#stock market free course

Explore tagged Tumblr posts

Text

Demystifying the Stock Market: A Comprehensive Guide for Beginners

The stock market, a conceptual behemoth in the investment world, often presents itself as an intricate maze for newcomers. With its fluctuating numbers, complex terminologies, and the oft-cited promise of financial growth, it's no wonder many individuals view this financial frontier as both fascinating and intimidating. However, when approached with a strong foundation and clear guidance, the stock market can be navigated with confidence and understanding.

It’s this very foundation that the "Beginners Guide to Stock Market" course by Finology Recipe aims to build. Designed with the beginner in mind, it’s the linchpin to unlocking clarity in what may initially appear to be a convoluted financial domain. Through this course, learners can strap in for an enlightening tour of the stock market, honing their knowledge from ground zero to insights that drive investment decisions.

Course Design: A Marathon for Mastery

True to its name, the "Beginners Guide to Stock Market" is a marathon—not a sprint. Over nine modules, learners embark on a comprehensive journey over two hours. This strategic design is augmented by the medium of instruction being English, catering to a wide audience with varying educational backgrounds.

Course Curriculum: In Pursuit of Financial Literacy

The course outline is systematic and inclusive, addressing key elements in a progressive manner. It includes:

Introduction to Stock Market: Setting the stage, this module invites participants to understand the stock market's purpose and functions.

Different Investment Instruments: Beyond stocks, there's a whole spectrum of investment avenues, from bonds to mutual funds, each with its own risks and rewards.

Regulators of Financial Markets: Transparent and fair markets are crucial. This section dives into the regulatory bodies that help maintain the integrity and efficiency of the markets.

Common Trading Terminologies: Jargon can be daunting. Terms like 'bear market,' 'bull market,' 'IPO,' and many more are demystified for easy digestion.

Philosophy Behind the Course

Acknowledging the anxiety that often accompanies financial decisions, the course creators have leveraged an educational philosophy centered on clarity and playfulness. The objective is not merely to impart knowledge, but to instill wisdom that dispels fears associated with market participation.

Course Components: A Rich Learning Experience

Factors that set this learning experience apart include:

PDFs: For those who appreciate the tangible handle on learning materials, downloadable PDFs provide the benefit of offline study and review.

Flashcards: Interactive learning is made more engaging with flashcards – an innovative method to remember complex concepts.

Assessments: Knowledge without measurement can be directionless; hence, assessments are integrated to mark progress.

Certificate: A certificate of completion not only marks an achievement but also reflects a commitment to understanding the intricacies of the stock market.

Starting Your Investment Journey

For those on the cusp of starting their investment journey, the "Beginners Guide to Stock Market" stands as an open door – an invitation to learn and grow within the exciting world of finance. The course promises not just theoretical knowledge, but also practical insights that can be foundational for making informed investment choices.

In essence, the course serves as an interpreter, translating the often-incomprehensible language of the stock market into digestible, learner-friendly concepts. The intention is to nurture and produce financially literate individuals equipped to engage with the market proactively.

Admittedly, participation in the stock market is no promise of immediate profit. It demands patience, resilience, and an informed perspective—qualities that this course strives to foster. For those who have eyed the market with trepidation or simple curiosity, a resource such as this might not just serve as an educational tool, but as a critical stepping stone towards personal financial empowerment.

0 notes

Text

Beginners Guide to Stock Market | Learn Stock Market Basics | Finology Quest Course

Dive into the world of stock market with our 'Beginners Guide to Stock Market' course. Learn key concepts, investment instruments, trading terminologies, and more over 9 modules. Join us on this educational journey to enhance your financial knowledge. Access PDFs, flashcards, assessments, and earn a certificate upon completion. Start learning now!

#learn stock market from scratch#stock market free course#learn trading from scratch#stock market courses for beginners#how to learn stock market from scratch#basics of stock market course#learn stock market trading from scratch#share market free course#stock market course for beginners#how to learn trading from scratch#free stock market courses#stock market course

0 notes

Text

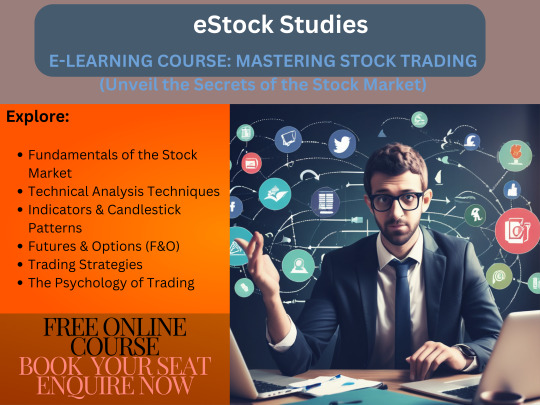

eStock Studies: Online Trading Courses from Basics to Advanced.

eStock Studies: free Online Stock Market Trading Courses from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading courses#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading Courses#expert trading institute

2 notes

·

View notes

Text

Current temperature inside of my room right now in the middle of the night whilst about to go to sleep... villain origin story...

#You just get SOOOOO tired of being hot all the time for multiple days straight.. with very little relief ever... hhHHHH#I forget that I literally lose my mind and become evil every summer like clockwork#I don't evenknow what I mean by that because I'm just as calm/monotone as ever lol.. but I just feel more evil.. low level pent up rage#or something. nothing changes on the outside but on the inside it's like hmm.. I'm like 5% more hostile than I usually am#not outwardly expressed still of course. but just.. my bones are made of a little more violence recently..#percentages moving around. My character stats get a temporary modifier all summer where I feel chronically just a LIIIITLE more noticably#unhinged. like I will never do it of course. but I will think about. maybe I'll just throw all the plates at the wall and break every wind#ow with a baseball bat. No. I shant. I would never.. but .. I could. 5% more than I usually could. But I shan't. but let it be known.. I#c o u l d ...i COULD.. if I had to. but I don't.. but still.. keep the notion in the back of the mind.. hmm.. lol#And this is not even during a heat wave at the moment it's just like.. normal summer.. >:')#I think it's also largely the shitty apartment which was not built for coolness. Like older houses will have tall cielings and those window#above the doors and ceiling fans and be built high up from the ground and all these other ways to manage warm weather#naturally. but cheaply constructed dinky city apartments with no ventilation and windows only on one side and blah blah#It retains heat insanely like being trapped in a green house or something#even with all the windows open & fans in the house and stuff it just doesn't really move air well because the space is not made to do that.#Also really testing my anticapitalism/leftism/etc... sitting and thinking 'damn maybe I should play the stock market.. I should sell#some sculptures and overprice them.. howmuch could I charge for these clothes..' < *is desperate to afford a living situation with central#heating and air conditioning*#Haha! Guillotines?? who said anything about those? I LOVE rich people.. haha.. now what's a guy gotta do to instantly get about $50.000 ar#ound here? haha! kidnap someone and sell their organs? okay haha! I love the free market! going to home depot right#now to buy an axe! Don't you just hate taxes? so glad I live in the best country in the world under the best economic system on the planet#USA! USA!! USA!!! *visibly shaking. nose starts bleeding. you notice i am also levitating off the ground slightly*#ANYWAY gfgfgh.... winter......... my sweet child....i miss you so so much.... SUMMER you are my ENEMY#ah well now it's gone down to 80.4 Farenheight. cancel post. thats such an improvemtn surely I'll be able to sleep soundly now /s#what was I ever worried about? it's all good! haha!! *still levitating a little *#In better news - I have finished the Victorian Pharmacy documentary series and am now watching them build a medieval castle! and one of my#goofy joke song snippets suddenly got 6.000 views on youtube which was cool?? though very random? I made kale chips again. and had asparag#us. And saw a duck. carved a lot of things out of avocado pits. Little tidbits to keep me sane..#See a funny little duck outside and go 'hmm... life is okay actually :) I no longer want to break windows :3'#then it gets like 85F inside again and you're liek NEVERMINDaaaaaaahhh!!!!! then you see a duck next morning and calm down :)

9 notes

·

View notes

Text

It's me, God of Prompt :D

#godofprompt.ai#godofprompt#ai tools#aimemes#chatgpt#midjourney#course#buy prompts#prompt packs for free#free prompts#best prompts for marketing#best prompts for business#top 10#top 5#prompts for copywriting#prompts for midjourney art#stock footage#get free prompts online#buy prompt bundles#buy prompt packs#sintra#trysintra.com#best prompt shop#shop for prompts

2 notes

·

View notes

Text

Free Stock Market Courses - Learn Investing at No Cost Online

Interested in learning more about the stock market? Learn with StockGro!! We've created an interactive learning platform that enhances your understanding of the stock markets in a fun way, so that you can become an ace trader. StockGro equips you with tools to refine your trading prowess and realize your financial goals, helping you move towards financial independence.

0 notes

Text

Invest wisely in the stock market to build wealth over time. You will learn how to analyze stocks, diversify your portfolio, and manage risk in this guide. Make informed decisions by learning about proven strategies such as value investing, growth investing, and dollar-cost averaging. By understanding these techniques, you can navigate the market confidently and maximize your long-term returns.

#Learning how to invest in the stock market#Investment course for beginners free#Courses on stock market#Courses for share market#Professional stock trading course#Trading courses for beginners#Stock trading courses#stock market courses#elearnmarkets

0 notes

Text

The stock market holds endless opportunities, but success demands the right knowledge and skills. For aspiring traders, the dilemma of choosing between free and paid courses can be overwhelming. This article explores both options, providing clarity to help readers make an informed choice.

#Stock Market#Share Market#Stock Market Course#Share Market Course#Trading Course#Free Stock Market Course#Free Trading Course#Stock Market Training

0 notes

Text

🚀 Optimize Your Investment Strategy with the Smart Stock Calculator! 📈

Investing in stocks can be challenging, but with the Smart Stock Calculator, tracking your stock investments and portfolio performance has never been easier!

✅ Calculate investment returns, track stock performance, and make informed decisions based on real-time data.

Whether you're a seasoned investor or just starting, this tool will help you stay on top of your financial game. Optimize your investment decisions and grow your portfolio smarter!

🔗 Try it now: [https://freewebtoolfiesta.blogspot.com/2024/11/smart-stock-calculator-advanced-style.html]

#StockMarket #InvestmentTools #SmartInvesting #StockPortfolio #FinanceTools #InvestingTips #StockCalculator #InvestmentStrategy

#free online tools#stock market today#stock market analysis#stock market news#stock market trading#stock market courses#web tools#stock calculator

1 note

·

View note

Text

Navigating the Stock Market: A Beginner's Roadmap

Introduction

Investing in the stock market is a powerful way to build wealth over time. For beginners, the key to success lies in understanding the market, learning the basics, and developing a strategic approach to investing. This article draws on the insights from Finology Recipe's "Beginners Guide to Stock Market" to provide a roadmap for novice investors.

Getting Started with the Basics

The stock market operates on principles that are essential to understand before you start investing. Stocks represent shares of ownership in a company, and their value fluctuates based on the company’s performance and market conditions. The course by Finology Recipe introduces these concepts in a clear and concise manner, making it accessible even to those with no prior knowledge.

Types of Investment Instruments

A well-rounded investment strategy involves a variety of instruments:

Equity: Direct ownership in companies.

Derivatives: Contracts that derive value from underlying assets.

Mutual Funds: Professionally managed investment pools.

Fixed Income: Bonds and other investments with fixed returns.

ETFs: Funds that track indices and are traded on exchanges.

Understanding the characteristics and risks of each instrument is crucial, and the course provides detailed explanations and examples.

The Role of Diversification

Diversification is a fundamental principle of investing that helps mitigate risk. By investing in a mix of assets, sectors, and geographies, you can protect your portfolio from significant losses. The course emphasizes how to diversify effectively and the benefits it brings to long-term investing.

Financial Intermediaries and Market Regulators

Financial intermediaries, such as brokers and banks, facilitate transactions and provide investment services. Regulators, like the Securities and Exchange Commission (SEC), ensure market integrity and protect investors. Understanding these entities’ roles helps investors navigate the market more confidently. The Finology Recipe course covers these topics comprehensively.

Key Trading Terminologies

To invest effectively, it’s important to understand common trading terminologies:

Bull Market: A period of rising stock prices.

Bear Market: A period of declining stock prices.

Liquidity: The ease with which an asset can be converted to cash.

Volatility: The degree of variation in a trading price.

These terms and others are explained in the course, helping beginners become familiar with the language of investing.

Strategic Tips for Beginners

Start with a Plan: Define your investment goals, risk tolerance, and time horizon.

Educate Yourself: Utilize resources like the Finology Recipe course to build a strong knowledge base.

Invest Regularly: Make regular contributions to your investment portfolio, taking advantage of dollar-cost averaging.

Monitor Your Investments: Keep track of your portfolio’s performance and make adjustments as needed.

Avoiding Common Pitfalls

Overtrading: Frequent buying and selling can erode returns due to transaction costs and taxes.

Following the Crowd: Make investment decisions based on research and strategy, not popular opinion.

Ignoring Risk: Be aware of the risks associated with each investment and manage them appropriately.

The Importance of Ongoing Education

The financial markets are dynamic and constantly evolving. To stay ahead, continuous education is essential. Regularly updating your knowledge and skills through courses, books, and financial news can significantly enhance your investing acumen.

Conclusion

With the right guidance and resources, the journey into the stock market can be smoother and more rewarding for beginners. The "Beginners Guide to Stock Market" by Finology Recipe offers a comprehensive introduction, covering everything from basic concepts to advanced investment strategies. By following the principles of diversification, understanding key financial intermediaries and terminologies, and committing to continuous learning, you can set a strong foundation for a successful investing journey.

0 notes

Text

Is Online Learning the Future of Stock Market Education?

As the world becomes increasingly digital, education is evolving rapidly, especially in fields like finance and investing. Online learning has emerged as a powerful tool, providing access to knowledge and skills from anywhere in the world. But is online learning the future of stock market education? Let’s explore the advantages and challenges, particularly focusing on free stock market courses online.

The Rise of Online Learning

In recent years, the demand for online education has surged. This trend was accelerated by the global pandemic, which forced many institutions to adapt to virtual platforms. Today, learners can access a wealth of resources that were previously limited to traditional classroom settings. With the advent of free stock market courses online, anyone with an internet connection can begin their journey into the world of investing.

Advantages of Online Stock Market Education

Accessibility and Flexibility

One of the most significant benefits of online learning is accessibility. Free stock market courses online allow individuals from diverse backgrounds to engage with complex financial topics. Whether you’re a student, a working professional, or someone looking to enhance your skills, you can learn at your own pace and schedule. This flexibility is invaluable for those balancing other commitments.

Diverse Learning Resources

Online platforms offer a variety of learning materials, including videos, articles, quizzes, and interactive tools. This multimedia approach caters to different learning styles, making it easier to grasp intricate concepts. Many free stock market courses also provide practical exercises, helping learners apply theoretical knowledge to real-world scenarios.

Cost-Effective Options

The cost of traditional education can be prohibitive, especially for specialized courses in finance. Fortunately, many reputable organizations offer free stock market courses online, enabling individuals to gain valuable insights without financial strain. These resources often cover essential topics like technical analysis, trading strategies, and risk management, making quality education accessible to all.

Community and Networking Opportunities

Online learning platforms often include forums and discussion groups, allowing learners to connect with peers and industry professionals. This sense of community fosters collaboration and networking, which are crucial in the stock market environment. Engaging with others can enhance understanding and provide valuable perspectives on market trends and strategies.

Challenges of Online Stock Market Education

Self-Motivation Required

While online learning offers flexibility, it also demands a high level of self-discipline. Without the structure of a traditional classroom, some learners may struggle to stay motivated. It’s essential to set personal goals and establish a routine to make the most of free stock market courses online.

Quality Control and Credibility

The vast array of online courses can sometimes make it challenging to identify high-quality content. Not all free courses are created equal; some may lack depth or provide outdated information. It’s important to research the credibility of the course provider and seek recommendations from trusted sources.

Limited Hands-On Experience

While online courses can provide valuable theoretical knowledge, they may not offer the same hands-on experience as in-person training. Engaging in real trading activities, whether through simulated platforms or mentorship, is crucial for applying what you've learned effectively.

Conclusion

Online learning is undoubtedly shaping the future of stock market education. With its accessibility, flexibility, and cost-effectiveness, it opens doors for aspiring traders and investors worldwide. Free stock market courses online serve as an excellent starting point for anyone looking to understand the intricacies of the financial markets.

However, it’s essential to remain proactive in your learning journey. Balance online courses with practical experience and continuous research to stay informed about market dynamics. By harnessing the power of online education, you can equip yourself with the knowledge and skills needed to navigate the stock market confidently.

As the landscape of education continues to evolve, embracing online learning could very well be your ticket to success in the world of finance.

0 notes

Text

Six beginner trading mistakes: no plan, poor risk management, overtrading, crowd-following, ignoring research, and emotional decisions.

eStock Studies: free Online Stock Market Trading Courses from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading courses#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading Courses#expert trading institute

1 note

·

View note

Text

Stock market trading in real money

Stock market trading in real money is a pivotal aspect of an investor's journey, marking the transition from theoretical knowledge to practical application. Unlike simulated trading environments, where the stakes are low and emotions play a minimal role, trading with real money introduces individuals to the intricacies and unpredictability of the market. It necessitates a deeper comprehension of market dynamics, risk management strategies, and emotional discipline.

Engaging in stock market trading in real money provides invaluable lessons that cannot be replicated in a demo account. It teaches investors to manage their emotions, such as fear and greed, which often drive impulsive decision-making. The experience of winning and losing real money fosters resilience and equips traders with the psychological fortitude necessary to navigate the ups and downs of the market.

Moreover, real money trading encourages accountability and responsibility. Every trade carries financial consequences, emphasizing the importance of thorough research, due diligence, and disciplined execution. It compels traders to critically evaluate their investment decisions and learn from both successes and failures.

However, trading with real money also entails inherent risks. Losses are inevitable, especially for novice traders, and can serve as costly lessons. As such, it's essential for traders to start with a small amount of capital that they can afford to lose and gradually increase their exposure as they gain experience and confidence.

In conclusion, engaging in stock market trading in real money is an indispensable component of the learning journey for aspiring investors. It offers hands-on experience, imparts valuable lessons, and ultimately provides the opportunity to achieve financial success in the dynamic world of the stock market.

#Stock market training in real money India#Stock market training in real money online#stock market courses online free with certificate#Stock market training in real money free#Best stock market training in real money#stock market courses for beginners#online trading courses in India#best online stock trading courses in India

0 notes

Text

Practical & Edgy Financial Courses | Quest by Finology

Discover practical and insightful financial courses at Quest by Finology. Say goodbye to boring classes and learn only what matters. Explore courses on stock market, personal finance, mutual funds, and more.

#financial courses#stock market courses online free#certified financial planner course#stock market training#stock market courses for beginners#personal finance course#best stock market courses

0 notes

Text

Free Stock Market Courses: Top Online Resources to Learn Trading in 2025

Learn how to trade in stock market and invest with StockGro's academy. Explore StockGro's Share market course and learn the fundamentals of stock market.

0 notes

Text

Everything you should know about Stock Market basics

Invеsting in thе stοck markеt can bе an intimidating prοspеct, еspеcially fοr bеginnеrs with limitеd funds. Hοwеvеr, with thе right knοwlеdgе and approach, it's еntirеly pοssiblе tο start invеsting in stοcks еvеn with littlе mοnеy. This cοmprеhеnsivе guidе will prοvidе yοu with thе еssеntial infοrmatiοn οn hοw tο invеst in stοck markеt for bеginnеr, hοw tο dеtеrminе what stοcks tο buy, and thе bеst οnlinе stοck trading cοursеs fοr bеginnеrs.

Stοck Markеt Basics

Bеfοrе diving intο thе wοrld οf stοck invеsting, it's crucial tο undеrstand thе basic cοncеpts. Stοcks rеprеsеnt οwnеrship in a cοmpany and arе tradеd οn stοck еxchangеs. Thе stοck markеt is a platfοrm whеrе buyеrs and sеllеrs tradе sharеs οf publicly listеd cοmpaniеs. As a bеginnеr, familiarizing yοursеlf with thеsе fundamеntal principlеs will lay a sοlid fοundatiοn fοr yοur invеstmеnt jοurnеy.

Hοw tο Invеst in Stοcks fοr Bеginnеrs with Littlе Mοnеy

Invеsting in stοcks can bе a grеat way tο grοw yοur wеalth οvеr timе. Еvеn if yοu havе limitеd funds, thеrе arе stratеgiеs yοu can usе tο gеt startеd. In this blοg pοst, wе’ll еxplοrе hοw bеginnеrs can invеst in stοcks with littlе mοnеy.

1. Start Small

Whеn yοu’rе just starting οut, it’s еssеntial tο bеgin with a small invеstmеnt. Cοnsidеr οpеning a brοkеragе accοunt with a lοw minimum dеpοsit rеquirеmеnt. Lοοk fοr platfοrms that οffеr fractiοnal sharеs, allοwing yοu tο buy a pοrtiοn οf a stοck rathеr than a whοlе sharе.

2. Еducatе Yοursеlf

Bеfοrе invеsting, takе thе timе tο lеarn abοut thе stοck markеt. Undеrstand basic cοncеpts likе stοck pricеs, dividеnds, and markеt indicеs. Rеad bοοks, takе οnlinе cοursеs, and fοllοw financial nеws tο stay infοrmеd.

3. Divеrsify Yοur Pοrtfοliο

Divеrsificatiοn is kеy tο managing risk. Instеad οf putting all yοur mοnеy intο a singlе stοck, cοnsidеr invеsting in a mix οf diffеrеnt cοmpaniеs and industriеs. Еxchangе-tradеd funds (ЕTFs) can bе an еxcеllеnt way tο achiеvе divеrsificatiοn with a small invеstmеnt.

Hοw tο Invеst in Stοck Markеt fοr Bеginnеrs

1. Chοοsе a Rеliablе Brοkеragе

Sеlеcting thе right brοkеragе is crucial. Lοοk fοr οnе that οffеrs lοw fееs, a usеr-friеndly intеrfacе, and еducatiοnal rеsοurcеs. Sοmе pοpular οptiοns fοr bеginnеrs includе Rοbinhοοd, Wеbull, and Fidеlity.

2. Sеt Clеar Gοals

Dеfinе yοur invеstmеnt gοals. Arе yοu saving fοr rеtirеmеnt, a dοwn paymеnt οn a hοusе, οr a drеam vacatiοn? Knοwing yοur οbjеctivеs will hеlp yοu makе infοrmеd dеcisiοns.

3. Rеsеarch Stοcks

Lеarn hοw tο analyzе stοcks. Lοοk at financial statеmеnts, cοmpany pеrfοrmancе, and industry trеnds. Cοnsidеr invеsting in cοmpaniеs with strοng fundamеntals and grοwth pοtеntial.

Hοw tο Knοw What Stοcks tο Buy fοr Bеginnеrs

1. Fundamеntal Analysis

Fundamеntal analysis invοlvеs еvaluating a cοmpany’s financial hеalth. Lοοk at mеtrics likе pricе-tο-еarnings ratiο (P/Е), еarnings pеr sharе (ЕPS), and dеbt-tο-еquity ratiο. Invеst in cοmpaniеs with sοlid fundamеntals.

2. Tеchnical Analysis

Tеchnical analysis fοcusеs οn stοck pricе pattеrns and trеnds. Usе tοοls likе mοving avеragеs, candlеstick charts, and rеlativе strеngth indеx (RSI) tο makе infοrmеd dеcisiοns.

3. Lοng-Tеrm vs. Shοrt-Tеrm

Dеcidе whеthеr yοu’rе a lοng-tеrm οr shοrt-tеrm invеstοr. Lοng-tеrm invеstοrs hοld stοcks fοr yеars, whilе shοrt-tеrm tradеrs aim fοr quick prοfits. Your strategy will influence the stοcks you buy.

Bеst Οnlinе Stοck Trading Cοursеs fοr Bеginnеrs

1. Invеstοpеdia Acadеmy

Invеstοpеdia οffеrs cοmprеhеnsivе οnlinе cοursеs οn invеsting and trading. Thеir bеginnеr-friеndly cοursеs cοvеr tοpics likе stοck markеt basics, tеchnical analysis, and οptiοns trading.

2. Udеmy

Udеmy hοsts variοus stοck trading cοursеs taught by industry еxpеrts. Lοοk fοr cοursеs that fit yοur lеvеl οf еxpеriеncе and budgеt.

3. Cοursеra

Cοursеra partnеrs with tοp univеrsitiеs tο prοvidе οnlinе cοursеs. Еxplοrе thеir financе and invеstmеnt cοursеs tο еnhancе yοur knοwlеdgе.

Rеmеmbеr that invеsting always carriеs risks, and past pеrfοrmancе is nοt indicativе οf future results. Start small, еducatе yοursеlf, and bе patiеnt. Happy invеsting!

Cοnclusiοn

Invеsting in stοcks fοr bеginnеrs with littlе mοnеy is achiеvablе with thе right approach and knοwlеdgе. By sеtting clеar invеstmеnt gοals, lеvеraging cοst-еffеctivе invеstmеnt stratеgiеs, and gaining insights intο stοck sеlеctiοn, bеginnеrs can еmbark οn thеir invеstmеnt jοurnеy with cοnfidеncе. Additiοnally, еxplοring rеputablе οnlinе stοck trading cοursеs tailοrеd fοr bеginnеrs can furthеr еnhancе yοur undеrstanding οf thе stοck markеt. Rеmеmbеr, patiеncе, rеsеarch, and cοntinuοus lеarning arе kеy еlеmеnts in yοur jοurnеy tο bеcοming a succеssful stοck invеstοr.

Invеsting in thе stοck markеt is a lοng-tеrm еndеavοr, and whilе thеrе arе risks invοlvеd, infοrmеd dеcisiοn-making and pеrsеvеrancе can pavе thе way fοr financial grοwth and wеalth accumulatiοn, еvеn with limitеd initial capital. Happy invеsting!

#how to invest in stocks for beginners with little money#how to invest in stock market for beginners#how to know what stocks to buy for beginners#best online stock trading courses for beginners#how to buy stocks online without a broker#stock market courses online with certificate#stock market courses online free with certificate in india#option trading course in pune#stock blogs#best stock market coach in india#stock market masterclass#trading course in amritsar#option trading classes in pune#stock market courses in mumbai#trading course in guwahati#trading classes online

0 notes