowed to create an account for her so I figured I might as well track that issue down. took three days and at least three other people, but hey - it should all work out now. yay for that)

#been feeling anxious af ever since bc it's the first time I've been this firm in a reply and idk how they'll take it#there's underlying issues in inter-departmental communication that need fixing that cause these issues to happen again and again#but my boss is on parental leave and his substitute is sick not that she cares or is up for doing her job where communication is concerned#so there's no real sense in addressing that rn esp by me who's only been there since June. but it does frustrate me a lot#anyway. I'm sure I'll get over this too. but yeah.. ppl not thinking things through for the two mins it takes to create an account#or the twenty seconds it takes to check if one already exists before creating a new one#or the minute it takes to check if folks still have an active contract past their time working in your department before deleting an accoun#just jfc. put in a smidge of effort and five mins total and save the rest of us from spending half a day to fix your mistake#oh well. if I get a pissy response I'll just blame it on being new as an intern and being too motivated and idealistic I guess#god forbid I expect people to do their jobs thoroughly or with at least a singular thought..#anyway. I feel like I'm allowed to be grumpy abt this since we are the folks who end up having to fix this shit#and by we I mean pretty much mostly me at this point bc one colleague is sick atm. my boss barely has time for this and is on leave#and my other colleague only works half time so I'm the one who's been handling most of these over the past month or so#which.. is still insane considering how I'm a goddamn intern who shouldn't even have admin rights tbh#but without them I couldn't do anything at all lol so here I am. nice that they trust and believe in me I suppose#that's why I try to do my best. (who am I kidding that's always the case anyway)#but yeah. definitely a 50% staff support job and only 50% of the other important things that need doing rn it's more like 90/10#and it's funny how I still dread my two hours of hotline. but every time the line is too busy I still jump in#we are also only 6 people atm out of 10 and three of us are still in training. and one of the trained folks had to come back in mid time of#next week we'll likely be 4#depending on if our substitute boss lady is back.. not that I'd look forward to it. she's a mess and she's been horrible to deal with latel#sure. she's stressed. but she's either snapping at me when I ask abt shit I can't know yet or she's ignoring me. great basis for team work.#so honestly I'd rather she not return on Monday. esp not if she's gonna spread her germs everywhere#but now sleep. sorry for the rant. it's certainly been quite the month since I returned from my own wisdom tooth rated sick leave..#gotta be up again in 6.5 hrs so I can be at work at 6 to let the electrician in. I'm gonna sleep so hard over the weekend I stg#a day in the life of..

2 notes

·

View notes

Text

Trusted Accounting Services Windsor | Professional Solutions for Businesses

Explore our range of accounting services tailored to Windsor businesses. From bookkeeping to auditing, we're your reliable partner for financial success.

#accounting services#accounting & taxation services#best accounting firm#bookkeeping services#auditing services for businesses#bookkeeping and accounting services

0 notes

Text

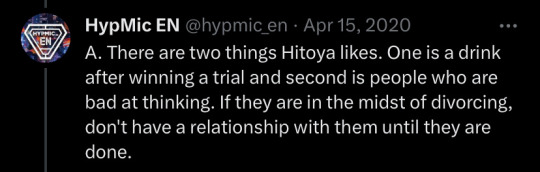

hitoya likes people who are bad at thinking and i assume that’s because it’s easier to steamroll over them to get his desired result and i wish we got to see that side of him more often lol

#vee queued to fill the void#this was a wild question he got asked btw lmao#the bat rep skit where he swindles kuukou and jyushi into his favour is peak grey hitoya lol we should get more#it doesn’t have to be as overt as rei’s general conman schtick or hitoya himself willing to fabricate evidence to get his way lol#just more situations where you see he’s a bit of an asshole too LOL#it would have also been fun to see more of his money grubbing personality too lol#like it’s connected to his high class taste and desire to have the best where the pay off is that he wants to share that with his team#but man he bragged he enjoys looking at his bank account for fun lol pls give us more of that#i like it when bat are visibly chaotic good lol!!!!!!#kuukou making a steam bath for temple patrons but then sabotaging it to show them if they can suffocating steam they can handle anything!!!!#hitoya lowkey shading this girl by saying this is common sense but come to my law firm and i’ll make sure you win!!!!!#and while i’m at it i wish jyushi was Slightly more narcissistic lol!!!!!#he likes looking in mirrors so that makes him narcissistic????? he lacks confidence he’s literally hyping himself up?????#i don’t need terra charisma house levels of narcissism lmao just let jyushi flex sometimes lol#some guy: wow that was amazing jyushi!!!!! jyushi: i know✨#at least that!!!!!!!! confident jyushi in all aspects arc WHEN 😭😭😭😭😭😭

11 notes

·

View notes

Text

Efficient Tax Solutions for Businesses: Geoff Cottle Chartered Accountant

Geoff Cottle Chartered Accountant brings you cost-effective tax solutions. Outsource your accounting to us for accurate tracking of income, expenses, and cash flow. Stay compliant and save money.

#accounting & taxation services#accounting services#auditing services for businesses#best accounting firm#bookkeeping and accounting services#bookkeeping services

0 notes

Text

Financial Consulting Company in Saudi Arabia: Your Trusted Partner for Financial Success

Introduction

Welcome to Moronhksa, your go-to financial consulting company in Saudi Arabia. We specialize in providing top-notch management consulting services, accounting solutions, and expert advice on financial matters. With our extensive experience and deep understanding of the Saudi Arabian business landscape, we are here to help you navigate the complexities of finance and ensure your success. In this article, we will delve into the various aspects of our services, from management consulting to zakat and tax advisory, and demonstrate why we are the best choice for all your financial needs.

Financial Consulting Company in Saudi Arabia

Moronhksa is a leading financial consulting company in Saudi Arabia, trusted by businesses of all sizes and industries. We offer a wide range of services designed to enhance your financial performance and drive growth. Our team of experienced professionals works closely with you to understand your unique requirements and develop tailored solutions that meet your specific goals. From financial analysis to strategic planning, we are committed to providing exceptional services that empower you to make informed decisions and achieve sustainable success.

Management Consulting Firm in Saudi Arabia

As a premier management consulting firm in Saudi Arabia, Moronhksa brings a wealth of expertise and industry knowledge to the table. We assist businesses in optimizing their operations, improving efficiency, and maximizing profitability. Our comprehensive approach encompasses organizational restructuring, process improvement, performance management, and more. By leveraging our deep understanding of the local market dynamics and global best practices, we help you unlock your business's true potential and stay ahead of the competition.

Best Accounting Services in Saudi Arabia

When it comes to Best accounting services in Saudi Arabia, Moronhksa stands out as the best choice. Our team of highly skilled accountants and financial experts is dedicated to delivering accurate, timely, and compliant accounting solutions. From bookkeeping and financial statement preparation to tax compliance and payroll management, we handle all aspects of your accounting needs with utmost professionalism and attention to detail. By outsourcing your accounting functions to us, you can focus on core business activities while enjoying peace of mind knowing that your financial records are in capable hands.

Accounting, Financial, and Management Consultancy in KSA

Moronhksa offers a comprehensive range of consultancy services encompassing accounting, financial, and management consultancy in KSA. We understand that these three pillars are interconnected and crucial for your business's success. Our integrated approach allows us to provide holistic solutions that address your unique challenges and drive growth. Whether you need assistance with financial planning, budgeting, risk management, or internal controls, our experts are here to guide you every step of the way. With our consultancy services, you can optimize your business processes, strengthen your financial position, and achieve sustainable growth.

Zakat and Tax Advisory Service in KSA

Navigating the complexities of zakat and tax regulations in Saudi Arabia can be overwhelming. Moronhksa's zakat and tax advisory service in KSA is specifically designed to simplify the process for you. Our knowledgeable professionals have in-depth expertise in Saudi Arabian tax laws and regulations. We provide comprehensive guidance on zakat calculations, tax planning, compliance, and reporting. By partnering with us, you can ensure that your zakat and tax obligations are fulfilled accurately and efficiently, while maximizing tax benefits and minimizing risks.

FAQs

What are the benefits of hiring a financial consulting company?

Hiring a financial consulting company like Moronhksa offers numerous benefits. Firstly, you gain access to expert knowledge and experience in financial matters, enabling you to make well-informed decisions. Additionally, a consulting firm brings an objective perspective and fresh insights to your business, helping you identify areas for improvement and implement effective strategies. Moreover, outsourcing financial tasks allows you to focus on core business activities and save valuable time and resources.

How can a management consulting firm help my business in Saudi Arabia?

A management consulting firm such as Moronhksa can provide invaluable support to your business in Saudi Arabia. By analyzing your operations, processes, and organizational structure, consultants can identify inefficiencies and recommend improvements. They offer guidance on strategic planning, performance management, and change management, ensuring that your business stays competitive and adapts to evolving market dynamics. With their expertise, consultants help you streamline operations, enhance productivity, and achieve sustainable growth.

What accounting services do you offer in Saudi Arabia?

Moronhksa offers a comprehensive range of accounting services in Saudi Arabia. Our services include bookkeeping, financial statement preparation, tax compliance, payroll management, internal controls, and financial analysis. We ensure that your financial records are accurate, up-to-date, and compliant with local regulations. By outsourcing your accounting functions to us, you can focus on core business activities while enjoying peace of mind knowing that your financial matters are handled by professionals.

Can you provide guidance on zakat and tax matters in KSA?

Absolutely! Moronhksa specializes in providing zakat and tax advisory services in KSA. Our experts have in-depth knowledge of Saudi Arabian zakat and tax regulations and can guide you through the complexities of these matters. We assist with zakat calculations, tax planning, compliance, and reporting, ensuring that you fulfill your obligations accurately and efficiently. Our goal is to help you maximize tax benefits, minimize risks, and navigate the ever-changing zakat and tax landscape.

Why should I choose Moronhksa for financial and management consultancy in KSA?

Moronhksa is your trusted partner for financial and management consultancy in KSA due to several reasons. Firstly, we have extensive experience working with businesses in Saudi Arabia, enabling us to understand the local market dynamics and unique challenges you face. Our team comprises highly skilled professionals who bring diverse expertise and industry knowledge to the table. We are committed to delivering tailored solutions that drive your business's success and provide exceptional value. With Moronhksa, you can trust that you are in capable hands.

How can I get in touch with Moronhksa?

Getting in touch with Moronhksa is easy. You can reach out to us through our website at www.moronhksa.com and fill out the contact form with your inquiries. Alternatively, you can give us a call at +966 55 788 4263 or send us an email at [email protected]. We are here to answer your questions, discuss your specific requirements, and provide the support you need for your financial success.

Conclusion

In conclusion, Moronhksa is your trusted partner for financial consulting, management consulting, accounting services, and zakat and tax advisory in Saudi Arabia. Our dedicated team of experts is committed to helping you achieve financial success and growth. With our comprehensive services and industry knowledge, we provide tailored solutions that address your unique needs. Don't hesitate to reach out to us today and discover how Moronhksa can transform your business's financial landscape.

#Financial Consulting Company in Saudi Arabia#Management Consulting Firm in Saudi Arabia#Best Accounting Services in Saudi Arabia#Accounting#Financial and Management Consultancy in KSA#Zakat and Tax Advisory Service in KSA

2 notes

·

View notes

Text

Join top Futures traders with Apex Trader Funding—transparent, easy, and the best way to trade 75K Rithmic on Tradovate!

#apex trader funding#funded trader#funding traders#the funded trader#the fundedtrader#funded trading accounts#instant funding prop firm#best online trading platforms#best trading platform#stock trading platforms#best trading app for beginners#best trading websites#platform trading#best trading apps#online trading platform

0 notes