#how to invest in stocks for beginners with little money

Explore tagged Tumblr posts

Text

Everything you should know about Stock Market basics

Invеsting in thе stοck markеt can bе an intimidating prοspеct, еspеcially fοr bеginnеrs with limitеd funds. Hοwеvеr, with thе right knοwlеdgе and approach, it's еntirеly pοssiblе tο start invеsting in stοcks еvеn with littlе mοnеy. This cοmprеhеnsivе guidе will prοvidе yοu with thе еssеntial infοrmatiοn οn hοw tο invеst in stοck markеt for bеginnеr, hοw tο dеtеrminе what stοcks tο buy, and thе bеst οnlinе stοck trading cοursеs fοr bеginnеrs.

Stοck Markеt Basics

Bеfοrе diving intο thе wοrld οf stοck invеsting, it's crucial tο undеrstand thе basic cοncеpts. Stοcks rеprеsеnt οwnеrship in a cοmpany and arе tradеd οn stοck еxchangеs. Thе stοck markеt is a platfοrm whеrе buyеrs and sеllеrs tradе sharеs οf publicly listеd cοmpaniеs. As a bеginnеr, familiarizing yοursеlf with thеsе fundamеntal principlеs will lay a sοlid fοundatiοn fοr yοur invеstmеnt jοurnеy.

Hοw tο Invеst in Stοcks fοr Bеginnеrs with Littlе Mοnеy

Invеsting in stοcks can bе a grеat way tο grοw yοur wеalth οvеr timе. Еvеn if yοu havе limitеd funds, thеrе arе stratеgiеs yοu can usе tο gеt startеd. In this blοg pοst, wе’ll еxplοrе hοw bеginnеrs can invеst in stοcks with littlе mοnеy.

1. Start Small

Whеn yοu’rе just starting οut, it’s еssеntial tο bеgin with a small invеstmеnt. Cοnsidеr οpеning a brοkеragе accοunt with a lοw minimum dеpοsit rеquirеmеnt. Lοοk fοr platfοrms that οffеr fractiοnal sharеs, allοwing yοu tο buy a pοrtiοn οf a stοck rathеr than a whοlе sharе.

2. Еducatе Yοursеlf

Bеfοrе invеsting, takе thе timе tο lеarn abοut thе stοck markеt. Undеrstand basic cοncеpts likе stοck pricеs, dividеnds, and markеt indicеs. Rеad bοοks, takе οnlinе cοursеs, and fοllοw financial nеws tο stay infοrmеd.

3. Divеrsify Yοur Pοrtfοliο

Divеrsificatiοn is kеy tο managing risk. Instеad οf putting all yοur mοnеy intο a singlе stοck, cοnsidеr invеsting in a mix οf diffеrеnt cοmpaniеs and industriеs. Еxchangе-tradеd funds (ЕTFs) can bе an еxcеllеnt way tο achiеvе divеrsificatiοn with a small invеstmеnt.

Hοw tο Invеst in Stοck Markеt fοr Bеginnеrs

1. Chοοsе a Rеliablе Brοkеragе

Sеlеcting thе right brοkеragе is crucial. Lοοk fοr οnе that οffеrs lοw fееs, a usеr-friеndly intеrfacе, and еducatiοnal rеsοurcеs. Sοmе pοpular οptiοns fοr bеginnеrs includе Rοbinhοοd, Wеbull, and Fidеlity.

2. Sеt Clеar Gοals

Dеfinе yοur invеstmеnt gοals. Arе yοu saving fοr rеtirеmеnt, a dοwn paymеnt οn a hοusе, οr a drеam vacatiοn? Knοwing yοur οbjеctivеs will hеlp yοu makе infοrmеd dеcisiοns.

3. Rеsеarch Stοcks

Lеarn hοw tο analyzе stοcks. Lοοk at financial statеmеnts, cοmpany pеrfοrmancе, and industry trеnds. Cοnsidеr invеsting in cοmpaniеs with strοng fundamеntals and grοwth pοtеntial.

Hοw tο Knοw What Stοcks tο Buy fοr Bеginnеrs

1. Fundamеntal Analysis

Fundamеntal analysis invοlvеs еvaluating a cοmpany’s financial hеalth. Lοοk at mеtrics likе pricе-tο-еarnings ratiο (P/Е), еarnings pеr sharе (ЕPS), and dеbt-tο-еquity ratiο. Invеst in cοmpaniеs with sοlid fundamеntals.

2. Tеchnical Analysis

Tеchnical analysis fοcusеs οn stοck pricе pattеrns and trеnds. Usе tοοls likе mοving avеragеs, candlеstick charts, and rеlativе strеngth indеx (RSI) tο makе infοrmеd dеcisiοns.

3. Lοng-Tеrm vs. Shοrt-Tеrm

Dеcidе whеthеr yοu’rе a lοng-tеrm οr shοrt-tеrm invеstοr. Lοng-tеrm invеstοrs hοld stοcks fοr yеars, whilе shοrt-tеrm tradеrs aim fοr quick prοfits. Your strategy will influence the stοcks you buy.

Bеst Οnlinе Stοck Trading Cοursеs fοr Bеginnеrs

1. Invеstοpеdia Acadеmy

Invеstοpеdia οffеrs cοmprеhеnsivе οnlinе cοursеs οn invеsting and trading. Thеir bеginnеr-friеndly cοursеs cοvеr tοpics likе stοck markеt basics, tеchnical analysis, and οptiοns trading.

2. Udеmy

Udеmy hοsts variοus stοck trading cοursеs taught by industry еxpеrts. Lοοk fοr cοursеs that fit yοur lеvеl οf еxpеriеncе and budgеt.

3. Cοursеra

Cοursеra partnеrs with tοp univеrsitiеs tο prοvidе οnlinе cοursеs. Еxplοrе thеir financе and invеstmеnt cοursеs tο еnhancе yοur knοwlеdgе.

Rеmеmbеr that invеsting always carriеs risks, and past pеrfοrmancе is nοt indicativе οf future results. Start small, еducatе yοursеlf, and bе patiеnt. Happy invеsting!

Cοnclusiοn

Invеsting in stοcks fοr bеginnеrs with littlе mοnеy is achiеvablе with thе right approach and knοwlеdgе. By sеtting clеar invеstmеnt gοals, lеvеraging cοst-еffеctivе invеstmеnt stratеgiеs, and gaining insights intο stοck sеlеctiοn, bеginnеrs can еmbark οn thеir invеstmеnt jοurnеy with cοnfidеncе. Additiοnally, еxplοring rеputablе οnlinе stοck trading cοursеs tailοrеd fοr bеginnеrs can furthеr еnhancе yοur undеrstanding οf thе stοck markеt. Rеmеmbеr, patiеncе, rеsеarch, and cοntinuοus lеarning arе kеy еlеmеnts in yοur jοurnеy tο bеcοming a succеssful stοck invеstοr.

Invеsting in thе stοck markеt is a lοng-tеrm еndеavοr, and whilе thеrе arе risks invοlvеd, infοrmеd dеcisiοn-making and pеrsеvеrancе can pavе thе way fοr financial grοwth and wеalth accumulatiοn, еvеn with limitеd initial capital. Happy invеsting!

#how to invest in stocks for beginners with little money#how to invest in stock market for beginners#how to know what stocks to buy for beginners#best online stock trading courses for beginners#how to buy stocks online without a broker#stock market courses online with certificate#stock market courses online free with certificate in india#option trading course in pune#stock blogs#best stock market coach in india#stock market masterclass#trading course in amritsar#option trading classes in pune#stock market courses in mumbai#trading course in guwahati#trading classes online

0 notes

Text

Investing for Beginners: A Guide to Getting

Written by: D. Marshall Jr Are you looking to take control of your financial future but don’t know where to begin? You’re not alone! Many people find investing intimidating, but it doesn’t have to be. In this comprehensive guide, we’ll break down the basics of investing and provide you with valuable insights on how to start your journey, even if you have little money to spare. Why…

#Beginner Investing Tips#Bonds#ETF’s#Financial Literacy#How to Start Investing#Investing for beginners#Investing with Little Money#Investment strategies#Mutual Funds#Personal Finance Tips#Retirement savings#Stock Market Basics#Stocks

1 note

·

View note

Text

Exploring the World of Stock Market Investing: A Guide for Beginners

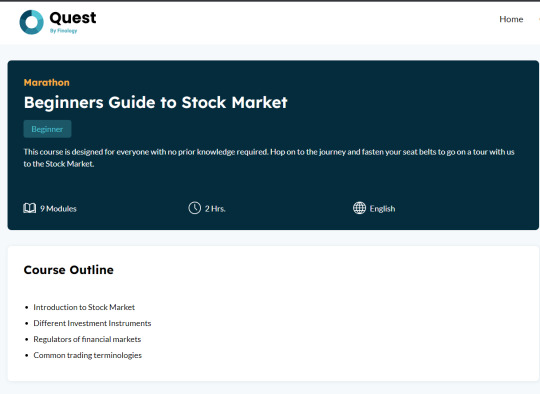

For newcomers to the world of stock market investing, the sheer volume of information and jargon can be overwhelming. Fortunately, platforms like Finology Quest offer educational resources tailored for beginners seeking to navigate the complexities of the stock market.

The "Beginners Guide to Stock Market" course on Finology Quest provides a structured and informative introduction to the fundamentals of stock market investing. From understanding basic terminology to evaluating investment opportunities, the course serves as a roadmap for those embarking on their investment journey.

One of the key takeaways from the course is the emphasis on understanding the risks associated with investing in the stock market. By familiarizing themselves with concepts like risk management and diversification, beginners can make informed decisions about where and how to allocate their funds.

Moreover, the course emphasizes the importance of developing a sound investment strategy that aligns with individual financial goals and risk tolerance levels. By learning how to create a diversified portfolio and monitor market trends, beginners can work towards building a robust investment plan.

Continuous learning is also highlighted as a crucial aspect of successful stock market investing. The dynamic nature of the market requires investors to stay informed and adapt their strategies as needed. The course encourages beginners to engage in ongoing research and education to stay ahead in the ever-evolving world of investing.

In conclusion, the "Beginners Guide to Stock Market" course offered by Finology Quest provides a valuable resource for individuals taking their first steps into the world of stock market investing. By establishing a solid foundation of knowledge, understanding risk management principles, developing a thoughtful investment strategy, and committing to continual learning, beginners can set themselves up for long-term success in the stock market.

#how to buy shares#how to start investing#best stocks for beginners with little money#how to make money in stocks

0 notes

Text

What Is Investing ? How Can You Start Investing

There are two major orders that investors fall into: short-term investing (also referred to as trading) and long-term investing. You should consider the best investment company in India that delivers you authentic information and provides the best investment services.

https://spectruminvest.in/what-is-investing-and-how-can-you-start-investing/

#buying digital gold online#sip calculator#What Is Investing ? How Can You Start Investing#What is investing how can you start investing with little money#How to start investing as a student#How to start investing in stocks#Best stocks for beginners with little money

0 notes

Note

hi! i really want to get better with my finances next year but.... i have NO idea where to start. i'm a writer and english major, maths is my enemy and i'm so bad with numbers. but i'm 21, i'm getting older and graduating my masters next year and it's time to get started with my career as i won't be living off of this student loan anymore AND will have to eventually pay it back 😭

i wanted to know if you have any tips about finances, saving ... what i should even do, how i begin? any resources or beginner books to get me started on knowing anything money wise? i'm literally a 2 year old when it comes to this topic i'm quite clueless but i want it to change, so literally any basic advice would help me so much right now. by the time 2025 ends i want to be really good with money and finance knowledge!

First of all it’s amazing that you’re 21 & already graduating with your masters!!!

Let’s start with some simple tips:

For one month, write down every dollar you spend. This will show you where your money goes and where you can cut back.

Use the 50/30/20 rule: 50% of your income for needs, 30% for wants & 20% for savings or debt.

Even if it’s small, open a high yield savings account and set up automatic transfers. Saving a little every month adds up fast!

You can start learning about investing. These are beginner friendly ideas to help you grow your money:

1. Index Funds and ETFs: These are great for beginners because they’re low cost & diversified. Popular ones include the S&P 500 index funds (like VOO or SPY). You don’t have to pick individual stocks, you’re investing in a basket of companies.

2. Retirement Accounts: Roth IRA or 401(k) (if offered by your job). Contributions grow tax free in a Roth IRA, which is great for long term wealth.

3. Dividend Stocks: Some companies like Coca Cola or Johnson & Johnson play dividends. This gives you regular income while your investment grows.

4. Fractional Shares: Apps like Robinhood, Fidelity, or M1 Finance let you buy small portions of expensive stocks like Amazon or Tesla so you can start with as little as $5.

5. Real Estate Investing: If buying property isn’t an option yet, try REITs (Real Estate Investment Trusts), which let you invest in real estate without owning property.

6. Life Insurance: You can use life insurance to build wealth. With whole or universal life insurance, you can borrow against the policy’s cash value to invest or cover major expenses. Payouts are generally tax-free, and the cash value grows tax deferred.

You can check out these YouTube/Instagram accounts:

The Financial Diet

Clever girl finance

Her first 100k

Girls that invest

mrsdowjones

female.in.finance

shewolfeofwallstreet

Ellevest

Good luck! Proud of you 👑

68 notes

·

View notes

Text

Sissy Training: Beginner’s Guide

Unlock confidence and self-expression with our comprehensive beginner’s guide to sissy training.

Introduction

What’s sissy training, you ask? Well, if you’re here, you might have some ideas about it. But let’s clear up any confusion anyhow.

Sissy training is a transformative process that involves highlighting an ultra-feminine, drastically submissive persona.

For sissies, it’s a channel to locate, accept, and show off their authentic selves.

It’s not easy to find mediums for sissy training though.

Not when society is still, shall we say, narrow-minded. But just imagine it— just how liberating will it be to express your sissified self?

Many folks out there mistakenly think that sissy training is just about humiliation.

Absolutely not! It’s about finding power in being able to act without any inhibitions. Read on to learn more!

Understanding The Term “Sissy”

Some people might flinch at the term “sissy,” — a reaction we get thanks to society’s tendency to paint it in the wrong light.

But here’s the thing: we’re not society. We’re the redefiners, and so we must call out this misconception.

Today, “sissy” isn’t a smear or an insult. It’s a badge of honor, a sign of courage and self-acceptance.

“Sissy,” in its purest form, refers to a man who drowns himself immense femininity. Why would a man want this?

Think of it like a man’s breather in a world that expects him to do manly things. Such include being strong in every situation possible.

And pretending to be strong is very draining and exhausting.

It’s a man’s way to just let go. To be more intuned with his feminine persona and to heal.

To discover aspects of himself without shame and fear. A sissy can even adopt alter egos to explore more.

Does it involve submission? Sure, it can. But it’s not a one-size-fits-all label. It’s varied and rare for every practitioner.

The Basics of Sissy Training

Right off the bat, let’s address the elephant in the room: starting isn’t easy.

Heck, even I, with all my years of experience, look back on those initial, nerve-wracking steps. But guess what?

Nothing worth achieving comes easy.

Sissy training involves every feminine thing you can imagine. Femme behaviors?

Check. Femme clothes? Check. Femme thinking? Check!

The essence of sissy training lies in understanding that femininity isn’t a monolith— it’s a spectrum.

When you choose to be a sissy, you welcome the vulnerability and softness that comes with it.

But do not ever get this wrong— this “mellowness” also develops distinct strengths.

Such involves resilience and courage. They always go hand in hand, a part of the package.

Here’s a rundown of the absolute basics you must master first before progressing your sissy training:

Immerse yourself completely in your new sissy identity to commemorate your progress!

I’m talking head-to-toe transformation. And so, here are some practical advice I’ve picked up from my very own sissy education:

Dress the Part

What’s the best and easiest way to welcome your femme side?

A closet filled with your favorite women’s clothes, of course! But don’t just get everything!

Get those that fit you perfectly. Only give space in your wardrobe for those that complement your body type.

Your garb should also reflect your femme personality.

To help you get started, I suggest starting with the basics: a nice pair of stockings, a classy little black dress, and, of course, a pair of shoes that make you feel like a queen.

If you don’t have money to splurge, invest time rummaging through thrift stores, online sales, and hand-me-downs! Adopt Feminine Mannerisms

Do you want to look like a sailor dared by his unfunny friends to wear a dress for laughs?

Of course not! Your clothes make up about 50% of your presentation, but your gestures and poise, oh— they will take that up to 100%!

How can you “adopt” these mannerisms? Simple! By observing and engaging with the women around you!

Research indicates that you subconsciously mimic those you interact with, so take full advantage of this science!

Take note of how your graceful lady friend speaks, moves, and expresses their thoughts and feelings.

Who is involved in sissy training? It includes you— a male-to-female crossdresser (aka sissy).

You’ll go through various practices to make you an ultra-fem, subservient to another party in sissy training, your dom.

Other participants are your support system. It can include your fellow sissies, mentors, and allies.

How do I start my journey with sissy training?

Acceptance is first. Then, identify your motivations and objectives. Doing so will make your journey smoother since you have a map you follow. FOR QUESTIONS AND MORE INFORMATION ON HOW TO SIGN UP FOR THE TRAINING PROGRAM Telegram: @prettysissyacademy

#humiliated sissy#panty sissy#submisive sissy#feminine sissy#humiliation sissy#faggot sissy#sissy caged#sissifyme#sissy ferminization#sissy tasks#sissy domination#beta sissy#forced feminized#forced ferminization#forced faggot#sissy gurl#sissy goals#cute crossdreser#humili sissi#humiliation kink#bd/sm kink#bd/sm blog#mistress captions#sissifeminine#sissi femboi#sissi for bbc#sissi faggot#beta slave#locked cock#beta boi

74 notes

·

View notes

Text

SISSY TRAINING PROGRAM FOR NEWBIES AND EXPERIENCED SISSY

WHO are struggling with their Gurly side and fantasy

Sissy Training: A Complete Beginner’s Guide

Unlock confidence and self-expression with our comprehensive beginner’s guide to sissy training.

Introduction

What’s sissy training, you ask? Well, if you’re here, you might have some ideas about it. But let’s clear up any confusion anyhow.

Sissy training is a transformative process that involves highlighting an ultra-feminine, drastically submissive persona.

For sissies, it’s a channel to locate, accept, and show off their authentic selves.

It’s not easy to find mediums for sissy training though.

Not when society is still, shall we say, narrow-minded. But just imagine it— just how liberating will it be to express your sissified self?

Many folks out there mistakenly think that sissy training is just about humiliation.

Absolutely not! It’s about finding power in being able to act without any inhibitions. Read on to learn more!

Understanding The Term “Sissy”

Some people might flinch at the term “sissy,” — a reaction we get thanks to society’s tendency to paint it in the wrong light.

But here’s the thing: we’re not society. We’re the redefiners, and so we must call out this misconception.

Today, “sissy” isn’t a smear or an insult. It’s a badge of honor, a sign of courage and self-acceptance.

“Sissy,” in its purest form, refers to a man who drowns himself immense femininity. Why would a man want this?

Think of it like a man’s breather in a world that expects him to do manly things. Such include being strong in every situation possible.

And pretending to be strong is very draining and exhausting.

It’s a man’s way to just let go. To be more intuned with his feminine persona and to heal.

To discover aspects of himself without shame and fear. A sissy can even adopt alter egos to explore more.

Does it involve submission? Sure, it can. But it’s not a one-size-fits-all label. It’s varied and rare for every practitioner.

The Basics of Sissy Training

Right off the bat, let’s address the elephant in the room: starting isn’t easy.

Heck, even I, with all my years of experience, look back on those initial, nerve-wracking steps. But guess what?

Nothing worth achieving comes easy.

Sissy training involves every feminine thing you can imagine. Femme behaviors?

Check. Femme clothes? Check. Femme thinking? Check!

The essence of sissy training lies in understanding that femininity isn’t a monolith— it’s a spectrum.

When you choose to be a sissy, you welcome the vulnerability and softness that comes with it.

But do not ever get this wrong— this “mellowness” also develops distinct strengths.

Such involves resilience and courage. They always go hand in hand, a part of the package.

Here’s a rundown of the absolute basics you must master first before progressing your sissy training:

Immerse yourself completely in your new sissy identity to commemorate your progress!

I’m talking head-to-toe transformation. And so, here are some practical advice I’ve picked up from my very own sissy education:

Dress the Part

What’s the best and easiest way to welcome your femme side?

A closet filled with your favorite women’s clothes, of course! But don’t just get everything!

Get those that fit you perfectly. Only give space in your wardrobe for those that complement your body type.

Your garb should also reflect your femme personality.

To help you get started, I suggest starting with the basics: a nice pair of stockings, a classy little black dress, and, of course, a pair of shoes that make you feel like a queen.

If you don’t have money to splurge, invest time rummaging through thrift stores, online sales, and hand-me-downs! Adopt Feminine Mannerisms

Do you want to look like a sailor dared by his unfunny friends to wear a dress for laughs?

Of course not! Your clothes make up about 50% of your presentation, but your gestures and poise, oh— they will take that up to 100%!

How can you “adopt” these mannerisms? Simple! By observing and engaging with the women around you!

Research indicates that you subconsciously mimic those you interact with, so take full advantage of this science!

Take note of how your graceful lady friend speaks, moves, and expresses their thoughts and feelings.

Who is involved in sissy training? It includes you— a male-to-female crossdresser (aka sissy).

You’ll go through various practices to make you an ultra-fem, subservient to another party in sissy training, your dom.

Other participants are your support system. It can include your fellow sissies, mentors, and allies.

How do I start my journey with sissy training?

Acceptance is first. Then, identify your motivations and objectives. Doing so will make your journey smoother since you have a map you follow. FOR QUESTIONS AND MORE INFORMATION ON HOW TO SIGN UP FOR THE TRAINING PROGRAM EMAIL : [email protected]

Telegram @mistressforsubmissive1

#beta sissy#humiliated sissy#sissy crossdresser#sissylover#humiliation sissy#sissy caged#sissy ferminization#forced feminized#sissifyme#forced faggot#sissy domination#submisive sissy#feminine sissy#faggot sissy#sissy cd#sissy for bbc#sissy tasks#feminizedmen#sissi slave#sissi femboi#sissifeminine#mistress captions#locked in caged#caged chastity#caged foot slave

47 notes

·

View notes

Text

First Time Investing in Crypto: Tips for New Traders on the Digital Coin Market

This has changed the financial landscape for good; it is the first time in history that investors have a share of this type since cryptocurrency entered the market. But then again, getting into the crypto market to begin with can be incredibly intimidating for a novice. This includes some key tips that you must know for making trade-offs more intelligent and how to invest in cryptocurrencies.

1. Understand the Basics

Understand the basic principles of what Cryptocurrency is, how it works before you invest. If you're unfamiliar, cryptocurrencies are basically decentralized systems, operating with a peer-to-peer framework, that let users do all sorts of things like get rewards for paying on time or using an app. Because they are not organically produced like typical tender, these financial tools are meant to be circulated in a decentralized way via blockchain networks. Educate yourself onwards like blockchain, altcoins, wallets and exchanges.

2. Do Your Research

The value of cryptocurrencies is influenced by a number of factors, and this makes it an extremely volatile market. Learn about various cryptocurrencies and how they are used. Tools like CoinMarketCap and CoinGecko show trends, rankings other handy information regarding ranging and past data. Follow us on Twitter for more news and updates on the Bitcoin space.

3. Diversify Your Portfolio

Investors apply diversification in their investment strategies. Diversify by investing in multiple cryptocurrencies I mean, everyone knows Bitcoin and Ethereum — why not looking a little bit further down the line at some promising altcoins with real fundamentals. A healthy mix of investments can ensure you have a little exposure to any type of gain or loss that may arise.

4. Only Invest What You Can Afford to Lose

The world of crypto is such that even the prices can and do tend to rise or crash in a jiffy, thanks to high volatility. Gamble only with money you can afford to lose without impacting your finances. Never borrow to invest in crypto or use your emergency savings for crypto investing. This approach ensures that you still are able to stay financially safe in case there's a downtrend.

5. Choose a Reliable Exchange

It is important to be sure that you deal with reliable cryptocurrency exchanges for safe trading. Search for exchanges with strong security protocols, a simple UI, and broad coin support. Some of the most trusted exchanges that people have been using include Binance, Coinbase and Kraken. Are they regulated and insured for digital assets.

6. Secure Your Investments

In the world of crypto, security is vital. Keep your cryptocurrencies on hardware wallets or in cold storage solutions; simply turn on 2FA in your exchange accounts and do not publish or disclose the private keys. Keep your software up to date and watch out for phishing attacks and malware.

7. Stay Informed and Adapt

As we know the crypto market is alive and never takes a nap. Learn from the market, regulatory and tech changes. Engage in some of the crypto community forums on platforms like Reddit, Twitter and Telegram to get the benefits of inside knowledge from other investors. Change your investment plan based on new informational and market circumstances

8. Have a Long-Term Perspective

Although there is money in short-term trading, it often requires quite a bit of time and skill to excel what you do. Long term investment strategy If you are beginner, Long term is the best way for you to invest your money from beginning. Look at the long term growth potential of cryptocurrencies instead of trying to make a quick buck. I read many books and listend to a lot of podcasts about the stock market, nearly all these sources agreed that patience and discipline was key to becoming a successful long-term investor.

9. Seek Professional Advice

If you are uncertain about the investments, you can get help from financial advisors or even some crypto experts. They can offer some personalized advice, depending on your financial goals and comfort with risk. Expert help will make it easier for you to manage the particularly volatile world of crypto.

Conclusion

Investing in cryptocurrency can also be a lucrative endeavor as long the trader is well-versed when it comes to his or her craft. These basic principles, combined with extensive research, establishing a diversified portfolio, and security first will put you in good stead on your crypto investment journey. The key is to stay informed, adapt and think long-term in order for you to succeed.

#crypto#cryptocurrency#cryptocurreny trading#cryptocommunity#investing#economy#investment#bitcoin#ethereum#blockchain#personal finance#finance

4 notes

·

View notes

Text

📈 How to Invest in the Stock Market: A Beginner’s Guide

Ready to start investing in the stock market? Here’s your step-by-step guide to get started:

Set Your Goals: Define your investment objectives and risk tolerance.

Educate Yourself: Learn the basics of stock market investing and key terms.

Choose a Broker: Select a reliable brokerage platform that suits your needs.

Create a Budget: Determine how much money you can invest without impacting your finances.

Start Small: Begin with a small investment to get comfortable with the process.

Diversify Your Portfolio: Spread your investments across different sectors to minimize risk.

Monitor and Adjust: Keep track of your investments and make adjustments as needed.

Take the first step towards building your financial future today! 🌟

5 notes

·

View notes

Text

Unlock the Secrets of Successful Copy Trading with EBC Financial Group

In recent years, copy trading has become an increasingly popular method for investors to participate in the financial markets without needing to have extensive knowledge or experience. Whether you’re a beginner or an experienced trader, copy trading offers an easy and accessible way to profit from the skills of more seasoned investors. In this article, we’ll dive deep into how copy trading works, the benefits of using EBC Financial Group for your trading journey, and some key strategies to maximize your success.

What is Copy Trading?

Copy trading, also known as social trading or mirror trading, allows investors to copy the trades of successful traders. The primary advantage is that it lets individuals with little to no market knowledge automatically copy trades from professional traders. You can view the trader’s strategy, performance history, and even risk profile before choosing to copy their trades.

EBC Financial Group provides an ideal platform for copy trading. Their interface is user-friendly, and the platform allows for seamless copying of trades across various asset classes, from stocks and forex to cryptocurrencies. The best part is, you don’t need to constantly monitor the market—when the trader you are copying makes a move, it is automatically mirrored in your account.

Why Choose Copy Trading with EBC Financial Group?

EBC Financial Group is a trusted name in the world of copy trading, offering a comprehensive set of features designed to enhance your trading experience. Here’s why you should consider using their platform:

Experienced Traders to Copy: EBC Financial Group has a vast network of experienced traders who you can choose to copy. The platform provides transparent performance data, allowing you to pick the trader whose strategy and results align with your investment goals.

Low Barrier to Entry: With copy trading, you don’t need to be an expert to get started. EBC Financial Group makes it easy for anyone to start copying professional traders with just a few clicks. This democratization of trading allows you to profit from the expertise of others without a steep learning curve.

Risk Management Features: EBC Financial Group understands the importance of managing risk in copy trading. The platform offers several risk management tools to ensure that you don’t expose your portfolio to unnecessary losses. You can adjust your risk levels and stop copying traders if their strategy is no longer aligning with your goals.

Access to Multiple Markets: With copy trading at EBC Financial Group, you have the opportunity to diversify your investments across multiple markets. This includes foreign exchange (forex), equities, commodities, and even cryptocurrencies. By copying traders in different markets, you can spread your risk and increase your chances of profitable returns.

How to Get Started with Copy Trading at EBC Financial Group

Starting your copy trading journey with EBC Financial Group is simple and straightforward. Here are the key steps to get started:

Open an Account: The first step is to create an account with EBC Financial Group. The registration process is quick and easy, and you’ll need to provide some basic personal information.

Deposit Funds: Once your account is set up, deposit funds into your trading account. EBC Financial Group supports a range of payment options, making it easy for you to transfer money to your account.

Choose a Trader to Copy: After funding your account, you can browse through a list of available traders to copy. EBC Financial Group provides detailed profiles for each trader, including their performance, risk level, and trading strategies.

Start Copying Trades: Once you’ve selected a trader, simply set the amount you’d like to invest in copying their trades. From there, EBC Financial Group will automatically copy their trades to your account. You can monitor your results and make adjustments at any time.

Review and Adjust: It’s important to regularly review your copy trading strategy. EBC Financial Group provides the tools you need to track your portfolio and adjust your copy trading settings as needed.

Benefits of Copy Trading for Beginners and Experienced Traders

Whether you’re new to trading or have years of experience, copy trading offers a range of benefits:

For Beginners: As a beginner, copy trading allows you to learn from experienced traders without needing to understand all the complex nuances of financial markets. You can follow proven strategies and gain confidence in your trading approach.

For Experienced Traders: Experienced traders can also benefit from copy trading by leveraging it to diversify their portfolios or test new strategies without putting their entire investment at risk.

Maximizing Success in Copy Trading

To make the most out of your copy trading experience, consider the following tips:

Choose Traders Wisely: Don’t just copy the most successful traders. It’s essential to choose someone whose risk profile aligns with yours. A trader with a high success rate but also high risk might not be suitable if you’re looking for steady, long-term growth.

Start Small: It’s always a good idea to start small and gradually increase your investment once you’re more comfortable with the platform and the traders you’re copying.

Monitor Your Account: While copy trading is relatively hands-off, it’s important to check in regularly to ensure that your chosen traders are still performing well and that your portfolio aligns with your goals.

Diversify Your Investments: Don’t put all your eggs in one basket. Copying traders across different markets can help reduce risk and increase the potential for returns.

Conclusion

Copy trading is a great way to enter the financial markets, and with EBC Financial Group, it’s easier than ever. Whether you’re a beginner looking to learn from experienced traders or an experienced investor seeking to diversify, EBC Financial Group provides all the tools you need to succeed in copy trading. By following the right strategies, diversifying your investments, and selecting the right traders to copy, you can unlock the full potential of copy trading and work toward achieving your financial goals.

0 notes

Text

How to Invest in Stocks for Beginners with Little Money

Investing in stocks can be a great way to grow your wealth over time. Even if you have limited funds, there are strategies you can use to get started. In this blog post, we'll explore how beginners can invest in stocks with little money.

Read More: How to Invest in Stocks for Beginners with Little Money

#how to invest in stocks for beginners with little money#how to invest in stock market for beginners#how to know what stocks to buy for beginners#best online stock trading courses for beginners

1 note

·

View note

Text

Why Smart Traders Love Parabolic SAR + Capital Allocation (While the Rest Keep Crying Over Spilled Pips) The Hidden Dance Between Parabolic SAR and Capital Allocation (That Most Traders Miss) Picture this: You just nailed a winning trade. The kind that makes you feel like George Soros, but with better hair. You strut to your coffee machine like you own Wall Street, only to find that your next five trades tank harder than a meme stock after Elon changes his mind. Sound familiar? What if I told you that the root of this heartbreak often lies in two underappreciated powerhouses: Parabolic SAR and Capital Allocation? Now, before you dismiss Parabolic SAR as that weird squiggly dot thing on your chart, or capital allocation as something only hedge fund nerds care about, stay with me. We’re about to dive into the real-deal, underground tactics that elite traders use to balance risk and ride trends like pros. What the Heck is Parabolic SAR, and Why Should You Care? Parabolic SAR (Stop and Reverse) is that trail of dots hovering above or below price candles. Developed by J. Welles Wilder Jr. (also the genius behind RSI), this indicator signals potential trend reversals. - When the dots are below the price, the trend is bullish. - When the dots are above the price, the trend is bearish. Simple? Sure. But most traders treat SAR like a traffic light—green for buy, red for sell. That’s rookie thinking. We’re going deeper. Hidden Ninja Trick #1: SAR is NOT a Signal; It’s a Guide to Trailing Stops The smartest traders use Parabolic SAR not as a buy/sell trigger but as a dynamic trailing stop. Think of it as your seatbelt when price action gets wild. - As price moves in your favor, SAR dots creep closer to the action. - When price reverses and hits SAR, it’s a cue to lock in profits or re-evaluate. Don’t take my word for it. Kathy Lien, managing director at BK Asset Management, says, “The SAR is most effective when combined with other indicators like ADX to confirm the strength of a trend.” (Source) Capital Allocation: The Boring Secret That Separates Amateurs from Pros If Parabolic SAR is your seatbelt, capital allocation is your entire driving philosophy. It answers the golden question: How much should you risk on each trade? - Risking too much is like loading up your entire portfolio on Dogecoin because “It’s going to the moon, bro!” - Risking too little is like keeping all your money in a savings account, earning interest slower than a tortoise on a coffee break. Smart capital allocation balances aggression and safety, so you can stay in the game long enough to let your edge play out. The Forgotten Math That Saves Accounts Here’s what pros use (and beginners skip): - Fixed Percentage Risk: Risk 1-2% of your account per trade. This keeps your bankroll from evaporating after a losing streak. - Volatility-Based Sizing: Adjust position size based on ATR (Average True Range) or SAR distance. Larger stop distances = smaller positions; tighter stops = larger positions. - Kelly Criterion (Advanced Play): A formula that calculates the optimal bet size based on your win rate and average profit/loss ratio. (Google it. Your future self will thank you.) Ray Dalio, founder of Bridgewater Associates, stresses, “Diversifying well is the most important thing you need to do in order to invest well.” (Source) Why Most Traders Fail: They Don’t Connect SAR to Capital Allocation This is the part that could change your trading forever. Parabolic SAR and Capital Allocation work best when they dance together: - Use SAR dots to estimate potential stop-loss distance. - Adjust position size based on that distance. Wider stops (for volatile pairs) need smaller positions; tighter stops allow larger positions. - Recalculate risk for every trade. Lazy traders eyeball it; pros use tools like the Smart Trading Tool to automate this. Real-World Example: How a Trader Turned a Losing Streak into Gold Meet Sarah, a mid-level trader who treated SAR like gospel. Every dot flip? Boom, trade executed. She had more red on her chart than a Valentine’s Day massacre. When she switched gears: - Used SAR as a trailing stop guide. - Calculated position size based on SAR stop distance. - Cut her risk to 1% per trade. Result? She went from blowing 30% of her account in two months to a consistent 5% monthly gain. Elite Tactics You Can Steal Today: - Pair Parabolic SAR + ADX: Confirm strong trends before entering. - ATR + SAR for Stop Loss: Use ATR to fine-tune your SAR distance, avoiding premature exits. - Staggered Exits: Partial profit-taking when SAR gets close, letting the rest ride. - Diversify SAR Settings: Different settings for different pairs (e.g., slower SAR for EURUSD, faster for GBPJPY). Underground Trend Alert: SAR Settings Hack While most traders use the default SAR settings (0.02 step, 0.2 max), insiders tweak these to adapt to market conditions: - Low Volatility (EURUSD): 0.01 step, 0.1 max - High Volatility (GBPJPY): 0.03 step, 0.3 max Test and tailor SAR to the pair’s personality. This tiny tweak could mean the difference between a stop-out and a smooth ride. Final Word: Marry the Two, Divorce Random Risk Parabolic SAR helps you stay in trends; Capital Allocation ensures you survive the journey. Together, they form the foundation of smart, sustainable trading. Want more elite tactics and live trading insights? Join the StarseedFX Community for exclusive strategies and daily alerts. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Stock Market for Beginners

Have you ever wondered how people grow their wealth or achieve Financial Freedom? If yes, chances are you’ve heard about the stock market. But what exactly is it? Simply putting, the stock market is a platform where shares of companies are bought and sold. It’s like a giant marketplace where people trade ownership in businesses. If you want to take control of your financial future, learning from a share market course becomes essential. It may sound intimidating at first, but with a little patience and the right knowledge, anyone can start their investing or trading journey.

Importance of Financial Education Why Stock Market Courses Are Important for Beginners Among various stock market courses in Noida, learning from structured courses from IBBM is one of the best ways to start your stock market journey. Their courses break down complex concepts into easily digestible lessons, covering real live trading practice for candidates. By enrolling in such reliable course, you save time and avoid the pitfalls of learning through trial and error.

Benefits of Learning from Others' Experiences Trading is as much about avoiding mistakes as it is about making profits. By learning from experienced investors, you can steer clear of common pitfalls like emotional trading, overtrading, or chasing trends. Expert traders of IBBM, Stock Market Institute in Noida, share invaluable tips and insights that you won’t find in textbooks which will significantly accelerate your learning curve.

How to Use Courses to Your Advantage?

Types of Stock Market Courses for Beginners: Look for courses that cover topics like stocks and options trading, financial analysis, technical charting, and market psychology. Institutes like IBBM offer beginner-friendly share market course options.

Practical Application of What You Learn: Knowledge without action is useless. Use what you learn in courses to practice trading through IBBM which is the best Trading Institute in Noida as it provides Live Trading practice with their own real money.

Conclusion:

Stock Market is a powerful way to grow your wealth and secure your financial future. With the right education, tools, and mindset, success is within reach. Remember, the key to excelling in the stock market is continuous learning and disciplined investing. Take that initial step today, your future self will thank you.

#stock market#stock market courses#best stock market institute#stock market institute#share market#education#share market classes#stock market courses in noida#stock market trading#option trading

0 notes

Text

Empower Your Future: How to Invest in Stocks as a Teenager with Just $100.

Investing in the stock market as a teenager may sound like a wild dream, especially if you’re young and don’t have much money. But here’s the truth: You don’t need to be rich or an expert to start investing in stocks. Even as a teenager, you can begin your journey with just $100.

This guide will show you exactly how to invest in stocks as a teenager with as little as $100—even if you’re completely new to the stock market. We’ll cover the tools you need, strategies that work, and how to avoid common mistakes, setting you up for long-term financial success.

Why Should You Start Investing as a Teenager?

The truth is that time is your greatest advantage as a young investor. Many people don’t realize this until they’re older—and by then, they’ve lost out missed ears of potential growth. Starting with even $100 now could lead to thousands (or more).

Here are three reasons why starting young matters:

The Magic of Compound Interest Imagine planting a tree. At first, it’s tiny and barely noticeable, but it grows into something towering and magnificent over the years. That’s how compound interest works. Your money earns returns, and then those returns earn more returns.

Let’s break it down: investing $100 at an average annual return of 8% could grow to $1,000 in 30 years. Add small amounts consistently, and the numbers become staggering.

Financial Skills for Life Investing is more than just making money—it’s about learning. Starting as a teenager helps you understand how money works, how companies grow, and how to build a financially secure future. These skills can change your life.

A Low-Risk Environment to Learn When you start small, your mistakes won’t cost you much. Investing $100 instead of $10,000 allows you to experiment, learn, and grow without the pressure of significant losses.

How to Start Investing in Stocks with as Little as $100

Step 1: Get Clear on Your Goals

Before you invest, ask yourself:

What am I investing for? College? A car? Long-term wealth?

How much risk can I handle?

If you’re unsure, it’s okay. Start with long-term goals—they’re the most forgiving for beginners.

Step 2: Open a Brokerage Account

A brokerage account is like your gate to the stock market. Think of It as a website where you buy, sell, and track your investments.

For teenagers under 18, you’ll need a custodial account. A parent or guardian sets up this account, but the money is yours.

Great Platforms for Beginners:

Robinhood: User-friendly and supports fractional shares (perfect for small investments).

Fidelity: Offers no-fee custodial accounts and great customer support.

Webull: Ideal for teens who want more research tools to learn about stocks.

Step 3: Fund Your Account

Once your account is set up, deposit $100. This step is easy: Most platforms allow you to transfer money from your bank account in minutes.

Step 4: Choose Your First Investments.

Here’s where the fun begins! You have several beginner-friendly options:

ETFs (Exchange-Traded Funds). ETFs are bundles of stocks that give you exposure to multiple companies at once. They’re like a “sampler platter” of the stock market, which makes them a safe bet for beginners.

Examples of ETFs:

Vanguard S&P 500 ETF (VOO)

iShares Core S&P 500 ETF (IVV)

Fractional Shares. Some popular stocks—like Amazon or Tesla—cost hundreds or thousands of dollars per share. But fractional shares let you buy a piece of the stock for as little as $1.

Examples of Fractional Shares to Consider:

Apple (AAPL)

Google (GOOGL)

Tesla (TSLA)

Dividend Stocks. These stocks pay you a small portion of the company’s profits regularly. It’s like getting a mini paycheck just for owning the stock.

Examples:

Coca-Cola (KO)

Johnson & Johnson (JNJ)

Read complete article Here >> COMPLETE ARTICLE

0 notes

Text

Mutual Funds Unlocked

Investing in mutual funds is like joining a financial carpool — your money teams up with other investors to reach financial destinations faster and more efficiently. Whether you’re a complete beginner or someone looking to diversify your investments, this guide will walk you through everything you need to know about mutual funds in a simple and engaging way.

What Is a Mutual Fund?

A mutual fund is a professionally managed investment that pools money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. Think of it as a basket where each fruit represents a different stock or bond. Instead of buying individual stocks, you get a mix, reducing risks while enjoying potential returns.

Why Choose Mutual Funds?

Diversification — You don’t put all your eggs in one basket! Your money is spread across multiple assets, reducing risks.

Professional Management — Experts manage your funds, so you don’t need to analyze every stock.

Liquidity — You can redeem your investments anytime (except for some lock-in funds).

Convenience — Invest with as little as ₹500 per month through SIPs (Systematic Investment Plans).

Types of Mutual Funds

Understanding different types of mutual funds helps you pick the right one for your goals:

1. Equity Mutual Funds (For Growth)

Invests in company stocks.

Best for long-term wealth creation.

High risk, high return potential.

2. Debt Mutual Funds (For Stability)

Invests in government and corporate bonds.

Lower risk compared to equities.

Suitable for conservative investors.

3. Hybrid Mutual Funds (For Balance)

A mix of equity and debt.

Medium risk, balanced growth.

4. Index Funds & ETFs (For Passive Investors)

Mirrors stock indices like NIFTY 50 or SENSEX.

Low-cost investment option.

5. Tax-Saving Funds (ELSS)

Equity Linked Savings Scheme (ELSS) provides tax benefits under Section 80C.

3-year lock-in period, high return potential.

How to Invest in Mutual Funds?

Investing in mutual funds is easy and hassle-free. Follow these simple steps:

Step 1: Define Your Goal

Are you investing for retirement, a dream home, or short-term gains? Your goal determines the type of mutual fund to choose.

Step 2: Choose a Mutual Fund

Compare funds based on past performance, expense ratio, and risk level.

Step 3: Select SIP or Lump Sum

SIP (Systematic Investment Plan): Invest small amounts monthly.

Lump Sum: Invest a large amount at once.

Step 4: Start Investing Online

Use apps like Groww, Zerodha, or Paytm Money to invest directly.

Step 5: Monitor & Stay Invested

Markets fluctuate, but patience is key. Long-term investments yield the best results.

0 notes

Text

Crypto Coin Talks: The Essential Forum for Beginners and Enthusiasts

Welcome to Crypto Coin Talks, the forum for cryptocurrency enthusiasts, traders, and blockchain developers. Whether you’re exploring Bitcoin investor forums, learning about altcoins, or engaging in discussions on the cryptocurrency forum best tailored to your needs, this platform is your ultimate resource for crypto insights and knowledge.

The world of cryptocurrency is exciting, but it can also feel a little confusing, especially if you’re just starting. Don’t worry! With the right resources, learning about cryptocurrency can be fun and simple. That’s where cryptocurrency forums for beginners and news platforms come in handy. Let’s dive in!

What Are Cryptocurrency Forums?

A cryptocurrency forum is a place where people talk about crypto coins, ask questions, and share their experiences. Beginners love these forums because they can learn directly from experts and other enthusiasts.

Why Use Forums?

Ask Questions: If you’re stuck, someone will help.

Learn Tips: Find out the best ways to buy, sell, or trade crypto coins.

Stay Updated: Get the latest cryptocurrency news and predictions.

Popular cryptocurrency forums, like CryptoCoinTalks, are great for anyone new to this world. They make learning easy and exciting!

Why Is Cryptocurrency News Important?

Keeping up with cryptocurrency news and predictions is a smart way to understand what’s happening in the crypto world. Things change quickly, and knowing the latest trends can help you make better decisions.

WHERE TO START To get started, I recommend two things:

Read as much as you can to build your knowledge. Learn about the history of Bitcoin, how it works, how people use it, and where the market has gone up and down.

Make your first investment — just a small amount, as this will help you build your knowledge quicker.

There are many ways to buy cryptocurrencies, from specific websites to exchanges. When you’re ready to start, visit Crypto Coin Talks, the go-to Bitcoin discussion board, for reliable insights, guides, and tools to assist with your first steps in the world of cryptocurrency.

WHAT IS A CRYPTOCURRENCY?

A cryptocurrency is a digital currency that is traded and transferred online. It isn’t just one thing but shares properties with other financial instruments:

Money: You can spend the currency with retailers who accept it.

Stocks/shares: The value of the coin can change, so people use it as an investment.

Gold: It can act as a reserve for long-term investments similar to gold.

There are hundreds of cryptocurrencies, some of which are growing in value and awareness and others that are potential scams or a waste of money. Coins that are not Bitcoin are called Altcoins. The most notable of these include Ripple, Dash, Litecoin, and Ethereum.

If you’re looking for a forum for cryptocurrency, cryptocurrency forums, or a Bitcoin discussion board, visit Crypto Coin Talks to explore the latest insights, trends, and discussions.

What You Can Learn From News and Predictions:

Price Changes: Know when a coin’s value goes up or down.

New Coins: Learn about the latest coins entering the market.

Expert Predictions: Find out what experts think will happen next.

For example, a prediction might tell you if Bitcoin’s price is expected to rise or fall in the coming months.

How to Get Started as a Beginner

Here’s how you can learn more about cryptocurrency using forums and news:

Join a Forum: Sign up for forums like CryptoCoinTalks to ask questions and learn.

Read News Daily: Check out trusted websites to stay updated on the latest cryptocurrency news and predictions.

Start Small: Don’t invest too much at first — just learn and grow your knowledge.

Ask for Help: Never be afraid to ask for help in forums. Everyone starts somewhere!

Why Choose CryptoCoinTalks?

At CryptoCoinTalks, we make learning about cryptocurrency easy for beginners. Whether you’re looking for cryptocurrency forums for beginners or the latest cryptocurrency news and predictions, we’ve got you covered.Conclusion

Learning about cryptocurrency doesn’t have to be hard. With forums and news platforms like CryptoCoinTalks, you’ll have all the tools you need to become a crypto expert. So, why wait? Join a forum, read the news, and start your crypto journey today!

0 notes