#tax service in Atlanta

Explore tagged Tumblr posts

Text

What Does the 1099-K Mean for Your Tax Season?

Have you seen the new 1099-K form floating around? As a premier tax service in Atlanta, ATC Income Tax is here to clear things up so you are well-prepared and confident when it's time to file.

What Is a 1099-K?

The 1099-K form plays a crucial role for the IRS, helping to track payments received through cash apps, online marketplaces, and payment processors like PayPal and Venmo. This form becomes relevant for businesses or individuals who've completed over 200 transactions or surpassed $20k in payments using these platforms since 2020. If you've dabbled in selling goods or services online, you must have received this form.

Why It Matters?

Receiving a 1099-K indicates that your online transactions have been reported to the IRS, requiring you to declare this income on your tax return. However, receiving this form doesn't necessarily mean your tax bill will increase. Understanding how to report this income correctly is essential to avoid potential issues.

Why You Need Professional Tax Service in Atlanta

This is where the expertise of a tax service in Atlanta becomes invaluable. Filing taxes can be complex, especially with the addition of forms like the 1099-K. ATC Income Tax professionals are adept at handling these complexities, ensuring your taxes are filed accurately and efficiently. They specialize in:

Identifying eligible business expenses and write-offs,

Maximizing deductions through the Qualified Business Income (QBI) deduction,

and Ensuring you pay only what is necessary.

Attempting to tackle the 1099-K on your own could lead to overlooked deductions or errors, potentially resulting in penalties. You can avoid these pitfalls by leveraging the expertise of a seasoned tax service in Atlanta.

Additional Tax Services in Atlanta Provided by ATC Income Tax

ATC Income Tax offers a comprehensive suite of tax services and financial products to help clients, such as

Their Refund Advance allows quick access to up to $6,000 of an anticipated refund in as little as 10 minutes.

Interest may apply for larger loans deducted from the refund, but 0% APR is deducted on portions up to $2,500.

Through Refund Transfer, clients can expect to check the delivery of their refund amount within 8-15 days of IRS acceptance.

ATC also provides a FasterMoney prepaid Visa card for fast, safe, and fee-free tax refund deposits.

For fast filing, clients can utilize E-File IRS Direct or download a W2 early through ATC's connections with major payroll providers.

These solutions empower clients to manage tax obligations and cash flow with maximum convenience and support.

Wrapping Up

If you've received a 1099-K, don't let it intimidate you. ATC Income Tax, a trusted tax service in Atlanta, is equipped to handle your unique tax situation. Bring us your 1099-K and other tax documents, and we'll ensure your side gig income is reported accurately. We aim to secure the most significant refund possible, demonstrating the tangible benefits of partnering with a knowledgeable tax service in Atlanta, like ATC Income Tax.

1 note

·

View note

Text

When Utah Leaders say that taxpayers "will not" pay for a ballpark, they mean that $900 million taxpayer dollars will be used

Over the last few months, more and more stories have been popping up online that discuss whether Salt Lake City or the state of Utah should build a ballpark for some future MLB expansion team. Utah residents have therefore been asking local leaders who exactly would be paying for such a project. Rep. Ryan Wilcox, R-Ogden, has an answer. He wants residents to know that “local taxpayers will not be…

View On WordPress

#Accommodations and Services Tax#Arlington TX#Atlanta Braves#Beach Renourishment#Clark County#Cobb County#Dallas Cowboys#Energy Sales and Use Tax#Fairpark Area Investment and Restoration District#General Fund#Hotel Taxes#JC Bradbury#Miami Marlins#MLB#Moody#Nevada#Property Tax#Resort Communities Sales and Use Tax#Room Tax#Ryan Wilcox#Salt Lake City#Stuart Adams#Tampa Bay#Tampa Bay Rays#Telecommunications License Tax#Texas#Tourist Taxes#Transient Room Tax#Utah#Utah State Legislature

0 notes

Text

TJ Marshall Tax Service & Accounting | Accounting Firm | Tax Services in Atlanta GA

Ours is a well-reputed Accounting Firm in Marietta GA, we provide comprehensive accounting services for individuals and businesses of all sizes. Our team is committed to providing honest advice, helping you easily navigate complex financial situations. Whether you need assistance with bookkeeping or payroll, we are here to help. Moreover, acquiring our exceptional Tax Services in Atlanta GA, can help you maximize tax savings and minimize liabilities. From preparing to filing your taxes on time, we do it all with great accuracy and precision. We stay up-to-date on all the latest tax laws and regulations, assuring that your taxes are in good hands. So, if you want to schedule our services, call us today.

#Accounting Firm in Marietta GA#Tax Services in Atlanta GA#Tax Accountant near me#Bookkeepers near me#Tax Preparation Services near me

1 note

·

View note

Text

Black Lives Matter Global Network Foundation is running out of cash and nearing its end "unless something changes dramatically," according to a new report.

The Free Press, an independent news organization founded by former New York Times journalist Bari Weiss, on Tuesday published a scathing deep dive into the "scrappy start-up that struck gold in 2020" headlined "BLM Collected Over $90 Million in Donations. Where Did It Go?"

"Capitalizing on the lucrative opportunities afforded to them as high-profile progressives, the three celebrity founders moved on, leaving the operation to wither in the hands of deputies who, sadly, turned on each other. A remarkable spate of legal trouble, brushes with law enforcement, and tangles with the Internal Revenue Service have all but spelled the death of the enterprise that you probably know best as Black Lives Matter," Free Press reporter Sean Patrick Cooper wrote.

"The spectacular rise and fall of BLM has surprisingly little in common with earlier civil rights campaigns, other than, perhaps, good intentions," he continued. "How BLM’s leaders exploited George Floyd’s murder to raise millions that they then put into their own pockets more closely resembles the stories of famous grifters like Elizabeth Holmes of Theranos or Sam Bankman-Fried’s foray into ‘effective altruism.’"

Cooper noted that in 2020, at the height of activism related to the death of George Floyd, corporations "revved up their diversity, equity, and inclusion programs, and threw millions of dollars at BLM" but four years later "DEI programs are in retreat" and the left cares more about Israel than police reform.

"And BLM four years later? It looks like little more than a hustle," Cooper wrote.

He feels the "latest proof" is that Sir Maejor Page, also known as Tyree Conyers-Page, a former leader of the Atlanta area BLM chapter, was sentenced to 3-and-a-half years in federal prison for money laundering and wire fraud earlier this month.

LEFT-WING ACTIVIST ALLEGEDLY DEFRAUDED $450G USING 'BLACK LIVES MATTER OF GREATER ATLANTA' FACEBOOK PAGE

But Page isn’t the only former BLM leader to face unflattering accusations.

"For years, local chapters have fought national parent BLM organizations in disputes over who actually represents the movement and are thus the rightful heirs to tens of millions of dollars in donations. You’ll note that I mentioned parent organizations. There are actually two of them: BLM Global Network Foundation and BLM Grassroots. The latter was formed in 2019 as an umbrella organization of local chapters of the group and is co-directed by Melina Abdullah. Since then, media reports have accused Abdullah and other chapter leaders of using Grassroots’ coffers to pay for vacations to Jamaica and her own personal expenses. (She hasn’t been charged with a crime," Cooper wrote.

"Abdullah has denied the allegations, but at least $8.7 million in donations is unaccounted for. The answer to where the money went may come soon," he continued. "California attorney general Rob Bonta has demanded that Grassroots turn over delinquent tax filings and late fees before Sunday, October 27. If it doesn’t, the organization’s tax-exempt status will be revoked."

The Free Press report declared that "charting the entire implosion of BLM is a confusing, chaotic endeavor," made even more confusing by legal disputes between BLM Global and BLM Grassroots. It detailed how BLM Global founders acquired a Los Angeles mansion, another mansion in Canada billed as a "transfeminist, queer affirming space politically aligned with supporting Black liberation work across Canada," and additional real estate including a Georgia property big enough for a private runway.

Cooper reported that co-founder Patrisse Cullors, who has long denied misusing funds, also paid several friends and relatives hundreds of thousands of dollars for things like security "services."

BLM HAS LEFT BLACK AMERICANS WORSE OFF SINCE THE MOVEMENT BEGAN, EXPERTS SAY

"But lately, donations to BLM Global have gone from a torrent to a trickle. In the fiscal year that ended in June 2023, BLM Global collected $4.6 million while spending $10.8 million, according to its federal filings. And while it still has $25 million in assets, its cash is dwindling. Unless something changes dramatically, the end is likely nigh," Cooper wrote.

"Maybe, if the founders had been as committed to social justice as to enriching themselves, BLM could have enjoyed a long life as a progressive institution," he added. "But it wasn’t to be."

Cullors did not immediately respond to a request for comment. She has long denied any wrongdoing related to misusing funds.

Black Lives Matter did not immediately respond to a request for comment.

#nunyas news#they really should have set up an endowment#but it was a scam anyhow#have to wonder if they thought it would keep going forever#like it was

23 notes

·

View notes

Text

I think the US has been a huge cultural shock for me for several different reasons (German here)

I have been to A LOT of different countries (Europe as well as south east Asia). And of course these countries all have different rules (how to tip f.e) and different food and traditions. But in the end it is always -more or less- easy navigating in those countries, because the „standard rules“ for „standard stuff“ are the same.

Not in the US… Idk if they even realize that btw?

That starts with the tipping. Every country has their own rules when to pay, who to tip, how much to tip. But no matter where i was, you usually round up to the next appropriate sum, hand out the money and say: „thank you.“

Not in the US. First you pay, (it’s not what you expect btw, because taxes aren’t included yet) then you get the recipe, then you write down your tip by hand, then you have to calculate the finale number and also write down the finale number by hand. The most complicated way to give a tip I ever encountered?!

Public toilets look like an invitation to spy on your neighbor?! (Just a side note)

Food? I have been on many different flights throughout my life (shame on me) and so far everyone said: „and after the dinner we serve water and coffee“. The American airline was the first one to say: „we serve a big selection of Coke“?! (That isn’t healthy!)

Same goes for the coffee break during our conference. Coffee wasn’t served, but Pepsi and Dr. pepper. Believe me, I am used to be served all kind of different stuff during coffee break from Fika to Geplak. But you always get water or tea or coffee.

And finding healthy food is incredible difficult. The US is the first country I have been to where they write the kcal next to their foods. I tried to find something without meat, a salad bowl… something like that. Nothing. Even the pizzeria served Burger? (Okay I was in Kansas City but still. Which Pizzeria served Burger?)

Also in the most rural area in Indonesia i was able to find an all vegan restaurant. Sure it’s part of their culture with having three major religions around, but today you can also easily find humus or avocado toast, nearly everywhere. Not in Kansas City. Atlanta Airport or Detroit airport. Nothing.

Also the insane amount of plastic that is used? I mean… maybe I was naïve but I thought: „hey they are western, I am western. The trash rules are probably similar.“

Yeah… no… Java has better anti plastic rules then the US (I am not talking about if Java also handles the plastic better at the end of the chain, but Java managed to enforce strict rules in a few years. Hardly any plastic anywhere. In the US? Everywhere.)

Also the costumer service. I mean they are all super friendly, they call you „hun“ and „babe“ (which i can deal btw) but because they act so bff with you I had more then one situation where they crossed the line to: „inappropriate“ in a way that I have never seen a costumer service do ever before

On the other hand I probably encountered the best costumer service ever.

So yeah… I had a wild time

12 notes

·

View notes

Text

Ga. islanders vow to keep fighting change favoring rich buyers

DARIEN, Ga. - Descendants of enslaved people living on a Georgia island vowed to keep fighting after county commissioners voted to double the maximum size of homes allowed in their tiny enclave.

Residents fear the move will accelerate the decline of one of the South’s few surviving Gullah-Geechee communities.

An aspect of the ordinance that residents take issue with is the fact that it erases a clause about protecting the island’s indigenous history.

During public meetings leading up to the vote, the zoning board proposed changes to the ordinance of lowering the newly allowed home size and removing talk of golf courses being added to the island.

Black residents of the Hogg Hummock community on Sapelo Island and their supporters packed a meeting of McIntosh County’s elected commissioners to oppose zoning changes that residents say favor wealthy buyers and will lead to tax increases that could pressure them to sell their land.

ISLAND’S HERITAGE

Gullah-Geechee communities like Hogg Hummock are scattered along the Southeast coast from North Carolina to Florida, where they have endured since their enslaved ancestors were freed by the Civil War. Scholars say these people long separated from the mainland retained much of their African heritage, from their unique dialect to skills and crafts such as cast-net fishing and weaving baskets.

Regardless, commissioners voted 3-2 to weaken zoning restrictions the county adopted nearly three decades ago with the stated intent to help Hogg Hummock’s 30 to 50 residents hold on to their land.

Yolanda Grovner, 54, of Atlanta said she has long planned to retire on land her father, an island native, owns in Hogg Hummock. She left the county courthouse Tuesday night wondering if that will ever happen.

“It’s going to be very, very difficult,” Grovner said. She added: “I think this is their way of pushing residents off the island.”

Hogg Hummock is one of just a few surviving communities in the South of people known as Gullah, or Geechee, in Georgia, whose ancestors worked island slave plantations.

MORE | Mom in Grovetown calls cops on U.S. energy secretary’s staff

Fights with the local government are nothing new to residents and landowners. Dozens successfully appealed staggering property tax hikes in 2012, and residents spent years fighting the county in federal court for basic services such as firefighting equipment and trash collection before county officials settled last year.

“We’re still fighting all the time,” said Maurice Bailey, a Hogg Hummock native whose mother, Cornelia Bailey, was a celebrated storyteller and one of Sapelo Island’s most prominent voices before her death in 2017. “They’re not going to stop. The people moving in don’t respect us as people. They love our food, they love our culture. But they don’t love us.”

Merden Hall, who asked not to be on camera, has lived on Sapelo his whole life. He says he’s worried about the sizes of homes now allowed on the island.

“I’m not comfortable with this. They approved the 3,000 square feet, that’s the only thing I disapprove of, because that’s going to raise property taxes,” he said.

Hogg Hummock’s population has been shrinking in recent decades, and some families have sold their land to outsiders who built vacation homes. New construction has caused tension over how large those homes can be.

Commissioners on Tuesday raised the maximum size of a home in Hogg Hummock to 3,000 square feet of total enclosed space. The previous limit was 1,400 square feet of heated and air-conditioned space.

Commissioner Davis Poole, who supported loosening the size restriction, said it would allow “a modest home enabling a whole family to stay under one roof.”

“The commissioners are not out to destroy the Gullah-Geechee culture or erase the history of Sapelo,” Poole said. “We’re not out to make more money for the county.”

Commission Chairman David Stevens, who said he’s been visiting Sapelo Island since the 1980s, blamed Hogg Hummock’s changing landscape on native owners who sold their land.

“I don’t need anybody to lecture me on the culture of Sapelo Island,” Stevens said, adding: “If you don’t want these outsiders, if you don’t want these new homes being built ... don’t sell your land.”

County officials have argued that size restrictions based on heated and cooled spaced proved impossible to enforce. County attorney Adam Poppell said more than a dozen homes in Hogg Hummock appeared to violate the limits, and in some cases homeowners refused to open their doors to inspectors.

Hogg Hummock landowner Richard Banks equated that to the county letting lawbreakers make the rules.

“If everybody wants to exceed the speed limit, should we increase the speed limits for all the speeders?” Banks said.

Hogg Hummock residents said they were blindsided when the county unveiled its proposed zoning changes on Aug. 16. Commissioners in July had approved sweeping zoning changes throughout McIntosh County, but had left Hogg Hummock alone.

Commissioner Roger Lotson, the only Black member of the county commission, voted against the changes and warned his colleagues that he fears they will end up back in court for rushing them.

Two attorneys from the Southern Poverty Law Center sat in the front row. Attorney Anjana Joshi said they had “due process and equal protection concerns” about the way the zoning ordinance was amended.

“In our view, this was not done correctly,” said Joshi, who added: “We’re just getting started.”

Located about 60 miles south of Savannah, Sapelo Island remains separated from the mainland and reachable only by boat. Since 1976, the state of Georgia has owned most of its 30 square miles of largely unspoiled wilderness. Hogg Hummock, also known as Hog Hammock, sits on less than a square mile.

Hogg Hummock earned a place in 1996 on the National Register of Historic Places, the official list of the United States’ treasured historic sites. But for protections to preserve the community, residents depend on the local government in McIntosh County, where 65% of the 11,100 residents are white.

#Ga. islanders vow to keep fighting change favoring rich buyers#Gullah Geechee#Gullah Land#sapelo#sapelo island#Freedmen Lands#Stolen Lands#nrohp#national register of historic places

66 notes

·

View notes

Text

The Civic Center MARTA Station never stops being impressive to me, hovering over the interstate highway and wrapped around West Peachtree Street. It's quite a sight, especially at night.

It's a shame that we aren't building train stations here anymore. The last one built inside the city limits of Atlanta was Buckhead Station, which opened nearly 30 years ago.

With the expansion of heavy rail looking less and less viable every year, due to the rising costs (which is a national problem), I had hoped we could at least fund some infill stations along the existing lines using the special transit tax. But the proposals for infill stations were dropped from the More MARTA spending list.

Will the ones built in the 20th century remain the only heavy-rail stations Atlanta has? It's certainly possible. At least for our lifetimes. If so, making the best usage of them is paramount.

Rezone for sensible density and affordable homes around all stations. Decrease the maximums for parking allowed near stations (studies have found the availability of parking is associated with lower transit ridership). Push the state government for dedicated operations funding to improve service and maintenance. Make sure the streets around stations have excellent design for walking and biking to stations.

Basically, act like we're in a city. Support our precious transit assets with urbanism that promotes ridership and that shifts more trips out of cars.

27 notes

·

View notes

Text

Following a string of water main bursts in Atlanta, the country is once again grappling with an age-old conundrum: how to stay ahead of an increasingly intractable list of water infrastructure challenges. Corroded pipes—some nearly a century old—failed near downtown and Midtown Atlanta, leading to shutoffs, boil-water advisories, and growing frustrations for thousands of households and businesses (the final tally is still unclear). Repair crews raced to fix the bursts and local leaders pledged financial relief for those affected, but ongoing concerns remain over the full extent of the water system’s needs.

Atlanta’s water needs are locally problematic, but they are also nationally emblematic of a broader water infrastructure challenge: America is failing to invest enough in its water systems.

From Flint, Mich., to Jackson, Miss., to a seemingly unending number of urban and rural communities, the country’s water infrastructure is aging and in need of repair. Contaminated drinking water, including lead pollution, is often the most glaring sign of an often-invisible challenge. But leaking pipes, combined sewer overflows, and other chronic issues persist too. An increasingly destructive climate, including more frequent floods and droughts, is not helping matters either. The ripple effects of these failures are also extensive across different systems, leading to network failures across neighborhoods and entire regions.

More than $600 billion in investment is estimated to be needed over the next 20 years to keep up with all the necessary improvements, according to the latest EPA national water assessments. Even with more federal funding from the Infrastructure Investment and Jobs Act (IIJA), these estimates continue to escalate.

Water main bursts like those in Atlanta are the quintessential example of our investment backlog. An estimated 260,000 pipe failures happen each year, or about 11.1 breaks for every 100 miles of pipes, based on a survey conducted by Utah State researchers. Many of these pipes are older (53 years on average) and made of more susceptible materials such as cast iron. But more striking is that an estimated 20% of pipes in this survey are beyond their useful life and will require $452 billion to replace. This figure also does not account for all the utilities scattered across the country, but only captures a fraction of the full extent of the national cost.

While these various water infrastructure needs and costs are concerning in themselves, the bigger issue is the lack of financial capacity to address them. Local water utilities are the primary owners and operators of this infrastructure, responsible for upwards of 90% of all public spending each year on the country’s water needs. Yet, with more than 50,000 utilities in the U.S., they are often highly localized and fragmented in their operations and service areas, as well as limited in their ability to generate predictable and durable revenue from ratepayers. That’s especially the case in cities like Flint and Jackson that have endured population loss and economic disinvestment over many decades. The tension between balancing water investment and affordability is ever-present.

The financial pressure is immense on local utilities—and other state agencies—who are constantly trying to cobble together enough resources to stay ahead of these needs. Beyond increasing rates, utilities are implementing new fees (e.g. stormwater fees) to keep up with the pace of repairs and other regulatory pressures. They are appealing to voters and passing ballot referenda; Atlanta, in fact, recently approved a one-cent sales tax to cover needed water upgrades. Utilities are also investing in more cost-effective designs, technologies, and other upgrades to provide more reliable service; Atlanta has also invested in widespread pipe improvements and more resilient green infrastructure installations.

But even these steps are not enough, as Atlanta’s recent experience demonstrates. So where does the country go from here?

The first step is to establish increased, sustained federal water funding. While the IIJA pumped about $57 billion into a host of different water infrastructure improvements, this figure still pales in comparison to the price tags noted earlier. Even when including additional funding for watershed and resilience improvements from the Inflation Reduction Act (IRA), there is still an outstanding needs gap. Federal investment, ideally tuned to need and ability to pay, can ensure all communities gain the resources they need. Recent conversations in Washington have generally supported more investment, including reauthorization of funding for flood control and other waterway projects. But the reality is that federal funding lags behind the full scale of water needs nationally, and utilities are scrambling for predictable resources.

The second step is to support continued local and state experimentation. While many utilities are struggling to simply keep up with existing repairs, that should not be an excuse for failing to test more proactive and collaborative solutions. Considering alternative revenue sources, breaking down governance siloes, and creating new asset management strategies are among these possible solutions. Admittedly, larger urban water systems tend to have greater capital budgets, existing financial resources, and staffing levels to accelerate new types of projects and other repairs. Seattle, for instance, has established more comprehensive and community-led plans around different upgrades, as have utilities in Milwaukee, Washington, and other cities. But utilities in more resource-constrained cities like Camden, N.J., and Buffalo, N.Y., are also launching innovative plans and partnerships to accelerate improvements.

Atlanta’s water dilemma is not an isolated phenomenon. Expect more water disruptions in the months and years to come. At this point, it’s not a question of if, but when in many communities. As these challenges and their associated price tags mount, though, they will serve as continual reminders of the need for more sustained funding and proactive innovation.

13 notes

·

View notes

Text

The Democratic party needs drastic changes in messaging to win the next election. The party is seen as old, affulent, and out of touch with middle America.

Harris did, in part, what she attempted to: make gains in white, college educated suburbs while minimizing losses everywhere else. She did the first part relatively well.

The Democrats believed that by moving to the right on specific issues, they could win moderate suburban (generally wealthier) voters. Harris portrayed herself as tough on crime, strong on border control, and put forth means tested welfare policies. She did her best to portray herself as an extension of the status quo, and Trump as a radical.

Democrats made gains they desired: in the suburbs of Atlanta and Dallas, and shifts to the right were minimized in wealthy suburbs outside cities like Milwalkee and Austin, even as those states made hard turns to the right. In 2024, more than any other election year in recent history, voters for the Democratic candidate were comparitively wealthier and older.

It is clear that voters wanted a change to the status quo. If the Democrats want to get back the voters they lost: Hispanic and Black voters in high cost of living cities, working class voters in the rust belt, young voters, they need to acknowledge that the issues they are facing are real.

Globalization and neoliberal economic policy have led to a loss in manufacturing jobs. Poor planning has made large cities too expensive to live in. Inequality and midde class flights have led to poverty concentration in urban centers and increased crime. Job growth is strong, but most of this growth has been in lower paid service sector work: underemployement is a real issue for young voters, and they are generally worse off than previous generations. And politicians, wealthier than ever, seem more bothered by fundraising and corporate interests.

And Republicans have been able to make these issues stick to Biden-Harris.

Workers feel screwed over and overworked, and Trump is telling people that they are. He says immigrants and "coastal elites" are bringing crime and taking jobs, while Americans are being left behind. Trump, to the working class voters who left the Democrats behind, was seen authentically pointing out issues "everyones thinking about:" job loss, crime, immigration, war, and inflation. Trump's platform is short and to the point, while Harris's takes 600 words to answer one policy question.

Elections are based on vibes, and the "Vibe" of the Democratic party is that it's dominated by liberal intellectuals and party machine candidates. Policy such as student loan forgiveness, tax cuts for first-time homebuyers, etc, mean nothing to voters who never went to college and can't imagine buying a home in this economy.

If the Democrats want to move to the right on issues like crime and immigration--if they think this will better reach voters--they cannot simply just take a page out of the Republican's playbook and start talking about border security and being tough on crime. Using Republican framing will fail and will just legitimize Republican talking points.

If they want to move right on issues of immigration and crime, Democrats need to frame the issues in "Democrat" ways. Talk about the potential depressing effect immigrants have on wages. Talk about how big agribusiness loves illegal immigration because they can exploit that labor more, and this is why nothing is done. Talk about inequality and its relation to crime. Talk about how large chains have eaten away at small businesses in middle America, killing downtowns and a small town middle-class.

Democrats also must talk about issues that are generally relatable to voters and motivate their base. Issues like expensive health insurance, strong union rights, high housing costs, stagnant real wages, and money in politics.

A Republican would tell you that it was DEI, abortion, and lgbt issues that caused voters to leave the Democratic party, but I would disagree. Harris, more than Hillary, minimized her gender and focused on policy. Voters broadly agree with the democratic party on issues of abortion and lgbt, but those issues are simply not as important as the core economic issues that bring people to the polls.

I voted for Harris, but I could see her loss coming before the election started. I work with people on the ground, and they feel unheard.

3 notes

·

View notes

Text

The first MARTA passengers, at GSU Station in July of 1979. MARTA rail came together pretty quickly, at least by today's standards.

Seattle voted down their proposed rail transit system in 1970, meaning the money (about $800 million) went to Atlanta

The MARTA sales tax was passed in 1971, guaranteeing operations funding

Rail construction began in 1975

Rail service on the east line began in 1979

That's less than 10 years between the funding and the first passengers. Even when you consider that preliminary concepts and political work for MARTA rail started in 1965, that's still less than 15 years.

Meanwhile, the Tax Allocation District funding for the Beltline began 20 years ago and the first rail line isn't expected to open until 2028. Better late than never, but I have nostalgia for the heady days of the 1970s when things seem to have happened more quickly.

(Photo source: GSU Digital Collections)

#atlanta#marta#public transportation#public transit#marta rail#rail station#transportation planning#urban planning#urbanism

10 notes

·

View notes

Text

All in the family

I finally broached the subject of Fox News and the Big Lie with my Trumper sister. As I suspected, being a Fox-only viewer, she had never even heard of the Dominion lawsuit and exposure of Fox and its 'talent' as bald-faced liars. Here's what I wrote her in response:

I know it must be hard to realize there is a TV network that to all outward appearances is a normal news outlet but is in actuality a sophisticated propaganda operation. Trump, as Joseph Goebbels before him, knew that if you repeat a lie enough times people will believe it because...well...they've heard it so many times it just must be true. Fox follows the same strategy.

Trump's inauguration had the biggest crowd ever. Remember that? The lying started on the first day. Crime is rising and out of control. Cities are too dangerous to go out at night. Lies. NYC is safer than Tallahassee and Atlanta. You'd never know that watching Fox News. Convoys of criminals are swamping the border. False. In any event, the US needs immigration. Who will clean the pools and pick the strawberries? Yes, current laws are a mess, but that's because the GOP torpedoes every attempt to fix them. Why solve a problem that provides such a juicy cudgel to beat your opponent with?

The US is a broken system right now and I'm not sure it can be fixed. One side is trying to conduct business as usual, even if they are flawed humans and make mistakes. Bridges and roads are finally getting repaired. LGBTQ+ problems are being addressed instead of condemned. Do I agree with every policy the Dems have? Christ I don't even understand some of them. I have to stop and do a mental walk-through to get it straight in my head what a trans woman is. But the other side is destruction and division. Marginalize the poor. Restrict women's right to control her own body. Banning books? The people in history who have done that never come out as the good guys.

Turn away the refugee, despite what their Good Book says. Look the other way when thousands of innocent children are mowed down into grotesque chunks of meat by weapons of war in the hands of other children. It's not 'mental health', it's not 'too soon' to talk about it. It's too many guns of a kind that should never be in civilian's hands.

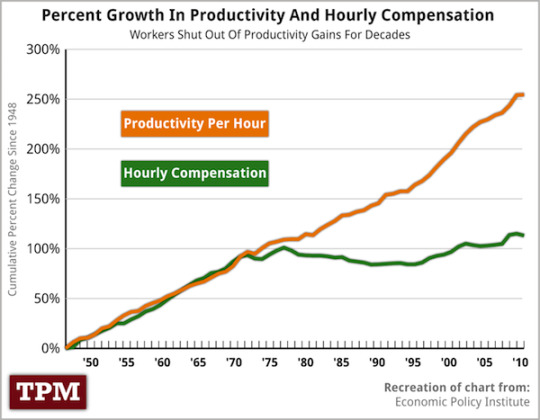

I have to include one chart, but it pretty much explains why the country you and I grew up in is no longer. The ability to raise a family, buy a house, send your kids to college, and take a vacation every year on one income is long gone. Why? Here's your answer:

Yes, the chart ends in 2010 but the damage had already been done. What it shows is that the profit made by producing goods and services was diverted away from the people producing them and taken instead by the 'rentier' class -- the owners. How? Well, Reagan broke the unions in his first months in office. (Air traffic controllers strike). The SEC bowed to pressure and for the first time allowed stock buy-backs, meaning companies could direct profits straight to the owners, bypassing the workers. The new oligarchs discovered they could buy the lawmakers and the courts and cut taxes drastically. The gap between the two lines in the chart represents trillions of dollars that were diverted from the workers to the owners. They should have just stuck to share-and-share alike and not gotten so greedy.

I could go on for a long time. There has been so much damage done...

As Jon Stewart said -- I guess I'm woke. I just thought I was good in history.

She basically replied "both sides are dirty" and told me to fuck off.

Oh well.

51 notes

·

View notes

Text

Info for Faith In The Future World Tour ATLANTA, GA - JUL 15 2023

With special guests THE SNUTS & ANDREW CUSHIN!

Important Times:

6:00 PM - Doors Open

7:00 PM - Andrew Cushin

8:00 PM - The Snuts

9:00 PM - Louis Tomlinson

Times are all approximate and subject to change.

General admission (lawn tickets):

The venue does not allow camping or overnight parking of any kind.

The lawn is always first come, first served.

Guests may notice a row or seat number on their lawn ticket, but that is only used for tracking purposes.

There are no assigned seats on the lawn.

Blankets are permitted, but for your safety chairs are not allowed.

Subject to updates. Check the venue’s socials for updates!

🔆⚠️HIGH TEMPERATURE ADVISORY ⚠️🔆

HIGH TEMPERATURES expected in Atlanta!

Temperatures will reach above 90ºF/ 32ºC

YOU MUST Hydrate before the show, while waiting in line and during the show

Thunderstorms expected ⛈. Prepare accordingly.

Wear sunscreen!

The whole venue is OUTDOORS. Event is rain or shine!

💧⚠️ HYDRATION ADVISORY ⚠️💧

YOU MUST Hydrate before the show, while waiting in line and during the show

For optimal hydration drink something with electrolytes such as Gatorade or LiquidIV

Eat well!

Here are important things to know:

Ticket screenshots will NOT be accepted. We strongly recommend downloading your tickets BEFORE you arrive at the venue so you do not have any trouble getting into the show.

The venue is cashless! Pay with card and mobile pay!

Multiple ATMs on site located on both plazas near Gate 1 & Gate 4.

Restrooms are located in both plazas, near Gate 1 and near Gate 4.

Parking: Parking is sold on the night of show for $30 plus tax. Handicap Parking is located near Gate 1 on Elliot Galloway Way NE. Please note accessible parking is first come, first served, so if you don't absolutely need it, please park elsewhere.

Taxis & Rideshare: The easiest place to meet a taxi is at the top of the hill by Gate 2 or you can walk to Horseradish Grill. Uber pickup and dropoff is at 4469 Stella Drive NW, Atlanta GA 30342

ADA info here

Cameras: non-professional only, no detachable lenses. Disposable cameras and small digital cameras ok. Any camera that has a detachable lens will not be allowed in. If the camera lens zooms out more than 1 in it will not be allowed in.

Average sized blankets or beach towels ALLOWED

Umbrellas - personal sized only, no sharp points. ALLOWED

Water: 1 factory sealed bottle up to 1 liter/33.8oz per person. Empty Aluminum bottles, refillable plastic water bottles are permitted.

NO Glass containers or cans

NO Alcohol

NO Coolers

NO Animals (except service animals with paperwork)

NO Illegal drugs

NO smoking

NO Lawn chairs

NO Balloons

NO Fireworks or sparklers

NO knives, firearms, Brass knuckles, Tasers & mace/pepper spray or weapons of any kind

NO Wallet chains or Long Chains/Sharp Spikes

NO Recording devices, iPads/laptops

NO Selfie sticks, drones

NO Laser Pointers/flashlights

NO Scooters/Skateboards or Hoverboards

NO Whistles, horns or other noisemakers

NO Strollers or Wagons

There is NO RE-ENTRY!

Lost & Found info here

VIEW VENUE MAP

VIEW SEAT MAP

*This list is not exhaustive. Items not appearing on the list may still be prohibited at the discretion of Security.

For more details click here and here

Bag Policy:

Clear plastic, vinyl or PVC tote bags no larger than 12” x 6” x 12” and/or

small clutch bags (6”x 9”), don't have to be clear

NO Large bags or backpacks

Banners, signs and flag policy:

Signs larger than 8.5" x 11" are not allowed. This size is a standard sheet of paper.

All signs must be appropriate in nature and not be a distraction to the artist.

Merch:

Merch will be available for all concerts at our Concert Gear booths located near Gate 1 and near Gate 4.

Please make sure you check that you have the correct size and there are no defects in the shirt before you walk away from the stand.

The venue cannot assist with replacing or refunding any merchandise after the event has ended.

Contact:

For additional questions please call the venue at 404-233-2227. You can also access their website. Check their Twitter and IG for updates. Address: 4469 Stella Dr NW, Atlanta, GA 30342. Venue: Cadence Bank Amphitheatre at Chastain Park

13 notes

·

View notes

Text

Huge Announcement! Our Firm Express Tax Financial Group is now helping taxpayers get IRS tax relief! IRS problems are a very personal type of problem and people often do not know where to turn for help, especially during times like these.

Many people just live with their back tax problem for months and sometimes years, assuming that nothing can be done about it. It’s easy for good, hard-working Americans to fall behind. Providing IRS Tax help to South Atlanta & surrounding areas was a natural evolution for us at Express Tax Financial Group.

I have come across many people who have tried to handle their IRS situation themselves (or with their current CPA or person who prepared their taxes) but didn’t receive the relief they were seeking.

The professionals on our staff know the “ins and outs” of the tax system and can negotiate a personalized solution for you.

My firm now handles IRS representation services which include: Preparation of Unfiled Income Tax Returns, Penalty Reduction, Offers in Compromise, Payment Plans, Financial Hardship Plans, Wage Garnishment/Bank Levy Releases, Audits and IRS Appeals.

We’ll listen to your IRS difficulties in our office, or via zoom, in complete confidence at NO CHARGE. We’ll answer your questions, explain your options, and suggest solutions and provide you with a written estimate of our fees to permanently resolve your IRS difficulties. Send us a private message or check out our website at www.expresstaxrescue.com

2 notes

·

View notes

Text

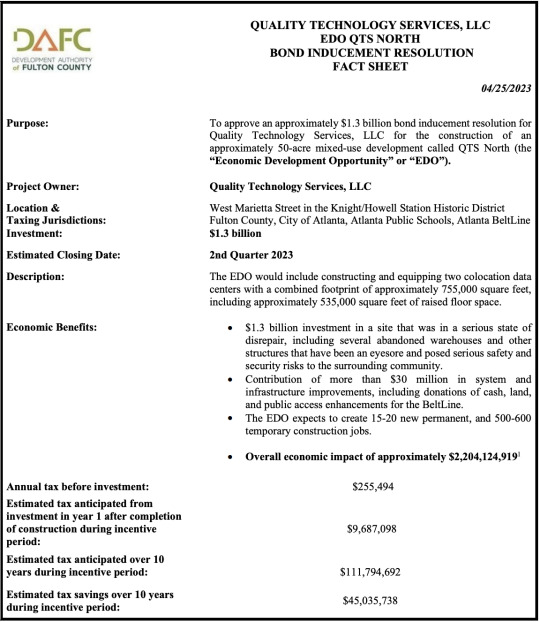

Atlanta & Fulton residents: say NO to $45m tax giveaway

CALL TO ACTION:

Please join us in sending a comment to the Development Authority of Fulton County today (Monday, April 24, 2023) about a ridiculous tax break they're considering at tomorrow's meeting!

Tell them to vote "no" on the Quality Technology Services bond inducement for their new data center on West Marietta Street. Since this project is already underway, providing it with a tax savings of $45,035,738 qualifies as an unnecessary handout to the company -- one that comes at a cost to Atlanta Public Schools, the City of Atlanta, and Fulton County.

This is a prime investment property in that it's next to the popular Atlanta Beltline. No inducement is needed for a place where developers are already willing to invest. It's exactly the kind of tax break that DAFC needs to stop providing. These big companies need to pay their taxes for the public good!

Address your public comment to the Regular Monthly Meeting of DAFC on Tuesday, April 25, 2023.

EMAIL: address:[email protected]

11 notes

·

View notes

Text

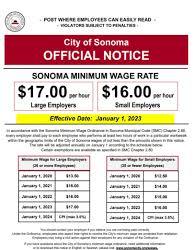

California followed suit with the fair chance act to compete for a job act of 2019 that me and Mayor Bill De Blasio put in to place if you know the story I got that from Michelle Alexander book the new Jim Crow of mass incarceration of the so called poorer people of America that law is suppose to help their chances of gaining employment and not facing discrimination in getting their housing apartments applications and a license to be a counselor , casac , security guards, even a barber or any other job needing licensure you can hit that with Article 23A and get your license and job , I still say we should ban the conviction box on the job application I think I taught you how to get out of that and get a job just scroll down on this page , recently California just raised their minimum wage following suit from me and Governor Andrew Cuomo minimum wage salaries raised program in New York City California went as much as $ 20 Dollars an hour that is very good better than New York but Kathy Hochul the Governor is fixing that for New Yorkers she is pretty good a friend of mines true I always say they should cut how much taxes they take from a person paycheck it is sad to see people working that can't afford child support let alone support themselves they can't afford the rent , food for the week or give their spouse support and even transportation and they work provide services for their employers and their city or town and they have a job providing services to make life better for the people's that is bad help them keep more of their paycheck in their pocket and bank accounts and boost their salary funny thing is employers that get in on that there are tax breaks and tax cuts for them and tax benefits for them where was they at before I came along being that the cost of living is okay in California other states should follow suit now imagine if they did that in regions like Louisiana , Atlanta , Texas , North Carolina , Delaware , Chicago , Boston , Baltimore , which they should being that you can get an apartment for $ 400 to $ 800 monthly that leaves money for transportation , food for the week , school tuition private school tuition for their kids to afford their kids a great future better city services like sanitation services and cleaner and better parks like New York City which now how laps and miles counters and city shelters have water fountains that save for recycling with their bottle refill machines , the wages has been stagnant for decades in those regions I propose we raised the National minimum wage level to $ 20 - $ 25 dollars an hour to better assist in the states creating a better quality of life for it's citizens and beautify their neighborhoods with Citibikes like New York City got now and legal recreational Marijuana stores on every corners and guardrails in our train stations ensuring the safety of the people .

I dedicate my life to Joyce Meyer my pastor and my mom and now she is a pastor of yours now and also a mother of yours now , the new Mother Teresa of our times on a serious note New Yorkers are using voodoo like it is the new cool even kids are using voodoo witchcraft now no the new cool is learning your religion all over again it is okay you are redeemed , restored and forgiven and love being one of Gods favorite people no matter what religion you consider yourself to be in you could be anything you want except a knowingly evil person the holy spirit will get you everytime and that is promised and is what is promised .

I'm inviting you and introducing you to some of my favorite people Joel Osteen of Lakewood church in Houston Texas get all his books your best life now and change your life your rusty old foul self into a beautiful beautiful beautiful human being and read my mom books and you can call her your mom now Joyce Meyer the new Mother Teresa of our times and the Joyce Meyer ministries read their books and follow their show that is what I do and so should you , get the books you are going to love the books that is on their bookshelves .

Introducing

National minimum wage salaries raised to better pay and quality of life bill .

Just scroll this page to learn more .

24 × 7 = 168 hours

In 1995 Timothy McVeigh killed 168 people poor soul

Columbia Presbyterian hospital is on 168th street and 168 is the end of the C train line

I am blessed and happy and to be envied because my iniquities are forgiven and my sins are covered up and completely buried . The Lord will take no account nor reckon it against me . - Romans 4:7 - 8

I am useful and helpful and kind to others , tenderhearted ( compassionate , understanding , loving - hearted ) , forgiving others ( readily and freely ) , as God in Christ forgive me . - Ephesians 4:32

All my children are christians and have christian friends , and God has set aside a Christian wife or husband for each of them . - 1 Corinthians 15:33

BE like this please 🥺 it works you love the lifestyle .

My children are not unequally yoked with unbelievers . - 2 Corinthians 6:14

My children walk and live ( habitually ) in the ( Holy ) spirit ( responsive to and controlled and guided by the spirit ) .

My children obey me in the lord , for this is right . They honor their father and mother - which is the first commandment with a promise - " that it may go well with them and that they may enjoy long life on the earth . " - Ephesians 6:1 - 3

I do not exasperate my children : instead I bring them up in the training and instruction of the lord . - Ephesians 6:4

God is good if I hear other humans talking to me 24 / 7 and is still able to do miracles like that and this page then I know God is the winner and not Satan in the end though and I choose to go the way of God not other forces .

Normal person hear cars and buses and trains go by them me I hear the sounds of the city but with me a tape is playing 24/ 7 in my head a verbal abusive self hating tape in my head it is people from the street crowd or rough and dirty crowd only dirty people do stuff like that it is sad that voodoo has become their way of life and no religion , no thank you since I became Talented Tenth now I judge other humans by the content of their character not the color of their skin , good luck to me and ridding myself of that auditory world of my own no thank you to those voices and bad people and their cognition distortions .

Thank you for Joyce Meyer and her books go get them they will change your life .

Thanks Governor Andrew Cuomo for my incubator in Brooklyn I'm keeping it and heeding to his advice , I'm good and enjoy the page .

1 note

·

View note

Photo

LETTERS FROM AN AMERICAN

March 16, 2023

Heather Cox Richardson

Yesterday, Tamar Hallerman and Bill Rankin of the Atlanta Journal-Constitution reported that the special grand jury in Fulton County, Georgia, investigating the attempt to overturn the 2020 presidential election in that state, heard yet another recording of former president Trump pushing a key lawmaker—in this case, Georgia House speaker David Ralston—to convene a special session of the legislature to overturn Biden’s victory.

One juror recalled that Ralston “basically cut the president off. He said, ‘I will do everything in my power that I think is appropriate.’ … He just basically took the wind out of the sails.” Ralston, who died last November, did not call a special session.

This is the third such recorded call. One was with Georgia secretary of state Brad Raffensperger, and another was with the lead investigator in Raffensperger’s office. Ralston had reported the call, but it was not public knowledge that there was a recording of it.

Hallerman and Rankin interviewed five members of the grand jury, which met for 8 months and heard testimony from 75 witnesses. The jurors praised the elections system, and one said, “I tell my wife if every person in America knew every single word of information we knew, this country would not be divided as it is right now.” Another said: “A lot’s gonna come out sooner or later…. And it’s gonna be massive. It’s gonna be massive.”

The special grand jury recommended Fulton County district attorney Fani Willis indict people involved in the attempt to overturn the election. The cases are now in her hands.

Yesterday, prosecutors in New York met with Stormy Daniels, the adult film actress whom Trump allegedly paid $130,000 to keep their sexual liaison quiet. Also yesterday, Trump fixer Michael Cohen testified before a grand jury about the hush-money payment. Cohen’s testimony suggests that Manhattan district attorney Alvin L. Bragg is considering an indictment on a felony charge for misrepresenting the nature of that payment.

Trump has a new lawyer in that case, Joe Tacopina, who has been making the rounds on television shows to insist that Trump isn’t guilty. Tacopina’s job isn’t easy, and he is not necessarily helping, telling MSNBC’s Ari Melber that Trump didn’t actually lie about the hush payment when he lied about it because he was not under oath and he didn’t want to violate a confidentiality agreement.

Also in New York, Trump has asked a judge to delay the $250 million civil case against him, his three oldest children, and the Trump Organization, for manipulating asset valuations to get bank loans and avoid taxes. New York attorney general Letitia James, who brought the suit, said the defendants had had plenty of time to prepare and that Trump is trying to move the case into the election season, at which point he will insist it must be delayed again.

Katelyn Polantz, Paula Reid, Kristen Holmes, and Casey Gannon of CNN reported today that the federal grand jury investigating Trump’s handling of classified documents has interviewed dozens of Mar-a-Lago staff, from servers to attorneys. Special Counsel Jack Smith continues to try to get Trump lawyer Evan Corcoran to testify after prosecutors learned that on June 24, 2022, Trump and Corcoran spoke on the phone as Trump had been ordered to produce the missing documents and the surveillance tapes of the area.

Prosecutors want Corcoran to have to testify despite the attorney-client privilege he claims, using the “crime-fraud exception,” which means that discussions that aided a crime cannot be kept secret.

In the face of this mounting legal pressure, Trump took to video to demand: “The State Department, the defense bureaucracy, the intelligence services, and all of the rest need to be completely overhauled and reconstituted to fire the deep staters.” Then, he said, his people need to finish the process he began of “fundamentally revaluating [sic] NATO’s purpose and NATO’s mission.” “[T]he greatest threat to Western civilization today is not Russia,” he said, but “some of the horrible USA-hating people that represent us.”

This speech was not simply a defense of Russia and its unprovoked invasion of Ukraine. In his attempt to undermine the legal cases against him, Trump has endorsed the “post-liberal order” whose adherents reject the American institutions that defend democracy. In their formulation, American institutions they do not control—“the State Department, the defense bureaucracy, the intelligence services, and all of the rest,” for example—are corrupt because they defend the ideas of equality before the law, a free press, religious freedom, and so on. They must be torn down and taken over by true believers who will use the state to enforce their “Christian nationalism.”

In that formulation, the FBI and the Department of Justice are persecuting good Americans who were trying to protect the country on January 6, 2021. And yesterday, Zoe Tillman of Bloomberg reported that Matthew Graves, the U.S. attorney in Washington, D.C., sent a letter on October 28 last year to Chief Judge Beryl Howell warning that as many as 1,200 more people could still face charges in connection with the January 6 attack on the U.S. Capitol.

Today, the House Republicans announced an investigation, run by Representative Barry Loudermilk (R-GA), into the House Select Committee to Investigate the January 6th Attack on the U.S. Capitol. The January 6th committee asked Loudermilk to talk to it voluntarily to explain why he gave a tour of the Capitol complex on January 5, 2021, a time when the coronavirus had ended public tours. One of the people on that tour showed up on a video the next day threatening lawmakers.

Loudermilk told Scott MacFarlane and Rebecca Kaplan of CBS News that Americans have “very little confidence” in the report of the January 6th committee, “[a]nd there’s good reason. I mean, you even consider what they did to me, the false allegations that they made against me regarding the constituents that I had in my office in the office buildings—accusing me of giving reconnaissance tours.”

Loudermilk, who chairs the House Administration subcommittee on Oversight, says his committee will work “aggressively” to explain why Capitol security failed on January 6 and will seek interviews with people involved, including former House speaker Nancy Pelosi (D-CA). He says his panel will “be honest, show the truth, show both sides.” Representative Norma Torres (D-CA), the top Democrat on the panel, notes that Loudermilk has not informed the Democrats even of the dates on which the committee is supposed to meet.

Politico’s Heidi Przybyla today reported on a February 2023 “bootcamp” for Republican staffers to learn how to investigate the Biden administration. The camp was sponsored by right-wing organizations including the Conservative Partnership Institute, which is led by Trump’s former chief of staff Mark Meadows and other right-wing leaders and which raised $45 million in 2021 alone. Sessions included “Deposing/Interviewing a Witness” and “Managing the News Cycle.”

At one of those investigations yesterday, Representative Marjorie Taylor Greene (R-GA), who sits on the Homeland Security committee, said she intended to divulge classified information, saying: “I’m not gonna be confidential because I think people deserve to know.” She claimed that drug cartels had left an explosive device on the border; U.S. Border Patrol chief Raul Ortiz later posted a picture of the “device” and said it was “a duct-taped ball filled with sand that wasn’t deemed a threat to agents/public.”

Meanwhile, the Biden administration continues to administer.

Today, Sanofi, the third major producer of insulin in the United States, announced it will cap prices for insulin at $35 a month. Sanofi, Eli Lilly, and Novo Nordisk produce 90% of the insulin in the U.S. The producers have faced pressure after the Inflation Reduction Act lowered the monthly cost of insulin to $35 a month for those on Medicare.

—LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

[From comments :: “Wild how Putin just assumed Trump would win one way or another and Ukraine would have been an easy acquisition. NATO and our State Department would have been dismantled.Scary to think this evil is still so prevalent in our government with the help of Mark Meadows and Steve Bannon lurking around the back doors.”]

#Heather Cox Richardson#Letters From an American#TFG#Gangster Trump#Fulton Co. Ga.#House Republicans#Corrupt GOP#Criminal GOP#January 6 2021#January 6 Commission

4 notes

·

View notes